Abstract

Due to the fact that risks can cause project delays and increase project implementation costs, successful construction project completion requires effective and holistic risk management. Identification and evaluation of critical risk factors (CRFs) associated with different types of projects are the most significant components of accurate risk management. This study aims to identify and evaluate the CRFs inherent with private–public partnership (PPP) projects specifically for the development of water and wastewater infrastructure (WWI) facilities in the developing country of Iran. In this line, a comprehensive literature analysis was undertaken to extract the CRFs in applying PPP projects for the development of infrastructure projects in developing countries in general. Then, four rounds of a Delphi survey were conducted to consolidate the major risks to the circumstances of Iran and WWI facilities. There were a total of 35 risks that were grouped into six categories. The main risks were then analyzed and ranked using the Measurement Alternatives and Ranking according to the Compromise Solution (MARCOS) technique. The overall ranking results of the various CRFs revealed that “lack of trust in government’s economic programs” risk was ranked first in terms of importance, followed by the risk of “delay in timely fund payment for project financing and credits,” and the risk of “delay in finalizing bank negotiations.” The overall ranking of the risks placed “economic changes, such as inflation, increase or decrease in prices, and exchange rate” risk in the bottom position. According to the risk ranking findings based on the opinions of private experts, “lack of commitment to the project schedule” was placed first. Conversely, experts from the public sector considered “choosing the wrong financing method” to be the most CRF. It is anticipated that the key research findings and effective recommendations of this study will considerably contribute to the smooth development and remarkable improvement of risk management in applying PPP for WWI facilities in developing countries while enhancing different stakeholders’ understanding of the CRFs for PPP projects, particularly towards WWI services in Iran.

1. Introduction

Today, risk and its related trends have found their place in various fields including investment; trade; insurance; safety; health and treatment; industrial and construction projects; and even political, social, and military issues. In the meantime, risk management has a special place and a common root with the project. Features such as the project uniqueness; relative reliability in the assumptions; the project goals and requirements; uncertainty in the estimations, design, supply, and procurement of the main equipment of the project; the effect of environmental factors on the project; the relationship between the members and the goals of the project; and expecting to achieve the desired product at the end of the project process are the sources of risk in the project. Hence, there is an inevitable need for strategic management planning to check project uncertainties and risks [1].

Risk management is a logical and systematic method to analyze, evaluate, and deal with risk related to any type of activity, enabling organizations to minimize losses while taking advantage of opportunities. The greatest benefit of risk management for a company is the general reduction in the occurrence of avoidable accidents and related costs, subsequently contributing to the continuity of business activity. Risk management leads to more informed decision making, coherent planning, and efficient use of resources. The complexity of the environment, the intensity of competition, the spread of novel and advanced technologies, the development of information and communication technology, new ways of supplying goods and services, environmental issues, etc., are among the main factors leading to numerous and even unforeseen risks for organizations and economic enterprises during their lifetime [2].

Due to the limited financial and budgetary resources, governments often face many problems besetting with financing large-scale construction projects and infrastructure services. The demand for investment in large and infrastructural projects has prompted countries to use a method called public–private partnership (PPP) alongside the public sector [1].

PPPs have been widely used in developing countries to carry out numerous projects in the energy, water and wastewater, telecommunication, airport, railway, and port sectors. In recent years, there has been a strong need for infrastructure in many countries due to increasing population growth and economic development [1]. Hence, governments are trying to find a new solution for these shortcomings by employing and activating the private sector in infrastructure projects [3].

Ke et al. [4] investigated the preferred risk allocation in China’s public–private partnership projects using the Delphi technique. The results indicated that the public sector was solely responsible for the risk (style of ownership and localization), and government officials were responsible for the majority of the next identified risks, which required their actions. In addition, 14 risks that the public and private sectors can deal with should be equally shared between the two parties. The private sector is responsible for 10 risks at the project level, according to which executive solutions should be proposed to overcome the identified risks. Chan et al. [5] investigated potential obstacles to the successful implementation of PPPs in Beijing and Hong Kong and prioritized 13 potential barriers to participation, extracted from the research literature. According to the research findings, lengthy delays in negotiation, lack of experience and appropriate skills, and lengthy delays because of the political debate were the top three obstacles rated by the Beijing respondents. Likewise, the first and third obstacles were also ranked within the top three by the Hong Kong respondents, while the factor of “very few schemes have reached the contract stage (aborted before the contract)” ranked as the second barrier to the partnership in Hong Kong.

Liu et al. [6] evaluated the critical factors affecting the effectiveness and efficiency of tendering processes in PPPs in Australia and China. The research identified 14 critical factors underpinning the implementation of PPP tendering under seven dimensions: robustness of business case development, quality of project brief, public sector capacity, governance structures, the effectiveness of communication, the balance between streamlining and competition, and level of transparency of tendering processes. The results of the comparative analysis of these factors in the two mentioned countries showed significant statistical differences regarding the importance of these factors among their PPP projects. It was emphasized that both public and private entities engaging in PPP projects would be in a better position to structure and manage the tendering processes by adopting the recommended strategies. Noorzai et al. [3] focused on selecting an appropriate PPP financing method to finance railroad projects in Iran. Sadeghi Shahedani et al. [7] investigated the priority development of PPPs in the transport sector of Iran. Najafi and Malekan [8] examined a strategy to finance new infrastructure PPP projects. Heibati et al. [9] studied the relationship between economic freedom and PPPs and provided a model for Iran. Maki-Abadi et al. [10] sought to identify and assess critical risk factors (CRFs) in HSR projects through PPPs in developing countries. Meanwhile, the precise identification of risks can significantly influence the management of risks within a project. The presence of risks within PPP contracts can lead to unfavorable outcomes and serve as a deterrent for contractors. In the context of developing countries, the reluctance to involve the private sector in the construction of water and sewage industry infrastructure can be attributed to the presence of several risks and uncertainties associated with such investment endeavors. Hence, the identification and examination of these risks and uncertainties, along with efforts to address them, can serve as a foundation for increased involvement of the private sector and the effective execution of PPP initiatives. Furthermore, the identification and thorough assessment of the risks involved can be regarded as a crucial first phase in the appropriate allocation of these risks between the private and public sectors. Consequently, this process will exert a substantial influence on the success and advancement of the objectives associated with these projects.

Prior research has not conducted a thorough examination of the risk assessment associated with PPPs in the water and wastewater sector. Hence, in order to address the existing research gaps, the primary objective of this work was to establish a robust methodology for the identification and assessment of risks associated with PPP initiatives in the context of water and wastewater infrastructure (WWI) development in Iran as a developing country. This study aimed to address two primary research questions: (1) What are the significant risks that pose a threat to PPP WWI facilities in the developing country of Iran? and (2) To what extent each of the identified risks can be considered a critical risk within the PPPs in Iran’s WWI facilities? This can include a wide range of water and sewage projects that can be implemented with the PPP models, including water supply and water transfer projects, dam construction projects, and the construction of sewage treatment plants, etc. The presence of risks within PPP contracts might potentially lead to unfavorable outcomes and serve as a deterrent for contractors. So far, there has been a dearth of comprehensive studies examining the multifaceted risks associated with PPP initiatives in the realm of WWI development in Iran. In this study, comprehensive consideration has been given to the risks associated with infrastructure projects in Iran and other developing countries. These risks encompass various aspects such as cost, time, and quality. It is imperative to identify and address these risks in a localized and regional context. Hence, the identification and assessment of significant and influential risks, as well as their suitable allocation between the private and public sectors, will exert a substantial influence on the prosperity and advancement of project objectives.

