Platforms for Construction: Definitions, Classifications, and Their Impact on the Construction Value Chain

Abstract

1. Introduction

2. Literature Review

2.1. What Are Platforms?

2.2. The Changing Narrative About Platforms

2.3. Platform Thinking in Construction

- Project temporality: Construction projects are time-bound, leading to fragmented and ad hoc partnerships.

- Regulatory complexity: Compliance with local codes, planning regulations, and liability structures creates silos in information flow.

- Supply chain fragmentation: The AEC sector is characterised by multi-tiered subcontracting and limited continuity of project teams.

3. Research Approach

4. Findings and Discussion

4.1. Platform Thinking Across Industries

4.2. Implications for Construction

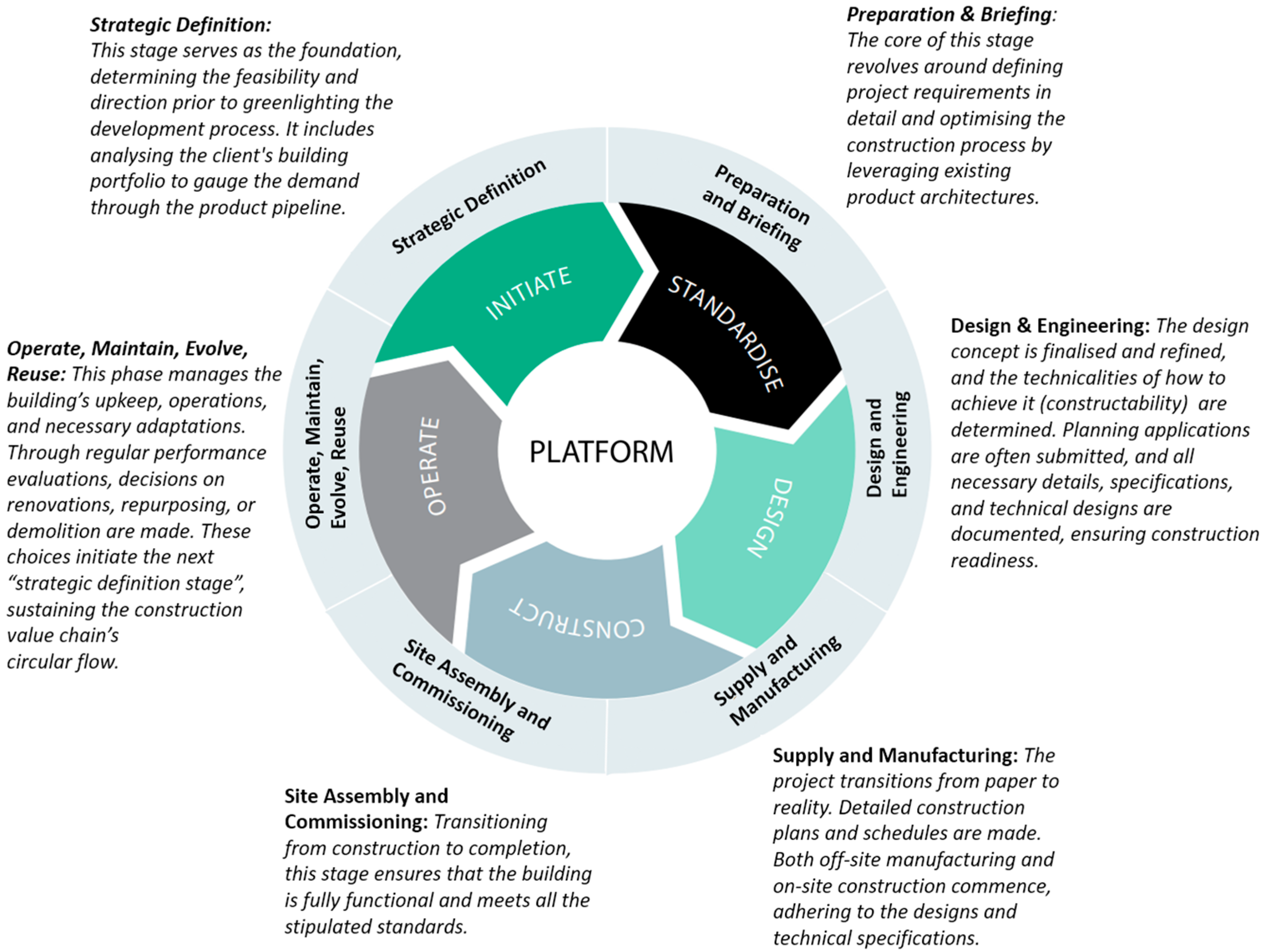

4.3. The Construction Platform Value Chain

5. Conclusions and Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Clarke, A.; Cheshire, L.; Parsell, C.; Morris, A. Reified scarcity & the problem space of ‘need’: Unpacking Australian social housing policy. Hous. Stud. 2024, 39, 565–583. [Google Scholar] [CrossRef]

