Abstract

Currently, corporate social responsibility and environmental/social/governance topics are gaining more relevance in business and finance. Attention to corporate diversity in boards and the workforce is included in this trend. Although most studies focus on executive boards and objective scores, the perception of diversity by employees and its rankability are not fully understood or researched. In this paper, we analyze corporate diversity rankings from the perspective of predictive and prescriptive analytics. Inside predictive analytics, the perceived diversity of a sample of 350 European diversity leader companies is predicted by using three different feature sets (raw financial data, ratios and objective diversity variables) and three machine learning algorithms (K Nearest Neighbors, Logistic Regression, Decision Tree). The best performing algorithm is the Decision Tree, and all three feature sets outperform one random dummy algorithm; the best performing set is the financial ratios set. Inside prescriptive analytics, several rankings involving American companies are intersected and compared in three exercises (studying diversity categorization, ethnic origin and comparing diversity with other unrelated metrics). From these, global rankings were built to search for the best possible agreement among the rankings. These results with both predictive and prescriptive analytics encourage managers to strategize and include diversity in management, as well as employ new technologies in their decision-making processes.

1. Introduction

Diversity in boards and in the workplace, within the Corporate Social Responsibility (CSR) paradigm, is a growing demand of society and a topic of scientific interest in business (Frynas & Yamahaki, 2016). As defined by Patrick and Kumar (2012), diversity refers to understanding, respecting and accepting the uniqueness of each individual, especially in the dimensions of race, ethnicity, gender, sexual orientation, socioeconomic status, age, physical abilities and religious, political or other beliefs. Foma (2014) argues that workplace diversity promotes positive points such as the exchange of ideas, development of friendship without discrimination, elimination of stereotyping, conflict management and employee retention; however, drawbacks include communication gaps due to language barriers and resistance to change. Similarly, Fine et al. (1990) suggest that men, women, and people of color have different views on organizational issues; therefore, considering gender and race as cultures might be a useful framework for understanding diversity. The advantages of corporate diversity should theoretically prove its business case; indeed, a diverse workforce is sometimes linked to an improvement in financial performance and innovation (Lorenzo & Reeves, 2018). The literature shows that diverse executive boards are positively correlated with CSR compliance (Harjoto et al., 2015). This is also applicable to gender diversity too (Beji et al., 2021; Rao & Tilt, 2016), which is one of the most researched themes in this field. However, empirical research on the effect of diversity on financial performance has produced mixed results: Jayne and Dipboye (2004) conclude that it is very context-dependent and recommend organizations to build senior management commitment, extensively assess the needs, emphasize team building and tie the business results via metrics with the diversity strategy.

Consequently, diversity is a relevant topic for analysis with important implications for businesses and corporations (Aßländer et al., 2016; Gotsis & Kortezi, 2013). The current academic debate surrounding corporate diversity, CSR, and performance is multifaceted, with ongoing discussions regarding the tangible financial benefits of diversity, meta-analyses and large-scale studies offering conflicting or context-dependent findings. Different perspectives may be adopted when analyzing corporate diversity. One popular perspective is to evaluate the relationship between corporate diversity and financial performance, where there is no clear consensus that the former improves the latter (Opstrup & Villadsen, 2015; Singal & Gerde, 2015). Even though predictive analytics techniques, such as Machine Learning (ML), are proven to be suitable for building robust models in general (Ahmed et al., 2022), literature applying it to the study of this relationship is not abundant and centered mostly on diversity at the board composition level (Behlau et al., 2024; Yang et al., 2024), instead of workforce corporate diversity as a whole and its perception by employees. These predictions bear more complex social outcomes, which remain less common and face validity challenges, inside the a-contextual, unclear and unstable concept of diversity climate (Cachat-Rosset et al., 2019). Another approach to corporate diversity are company rankings, where diversity is increasingly employed as a criterion for ranking and comparing firms (Bouslah et al., 2023; Pasztor, 2019). Even though companies are recurrently ranked in terms of diversity and prescriptive analytics techniques, such as Operations Research (OR), and provide methods to analyze these rankings (Birge & Linetsky, 2007), literature comparing the results of companies among different diversity rankings is very limited. While the focus in business and research is shifting from simple demographic representation to measuring genuine equity and inclusion, robust metrics remain elusive: proliferation of corporate diversity ratings and rankings faces scrutiny regarding methodological consistency, transparency, and potential ‘greenwashing’ or ‘diversity-washing’. The gaps in the literature are, consequently, three-fold. In theory, diversity climate is generally analyzed in terms of how effective HR policies are when set in place, such as the age diversity ones in Boehm et al. (2014), or the differences between the objective reality and perceived diversity, as in Reinwald et al. (2019). However, references linking financial performance and diversity climate are more scarce. Diversity rankings and its relationship to other corporate rankings is also underanalyzed, even though their relevance as a source of institutional legitimacy is defended in Tayar (2017), including how some of them may only reflect superficial elements and not deeply ingrained diversity. Finally, in practice, diversity climate has not been analyzed with ML and OR tools, despite their potential and application in other fields.

Therefore, in this paper, these gaps in the literature on corporate workforce diversity. In the predictive ML part, the relationship between financial performance and corporate workforce diversity is studied by building several ML models to predict employees’ perception of diversity in European corporations using three different feature sets: raw financial variables, preprocessed financial ratios and objective diversity scores as extracted from recognized rankings and databases. The best ML models were Decision Trees fitted with financial ratios, with an accuracy of ∼66%. In the prescriptive, OR part, performed in American companies, the similarity and conflict between the criteria of 11 recognized rankings is explored, employing a mixed integer linear programming formulation to aggregate the grading orders of the individual rankings into a general grading order, which most rankings agree with. The three OR comparison exercises carried out include one on best companies solely according to diversity scores, another on best companies depending on the ethnic origin of the employee, and one crossing the best companies in diversity jointly with other metrics, such as accessibility for new graduates or veterans. Small intersections and moderate–low correlations between individual rankings were obtained, and several solutions for the OR ranking exercises where found.

This paper contributes to the debate on the effects of corporate diversity in several ways. The ML part suggests a fair relationship between the financial performance and the perceived workforce diversity of a firm. Moderately linking corporate diversity to financial performance highlights how profitability can affect the perception employees have of corporate diversity, as well as their engagement. Likewise, not adopting diversity initiatives or having a low corporate diversity score might become a risk in strategy management. In this case, ML becomes useful for extracting decision-making insights regarding diversity, and the fair agreement in the models positions our paper in line with those that suggest a neutral, mildly positive relationship between corporate diversity and firm performance. The OR part manifests the possibility of constructing aggregated ranks of companies from partial rankings built with different methodologies, confirming the importance of formulating comprehensive diversity strategies that address its several dimensions. Aggregated ranks also portray industry-specific insights and allow managers to evaluate their relative positions in diversity policies with respect to industrial peers. Moreover, this work opens additional future research lines on the use of ML and OR in the study of diversity.

2. Literature Review

2.1. Corporate Diversity Theory

The study of board and workforce diversity and its outcomes in organizational and financial performance is of scientific interest; in De Abreu Dos Reis et al. (2007), a literature review of over 50 years of empirical research, corporate diversity is divided into the ethnical-racial, gender, age, group tenure, organizational tenure, functional background and educational background dimensions. Most of this research on corporate diversity consists of econometric analyses, of a deductive nature.

When discussing corporate diversity in terms of nationality, theories like Hofstede’s cultural dimensions explain differences in behavior between people in the business environment (Beugelsdijk et al., 2017). This cultural theory includes six dimensions: power distance, individualism/collectivism, masculinity/femininity, avoidance of uncertainty, long-term orientation and indulgence/restraint. Xu et al. (2024) proves that power distance has a negative effect on green innovation, while individualism, masculinity, uncertainty avoidance, long-term orientation and indulgence have a positive effect, from data of Asian economies in the period 2000–2019. Afzal and Lyu (2025) analyzes 100 construction firms and concludes that female board representation positively influences diversity outcomes, moderated by cultural traits: low power distance, high indulgence and high uncertainty avoidance positively correlated with diversity outcomes.

In the case of ethnic-racial diversity, while some studies argue for its positive effects on performance (Hartenian & Gudmundson, 2000; Richard, 2000), others found a negative relationship (Kirkman et al., 2004; Sacco & Schmitt, 2005); further works found that ethnic-racial diversity had no or negligible effects (Ely, 2004). Similarly, research shows that gender diversity may have a positive (Erhardt et al., 2003), negative (Alagna et al., 1982) or no effect at all (Kochan et al., 2003) on performance.

Similarly, according to Ding and Riccucci (2023), diversity also presents mixed and context-specific results in the public administration sector. While it contributes positively to the operation of public organizations (Nicholson-Crotty et al., 2017), innovation (Choi et al., 2018) and inclusion (Sabharwal, 2014), it also incurs communication costs (Owens & Kukla-Acevedo, 2012) and low commitment from some groups (Ritz & Alfes, 2018). In the CSR field, other empirical results prove that diversity, specifically gender, can create a more stable and rigorous corporate climate and improve corporate soundness and social contributions (Rhee et al., 2023). Furthermore, age and tenure diversity can contribute to adopting more sustainable approaches in corporations’ vision and strategies, improving governance and reducing carbon emissions (Cahyono et al., 2023; Ferrero-Ferrero et al., 2015).

