Culture, Board Composition and Corporate Social Reporting in the Banking Sector

Abstract

1. Introduction

2. Board Composition and CSR Disclosures: Research Hypotheses

2.1. Independence of the Board and CSR Reporting

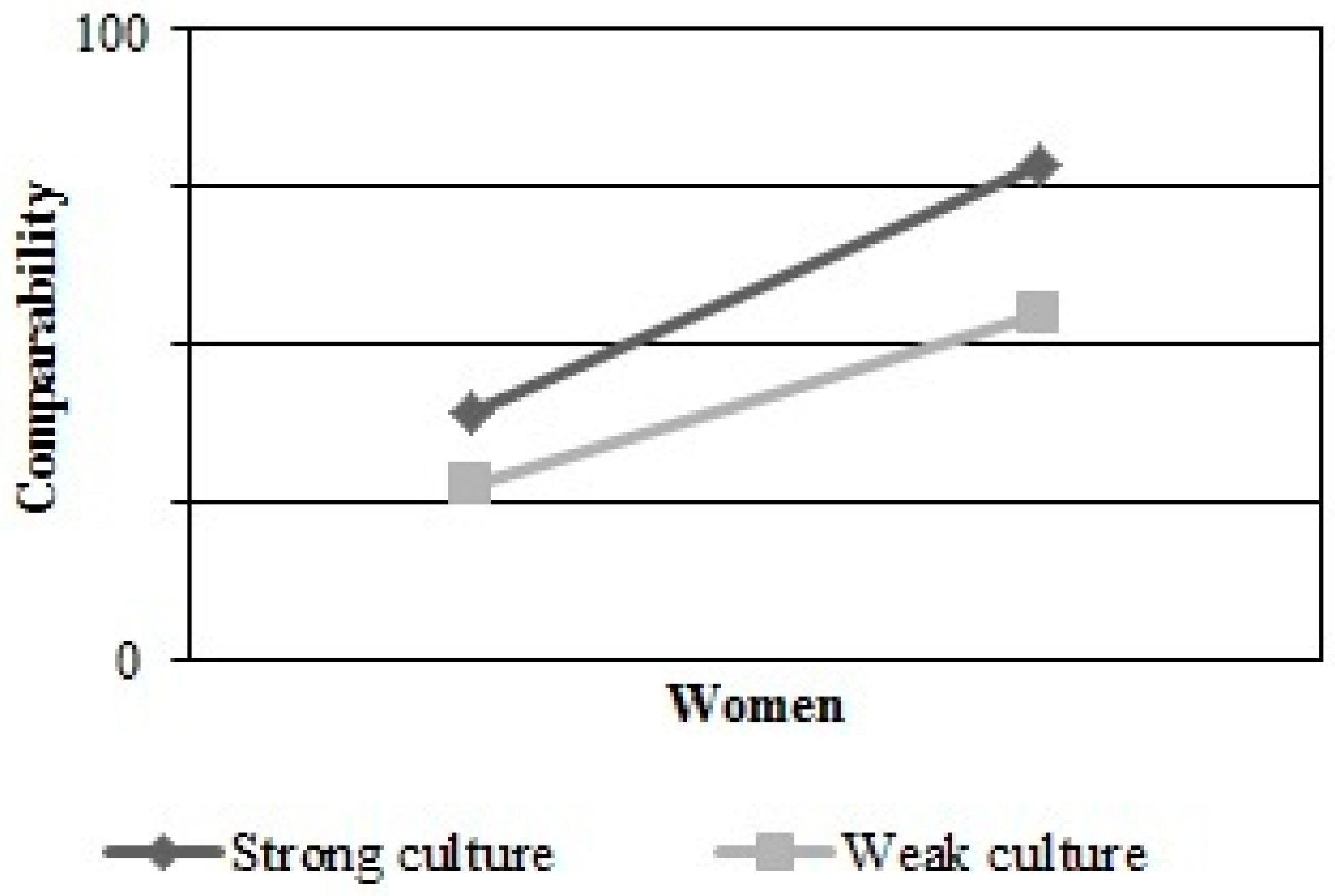

2.2. Diversity of the Board and CSR Reporting in the Banking Sector

3. Effect of the National Cultural System: Hofstede’s Dimensions

4. Methodological Approach

4.1. Sample of Financial Institutions

4.2. Variables for the Analyses

4.2.1. Dependent Variable: CSR Disclosures

4.2.2. Independence and Diversity of the Board: Explanatory Variables

4.3. Models for the Analyses

5. Results of the Descriptive and Exploratory Analyses

Robustness Checking

6. Concluding Remarks

Author Contributions

Funding

Conflicts of Interest

References

- Abu-Banker, Nafez, and Kanial Naser. 2000. Empirical evidence on corporate social disclosure (CSD) practices in Jordan. International Journal of Commerce and Management 10: 18–34. [Google Scholar] [CrossRef]

- Adams, Carol A. 2002. Internal Organisational Factors Influencing Corporate Social and Ethical Reporting: Beyond Current Theorising. Accounting, Auditing and Accountability Journal 15: 233–50. [Google Scholar] [CrossRef]

- Archel, Pablo. 2003. La divulgación de la información social y medioambiental en la gran empresa española en el periodo 1994–1998: Situación actual y perspectivas. Revista Española de Financiación y Contabilidad 32: 571–601. [Google Scholar]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at the instrumental variables estimation of error components models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Ayuso, Silvia, and Antonio Argandoña. 2007. Responsible Corporate Governance: Towards a Stakeholder Board of Directors? IESE Business School Working paper No. 701. Barcelona, Spain: IESE Business School. [Google Scholar]

- Barako, Dulacha G., and Alistair M. Brown. 2008. Corporate social reporting and board representation: Evidence from the Kenyan banking sector. Journal of Managerial Government 12: 309–24. [Google Scholar] [CrossRef]

- Basel Committee on Banking Supervision. 1998. Enhancing Bank Transparency. Basel: Bank for International Settlements. [Google Scholar]

- Brett, Jeanne M., and Tetsushi Okumura. 1998. Inter-and intracultural negotiation: US and Japanese negotiators. Academy of Management Journal 41: 495–510. [Google Scholar]

- Buhr, Nola, and Martin Freedman. 2001. Culture, institutional factors and differences in environmental disclosure between Canada and United States. Critical Perspectives on Accounting 12: 293–22. [Google Scholar] [CrossRef]

- Carter, David A., Betty J. Simkins, and W. Gary Simpson. 2003. Corporate governance, board diversity and firm value. The Financial Review 38: 33–53. [Google Scholar] [CrossRef]

- Chau, Gerald, and Sidney J. Gray. 2010. Family ownership, board independence and voluntary disclosure: Evidence from Hong Kong. Journal of International Accounting, Auditing and Taxation 19: 93–109. [Google Scholar] [CrossRef]

- Chen, Charles J. P., and Bikki Jaggi. 2000. Association between independent non-executive directors, family control and financial disclosures in Hong Kong. Journal of Accounting and Public Policy 19: 285–310. [Google Scholar] [CrossRef]

