1. Introduction

Given the rapid spread of the COVID-19 virus and the associated lockdown measures, governments have had to respond rapidly and quite severely to slow the spread of the virus and flatten the curve of new infections, hospitalisations and deaths. This has had significant and wide-reaching implications on many aspects of life—health, economic and social—and has been affecting different social groups in highly asymmetric ways.

Previous research for Ireland and elsewhere has shown how the employment losses engendered by the pandemic and the mitigation measures enacted by the government have affected household disposable income. Analysis from

Christl et al. (

2021) shows that, in EU countries, national tax–benefit systems were able to absorb a significant share of the drop in earnings (73.3% at the EU level) and that monetary compensation schemes played a major role in this cushioning effect (35.2% at the EU level). In Ireland,

Doorley et al. (

2020) showed that discretionary policies enacted to cushion the effect of the pandemic on household incomes halved the income losses suffered at the household level, on average, with larger cushioning effects experienced by low-income households.

This research focuses on gender income inequality and its likely trajectory during and in the immediate aftermath of the pandemic. Ireland is a country with a significant and recent history of progress in gender equality but one that still retains a sizable gender wage and gender work gap (

Russell et al. 2017)—these combined lead to a significant gender income gap. Ireland experienced substantial employment and income loss during the pandemic. More than half of the workforce in Ireland was in receipt of state income support at the height of the crisis in April 2020.

This gender gap in market, or pre-tax and transfer income, is certain to be affected by the economic effects of the pandemic. Women are disproportionately in low-paying and insecure jobs. They are traditionally more likely to shoulder the burden of childcare and elder care, which is particularly relevant during a period of school closure and elderly cocooning. However, women also tend to be over-represented in both locked-down sectors (such as hospitality) and essential sectors (such as healthcare) cocooning (

Alon et al. 2020). Research to date presents a somewhat mixed view of the gender division of job and income losses during the pandemic.

Most of the research suggests that women were more likely to suffer job and income losses as a result of the pandemic than men (

Adams-Prassl et al. 2020;

Andrew et al. 2020;

Alon et al. 2021;

Fabrizio et al. 2021). However, some research indicates important cross-country differences. In a study of six countries,

Dang and Nguyen (

2021) show that women were more likely to permanently lose their jobs than men in China, Italy and the US but were less likely to permanently lose their jobs in Japan, South Korea and the UK. They also showed that women were more likely to temporarily lose their jobs in China and the UK but were less likely to temporarily lose their jobs in Japan, South Korea, Italy and the US.

Alon et al. (

2021) showed that women’s labour supply fell relative to men’s in 18 of 28 countries studied when measured by employment and in 19 of 28 countries when measured by hours worked. However, Ireland was one of the few countries that saw a slight increase in women’s labour supply relative to men’s under both measures.

1Even within a country, there is not always consensus on the immediate impact of the crisis by gender. By using data from the COVID-19 supplement of Understanding Society,

Hupkau and Petrongolo (

2020) found that labour market outcomes of men and women were roughly equally affected at the extensive margin but that women suffered smaller losses at the intensive margin. This is in contrast to other research for the UK, which relies on independent surveys and finds that women’s employment decreased by more than men’s employment (

Oreffice and Quintana-Domeque 2020;

Sevilla and Smith 2020). Administrative information on job losses in Ireland to date indicates that their scale has been reasonably similar for men and women.

In addition to the gender gap in market income, the gender gap in disposable, or post-tax and transfer income, is also likely to be affected by the pandemic and not only through its effect on market income. Tax–benefit changes enacted so far due to the pandemic have increased the generosity of welfare payments in many countries, including Ireland, without increasing income taxes. While tax–benefit systems do not differentiate based on gender, traditional gender divisions of work and caring roles mean that men are disproportionately affected by income tax changes while women are disproportionately affected by changes to welfare payments (

Stotsky 2016). The extent of gender differences in wages and work intensity and the design of the tax–benefit system determines how men and women are affected by policy changes. The question of how pandemic-related employment and wage changes and discretionary tax–benefit policy have affected men and women is, therefore, an empirical one.

The purpose of this research was to move away from the household perspective of the effect of the pandemic and related mitigation measures on income inequality, which has been covered in previous work. Instead, we estimated, at the individual level, the gender income gap in Ireland before the pandemic and at three points during the pandemic, corresponding to the three waves of the virus. This focus serves a number of purposes.

First, progress has been made in recent years in closing the gender wage and the gender work gaps in Europe and elsewhere. There is a risk that the pandemic may have stalled or reversed some of this progress. We showed how employment changes during the pandemic affected men and women separately in Ireland. There is reason to believe that these effects are not symmetrical. Like old vs. young workers, male and female workers have different wage, tenure and occupation profiles. We expect this analysis to shed light on whether policy intervention may be needed to restore employment levels of men and women to their pre-pandemic state.

Second, we showed how the gender income gap is cushioned by the pre-pandemic tax and transfer system as well as by the pandemic-related income supports. Previous research for Ireland showed that, during the financial crisis, changes to the tax and welfare system reduced the income of women relative to the income of men. This discrepancy was not reversed in post-crisis policy reforms (

Doorley et al. 2018). Our current analysis indicates whether or not this pattern has been repeated in the context of the current crisis and has implications for policy makers who engage in gender-responsive budgeting.

