1. Introduction

China’s urbanization process is approaching completion. However, since the government officially discontinued the in-kind allocation of housing in 1998 and implemented housing monetarization reforms to introduce market mechanisms, the housing market has experienced rapid expansion. Nevertheless, this has also led to a surge in housing prices and an increased housing burden on residents. Given the financial and residential characteristics of existing commercial housing, the uncontrollable rise in housing prices and the emergence of a real estate bubble have had significant implications for people’s livelihoods and have augmented the living costs of residents, especially those of the floating population. Although China has implemented policies to curb the rapid increase in housing prices, prices have still exhibited a tendency to rebound sharply. Evidently, relying solely on economic policies to stabilize housing prices proves to be a challenging task. It is essential to provide affordable housing to absorb a substantial amount of demand and relieve pressure on the commercial housing market.

China’s affordable housing system has witnessed substantial transformations since the late 20th century. From 1998 to 2002, policies primarily focused on facilitating the construction of affordable housing for low- and middle-income families, with the completion of affordable housing accounting for over 20% of the total housing volume. From 2003 to 2006, as policies shifted towards encouraging the purchase of commercial housing, the construction of affordable housing temporarily stalled, and the completion ratio of affordable housing declined to 8%. From 2007 to 2010, the security system began to diversify, extending its scope to migrant workers and incorporating new forms of affordable housing, such as public rental housing. From 2011 to 2019, public rental housing and shantytown renovation emerged as policy priorities, accompanied by a significant increase in the proportion of construction land. Particularly after the introduction of the “housing is for living in, not for speculation” policy in 2016, the government emphasized stabilizing housing prices and the housing market through long-term mechanisms, such as the standardization of the housing rental market and the enhancement of the affordable housing system. Commencing from 2020, the emphasis of affordable rental housing construction expanded to encompass young people and new citizens, with a plan to construct 8.7 million affordable rental housing units during the “14th Five-Year Plan” period, catering to approximately 26 million individuals. In the government work report on 5 March 2024, Chinese Premier Li Qiang underscored the strategy of addressing both the symptoms and root causes of real estate risks, with plans to augment the construction and supply of affordable housing and improve the commercial housing system to fulfill residents’ basic and diverse housing requirements. The report proposed stabilizing the market through government credit support and enhanced supervision, such as promoting the construction of protective teaching buildings and establishing corporate whitelists. Additionally, increasing the supply of affordable housing is regarded as a core strategy to tackle the oversupply of commercial housing.

To investigate the role of affordable housing construction within the housing market, this study selected 35 monitoring cities from the “Guiding Opinions” as the research subjects. Based on panel data of 35 cities in China spanning from 2010 to 2023, a fixed-effects model was employed to conduct an in-depth analysis of the impact of affordable housing policies on the real estate market. This paper adopts a fixed-effects model because it can effectively control the heterogeneous characteristics of cities that do not change over time, which is consistent with the idea of capturing the long-term impact of policies through cumulative supply variables in existing studies [

1], and is more in line with the regionally differentiated characteristics of China’s housing policies. The empirical analysis demonstrates that the construction of affordable housing significantly curbs the escalation of housing prices and exerts a positive effect on the volume of the housing market. The GMM estimation and instrumental variable estimation further verify the robustness of our results. By analyzing historical data on housing prices and transaction volumes, this paper uncovers the regulatory impacts of affordable housing policies under different economic and market conditions. Moreover, this paper also discloses the regional heterogeneity of the effects of affordable housing policies, indicating that the construction effects of affordable housing are more prominent in areas under greater housing price pressure. And we further find that the affordable housing has a positive effect on the residential housing transaction area but has no effect on the housing investment. The newly added supply of affordable housing plays an active role in curbing the increase in housing prices and enhancing market transaction volumes during the pandemic.

The contributions of this study are primarily manifested in the following aspects: Firstly, this paper collects and collates the land transfer data earmarked for affordable housing in cities and utilizes panel data to conduct a comprehensive assessment of the short-term impact of affordable housing construction on the real estate market, thereby enriching the research body concerning the impact of affordable housing. Secondly, the endogeneity between the supply of affordable housing and real estate prices has long been a thorny issue. This study endeavors to surmount this problem through multiple methods, such as the Generalized Method of Moments (GMM) and the instrumental variable method, and arrives at relatively robust conclusions. Thirdly, the conclusions of this article further expound on the role of affordable housing supply in market stabilization in the face of external shocks, validating whether affordable housing functions as a stabilizer.

The structure of our paper is as follows:

Section 1 serves as the introduction, in which the research background and objectives are expounded.