- Clarkson, Peter M., Yue Li, Gordon D. Richardson, and Florin P. Vasvari. 2008. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society 33: 303–27. [Google Scholar] [CrossRef]

- De Andrés, Pablo, and Eleuterio Vallelado. 2008. Corporate governance in banking: The role of the board of directors. Journal of Banking and Finance 32: 2570–80. [Google Scholar] [CrossRef]

- Deegan, Craig, Michaela Rankin, and John Tobin. 2002. An examination of the corporate social and environmental disclosures of BHP from 1983–1997: A test of legitimacy theory. Accounting, Auditing and Accountability Journal 15: 312–43. [Google Scholar] [CrossRef]

- Douglas, Alex, John Doris, and Brian Johnson. 2004. Corporate social reporting in Irish financial institutions. The TQM Magazine 16: 387–95. [Google Scholar] [CrossRef]

- Drogendijk, Rian, and Ulf Holm. 2015. Cultural Distance or Cultural Positions? Analysing the Effect of Culture on the HQ—Subsidiary Relationship. In Knowledge, Networks and Power. Edited by Mats Forsgren, Ulf Holm and Jan Johanson. London: Palgrave Macmillan, pp. 366–92. [Google Scholar]

- Drogendijk, Rian, and Arjen Slangen. 2006. Hofstede, Schwartz, or managerial perceptions? The effects of different cultural distances measures on establishment mode choices by multinational enterprises. International Business Review 15: 361–80. [Google Scholar] [CrossRef]

- Eagly, Alice H., and Mary C. Johannesen-Schmidt. 2001. The leadership styles of women and men. Journal of Social Issues 57: 781–97. [Google Scholar] [CrossRef]

- Eagly, Alice H., and Steven J. Karau. 1991. Gender and the emergence of leaders: A meta analysis. Journal of Personality and Social Psychology 60: 685–710. [Google Scholar] [CrossRef]

- Eagly, Alice H., Mary C. Johannesen-Schmidt, and Marloes L. van Engen. 2003. Transformational, transactional and laissez-faire leadership styles: A meta-analysis comparing women and men. Psychological Bulletin 129: 569–91. [Google Scholar] [CrossRef] [PubMed]

- Elkington, John. 1994. Towards the sustainable corporation win-win-win business strategies for sustainable development. California Management Review 36: 90–100. [Google Scholar] [CrossRef]

- Fernández-Feijoo, Belen, Silvia Romero, and Silvia Ruiz. 2012. Does board gender composition affect corporate social responsibility reporting? International Journal of Business and Society Science 3: 31–38. [Google Scholar]

- Filatotchev, Igor, Gregory Jackson, Howard Gospel, and Deborah Allcock. 2007. Key Driver’s of ‘Good’ Corporate Governance and the Appropriateness of UK Policy Responses; Final Report. London: Department of Trade and Industry.

- Frías-Aceituno, José V., Lázaro Rodríguez-Ariza, and Isabel M. García-Sánchez. 2013. Explanatory factors of integrated sustainability and financial reporting. Business Strategy and the Environment 23: 56–72. [Google Scholar] [CrossRef]

- García-Marco, Teresa, and M. Dolores Robles-Fernandez. 2008. Risk-taking behaviour and ownership in the banking industry: The Spanish evidence. Journal of Economics and Business 60: 332–54. [Google Scholar] [CrossRef]

- García-Sánchez, Isabel M., and Jennifer Martínez-Ferrero. 2017. Independent directors and CSR disclosures: The moderating effects of proprietary costs. Corporate Social Responsibility and Environmental Management 24: 28–43. [Google Scholar] [CrossRef]

- García-Sánchez, Isabel M., and Jennifer Martínez-Ferrero. 2018. How do Independent Directors Behave with Respect to Sustainability Disclosure? Corporate Social Responsibility and Environmental Management 25: 609–27. [Google Scholar] [CrossRef]

- García-Sánchez, Isabel M., Beatriz Cuadrado-Ballesteros, and Cindy Sepúlveda. 2014. Does media pressure moderate CSR disclosures by external directors? Management Decision 52: 1014–45. [Google Scholar] [CrossRef]

- Garrigues-Walker, Antonio, and Francisco Trullenque-San Juan. 2008. Responsabilidad social corporativa: papel mojado o necesidad estratégica? Harvard Deusto Business Review 164: 18–36. [Google Scholar]

- Halabi, Abdel K., Ashrah U. Kazi, Vy Dang, and Martin Samy. 2006. Corporate social responsibility: How the top ten stack up. Monash Busisness Review 3: 20–24. [Google Scholar] [CrossRef]

- Haniffa, Ros M., and Terry E. Cooke. 2002. Culture, corporate governance and disclosure in Malaysian corporations. Abacus 38: 317–49. [Google Scholar] [CrossRef]

- Haniffa, Ros M., and Terry E. Cooke. 2005. The impact of culture and governance on corporate social reporting. Journal of Accounting and Public Policy 24: 391–430. [Google Scholar] [CrossRef]

- Hertz, Kathleen, Darrell Brown, and Scott Marshall. 2012. Governance, media and the quality of environmental disclosure. Journal of Accounting and Public Policy 31: 610–40. [Google Scholar]

- Hofstede, Geert H. 1983. The cultural relativity of organizational practices and theories. Journal of International Business Studies 82: 76–88. [Google Scholar] [CrossRef]

- Hofstede, Geert. 2011. Dimensionalizing Cultures: The Hofstede Model in Context. Online Readings in Psychology and Culture 2. Available online: https://scholarworks.gvsu.edu/orpc/vol2/iss1/8/ (accessed on 26 July 2018).

- Hofstede, Geert, and Robert R. McCrae. 2004. Personality and culture revisited: Linking traits and dimensions of culture. Cross-Cultural Research 38: 52–88. [Google Scholar] [CrossRef]

- Hofstede, Geert, Gert J. Hofstede, and Michael Minkov. 2010. Cultures and Organizations. Software of the Mind. New York: McGraw-Hill. [Google Scholar]

- Hosmer, Larue T. 1994. Strategic planning as of ethics mattered. Strategic Management Journal 15: 17–34. [Google Scholar] [CrossRef]

- Htay, Sheila Nu Nu, Hafiz Majdi Ab. Rashid, Mohamad Akhyar Adnan, and Ahamed Kameel. 2012. Impact of corporate governance on social and environmental information disclosure of Malaysian listed banks: Panel data analysis. Asian Journal of Finance and Accounting 4: 1–24. [Google Scholar] [CrossRef]

- Hubbard, Graham. 2009. Measuring organizational performance: Beyond the triple bottom line. Business Strategy and the Environment 18: 177–91. [Google Scholar] [CrossRef]

- Ibrahim, Nabil A., and John P. Angelidis. 1994. Effect of board members’ gender on corporate social responsiveness orientation. Journal of Applied Business Research 10: 35–41. [Google Scholar] [CrossRef]

