1. Introduction

Construction machinery is costly, operates in complex environments, and requires extensive maintenance. It is also closely linked to significant societal issues, such as safety risks and high carbon emissions. In 2023, the Ministry of Housing and Urban-Rural Development of the People’s Republic of China (MOHURD) issued the

Guiding Opinions on Standardizing Construction Safety and Quality, emphasizing the importance of standardized management, enhanced product performance, and improved safety supervision to foster high-quality development within the construction industry. Despite these efforts, safety remains a primary concern in construction projects. According to official statistics from MOHURD, 406 fatal construction accidents occurred in mainland China between 1 January 2020 and 31 December 2024 [

1]. Crane-related accidents pose a significant hazard due to the heavy loads and substantial heights involved [

2]. These risks are amplified by the intricate and inherently dangerous processes of installing and dismantling construction machinery, further complicated by unclear responsibility assignments and regulatory gaps. Consequently, the installation and dismantling of construction machinery represents a key area for risk mitigation [

3]. Notably, a reported 68.4% of fatal tower crane accidents happen during these phases [

4], largely attributed to inadequate professional qualifications and undefined roles and responsibilities [

5].

The construction machinery market has long been dominated by a leasing model, which allows construction companies to access machinery at lower costs while benefiting from professional maintenance services [

6]. This model promotes sustainability and a low-carbon approach to production and consumption by reducing the financial strain on construction firms, enhancing equipment utilization efficiency, and decreasing the need for new machinery production. Furthermore, remanufacturing, a practice often facilitated by the leasing model, significantly reduces the environmental impact. Estimates from the China Circular Economy Association indicate that remanufactured construction machinery achieves a 60% reduction in energy consumption compared to new manufacturing, boasts an average reuse rate of 55% for used components, and results in an overall energy consumption reduction exceeding 80% during the manufacturing process [

7].

Since 2023, numerous provincial and municipal governments in China, including those in Hubei and Fujian, have introduced the Guiding Opinions on the Integrated Management of Construction Hoisting Machinery, advocating for an “integrated installation and dismantling” service model. Under this model, leasing companies assume responsibility for providing professional installation, dismantling, and maintenance services. However, as the policy is implemented, leasing companies face increased financial pressures due to the added costs associated with installation, dismantling, and the need for specialized personnel training. Moreover, difficulties in acquiring and sharing construction machinery data have become significant barriers to the effective implementation of the “integrated installation and dismantling” service model.

To address these challenges, industrial internet platforms, such as Xuzhou Construction Machinery Group’s “HanCloud”, have been developed to offer comprehensive support throughout the lifecycle of construction machinery, including manufacturing, operation and maintenance, leasing, and recycling [

8]. These platforms enable seamless connectivity and data sharing across all stages of the machinery lifecycle. A key challenge faced by government regulators and industry stakeholders is determining how to motivate leasing companies to actively engage in installation and dismantling services to maximize the benefits of the “integrated installation and dismantling” policy. To address this, our research adopts a supply chain perspective to explore optimal pricing strategies for construction machinery sales, leasing, installation, dismantling, and maintenance. Furthermore, we focus on designing joint contracts to optimize profit distribution and promote collaboration among supply chain members to improve overall performance. This approach will facilitate the integration of installation, dismantling, and recycling services, ensuring safer construction practices while advancing the industry’s transition toward low-carbon and sustainable development.

2. Literature Review

Construction safety remains a central concern, with the installation, dismantling, and maintenance of construction machinery being among the most critical operations. Compared to other industries, the accident rate in the construction industry is exceptionally high [

9,

10]. While constituting approximately 7% of the global workforce, the construction sector accounts for 30–40% of occupational fatalities worldwide [

11]. Research in this field predominantly focuses on safety risks and regulatory oversight in these areas. For example, Q. Xu and K. Xu [

12] found in their research on fatal accidents in the Chinese construction industry that incidents involving hoisting machinery made up 17.05% of the total. Lingard et al. [

13] reported that personnel management systems and the safety status of construction machinery and equipment are both critical factors in the construction safety risk. Sadeghi et al. [

14] discovered in their research on crane safety solutions that insufficient regulatory quality and the failure to properly assign responsibilities remain significant contributors to construction risks.

In response to these challenges, the “integrated installation and dismantling” policy for construction hoisting machinery has been introduced. This policy clearly defines the responsibilities of leasing companies and institutionalizes the qualification of specialized personnel, thus reducing risks associated with the fragmented management of installation, dismantling, and maintenance [

15]. By ensuring professional qualifications and enhancing coordination, the policy effectively mitigates safety hazards and improves overall construction site safety. However, addressing the challenges faced during its implementation and promoting its effective execution are crucial to realizing the policy’s full potential.

Effective policy implementation in the construction machinery leasing sector requires coordinated efforts among multiple stakeholders and efficient resource allocation. Supply chain coordination, which emphasizes collaboration, information sharing, and resource integration, provides a useful framework for analyzing these complex interactions [

16].

Recent studies on supply chain management provide valuable insights into the strategic relationships among policies, stakeholders, and markets, contributing to industry standardization and sustainable development. In the manufacturing sector, Zhao et al. [

17] developed a supply chain model for new energy and traditional internal combustion engine vehicles, proposing a negotiation contract that improved coordination and profitability. Wang et al. [

18] analyzed a two-tier supply chain in which manufacturers overestimated the production capacity and introduced an option contract to optimize overall performance. Zhao and Ma [

19] demonstrated that profit-shifting and cost-sharing contracts can effectively coordinate the supply chain, increasing both the demand for new energy vehicles and the actual amount of recycling.

