The Value of Public Sector Risk Management: An Empirical Assessment of Ghana

Abstract

1. Introduction

Prior Studies

2. The Concept of Risk

2.1. Events Identification

2.2. Risk Response

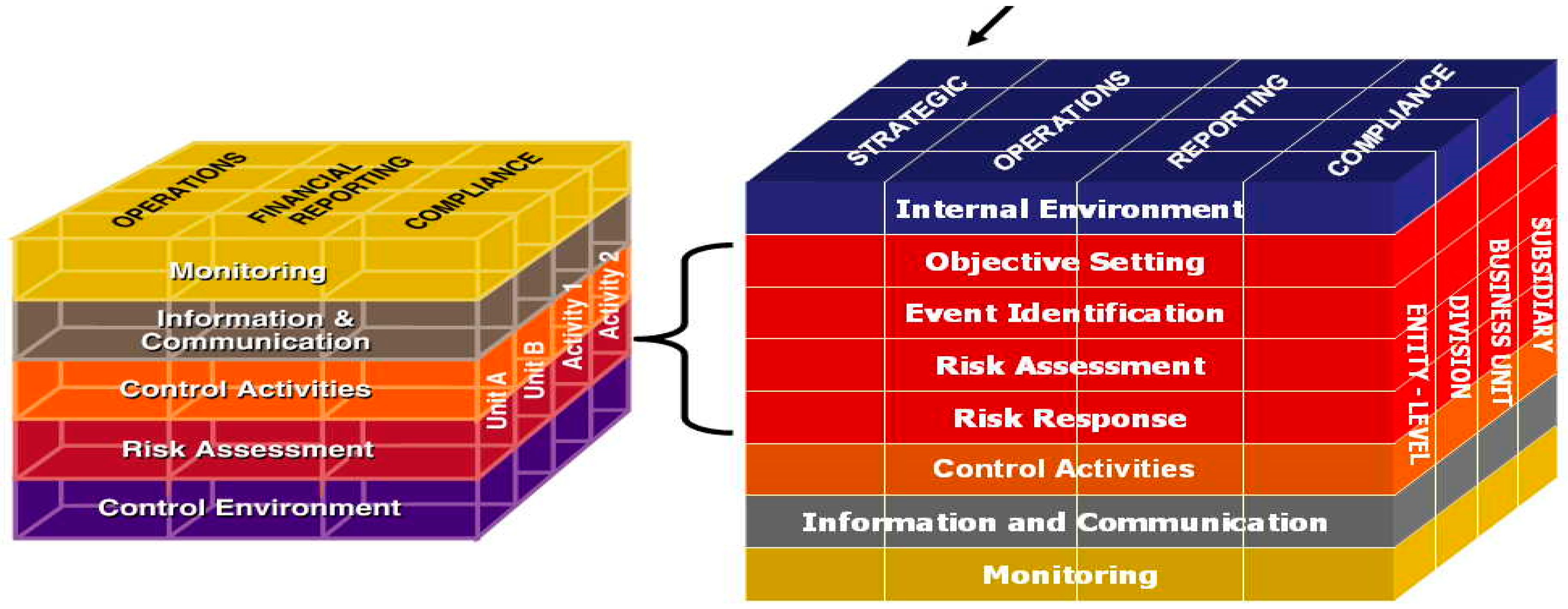

2.3. Risk Assessment and Internal Control

2.4. Importance of Risk Management in the Public Sector

“Poor controls lead to losses, scandals, failures and damage to the reputation of organisations in whatever sector they are from. Where risks are allowed to run wild and new ventures are undertaken without a means of controlling risk, there are likely to be problems.”