- Ibrahim, Nabil A., and John P. Angelidis. 1995. The corporate social responsiveness orientation of board members: Are there differences between inside and outside directors? Journal of Business Ethics 14: 405–10. [Google Scholar] [CrossRef]

- Jackson, Gregory, and Androniki Apostolakou. 2010. Corporate social responsibility in Western Europe: An institutional mirror or substitute? Journal of Business Ethics 94: 371–94. [Google Scholar] [CrossRef]

- Jamali, Dima, Asem M. Safieddine, and Myriam Rabbath. 2008. Corporate governance and corporate social responsibility synergies and interrelationships. Corporate Governance: An International Review 16: 443–59. [Google Scholar] [CrossRef]

- Khan, Md. Habib-Uz-Zaman. 2010. The effect of corporate governance elements on corporate social responsibility (CSR) reporting. Empirical evidence from private commercial banks of Bangladesh. International Journal of Law and Management 52: 82–109. [Google Scholar] [CrossRef]

- Kim, Yungwook, and Soo-Yeon Kim. 2010. The influence of cultural values of perceptions of corporate social responsibility: Application of Hofstede’s dimensions to Korean public relations practitioners. Journal of Business Ethics 9: 485–500. [Google Scholar] [CrossRef]

- Kogut, Bruce, and Harbir Singh. 1988. The effect of national culture on the choice of entry mode. Journal of International Business Studies 19: 411–32. [Google Scholar] [CrossRef]

- Konrad, Alison M., and Vicki W. Kramer. 2006. How many women do boards need? Harvard Business Review 84: 22. [Google Scholar]

- La Porta, Rafael, Florencio Lopez-de-Silane, Andrei Shleifer, and Robert W. Vishny. 1998. Law and Finance. Journal of Political Economy 106: 1113–55. [Google Scholar] [CrossRef]

- Legendre, Stéphane, and François Coderre. 2012. Determinants of GRI G3 application levels: The case of the Fortune Global 500. Corporate Social Responsibility and Environmental Management 20: 182–92. [Google Scholar] [CrossRef]

- Liao, Lin, Le Luo, and Qingliang Tang. 2015. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. The British Accounting Review 47: 409–24. [Google Scholar] [CrossRef]

- Maignan, Isabelle. 2001. Consumers’ Perceptions of Corporate Social Responsibilities: A Cross-Cultural Comparison. Journal of Business Ethics 30: 57–72. [Google Scholar] [CrossRef]

- Masulis, Ronald W., and Shawn Mobbs. 2013. The consequences of independent director reputation incentives on board decision making and firm actions. Paper presented at the 40th Annual Conference of the European Finance Association, Cambridge, UK, August 28–31. [Google Scholar]

- Mehran, Hamid, Alan Morrison, and Joel Shapiro. 2011. Corporate Governance and Banks: What Have We Learned from the Financial Crisis? Working paper No. 502. New York, NY, USA: Federal Reserve Bank of New York. [Google Scholar]

- Michelon, Giovanna, and Antonio Parbonetti. 2010. The effect of corporate governance on sustainability disclosure. Journal of Management and Governance 16: 477–509. [Google Scholar] [CrossRef]

- Moyo, Theresa, and Shannon Rohan. 2006. Corporate citizenship in the context of the financial services sector: What lessons from the Financial Sector Charter? Development Southern Africa 23: 289–303. [Google Scholar] [CrossRef]

- Nikolaeva, Ralitza, and Marta Bicho. 2011. The role of institutional and reputational factors in the voluntary adoption of corporate social responsibility reporting standards. Journal of the Academy of Marketing Science 39: 136–57. [Google Scholar] [CrossRef]

- Pincus, Karen, Mark Rusbarsky, and Jilnaught Wong. 1989. Voluntary formation of corporate audit committees among NASDAQ firms. Journal of Accounting and Public Policy 8: 239–65. [Google Scholar] [CrossRef]

- Pindado, Julio, and Ignacio Requejo. 2014. Panel Data: A Methodology for Model Specification and Testing. In Wiley Encyclopedia of Management, 3rd ed. Hoboken: John Wiley and Sons, Ltd. [Google Scholar]

- Prado-Lorenzo, José M., Isabel Gallego-Álvarez, and Isabel M. García-Sánchez. 2009. Stakeholder engagement and corporate social responsibility reporting: The ownership structure effect. Corporate Social Responsibility and Environmental Management 16: 94–107. [Google Scholar] [CrossRef]

- Rao, Kathyayini K., Carol A. Tilt, and Laurence H. Lester. 2012. Corporate governance and environmental reporting: An Australian study. Corporate Governance: The International Journal of Business in Society 12: 143–63. [Google Scholar]

- Ringov, Dimo, and Maurizio Zollo. 2007. The impact of national culture on corporate social performance. Corporate Governance: The International Journal of Business in Society 7: 476–85. [Google Scholar] [CrossRef]

- Rosenstein, Stuart, and Jeffrey G. Wyatt. 1990. Outside directors, board independence and shareholder wealth. Journal of Financial Economics 26: 175–91. [Google Scholar] [CrossRef]

- Samaha, Khaled, Khaled Dahawy, Khaled Hussainey, and Pamela Stapleton. 2012. The extent of corporate governance disclosure and its determinants in a developing market: The case of Egypt. Advances in Accounting 28: 168–78. [Google Scholar] [CrossRef]

- Schwartz, Shalom H. 1994. Beyond individualism/collectivism: New cultural dimensions of values. In Cross-Cultural Research and Methodology Series. Individualism and Collectivism: Theory, Method and Applications. Edited by Uichol Kim, Harry C. Triandis, Çigdem Kâğitçibaşi, Sang-Chin Choi and Gene Yoon. Thousand Oaks: Sage Publications, Inc., vol. 18, pp. 85–119. [Google Scholar]

- Schwartz, Mark S., and Archie B. Carroll. 2003. Corporate social responsibility: A three-domain approach. Business Ethics Quarterly 13: 503–30. [Google Scholar] [CrossRef]

- Sharif, Mehmoona, and Kashif Rashid. 2014. Corporate governance and corporate social responsibility (CSR) reporting: And empirical evidence from commercial banks (CB) of Pakistan. Quality and Quantity 48: 2051–521. [Google Scholar] [CrossRef]

- Sharma, Narendra. 2013. Web-based disclosures and their determinants: Evidence from listed commercial banks in Nepal. Accounting and Finance Research 2. [Google Scholar] [CrossRef]

- Søndergaard, Mikael. 1994. Research note: Hofstede’s consequences: A study of reviews, citations and replications. Organization Studies 15: 447–56. [Google Scholar] [CrossRef]

- Thompson, Paul, and Christopher J. Cowton. 2004. Bringing the environment into bank lending: Implications for environmental reporting. The British Accounting Review 36: 197–218. [Google Scholar] [CrossRef]

