Evaluation of Investments in Wind Energy Projects, under Uncertainty. State of the Art Review

Abstract

1. Introduction

2. Strategies to Beat Public Opposition

3. Methodology

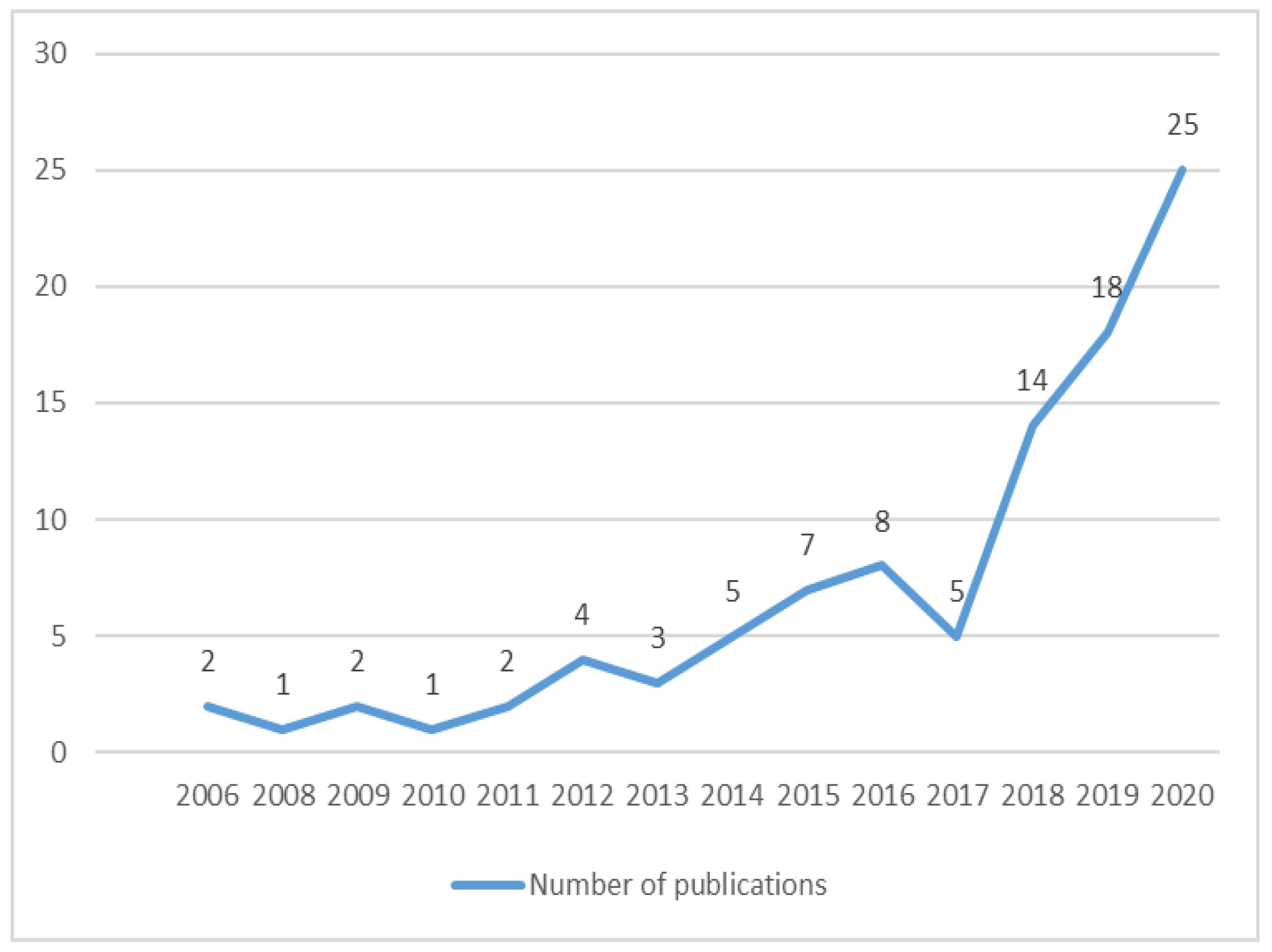

4. Results Analysis

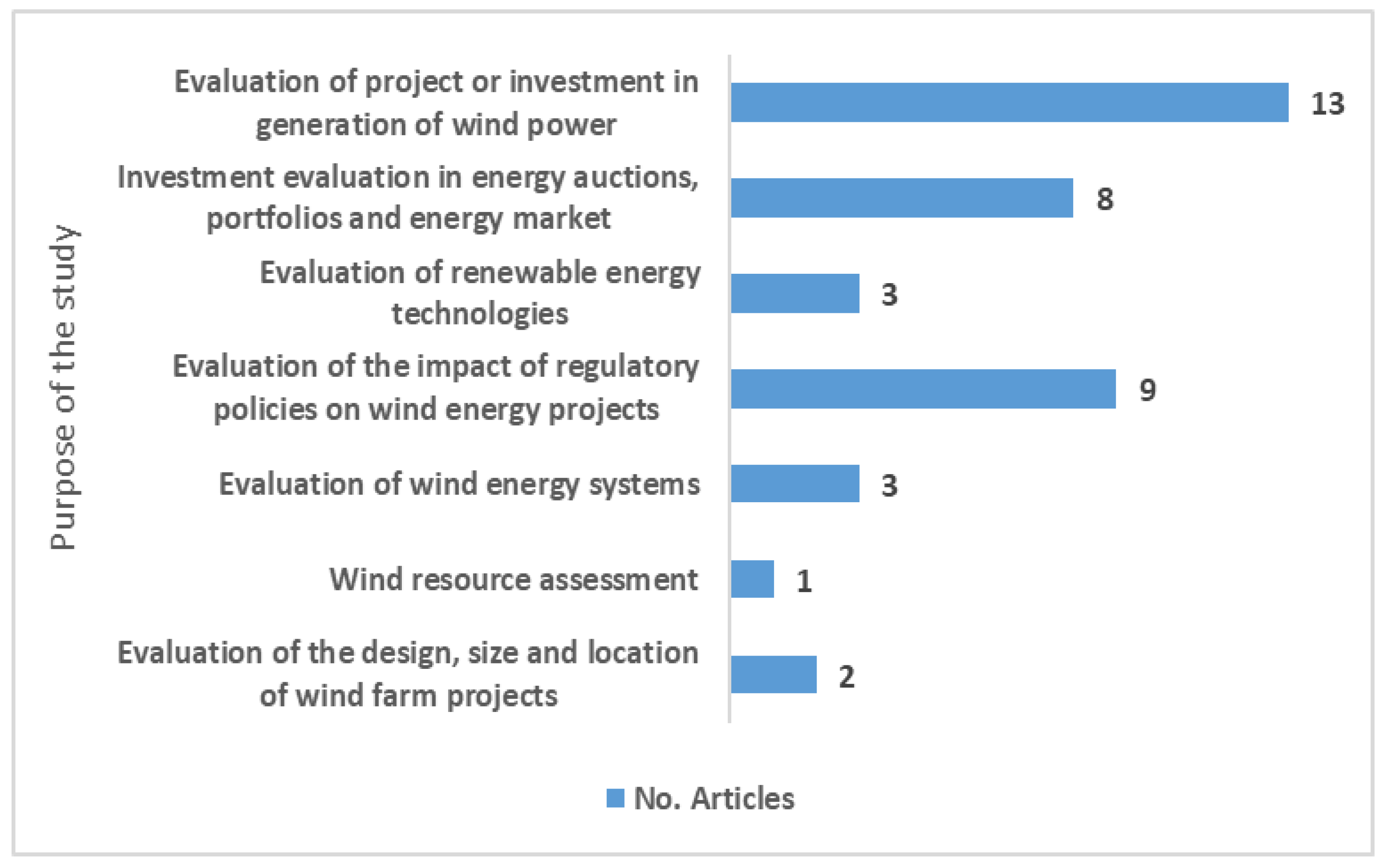

4.1. Studies with a Real Options Approach, Based on the Ends and Purposes of Its Application

4.1.1. Analysis by Group According to Their Application Purposes

Evaluation of Wind Energy Generation Project or Investment

Evaluation of Energy Auctions, Portfolios, and Energy Market Investments

Evaluation of Renewable Energy Technologies

Evaluation of the Impact of Regulatory Policies on Wind Energy Projects

Evaluation of Wind Energy Systems

Evaluation of Wind Resources

Evaluation of Design, Size, and Location of Wind Farm Projects

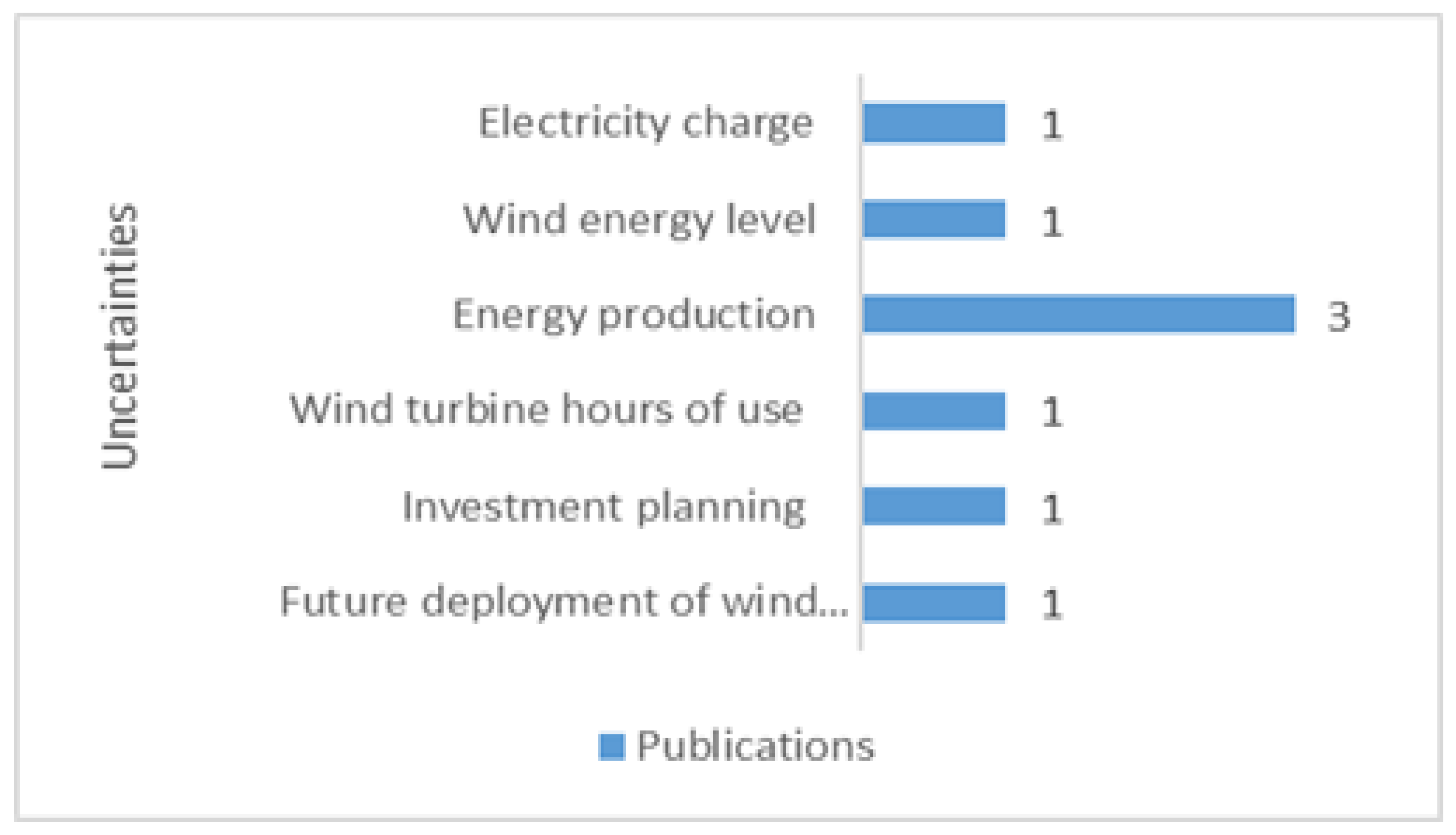

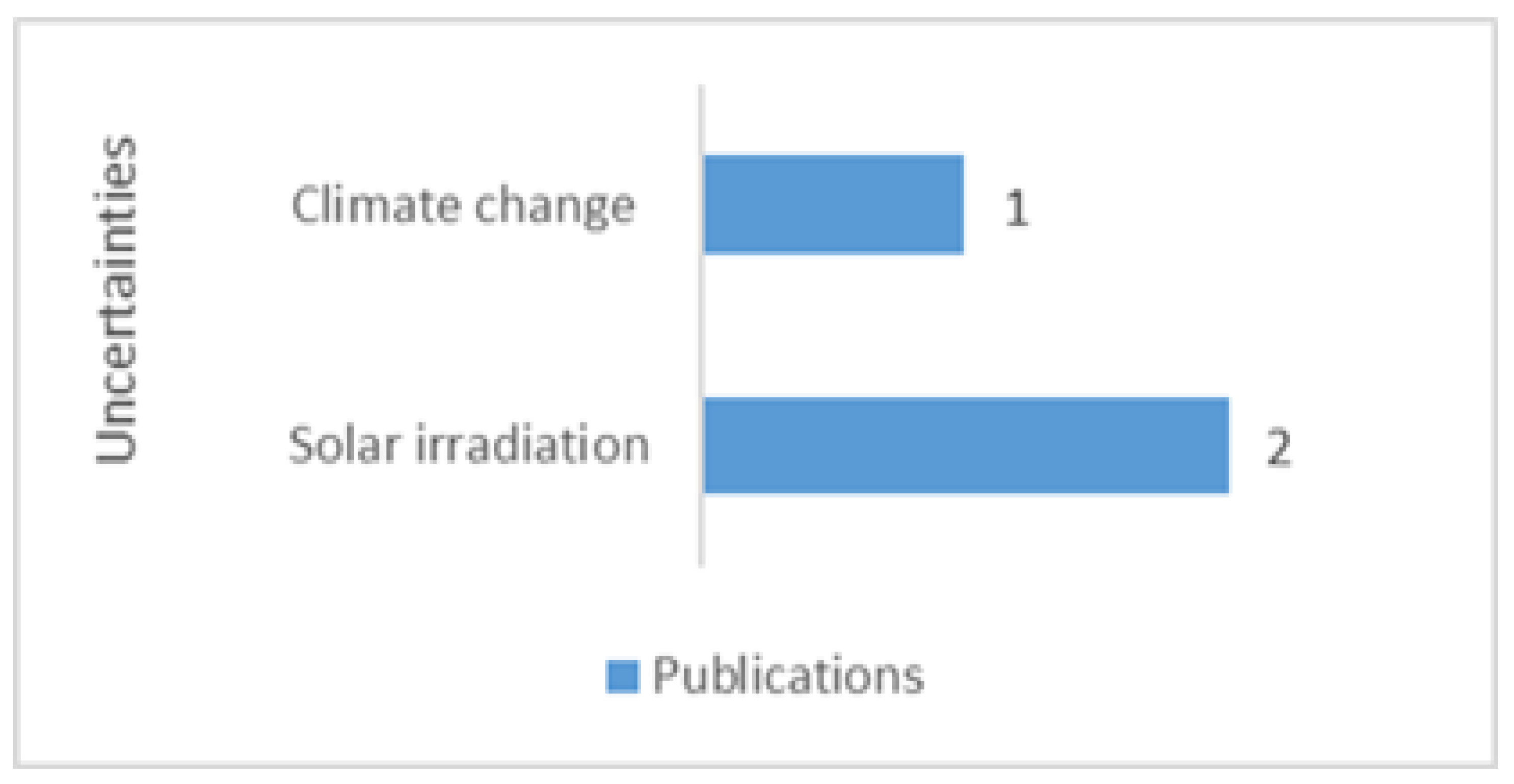

4.2. Types of Uncertainties Explored in Publications with a Real Options Approach

- Power generation contains the uncertainties that affect the process of generating wind energy, such as electricity charge, wind energy level, energy production, wind turbine hours of use, investment planning, and future deployment of wind energy. Energy production prevails, with three applications, as shown in Figure 4.

- 2.