3. Methodology

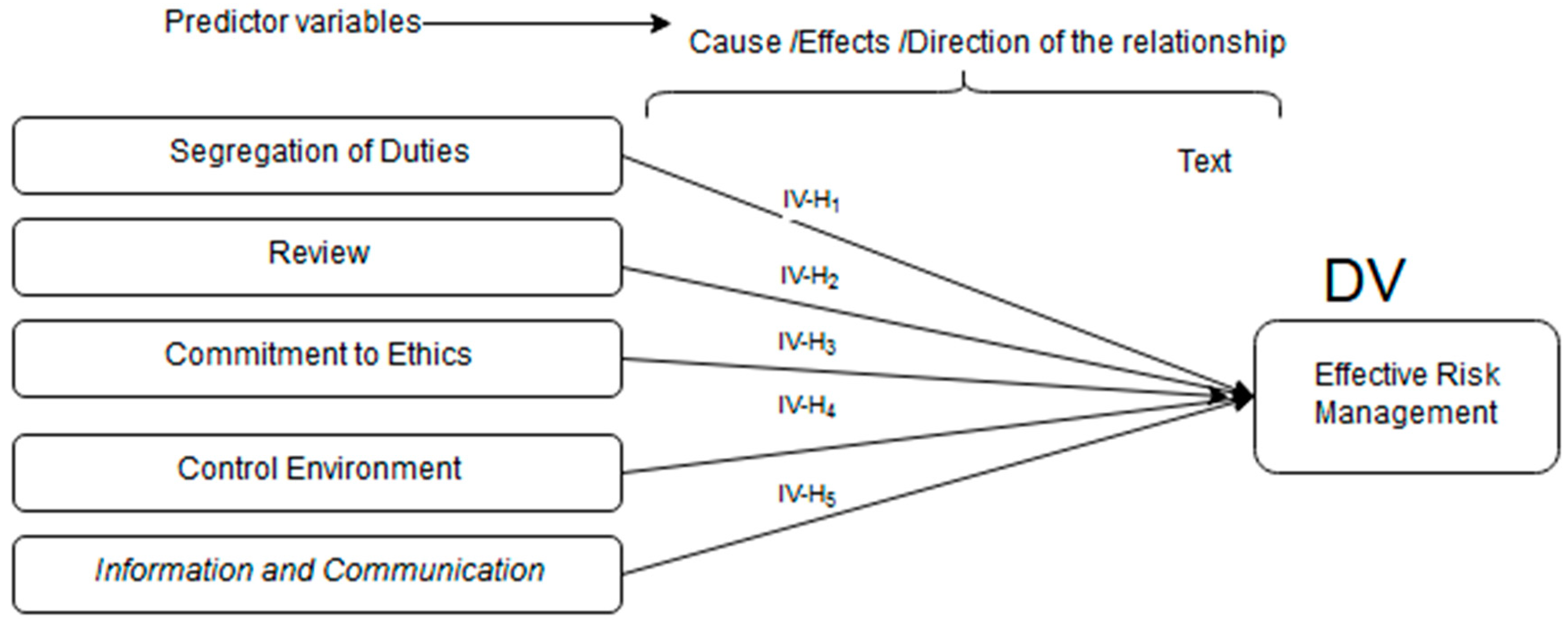

3.1. The Conceptual Framework and Hypothetical Assumption

3.2. Reliability and Model Definition

Cronbach’s Alpha

Model Specification

- Yi = dependent variable–Effectiveness (EFF).

- β0 represents the population intercept of the dependent variable Y.

- β1—represents the slope and coefficient of the population (β1… β5).

- Xi—represents the explanatory variables—(control envin. commitment to ethics, segregation, review and communication)

- εi = Random error term

4. Result and Implication

4.1. Descriptive Statistics

4.1.1. Principal Component Analysis (PCA)

4.1.2. Discriminant Analysis

4.2. Discussion and Theoretical Implication

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Abbott, Lawrence J., Daugherty Brian, Susan Parker, and Gary F. Peters. 2016. Internal audit quality and financial reporting quality: The joint importance of independence and competence. Journal of Accounting Research 54: 3–40. [Google Scholar] [CrossRef]

- Adhikari, Pawan, and Levi Gårseth-Nesbakk. 2016. Implementing public sector accruals in OECD member states: Major issues and challenges. Accounting Forum 40: 125–42. [Google Scholar] [CrossRef]

- Afiah, Nur Nunuy, and Peny Cahaya Azwari. 2015. The Effect of the Implementation of Government Internal Control System (GICS) on the Quality of Financial Reporting of the Local Government and its Impact on the Principles of Good Governance: A Research in District, City, and Provincial Government in South Sumatera. Procedia—Social and Behavioral Sciences 211: 811–18. [Google Scholar]