2. Literature Review

The widespread demand and lack of capital for water infrastructure have led to the rapid growth of PPPs in the water sector. However, the current trend in this market shows that many foreign companies have either reduced their activity or are withdrawing from the market [11]. These conditions can be associated with specific risks in investing in water and wastewater infrastructure (WWI), including the current low level of water prices and the difficulty of (market) regulation. Thus, accurate identification of the risks of PPP projects in WWI is necessary along with appropriate solutions to deal with such risks [12,13,14,15].

Several studies have identified and investigated obstacles and risks related to WWI in developing countries [16,17]. According to these studies, various risks threaten the development of WWI, including failure to provide sufficient funds on time, failure to provide and pay the contractors and manpower claims on time, failure of the employer to obtain necessary permits, uncertainty, and purchase of the project site by the employer. Some studies also show that managerial, financial, legal, and political risks are the most CRFs of water projects in developing countries, including Iran [18]. As can be seen, financial problems and issues are at the top of the risks related to the development of WWI in developing countries. PPP contracts can be a suitable solution to deal with this issue [14]. However, it is noteworthy that the use of such contracts should be accompanied by the necessary awareness of uncertainties, enabling the parties to the contract to participate in the development of infrastructure with greater certainty of success in the realization of their goals [14,18].

Risk results from the interaction of project goals, i.e., time, cost, quality, performance, the scope of work, and uncertainty, which can lead to threats or opportunities. The independent analysis of risk allocation in the water and wastewater sector has value and information content. Project risk management includes six steps: 1. risk management planning, 2. risk identification, 3. qualitative assessment, 4. evaluation, 5. risk response planning, and 6. risk monitoring and control [2].

Priya and Jesintha [19] discussed the public–private partnership among the domestic and foreign players and found that using both groups in these projects would lead to progress in India. Kayaga (2008) emphasized that local conditions in PPP water projects are often not carefully examined, due to which the project structure cannon comply with the prevailing constraints. As a result, many PPP water projects in developing countries are not carried out properly, face conflicts, or get involved in disputes that affect their performance negatively.

Ameyaw and Chan [20] introduced 40 risk factors in PPP water projects in developing countries and highlighted CRFs in this field after examining six cases from these countries. These factors included weak regulations, financial weakness, non-payment of claims, lack of experience in research related to risk identification, and limited evaluation of PPP contracts according to the environmental conditions of developing countries. Wibowo and Mohamed [21] investigated risk factors in PPP water projects in Indonesia and identified 39 risk factors, some of the most important of which included uncertainty of pricing (tariff), breach of contract by the government, lack of raw water, and high costs of infrastructure construction.

Ezeldin and Badran [22] identified 59 CRFs affecting PPP water projects through a literature review and interviews with experts and divided them into several CRFs groups. The risk factors were investigated by distributing a questionnaire among 25 experts who worked internationally and were active in the Egyptian market. They introduced risk factors such as financial and macroeconomic, commercial, legal, political, government supervision, government maturity, and technical and unforeseen risks as most CRFs groups.

In Ghana, Ameyaw and Chan [23] identified 40 risk factors in PPP water projects and introduced 22 risk factors in the form of three financial/commercial, social/political, and technical/technical groups as CRFs. In this investigation, the financial/commercial group had the highest level of total risk, followed by the social/political and technical/technical groups in the second and third ranks, respectively.

Yin et al. [24] examined PPPs in water projects in China and introduced nine risk groups, namely, construction, cooperation relationship, operational, policy, environment, political, design, macroeconomic, and financing risk factors. According to the results, financial risks were found to be the most critical group of risks in PPPs for water projects in China.

Issa et al. [25] focused on a risk allocation model for construction projects in Yemen and concluded that construction projects in Yemen always experience high levels of risk due to their complex and dynamic environments. The model was developed considering 54 risks in 10 groups. They stated that the 30 identified CRFs must be allocated to the owner or contractor, or shared between them. The results showed that this model is easy to understand and use by contract parties. The model also helps decision-makers make appropriate decisions regarding the selection among different projects based on risk factors in the bidding and price proposal stages. The risk allocation model enables risk management.

Liu et al. [6] obtained 14 critical factors in the implementation of PPP water projects according to a literature review, interviews with experts, and the distribution of questionnaires. Rezaei Noor and Mousavi [18] dealt with risk ranking in PPPs of water supply projects using failure mode and effect analysis (FMEA) and fuzzy synthetic evaluation methods in Qom province. First, 39 risk factors were introduced according to the literature and national and international research. The risk priority values were then obtained using the failure mode and effect analysis (FMEA) method. After normalization, 22 factors were recognized as CRFs and classified into four managerial, legal/political, financial, and technical subgroups. According to the examination and calculation of the overall level of risk in each subgroup using the fuzzy synthetic evaluation method, the managerial subgroup was the most critical subgroup, followed by the financial, legal/political, and technical subgroups in the next priorities. The total risk of PPPs for water projects in Qom province was 6.19, indicating high levels of risk for the mentioned projects. Rasouli et al. [1] identified, ranked, and allocated CRFs of public–private partnership stages using the Delphi technique in the framework of a resistance economy in WWI Gilan province. Their article identified, evaluated, and allocated CRFs of WWI projects in Gilan province in different stages and within each stage. The study used Build–Operate–Transfer (BOT) to extract CRFs from executive agents with direct responsibility for contracts concluded using the method of construction. A total of 37 samples were identified for the study. Then, using the Delphi technique, 17 risks with a significant degree of ≥3 were extracted and distributed among the samples through a questionnaire. Nonparametric statistical methods were used to analyze data collected in each stage of the public–private partnership (feasibility assessment, procurement, construction, operation, and transfer). The results showed a significant relationship between the risks with a significant degree of > 3 in different stages of public–private partnership in WWI of Gilan province. Also, this relationship was significant for each risk in each stage, except for one case.

The analysis of the identified factors in this research showed the significant contribution of different levels of risk awareness and the involvement of senior management in reducing and avoiding the identified risks. As revealed by the literature review, failure to address the risks of evaluation based on accurate approaches is an important research gap in the studies of public–private partnership projects. Therefore, the current study discusses new approaches in this field. Most of the reviewed studies used the Delphi technique, interviews, and literature review as their methodology. All these studies show that while the importance of risks identified in PPP projects varies among countries, the parties to the contract face relatively similar risks in implementing such projects in most developing countries. Therefore, a comprehensive investigation in this field can be a positive step toward the effective identification of the risks of these projects.