In any case, most studies linking corporate diversity and organizational or financial performance focus on gender or ethnic origin equality in executive boards (Amorelli & García-Sánchez, 2021). Some works argue that boards with larger gender diversity are associated with better environmental and social performance (Buertey, 2021; Orazalin & Baydauletov, 2020), while others conclude that it has no relevant effect (Veltri et al., 2021). In addition, most of these studies used linear or logistic regression. In Carter et al. (2007), these two dimensions are analyzed in a sample of Fortune 500 listed firms over 4 years. A positive link between board diversity and financial performance is found, supporting the economic case of board diversity. However, this positive effect was subtle and complex, suggesting that gender and ethnic origin diversity cannot be treated as a same category. Similarly, Rose et al. (2013) study female and citizenship board representation in the largest listed firms in Germany, Denmark, Sweden, Finland and Norway. Using data from 2010 onwards, several correlations were found between the size of the board and the proportion of females and non-nationals present in them. In the regression analyses, the ROA, ROE and ROCE ratios were employed as dependent variables. The results showed that female board representation was not associated with superior performance, and larger executive boards had a negative impact on performance. Still, having non-nationals from the US, the UK or Australia on the boards had a positive impact on the performance. Campbell and Mínguez-Vera (2008), when researching Spanish executive boards, recognized that investors did not penalize gender diversity in boards through two regression models, one based on Tobin’s Q. Gender diversity did not destroy shareholder value, implying it may generate economic returns. Other works, such as Moreno-Gómez et al. (2018), are more firm on this assertion: their results showed, from a sample of 54 Colombian public businesses studied during 2008–2015, that gender diversity is positively associated with business performance. The presence of women in CEO positions and in top management benefited ROA, while women’s representation in the boardroom was more evident in ROE.

Most previous literature studies corporate diversity through objective scores, quotas, ratios or KPIs. However, the diversity as perceived by the employees of the firm might not match this objective reality, nor be the same for every person. For instance, Kossek and Zonia (1993) found that, compared to white men, white women and racioethnic minorities appreciated an employer’s efforts to promote diversity, holding more favorable attitudes regarding the qualifications of women and racioethnic minorities. In Higgins (2020), diversity climate perception was positively related to work engagement and organizational justice in 230 surveys of employees mainly belonging to the technology, education and healthcare sectors. Similar conclusions were reached by Jauhari and Singh (2013), who found a mediating role of perceived organizational support in the positive relationship between perceived diversity climate and employees’ organizational loyalty. Wolfson et al. (2011) and Madera et al. (2013) associate a perceived diversity climate with organizational commitment and increased job satisfaction, while Seriwatana (2021) considers it key for employee retention.

The Literature also focuses on how diversity climate changes over time, after relevant social, political or economic events happen. For instance, while the COVID-19 pandemic was an opportunity for social innovation to help overcoming the lack of diversity management in countries like Turkey (Palalar Alkan et al., 2022), it also produced an increase in societal polarization and cleavages in the US due to individualism and anti-statism (Bazzi et al., 2021). However, in contrast to the subprime 2007 crisis, economic interventions by the Federal Reserve generated positive spillovers during the pandemic (Cortes et al., 2022). Also in the US, the aftermath of George Floyd’s murder brought increasing societal demands for diversity-promoting policies (Balakrishnan et al., 2023), which in turn produced rejection from specific societal groups a few years later (Rajgopal et al., 2023). ESG is given higher relevance in investment and policy depending on politics (Dantas, 2021; Hilson, 2024), which currently includes a rollback of diversity initiatives creating a climate of fear, exacerbating existing inequalities and intensifying political polarization (Ng et al., 2025).

Some works also examine diversity climate in terms of organizational and financial performance. Regression analysis in Allen et al. (2007) supports the positive link between organizational performance and diversity climate, while recognizing limitations in purely basing the study in perceptual measures and not objective scores (perception versus reality). Lim et al. (2023) found a positive link between diversity perception by employees and a firm’s financial performance, which is positively moderated by diversity at the board management level. McKay et al. (2008) found that diversity climate moderated the sales performance of employees depending on their racial-ethnic differences. In the cultural dimension, openness to linguistics, value, and informational diversity showed strong positive associations with perceived group performance in Lauring and Selmer (2011). In contrast, H. Lee (2019) finds that diversity climate bears good outcomes only in U.S. federal agencies that mainly work on promoting social equity for disadvantaged populations. Moon and Christensen (2020) go one step further, suggesting that racial and tenure diversity have positive relationships with organizational performance, but functional diversity does not.

More recently, due to political changes, the diversity and inclusion paradigm has been challenged by corporate entities and national authorities (McGowan et al., 2025). Some works continue defending it: in 18 interviews analyzed in Beckert and Koch (2025), diversity managers reveal internal factors (increased creativity and productivity) and external pressures (stakeholders expectations and talent attraction) affecting diversity initiatives, and how diversity-washing implies potential credibility loss and reputational damage. On the other hand, Armstrong (2025) suggests a complete and radical reconceptualization of diversity and inclusion, so that it addresses power imbalance. The relationship between diversity climate and the objective diversity of a firm remains the object of debate; as summarized in Herdman and McMillan-Capehart (2010), achieving a diversity climate is positively related to implementing diversity initiatives in a not straightforward manner, hence the relevance of studying it with novel techniques.

2.2. Corporate Diversity Studies with Predictive Models

Even though studies involving board and workforce diversity in business are abundant, references that employ ML techniques are scarce. Ranta and Ylinen (2023) employed 21 features related to board and firm characteristics to predict three workplace diversity labels. These diversity labels were gender equality, inclusiveness/diversity and attitude towards older colleagues, which were extracted from a sample of 250,000 employee reviews from Kununu, a recruiting website similar to Glassdoor. For the ML part, Gradient Boosting trees were employed with a typical training/testing split of 80%/20%. In the training set, hyperparameter tuning was performed using a 5-fold cross-validation GridSearch scheme. The Gradient Boosting trees (Friedman, 2001) were compared and benchmarked against an Ordinary Least Squares (OLS) regressor and the Least Absolute Shrinkage and Selection Operator (LASSO) regressor. SHAP values were also employed in the analysis of the models (Lundberg & Lee, 2017). The Gradient Boosting trees obtained a higher and lower Mean Square Error (MSE) than OLS and LASSO. Gender diversity in the workplace was a predictor of firm value and was strongly positively associated with equality and inclusivity on boards; however, it was weakly negatively associated with age diversity. Yousaf et al. (2021) coupled board diversity attributes with ML prediction capabilities of corporate financial distress. The final sample consisting of 160 healthy and 135 insolvent Chinese A-listed companies was extracted from Shanghai and Shenzhen Stock Exchanges data from 2007 to 2016. The ML analysis was performed with a training/testing split proportion of 90%/10% (Veganzones & Séverin, 2018), as well as two different feature sets: one formed by 23 economic variables (including accounting, market, growth, macro economic and corporate governance ratios) and another one formed by eight economic variables plus seven diversity variables. Both feature sets were tested using Logistic Regression, Dynamic Hazard, Random Forest, bagging, boosting and K Nearest Neighbors algorithms. The feature set including board diversity slightly outperformed the feature set containing only financial variables. Koseoglu et al. (2025) proved the use of financial indicators to predict diversity scores with R programming, on 873 multinational companies data from 2021.

Other works like Bianchi et al. (2022) argue otherwise. This empirical study researched the board of directors’ diversity (gender, nationality and age) of a sample of 59,229 Italian companies during 2017–2019. This work specifically targeted Small and Medium Enterprises (SMEs) with a total production of less than 50 million euro and less than 250 employees. The ML pipeline included a 5-fold cross validation scheme and a GridSearch hyperparameter tuning of the training set. Linear, LASSO and Ridge regressions were employed in the regression analysis, and the classification included Logistic Regression, Decision Tree and Random Forest (Breiman, 2001). In both sets of cases, ML was not capable of learning how to predict corporate financials from diversity variables, exhibiting high Root Mean Square Errors (RMSEs) and low accuracy values.

2.3. Corporate Diversity Studies with Prescriptive Models

In business management and economic research, rankings are commonly employed to compare business schools (Bickerstaffe & Ridgers, 2007), countries (Malul et al., 2009) and top companies in specific sectors (Klass et al., 2006). The aggregation of different overlapping ranks to form combined, summarizing rankings is useful for simplified decision-making and prioritization in many other disciplines, as it can integrate information from individual genomic studies addressing the same questions in biology (X. Li et al., 2019), as well as building meta-searches and improving search precision on the web (Dwork et al., 2001). In business, ranks are aggregated in Filbeck et al. (2013), who study four different corporate rankings. The cumulative and interactive effects in companies listed in these rankings add short-term and long-term value to business portfolios, especially when a given company is present in more than two or three of these rankings simultaneously. In addition, Martín-Zamora et al. (2025) proved the positive relationship between gender diversity in TMTs and corporate reputation by analyzing rankings.

