1. Introduction

With the intent of decarbonising energy systems, the European Union (EU) has promoted a package of eight different directives, known as the Clean Energy Package [

1,

2]. Among them, Directive 2018/2001/EU, commonly known as RED II [

3], put forward a new legal framework to develop renewable energy sources (RESs) with the aim of encouraging energy users such as citizens and Small- and Medium-sized Enterprises (SMEs) to actively participate to the energy transition [

4].

Users, indeed, can become members of Jointly Acting Renewable Self-consumption (JARS) groups, commonly known as collective self-consumption (CSC) (also known as remote collective self-consumption or as a collective self-consumption group (CSG) or renewable energy self-consumption communities that act collectively) groups, and Renewable Energy Communities (RECs) [

5]. JARS groups are legally limited to participants within the same building or multi-apartment complex [

6], making condominiums a natural setting for their implementation. This is especially relevant in countries like Italy, where a substantial portion of the population—estimated at around 60% [

7]—lives in such multi-unit residential buildings. Condominiums thus offer a concrete and widespread setting for applying the JARS model, making them a strategic focal point for self-consumption initiatives.

RECs can include members across a wider geographical area, such as a neighbourhood or municipality, connected to the same distribution grid [

8]. Both configurations provide an effective context within European legislation based on the concept of energy sharing, introduced ten years ago in the UK [

9], which outlined a number of main objectives such as “provide environmental, economic and social community benefits for its shareholders, members and for the local areas where it operates, rather than financial profits”.

Among EU member states, Italy has strongly supported the growth of RECs and JARS through the transposition of RED II as well as the introduction of related provisions [

10]. In particular, the Italian government initially introduced collective self-consumption on a national level as a temporary measure [

11] and then as a permanent measure [

12], making collective self-consumption one of the common self-consumption configurations [

13].

A self-consumption group consists of at least two distinct subjects who are both members of the configuration as end customers and/or producers of electricity [

14]. Additionally, the self-consumption group includes at least two distinct connection points to which a power utility and a production plant are connected, respectively, provided that the connection points of the end customers are located in the area pertaining to the building or condominium [

1,

15]. Systems can be located within the building, the condominium, or even elsewhere, provided that the location is fully available to one or more of the group’s end customers. However, the location must be in an area served by the same primary station [

16], i.e., an HV/MV substation.

Because of EU directives, each country has already implemented or is in the process of implementing various collective self-consumption incentives [

17]. With the introduction of a new ministerial decree [

13], the Italian government aims to boost self-consumption within RECs and JARS groups by issuing a financial contribution called an “incentive tariff”. The specific rate of this tariff varies based on the capacity of the renewable energy installation, its location, and the market price of energy. This incentive is issued by the national authority to the representative of the self-consumption group over a period of 20 years.

Although the supporting European and Italian legislations specify that RECs and JARS groups provide environmental, social, and economic benefits, the economic feasibility of the related investments is typically the driving force behind the choice to actively take part in energy self-consumption [

18], sometimes even more than the environmental benefits [

19].

It is also important to underline that, in compliance with the Italian legislation [

20], future energy communities will be able to maximize the earnings from the investment in the systems owned by the community. In fact, to guarantee a fair economic return and to avoid distortions where only a few may benefit at the expense of many, the Italian legislation has imposed a “protective” measure. The so-called “55% threshold”, indeed, guarantees that at least 45% of the incentive is redistributed to the residential domestic user or toward social purposes [

21]. This 55% redistribution threshold is not explicitly considered within a JARS group, since the economic return from incentivization is automatically redistributed among the condominium members (the earnings from shared components like solar panels, even if not directly redistributed, are reported by each co-owner based on their ownership share (in thousandths) and their individual tax situation) participating in the JARS group, so the investors are the direct owners of the systems.

In general, JARS (current legislation does not mandate a specific self-consumption model for condominiums, but the collective shared self-consumption model used in this study focuses on typical condominium setups, as most multi-unit buildings in Italy are effectively condominiums) uses a renewable system able to immediately lower common energy consumptions as well as to generate financial remuneration through the state incentive, limited to the building where the self-consumption takes place. Therefore, within the same condominium, physical self-consumption and shared self-consumption can co-exist with the relative and complementary benefits [

22]. On the other hand, RECs can exploit larger networks and therefore try to optimize energy production and consumption within a broader range of users [

23]. Furthermore, the “critical mass” of REC members also makes it possible to implement ancillary services whose aim is to make savings [

24,

25].

The economic return from RECs and JARS can diversify due to numerous parameters, such as the cost of energy and the percentage of incentive returned to the end user [

26]. However, it can also be affected by the size of the self-consumption configuration and, therefore, by the number and the type of actors involved in the “community” [

