1. Introduction

Public Private Partnerships (PPPs) are cooperative ventures between government entities and private sector organizations [

1]. They involve a collaborative arrangement where both parties contribute resources, expertise, and capital to achieve public infrastructure projects and deliver public services [

2]. In these projects, the private sector provides its expertise in handling the risks related to the construction and operations of these projects, while the public sector provides legal frameworks and, frequently, funding to carry out public projects [

3]. PPPs are largely used for infrastructure development and service delivery in developed and developing countries [

2].

An essential aspect of a PPP contract is the concession period, which refers to the time during which a business entity, namely, Special Purpose Vehicle (SPV), is responsible for financing, building, operating, and maintaining a public asset before transferring it back to the granting authority [

4]. The duration of the concession period may span from 10 to 99 years, but usually lasts from 20 to 30 years. A typical concession duration is set as a fixed 30-year long period, such as in bridges, pay toll roads, and other transport infrastructures [

5]. However, a reasonable length of the concession period must be determined and negotiated in order to compensate the SPV with an appropriate return on investment and risk taking [

6]. A vast literature reports cases of PPP projects where the duration has implications on the risk profile and financial viability, such as municipal buildings, urban infrastructures, and social facilities [

7,

8,

9].

In fact, the concession period has several significant implications. Firstly, longer concession periods increase project-related uncertainties and risks, as economic, political, and social conditions can change over time, affecting the project’s viability and regulatory environment [

10]. Moreover, longer periods lead to higher Operational Expenses (OPEX) for the private partner due to maintenance, upgrades, and labor costs [

11]. Additionally, longer concession periods prolong the payback period for private companies, impacting cash flow and financial viability [

12]. Furthermore, longer durations may result in higher Capital Expenditures (CAPEX) during the construction phase to ensure long-term performance [

2]. Longer concessions also may trigger detrimental impacts on public funding in the long term due to the longer payback periods for the SPVs [

13]. Understanding the driving factors behind concession periods is then crucial for effectively regulating PPP contracts [

14].

Although there are countless papers on models to determine “optimal” concession periods of PPP projects [

4,

11,

13,

15,

16,

17], far less attention has been devoted to understanding the determinants of the concession period based on evidence from projects conducted within national PPP programs. Moreover, the definition of an adequate concession period becomes more complex for social infrastructure PPPs, particularly under an availability payment mechanism. To contribute to addressing these gaps, this study conducts a statistical analysis of PPP projects to build or renovate Italian healthcare facilities in order to analyze the main factors that may influence the concession period of PPPs. This is expected to contribute to a better definition of the concession period, especially for social infrastructure that does not rely on user payments.

The paper is structured as follows. In

Section 2, an overview of the current relevant literature on the concession period of PPP projects is presented. Moving on to the research methodology in

Section 3, the main factors related to the concession period are identified and a model is proposed to establish their relationship.

Section 4 includes the project data set and the results of the linear regression analysis. Empirical findings are discussed in

Section 5, offering interpretations of the research results. Finally, the research conclusions are drawn, providing recommendations and outlining future research directions.

2. Conceptualization of PPP Concession Period

The concession period denotes the timeframe during which the concessionaires are entrusted with the responsibilities of financing, constructing, operating, and maintaining a public capital asset before its eventual transfer back to public authorities [

13]. This temporal dimension assumes profound significance as it encapsulates several pivotal facets of the project.

Primarily, the concession period functions as an indicator of the protracted uncertainties inherent in the project. A protracted concession period augments the spectrum of uncertainties and risks associated with the undertaking [

18]. Prolonging the partnership’s duration extends the window within which various risks and uncertainties may manifest [

17]. Economic, political, technological, and societal conditions can undergo substantial transformations over extended periods [

15], thereby impacting the project’s fiscal feasibility, demand forecasts, regulatory frameworks, and operational milieu. Effectively managing these uncertainties becomes increasingly challenging with the elongation of the concession period, potentially resulting in unforeseen expenditures, performance gaps, or disputes between the public and private stakeholders.

Moreover, protracted concession periods entail a lengthier provision of operational services, consequently yielding higher overall OPEX. As the partnership endures over an extended timeframe, the private partner assumes responsibility for the sustained maintenance and operation of the infrastructure or the continuous provision of services. Over time, operational outlays, including maintenance, repairs, upgrades, and labor costs, are prone to escalation due to factors such as inflation, evolving market dynamics, and aging infrastructure [

19]. Additionally, as the project evolves and technological advancements materialize, the private partner may necessitate investments in modernization or the adoption of emerging technologies, further amplifying operational expenditures [

15].

Moreover, the concession period significantly affects the determination of the payback period of the SPV’s investment. Longer concession periods result in a delayed payback period for the private companies involved and the private equity invested in the public project [

11,

12]. Extending the time frame for revenue generation may trigger multiple underperformances such as gradual project ramp-ups and lower accuracy in long-term demand [

20,

21,

22]. Moreover, prolonging the payback period for the SPV impacts project cash flow and long-term public payments. From a public sector’s perspective, longer concession periods mean a prolonged duration of public payments and an increase in long-term subsidies paid by the government because the project IRR is significantly higher than the public debt interest rate [

2]. Additionally, during the concession period, the long-term public payments necessarily imply diverting funds from the public budget and potentially impacting other public expenses [

23].

Furthermore, a longer concession period can further be detrimental as it can lead to a larger Capital Expenditure (CAPEX) in the construction phase. As the SPV takes the operation responsibility for a longer period, it may need to invest more upfront capital during the construction phase to ensure the infrastructure meets the expected standards and requirements for a larger concession period. This may involve additional spending on higher quality materials, enhanced design features, technological advancements, or future proofing measures [

24]. While this approach aims to minimize the need for major upgrades or costly modifications in the later stages of the project, it also requires more upfront financial resources.