- Bawuah, P. Can Ontario’s Housing Crisis Be Fixed? Understanding the Origins and Proposed Solutions to an Ongoing Crisis in Housing Affordability. 2024. Available online: https://uwindsor.scholaris.ca/home (accessed on 13 July 2025).

- van Oorschot, J.A.W.H.; Halman, J.I.M.; Hofman, E. The adoption of green modular innovations in the Dutch housebuilding sector. J. Clean. Prod. 2021, 319, 128524. [Google Scholar] [CrossRef]

- Tavares, V.; Soares, N.; Raposo, N.; Marques, P.; Freire, F. Prefabricated versus conventional construction: Comparing life-cycle impacts of alternative structural materials. J. Build. Eng. 2021, 41, 102705. [Google Scholar] [CrossRef]

- Rangasamy, V.; Yang, J.-B. The convergence of BIM, AI and IoT: Reshaping the future of prefabricated construction. J. Build. Eng. 2024, 84, 108606. [Google Scholar] [CrossRef]

- Montazeri, S.; Lei, Z.; Odo, N. Design for Manufacturing and Assembly (DfMA) in Construction: A Holistic Review of Current Trends and Future Directions. Buildings 2024, 14, 285. [Google Scholar] [CrossRef]

- Aksenova, G.; Oti-Sarpong, K. Beyond “platformania” in the construction sector: Conceptualisations and implications of product platformisation in the UK. Constr. Manag. Econ. 2024, 42, 229–250. [Google Scholar] [CrossRef]

- Das, P.; Hijazi, A.A.; Maxwell, D.W.; Moehler, R.C. Can Business Models Facilitate Strategic Transformation in Construction Firms? A Systematic Review and Research Agenda. Sustainability 2023, 15, 13022. [Google Scholar] [CrossRef]

- Veenstra, V.S.; Halman, J.I.; Voordijk, J.T. A methodology for developing product platforms in the specific setting of the housebuilding industry. Res. Eng. Des. 2006, 17, 157–173. [Google Scholar] [CrossRef]

- Jansson, G.; Viklund, E. Advancement of platform development in industrialised building. Procedia Econ. Financ. 2015, 21, 461–468. [Google Scholar] [CrossRef]

- Gawer, A. Bridging differing perspectives on technological platforms: Toward an integrative framework. Res. Policy 2014, 43, 1239–1249. [Google Scholar] [CrossRef]

- Gawer, A. Digital platforms’ boundaries: The interplay of firm scope, platform sides, and digital interfaces. Long Range Plan. 2021, 54, 102045. [Google Scholar] [CrossRef]

- Mosca, L.; Jones, K.; Davies, A.; Whyte, J.; Glass, J. Platform Thinking for Construction. In Plus, Transforming Construction NETWORK; UCL: London, UK, 2020; Available online: https://www.ucl.ac.uk/bartlett/sites/bartlett/files/digest-platform-thinking-for-construction.pdf (accessed on 13 July 2025).

- RIBA. The RIBA Plan of Work (The Design for Manufacture and Assembly (DfMA) Overlay), 2nd ed.; Royal Institute of British Architects London: London, UK, 2021. [Google Scholar]

- Monash University. Handbook for the Design of Modular Structures; Monash University: Clayton, VIC, Australia, 2017. [Google Scholar]

- TfNSW. Digital Engineering Standard Part 2—Requirements; TfNSW, Ed.; Digital Engineering at Transport for NSW: Sydney, Australia, 2019. [Google Scholar]

- Hijazi, A.A.; Das, P.; Li, Y.; Moehler, R.C.; Maxwell, D.W. A contingency approach to platform implementation: Platform types, attributes, and value chain integration. Build Res. Inf. 2025, 1–12. Available online: https://www.tandfonline.com/doi/full/10.1080/09613218.2025.2510270 (accessed on 13 July 2025). [CrossRef]