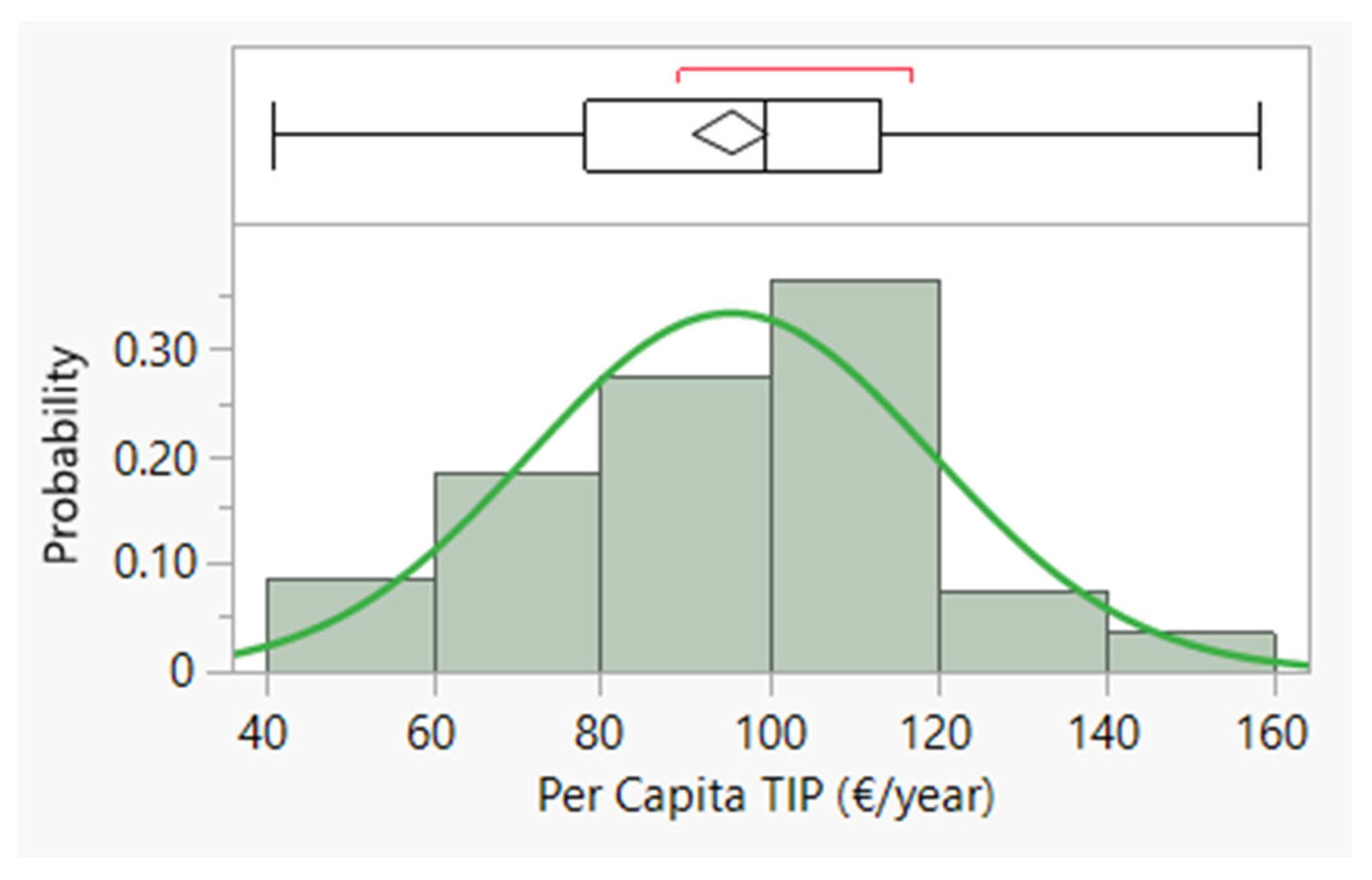

27]. The economic return can oscillate between 360 EUR/year and 160 EUR/year for the residential users in an REC, and it can amount to 97 EUR/year for the residential users in a JARS group [

28]. Another study [

21] showed that the incentive can provide even lower net revenues, which oscillate between 29.20 EUR/year and 52.30 EUR/year, depending on the effort made to coordinate and optimize self-consumption among community members.

However, these studies are based on hypotheses and on a limited amount of real data, since there are few self-consumption configurations currently working and able to share the data they produce [

8]. Therefore, the models and results in these studies will need to be verified based on the real data produced over the next few years by the effectively activated RECs and JARS [

29].

From an economic standpoint, the scientific community has started to analyze the relative advantages of RECs [

24], as listed in

Table 1, even within the context of Italy [

30].

On the other hand, the literature has neglected JARS. Its economic evaluation has not been deepened, with the exception of a technical study from Spain [

31], an analysis of economic performance in Italy [

32], and an analysis of predictive systems [

33]. Focusing on Italy, there are not many active JARS configurations in the country [

34]. Moreover, many of these are experimental configurations [

35] for technical analysis [

36] rather than economic ones [

37].

Moreover, validating such systems is essential to assess their effectiveness and real-world applicability. However, the current scarcity of large-scale, fully operational JARS implementations limits the possibility of empirical evaluation at this stage [

38]. As more energy communities become active and richer empirical datasets emerge, the potential for robust validation and comparative benchmarking of the JARS framework will significantly increase [

39].

Table 1.

Research present in the literature on Renewable Energy Communities.

Table 1.

Research present in the literature on Renewable Energy Communities.

| Topic | Reference |

|---|

| Analysis of savings on costs | [40] |

| Increased energy security | [41] |

| Energy independence | [42] |

| Creation of jobs | [19] |

| Fighting against energy poverty | [43] |

Theorizing of more complex and

innovative economic models | [25] |

| Implementation of ancillary services | [44] |

| Comparison with previous historical models of energy cooperatives | [39] |

The present study aims to provide a detailed economic evaluation of JARS in real-world urban settings, with a particular focus on condominium-based photovoltaic systems.

Moreover, while the existing literature tends to analyze RECs and JARS separately, this study is among the first to explore the incremental economic and energy benefits of transitioning from JARS-only setups to configurations that participate in RECs using high-resolution spatial and consumption data. To assess their competitiveness, the analysis compares self-consumption and economic performance in these two configurations.

Specifically, the economic return due to the implementation of JARS configurations in condominiums is examined in the city of Prato, as detailed hereafter.

The novelty of this work lies in its dual-layered analysis: evaluating JARS in isolation and then assessing its performance within RECs. This is developed using an empirically grounded, spatially detailed methodology that has not yet been applied in the Italian context. This contributes new insights to the literature on JARS by addressing the underexplored area of condominium-level energy sharing models and their economic scalability.

The remainder of the paper is structured as follows: after the Introduction,

Section 2 includes a description of the case study area and an overview of the simulation tools employed; then,

Section 3 presents the evaluation of JARS from an energy and economic point of view, along with an analysis of the inclusion of JARS within RECs. Finally,

Section 4 summarizes the main contributions of the present study, in addition to providing limitations and avenues for future research.

2. Materials and Methods

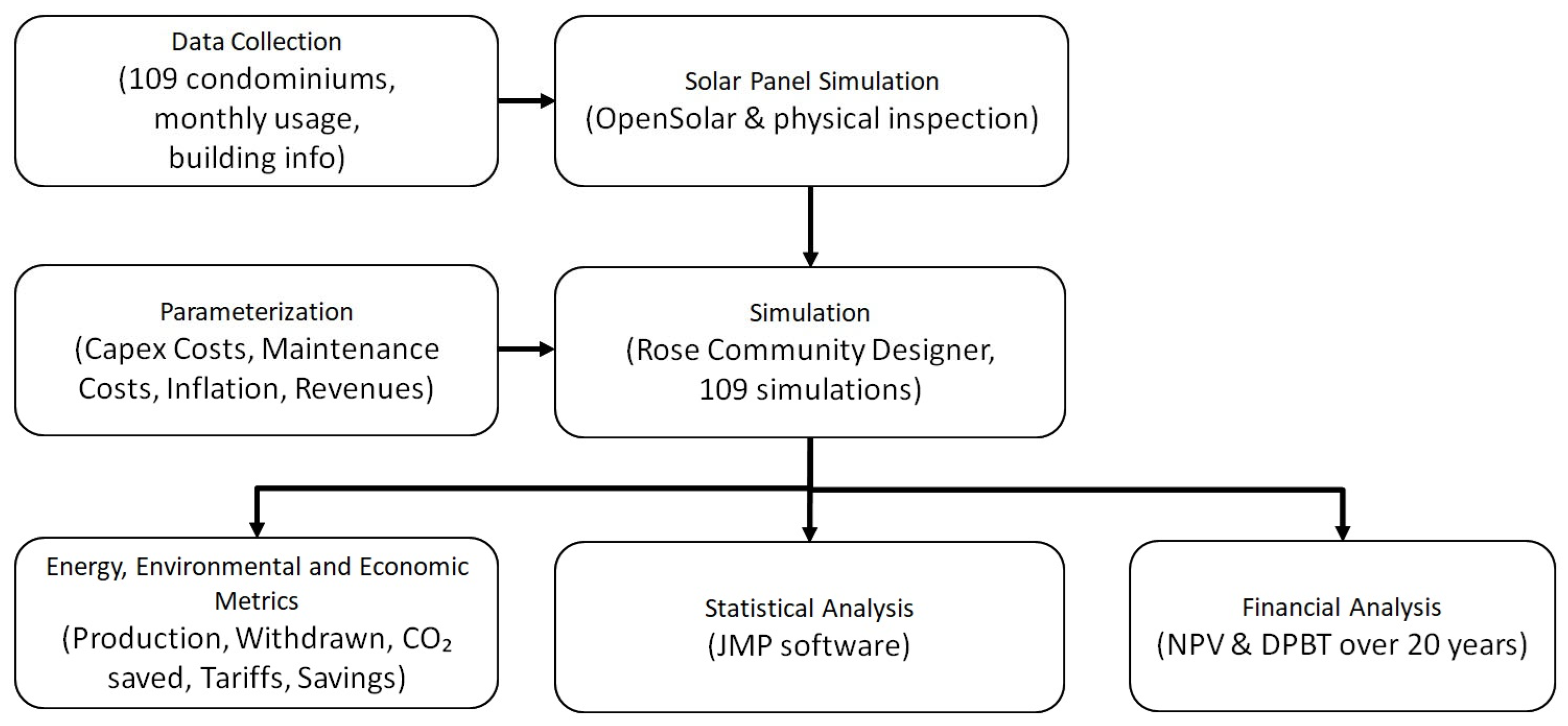

This research follows a structured methodology to evaluate the financial feasibility of implementing JARS configurations in 109 residential buildings (i.e., condominiums), as illustrated in

Figure 1.