Quantifying the effect of the pandemic on the incomes of men and women is complicated by the fact that most representative surveys that contain information on family income, taxes, benefits and demographics are released with a delay of two or more years. In order to overcome this, we employed a nowcasting technique based on microsimulation (

O’Donoghue and Loughrey 2014) using the most recent data on employment and wage levels to calibrate a simulation model of household incomes, taxes and benefits. This approach produces a real-time picture of the population and the distribution of income from different sources and allows us to identify those most affected by the pandemic. We merged this framework with a gender decomposition technique developed by

Doorley and Keane (

2020). The authors develop a method to measure the cushioning effect of the tax–benefit system on gender income inequality and, using data and policies from 2017, estimate that the gender income gap is reduced tax–benefit policy by 10–40% in a cross-section of European countries.

We used the resulting method to “nowcast” the 2020 income distribution in Ireland, accounting for pandemic-related employment and income. We then quantified (i) the composition of the gender gap in income in Ireland, (ii) how the gender gap in income was cushioned by the tax–benefit system immediately prior to the pandemic and (ii) the relative roles of the market and the tax–benefit system in changing the gender income gap during the three waves of the pandemic. Conclusions were drawn regarding the likely trajectory of gender income inequality in Ireland and elsewhere in the future. Our results suggest the growing importance of gender and equality budgeting.

2. Gender Equality in Ireland

The structure of the Irish labour force has been strongly influenced by the historical role of women in Irish society.

2 In the 1937 Constitution of the Republic of Ireland, there was a legal basis for excluding women from the labour market and confining them to the home. The marriage bar of 1932 prevented married women from working in the civil service and existed until 1973. Similar marriage bars existed elsewhere but were lifted earlier. For example, the British marriage bar was lifted in 1944, reflecting the increased prevalence of women in male-dominated industries during the Second World War. A system of fully joint taxation for married couples existed in Ireland until the early 2000s, and indeed, prior to the 1980 Supreme Court ruling, a wife’s income was regarded as part of their husband’s for tax purposes (

O’Donoghue and Sutherland 1999). This provided a disincentive for the secondary earner in a couple, who was usually female, to work. Reforms to this system were strongly opposed, and the current system is now a hybrid, partially individualised one, which retains some of the same disincentives (

Doorley 2017).

The activity and employment rates of Irish women have been rising over the last couple of decades and are currently around the EU average. Eurostat figures compiled from the Labour Force Survey for 20–64-year-olds show that 70% of Irish women and 80% of Irish men were employed in 2021. Comparable figures for the EU-27 were 68% (women) and 79% (men). The average weekly hours worked by Irish women—at 33—is lower than that of women in the EU as a whole (35).

The raw Irish gender pay gap, measured as the percentage difference between average male and female hourly wages, is low by European standards, at around 14% in 2018. Comparable figures for the UK and EU are 20% and 15%, respectively. An adjusted measure of the gender wage gap, which accounts for different labour market characteristics of men and women, puts the Irish gender wage gap closer to 11%, similar to the adjusted UK gender wage gap at around 12% (

Redmond and McGuinness 2019).

The gender gap in market income—defined as earnings plus private pensions plus investment income—is relatively high, at close to 50%, in Ireland. However, the Irish tax–benefit system is also relatively effective at redistributing between men and women.

Doorley and Keane (

2020) estimate that, in 2017, the gender gap in income was reduced by one-fifth due to the tax benefit system. Roughly half of this redistribution was performed by the benefit system, while another half was attributable to taxation. This was at the upper end of the redistribution between men and women estimated for the countries studied. As elaborated upon in the next section, however, heterogeneity in how the COVID-19 pandemic has affected the labour market could significantly change this estimate, with implications for policy makers who are engaged in gender budgeting.

4. Methodology

In order to understand how policy, economic and social changes such as those described in

Section 2 affect income inequality and gender income inequality, household survey data are typically used. There is, however, a substantial time lag (2 years or more) between the collection and the release of survey data for research. In Europe, the main survey with data on the income situation of households in European countries is the Survey of Income and Living Conditions (SILC). Its latest release at the time of analysis occurred in 2018, with an income reference period of 2017. A two-year time lag prevents survey data from being fully representative of the current period, even in normal times. When sudden changes in economic conditions occur, the time lag hinders a timely analysis of these shocks.

Other more recent datasets are available such as the Labour Force Survey, which is available every quarter at a 6-week lag, or up-to-date register data that are available every month at a short lag. Earnings indexation is available on a quarterly time period. Their main limitation, however, is the lack of micro-information on incomes. Without good information on household incomes, these datasets cannot be used to design policies that mitigate the impacts of a crisis at least cost.

Therefore, the key methodological challenge in identifying and addressing changing income inequalities due to the pandemic is the lack of up-to-date data. We overcame this by using a “nowcasting” methodology based on microsimulation (

O’Donoghue and Loughrey 2014) using the most recent data on employment and wage levels to calibrate a simulation model of household incomes, taxes and benefits. This approach produces a near real-time picture of the population and the distribution of income from different sources and allows us to identify those most affected by the pandemic.

There are a number of different “nowcasting” methods. Some more simple methods apply wage indexation factors and proportionally change the employment rate in specific industries (

Navicke et al. 2014). We utilised a more nuanced approach that allows us to model the heterogeneity of changes in the population, following the latest developments by

O’Donoghue et al. (

2020,

2021);

Sologon et al. (

2022) and

O’Donoghue et al. (

2022).

Figure 4 provides a graphical description of the method. This method relies on two core components:

An income generation model (IGM) to characterise and simulate the distribution of household income and its subcomponents;

A nowcasting component that calibrates the simulations of the IGM to the external labour market, wage and price statistics in order to reflect the most recent developments in the distribution of income.

We extended this infrastructure by integrating a third component, a gender decomposition of income, following the method developed by

Doorley and Keane (

2020). This allows us to understand how gender income gaps are likely to change in the short term as a result of the COVID-19 pandemic.