- Baldwin, C.Y.; Woodard, C.J. The architecture of platforms: A unified view. Platf. Mark. Innov. 2009, 32, 19–44. [Google Scholar]

- Tushman, M.L.; Murmann, J.P. Dominant Designs, Technology Cycles, and Organization Outcomes. In Academy of Management Proceedings; Academy of Management Briarcliff Manor: Briarcliff Manor, NY, USA, 1998. [Google Scholar]

- Maxwell, D.W. The Case for Design-Value in Industrialised House Building Platforms: Product to Ecosystem. Ph.D. Thesis, The University of Sydney, Camperdown, NSW, Australia, 2018. [Google Scholar]

- Hijazi, A.A.; Das, P.; Moehler, R.C.; Maxwell, D. A Roadmap to A Shared Vision for Platforms: The Motivations and Roles of Stakeholders in The Transformation from Projects to Platforms. In Proceedings of the Creative Construction e-Conference 2023, Keszthely, Hungary, 20–23 June 2023; Budapest University of Technology and Economics: Keszthely, Hungary, 2023. [Google Scholar]

- Cusumano, M.A.; Yoffie, D.B.; Gawer, A. The Future of Platforms; MIT Sloan Management Review: Cambridge, MA, USA, 2020; pp. 26–34. [Google Scholar]

- De Reuver, M.; Sørensen, C.; Basole, R.C. The digital platform: A research agenda. J. Inf. Technol. 2018, 33, 124–135. [Google Scholar] [CrossRef]

- Van Alstyne, M.; Parker, G. Platform Business: From Resources to Relationships. Platf. Bus. 2017, 9, 25–29. [Google Scholar] [CrossRef]

- Meyer, M.H.; Lehnerd, A.P. The Power of Product Platforms; Simon and Schuster: New York, NY, USA, 1997. [Google Scholar]

- Robertson, D.; Ulrich, K. Planning for product platforms. Sloan Manag. Rev. 1998, 39, 19–31. [Google Scholar]

- Zhu, F.; Furr, N. Products to platforms: Making the leap. Harv. Bus. Rev. 2016, 94, 72–78. [Google Scholar]

- Bonchek, M.; Choudary, S.P. Three elements of a successful platform strategy. Harv. Bus. Rev. 2013, 92. [Google Scholar]

- Van Alstyne, M.W.; Parker, G.G.; Choudary, S.P. Pipelines, platforms, and the new rules of strategy. Harv. Bus. Rev. 2016, 94, 54–62. [Google Scholar]

- Sandberg, J.; Holmström, J.; Lyytinen, K. Digital transformation of ABB through platforms: The emergence of hybrid architecture in process automation. In Digitalization Cases: How Organizations Rethink Their Business for the Digital Age; Springer: Berlin/Heidelberg, Germany, 2019; pp. 273–291. [Google Scholar]

- Lessing, J.; Brege, S. Industrialized Building Companies’ Business Models: Multiple Case Study of Swedish and North American Companies. J. Constr. Eng. Manag. 2017, 144, 05017019. [Google Scholar] [CrossRef]

- Lessing, J.; Brege, S. Business models for product-oriented house-building companies—Experience from two Swedish case studies. Constr. Innov. 2015, 15, 449–472. [Google Scholar] [CrossRef]

- Li, Y.; Das, P.; Kuzmanovska, I.; Lara-Hamilton, E.; Maxwell, D.W.; Moehler, R. Business Model Innovation in the Construction Industry: Emerging Business Model Archetypes from Bathpod Modularization. J. Manag. Eng. 2024, 40, 04023066. [Google Scholar] [CrossRef]

- Bryden Wood (Construction Innovation Hub). Bridging the Gap Between Construction + Manufacturing; Construction Innovation Hub: London, UK, 2018. [Google Scholar]

- Maxwell, D.; Aitchison, M. Design-value in the platform approach. In Proceedings of the 25th Annual Conference of the International Group for Lean Construction, Heraklion, Greece, 9–12 July 2017; pp. 349–356. [Google Scholar]

- Bartlett, K.; Blanco, J.L.; Fitzgerald, B.; Johnson, J.; Mullin, A.L.; Ribeirinho, M.J. Rise of the Platform Era: The Next Chapter in Construction Technology. Available online: https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/rise-of-the-platform-era-the-next-chapter-in-construction-technology (accessed on 5 September 2021).

