Abstract

Background: Studies have highlighted how public–private partnerships are characterized by a lack of transparency, low availability of data, low accountability, and, often, strong opportunism. All these factors do not allow potential interested parties to trust it. This undermines the possibility of good cooperation between the public and private sectors and has presented a great limit for the Public Private Partnerships (PPPs) diffusion. Several articles in the literature highlight, in general, the numerous advantages generated using the blockchain in different organizations. The adoption of blockchain in the operation of PPPs could be a solution to overcome the limitations encountered in public–private partnerships. The aim of this study is to propose a theoretical framework aimed at connecting two topics (PPPs and Blockchain)—analyzed separately by literature—to highlight how blockchain can correct the limitations inherent to the functioning of traditional PPPs. Methods: The authors applied a qualitative research method to examine the role of blockchain from a PPP perspective. The authors present a conceptual work in which they advance a theoretical framework by integrating and proposing new relationships between constructs and developing logical arguments for these associations. Through a problem-focused approach, besides presenting a solution to overcome the critical issues, the authors also put forward ideas to help fill a gap in the literature to date. Results: The study showed that blockchain can generate a major shift in the function of PPPs. On the one hand, it makes it possible to overcome many limitations that have hindered the development of partnerships, thus making it possible to spread them further, while on the other hand, it has a positive impact on the strategic role of PPPs in achieving sustainable development goals. Conclusions: Blockchain technology is considered very immature, probably because a single underlying standard does not exist and concepts are difficult to master. Based on state-of-the-art standards, blockchain has the potential to be considered a transformative or even disruptive innovation for PPPs.

1. Introduction

In the last decades, public–private partnerships (PPPs) have become a significant topic in management research (Osborne 2000; Bovaird 2004; Hammerschmid and Ysa 2010; Marsilio et al. 2011; Reynaers 2014; Borgonovi et al. 2017; Vecchi and Hellowell 2018; Wang et al. 2018). PPPs were introduced just before the start of the 1990s, when in 1992 the government led by John Major in the United Kingdom introduced the private finance initiative (Hellowell 2010), which was the first systematic program aimed at encouraging public partnerships. For this reason, PPPs’ aims lie mainly in attracting private capital to replace the state’s financing role in services of public interest. Indeed, as Casady et al. (2018, p. 3) stated, the U.S. and governments both of developed and developing countries (Bovaird 2004; Jamali 2004; Grimsey and Lewis 2005; Almarri and Abuhijleh 2017; Osei-Kyei and Chan 2017; Kang et al. 2019) “have been increasingly incorporating private-sector expertise, resources and risk management proficiency into infrastructure project delivery through the use of PPPs”.

Generally, most of the attention on PPP studies has been focused on PPP policy aimed at creating private finance initiatives to encourage private participation in infrastructure development and social service delivery in order to bring competitiveness to public sector monopolies (McQuaid 2000; Broadbent and Laughlin 2003; Lonsdale 2007).

On the contrary, there have been fewer studies that have focused on PPPs as institutional arrangements to achieve public value. As Jørgensen and Bozeman (2007) stated, public value is not the exclusive prerogative of the public sector, although it has a special role as a guarantor of it.

In this context, public–private collaborations not only represent an operational tool to pursue public strategies but also constitute a pillar of the strategy itself for generating and orchestrating the creation of public value (Reynaers and De Graaf 2014; dos Reis and Gomes 2023).

The goals of a public–private collaboration are not only those of mobilizing private capital with which to make, for example, public investments, but also those of bringing together public and private actors (both profit and non-profit) to co-design, co-produce, and co-create solutions, sharing resources and skills that can be instrumental to limiting risks and pursuing benefits by generating value for society (Rybnicek et al. 2020; Tallaki and Bracci 2021).

Bryson et al. (2006), too, argued that collaboration is the connection for the sharing of information, resources, activities, and skills among organizations to achieve a result that single organizations could not achieve separately.

Based on many studies (Esposito and Dicorato 2020; De Matteis et al. 2021; Vecchi et al. 2021; Tian et al. 2022; Vecchi 2022), it may also be said that public–private collaborations represent the driving force to tackle the pursuit of the global challenges of social and economic development and, more specifically, environmental protection set out through the SDGs. It is no coincidence, in fact, that among the sustainable development goals, the UN has proposed the encouragement and promotion of public partnerships, public–private partnerships, and partnerships with communities.

PPPs are in constant transformation, re-thinking their roles, looking both to be more responsive to societal needs and to become agents of change, contributing to a new socially responsible and sustainable model of socio-economic development. As UNECE (2019, p. 3) stated, the PPPs model has often been used as a financing tool: this model was able to “capture private financing for infrastructure when public financing and budgetary funds were not sufficient, and only later did “value for money” analysis come about when budgetary constraints eased but the project still needed to be justified from a financial perspective”.

Collaboration between local public administration and businesses is one of the most important tools for implementing effective measures for local sustainable development (Pinz et al. 2018; Spraul and Thaler 2020). The application of PPPs to help overcome the challenges of the sustainable development goals is recognized in the literature (Cruz and Sarmento 2017; Dal Mas et al. 2020; Jayasena et al. 2021). The experiences of public–private partnerships, in fact, leverage the ability of the local public administration to collaborate with businesses to foster the competitiveness of the territory, local well-being, and citizens’ welfare. These are models where companies and administrators define common objectives at a value, political, and technical level, implement them, and verify the effects of their realization. As in all organizations, in PPPs, trust is fundamental to its transparency, the participation of its members in governance, financial, entrepreneurial, and commercial initiatives, and hence its growth.

This article explores blockchain as a tool that ensures an essential layer of trust among the members of PPPs, highlighting that organizations can be governed on blockchain through smart contracts without the possibility of human manipulation. Blockchain has proven itself to be a tool for consensus in a decentralized environment, enforcing a culture of complete transparency and immutability of records (Kundu 2019).

This framework includes blockchain as a technological tool to facilitate the operations necessary both to create partnerships and to implement projects. Although, from a technological point of view, there is an ever-increasing amount of literature, few articles focus on the ways it can enable collaboration between public and private entities (Abodei et al. 2019; Nel 2020), likely because PPPs based on blockchain applications are still in the early stages of their development.

Therefore, the authors propose a theoretical framework aimed at connecting two topics (PPPs and Blockchain) analyzed separately in the literature to highlight how blockchain can correct the limitations inherent to the functioning of traditional PPPs. In other words, this study aims to explore how blockchain technology coupled with PPPs can potentially improve the adoption of public–private partnerships focused on the smart collaborative management method rather than procurement and compliance (Berawi et al. 2020; Nel 2020). Through a proactive strategy that integrates the practical and technical benefits of blockchain into the operation of PPPs, the paper-centric processes can be overcome through digital record-keeping processes that are always more reliable and verifiable by all members.

The use of blockchain technology could potentially increase transparency and traceability in the PPP administration, enhance collaboration and coordination among the project partners, increase productivity and profitability, and contribute, therefore, to the creation of smart PPPs. By using blockchain to record and verify the data, project stakeholders can have a clear view of the project’s status, progress, and quality. They can also track and audit the transactions between parties, thereby reducing disputes and fraud. Moreover, project partners can optimize their performance and outcomes. In fact, the use of the data provided by the blockchain systems offers a variety of advantages, among which are making better informed decisions, improving quality, and reducing risks and errors. In summary, the inherent properties of blockchain can result in a more collaborative, open working environment, ultimately achieving greater alignment among project stakeholders.