4.1. Household Income Generation Model

The household income generation model (IGM) follows the framework developed by

Sologon et al. (

2021), which relies on a system of hierarchically structured, multiple equation models for the components of household income that describe parametrically how the receipt and the level of income sources vary with personal characteristics. Residuals link the model predictions to observed income sources. A similar IGM was used for cross-country analysis (

Sologon et al. 2021), for historical analysis in Lithuania (

Černiauskas et al. 2022) and in Australia (

Li et al. 2021). The IGM describes the distribution of household disposable income in a particular period and then allows the simulation of counterfactual distributions under alternative labour market, policy, returns or demographic scenarios.

We presented first the five main household income components modelled in our approach:

= gross labour income (for employees and the self-employed);

= capital income (investment and property (rental) income);

= other market incomes (including private pensions, private transfers and other incomes);

= public benefits;

= personal direct taxes and social insurance contributions.

Each income component was parametrically linked with the observed individual and household characteristics (typically education and demographic characteristics for labour market models and, in addition, labour market characteristics such as industry, occupation, sector and hours for employment income).

4 For each income source, we applied a two-step procedure:

- 1.

First, we estimated the incidence of the income source

for individual

in household

,

where

S ∈ {employment, self-employment, investment, property, other}.

- 2.

Second, we estimated the level of the income source , for those that receive it (.

For annual labour income, we first estimated an in-work binary indicator equal to 1 if the individual receives any income from work and 0 otherwise. For those in work, we estimated a model for being employed versus self-employed, their occupation, industry and sector. A similar binary strategy was applied for the remaining market income (sub-)components: capital and other incomes. The modelling of the prevalence of the income sources and the labour market structure (employment status, occupation, industry, sector and hours) is part of the labour market module in

Figure 4 and involves estimating logistic and multinomial logistic models.

After modelling the labour market structure, we proceeded to modelling the income sources, conditional on the variables modelled in the preceding step. This is part of the income module in

Figure 4. It involves estimating log-linear models for monthly wages, self-employment income, investment, property and other market income sources.

We estimated each equation of the model independently and stored the vector of parameter estimates and the vector of residuals for each model. All of the labour market models in our IGM were estimated separately by gender.

Formally, this is represented by:

where

is the number of individuals in the household.

These parametric relationships are reduced-form projections that describe the empirical associations between the household and individual characteristics and the various income sources. We used these projections to simulate counterfactual distributions of market incomes under alternative scenarios: a different labour market structure, a different structure of economic returns or a different demographic composition. Specifically, for this analysis, we used our projections to (i) nowcast the latest available data to reflect the situation before and during the crisis and (ii) simulate counterfactual distributions of market incomes for women if they were paid according to the male wage structure and if their labour market participation and hours and occupation/industry choice followed the male distributions.

Benefits, taxes and social security contributions for projections and counterfactuals were simulated using the NUI Galway microsimulation model developed for studying the impacts of an economic crisis (

O’Donoghue et al. 2018). Household benefits (

) are defined as the sum of household pension income, means-tested benefits and non-means-tested benefits:

Direct taxes combine income taxes and social security contributions:

These not only transform the distributions of market income into disposable income but also allow us to simulate further counterfactual distributions of disposable income under alternative tax–benefit rules, such as those introduced in response to the pandemic.

4.2. Simulating Counterfactual Distributions and Nowcasting

The IGM estimated in the previous step was used to nowcast the micro-survey data from the most recent collected data,

s (2017), to period

(pre-COVID, corresponding to December 2019) and periods

during the COVID-19 crisis corresponding to successive waves of the virus

k = 1, 2, 3. Wave 1 corresponds to May 2020, wave 2 to November 2020 and wave 3 to January 2021. Calibration totals utilise administrative data for employment and industry, while wage levels draw upon a quarterly earnings survey. For period s (estimation data), we formalised the IGM as follows:

where:

- ○

is household disposable income, a function of:

- ○

is a vector of exogenous individual and household characteristics;

- ○

is the vector of parameter values describing the labour market structure (), the structure of returns () and the tax–benefit rules ();

- ○

is a vector of unobserved heterogeneity terms.

5

The income-generating process is a statistical representation of the structure of the prevalence and the level of market incomes and their sub-components, combined with the tax–benefit rules converting market incomes into disposable counterparts.

This setup allows us to understand how the distribution of a random variable (such as disposable income) as well as any function of interest (such as inequality indices, quantiles) changed due to the impact of the COVID-19 crisis.

4.3. Nowcasting the Distribution to t (Pre-COVID) and t + 1 (Wave 1, 2 and 3)

The nowcasting component calibrates the simulations resulting from the IGM to external statistics in order to update the data from the most recent available survey data (period

) to the targeted periods

(pre-COVID) and waves

during the crisis. We followed the nowcasting method applied by

O’Donoghue et al. (

2020) and explained in detail in

O’Donoghue et al. (

2020,

2022). The age range to which the simulations and calibrations apply is the population above the age of 16.

Calibration for logit models was based upon the rank of the

estimated by the model compared with the target number of, for example, those in work generated from near-real-time calibration totals. This calibration method is known as alignment and is described in

Li and O’Donoghue (

2013). For multinomial logit models of, for example, industry or occupation,

is ranked for each category

, with the highest ranks selected until the weighted number of categories is selected. This method has the advantage that it captures more observed heterogeneity than purely random selection, reflecting the fact that certain groups are more likely to be in work. The incorporation of stochastic terms means that we capture unobserved heterogeneity so that, for example, some higher educated are out of work and some lone-parents work. Ranking by

alone could result in only those with a high chance of being selected. It is thus akin to Monte Carlo simulation but allows for external totals to be hit rather than merely replicating the observed relationships in the estimation dataset.

