Abstract

The contemporary innovations in financial technology (fintech) serve society with an environmentally friendly atmosphere. Fintech covers an enormous range of activities from data security to financial service deliverables that enable the companies to automate their existing business structure and introduce innovative products and services. Therefore, there is an increasing demand for scholars and professionals to identify the future trends and directions of the topic. This is why the present study conducted a bibliometric analysis in social, environmental, and computer sciences fields to analyse the implementation of environment-friendly computer applications to benefit societal growth and well-being. We have used the ‘bibliometrix 3.0’ package of the r-program to analyse the core aspects of fintech systematically. The study suggests that ‘ACM International Conference Proceedings’ is the core source of published fintech literature. China leads in both multiple and single country production of fintech publications. Bina Nusantara University is the most relevant affiliation. Arner and Buckley provide impactful fintech literature. In the conceptual framework, we analyse relationships between different topics of fintech and address dynamic research streams and themes. These research streams and themes highlight the future directions and core topics of fintech. The study deploys a co-occurrence network to differentiate the entire fintech literature into three research streams. These research streams are related to ‘cryptocurrencies, smart contracts, financial technology’, ‘financial industry stability, service, innovation, regulatory technology (regtech)’, and ‘machine learning and deep learning innovations’. The study deploys a thematic map to identify basic, emerging, dropping, isolated, and motor themes based on centrality and density. These various themes and streams are designed to lead the researchers, academicians, policymakers, and practitioners to narrow, distinctive, and significant topics.

Keywords:

fintech; financial technology; blockchain; deep learning; regtech; environment; social sciences 1. Introduction

As the world is entering the digitalisation age, many organisations are adopting and investing in new technologies to cope with societal and environmental needs. The financial industry is not so different; it evolves day by day with various fintech technologies. Fintech is the combination of financial technology used to enhance financial operations’ effectiveness and efficiency. Its rise has changed the ways of businesses of commercial banking systems [1]. It is implied that it is an emerging area of finance with a significant contribution to technology [2,3]. Nowadays, it has become an industry that successfully takes advantage of the recent development of information technology tools such as cloud computing, big data, the internet of things, social computing, etc. [4]. This advancement supports the existing business structure but also helps the financial service industry to introduce new processes, systems, products, and services that can enhance their efficiency [5]. The companies are intended to restructure their businesses and are more inclined towards hybrid client interactions and more customer self-services, [6], particularly during Covid-19.

The latest fintech technology trends include categorising and assessing various artificial intelligence technologies based on their availability and maturity [7]. Furthermore, it provides studies such as the contextualisation of users’ facilities and experience of the web interface in the financial service industry [8], machine learning tools in electronic finance market trading [9], and advanced modelling for stock movements [10] and settlement models with renewable energy that are based on blockchain technology [11]. The researchers believe that there is a need to develop a conceptual framework to understand the perspectives of Fintech [12]. Few researchers presented the Fintech framework based on the flow of money theories applied in the E-commerce system. However, still required is a suitable conceptual framework developed in the context of relevant fields [13]. As well, there is a still need to identify the core contributors in the field of computer, social, and environmental sciences, as well as the future research streams and themes that will lead the scholars to make a significant contribution in the area. Therefore, the purpose of the current study is to conduct a bibliometric analysis for the period of 2010 to 2021.

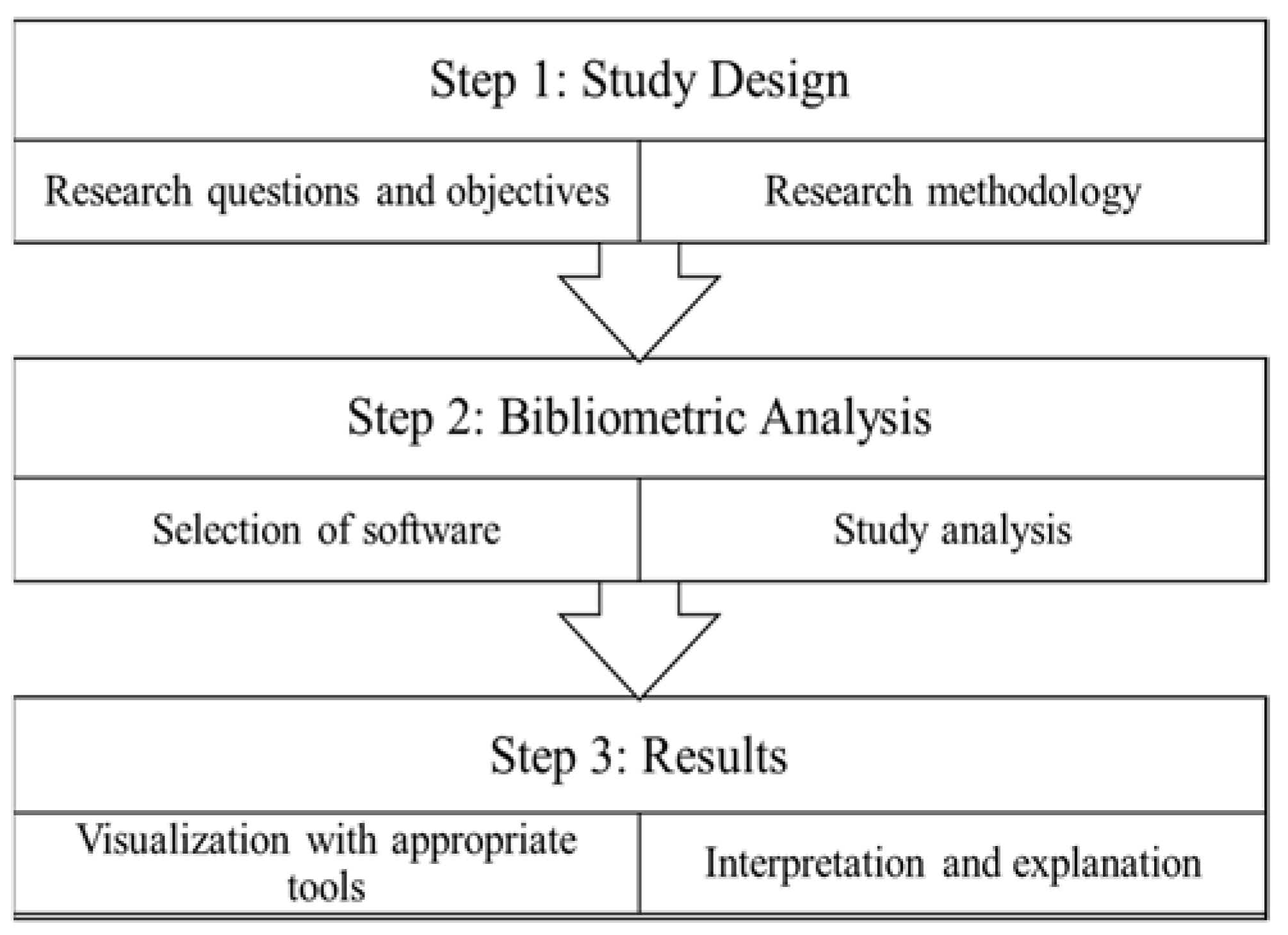

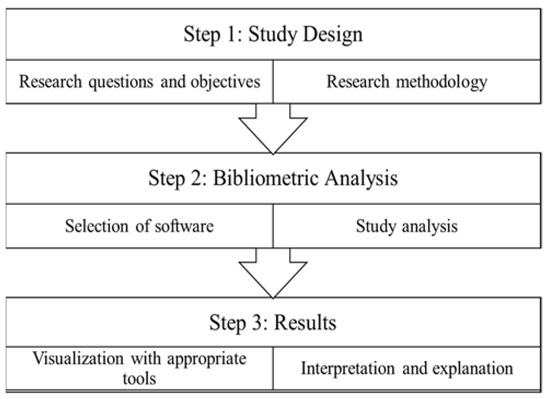

The current study highlights various influential and conceptual aspects of fintech technology in computer, social, and environmental sciences from the last decade. The significant growth of fintech technologies has raised specific questions for academicians and practitioners. These questions are: (1) What are the contributory key authors and journals of the fintech literature? (2) What are core affiliations, sources and contributing countries in the field of fintech and computer, management, and environmental sciences? (3) What key themes does fintech offer in the field of computer, management, and environmental sciences? (4) With the help of research streams offered by fintech literature, what are the future research gaps to fill by researchers, academicians, and practitioners? The workflow of the study is presented in Figure 1.

Figure 1.

Workflow of study.

2. Study Design and Descriptive Outlook

This study aims to conduct a comprehensive bibliometric analysis to identify the influential and conceptual structure of the fintech literature in computer, social, and environmental sciences. The procedure and steps of studies are shown in Figure 1, using the workflow followed by Nasir et al. [14]. The study proceeds with the study design, where we define our research questions and methodology in step 1. We have used the ‘bibliometrix 3.0’ package of r-studio to analyse various influential and conceptual aspects of fintech literature [15]. We have used Scopus, emerald, and science direct databases for searching fintech literature. The finalised search query is simply fintech in the computer, social, and environmental science fields. We analysed on 17 March 2021. There is a minimum contribution of fintech literature in the rest of the areas. Furthermore, we have removed the duplicates from our data and ended up with 1556 documents, from which 786 are research articles, 26 are books, 86 are book chapters, 553 are conference papers, 61 are reviews, and 22 are conference reviews and editorials.