In the food industry, Rackl and Menapace [

20] examined collaboration challenges between small and medium-sized food suppliers and large retailers, proposing mechanisms to increase transaction efficiency and profitability. Li et al. [

21] addressed food waste by optimizing production and pricing strategies for holiday foods, implementing a risk-sharing mechanism through option contracts to mitigate financial risks for retailers and suppliers. Pourmohammad-Zia et al. [

22] designed a cost-sharing contract to solve coordination and conflict management problems in a three-tier food supply chain.

In the healthcare sector, Liu et al. [

23] constructed a game model of a vaccine supply chain, revealing that cost-sharing contracts could enhance the performance of vaccine manufacturers and vaccination units. Bai et al. [

24] developed three production game models to explore the impact of government subsidies on production dynamics within the supply chain of medical products. Li et al. [

25] proposed a two-part tariff contract—combining a membership fee with a commission—based on public welfare levels to coordinate the drug supply chain and achieve mutually beneficial outcomes.

In the construction sector, researchers have explored supply chain coordination strategies to improve efficiency. Zeng et al. [

26] employed side-payment contracts to enhance coordination in prefabricated modular construction, improving profits for both contractors and manufacturers while promoting just-in-time procurement. Cheng et al. [

27] laid the theoretical groundwork for low-carbon collaboration within supply chains and developed models for government subsidy policies. Wang and Gao [

28] applied the Cobb–Douglas function to establish a benefit distribution model for cooperative supply chain relationships.

Despite extensive research on supply chain coordination, studies specific to construction machinery remain limited. Huang et al. [

29] examined how equipment quality uncertainty affects recycling prices and remanufacturing costs, using a modal interval algorithm for dynamic pricing and recycling strategies. Yi et al. [

30] developed a game-theoretic closed-loop supply chain model with dual recovery channels, determining optimal recovery allocations between retailers and third-party collectors.

While these studies focus on aspects, such as manufacturing, sales, and recycling, research on leasing processes remains underexplored. In the broader context of durable goods leasing, Kalantari et al. [

31] developed a dual-channel supply chain model, demonstrating how dynamic leasing prices are influenced by customer consumption patterns, production costs, and sales prices. Zhang et al. [

32] proposed an online financial leasing model incorporating second-hand transactions, using competitive analysis to derive optimal leasing strategies. Sadrnia et al. [

33] assessed the impact of aircraft leasing on airline profitability, establishing confidence intervals for optimal leasing levels. Prior research has widely acknowledged that leasing and sales prices are shaped by factors, such as production costs and consumer preferences, which directly influence supply chain profitability and product demand [

34,

35,

36].

Extensive studies on supply chain coordination and pricing strategies have shown that contract-based approaches can enhance profitability and operational efficiency across industries [

37,

38]. Research on leasing supply chains for industrial goods—such as automobiles and automotive batteries—as well as studies on construction machinery recycling, provide valuable insights for this study. However, construction machinery leasing differs from other industrial goods due to its strict safety requirements. Lessors must not only supply machinery but also provide installation, dismantling, and maintenance services—factors that previous models have largely overlooked.

This study addresses this gap by examining the leasing model for construction machinery within an industrial internet platform, accounting for the unique characteristics of both the equipment and platform operations. It introduces key parameters, such as the elasticity of information service levels for installation and dismantling, leasing information services, platform costs, and service effort levels. The research develops centralized and decentralized decision-making models for a supply chain composed of manufacturers and lessors. Furthermore, it proposes a profit-sharing and cost-sharing contract designed to achieve Pareto improvements in profitability. By integrating safety considerations with economic incentives through installation and dismantling services into leasing operations, this approach aims to enhance financial returns while ensuring compliance with safety standards.

4. Model Solutions and Contract Coordination Design

4.1. Demand Functions and Profit Functions

Based on the defined symbols and problem assumptions, the demand functions for both the construction machinery leasing (

Ql) and the installation and dismantling services (

Qa) are formulated as follows:

The profit functions for the manufacturer(

πmi), the lessor (

πri), and the overall supply chain (

πti) are derived as follows:

These functions form the foundation for analyzing the pricing strategies and coordination mechanisms within the construction machinery leasing supply chain, particularly under the integrated service model that includes both installation and dismantling.

4.2. Centralized Decision-Making Scenario Analysis

In a centralized decision-making framework, manufacturers and lessors collaborate to maximize the total profits of the supply chain. This cooperation is facilitated through comprehensive information sharing and joint decision-making processes. As a result, manufacturers forgo product sales fees and platform commissions, while lessors relinquish revenue from recycling used products.

The concavity or convexity of the supply chain’s total profit function under specific conditions is determined through an analysis of the principal minors of the Hessian matrix. Optimal values for decision variables are derived by setting the first-order partial derivatives of the profit function with respect to each decision variable to zero.

In the Equation (6)

, the odd-order leading principal minors are ∆

1 = −2

θl < 0 and ∆

3 = 2

θlδa2 − 4

cθlθa < 0, while the even-order leading principal minor is ∆

2 = 4

θlθa > 0. These results indicate that

πtc is concave with respect to the variables

pl,

pa, and

v. By solving the equations

,

, and

, the product leasing price under centralized decision-making (

plc*), price of dismantling and installation services under centralized decision-making (

pac*), and installation and dismantling service level under centralized decision-making (

vc*) are derived:

By substituting the optimal values

plc*,

pac*, and

vc* into Equations (1), (2) and (5), the construction machinery leasing demand functions under centralized decision-making (

Qlc*), the installation and dismantling services function under centralized decision-making (

Qac*) and the optimal values under centralized decision-making (

πtc*) are obtained:

where

A1 is detailed in the

Appendix A.

Based on the results from the centralized decision-making analysis, the following propositions are established:

Proposition 1-1. Under centralized decision-making, total supply chain profits (πtc*) and the demand for construction machinery leasing (Qlc*) are positively correlated with the level of the leasing information service coefficient (δl). Additionally, the demand for installation and dismantling services (Qac*), as well as total supply chain profits (πtc*), is positively correlated with the installation and dismantling information services coefficient (δa).