However, references specifically linking OR and corporate diversity are very limited, despite the necessity to address non-uniformity and heterogeneity in diversity benchmarking methodologies (Foster et al., 2023). Most studies remain purely theoretical and mathematical: Kuo et al. (1993) and Martí et al. (2010) discuss the maximum diversity problem, that consists of selecting a subset of elements from a set such that the sum of distances between the chosen elements is maximized. Bhadury et al. (2000) found that workforce diversity in project teams is maximized by solving the dining problem, within the network-flow domain (Wolsey & Nemhauser, 2014). Nonetheless, no OR technique has been applied to thoroughly study companies as a whole in terms of diversity; hence, the relevance and novelty of this work.

3. Methodology

3.1. Data and Variables

The financial and diversity information of a set of European companies was studied in the ML exercise. These European companies are among the 850 ranked in Europe’s Diversity Leaders 2023, published by Statista R and Financial Times (Vincent, 2022). This ranking is produced by more than 100,000 surveys of European corporations employing at least 250 people, from April to July 2022. The surveys included direct and indirect evaluations of companies through five-point Likert scale statements on general, gender, ethnicity, LGBTQ+ status, age and disability diversity. Higher importance was given to the survey answers coming from the diversity groups. Each one of the 100,000 employees surveyed took an average of 6–9 min to complete the survey, evaluating not only their own employer but also other relevant employers in their industry, resulting in a total of 300,000 evaluations of companies. The result of these evaluations was a numeric score given to each company, namely di. To form the ranking, the companies were ordered from best to worst by their di score. This source represents perceived diversity because it is based on the subjectivity of employees’ responses, rather than objective numeric quotas or ratios involving corporate diversity.

The financial information of these European companies was then extracted from 15 ratios and 11 variables contained in Yahoo Finance through the income statement, balance sheet and cash flow (Yahoo, 2023). As for the diversity information, two scores (pd, wo) out of the eight available were sampled from Refinitiv Eikon (LSEG, 2023), while the remaining one, di, was extracted from the original Financial Times ranking. The variables of this ML exercise are collected and abbreviated in Table 1; they are commonly employed in other ML works involving Finance (D’Amato et al., 2021; Paule-Vianez et al., 2019; Roman & Șargu, 2013). Those companies present in Europe’s Diversity Leaders 2023 that had no financial information on Yahoo Finance or diversity scores on Eikon were excluded from the analysis, like Giorgio Armani or Start People. These data availability issues resulted in a reduction in the final dataset from the potential 850 original companies in the Financial Times ranking to around 350 companies.

Table 1.

Variables in the machine learning study.

The OR exercise consists of analyzing a series of rankings of American companies. Three different studies are proposed: one compares diversity rankings, another focuses on ethnic origin and a third one links diversity with other corporate metrics. The rankings employed in this OR exercise were performed in 2023 and are listed in Table 2, where the number of companies in the lists is also included.

Table 2.

Rankings and scores included in the operation research study.

The aim of the diversity study is to compare how diversity is measured differently in three data sources. One of them is America’s Best Employers for Diversity 2023, by Forbes and Statista R (Peachman, 2023c). This ranking was built upon direct and indirect scoring made by 45,000 employees of companies with more than 1000 employees, as well as objective KPIs involving management and engagement. Another ranking employed is Top 50 Companies For Diversity, collected by Fair360 on companies with more than 750 employees. In this ranking, over 1400 factors categorize companies with respect to leadership accountability, talent programs, human capital metrics, workplace practices, supplier fairness and philanthropy (Gray Miller, 2023a). The third pillar of this study is composed of companies’ D&I scores in Glassdoor, with nearly 50,000 verified companies (Landbase, 2025); this online portal is usually studied when researching employee satisfaction within corporations (Das Swain et al., 2020; Dube & Zhu, 2021). These three sources are among the most employed in diversity research in the US context, referenced in works like Filbeck et al. (2017) and Dobbin and Kalev (2022).

The ethnic origin study contrasts if fair opportunities and diversity are applied to all racial backgrounds equally; in this line, some ethnic minorities may be promoted or cared for while others may be marginalized (Van der Meer & Roosblad, 2004). To study this, four different rankings representing the best companies for Asian American, Black, Latino and Native American/Pacific Islander executives were collected. These rankings belong, as specialty lists, to the aforementioned Top 50 Companies For Diversity of Fair360. The companies are ranked for the hiring, promotion, and retention of each ethnic origin separately, as well as their presence in management levels 1–4 and in the 10% highest-paid employees (Gray Miller, 2023b). These rankings also evaluate the participation of ethnic minorities in mentoring and sponsorship programs, as well as leadership commitment to achieving proportional race representation.

The global study evaluates whether companies best at diversity are also outperforming in other different corporate fields. The research sample is formed by another five studies from Forbes and Statista R. The first one is the aforementioned America’s Best Employers for Diversity 2023, which serves as diversity-as-a-whole reference. The second one, America’s Best Employers for Women, surveyed 40,000 women in companies with more than 1000 employees by using four criteria: direct recommendations in general, direct recommendations in topics specifically related to women, indirect recommendations and diversity among top executives and board (Schwarz, 2023a). The other three rankings are not necessarily related to workplace diversity; in one of them, America’s Best Large Employers, 45,000 employees working for companies with at least 1000 people responded on the willingness to recommend one’s own employer and the willingness to recommend other employers, which was translated into a direct and an indirect score (Schwarz, 2023b). In America’s Best Employers For New Grads, 28,000 U.S. young professionals in companies with at least 1000 employees were again queried on direct and indirect recommendations regarding corporate atmosphere and development, image, working conditions, salary wage, workplace, diversity and likelihood of recommendation (Peachman, 2023a). Finally, America’s Best Employers For Veterans surveyed 8500 U.S. veterans in companies with at least 1000 employees with the same direct–indirect scoring structure; the targeted topics in the surveys were the same as with the new grads, except for the specific veteran topics (Peachman, 2023b).

3.2. Predictive Analytics Pipeline

A total of 10 ML simulations were performed using Python and the Sci-kit Learn library (Pedregosa et al., 2011). The targeted label to be predicted by ML is the diversity index of the Financial Times ranking, di, which represents corporate diversity perceived by employees. Several regression, classification and discretization approaches were examined, of which the best performing are kept in the paper. A classification approach was chosen over a regression approach because of its better performance, as illustrated in works comparing both like Strecht et al. (2015) and Martin-Melero et al. (2025). To obtain a classification problem, di can be discretized using different schemes (S. Garcia et al., 2012). In this work, di was discretized into two different levels: high and low. For this application, binning the categories into two levels is optimal (Carmona et al., 2013) and the 45%/55% proportion between classes is ideal to avoid data imbalance problems, which worsens the performance and fitness of ML models (Luque et al., 2019). The ML models were tested on three different feature sets: one composed of financial ratios (variables ps, er, ee, bt, wk, pr, pf, op, cr, qr, ch, dr, ra, re, es), another one on financial information (variables rv, eb, ni, ca, cs, iv, na, cl, nl, wc, eq) and a last one focused on diversity data (variables pd, wo). The first and second feature sets compare the fits of raw financial data versus financial ratios, which are useful in multiple econometric analyses (Delen et al., 2013; Song et al., 2018) but also do present their limitations (Feroz et al., 2003). The third feature set is employed to compare objective diversity metrics from Eikon to the ML label of diversity as perceived by employees, which might not coincide (Hentschel et al., 2013; Shemla et al., 2016). Indeed, the relationship between both is complex (Cachat-Rosset et al., 2019), and benefits from objective diversity are only maximized when individuals perceive the diversity-favoring climate; if not, the benefits are lost (Cox, 1994).

Several ML algorithms were employed and compared with a dummy random classifier in each one of the three feature sets studied in the ML analysis, resulting in the 3 feature sets × 3 algorithms + 1 dummy classifier = 10 ML cases. The K Nearest Neighbors, Logistic Regression and Decision Tree algorithms are selected for the ML exercises because of their good performance in different fields (Sarker, 2021) as well as in financial applications (Dixon et al., 2020). Three of these are very different construction-wise, which provides a varied pool of prediction models. To ensure a fair comparison between the models, all simulations had the same training/testing division of 80%/20%, which is a widely employed proportion in ML studies (Gholamy et al., 2018). Moreover, a hyperparameter tuning analysis was performed on the training set with a 10-fold cross validation GridSearch; Table 3 shows the modified parameters for each model.

Table 3.

Hyperparameters tuned in GridSearch.

The performance metrics employed are expressed in Equations (1)–(6), and include the accuracy, sensitivity (or recall), specificity, precision, F1-Score and area under curve; they are among the most frequent and employed in classification exercises (Canbek et al., 2017, 2022).

where

- are the True Positive values, high di predicted as so.