3. Research Methodology

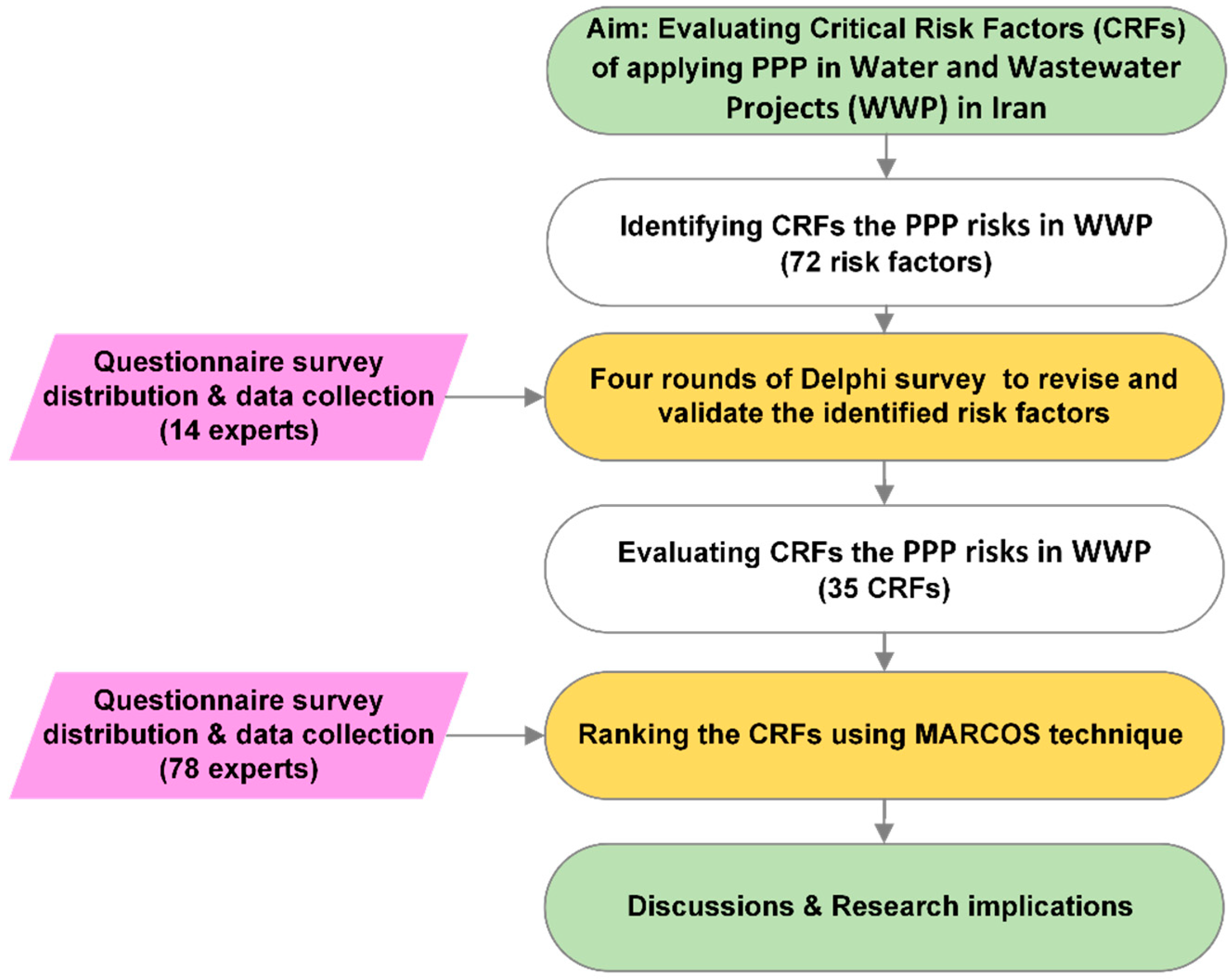

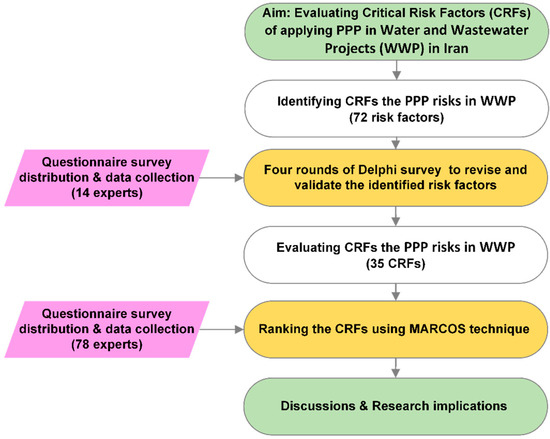

The decision problem algorithm was designed based on the identification and prioritization of risks of public–private partnership projects and included three main parts. The first part was allocated to the identification of PPP risks through a literature review, including scientific articles, internet sources, books, and documents in construction companies. Then, a questionnaire was designed to ask the experts to value the risks and determine the importance of each. Risk screening was then carried out considering the mean of the total values and selecting the risks whose importance was higher than the obtained mean. The second part focused on evaluating each risk in public–private partnership projects. The questionnaire was designed and distributed in this section, while data analysis was conducted using the MARCOS method. The current study belongs to survey research. The statistical population of the study consisted of employers, consultants, executives, specialists, and experts active in WWi PPP projects all over Iran who had adequate knowledge, expertise, and experience in risk management. Figure 1 shows the approach used in this research.

Figure 1.

The research framework of the study.

3.1. Research Tools

In this study, a research questionnaire covering the risks of PPP for WWI in Iran was prepared. A total of 14 experts were asked to give their opinions on whether any identified factors could be considered risks of PPP projects in Iran’s WWI. The experts provided their opinions on a five-point Likert scale (very much, much, to some extent, little, very little) to identify the risks. It is noteworthy that only items with an importance of ≥3.4 were selected after determining the significance of all items on a scale of one to five. This value is one of the criteria put forward by Fink et al. [26] to determine the consensus among participants regarding the inclusion or exclusion of specific elements in the Delphi method. According to Fink’s perspective, the researchers have incorporated the threshold value of 3.4 to enhance the precision of screening the identified risks. In the fourth round, all the experts concluded that all the questions and categories in the questionnaire were appropriate, and a mean opinion of > 3.4 was obtained for all the questions. Therefore, the Delphi process was stopped. The researcher-made questionnaire was prepared considering the theoretical foundations along with national and international studies to identify the risks of PPP projects in WWI in Iran. The four Delphi rounds led to 7 groups (political, operational, financial, investment, environmental, economic, and managerial) and 35 risks.

The findings indicated that out of 72 risks identified in Iran’s water and wastewater PPP projects through the literature review, 35 risks were critical, as represented in Table 1. The main basis for the risks identified was a comprehensive literature study pertaining to the research topic. In this context, an attempt was made to comprehensively identify all the risks connected with PPP initiatives, irrespective of their recurrence and frequency in prior research studies. Through this view, it was feasible to ascertain a comprehensive inventory of associated risks. To integrate and clarify the identified risks, risks that had similar substance and meaning were consolidated to prevent duplication and misunderstanding. Moreover, the identified risks were screened over the course of four Delphi rounds, wherein experts possessing relevant educational and professional backgrounds in PPP initiatives within the WWI sector were actively involved. Based on the Delphi survey rounds, a total of 35 dangers of significant importance were detected. The utilization of the Delphi technique for screening purposes facilitated the initial stage of risk identification in the specific context of Iran. The categorization of risks was conducted based on the classification established in prior research and afterward validated by experts through the Delphi method.

Table 1.

Identified CRFs with high importance.

The primary objective of the literature evaluation was to assess the potential risks associated with public and private partnership ventures during the First World War. The subsequent phase involved the development of a questionnaire that was formulated in accordance with the fundamental concepts of the assessments. The original questionnaire comprises a total of 72 items and was developed for the utilization of the Delphi method. Subsequently, the initial questionnaire was distributed to a panel of 14 experts [45,46]. The present study employed a purposive sampling technique to pick survey participants, an approach that has been utilized by previous scholars in comparable research domains [33]. In this context, a group of 14 individuals with extensive experience and expertise in the water and sewage business in Iran were carefully chosen from among relevant professionals. The number of respondents who participated in all four rounds of the Delphi survey remained consistent, with a total of 14 experts completing the questionnaires. The aforementioned 14 experts remained consistent throughout the Delphi procedure, and the identical fourteen-person team completed the questionnaires in all four rounds of the Delphi method. Following the establishment of a consensus, Kendall’s coordination coefficient, as proposed by Siegel and Castellan [47], was employed as a prevalent statistical approach to assess the degree of agreement among the participants. The scale’s value ranges from zero to one, denoting the level of consensus. A number greater than 0.9 signifies a very strong agreement, while a value of 0.1 indicates a very weak consensus [14]. According to Schmidt [48], even panels with more than 10 members regard modest values of W as meaningful. Furthermore, the final questionnaire underwent evaluation and received validation in relation to its reliability and validity. The questionnaire underwent a process of revision based on the input and insights of experts. Subsequently, the updated questionnaire was distributed to the experts for their evaluation, resulting in the development of a thirty-five-item questionnaire.

