The Potential of Blockchain in Building Construction

Abstract

:1. Introduction

2. Literature Review on Blockchain

- You can view it;

- You can add to it, but;

- You cannot change the information that is already there.

- Cryptography: The use of a variety of cryptographic techniques including cryptographic one–way hash functions, Merkle trees, and public key infrastructure (private-public key pairs).

- Peer to peer (P2P) network: A network for peer discovery and data sharing in a peer-to-peer fashion.

- Consensus mechanism: An algorithm that determines the ordering of transactions in an adversarial environment (i.e., assuming that not every participant is honest).

- Ledger: A list of transactions bundled together in cryptographically linked ‘blocks’.

- Validity rules: A common set of rules of the network (i.e., what transactions are considered valid, how the ledger gets updated, etc.) [5].

- Distributed, which makes it harder to hack or tamper with, but not impossible. If enough nodes decide to collude then blocks comprising of transactions can, in theory, be reversed.

- Consensus-based, which makes it harder to hack or tamper with - and

- Requires less trust; a blockchain can only reduce the need for trust. At the bare minimum, trust must be placed in the underlying cryptography. The chain is only as good as the data input, so trust in the quality of the data that others provide is also essential. In the case of a permissioned network (Permissioned blockchain networks allow the network to appoint a group of participants who are given the express authority to validate blocks of transactions and to participate in the consensus mechanism. The second key difference is the ability to restrict who can create smart contracts and/or transact on the blockchain network. (https://monax.io/explainers/permissioned_blockchains/)) trust must be placed in the operator(s) and/or the validators.

- A 51% attack: if more than half of the computers working as nodes to service the network tell a lie, the lie will become the truth. This is called a ‘51% attack’ and was highlighted by Satoshi Nakamoto (2008) when he launched Bitcoin [7]. Blockchains employ cryptography for authentication, permission enforcement, integrity verification, and other areas. The mere application of cryptography, however, does not automatically make the system more secure per se. The system may be more resilient as data storage and permissions are distributed but compromising the private keys of some network participants could give attackers full access to the shared database, including the ability to reverse a transaction history.

- Data quality: If a blockchain is used as a database [8], the information going into the database needs to be of high quality. The data stored on a blockchain is not inherently trustworthy, so events need to be recorded accurately in the first place. The phrase ‘garbage in, garbage out’ holds true in a blockchain system of record, just as with a centralized database. Blockchains are particularly well suited for the transfer of assets or data native to the respective blockchain. A blockchain cannot assess whether a given input from the ‘outside world’ is accurate/true or not. If the input is inaccurate or wrong, the blockchain will just treat it as any other input and consider all transfers involving the input as valid as long as certain conditions are met. Attention needs to be paid to data validity and integrity.

- Blockchains: like all distributed systems, are not so much resistant to bad actors as they are ‘antifragile’; In order to reap the full benefits, this requires a robust network of users with a widely distributed grid of nodes [9]. There are some discussions and debates about whether this a fatal flaw for some permissioned blockchain projects (https://www.coindesk.com/information/blockchains-issues-limitations/). As well as a limitation, this can be a strength.

- Data storage and bandwidth requirements: the current limited size of blocks makes it slow to write transactions. The current block size for a chain that started in 2008 is over 180 GB (Nov18) [10].

- Limit to the number of transactions per block:

- Audit requirement: the integrity of a blockchain demands that anyone can audit the chain back to the first block, a measure that increases the time and cost of doing an audit [11].

- Scalability: according to Microsoft, the Bitcoin network consumes enough energy to power more than 1.3 million households. Bitcoin is one example of the blockchain application.

- Adaptability: once confirmed, the history of transactions cannot be reversed in a blockchain. However, with the agreement of all parties, agreements can be changed.

- Regulation: regulations cannot keep up with advances in technology. Regulations are expected to take decades to set adequate standards and policies for the democratization of blockchain.

- Technological immaturity: Relatively immature technology, origins in 2008 (Nakamoto 2008).

- Privacy: there are limitations to the privacy offered by current blockchain technology.

3. Research Methodology

3.1. Presentation of the Real Estate Developer Case Study

3.2. Data Collection

4. Results and Discussion

4.1. Discussion and Synthesis of the Role of Blockchain in Construction

4.1.1. Implications

- A definition of the precise tasks of the act of building.

- A listing of all the possible variants related to a given task. To clarify this point, it will be assumed that the tiler was absent, and the electrician’s work was therefore delayed. The intelligent contract must take into account all scenarios.