Proof. Find

,

,

,

, we can obtain

□

Proposition 1-2. Under centralized decision-making, the product leasing price (plc*) is positively correlated with the level of the leasing information service coefficient (δl). Similarly, both the price (pa) and level (v) of installation and dismantling services are positively correlated with the installation and dismantling information services coefficient (δa).

The proof methodology for Proposition 1-2 is analogous to that of Proposition 1-1.

4.3. Decentralized Decision-Making Scenario Analysis

In a decentralized decision-making framework, the manufacturer and lessor operate independently, each aiming to maximize their individual profits. The manufacturer, as the dominant entity, first determines the decision variable

w. Following this, the lessor, acting as the subordinate entity, optimizes the parameters

pl,

pa, and

v. To derive the optimal values for these variables, a reverse solution method is employed, utilizing the Hessian matrix for concavity analysis.

For the Equation (17), the odd-order leading principal minors are ∆

1 = 2

θl(

ρ − 1) < 0 and ∆

3 = 2

θlδa2(

ρ − 1)

3–4

cθlθa(

ρ − 1)

2 < 0. The even-order leading principal minor is ∆

2 = 4

θlθa(

ρ − 1)

2 > 0. These conditions confirm that

πrc* is concave with respect to

pl,

pa, and

v. By solving

,

, and

, the product leasing price under decentralized decision-making (

pls*), the price of dismantling and installation services (

pas*) under decentralized decision-making, and the installation and dismantling service level (

vs*) under decentralized decision-making the optimal values are obtained:

Substituting

pls* and

pas* into Equation (3), it can be shown that

is obtained. Consequently,

πms* is a strictly concave function of

w. Solving for

, we can obtain the product selling price under decentralized decision-making (

ws*):

Substituting

ws* into Equations (18) and (19) gives the following result:

By further substituting

vs*,

ws*,

pls**, and

pas**I into Equations (1)–(5), the construction machinery leasing demand functions (

Qls*), the installation and dismantling services function (

Qas*), the manufacturer’s(

πms*), the lessor’s (

πrs*), and the total supply chain (

πts*) profit under decentralized decision-making are derived as follows:

The definitions and derivations of

B1,

B2, and

B3 are provided in the

Appendix A for further reference.

Proposition 1-3. Under centralized decision-making, the total profits of the supply chain (πtc*) are always greater than under decentralized decision-making (πts*).

Proof. By evaluating π

tc* − π

ts*, this proposition is confirmed.

□

The definitions and derivations of A, B, C, and

B4 are provided in

Appendix A.

Proposition 1-4. Under centralized decision-making, the price of installation and dismantling services (pac*), maximum market demand for leasing (Qlc*), and the demand (Qac*) and level (cc*) of installation and dismantling services are higher than under decentralized decision-making. Conversely, the product leasing price (plc*) is lower under centralized decision-making.

Proposition 1-5. Under centralized decision-making, the product leasing demand (Qlc*), manufacturer profits (πmc*), lessor profits (πrc*), and total supply chain profits (πtc*) are positively correlated with the level of leasing information services coefficient (δl). Similarly, the demand for installation and dismantling services (Qac*), manufacturer profits (πmc*), lessor profits (πrc*), and total supply chain profits (πtc*) are positively correlated with the installation and dismantling information services coefficient (δa).

Proposition 1-6. Under decentralized decision-making, the product leasing price (pls*) is positively correlated with the level of leasing information services (δl). Additionally, the price (pac*) and level (cc*) of installation and dismantling services are positively correlated with the installation and dismantling information services coefficient (δa).

The proofs for Propositions 1-4–1-6 follow methodologies analogous to those used in earlier propositions. Proposition 1-4 aligns with Proposition 1-3, while Propositions 1-5 and 1-6 mirror Proposition 1-1. Due to their structural similarities, detailed proofs are omitted for brevity.

4.4. Profit–Cost Sharing Contract

The preceding sections have examined optimal decision-making within both centralized and decentralized frameworks. Under decentralized decision-making, the manufacturer incurs considerable capital, time, and effort to establish and maintain an industrial internet platform. However, given the significant unilateral and ongoing costs, the manufacturer’s motivation to sustain platform operations diminishes if revenue is limited to commissions alone. This reduction in motivation leads to decreased platform efficiency, hindering the continuation of online leasing services and ultimately causing a significant decline in demand within the construction machinery market.

To address this inefficiency, a profit–cost sharing joint contract is proposed. Under this contract, the lessor shares a portion of its profits with the manufacturer at a predetermined ratio, λ1 (0 < λ1 < 1), thereby enhancing the manufacturer’s revenue and compensating for its operational expenses. Concurrently, recognizing that the lessor must invest in improving the installation and dismantling service level (c), the manufacturer agrees to share part of these service costs at a ratio of λ2 (0 < λ2 < 1). This arrangement alleviates the lessor’s financial burden and incentivizes higher service quality.

The profit functions for the manufacturer (

πmo) and the lessor (

πmo) under this joint contract are defined accordingly.

By solving for the key decision variables—under this joint contract, the product leasing price (

plo*), the installation and dismantling services price (

pao*), and the installation and dismantling services level (

vo*)—the following optimal expressions are derived.

For the supply chain to achieve optimal performance under the profit–cost sharing contract, the decision variables must align with those from the centralized decision-making scenario. Specifically, the following conditions must hold: plo* = plc*, pao* = pac*, vo* = vc*.

By solving this system of equations, the product selling price (

wo*) under the profit–cost sharing joint contract are determined.