In the literature, many studies argue that PPPs represent a valid tool for the pursuit of sustainable development. However, their diffusion is slowed down due to some limitations (mainly a lack of transparency and trust among the partners). These limits can be overcome using Blockchain technology, thus allowing the diffusion of PPPs and the pursuit of the Sustainable Development Goals (SDGs).

This paper raises a specific research question:

- RQ: How can blockchain enhance the decision-making of actors in public–private partnerships, transforming traditional public–private partnerships into a smart system for sustainable development?

Regarding the methodology adopted, this study represents a conceptual work in which the authors propose a theoretical framework integrating and proposing new relationships between constructs, developing logical arguments for associations (Whetten 1989; Smithey Fulmer 2012; Gilson and Goldberg 2015). Considering that in a conceptual paper it is critical that authors take a problem-focused approach, the authors, as well as presenting a solution to overcome the critical issues, also provide ideas that can help fill a gap in the literature.

The steps of the conceptual research are:

- (a)

- Select a specific topic for analysis. PPPs are selected as useful organizations, especially for those projects that are strategically required to achieve sustainable development goals.

- (b)

- Collect relevant literature on PPPs to identify the main critical factors that hinder their diffusion and to highlight the need to identify a solution.

- (c)

- Identify a specific tool that could solve the critical issues. Among the various kinds of technologies that have become powerful drivers of change and success for public, private, and hybrid organizations, the authors have chosen blockchain based on the numerous advantages that the literature generally recognizes in this tool.

- (d)

- Discuss how, effectively, blockchain can solve the critical issues of PPP development.

The proposed solution, obviously, represents a topic in need of attention from a theoretical lens, considering that the related studies are very limited both from theorical and empirical points of view. Furthermore, the authors have not found concrete applications for the use of the blockchain in PPPs.

The remainder of the paper is structured as follows: Section 2 frames the main literature on PPPs, focusing attention on the factors that limit its use (Section 2.1) and on blockchain, useful for defining its essential elements, advantages, and possible limits (Section 2.2). Then, the possible role of blockchain in developing PPPs is discussed (Section 3). In Section 4, we illustrate the conclusions, state the limitations of the study, and propose future lines of research.

2. Theoretical Background

2.1. Public–Private Partnerships

Governments in many countries are increasingly using public–private partnerships as a policy tool that can deliver public infrastructure or needed services quickly, adopting private finances to keep the budget in balance (Hodge et al. 2010; Opara et al. 2017). To cover this public sector funding gap, public administrations are inclined to reach out to private sector developers and investors, implementing PPPs, especially for those projects that are strategically required in order to achieve their national sustainable development priorities (Selim et al. 2018; Berrone et al. 2019; Maslova 2020; Wang and Ma 2021; Ma et al. 2022), and not only as a better option for the provision of relevant local public services.

The literature on PPPs is divisive. On the one hand, some studies highlight their advantages, while other studies instead underline their critical points, although it is generally believed that the former outweigh the latter. The main advantages of PPPs are not linked solely to their capacity to avoid exceeding the debt limit and budgetary constraints legislated for public administration (Greve and Hodge 2013; van den Hurk 2018). Indeed, the capacity of PPPs both to deliver projects on time, avoiding the usual delays in traditional public procurement (Grimsey and Lewis 2005; Vinogradov and Shadrina 2018), and to generate efficiencies in governmental projects and services via the creation of value for money (Siemiatycki and Farooqi 2012) must also be highlighted (Grimsey and Lewis 2005; Ball et al. 2007; Hodge and Greve 2017).

Value for money is defined by Grimsey and Lewis (2005, p. 352) as “the best price for a given quantity and standard of output, measured in terms of relative financial benefit”. What is necessary here is a comparative analysis of the costs of the different solutions for the same outputs in order to make comparisons with the bidder’s cash flow.

Despite the existence of different approaches for evaluating value for money for PPPs, the assessment is always useful in order to understand whether it is opportune to set up a new public–private partnership rather than adopt traditional procurement procedures. Indeed, value for money provides the public sector with a simple methodology and an easy tool for estimating the costs, benefits, and risks involved in a project.

Nevertheless, value for money cannot be the only factor in the decision to pursue a project in a public–private partnership; each partner must also evaluate their capacity to manage such complex and long-term projects. Furthermore, some studies reveal that through public–private partnerships, the overall cost of the project decreases. This is made possible by adopting—during the project design stage—a whole-of-life cycle approach, which makes for better management in all phases and lower operational costs over the entire project life. However, on this point, some authors (Parker and Hartley 2003) have expressed doubts.

According to Shaoul (2005), the quality-price ratio is associated with the principles of economy, efficiency, and effectiveness and not with the lowest offer, especially considering that the public sector, through partnerships, also aims to guarantee the quality and competence of the work typically carried out in the private sector.

Another important aspect that has been explored in the literature is the nature of the partnership, considering the plurality of public and private entities that can form one and, consequently, the expectations in terms of performance (Grimsey and Lewis 2005; Hodge and Greve 2017; Esposito and Dicorato 2020) and goals that the different constituents intend to realize (Opara and Rouse 2019).

In this regard, Shaoul et al. (2012)—considering that public entities point to accessible and equitable service provision while private entities are interested in profit-making—believe that through the organizational arrangements and governance strategy typical of a PPP, it is difficult, if not impossible, to reasonably realize common benefits. In this sense, Weihe (2008) stated that there may be an inherent contradiction between achieving material value for PPPs and safeguarding public value.

Generally, public–private partnerships have been considered hybrid organizations (Rufin and Rivera-Santos 2010; Quelin et al. 2017) that present significant governance and accountability challenges (Henisz 2006; Forrer et al. 2007; Shaoul et al. 2012).

Grimsey and Lewis (2007) asserted that, on the public side, PPP schemes appear to work well. The main difference is inherent in the levels of responsibility and accountability, considering that the costs for the public entities to raise the necessary funds for the project are not related to the risks. If the partnership is well structured, it can introduce clear lines of accountability and transparency in results and performance.

Spackman (2002) argued that private financing of public services, on the one hand, has produced clearer objectives, new ideas, better planning, and the incentives for wider competitive tendering; on the other hand, it has imposed on top management the obligation to pay more attention to the general process and monitor legal fees and risk premiums. Under a public–private partnership, the public sector transfers land, property, or facilities controlled by it to the private sector, which is given ownership or control rights for the term of the concession or lease. This assignment of the residual control rights provides an incentive for the private sector entity to undertake relation-specific cost-saving investment (for example, in road maintenance technology) that increases productive efficiency (Verweij and van Meerkerk 2021). In the absence of this assignment, the private firm could not be sure that the investment would pay off, and there would be underinvestment in new technology. Turning over control rights for the infrastructure can alleviate this problem.

Another defining characteristic of public–private partnerships is “bundling”, whereby the construction and operation of infrastructure assets are combined into a single contractual framework (Hart 2003). This issue has been framed in terms of transaction costs, with the choice being between bundled or unbundled structures, decided by whether it is easier to write contracts on service provision than on the quality of the building.

The transfer of risk to the private sector can also make a public–private partnership more cost-efficient than traditional procurement. Some studies emphasize information costs and the incentive structure created by the public–private partnership service payment mechanism. An effective transfer of risk from the public to the private sector can lead to a more explicit treatment of risk since it is the acceptance of risk that gives the private entity the motivation to price and produce efficiently. Private finance (debt and equity) is central to this process, although its role has been overlooked thus far in the theoretical literature on public–private partnerships. It is the only way, which is not possible in the public sector, to use risk management techniques. In the public sector, risk is transferred to taxpayers or end users, and therefore, the cost of capital is lower than in the private sector.