4.1.2. The Notion of Value

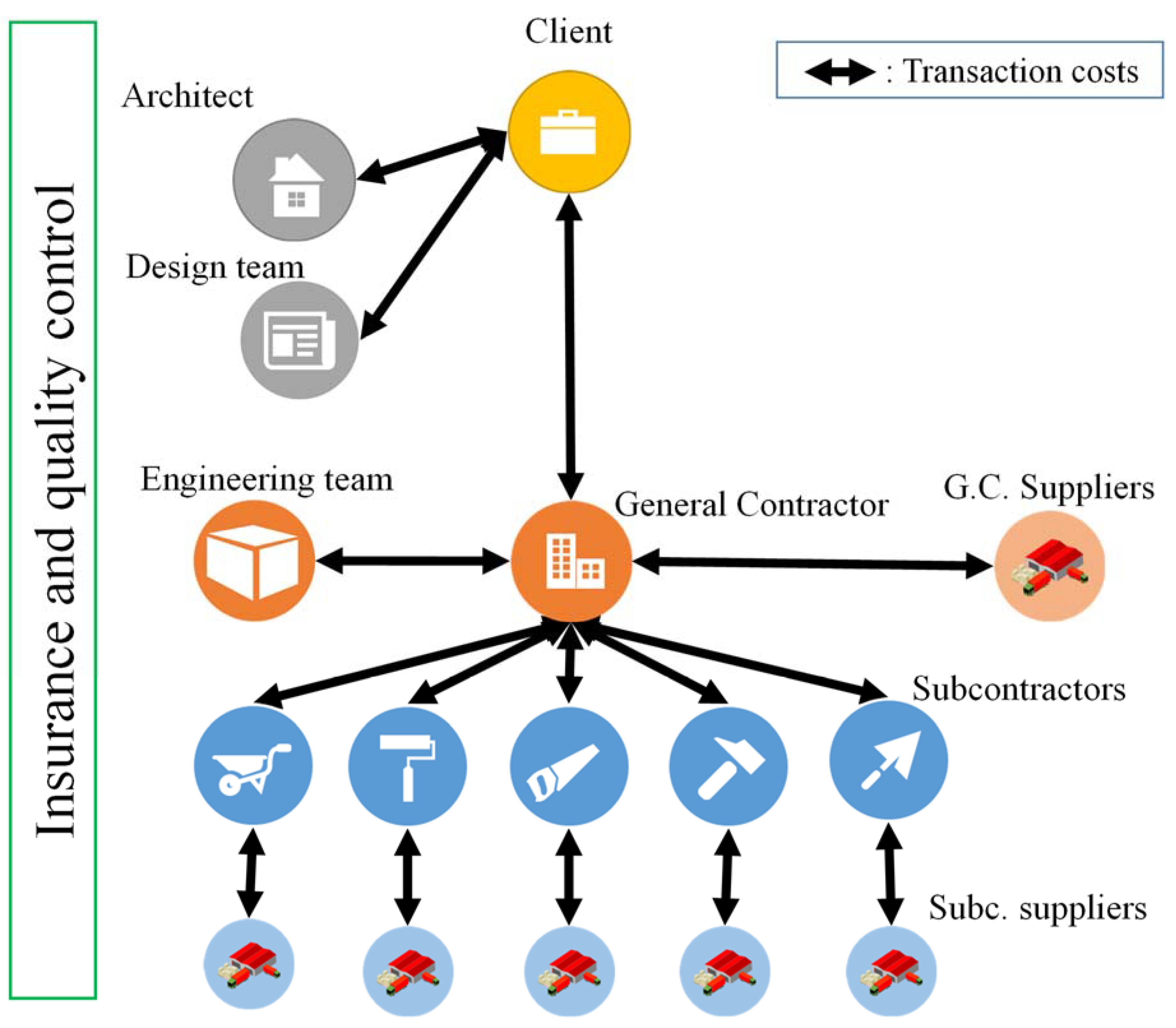

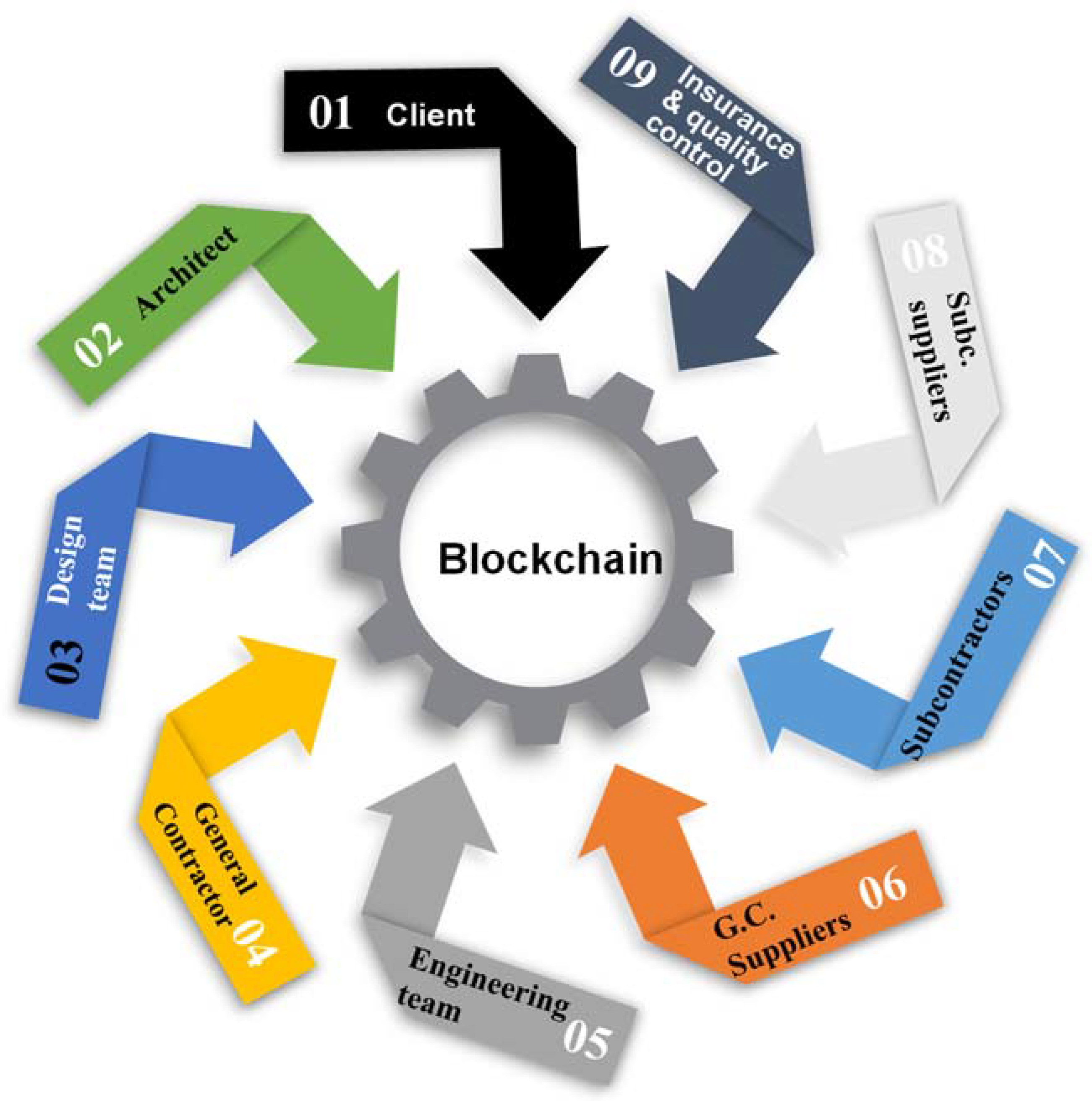

4.1.3. The Construction Value Chain

- Intermediaries inherent to the construction value chain: Cost consultants/QS, labor-only sub-contractors, client rep. (who stands between client and teams), project managers, accountants, and auditors. Another type of intermediary is when a subcontractor pays the general contractor, and after that the client pays the general contractor for the work done.

- Intermediaries outside the construction value chain: Banks, lawyers, courts, and the government.

5. Conclusions

- Consensus: For a transaction to be valid, all participants must agree on its validity.

- Provenance: Participants know where the asset came from and how its ownership has changed over time because it maintains a strong and secure digital signature.

- Immutability: No participant can tamper with a transaction after it has been recorded to the ledger. If a transaction is in error, a new transaction must be used to reverse the error, and both transactions are then visible, thus providing an easy audit trail for big companies.