3.2. Sample Size

A preliminary study including 30 questionnaires was conducted to determine the sample size required for the current research because of the unlimited size of the statistical population. Equation (1) was used to determine the sample size in an unlimited statistical population [49], indicating a sample size of 78 appropriate for the study. Therefore, 78 questionnaires were distributed, of which 71 were returned, leading to a return rate of 91.03%.

The standard error value (d), variance of the original sample (S2), and acceptable confidence level (Zα/2) were 0.05, 0.051, and 1.96, respectively.

Sampling was conducted using the snowball sampling method, in which the research participants guide the researcher to other people who can help with the research topic. The Delphi method involves the involvement of individuals possessing knowledge and expertise in the research subject. Consequently, in accordance with the research subject’s definition, the necessary expertise and composition of the Delphi panel are determined through non-probability sampling, employing a combination of targeted methods such as judgment and chain. According to the available information, an initial selection process resulted in the nomination of six experts who were deemed acceptable for inclusion in this research study. The experts in question were affiliated with the academic staff, specializing in construction and civil engineering, construction management engineering trends, water and sewage, and occasionally other relevant areas. Subsequently, through these experts, the remaining individuals comprising the panel were introduced, each possessing a university education, pertinent professional background, and requisite expertise in PPPs within the domain of WWI initiatives. In addition, the selection of the Delphi panel members was non-probabilistic, and all individuals picked possessed expertise in the subject matter pertaining to risk management in Iran’s water and sewage projects within the context of PPPs. Hence, given the panel members’ expertise and familiarity with the research topic, additional training was deemed unnecessary, except for a briefing on the questionnaire’s content and instructions for responding to the questions.

3.3. MARCOS Technique

The Measurement Alternatives and Ranking according to the Compromise Solution (MARCOS) technique can be defined as a novel multi-attribute decision making (MADM) method with various applications. This methodology, akin to other approaches within its category, such as TOPSIS, evaluates and prioritizes alternatives by constructing a decision matrix. In circumstances where decision-makers encounter challenges in articulating the benefits of a particular issue, this approach can serve as a highly efficacious instrument for decision making. There are various applications that can be identified, including selecting a suitable location for project development, selecting a reliable supplier, determining the business strategies of a company, and evaluating potential investment projects, among others. This method is developed on the basis of ideal and anti-ideal solutions. Afterward, the utility of the alternatives is measured, followed by the calculation of various utility functions based on the value of the alternative utilities to ultimately find the alternative weightings and their ranking. The methodology is applied to this study through the following steps [50]:

Step 1: Formation of the initial decision matrix: Multicriteria models include a set of n criteria and m alternatives. In the case of group decision making, a group of experts (r) should be formed to evaluate alternatives based on criteria. In the case of group decision making, the expert evaluation matrices are integrated into an initial group decision-making matrix.

Step 2: Formation of an extended initial decision matrix: In this step, the initial matrix is expanded by defining the ideal (AI) and anti-ideal (AAI) solutions.

The anti-ideal solution (AAI) is the worst alternative, while the ideal solution (AI) is the alternative with the best feature. Depending on the nature of the criteria, AAI and AI are defined using Equations (3) and (4):

where B and C represent a group of benefit and cost criteria, respectively.

Step 3. Normalization of the extended initial matrix (X): The elements of the normalized matrix are obtained using Equations (5) and (6):

where xij and xai represent the elements of matrix X.

Step 4. Determining weighted matrix : The weighted matrix V is obtained by multiplying the normalized matrix N by the weighted coefficients of the criterion Wj, according to Equation (7):

Step 5. Calculating the utility degree of Ki alternatives: The utility degrees of an alternative are calculated considering the ideal and anti-ideal solutions and using Equations (8) and (9):

where shows the sum of elements of weighted matrix V, according to Equation (10):

Step 6. Determining utility function of alternatives, : The utility function represents the alternative trade-off related to the ideal and anti-ideal solutions. The utility function of alternatives is defined by the following equation:

where shows the utility function related to the anti-ideal solution, while represents utility function related to the ideal solution. The utility functions related to ideal and anti-ideal solutions are determined using Equations (12) and (13):

Step 7. Ranking of alternatives: The alternative ranking is based on the final values of the utility function. In the most optimal case, an alternative has the highest possible value of the utility function.

This study involved conducting calculations pertaining to the Delphi rounds and reviewing the inferential findings of the study. These calculations included analyzing the demographic characteristics using the SPSS software version 25, assessing the structural validity of the questionnaire using the SmartPLS software version 4. Furthermore, the process of prioritizing the critical risks was carried out by utilizing Microsoft Excel software version 2023 to implement the MARCOS technique’s calculating methodology as described in different stages.

4. Presentation of the Study Results

4.1. Statistical Analysis

This part of the statistical analysis investigated the distribution of statistical samples in terms of demographic variables. Males and females formed 74.6% and 25.4% of the participants, respectively. Moreover, 52.1% of participants were in the age range of 35–45 years, with 25.4% between 25 and 35 years, 18.3% between 45 and 55 years, and 4.2% over 55 years old. Out of the study participants, 66.2%, 16.9%, and 16.9% had MSc, MA, and Ph.D. degrees, respectively. The work experience of 31.0% of participants was 15–20 and more than 20 years, while 14.1% and 23.9% had experience of <10 and 10–15 years, respectively. On the other hand, work experience in water and wastewater was <10 years, 10–15 years, 15–20 years, and more than 20 years in 36.6%, 28.2%, 16.9%, and 18.3% of participants, respectively. Work experience in PPP projects was <10 years, 10–15 years, and 15–20 years in 53.5%, 33.8%, and 12.7% of participants, respectively. Contractors, employers/employer representatives, consultants, faculty members, experts, and financial experts formed 26.8%, 15.5%, 23.9%, 2.8%, 23.9%, and 7.0% of participants, respectively. Concerning the type of responsibility, experts/senior experts, managers, deputies, employees, supervisors/head supervisors, executive agents, and other responsibilities formed 25.4%, 23.9%, 9.9%, 18.3%, 15.5%, and 2.8% of participants, respectively. Tehran and Bandar Abbas were the cities where 38.0% and 35.2% of participants worked, respectively. Moreover, 1.4% of participants worked in Isfahan, Parsian, Bandar Lenge, Tabriz, Rasht, Mashhad, and Kerman. Karaj and Qeshm, Shiraz, and Golestan were the cities where 4.2%, 5.6%, and 2.8% of participants worked.

4.2. Ranking of CRFs of Public–Private Partnership Projects

The MARCOS method was used to rank the CRFs of PPP projects in WWI. The calculations are shown in Table 2.

Table 2.

The degree of desirability of alternatives and final ranking.

The ranks of CRFs were assessed and compared according to public and private sector professionals’ opinions using the MARCOS approach. Table 3 presents the conclusive rankings of different options within the private and public sectors, separately. In fact, Table 2 presents the overall risk ranking derived from the collective perspectives of all respondents, encompassing both the public and private sectors. Conversely, Table 3 delineates the risk ranking outcomes obtained from the distinct viewpoints of the private and public sectors individually.

Table 3.

The final rankings of alternatives between the private and public sectors.

5. Discussions of Study Results

The present research sought to evaluate and rank the CRFs of PPP projects in the development of WWI in the developing country of Iran using a multi-criteria decision-making method.