The methodological framework starts with a comprehensive data collection on monthly electricity consumption and structural characteristics of the buildings. This is followed by a photovoltaic (PV) panels energy production simulation, carried out using the OpenSolar 2.0 software (v2025) and supplemented by physical inspections to ensure accurate modeling and optimal sizing of the photovoltaic production system.

The resulting data is then parametrized considering capital expenditure (CAPEX), maintenance costs, inflation rates, and projected revenues. These parameters are used in a comprehensive simulation process utilizing the Rose Community Designer 2.0.6 tool (v2025), running 109 individual simulations to model each building scenario.

The outputs are analyzed across three domains: energy, environmental, and economic. Adopted metrics include energy production, grid energy withdrawals, self-consumption percentage, CO2 savings, tariff impacts, and monetary savings. Moreover, a statistical analysis through the JMP 18.2.0 software (student edition v2025) was developed together with an economic analysis assessing Net Present Value (NPV) and Discounted Payback Time (DPBT) over a 20-year period.

2.1. The Case Study Area

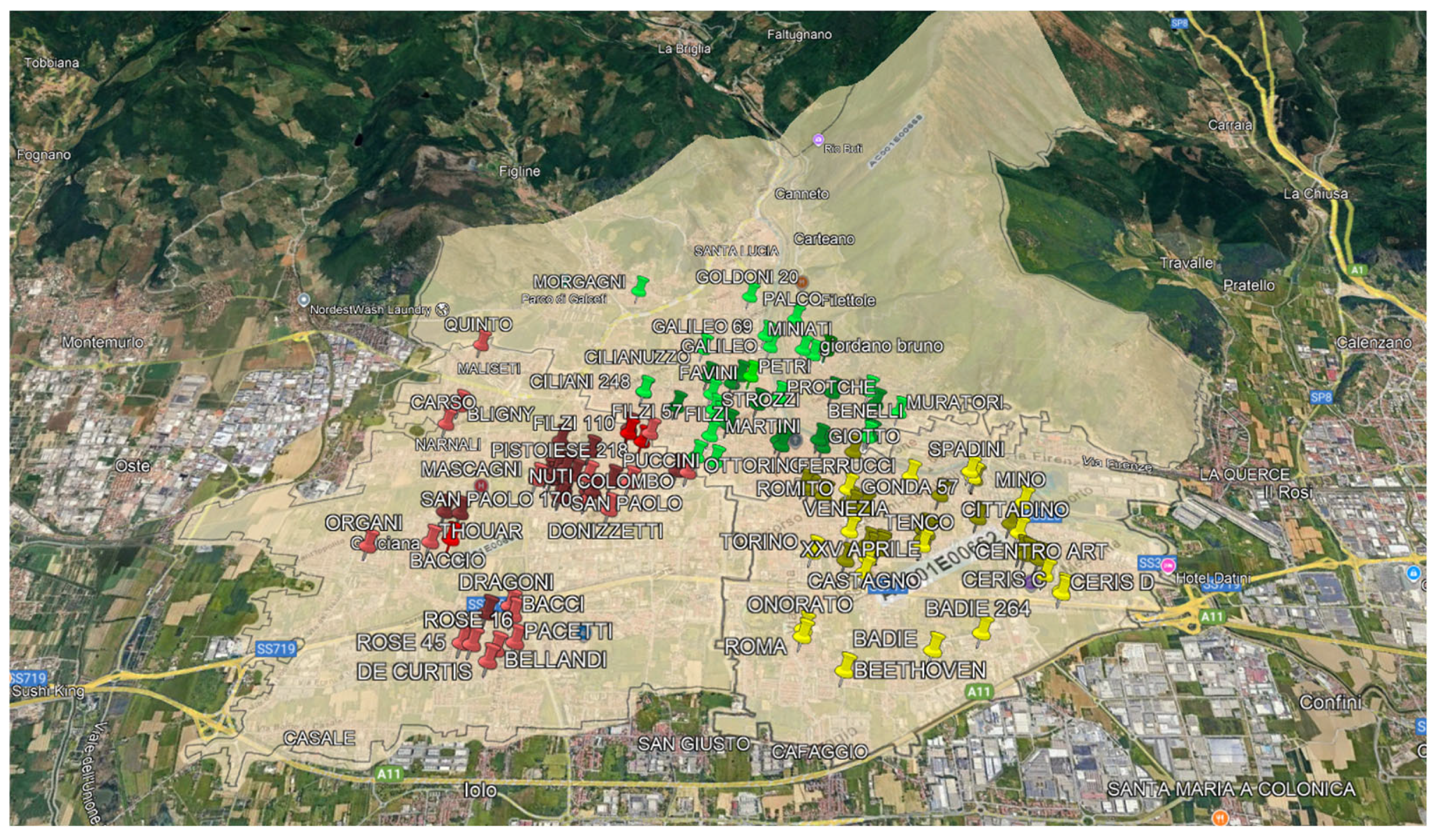

The analysis was conducted on 109 condominiums located in the same metropolitan area, i.e., Prato, Italy. The electricity distribution uses a total of 6 HV/MV [

45] substations to cover the entire urban area of Prato. Two substations cover specifically industrial areas and therefore were not included in the analyses of this study due to the almost total absence of condominiums and residential housing units in their areas. Data was collected and analyzed over the remaining 4 HV/MV substations listed in

Table 2 and shown in

Figure 2. Moreover, Prato represents a privileged statistical sample due to the possibility of collecting data through the voluntary participation of many condominium administrators in the study. However, the building profile by number of floors is compatible with the profile of buildings on a national scale. Two- and three-story buildings represent 75% of the buildings analyzed, while on a national scale, they represent a similar and compatible 73% of the buildings in the area. Prato can be also considered representative of the 50 most populous cities in Italy, with a population density of 1867.69 inh./km

2, which closely approximates the sample mean of 1877.5 [

46].

The 109 condominiums (The term “condominium” refers to a particular association within a building consisting in a number of units, where private and communal properties coexist, as specified in Article 1117 following the Italian Civil Code. The exclusive ownership of individual apartments is accompanied by shared ownership of other components, such as the roof, stairwell, entrance, caretaker’s lodge, supporting walls, and laundry areas, which require communal management regulated by the condominium rules. As per Italian legislation, a collective photovoltaic system can be added to this list of communal areas) analyzed include 2674 private users, 139 offices, and 129 business activities.