- Agyei-Mensah, and Ben Kwame. 2016. Impact of Adopting IFRS in Ghana: Empirical Evidence In Economics and Political Implications of International Financial Reporting Standards. Hershey: IGI Global, pp. 191–230. [Google Scholar]

- Ahluwalia, Saurabh, O. C. Ferrell, Linda Ferrell, and Terri L. Rittenburg. 2016. Sarbanes–Oxley Section 406 Code of Ethics for Senior Financial Officers and Firm Behavior. Journal of Business Ethics, 1–13. [Google Scholar] [CrossRef]

- Ahmed, Iddrisu. 2016. Audit expectation gap in Ghana (Case Study of Senior High Schools in Kumasi Metropolitan assembly, Ashanti region). Available online: http://ir.knust.edu.gh/xmlui/handle/123456789/8491 (accessed on 21 February 2018).

- Ahsan, Kamrul, and Shams Rahman. 2017. Green public procurement implementation challenges in Australian public healthcare sector. Journal of Cleaner Production 152: 181–97. [Google Scholar] [CrossRef]

- Akotia, Pino. 2016. Audit and Accountability in the Government of Ghana: A Records Management Perspective. In Integrity in Government through Records Management: Essays in Honour of Anne Thurston. Didcot: Taylor, pp. 127–37. [Google Scholar]

- Aliewi, Amjad, El-Sayed Essam, Akbar Adam, Hadi Khaled, and Al-Rashed Muhammad. 2017. Evaluation of desalination and other strategic management options using multi-criteria decision analysis in Kuwait. Desalination 413: 40–51. [Google Scholar] [CrossRef]

- Anna, Kuraeva, and Kazantsev Nikolay. 2015. Survey on Big Data Analytics in Public Sector of Russian Federation. Procedia Computer Science 55: 905–11. [Google Scholar] [CrossRef]

- Apergis, Nicholas, Irene Fafaliou, and Marinos Stefanitsis. 2016. Asymmetric information and employment: Evidence from the U.S. banking sector. The Journal of Economic Asymmetries 14: 199–210. [Google Scholar] [CrossRef]

- Appiah, Kingsley Opoku, Lawrence Adu Asamoah, and Beatrice Osei. 2016. Nomination committee-board gender diversity nexus in Ghana. International Journal of Business Governance and Ethics 11: 135–58. [Google Scholar] [CrossRef]

- Arena, Marika, Michela Arnaboldi, and Tommaso Palermo. 2017. The dynamics of (dis)integrated risk management: A comparative field study. Accounting, Organizations and Society 62: 65–81. [Google Scholar] [CrossRef]

- Arundel, Anthony, Casali Luca, and Hollanders Hugo. 2015. How European public sector agencies innovate: The use of bottom-up, policy-dependent and knowledge-scanning innovation methods. Research Policy 44: 1271–82. [Google Scholar] [CrossRef]

- Asante, Asare Olivia. 2016. Auditors’independence and Audit Quality: Evidence from Banks in Ghana. Abetefi: Presbyterian University College. [Google Scholar]

- Ashraf, Junaid, and Shahzad Uddin. 2016. New public management, cost savings and regressive effects: A case from a less developed country. Critical Perspectives on Accounting 41: 18–33. [Google Scholar] [CrossRef]

- Asiedu, Kofi Fred, and Eric Worlanyo Deffor. 2017. Fighting Corruption by Means of Effective Internal Audit Function: Evidence from the Ghanaian Public Sector. International Journal of Auditing 21: 82–99. [Google Scholar] [CrossRef]

- Axelsen, Micheal, Green Peter, and Ridley Gail. 2017. Explaining the information systems auditor role in the public sector financial audit. International Journal of Accounting Information Systems 24: 15–31. [Google Scholar] [CrossRef]

- Aziz, Mohamad Azizal Abd, Hilmi Ab Rahman, Md Mahmudul Alam, and Jamaliah Said. 2015. Enhancement of the Accountability of Public Sectors through Integrity System, Internal Control System and Leadership Practices: A Review Study. Procedia Economics and Finance 28: 163–69. [Google Scholar] [CrossRef]