The results of identifying and assessing the risks of PPP projects in the development of WWI in the developing country of Iran showed that the 10 most CRFs of PPP projects of WWI in the developing country are fluctuations in the value of materials; the contradiction in government policies; government instability and the PPP program suspension in terms of implementing infrastructure projects because of the government change; lack of defined government policies to support the private sector; economic changes, such as inflation, increase or decrease in prices, and exchange rate; long and inefficient implementation of projects; the economic instability of the country and lack of economic stability and security; insufficient resources for the implementation of the project by the relevant institutions and investors; poor management of sub-contracts; and delay in finalizing bank negotiations.

Risk assessment is necessary to achieve success in construction projects. The results of ranking the CRFs of PPP projects in WWI of the country revealed the following risks in the first to the tenth ranks: lack of trust in the government’s economic programs, delay in timely fund payment for project financing and credits, delay in finalizing bank negotiations, failure to pay private sector claims on time, increased repair and maintenance costs due to lack of proper forecasting, fluctuations in the value of materials, continuous change of senior managers and subsequent lack of accountability and policy maintenance, lack of healthy economic conditions and competition environment, government instability and the PPP program suspension in terms of implementing infrastructure projects because of the government change, and the disproportion between the investor’s expenses with inflation and the economic conditions of the country.

A comparison of the ranking results obtained from the opinions of private and public sector experts indicated that the former considered the lack of contractor commitment to the project schedule, delay in timely fund payment for project financing and credits, and lack of trust in government economic programs as the most critical PPP project risks in the country’s WWI. According to experts in the public sector, choosing the wrong financing method, fluctuations in the value of materials, and lack of trust in the government’s economic programs were the most CRFs of PPP projects in the country’s WWI.

If these economic and financial risks emerge in the early stages of the project, decision-makers of WWI PPP projects can withdraw before overinvestment. On the other hand, decision-makers can avoid these risks through insurance against the economic and financial risks of WWI PPP projects. This insurance would be even more financially acceptable if those responsible for WWI PPP projects have already invested in other projects. Large-scale projects allow power holders to control investments with varying degrees of risk exposure, subsequently reducing the overall risk of failure. However, insurance protection is not effective for risks with traffic permits and the condition of nearby buildings, which are always outside the control of the project management team. These risks can delay (or undermine the outcome of) WWI PPP projects and reduce their value. In these cases, decision-makers of WWI PPP projects can choose between continuing the project while trying to maintain economic and financial balance, or suspending the project if these risks affect the possibility of achieving the planned return on investment. Finally, the risks resulting from failure to use and share experiences, incorrect technical knowledge transfer, and the weakness of pre-investment studies and economic evaluation of projects can also play a critical role by delaying the implementation of WWI PPP projects while weakening its management and coordination. Meanwhile, these risks can be directly controlled because they relate to the processes enabled by the management of WWI PPP projects. The incorrect technical knowledge transfer can usually be addressed through appropriate training courses that can properly transfer knowledge and show how to benefit from technology for WWI PPP projects. The same solution applies to poor pre-investment studies and economic evaluation of projects, which can jeopardize the feasibility study of WWI PPP projects. Overall, the recruitment of qualified managers and consultants should minimize forecasting errors of the management team.

Within the scope of the identified critical risks, certain risks pertain to intra-project matters while others pertain to extra-project matters. However, it is important to note that all of these risks have the potential to exert a substantial impact on the success of PPP projects aimed at developing WWI. The extent of this impact may vary depending on the prevailing conditions, such as the level of development in the country in question. Certain external risks, such as economic fluctuations like inflation or fluctuations in prices, are outside the control of the entities overseeing WWI PPP projects. These risks can significantly affect the life cycle stage in particular. Indeed, should these economic and financial risks manifest during the initial phases of the project, the individuals responsible for making decisions on water and sanitation infrastructure PPP initiatives may find themselves in a position where they can only hope that they have not already made excessive investments. However, it is possible for decision-makers to mitigate these risks by utilizing insurance as a means of safeguarding against the economic and financial uncertainties associated with WWI PPP projects. The financial viability of this insurance would be further enhanced if the stakeholders involved in WWI PPP initiatives have previously made prior investments in other ventures. The process of expanding the project enables established entities to manage investments with different levels of risk exposure, thus effectively mitigating the overall risk of potential failure. Nevertheless, insurance coverage is ineffective in mitigating risks associated with traffic permits and the condition of neighboring structures, as these factors consistently lie beyond the purview of the project management team. If these risks manifest, they have the potential to impede the progress or effectiveness of water and wastewater infrastructure PPP projects, thereby diminishing the overall value of such projects. In such instances, the decision-makers overseeing water and wastewater infrastructure projects implemented through public–private partnerships (PPPs) face the option of either persevering with the project while striving to uphold economic and financial equilibrium, or opting for its liquidation if the associated risks impede the attainment of the projected return on investment. In conclusion, the absence of utilization and sharing of experiences, inadequate methods of transferring technical knowledge, and insufficient pre-investment studies and economic evaluations of projects can significantly affect the implementation of WWI PPP projects. These factors can lead to delays in project execution and undermine the effectiveness of project management and coordination, similar to the aforementioned cases. Simultaneously, these factors can be directly regulated as they pertain to the operations facilitated by WWI PPP initiatives. The ineffective method of transmitting technical knowledge may often be resolved by implementing suitable training programs that effectively disseminate knowledge and provide guidance on leveraging technology for WWI PPP initiatives. The aforementioned issue pertains to the vulnerability of pre-investment studies and economic evaluations in the context of WWI PPP projects, hence posing a potential threat to the viability assessment of such endeavors. Indeed, the utilization of competent managers and consultants has the potential to mitigate forecasting errors made by the management team.

As anticipated, given the temporal constraints imposed by sanctions and significant economic challenges in Iran, the primary PPP initiatives pertaining to WWI were associated with the category of economic hazards. The imposition of sanctions on Iran has led to a reduction in available funds and a rise in inflation, consequently impacting the cost of equipment and materials. Consequently, factors such as fluctuations in exchange rates and inflation, coupled with changes in bank interest rates, introduce significant uncertainties for WWI projects operating under the public–private partnership model. The underlying cause for this phenomenon can be attributed to the reliance on imported mechanical, electrical, and construction components and equipment from industrialized nations for water and sewerage projects in Iran. Hence, the expenses associated with the development of WWI in Iran exhibit a direct correlation with variations and swings in the currency rate. Moreover, the acquisition of these projects frequently encounters challenges, thus leading to adverse consequences during project execution and consistently impeding the progress of water and sewage initiatives in Iran. Given the unique characteristics inherent in these projects, the successful attainment of project completion necessitates the presence of a proficient and knowledgeable personnel. In Iran, a significant proportion of the workforce possesses expertise primarily in the domain of uniform building goods. Consequently, there is a pronounced demand for training programs to address this specific area of specialization. The aforementioned matter is readily apparent in relation to the installation of mechanical and electronic apparatus. Conversely, the appreciation of the exchange rate has rendered the employment of foreign professionals in water and sewage development projects by government and private entities in Iran exceedingly challenging. The cost of constructing water and sewage projects will be significantly influenced by the importation of technical and engineering services in this particular context. In relation to the potential risk of investors’ spending becoming disproportionate to inflation and the prevailing economic conditions, it is recognised that economic challenges might indeed result in a reduction of contractors’ profit margins. Consequently, this may give rise to various claims being made thereafter. The outcome of this matter will have implications not only on the management of executive affairs and the final product quality, but also on the potential legal ramifications and difficulties faced by the involved parties.