- are the True Negative values, low di predicted as so.

- are the False Positive values, low di predicted as high di.

- are the False Negative values, high di predicted as low di.

3.2.1. K Nearest Neighbors

The K Nearest Neighbors (KNN) algorithm is a non-parametric classifier that predicts the grouping of data points by employing proximity. First defined by Cover and Hart (1967), it is based on majority voting, which consists of predicting labels by studying the most frequently represented ones around the data point. The distance between two datapoints and is expressed in Equation (7), as defined by Minkowski, where each datapoint x comprises a number of attributes (Cunningham & Delany, 2021; Sun & Huang, 2010).

where

- n is the dimensionality of the vector, or number of attributes.

- is the bth attribute.

- is the weight of the bth attribute.

- p is Minkowski’s order.

Different expressions for the distance can be found when altering p. The value represents the Manhattan distance, the Euclidean distance and when , Chebyshev’s distance is obtained; the optimization of p has been extensively researched in the literature (Lubis & Lubis, 2020; Prasatha et al., 2017). Therefore, the smaller is, the more similar the datapoints are. The label is finally assigned to a test data point by the majority vote of its k nearest neighbors, according to Equation (8).

where

- is a test data point.

- is a k nearest neighbor to .

- indicates if belongs to class .

3.2.2. Logistic Regression

The Logistic Regression (LR) algorithm estimates the maximum likelihood; the model is adjusted by finding the parameter values that maximize the likelihood of making the given observations (Dangeti, 2017). LR applies this principle after transforming the label to predict into a natural odds of occurring (or logit) label, with respect to the features. The original LR algorithm predicts its dichotomous labels by outputting the probability of belonging to one class or the other, which is modeled in Kleinbaum et al. (2002) as Equation (9).

where

- represents the probability of the label belonging to class z.

- are independent variables.

- and are unknown constant parameters.

Among its business applications, LR has been employed in performance measurement (Wood, 2006), customer satisfaction data analysis (Lawson & Montgomery, 2006) and business failure prediction (H. Li et al., 2013).

3.2.3. Decision Tree

Decision Trees (DTs) or ensembles based on them are among the most popular and powerful ML classifiers (Fernández-Delgado et al., 2014). These sequential models are expressed as recursive partitions of the instance space. DT essentially consists of a series of internal nodes that split the instance space into two or more subspaces, according to a certain threshold (Rokach & Maimon, 2005). The decision nodes where no more splitting is performed, known as leaves, represent the termination of the tree. The construction of a DT consists of two phases. In the growth phase, the training set is iteratively split until each leaf is associated with a single class or is compliant with a certain criteria. In the pruning phase that follows, the DT is generalized by creating a subtree that prevents overfitting of the training data (Kotsiantis, 2013). The node splitting strategy is key for achieving a well-performing DT; Equations (10) and (11) show Entropy and Gini methods (Safavian & Landgrebe, 1991), where is the probability of selecting a data point in class i.

3.3. Prescriptive Analytics Pipeline

To adequately compare the agreement and conflict between the different rankings in the studies, an intersection of them was first performed. Therefore, the companies forming the final dataset for each one of the three studies are those companies present in all the rankings belonging to that specific study. Once this intersection is found, each individual ranking is reorganized to maintain the same order as in the original one, but with different numbers. Companies that were not simultaneously present in all rankings belonging to one specific study were discarded from the final dataset.

Different rank correlation metrics have been proposed in works like Blest (2000) and Borroni (2013). In this paper, Kendall’s as proposed by Kendall (1938) is employed, being one of the most robust and widely used ones. Kendall’s ranges from −1 to +1, medium correlations are considered higher than 0.3, and high correlations are considered from 0.5 onwards (Kuckartz et al., 2013). The two methods for expressing are described as follows. Let be a set of observations of criteria X and Y, so that all and are unique. Any pair of observations and , where , is said to be concordant if the classification order of and agrees; if they disagree, they are said to be discordant. Kendall’s can be defined as in Equation (12), or explicitly as in Equation (13).

where

- are the concordant pairs.

- are the discordant pairs.

- n are the total number of elements.

From a business and mathematics perspective, the study of agreement and conflict in rankings is complex (Gordon, 1979; Ray & Triantaphyllou, 1998). In this paper, the linear ordering problem algorithm is employed for ranking comparison purposes; it has been applied to many different fields, like input–output economic analysis (Grötschel et al., 1984; Mitchell & Borchers, 1996), job scheduling in manufacturing (Ascheuer et al., 1993) and archeological seriation (Glover et al., 1974). One of its many applications includes the rankability of data (P. Anderson et al., 2019; Cameron et al., 2021).

The Linear Ordering Problem (LOP), first described by Chenery and Watanabe (1958), is an extensively researched combinatorial optimization problem of NP-hard nature (Baioletti et al., 2018; Santucci, 2021), reflecting the difficulty in solving instances up to optimality. More recently, it has been studied in ML (Mishra & Singh, 2022; Santucci et al., 2020) and textual translations (Kondo et al., 2011; Tromble & Eisner, 2009). This problem seeks to find a permutation of rows and columns that maximizes the sum of the superdiagonal in a squared non-negative matrix.

In the context of this paper, this squared matrix was built by evaluating the relative order between the elements in the different criteria belonging to a ranking. Therefore, the diversity, ethnic origin and general studies are converted into three, four and five criteria rankings, respectively. The LOP can be formulated according to Martí and Reinelt (2011). A preference matrix D is composed of elements that represent the number of times one element outperforms another element throughout all criteria in a given ranking. The goal of the LOP is to obtain an order that represents the best agreement among the different criteria of the ranking, modeled as the mixed-integer linear problem expressed in Expressions (14)–(17).

where is a binary variable that equals 1 when element i is ranked before element j and 0 otherwise. Expression (14) represents the objective function to maximize, which is the sum of the upper diagonal values in the ranked preference matrix. Expression (15) states that element i goes before element j or element j goes before element i, but not both simultaneously. Expression (16) disables forbidden cases; if i goes before j and j goes before k, then k cannot go before i. Lastly, Expression (17) constrains variable to the binary domain.

4. Diversity Prediction with Machine Learning

4.1. Descriptive Statistics of the Data

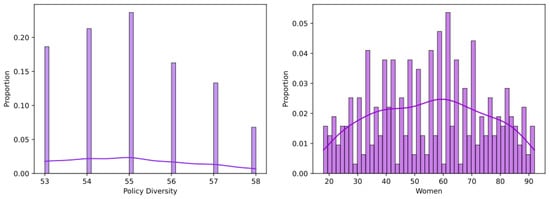

The most relevant statistics of the ML dataset and the companies included in this study are described in Table A1 and Table A2, respectively, in Appendix A. Table A3, also in Appendix A, shows the sectors and countries of origin of the 350 companies in the ML study. The 25 sectors and 17 countries these companies belong to reflect that the final dataset remains representative of European corporate diversity. Figure 1 represents the histograms of pd and wo, which confirm the diversity feature set and represent Eikon’s percentage of female employees and whether the company has a policy to drive diversity and equal opportunity or not. As shown, pd ranges from 53 to 58 and is relatively balanced: all values represent around 10–20% of the total. The share of women in companies, wo, is distributed along a wider range. More than half of the companies studied have a proportion of women employees higher than 50%; in addition, the majority of the companies have 30–80% female employees.

Figure 1.

Histograms and density plots of diversity features.