We implemented three transformations:

- 3.

Labour market transformation: The labour market transformation consists of modelling the labour market structure in period

s and using the parameter estimates, in conjunction with external labour market statistics, to re-calibrate so that the new simulated labour market structure reflects the targeted period (

t or

) with respect to the age and gender composition of the probability of being in work, the employment rate, occupation and industry structure, and unemployment. The labour market status and characteristics of all individuals of working age are simulated and captured by a new vector for each time period

reflecting the aligned labour market characteristics with the target period:

t or

t + k,

k = 1, 2, 3;

- 4.

Returns transformation: The returns transformation involves: (i) first, re-simulating all incomes based on the updated labour market structure using the parameter estimates of the income models for period

; (ii) updating monetary values using income growth indices for earnings differentiated by industry and occupation and CPI indices for the adjustment of remaining incomes.

6 The income of all individuals is updated in this way and captured by a new vector

reflecting the aligned incomes with the target period:

;

- 5.

Tax–benefit transformation: The tax–benefit transformation consists of updating the tax–benefit rules and the parameters of the system to reflect the target period and applying them to the distribution of market incomes obtained in step 2 in order to obtain the nowcasted distribution of disposable incomes at time

and

:

By comparing the two distributions, we obtained the nowcasted change in the distribution of disposable income due to the COVID crisis, taking into account the change in the labour market structure, incomes and tax–benefit rules. We could also evaluate the counterfactual effect of changing just one of these components (i.e., increased unemployment with no targeted tax–benefit changes) or of changing the returns structure of women so that their income distribution follows the male pattern.

4.4. Gender Income Inequality

In the final stage of the analysis, we compared the distribution of male and female income and the drivers of the gender gap in income before and after accounting for the impact of the pandemic. Therefore, we incorporate a gender decomposition developed by

Doorley and Keane (

2020) into our simulation. This allowed us to show how the pandemic-induced income and employment shock and the tax–benefit response alter gender income inequality in both market and disposable income.

4.4.1. Income Sharing

Estimating gender income inequality using a population of single individuals is relatively straightforward. However, taking the complexity of married couple households into account requires some assumptions about how married couples split their income. Most income distribution analyses, such as the measurement of inequality using the Gini Index, are carried out at the household level. The implicit assumption is that household income is pooled so that all household members enjoy the same standard of living. There is empirical evidence that households do pool a significant proportion of income, supporting this unitary model of household behaviour (

Watson et al. 2013).

In this work, we considered each member of a couple as an individual in terms of their market income, tax liability and benefit entitlement. We assume that family benefits and household level benefits are shared equally among members of a couple.

7 One exception is Child Benefit, which we assigned to the mother as this is the default payment rule for this benefit. We considered this individual approach as representing an upper bound of the gender gap in income. An assumption of full income-sharing may be closer to reality as empirical studies suggest that most couples share most of their income (

Watson et al. 2013). The assumption of no income sharing, however, allows us to estimate the redistribution performed by the State through the tax–benefit system, separately from the private redistribution performed at the household level between members of a couple. The former measure was of interest for this analysis as it is the margin of change readily available to policy-makers. It is also a useful measure in that it represents potential income (consumption, bargaining, etc.) inequality.

4.4.2. Decompositions

At the core of our analysis lies the gender gap in the average market income gap (

and the gender gap in average disposable income

, defined as:

where

and

stand for nowcasted average market and disposable income of men and women and are formalised as follows:

Decomposition of the Gender Gap in Market Incomes

First, we estimated how the structure of the gender gap in market incomes, changed during the course of the pandemic, between t and .

To this end, we decomposed the difference between the nowcasted distributions of market incomes for men and women to identify the contribution of differences in labour market characteristics between men and women (participation, hours and wages, occupational structure, etc.) and how these have changed during the pandemic.

The decomposition of the difference in average market incomes between men and women can be formalised as:

where

is the counterfactual average market income of women if women had the labour market participation, hours and wage structure of men, and

is the counterfactual market income of women if women also had the occupational and industry structure of men.

is obtained by applying the coefficients of the labour market participation, wage and earnings model for men to women while retaining the residuals for women and predicting a counterfactual market income for women.

is obtained by importing in also the coefficients from the occupation and industry models for men and simulating the resulting market incomes for women.

By following this logic, the gender gap in market income was decomposed into (1) the contribution of gender differences in wages and labour supply, (2) gender differences in occupation and industry structures and (3) the contribution of all other differences in characteristics/returns between men and women. These other characteristics include gender differences in income due to demographics, non-labour income and self-employment status. The decomposition is performed for each period: t (pre-COVID) and t + k (post-COVID wave ).

Decomposition of the Cushioning Effect of the Tax–Benefit System

By comparing the gap in average market income between men and women (

and the gap in average disposable income between men and women

, we obtained the “cushioning” effect of the tax–benefit system on the gender gap in market income in each period:

Defining gross income,

, as market income plus benefits, the gender gap in gross income is:

Defining net income,

, as market income net of tax, the gender gap in net income is:

can then be further decomposed into the “cushioning” effect of benefits and the “cushioning” effect of taxes.

5. Data

Our analysis required two data sources: (i) microdata for estimating the income generation model and for simulating the distributions of disposable income and (ii) calibration data to align the simulations with the timely changes in labour market and income growth.