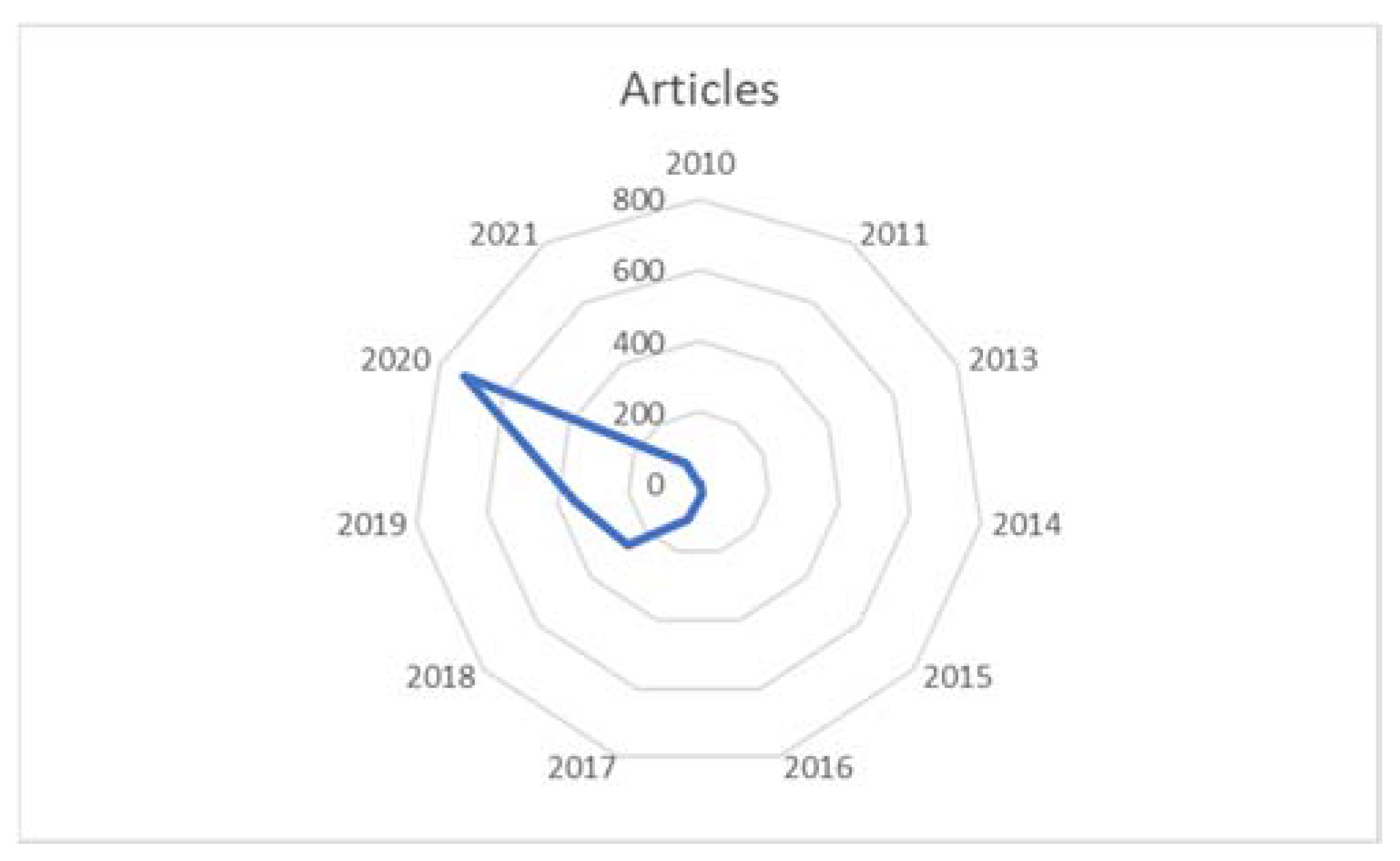

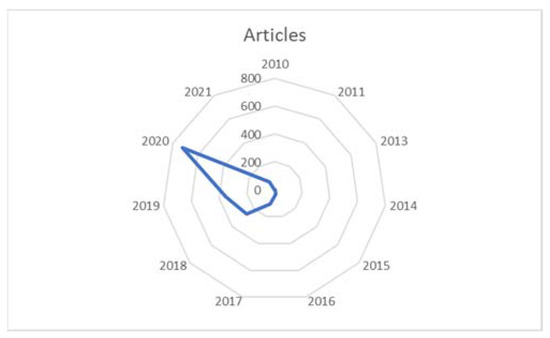

Table 1 also highlights the total number of author keywords and keyword plus used by the literature; furthermore, we have taken the literature from 2010 to 2021. The table describes various characteristics such as the collaboration between countries index, authors per documents, and single and multiple-authored documents in fintech literature. Figure 2 represents the annual production of publications per year; fintech is a recent trend globally as, in 2020, there were 724 publications. The growth is substantial, from 1 publication in 2010, to 10 publications in 2015, to 724 publications in 2020. The year 2021 is still ongoing, however, we can see 69 publications in fintech, more than the 30 publications in 2016. The relevant growth in financial technology literature starts in 2017, where we can see 107 publications, followed by 262 in 2018 and 348 in 2019.

Table 1.

Main information about fintech literature.

Figure 2.

Annual publications production radar.

3. Bibliometric Analysis

The forthcoming segment represents the holistic bibliometric analysis of fintech literature. The bibliometric analysis is twofold. First, we study dynamic, influential aspects such as core authors having a considerable impact in fintech. We highlight core sources and how they impact the literature on various topics. We propose the main countries and corresponding countries of fintech literature. Then, we discuss primary affiliations or institutions conducting significant research on multiple topics of fintech. We discuss the main contributions of highly ranked documents. We lastly indicate the main keywords in fintech literature.

The second part of the bibliometric analysis provides a conceptual framework. In this section, we discuss various themes and streams of fintech literature. It provides an understanding of the core topics of fintech in computer, social, and environmental sciences, and helps us propose what the future holds for fintech technologies. This section presents a co-occurrence network which creates a matrix of keywords and links them together in various clusters that suggest the main topics. Furthermore, we investigate the thematic map, which divides multiple topics into four quadrants with different characteristics. Finally, from emerging and developing issues, we propose a future research agenda in fintech literature.

3.1. Influential Aspects

3.1.1. Core Sources

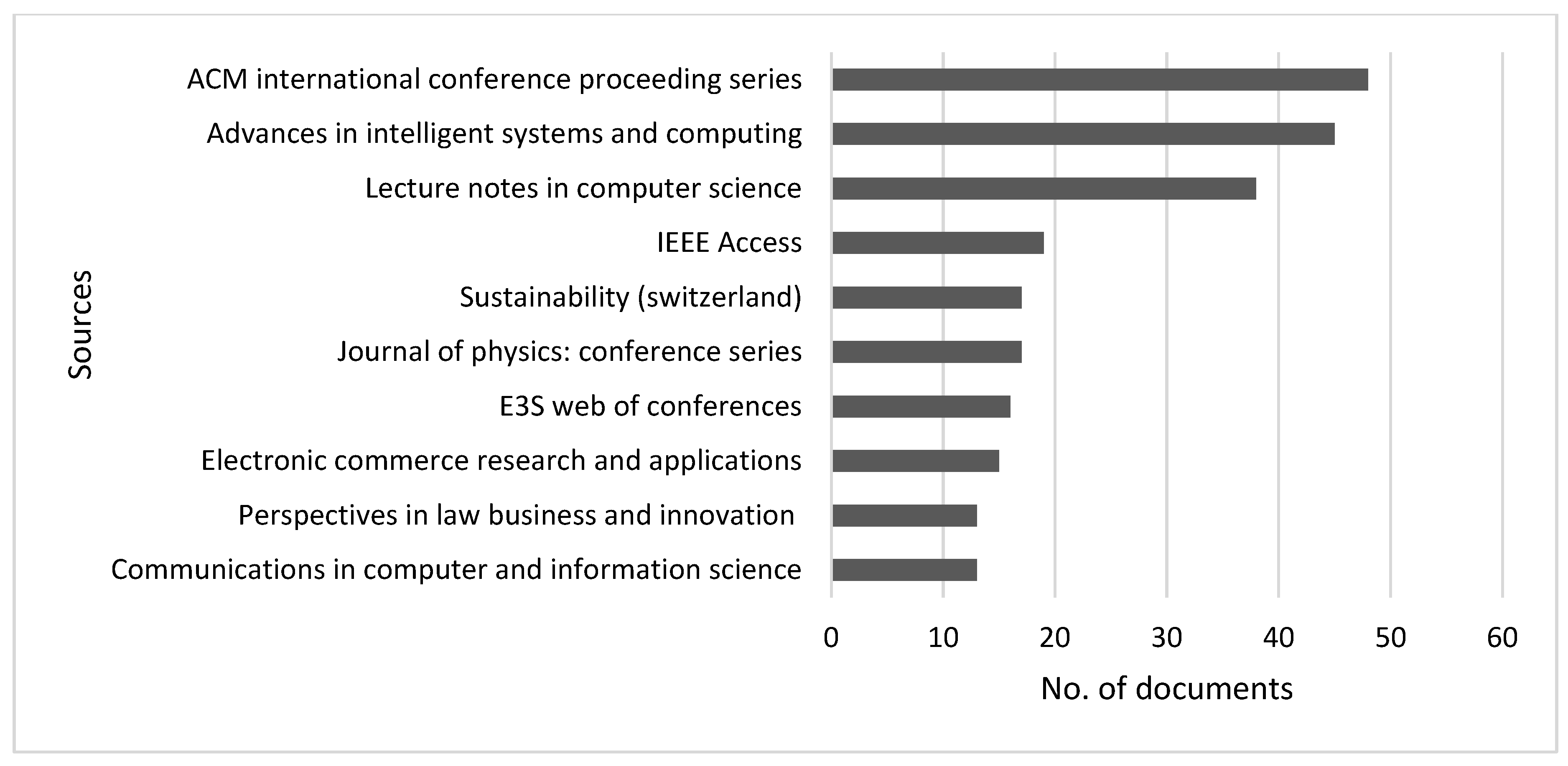

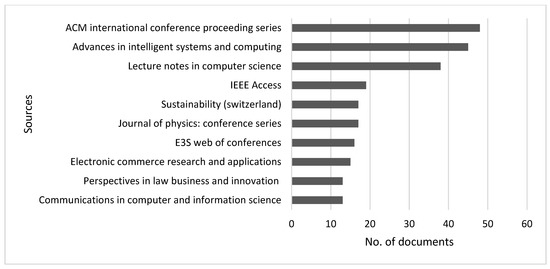

Figure 3 represents the top 10 critical influential sources of fintech literature. ACM International Conference Proceedings is the core source in the field. Contemporary research is often presented at the ACM international conference. The core source represents recent studies of diverse, agile tailoring models [16], the advanced mechanism for agricultural marketing and smart contracts using blockchains [17], and the facilitation of decentralised ledger technology for financial derivative markets [18]. T he second leading source of fintech literature is Advances in Intelligent Systems and Computing. This journal publishes literature on the digitalisation of the banking and insurance sector [19], introducing the QR-code-based payment systems at fintech future [20] and dynamic uses of blockchain technology such as e-voting [21]. The third primary source is lecture notes in computer sciences that involve literature on fintech innovation with patent data [22], the role of information technology (IT) in developing fintech business model canvases [23], and the use of fintech AI that is interpretable in evaluating the efficiency of lending risk [24]. IEEE access provides literature on the development of a blockchain-based microgrid transaction model for optimised bidding [25], market settlement models based on blockchain technology while securing efficient energy trading mechanisms [26], and contract production and transaction with dynamic technology such as a block-enabled integrated marketing platform [27].

Figure 3.

Most relevant sources, according to publications.

Table 2 represents the primary sources listed and arranged based on h-index and g-index. It shows the impact of the journal on fintech literature. Electronic commerce, research, and applications are top-ranked sources for producing fintech literature with an h-index of 7 and a g-index of 13. Its 15 publications have 186 total citations, and the first article on fintech was published in 2015. The journal highlights the key areas of fintech, which are initial coin offerings (ICO) and information asymmetries associated with it [28], the proposed value created by the mobile payment ecosystem [29], and contract signing protocol with blockchain technologies [30]. Financial innovation comes on the second number in the source impact list with an h-index of seven, a g-index of nine, and its total 9 publications having 148 total citations. It covers the main topics of fintech governance and emergence in Peer to Peer (P2P) lending [31,32] and the growth of digital banking in the financial industry [33]. The first article on technological forecasting and social change (ranked third) was published in 2018; however, it comes in third place with 89 total citations with 11 fintech technology publications.

Table 2.

Top ten sources with impact.

3.1.2. Influential Authors in Fintech Literature

This section represents the core authors who contributed significantly to fintech in the computer, social and environmental sciences. Table 3 describes the ranking of the principal authors and divides the order into two panels. Panel A represents ranking according to h, g and m-index, while panel B grades authors according to total citations.

Table 3.

Top authors in fintech literature.

D.W. Arner is ranked first according to the top five author list in panel A. one of his main contributions is drivers of financial inclusion and compliance with sustainable development goals (SDGs) [34]. Furthermore, his work covers the protection against fraud and detection through digital identity infrastructure to fulfil the obligations of knowing your customers [35]. He also worked on fintech regulations, digitalisation of manual reporting, and compliance processes such as regtech (regulation technology) [36,37,38]. In panel A, R.P. Buckley (ranked second) collaborated with D.W. Arner in most of his work [39]. His work as the principal author is related to dependence on digital technologies and cybersecurity during the time of the COVID-19 pandemic [40]. With D.W. Arner, he worked on regtech to control systematic risk in financial crisis, data protection rules, and electronic identification legislation [41]. P. Gomber in Panel B has the highest rank concerning the number of citations. His most cited work is related to technology innovation, transformation, and disruption in financial services [42]. The common name in both panels is R.J. Kauffman, with five publications from 2015. He is the second-highest cited author in the field of fintech in computer, social, and environmental sciences. His apparent work represents the computational social sciences [43] and the changing environment concerning payments through cards [44].

The most cited publication is done by S. Adhami, with only one publication in 2018 and with a total number of citations of 126. He is the fifth most highly cited author because he has produced only one publication in fintech technologies. His work is about the ICOs phenomena, and he addressed the success of token offerings [45].