Section 2 is dedicated to the literature review, where the cutting-edge research and theoretical underpinnings in related fields are deliberated.

Section 3 focuses on the research design.

Section 4 pertains to the empirical analysis.

Section 5 is centered around the heterogeneity analysis.

Section 6 involves further analysis. The final section presents the conclusions.

2. Literature Review

In the domain of housing security policy, scholars have formulated a relatively comprehensive theoretical framework, dissecting the impact mechanisms and pathways of such policies on the housing market from both the supply and demand perspectives. From the supply aspect, Murray [

2] validated the impact route of housing construction programs on housing supply in light of crowding-out effects. Additionally, it was discovered that the stability of the U.S. housing supply from the 1960s to the 1980s was attributable to the crowding-out of private housing investment by housing security policies. Lee [

3], leveraging panel data of the South Korean real estate industry, established a VAR model and determined that as the homeownership rate ascended, the variation in housing stock diminished and the crowding-out effect became more prominent. These investigations collectively suggest that the construction of affordable housing vies with commercial housing for land, curtailing the supply of commercial housing and precipitating an elevation in housing prices. Zhang and Lian [

4] employed a multiple regression model to scrutinize the factors influencing commercial housing prices, contending that if the government’s construction of affordable housing fails to rigorously segregate the affordable housing market from the commercial housing market, the policy outcomes will be arduous to realize as anticipated. Ren and Zhang [

5] constructed an error correction model of panel data, and the empirical findings demonstrated that land supply exerts a long-term and stable influence on housing supply and housing prices. Constraining land supply would result in a reduction in housing supply and trigger an increase in housing prices.

From the demand perspective, a multitude of studies corroborate the suppressive effect of affordable housing on commercial housing prices. Wang and Zhao [

6] formulated a real estate supply and demand model, and the empirical results indicated an inverse correlation between the construction volume of affordable housing and market housing prices, signifying that an increase in affordable housing can depress commercial housing prices. Gao [

7] further dissected the internal mechanism by which affordable housing construction impacts commercial housing prices and posited that affordable housing diverts the demand for commercial housing. Wang and Gao [