Our microdata is the 2017 version of the Irish component of the European Union Survey on Income and Living Conditions (EU-SILC). EU-SILC is a representative survey with information on household incomes, labour market characteristics, demographics and living conditions, typically used for building poverty and inequality indicators for the EU countries. The Irish component relies both on survey and register data. Income information for 80% of the respondents comes primarily from administrative sources linked to the individual’s tax number (PPSN) (

Callan et al. 2010).

Our analysis used a set of calibration control totals capturing the evolution of the macro-economic climate in Ireland between 2017 and the COVID-19 crisis. The calibration control totals were drawn from the Labour Force Survey, Live-Register data and official statistics provided by the Irish Central Statistics Office.

We described below the adjustments made to the SILC data in order to simulate the pre-COVID period—December 2019—and the three waves of the COVID-19 pandemic: May 2020, November 2020 and January 2021.

5.1. Employment Rate and Sectoral Impact

Individuals who have lost their job because of COVID-19 were eligible for a COVID-19 Pandemic Unemployment Payment (PUP), a flat rate non-means tested benefit paid to those aged 18–66. Unlike traditional jobseekers’ supports, there are no additional payments for dependents. The changes in the instrument structure over the crisis were captured in our simulations.

We used the income generation model to simulate the numbers and the type of individuals affected by the crisis and eligible for the PUP. The overall employment rate, determined by the number of people in work relative to the population of a particular age group, was first used to calibrate the simulations from the income generation model. The overall and age-specific employment rates are drawn from the Labour Force Survey (LFS). However, as a quarterly survey, there is still a 2–3 month lag between data collection and publication. In order to model in “real-time” a period of economic volatility such as the COVID-19 crisis, we needed even more timely data.

Given the asymmetric employment shock, with some industries remaining at work and others closing almost fully during the pandemic, we were confronted with limited “real time” data to capture the sectoral impact of the crisis. We fine-tune the simulations by relying in addition on age-specific administrative data from the Live-Register on a monthly basis, together with weekly updates of their aggregates. Given that the Live-Register data does not reflect the level of unemployment equivalent to the ILO definition, people could be working part-time while receiving benefits, and conversely, someone could be out of work and seeking work but not eligible for unemployment benefits. However, in the short term, the changes observed in the Live-Register are a proxy for changes in the numbers out of work (or non-employment rate). We used the LFS to nowcast to December 2019, and then we used administrative data to nowcast to May 2020 (wave 1), November 2020 (wave 2) and January 2021 (wave 3).

5.2. COVID-19 Infections

Individuals who had to stop working due to a COVID-19 infection or due to having been a close contact qualified for the COVID enhanced Illness Benefit (CEIB), which was paid at the maximum PUP rate. In our simulations, both workers and non-workers were infected with COVID-19. The cases were randomly allocated across in-work and out-of-work based on the national age distribution of the COVID-19 cases. The recipient rate of the COVID-19-related illness benefit is obtained by dividing by the proportion of workers in each age group.

5.3. Pandemic Wage Subsidy

The Wage Subsidy itself has a limited distributional impact, but it shifts the burden of payments from the private sector to the public sector. In modelling the subsidy, we assumed that the sum of the subsidy component and the employer component remains constant. The subsidy is simulated parametrically and has changed 5 times over the year, reflecting different objectives and teething problems (

O’Donoghue et al. 2021). The employer component is therefore modelled as the residual of the original wage less the subsidy.