- Environment refers to the uncertainties present in environmental conditions necessary for the development of projects such as climate change and solar irradiation. Solar irradiation stands out, with two applications, as shown in Figure 5.

- 3.

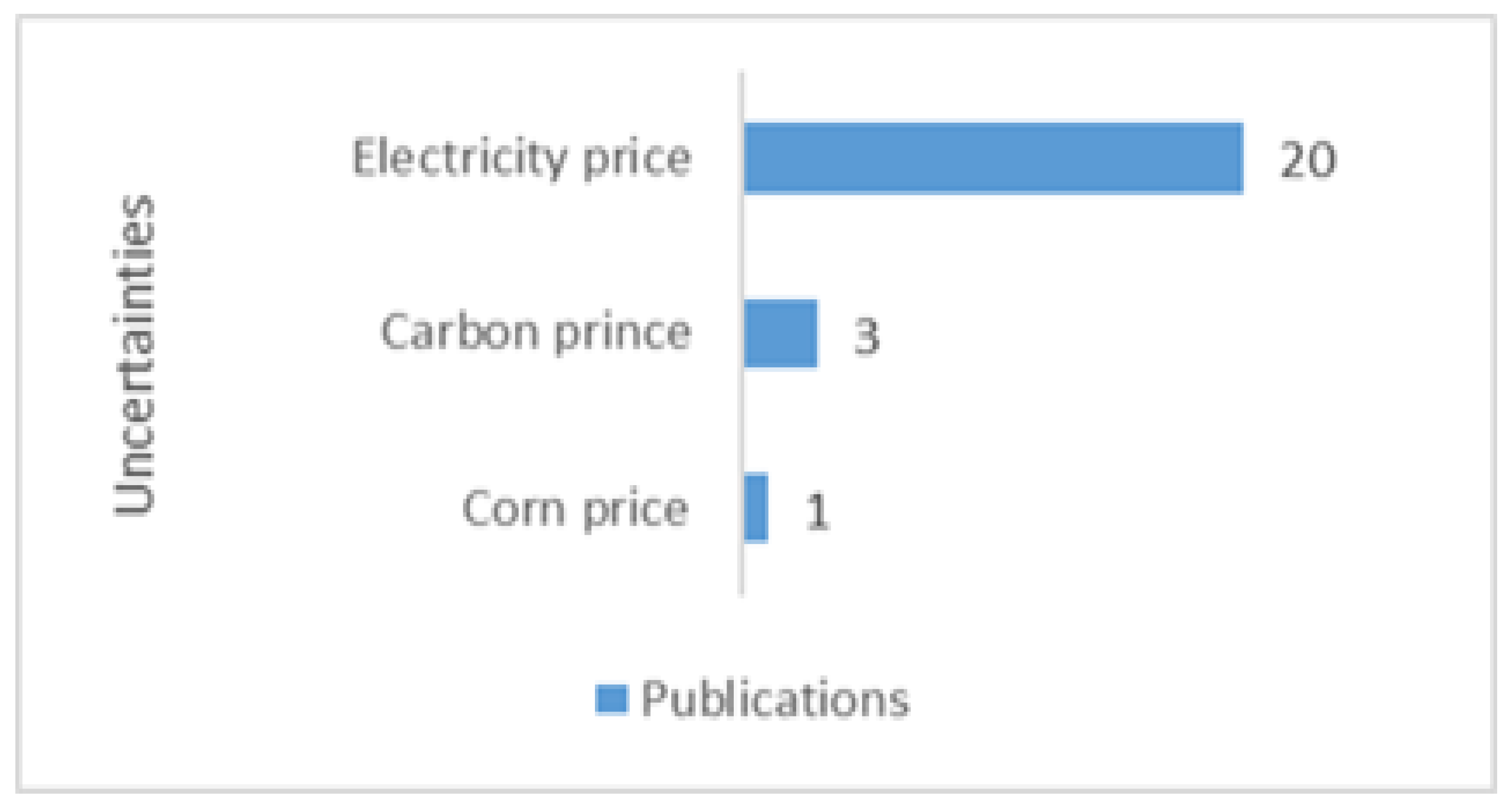

- Energy price considers the uncertainties generated by price fluctuations in the market, in response to the behavior of energy demand and supply, including among others the price of electricity, coal price, and the price of corn. The price of electricity is the source of uncertainty most studied by researchers, being considered in 20 (65.5%) publications, as shown in Figure 6.

- 4.

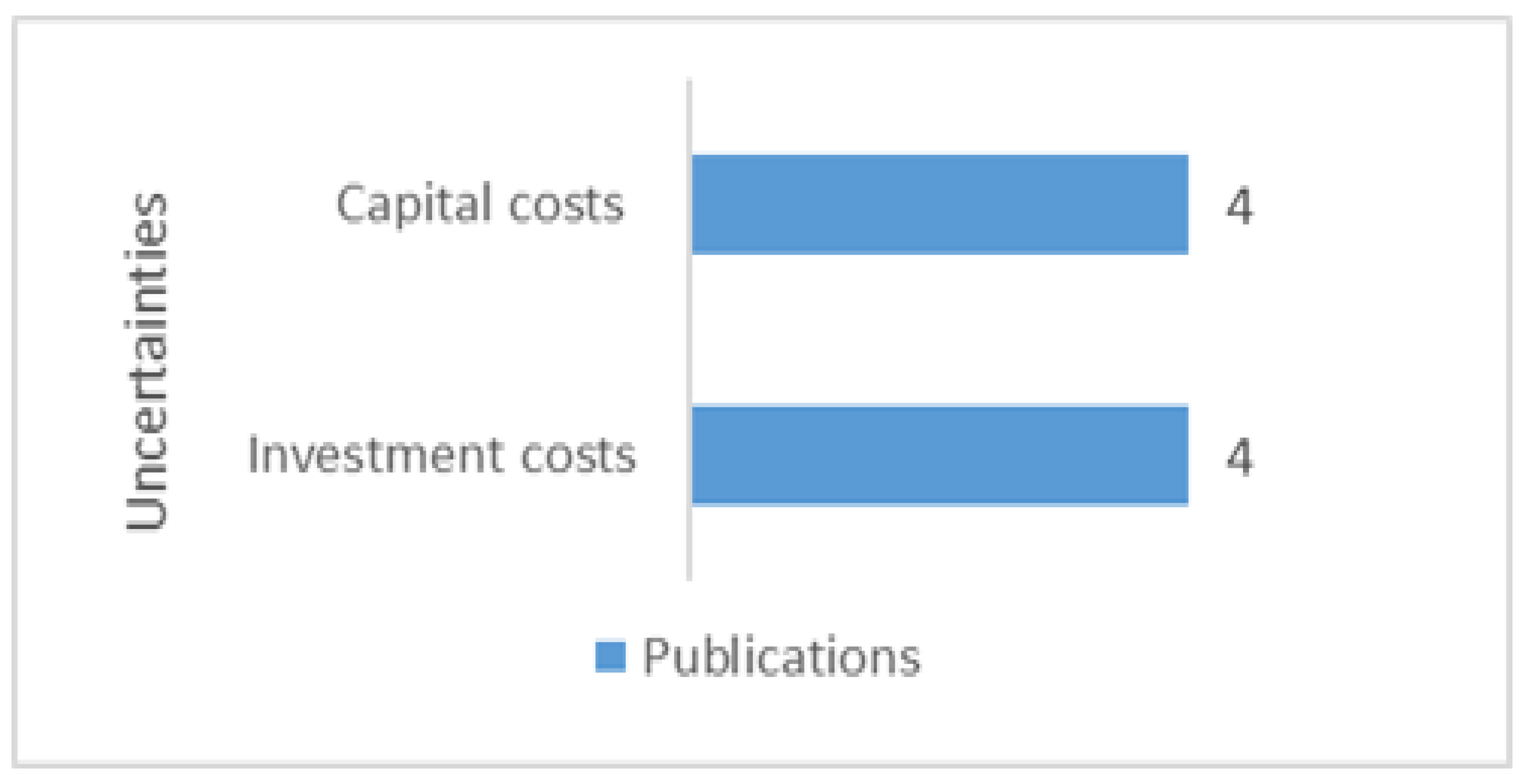

- Costs studies were integrated that analyze the uncertainties caused by the incidence of the behavior of costs in the profitability of the investment, whether they are capital costs or investment costs. Both costs were studied in four publications, as shown in Figure 7.

- 5.

- Regulatory policies include the uncertainties caused by changes implemented in the policies for the generation of wind energy, among which are production certificates, changes in asset tariff, credit policy, government policies, and feed-in tariffs-subsidies. The rates of food and subsidies have been the most studied by researchers, being considered in five publications, as reflected in Figure 8.

- 6.