The results of this study align with prior research investigations. The findings presented exhibit similarities to the research conducted by Valipour et al. [42]. They demonstrated that risk indicators in highway PPP projects in Iran primarily stem from factors such as domestic and international fluctuations, the country’s economic efficacy, labor force dynamics, construction attributes, and consulting and contractual provisions. There exists a correlation between the two. In another investigation, Chan et al. [51] employed the Delphi technique to ascertain and rank a set of risk assessment criteria pertaining to social, economic, environmental, and technological prerequisites that are closely associated with the advancement of PPP initiatives. The risks associated with a project are subject to change based on the prevailing project conditions. However, the outcomes of this study align closely with prior studies. In their study, Hatfi et al. [52] assessed the risks associated with projects implemented through the Build–Operate–Transfer (BOT) method. The identified risks encompassed initial price fluctuations, inflation rate increases, exchange rate fluctuations, bank interest fluctuations, and tax increases, as well as the absence of clear policies. In terms of attaining financial success, in a separate study, Kumar et al. [53] elucidated the potential risks associated with inflation, government bonds, local legislation, equipment suppliers, and technology choices in the context of PPP projects. Furthermore, in a separate study aimed at assessing risk indicators in PPP projects, the researchers documented many factors including the economic efficiency of the country, the labor dynamics, and the construction characteristics, as well as the quality of consulting and contractual services.

The findings of this study have practical implications for project stakeholders, as they may utilize them to effectively achieve the primary goals of the project. This can be accomplished by giving particular consideration to the risks that have the greatest impact on the project’s performance over its entire life cycle. In relation to this matter, one of the risks identified in this study pertains to the potential influence of exchange rate changes on all project objectives. Hence, the implementation of projects in countries and/or time periods characterized by a stable currency rate enhances the attainment of project objectives. Nonetheless, it is important to acknowledge that project risks exhibit fluctuations over time, contingent upon the project’s advancement [54,55]. This holds particularly true for financial risks, including the volatility of exchange rates, which have the potential to undergo abrupt alterations as a consequence of unforeseen occurrences [56], particularly those originating from external sources. Therefore, considering the project’s life cycle [57,58,59], it is evident that the influence of the identified risk groups cannot be limited to certain periods of WWI project construction. I engaged in a study utilizing the PPP concept. When examining the domain of “management” risks, it becomes evident that the constituent risks within this category hold significance across many stages of the WWI projects’ life cycle when implemented with the PPP model. This scenario pertains to the occurrence of “governmental delay in granting design approval,” which tends to be more prevalent during the initial phases of WWI projects implemented under the PPP model. Another significant risk that persists throughout all project stages is the “inadequate management of component contracts.” The water and wastewater sector operates under a PPP model, encompassing several aspects such as design and engineering, as well as procurement and construction. Given the aforementioned considerations, it is advisable for practitioners to address and minimize individual risks that are prone to occur at various stages of the water and wastewater project life cycle in PPP. Additionally, it is crucial to continuously monitor the development of risks and their impact on project performance, even after the stages where they are anticipated to arise have been surpassed. This can be achieved through the utilization of methodologies such as the real options method or scenario-based approach, as demonstrated by previous studies [60,61]. In general, WWI projects implemented using the PPP model may encounter disparities in both external and internal conditions, leading to the emergence of unforeseen dangers that were previously deemed improbable. Therefore, it is imperative for professionals to diligently consider risks and changes in both the internal and external environment and adequately equip themselves to address their manifestations [62].

This study examined the factors contributing to the increased risks of WWI PPP projects in Iran. The review was conducted by a panel of experts who possess a high level of proficiency in the subject matter pertaining to risk management in public–private partnership projects. Based on the findings, it was determined that 35 risks were within the critical range. Subsequently, the final assessment of critical risks in PPP projects within the WWI industry was conducted by integrating the outcomes of the first stages and employing the MARCOS method. The comparison of the findings from this study with those of previous research demonstrates the robustness of the results and suggests that the key risk factors have been accurately identified, with the outcomes possessing adequate validity. WWI infrastructure development has emerged as a significant priority in numerous developing nations, with Iran being no exception, over the past few years. The findings are given in alignment with prior questionnaires and existing literature, thus offering a foundation for practical initiatives and potential enhancements to the quality of infrastructure.

6. Conclusions

Risk assessment in construction projects is necessary to ensure successful implementation. The current study aimed to identify, evaluate, and rank the CRFs of PPP projects in the development of WWI in Iran as a developing country. The results highlighted 35 risks as critical. Fluctuations in the value of materials, the contradiction in government policies and instability of the government, and the PPP project suspension when implementing infrastructure projects due to government change ranked the first to the third CRFs. Accurate risk assessment is carried out using different criteria. This study identified 13 risk assessment criteria using the research background. The results of ranking 35 risks of PPP projects in WWI of Iran using the MAROS method indicated that lack of trust in the government’s economic programs, delays in timely fund payment for project financing and credits, and delay in finalizing bank negotiations were the first to third priorities. A comparison of risk ranking according to the opinions of experts in the public and private sectors indicated that choosing the wrong financing method and lack of contractors committed to the project schedule were ranked first by the public and private sector experts, respectively.

The risks associated with PPP projects in WWI facilities are integral to the executive measures involved in the development and implementation of project-oriented activities. These risks cannot be disregarded by organizations and are consistently incorporated into the project planning system. The user’s text is a simple statement. In the context of PPP initiatives, it is imperative for execution companies to adopt appropriate effective measures to cope with and mitigate the risks associated with such endeavors. This entails the execution of proper control mechanisms aimed at minimizing the impact of recognized risks on the whole project delivery process. In cases where some risks are deemed uncontrollable, corporations should handle them directly. It is imperative to make adequate efforts and preparations in order to deal with and mitigate any risks arising. The objective of this study was to ascertain the essential risks associated with PPP projects. To achieve this, an innovative framework was developed utilizing the MARCOS approach. The study’s findings have provided a strong foundation for proper risk management in PPP projects, offering valuable insights for WWI firms in Iran and other developing nations. These insights enable these companies to effectively and efficiently monitor and detect the key risks associated with PPP projects.

The study’s findings propose several successful implementation options and insightful measures that policymakers might consider to enhance the position of private sector investment in developing nations, hence offering practical implications for policy development, formulation, and decision making. For example: (i) The primary objectives include the acquisition of foreign exchange and the elimination of obstacles and concerns related to investment. (ii) Another goal is to fulfill international trade obligations, such as reducing clearance time, and maintaining political stability within the country to enhance satisfaction among foreign investors. (iii) The government aims to achieve a satisfactory return on capital within a specified timeframe. (iv) The government of developing nations seeks to identify competent integration managers who possess a strong educational background and abundant professional experience. These managers play a crucial role in engaging with private investors and garnering support for WWI projects. Based on the available information, it is crucial for both practitioners and policymakers to actively engage in the effective implementation of PPPs. Specifically, institutions must prioritize ensuring adequate transparency and conducting unbiased evaluations of legislation to develop and assess the PPP selection criteria for potential bidders. These factors are identified as primary determinants for achieving success in PPP initiatives. In this context, it is essential for policymakers to initiate the establishment of a comprehensive regulatory framework, accompanied by well-defined and explicit selection criteria, to effectively identify the most competent private sector partners for participation in PPPs in the field of water and wastewater infrastructure facilities in developing nations like Iran.

The main limitation of this research is the small number of experts who participated in the survey, although they can certainly be regarded as suitable for the research. Future studies should increase the validity of the proposed results by either a greater number of experts participating in the survey or replicating the presented study in other developing countries. In addition, it would be interesting to compare the results between developing and developed countries to identify their similarities and differences. The findings of the present research study can be a suitable tool for decision making in both public and private sectors to successfully implement proper risk management of PPP projects in the WWI sector.