- Whyte, J.; Mosca, L.; Zhou, S.A. 22. Digital project capabilities and innovation: Insights from the emerging use of platforms in construction. In Handbook on Innovation and Project Management; Edward Elgar Publishing: Cheltenham, UK, 2023; pp. 408–422. [Google Scholar]

- Rupnik, I.; Smith, R.E.; Schmetterer, T. Modularization Precedes Digitalization in Offsite Housing Delivery; Joint Center for Housing Studies of Harvard University: Cambridge, MA, USA, 2022. [Google Scholar]

- Zhou, S. Platforming for industrialized building: A comparative case study of digitally-enabled product platforms. Build. Res. Inf. 2023, 52, 4–18. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Graebner, M.E. Theory building from cases: Opportunities and challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Sarhan, S.; Pretlove, S.; Elghaish, F.; Matarneh, S.; Mossman, A. Sources of occupational stress in UK construction projects: An empirical investigation and agenda for future research. Smart Sustain. Built Environ. 2024. ahead of print. Available online: https://www.emerald.com/insight/content/doi/10.1108/sasbe-11-2023-0356/full/html?casa_token=xgrYOroeKXoAAAAA:TwZbm9m86IEWdxhDUxKFrfKjz1Lk7yzwVKBOb8joaBRjHzyaeZFcWt4YLX9IQNiFPcynQVEb5GjQmGJ5syLiKUVN8WUBrHVwtnu0AEam37AZfjpCtoY (accessed on 13 July 2025). [CrossRef]

- Matarneh, S. Construction Disputes Causes and Resolution Methods: A Case Study from a Developing Country. J. Constr. Dev. Ctries. 2024, 29, 139–161. [Google Scholar] [CrossRef]

- Spens, K.M.; Kovács, G. A content analysis of research approaches in logistics research. Int. J. Phys. Distrib. Logist. Manag. 2006, 36, 374–390. [Google Scholar] [CrossRef]

- Royal Academy of Engineering. Philosophy of Engineering: Volume 1 of the Proceedings of a Series of Seminars Held at the Royal Academy of Engineering; Royal Academy of Engineering: London, UK, 2010. [Google Scholar]

- Venable, J. The role of theory and theorising in design science research. In Proceedings of the 1st International Conference on Design Science in Information Systems and Technology (DESRIST 2006), Claremont, CA, USA, 24–25 February 2006; pp. 1–18. [Google Scholar]

- Miles, M.B.; Huberman, A.M. Qualitative Data Analysis: An Expanded Sourcebook; Sage: Newcastle upon Tyne, UK, 1994. [Google Scholar]

- Okoli, C.; Pawlowski, S.D. The Delphi method as a research tool: An example, design considerations and applications. Inf. Manag. 2004, 42, 15–29. [Google Scholar] [CrossRef]

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods for Business Students, 7th ed.; Pearson Education Limited: London, UK, 2016. [Google Scholar]

- Fichman, R.G.; Dos Santos, B.L.; Zheng, Z. Digital innovation as a fundamental and powerful concept in the information systems curriculum. MIS Q. 2014, 38, 329–354. [Google Scholar] [CrossRef]

- Biswas, S.; Sen, J. A proposed architecture for big data driven supply chain analytics. arXiv 2017, arXiv:1705.04958. [Google Scholar]

- Tokazhanov, G.; Galiyev, O.; Lukyanenko, A.; Nauyryzbay, A.; Ismagulov, R.; Durdyev, S.; Turkyilmaz, A.; Karaca, F. Circularity assessment tool development for construction projects in emerging economies. J. Clean. Prod. 2022, 362, 132293. [Google Scholar] [CrossRef]

- Construction Innovation Hub (UK Research and Innovation). The Product Platform Rulebook, 1.2 ed.; UK Research and Innovation: London, UK, 2023. [Google Scholar]

- Ghafoor, S.; Hosseini, M.R.; Kocaturk, T.; Weiss, M.; Barnett, M. The product-service system approach for housing in a circular economy: An integrative literature review. J. Clean. Prod. 2023, 403, 136845. [Google Scholar] [CrossRef]

- Guerra, B.C.; Shahi, S.; Mollaei, A.; Skaf, N.; Weber, O.; Leite, F.; Haas, C. Circular economy applications in the construction industry: A global scan of trends and opportunities. J. Clean. Prod. 2021, 324, 129125. [Google Scholar] [CrossRef]