- Finality: A single, shared ledger provides one place to go to determine the ownership of an asset or the completion of a transaction, thus providing a great contract management system between the involved parties.

Author Contributions

Funding

Conflicts of Interest

References

- Turk, Ž.; Klinc, R.Ž. Potentials of Blockchain Technology for Construction Management. Procedia Eng. 2017, 196, 638–645. [Google Scholar] [CrossRef]

- Keiser, J.A. Leadership and Cultural Change: Necessary Components of a Lean Transformation. In Proceedings of the 20th Annual Conference of the International Group for Lean Construction, San Diego, CA, USA, 18–20 July 2012. [Google Scholar]

- Fung, P.K.; Chen, I.S.; Yip, L.S. Relationships and performance of trade intermediaries: An exploratory study. Eur. J. Mark. 2007, 41, 159–180. [Google Scholar] [CrossRef]

- Janssen, M.; Sol, H.G.M. Evaluating the role of intermediaries in the electronic value chain. Internet Res. 2000, 10, 406–417. [Google Scholar] [CrossRef]

- Hileman, G.; Rauchs, M.G. Global Blockchain Benchmark Study. Cambridge, 2017. Available online: https://cdn.crowdfundinsider.com/wp-content/uploads/2017/09/2017-Global-Blockchain-Benchmarking-Study_Hileman.pdf (accessed on 8 February 2019).