As a consequence, it is crucial to determine the driving factors for the concession periods of healthcare PPP projects. The first step towards this endeavor is analyzing the potential driving factors that influence the length of the concession period. Conducting a comprehensive analysis of these factors can help improve decision making, and enhance the performance and sustainability of PPP projects [

25,

26].

The interplay between project risk and concession period is intricate, dynamic, and profoundly influenced by the nature and magnitude of the associated risks [

27]. These risks yield substantial influence over the economic feasibility of projects, alongside their capacity to allure investments and secure financing [

4]. The rationale behind this lies in the potential for risks to precipitate substantial financial losses and obligations, consequently undermining the financial robustness of these projects and diminishing their attractiveness to investors and financiers [

28].

The risk profile characterizing PPPs typically delineates the probability and potential consequences of events that could impact the project’s cost, schedule, or performance during the concession period [

29]. A multitude of factors can exert influence on the risk profile, encompassing technical intricacy, legal and regulatory prerequisites, market conditions, financial exigencies, and environmental hazards [

17]. PPPs inherently bear a higher risk profile compared to conventional procurement methodologies due to their protracted engagement between the involved parties across multiple lifecycle phases, ranging from planning and design to construction and operations [

30].

The concession period underpinning a project delineates its framework, incorporating the roles and obligations of the public and private counterparts with respect to elements such as financing, revenue, and risk [

31]. The PPP business model necessitates meticulous design to ensure the project’s fiscal viability and judicious allocation of risks [

32].

The correlation between a PPP project’s risk profile and its concession period is intricate. A heightened risk profile typically mandates a more substantial financial commitment from the private partner, consequently influencing the concession period. In essence, the private partner may demand a greater return on investment to offset the heightened risk, potentially resulting in longer concession periods [

33]. Consequently, the business model must be artfully devised to strike an equilibrium between risk and return for both parties.

To mitigate the impact of risks on the PPP concession period, it is imperative to adopt suitable risk management strategies tailored to the precise nature and magnitude of these risks. This necessitates an exhaustive comprehension of the risks associated with specific infrastructure types, along with the technical, financial, and regulatory challenges they may pose. One approach to risk management in PPP projects involves the adoption of a risk-sharing business model, entailing the apportionment of risks and rewards between the public and private sector partners [

34]. This approach ensures that both parties have a vested interest in the project’s success and are incentivized to embrace optimal risk management practices. Another approach involves optimizing project design and development to enhance the economic viability of PPP projects without requiring an increase in the concession period, thereby diminishing financial risks and other prospective liabilities. The mitigation of these risks further augments the social and environmental sustainability of PPPs [

35].

3. Research Methodology

This paper presents an analysis of the various factors influencing the concession period in PPP projects. To achieve this, the first step is to identify a set of potential variables that could serve as influencing factors in the model. Subsequently, a statistical analysis method is employed to measure the effect of the chosen factors and their relationship with the concession period.

The analytical process unfolds in several distinct steps. The initial phase involves the meticulous identification of a set of potential variables that could serve as influential factors within the model. These variables are carefully chosen to encompass a broad spectrum of potential influencers on the concession period, taking into account past research and practical considerations. Once the potential variables were identified, data from real cases were gathered. To collect data on healthcare PPP cases, a triangulation approach was employed, drawing information from diverse sources including scientific literature, public databases, Italian newsletters, and direct access to the contracts of some PPP projects. A total of 28 healthcare PPPs initiated in 2004, with a total value of EUR 3.2 billion, were considered for analysis. Finally, a statistical regression analysis was conducted to identify significant drivers of PPP outcomes. This statistical technique enables the testing of the influence of independent variables on the chosen dependent variable, the concession period. It is worth noting that the correlation among the independent variables is closely examined to ensure that there are no collinearities among them.

3.1. Driving Factors for the Risk Model

This section presents the potential driving factors that may significantly influence the concession period of PPP contracts. The chosen variables include project investment size, project construction scale, project capacity, project normalized cost, public share, public experience, SPV size, and catchment population.

Table 1 provides an overview of these factors.

The first variable considered is the overall investment size of PPP projects, which represents the total initial investment required to build or renovate the healthcare facility. It encompasses the sum of Public Financing, Private Debt, and Equity contributed by the SPV undertaking the project. Current practice and extant literature require considering the size of the project investment when estimating the concession period [

36]. Similarly, construction costs have been considered in previous research as a potential factor affecting the concession period [

13,

16].

The project construction scale, represented by the duration of the construction period, is another potential factor indicating the complexity and scale of the overall project [

37]. Multiple studies have previously used the construction period as an indicator of project complexity and its impact on the concession period [

13,

17,

38]. On the one hand, larger projects with longer duration of construction may be expected to be positively related to the concession period. Conversely, extant research also supports larger public projects can benefit from greater economies of scale, and, consequently, higher potential revenues that may result in shorter concession periods [

39].

The capacity of the healthcare PPP projects is also considered for the analysis, reflecting the number of patients the hospital can treat at a given time. Higher capacity could potentially generate higher revenue for the SPV over time. Literature highlights the importance of revenues and related uncertainties as determinants of concession periods [

16]. Previous studies have also considered hospital capacity as a potential factor, though primarily focusing on public finance and project performance parameters [

39,

40,

41].