Substituting these values into Equations (1)–(5) and (32)–(34) yields the final optimal outcomes under joint contract for the product leasing price (

plo**), the installation and dismantling services price (

pao**), installation and dismantling services level (v

o**), product leasing demand (

Qlo*), installation and dismantling services demand (

Qao*), manufacturer profits (

πmo*), lessor profits (

πro*), and total supply chain profits (

πto*).

The definitions and derivations of

C1,

C2, and

C3 are provided in

Appendix A.

5. Numerical Analysis

5.1. Influence of λ1 and λ2 on Profit

Under the profit–cost sharing joint contract, the manufacturer collects a portion of the lessor’s profits, denoted by the profit-sharing ratio λ1. The cost-sharing ratio for installation and dismantling services is defined as λ2 = λ1 + ρ. For the contract to effectively coordinate the supply chain, the profit-sharing ratio must satisfy the condition A ≤ λ1 ≤ B.

To ensure that both the manufacturer and the lessor accept the coordination contract, the following conditions must be met:

This section evaluates the impact of incorporating installation and dismantling service levels into the construction machinery leasing supply chain. Specifically, it examines how the installation and dismantling information services and leasing information services influence the leasing prices, demand for installation and dismantling services, product demand, and overall supply chain profits. The parameters used in this analysis are as follows:

cn = 400,

θl = 4,

θa = 3,

α1 = 10,000,

α2 = 7000,

δl = 6,

δa = 2,

a = 16,

b = 4,

c = 10,

r = 80,

s = 500,

e = 40,

h = 20,

m = 0.6,

M = 6,

N = 2,

u = 10,

ρ = 0.02.

By substituting the specified parameters into Equations (45) and (46), the acceptable range for the manufacturer’s profit-sharing ratio is determined to be 0.16 ≤ λ1 ≤ 0.47.

To assess whether the joint contract facilitates supply chain coordination, the profits of each supply chain member under the joint contract (

πmo*,

πro*), and decentralized decision-making (

πms**,

πrs*) are compared. The difference in total supply chain profits is represented by ∆

πt. Simulations yield the results summarized in

Table 2.