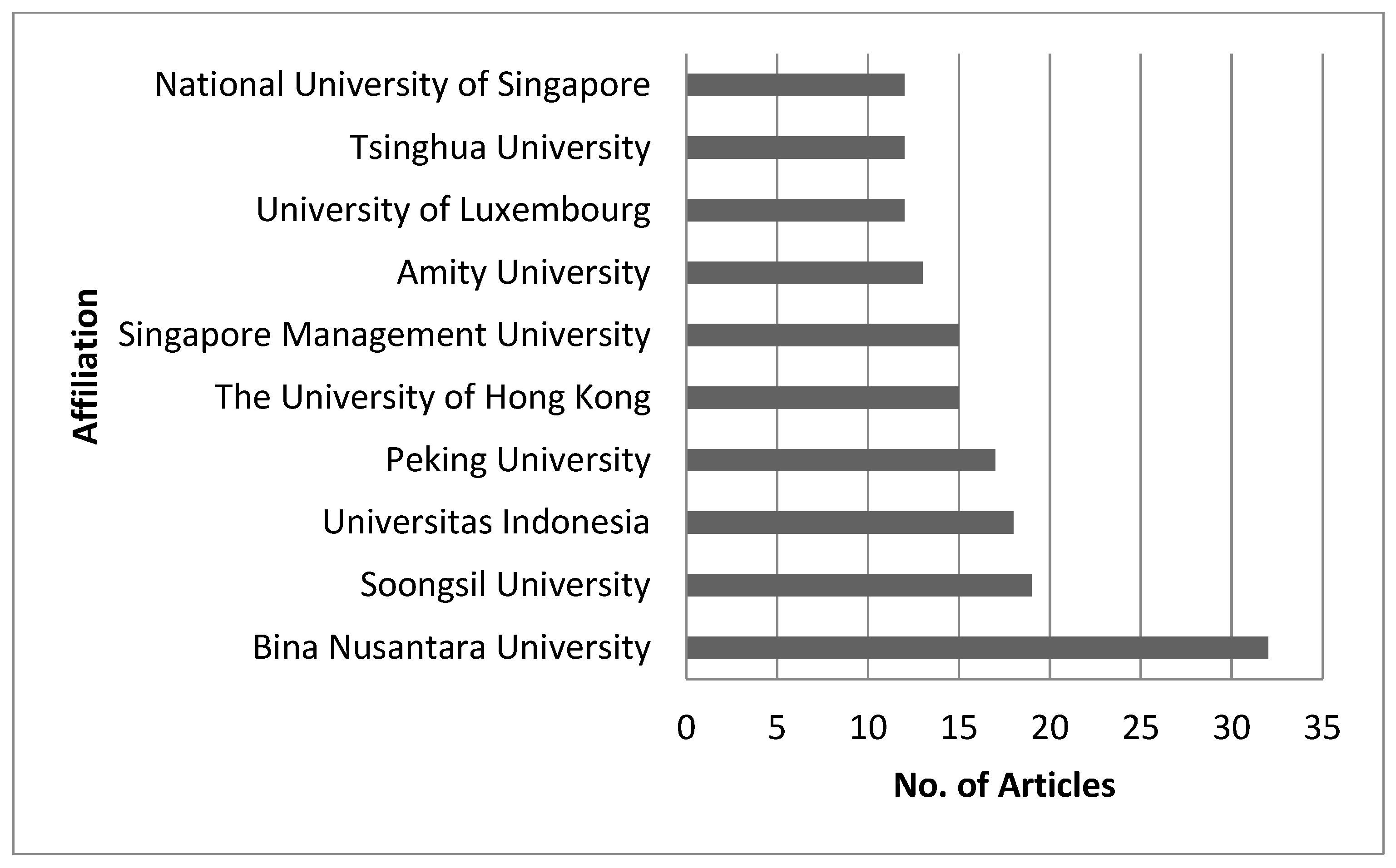

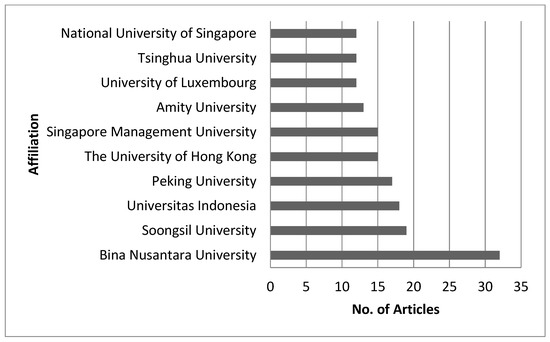

3.1.3. Most Relevant Affiliations

This section deals with the most relevant affiliations. As shown in Figure 4, Bina Nusantara University is the core affiliation, with 33 publications in fintech technology. The university evolved from a computer training institute founded on 21 October 1974 [46]. The affiliation conducts studies on asset baked tokens with blockchain networks [47], consumer protection in lending transactions [48,49], mobile payment application and acceptance [50], and unified theory of acceptance and use of technology [51].

Figure 4.

Most relevant affiliations.

Soongsil University is the second-largest affiliation with 18 publications. The university was founded in 1897 by William M. Baird as a private school. Soongsil pioneered a computer science program in Korea, ranked number two in Soul National University [52]. The main topics that Soongsil University covers are small foreign currency remittance with blockchain technology [53], machine learning and adaptive fintech security provision [54], the emergence of mobile-accessible payment services [55,56], and peer to peer (P2P) lending applications [57]. In third place, Universitas Indonesia published 17 documents. The significant studies conducted are related to the effect of fintech on stock returns [58], fintec- based financial instructions, financial performance and consumer behaviour [59] and P2P lending, and women’s empowerment [60].

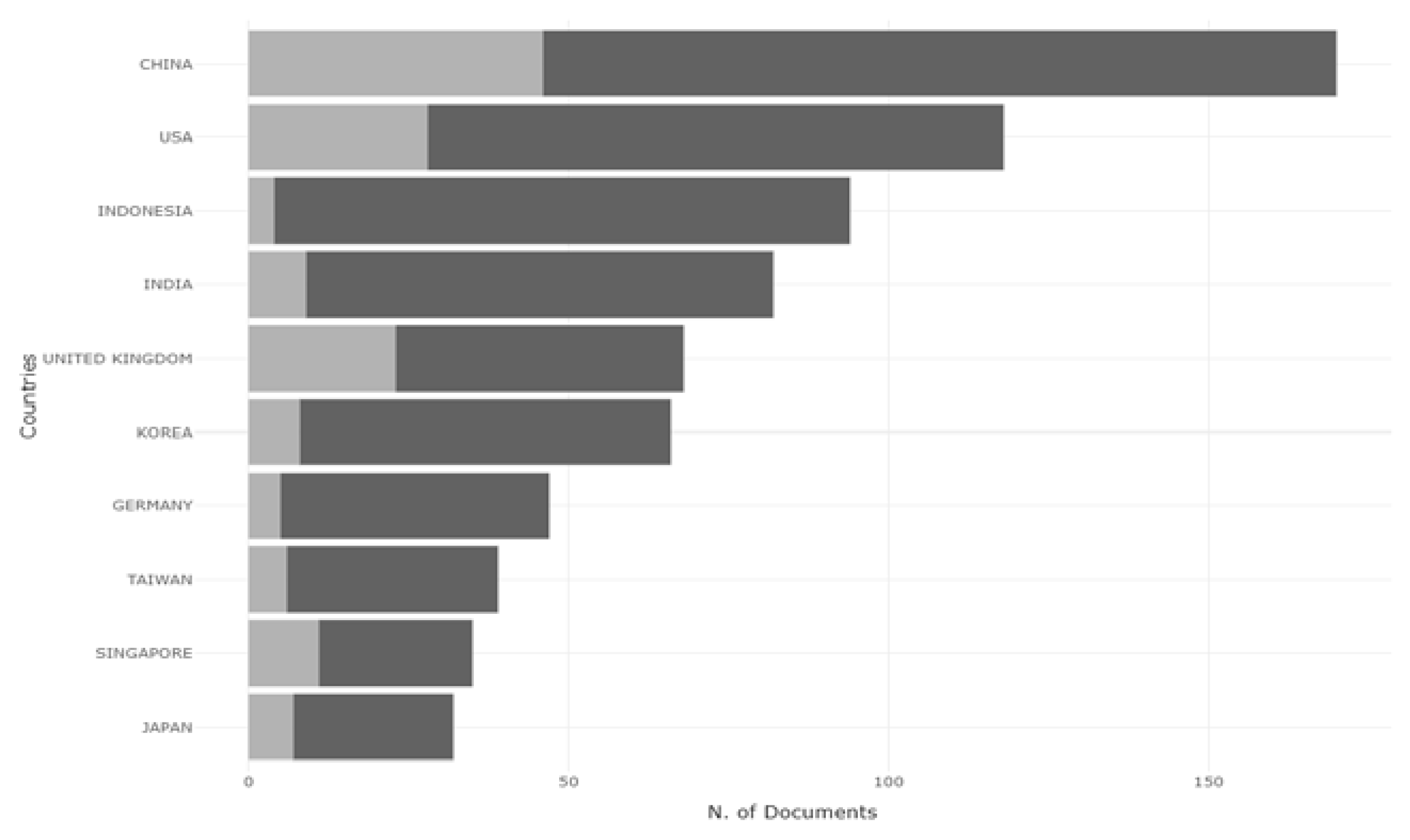

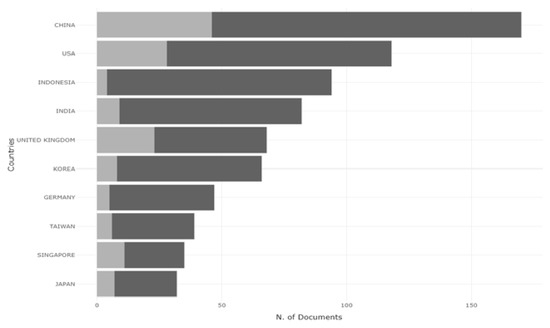

3.1.4. Influential Countries

Concerning Table 4, the USA and China are leading in terms of citations and number of publications. It is seen that China has well over 400 publications, which is 41% higher than the USA’s number of publications. Still, on the other hand, in the citations section, the USA has published some of the most fascinating and citable work in fintech and has secured 742 citations. China has 419 publications got 457 citations. There are 114 publications from South Korea; however, the country earned 411 citations. The UK is in the third position in terms of publications; however, UK publications obtained 394 citations. Indonesia and India are in the fourth and fifth positions in terms of publications; however, these countries are not on the citations list. In contrast, Italy and Taiwan are the last two countries in terms of the number of publications. However, a small number of publications from these two countries have significant contributions, as their publications are cited significantly.

Table 4.

Core Countries in Terms of Number and Citations.

Figure 5 represents the top 10 corresponding author countries, and it is divided into two parts. The figure’s first part shows that the orange colour represents many multiple country publications (MCP). These publications are collaborated on by at least one foreign country author. Bars in green represent single country publications (SCP), where correspondence and collaborations are from the same country [61].

Figure 5.

Corresponding author country.

As shown in Figure 5, China has the highest number of both SCP and MCP. The country has produced 170 corresponding articles, of which 124 are SCP, and 46 are MCP. USA comes in second place with 118 corresponding articles, 90 SCP, and 28 MCP. The exact amount of SCP is produced by Indonesia (ranked third); however, it lacks in MCP with only four publications. India (ranked fourth) and the United Kingdom (ranked fifth) have more inter-country collaboration than Indonesia. India has 9 MCP, and the United Kingdom has 23 MCPs.