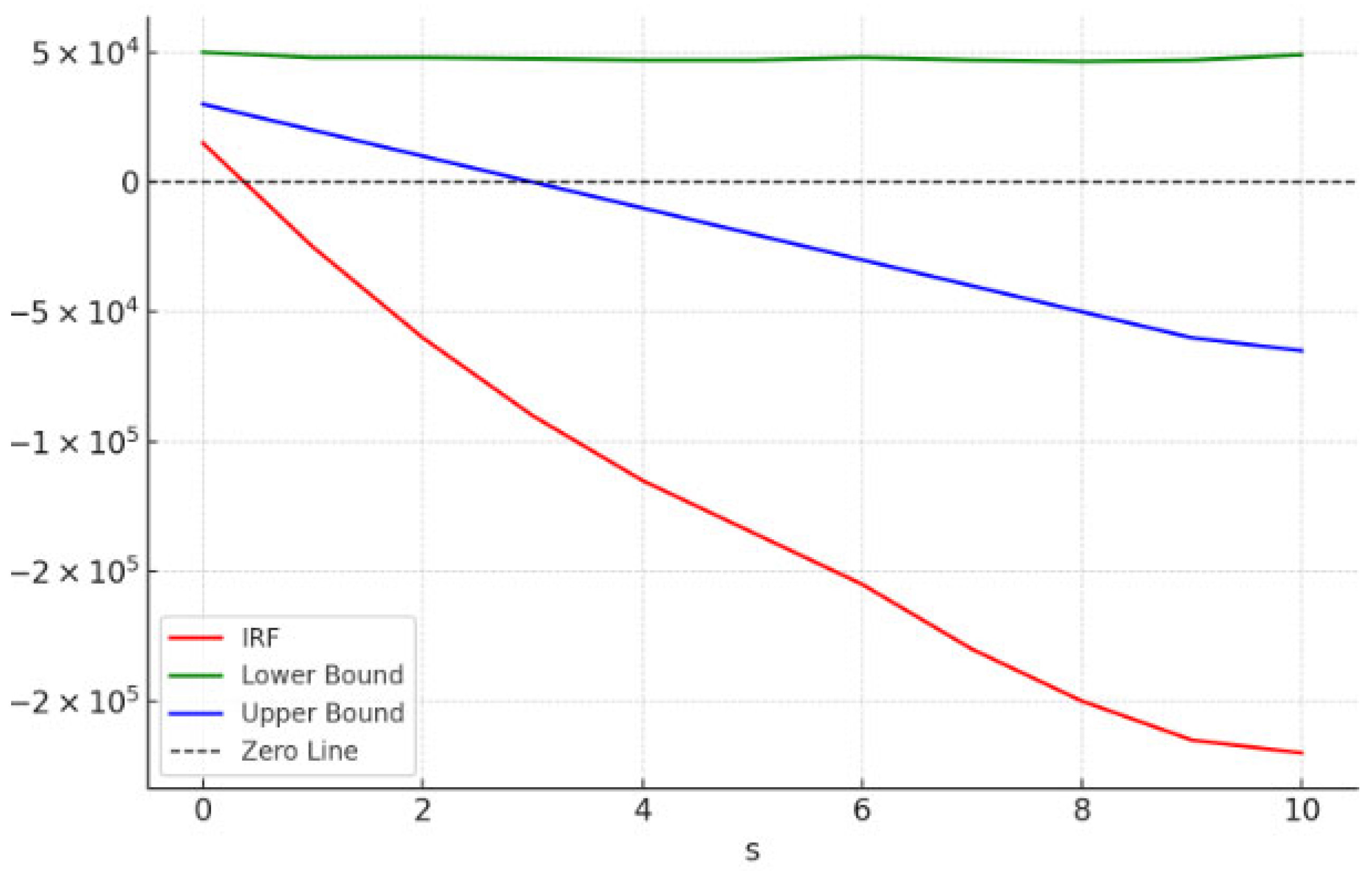

8] constructed an SVAR model, and upon empirical testing, concluded that the construction of affordable housing has a significant dampening effect on the escalation of commercial housing prices. Ma and Tian [

9] discovered that the construction of affordable housing assimilates a portion of the latent demand in the commercial housing market, thereby exerting a role in reducing the overall level of housing prices. Jin [

10] empirically analyzed the influence of affordable housing on the commercial housing market and ascertained that affordable housing, to a certain extent, curbs the rise of housing prices while fulfilling the housing requirements of low-income families. Existing research concerning the impact of affordable housing on commercial housing predominantly employs vector autoregression (VAR) models and other time series methodologies to dissect the influence of affordable housing on the commercial housing market. These studies, by establishing dynamic relationships among housing market variables, deeply probe into the long-term impact of affordable housing pricing on commercial housing prices. The merit of utilizing the VAR model resides in its capacity to disclose the intricate interrelationships between variables, rendering it particularly well-suited for capturing the dynamic traits of time series.

With the continuous progression of research, the analysis of the impact of affordable housing construction on the housing market necessitates the consideration of not only the effects on the supply and demand fronts but also certain external shocks and regional disparities to ensure the stability of the housing market and address the real estate crisis. Qian et al. [

11] demonstrated in their research within the Chinese context that the epidemic led to a substantial decline in housing prices in severely affected regions. As time elapsed and effective epidemic prevention and control measures were implemented, housing prices gradually rebounded and stabilized. The study accentuated the immediate adverse impact of the epidemic on housing prices in high-infection areas, yet the long-term influence was relatively feeble. Akbari et al. [

12] investigated the correlation between housing and mental health during the epidemic and noted that affordable housing played a significant cushioning role during periods of economic instability. Evidently, in the face of external shocks, such a policy can, to a certain extent, uphold market stability.

In order to quantify the impact of secure housing on residents, this is usually done by calculating various types of housing affordability indicators. Brooks’ study [

13] found that different measurement methods (e.g., residual income method vs. expenditure ratio method) significantly affect the results of housing affordability assessment, especially on racial disparity assessment. Based on panel data analysis, Arnerić et al. [

14] revealed that rising housing costs and inadequate supply are the main causes of the housing affordability crisis in EU countries and called for more comprehensive affordability indicators. A study [

15] applied Engel’s law to analyze the housing affordability of the urban poor and found that housing policies in India still do not meet the actual income structure. Affordable housing reflects the importance of the ability to pay for housing costs and is essentially a market-based concept. The fundamental dilemma faced by the urban poor in India is that some households cannot afford adequate housing at any stage. Low-income households need to spend a larger share of their income on basic needs and do not have the disposable income to pay for affordable housing. Additionally, the affordable housing provided by the Government of India through its prestigious flagship program, the Prime Minister’s Housing Yojana (PMAY), falls far short of market realities.