- Thomson, Dianne, and Ameeta Jain. 2010. Corporate Social Responsibility Reporting: A Business Strategy by Australian Banks? Corporate Ownership and Control 7: 213–28. [Google Scholar]

- Tsakumis, George T. 2007. The influence of culture on accountants’ application of financial reporting rules. Abacus 43: 27–49. [Google Scholar] [CrossRef]

- Tsang, Eric W. K. 1998. A longitudinal study of corporate social reporting in Singapore the case of the banking, food and beverages and hotel industries. Accounting, Auditing and Accountability Journal 11: 624–35. [Google Scholar] [CrossRef]

- Van der Walt, Nicholas, and Coral Ingley. 2003. Board dynamic and the influence of professional background, gender and ethnic diversity of directors. Corporate Governance: An International Review 11: 218–34. [Google Scholar] [CrossRef]

- Van Oudenhoven, Jan Pieter. 2001. Do organizations reflect national cultures? A 10-nation study. International Journal of Intercultural Relations 25: 89–107. [Google Scholar] [CrossRef]

- Wan-Hussin, Wan N. 2009. The impact of family-firm structure and board composition on corporate transparency: Evidence based on segment disclosures in Malaysia. International Journal of Accounting 44: 313–33. [Google Scholar] [CrossRef]

- Williams, S. Mitchell. 1999. Voluntary Environmental and Social Accounting Disclosure Practices in the Asia-Pacific Region: An International Empirical Test of Political Economy Theory. The International Journal of Accounting 34: 52–70. [Google Scholar] [CrossRef]

- Williams, Robert J. 2003. Women on corporate boards of directors and their influence on corporate philanthropy. Journal of Business Ethics 41: 1–10. [Google Scholar] [CrossRef]

- Williams, Geoffrey, and John Zinkin. 2008. The effect of culture on consumers’ willingness to punish irresponsible corporate behaviour: Applying Hofstede’s typology to the punishment aspect of corporate social responsibility. Business Ethics: A European Review 17: 210–26. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2010. Econometric Analysis of Cross Section and Panel Data. Cambridge: The MIT Press. [Google Scholar]

- Zéghal, Daniel, and Sadrudin A. Ahmed. 1990. Comparison of social responsibility information disclosure media used by Canadian firms. Accounting, Auditing and Accountability Journal 3: 38–53. [Google Scholar] [CrossRef]

| 1 | Some advantages of CSR disclosures are: capital cost reduction, uncertainty reduction, investors’ and employees’ attraction, criticism reduction, etc. (Adams 2002; Filatotchev et al. 2007). Among the most important disadvantages are the disclosure of valuable information to competitors and the monetary cost of developing CSR practices, which impacts on the financial results (Thomson and Jain 2010). |

| 2 | According to these guidelines, the information contained in the CSR reports should be global, comparable and harmonized, to ensure that it shows all relevant information, being represented in monetary or numerical terms and being comprehensible for all stakeholders. |

| 3 | A higher level of the most dimensions (Individualism, Masculinity, Uncertainty Avoidance, Power distance) represents a weaker cultural system, except in the case of Long-term orientation and Indulgence dimensions. Thus, to be consistent, we use the opposite values in the case of the two last dimensions (100—original value) for creating the global indicator, namely Cultural_weakness. |

| 4 | The most of criticisms refer to the validity of data, since they are obtained from an IBM employees survey that was not designed to identify cultural dimensions, so it could be no representative of the general population characteristics (Schwartz 1994). |

| Panel A. Sample Distribution by Year | |||||||||||||

| TOTAL | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | ||||||

| 877 | 87 | 97 | 117 | 137 | 154 | 148 | 137 | ||||||

| 100% | 9.92% | 11.06% | 13.34% | 15.62% | 17.56% | 16.88% | 15.62% | ||||||

| Panel B. Sample Distribution by Country | |||||||||||||

| TOTAL | Canada | France | Germany | Italy | Netherlands | Spain | Sweden | UK | USA | ||||

| 877 | 67 | 19 | 23 | 66 | 25 | 56 | 21 | 186 | 414 | ||||

| 100% | 7.64% | 2.17% | 2.62% | 7.53% | 2.85% | 6.39% | 2.39% | 21.21% | 47.21% | ||||

| Utility | Points | |

| Item 1 | Whether bank discloses information about employee conditions and human rights. | 5, 7.5, 10 |

| Item 2 | Whether bank discloses information about ethical practices. | 5, 7.5, 10 |

| Item 3 | Whether bank discloses information about the community and society in general. | 5, 7.5, 10 |

| Item 4 | Whether bank discloses information about environmental issues. | 5, 7.5, 10 |

| Comparability | Points | |

| Item 5 | Whether CSR report is adapted to the level C of the GRI guidelines. | 10 |

| Item 6 | Whether CSR report is adapted to the level C+ of the GRI guidelines. | 20 |

| Item 7 | Whether CSR report is adapted to the level B of the GRI guidelines. | 30 |

| Item 8 | Whether CSR report is adapted to the level B+ of the GRI guidelines. | 40 |

| Item 9 | Whether CSR report is adapted to the level A of the GRI guidelines. | 50 |

| Item 10 | Whether CSR report is adapted to the level A+ of the GRI guidelines. | 60 |

| CSRdisclosure = Utility + Comparability | 0–100 | |

- Profile disclosures: statements 1.1; from 2.1 to 2.10; from 3.1 to 3.8; from 3.10 to 3.12; from 4.1 to 4.4; 4.14 and 4.15.

- Disclosures on the management approach: not required.

- Performance indicators and sector supplement performance indicators: a minimum of any 10 performance indicators, including at least one from each of social, economic and environment. Performance indicators may be selected from any finalized sector supplement but 7 of 10 must be from the original GRI guidelines.

- Profile disclosures: statements 1.1; 1.2; from 2.1 to 2.10; from 3.1 to 3.13; from 4.1 to 4.17.

- Disclosures on the management approach: for each indicator category.

- Performance indicators and sector supplement performance indicators: a minimum of any 20 performance indicators, including at least one from each of economic, environment, human rights, labor, society and product responsibility. Performance indicators may be selected from any finalized sector supplement but 14 of 20 must be from the original GRI guidelines.

- Profile disclosures: statements 1.1; 1.2; from 2.1 to 2.10; from 3.1 to 3.13; from 4.1 to 4.17.

- Disclosures on the management approach: for each indicator category.