There are many limitations that the literature has found regarding the concrete and correct functioning of PPPs (Klijn and Teisman 2000).

Certainly, contract limitations challenge the effectiveness of PPP projects, leading to poor alignment between public sector expectations, private consortium performance, and contract terms. Unfortunately, it is quite common that PPP projects have data silos that are not always accessible to critical decision-makers, have project information that is often poorly archived, and can be vulnerable to information manipulation by nefarious players. These concerns and realities can undermine trust between public and private sector partners and put collaborative project management at risk. Some studies have underlined how PPPs are characterized by a lack of transparency and trust and therefore by opportunism (Hood et al. 2006) and possible corruption (Bildfell 2018).

This undermines the possibility of good cooperation between the public and private sectors. PPPs usually expect the presence of multiple intermediaries due to the complex administration of long-term contracts. Could blockchain be the tool that allows us to overcome these limits?

2.2. Blockchain

Management literature has investigated the first adoptions of blockchain in the context of both the private sector—especially in financial (Tapscott and Euchner 2019), healthcare (Agbo et al. 2019; McGhin et al. 2019; Fusco et al. 2020; Balasubramanian et al. 2021), agriculture (Verma 2021), and energy companies (Casino et al. 2019)—and the public sector, in which all distributed ledgers (in particular, blockchain and smart contracts) represent innovative technologies to be considered in the field of the “new digital government paradigm” (Allessie et al. 2019).

The expansion of the fields of application of blockchain goes both with technological evolution and the emergence of new business models that require collaborative methods, which can be incentivized with technological tools, allowing trust between actors to grow (Karamitsos et al. 2018; de Hoyos Guevara et al. 2020).

As Alharby et al. (2018, p. 1) asserted, “blockchain is a distributed database that maintains the history of all transactions that have ever occurred in the blockchain network. All network nodes have a copy of this database, making it replicated and backed up. As the name indicates, a blockchain is a series of blocks connected to each other through a cryptographic hash. Each block references the previous block by storing its cryptographic hash, resulting in a chain of blocks”.

This means that, in this system, transactions are logged and added following a chronological criterion with the aim of obtaining permanent tamper-proof records, and that, therefore, security and privacy are at the core of blockchain technologies (Karame and Capkun 2018).

Sherman et al. (2019) identified the following essential characteristics of blockchain:

- (a)

- It is a distributed ledger comprising blocks (records) of information about transactions among two or more parties, where each message is irrevocably recorded;

- (b)

- It is a system where each block is cryptographically linked to the others to create an immutable ledger;

- (c)

- Its administration is driven by the following three policies: the access policy that states who may read the information; the control policy that defines who may participate in the evolution of blockchain and how new blocks may potentially be appended to blockchain; and the consensus policy that establishes which state of blockchain is valid, resolving disputes of any kind.

According to Caradonna (2020), the most common version of the origins of blockchain dates back to 2008, when Satoshi Nakamoto, in a white paper, proposed a computer science design to enable the secure direct trading of assets among peers who may not have confidence in each other, allowing them to avoid resorting to central intermediaries. Therefore, blockchains represent a novel digital concept for decentralized storing of data and—combining a high level of security based on cryptography (Magnier and Barban 2018)—secure trust among entities wishing to conclude a transaction without the need of a trusted third party, adopting a peer-to-peer system.

Among the main advantages of blockchain highlighted in the literature, it is important to mention the following:

- -

- It is a system that allows for the reduction of costs, time, and complexities in executing information exchange and administrative functions. Considering that blockchain primarily works as a database register, it follows that it offers an efficient way to build a central database at a lower cost. Consequently, blockchain could help reduce costs in terms of money and save the time necessary to fulfill information duties.

- -

- It is a system that offers increased transparency of data and transactions, which is also guaranteed through the immutability of the storage, which, for any change, requires the approval of all participants. Consequently, the accountability and auditability of the activities of the subjects who adhere to the system increase. The blockchain system is, in essence, self-auditing. Any retroactive change results in a record that is disclosed by alterations to subsequent blocks. This makes corruption difficult and reduces the financial and operational costs associated with corruption that could place a project in jeopardy.

- -

- It is a system that contributes to increased public trust due to effective record-keeping and information availability (Allessie et al. 2019; Becker and Bodó 2021).

- -

- It is a system that reduces fraud, bureaucracy, and corruption. Blockchain technology ensures that transactions comply with programmed rules through smart contracts. The latter provide a digital workflow process, whereby a series of binding steps need to be undertaken before an outcome is reached. In this way, eventual contractual frauds are easily detected, thus enhancing the security of contracts (Min 2019). As Karamitsos et al. (2018) stated, the contract is finalized only after the completion of the aforementioned processes.

However, blockchain is not without limits or risks.

Firstly, the transparency of a blockchain can prove averse to governance, and some management decisions will lack the required confidentiality.

Secondly, the permanent structure of a blockchain can prove detrimental when human intervention is needed, such as in a court decision. Moreover, errors in blockchain can prove difficult to adjust, with the potential for global paralysis for the company.

Thirdly, conflicts of interest may remain or worsen on a blockchain as it is code- and algorithm-based.

3. Discussion

The review of the main literature on PPPs and Blockchain was helpful in locating the commonalities in their functioning processes.

Although PPPs are the basis for the achievement of important economic and social objectives, their development and, consequently, the implementation of related projects are often hindered by the limitations highlighted in the literature and referred to in the previous Section 2.1.

It has been demonstrated that a lack of trust has often represented a critical and determining element in the PPP project’s failure. The risk of not having a solid collaborative project shared among the partners is linked to data that is not accessible to critical decision-makers or to project information that has been poorly archived enough to allow it to be manipulated.

The technological innovation of blockchain could encourage the development of innovative models of collaboration between public and private subjects, generating new forms of PPPs compared with the past. For example, in their study, Berawi et al. (2020) proposed an alternative public–private partnership (PPP) model that can attract the interest of both institutional and individual private investors by proposing a financing model that incorporates the crowdfunding method.