Thanks to the collaboration with numerous condominium administrators, consumption data from communal areas and private flats were collected according to the monthly range for the years 2023 and partially 2024. They also provided details about the composition of the buildings, indicating the number of apartments and the type of family living in each apartment as well as the presence of businesses. Due to the unavailability of specific electricity consumption profiles for individual households, the study relied on values from the literature [

47] and assigned average annual consumption figures to each residential unit as per

Table 3. The study [

47] presents a detailed case study of a small/medium condominium in northern Italy, aligning directly with the regulatory setting of this research. For this reason, the consumption patterns and assumptions are highly applicable to this analysis. Moreover, the paper focuses on mixed-use residential and commercial condominiums—a configuration common in urban Italy [

48] and relevant to the typical JARS context. The electricity demand profiles reflect realistic occupancy and usage types (e.g., elderly couples, young workers, and families), which mirror the type of end users analyzed here.

Finally, the paper in question uses a combination of demand data from the literature, typical day profiles, and realistic behavioral assumptions (e.g., load shifting, occupancy variation) to simulate electricity consumption. This provides a nuanced and credible set of profiles suitable for modeling purposes.

For these reasons, the study [

47] was deemed a representative and technically robust source for household electricity profiles in this case study.

Conversely, actual electricity consumption data were available for commercial activities and were used directly in the analysis.

For every condominium, the same JARS configuration was modeled, where the PV system is directly connected to the shared condominium POD. The system is under the common ownership of every apartment owner in proportion to their percentage share ownership of common parts and in conformity with Article 1117 of the Italian Civil Code. A “driven by citizen” model, already seen for the Jointly Acting Renewable Self-consumption groups used for RECs [

49], as well as the ecopreneur model [

50], is therefore applied to apartment owners, making them an active part in the entire renewable energy self-consumption chain.

2.2. Simulation Tools

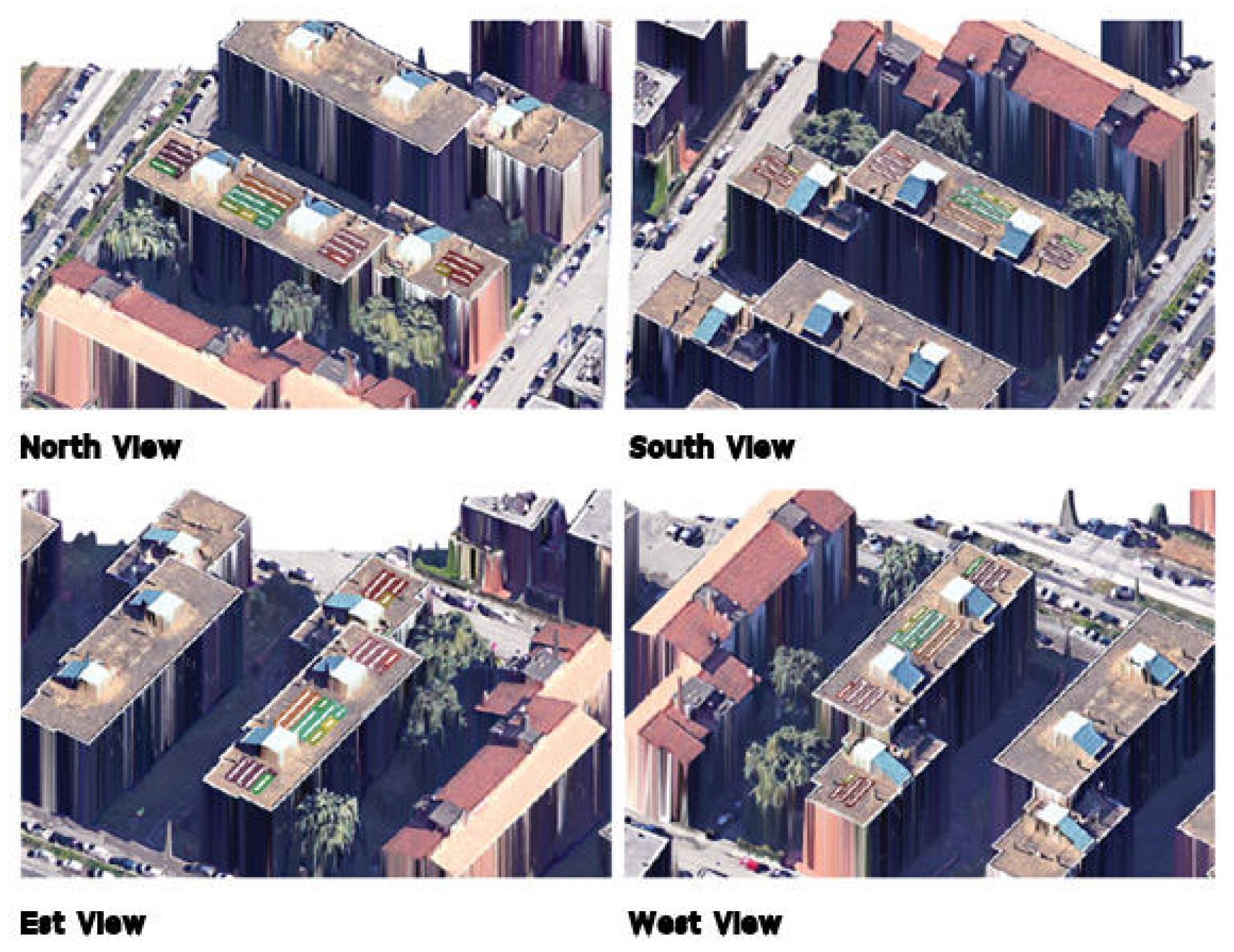

The rooftop PV panel simulations were carried out using the OpenSolar software ([

51]

https://www.opensolar.com/, accessed on 4 August 2025) geo-referenced to Google Earth, as shown in

Figure 3. The software includes a 3D analysis of obstructions and shadow areas caused by other buildings with spatial and meteorological input data. More in detail, independent validations confirm OpenSolar’s precision. The National Renewable Energy Laboratory (NREL) measured Sun Access Values (SAVs) [

52] and found that OpenSolar’s estimates were within ±3% of on-site SunEye measurements. PV Evolution Labs (PVEL) confirmed the roof scale within 1

1/

3 ft (≈0.4 m) 100% of the time and the roof pitch within 4° in over 97% of cases. These studies, conducted in the US, validate core computational and modeling methods (roof geometry, solar irradiance, energy yield) if the local climate and irradiance inputs are accurate. The software used the average efficiency and loss values highlighted in

Table 4.

Thanks to this and the automatic optimization functionalities of the software, it was possible to obtain the best layout and positioning for the panels to maximize energy production. Furthermore, 20% of roofs were re-checked through a physical inspection that guaranteed the removal of obstructions in the model since they were not always visible by using only satellite imagery. Therefore, the condominium photovoltaic systems were designed based on the available roof area, shadow net areas, and obstructions.

Systems just a little over 20 kWp were approximated to 20 kWp to avoid bureaucratic issues and costs linked to the requirement of setting up a mandatory electricity workshop [

53]. This resulted in an overall installed power of 2274 MWp over a gross 50,502 m

2 surface area, with an average installed power for each building equal to 20.87 kWp (

Figure 4 and

Table 5). Based on previous economic analysis [

37], the installation of storage systems was not taken into consideration because the investment is too financially expensive for families. Considering the current legislation [

13], it is possible to obtain the maximum state incentive with photovoltaic systems below 200 kWp. None of the analyzed condominiums here have the potential physical space to install photovoltaic systems above this value.