- Balabonienė, Ingrida, and Giedre Večerskienė. 2015. The Aspects of Performance Measurement in Public Sector Organization. Procedia—Social and Behavioral Sciences 213: 314–20. [Google Scholar] [CrossRef]

- Barafort, Beatrix, Antoni-Lluis Mesquida, and Antonia Mas. 2017. Integrating risk management in IT settings from ISO standards and management systems perspectives. Computer Standards & Interfaces 54: 176–85. [Google Scholar] [CrossRef]

- Basu, Sanjib K. 2016. Auditing & Assurance. Delhi: Pearson Education India. [Google Scholar]

- Basu, Shantanu. 2016. Chapter VI—Discussions on Standards for Risk Assessment and Safety Instrumented Systems. In Plant Hazard Analysis and Safety Instrumentation Systems. Edited by Shantanu Basu. Cambridge: Academic Press, pp. 385–466. [Google Scholar]

- Baumgartner, Rupert J., and Romana Rauter. 2017. Strategic perspectives of corporate sustainability management to develop a sustainable organization. Journal of Cleaner Production 140: 81–92. [Google Scholar] [CrossRef]

- Blok, Vincent, Wesselink Renate, Studynka Oldrich, and Kemp Ron. 2015. Encouraging sustainability in the workplace: A survey on the pro-environmental behaviour of university employees. Journal of Cleaner Production 106: 55–67. [Google Scholar] [CrossRef]

- Boe, Ole, and Øyvind Kvalvika. 2015. Effective Use of Resources in the Public Management Sector in Norway. Procedia Economics and Finance 26: 869–74. [Google Scholar] [CrossRef]

- Bosten, Jenny, P. T. Goodbourn, G. Bargary, R. J. Verhallen, A. J. Lawrance-Owen, R. E. Hogg, and John Dixon Mollon. 2017. An exploratory factor analysis of visual performance in a large population. Vision Research 141: 303–16. [Google Scholar] [CrossRef] [PubMed]

- Bromiley, Philip, Michael McShane, Anil Nair, and Elzotbek Rustambekov. 2015. Enterprise Risk Management: Review, Critique, and Research Directions. Long Range Planning 48: 265–76. [Google Scholar] [CrossRef]

- Brzeziński, Stanislaw, and Agnieszka Bąk. 2015. Management of Employees’ Commitment in the Process of Organization Transformation. Procedia Economics and Finance 27: 109–15. [Google Scholar] [CrossRef]

- Callahan, Carolyn, and Jared Soileau. 2017. Does Enterprise risk management enhance operating performance? Advances in Accounting 37: 122–39. [Google Scholar] [CrossRef]

- Chang, She-I., David C. Yen, I-Cheng Chang, and Derek Jan. 2014. Internal control framework for a compliant ERP system. Information & Management 51: 187–205. [Google Scholar]

- Cofie, Yvonne. 2016. Antecedents and Consequences of Board Interlocks: Evidence from the Ghana Stock Exchange, University Of Ghana. Available online: http://ugspace.ug.edu.gh (accessed on 18 March 2018).

- Colbert, Melissa C., Robert B. Nussenblatt, and Michael M. Gottesman. 2018. Chapter 3—Integrity in Research: Principles for the Conduct of Research. In Principles and Practice of Clinical Research, 4th ed. Edited by John I. Gallin and Frederick P. Ognibene. Boston: Academic Press, pp. 33–46. [Google Scholar]

- Collier, Paul M. 2009a. Chapter 9—Internal Control and the Manager’s Role in Enterprise Risk Management. In Fundamentals of Risk Management for Accountants and Managers. Edited by Paul Collier. Oxford: Butterworth-Heinemann, pp. 99–112. [Google Scholar]

- Collier, Paul M. 2009b. Chapter 23—The Audit Committee, Enterprise Risk Management and Internal Control. In Fundamentals of Risk Management for Accountants and Managers. Edited by Paul Collier. Oxford: Butterworth-Heinemann, pp. 245–59. [Google Scholar]