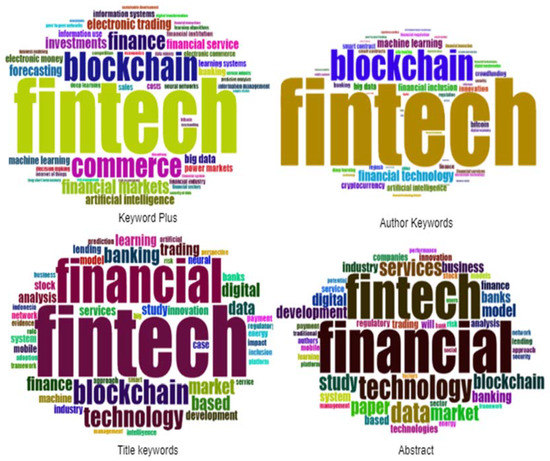

3.1.5. Keyword Analysis

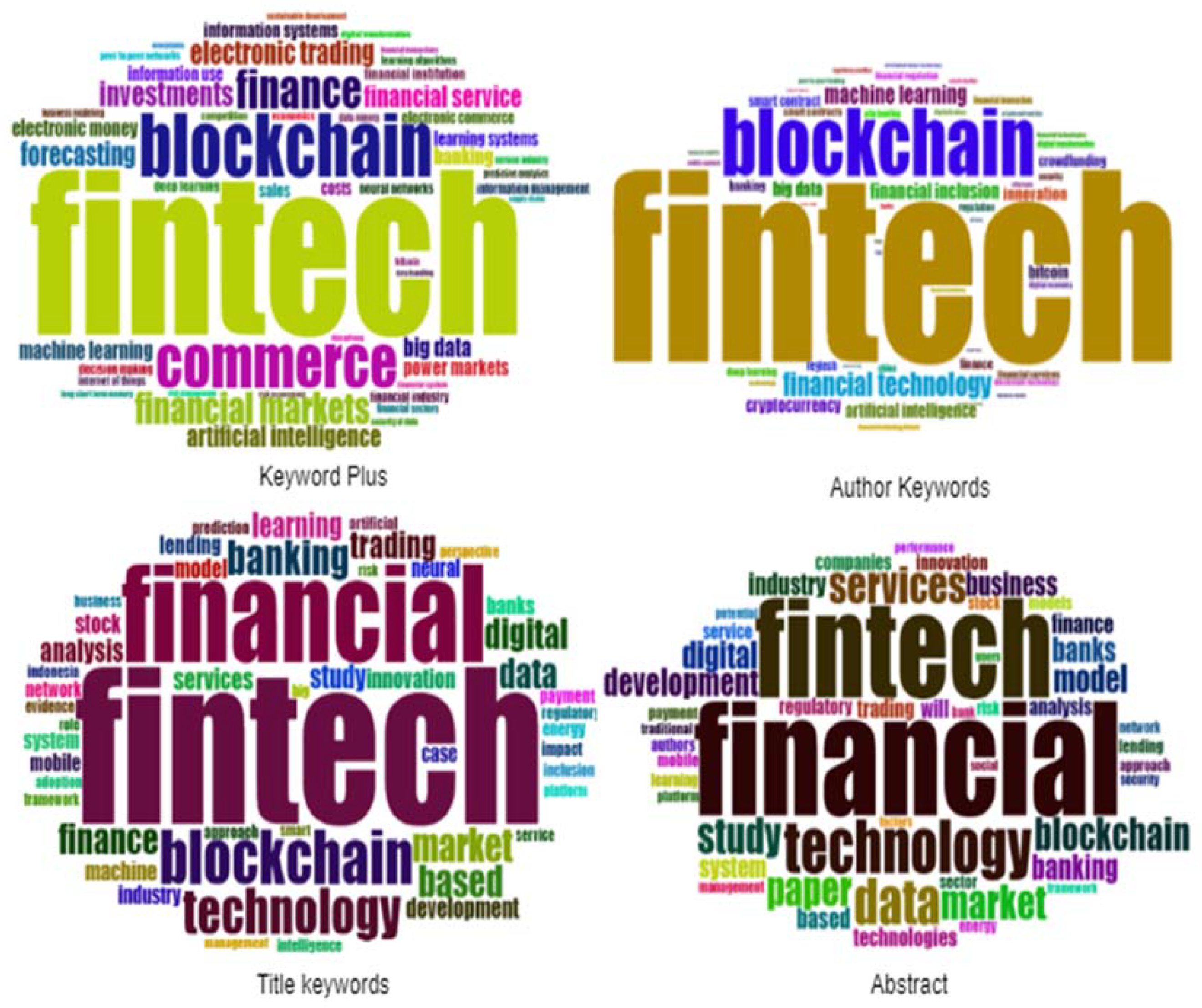

Keywords are an essential factor in searching the literature. We have found essential keywords in fintech literature, shown in the shape of word clouds in Figure 6. It is evident that fintech is the main keyword for the literature; our focus is on other keywords representing various topics or fields. In the abstract, financial is the most commonly used keyword in studies relating to technology, market, and blockchain. Similar keywords are found in the study’s title; besides, the title covers keywords related to the digital market and banks, as shown in Table 5.

Figure 6.

Word clouds.

Table 5.

Research stream of Fintech literature.

Keryword plus author represents authentic fintech topics such as financial markets, investments, electronic trading, artificial intelligence, financial services, blockchain, and commerce. In addition to keyword plus author, keywords represent thematic topics in fintech such as blockchain technologies, financial technology, machine learning, financial inclusion, big data, artificial intelligence, and cryptocurrency bitcoin fintech innovation.

This study suggests that author keywords represent significant and authentic keywords compared to other sources, and these keywords cover and analyse a wide variety of topics in fintech. We can find and propose key themes and streams in fintech in computer, social, and environmental sciences by analysing the author’s keywords.

3.2. Conceptual Framework

This section will study various themes and streams that are a significant part of the fintech literature. In addition to tools such as co-occurrence network, thematic map, and thematic evolution, we have proposed a potential future agenda for researchers, educationists, engineers, and policymakers.

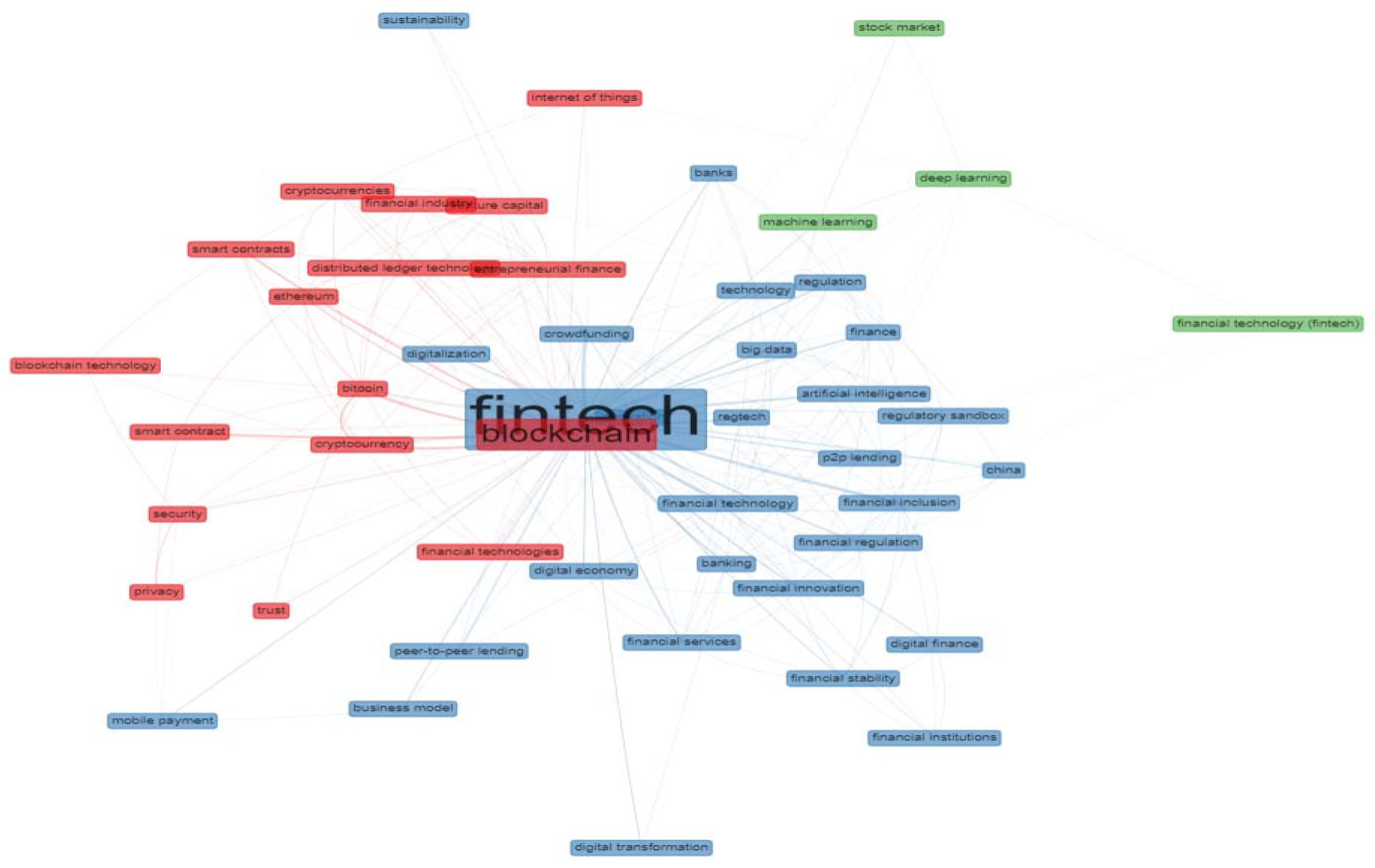

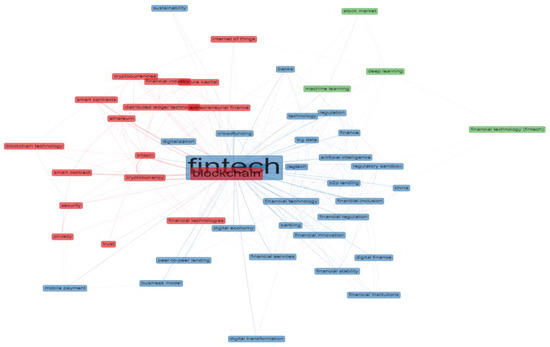

3.2.1. Co-Occurrence Network

We have conducted the co-occurrence analysis using the author keyword and identified three main clusters of fintech literature, as shown in Figure 7. These clusters represent distinct research streams which can help the researchers to differentiate the literature significantly. A highly centralised cluster is a blue cluster representing the research stream we have given the name of digital transformation, innovation financial industry, and regulations. There are many topics to seek in this research stream, most prominently, the regulations related to analysing the application and implementation of fintech technologies. Skilful regulations are required for the outbreak of financial innovations throughout the economic systems [62].

Figure 7.

Co-occurrence network.

Regulatory technology or regtech is a prominent topic that uses information technology for monitoring, compliance, and reporting [39]. Regtech is a better financial solution. Furthermore, certain shared ledger technologies provide potential solutions for finance and banking procedures [63].

Financial regulatory technology would help shape the digital currency’s internationalisation by strengthening blockchain’s legal context [64]. Tsai et al. [65] introduced the framework for online supply chain finance for small and medium enterprises and suggested replacing it with a traditional supply chain financial mechanism. The innovative regulatory framework streamed by fintech provides a conducive innovative environment, protecting consumer rights and ensuring financial stability with advanced ecosystems [66,67,68,69,70,71,72]. The red stream proposed by the co-occurrence network represents the overall research stream of financial technology in cryptocurrencies and smart contracts. Some of the literature is dedicated to the combination of the latest financial technologies and environmental sciences. Le et al. [73] studied the spillovers and connections among green bonds, fintech, and cryptocurrencies, and found long term hedging benefits among them. Many traditional offline activities have been become easy, comfortable, and secure with the penetration of blockchain technology. Rao et al. [21] suggest that the Ethereum blockchain has made e-voting secure and transparent. It has enhanced the scope of smart contracts. Fintech technologies have helped to develop new innovative financial products that transform traditional payment systems into mobile-based application payment systems [74]. Various fields of research are yet to be explored in fintech in relation with the blockchain technology. Nasir et al. [55] studied blockchain technologies’ core theme and research streams, and identified fintech technologies as the key emerging and developing theme. A part of fintech is about making smart contracts, and from the passage of time, the smart contract procedures have evolved significantly. They have become secure, regulated, and user friendly [75,76]. Fintech is making progress in preserving the environment. Hu et al. [77] proposed the trading system that is blockchain distributed carbon emission.

The green research stream is away from centrality, indicating that some potential topics can set the future research agenda. The stream relates fintech literature with machine learning, deep learning, and stock markets. Certain studies study machine learning techniques to simplify, develop, and increase the online financial market trading systems [6]. Oliveira et al. [78] use machine learning techniques such as the k-mean algorithm, long short term memory (LSTM), and the density-based spatial clustering (DBSC) algorithm to forecast stock market price movements. Abe et al. [79] deploy deep learning on cross-sections of various stock markets with multifactor models and indicate that deep learning is a significant model for the prediction of the cross-section of stock returns. There is a substantial development in the machine and deep learning techniques to propose the prediction model for stock markets [80,81,82]. Machine learning is also helpful in portfolio risk management [83].