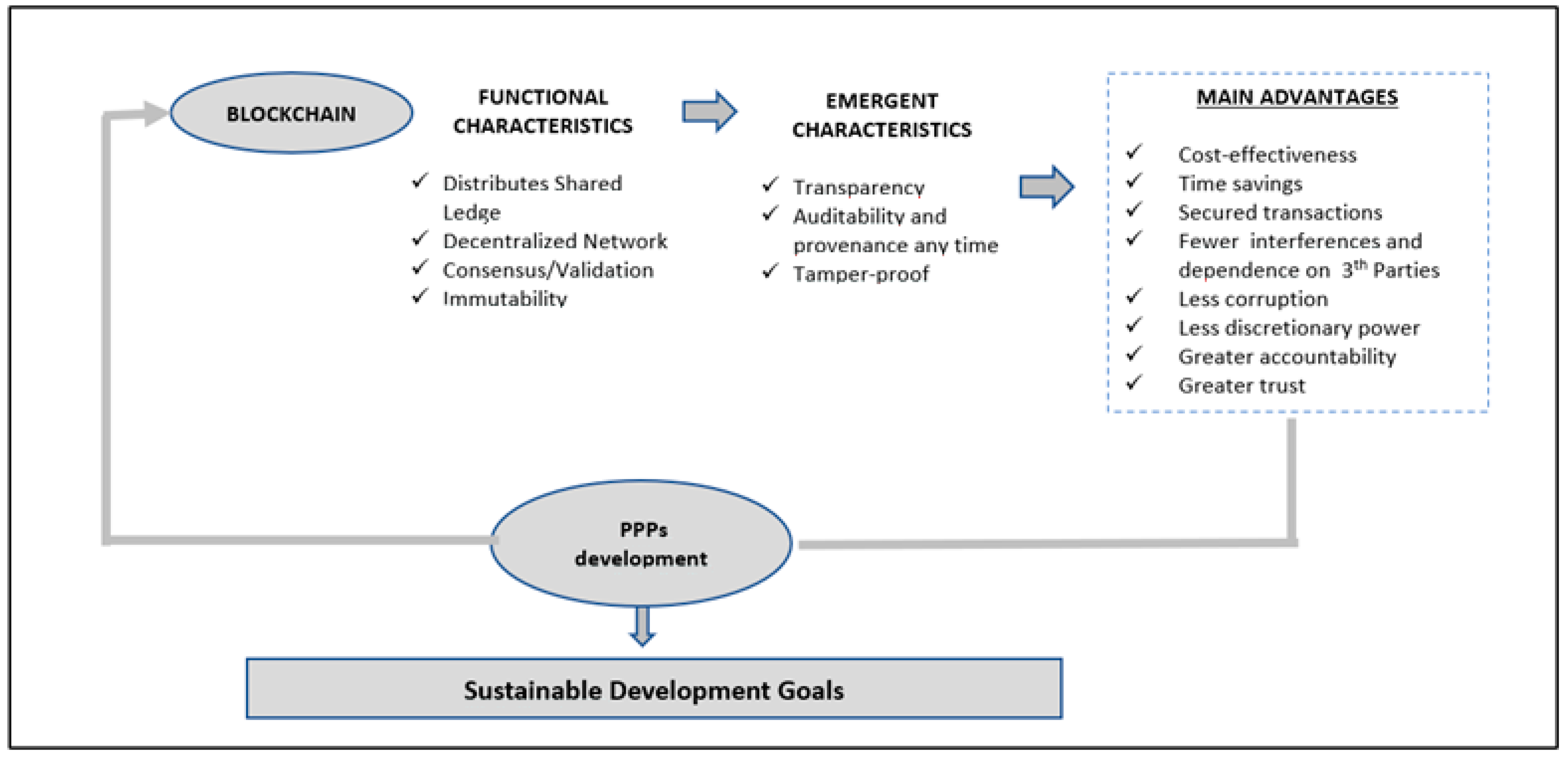

Blockchain offers an opportunity to expand the contract space in PPPs through smart contracts (Nel 2020; Cong and He 2019). Considering the contents defined in the previous section (see Figure 1 for conceptualization), it is possible to distinguish the characteristics of blockchain into two types: “functional characteristics” and “emergent characteristics”.

Figure 1.

PPPs, Blockchain, and Sustainable Development Goals. Source: own processing.

The former are those that are mandatory for the correct functioning of the system. The latter can be considered the natural result of functional characteristics. Both derive various advantages that can represent the solution to overcoming the limits that have so far hindered the diffusion of PPPs.

The cryptographic mechanisms on which blockchains are based increase the transparency and verifiability of data and information. Consequently, trust among public and private project stakeholders is increased, thereby improving the efficiency of project delivery and the information flow between different stakeholders who are interested in consulting on the project’s progress.

In the past, the lack of trust has usually represented a critical and determining element in PPP’s project failure (Hood et al. 2006; Bildfell 2018).

The characteristics of blockchain—immutability, security, and traceability—facilitate transparency, ensuring enhanced public–private collaboration. Then, when you consider that blockchain-based smart contracts can be partially or fully executed or enforced without human interaction, they also have the potential to reduce moral hazard (Verweij and van Meerkerk 2021), which usually finds its root in asymmetric information.

In the literature on PPPs, the problem of information asymmetry has emerged. Especially if they are considered the studies that have focused on the theory of agency for the functioning and governance of PPPs.

De Palma et al. (2009) and Shrestha and Martek (2015) highlighted how, in PPPs, the relationships between public and private entities are characterized by an asymmetry of information. They stated that the agents (private entities) are better informed than the principals (public entities), so for them it is easier to favor the satisfaction of their own interests over public interests.

The users of information stored in a blockchain have all the PPP’s information required by law available so that they can verify if the organization has correctly complied with its duty.

The PPP organization, instead, profits because it has been easier for it to collect data concerning the entities adhering to the partnership. With access to more information, the PPP improves its knowledge of its structure and creates a greater sense of democracy in the partnership system. The open sharing of information and open innovation are effective ways of both boosting collaborative management practices (Saidel 2017; dos Reis and Gomes 2023) and integrating operational and financial systems (Sklaroff 2017) and, therefore, improving the PPP’s success (Willems 2014; Reynaers and Grimmelikhuijsen 2015; Wermeille et al. 2015).

Although trust between partners is seen as an essential condition for the successful completion of PPP projects, this condition is not easy to achieve and constitutes a major obstacle considering that the communication process, the information sharing, and the coordination of the actions of multiple parties are complicated. This is especially true when a collaborative activity requires the sharing of knowledge between partners, but said knowledge comes from different information systems that record data in different ways.

To this we must also add the fact that, at times, the exchange of information still takes place through the preparation of paper documents that could easily get lost or through emails that cannot be archived in an organized way.

For collaborations to work out, you need to ensure each party behaves as agreed upon and activities are well coordinated.

How could PPPs work better? Through blockchain.

To appreciate the ways in which blockchains can support complex collaborations, consider the steps of a PPP project that requires effective coordination between public and private members.

In each step of a classic PPP, a flood of information is transferred. Each member keeps his own record and tends to communicate with one partner at a time. This often leads to inconsistent knowledge across participants and, sometimes, counterfeit documentation or products.

Problems like these can manifest in any collaboration that requires cumbersome information sharing among partners and may involve disputes in the process. While partners usually sign contracts specifying the conditions of their collaboration along with legal remedies, disputes can open the door to a long, costly, and uncertain legal process. Alternatively, parties can exert social sanctions, such as ceasing all future collaborations and sharing the negative experience with other firms.

Blockchain offers a solution to collaboration problems: it enables quasi-automatic enforcement of even very complex transactions.

Through blockchain, efficiency, based on a set of protocols representing an autonomous system of rules, increases. Furthermore, with blockchain, all participants can access a single version of information about the status of the PPP project. This removes the need for reconciliation across the independent systems of each partner. Information becomes secure, immutable, transparent, and traceable when stored and processed on the blockchain. With a much higher level of accuracy and authentication, the parties have less concern about possible collaboration failures.

As Lumineau et al. (2021) stated, blockchain positively affects each phase of a collaboration, including

- (a)

- Partner selection;

- (b)

- Agreement formation;

- (c)

- Execution.

A key step in building a public–private partnership is the selection of an appropriate set of partners. Through the blockchain, this step can be simplified.

While, in traditional PPPs, the public partner selects its partners on the basis of their reliability (financial, economic, and moral), derived from documents that could be forged (for example, falsified financial statements), with blockchain, which allows for the sharing of identical information to all parties, and with smart contracts, which automatically ensure the execution of agreements, the possibilities of cheating are reduced to a minimum.