- Cutler, Tony. 2015. New Managerialism and New Public Sector Management A2—Wright. In International Encyclopedia of the Social & Behavioral Sciences, 2nd ed. Edited by D. James. Oxford: Elsevier, pp. 770–775. [Google Scholar]

- Da Silva Etges, Ana Paula Beck, Veronique Grenon, Joana Siqueira de Souza, Francisco Jose Kliemann Neto, and Elaine Aparecida Felix. 2018. ERM for Health Care Organizations: An Economic Enterprise Risk Management Innovation Program (E2RMhealth care). Value in Health Regional Issues 17: 102–8. [Google Scholar] [CrossRef] [PubMed]

- Dănescu, Tatiana, and Mihael Prozan. 2015. Aspects Regarding Risks in Financial Reporting. Procedia Economics and Finance 23: 161–67. [Google Scholar] [CrossRef]

- Daniela, Petraşcu, and Tamaş Attila. 2013. Internal Audit versus Internal Control and Coaching. Procedia Economics and Finance 6: 694–702. [Google Scholar] [CrossRef]

- Davis, James Stephen. 2016. A Quantitative Analysis of the Indirect Costs of Compliance for Large Public Corporations under the Sarbanes-Oxley Act of 2002. Scottsdale: Northcentral University. [Google Scholar]

- Dawuda, Abudu, Gariba Oswald Aninanya, and Samuel Erasmus Alnaa. 2015. The Organizational Independence of Internal Auditors in Ghana: Empirical Evidence from Local Government. Asian Journal of Economic Modelling 3: 33–45. [Google Scholar] [CrossRef]

- De Magalhães, Claudio, and Sonia Freire Trigo. 2017. Contracting out publicness: The private management of the urban public realm and its implications. Progress in Planning 115: 1–28. [Google Scholar] [CrossRef]

- Delaplace, Guillaume, Fabrice Ducept, Karine Loubière, and Romain Jeantet. 2015. 2—Dimensional Analysis: Principles and Methodology. In Dimensional Analysis of Food Process. Edited by Guillaume Delaplace, Fabrice Ducept, Karine Loubière and Romain Jeantet. New York: Elsevier, pp. 13–59. [Google Scholar]

- Demek, Kristina C., Robyn L. Raschke, Diana J. Janvrin, and William N. Dilla. 2018. Do organizations use a formalized risk management process to address social media risk? International Journal of Accounting Information Systems 28: 31–44. [Google Scholar] [CrossRef]

- Dementiev, Andrei. 2016. Strategic partnerships in local public transport. Research in Transportation Economics 59: 65–74. [Google Scholar] [CrossRef]

- Domingues, Ana Rita, Rodrigo Lozano, Kim Ceulemans, and Tomas B. Ramos. 2017. Sustainability reporting in public sector organisations: Exploring the relation between the reporting process and organisational change management for sustainability. Journal of Environmental Management 192: 292–301. [Google Scholar] [CrossRef] [PubMed]

- Dong, Yizhe, Claudia Girardone, and Jing-Ming Kuo. 2017. Governance, efficiency and risk taking in Chinese banking. The British Accounting Review 49: 211–29. [Google Scholar] [CrossRef]

- Earley, Christine E., Karen Hooks, Jennifer R. Joe, Paul W. Polinski, Zabihollah Rezaee, Pamela B. Roush, and Yi.-Jing Wu. 2016. The Auditing Standards Committee of the Auditing Section of the American Accounting Association’s Response to the International Auditing and Assurance Standard’s Board’s Invitation to Comment: Enhancing Audit Quality in the Public Interest. Current Issues in Auditing 11: C1–C25. [Google Scholar] [CrossRef]

- Elbanna, Said. 2016. Managers’ autonomy, strategic control, organizational politics and strategic planning effectiveness: An empirical investigation into missing links in the hotel sector. Tourism Management 52: 210–20. [Google Scholar] [CrossRef]

- Gantz, Stephen D., and Daniel R. Philpott. 2013. Chapter 3—Thinking About Risk. In FISMA and the Risk Management Framework. Edited by Stephen D. Gantz and Daniel R. Philpott. Syngress: Maryland Heights, pp. 53–78. [Google Scholar]

- Ge, Weili, Allison Koester, and Sarah E. McVay. Benefits and Costs of Sarbanes-Oxley Section 404(B) Exemption: Evidence from Small Firms’ Internal Control Disclosures. Journal of Accounting & Economics (JAE). Forthcoming. Available online: https://ssrn.com/abstract=2405187 (accessed on 25 March 2018).