- Performance indicators and sector supplement performance indicators: each core and sector supplement indicator.

| A. Individualism | B. Masculinity | C. Uncertainty Avoidance | D. Power Distance | E. Long-Term Orientation | F. 100—Long-Term Orientation Score | G. Indulgence | H. 100—Indulgence Score | Cultural_Weakness (A + B + C + D + F + H) | |

|---|---|---|---|---|---|---|---|---|---|

| Canada | 80 | 52 | 48 | 39 | 36 | 64 | 68 | 32 | 315 |

| France | 71 | 43 | 86 | 68 | 63 | 37 | 48 | 52 | 357 |

| Germany | 67 | 66 | 65 | 35 | 83 | 17 | 40 | 60 | 310 |

| Italy | 76 | 70 | 75 | 50 | 61 | 39 | 30 | 71 | 380 |

| Netherlands | 80 | 14 | 53 | 38 | 67 | 33 | 68 | 32 | 250 |

| Spain | 51 | 42 | 86 | 57 | 48 | 52 | 44 | 56 | 344 |

| Sweden | 71 | 5 | 29 | 31 | 53 | 47 | 78 | 22 | 205 |

| UK | 89 | 66 | 35 | 35 | 51 | 49 | 69 | 31 | 305 |

| USA | 91 | 62 | 46 | 40 | 26 | 74 | 68 | 32 | 345 |

| Variable | Mean | Std. Dev. | Min | Max | 1 | 2 | 3 | 4 | 5 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. CSRdisclosure | 16.4495 | 24.2305 | 0 | 100 | 1 | |||||||

| 2. Utility | 9.196 | 11.6209 | 0 | 40 | 0.8147 *** | 1 | ||||||

| 3. Comparability | 7.2365 | 16.1934 | 0 | 60 | 0.909 *** | 0.4997 *** | 1 | |||||

| 4. Independent | 0.6861 | 0.2075 | 0 | 1 | −0.1854 *** | −0.2146 *** | −0.1217 *** | 1 | ||||

| 5. Women | 0.0921 | 0.123 | 0 | 1 | 0.1048 ** | 0.1286 *** | 0.0684 ** | 0.0759 ** | 1 | |||

| 6. Company Size | 10.0888 | 2.6095 | −2.1507 | 14.6012 | 0.1887 *** | 0.1105 ** | 0.1767 *** | 0.1423 *** | 0.1485 *** | 1 | ||

| 7. ROA | 0.0208 | 0.1366 | −1.5776 | 1.2423 | −0.0349 | 0.0463 | 0.0263 | −0.0156 | 0.0607 † | −0.0977 ** | 1 | |

| 8. Loans | 0.1095 | 0.1386 | 0 | 0.7534 | −0.145 *** | −0.131 *** | −0.1249 *** | 0.0131 | −0.1139 *** | −0.1591 *** | −0.0197 | 1 |

| Panel A. CSRdisclosure Variable | |||||||||

| Score | Canada | France | Germany | Italy | Netherlands | Spain | Sweden | UK | USA |

| 0 | 23.88 | 0.00 | 17.39 | 26.67 | 16.00 | 12.50 | 4.76 | 12.57 | 75.24 |

| 5 | 25.37 | 0.00 | 21.74 | 10.00 | 4.00 | 5.36 | 23.81 | 4.92 | 14.32 |

| 10 | 25.37 | 21.05 | 8.70 | 13.33 | 4.00 | 7.14 | 33.33 | 6.56 | 3.16 |

| 15 | 0.00 | 0.00 | 13.04 | 10.00 | 4.00 | 8.93 | 4.76 | 11.48 | 0.97 |

| 20 | 2.99 | 0.00 | 0.00 | 11.67 | 0.00 | 0.00 | 0.00 | 11.48 | 1.46 |

| 25 | 5.97 | 15.79 | 0.00 | 8.33 | 0.00 | 1.79 | 14.29 | 9.29 | 0.24 |

| 30 | 8.96 | 0.00 | 0.00 | 0.00 | 16.00 | 0.00 | 4.76 | 15.30 | 1.21 |

| 35 | 1.49 | 15.79 | 0.00 | 5.00 | 16.00 | 1.79 | 14.29 | 4.37 | 0.00 |

| 40 | 1.49 | 0.00 | 0.00 | 1.67 | 0.00 | 1.79 | 0.00 | 5.46 | 1.21 |

| 45 | 0.00 | 15.79 | 0.00 | 0.00 | 8.00 | 0.00 | 0.00 | 0.00 | 0.49 |

| 50 | 4.48 | 0.00 | 0.00 | 0.00 | 4.00 | 5.36 | 0.00 | 5.46 | 0.97 |

| 55 | 0.00 | 0.00 | 4.35 | 1.67 | 8.00 | 3.57 | 0.00 | 1.64 | 0.73 |

| 60 | 0.00 | 0.00 | 0.00 | 5.00 | 0.00 | 1.79 | 0.00 | 3.83 | 0.00 |

| 65 | 0.00 | 0.00 | 4.35 | 0.00 | 0.00 | 0.00 | 0.00 | 1.64 | 0.00 |

| 70 | 0.00 | 15.79 | 8.70 | 1.67 | 4.00 | 1.79 | 0.00 | 1.64 | 0.00 |

| 75 | 0.00 | 0.00 | 4.35 | 0.00 | 8.00 | 3.57 | 0.00 | 3.28 | 0.00 |

| 80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.09 | 0.00 |

| 85 | 0.00 | 15.79 | 0.00 | 0.00 | 8.00 | 14.29 | 0.00 | 0.00 | 0.00 |

| 90 | 0.00 | 0.00 | 0.00 | 1.67 | 0.00 | 23.21 | 0.00 | 0.00 | 0.00 |

| 95 | 0.00 | 0.00 | 8.70 | 1.67 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 100 | 0.00 | 0.00 | 8.70 | 1.67 | 0.00 | 7.14 | 0.00 | 0.00 | 0.00 |