The normalized cost per bed is another factor considered to incorporate the investment made for each patient that can be simultaneously treated in the hospital. This factor could indicate the intensity of the investment and identify specialized facilities with particular complexities or risks. This parameter has been utilized in studies of toll road PPP projects to account for the project’s normalized cost [

42,

43].

Moreover, the public share, representing the proportion of the initial project investment paid directly through public subsidies, is another significant factor. Several studies have attempted to use public financing and government subsidies as a determinant of the concession period [

4,

36,

44]. A balance between the level of government subsidies provided and risks borne by the private sector is crucial to the concession period [

4].

The year of contract award, serving as a proxy for the experience of the public authorities in regulating and carrying out PPP projects, is another factor considered. Moreover, as time passes, the PPP-enabling legislation is enhanced, in particular for Italy. The last legislation in this regard is the Italian Legislative for Public-Private Partnerships, which came into effect in 2016. The effect of increased public experience in PPP projects has been pointed out in previous studies [

45]. Previous research has pointed out how public authorities focused primarily on utilizing private financing sources rather than adopting a value-for-money approach in PPPs procured decades ago, which resulted in imbalanced profit gains by the private sector in those projects [

14]. Public and private sector experience in PPP undertakings has also been pointed out as an important factor [

39]. It is expected that the more recent the contract award, the better the experience and capacities of the public sector in managing PPPs.

Furthermore, the size of the SPV participating in the PPP project is considered another potential factor that could affect the concession period. A higher number of companies and stakeholders in the SPV may indicate a stronger capacity to deal with project tasks. Previous studies have considered the SPV size as a potential contributor to the project risk [

46]. However, a large number of partners in the SPV could be the result of higher perception of risk and complexity of the project. A large number of partners in the SPV might also increase the occurrence of contractual and management issues [

47].

Finally, the Catchment Population is added to the analysis. It represents the number of people the hospital or facility must serve in a given area or province. The catchment population has been used as an influencing variable for project outcomes in previous studies [

40]. Additionally, a higher Catchment Population may impact the project’s profitability, and thus can be considered to assess its potential influence on the PPP Concession Period.

Before proceeding with the statistical analysis, it is crucial to convert the identified independent variables into quantifiable parameters. A summary of these parameters is provided in

Table 1.

Regarding the investment size, the total initial investment of the project is considered, as recommended by previous studies [

17,

36]. The project construction scale is measured by the construction period, defined as the number of years between the financial closure and the beginning of operations [

40]. For the hospital capacity, the number of beds in the facility is considered, following the recommendations of previous research [

39,

41]. The independent variable of project normalized cost is quantified by dividing the capital investment by the number of beds. To determine the public share, the overall percentage of project investment covered by the public sector is considered [

12,

39]. The size of the SPV is quantified by the number of equity holders participating in the SPV, as recommended by past research [

48]. For the catchment population, the number of inhabitants in the province where the facility is located is used as a parameter, as previously considered in extant literature [

40].

Public experience is represented by the year of contract award, indicating when the PPP project was awarded to the SPV. The rationale behind using the “year of contract award” as a metric for public experience is rooted in the assumption that public authorities’ knowledge and proficiency in handling PPPs have likely evolved and improved over time. Over the years, governments and public entities have gained valuable experience in structuring, negotiating, and managing these complex partnerships. This experience has been accumulated through trial and error, learning from past projects, and adapting to changing economic and legal environments. When governments first began engaging in PPPs, they often faced challenges related to project design, risk allocation, and contract negotiation. These early experiences highlighted the need for continuous improvement and learning, which grows as time passes. As a result, public authorities have become more adept at addressing the intricacies of PPP agreements. PPP legal and regulatory frameworks are enhanced over time as a result of a deeper understanding of best practices and lessons learned from earlier projects. Regulatory improvements often translate into more effective governance and oversight of PPPs, contributing to better outcomes and a more mature PPP market. As governments increasingly turn to private sector partners to deliver public infrastructure, the industry responds with innovative solutions and standardized practices that improve as time passes. This evolution has encouraged both public and private parties to adopt more sophisticated approaches to project development. Experience has also sharpened the decision-making abilities of public authorities who are now better equipped to assess the suitability of a project for the PPP model, determine risk-sharing arrangements, and evaluate potential private sector partners. This enhanced decision-making process can lead to more successful project outcomes.

3.2. Data Collection

To gather data regarding healthcare PPP cases, multiple sources were triangulated. The information regarding the business case of PPP hospital projects was complemented and refined through the analysis and comparison of multiple sources. These sources included scientific literature, public databases, Italian newsletters, and direct access to the contract of some PPP projects, facilitated by the involvement of the authors in those projects.

One of the authors acted as a consultant to the Regional Government Evaluation Board of PPPs and could collect first-hand data from the main contract documents of 13 PPPs. Complementary, 15 additional projects were gathered through a comprehensive content analysis of public databases and scientific literature related to PPPs and concession periods. The literature search included the following keywords: PPP, Public Private Partnership, Build Operate Transfer, BOT, private finance initiative, health care project, hospital project, PFI, and concession period. The search was focused on papers related to Italian cases spanning from the year 2003 to 2023. From the resulting papers, the authors screened and analyzed PPP projects specifically related to healthcare to gather data on the business cases of these projects.

For the purposes of this paper, the selected healthcare cases are a set of 28 PPPs initiated in the year 2004, with a total value of EUR 3.2 billion. Most of these projects are already in the operation phase, while a few are scheduled to begin construction in the year following the time of writing this paper.

Having established the model and with access to the data set of the PPP healthcare projects,

Table 2 provides a summary of the Italian healthcare PPP projects and the statistical distribution of the corresponding independent parameters, which are hypothesized to influence the concession period. The table includes the lower, median, and upper quartiles of the data, along with the corresponding standard deviation.