- Grady, C. 2018. Chapter 2—Ethical Principles in Clinical Research. In Principles and Practice of Clinical Research, 4th ed. Edited by John I. Gallin, Frederick P. Ognibene and Laura Lee Johnson. Boston: Academic Press, pp. 19–31. [Google Scholar]

- Grover, Shawna S. Sarkar, Gurudutt Gupta, Natasha Kate, Abhishek Ghosh, Subho Chakrabarti, and Ajit Avasthi. 2018. Factor analysis of symptom profile in early onset and late onset OCD. Psychiatry Research 262: 631–35. [Google Scholar] [CrossRef]

- Guo, K. H., and Brenda L. Eschenbrenner. 2018. CVS Pharmacy: An instructional case of internal controls for regulatory compliance and IT risks. Journal of Accounting Education 42: 17–26. [Google Scholar] [CrossRef]

- Hagigi, Moshe, and Kumar Sivakumar. 2009. Managing diverse risks: An integrative framework. Journal of International Management 15: 286–95. [Google Scholar] [CrossRef]

- Herron, Terri L., and Craig W. Crawford. “ACTG 411.02: Auditing I” (2016). Syllabi. 3927. Available online: https://scholarworks.umt.edu/syllabi/3927 (accessed on 20 May 2018).

- Hey, Robert Bruce. 2017. Chapter 11—Risk Management. In Performance Management for the Oil, Gas, and Process Industries. Edited by Robert Bruce Hey. Boston: Gulf Professional Publishing, pp. 159–75. [Google Scholar]

- Hillman, Joanne, Stephen Axon, and John Morrissey. 2018. Social enterprise as a potential niche innovation breakout for low carbon transition. Energy Policy 117: 445–56. [Google Scholar] [CrossRef]

- Horne, Stephen. 2017. 8–27 Years of fraud control in the New South Wales public sector: 1989–2016. In The Changing Face of Corruption in the Asia Pacific. New York: Elsevier, pp. 111–25. [Google Scholar]

- Huang, Jianglou, Jinsong Liu, Kejia Wang, Zhengang Yang, and Xiamin Liu. 2018. Classification and identification of molecules through factor analysis method based on terahertz spectroscopy. Spectrochimica Acta Part A: Molecular and Biomolecular Spectroscopy 198: 198–203. [Google Scholar] [CrossRef] [PubMed]

- Jawadi, Fredj, and Wael Louhichi. 2017. Overview on the recent developments of banking and risk management. Research in International Business and Finance 39: 896–98. [Google Scholar] [CrossRef]

- Jill, M. D., and Robert Houmes. 2014. COSO’s Updated Internal Control and Enterprise Risk Management Frameworks. The CPA Journal 84: 54. [Google Scholar]

- Johansson, Tobias, and Sven Siverbo. 2014. The appropriateness of tight budget control in public sector organizations facing budget turbulence. Management Accounting Research 25: 271–83. [Google Scholar] [CrossRef]

- Joyce, Paul. 2015. Strategic Management in the Public Sector. Abingdon-on-Thames: Routledge. [Google Scholar]

- King, Alfred M. 2016. A guide to COSO’s framework: An important, practical resource to help your transition to the updated COSO internal control framework. Strategic Finance 97: 12–13. [Google Scholar]

- Knechel, W. Robert, and Steven E. Salterio. 2016. Auditing: Assurance and Risk. Abingdon-on-Thames: Routledge. [Google Scholar]

- Lawson, Bradley P., Leah Muriel, and Paula R. Sanders. 2017. A survey on firms’ implementation of COSO’s 2013 Internal Control–Integrated Framework. Research in Accounting Regulation 29: 30–43. [Google Scholar] [CrossRef]