Although agreement formation has always been a fundamental step in a PPP project, it is gaining even greater relevance with the use of blockchain.

This is because blockchain protocols, once put in place, cannot be easily altered. The technical design of blockchains makes it virtually impossible for anyone to change the contents of the ledger without approval from other parties. Moreover, they can be paired with smart contracts—programmed codes that are automatically executed once certain conditions are met.

Furthermore, while in traditional PPPs, the negotiation phase envisages a traditional two-party interaction, with blockchain, it becomes a collective task involving multiple players in the blockchain network.

In the execution phase, the three main advantages of using blockchain are

- -

- The automated enforcement of agreements and the resulting decrease in dishonest behavior;

- -

- A single truth, valid for all participants, is shared across the network;

- -

- Partners are more responsive during the execution phase because information must be confirmed in real-time rather than only after the fact.

Digital investments, understood as digital solutions for managing the investment process in terms of security and transparency, can represent a turning point in PPPs. The technological medium thus plays a double role: on the one hand, it is an instrument capable of guaranteeing the transparency and legitimacy of public proceedings, and on the other hand, it represents an instrument for financing PPP projects. The single subject adhering to the partnership, on the other hand, simultaneously assumes the role of lender, co-decision maker, or controller, depending on the level of inclusion that is decided to implement in each project.

PPPs exploit synergies in the joint use of resources and in the application of management knowledge to obtain the optimal attainment of the goals of all parties involved (Linder and Rosenau 2000). An institutional capacity to adopt and manage PPPs through blockchain is essential to ensure that they become an effective tool both to deliver essential services and to achieve Sustainable Development Goals (SDGs), especially in developing countries (Haque et al. 2020).

This is how blockchain can improve the decision-making process of PPP actors, transforming traditional PPPs into an intelligent system for sustainable development.

It is important that PPPs are sustainable and resilient and that blockchain adoption is a way to authenticate PPP project stakeholders, mitigating risks, managing projects better, and ensuring that PPP partners are held accountable for promised outcomes.

4. Concluding Remarks

This study tried to identify and describe the role that the use of blockchain could have in enabling the sustainable development of PPPs. Indeed, the research attempts to suggest to public sector entities (at both local and national levels) and to private entities the potential of blockchain technologies, which, with their characteristics, make it possible to overcome the limitations inherent in PPPs, increasing their adoption. Consequently, the possibility of achieving the SDGs that recognize valid support in PPPs could also be increased.

Blockchain technology is considered very immature (Jović et al. 2019) because a single underlying standard does not exist and concepts are difficult to master. Based on the state of the art, blockchain has not yet demonstrated itself to be either a transformative or even a disruptive innovation for PPPs as considered in the agribusiness or fintech industries. Although some works show understanding and acceptance of the blockchain concept and its related elements, less attention has been paid to investigating how the practice should be prioritized for the optimization of PPP value creation (Kivleniece and Quélin 2012). Digital transformation is generating a major shift for PPP functions, not only by reengineering processes and structures but also by inducing fundamental changes in the PPP’s strategic role.

The different stakeholders in a public–private partnership pursue different and sometimes conflicting goals:

- -

- The institutional public partner aspires to lead while staying in power, ensuring that the private member meets its contractual obligations properly and using public funds efficiently and effectively;

- -

- Private partners want to earn a profit;

- -

- Users seek a new facility or service at a minimum cost.

Aligning the expectations of all stakeholders makes these arrangements problematic. Blockchain could guarantee a win-win situation for the government, the private sector, and the public. This is possible because, as Berkeley (2015) asserted, blockchain technology is a new “trust machine” because of its ability to allow people to interact and conduct transactions even though they may not know each other or have a pre-existing trust-based relationship. Blockchain is considered a mechanism for improving and sharing data and information trust in PPP Projects (Willems 2014; Reynaers and Grimmelikhuijsen 2015): the improved quantity and quality of data made available to members can grant the partners and other direct stakeholders (i.e., financial investors or debt providers) continuous monitoring of the project with no possibility for fraud to occur.

New forms of participation and relationships between the public and private are possible and could create value for both society and the government. Blockchain technology could manage and trace the operations of each node, simplifying and standardizing internal PPP processes, ensuring in this way both more reliable interactions and exchanges of data with all public and private entities that join the network and greater protection against errors and falsifications (Caradonna 2020). From the analysis carried out, some important managerial implications emerge. Firstly, it is important when building a project blockchain data structure that project managers clearly understand their information management needs and focus on developing a secure environment. Blockchain implementation should be done in a collaborative manner with a full project team of experts—from different backgrounds—who should drive the ideas behind blockchain and advise the code writers who create the platform. Secondly, the management of PPPs that adopt blockchain requires the acquisition of specialized skills not normally found in a PPP team. Consequently, adopting an appropriate personnel selection policy that selects those equipped with adequate skills will be essential.

Thirdly, this study suggests that the ability to adapt to technological changes could also allow PPPs to persist and further develop in a sustainable manner.

From an academic point of view, this study presents some limitations that can be considered the starting point for future research lines.

The main limit is that the analysis stops at a theoretical level. The study was designed as a critical analysis rather than an extensive literature review, principally for two reasons. The first is that there are many specific studies on single topics—PPPs or Blockchain—but the literature that deals with both topics simultaneously is extremely limited. The second reason is that it is not possible to analyze case studies due to the topicality of the use of blockchain in public–private partnerships.

However, because this case in point is rare, the considerations proposed in this paper offer potentially useful hints to push the implementation of blockchain into the sector of public–private partnerships.

Author Contributions

Conceptualization, A.T., G.D. and A.C.; methodology, A.T. and G.D.; data curation, A.T. and G.D.; writing—original draft preparation, A.T., G.D. and A.C.; writing—review and editing, A.T. and G.D.; visualization, A.T. and G.D.; supervision, A.T. and G.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external founding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abodei, Ebizimoh, Irene Azogu Alex Norta, Chibuzor Udokwu, and Dirk Draheim. 2019. Blockchain technology for enabling transparent and traceable government collaboration in public project processes of developing economies. In Digital Transformation for a Sustainable Society in the 21st Century: 18th IFIP WG 6.11 Conference on e-Business, e-Services, and e-Society, I3E 2019, Trondheim, Norway, September 18–20. Proceedings 18. Berlin and Heidelberg: Springer International Publishing, pp. 464–75. [Google Scholar]

- Agbo, Cornelius C., Qusay H. Mahmoud, and J. Mikael Eklund. 2019. Blockchain technology in healthcare: A systematic review. Healthcare 7: 56. [Google Scholar] [CrossRef] [PubMed]

- Alharby, Maher, Amjad Aldweesh, and Aad van Moorsel. 2018. Blockchain-based Smart Contracts: A Systematic Mapping Study of Academic Research 2018. Paper presented at 2018 International Conference on Cloud Computing, Big Data and Blockchain (ICCBB), Fuzhou, China, November 15–17; pp. 1–6. [Google Scholar] [CrossRef]

- Allessie, David, Maciej Sobolewski, Lorenzino Vaccari, and Francesco Pignatelli, eds. 2019. Blockchain for Digital Government. EUR 29677 EN. Luxembourg: Publications Office of the European Union. [Google Scholar] [CrossRef]

- Almarri, Khalid, and Bassam Abuhijleh. 2017. A qualitative study for developing a framework for implementing public–private partnerships in developing countries. Journal of Facilities Management 15: 170–89. [Google Scholar] [CrossRef]