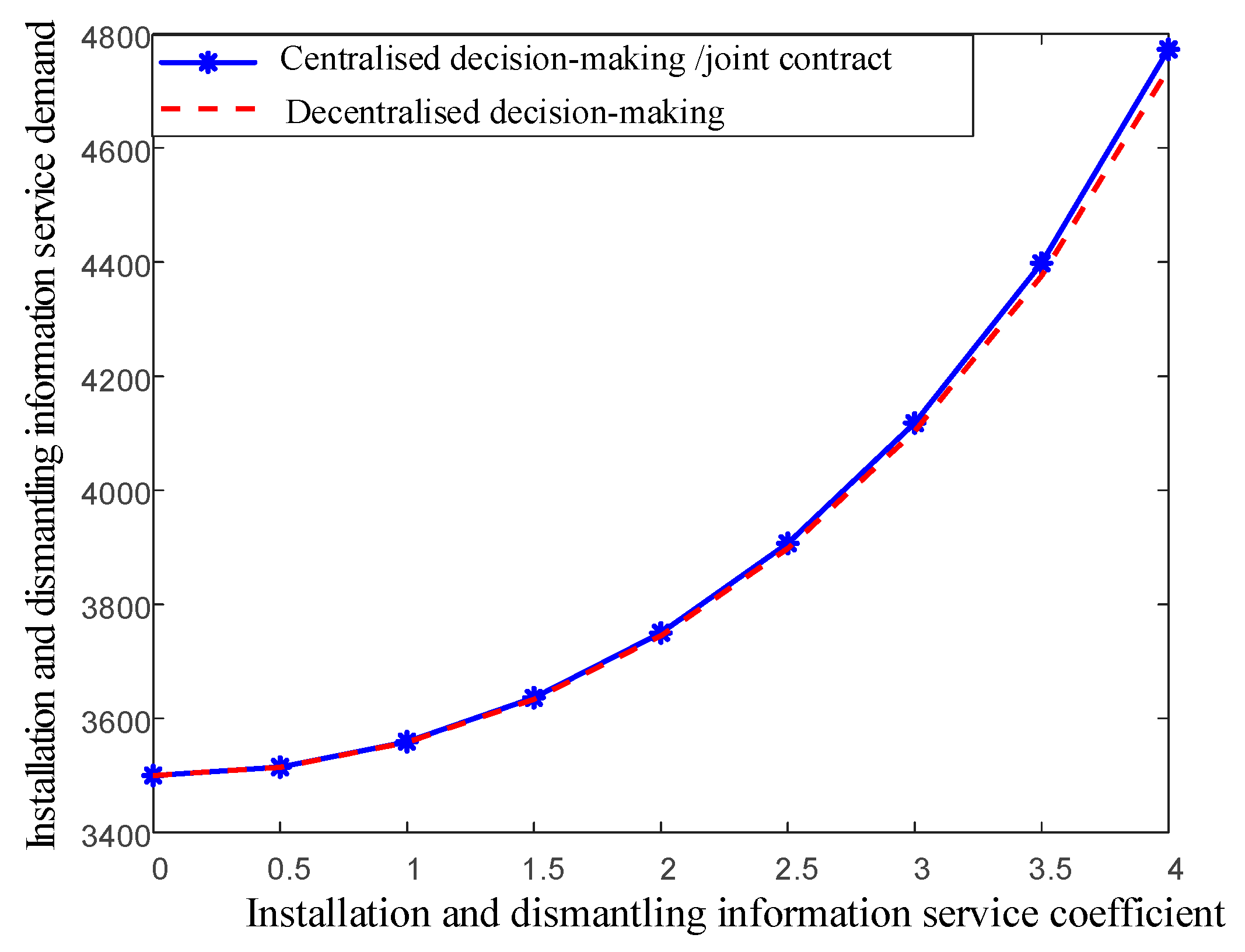

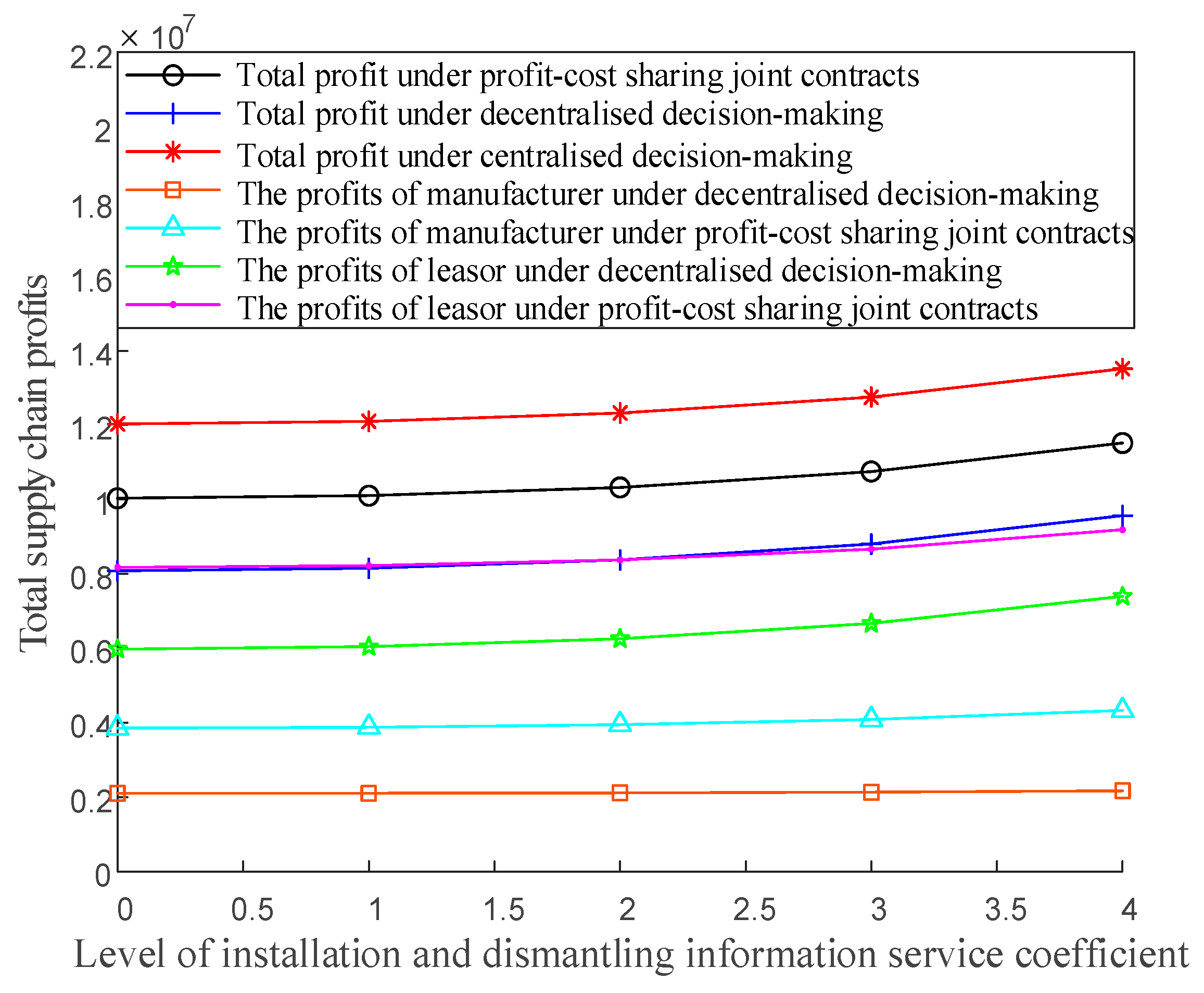

5.2. Impact of Installation and Dismantling Information Service Coefficient δa

The installation and dismantling information services coefficient

δa reflects the extent to which the platform’s operational level in providing such services influences the demand for installation and dismantling services. In supply chain models, the introduction quantifies the critical driving role of the platform’s service capability on downstream service demand, thereby establishing a theoretical foundation for analyzing profit distribution among stakeholders and coordination mechanisms under diverse decision-making scenarios. This section examines the influence of the installation and dismantling information service coefficient (

δa) on the demand, decision variables, and profits of both the manufacturer (

πm) and lessor (

πr), as well as the total supply chain profits (

πt). The analysis compares three scenarios: centralized decision-making, decentralized decision-making, and the joint profit-cost sharing contract. All other parameters remain constant, with

δa ranging from 0 to 4 and

λ1 set at 0.3. The simulation results are illustrated in

Figure 2 and

Figure 3.

As δa increases, the level (v), price (pa), and demand (Qa) for installation and dismantling services rise across all three scenarios. This is due to the critical role that professional installation and dismantling play in ensuring the safety and reliability of the construction machinery. The integrated model, which combines leasing with installation and dismantling services, effectively meets consumer demands, and when the leasing information service coefficient increases from 0 to 4, it can boost the installation and dismantling services demand (Qa) by up to 30%. However, this increase in δa also raises the lessor’s operating costs for these services, leading to higher service prices.

The increase in δa improves the installation and dismantling services level (v), allowing the lessor to offer more professional, high-quality installation and dismantling services. This, in turn, increases the demand and expands the lessor’s profit opportunities. Simultaneously, the manufacturer benefits from higher commissions due to the lessor’s services offered on the platform, leading to increased profits.