| Panel B. Utility Variable | |||||||||

| 0 | 23.88 | 0.00 | 17.39 | 26.67 | 16.00 | 14.29 | 4.76 | 12.57 | 77.54 |

| 5 | 31.34 | 0.00 | 21.74 | 11.67 | 12.00 | 5.36 | 38.10 | 5.46 | 14.98 |

| 10 | 34.33 | 21.05 | 8.70 | 13.33 | 24.00 | 12.50 | 38.10 | 8.74 | 5.31 |

| 15 | 1.49 | 15.79 | 21.74 | 11.67 | 36.00 | 16.07 | 19.05 | 12.57 | 1.69 |

| 20 | 4.48 | 0.00 | 0.00 | 16.67 | 0.00 | 0.00 | 0.00 | 13.66 | 0.00 |

| 25 | 0.00 | 47.37 | 4.35 | 6.67 | 8.00 | 16.07 | 0.00 | 10.38 | 0.00 |

| 30 | 4.48 | 15.79 | 8.70 | 3.33 | 4.00 | 25.00 | 0.00 | 20.22 | 0.00 |

| 35 | 0.00 | 0.00 | 8.70 | 6.67 | 0.00 | 1.79 | 0.00 | 8.20 | 0.00 |

| 40 | 0.00 | 0.00 | 8.70 | 3.33 | 0.00 | 8.93 | 0.00 | 8.20 | 0.00 |

| Panel C. Comparability Variable | |||||||||

| 0 | 77.61 | 36.84 | 60.87 | 85.00 | 28.00 | 37.50 | 66.67 | 78.14 | 93.72 |

| 20 | 22.39 | 31.58 | 0.00 | 1.67 | 32.00 | 1.79 | 33.33 | 11.48 | 2.90 |

| 40 | 0.00 | 15.79 | 17.39 | 8.33 | 24.00 | 12.50 | 0.00 | 10.38 | 3.38 |

| 60 | 0.00 | 15.79 | 21.74 | 5.00 | 16.00 | 48.21 | 0.00 | 0.00 | 0.00 |

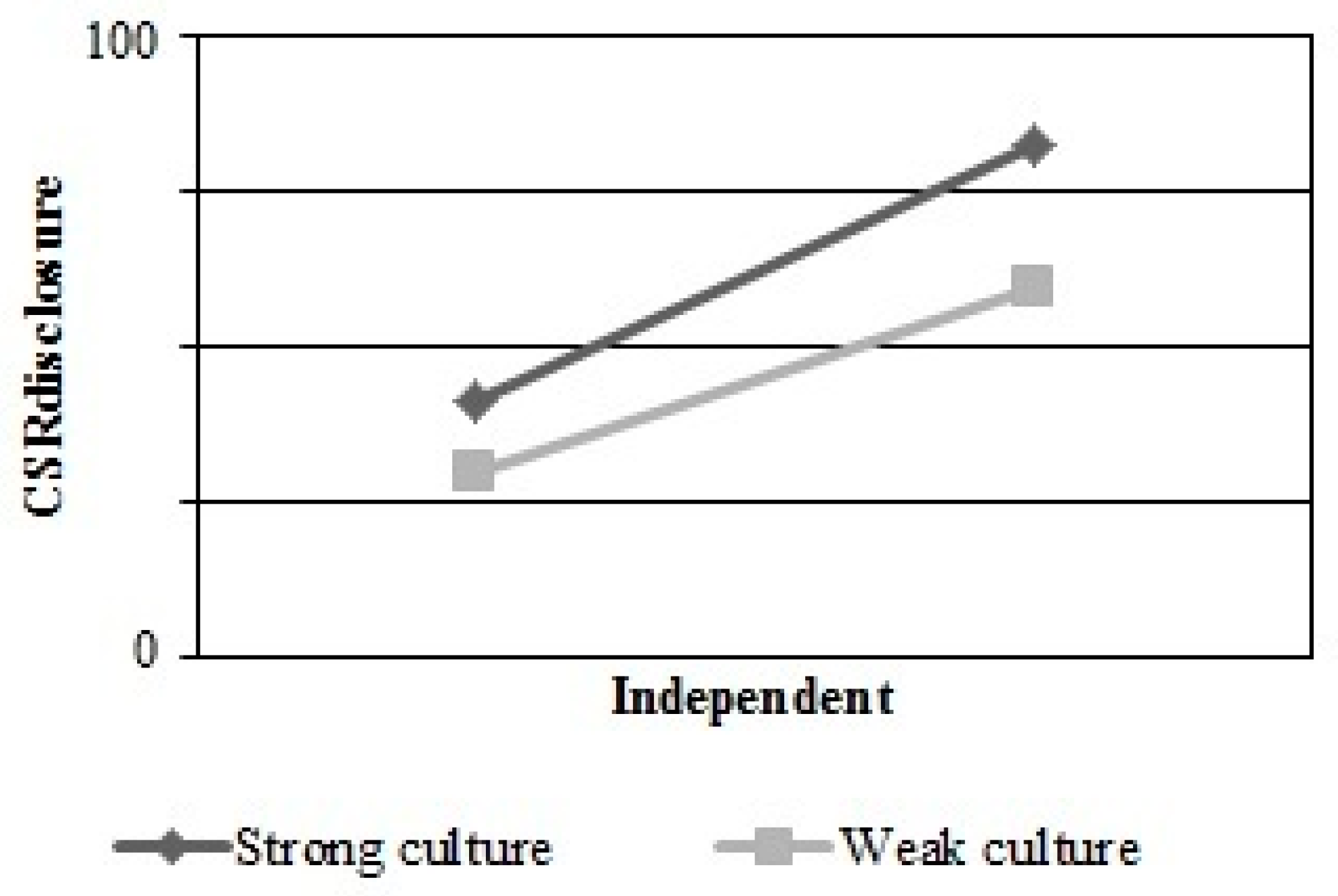

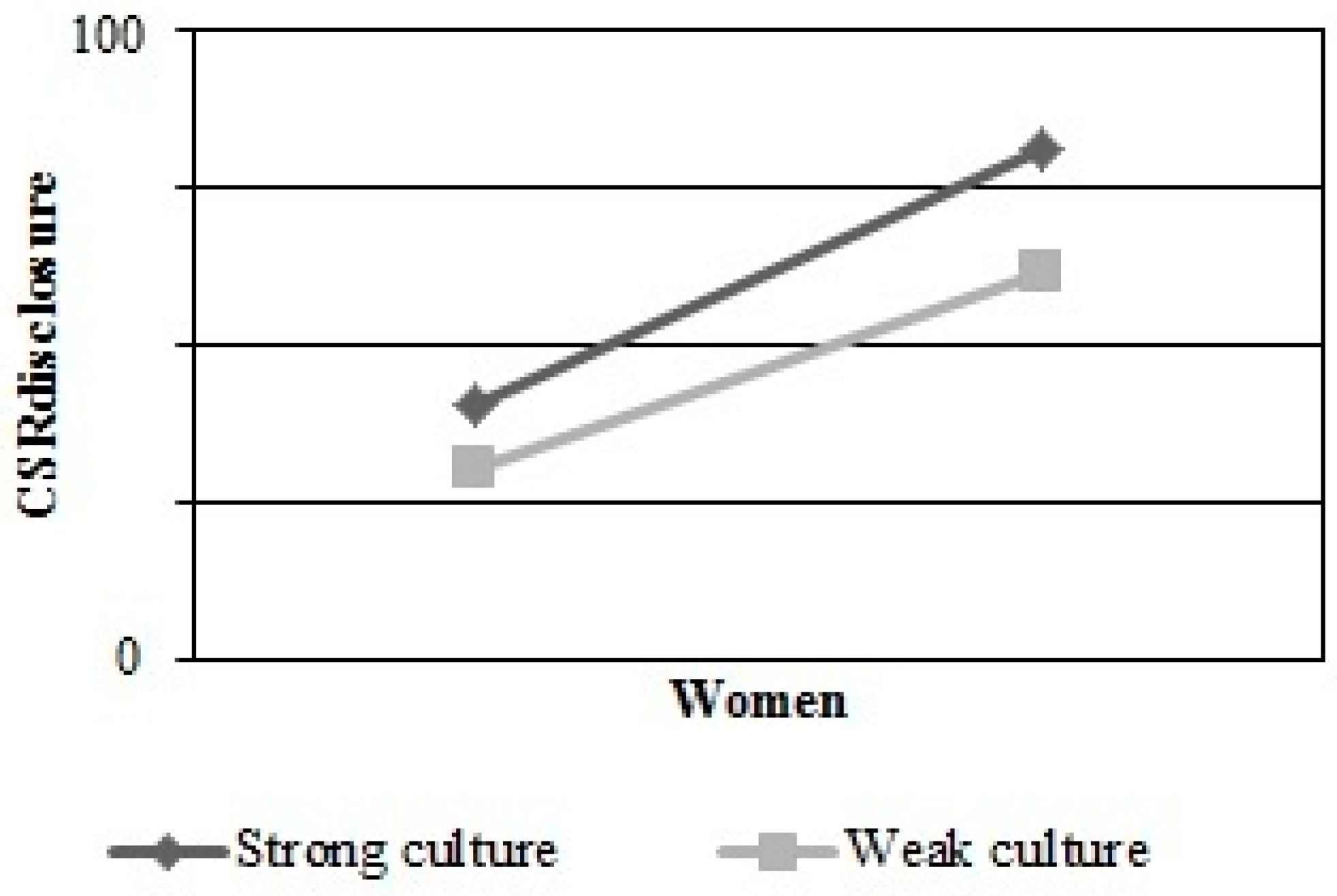

| Model 1 | Model 2 | |||

|---|---|---|---|---|

| Dependent Variable: CSRdisclosure | Coef. | Std. Err. | Coef. | Std. Err. |

| Independent | 0.2906 *** | 0.0044 | 16.4699 *** | 0.5332 |

| Women | 7.9603 *** | 0.0463 | 24.3276 *** | 3.3058 |

| Cultural_weakness | −0.0513 * | 0.0214 | ||

| Independent * Cultural_weakness | −4.5309 *** | 0.1472 | ||

| Women * Cultural_weakness | −5.9244 *** | 0.9617 | ||

| Bank Size | −0.0246 *** | 0.001 | 0.4283 *** | 0.0219 |

| ROA | −0.0558 *** | 0.0017 | −0.6008 *** | 0.0112 |

| Loans | 1.1373 *** | 0.0411 | 7.9649 *** | 0.7021 |

| Countryj | Yes | No | ||

| Yeark | Yes | Yes | ||

| Arellano-Bond test for AR(2) in first differences | z = −0.72 | z = −0.41 | ||

| Pr > z = 0.473 | Pr > z = 0.683 | |||

| Hansen test of overid. restrictions | chi2(137) = 150.95 | chi2(137) = 141.79 | ||