3.3. Data Analysis

In the model, the Concession Period (CcP) is the response variable, representing the number of years during which the SPV is responsible for operating the project.

To identify the significant parameters among those considered, a linear regression test was conducted, which is a widely-used method in literature for identifying significant drivers of PPP outcomes [

39,

40,

46,

48]. Linear regression analysis makes it possible to statistically test the influence of independent variables on the chosen dependent variable and reveals positive or negative relationships between them [

46]. SPSS was used as the analytical tool to conduct the regression test.

In this type of analysis, a positive correlation implies that variations in the independent variable result in corresponding changes in the dependent variable in the same direction. Conversely, a negative correlation indicates that changes in the independent variable lead to opposite changes in the dependent variable.

It must be noted that the correlation among the independent variables must be checked to check that there are no collinearities among them. This can be achieved by calculating a Variance Inflation Factor (VIF) for each of the independent variables. The absence of multicollinearity can be guaranteed if the VIF value is low. Variables with high VIF values, indicating unacceptable levels of collinearity, must be excluded from the regression analysis.

4. Results

An exploratory analysis is first carried out in order to verify the reliability of the independent variables and to check for any multicollinearities between them.

Table 3 shows the analysis results based on the mentioned database by considering all the independent variables.

In order for the results to be valid, the significant p-factor must be of a certain value, which would, in turn, show the reliability of the independent variable in question. A mean value of 0.05 was chosen as the benchmark for the significant factors. In addition, a multicollinearity analysis is carried out in parallel to make sure that the dependent variables are not overly affecting each other. This is carried out by calculating a Variance Inflation Factor (VIF). Ideally, this value would be between 1 and 5 so that we are able to reject multicollinearity.

A first analysis was conducted, indicating that the variable of CPB has a VIF value of more than 5, indicating the existence of multicollinearity between CPB and other variables, resulting in its removal.

The results of the analysis are given in

Table 3. In essence, the regression assesses the relationships between the Concession Period (CcP) and multiple independent variables. It can indeed be observed that the removal of CPB has had a positive impact on the reliability of the other independent variables. Moreover, variables of InS, PSh, YCA, NoEH, and CPop have shown significant

p-factors that render their influence on the dependent variable a reliable one, while CoP and HoC do not show to have a noteworthy influence on the PPP Concession Period. Also, there are no longer any multicollinearities among the remaining variables, and all VIF values are under 4 as recommended by previous sources [

46], indicating that the dependent variables are not overly affecting each other. Consequently, the result of the regression analysis performed can be expressed as:

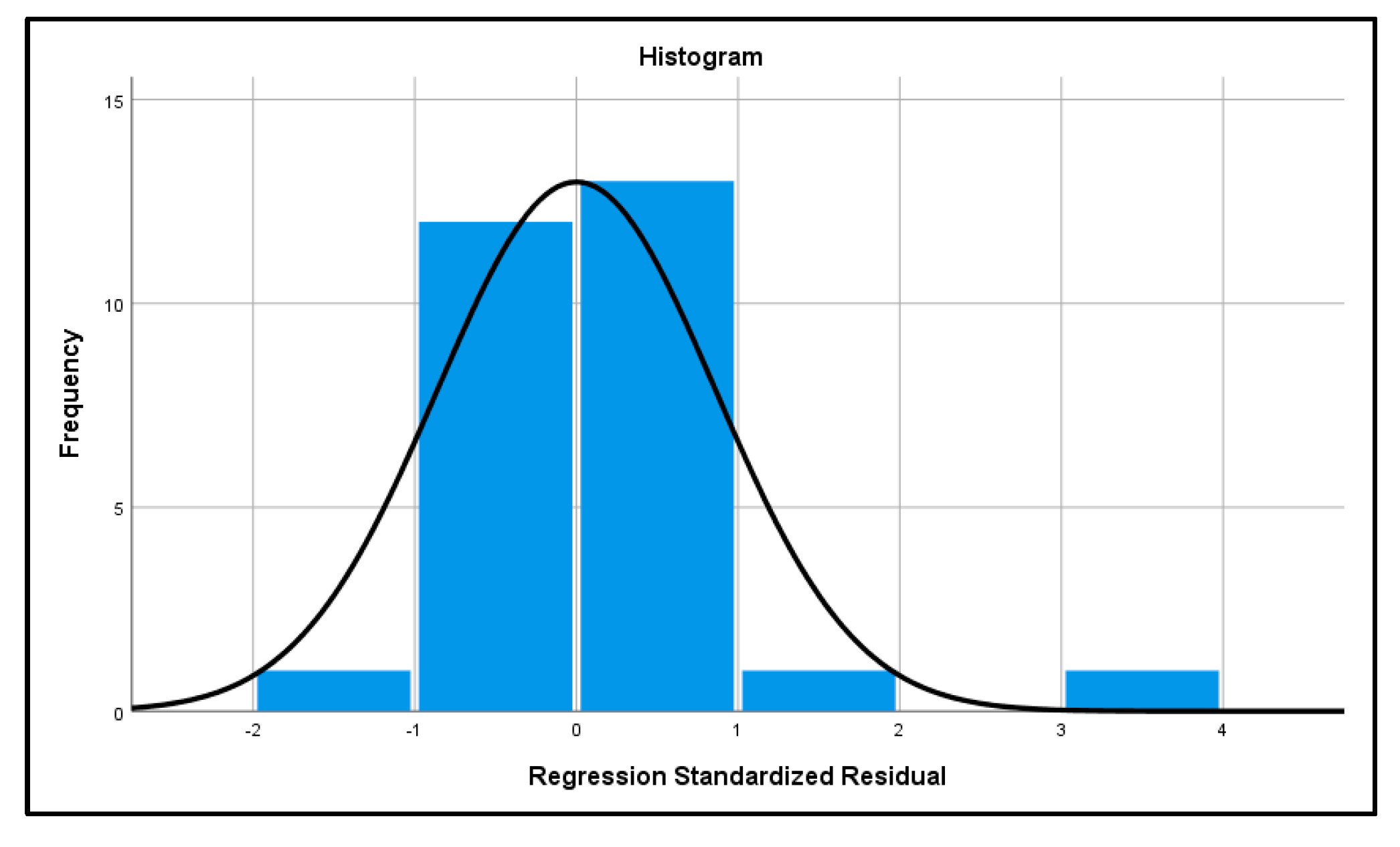

In order to validate the results of the analysis, some tests on the regression residuals were conducted. The histogram of the residuals resembles a normal curve, thus demonstrating the normality of the data set (

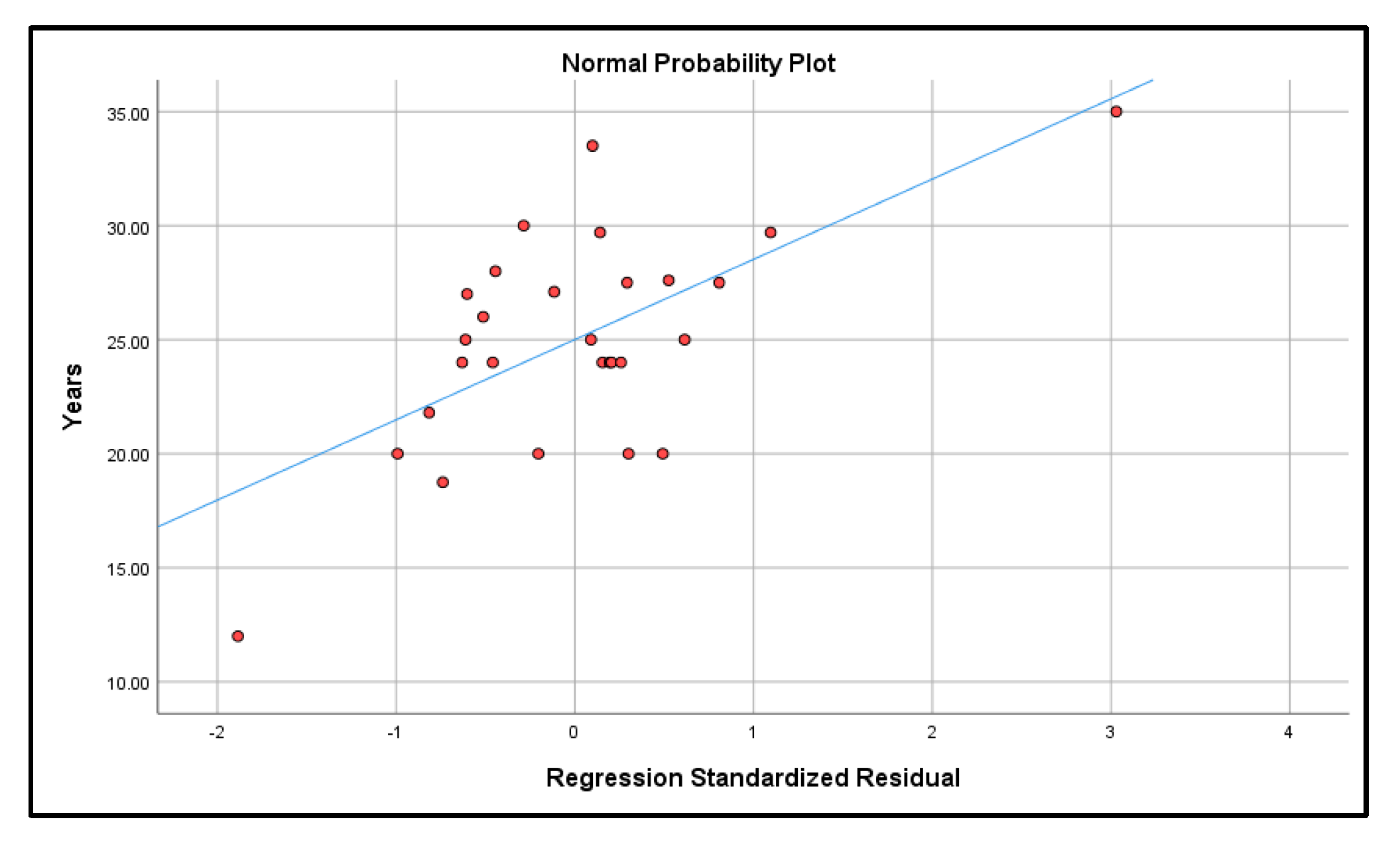

Figure 1). The normal probability plot shows that the residuals are normally distributed, and they generally follow a straight line with few significant outliers (