6. Results

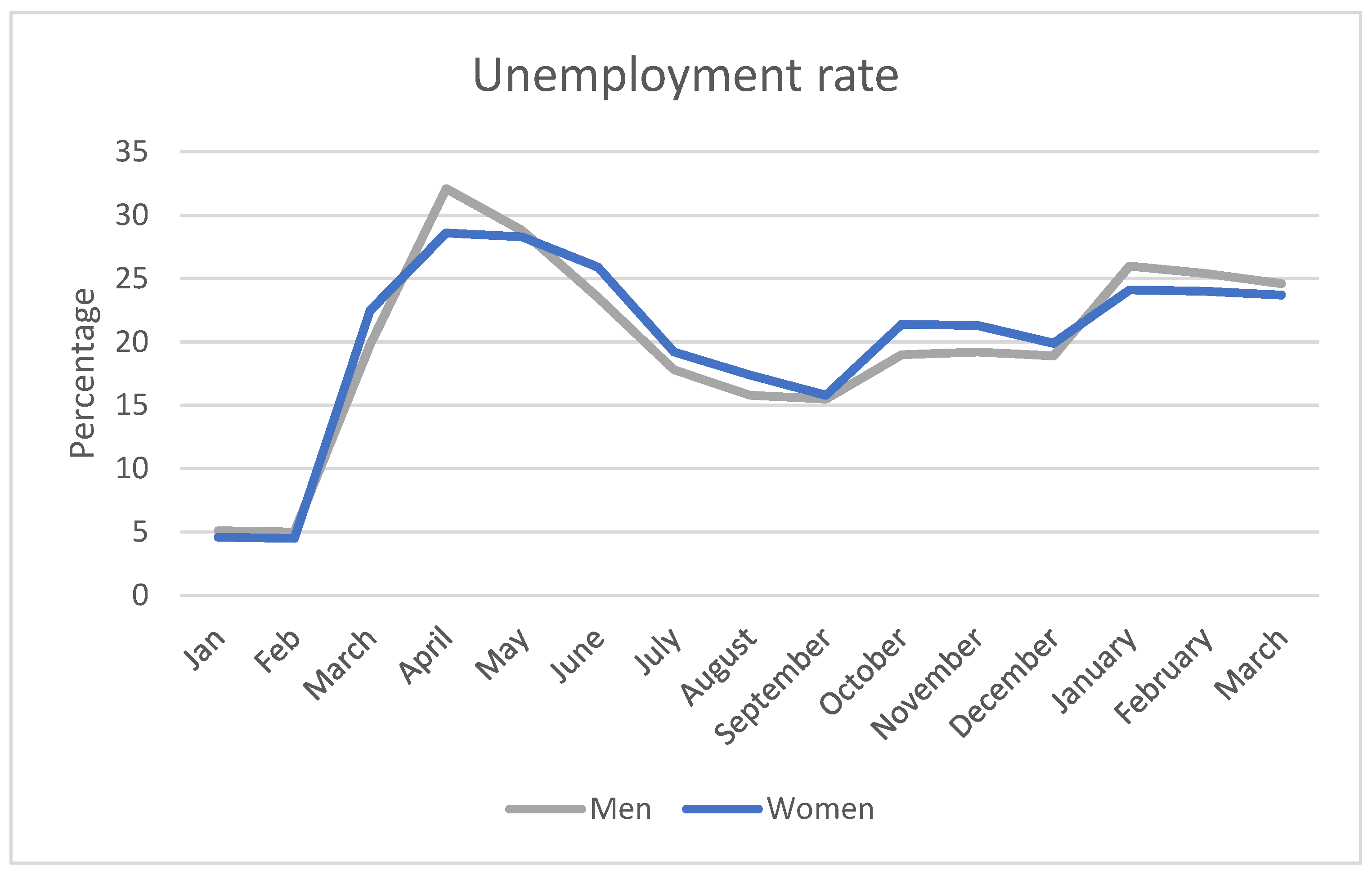

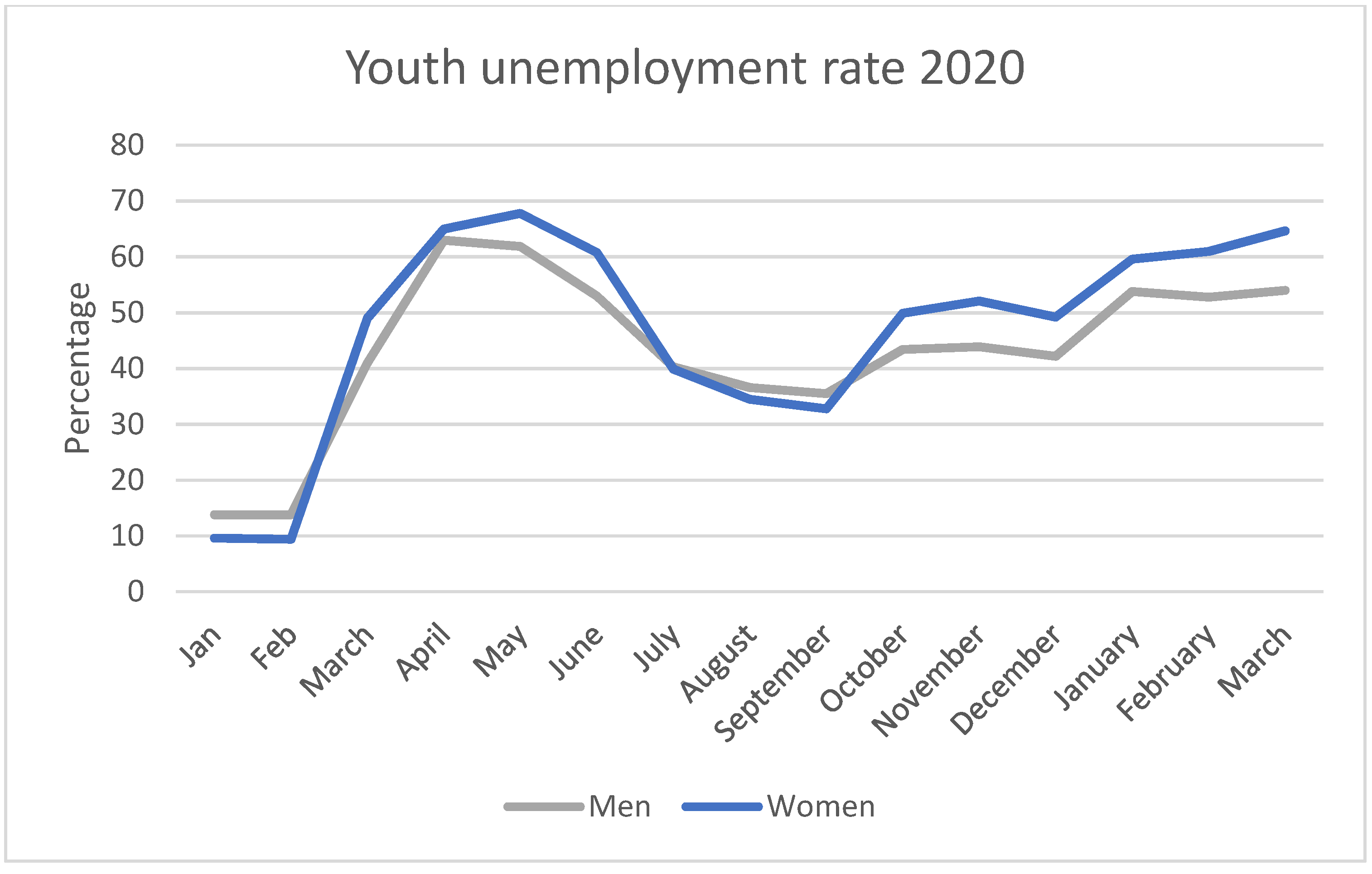

We started by looking at the core employment and income statistics by gender and how they evolved during the course of the crisis (

Table 1). As expected, we found lower employment levels both for men and women during the three waves of the pandemic than before the crisis, with the largest employment shock recorded during the first wave. Women have lower employment levels than men in all time periods. At the same time, they also lose less employment, especially during the first wave of the crisis. During the first wave, the drop in employment was 27 pp for men versus 20pp for women, narrowing the absolute gender gap in employment. The gender gap in hours of work followed a similar pattern, narrowing slightly during the first wave. However, the gender gap in hourly wages, which was very small in the pre-COVID scenario, widened during the pandemic.