| Prob > chi2 = 0.196 | Prob > chi2 = 0.191 | |||

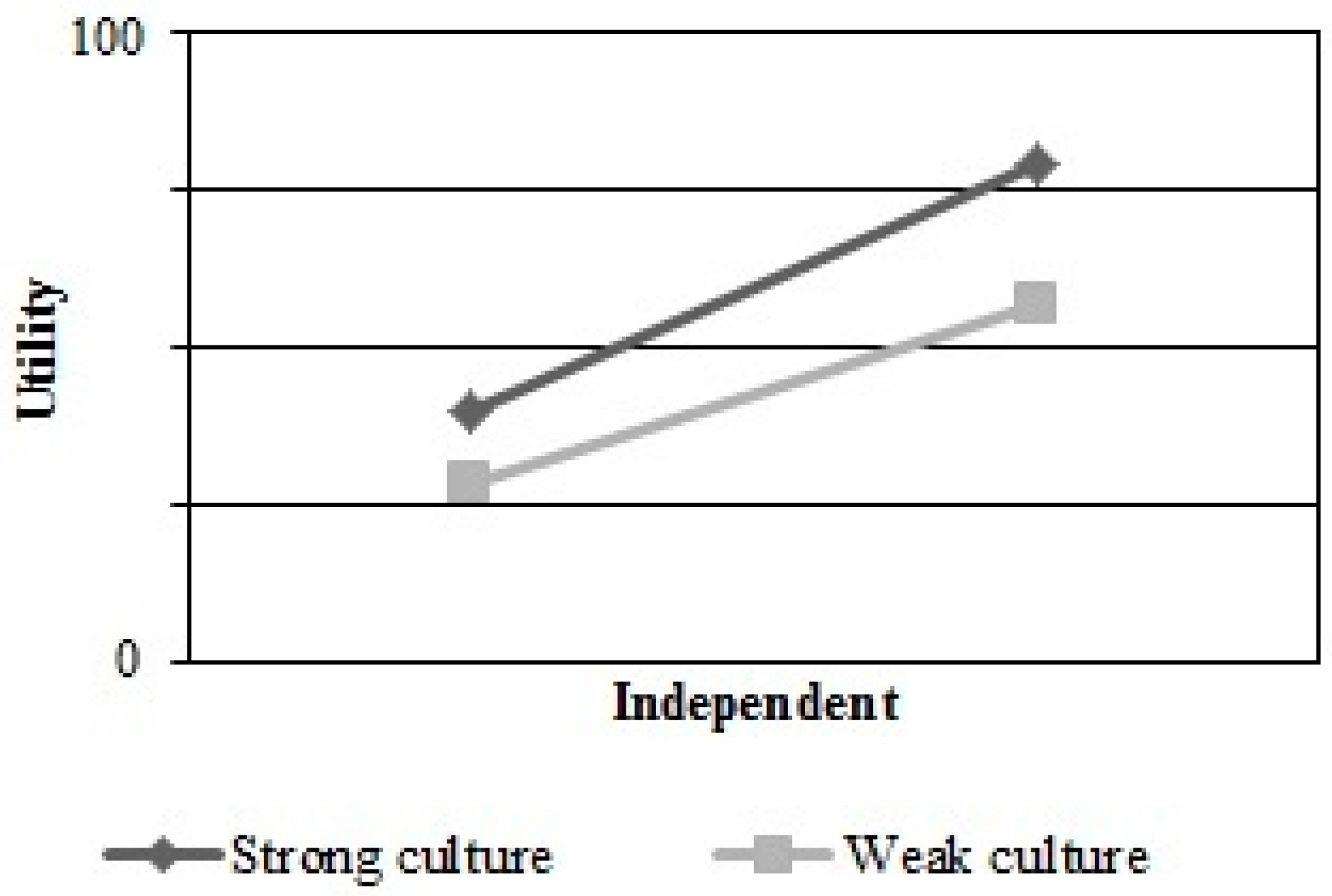

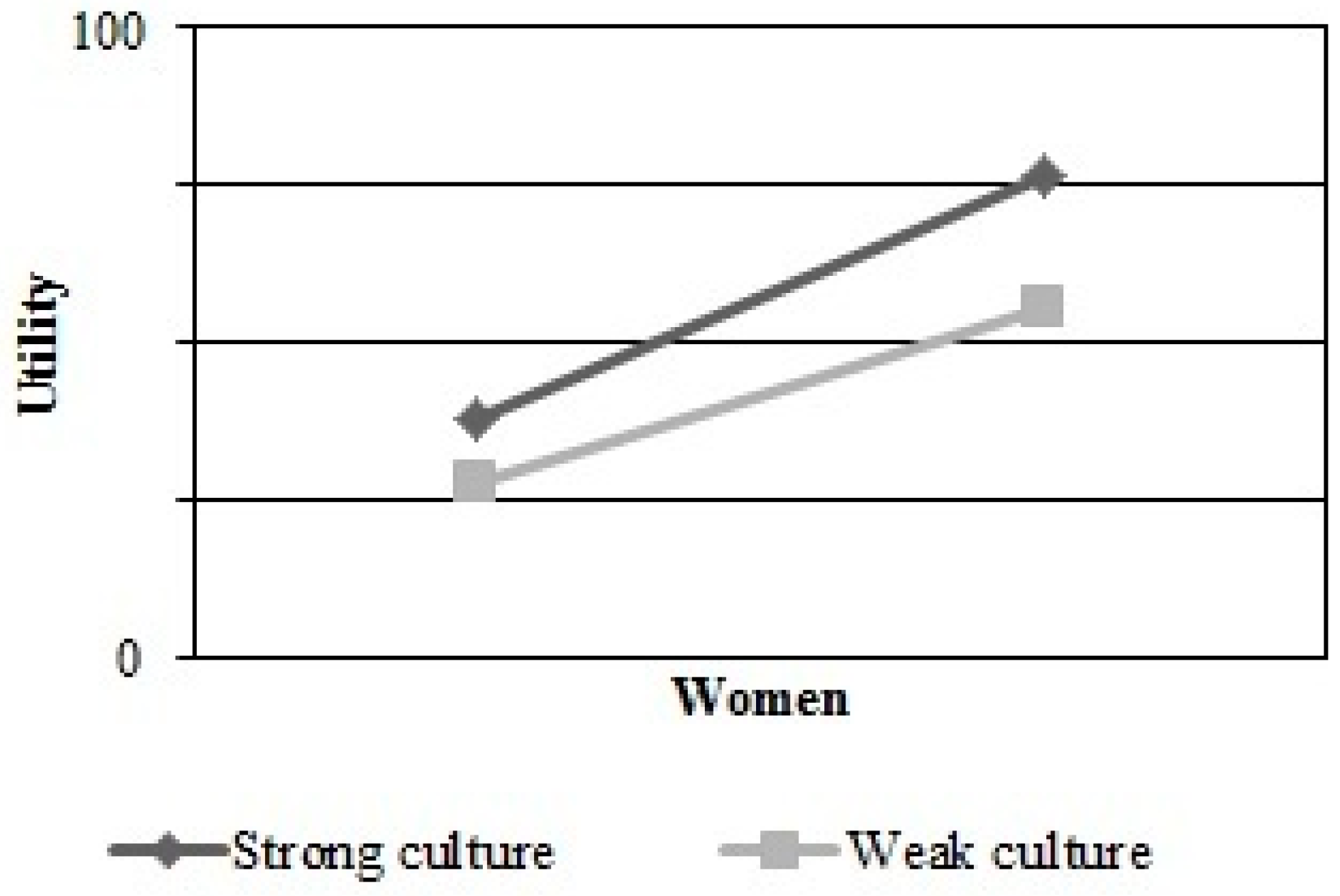

| Model 3 | Model 4 | |||

|---|---|---|---|---|

| Dependent Variable: Utility | Coef. | Std. Err. | Coef. | Std. Err. |

| Independent | 1.1336 *** | 0.0086 | 11.0831 *** | 0.4577 |

| Women | 12.1126 *** | 0.12931 | 22.8438 *** | 1.1563 |

| Cultural_weakness | −0.1168 *** | 0.0131 | ||

| Independent * Cultural_weakness | −3.0678 *** | 0.1264 | ||

| Women * Cultural_weakness | −6.2724 *** | 0.3236 | ||

| Bank Size | −0.1952 *** | 0.0025 | −0.2698 *** | 0.0110 |

| ROA | −0.0547 *** | 0.0018 | −0.4641 *** | 0.0099 |

| Loans | −3.2491 *** | 0.1418 | −4.5125 *** | 0.2816 |

| Countryj | Yes | No | ||

| Yeark | Yes | Yes | ||

| Arellano-Bond test for AR(2) in first differences | z = 0.50 | z = −0.06 | ||

| Pr > z = 0.615 | Pr > z = 0.956 | |||

| Hansen test of overid. restrictions | chi2(137) = 150.58 | chi2(137) = 145.34 | ||

| Prob > chi2 = 0.202 | Prob > chi2 = 0.141 | |||

| Model 5 | Model 6 | |||

|---|---|---|---|---|

| Dependent Variable: Comparability | Coef. | Std. Err. | Coef. | Std. Err. |

| Independent | 0.3021 *** | 0.0275 | 80.0811 *** | 0.5415 |

| Women | 27.1152 *** | 0.3003 | 23.5038 * | 11.8012 |

| Cultural_weakness | −0.1605 *** | 0.0053 | ||

| Independent * Cultural_weakness | −2.192 *** | 0.0151 | ||

| Women * Cultural_weakness | −6.9289 *** | 0.0864 | ||