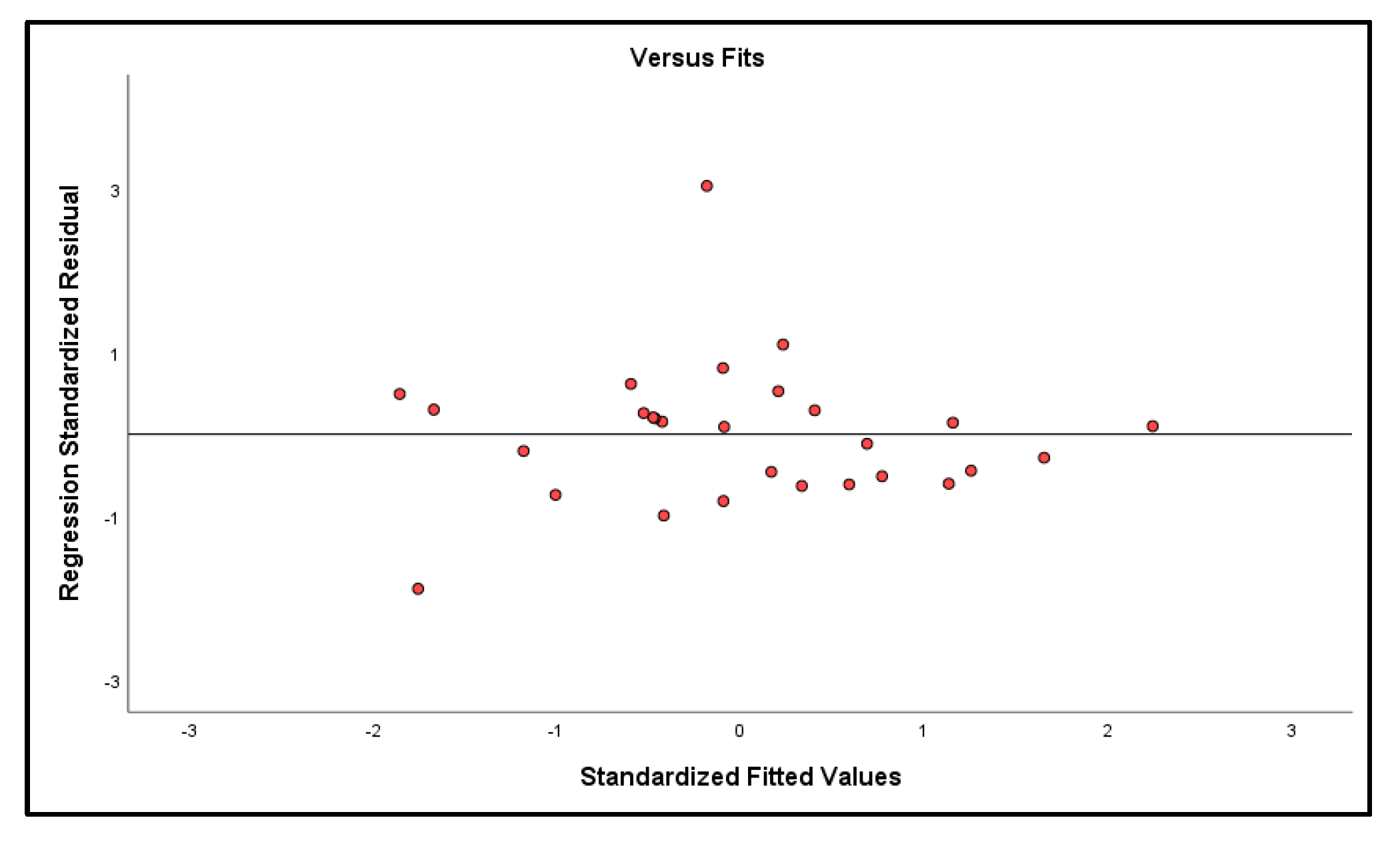

Figure 2). In addition, the residuals versus fits test (

Figure 3) does not show evidence of systematic error in the residuals of the regression. Finally, the residuals versus orders test (