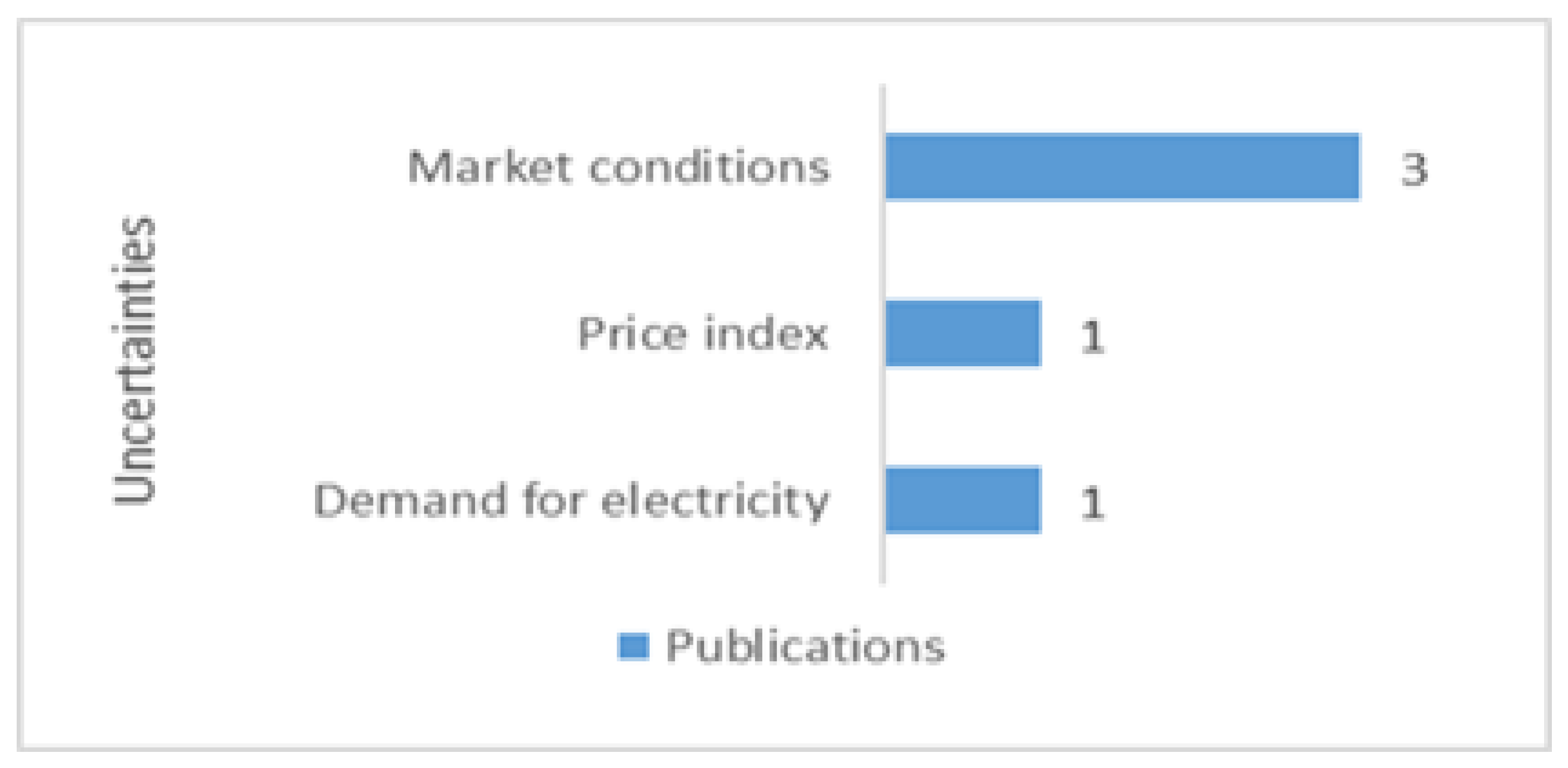

- Market relates sources of uncertainties other than prices and costs which affect their market behavior, such as market conditions, price indices, and electricity demand. Market conditions prevail, with three applications, as shown in Figure 9.

- 7.

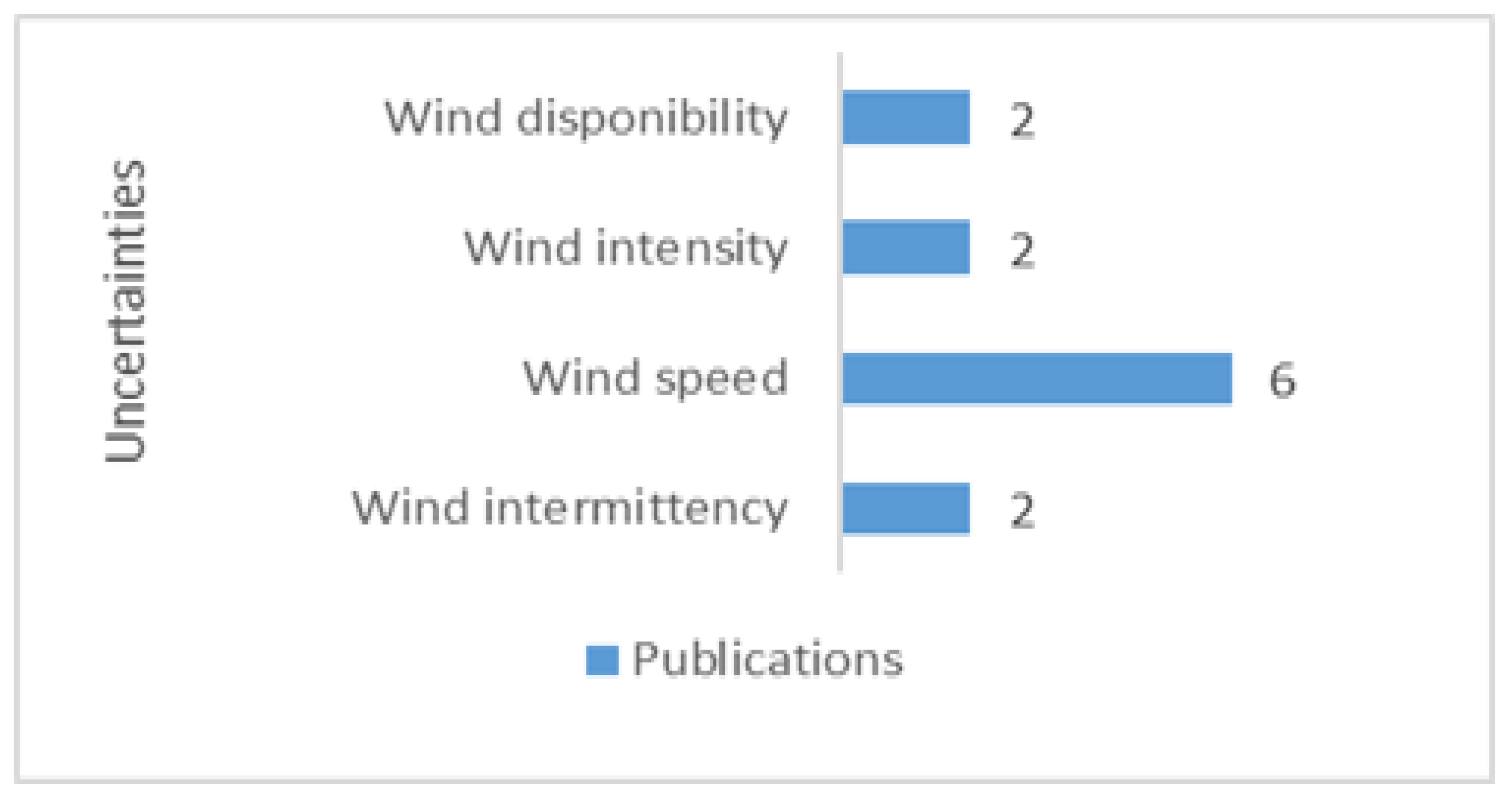

- Wind conditions addresses uncertainties caused by variability of the wind characteristics in the generation of wind energy, such as the availability of wind, its intensity, its speed, and its intermittency. After the price of electricity, wind conditions are the source of uncertainty that generates the greatest interest in the studies analyzed, especially wind speed, as it has a great impact on the generation of wind energy. Wind speed was studied in six publications, as shown in Figure 10.

- 8.

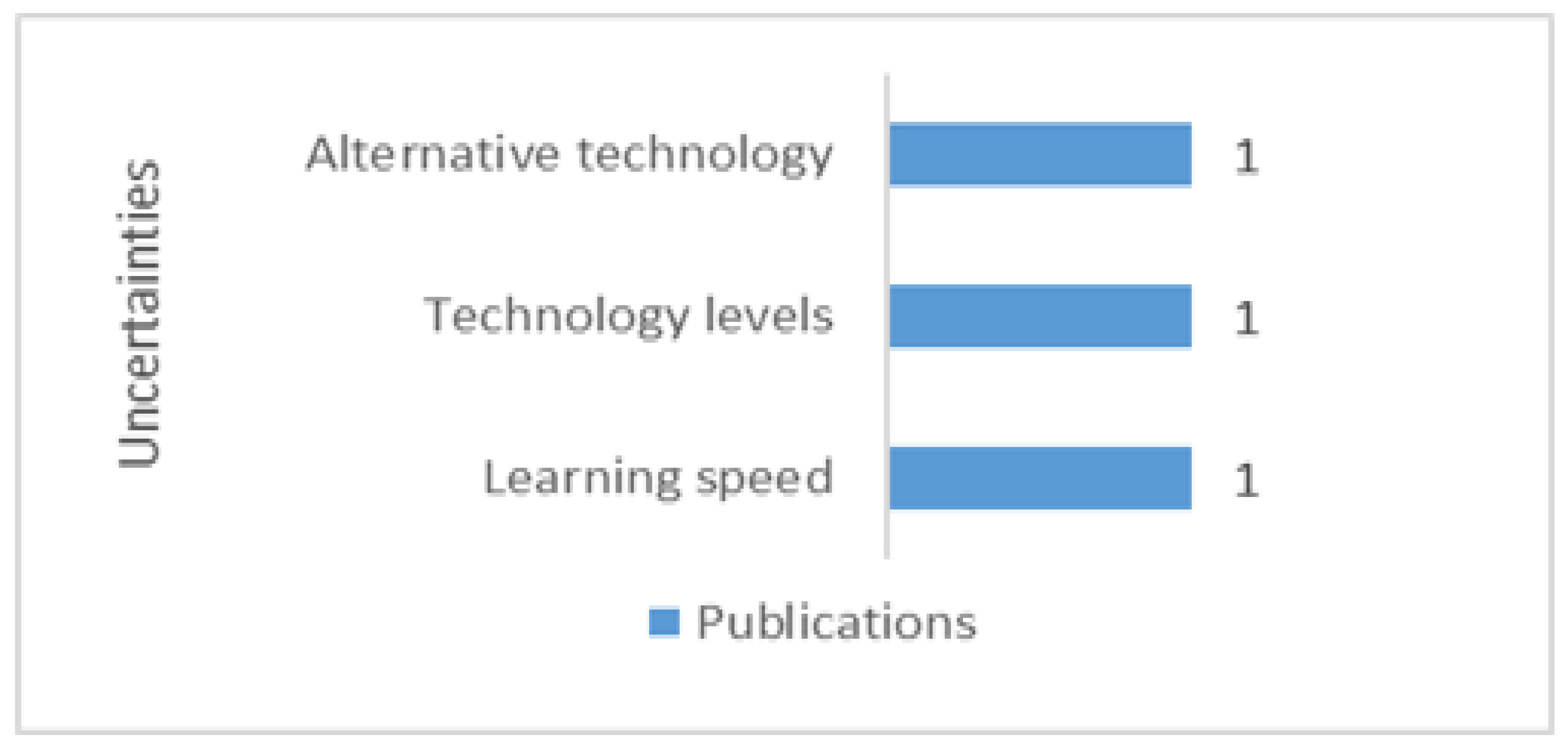

- Technological progress focuses on the analysis of the uncertainties caused by the generation and use of knowledge (R&D) that affect the productivity, such as alternative technology, technology levels, and learning speed. All sources of uncertainties have only been studied in one investigation, as shown in Figure 11.

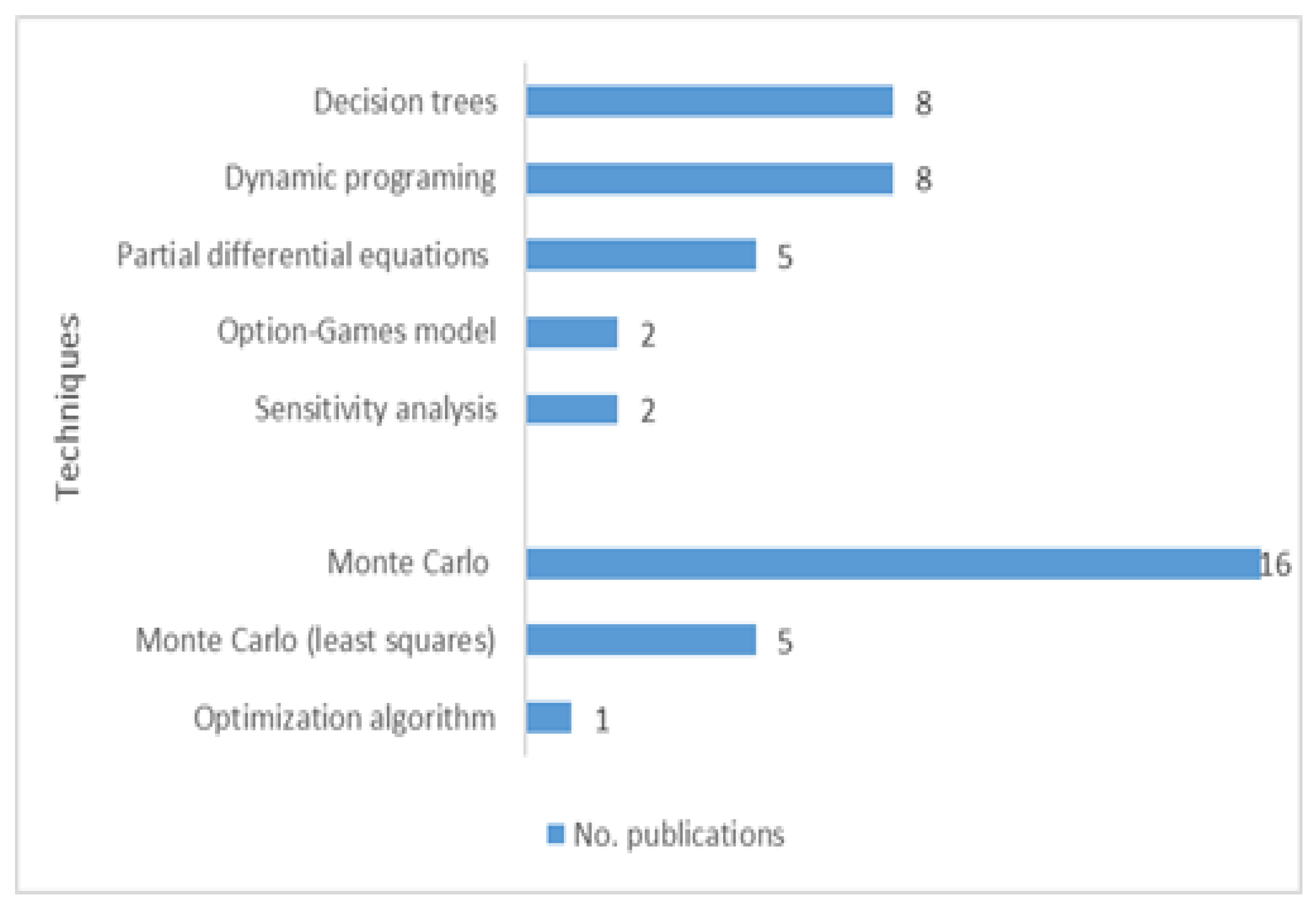

4.3. Evaluation of Real Options and Modeling of Uncertainties

- (1)