- Taylor, P.J.; Dargahi, T.; Dehghantanha, A.; Parizi, R.M.; Choo, K.K.R. A systematic literature review of blockchain cyber security. Digital Commun. Networks 2019. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. 2008. Available online: https://s3.amazonaws.com/academia.edu.documents/54517945/Bitcoin_paper_Original_2.pdf?AWSAccessKeyId=AKIAIWOWYYGZ2Y53UL3A&Expires=1551242712&Signature=ZU4cZ0%2BjBdcoTC087%2BJyYagFsCk%3D&response-content-disposition=inline%3B%20filename%3DBitcoin_A_Peer-to-Peer_Electronic_Cash_S.pdf (accessed on 8 February 2019).

- Atlam, H.F.; Wills, G.B. Technical aspects of blockchain and IoT. In Role of Blockchain Technology in IoT Applications; Elsevier: Amsterdam, The Netherlands, 2018; pp. 1–39. [Google Scholar]

- Mohsin, A.H.; Zaidan, A.A.; Zaidan, B.B.; Albahri, O.S.; Albahri, A.S.; Alsalem, M.A.; Mohammed, K.I. Blockchain authentication of network applications: Taxonomy, classification, capabilities, open challenges, motivations, recommendations and future directions. Comput. Stand. Interfaces 2018. [Google Scholar] [CrossRef]

- Global Market for Blockchain Technology 2016–2021 Statistic. 2019. Available online: https://www.statista.com/statistics/647231/worldwide-blockchain-technology-market-size/ (accessed on 21 February 2019).

- Ali, M.; Nelson, J.; Shea, R.; Freedman, M.J. Bootstrapping Trust in Distributed Systems with Blockchains. 2016. Available online: https://www.usenix.org/system/files/login/articles/login_fall16_10_ali.pdf (accessed on 21 February 2019).

- Veuger, J. Trust in a viable real estate economy with disruption and blockchain. Facilities 2018, 36, 103–120. [Google Scholar] [CrossRef]

- Mason, J. Intelligent Contracts and the Construction Industry. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2017, 9, 04517012. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods, 5th ed.; Sage Publications Inc.: Thousand Oaks, CA, USA, 2013. [Google Scholar]

- Institution of Civil Engineers. From Transactions to Enterprises A New Approach to Delivering High Performing Infrastructure Infrastructure Client Group. 2017. Available online: https://www.majorprojectsknowledgehub.net/resources/from-transactions-to-enterprises-a-new-approach-to-delivering-high-performing-infrastructure/ (accessed on 21 February 2019).

- Salvatierra-Garrido, J.; Pasquire, C.; Miron, L. Exploring Value Concept Through the IGLC Community: Nineteen Years of Experience. In Proceedings of the 20th Annual Conference of the International Group for Lean Construction, San Diego, CA, USA, July 2012. [Google Scholar]

- Flores, F. Conversations for Action and Collected Essays: Instilling a Culture of Commitment in Working Relationships; CreateSpace: Scotts Valley, CA, USA, 2012; p. 138. [Google Scholar]

- Womack, J.P.; Jones, D.T. Lean Thinking: Banish Waste and Create Wealth in Your Corporation; Free Press: New York, NY, USA, 1996. [Google Scholar]

| Total Cost | |

|---|---|

| 1. Construction | Works contract |

| Risk | |

| 2. Management | Project Management |

| Additional expenses | |

| 3. Sales administration | Marketing |

| Commercial costs | |

| Sales support | |

| Average (%) | Median (%) | Standard Deviation (%) |

|---|---|---|

| 8.30 | 8.00 | 1.26 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dakhli, Z.; Lafhaj, Z.; Mossman, A. The Potential of Blockchain in Building Construction. Buildings 2019, 9, 77. https://doi.org/10.3390/buildings9040077

Dakhli Z, Lafhaj Z, Mossman A. The Potential of Blockchain in Building Construction. Buildings. 2019; 9(4):77. https://doi.org/10.3390/buildings9040077

Chicago/Turabian StyleDakhli, Zakaria, Zoubeir Lafhaj, and Alan Mossman. 2019. "The Potential of Blockchain in Building Construction" Buildings 9, no. 4: 77. https://doi.org/10.3390/buildings9040077

APA StyleDakhli, Z., Lafhaj, Z., & Mossman, A. (2019). The Potential of Blockchain in Building Construction. Buildings, 9(4), 77. https://doi.org/10.3390/buildings9040077