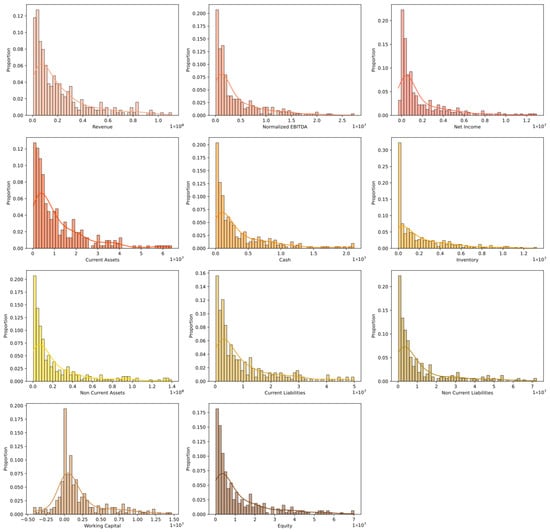

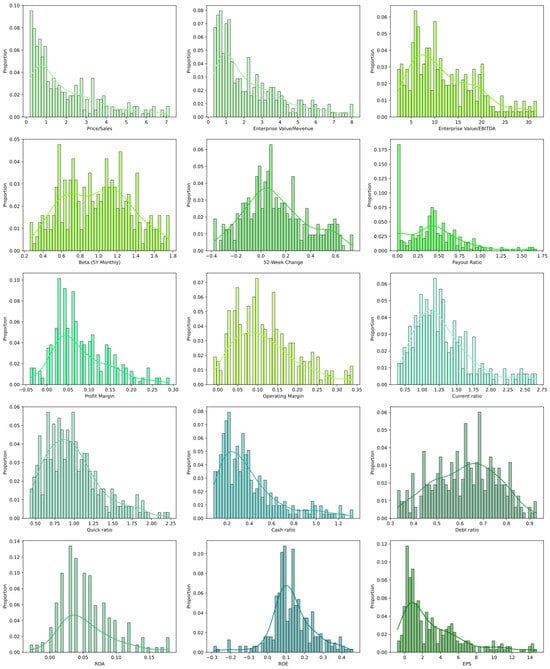

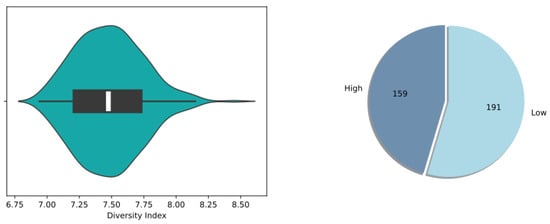

The histograms of the second feature set, raw financial data, are represented in Figure 2. These values present a larger dispersion, as the range typically starts from 0 and reaches or . The reason for this is the presence of both large multinational companies (like Dell or Microsoft) and other smaller regional ones (such as Polish Allegro or French Konica Minolta) in the same dataset; practically any metric can be orders of magnitude apart. The patterns observed in these graphs are similar: an accumulation of values towards the left, which represent approximately 10–20% of each variable. The most extreme case is iv, the inventory, which has up to 30% of its data below . As for the tails in the right half of the graphs, these parts account for less than ∼10% in all variables. The use of financial ratios as a feature set was partly to avoid this large data dispersion. Even though the raw financial data might be orders of magnitude apart, these differences are considerably reduced when taking ratios. The descriptive histograms of the financial ratios in Figure 3 show more balanced distributions. The ranges are also shorter: while ps, er, ee and es are between 1 and 30 in the widest range (ee), the rest of the variables are contained between −1 and 3, at most. These histograms can be divided into two types. In some cases, there is a clear accumulation of values around several adjacent bars: ps and er approximately lie around 0 and 1, re around 0 and 0.2, and es around 0 and 2. In the second kind of histograms, the distribution is more irregular: for instance, dr has a consistent presence of variables between 0.4 and 0.8, without a clear peak. Similarly, ee and bt do not show a clear peak but rather a constant and consistent distribution of points around two values. The pr variable represents a special case, as it presents two clear peaks: one in 0 and the other one around 0.4. The violinplot and pie chart in Figure 4 show the distributions of the label, di. In its continuous form, it resembles a normal distribution positively skewed; in its discrete form, the “High” and “Low” di labels form a practically balanced dataset.

Figure 2.

Histograms and density plots of financial data.

Figure 3.

Histograms and density plots of financial ratios.

Figure 4.

Violinplot and pie chart of the continuous and discrete diversity index.

The Pearson correlation values for the dataset are listed in Table 4. All feature sets present low correlation (less than 30%) with label di; it is surprising that the diversity features are among the least correlated with di (less than 10%). Financial ratios exhibit moderate–low correlations among themselves (except pairs er-ps and cr-qr), while raw financial variables are highly correlated (60–90% for most cases). However, these two groups are not correlated, nor with the diversity features.

Table 4.

Pearson correlation matrix of the financial and diversity variables (%).

4.2. Performance of the Simulations

The results of the ML analysis of the random dummy model and the algorithms applied to the three different feature sets are presented in Table 5. The loss in performance of the ML models between the fitted training sets and the predicted testing sets is approximately 5–15%, which are reasonable values that demonstrate the generalization capabilities of ML and the agreement of the models with the data.

Table 5.

Performance metrics of the machine learning simulations.

The three feature sets have at least one algorithm that outperforms the dummy random guess in terms of ACC and F1S for both the train and test sets, proving that diversity and financial information have at least some predictive power for corporate diversity perception by employees. In principle, this relationship between the feature sets and the perceived diversity is not strong at all; the accuracy metrics do not surpass 70%, which shows a fair (and not good, or excellent) agreement of the models with the data (Cabitza et al., 2020). In general, the three feature sets have high SPEs and low SENs, manifesting a slight overfit towards predicting labels as the majority class, low values. Interestingly, the diversity and financial raw data feature sets share similar metrics: ACCs of approximately 40–55% and high and low PREs, SENs and F1Ss, depending on the ML algorithm. In contrast, the ratios feature set is the best performing of all, achieving consistent ACCs around 60%, PREs of 60–75% and SENs and F1Ss of 30–55%, in the testing set. In a way, this improved performance might be due to the fact that financial ratios correct the effect of the firm size with respect to raw financial data, as they are in relative form (Lev & Sunder, 1979). Similarly, financial ratios are more predictive of the label di than the group of objective diversity features pd-wo, implying how diversity perception may be affected by the firm performance (Allen et al., 2007; Jauhari & Singh, 2013).

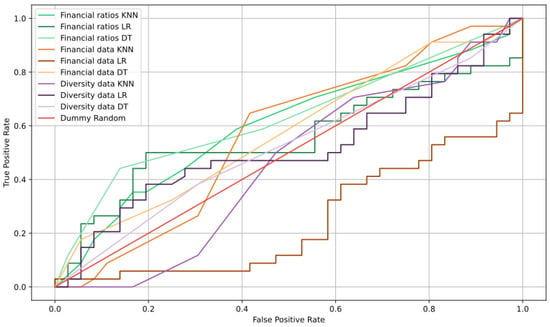

As for the ML algorithms, some common patterns were observed across the three feature sets. KNN and LR behave similarly in the training sets; however, the LR is responsible for two exceptionally low SENs (<10%) in the testing sets. In contrast, DT is responsible for the best metrics in the training sets, with ACCs of 60–69% and outperforming the other two by 2–3%. It is also the best in the testing sets, with 66% of ACC and 75% PRE using financial ratio features. These insights are further supported by the Receiver-Operating Characteristic (ROC) curves of the training and testing sets as illustrated in Figure 5 and Figure 6, respectively, as well as their AUC values included in Table 5. For the training set, all feature sets and learning models have higher AUCs than the random dummy, and practically all of them (except for LR with diversity data) are higher than 0.6, considered fair classification by works like Shatnawi et al. (2010). The KNN for financial ratios obtained an AUC of 0.722, which is considered acceptable. However, the ROCs and AUCs on testing sets significantly worsened: the only feature set where all learning models successfully outperform the AUC of the random dummy is the financial ratios. With this feature set, a maximum AUC of 0.631 was achieved with DT, which is once again regarded as fair, and not a strong fit. This further proves the moderate fit of the models with the data, limited by size of the dataset and perhaps the relevant variables of study.

Figure 5.

ROC curves of training sets.

Figure 6.

ROC curves of testing sets.

Therefore, this ML exercise suggests a fair relationship between financial performance and corporate diversity, belonging to the literature that defends a mildly positive economic case for diversity initiatives in companies: increased profitability, innovation and talent retention (Latukha et al., 2022). Managers can leverage these insights in recruitment and hiring practices, as diversity appears to be positive from the financial side, in line with Koseoglu et al. (2025). The predictive power of ML also supports the allocation of resources to improve diversity, as well as identifying low diversity scores or non-compliance in diversity as potential corporate risks (Jane Lenard et al., 2014). Management may also employ the conclusions from ML to communicate and convince stakeholders and customers about the importance of corporate diversity. In stakeholder theory, this fair agreement between perceived diversity and financial performance enhances decision-making and fairness among stakeholders: the former among managers and the latter among the hired employees, product of the diversity policies. However, at the same time, unexplainable ML models can also erode transparency and trust in stakeholder relationships, making the inclusion of feedback from stakeholders essential when deploying ML.

5. Diversity Rankings with Operations Research

5.1. Intersection of the Rankings

Intersecting the different targeted rankings and converting them into criteria for the final rankings representing the diversity, ethnic origin and global studies is the first step in the OR pipeline. Table 6 shows the number of companies in common among the different rankings of each study.

Table 6.

Intersection matrix of the individual rankings.

For the diversity study, the limitation is marked by Fa_D: this original ranking only contained 50 companies, of which 35 also appeared in the top 500 classified by Fo_D. The Gl_D scores were not a limitation in this case, as they were extracted based on the already intersecting 35. As the rankings of the ethnic origin study were all collected by Fair360, the consistency in methodology enables a nearly full intersection of the companies between the rankings. For instance, top companies in Fa_N also appear in Fa_L; similarly, the totality of companies in Fa_A are present in Fa_L and Fa_N too. In contrast, the intersections in the rankings forming the global study are much more heterogeneous, even though they all come from the same source and a similar methodology. Part of this is due to the different number of companies in each ranking; for example, intersections of the rankings with Fo_V might seem low, but Fo_V ranks only 150 companies, so in most cases the resulting intersection already comprehends 30–50% of the size of Fo_V. On the other hand, this study probes the relationship of diversity with other different corporate themes, hence allowing a larger disparity at the intersections.

