1. Introduction

Over the past few years, with rapid economic expansion and the ongoing effects of the COVID-19 pandemic, the limited fiscal revenue provided by local government is far from enough to meet the huge funding needs for infrastructure construction and public services [

1]. Public-private partnership (PPP) has increased in popularity as an alternative method of procurement to alleviate financial pressures and improve the quality and efficiency of public projects and services [

2,

3]. PPP is characterized as a type of collaboration between the government and social capital in China. State-owned enterprises constitute a substantial portion of the second “P” of PPP because of their typical Chinese features [

4]. Private enterprises’ competitors, the state-owned enterprises, and centralized enterprises have the natural advantages of robust financial strength, low expectations of profits, and closer relationships with the government due to their backgrounds, advantages that are not available to private enterprises, which must also fulfill certain economic responsibilities for the government while pursuing profits and economic goals [

5].

On the other hand, the apparent difference between state-owned and private enterprises participating in PPP projects has resulted in major “crowding-out consequences” to private enterprises and even the possibility of a state-owned monopoly [

6]. Problems such as disguised financing, public-sector government cooperation, higher and lower levels of government cooperation, government manipulation, and actual management rights have arisen one after the other during the course of cooperation between local governments and state-owned enterprises [

6]. This runs counter to the PPP model’s goal of leveraging private finance, utilizing private enterprise production and management technology to reduce project risks and optimize overall profits [

2,

3]. Naturally, the commonplace emphasis on PPP programmatic development, stability, and permanency across studies allows us to define, for this study, the fact that mobilizing private investment is critical to the sustained and stable development of infrastructure through PPPs [

7,

8]. However, private enterprises have always retained their low participation and small share. To effectively utilize the capital and technology of private enterprises, reviewing internal and external factors on how to restrict private enterprise involvement in PPP projects and identifying participation paths for private enterprises in PPP projects are critical.

PPP projects usually have a long payback period, high risk, and relatively low return rate [

9]. In recent studies on private enterprises’ participation in PPP projects, researchers started with the influencing factors restricting the participation of private enterprises, based on the policy text, to discover the reasons behind their low participation [

7,

10]. Some scholars have used case-study methodologies to summarize the market-led, government-led, and enterprise-led factors that influence private company participation in PPP projects [

11,

12,

13]. Others employed empirical research methods to analyze the net effect of various restrictions on private enterprise participation from various perspectives [

2,

14,

15]. Most previous studies have focused on how to evaluate the effect of various factors on private enterprises participating in PPP(PEP3P), whereas the factors that limit private firms’ participation in PPP projects are not mutually independent but rather have complicated causal relationships. Despite the relevance and high visibility of this situation in China, this topic has received little research attention regarding the participation paths for private enterprises. Given this finding, the purpose of this article is to answer the following questions:

Is there a single necessary condition for private enterprise participation in PPP?

What are the configuration paths for private enterprises to make them participate in PPP projects in China?

What are the differences in configuration paths between high and low participation in PPP for private companies?

Given the current state of the PPP model in China and the difficulties encountered by private enterprises when participating in PPP projects, this study takes 102 PPP projects regarding sewage treatment as the research object and aims to identify the configuration paths that motivate private enterprises to participate in PPP projects by using the necessary condition analysis(NCA) and fuzzy-set qualitative comparative analysis(fsQCA) methods. The contributions of this study are therefore geared toward identifying the factors that influence PEP3P from three perspectives: these include participant characteristics, doing business(DB), and project characteristics; employing set theory to explain the complex causal relationships among multiple factors and unveiling the condition configuration paths that drive private enterprises to participate in PPP projects, making up for the shortcomings of traditional measurement methods that rely on univariate net effect analysis; and utilizing fsQCA to analyze causal asymmetry for the configuration paths of PEP3P and explore separately the configuration paths that lead to high and low participation, which helps government departments to make better decisions and solve problems more effectively.

The remainder of the paper is structured as follows: a detailed literature review is given in

Section 2, which helps to identify the factors influencing PEP3P, followed by a summary of the research design. In

Section 3, the methodologies and data used in this study are explained.

Section 4 shows the results of this study and the research findings.

Section 5 puts forward our recommendations to encourage private enterprises to participate in the PPP, based on the findings. The paper ends with concluding remarks, a summary of the study’s limitations, and suggestions for future research in

Section 6.

2. Literature Review and Research Propositions

2.1. Literature Review

2.1.1. Participants’ Characteristics

Most studies about participants in the PPP field currently focus on participant management [

16,

17], risk allocation [

17,

18,

19,

20], the distribution of control rights [

21,

22], and governance mechanisms [

23,

24], which ignores the micro factors of a single subject. The objective characteristics of government and enterprises play a crucial impact on private enterprise participation in PPP investment.