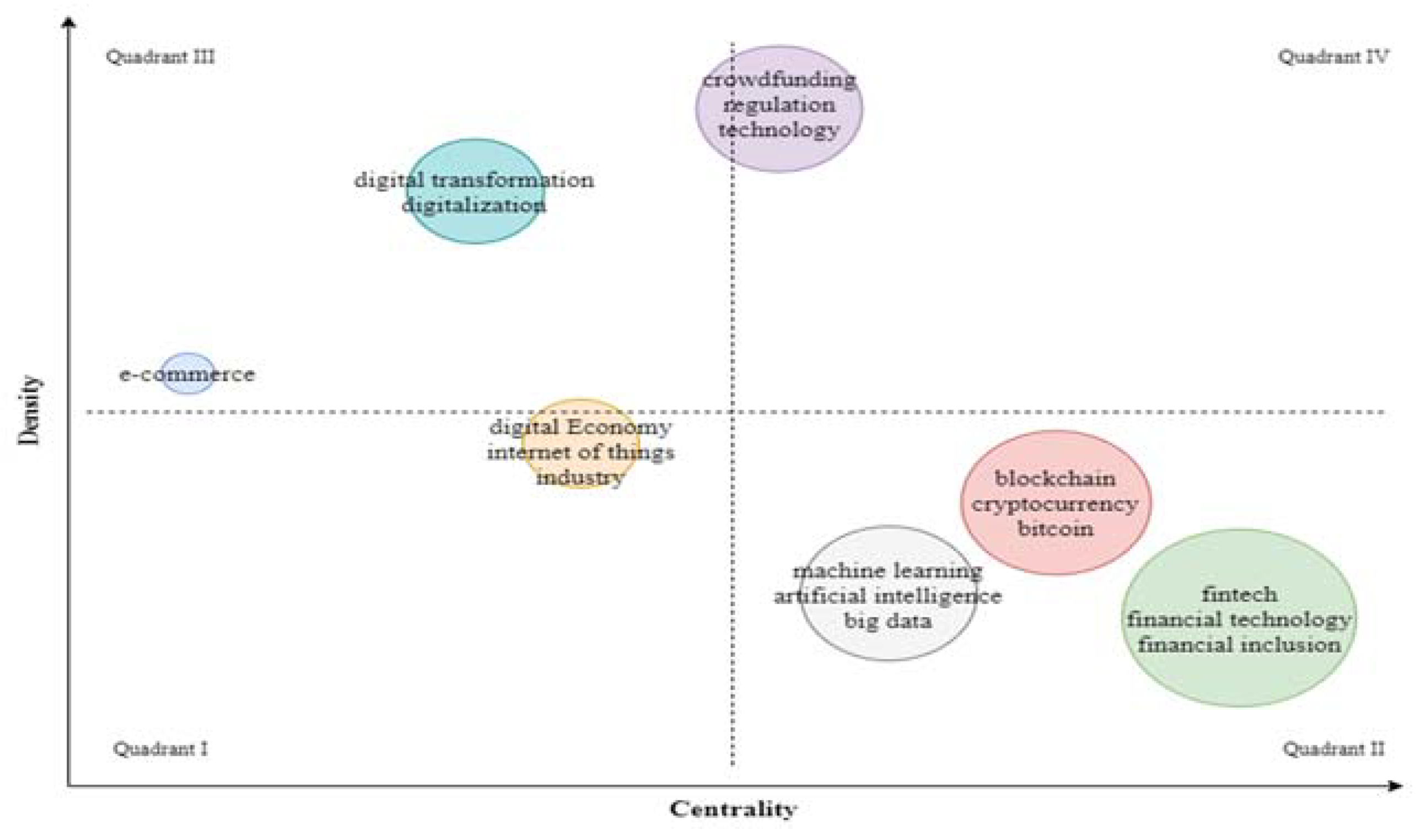

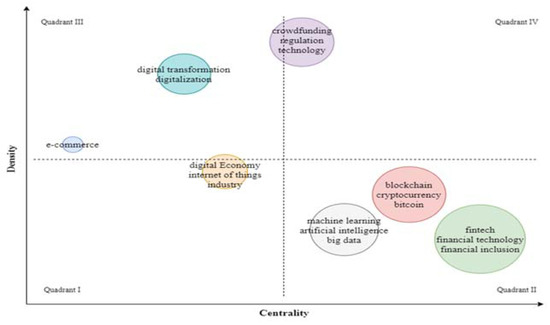

3.2.2. Thematic Map

We have a thematic map (Figure 8) in the study that proposes research themes according to four quadrants. According to Nasir et al. [14], the thematic map divides themes according to two factors (centrality and density). Centrality represents the high volume of work in a specific theme, and density means the importance of a particular theme. The first quadrant in Figure 8 indicates low-density themes with low centrality. These themes are either new, developing, or emerging because they have low density and low centrality. The second quadrant represents basic themes that provide high volume (centrality) but that are less critical (density). The third quadrant represents essential themes in the field; however, less work has been done in such areas. This field should be discussed significantly because these themes can provide potential future directions. The fourth quadrant has themes with both high centrality and density.

Figure 8.

Thematic map.

Digital economy, internet of things, and financial industry-related themes are in the first quadrant. These keywords represent the topic with low centrality and low density. These themes either emerge as a strong future agenda or drop out from the future literature.

In the digital economy, Rozi et al. [84] study innovations and privacy issues for startup companies. In the digital economy era, Jiang et al. [85] analysed the significant risk profile by deploying conditional value at risk models on China’s financial banks and found significant systematic risk exposure of small banks compared to big financial institutions. The digital economy is possessed with considerable challenges, such as centralisation of technology, trust, and security; e-commerce transactions are shaping the digital economy’s future. Ferrer-Gomila [30] uses the blockchain for contract signing between various parties, making e-commerce transactions easy and cost-effective. One of the emerging topics is industry 4.0. Li et al. [86] use blockchain for immutable, secure, transparent, and auditable peer to peer energy transactions in the industrial internet of things. Moreover, the industrial and financial internet of things is discussed by [87,88,89,90].

The basic themes of fintech literature are filled with various significant topics. It is obvious that, for topics related to financial technology, fintech will have strong centrality in the literature. Furthermore, in recent times, blockchain technology for auditable, immutable, transparent, and secure transactions is considered the main fintech tool [91,92,93,94,95]. The blockchain also reduces financial comfort and cost efficiency, as Šapkauskienė [92] studied initial coin offerings of new companies and explained how blockchain reduces cost with ICOs. Machine learning, artificial intelligence, and big data themes are also common in the fintech literature. Significant machine learning literature is related to estimating the movement and pricing of financial assets [96,97,98,99,100,101,102]. Kulshrestha et al. [103] deploy technical, fundamental, and artificial intelligence to propose optimal portfolio performance. Big data is about considering various techniques to ensure the quality of the data and its estimations and prediction ability [104]. Fintech has a significant role in shaping the architecture of big data [105].

E-commerce is a highly developed theme; however, its centrality is very low. The growth of e-commerce is significant, and there is a lot to offer by deploying various fintechs such as payment applications, blockchain, bitcoins, price disruption, and channel modelling [106]. Certain issues related to e-commerce business proliferation include online payment models and B2C market supply chain management [107]. There are certain gaps and challenges related to digital wallet payments [108]. Government regulations and understanding of the mobile payment system is another challenge for e-commerce development [109]. Furthermore, fintech contributions in e-commerce is studied by [110,111,112,113,114].

Crowdfunding, regulations, and technology are the motor theme, which indicates high centrality and high density. In contemporary times, raising capital from many people to fund innovative projects is an integral part of startup growth. Jin [115] studies the various patterns of crowdfunding and the various stages of the project. Various technologies and topologies of crowdfunding are studied by [116]. Zetzsche et al. [117] consider studying crowdfunding and propose harmonising or standardising the crowdfunding procedure. It is the stepping stone towards developing and changing businesses’ technological environments and significantly achieving entrepreneurial goals [118]. Regtech represents regulation technology and is mainly associated with data protection [41], algorithmic regulations [112], decentralized blockchain [70,118,119], financial markets and risk management [119,120], artificial intelligence [121], anti-money laundering [29], and superior supply chain management [122].

4. Future Research

With the help of fintech literature, we can identify critical areas where further research can be pursued. The following are some recommendations for researchers, policymakers, academicians, and information technology people.

- Using financial technology to achieve sustainable development goals;

- Identify limitations and proliferate industry 4.0 with the internet of things, blockchain, and digital transformation mechanism;

- Will the world see fintech as the opportunity for a new era after the COVID-19 outbreak, or are there challenges ahead;

- Ecommerce proliferation: gap-filling regarding government regulations regarding online payments, supply chain management, blockchain and bitcoin penetration, product differentiation, logistic financial methods, fraud detection, safety policies, law enforcement, ease of startups, and reshaping financial orders;

- Identify and implement various crowdfunding techniques such as blockchain and bitcoin investment with proper regulations to fund multiple new ventures;

- Implementing fintech tools in Islamic banking and finance. Digital transformation of Islamic instruments such as Mudarabah, Musharakah, Islisna, Salam, Ijarah, Sukuk, and Takaful;

- In developing models, applications of fintech technologies, especially blockchains, ensure standard recording, reporting, and companies’ disclosure requirements such as technological transformation regarding corporate governance-related recordings [123];

- Using fintech, such as machine learning and neural networks tools, develops banking operations such as know-your-customer, risk management, and forecasting;

- Analysis of Asset pricing models, such as Fama et al.’s [124] three-factor model and five-factor model [125], and other models [126,127,128,129], using machine learning [130,131], artificial intelligence [132,133], and deep learning techniques;

- Identify opportunities, gaps, and challenges for implementing and developing regulatory technology.

5. Limitation of Study

- The search query is conducted at one point in time, i.e., 17 March 2021; this is a limitation because these studies may change as new literature may be added on future dates.

- There is limited literature available on fintech literature related to social and environmental sciences. More literature will refine the concept.

6. Conclusions

The study suggests that fintech is the future of business, economy, and information technology, and will help preserve the world’s environment. The research indicates various influential and conceptual aspects of the fintech literature from the past decade. We have discovered some of the core factors of fintech literature. It is worth considering that the development of fintech is contemporary, and research has grown substantially in recent years. Among influential aspects, it is observed that the ACM International Conference Proceedings is the core source of fintech publications. It is the source with the highest impact in fintech literature is Electronic commerce research and applications. D.W. Arner is the most prolific author in fintech publications, while P. Gomber can capture the highest number of citations in the field of fintech. With 33 publications, Bina Nusantara University is the top affiliation. Among top countries, China, the USA, and the UK scored in the top three in terms of publications; however, the USA scores total citations.

Overall, China is the core country, ranked first with the highest correspondence in multiple and single country publications. We have addressed conceptual aspects of fintech literature with a co-occurrence network and thematic map. We have shortlisted three main research streams of fintech literature to narrow down. The first research stream is ‘cryptocurrency, smart contract, and financial technology.’ The second research stream is ‘financial industry stability, service, innovation, and regulatory technology (regtech).’ The third research stream, which divides the overall fintech literature, is ‘machine learning, deep learning, and artificial intelligence.’ These research streams have narrowed down the vast literature of fintech into parts to understand mechanics. We further conceptually differentiate the fintech literature in terms of emerging, basic, isolated, and motor themes. We found that blockchain, cryptocurrency, financial inclusions, machine learning, artificial intelligence, and big data-related topics have high centrality and low density in the fintech literature. It may be difficult to find gaps in said topics. E-commerce is a highly anticipated topic as it is isolated with low centrality and high density. The digital economy, internet of things, and financial industry in fintech are emerging and dropping themes. Crowdfunding and regtech are motor themes with high centrality and high importance.