- Hijazi, A.A.; Perera, S.; Calheiros, R.N.; Alashwal, A. Rationale for the Integration of BIM and Blockchain for the Construction Supply Chain Data Delivery: A Systematic Literature Review and Validation through Focus Group. J. Constr. Eng. Manag. 2021, 147, 03121005. [Google Scholar] [CrossRef]

- Das, M.; Luo, H.; Cheng, J.C. Securing interim payments in construction projects through a blockchain-based framework. Autom. Constr. 2020, 118, 103284. [Google Scholar] [CrossRef]

- Elghaish, F.; Abrishami, S.; Hosseini, M.R. Integrated project delivery with blockchain: An automated financial system. Autom. Constr. 2020, 114, 103182. [Google Scholar] [CrossRef]

- Hamledari, H.; Fischer, M. Role of blockchain-enabled smart contracts in automating construction progress payments. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2021, 13, 04520038. [Google Scholar] [CrossRef]

- Shivegowda, M.D.; Boonyasopon, P.; Rangappa, S.M.; Siengchin, S. A review on computer-aided design and manufacturing processes in design and architecture. Arch. Comput. Methods Eng. 2022, 29, 3973–3980. [Google Scholar] [CrossRef]

- Molu, M.M.; Goertz, N. A comparison of soft-coded and hard-coded relaying. Trans. Emerg. Telecommun. Technol. 2014, 25, 308–319. [Google Scholar] [CrossRef]

- Alonso, R.; Borras, M.; Koppelaar, R.H.; Lodigiani, A.; Loscos, E.; Yöntem, E. SPHERE: BIM digital twin platform. Multidiscip. Digit. Publ. Inst. Proc. 2019, 20, 9. [Google Scholar]

- Woodhead, R.; Stephenson, P.; Morrey, D. Digital construction: From point solutions to IoT ecosystem. Autom. Constr. 2018, 93, 35–46. [Google Scholar] [CrossRef]

- Soman, R.K.; Whyte, J.K. Codification challenges for data science in construction. J. Constr. Eng. Manag. 2020, 146, 04020072. [Google Scholar] [CrossRef]

- ISO 19650-1:2018; Organization and Digitization of Information About Buildings and Civil Engineering Works, Including Building Information Modelling (BIM)—Information Management Using Building Information Modelling—Part 1: Concepts and Principles. International Organization for Standardization: Geneva, Switzerland, 2018.

- Pishdad-Bozorgi, P.; Gao, X.; Eastman, C.; Self, A.P. Planning and developing facility management-enabled building information model (FM-enabled BIM). Autom. Constr. 2018, 87, 22–38. [Google Scholar] [CrossRef]

| Code | Designation | Experience | Area of Experience | Stakeholder Group |

|---|---|---|---|---|

| S1 | Strategic Development Director | 20+ | Building services-integrated solutions | Specialised Contractor/Designers and Engineers |

| S2 | General Manager | 15+ | Construction management | Developer |

| S3 | Senior Manager | 15+ | Construction Business Development | Developer/Material Processing |

| S4 | Engineering Manager | 15+ | Engineering management of mega projects | Material Processing/Component Manufacturers |

| S5 | Business Development Lead | 20+ | Construction Business Development | Material Processing/Component Manufacturers |

| S6 | Enterprise Transformation Leader | 15+ | Digital Transformation | Material Processing/Component Manufacturers/Specialised Contractor |

| Industry Sector (ANZSIC) | Digital | Physical | Hybrid | Total |

|---|---|---|---|---|

| A—Agriculture, Forestry and Fishing | 6 | 2 | 3 | 11 |

| B—Mining | 7 | 1 | 1 | 9 |

| C—Manufacturing | 4 | 5 | 2 | 11 |

| D—Electricity, Gas, Water and Waste Services | 6 | 2 | 5 | 13 |

| F—Wholesale Trade | 7 | 4 | 1 | 12 |

| G—Retail Trade | 10 | 5 | - | 15 |

| H—Accommodation and Food Services | 4 | 4 | 2 | 10 |

| I—Transport, Postal and Warehousing | 8 | 5 | 1 | 14 |

| J—Information Media and Telecommunications | 13 | 1 | 3 | 17 |

| K—Financial and Insurance Services | 5 | 6 | 5 | 16 |

| L—Rental, Hiring and Real Estate Services | 9 | 3 | 1 | 13 |

| M—Professional, Scientific and Technical Services | 12 | 1 | 1 | 14 |

| N—Administrative and Support Services Public Administration and Safety | 6 | 4 | 4 | 14 |