At the government level, the PPP method offers a means for the administration to hide fiscal deficits and circumvent expenditure restrictions, providing a fiscal protection mechanism for the government [

25]. An inverted U-shaped relationship exists between the weakness of local free financial resources and private sector participation in PPP projects [

26]. Furthermore, PPP transactions need aggressive management by a strong, competent government [

27,

28]. The reasons for past PPP failure focus on limited public sector capacity, lack of political will, and perceived legitimacy and trust issues between the public and private sectors [

8,

29]. The capacity of government institutions is an important indicator of the effectiveness of government PPP governance, and government departments must have a comprehensive and clear PPP concept that can guide more private enterprises to obtain investment opportunities [

7,

30].

At the enterprise level, PPP is most apparent in the differences in finance, profitability, and technical innovation capability. Discrimination against diverse ownership led to difficult and expensive financing for private enterprises, drastically reducing profit space and indirectly raising the limit of PEP3P [

31]. The private enterprises’ technology innovation capacity plays an important role in their participation in PPP projects. Private enterprises with a high level of technological innovation are more likely to participate in PPP projects [

32]. Conversely, private enterprises with a low level of technological innovation are less likely to participate.

2.1.2. Doing Business

Economic theory studies translate “doing business” (DB) into the possible advantages or costs to participants, which is an important and comprehensive aspect that directly influences government decision-making and enterprise investment. A favorable DB efficiently decreases information asymmetry, reduces the cost of government–enterprise collaboration, and reduces risks in investment activities [

26]. A poor DB increases private enterprise participation costs and forces them to abandon PPP projects in search of alternative investment opportunities. A complete legal framework [

33,

34,

35], regional economic development level [

17,

19], available financial markets [

17,

19,

36] and the degree of information transparency [

37,

38], corruption [

11,

14,

29], foreign exchange and inflation risks [

35,

39,

40], and other single environmental factors have been shown by many scholars to have an impact on private enterprises’ participation in PPP projects.

However, analyzing the impact of the macroenvironment on participants from the point of view of a single aspect might easily obscure the nature of the impact of the macroenvironment on participants. A few scholars have been drawn to the DB as a thorough indication of the macroenvironment [

26,

31,

41]. A favorable DB contributes to the elimination of rent-seeking and the promotion of enterprise innovation and development. A good DB plays a positive regulating role in the relationship between the local government’s financial resources and enterprises attracted by PPP projects, which is conducive to reducing the resistance of the private financial resources gap to PPP projects [

41]. The government represents the interests of the public and must create good DB to guide investors in exerting a great deal of effort in a partnership [

31].

2.1.3. Project Characteristics

In addition to the influence of participant characteristics and DB on private enterprise investment decisions, project characteristics are also necessary factors for enterprises to consider regarding investment. While research on project characteristics factors focuses on the project franchise period, project type, project scale, and project risk [

5,

17,

33,

34,

37,

39,

40], how to design appropriate PPP projects to promote private enterprise participation needs to be studied further.

As rational economic subjects, private enterprises consider avoiding risks and delivering predictable returns to be the crucial project selection criteria [

31]. However, PPP project characteristics, such as long return cycles, high financing costs, and unpredictable returns, increase the enterprises’ concerns [

17]. Private enterprises will invest in a project only if the profit they can gain from this project is equal to or greater than the income they can obtain from other, similar, projects [

42]. Project risks, for example, run throughout the project’s whole life cycle, and reasonable risk allocation is the key for the government and private enterprises to “play to their respective strengths” and achieve the collaboration aim of “

”. The government usually shares the risk with enterprises, but excessive risk-taking increases the government’s financial burden, whereas an insufficient risk responsibility reduces the confidence of the investors participating in the project [

31,

43]. Reasonable projects’ risk allocation (PRA) not only minimizes the government’s risks but also increases investors’ confidence, thereby reducing costs and improving social welfare. Furthermore, with limited capital, private enterprises prefer small-scale and low-cost projects, such as sewage treatment, ecological environmental protection, and culture [

14,

17].

Few if any of these studies have examined whether different constellations of factors create conditional configuration paths to attract private enterprises to participate in PPP projects [

44]. This study thus attempts to build on the cross-project findings and influencing factors of PEP3P from other extant studies by addressing the following research question: What combinations of factors lead to PEP3P? To address this research question, we begin by outlining the importance of PEP3P. Next, we identify the influencing factors affecting PEP3P. Then, we outline our analytical approach and case selection strategy using NCA and fsQCA. Finally, we discuss the results of our fsQCA and the implications of our findings for future research on PPP areas.