Author Contributions

Conceptualization, A.N. and K.S.; methodology, A.N., K.S., K.I.K., I.A.H. and T.M.A.; software, A.N., K.S., K.I.K., I.A.H. and T.M.A.; validation, A.N. and K.S.; formal analysis, A.N., K.S., K.I.K., I.A.H., T.M.A. and S.L.; investigation, A.N., K.S., K.I.K., I.A.H., T.M.A. and S.L.; resources, I.A.H. and S.L.; data curation, A.N., K.S., K.I.K., I.A.H., T.M.A. and S.L.; writing—original draft preparation, A.N. and K.S.; writing—review and editing, A.N., K.S., K.I.K., I.A.H., T.M.A. and S.L.; visualization, A.N., K.S., K.I.K., I.A.H., T.M.A. and S.L.; supervision, I.A.H. and S.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Qi, B.Y.; Xiao, J. Fintech: AI powers financial services to improve people’s lives. Commun. ACM 2018, 61, 65–69. [Google Scholar] [CrossRef]

- Wang, Y.; Sui, X.P.; Zhang, Q. Can fintech improve the efficiency of commercial banks?—An analysis based on big data. Res. Int. Bus. Financ. 2021, 55, 101338. [Google Scholar] [CrossRef]

- Dranev, Y.; Frolova, K.; Ochirova, E. The impact of fintech M&A on stock returns. Res. Int. Bus. Financ. 2019, 48, 353–364. [Google Scholar] [CrossRef]

- Legowo, M.B.; Subanidja, S.; Sorongan, F.A. Fintech and bank: Past, present, and future. J. Tek. Komput. 2021, 7, 94–99. [Google Scholar] [CrossRef]

- Puschmann, T. Fintech. Bus. Inf. Syst. Eng. 2017, 59, 69–76. [Google Scholar] [CrossRef]

- Nüesch, R.; Alt, R.; Puschmann, T. Hybrid customer interaction. Bus. Inf. Syst. Eng. 2015, 57, 73–78. [Google Scholar] [CrossRef]

- Martínez-Plumed, F.; Gómez, E.; Hernández-Orallo, J. Futures of artificial intelligence through technology readiness levels. Telemat. Inform. 2021, 58, 101525. [Google Scholar] [CrossRef]

- Veilleux, M.; Sénécal, S.; Demolin, B.; Bouvier, F.; Di Fabio, M.-L.; Coursaris, C.; Léger, P.-M. Visualizing a user’s cognitive and emotional journeys: A fintech case. In Design, User Experience, and Usability. Interaction Design; Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Springer: Cham, Switzerland, 2020; Volume 12200, pp. 549–566. [Google Scholar] [CrossRef]

- Rabhi, F.A.; Mehandjiev, N.; Baghdadi, A. State-of-the-Art in Applying Machine Learning to Electronic Trading. In Enterprise Applications, Markets and Services in the Finance Industry; Lecture Notes in Business Information Processing; Springer: Cham, Switzerland, 2020; Volume 401, pp. 3–20. [Google Scholar] [CrossRef]

- Li, W.; Bao, R.; Harimoto, K.; Chen, D.; Xu, J.; Su, Q. Modeling the stock relation with graph network for overnight stock movement prediction. In Proceedings of the IJCAI International Joint Conference on Artificial Intelligence, Yokohama, Japan, 11–17 July 2020; pp. 4541–4547. [Google Scholar]

- Oprea, S.-V.; Bara, A.; Andreescu, A.I. Two Novel Blockchain-Based Market Settlement Mechanisms Embedded into Smart Contracts for Securely Trading Renewable Energy. IEEE Access 2020, 8, 212548–212556. [Google Scholar] [CrossRef]

- Erosa, V.E. Online Money Flows: Exploring the Nature of the Relation of Technology’s New Creature to Money Supply—A Suggested Conceptual Framework and Research Propositions. Am. J. Ind. Bus. Manag. 2018, 8, 250–305. [Google Scholar] [CrossRef][Green Version]

- Broto Legowo, M.; Subanija, S.; Sorongan, F.A. Role of FinTech mechanism to technological innovation: A conceptual framework. Int. J. Innov. Sci. Res. Technol. 2020, 5, 1–6. [Google Scholar]

- Nasir, A.; Shaukat, K.; Hameed, I.A.; Luo, S.; Alam, T.M.; Iqbal, F. A Bibliometric Analysis of Corona Pandemic in Social Sciences: A Review of Influential Aspects and Conceptual Structure. IEEE Access 2020, 8, 133377–133402. [Google Scholar] [CrossRef]

- Aria, M.; Cuccurullo, C. Bibliometrix: An R-tool for comprehensive science mapping analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Salameh, A.; Bass, J.M. Heterogeneous Tailoring Approach Using the Spotify Model. In ACM International Conference Proceeding Series; Association for Computing Machinery: New York, NY, USA, 2020; pp. 293–298. [Google Scholar]

- Kumarathunga, M.; Calheiros, R.; Ginige, A. Towards Trust Enabled Commodity Market for Farmers with Blockchain Smart Contracts. In ACM International Conference Proceeding Series; Association for Computing Machinery: New York, NY, USA, 2020; pp. 75–82. [Google Scholar]

- Paulson-Luna, M.; Reily, K. The Financial Derivative Ecosystem is Old-Decentralized Ledger Technology is its Fountain of Youth. In ACM International Conference Proceeding Series; Association for Computing Machinery: New York, NY, USA, 2020; pp. 105–112. [Google Scholar]

- Chakravaram, V.; Ratnakaram, S.; Vihari, N.S.; Tatikonda, N. The Role of Technologies on Banking and Insurance Sectors in the Digitalization and Globalization Era—A Select Study. Adv. Intell. Syst. Comput. 2021, 1245, 145–156. [Google Scholar] [CrossRef]

- Nam, G. Bringing the QR Code to Canada: The Rise of AliPay and WeChatPay in Canadian e-Commerce Markets. Adv. Intell. Syst. Comput. 2021, 1290, 622–628. [Google Scholar] [CrossRef]

- Rao, V.; Singh, A.; Rudra, B. Ethereum Blockchain Enabled Secure and Transparent E-Voting. Adv. Intell. Syst. Comput. 2021, 1290, 683–702. [Google Scholar] [CrossRef]

- Xu, L.; Lu, X.; Yang, G.; Shi, B. Identifying fintech innovations with patent data: A combination of textual analysis and machine-learning techniques. In Sustainable Digital Communities; Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Springer: Cham, Switzerland, 2020; Volume 12051, pp. 835–843. [Google Scholar] [CrossRef]

- Mamonov, S. The Role of Information Technology in Fintech Innovation: Insights from the New York City Ecosystem. Responsible Des. Implement. Use Inf. Commun. Technol. 2020, 12066, 313–324. [Google Scholar] [CrossRef]

- Li, L.; Zhao, T.; Xie, Y.; Feng, Y. Interpretable Machine Learning Based on Integration of NLP and Psychology in Peer-to-Peer Lending Risk Evaluation. In Natural Language Processing and Chinese Computing; Zhu, X., Zhang, M., Hong, Y., He, R., Eds.; Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Springer: Cham, Switzerland, 2020; pp. 429–441. [Google Scholar]

- Liu, B.; Wang, M.; Men, J.; Yang, D. Microgrid Trading Game Model Based on Blockchain Technology and Optimized Particle Swarm Algorithm. IEEE Access 2020, 8, 225602–225612. [Google Scholar] [CrossRef]

- Masaud, T.M.; Warner, J.; El-Saadany, E.F. A Blockchain-Enabled Decentralized Energy Trading Mechanism for Islanded Networked Microgrids. IEEE Access 2020, 8, 211291–211302. [Google Scholar] [CrossRef]

- Liao, C.-H.; Lin, H.-E.; Yuan, S.-M. Blockchain-Enabled Integrated Market Platform for Contract Production. IEEE Access 2020, 8, 211007–211027. [Google Scholar] [CrossRef]

- Chen, R.R.; Chen, K. A 2020 perspective on “Information asymmetry in initial coin offerings (ICOs): Investigating the effects of multiple channel signals”. Electron. Commer. Res. Appl. 2020, 40, 100936. [Google Scholar] [CrossRef]

- Jocevski, M.; Ghezzi, A.; Arvidsson, N. Exploring the growth challenge of mobile payment platforms: A business model perspective. Electron. Commer. Res. Appl. 2020, 40, 100908. [Google Scholar] [CrossRef]

- Ferrer-Gomila, J.-L.; Hinarejos, M.F. A 2020 perspective on “A fair contract signing protocol with blockchain support”. Electron. Commer. Res. Appl. 2020, 42, 100981. [Google Scholar] [CrossRef]

- Tritto, A.; He, Y.; Junaedi, V.A. Governing the gold rush into emerging markets: A case study of Indonesia’s regulatory responses to the expansion of Chinese-backed online P2P lending. Financ. Innov. 2020, 6, 51. [Google Scholar] [CrossRef]

- Yan, J.; Yu, W.; Zhao, J.L. How signaling and search costs affect information asymmetry in P2P lending: The economics of big data. Financ. Innov. 2015, 1, 19. [Google Scholar] [CrossRef]

- Li, Y.; Spigt, R.; Swinkels, L. The impact of FinTech startups on incumbent retail banks’ share prices. Financ. Innov. 2017, 3, 26. [Google Scholar] [CrossRef]

- Arner, D.W.; Buckley, R.P.; Zetzsche, D.A.; Veidt, R. Sustainability, FinTech and Financial Inclusion. Eur. Bus. Organ. Law Rev. 2020, 21, 7–35. [Google Scholar] [CrossRef]

- Arner, D.W.; Zetzsche, D.A.; Buckley, R.P.; Barberis, J.N. The Identity Challenge in Finance: From Analogue Identity to Digitized Identification to Digital KYC Utilities. Eur. Bus. Organ. Law Rev. 2019, 20, 55–80. [Google Scholar] [CrossRef]

- Donald, D.C. Smart Precision Finance for Small Businesses Funding. Eur. Bus. Organ. Law Rev. 2020, 21, 199–217. [Google Scholar] [CrossRef]

- Donald, D.C. Hong Kong’s fintech automation: Economic benefits and social risks. In Regulating FinTech in Asia; Perspectives in Law, Business and Innovation; Springer: Singapore, 2020; pp. 31–50. [Google Scholar] [CrossRef]

- Arner, D.W.; Barberis, J.; Buckley, R.P. FinTech, regTech, and the reconceptualization of financial regulation. Northwest J. Int. Law Bus. 2017, 37, 373–415. [Google Scholar]

- Arner, D.W.; Barberis, J.; Buckley, R.P. RegTech: Building a Better Financial System. In Handbook of Blockhain, Digital Finance and Inclusion; Elsevier Inc.: Amsterdam, The Netherlands, 2018. [Google Scholar]

- Buckley, R.P.; Arner, D.W.; Zetzsche, D.A.; Selga, E.K. Techrisk. Singap. J. Leg. Stud. 2020, pp. 35–62. Available online: http://hub.hku.hk/handle/10722/293372 (accessed on 2 September 2021).

- Buckley, R.P.; Arner, D.W.; Zetzsche, D.A.; Weber, R.H. The road to RegTech: The (astonishing) example of the European Union. J. Bank. Regul. 2020, 21, 26–36. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Kauffman, R.J.; Kim, K.; Lee, S.-Y.T.; Hoang, A.-P.; Ren, J. Combining machine-based and econometrics methods for policy analytics insights. Electron. Commer. Res. Appl. 2017, 25, 115–140. [Google Scholar] [CrossRef]

- Kauffman, R.J.; Ma, D. Special issue: Contemporary research on payments and cards in the global fintech revolution. Electron. Commer. Res. Appl. 2015, 14, 261–264. [Google Scholar] [CrossRef]

- Adhami, S.; Giudici, G.; Martinazzi, S. Why do businesses go crypto? An empirical analysis of initial coin offerings. J. Econ. Bus. 2018, 100, 64–75. [Google Scholar] [CrossRef]

- History | BINUS UNIVERSITY. Available online: https://binus.ac.id/history/ (accessed on 2 September 2021).