The joint coordination contract yields better supply chain performance compared to the decentralized scenario. Under this contract, the manufacturer shares in the installation and dismantling costs, reducing the lessor’s financial burden. In return, the lessor shares a portion of its profits with the manufacturer. This mutual support fosters stronger collaboration, ensures a fair distribution of profits across the supply chain, and when the leasing information service coefficient increases from 0 to 4, it boosts the profits of the manufacturer (πm), the lessor (πr) and the entire supply chain (πt) by 3–180%, 0.3–41.7% and 10%, respectively.

As δa increases, the level (v), price (pa), and demand (Qa) for installation and dismantling services rise across all three scenarios. This is due to the critical role that professional installation and dismantling play in ensuring the safety and reliability of the construction machinery. The integrated model, which combines leasing with installation and dismantling services, effectively meets consumer demands, thereby boosting the installation and dismantling services demand (Qa). However, this increase in δa also raises the lessor’s operating costs for these services, leading to higher service prices.

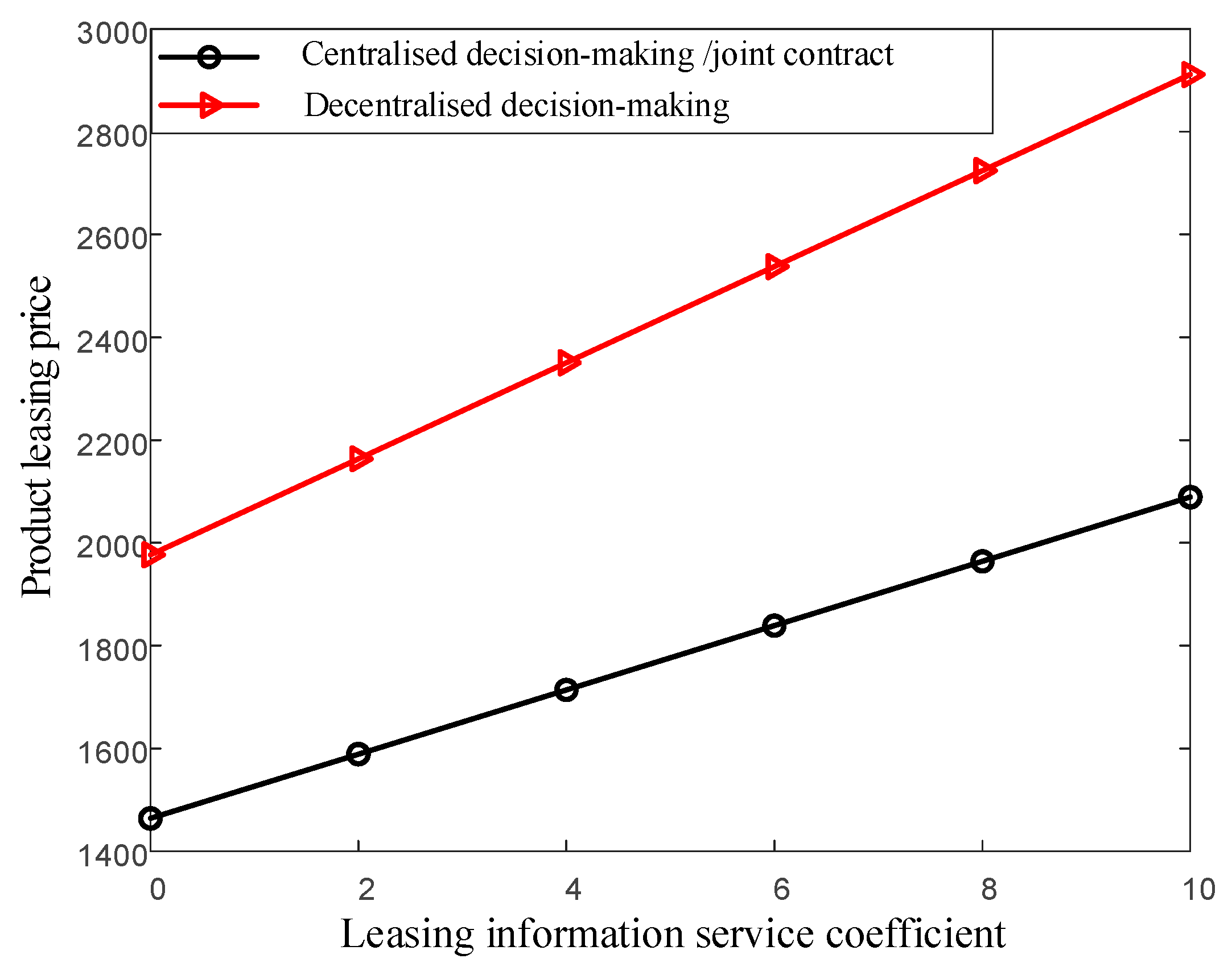

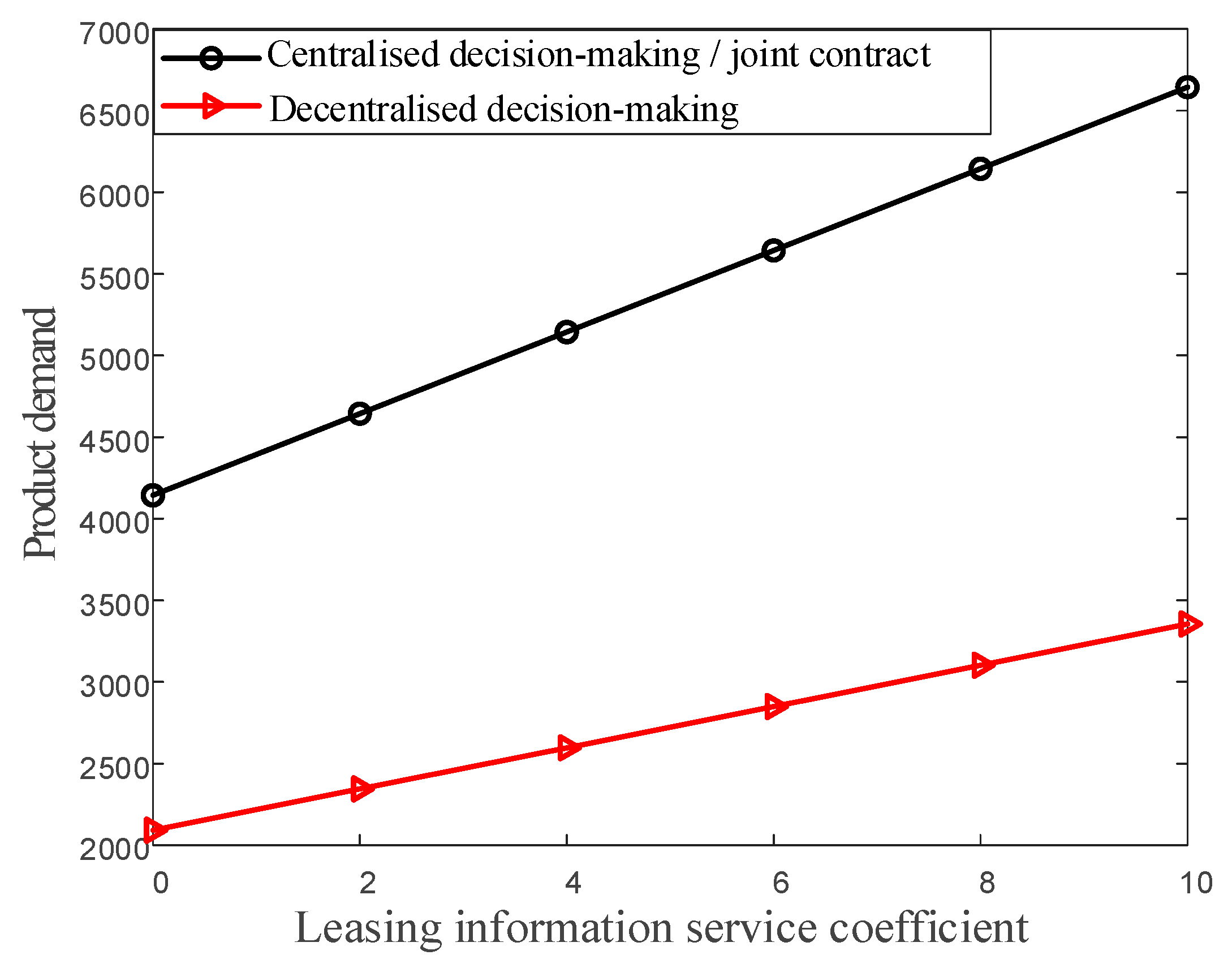

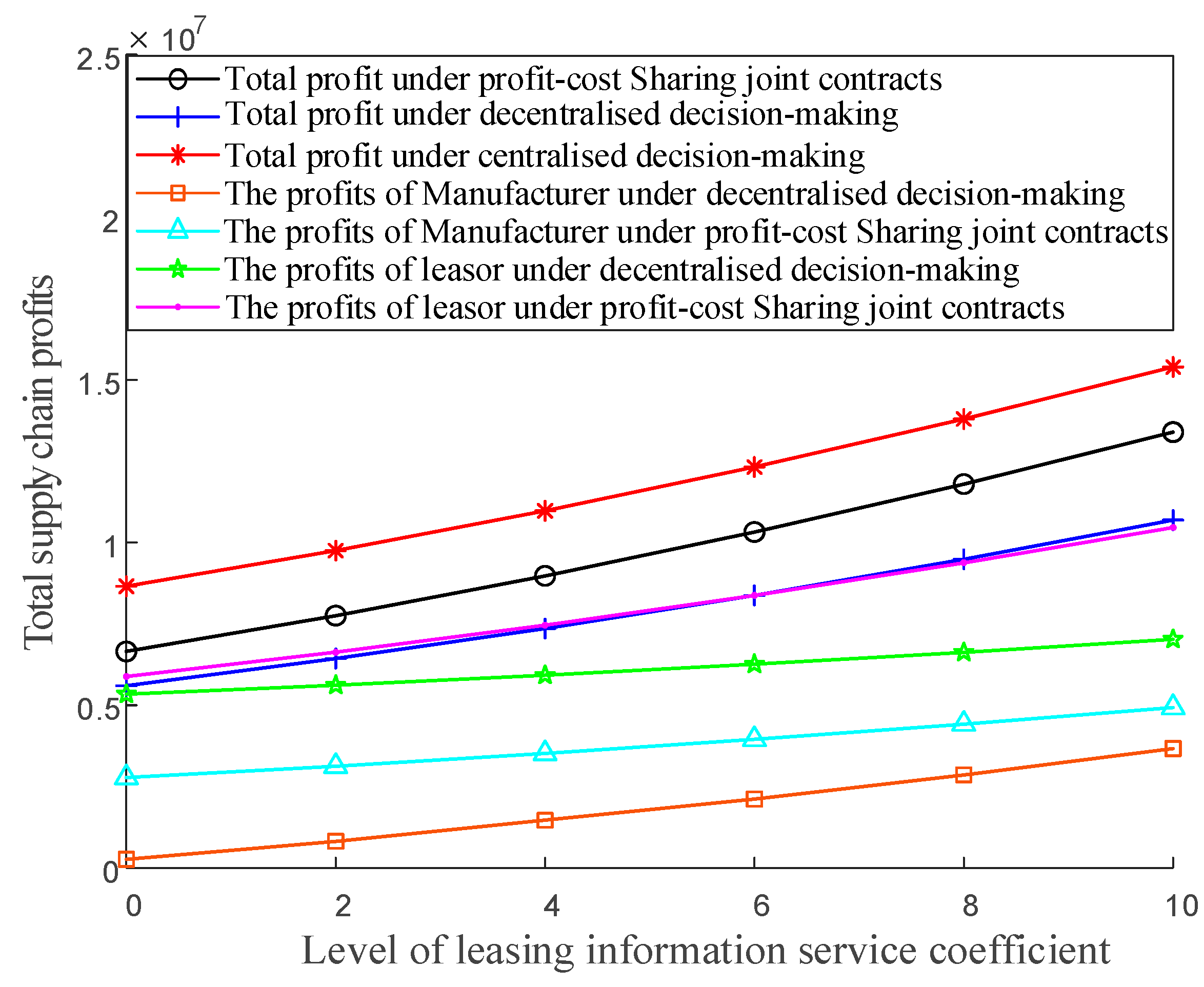

5.3. Impact of Leasing Information Service δl

This section examines how the leasing information service coefficient (

δl) influences the demand, decision variables, manufacturer profits (

πm), lessor profits (

πr), and total supply chain profits (

πt) across three scenarios: centralized decision-making, decentralized decision-making, and a joint contract. All other parameters remain constant, with

δl ranging from 0 to 10 and

λ1 set at 0.3. The simulation results are illustrated in

Figure 4,

Figure 5 and

Figure 6.

Figure 4 and

Figure 5 show that as

δl increases, both the product leasing price (

pl) and product leasing demand (

Ql) rise under centralized and decentralized decision-making. An enhanced platform services level(

s) expands the construction machinery rental market, allowing more consumers with unmet rental needs to access products via the platform, thus boosting demand. The platform’s ability to manage leasing and product life cycles adds further value. However, as platform construction, operation, and optimization require more investment, the manufacturer increases platform commissions charged to the lessor to cover these costs. Consequently, the lessor raises rental prices to maintain profitability.