- Decision trees: initially introduced by Cox, Ross, and Rubinstein (1979) as a binomial model to value American-type options. It was later adapted to simulate the evolution of uncertainty in discrete scenarios of multiple interrelated options [132]. It allows modeling the evolution of the price of the underlying asset under uncertainty in discrete scenarios, assuming that the underlying asset follows a multiplicative binomial process [133].

- (2)

- Dynamic programming: an optimization method by way of dividing the problem into superimposed subproblems and optimal substructures, especially when the subproblems are not independent. It is based on the principle of optimum as enunciated by Bellman in 1957: “In an optimal decision sequence, every subsequence must also be optimal”, and it allows combining different types of real options with various possible scenarios [134].

- (3)

- Partial Differential Equations: a set of equations, initially used for the valuation of financial options [135,136], later adapted to evaluate specific real options under fixed assumptions [132]. The results of the Black-Scholes model can be obtained from a binomial model for n periods, where n tends to infinity [137].

- (4)

- Option-Games model: a valuation tool that combines the real option approach with game theory, with the aim of quantifying the values of flexibility, allowing for better investment decisions to be taken [138].

- (5)

- Sensitivity analysis: measures the impact that variations in one of the independent variables have on the model [31].

- (1)

- Monte Carlo simulation: a numerical method used to evaluate options when there are no closed formulas such as Black-Scholes [137]. Its purpose is to easily value real options for complex projects, since it does not require the formulation of cash flow through differential equations or trees [139]. It creates a distribution of project values from all given sources of uncertainty [140]. An advantage of this method is that it offers the distribution of the volatility factor, which is key in evaluating the sensitivity of the value of the real options of a project [141].

- (2)

- Least squares Monte Carlo: combines the Monte Carlo simulation with least squares regression, which helps reduce the number of scenarios while still producing an accurate assessment [142]. At any time, the holder of an American option can optimally compare the reward of exercising that option immediately, with the expected reward of not exercising it yet [143].

- (3)

- Optimization algorithms: includes traditional algorithms, such as gradient-based methods and quadratic programming, evolutionary algorithms, heuristic or metaheuristic algorithms, and various hybrid techniques. Optimization problems tend to be non-linear with complex objectives [144].

- (1)

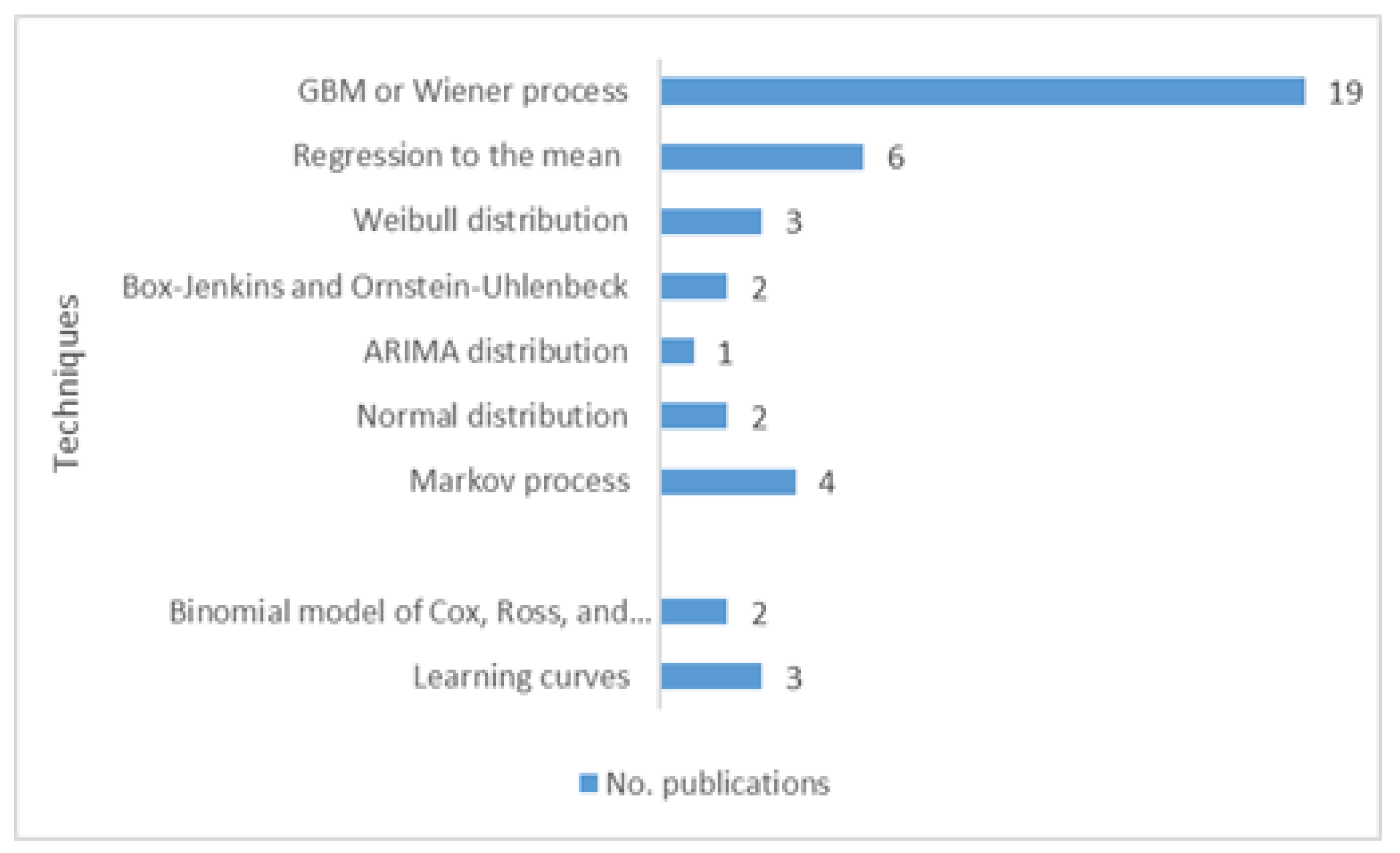

- Geometric Brownian Motion, used in 61.3% (19) of the studies, is a stochastic process in continuous time, generated from a transformation of a standard Wiener process, with the particularity of not allowing asset prices to take negative values [145]. Geometric Brownian Motion appears to be better suited to long-term energy-related investments [146].

- (2)

- Reversal of the mean indicates that values, such as prices, may move away from the mean or intrinsic value, but, over time, they will eventually return to those mean values [147].

- (3)

- The Weibull distribution is the probability function that best describes the wind speed path, thanks to the orthogonal composition of two correlated Gaussian functions. The Weibull density function consists of two parameters: one refers to the maximum speed and the other indicates the degree of dispersion of the samples (Muñoz et al., 2009).

- (4)

- The Box-Jenkins and Ornstein-Uhlenbeck model is the basis of all modern time series analysis theory, and consists of the analysis of probabilistic or stochastic properties of economic time series where the endogenous variable (Yt) is explained by past values or lags of itself and by stochastic error terms [148].

- (5)

- The ARIMA distribution is an econometric methodology based on dynamic models using time series data, made up of three components: the autoregressive (AR), the integration (I), and the moving average (MA), represented by the parameters p, d, and q, respectively. The model includes the values of the series, prediction of errors, and a random term [149].

- (6)

- The normal distribution is a mathematical model that allows determining probabilities of occurrence for different values of the variable. The graph of the normal distribution has the shape of a bell, and for this reason it is also known as the Gaussian bell, whose central elements are the mean and the variance [150].

- (7)

- Markov chains are discrete stochastic processes used to study the evolution of certain systems in repeated trials, in which the probability of an event occurring depends only on the immediately preceding event. Transition probabilities are used to describe the way the system passes to the next state.

4.4. Public Opposition under Real Options

5. Discussion

6. Conclusions

- Within a framework of Real Options, investigate the decision of communities to invest in wind energy [72].

- Delve into how the application of the real options approach has the potential to increase the expected value of the investment in wind energy, by addressing the impact of uncertainty in the evaluation of the wind resource and contemplating the flexibility within the design and in the project planning [113].

- Deepen the impact of the uncertainty caused in the future development of regulatory policies for the generation of renewable energy [114].

- Investigate the impact of additional, sequential, or staged investment options at the optimal investment time and size.

- Develop studies that consider the real options approach to evaluate the impact of public opposition on investment in renewable energy projects.

- Study on how to create institutional capital for wind energy and other renewable resources. This implies that more participatory planning practices and inclusive politics of the communities are needed [153].

- Research aimed at establishing the determinants for indigenous and Afro-descendant communities within their uses and custom to accept the location of renewable energy projects [155].

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Harjanne, A.; Korhonen, J.M. Abandoning the concept of renewable energy. Energy Policy 2019, 127, 330–340. [Google Scholar] [CrossRef]

- Mentis, D.; Howells, M.; Rogner, H.; Korkovelos, A.; Arderne, C. Lighting the World: The first application of an open source, spatial electrification tool (OnSSET) on Sub-Saharan Africa Lighting the World: The first application of an open source, spatial electrification tool (OnSSET) on Sub-Saharan Africa. Environ. Res. Lett. 2017, 12, 085003. [Google Scholar] [CrossRef]

- Lehne, K.-H. Informe Especial: Emisiones de Gases de Efecto Invernadero en la UE: Se Notifican Correctamente, Pero es Necesario Tener un Mayor Conocimiento de las Futuras Reducciones. 2019. Available online: https://www.eca.europa.eu/es/Pages/DocItem.aspx?did=51834 (accessed on 12 July 2021).

- GWEC. Global Wind Report|Gwec; Globle Wind Energy Counc.: Brussels, Belgium, 2021; p. 75. [Google Scholar]

- Ministerio de Minas y Energía. La Transición Energética de Colombia; Ministerio de Minas y Energía: Bogotá, Colombia, 2020.

- Kordmahaleh, A.A.; Naghashzadegan, M.; Javaherdeh, K.; Khoshgoftar, M. Design of a 25 MWe Solar Thermal Power Plant in Iran with Using Parabolic Trough Collectors and a Two-Tank Molten Salt Storage System. Int. J. Photoenergy 2017, 2017. [Google Scholar] [CrossRef]

- Deutch, J. Decoupling Economic Growth and Carbon Emissions. Joule 2017, 1, 3–5. [Google Scholar] [CrossRef]

- Zafar, R.; Mahmood, A.; Razzaq, S.; Ali, W.; Naeem, U.; Shehzad, K. Prosumer based energy management and sharing in smart grid. Renew. Sustain. Energy Rev. 2018, 82, 1675–1684. [Google Scholar] [CrossRef]

- Fernandes, B.; Cunha, J.; Ferreira, P. The use of real options approach in energy sector investments. Renew. Sustain. Energy Rev. 2011, 15, 4491–4497. [Google Scholar] [CrossRef]

- Burke, M.J.; Stephens, J.C. Energy Research & Social Science Political power and renewable energy futures: A critical review. Energy Res. Soc. Sci. 2018, 35, 78–93. [Google Scholar]

- IRENA. Renewable Capacity Statistics 2021. 2021. Available online: https://www.irena.org/publications/2021/March/Renewable-Capacity-Statistics-2021 (accessed on 25 July 2021).