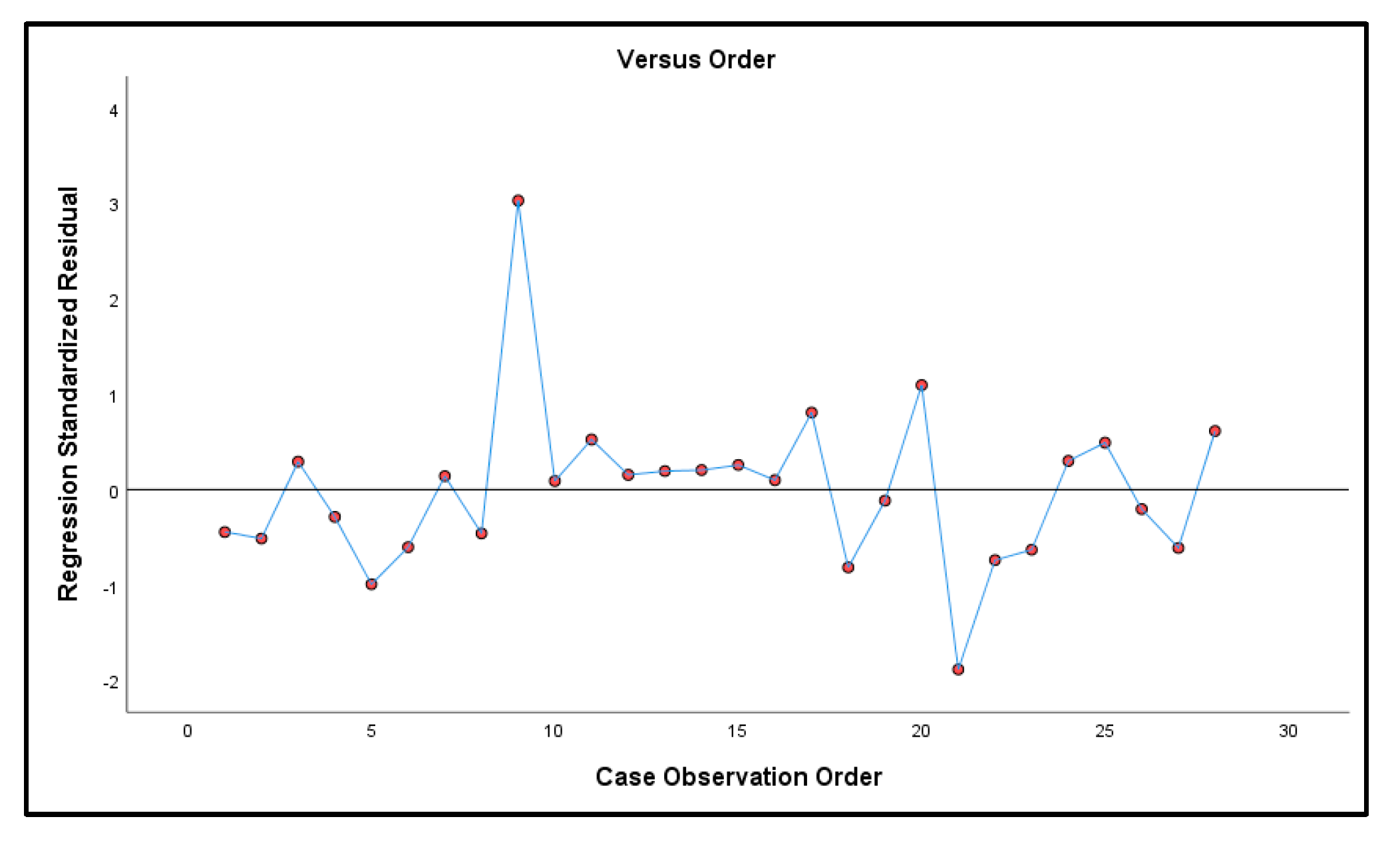

Figure 4) shows no indication of the presence of trends, time series, or periodicity.

5. Discussion

Results indicate that certain factors, namely, Investment Size (InS), Public Share (PSh), Year of Contract Award (YCA), Number of Equity Holders (NoEH), and Catchment Population (CPop), significantly influence the Concession Period granted to the SPVs by the public sector. Conversely, the Construction Period (CoP) and Hospital Capacity (HoC) were found to have no significant impact on the Concession Period.

Two parameters were found to have no significant relationship with the concession period. Interestingly, both factors were recognized as significant parameters for the concession period in the extant literature as follows.

Firstly, the Construction Period (CoP) is not a significant parameter for the concession period of healthcare projects. Interestingly, the construction period has been extensively incorporated to determine optimal concession periods in general PPPs [

17], and has been specifically applied to estimate this period in toll road PPPs [

38]. There are suitable reasons that may explain why our findings contrast with previous literature. Firstly, healthcare PPP projects may possess distinct characteristics compared to other types of PPPs, such as toll roads or general PPP projects, such as complex services and specialized equipment that may not be related to the construction period, which could differ significantly from the construction of other buildings or infrastructure. Additionally, the financial viability and risk allocation in healthcare PPPs may rely on long-term revenue streams from government payments or insurance reimbursements, which might not be directly influenced by the duration of the construction period. Moreover, a higher proportion of private financing generates strong incentives to complete the construction quickly regardless of the project size, resulting in relatively homogeneous construction periods.

Secondly, the lack of significant impact of Hospital Capacity (HoC) on the project concession period also contrasts with previous studies. In previous research, hospital capacity was found to be influential in determining the public share of PPPs [

39]. However, this study presents contrasting results in this regard, indicating that hospital capacity does not exert a similar influence on the concession period. These findings suggest that the link between hospital capacity and the concession period might be more context dependent. For example, PPPs with higher hospital capacity may result in higher public subsidies and a lower proportion of private capital provision, which could shorten the concession period. Alternatively, even in higher hospital capacity PPPs with a higher proportion of private capital, there may be mechanisms in place to ensure increasing yearly revenues, thus preventing the need for an extended concession period.

Complementary, the analysis also uncovered a positive relation between the Number of Equity Holders (NoEH) in the SPV and the concession period. This suggests that when the market notices a bidding process with a relatively long concession period, the private companies interested in the project tend to form SPVs shared by more equity holders to enhance their capabilities and risk sharing. Having increasing equity holders may indicate a more robust and capable SPV, better equipped to deal with project risks and ensure lenders’ timely debt repayments. Extant literature explored the effect of the number of partners in the SPV in reducing project risk, however, they only considered its effect on public finance [

46,

49,

50]. This paper complements this perspective by extending the analysis to consider the influence of shareholders in the concession period.

Surprisingly, the Catchment Population (CPop) was found to have a counterintuitive effect, positively influencing the concession period. This contradicts the initial hypothesis, which assumed that a higher population of end users would result in increased revenues or higher availability payment, thereby shortening the concession period. Moreover, the complexity of facilities and services offered by healthcare PPPs catering to large populations along with the fiscal constraints faced by the public sector concerning yearly payments contribute to the decision to opt for longer concession periods. This finding contrasts with previous studies that disregarded catchment population as a significant influencing factor in PPP projects [

40] and Build-Operate-Transfer toll road projects [

12]. This analysis demonstrates that this factor indeed plays a significant relationship with the concession period. In summary, this implies that as the number of potential users increases, there is a corresponding need for more extensive maintenance and operational interventions. This heightened demand for OPEX may, in turn, extend the concession period. While the connection between OPEX and concession period has been examined in prior studies [

51,

52], it is worth noting that the specific role of catchment population as a mediator in this relationship has not been thoroughly explored in previous research.