Later, the Rose Community Designer (

https://energy.mapsgroup.it/en/energy-community-designer-en/, accessed on 4 August 2025) software was used to assess the financial feasibility of developing JARS, along with its energy, environmental, and economic metrics. The Rose software uses production data from the Photovoltaic Geographical Information System developed by the European Commission’s Joint Research Centre (JRC) [

54]. This cloud-based tool enables preliminary simulations of JARS and other energy community configurations. While originally developed with a focus on the US market, its core modeling principles—such as load matching, PV production estimation, and financial projections [

55]—are adaptable to the Italian context when localized inputs (e.g., tariffs, irradiance, incentives) are correctly applied. However, further real-world validation in Italy would strengthen confidence in its predictive accuracy, which remains a limitation to be addressed in future research [

56].

The economic analysis was conducted under the assumption that participants in the self-consumption group maintained their standard, pre-existing consumption behavior without the implementation of adaptive or automated demand-side management strategies [

15]. This assumption reflects the prevailing conditions in the study area, where over 90% of electricity delivery points are residential and do not employ home automation technologies [

57]. Such systems imply high installation and maintenance costs [

58,

59], and these expenses are not eligible for tax deductions under current Italian legislation. Although smart meters can provide detailed consumption data, they do not inherently lead to sustained behavioral changes [

60,

61]. Moreover, incentives aimed at promoting self-consumption may trigger a rebound effect, as users may respond by increasing their energy use to maximize perceived benefits [

62,

63], further complicating demand modeling and potentially undermining energy savings.

We acknowledge that this assumption limits the generalizability of the results. Future studies can address scenarios involving behavioral adaptation or smart control strategies, which could significantly affect self-consumption patterns.

By inserting in the software the data of the designed photovoltaic systems, condominium consumption data, average load profiles of residential units, and power consumption of business activities, it was possible to create 109 distinct simulations of condominium JARS configurations. The following data for each condominium were calculated:

Annual energy production: ;

Annual energy fed (into the grid): ;

Annual condominium energy withdrawn (from the grid): ;

Annual residential energy withdrawn (from the grid): ;

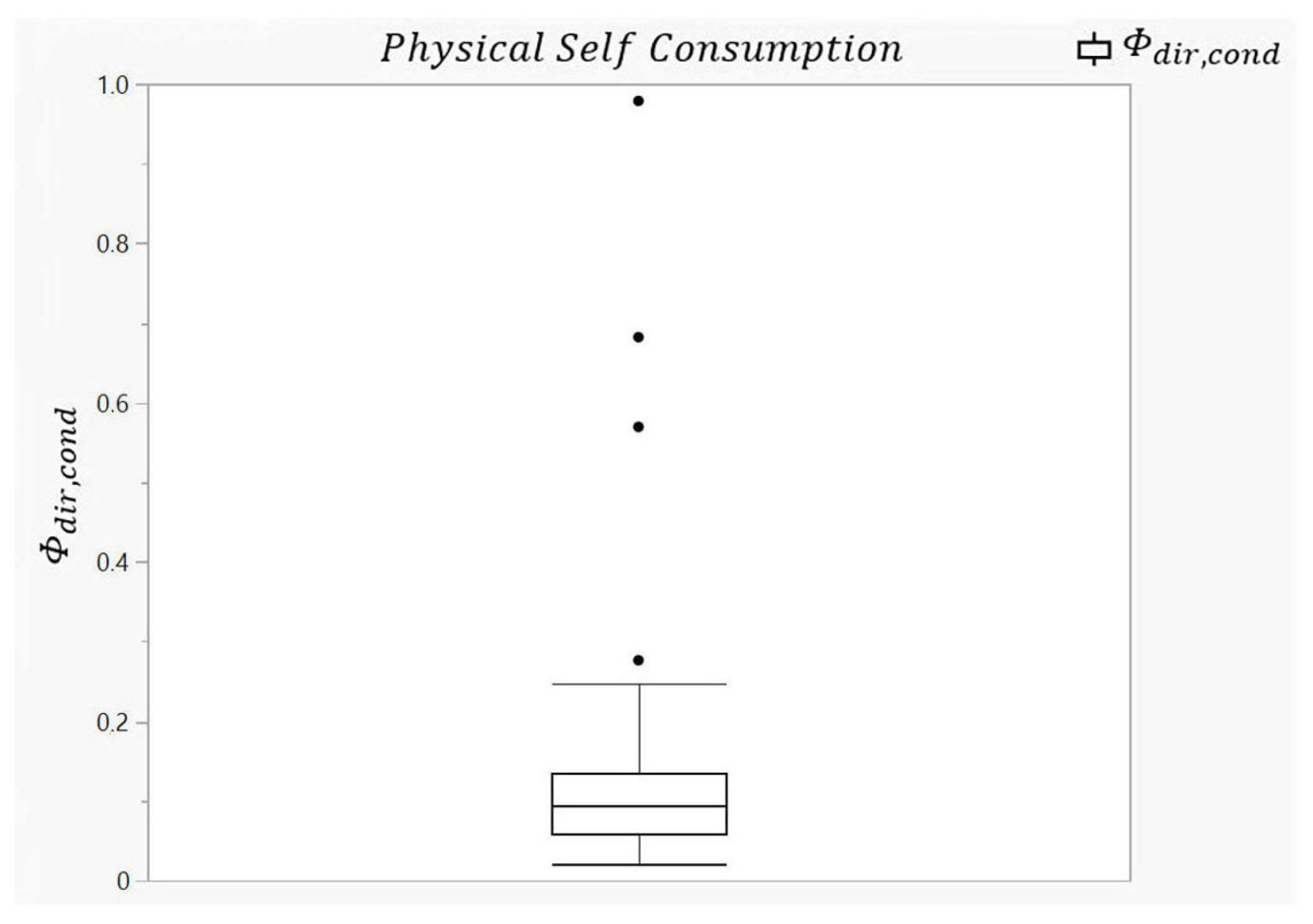

Physical self-consumption: ;

Annual shared energy: ;

saved: ;

Zonal hourly price of electricity: ;

Incentive premium rate (tariffa incentivante premio): ;

Incentive self-consumption tariff received: ;

Condominium energy bill saving: ;

Compensation for the sale of excess electricity: ;

Earnings from the sale of energy—RID (RID is to Ritiro Dedicato, (Dedicated Off-take Regime) which is a mechanism established under the Italian energy framework, whereby the Gestore dei Servizi Energetici (GSE) acts as the single buyer for electricity generated by small-scale renewable and cogeneration plants. Under this scheme, producers are entitled to sell their electricity to the GSE at regulated conditions, thereby facilitating grid access and simplifying market participation for distributed generation facilities) (EUR/year);

Annual fiscal bonus (EUR/year): .