- Balasubramanian, Sreejith, Vinaya Shukla, Jaspreet Singh Sethi, Nazrul Islam, and Roy Saloum. 2021. A readiness assessment framework for Blockchain adoption: A healthcare case study. Technological Forecasting and Social Change 165: 120536. [Google Scholar] [CrossRef]

- Ball, Rob, Heafey Maryanne, and David King. 2007. The private finance initiative in the UK: A value for money and economic analysis. Public Management Review 9: 289–310. [Google Scholar] [CrossRef]

- Becker, Moritz, and Balázs Bodó. 2021. Trust in blockchain-based systems. Internet Policy Review 10: 1–10. [Google Scholar] [CrossRef]

- Berawi, Mohammed Ali, Gabriel Reyes, Mustika Sari, and Gunawan Saroji. 2020. Developing Public-Private Partnership Model with Blockchain-Based Crowdfunding Concept for Port City Project. In Proceedings of the 2nd International Scientific Conference on Innovations in Digital Economy. Saint Petersburg: Association for Computing Machinery, pp. 1–7. [Google Scholar]

- Berkeley, Jhon. 2015. The Trust Machine—The Technology behind Bitcoin could Transform How the Economy Works. The Economist. Available online: https://www.economist.com/leaders/2015/10/31/the-trust-machine (accessed on 30 November 2022).

- Berrone, Pascual, Joan Enric Ricart, Ana Isabel Duch, Valeria Bernardo, Jordi Salvador, Juan Piedra Peña, and Miquel Rodríguez Planas. 2019. EASIER: An evaluation model for public–private partnerships contributing to the sustainable development goals. Sustainability 11: 2339. [Google Scholar] [CrossRef]

- Bildfell, Connor. 2018. P3 Infrastructure Projects: A Recipe for Corruption or an Antidote? Public Works Management & Policy 23: 34–57. [Google Scholar]

- Borgonovi, Elio, Eugenio Anessi Pessina, and Carmine Bianchi. 2017. Outcome-Based Performance Management in the Public Sector. Berlin and Heidelberg: Springer International Publishing. [Google Scholar]

- Bovaird, Tony. 2004. Public–private partnerships: From contested concepts to prevalent practice. International Review of Administrative Sciences 70: 199–215. [Google Scholar] [CrossRef]

- Broadbent, Jane, and Richard Laughlin. 2003. Public private partnerships: An introduction. Accounting. Auditing & Accountability Journal 16: 332–41. [Google Scholar]

- Bryson, John M., Barbara C. Crosby, and Melissa Middleton Stone. 2006. The design and implementation of Cross-Sector collaborations: Propositions from the literature. Public Administration Review 66: 44–55. [Google Scholar] [CrossRef]

- Caradonna, Toni. 2020. Blockchain and society. Informatik Spektrum 43: 40–52. [Google Scholar] [CrossRef]

- Casady, Carter B., Kent Eriksson, Raymond E. Levitt, and W. Richard Scott. 2018. Examining the state of public-private partnership (PPP) institutionalization in the United States. The Engineering Project Organization Journal 8: 177–98. [Google Scholar] [CrossRef]

- Casino, Fran, Thomas K. Dasaklis, and Constantinos Patsakis. 2019. A systematic literature review of blockchain-based applications: Current status, classification and open issues. Telematics and Informatics 36: 55–81. [Google Scholar] [CrossRef]

- Cong, Lin William, and Zhiguo He. 2019. Blockchain Disruption and Smart Contracts. The Review of Financial Studies 32: 1754–97. [Google Scholar] [CrossRef]

- Cruz, Carlos Oliveira, and Joaquim Sarmento. 2017. Reforming traditional PPP models to cope with the challenges of smart cities. Competition and Regulation in Network Industries 18: 94–114. [Google Scholar] [CrossRef]

- Dal Mas, Francesca, Grazia Dicuonzo, Maurizio Massaro, and Vittorio Dell’Atti. 2020. Smart Contracts to Enable Sustainable Business Models. A Case Study. Management Decision 58: 1601–19. [Google Scholar] [CrossRef]

- de Hoyos Guevara, Luciano Antonio, Luis Hernan Contreras Pinochet, and Kallita Ester Magalhães. 2020. Blockchain Technology and the Impact on Business Models. Innovation And Management 3: 161. [Google Scholar]

- De Matteis, Fabio, Giovanni Notaristefano, and Piervito Bianchi. 2021. Public—Private Partnership Governance for Accessible Tourism in Marine Protected Areas (MPAs). Sustainability 13: 8455. [Google Scholar] [CrossRef]

- De Palma, André, and Luc Leruthand Guillaume Prunier. 2009. Towards a Principal–Agent-Based Typology of Risks in Public–Private Partnerships. Washington, DC: International Monetary Fund. [Google Scholar]

- dos Reis, Claudio José Oliveira, and Ricardo Corrêa Gomes. 2023. Public value creation and appropriation mechanisms in public–private partnerships: How does it play a role? Public Administratio 101: 693–715. [Google Scholar] [CrossRef]

- Esposito, Paolo, and Spiridione Lucio Dicorato. 2020. Sustainable development, governance and performance measurement in public private partnerships (PPPs): A methodological proposal. Sustainability 12: 5696. [Google Scholar] [CrossRef]

- Forrer, John, James Edwin Kee, Kathryn E. Newcomer, and Eric Boyer. 2007. Public-Private Partnerships and the Public Accountability Question. Public Administration Review 70: 475–84. [Google Scholar] [CrossRef]

- Fusco, Antonio, Grazia Dicuonzo, Vittorio Dell’Atti, and Marco Tatullo. 2020. Blockchain in healthcare: Insights on COVID-19. International Journal of Environmental Research and Public Health 17: 7167. [Google Scholar] [CrossRef] [PubMed]

- Gilson, Lucy L., and Caren B. Goldberg. 2015. Editors’ comment: So, what is a conceptual paper? Group & Organization Management 40: 127–30. [Google Scholar]

- Greve, Carsten, and Graeme A. Hodge. 2013. Rethinking Public-Private Partnerships. London: Routledge, pp. 1–32. [Google Scholar]

- Grimsey, Darrin, and Mervyn K. Lewis. 2005. Are public private partnerships value for money? Accounting Forum 29: 345–78. [Google Scholar] [CrossRef]

- Grimsey, Darrin, and Mervyn K. Lewis. 2007. Public Private Partnerships and Public Procurement. Agenda 14: 171–88. [Google Scholar] [CrossRef]

- Hammerschmid, Gerhard, and Tamyko Ysa. 2010. Empirical PPP experiences in Europe: National variations of a global concept. In International Handbook in Public-Private Partnerships. Edited by Graeme A. Hodge, Carsten Greve and Anthony Boardman. Cheltenham: Edward Elgar, pp. 333–53. [Google Scholar]

- Haque, Md Nazmul, Mustafa Saroar, Md Abdul Fattah, and Syed Riad Morshed. 2020. Public-Private Partnership for achieving sustainable development goals: A case study of Khulna, Bangladesh. Public Administration and Policy 23: 283–98. [Google Scholar] [CrossRef]

- Hart, Oliver. 2003. Incomplete Contracts and Public Ownership: Remarks and an Application to Public-Private Partnerships. Economic Journal 113: C69–C76. [Google Scholar] [CrossRef]

- Hellowell, Mark. 2010. The UK’s private finance initiative: History, evaluation, prospects. In International Handbook in Public-Private Partnerships. Edited by Graeme A. Hodge, Carsten Greve and Anthony Boardman. Cheltenham: Edward Elgar. [Google Scholar]