In any case, the final sample of companies studied in this OR part is included in Table A7 of the Appendix A, including their State in the US where they are headquartered, the industry they belong to, the abbreviation employed in further tables to refer to them and in which of the three studies they appear. Likewise, Appendix A also contains the preprocessing steps of collecting the intersected companies in each study and reorganizing their numeration, to create the new criteria that conform the three targeted studies. These tables are divided into two parts: the positions of the companies in the original rankings, and their numeration reorganized for the ranking comparisons. Table A4 includes these steps for the diversity study, Table A5 for the ethnic origin study and Table A6 for the global study. In addition, for summarizing purposes, the main body of the paper includes the results of these preprocessing steps. The intersected rankings to be inputted into the OR model are present in Table 7, which uses the companies abbreviations as defined in Appendix A.

Table 7.

Positions of companies in each individual ranking inside the diversity, ethnic origin and global studies.

5.2. Descriptive Statistics of Rankings

The correlation values for the three prescriptive analytics studies are listed in Table 8. The correlations were low in the diversity study, as they did not exceed 30%. The correlation Fa_D-Fo_D is very low; Fa_D and Fo_D have both higher correlations with Gl_D but are still low. One relevant reason behind ranking discrepancies are differences in methodology: criteria may be weighed (or even considered) differently. For instance, Shehatta and Mahmood (2016) found moderate–high correlations in six university rankings, while Schütte et al. (2018) found transparency discrepancies between three healthcare system rankings. Ranking methodologies are especially relevant in diversity climate, highly complex and subjective, and some rankings only explore superficial aspects of inclusion with the potential to diversity-wash (Tayar, 2017).

Table 8.

Kendall’s correlation coefficients (%) for intersected rankings.

The ethnic origin study presented much higher correlations, reaching around 50–80% as maximum values. In contrast to the diversity study, the four original ethnicity rankings from Fair360 employ a same methodology and rank approximately the same set of companies, ensuring higher correlations and explainability among them. However, interestingly, equal opportunities in companies are not the same among all ethnic origins. While top companies for Asian Americans are highly correlated with top companies of Latinos and Native American/Pacific Islanders, the correlation with top companies for Blacks is very low. Similarly, top companies for Blacks have a moderate–low correlation with top companies for Latinos and Native American/Pacific Islanders. In this line, there is a clear difference in correlation with regard to the top companies for Blacks, consistent with Collins (1993) and Bermiss et al. (2024). The global study has mixed results, correlation-wise. The lowest correlations of rankings were found for Fo_D, which was not higher than 20%. In fact, the correlation between Fo_D and Fo_V is slightly negative, meaning that there is a weak pattern between the worst-performing companies in terms of diversity and the best ones for veterans, and vice versa. The best companies for women, Fo_W, is moderately correlated with the best large companies and the best companies for graduates, as in Terjesen et al. (2007), and the Fo_G-Fo_L pair is also fairly correlated, consistent with Murphy and Collins (2015). The correlation between Fo_V and the rest of the rankings (except the aforementioned Fo_D) is moderate to low, ranging around 20–30%, which is consistent with Ainspan and Saboe (2021).

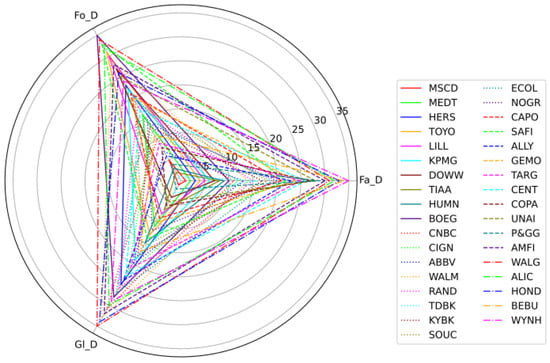

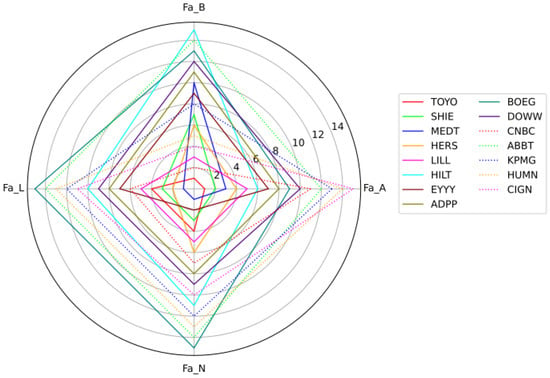

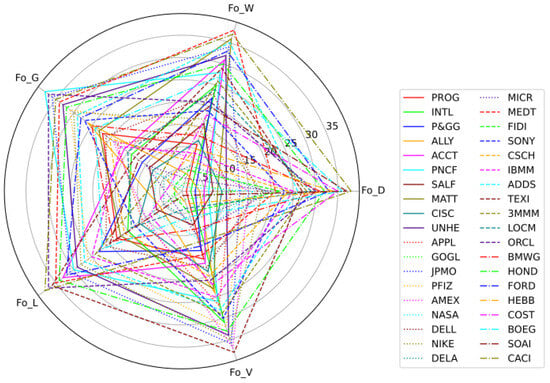

The descriptive statistics of the ranking intersections found previously can be illustrated using radar plots, which are useful tools for visually comparing multicriteria ranked elements. Figure 7, Figure 8 and Figure 9 represent the radar plots for the diversity, ethnic origin and global studies, respectively. Each line corresponds to a different company: the smaller the shape traced by a firm, the better the firm has resulted across the different criteria.

Figure 7.

Radar plot of the diversity study.

Figure 8.

Radar plot of the ethnic origin study.

Figure 9.

Radar plot of the global study.

These plots are already somewhat indicative toward building the global orders with the LOP, as well as finding the individual correlation between ranking criteria. In Figure 7, the smallest triangle is obtained by MSCD, whereas the largest and least favourable one corresponds to WALG. Figure 8 is perhaps clearer due to the lower number of companies in the ethnic origin intersections: the best polygon appears to be TOYO, while the largest one seems to be BOEG. As for Figure 9, there is not a clear best and worst firm, but rather the positions fluctuate significantly with the criteria.

5.3. Comparison of Rankings

The optimal orders of the companies obtained using the LOP algorithm are listed in Table 9. Each study includes three different optimal solutions that have the same LOP optimum value. Indeed, LOP problems can have multiple optimals, adding a fairness component (P. E. Anderson et al., 2022). Table 10 shows the correlation values of the solutions: all of which are higher than 90%, which demonstrates that the obtained LOP optimal solutions are very similar to each other (Okoye & Hosseini, 2024). Therefore, an effort to normalize and standardize the criteria of several rankings related to diversity into one and obtain a general classification of companies is possible.

Table 9.

Optimal solutions and LOP values for the operations research studies.

Table 10.

Kendall’s correlation coefficients (%) for LOP solutions.

The technology and financial sectors rank among the top: MSCD and GOGL have been extensively praised for their diversity programs and studied in works such as Allen and Montgomery (2001) and Ly-Le (2022). In contrast, cutting on diversity and inclusion favors bad positions in aggregated rankings, as seen with BOEG in Dungan (2024). In addition, Table 11 describes the correlation values of the optimal solutions with respect to the original rankings. The LOP solutions were fairly to highly correlated with the original rankings in the three studies, with all values greater than 30%, except for Fo_D in the global study. This further justifies the usefulness of rank aggregation, as the obtained solutions maintain the similarity with the original rankings while providing a combination of them, which were not always highly correlated by separation.

Table 11.

Kendall’s correlation coefficients (%) for LOP and original rankings.

This OR exercise verifies the existence of a moderate–small intersection or general agreement between rankings built using different methodologies, and proves their adequacy. Ranking aggregation is valuable, even with moderate–small intersections, as it provides a simplification of decision making for stakeholders lacking the time, knowledge or resources to analyze multiple standalone rankings. Aggregated rankings also improve comparability among factors that are difficult to contrast individually, reduce bias towards inconsistent methodologies and allow for the identification of consistent top performer organizations. However, rank aggregation may also present some drawbacks, one of which is the increased computational capacity it requires. Handling incomplete rankings or those with numerous ties, like Newsweek America’s Greatest Workplaces for Inclusion & Diversity, is also problematic (Newsweek & Group, 2025). Rank aggregation might also oversimplify problems by losing information, as well as not fully satisfy any of the individual rankings.

In stakeholder theory, aggregating ranks involves enhanced understanding and fairer representation of diverse stakeholders interests, which increases engagement and induces greater trust and legitimacy. As for corporate diversity, it encompasses several dimensions and encourages managers to take a more integrated and holistic approach (Cachat-Rosset et al., 2019). Strong positions in aggregated diversity rankings can increase a company’s reputation and capacity to attract top talent and socially responsible consumers, while enabling managers to identify them as leaders in diversity initiatives and as an example to follow (Kamal & Ferdousi, 2009). The use of several diversity rankings also drives public image and accountability (Espeland & Sauder, 2008) and allows more tailored communication to internal and external stakeholders (Beckert & Koch, 2025).