- Lerskullawat, Attasuda. 2017. Effects of banking sector and capital market development on the bank lending channel of monetary policy: An ASEAN country case study. Kasetsart Journal of Social Sciences 38: 9–17. [Google Scholar] [CrossRef]

- Lim, Chu Yeong, Margaret Woods, Christopher Humphrey, and Jean Lin Seow. 2017. The paradoxes of risk management in the banking sector. The British Accounting Review 49: 75–90. [Google Scholar] [CrossRef]

- Ma, Junhai, and Chunyong Ma. 2011. Factor Analysis Based On The COSO Framework And The Goverment Audit Performance Of Control Theory. Procedia Engineering 15: 5584–89. [Google Scholar] [CrossRef]

- Martin, Kasey, Sander Elaine, and Scalan Genevieve. 2014. The potential impact of COSO internal control integrated framework revision on internal audit structured SOX work programs. Research in Accounting Regulation 26: 110–17. [Google Scholar] [CrossRef]

- Maudos, Joaquin. 2017. Income structure, profitability and risk in the European banking sector: The impact of the crisis. Research in International Business and Finance 39: 85–101. [Google Scholar] [CrossRef]

- Menke, William. 2018. Chapter 10—Factor Analysis. In Geophysical Data Analysis, 4th ed. Edited by William Menke. Cambridge: Academic Press, pp. 207–22. [Google Scholar]

- Mensah, Jones Odei, and Gamini Premaratne. 2017. Dependence patterns among Asian banking sector stocks: A copula approach. Research in International Business and Finance 41: 516–46. [Google Scholar] [CrossRef]

- Niroumand, Hamed. 2017. Chapter 3—Research Methodology. In Irregular Shape Anchor in Cohesionless Soils. Oxford: Butterworth-Heinemann, pp. 33–42. [Google Scholar]

- Onder, Savas, Bulent Damar, and Alper Ali Hekimoglu. 2016. Macro Stress Testing and an Application on Turkish Banking Sector1. Procedia Economics and Finance 38: 17–37. [Google Scholar] [CrossRef]

- Onyiriuba, Leonard. 2016. Chapter 12—Public Sector Banking Analysis and Risks Management in Developing Economies. In Bank Risk Management in Developing Economies. Cambridge: Academic Press, pp. 205–21. [Google Scholar]

- Paino, Halil, Fazlida Mohd Razali, and Faizan Abd Jabar. 2015. The Influence of External Auditor’s Working Style, Communication Barriers and Enterprise Risk Management toward Reliance on Internal Auditor’s Work. Procedia Economics and Finance 28: 151–55. [Google Scholar] [CrossRef]

- Pellegrini, Carlo Bellavite, Michele Meoli, and Giovanni Urga. 2017. Money market funds, shadow banking and systemic risk in United Kingdom. Finance Research Letters 21: 163–71. [Google Scholar] [CrossRef]

- Qiu, Qihua, Jaesang Sung, Will Davis, and Rusty Tchernis. 2018. Using spatial factor analysis to measure human development. Journal of Development Economics 132: 130–49. [Google Scholar] [CrossRef]

- Scheers, Bram, Miekatrien Sterck, and Geert Bouckaert. 2006. Lessons from Australian and British Reforms in Results oriented Financial Management. OECD, 133–62. [Google Scholar] [CrossRef]

- Shao, Xueguang, Xiaoyu Cui, Xiaoming Yu, and Wensheng Cai. 2018. Mutual factor analysis for quantitative analysis by temperature dependent near infrared spectra. Talanta 183: 142–48. [Google Scholar] [CrossRef] [PubMed]

- Sprčić, Danijela Milos, Antonija Kazul, and Ena Pacina. 2015. State and Perspective of Enterprise Risk Management Systems Development–The Case of Croatian Companies. Procedia Economic Finance. [Google Scholar] [CrossRef]

- Steinbart, Paul John, Robyn L. Raschke, Graham Gal, and William N. Dilla. 2018. The influence of a good relationship between the internal audit and information security functions on information security outcomes. Accounting, Organizations and Society. [Google Scholar] [CrossRef]