- Henisz, Witold Vit Jerzy. 2006. Governance issues in public private partnerships. International Journal of Project Management 24: 537–38. [Google Scholar] [CrossRef]

- Hodge, Graeme A., and Carsten Greve. 2017. On public–private partnership performance: A contemporary review. Public Works Management & Policy 22: 55–78. [Google Scholar] [CrossRef]

- Hodge, Graeme A., Carsten Greve, and Anthony Boardman, eds. 2010. International Handbook on Public-Private Partnership. Cheltenham: Edward Elgar Publishing. [Google Scholar]

- Hood, John, Ian Fraser, and Neil Mcgarvey. 2006. Transparency of risk and reward in UK public–private partnerships. Public Budgeting & Finance 26: 40–58. [Google Scholar] [CrossRef]

- Jamali, Dima. 2004. Success and Failure Mechanisms of Public-Private Partnerships (PPPs) in Developing Countries. International Journalof Public Sector Management 17: 414–30. [Google Scholar] [CrossRef]

- Jayasena, Nimesha, Daniel W.M. Chan, and Mohan Kumaraswamy. 2021. A systematic literature review and analysis towards developing PPP models for delivering smart infrastructure. BEPAM—Special Issue on “Public-Private Partnerships—Theory vs. Practice: Charting New Trajectories” 11: 121–37. [Google Scholar] [CrossRef]

- Jørgensen, Torben Beck, and Barry Bozeman. 2007. Public values: An inventory. Administration & Society 39: 354–81. [Google Scholar] [CrossRef]

- Jović, Marija, Marko Filipović, Edvard Tijan, and Mlaen Jardas. 2019. A review of blockchain technology implementation in shipping industry. Pomorstvo 33: 140–48. [Google Scholar] [CrossRef]

- Kang, Seong, Dhanakorn Mulaphong, Eunjin Hwang, and Chih-Kai Chang. 2019. Public-private partnerships in developing countries: Factors for successful adoption and implementation. International Journal of Public Sector Management 32: 334–51. [Google Scholar] [CrossRef]

- Karame, Ghassan, and Srdjan Capkun. 2018. Blockchain security and privacy. IEEE Security & Privacy 16: 11–12. [Google Scholar]

- Karamitsos, Ioannis, Maria Papadaki, and Nedaa Baker Al Barghuthi. 2018. Design of the Blockchain Smart Contract: A Use Case for Real Estate. Journal of Information Security 9: 177–90. [Google Scholar] [CrossRef]

- Kivleniece, Ilze, and Bertrand Quélin. 2012. Creating and capturing value in public-private ties: A private actor’s perspective. Academy of Management Review 37: 272–99. [Google Scholar] [CrossRef]

- Klijn, Erik-Hans, and Geert R. Teisman. 2000. Governing public-private partnerships: Analyzing and managing the processes and institutional characteristics of public-private partnerships. In Public Private Partnerships: Theory and Practice in International Perspective. London: Routledge, pp. 252–64. [Google Scholar]

- Kundu, Debasish. 2019. Blockchain and trust in a smart city. Environment and Urbanization ASIA 10: 31–43. [Google Scholar] [CrossRef]

- Linder, Stephen H., and Pauline Vaillancourt Rosenau. 2000. Mapping the Terrain of the Public-Private Policy Partnership. In Public-Private Policy Partnerships. Edited by Pauline Vaillancourt Rosenau. Cambridge: MIT Press, pp. 1–18. [Google Scholar]

- Lonsdale, Chris. 2007. The challenge of public-private partnerships. Local Government Studies 33: 311–19. [Google Scholar] [CrossRef]

- Lumineau, Fabrice, Wenqian Wang, Oliver Schilke, and Laura Huang. 2021. How blockchain can simplify partnerships. Harvard Business Review. Available online: https://hbr.org/2021/04/how-blockchain-can-simplify-partnerships (accessed on 20 February 2023).

- Ma, Minxun, Nannan Wang, Wenjian Mu, and Lin Zhang. 2022. The Instrumentality of Public-Private Partnerships for Achieving Sustainable Development Goals. Sustainability 14: 13756. [Google Scholar] [CrossRef]

- Magnier, Véronique, and Patrick Barban. 2018. The Potential Impact Of Blockchains On Corporate Governance: A Survey On Shareholders’rights In The Digital Era. InterEULawEast: Journal for the International and European Law, Economics and Market Integrations 5: 189–226. [Google Scholar]

- Marsilio, Marta, Giulia Cappellaro, and Corrado Cuccurullo. 2011. The intellectual structure of research into PPPS: A bibliometric analysis. Public Management Review 13: 763–82. [Google Scholar] [CrossRef]

- Maslova, Svetlana. 2020. Achieving sustainable development goals through public private partnership: Critical review and prospects. International Journal of Innovation and Sustainable Development 14: 288–312. [Google Scholar] [CrossRef]

- McGhin, Thomas, Kim-Kwang Raymond Choo, Charles Zhechao Liu, and Debiao He. 2019. Blockchain in healthcare applications: Research challenges and opportunities. Journal of Network and Computer Applications 135: 62–75. [Google Scholar] [CrossRef]

- McQuaid, Ronald W. 2000. The theory of partnership. Why have partnerships? In Managing Public-Private Partnerships for Public Services: An International Perspective. London: Routledge, pp. 9–35. [Google Scholar]

- Min, Hokey. 2019. Blockchain technology for enhancing supply chain resilience. Business Horizons 62: 35–45. [Google Scholar] [CrossRef]

- Nel, Danielle. 2020. Allocation of risk in public private partnerships in information and communications technology. International Journal of Ebusiness and Egovernment Studies 12: 17–32. [Google Scholar] [CrossRef]

- Opara, Michael, and Paul Rouse. 2019. The perceived efficacy of public-private partnerships: A study from Canada. Critical Perspectives on Accounting 58: 77–99. [Google Scholar] [CrossRef]

- Opara, Michael, Fathi Elloumi, Oliver Okafor, and Hussein Warsame. 2017. Effects of the institutional environment on public-private partnership (P3) projects: Evidence from Canada. Accounting Forum 41: 77–95. [Google Scholar] [CrossRef]

- Osborne, S., ed. 2000. Managing Public-Private Partnerships for Public Services: An International Perspective. London: Routledge. [Google Scholar]

- Osei-Kyei, Robert, and Albert P. Chan. 2017. Empirical comparison of critical success factors for public-private partnerships in developing and developed countries: A case of Ghana and Hong Kong. Engineering, Construction and Architectural Management 24: 1222–45. [Google Scholar] [CrossRef]

- Parker, David, and Keith Hartley. 2003. Transaction Costs, Relational Contracting and Public Private Partnerships: A Case Study of UK Defence. Journal of Purchasing & Supply Management 9: 97–108. [Google Scholar] [CrossRef]

- Pinz, Alexander, Nahid Roudyani, and Julia Thaler. 2018. Public–private partnerships as instruments to achieve sustainability-related objectives: The state of the art and a research agenda. Public Management Review 20: 1–22. [Google Scholar] [CrossRef]

- Quelin, Bertrand V., Ilze Kivleniece, and Sergio Lazzarini. 2017. Public-private collaboration, hybridity and social value: Towards new theoretical perspectives. Journal of Management Studies 54: 763–92. [Google Scholar] [CrossRef]