In the pre-COVID scenario, male employees earned an average of EUR 19.20 per hour. This fell to EUR 18.18 in wave one and EUR 17.14 in wave two before slightly recovering to EUR 17.94 in wave three. The average wage rate for women fell from EUR 19.01 in the pre-COVID scenario to EUR 16.36 in wave one of the pandemic. Female hourly wages registered a slight recovery after wave one, increasing to EUR 16.82 and EUR 16.66 in waves two and three. However, in all three waves of the pandemic, the raw gender wage gap for employees is larger than in the pre-COVID scenario. This is likely to reflect the non-random nature of job losses, which are concentrated in particular sectors of the economy such as hospitality, construction and childcare, as well as asymmetric wage reductions by gender. The result of changes to employment and wages is that market incomes dropped for men and women, but the relative gender gap in market incomes was maintained at around 40%–41%.

The system of taxes and benefits, however, works well to reduce the gender income gap during the pandemic. After taxes and benefits, the gender gap in disposable income is 35% in the pre-COVID scenario. This gap was reduced to 29% in the first wave and 30–31% in the following waves. Men caught up with women in terms of benefits during the first wave, profiting from larger relative increases compared to women. This is consistent with the larger drops in employment experienced by men in the first wave. In contrast, gender differences in taxes paid seem to have been affected little during the pandemic, with both groups paying less in tax.

Table 2 shows how the components of disposable income change for men and women in the baseline (pre-COVID) and in the three subsequent waves of the pandemic. Pre-COVID annual market income, which includes earnings, investment income and private pensions, is EUR 43,047 for men and EUR 25,806 for women. This gives a gender gap in market income of 40%. Gross income, which sums up market income and benefits, is higher than market income at EUR 48,892 for men and EUR 39,906 for women. The absolute difference between male and female gross income is less than the difference between male and female market income, indicating that benefits provide some redistribution between men and women. Market income net of tax (which excludes benefits) is EUR 29,971 for men and EUR 16,350 for women. Finally, disposable income for men, at EUR 35,816, is 35% higher than the disposable income of women of EUR 23,450. The tax benefit system cushions the gender income gap by five percentage points in the pre-COVID baseline.

Looking at the adjusted* and adjusted** scenarios for women indicates how this picture would change if women (i) supplied labour at the same rate as men and were rewarded for their labour market characteristics in the same way as men and (ii) if women additionally worked according to the occupation and industry structure of men. In the adjusted* scenario, the gender gap in market income falls from 40% to 5%, and the gender gap in disposable income falls from 35% to 7%. In the adjusted** scenario, the gender gap in market income falls further to 2%, and the gender gap in disposable income falls to 4%. In each case, the inclusion of benefits decreases the absolute gender gap in income. In the baseline, the inclusion of tax also decreases the gender gap in income, while in the adjusted* and adjusted** scenarios, the inclusion of tax increases the gender income gap slightly. This results in a relative gender gap in disposable income that is slightly higher than the gender gap in market income for the two adjusted scenarios.

Post-COVID, the gender gap in market income is similar in relative terms (40–41% depending on the wave in question) to the baseline, although market income for men and women has decreased significantly. This reflects the fact that, while average labour supply decreased relatively more for men (particularly in the first wave), average hourly wages decreased relatively more for women. However, the gender gap in disposable income is significantly lower in each wave of the pandemic (at 29–31%) than in the baseline. Benefits reduce the gender gap in income slightly in each wave, but taxation provides much stronger redistribution, reducing the absolute size of the gender gap in income substantially in each wave. Men, who see relatively larger decreases in their labour supply, benefit relatively more from the welfare system, while women, who see relatively larger decreases in their average wage, pay relatively less in tax. The overall effect is in favour of women as the cushioning effect of the tax–benefit system on the gender gap in income doubles in the pandemic scenarios to 10–12 percentage points, depending on the wave.

These results can be visualised more clearly in

Figure 5 and

Figure 68. First, we explored how the structure of the gender gap in market incomes evolved during the course of the COVID-19 crisis.

Figure 5 decomposes the gender gap in market income into the contribution of gender differences in wages and labour market participation and hours, gender differences in occupation and industry structures and the contribution of all other differences in characteristics/returns between men and women

9.

During the COVID-19 crisis, the absolute gender gap in market incomes dropped compared to the pre-COVID period. The largest drop in the absolute gap was recorded during the first wave, followed by a slight increase in wave 2/3. In relative terms, the gender market income gap was stable at around 40–41% (men = reference). The structure of the gap, however, changed. We found an increase in the relative contribution of the gender differences in labour market participation, hours and wage structure, counterbalanced by a negative contribution of gender differences in the occupation and industry structure. In other words, labour market participation, hours and wage differences between men and women contributed more to gender income gaps during the crisis: women would have lost less during the crisis had they had the labour market participation, hours and returns of men. On the other hand, gender differences in the structure of occupation and industry benefitted women: had their occupations been distributed similarly to men’s, women would have recorded higher losses in market incomes. This finding is consistent with conclusions made by

Alon et al. (

2021) that occupation and industry structure played a major role in determining unequal impacts of the crisis by gender. In the case of Ireland, the gender division of occupation and industry actually benefitted women. Their representation in essential roles outweighed their representation in locked-down roles. This finding differs somewhat from speculation by

Dang and Nguyen (

2021) that, because women are over-represented in the services sector, they were more likely to lose their job during the pandemic in the six countries in their study. This cross-country discrepancy may be due to different patterns of occupational sorting in Ireland compared to other countries or national lockdowns of different severities. A cross-country study using decomposition methods linked to microsimulation models could determine the precise explanation.