| P—Education and Training | 13 | 1 | - | 14 |

| Q—Health Care and Social Assistance | 8 | 3 | 2 | 13 |

| R—Arts and Recreation Services | 5 | 2 | 3 | 10 |

| ANZSIC Sector | Platform | Description | Physical Digital/Hybrid |

|---|---|---|---|

| C | MasterControl | Document management system used in pharmaceutical industry that spans regulatory approvals, batch control, quality control and regulatory reporting | D |

| G | MailOrder | Mail order retail pre-dates online retail. Lead company selects a range of product, assembles into a catalogue and makes the catalogue available to a wide range of potential consumers. Consumer mail orders then triggered delivery of the items selected. | P |

| I | Postal Service | Established locations for receipt, processing, logistics & distribution of mail, nationally & interaction globally. | P |

| J | Phone network | Platform of exchanges connected by wires/wirelessly for the transfer of voice calls between one standard phone handset to another. | H |

| K | Insurance Policies | Standard policy contract provides a mechanism upon which both insured and insurer can rely upon occurrence of an event listed within the policy. | H |

| K | SWIFT | Society for Worldwide Interbank Financial Telecommunication, is a Belgian cooperative society providing services related to the execution of financial transactions and payments between banks worldwide. | D |

| L | RentMan | Software solution for the management of equipment used by a hire company using barcoded identifiers. | D |

| Key Finding | What It Means | Implications for Construction |

|---|---|---|

| Most platforms are digital. | Barriers to entry in digital platforms are lower than for physical platforms. | Building is principally a physical activity, so adoption challenges will be higher. |

| Few platforms span both the digital and physical space. | Value capture requires a higher level of innovation when spanning digital and physical spaces. | Higher level of investment in innovation will be required upfront to establish a building platform. |

| Only a small number of platforms span the entire lifecycle and, in such cases, these are typically either within the digital or physical space and not across both spaces. | Sustainability of a platform has a short shelf life relative to product life. | The long life of buildings challenges the demonstrated capability of the platform model to sustain beyond design and construct to end of life. |

| Initiate stage of the lifecycle is typically dominated by a large player in industry. | Leadership is required for the establishment of a platform. | Investors and developers have a lead role in the industry and would be well placed to initiate a platform. |

| Standardisation is widely observed in platforms, underpinning their operation. | Platforms need components like LEGO bricks that fit together effortlessly. | There are many standards in building, which will need to be brought together to enable interlinking with one another. |

| Digital technologies have shifted investment from the platform provider to the providers of products and services. | Exchange relationships, liabilities and responsibilities are changing. | Building has already captured the benefit of shifting responsibilities to subcontractors, so immediate return on establishing a platform will be less. |

| Operate stage is the domain of the platforms studied and has provided considerable opportunity for business model innovation. | Operate stage attracts investment in the platform business model. | Investors and developers seeking to develop platforms would benefit from including facilities managers who operate buildings to capture the operate investment opportunities. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hijazi, A.A.; Das, P.; Moehler, R.C.; Maxwell, D. Platforms for Construction: Definitions, Classifications, and Their Impact on the Construction Value Chain. Buildings 2025, 15, 2482. https://doi.org/10.3390/buildings15142482

Hijazi AA, Das P, Moehler RC, Maxwell D. Platforms for Construction: Definitions, Classifications, and Their Impact on the Construction Value Chain. Buildings. 2025; 15(14):2482. https://doi.org/10.3390/buildings15142482

Chicago/Turabian StyleHijazi, Amer A., Priyadarshini Das, Robert C. Moehler, and Duncan Maxwell. 2025. "Platforms for Construction: Definitions, Classifications, and Their Impact on the Construction Value Chain" Buildings 15, no. 14: 2482. https://doi.org/10.3390/buildings15142482

APA StyleHijazi, A. A., Das, P., Moehler, R. C., & Maxwell, D. (2025). Platforms for Construction: Definitions, Classifications, and Their Impact on the Construction Value Chain. Buildings, 15(14), 2482. https://doi.org/10.3390/buildings15142482