Meanwhile, under the joint coordination contract, the product leasing demand (Ql) is 98% higher than when decentralized decisions were made, while product leasing prices (pl) are 37.4% lower, as the leasing information service coefficient increases from 0 to 10. This suggests that the joint contract strengthens collaboration between the lessor and manufacturer, driving higher demand for construction machinery and reducing leasing prices.

The improvement in the level of leasing information services coefficient (

δl) enhances the level of platform services(

s), with manufacturer profits (

πm), lessor profits (

πr), and total supply chain profits (

πt) all increasing. Under profit–cost sharing joint contracts, the supply chain performance is higher than in decentralized decision-making. The lessor assumes part of the platform’s operational costs, alleviating some of the financial pressure on the manufacturer, while the manufacturer shares a portion of the profits with the lessor. This fosters closer collaboration between them, leading to a more reasonable distribution of supply chain profits. As a result, when the leasing information service coefficient increases from 0 to 10, the manufacturer’s profit (

πm) and lessor’s profit (

πr) and the overall supply chain profit (

πt) improved by 90%, 32.3%, and 46.1%, respectively. Furthermore, supply chain performance under the joint contract surpasses that of decentralized decision-making. As depicted in

Figure 6, the joint contract significantly enhances the supply chain profitability.

As shown in

Table 2, when the manufacturer’s profit-sharing ratio

λ1 in the joint contract falls within 0.16 ≤

λ1 ≤ 0.47 and the cost-sharing ratio

λ2 for installation and dismantling services is within 0.18 ≤

λ2 ≤ 0.49, the conditions

πmo* >

πms** and

x > 0 are satisfied. These results demonstrate that the profit–cost sharing joint contract enhances total supply chain profits and successfully coordinates the overall supply chain performance. Furthermore, within this profit-sharing range, the increment in total supply chain profits remains consistent following contract coordination.

6. Conclusions