Next, we explored the cushioning effect of the tax–benefit system on the gender income gap by taking the difference between the gender gap in market income and the gender gap in disposable income, similar to

Doorley and Keane (

2020).

Figure 6 illustrates the cushioning effect of the tax–benefit system during the course of the pandemic, isolating the contribution of benefit policy from the contribution of tax policy.

Before the COVID-19 crisis, both taxes and benefits were contributing to cushioning the gender gap in income, although taxes were playing a larger role. However, during the pandemic, most of the cushioning role was taken over by tax policy. As

Table 1 shows, benefit receipt by men and women is roughly similar in the three waves of the pandemic, although it was relatively higher for women in the pre-COVID scenario. While women were disproportionately benefiting from the welfare system prior to the crisis, the scale of job loss and the introduction of flat-rate, non-means-tested benefits for the newly unemployed means that men are benefitting from the welfare system at the same rate as women during the pandemic.

The effect of benefits on the gender income gap is lower, the stronger the shock (e.g., wave 1). There are two consequences of this: firstly, although the tax–benefit system provides less cushioning in absolute terms than before the crisis, the relative effect is larger. Women’s disposable income is actually higher than their market income, on average, during the crisis, reflecting the generous nature of the new pandemic income supports. Men’s disposable income is lower than market income, on average, although not by as much as it was in the pre-COVID scenario. Second, the taxation system is performing most of the heavy lifting in terms of redistribution between men and women during the pandemic. Men’s market income remains higher than women’s, although they suffer a slightly higher loss of employment, so men continue to pay systematically more tax than women.

7. Discussion

This paper investigated the effect of three waves of the COVID-19 pandemic on gender income inequality in Ireland. By using a nowcasting technique linked to a decomposition framework, we showed the drivers of gender income inequality in Ireland just prior to the COVID-19 pandemic and how these have changed over the course of the pandemic.

Job losses were more concentrated among men during the first wave of the pandemic. As in the case of the financial crisis, employment in white-collar, professional employment proved to be more resilient than for men, while blue-collar, more manual work was less robust. However, when the construction sector was allowed to remain open in later waves of the pandemic, this differential disappeared.

Average hourly wages of men and women were very similar prior to the pandemic, but these decreased more among women than men during the first wave of the pandemic. This may reflect selection among those who remained in employment during the crisis but might also reflect higher scarring of female wages than of male wages by the labour market shock induced by the pandemic.

10 Wage effects were more similar by gender in subsequent waves of the pandemic.

The overall effect of employment and wage changes was that market income decreased by similar relative amounts for men and women, and the gender gap in market incomes remained stable at 40%. However, the composition of the market income gap shifted during the pandemic. While the main source of this gap, labour supply and wage gaps, remained stable, there was a shift in the contribution of occupational segregation. Prior to the pandemic, occupational segregation contributed positively to the gender income gap as men were disproportionately working in high-income occupations and industries. This reflects traditional gender stereotypes in specific industries and professions that limit opportunities for women. The structure of job and earnings loss during the pandemic has reversed this, with women’s occupation and industry structure currently providing them with an earnings advantage. This finding warrants monitoring as the economy recovers.

Prior to the pandemic, the tax–benefit system was reducing the gender income gap from 40% to 35%. However, its cushioning effect doubled during the pandemic. Men benefitted relatively more than women from welfare due to their higher employment losses and the flat and non-means-tested nature of new supports. However, taxation policy continued to automatically redistribute between men and women with the result that the cushioning effect of the tax–benefit system on the gender income gap increased. Tax as an automatic stabiliser provided very important redistribution between men and women during the pandemic.

These results highlight the impact of a number of long-term trends in the Irish labour market that impact underlying gender differences in market and disposable incomes. Firstly, the gender gap in income is driven to a greater extent by hours worked and labour force participation than by wage differences. High childcare costs are particularly relevant to this issue. Successive OECD reports estimated that out-of-pocket childcare costs for full-time care in Ireland are one of the highest in the OECD.

Doorley et al. (

2021) showed that most households with children use considerably less formal childcare than this and this is likely to be linked to affordability. Although the labour force participation rates and hours of work for men and women have somewhat converged since the 1980s, there remains a larger gap after childbearing. Further reducing the gender gap in income will require improved policies both to enable work–life balance to support child-rearing, education policies that reduce the growing gap in educational outcomes between men and women and challenges to gender stereotypes. Continued monitoring of the evolution of the gender income gap as the Irish economy recovers will indicate if the pandemic has harmed or bolstered progress made to date.

These results also highlight international differences in labour markets and in the effect of economic lockdowns. Ireland was one of the few countries studied to date in which men lost more employment than women did during the pandemic. Our decomposition analysis shows that this gender difference in employment loss is due to occupational sorting. Women were over-represented in essential sectors in Ireland during the pandemic, so their employment levels fell by less than men’s. The severity of the Irish lockdowns compared to those experienced internationally may explain this finding. Alternatively, decomposition analysis such as that carried out in this paper could be used for other countries to highlight the explanatory difference in occupational sorting by gender.