- Reynaers, Anne-Marie. 2014. Public values in public–private partnerships. Public Administration Review 74: 41–50. [Google Scholar] [CrossRef]

- Reynaers, Anne-Marie, and Gjalt De Graaf. 2014. Public Values in Public–Private Partnerships. International Journal of Public Administration 37: 120–28. [Google Scholar] [CrossRef]

- Reynaers, Anne-Marie, and Stephan Grimmelikhuijsen. 2015. Transparency in public-private partnerships: Not so bad after all? PublicAdministration 93: 609–26. [Google Scholar] [CrossRef]

- Rufin, Carlos, and Miguel Rivera-Santos. 2010. Between commonweal and competition: Understanding the governance of public-private partnerships. Journal of Management 36: 1–21. [Google Scholar] [CrossRef]

- Rybnicek, Robert, Julia Plakolm, and Lisa Baumgartner. 2020. Risks in public–private partnerships: A systematic literature review of risk factors, their impact and risk mitigation strategies. Public Performance & Management Review 43: 1174–208. [Google Scholar]

- Saidel, Judith. 2017. Smart partnership in contracting: Thriving in a period of intense policy uncertainty. Nonprofit Professionals Forum 8: 121–32. [Google Scholar] [CrossRef]

- Selim, Ahmed M. S., Pasent H. A. Yousef, and Mohamed R. Hagag. 2018. Smart infrastructure by (PPPs) within the concept of smart cities to achieve sustainable development. International Journal of Critical Infrastructures 14: 182–98. [Google Scholar] [CrossRef]

- Shaoul, Jean. 2005. A Critical Financial Analysis of the Private Finance Initiative: Selecting a Financing Method or Allocating Economic Wealth? Critical Perspectives in Accounting 16: 441–71. [Google Scholar] [CrossRef]

- Shaoul, Jean, Anne Stafford, and Pamela Stapleton. 2012. Accountability and corporate governance of public private partnerships. Critical Perspectives on Accounting 23: 213–29. [Google Scholar] [CrossRef]

- Sherman, Alan T., Farid Javani, Haibin Zhang, and Enis Golaszewsky. 2019. On the origins and variations of blockchain technologies. IEEE Security & Privacy 17: 72–77. [Google Scholar]

- Shrestha, Asheem, and Igor Martek. 2015. Principal agent problems evident in Chinese PPP infrastructure projects. In Proceedings of the 19th International Symposium on Advancement of Construction Management and Real Estate. Edited by Shen Liyin, Kunhui Ye and Chao Mao. Berlin and Heidelberg: Springer, pp. 759–70. [Google Scholar]

- Siemiatycki, Matti, and Naeem Farooqi. 2012. Value for money and risk in public–private partnerships: Evaluating the evidence. Journal of the American Planning Association 78: 286–299. [Google Scholar] [CrossRef]

- Sklaroff, J. 2017. Smart Contracts and the Cost of Inflexibility (September 18, 2017). University of Pennsylvania Law Review, 166. Available online: https://ssrn.com/abstract=3008899 (accessed on 20 February 2023).

- Smithey Fulmer, Ingrid. 2012. Editor’s comments: The craft of writing theory articles—Variety and similarity in AMR. Academy of Management Review 37: 327–31. [Google Scholar] [CrossRef]

- Spackman, Michael. 2002. Public-Private Partnerships: Lessons from the British Approach. Economic Systems 26: 283–301. [Google Scholar] [CrossRef]

- Spraul, Katharina, and Julia Thaler. 2020. Partnering for good? An analysis of how to achieve sustainability-related outcomes in public–private partnerships. Business Research 13: 485–511. [Google Scholar] [CrossRef]

- Tallaki, Mouhcine, and Enrico Bracci. 2021. Risk allocation, transfer and management in public–private partnership and private finance initiatives: A systematic literature review. International Journal of Public Sector Management 34: 709–31. [Google Scholar] [CrossRef]

- Tapscott, Dom, and Jim Euchner. 2019. Blockchain and the Internet of Value: An Interview with Don Tapscott Don Tapscott talks with Jim Euchner about blockchain, the Internet of value, and the next Internet revolution. Research-Technology Management 62: 12–19. [Google Scholar] [CrossRef]

- Tian, Bo, Jiaxin Fu, Yongshun Xu, and Longshan Sun. 2022. How does contract flexibility affect the sustainability performance of public–private partnership projects? A serial multiple mediator model. Engineering, Construction and Architectural Management, ahead-of-print. [Google Scholar]

- UNECE. 2019. “Guiding Principles on People-first Public-Private Partnerships in support of the United Nations Sustainable Development Goals. Note by the secretariat” (ECE/CECI/2019/5), Working Party on Public-Private Partnerships. Available online: https://unece.org (accessed on 23 February 2023).

- van den Hurk, Martijn. 2018. Public–private partnerships: Where do we go from here? A Belgian perspective. Public Works Management & Policy 23: 274–94. [Google Scholar]

- Vecchi, Veronica. 2022. Public private partnership for sustainable development. In Encyclopedia for Public Management. Edited by Kuno Schedler. London: Edward Elgar. [Google Scholar]

- Vecchi, Veronica, and Mark Hellowell. 2018. Public—Private partnerships: Recent trends and the central role of managerial competence. In The Palgrave Handbook of Public Administration and Management in Europe. Edited by Edoardo Ongaro and Sandra Van Thiel. London: Palgrave Macmillan, pp. 381–401. [Google Scholar]

- Vecchi, Veronica, Francesca Casalini, Niccolò Cusumano, and Velia M. Leone. 2021. Public Private Partnerships: Principles for Sustainable Contracts. London: Palgrave Macmillan. [Google Scholar]

- Verma, Manish. 2021. Smart contract model for trust-based agriculture using blockchain technology. International Journal of Research and Analytical Reviews 8: 354–55. [Google Scholar]

- Verweij, Stefan, and Ingmar van Meerkerk. 2021. Do public–private partnerships achieve better time and cost performance than regular contracts? Public Money & Management 41: 286–95. [Google Scholar] [CrossRef]

- Vinogradov, Dmitri, and Elena Shadrina. 2018. Public-private partnerships as collaborative projects: Testing the theory on cases from EU and Russia. International Journal of Public Administration 41: 446–59. [Google Scholar] [CrossRef]

- Wang, Nannan, and Minxum Ma. 2021. Public–private partnership as a tool for sustainable development—What literatures say? Sustainable Development 29: 243–58. [Google Scholar] [CrossRef]

- Wang, Wuanming, Wei Xiong, Guangdong Wu, and Dajian Zhu. 2018. Public–private partnership in Public Administration discipline: A literature review. Public Management Review 20: 293–316. [Google Scholar] [CrossRef]

- Weihe, Gudrid. 2008. Public-private partnerships and public-private value trade-offs. Public Money and Management 28: 153–58. [Google Scholar] [CrossRef]

- Wermeille, Antoine, Jean Pier Chanet, Michel Berducat, and Daniel Didelot. 2015. Stakeholders’ involvement in establishing public-private partnerships through innovation in agricultural mechanisation: A case study. International Journal of Agricultural Management 4: 68–71. [Google Scholar]

- Whetten, David A. 1989. What constitutes a theoretical contribution? Academy of Management Review 14: 490–95. [Google Scholar] [CrossRef]

- Willems, Tom. 2014. Democratic accountability in public–private partnerships: The curious case of Flemish school infrastructure. Public Administration 92: 340–58. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).