| Bank Size | 0.0677 *** | 0.0018 | 0.0083 | 0.0342 |

| ROA | −0.2277 *** | 0.01 | −0.1348 *** | 0.0030 |

| Loans | 9.0502 *** | 0.1941 | 11.3508 *** | 0.1656 |

| Countryj | Yes | No | ||

| Yeark | Yes | Yes | ||

| Arellano-Bond test for AR(2) in first differences | z = −1.72 | z = −1.29 | ||

| Pr > z = 0.085 | Pr > z = 0.196 | |||

| Hansen test of overid. restrictions | chi2(137) = 149.65 | chi2(137) = 152.28 | ||

| Prob > chi2 = 0.217 | Prob > chi2 = 0.656 | |||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

García-Meca, E.; Uribe-Bohórquez, M.-V.; Cuadrado-Ballesteros, B. Culture, Board Composition and Corporate Social Reporting in the Banking Sector. Adm. Sci. 2018, 8, 41. https://doi.org/10.3390/admsci8030041

García-Meca E, Uribe-Bohórquez M-V, Cuadrado-Ballesteros B. Culture, Board Composition and Corporate Social Reporting in the Banking Sector. Administrative Sciences. 2018; 8(3):41. https://doi.org/10.3390/admsci8030041

Chicago/Turabian StyleGarcía-Meca, Emma, María-Victoria Uribe-Bohórquez, and Beatriz Cuadrado-Ballesteros. 2018. "Culture, Board Composition and Corporate Social Reporting in the Banking Sector" Administrative Sciences 8, no. 3: 41. https://doi.org/10.3390/admsci8030041

APA StyleGarcía-Meca, E., Uribe-Bohórquez, M.-V., & Cuadrado-Ballesteros, B. (2018). Culture, Board Composition and Corporate Social Reporting in the Banking Sector. Administrative Sciences, 8(3), 41. https://doi.org/10.3390/admsci8030041