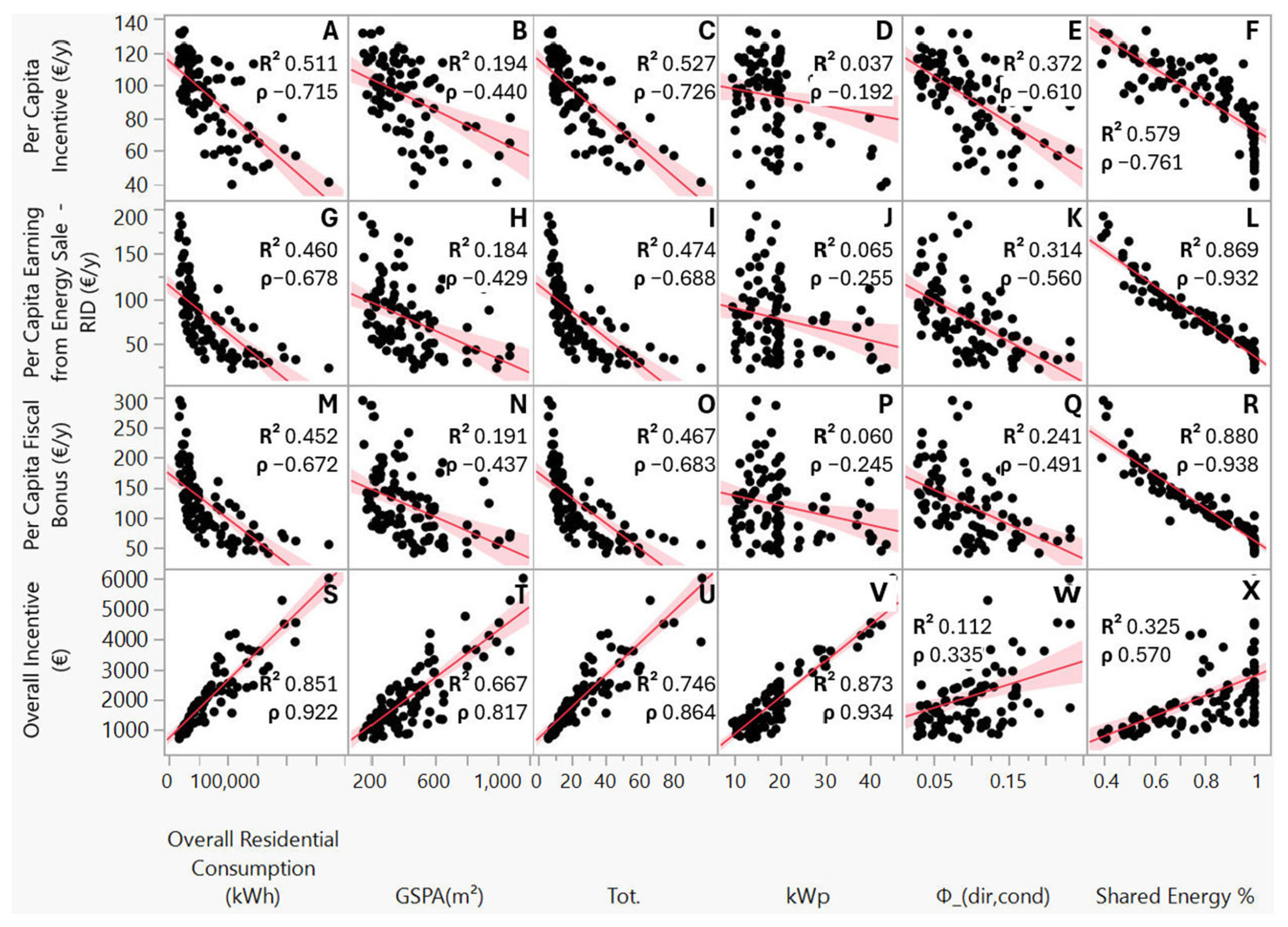

The output was analyzed, seeking the average values and any correlations between the power self-consumption values, the relative economic incentive, and the various condominium parameters. The correlation () is derived from the coefficient of determination () with the formula , where the sign is decided based on the slope of the curve.

Statistical analyses were carried out using the JMP 18.2.0 software (

https://www.jmp.com/en_us/home.html, accessed on 4 August 2025) by SAS (Statistical Analysis System, Cary, NC, USA). The analysis was conducted on non-optimized self-consumption communities with an assumed energy behavior in line with historic statistics.

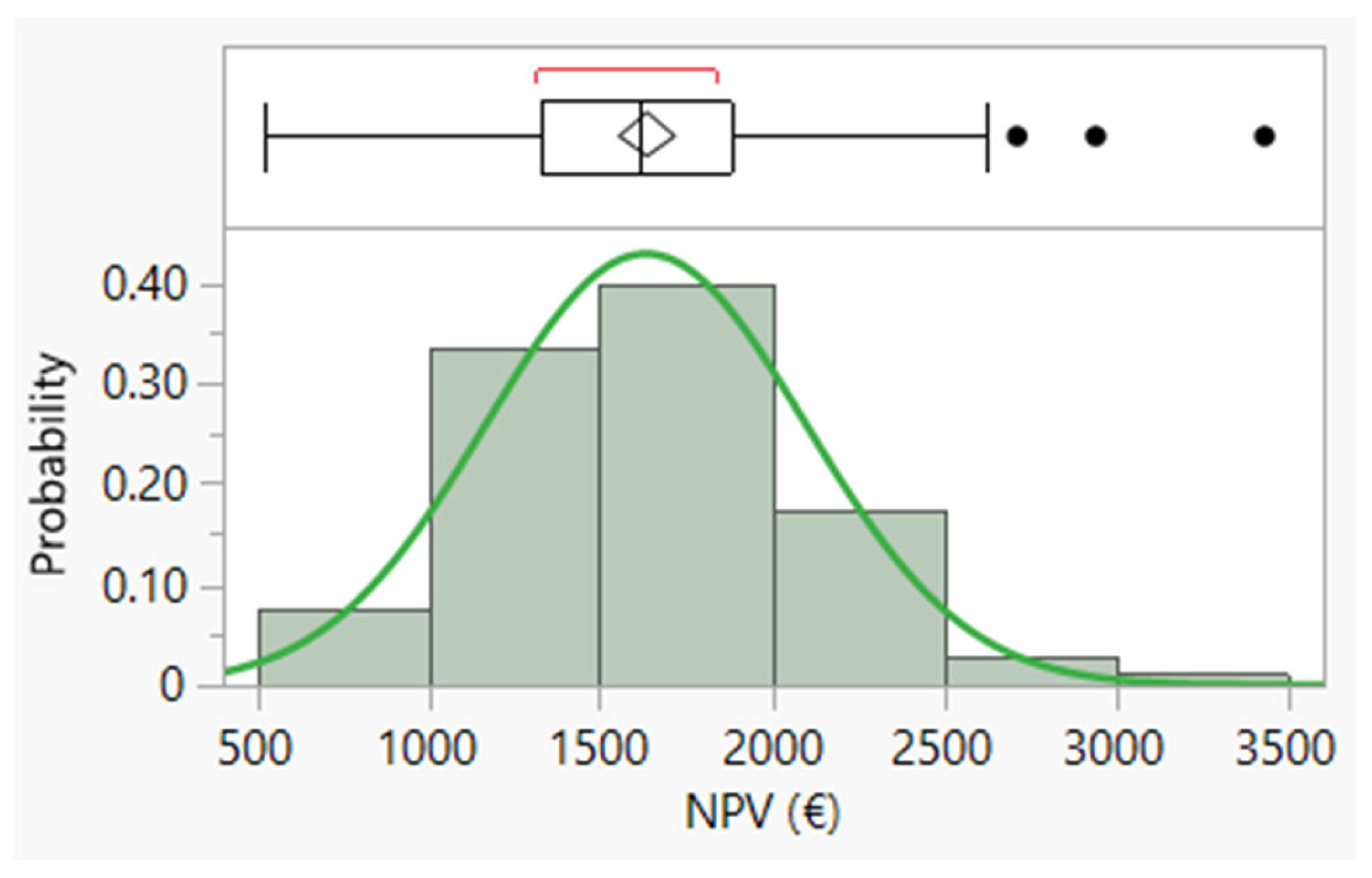

At the end of the analysis of each condominium, the Net Present Value () was calculated, which represents the actualization of cash inflows linked to future revenues received by the condominium net of cash outflows over a 20-year period .