6. Conclusions

In this paper, corporate diversity, its perception by employees and its link to financial performance have been analyzed by employing analytics tools to build models. While prescriptive OR enables the formulation of mathematical optimization models, predictive ML is employed to obtain labels from a sample of features.

6.1. Summary of Machine Learning and Operations Research

Specifically, the ML analysis probed the prediction of the relationship between financial performance and corporate diversity perception based on several feature sets. The three feature sets consisted of 11 raw financial variables, 15 financial ratios and 2 diversity features. The raw financial data feature set showed moderate levels of correlation with itself, but the rest of the feature sets were not correlated, nor with the label. All successfully outperformed a dummy model based on random guess for a dataset of 350 European companies, indicating their predictive capabilities on the labels. The best models were based on financial ratios rather than diversity features, and the best ML algorithms was the DT. The DT applied on financial ratios achieved an accuracy of ∼66%, precision of 75% and F1 Score of ∼56% in the test set. This is considered reasonable, yet not a good or excellent fit, implying that other variables not considered in this study also play an important role in predicting corporate diversity.

The comparison of diversity in rankings and scoring was analyzed throughout three OR exercises. In one of them, diversity rankings are collected from different sources. In another, one common source that compares the best companies for four ethnic origins is analyzed. In the third exercise, diversity is compared with other criteria to rank top companies, such as suitability for graduates or veterans. In the three cases, the intersections between the rankings were fairly small, partly due to the different size of each individual ranking. The correlations between the rankings when analyzing diversity was moderate–low, mainly caused by differences in methodology when classifying companies. The ethnic origin study presented higher correlations, but the distribution of equal opportunities was not entirely the same: the top companies among Asian Americans, Native American/Pacific Islanders and Latinos were similar between them and different from those top companies for Blacks. The heterogeneity of rankings in the global study signified moderate–low correlations; this time, the diversity ranking was the least correlated with the others. In any case, the LOP formulation enabled the extraction of several aggregated classifying orders with the best agreement between the individual rankings; for all studies, these optimal orders were similar to each other, proving how different rankings can be homogenized and normalized by employing OR.

6.2. Implications and Impact of Research

These results highlight the relevance of adopting data-driven decisions, which has several implications. In terms of policy, these points confirm the need for regulatory standards for consistent, transparent and standardized diversity reporting. Diversity has been effectively proven as a relevant Environmental/Social/Governance metric that can incentivize investment to adopt more inclusive practices (Hunt et al., 2015). Governments might also consider introducing legislation in the form of incentives or penalties for compliance with corporate diversity standards, or perhaps industry benchmarks (Primec & Belak, 2022). These benchmarks may be implemented at an international level, allowing organizations, companies and public administrations to align their policies with best practices. In addition, procurement strategies in the public and private sectors may prioritize partnerships with companies that excel in diversity.

Moreover, promoting diversity as suggested by the ML and OR sections, supports broader international goals, like Sustainable Development Goals (SDG) 5 and 8 (Gupta & Vegelin, 2016). As proven in M. F. Garcia et al. (2025), managers must strategize about diversity and work-life balance because it mediates the relationship between SDG 5 and social performance; in Singha (2022), it is deemed as essential to develop a powerful and talent-attractive industry, in the case of banking in India. As for SDG 8, Šilenskytė and Rašković (2024) defends its embedding in business school education to promote a more equitable, just, and inclusive economy. From the policy perspective, Asif et al. (2023) recommends the implementation of ISO 3700-2021 (ISO, 2021) to boost firm sustainability and promote a circular economy. As a contribution to these works, our paper supports that companies actively employing advanced analytics in corporate diversity could support in the achievement of these goals. In summary, this paper impacts the following areas.

- There is a relationship between financial variables and diversity scores, and ML can be used to predict the diversity scores from corporate financial variables, in line with Koseoglu et al. (2025). The performance of ML is fair, suggesting the complexity of the diversity climate. This encourages managers to adopt diversity initiatives and is useful for ESG investors to consider investments in diversity-compliant companies (O. Lee et al., 2022).

- Generally, methodologies are different across diversity rankings, producing moderate–low correlations between them; as in Tayar (2017), some of these rankings may only focus on superficial aspects of diversity. When comparing ethnic origin, best companies for Blacks are lowly correlated with best companies for Asian American, Latinos and Native American/Pacific Islanders, especially applicable in the current political scenario (Rice et al., 2025). When comparing diversity to other metrics, the best companies for women are moderately correlated with the best large companies and the best companies for new graduates, in line with LLC (2023) and Dennison (2025). Our results catch the rise in women’s rights awareness that new graduates and Generation Z are creating in the workplace, as detected also in Global (2025).

- The discrepancies between diversity ranking methodologies can be smoothed with rank aggregation tools like the LOP. Treating the different diversity rankings proves how unstable and multifaceted the diversity climate is (Cachat-Rosset et al., 2019). For this paper, LOP solutions were moderately correlated with rankings that were weakly correlated between them, thus providing the LOP a simplified, balanced summary of them. Even though this may imply losing information and perhaps oversimplifying the comparison, it is useful for faster decision-making for managers and ESG investors, as well as for simpler communication of a company’s position across different rankings to both employees and shareholders or investors.

6.3. Limitations and Future Research Directions

This work pioneers the combination of ML and OR to study corporate diversity rankings and the methodology employed in them, saving time in accounting documentation revision and increasing transparency in this scoring process. Nevertheless, limitations in both parts justify the need for further research.

In the ML analysis, the discretization of the problem for classification and the relatively small training set are limitations that could have been potential sources of error and loss of relevant information. The dataset of companies was small due to financial data availability issues and Eikon only providing eight diversity scores; in many companies most of these scores were empty or null, so they were discarded. Employing fewer features from financial raw data and ratios effectively enlarges the possible dataset size, and including environmental or governance scores (more numerous in Eikon) jointly with diversity scores would improve the diversity feature set. Non-financial data, like texts in employee reviews or surveys on workplace environment, could potentially be employed and require more sophisticated ML models capable of handling multi-modal data. As for the ML models, other algorithms could be studied, as well as feature importance via SHAP values to uncover which variables are the most relevant.

As for the OR part, the incorporation of more rankings would enrich the problem, involving other forms of diversity such as linguistic, religious or neurodiversity. A more exhaustive analysis of the complete set of optimal solutions would also be relevant, as well as different rank aggregation optimization problems (or weighing schemes) and solving rank aggregation with ties. Examining different industries or comparing findings across different geographic regions could yield valuable information.

For both ML and OR parts, a longitudinal comparative analysis of how diversity climate and rankings vary over time would offer dynamic insights, which is especially relevant after certain political, economic or social events happen. This would require more data gathering of the same rankings, financial variables and diversity scores from previous years, enabling a two-fold comparison: the snapshot of each specific year, and how it evolved through time, with the current paper being the analysis of the snapshot for the years 2023-2024. The differences in cultural traits among nationalities, more linkable to Hofstede’s cultural theories, would also be interesting to analyze with ML and OR: perhaps ranking correlations or diversity predictability variations depending on the specific national context and their relationship with Hofstede’s six dimensions.

Author Contributions

Conceptualization, I.M.-M. and F.H.-P.; methodology, I.M.-M., R.G.-M. and M.L.M.-G.; software, I.M.-M.; validation, I.M.-M. and F.H.-P.; formal analysis, I.M.-M.; investigation, I.M.-M.; resources, F.H.-P., R.G.-M. and M.L.M.-G.; data curation, I.M.-M.; writing—original draft preparation, I.M.-M.; writing—review and editing, F.H.-P., R.G.-M. and M.L.M.-G.; visualization, I.M.-M.; supervision, F.H.-P., R.G.-M. and M.L.M.-G.; project administration, F.H.-P., R.G.-M. and M.L.M.-G.; funding acquisition, F.H.-P., R.G.-M. and M.L.M.-G. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no specific grant from any funding agency in the public, commercial, or not-for-profit sectors.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author, upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest in the writing and submission of this paper.

Appendix A. Additional Tables

Table A1.

Descriptive statistics of variables in machine learning exercises.

Table A1.