- Bolinger, M.; Wiser, R. Wind power price trends in the United States: Struggling to remain competitive in the face of strong growth. Energy Policy 2009, 37, 1061–1071. [Google Scholar] [CrossRef]

- Mengal, A.; Uqaili, M.A.; Harijan, K.; Memon, A.G. Competitiveness of wind power with the conventional thermal power plants using oil and natural gas as fuel in Pakistan. Energy Procedia 2014, 52, 59–67. [Google Scholar] [CrossRef]

- Astariz, S.; Iglesias, G. Enhancing wave energy competitiveness through co-located wind and wave energy farms. A review on the shadow effect. Energies 2015, 8, 7344–7366. [Google Scholar] [CrossRef]

- Albadi, M.H.; El-Saadany, E.F. Overview of wind power intermittency impacts on power systems. Electr. Power Syst. Res. 2010, 80, 627–632. [Google Scholar] [CrossRef]

- Notton, G.; Nivet, M.L.; Voyant, C.; Paoli, C.; Darras, C.; Motte, F.; Fouilloy, A. Intermittent and stochastic character of renewable energy sources: Consequences, cost of intermittence and benefit of forecasting. Renew. Sustain. Energy Rev. 2018, 87, 96–105. [Google Scholar] [CrossRef]

- Baagøe-Engels, V.; Stentoft, J. Operations and maintenance issues in the offshore wind energy sector. Int. J. Energy Sect. Manag. 2016, 10, 245–265. [Google Scholar] [CrossRef]

- Peeters, C.; Guillaume, P.; Helsen, J. Vibration-based bearing fault detection for operations and maintenance cost reduction in wind energy. Renew. Energy 2018, 116, 74–87. [Google Scholar] [CrossRef]

- Ayodele, T.R.; Jimoh, A.; Munda, J.L.; Agee, J.T. Challenges of grid integration of wind power on power system grid integrity: A review. Int. J. Renew. Energy Res. 2012, 2, 618–626. [Google Scholar]

- Yuan, X.; Cheng, S.; Wen, J. Prospects analysis of energy storage application in grid integration of large-scale wind power. Dianli Xitong Zidonghua Autom. Electr. Power Syst. 2013, 37, 14–18. [Google Scholar]

- Saidur, R.; Islam, M.R.; Rahim, N.A.; Solangi, K.H. A review on global wind energy policy. Renew. Sustain. Energy Rev. 2010, 14, 1744–1762. [Google Scholar] [CrossRef]

- Leung, D.Y.C.; Yang, Y. Wind energy development and its environmental impact: A review. Renew. Sustain. Energy Rev. 2012, 16, 1031–1039. [Google Scholar] [CrossRef]

- Saidur, R.; Rahim, N.A.; Islam, M.R.; Solangi, K.H. Environmental impact of wind energy. Renew. Sustain. Energy Rev. 2011, 15, 2423–2430. [Google Scholar] [CrossRef]

- IREA; IRENA. Future of Wind Deployment, Investment, Technology, Grid Integration and Socio-Economic Aspects. 2019. Available online: https://www.irena.org/-/media/files/irena/agency/publication/2019/oct/irena_future_of_wind_2019.pdf (accessed on 26 July 2021).

- Presidencia de la República de Colombia. Decreto 2164 de 1995. D. Of. 1995, 1995, 12. Available online: https://www.mininterior.gov.co/la-institucion/normatividad/decreto-2164-de-1995 (accessed on 19 June 2021).

- Congreso de Colombia. Ley 21 de 1991: Convenio 169. Convenio sobre Pueblos Indígenas y Tribales en Países Independientes. D. Of. 1991, p. 14. Available online: http://www.urosario.edu.co/jurisprudencia/catedra-viva-intercultural/Documentos/ley_21_91.pdf (accessed on 8 June 2021).

- Aitken, M.; Haggett, C.; Rudolph, D. Wind farms community engagement: Good practice review. Edinb. Clim. 2014, 1–103. Available online: https://core.ac.uk/download/pdf/84000113.pdf (accessed on 15 June 2021).

- Ledec, G.C.; Rapp, K.W.; Aiello, R.G. Greening the Wind; World Bank Publications: Washington, DC, USA, 2011. [Google Scholar] [CrossRef]

- Munday, M.; Bristow, G.; Cowell, R. Wind farms in rural areas: How far do community benefits from wind farms represent a local economic development opportunity? J. Rural Stud. 2011, 27, 1–12. [Google Scholar] [CrossRef]

- Hernando, A.; Razmilic, S.; Jiménez, S.; Katz, R.; Martínez, D. Puntos de referencia: [Editorial]. Rev. ADM 2017, 282–284. [Google Scholar]

- Kinias, I.; Tsakalos, I.; Konstantopoulos, N. Investment evaluation in renewable projects under uncertainty, using real options analysis: The case of wind power industry. Investig. Manag. Financ. Innov. 2020, 14, 96–103. [Google Scholar] [CrossRef][Green Version]

- Detemple, J.; Kitapbayev, Y. The value of green energy under regulation uncertainty. Energy Econ. 2020, 89, 104807. [Google Scholar] [CrossRef]

- Krömer, S. Model risk regarding monthly wind energy production for the valuation of a wind farm investment. Int. J. Energy Sect. Manag. 2019, 13, 862–884. [Google Scholar] [CrossRef]

- Nasrolahpour, E.; Zareipour, H.; Rosehart, W.D. Battery investment by a strategic wind producer: A scenario-based decomposition approach. Electr. Power Syst. Res. 2020, 182, 106255. [Google Scholar] [CrossRef]

- Oh, E.; Son, S. Theoretical energy storage system sizing method and performance analysis for wind power forecast uncertainty management. Renew. Energy 2020, 155, 1060–1069. [Google Scholar] [CrossRef]

- Ioannou, A.; Angus, A.; Brennan, F. Stochastic fi nancial appraisal of offshore wind farms. Renew. Energy 2020, 145, 1176–1191. [Google Scholar] [CrossRef]

- Mehrjerdi, H.; Hemmati, R. Wind-hydrogen storage in distribution network expansion planning considering investment deferral and uncertainty. Sustain. Energy Technol. Assess. 2020, 39, 100687. [Google Scholar] [CrossRef]

- Liu, R.; He, L.; Liang, X.; Yang, X.; Xia, Y. Is there any difference in the impact of economic policy uncertainty on the investment of traditional and renewable energy enterprises?—A comparative study based on regulatory effects. J. Clean. Prod. 2020, 255, 120102. [Google Scholar] [CrossRef]

- Chowdhury, N.; Pilo, F.; Pisano, G. Optimal Energy Storage System Positioning and Sizing with Robust Optimization. Energies 2020, 13, 512. [Google Scholar] [CrossRef]

- Tan, J.; Wu, Q.; Hu, Q.; Wei, W.; Liu, F.; Eb, C.H.P. Adaptive robust energy and reserve co-optimization of integrated electricity and heating system considering wind uncertainty. Appl. Energy 2020, 260, 114230. [Google Scholar] [CrossRef]

- Zhan, S.; Hou, P.; Enevoldsen, P.; Yang, G.; Zhu, J.; Eichman, J.; Jacobson, M.Z. Electrical Power and Energy Systems Co-optimized trading of hybrid wind power plant with retired EV batteries in energy and reserve markets under uncertainties. Electr. Power Energy Syst. 2020, 117, 105631. [Google Scholar] [CrossRef]

- Verleysen, K.; Coppitters, D.; Parente, A.; De Paepe, W.; Contino, F. How can power-to-ammonia be robust ? Optimization of an ammonia synthesis plant powered by a wind turbine considering operational uncertainties. Fuel 2020, 266, 117049. [Google Scholar] [CrossRef]

- Yang, G.; Jiang, Y.; You, S. Planning and operation of a hydrogen supply chain network based on the off-grid wind-hydrogen coupling system. Int. J. Hydrogen Energy 2020, 45, 20721–20739. [Google Scholar] [CrossRef]

- Al, A.; Sirjani, R.; Daneshvar, S. New hybrid probabilistic optimisation algorithm for optimal allocation of energy storage systems considering correlated wind farms. J. Energy Storage 2020, 29, 101335. [Google Scholar]

- Hübler, C.; Piel, J.; Stetter, C.; Gebhardt, C.G.; Breitner, M.H.; Rolfes, R. In fl uence of structural design variations on economic viability of offshore wind turbines: An interdisciplinary analysis. Renew. Energy 2020, 145, 1348–1360. [Google Scholar] [CrossRef]

- Ge, L.; Zhang, S.; Bai, X.; Yan, J.; Shi, C.; Wei, T. Optimal Capacity Allocation of Energy Storage System considering Uncertainty of Load and Wind Generation. Math. Probl. Eng. 2020, 2020, 2609674. [Google Scholar] [CrossRef]

- Yang, H.; Yu, Q.; Liu, J.; Jia, Y.; Yang, G.; Ackom, E.; Dong, Z.Y. Optimal Wind-Solar Capacity Allocation with Coordination of Dynamic Regulation of Hydropower and Energy Intensive Controllable Load. IEEE Access 2020, 8, 110129–110139. [Google Scholar] [CrossRef]

- Kong, L.; Li, Z.; Liang, L.; Xia, Y.; Xie, J. A capacity-investment model of wind power with uncertain supply-price under high penetration rate. J. Clean. Prod. 2020, 178, 917–926. [Google Scholar] [CrossRef]

- Keck, R.; Sondell, N. Validation of uncertainty reduction by using multiple transfer locations for WRF—CFD coupling in numerical wind energy assessments. Wind Energy Sci. 2020, 5, 997–1005. [Google Scholar] [CrossRef]

- Stetter, C.; Piel, J.; Hamann, J.F.H.; Breitner, M.H. Competitive and risk-adequate auction bids for onshore wind projects in Germany. Energy Econ. 2020, 90, 104849. [Google Scholar] [CrossRef]

- Abdalla, O.H.; Smieee, L.; Adma, M.A.A.; Ahmed, A.S. Two-stage robust generation expansion planning considering long- and short-term uncertainties of high share wind energy. Electr. Power Syst. Res. 2020, 189, 106618. [Google Scholar] [CrossRef]

- Henckes, P.; Frank, C.; Küchler, N.; Peter, J.; Wagner, J. Uncertainty estimation of investment planning models under high shares of renewables using reanalysis data. Energy 2020, 208, 118207. [Google Scholar] [CrossRef]

- ANiromandfam, A.; Movahedi, A.; Zarezadeh, E. Virtual energy storage modeling based on electricity customers’ behavior to maximize wind profit. J. Energy Storage 2020, 32, 101811. [Google Scholar] [CrossRef]

- Zhou, J.; Wu, Y.; Dong, H.; Tao, Y.; Xu, C. Proposal and comprehensive analysis of gas-wind-photovoltaic- hydrogen integrated energy system considering multi-participant interest preference. J. Clean. Prod. 2020, 265, 121679. [Google Scholar] [CrossRef]

- Zhao, X.; Yao, J.; Sun, C.; Pan, W. Impacts of carbon tax and tradable permits on wind power investment in China. Renew. Energy 2019, 135, 1386–1399. [Google Scholar] [CrossRef]

- Maeda, M.; Watts, D. The unnoticed impact of long-term cost information on wind farms’ economic value in the USA—A real option analysis. Appl. Energy 2019, 241, 540–547. [Google Scholar] [CrossRef]

- Vavatsikos, A.P.; Arvanitidou, A.; Petsas, D. Wind farm investments portfolio formation using GIS-based suitability analysis and simulation procedures. J. Environ. Manag. 2019, 252, 109670. [Google Scholar] [CrossRef]

- Askari, M.T.; Zainal, M.; Ab, A.; Tahmasebi, M.; Bolandifar, E. Modeling optimal long-term investment strategies of hybrid wind-thermal companies in restructured power market. J. Mod. Power Syst. Clean Energy 2019, 7, 1267–1279. [Google Scholar] [CrossRef]

- Abdulgalil, M.A.; Khalid, M.; Alismail, F. Optimal Sizing of Battery Energy Storage for a Grid-Connected Microgrid Subjected to Wind Uncertainties. Energies 2019, 12, 2412. [Google Scholar] [CrossRef]

- Junior, P.R.; Fischetti, E.; Araújo, V.G.; Peruchi, R.S.; Aquila, G.; Rocha Luiz, C.; Lacerda, L.S. Wind Power Economic Feasibility under Uncertainty and the Application of ANN in Sensitivity Analysis. Energies 2019, 12, 2281. [Google Scholar] [CrossRef]

- Abdulgalil, M.; Khalid, M.; Alismail, F. Optimizing a Distributed Wind-Storage System Under Critical Uncertainties Using Benders Decomposition. IEEE Access 2019, 7, 77951–77963. [Google Scholar] [CrossRef]

- Li, Y.; Wang, J.; Gu, C.; Liu, J.; Li, Z. Investment optimization of grid-scale energy storage for supporting different wind power utilization levels. J. Mod. Power Syst. Clean Energy 2019, 7, 1721–1734. [Google Scholar] [CrossRef]

- Pizarro-alonso, A.; Ravn, H.; Münster, M. Uncertainties towards a fossil-free system with high integration of wind energy in long-term planning. Appl. Energy 2019, 253, 113528. [Google Scholar] [CrossRef]