The outflows mentioned are due to the initial investment in the system (

) together with the cost of maintenance (

), the cost of running the system (

), and the insurance cost (

). The NPV has already been used as a reference parameter to evaluate investments in other studies regarding the installation of photovoltaic systems for remote self-consumption [

26,

27,

43,

64]. Nevertheless, analyzing the value and size of an entire investment in energy communities cannot be adapted to condominium buildings because, in terms of configuration, size, and cost, the photovoltaic systems installed for RECs are different from those installed for JARS [

13]. The NVP that corresponds to the state self-consumption incentivization period (N) is:

where:

is the total initial cost of photovoltaic panels equal to the installed power capacity multiplied by the photovoltaics cost ( = );

is the condominium net of cash outflows equal to:

;

is the annual self-consumption incentive;

is the compensation for the sale of input electricity;

is the annual condominium energy bill saving;

is the overall annual system maintenance cost equal to the annual maintenance cost multiplied by the photovoltaics cost ( = );

is the overall annual running costs of the JARS system;

is the overall annual insurance cost equal to the annual insurance cost multiplied by the photovoltaics cost ( = );

In addition to the NPV, Discounted Payback Time (DPBT) was also estimated. DPBT is calculated by solving Equation (1) compared to the time

by the predefined value of

. For NPV and DPBT calculation, the compensation for the sale of excess electricity to the grid, i.e., the fed-in tariff, increases over the twenty years of simulated life due to an inflation value of 2% per year, an inflation value present in the financial stability program report of the Ministry of Economy and Finance [

65].

The parameters values summarized in

Table 6 were assumed to evaluate the NPV and DPBT. All the symbols’ meanings and units of measure are summarized in the List of Symbols at the end of the paper.

4. Conclusions

Jointly acting renewable self-consumption can be a helpful solution during the delicate phases of the future energy transition [

86]. Our research aims to fill a gap in the literature on collective condominium self-consumption. This study analyzes the overall advantage for a family wishing to actively take part in the energy transition, not just as an active consumer but also as an ecopreneur [

50]. This was evaluated through a broader statistical base compared to previous studies which focused on a few isolated condominiums [

37].

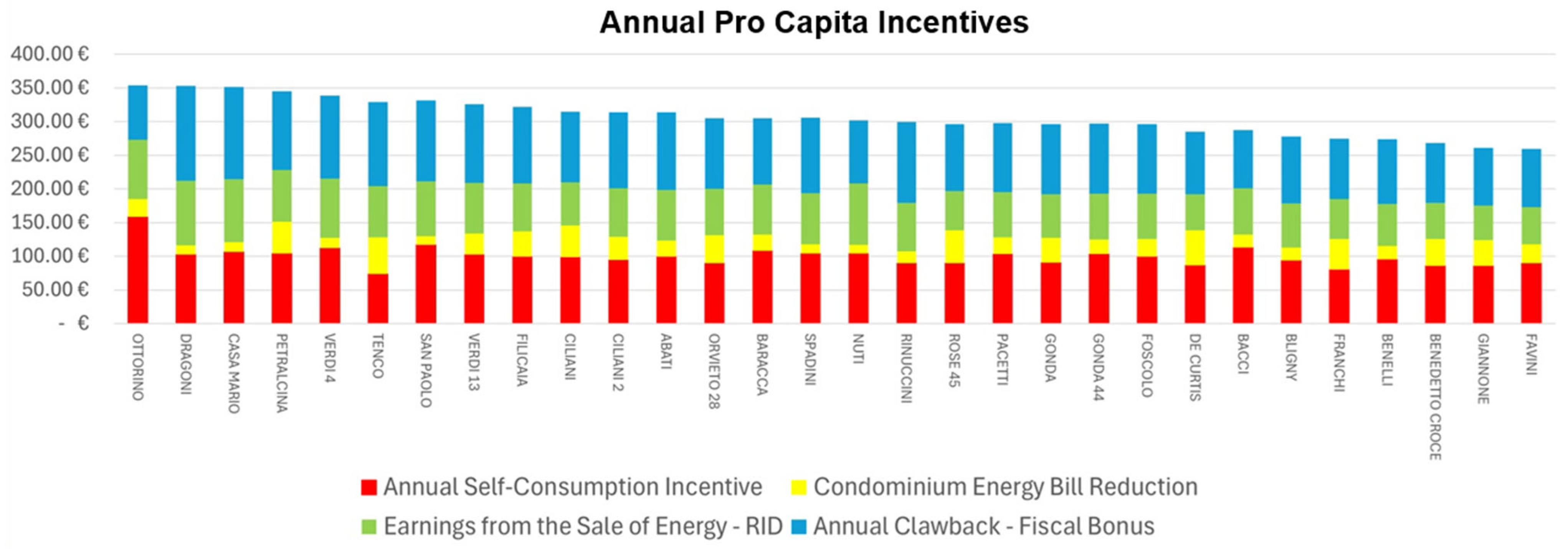

The analysis has highlighted that, thanks to the government contribution to incentivize energy self-consumption, a family can receive an average of 94.34 EUR/year, with an average investment recovery time of 8.8 years. This value further increases when all the economic profits linked to this use of renewable energy sources are taken into consideration. In fact, a decrease in the energy costs of shared areas, the profit linked to the sale of excess energy, and tax benefits lead to a total average benefit up to 340 EUR/year, and this result can be taken into consideration as an estimated average value for those who, in Italy, want to implement shared self-consumption at the condominium level in the form of JARS.