Descriptive statistics of variables in machine learning exercises.

| Mean | Std. | Min. | Q1 (25%) | Q2 (50%) | Q3 (75%) | Max. | |

|---|---|---|---|---|---|---|---|

| ps | 2.43 | 3.02 | 0.00 | 0.57 | 1.38 | 3.25 | 20.51 |

| er | 2.73 | 3.17 | 0.02 | 0.77 | 1.67 | 3.49 | 22.24 |

| ee | 13.21 | 19.56 | −153.99 | 6.16 | 10.39 | 17.90 | 238.68 |

| bt | 0.99 | 0.47 | −0.08 | 0.65 | 0.99 | 1.27 | 2.96 |

| wk | 0.14 | 0.36 | −0.93 | −0.07 | 0.08 | 0.31 | 1.83 |

| pr | 0.71 | 1.78 | 0.00 | 0.19 | 0.42 | 0.67 | 21.14 |

| pf | 0.08 | 0.12 | −0.55 | 0.03 | 0.06 | 0.13 | 1.07 |

| op | 0.12 | 0.16 | −1.46 | 0.05 | 0.10 | 0.17 | 1.21 |

| cr | 1.46 | 1.20 | 0.19 | 0.99 | 1.21 | 1.56 | 15.46 |

| qr | 1.11 | 1.07 | 0.17 | 0.70 | 0.94 | 1.21 | 15.46 |

| ch | 0.51 | 0.77 | 0.01 | 0.19 | 0.33 | 0.53 | 8.55 |

| dr | 0.63 | 0.19 | 0.11 | 0.50 | 0.63 | 0.74 | 1.40 |

| ra | 0.05 | 0.07 | −0.52 | 0.02 | 0.05 | 0.08 | 0.45 |

| re | 0.12 | 0.92 | −9.25 | 0.06 | 0.12 | 0.20 | 10.40 |

| es | 8.37 | 1.56 | −38.96 | 0.54 | 1.83 | 5.10 | 2.93 |

| rv | 3.05 | 5.37 | 1.59 | 4.97 | 1.32 | 3.10 | 5.29 |

| eb | 6.41 | 1.35 | −6.25 | 6.66 | 1.88 | 6.44 | 1.19 |

| ni | 2.93 | 8.07 | −6.44 | 1.89 | 7.31 | 2.71 | 8.92 |

| ca | 1.66 | 2.87 | 4.07 | 2.57 | 6.69 | 1.87 | 2.24 |

| cs | 5.64 | 1.22 | 6.70 | 5.10 | 1.80 | 5.73 | 1.02 |

| iv | 3.26 | 6.61 | 0.00 | 1.25 | 1.18 | 3.72 | 7.34 |

| na | 3.13 | 5.37 | 2.90 | 3.51 | 9.92 | 3.42 | 3.41 |

| cl | 1.36 | 2.32 | 7.36 | 2.01 | 5.10 | 1.52 | 1.83 |

| nl | 1.66 | 2.95 | 4.11 | 1.63 | 5.05 | 1.66 | 2.18 |

| wc | 2.97 | 9.52 | −2.15 | −1.33 | 8.50 | 3.01 | 8.25 |

| eq | 1.77 | 3.45 | −1.58 | 1.95 | 5.43 | 1.83 | 2.61 |

| pd | 55.04 | 1.67 | 52.00 | 54.00 | 55.00 | 56.00 | 61.00 |

| wo | 54.81 | 22.88 | 1.00 | 38.00 | 56.00 | 72.00 | 99.00 |

| di | 7.48 | 0.26 | 6.94 | 7.29 | 7.47 | 7.65 | 8.45 |

Table A2.

Companies studied in machine learning exercises.

Table A2.

Companies studied in machine learning exercises.

| Infineon | Amazon | Royal BAM Group | Iberia | Adecco Group | Redrow |

| Allegro | Asics | Vodafone | CBRE | Stora Enso | Bombardier Group |

| Cd Projekt | Air France-KLM Group | Air Products | John Deere | TF1 Group | Alcoa |

| Hermès | 3M | GSK (GlaxoSmithKline) | BASF | Mondadori | A2A |

| Keysight Technologies | Dell Technologies | Bosch | Nestlé | Rentokil Initial | SAS |

| Prada Group | Expedia | Knorr-Bremse | Samsung | Teva Pharmaceuticals | Novo Nordisk |

| Merit Medical | Aalberts Surface Treatment | Intel | McDonald’s | Asus | ENGIE |

| Agilent Technologies | Essity | Lenzing | Fortum | Mitsubishi Electric | The Swatch Group |

| Salesforce | Fujitsu | Procter & Gamble | Schindler | Fraport | Konica Minolta |

| Accenture | Kingfisher | Daimler | WSP | Sodexo | |

| Hyatt Hotels Corporation | Eaton | Mondi | Shell | Renault | Voestalpine |

| PayPal | Epiroc | PKN Orlen | Sanofi | Honeywell | KONE |

| AbbVie | Orange | Texas Instruments | OMV | Motorola Solutions | Saab Group |

| Microsoft | Cognizant | Concentrix | BlackRock | TAURON | Western Union |

| Hugo Boss | Severn Trent | Sony | Telenor | Elisa | Ipsos |

| alight | Givaudan | Sika | Thales Group | Mitchells & Butlers | Metso |

| Sartorius | PEAB | Scandic Hotels | Evonik Industries | Baxter | Morgan Sindall |

| EnBW | Jacobs Engineering | Sainsbury’s | The Coca-Cola Company | Skanska | Lassila & Tikanoja |

| Orkla | Melia Hotels International | Inditex | Auto Trader | adesso | Estée Lauder |

| Cummins | Hapag-Lloyd | Airbus | ABB | Bridgestone | Nokia |

| Rexel | adidas | Symrise | Schibsted | Infosys | Grupo Acciona |

| IBM | Husqvarna | Rheinmetall | Enel Group | Swisscom | KSB |

| Roche | Novartis | Diageo | Aon | Publicis | Magna |

| AGCO | Polsat Box | Computacenter | Ahold Delhaize | Canon | DXC Technology |

| Boston Scientific | Heidelberg Cement Group | Alfa Laval | Yit | Honda | ArcelorMittal |

| Lilly | Deutsche Telekom | Philips | Tokmanni | Koninklijke KPN | SSAB |

| Arrow Electronics | Wickes | BMW | Jabil | Prysmian Group | Zeiss |

| AstraZeneca | Ericsson | Solvay | Kering | Plastic Omnium | Strabag |

| Cisco | L’Oréal | Avery Dennison | Uber | United Internet | Valeo |

| Chevron | Beiersdorf | Hitachi | Hyundai Motor Company | Arkema | mastercard |

| Louis Vuitton | RELX Group | Unilever | Sandvik | Worldline | Spotify |

| Whitbread | Pandora | Ocado Group | Brembo | Costco | knowit |

| Booking | Henkel | Goodyear Dunlop | Pepsico | Cloetta | Smith & Nephew |

| SAP | Marriott International | BD (Becton, Dickinson and Co.) | Grupa Azoty | FirstGroup | Deutsche Post |

| Volvo Car Group | Willis Towers Watson | Taylor Wimpey | Colruyt Group | Bureau Veritas | Netflix |

| Fnac Darty | EssilorLuxottica | Brenntag | Greggs | Groupe Carrefour | Saint-Gobain |

| Merck | Pets at Home Group | Telia Company | MTU Aero Engines | Nexity | Leonardo |

| United Utilities | TietoEVRY | Amadeus | Repsol | OVS | Greencore Group |

| Apple | Dalata Hotel Group | RB (Reckitt Benckiser) | STMicroelectronics | SKF Group | Foot Locker |

| BP | Takeda | AccorHotels | Schaeffler-Gruppe | Olympus | |

| Dow | Tesla | Lufthansa | Oracle | CNH Industrial | amplifon |

| Budimex | DuPont | PORR | BAE Systems | Eni | FedEx |

| Hewlett Packard Enterprise | Philip Morris International | Marks & Spencer | Danone | Alcon | ITV |

| Pfizer | Logista | H&M Hennes & Mauritz | Bouygues | Neuca | Boeing |

| Wolters Kluwer | Carnival | eBay | Electrolux | Valmet | Levi Strauss & Co |

| Easyjet | Abbott | BT Group | TUI | The Walt Disney Company | Agfa-Gevaert |

| NTT Data | Nissan Motor Corporation | Axfood | Lonza | Aubay | Xerox |

| Akamai Technologies | Nike | Telefónica O2 | Siemens | Balfour Beatty | |

| Medtronic | PageGroup | Nkt | Bayer | DS Smith | |

| Moody’s Corporation | Dunelm | Adva Optical Networking | AECOM | ANDRITZ | |

| Sage | RWE | Atlas Copco | Iberdrola | Etteplan | |

| Logitech International | Microchip | General Electric | GXO Logistics | Caterpillar | |

| Ferrari | Zalando | National Grid | BioNTech | BayWa | |

| Johnson & Johnson | Savencia Fromage & Dairy | Air Liquide | Centrica | Alstom | |

| Sky | Colgate-Palmolive | About You | Thermo Fisher Scientific | MTR Corporation | |

| Adobe | Tesco | Capgemini | Legrand | Arcadis | |

| PUMA | Ford Motor Company | Ralph Lauren | CGI | Eurofins | |

| Icon Plc | Safran Group | Starbucks | Broadcom | Trelleborg | TCS (Tata Consultancy Services) |

| Hilton Hotels & Resorts | AT&T | Rolls-Royce | Heinz | Babcock International | UPS (United Parcel Service) |