- Richard; Heryadi, Y.; Lukas; Trisetyarso, A. Leverage from Blockchain in Commodity Exchange: Asset-Backed Token with Ethereum Blockchain Network and Smart Contract. In Smart Trends in Computing and Communications: Proceedings of SmartCom 2020; Zhang, Y.-D., Senjyu, T., So-In, C., Joshi, A., Eds.; Smart Innovation, Systems and Technologies; Springer: Singapore, 2021; pp. 301–309. [Google Scholar]

- Yuniarti, S.; Rasyid, A. Consumer Protection in Lending Fintech Transaction in Indonesia: Opportunities and Challenges. Phys. Conf. Ser. 2020, 1477, 052016. [Google Scholar] [CrossRef]

- Candra, S.; Nuruttarwiyah, F.; Hapsari, I.H. Revisited the Technology Acceptance Model with E-Trust for Peer-to-Peer Lending in Indonesia (Perspective from Fintech Users). Int. J. Technol. 2020, 11, 710–721. [Google Scholar] [CrossRef]

- Abdullah, E.M.E.; Rahman, A.A.; Rahim, R.A. Adoption of financial technology (Fintech) in mutual fund/ unit trust investment among Malaysians: Unified Theory of Acceptance and Use of Technology (UTAUT). Int. J. Eng. Technol. 2018, 7, 110–118. [Google Scholar] [CrossRef]

- Yohanes, K.; Junius, K.; Saputra, Y.; Sari, R.; Lisanti, Y.; Luhukay, D. Unified Theory of Acceptance and Use of Technology (UTAUT) model perspective to enhance user acceptance of fintech application. In Proceedings of the 2020 International Conference on Information Management and Technology, ICIMTech 2020, Bandung, Indonesia, 13–14 August 2020; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2020; pp. 643–648. [Google Scholar]

- Soongsil University. Available online: http://www.ssu.ac.kr/web/eng/home (accessed on 2 September 2021).

- Kim, J.-H.; Jo, S.-I.; Hong, S.-W.; Gim, G.-Y. Small foreign currency remittance based on block chain in Korea and Vietnam. Asia Life Sci. 2019, pp. 57–67. Available online: https://scholarworks.bwise.kr/ssu/handle/2018.sw.ssu/34793 (accessed on 2 September 2021).

- La, H.J.; Kim, S.D. A machine learning framework for adaptive FinTech security provisioning. J. Internet Technol. 2018, 19, 1545–1553. [Google Scholar] [CrossRef]

- Lee, H.J.; Han, K.S. A study on mobile easy payment service based on fintech to reduce smart divide and income gap. Int. J. Adv. Sci. Technol. 2018, 116, 35–48. [Google Scholar] [CrossRef]

- Tran, T.A.; Han, K.S.; Yun, S.Y. Factors influencing the intention to use mobile payment service using fintech systems: Focused on Vietnam. Asia Life Sci. 2018, pp. 1731–1747. Available online: https://scholarworks.bwise.kr/ssu/handle/2018.sw.ssu/34383 (accessed on 2 September 2021).

- Lee, S. Evaluation of mobile application in user’s perspective: Case of P2P lending apps in FinTech industry. KSII Trans. Internet Inf. Syst. 2017, 11, 1105–1115. [Google Scholar] [CrossRef]

- Asmarani, S.C.; Wijaya, C. Effects of fintech on stock return: Evidence from retail banks listed in Indonesia stock exchange. J. Asian Financ. Econ. Bus. 2020, 7, 95–104. [Google Scholar] [CrossRef]

- Yulianita Gitaharie, B.; Abbas, Y.; Dewi, M.K.; Handayani, D. Research on Firm Financial Performance and Consumer Behavior; Nova Science Publishers, Inc.: Hauppauge, NY, USA, 2020. [Google Scholar]

- Saputra, A.D.; Burnia, I.J.; Shihab, M.R.; Anggraini, R.S.A.; Purnomo, P.H.; Azzahro, F. Empowering Women Through Peer to Peer Lending: Case Study of Amartha.com. In Proceedings of the 2019 International Conference on Information Management and Technology, ICIMTech 2019, Jakarta/Bali, Indonesia, 19–20 August 2019; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2019; pp. 618–622. [Google Scholar]

- Nasir, A.; Shaukat, K.; Khan, K.I.; Hameed, I.A.; Alam, T.M.; Luo, S. What is core and what future holds for blockchain technologies and cryptocurrencies: A bibliometric analysis. IEEE Access 2021, 9, 989–1004. [Google Scholar] [CrossRef]

- Michaels, L.; Homer, M. Regulation and Supervision in a Digital and Inclusive World. In Handbook of Blockhain, Digital Finance and Inclusion; Elsevier Inc.: Amsterdam, The Netherlands, 2018. [Google Scholar]

- Birch, D.G.W.; Parulava, S. Ambient Accountability: Shared Ledger Technology and Radical Transparency for Next Generation Digital Financial Services. In Handbook of Blockhain, Digital Finance and Inclusion; Elsevier Inc.: Amsterdam, The Netherlands, 2018. [Google Scholar]

- Ebenhoch, P. Blockchain Compliance. Jusletter IT. 2018. Available online: https://jusletter-it.weblaw.ch/en/issues/2018/IRIS/blockchain-complianc_04fc310f86.html__ONCE&login=false (accessed on 2 September 2021).

- Tsai, C.-H.; Peng, K.-J. The FinTech Revolution and Financial Regulation: The Case of Online Supply-Chain Financing. Asian J. Law Soc. 2017, 4, 109–132. [Google Scholar] [CrossRef]

- Fan, P.S. Singapore Approach to Develop and Regulate FinTech. In Handbook of Blockhain, Digital Finance and Inclusion; Elsevier Inc.: Amsterdam, The Netherlands, 2018. [Google Scholar]

- Fenwick, M.; Vermeulen, E.P.M.; Corrales, M. Business and regulatory responses to artificial intelligence: Dynamic regulation, innovation ecosystems and the strategic management of disruptive technology. In Robotics, AI and the Future of Law; Perspectives in Law, Business and Innovation; Springer: Singapore, 2018; pp. 81–103. [Google Scholar] [CrossRef]

- Fenwick, M.; Kaal, W.A.; Vermeulen, E.P.M. Regulation tomorrow: Strategies for regulating new technologies. In Transnational Commercial and Consumer Law; Perspectives in Law, Business and Innovation; Springer: Singapore, 2018; pp. 153–174. [Google Scholar] [CrossRef]

- Gerlach, J.M.; Rugilo, D. The predicament of fintechs in the environment of traditional banking sector regulation—An analysis of regulatory sandboxes as a possible solution. Credit Cap. Mark. 2019, 52, 323–373. [Google Scholar] [CrossRef]

- Sangwan, V.; Harshita; Prakash, P.; Singh, S. Financial technology: A review of extant literature. Stud. Econ. Financ. 2020, 37, 71–88. [Google Scholar] [CrossRef]

- Makarov, V.O.; Davydova, M.L. On the concept of regulatory sandboxes. In “Smart Technologies” for Society, State and Economy. ISC 2020; Lecture Notes in Networks and Systems; Springer: Cham, Switzerland, 2021; pp. 1014–1020. [Google Scholar]

- Liao, F. Does china need the regulatory sandbox? A preliminary analysis of its desirability as an appropriate mechanism for regulating fintech in China. In Regulating FinTech in Asia; Perspectives in Law, Businsess and Innovation; Springer: Singapore, 2020; pp. 81–95. [Google Scholar] [CrossRef]

- Le, T.N.-L.; Abakah, E.J.A.; Tiwari, A.K. Time and frequency domain connectedness and spill-over among fintech, green bonds and cryptocurrencies in the age of the fourth industrial revolution. Technol. Forecast. Soc. Chang. 2021, 162, 120382. [Google Scholar] [CrossRef]

- Petrov, N.A. Main Trends in the Market of Electronic Financial Services in Russia. In Economic Systems in the New Era: Stable Systems in an Unstable World. IES 2020; Ashmarina, S.I., Horak, J., Vrbka, J., Suler, P., Eds.; Lecture Notes in Networks and Systems; Springer: Cham, Switzerland, 2021; pp. 708–712. [Google Scholar]

- Teeluck, R.; Durjan, S.; Bassoo, V. Blockchain technology and emerging communications applications. In Security and Privacy Applications for Smart City Development; Studies in Systems, Decision and Control; Springer: Cham, Switzerland, 2021; pp. 207–256. [Google Scholar]

- Mbodji, F.N.; Mendy, G.; Mbacke, A.B.; Ouya, S. Proof of concept of blockchain integration in P2P lending for developing countries. In Infrastructure and e-Services for Developing Countries. AFRICOMM 2019; Zitouni, R., Agueh, M., Houngue, P., Soude, H., Eds.; Lecture Notes of the Institute for Computer Sciences, Social-Informatics and Telecommunications Engineering; Springer: Cham, Switzerland, 2020; pp. 59–70. [Google Scholar]

- Hu, Z.; Du, Y.; Rao, C.; Goh, M. Delegated Proof of Reputation Consensus Mechanism for Blockchain-Enabled Distributed Carbon Emission Trading System. IEEE Access 2020, 8, 214932–214944. [Google Scholar] [CrossRef]

- De Oliveira, A.D.C.M.; Pinto, P.F.A.; Colcher, S. Stocks Clustering Based on Textual Embeddings for Price Forecasting. In Intelligent Systems. BRACIS 2020; Cerri, R., Prati, R.C., Eds.; Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Springer: Cham, Switzerland, 2020; pp. 665–678. [Google Scholar]

- Abe, M.; Nakagawa, K. Deep Learning for Multi-factor Models in Regional and Global Stock Markets. In New Frontiers in Artificial Intelligence. JSAI-isAI 2019; Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Springer: Cham, Switzerland, 2020; Volume 12331, pp. 87–102. [Google Scholar] [CrossRef]

- Nabipour, M.; Nayyeri, P.; Jabani, H.; Shahab, S.; Mosavi, A. Predicting Stock Market Trends Using Machine Learning and Deep Learning Algorithms Via Continuous and Binary Data; A Comparative Analysis. IEEE Access 2020, 8, 150199–150212. [Google Scholar] [CrossRef]

- Chen, Y.; Liu, K.; Xie, Y.; Hu, M. Financial Trading Strategy System Based on Machine Learning. Math. Probl. Eng. 2020, 2020, 3589198. [Google Scholar] [CrossRef]

- Obthong, M.; Tantisantiwong, N.; Jeamwatthanachai, W.; Wills, G. A survey on machine learning for stock price prediction: Algorithms and techniques. In Proceedings of the FEMIB 2020—2nd International Conference on Finance, Economics, Management and IT Business, Prague, Czech Republic, 5–6 May 2020; SciTePress: Prague, Czech Republic, 2020; pp. 63–71. [Google Scholar]

- Lozano-Medina, J.I.; Hervert-Escobar, L.; Hernandez-Gress, N. Risk profiles of financial service portfolio for women segment using machine learning algorithms. In Computational Science—ICCS 2020. ICCS 2020; Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Springer: Cham, Switzerland, 2020; Volume 12143, pp. 561–574. [Google Scholar] [CrossRef]

- Rozi, M.F.; Sucahyo, Y.G.; Gandhi, A.; Ruldeviyani, Y. Appraising Personal Data Protection in Startup Companies in Financial Technology: A Case Study of ABC Corp. In ACM International Conference Proceeding Series; Association for Computing Machinery: New York, NY, USA, 2020; pp. 9–14. [Google Scholar]

- Jiang, H.; Zhang, J. Discovering systemic risks of China’s Listed Banks by CoVaR approach in the digital economy era. Mathematics 2020, 8, 180. [Google Scholar] [CrossRef]

- Li, M.; Hu, D.; Lal, C.; Conti, M.; Zhang, Z. Blockchain-Enabled Secure Energy Trading with Verifiable Fairness in Industrial Internet of Things. IEEE Trans. Ind. Inform. 2020, 16, 6564–6574. [Google Scholar] [CrossRef]

- Yao, S.; Li, J.; Liu, D.; Wang, T.; Liu, S.; Shao, H.; Abdelzaher, T. Deep compressive offloading: Speeding up neural network inference by trading edge computation for network latency. In SenSys 2020—Proceedings of the 2020 18th ACM Conference on Embedded Networked Sensor Systems; Association for Computing Machinery, Inc.: New York, NY, USA, 2020; pp. 476–488. [Google Scholar]

- Cui, Y.; Pan, B.; Sun, Y. A Survey of Privacy-Preserving Techniques for Blockchain. In Artificial Intelligence and Security. ICAIS 2019; Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Springer: Cham, Switzerland, 2019; Volume 11635, pp. 225–234. [Google Scholar] [CrossRef]

- Gayathri, S.; Mohana, R.S. Optical Character Recognition in Banking Sectors Using Convolutional Neural Network. In Proceedings of the 3rd International Conference on I-SMAC IoT in Social, Mobile, Analytics and Cloud, I-SMAC 2019, Palladam, India, 12–14 December 2019; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2019; pp. 753–756. [Google Scholar]