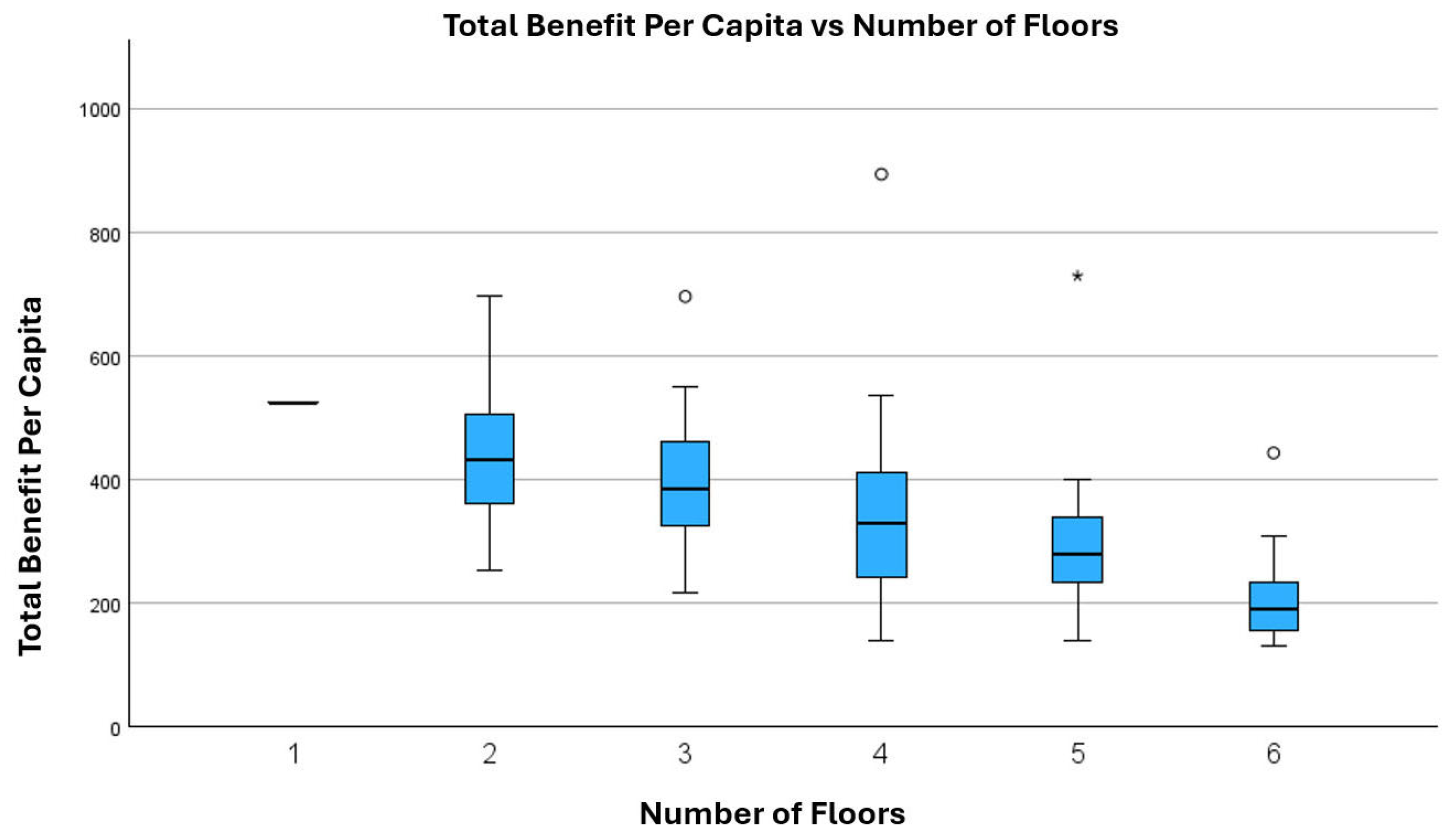

However, this value can vary due to parameters that cannot be controlled by the consumer, such as the percentage of tax deduction, managed by state policies, and the energy sale and purchase price, established by difficulties in the energy market. The analysis highlights other variables that considerably modify the degree of incentive and the global benefit, coming from photovoltaic investment and from the formation of JARS groups. These are the overall number of participants in the self-consumption group and the number of floors in the building where the energy is shared. An increase in participants, indeed, decreases the absolute average of the individual economic return, even if the initial investment is proportionally less important. At the same time, although the statistical sample is limited to buildings with up to six floors, though in-line with the Italian rate of 90.3% of residential buildings [

46], we can underline from our analysis that taller buildings produce lower incomes per capita. Therefore, large buildings with many apartment owners may not be the most attractive configuration for setting up a JARS group. It is also possible to notice that the sums seen may not be attractive enough to push individual apartment owners to invest in shared renewable energy sources, unless influenced at the same time by other non-economic reasons.

Statistical analysis shows that the per capita value of the incentive is inversely proportional to the number of families within the building and to the number of floors in the building. The per capita value of the incentive, instead, increases proportionally with the increase in overall consumption.

A comparison was also made between the jointly acting renewable shared energy and physical self-consumption rates generated by a condominium’s participation in JARS configurations and participation in an REC with all condominiums belonging to the same primary station. The REC configuration shows higher shared energy rates and economic benefits than the JARS configuration. Switching condominiums from a JARS system to an REC configuration led to an increase in the shared energy rate from 78% up to 93%. This increase in shared energy rates leads, also, to a proportional increase in economic benefits. This is in line with previous research indicating that larger JARS configurations offer greater benefits and should encourage condominiums’ participation in Renewable Energy Communities rather than individual self-consumption configurations.

This study presents the geographical limit of the Italian territory due to the specificities related to the incentives for energy self-consumption and tax bonuses that are granted according to national regulations and that can be substantially different from country to country. Our model provides a flexible base that can be recalibrated for geographical areas and legislative contexts. This adaptability enhances the model’s relevance for both comparative research and real-world deployment across diverse urban environments.

The applicability to other contexts, however, implies the presence of a supportive regulatory framework together with adjustments to model inputs such as prosumer rights, local incentives, user behavior, and technical conditions.

Indeed, in the event of changes to legislation or incentive schemes, the analysis must be re-evaluated to ensure alignment with the updated regulatory and economic framework. The effectiveness of JARS configurations is tightly linked to the incentive landscape, which shapes their financial attractiveness and feasibility. Our results show that economic viability is particularly sensitive to upfront investment costs and access to financing mechanisms—especially for condominium-based implementations, which currently make up the majority of potential participants. In this context, one policy change that could facilitate the adoption of self-consumption configurations is allowing households to receive tax credit benefits for PV systems upfront through a direct discount on the supplier’s invoice. This incentive was discontinued in Italy as of February 2023 due to widespread misuse, but developing similarly accessible financing schemes could lower entry barriers for residential users and accelerate participation.

Moreover, tailoring incentive structures to favor collective self-consumption configurations over individual ones or to support smaller-scale communities may help ensure a more equitable and widespread rollout. Such calibrated approaches could make the JARS model not only more effective but also more inclusive and aligned with the decentralized vision promoted by EU energy directives.

Future work will also explore the potential role of condominium and building managers as aggregators of Jointly Acting Renewable Self-consumption (JARS). To this end, it is necessary to conduct a study based on a statistical sample of building managers to assess whether allocating a portion of the incentive could serve as an effective mechanism to encourage them to promote the formation of self-consumption groups within the buildings they manage, expanding the sample for analysis by increasing the number of buildings, households, and primary substations involved.

Future work should explore how different incentive structures affect the adoption and performance of JARS configurations under varying regulatory and socio-technical conditions. Furthermore, the legislation for the establishment of these forms of energy sharing is decidedly recent and will make it necessary to compare simulated data with real data obtained from the actual establishment of configurations in a fully operational mode. While our analysis is based on static user behavior, future developments in automation technologies and supportive policy frameworks could significantly alter consumption patterns, underscoring the need for further research that incorporates dynamic demand-side participation and its potential rebound effects. The model was partially built on available data complemented by average statistical consumption figures, and the results may provide valuable insights for industry stakeholders and might help address an existing gap in the literature.

We believe that a more in-depth analysis of the increase in self-consumption due to energy sharing between multiple condominiums is necessary by analyzing economic models in RECs consisting of the aggregation of multiple condominiums.