- Yan, J.; Zhang, H.; Liu, Y.; Han, S.; Li, L. Uncertainty estimation for wind energy conversion by probabilistic wind turbine power curve modelling. Appl. Energy 2019, 239, 1356–1370. [Google Scholar] [CrossRef]

- Tagliapietra, S.; Zachmann, G.; Fredriksson, G. Estimating the cost of capital for wind energy investments in Turkey. Energy Policy 2019, 131, 295–301. [Google Scholar] [CrossRef]

- Van Thang, V.; Trung, N.H. Evaluating efficiency of renewable energy sources in planning micro-grids considering uncertainties. J. Energy Syst. 2019, 3, 14–25. [Google Scholar] [CrossRef][Green Version]

- Quan, N.; Kim, H.M. Greedy robust wind farm layout optimization with feasibility guarantee feasibility guarantee. Eng. Optim. 2019, 51, 1152–1167. [Google Scholar] [CrossRef]

- Mora, E.B.; Spelling, J.; van der Weijde, A.H.; Pavageau, E.M. The effects of mean wind speed uncertainty on project finance debt sizing for offshore wind farms. Appl. Energy 2019, 252, 113419. [Google Scholar] [CrossRef]

- Fuchs, C.; Marquardt, K.; Kasten, J.; Skau, K. Wind Turbines on German Farms—An Economic Analysis. Energies 2019, 12, 1587. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, L.; Wang, N.; Duan, L.; Zong, Y.; You, S.; Marechal, F.; Yang, Y. Balancing wind-power fluctuation via onsite storage under uncertainty: Power-to-hydrogen-to-power versus lithium battery. Renew. Sustain. Energy Rev. 2019, 116, 109465. [Google Scholar] [CrossRef]

- Ioannou, A.; Angus, A.; Brennan, F. Informing parametric risk control policies for operational uncertainties of o ff shore wind energy assets. Ocean Eng. 2019, 177, 1–11. [Google Scholar] [CrossRef]

- Ribeiro, A.; Finotti, F.; Perobelli, C.; Baumgratz, A. Counterfactual comparisons of investment options for wind power and agricultural production in the United States: Lessons from Northern Ohio. Energy Econ. 2018, 74, 299–309. [Google Scholar]

- Finjord, F.; Hagspiel, V.; Lavrutich, M.; Tangen, M. The impact of Norwegian-Swedish green certificate scheme on investment behavior: A wind energy case study. Energy Policy 2018, 123, 373–389. [Google Scholar] [CrossRef]

- Dalby, P.A.O.; Gillerhaugen, G.R.; Hagspiel, V.; Leth-olsen, T.; Thijssen, J.J.J. Green investment under policy uncertainty and Bayesian learning. Energy 2018, 161, 1262–1281. [Google Scholar] [CrossRef]

- Li, Y.; Wu, M.; Li, Z. A Real Options Analysis for Renewable Energy Investment Decisions under China Carbon Trading Market. Energies 2018, 11, 1817. [Google Scholar] [CrossRef]

- Gazheli, A.; Van Den Bergh, J. Real options analysis of investment in solar vs. wind energy: Diversi fi cation strategies under uncertain prices and costs. Renew. Sustain. Energy Rev. 2018, 82, 2693–2704. [Google Scholar] [CrossRef]

- Romanuke, V. Wind Farm Energy and Costs Optimization Algorithm under Uncertain Parameters of Wind Speed Distribution. Stud. Inform. Control 2018, 27, 155–164. [Google Scholar] [CrossRef]

- Yu, Y.; Wen, X.; Zhao, J.; Xu, Z.; Li, J. Co-Planning of Demand Response and Distributed Generators in an Active Distribution Network. Energies 2018, 11, 354. [Google Scholar] [CrossRef]

- Aaboud, M.; Aad, G.; Abbott, B.; Abeloos, B.; Abidi, S.H.; AbouZeid, O.S.; Abraham, N.L.; Abramowicz, H.; Abreu, H.; Abreu, R.; et al. Search for dark matter and other new phenomena in events with an energetic jet and large missing transverse momentum using the ATLAS detector. J. High Energy Phys. 2018, 2018, 1–53. [Google Scholar] [CrossRef]

- Valinejad, J.; Marzband, M.; Funsho Akorede, M.; DElliott, I.; Godina, R.; Matias, J.C.; Pouresmaeil, E. Long-Term Decision on Wind Investment with Considering Different Load Ranges of Power Plant for Sustainable Electricity Energy Market. Sustainability 2018, 10, 3811. [Google Scholar] [CrossRef]

- Jiang, X.; Nan, G.; Liu, H.; Guo, Z.; Zeng, Q.; Jin, Y. Optimization of Battery Energy Storage System Capacity for Wind Farm with Considering Auxiliary Services Compensation. Appl. Sci. 2018, 8, 1957. [Google Scholar] [CrossRef]

- Deshmukh, R.; Mileva, A.; Wu, G.C. Renewable energy alternatives to mega hydropower: A case study of Inga 3 for Southern Africa. Environ. Res. Lett. 2018, 13, 064020. [Google Scholar] [CrossRef]

- Li, Z.; Wang, C.; Li, B.; Wang, J.; Zhao, P.; Zhu, W.; Yang, M.; Ding, Y. Probability-interval-based optimal planning of integrated energy system with uncertain wind power. IEEE Trans. Ind. Appl. 2018, 56, 4–13. [Google Scholar] [CrossRef]

- Ioannou, A.; Angus, A.; Brennan, F. A lifecycle techno-economic model of offshore wind energy for di ff erent entry and exit instances. Appl. Energy 2018, 221, 406–424. [Google Scholar] [CrossRef]

- Esmaieli, M.; Ahmadian, M. The effect of research and development incentive on wind power investment, a system dynamics approach. Renew. Energy 2018, 126, 765–773. [Google Scholar] [CrossRef]

- Kristiansen, M.; Svendsen, H.G.; Korpas, M.; Fleten, S.-E. Multistage grid investments incorporating uncertainty in offshore wind development. Energy Procedia 2017, 137, 468–476. [Google Scholar] [CrossRef]

- Jannati, J.; Yazdaninejadi, A.; Talavat, V. Simultaneous Planning of Renewable/Non-Renewable Distributed Generation Units and Energy Storage Systems in Distribution Networks. Trans. Electr. Electron. Mater. 2017, 18, 111–118. [Google Scholar] [CrossRef][Green Version]

- Chen, L.; Macdonald, E. Wind Farm Layout Sensitivity Analysis and Probabilistic Model of Landowner Decisions. J. Energy Resour. Technol. 2017, 139, 031202. [Google Scholar] [CrossRef]

- Hamoudi, H.; Maule, I. Photovoltaic and wind cost decrease estimation: Implications for investment analysis. Energy 2017, 137, 1054–1065. [Google Scholar]

- Aquila, G.; Rotela, P.; de Oliveira, E.; de Queiroz, A. Wind power feasibility analysis under uncertainty in the Brazilian electricity market. Energy Econ. 2017, 65, 127–136. [Google Scholar] [CrossRef]

- Eryilmaz, D.; Homans, F.R. How does uncertainty in renewable energy policy affect decisions to invest in wind energy? Electr. J. 2016, 29, 64–71. [Google Scholar] [CrossRef]

- Kitzing, L.; Juul, N.; Drud, M.; Krogh, T. A real options approach to analyse wind energy investments under different support schemes. Appl. Energy 2016, 188, 83–96. [Google Scholar] [CrossRef]

- Pazouki, S.; Haghifam, M. Optimal planning and scheduling of energy hub in presence of wind, storage and demand response under uncertainty. Int. J. Electr. Power Energy Syst. 2016, 80, 219–239. [Google Scholar] [CrossRef]

- Lamadrid, A.J.; Maneevitjit, S.; Mount, T.D. The Economic Value of Transmission Lines and the Implications for Planning Models. Energy Econ. 2016, 57, 1–15. [Google Scholar] [CrossRef]

- Caralis, G.; Chaviaropoulos, P.; Ruiz, V.; Diakoulaki, D.; Kotroni, V.; Lagouvardos, K.; Gao, Z. Lessons learnt from the evaluation of the feed-in tariff scheme for offshore wind farms in Greece using a Monte Carlo approach. J. Wind Eng. Ind. Aerodyn. 2016, 157, 63–75. [Google Scholar] [CrossRef]

- Werner, L.; Scholtens, B. Firm Type, Feed-in Tariff, and Wind Energy Investment in Germany: An Investigation of Decision Making Factors of Energy Producers Regarding Investing in Wind Energy Capacity. J. Ind. Ecol. 2016, 21, 402–411. [Google Scholar] [CrossRef]

- Sjoerd, A.; Van Den Broek, M.; Özdemir, Ö.; Koutstaal, P.; Faaij, A. Business case uncertainty of power plants in future energy systems with wind power. Energy Policy 2016, 89, 237–256. [Google Scholar]

- Xiao, Y.; Wang, X.; Wang, X.; Wu, Z. Trading wind power with barrier option. Appl. Energy 2016, 182, 232–242. [Google Scholar] [CrossRef]

- Díaz, G.; Gómez-aleixandre, J.; Coto, J. Dynamic evaluation of the levelized cost of wind power generation. Energy Convers. Manag. 2015, 101, 721–729. [Google Scholar] [CrossRef]

- Díaz, G.; Moreno, B.; Coto, J.; Gómez-aleixandre, J. Valuation of wind power distributed generation by using Longstaff—Schwartz option pricing method. Appl. Energy 2015, 145, 223–233. [Google Scholar] [CrossRef]

- Fang, X.; Li, F.; Wei, Y.; Azim, R. Reactive Power Planning under High Penetration of Wind Energy using Benders Decomposition. IET Gener. Transm. Distrib. 2015, 9, 1835–1844. [Google Scholar] [CrossRef]

- Seljom, P.; Tomasgard, A. Short-term uncertainty in long-term energy system models—A case study of wind power in Denmark. Energy Econ. 2015, 49, 157–167. [Google Scholar] [CrossRef]

- Hong, Y.; Lai, Y.; Chang, Y.; Lee, Y.; Liu, P. Optimizing Capacities of Distributed Generation and Energy Storage in a Small Autonomous Power System Considering Uncertainty in Renewables. Energies 2015, 8, 2473–2492. [Google Scholar] [CrossRef]

- Siddons, C.; Allan, G.; Mcintyre, S. How accurate are forecasts of costs of energy? A methodological contribution. Energy Policy 2015, 87, 224–228. [Google Scholar] [CrossRef][Green Version]

- Rodríguez, O.; del Río, J.A.; Jaramillo, O.A.; Martínez, M. Wind Power Error Estimation in Resource Assessments. PLoS ONE 2015, 10, e0124830. [Google Scholar] [CrossRef]

- Abadie, L.M.; Chamorro, J.M. Valuation of Wind Energy Projects: A Real Options Approach. Energies 2014, 7, 3218–3255. [Google Scholar] [CrossRef]

- Krogh, T.; Meade, N.; Fleten, S. Renewable energy investments under di ff erent support schemes: A real options approach. Eur. J. Oper. Res. 2012, 220, 225–237. [Google Scholar]

- Correa, M.D.; Gomes, L.L.; Teixeira, L.E.B. Investors’ asymmetric views and their decision to enter Brazil’s wind energy sector. Pesqui. Oper. 2014, 34, 319–345. [Google Scholar]

- Weibel, S.; Madlener, R. Cost-Effective Design of Ringwall Storage Hybrid Power Plants: A Real Options Analysis. Energy Procedia 2014, 61, 2196–2200. [Google Scholar] [CrossRef][Green Version]

- Serrano, J.; Burgos, M.; Riquelme, J. M Optimization of Wind Farm Turbine Layout Including Decision Making Under Risk; IEEE: Piscataway, NJ, USA, 2014. [Google Scholar]

- Monjas-barroso, M.; Balibrea-Iniesta, J. Valuation of projects for power generation with renewable energy: A comparative study based on real regulatory options. Energy Policy 2013, 55, 335–352. [Google Scholar] [CrossRef]

- Jin, S.; Botterud, A.; Ryan, S.M. Impact of Demand Response on Thermal Generation Investment with High Wind Penetration. IEEE Trans. Smart Grid 2013, 4, 2374–2383. [Google Scholar] [CrossRef]

- Kaiser, M.J.; Snyder, B.F. Modeling offshore wind installation costs on the US Outer Continental Shelf. Renew. Energy 2013, 50, 676–691. [Google Scholar] [CrossRef]

- Heinrich, W.; Szolgayová, J.; Fuss, S.; Obersteiner, M. Renewable energy investment: Policy and market impacts. Appl. Energy 2012, 97, 249–254. [Google Scholar]

- Heinrich, W.; Fuss, S.; Szolgayová, J.; Obersteiner, M. Investment in wind power and pumped storage in a real options model. Renew. Sustain. Energy Rev. 2012, 16, 2242–2248. [Google Scholar]

- Martinez-cesena, E.A.; Member, S.; Mutale, J.; Member, S. Wind Power Projects Planning Considering Real Options for the Wind Resource Assessment. IEEE Trans. Sustain. Energy 2012, 3, 158–166. [Google Scholar] [CrossRef]

- Ochoa, M.; Betancur, H.; David, J.; Múnera, G.; Mauricio, Ó. L a Valoración de Proyectos Bajo el Enfoque de Opciones. 2012. Available online: https://www.redalyc.org/pdf/205/20523152009.pdf (accessed on 17 July 2021).