Author Contributions

Conceptualization, L.M.S. and H.S.; methodology, L.M.S. and H.S.; software, L.M.S.; validation, H.S., B.A. and D.W.M.C.; formal analysis, L.M.S.; investigation, H.S., B.A. and D.W.M.C.; data curation, H.S., B.A. and D.W.M.C.; writing—original draft preparation, L.M.S.; writing—review and editing, H.S., B.A. and D.W.M.C.; visualization, H.S., B.A. and D.W.M.C.; supervision, B.A.; project administration, H.S.; funding acquisition, D.W.M.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Rasouli, B.; Khurdiar, S.; Bani Mahd, B. Identification, ranking, and allocation of CRFs in the stages of public-private partnership with Delphi technique in the context of resistance economy (case study: WWI of Gilan province). J. Investig. Knowl. 2018, 7, 125–139. [Google Scholar]

- Askari, M.M.; Sadeghi Shabhani, M.; Sajjad Siflo, S. Identifying and prioritizing the risks of upstream oil and gas projects in Iran using the Risk Breakdown Structure (RBS) format and the TOPSIS technique. J. Econ. Res. Policies 2016, 24, 57–96. (In Persian) [Google Scholar]

- Noorzai, E.; Jafari, K.G.; Golabchi, M.; Hamedi, S. Selecting an appropriate finance method of public-private partnership for railway projects in Iran through AHP method. Int. J. Struct. Civ. Eng. Res. 2016, 5, 74–79. (In Persian) [Google Scholar] [CrossRef][Green Version]

- Ke, Y.; Wang, S.; Chan, A.P.C.; Lam, P.T.I. Preferred risk allocation in China’s public–private partnership (PPP) projects. Int. J. Proj. Manag. 2010, 28, 482–492. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Lam, P.T.I.; Chan, D.W.M.; Cheung, E.; Ke, Y. Potential obstacles to successful implementation of public-private partnerships in Beijing and the Hong Kong special administrative region. J. Manag. Eng. 2010, 26, 30–40. [Google Scholar] [CrossRef]

- Liu, T.; Wang, Y.; Wilkinson, S. Identifying critical factors affecting the effectiveness and efficiency of tendering processes in Public–Private Partnerships (PPPs): A comparative analysis of Australia and China. Int. J. Proj. Manag. 2016, 34, 701–716. [Google Scholar] [CrossRef]

- Sadeghi Shahedani, M.; Shabazi Ghiasi, M.; Bigdeli, V. Priority development of public- private partnerships in the transport sector of using MCDM. J. Econ. Model. Res. 2011, 5, 13–21. (In Persian) [Google Scholar]

- Najafi, G.H.; Malekan, Y. Public Private Partnership Or PPP: Strategy to finance new infrastructure projects. Cent. Educ. Res. Rail 2013, 271, 1–7. (In Persian) [Google Scholar]

- Heibati, F.; Rahnamaye Foudposhti, F.; Nikomaram, H.; Ahmadi, M. The relationship between economic freedom with public-private partnerships and provide a model for Iran. J. Econ. Model. Res. 2008, 2, 25–52. (In Persian) [Google Scholar]

- Maki-Abadi, S.R.; Bahina, K.; Akbari, A. Identify and assess CRFs in HSR projects through public private partnerships in developing countries. J. Struct. Eng. Constr. 2013, 1, 11–21. (In Persian) [Google Scholar]

- Choi, J.-H.; Chung, J.; Lee, D.-J. Risk perception analysis: Participation in China’s water PPP market. Int. J. Proj. Manag. 2010, 28, 580–592. [Google Scholar] [CrossRef]

- Valipour, A.; Yahaya, N.; Noor, N.M.; Valipour, I.; Tamošaitienė, J. A SWARA-COPRAS approach to the allocation of risk in water and sewerage public–private partnership projects in Malaysia. Int. J. Strat. Prop. Manag. 2019, 23, 269–283. [Google Scholar] [CrossRef]

- Yang, M.; Chen, H.; Xu, Y. Stakeholder-associated risks and their interactions in PPP projects: Social network analysis of a water purification and sewage treatment project in China. Adv. Civ. Eng. 2020, 2020, 8897196. [Google Scholar] [CrossRef]

- Sarvari, H.; Cristofaro, M.; Chan, D.W.M.; Noor, N.M.; Amini, M. Completing abandoned public facility projects by the private sector: Results of a Delphi survey in the Iranian Water and Wastewater Company. J. Facil. Manag. 2020, 18, 547–566. [Google Scholar] [CrossRef]

- Ndungutse Ingabire, N. Project Risk Management and the Performance of Public Private Partnership in Infrastructure Project: A Case Study of SUS Water & Sanitation Project No P-RW-F00-016 2016-2019. Doctoral Dissertation, University of Rwanda, Kigali, Rwanda, 2021. [Google Scholar]

- Zarepour, M. Identifying and prioritizing the risks of rural WWI using multi-criteria decision-making methods in a fuzzy environment (case study: Abfar Gilan). J. Water Wastewater 2018, 30, 35–50. [Google Scholar]

- Feyzbakhsh, S.; Telvari, A.; Lork, A.R. Investigating the causes of delay in construction of urban water supply and wastewater project in water and waste water project in Tehran. Civ. Eng. J. 2018, 3, 1288. [Google Scholar] [CrossRef]

- Rezaei Noor, J.; Mousavi, S.M. Risk assessment and rating in public-private partnerships of water supply projects using FMEA and Fuzzy Synthetic Evaluation methods: A case study of Qom province. J. Iran Water Resour. Res. 2016, 13, 100–117. [Google Scholar]

- Priya, M.S.; Jesintha, P. Public private partnership in India. J. Manag. Sci. 2011, 1, 82–94. [Google Scholar]

- Ameyaw, E.E.; Chan, A.P.C. Identifying public-private partnership (PPP) risks in managing water supply projects in Ghana. J. Facil. Manag. 2013, 11, 152–182. [Google Scholar] [CrossRef]

- Wibowo, A.; Mohamed, S. Risk criticality and allocation in privatised water supply projects in Indonesia. Int. J. Proj. Manag. 2010, 28, 504–513. [Google Scholar] [CrossRef]

- Ezeldin, A.S.; Badran, Y. Risk decision support system for public private partnership projects in Egypt. Int. J. Eng. Innov. Technol. 2013, 3, 479–486. [Google Scholar]

- Ameyaw, E.E.; Chan, A.P.C. Evaluation and ranking of risk factors in public–private partnership water supply projects in developing countries using fuzzy synthetic evaluation approach. Expert Syst. Appl. 2015, 42, 5102–5116. [Google Scholar] [CrossRef]

- Yin, H.; Li, Y.-F.; Zhao, D.-M. Risk factor empirical research of PPP projects based on factor analysis method. Am. J. Ind. Bus. Manag. 2015, 5, 383–387. [Google Scholar] [CrossRef][Green Version]

- Issa, U.H.; Farag, M.A.; Abdelhafez, L.M.; Ahmed, S.A. A risk allocation model for construction projects in Yemen. Civ. Environ. Res. 2015, 7, 78–89. [Google Scholar]

- Fink, A.; Kosecoff, J.; Chassin, M.; Brook, R.H. Consensus Methods: Characteristics and Guidelincs for Use. Am. J. Public Health 1984, 74, 979–983. [Google Scholar] [CrossRef]

- Prasanta, K.D. Managing project risk using combined analytic hierarchy process and risk map. Appl. Soft Comput. 2010, 10, 990–1000. [Google Scholar]

- Wang, H.; Xiong, W.; Wu, G.; Zhu, D. Public-private partnership in public administration discipline: A literature review. Public Manag. Rev. 2018, 20, 293–316. [Google Scholar] [CrossRef]

- Wang, L.; Yan, D.; Xiong, Y.; Zhou, L. A review of the challenges and application of public-private partnership model in Chinese garbage disposal industry. J. Clean. Prod. 2019, 230, 219–229. [Google Scholar] [CrossRef]