- Hasegawa, T. Toward the mobility-oriented heterogeneous transport system based on new ICT environments—Understanding from a viewpoint of the systems innovation theory. IATSS Res. 2018, 42, 40–48. [Google Scholar] [CrossRef]

- Garrido, G.M.; Miehle, D.; Luckow, A.; Matthes, F. A Blockchain-based Flexibility Market Platform for EV Fleets. In Proceedings of the Clemson University Power Systems Conference, PSC 2020, Clemson, SC, USA, 10–13 March 2020; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2020. [Google Scholar]

- Gupta, S.; Sharma, H.; Hassija, V.; Saxena, V. BitCom: A Commerce Model on Blockchain. In Proceedings of the 6th International Conference on Signal Processing and Communication, ICSC 2020, Noida, India, 5–7 March 2020; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2020; pp. 64–70. [Google Scholar]

- He, T.; Gui, X.; Zhang, Z.; Zhou, D.; Hu, Z.; Chen, J.; Li, W. Blockchain-Based Distributed Energy Trading Scheme. In Proceedings of the 2020 Asia Energy and Electrical Engineering Symposium, AEEES 2020, Chengdu, China, 29–31 May 2020; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2020; pp. 919–924. [Google Scholar]

- Ozili, P.K. Contesting digital finance for the poor. Digit. Policy Regul. Gov. 2020, 22, 135–151. [Google Scholar] [CrossRef]

- Liu, J.; Li, X.; Wang, S. What have we learnt from 10 years of fintech research? A scientometric analysis. Technol. Forecast. Soc. Change 2020, 155, 120022. [Google Scholar] [CrossRef]

- Ravikumar, S.; Saraf, P. Prediction of stock prices using machine learning (regression, classification) Algorithms. In Proceedings of the 2020 International Conference for Emerging Technology, INCET 2020, Belgaum, India, 5–7 June 2020; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2020. [Google Scholar]

- Ampomah, E.K.; Qin, Z.; Nyame, G. Evaluation of tree-based ensemble machine learning models in predicting stock price direction of movement. Information 2020, 11, 332. [Google Scholar] [CrossRef]

- Harahap, L.A.; Lipikorn, R.; Kitamoto, A. Nikkei Stock Market Price Index Prediction Using Machine Learning. J. Phys. Conf. Ser. 2020, 1566, 012043. [Google Scholar] [CrossRef]

- Ismail, M.S.; Md Noorani, M.S.; Ismail, M.; Abdul Razak, F.; Alias, M.A. Predicting next day direction of stock price movement using machine learning methods with persistent homology: Evidence from Kuala Lumpur Stock Exchange. Appl. Soft Comput. J. 2020, 93, 106422. [Google Scholar] [CrossRef]

- Saifan, R.; Sharif, K.; Abu-Ghazaleh, M.; Abdel-Majeed, M. Investigating algorithmic stock market trading using ensemble machine learning methods. Informatica 2020, 44, 311–325. [Google Scholar] [CrossRef]

- Zhang, M. Artificial Intelligence and Application in Finance. In ACM International Conference Proceeding Series; Association for Computing Machinery: New York, NY, USA, 2020; pp. 317–322. [Google Scholar]

- Chang, J.; Ding, Y.; Tu, W. FollowAKOInvestor: Using Machine Learning to Hear Voices from All Kinds of Investors. In Proceedings of the International Conference on Tools with Artificial Intelligence, ICTAI, Baltimore, MD, USA, 9–11 November 2020; IEEE Computer Society: Washington, DC, USA, 2020; pp. 875–882. [Google Scholar]

- Kulshrestha, N.; Srivastava, V.K. Synthesizing Technical Analysis, Fundamental Analysis Artificial Intelligence—An Applied Approach to Portfolio Optimisation Performance Analysis of Stock Prices in India. In Proceedings of the ICRITO 2020—IEEE 8th International Conference on Reliability, Infocom Technologies and Optimization (Trends and Future Directions), Noida, India, 4–5 June 2020; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2020; pp. 1185–1188. [Google Scholar]

- Wong, K.Y.; Wong, R.K. Big data quality prediction on banking applications: Extended abstract. In Proceedings of the 2020 IEEE 7th International Conference on Data Science and Advanced Analytics, DSAA 2020, Sydney, NSW, Australia, 6–9 October 2020; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2020; pp. 791–792. [Google Scholar]

- Ceaparu, C. IT solutions for big data processing and analysis in the finance and banking sectors. Adv. Intell. Syst. Comput. 2021, 1243, 133–144. [Google Scholar] [CrossRef]

- Zhang, Q.; Liu, F. Research on channel model and price dispersion of E-commerce market based on blockchain technology. Wirel. Commun. Mob. Comput. 2020, 2020, 8824754. [Google Scholar] [CrossRef]

- Delger, O.; Tseveenbayar, M.; Namsrai, E.; Tsendsuren, G. Current State of E-Commerce in Mongolia: Payment and Delivery. In Advances in Intelligent Information Hiding and Multimedia Signal Processing; Pan, J.-S., Li, J., Tsai, P.-W., Jain, L., Eds.; Smart Innovation, Systems and Technologies; Springer: Singapore, 2020; pp. 289–297. [Google Scholar]

- Almuhammadi, A. An overview of mobile payments, fintech, and digital wallet in Saudi Arabia. In Proceedings of the 7th International Conference on Computing for Sustainable Global Development, INDIACom 2020, New Delhi, India, 12–14 March 2020; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2020; pp. 271–278. [Google Scholar]

- Kennedyd, S.I.; Guo, Y.; Fu, Z.; Liu, K. The Cashless Society Has Arrived: How Mobile Phone Payment Dominance Emerged in China. Int. J. Electron. Gov. Res. 2020, 16, 94–112. [Google Scholar] [CrossRef]

- Li, M.; Shao, S.; Ye, Q.; Xu, G.; Huang, G.Q. Blockchain-enabled logistics finance execution platform for capital-constrained E-commerce retail. Robot. Comput. Integr. Manuf. 2020, 65, 101962. [Google Scholar] [CrossRef]

- Ferrer-Gomila, J.-L.; Francisca Hinarejos, M.; Isern-Deyà, A.-P. A fair contract signing protocol with blockchain support. Electron. Commer. Res. Appl. 2019, 36, 100869. [Google Scholar] [CrossRef]

- Najdawi, A.; Chabani, Z.; Said, R.; Starkova, O. Analysing the Adoption of E-Payment Technologies in UAE Based on Demographic Variables. In Proceedings of the 2019 International Conference on Digitization: Landscaping Artificial Intelligence, ICD 2019, Sharjah, United Arab Emirates, 18–19 November 2019; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2019; pp. 244–248. [Google Scholar]

- Ding, D.; Chong, G.; Chuen, D.L.K.; Cheng, T.L. From Ant Financial to Alibaba’s Rural Taobao Strategy—How Fintech Is Transforming Social Inclusion. In Handbook of Blockhain, Digital Finance and Inclusion; Elsevier Inc.: Amsterdam, The Netherlands, 2018. [Google Scholar]

- Dula, C.; Chuen, D.L.K. Reshaping the Financial Order. In Handbook of Blockhain, Digital Finance and Inclusion; Elsevier Inc.: Amsterdam, The Netherlands, 2018. [Google Scholar]

- Jin, B.H.; Li, Y.M.; Li, Z.W. Study on crowdfunding patterns and factors in different phases. In Proceedings of the Americas Conference on Information Systems 2018: Digital Disruption, AMCIS 2018, New Orleans, LA, USA, 16–18 August 2018; Association for Information Systems: Atlanta, GA, USA, 2018. [Google Scholar]

- Stasik, A.; Wilczyńska, E. How do we study crowdfunding? An overview of methods and introduction to new research agenda. J. Manag. Bus. Adm. Cent. Eur. 2018, 26, 49–78. [Google Scholar] [CrossRef]

- Zetzsche, D.; Preiner, C. Cross-Border Crowdfunding: Towards a Single Crowdlending and Crowdinvesting Market for Europe. Eur. Bus. Organ. Law Rev. 2018, 19, 217–251. [Google Scholar] [CrossRef]

- Ferreira, F.; Pereira, L. Success Factors in a Reward and Equity Based Crowdfunding Campaign. In Proceedings of the 2018 IEEE International Conference on Engineering, Technology and Innovation, ICE/ITMC 2018, Stuttgart, Germany, 17–20 June 2018; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2018. [Google Scholar]

- Pokrovskaya, M. Risk mitigation based on innovative solutions. In Proceedings of the International Astronautical Congress, IAC. International Astronautical Federation, IAF (2019), Washington, DC, USA, 21–25 October 2019. [Google Scholar]

- Miraz, M.H.; Donald, D.C. Application of Blockchain in Booking and Registration Systems of Securities Exchanges. In Proceedings of the 2018 International Conference on Computing, Electronics and Communications Engineering, iCCECE 2018, Southend, UK, 16–17 August 2018; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2019; pp. 35–40. [Google Scholar]

- Nasir, F.; Saeedi, M. ‘RegTech’ as a Solution for Compliance Challenge: A Review Article. J. Adv. Res. Dyn. Control Syst. 2019, 11, 912–919. [Google Scholar] [CrossRef]

- Goul, M. Services computing and regtech. In Proceedings of the 2019 IEEE World Congress on Services, SERVICES 2019, Milan, Italy, 8–13 July 2019; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2019; pp. 219–223. [Google Scholar]

- Singh, H.; Jain, G.; Munjal, A.; Rakesh, S. Blockchain technology in corporate governance: Disrupting chain reaction or not? Corp. Gov. 2019, 20, 67–86. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. The Cross-Section of Expected Stock Returns. J. Financ. 1992, 47, 427–465. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. A five-factor asset pricing model. J. Financ. Econ. 2014, 116, 1–22. [Google Scholar] [CrossRef]

- Nasir, A.; Khan, K.I.; Mata, M.N.; Mata, P.N.; Martins, J.N. Optimisation of Time-Varying Asset Pricing Models with Penetration of Value at Risk and Expected Shortfall. Mathematics 2021, 9, 394. [Google Scholar] [CrossRef]

- Shaukat, K.; Iqbal, F.; Alam, T.M.; Aujla, G.K.; Devnath, L.; Khan, A.G.; Iqbal, R.; Shahzadi, I.; Rubab, A. The impact of artificial intelligence and robotics on the future employment opportunities. Trends Comput. Sci. Inf. Technol. 2020, 5, 50–54. [Google Scholar]

- Shaukat, K.; Alam, T.M.; Hameed, I.A.; Luo, S.; Li, J.; Aujla, G.K.; Iqbal, F. A comprehensive dataset for bibliometric analysis of SARS and coronavirus impact on social sciences. Data Brief 2020, 33, 106520. [Google Scholar] [CrossRef] [PubMed]

- Alam, T.M.; Mushtaq, M.; Shaukat, K.; Hameed, I.A.; Sarwar, M.U.; Luo, S. A Novel Method for Performance Measurement of Public Educational Institutions Using Machine Learning Models. Appl. Sci. 2021, 11, 9296. [Google Scholar] [CrossRef]

- Shaukat, K.; Luo, S.; Varadharajan, V.; Hameed, I.A.; Xu, M. A survey on machine learning techniques for cyber security in the last decade. IEEE Access 2020, 8, 222310–222354. [Google Scholar] [CrossRef]

- Shaukat, K.; Luo, S.; Varadharajan, V.; Hameed, I.A.; Chen, S.; Liu, D.; Li, J. Performance comparison and current challenges of using machine learning techniques in cybersecurity. Energies 2020, 13, 2509. [Google Scholar] [CrossRef]

- Shaukat, K.; Luo, S.; Chen, S.; Liu, D. Cyber Threat Detection Using Machine Learning Techniques: A Performance Evaluation Perspective. In Proceedings of the 2020 International Conference on Cyber Warfare and Security (ICCWS), Islamabad, Pakistan, 20–21 October 2020; pp. 1–6. [Google Scholar]

- Shaukat, K.; Masood, N.; Khushi, M. A Novel Approach to Data Extraction on Hyperlinked Webpages. Appl. Sci. 2019, 9, 5102. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).