- Al-yahyai, S.; Charabi, Y.; Al-badi, A.; Gastli, A. Nested ensemble NWP approach for wind energy assessment. Renew. Energy 2012, 37, 150–160. [Google Scholar] [CrossRef]

- Lee, S. Using real option analysis for highly uncertain technology investments: The case of wind energy technology. Renew. Sustain. Energy Rev. 2011, 15, 4443–4450. [Google Scholar] [CrossRef]

- Dicorato, M.; Forte, G.; Pisani, M.; Trovato, M. Guidelines for assessment of investment cost for offshore wind generation. Renew. Energy 2011, 36, 2043–2051. [Google Scholar] [CrossRef]

- Barradale, M.J. Impact of public policy uncertainty on renewable energy investment: Wind power and the production tax credit. Energy Policy 2010, 38, 7698–7709. [Google Scholar] [CrossRef]

- Méndez, M.; Goyanes, A.; Lamothe, P. Real Options Valuation of a Wind Farm. February 2009. Available online: http://www.realoptions.org/papers2009/46.pdf (accessed on 24 July 2021).

- Muñoz, J.I.; Contreras, J.; Caamaño, J.; Correia, P.F.; Carlo, M. Risk Assessment of Wind Power Generation Project Investments based on Real Options. In 2009 IEEE Bucharest PowerTech; IEEE: Piscataway, NJ, USA, 2009; pp. 1–8. [Google Scholar]

- Dykes, K.; de Neufville, R. Real options for a wind farm in Wapakoneta, Ohio: Incorporating uncertainty into economic feasibility studies for community wind. In Proceedings of the Paper submitted for the World Wind Energy Conference of 2008, Kingston, ON, Canada, 24–26 June 2007. [Google Scholar]

- Magnus, K.; Fleten, S.; Maribu, K.M.; Wangensteen, I. Optimal investment strategies in decentralized renewable power generation under uncertainty. Energy 2007, 32, 803–815. [Google Scholar]

- Yu, W.; Sheblé, G.B.; Lopes, J.A.P.; Matos, M.A. Valuation of switchable tariff for wind energy. Electr. Power Syst. Res. 2006, 76, 382–388. [Google Scholar] [CrossRef][Green Version]

- Aponte, R.; Muñoz, F.; Álzate, L. La Evaluación Financiera De Proyectos Y Su Aporte En La Generación De Valor Corporativo. Cienc. Y Poder Aéreo 2017, 12, 144–155. [Google Scholar] [CrossRef]

- Santos, L.; Soares, I.; Mendes, C.; Ferreira, P. Real options versus traditional methods to assess renewable energy projects. Renew. Energy 2014, 68, 588–594. [Google Scholar] [CrossRef]

- González, Y.; Zuluaga, M.; Maya, C. El Valor de la Propiedad Industrial Aproximación a un Método de Valoración Financiera de Activos Intangibles; Universidad EAFIT: Medellín, Colombia, 2010. [Google Scholar]

- Attoh-Okine, N.O.; Ayyub, B.M. Applied Research in Uncertainty Modeling and Analysis; Springer: New York, NY, USA, 2005. [Google Scholar]

- Conejo, A.J.; Carrión, M.; Morales, J.M. Decision Making under Uncertainty in Electricity Markets; Springer: New York, NY, USA, 2010; Volume 1. [Google Scholar]

- Dixit, R.K.; Pindyck, R.S. Investment under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Cuervo, F.I.; Botero, S.B. Aplicación de las opciones reales en la toma de decisiones en los mercados de electricidad. Estud. Gerenc. 2014, 30, 397–407. [Google Scholar] [CrossRef]

- Guerequeta, R.; Vallecillo, A. Técnicas de Diseño de Algorismos. 2000. Available online: https://archive.org/details/TecnicasDiseoAlgoritmosGuequeretaYVallecillo (accessed on 28 July 2021).

- Black, F.; Scholes, M. The pricing of options and corporate liabilities. J. Political Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Merton, R.C. Theory of rational option pricing. Bell J. Econ. Manag. Sci. 1973, 4, 141–183. [Google Scholar] [CrossRef]

- Mascareñas, J. Opciones Reales y Valoración de Activos: Como Medir la Flexibilidad Operativa en la Empresa; Prentice Hall: Hoboken, NJ, USA, 2004. [Google Scholar]

- Ferreira, N.; Kar, J.; Trigeorgis, L. Option Games. Harv. Bus. Rev. 2009, 87, 101–107. [Google Scholar]

- Kozlova, M. Real option valuation in renewable energy literature: Research focus, trends and design. Renew. Sustain. Energy Rev. 2017, 80, 180–196. [Google Scholar] [CrossRef]

- Boyle, P.P. Options: A Monte Carlo approach. J. Financ. Econ. 1977, 4, 323–338. [Google Scholar] [CrossRef]

- Kodukula, P.; Papudesu, C. Project Valuation Using Real Options: A Practitioner’s Guide; J. Ross Publishing: Fort Lauderdale, FL, USA, 2006. [Google Scholar]

- Morrison, S. Nested Simulation for Economic Capital. Barrie + hibbert. 2009. Available online: www.barrhibb.com (accessed on 22 July 2021).

- Longstaff, F.A.; Schwartz, E.S. Valuing American Options by Simulation: A Simple Least-Squares Approach. Rev. Financ. Stud. 2001, 14, 113–147. [Google Scholar] [CrossRef]

- Yang, X.-S. Nature-Inspired Algorithms and Applied Optimization; Springer: New York, NY, USA, 2018. [Google Scholar]

- Mosiño, A.; Salomón-Núñez, L.A.; Moreno-Okuno, A.T. Estudio empírico sobre el tipo de cambio. Econoquantum 2019, 16, 33–56. [Google Scholar] [CrossRef]

- Pindyck, R.S. The dynamics of commodity spot and futures markets: A primer. Energy J. 2001, 22. [Google Scholar] [CrossRef]

- Vveinhardt, J.; Streimikiene, D.; Rizwan, A.R.; Nawaz, A.; Rehman, A. Mean reversion: An investigation from Karachi stock exchange sectors. Technol. Econ. Dev. Econ. 2016, 22, 493–511. [Google Scholar] [CrossRef]

- Gujarati, D.N.; Porter, D.C. Econometria Básica, 4th ed.; Editora Campus: São Paulo, Brasil, 2006. [Google Scholar]

- Góngora, D.A.; Azumendi, D. Predicción de la Velocidad del Viento para la Estimación de la Energía Generada por un Aerogenerador; Uniandes: Bogotá, Colombia, 2018. [Google Scholar]

- Quevedo, F. Distribución normal. Medwave 2011, 1–5. [Google Scholar] [CrossRef]

- Latiff, A. La “Curva de Aprendizaje”. Qué es y cómo se mide. Rev. Urol. Colomb. 2005, XIV, 15–17. [Google Scholar]

- Silva, P.P.B.; Riveros, D.P.B.; Naranjo, C.J. Aplicación de la lúdica en la curva de aprendizaje. Sci. Et Tech. 2005, 1, 185–190. [Google Scholar]

- Wolsink, M. Wind power and the NIMBY-myth: Institutional capacity and the limited significance of public support. Renew. Energy 2000, 21, 49–64. [Google Scholar] [CrossRef]

- Wolsink, M. Wind power implementation: The nature of public attitudes: Equity and fairness instead of “backyard motives”. Renew. Sustain. Energy Rev. 2007, 11, 1188–1207. [Google Scholar] [CrossRef]

- Wüstenhagen, R.; Wolsink, M.; Bürer, M.J. Social acceptance of renewable energy innovation: An introduction to the concept. Energy Policy 2007, 35, 2683–2691. [Google Scholar] [CrossRef]

- Buijs, P.; Bekaert, D.; Cole, S.; Van Hertem, D.; Belmans, R. Transmission investment problems in Europe: Going beyond standard solutions. Energy Policy 2011, 39, 1794–1801. [Google Scholar] [CrossRef]

- Khademi, E.; Timmermans, H.; Borgers, A. Temporal adaptation to reward schemes: Results of the spitsscoren project. Transp. Res. Procedia 2014, 3, 60–69. [Google Scholar] [CrossRef]

- Jung, N.; Moula, M.E.; Fang, T.; Hamdy, M.; Lahdelma, R. Social acceptance of renewable energy technologies for buildings in the Helsinki Metropolitan Area of Finland. Renew. Energy 2016, 99, 813–824. [Google Scholar] [CrossRef]

| Type of Barrier | Description |

|---|---|

| Technological |

|

| Economic and market-based |

|

| Regulatory, political, and social |

|

| Environmental |

|

| Authors | Year | Models or Approaches in the Literature | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | Others | ||

| Kinias, Tsakalos, & Konstantopoulos [31] | 2020 | ✓ | |||||||

| Detemple & Kitapbayev [32] | 2020 | ✓ | |||||||

| Krömer [33] | 2020 | ✓ | |||||||

| Nasrolahpour, Zareipour, & Rosehart [34] | 2020 | ✓ | |||||||

| Oh & Son [35] | 2020 | ✓ | |||||||

| Ioannou, Angus, & Brennan [36] | 2020 | ✓ | |||||||

| Mehrjerdi & Hemmati [37] | 2020 | ✓ | |||||||

| Liu, He, Liang, Yang, & Xia [38] | 2020 | ✓ | |||||||

| Chowdhury, Pilo, & Pisano [39] | 2020 | ✓ | |||||||

| Tan et al. [40] | 2020 | ✓ | |||||||

| Zhan et al. [41] | 2020 | ✓ | |||||||

| Verleysen, Coppitters, Parente, Paepe, & Contino [42] | 2020 | ✓ | |||||||

| G. Yang, Jiang, & You [43] | 2020 | ✓ | |||||||

| Al, Sirjani, & Daneshvar [44] | 2020 | ✓ | |||||||

| Hübler et al. [45] | 2020 | ✓ | |||||||

| Ge et al. [46] | 2020 | ✓ | |||||||

| H. Yang et al. [47] | 2020 | ✓ | |||||||

| Kong, Li, Liang, Xia, & Xie [48] | 2020 | ✓ | |||||||

| Keck & Sondell [49] | 2020 | ✓ | |||||||

| Stetter, Piel, Hamann, & Breitner [50] | 2020 | ✓ | |||||||

| Abdalla, Smieee, Adma, & Ahmed [51] | 2020 | 17 | |||||||

| Henckes, Frank, Küchler, Peter, & Wagner [52] | 2020 | 18 | |||||||

| Niromandfam, Movahedi, & Zarezadeh [53] | 2020 | 19 | |||||||

| Zhou, Wu, Dong, Tao, & Xu [54] | 2020 | 20 | |||||||

| Zhao, Yao, Sun, & Pan [55] | 2019 | ✓ | |||||||

| Maeda & Watts [56] | 2019 | ✓ | |||||||

| Vavatsikos, Arvanitidou, & Petsas [57] | 2019 | ✓ | |||||||

| Askari, Zainal, Ab, Tahmasebi, & Bolandifar [58] | 2019 | ✓ | |||||||

| M. A. Abdulgalil, Khalid, & Alismail [59] | 2019 | ✓ | |||||||

| Junior et al. [60] | 2019 | ✓ | |||||||

| M. Abdulgalil, Khalid, & Alismail [61] | 2019 | ✓ | |||||||

| Yunhao Li, Wang, Gu, Liu, & LI [62] | 2019 | ✓ | |||||||

| Pizarro-alonso, Ravn, & Münster [63] | 2019 | ✓ | |||||||

| Yan, Zhang, Liu, Han, & Li [64] | 2019 | ✓ | |||||||

| Tagliapietra, Zachmann, & Fredriksson [65] | 2019 | ✓ | |||||||

| Thang & Trung [66] | 2019 | ✓ | |||||||

| Quan & Kim [67] | 2019 | ✓ | |||||||

| Borràs, Spelling, Weijde, & Pavageau [68] | 2019 | ✓ | |||||||

| Fuchs, Marquardt, Kasten, & Skau [69] | 2019 | 9 | |||||||

| Zhang et al. [70] | 2019 | 8 | |||||||

| Ioannou, Angus, & Brennan [71] | 2019 | 16 | |||||||

| Ribeiro, Finotti, Perobelli, & Baumgratz [72] | 2018 | ✓ | |||||||

| Finjord, Hagspiel, Lavrutich, & Tangen [73] | 2018 | ✓ | |||||||

| Dalby, Gillerhaugen, Hagspiel, Leth-olsen, & Thijssen [74] | 2018 | ✓ | |||||||