The issue of supply of affordable housing has become a major concern for policy makers and urban planners, and it is critical to identify suitable locations for affordable housing in order to minimize competition for land. Suitable locations for affordable housing will increase housing satisfaction among low-income residents by increasing their social and economic well-being, providing better access to opportunities and services, and reducing the concentration of poverty. Afshan et al. [

16] identify factors affecting the spatial location of affordable housing through an exploratory study of relevant literature covering different geographic contexts, socioeconomic conditions, and levels of technological and economic advances of affordable housing spaces. A total of 61 parameters involving six categories of neighborhood characteristics, urban characteristics, social factors, economic parameters, demographic factors, and housing quality were identified and, the choice of location for government development of affordable housing is spatially heterogeneous in cities. In developing countries, parameters, such as socioeconomic criteria, accessibility to various facilities, and employment opportunities, are of greater significance. In some developed countries, however, factors, such as security, environmental considerations, and type of housing, are emphasized over accessibility. Governments in different regions need to take into account local circumstances in their decision-making. In terms of regional differences, Ren and Zhang [

5] discovered through panel data analysis of 35 large and medium-sized cities in China that land supply significantly impacts the newly-built commercial housing market, with policy effects varying across regions. In economically developed regions, the supply of affordable housing was inversely related to housing prices, while different outcomes might emerge in other areas. This implies that policies need to account for the distinctions among cities during formulation and be optimized in accordance with the actual circumstances to enhance policy effectiveness. Aggregating global examples (e.g., Singapore, Vienna) for case studies, it is found that affordable housing can promote inclusive growth and improve employment and community participation. The article also analyzes the economic impacts of affordable housing, such as labor stability, economic mobility, and challenges, such as finance, policy barriers, and community resistance. The centrality of affordable housing in the global socioeconomic landscape is emphasized [

17].

Overall, in the extant research concerning the impact of affordable housing on commercial housing, the prices and sales of affordable housing are typically employed as explanatory variables, and time series analyses are carried out using models, such as vector autoregression. Nevertheless, this approach frequently presupposes the homogeneity between affordable housing and commercial housing, thereby overlooking the heterogeneity that exists between the two. Existing studies mostly use time series models, but the regional heterogeneity and policy dynamics of China’s housing market require a more accurate panel data approach. This paper breaks through the traditional model’s assumption of market homogeneity by combining cumulative supply variables with fixed effects [

1].

To dissect the short-term impact of affordable housing supply on the real estate market, this paper opts to employ a fixed-effects model to scrutinize the influence of affordable housing policies on the commercial housing market. The fixed-effects model is capable of effectively nullifying the impact of inherent differences in city characteristics that remain invariant over time by controlling for city-specific attributes, thereby guaranteeing the precision and robustness of the research outcomes. In the robustness test, this paper also resorted to the VAR model for estimation, which did not modify the fundamental conclusions of the paper. Furthermore, this paper designates the cumulative supply of affordable housing in cities as the core variable, analyzing the impact of affordable housing on the commercial housing market from the vantage point of policy influence rather than market homogeneity, with the aim of furnishing more accurate and representative empirical evidence for future policy formulation.

5. Heterogeneity Analysis

This paper categorizes the 35 sample cities into three groups based on their geographical location and level of economic development for heterogeneous analysis: Eastern (including Beijing, Shanghai, Guangzhou, Shenzhen, Tianjin, Hangzhou, Nanjing, Qingdao, Jinan, Dalian, Xiamen, Fuzhou, Ningbo, and Suzhou, totaling 18 cities), Central (including Zhengzhou, Wuhan, Changsha, Harbin, Hefei, Changchun, Taiyuan, and Nanchang, totaling 9 cities), and Western (including Chongqing, Chengdu, Xi’an, Kunming, Guiyang, Nanning, Urumqi, and Shenyang, totaling 8 cities). This grouping method helps to delve into the differential impact of affordable housing policies across different regions.

Table 7 presents the results of the regression for the three groups.

The regression outcomes demonstrate that in the eastern region, the coefficient is significantly negative at the 5% significance level, signifying a substantial negative correlation between the supply of affordable housing and the prices of commercial housing in the eastern area. This might be attributed to the highly sophisticated real estate market in the eastern region, where affordable housing policies exert a significant restraining influence on the housing demand side. Given the relatively tight housing supply and demand situation in the eastern region, the augmentation of affordable housing supply effectively mitigates the upward pressure on housing prices.

Conversely, the regression results for the central region reveal that the coefficient is significantly positive at the 1% significance level, and although the coefficient for the western region is also positive, it is not statistically significant. This implies that in the central and western regions, the supply of affordable housing may have a stimulative effect on the prices of commercial housing. Such a disparity may arise from the intricacy of the supply and demand relationship in the affordable housing market of the central and western regions. The pressure on housing prices in the central and western regions is relatively lower compared to that in the eastern region, and the housing demand is also relatively smaller. The impact of affordable housing construction on aspects ,such as land competition, might be more pronounced than its diversion effect on the demand for commercial housing, resulting in an overall increase in the prices of commercial housing. Moreover, the development of the real estate market in the western region is restricted by infrastructure and external investment factors, rendering the short-term impact of affordable housing construction on commercial housing prices insignificant.