- Zhang, X. Paving the way for public–private partnerships in infrastructure development. J. Constr. Eng. Manag. 2005, 131, 71–80. [Google Scholar] [CrossRef]

- An, X.; Li, H.; Wang, L.; Wang, Z.; Ding, J.; Cao, Y. Compensation mechanism for urban water environment treatment PPP project in China. J. Clean. Prod. 2018, 201, 246–253. [Google Scholar] [CrossRef]

- Ibrahim, A.D.; Price, A.D.F.; Dainty, A.R.J. The analysis and allocation of risks in public private partnerships in infrastructure projects in Nigeria. J. Financ. Manag. Prop. Constr. 2006, 11, 149–164. [Google Scholar] [CrossRef]

- Sarvari, H.; Chan, D.W.M.; Banaitiene, N.; Noor, N.M.; Beer, M. Barriers to development of private sector investment in water and sewage industry. Built Environ. Proj. Asset Manag. 2021, 11, 52–70. [Google Scholar] [CrossRef]

- Sarvari, H.; Nassereddine, H.; Chan, D.W.M.; Amirkhani, M.; Noor, N.M. Determining and assessing the significant barriers of transferring unfinished construction projects from the public sector to the private sector in Iran. Constr. Innov. 2020, 21, 592–607. [Google Scholar] [CrossRef]

- Shen, L.-Y.; Platten, A.; Deng, X. Role of public private partnerships to manage risks in public sector projects in Hong Kong. Int. J. Proj. Manag. 2006, 24, 587–594. [Google Scholar] [CrossRef]

- Yang, J.-B.; Wei, P.-R. Causes of delay in the planning and design phases for construction projects. J. Arch. Eng. 2010, 16, 80–83. [Google Scholar] [CrossRef]

- Yang, T.; Long, R.; Li, W. Suggestion on Tax Policy for Promoting the PPP Projects of Charging Infrastructure in China. J. Clean. Prod. 2018, 174, 133–138. [Google Scholar] [CrossRef]

- Li, B.; Akintoye, A.; Edwards, P.J.; Hardcastle, C. The allocation of Risk in PPP/PFI Construction Projects in the UK. Int. J. Proj. Manag. 2005, 23, 25–35. [Google Scholar]

- Suslick, S.B.; Schiozer, D.J.; Rodriguez, M.R. Uncertainty and Risk Analysis in Petroleum Exploration and Production. TERRAE 2009, 6, 1–32. [Google Scholar]

- Chan, D.W.M.; Kumaraswamy, M.M. Compressing construction durations: Lesson learned from Hong Kong building projects. Int. J. Proj. Manag. 2002, 20, 23–35. [Google Scholar] [CrossRef]

- Sastoque, L.M.; Arboleda, C.A.; Ponz, J.L. A Proposal for Risk Allocation in Social Infrastructure Projects Applying PPP in Colombia. Procedia Eng. 2016, 145, 1354–1361. [Google Scholar] [CrossRef]

- Valipour, A.; Yahaya, N.; Noor, N.M.; Kildienė, S.; Sarvari, H.; Mardani, A. A fuzzy analytic network process method for risk prioritization in freeway PPP projects: An iranian case study. J. Civ. Eng. Manag. 2015, 21, 933–947. [Google Scholar] [CrossRef]

- Chan, D.W.M.; Sarvari, H.; Husein, A.A.J.A.; Awadh, K.M.; Golestanizadeh, M.; Cristofaro, M. Barriers to Attracting Private Sector Investment in Public Road Infrastructure Projects in the Developing Country of Iran. Sustainability 2023, 15, 1452. [Google Scholar] [CrossRef]

- Tamošaitiene, J.; Zavadskas, E.K.; Turskis, Z. Multi-criteria risk assessment of a construction project. Procedia Comput. 2013, 17, 129–133. [Google Scholar] [CrossRef]

- Brady, S.R. Utilizing and adapting the Delphi method for use in qualitative research. Int. J. Qual. Methods 2015, 14. [Google Scholar] [CrossRef]

- Sarvari, H.; Chan, D.W.M.; Ashrafi, B.; Olawumi, T.O.; Banaitiene, N. Prioritization of Contracting Methods for WWI Using the Fuzzy Analytic Hierarchy Process Method. Energies 2021, 14, 7815. [Google Scholar] [CrossRef]

- Siegel, S.; Castellan, J.R. Nonparametric Statistics for the Behavioral Sciences; McGraw Hill: New York, NY, USA, 1988. [Google Scholar]

- Schmidt, R.C. Managing Delphi surveys using nonparametric statistical techniques. Decis. Sci. 1997, 28, 763–774. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences, 2nd ed.; Lawrence Erlbaum Associates: Hillside, NJ, USA, 1988. [Google Scholar]

- Stević, Ž.; Pamucar, D.; Puška, A.; Chatterjee, P. Sustainable supplier selection in healthcare industries using a new MCDM method: Measurement of alternatives and ranking according to COmpromise solution (MARCOS). Comput. Ind. Eng. 2020, 140, 106231. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Osei-Kyei, R.; Hu, Y.; Yun, L.E. A fuzzy model for assessing the risk exposure of procuring infrastructure mega-projects through public-private partnership: The case of Hong Kong-Zhuhai-Macao Bridge. Front. Eng. Manag. 2018, 5, 64–77. [Google Scholar] [CrossRef]

- Hatefi, S.M.; Mohseni, H. Evaluating and prioritizing the risks of BOT projects using structural equations and integrated model of fuzzy AHP and fuzzy TOPSIS. J. Struct. Constr. Eng. 2019, 6, 111–130. [Google Scholar]

- Kumar, G.; Yogesh, S.; Fouzdar Prakhar, D. Risk management in PPP (public private partnership) projects. Int. J. Eng. Technol. Sci. Res. 2016, 3, 305–313. [Google Scholar]

- Jaafari, A. Management of risks, uncertainties and opportunities on projects: Time for a fundamental shift. Int. J. Proj. Manag. 2001, 19, 89–101. [Google Scholar] [CrossRef]

- Perroni, M.; Dalazen, L.L.; Da Silva, W.V.; Gouvêa, S.; Da Veiga, C.P. Evolution of risks for energy companies from the energy efficiency perspective: The Brazilian case. Int. J. Energy Econ. Policy 2015, 5, 612–623. [Google Scholar]

- Froot, K.A. The Intermediation of financial risks: Evolution in the catastrophe reinsurance market. Risk Manag. Insur. Rev. 2008, 11, 281–294. [Google Scholar] [CrossRef]

- Jordani, D.A. BIM and FM: The Portal to Lifecycle Facility Management; Springer: Berlin/Heidelberg, Germany, 2010; pp. 13–16. [Google Scholar]

- Eadie, R.; Browne, M.; Odeyinka, H.; McKeown, C.; McNiff, S. BIM implementation throughout the UK construction project lifecycle: An analysis. Autom. Constr. 2013, 36, 145–151. [Google Scholar] [CrossRef]

- Wetzel, E.M.; Thabet, W.Y. The use of a BIM-based framework to support safe facility management processes. Autom. Constr. 2015, 60, 12–24. [Google Scholar] [CrossRef]

- Chen, T.; Zhang, J.; Lai, K.-K. An integrated real options evaluating model for information technology projects under multiple risks. Int. J. Proj. Manag. 2009, 27, 776–786. [Google Scholar] [CrossRef]

- Bañuls, V.A.; López, C.; Turoff, M.; Tejedor, F. Predicting the impact of multiple risks on project performance: A scenario-based approach. Proj. Manag. J. 2017, 48, 95–114. [Google Scholar] [CrossRef]

- Cristofaro, M. Reducing biases of decision-making processes in complex organizations. Manag. Res. Rev. 2017, 40, 270–291. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).