This study addresses a critical gap in construction machinery supply chain management by introducing a coordination framework that harmonizes China’s safety-driven integrated installation–dismantling mandate with the economic imperatives of leasing firms. By employing a game-theoretic approach, the study identifies optimal profit-sharing and cost-sharing ratios that mitigate the double marginalization effect inherent in decentralized decision-making. Specifically, when the profit-sharing ratio between the lessor and manufacturer falls within the range of (0.16, 0.47) and the cost-sharing proportion for installation and dismantling services remains within (0.18, 0.49), the proposed joint contract model enhances collaborative decision-making, boosts profits for all supply chain participants, and significantly improves the overall supply chain efficiency. Furthermore, the study reveals that improved information services for installation and dismantling can stimulate demand for these services, although rising costs may require lessors to implement strategic pricing adjustments accordingly.

The findings also underscore the transformative role of industrial internet platforms, which amplify the demand elasticity by approximately 97–98%. However, their effectiveness critically depends on maintaining balanced cost-sharing (16–47%) and profit-sharing (18–49%) ratios. This insight offers a concrete strategic roadmap for the digital integration of construction leasing markets, enabling stakeholders to harness the full potential of technological advancements while ensuring equitable value distribution.

From a practical perspective, the framework creates a win–win scenario: lessees experience reduced financial burdens, while lessors benefit from higher service utilization. This synergy fosters a self-reinforcing cycle that aligns safety, sustainability, and economic incentives, thereby promoting sustainable long-term value creation across the entire supply chain ecosystem.

Based on these findings, policymakers should incentivize profit–cost sharing contracts to accelerate integrated installation–dismantling adoption without requiring direct governmental subsidization. Leasing firms must prioritize platform-driven data transparency to optimize service pricing and cost allocation mechanisms. Project managers can leverage the model to negotiate fairer contracts that effectively mitigate machinery-related risks and enhance operational safety.

While the model focuses on tower cranes in China, future studies could extend it to diverse machinery types (e.g., excavators, bulldozers, or mobile cranes) or regional markets with varying regulatory landscapes. Additionally, integrating dynamic carbon pricing mechanisms could further enhance the model’s sustainability dimensions and align with global environmental governance frameworks.