| Yanbin Li, Wu, & Li [75] | 2018 | ✓ | |||||||

| Gazheli & Bergh [76] | 2018 | ✓ | |||||||

| Romanuke [77] | 2018 | ✓ | |||||||

| Y. Yu, Wen, Zhao, Xu, & Li [78] | 2018 | ✓ | |||||||

| Aaboud et al. [79] | 2018 | ✓ | |||||||

| Valinejad et al. [80] | 2018 | ✓ | |||||||

| Jiang et al. [81] | 2018 | ✓ | |||||||

| Deshmukh, Mileva, & Wu [82] | 2018 | ✓ | |||||||

| Z. Li et al. [83] | 2018 | ✓ | |||||||

| Ioannou, Angus, & Brennan [84] | 2018 | ✓ | |||||||

| Esmaieli & Ahmadian [85] | 2018 | 15 | |||||||

| Kristiansen, Svendsen, Korpas, & Fleten [86] | 2017 | ✓ | |||||||

| Jannati, Yazdaninejadi, & Talavat [87] | 2017 | ✓ | |||||||

| Chen & Macdonald [88] | 2017 | ✓ | |||||||

| Hamoudi & Maule [89] | 2017 | ✓ | |||||||

| Aquila, Rotela, de Oliveira, & de Queiroz [90] | 2017 | 14 | |||||||

| Eryilmaz & Homans [91] | 2016 | ✓ | |||||||

| Kitzing, Juul, Drud, & Krogh [92] | 2016 | ✓ | |||||||

| Pazouki & Haghifam [93] | 2016 | ✓ | |||||||

| Lamadrid, Maneevitjit, & Mount [94] | 2016 | ✓ | |||||||

| Caralis et al. [95] | 2016 | ✓ | |||||||

| Werner & Scholtens [96] | 2016 | ✓ | |||||||

| Sjoerd, Broek, Özdemir, Koutstaal, & Faaij [97] | 2016 | 12 | |||||||

| Xiao, Wang, Wang, & Wu [98] | 2016 | 13 | |||||||

| Díaz, Gómez-aleixandre, & Coto [99] | 2015 | ✓ | |||||||

| Díaz, Moreno, Coto, & Gómez-aleixandre [100] | 2015 | ✓ | |||||||

| Fang, Li, Wei, & Azim [101] | 2015 | ✓ | |||||||

| Seljom & Tomasgard [102] | 2015 | ✓ | |||||||

| Hong, Lai, Chang, Lee, & Liu [103] | 2015 | ✓ | |||||||

| Siddons, Allan, & Mcintyre [104] | 2015 | ✓ | |||||||

| Rodríguez, del Río, Jaramillo, & Martínez [105] | 2015 | 11 | |||||||

| Abadie & Chamorro [106] | 2014 | ✓ | |||||||

| Krogh, Meade, & Fleten [107] | 2014 | ✓ | |||||||

| Correa, Gomes, & Teixeira [108] | 2014 | ✓ | |||||||

| Weibel & Madlener [109] | 2014 | ✓ | |||||||

| Serrano, Burgos, & Riquelme [110] | 2014 | ✓ | |||||||

| Monjas-barroso & Balibrea-Iniesta [111] | 2013 | ✓ | |||||||

| Jin, Botterud, & Ryan [112] | 2013 | ✓ | |||||||

| Kaiser & Snyder [113] | 2013 | ✓ | |||||||

| Reuter, Szolgayová, Fuss, & Obersteiner [114] | 2012 | ✓ | |||||||

| Heinrich, Fuss, Szolgayová, & Obersteiner [115] | 2012 | ✓ | |||||||

| Martinez-cesena, Member, Mutale, & Member [116] | 2012 | ✓ | |||||||

| Ochoa, Betancur, David, Múnera, & Mauricio [117] | 2012 | ✓ | |||||||

| Al-yahyai, Charabi, Al-badi, & Gastli [118] | 2012 | ✓ | |||||||

| Lee [119] | 2011 | ✓ | |||||||

| Dicorato, Forte, Pisani, & Trovato [120] | 2011 | ✓ | |||||||

| Barradale [121] | 2010 | 10 | |||||||

| Méndez, Goyanes, & Lamothe [122] | 2009 | ✓ | |||||||

| Muñoz, Contreras, Caamaño, Correia, & Carlo [123] | 2009 | ✓ | |||||||

| Dykes & Neufville [124] | 2008 | ✓ | |||||||

| Magnus, Fleten, Maribu, & Wangensteen [125] | 2006 | ✓ | |||||||

| W. Yu, Sheblé, Lopes, & Matos [126] | 2006 | ✓ | |||||||

| OTHERS:

|

| |||||||

| Purpose | Authors (Years) |

|---|---|

| Evaluation of wind energy generation project or investment | [31,56,72,75,77,99,100,106,117,119,123,124,125]. |

| Evaluation of energy auctions, portfolios, and energy market investments | [31,57,58,86,106,108,122,126]. |

| Evaluation of renewable energy technologies | [32,58,76]. |

| Evaluation of the impact of regulatory policies on wind energy projects | [32,55,73,74,91,92,107,111,126]. |

| Evaluation of wind energy systems | [86,109,114]. |

| Evaluation of wind resources | [116]. |

| Evaluation of design, size, and location of wind farm projects | [109,116]. |

| 1. Power Generation | 5. Regulatory Policies |

| 1.1. Electricity charge | 5.1. Production certificates |

| 1.2. Wind energy level | 5.2. Changes in asset rates |

| 1.3. Energy production | 5.3. Credits policy |

| 1.4. Wind turbine hours of use | 5.4. Government policies |

| 1.5. Investment planning | 5.5. Feed-in rates-subsidies |

| 1.6. Future deployment of wind energy | |

| 6. Market | |

| 2. Environmental | 6.1. Market conditions |

| 2.1. Climate change | 6.2. Price index |

| 2.2. Solar irradiation | 6.3. Demand for electricity |

| 3. Prices | 7. Wind Conditions |

| 3.1. Electricity price | 7.1. Wind disponibility |

| 3.2. Carbon price | 7.2. Wind intensity |

| 3.3. Corn price | 7.3. Wind speed |

| 7.4. Wind intermittency | |

| 4. Costs | |

| 4.1. Capital costs | 8. Technological Progress |

| 4.2. Investment costs | 8.1. Alternative technology |

| 8.2. Technology levels | |

| 8.3. Learning speed |

| Authors-Years | 1. Power Generation | 2. Environmental | 3. Prices | 4. Costs | 5. Regulatory Policies | 6. Market | 7. Wind Conditions | 8. Technological Progress | Total | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.1 | 1.2 | 1.3 | 1.4 | 1.5 | 1.6 | 2.1 | 2.2 | 3.1 | 3.2 | 3.3 | 4.1 | 4.2 | 5.1 | 5.2 | 5.3 | 5.4 | 5.5 | 6.1 | 6.2 | 6.3 | 7.1 | 7.2 | 7.3 | 7.4 | 8.1 | 8.2 | 8.3 | ||

| [125] | ✓ | ✓ | ✓ | 3 | |||||||||||||||||||||||||

| [124] | ✓ | ✓ | 2 | ||||||||||||||||||||||||||

| [122] | ✓ | ✓ | ✓ | 3 | |||||||||||||||||||||||||

| [106] | ✓ | ✓ | ✓ | 3 | |||||||||||||||||||||||||

| [72] | ✓ | ✓ | 2 | ||||||||||||||||||||||||||

| [119] | ✓ | ✓ | 2 | ||||||||||||||||||||||||||

| [31] | ✓ | 1 | |||||||||||||||||||||||||||

| [126] | ✓ | ✓ | ✓ | 3 | |||||||||||||||||||||||||

| [115] | ✓ | ✓ | 2 | ||||||||||||||||||||||||||

| [107] | ✓ | ✓ | ✓ | ✓ | 4 | ||||||||||||||||||||||||

| [108] | ✓ | 1 | |||||||||||||||||||||||||||

| [91] | ✓ | 1 | |||||||||||||||||||||||||||

| [73] | ✓ | ✓ | ✓ | 3 | |||||||||||||||||||||||||

| [74] | ✓ | 1 | |||||||||||||||||||||||||||

| [55] | ✓ | ✓ | ✓ | 3 | |||||||||||||||||||||||||

| [32] | ✓ | ✓ | ✓ | 3 | |||||||||||||||||||||||||

| 111] | ✓ | ✓ | ✓ | ✓ | 4 | ||||||||||||||||||||||||

| [92] | ✓ | ✓ | 2 | ||||||||||||||||||||||||||

| [56] | ✓ | ✓ | 2 | ||||||||||||||||||||||||||

| [99] | ✓ | ✓ | ✓ | 3 | |||||||||||||||||||||||||

| [123] | ✓ | ✓ | 2 | ||||||||||||||||||||||||||

| [116] | ✓ | 1 | |||||||||||||||||||||||||||

| [117] | ✓ | ✓ | ✓ | ✓ | ✓ | 5 | |||||||||||||||||||||||

| [109] | ✓ | ✓ | ✓ | ✓ | 4 | ||||||||||||||||||||||||

| [100] | ✓ | ✓ | ✓ | 3 | |||||||||||||||||||||||||

| [75] | ✓ | ✓ | ✓ | ✓ | 4 | ||||||||||||||||||||||||

| [76] | ✓ | ✓ | 2 | ||||||||||||||||||||||||||

| [57] | ✓ | 1 | |||||||||||||||||||||||||||

| [58] | ✓ | ✓ | 2 | ||||||||||||||||||||||||||

| [86] | ✓ | 1 | |||||||||||||||||||||||||||

| [77] | ✓ | 1 | |||||||||||||||||||||||||||

| Total | 1 | 1 | 3 | 1 | 1 | 1 | 1 | 2 | 20 | 3 | 1 | 4 | 4 | 2 | 1 | 1 | 2 | 5 | 3 | 1 | 1 | 2 | 2 | 6 | 2 | 1 | 1 | 1 | 74 |

| Author-Year | Technique of Assessment | Modeling Technique | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Not Random | Random | Random | Not Random | ||||||||||||||

| 1 | 2 | 3 | 4 | 5 | 1 | 2 | 3 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 1 | 2 | |

| [125] | ✓ | ✓ | |||||||||||||||

| [124] | ✓ | ✓ | ✓ | ✓ | |||||||||||||

| [106] | ✓ | ✓ | ✓ | ✓ | |||||||||||||

| [72] | ✓ | ||||||||||||||||

| [58] | ✓ | ✓ | ✓ | ||||||||||||||

| [31] | ✓ | ✓ | ✓ | ✓ | |||||||||||||

| [123] | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| [116] | ✓ | ✓ | ✓ | ✓ | |||||||||||||

| [117] | ✓ | ✓ | ✓ | ✓ | |||||||||||||

| [111] | ✓ | ✓ | ✓ | ✓ | |||||||||||||

| [126] | ✓ | ✓ | ✓ | ||||||||||||||

| [115] | ✓ | ✓ | |||||||||||||||

| [32] | ✓ | ✓ | |||||||||||||||

| [56] | ✓ | ✓ | |||||||||||||||

| [109] | ✓ | ✓ | |||||||||||||||

| [75] | ✓ | ✓ | |||||||||||||||

| [57] | ✓ | ✓ | |||||||||||||||

| [122] | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||

| [119] | ✓ | ✓ | ✓ | ||||||||||||||

| [107] | ✓ | ✓ | ✓ | ||||||||||||||

| [108] | ✓ | ✓ | |||||||||||||||

| [91] | ✓ | ||||||||||||||||

| [73] | ✓ | ✓ | |||||||||||||||

| [74] | ✓ | ✓ | ✓ | ✓ | |||||||||||||

| [78] | ✓ | ✓ | |||||||||||||||

| [92] | ✓ | ✓ | |||||||||||||||

| [99] | ✓ | ✓ | |||||||||||||||

| [100] | ✓ | ✓ | ✓ | ||||||||||||||

| [76] | ✓ | ✓ | ✓ | ||||||||||||||

| [86] | ✓ | ✓ | ✓ | ✓ | |||||||||||||

| [77] | ✓ | ✓ | |||||||||||||||

| 8 | 8 | 5 | 2 | 2 | 16 | 5 | 1 | 19 | 6 | 3 | 2 | 1 | 2 | 4 | 2 | 3 | |

| Valuation of options • Non-random

| Modeling of uncertainties • Random

| ||||||||||||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Murgas, B.; Henao, A.; Guzman, L. Evaluation of Investments in Wind Energy Projects, under Uncertainty. State of the Art Review. Appl. Sci. 2021, 11, 10213. https://doi.org/10.3390/app112110213

Murgas B, Henao A, Guzman L. Evaluation of Investments in Wind Energy Projects, under Uncertainty. State of the Art Review. Applied Sciences. 2021; 11(21):10213. https://doi.org/10.3390/app112110213

Chicago/Turabian StyleMurgas, Benjamin, Alvin Henao, and Luceny Guzman. 2021. "Evaluation of Investments in Wind Energy Projects, under Uncertainty. State of the Art Review" Applied Sciences 11, no. 21: 10213. https://doi.org/10.3390/app112110213

APA StyleMurgas, B., Henao, A., & Guzman, L. (2021). Evaluation of Investments in Wind Energy Projects, under Uncertainty. State of the Art Review. Applied Sciences, 11(21), 10213. https://doi.org/10.3390/app112110213