Findings indicate a significant and positive relation between Investment Size (InS) and the concession period. This relationship can be attributed to the high risk and complexity associated with larger projects, prompting the public sector to offer a longer concession in order to incentivize private sector participation in those projects. This finding complements the previous hypotheses that larger project initial investments lead to extended concession periods, mainly due to the higher expected returns sought by the investors [

16]. This aligns with claims that larger projects bear greater risk for private investors, necessitating longer concession periods to mitigate the perceived risks [

13].

Furthermore, results show a significant negative relationship between the Public Share of capital expenditure (PSh) and the concession period, indicating that, as the share of public funding in the initial investment decreases, the concession period increases. Consequently, when the SPV receives fewer subsidies from the public sector, it may require a longer concession period in order to generate sufficient revenues over time to ensure the desired profitability and project internal rate of return. PPP literature considered the effect of public financing and concession periods on the project NPV [

44]. This paper’s findings emphasize the relevance of understanding the negative relationship between public share and concession period to strike a balance between public and private sector interests. These results are consistent with other studies, which also found that government subsidies shorten the concession period [

39] and help governments secure earlier operational revenues [

4].

Furthermore, the analysis reveals a negative relationship between the Year of Contract Award (YCA) and the concession period. This suggests that PPPs awarded more recently, tend to have reduced concession periods. One suitable explanation for this trend is that over the years, the public sector has gained more experience and expertise in contract management of PPP projects, particularly in the context of healthcare facilities. As a result, they have become more prone to procure shorter concession periods in order to avoid burdening public budgets with excessive long-term costs. The adjustments made in 2016 to the PPP Italian legislation also serve as an indicator of the public sector’s commitment to regulating and improving the efficiency of PPP contracts, while ensuring the preservation of the benefits for the public.

6. Conclusions, Implications, and Limitations

This study helps in understanding the factors that influence the length of the concession period in PPP projects, particularly in the context of healthcare facilities in developed countries. The findings shed light on the importance of understanding the driving factors behind concession periods to effectively regulate PPP contracts. The results show that investment size, public share, year of contract award, number of equity holders in the SPV, and catchment population significantly influence the concession period, while the construction duration and the hospital capacity do not show a significant impact.

The findings of this study have practical implications for both the public and private sectors involved in PPP projects. Decision makers in the public sector can leverage the understanding of the negative relationship between the public share and concession period to strategically plan concession periods according to short-term fiscal constraints. Prioritizing higher short-term public shares can help reduce the need for private capital investment, leading to shorter concession periods and avoiding long-term financial burdens.

For the private sector, the positive relationship between the number of equity holders in the SPV and the concession period offers valuable insights for structuring SPVs during the procurement phase. Recognizing the correlation between concession period and uncertainty, private sector stakeholders can consciously shape SPV compositions to optimize risk management strategies. A higher number of partners in the SPV can better manage project risks by leveraging diverse technical knowledge, experiences, and strengths.

The findings of this study offer valuable insights that can be strategically utilized by decision makers to purposely plan the concession period and related strategies.

Firstly, the understanding of the significant negative relationship between the public share and concession period can be leveraged by public sector decision makers to purposefully determine the concession period based on their short-term fiscal constraints. In cases where the public budget is not excessively constrained due to fiscal pressures (as seen in multiple developed countries), decision makers can prioritize increasing the short-term public share. As a result, they can reduce the need for private capital investment, leading to a shorter concession period and ultimately preventing excessive public payments and additional financial costs in the long term. Overall, this approach allows decision makers to strike a balance between meeting immediate PPP financial requirements and optimizing the long-term benefits of the project.

Furthermore, the positive relationship found between the number of equity holders in the SPV and the concession period holds practical implications for the private sector in structuring the SPV during the procurement phase and tendering process. Understanding this correlation can help private sector stakeholders in consciously shaping the SPV composition in alignment with the established concession period and optimizing risk management strategies. When the concession period is longer, it implies a higher level of uncertainty, which can be better managed by a greater number of partners in the SPV to specifically manage specific risks. This is achieved by leveraging the diverse technical knowledge, experiences, and strengths of each partner. Conversely, when there is less uncertainty associated with a shorter concession period, a lower number of partners may suffice to manage the risks effectively.

The positive impact of the catchment population on the concession period holds significant implications for the public sector. When procuring healthcare PPPs in areas with smaller catchment populations, such as local or regional public sector entities, a strategic approach should prioritize shorter concession periods. This approach is advantageous as it helps to prevent the burden of excessive long-term expenses and financial costs, particularly when the level of services required may not be as high. Conversely, for public institutions procuring PPPs in larger cities with substantial catchment populations, there is an opportunity to focus on enhancing the capacity and service levels through financially leveraging higher short-term capital investments.

Despite its contributions, this study has certain limitations that should be acknowledged. Firstly, the analysis relies on a linear regression model, which assumes a linear relationship between independent and dependent variables. This simplification may not capture more complex, non-linear interactions that could exist in the data. Secondly, while the analysis identifies relationships between factors and the concession period, it cannot definitively establish causative links, given that linear regression establishes correlations between variables but does not prove causation. Thirdly, given the data available from the 28 projects studied, the analysis focuses on the selected independent variables and does not consider other potentially influential factors that may affect the concession period.

To further enhance the understanding of concession periods in PPP projects, future research could also explore additional factors that might influence the concession period such as political and institutional factors. By delving into these factors, policymakers and stakeholders can gain a more comprehensive view of the determinants of concession periods, enabling better decision making and project planning.