- Tan, Yong. 2016. Chapter 2—Chinese Banking Sector and Reforms. In Efficiency and Competition in Chinese Banking. Oxford and Cambridge: Chandos Publishing, pp. 11–44. [Google Scholar]

- Themsen, Tim Neerup, and Peter Skærbæk. 2018. The performativity of risk management frameworks and technologies: The translation of uncertainties into pure and impure risks. Accounting, Organizations and Society. [Google Scholar] [CrossRef]

- Van Kleef, Ellen, and Hans C. M. van Trijp. 2018. Chapter 13—Methodological Challenges of Research in Nudging. In Methods in Consumer Research. Edited by Gaston Ares and Paula Varela. Sawston: Woodhead Publishing, vol. 1, pp. 329–49. [Google Scholar]

- Woods, Magaret, Philip Linsley, and Marco Maffei. 2017. Accounting and Risk Special Issue: Editorial. The British Accounting Review 49: 1–3. [Google Scholar] [CrossRef]

- Zins, Alexandra, and Laurent Weill. 2017. Islamic banking and risk: The impact of Basel II. Economic Modelling 64: 626–37. [Google Scholar] [CrossRef]

| Reliability Statistics | |

|---|---|

| Cronbach’s Alpha | N of Items |

| 0.820 | Commitment to Ethics |

| 0.717 | Control Environment |

| 0.780 | Segregation of duties |

| 0.867 | Review |

| 0.830 | Information & communication |

| 0.882 | Effective Risk Management |

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | ||||

|---|---|---|---|---|---|---|

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 1.804 | 36.088 | 36.088 | 1.804 | 36.088 | 36.088 |

| 2 | 1.427 | 28.543 | 64.631 | 1.427 | 28.543 | 64.631 |

| 3 | 1.004 | 20.078 | 84.709 | 1.004 | 20.078 | 84.709 |

| 4 | 0.602 | 12.037 | 96.745 | |||

| 5 | 0.163 | 3.255 | 100.000 | |||

| Cox and Snell | 0.940 |

| Nagelkerke | 0.906 |

| McFadden | 0.916 |

| Model | −2 Log Likelihood | Chi-Square | Df | Sig. |

|---|---|---|---|---|

| Null Hypothesis | 0.000 | |||

| General | 0.000b | 0.000 | 1472 | 1.000 |

| Number of Variables | Lambda | df1 | df2 | df3 | Exact F | Approximate F | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Statistic | df1 | df2 | Sig. | Statistic | df1 | df2 | Sig. | |||||

| 1 | 0.331 | 1 | 17 | 281 | 33.410 | 17 | 281.000 | 0.000 | 0.000 | |||

| 2 | 0.169 | 2 | 17 | 281 | 23.586 | 34 | 560.000 | 0.000 | 0.000 | |||

| 3 | 0.135 | 3 | 17 | 281 | 0.000 | 15.647 | 51 | 831.433 | 0.000 | |||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kong, Y.; Lartey, P.Y.; Bah, F.B.M.; Biswas, N.B. The Value of Public Sector Risk Management: An Empirical Assessment of Ghana. Adm. Sci. 2018, 8, 40. https://doi.org/10.3390/admsci8030040

Kong Y, Lartey PY, Bah FBM, Biswas NB. The Value of Public Sector Risk Management: An Empirical Assessment of Ghana. Administrative Sciences. 2018; 8(3):40. https://doi.org/10.3390/admsci8030040

Chicago/Turabian StyleKong, Yusheng, Peter Yao Lartey, Fatoumata Binta Maci Bah, and Nirmalya B. Biswas. 2018. "The Value of Public Sector Risk Management: An Empirical Assessment of Ghana" Administrative Sciences 8, no. 3: 40. https://doi.org/10.3390/admsci8030040

APA StyleKong, Y., Lartey, P. Y., Bah, F. B. M., & Biswas, N. B. (2018). The Value of Public Sector Risk Management: An Empirical Assessment of Ghana. Administrative Sciences, 8(3), 40. https://doi.org/10.3390/admsci8030040