The regional heterogeneity analysis in

Table 7 reveals a stark divergence in policy effects. In eastern China, where housing demand is most intense, the cumulative supply of affordable housing significantly suppresses commercial housing prices. In contrast, central and western regions exhibit positive coefficients, suggesting that land use competition dominates in these areas with lower market pressures. This aligns with the theoretical framework that policy impacts vary with local demand elasticity and land allocation dynamics.

To further explore the impact of affordable housing construction on housing prices in regions with different economic levels, this study divides the 35 cities into three groups based on average housing prices: high housing price group (average housing price higher than the third quartile), medium housing price group (average housing price between the first and third quartiles), and low housing price group (average housing price lower than the first quartile). This grouping explicitly captures the market pressure gradient, where high-price cities represent areas with acute demand-supply imbalances, while low-price cities reflect relatively stable markets. The regression results in

Table 8 demonstrate that the price-suppressing effect of affordable housing is most pronounced in medium-price cities, whereas low-price cities exhibit a counterintuitive positive correlation, likely driven by land use competition [

3] in underdeveloped markets. The regression results are shown in

Table 8, corresponding to columns (1) to (3).

The regression results manifest that within the high housing price group; the augmentation of affordable housing construction does not exert a significant influence on housing prices (with a coefficient of −0.0004 and a standard error of 0.0007). This suggests that in cities characterized by relatively higher housing prices, the direct impact of affordable housing construction on restraining housing price escalation is not pronounced. For cities falling within the medium housing price group, the cumulative supply of affordable housing has a significant effect on housing prices at the 10% significance level (with a coefficient of −0.0005 and a standard error of 0.0002), signifying that affordable housing construction effectively curbs the excessive growth of housing prices in such cities. Nevertheless, in the low housing price group, there exists a positive correlation between affordable housing construction and housing price growth (with a coefficient of 0.0002 and a standard error of 0.0003), implying that in cities with lower housing prices, increasing the supply of affordable housing might indirectly drive up housing prices via factors, such as intensified competition for land use. This is analogous to the regression results obtained for the western region, indicating that in areas where the housing market is less developed, affordable housing policies may need to place greater emphasis on local market demand and development circumstances.

7. Conclusions

This paper undertakes an in-depth empirical examination to investigate the role of affordable housing construction within the housing market, with a particular focus on its efficacy in curbing housing price escalation, stimulating residential sales, and mitigating the impact of the COVID-19 pandemic. The research findings reveal that affordable housing construction has yielded positive outcomes in multiple dimensions. Firstly, the cumulative supply of affordable housing exerts a significant dampening effect on the growth of housing prices while concurrently facilitating an augmentation in residential sales. This implies that affordable housing policies, by siphoning off demand from the commercial housing sector, also enhance residents’ purchasing confidence, thereby effectively alleviating risks inherent in the real estate market. Secondly, the study demonstrates that the impacts of affordable housing construction are regionally heterogeneous, with more pronounced effects observed in regions experiencing greater housing price pressures. Finally, the pandemic’s influence on the housing market is manifested by a substantial suppression of transaction volumes. However, affordable housing policies have exhibited a conspicuous buffering effect during the pandemic, curtailing market volatility, suppressing housing prices, and promoting residential sales.

Based on the aforementioned conclusions, this paper proffers the following policy prescriptions. Firstly, continuous endeavors should be made to augment the construction of affordable housing, especially in areas subject to more intense housing price pressures, so as to further capitalize on the market-stabilizing function of affordable housing. Local governments ought to enhance the supply of affordable housing in economically developed regions to more efficaciously divert demand from commercial housing and relieve housing price strains. Secondly, policy formulation should take into account the implications of extraordinary events, such as pandemics and other public health emergencies. It is recommended that the government intensify its support for affordable housing construction during significant events to temper market oscillations and safeguard the stability of the housing market. Additionally, to augment the efficacy of affordable housing policies, the spatial distribution of affordable housing should be optimized to ensure that affordable housing projects can effectively redirect housing demands across different strata, especially those of low-income and young cohorts. At the same time, policymakers should also set the proportion of subsidized housing allocation in the future, taking into account the size of the city in a hierarchical manner. with the aim of further alleviating the backlog in the housing market and diminishing real estate-related risks.