2.2. Research Propositions

The majority of previous studies indicate that private enterprise participation in PPP is affected by many factors. In this context, the paper argues that examining configurations of factors is more important for understanding private enterprise participation in PPP than evaluating individual causal conditions. The configurational perspective implies complicated causal patterns and higher-level interactions among the constructs. Configuration theory emphasizes conjunction causality [

45], meaning that outcomes of interest (e.g., private enterprise participation in PPP) rarely result from a single cause but rather from sequential causal conditions that create insufficient configurations that result in the outcome. Thus, a causal condition causes an outcome that is not in isolation but is in combination with another one or more other conditions. In this respect, this article puts forth the following hypotheses:

Proposition 1 (P1). A single condition is not a necessary condition for private enterprise involvement in PPP; it is rather a variety of conditions interacting to influence private enterprise participation in PPP.

Proposition 2 (P2). There is no single best configuration path of antecedent conditions that occurs to explain private enterprise involvement in PPP, but multiple, equally effective configurations of causal factors do exist.

The configuration theory also proposes the occurrence of causal asymmetries. Causal asymmetry means that an outcome may occur even when a causal condition does not exist, depending on how it combines with other causal conditions; a configuration that explains the presence of an outcome cannot be interpreted as the mirror image of a configuration that explains its absence [

45,

46,

47]. For example, alternative configurations of private enterprise participation in PPP may involve high government revenue in one configuration and low government revenue in another configuration. A causal condition can be associated with a positive or negative outcome, based on how it is combined with other causal conditions. In addition, even if all the antecedent conditions are the same, the non-set of the conditional configuration of high participation is not the conditional configuration of the low participation of private enterprises. Thus, explanations for the presence of an outcome do not imply that reversed explanations inevitably account for its absence [

47]. Therefore, this article puts forth two additional propositions:

Proposition 3 (P3). Single causal conditions (i.e., government fiscal revenue, government institute capacity, enterprise credit level, enterprise technology level, and so on) may be present or absent within configurations for PEP3P, depending on how they combine with other causal conditions.

Proposition 4 (P4). Configuration paths of the high participation in the PPP of private enterprise are not perfect reverses of the configuration paths of the low participation in PPP of private enterprise.

3. Methodology and Data

3.1. Research Design

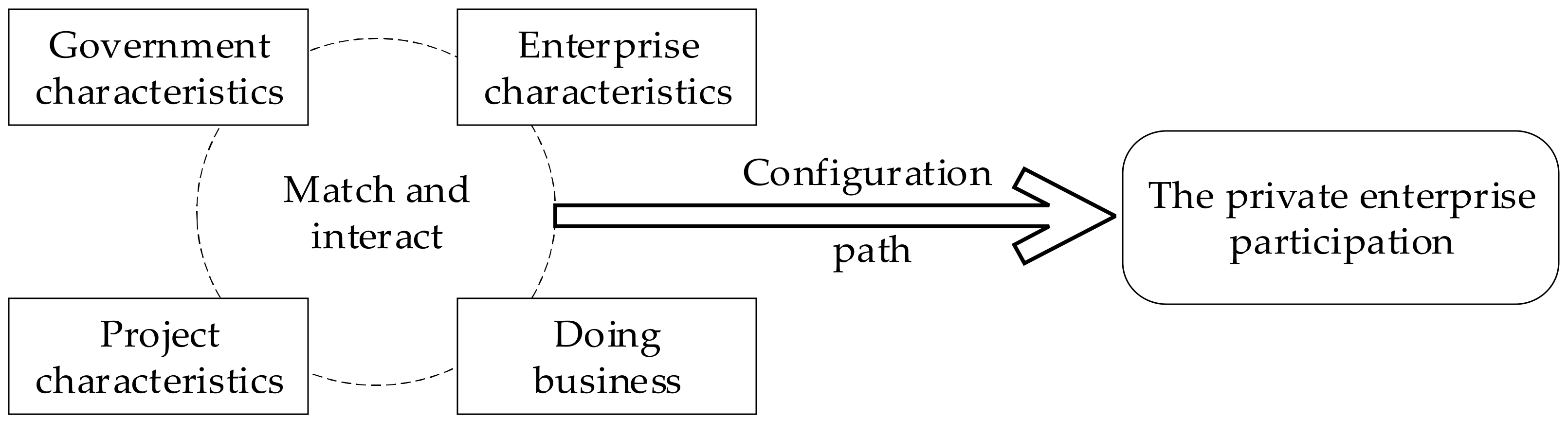

There is a matching link between the characteristics of participants, the DB, and the characteristics of a project. First, government characteristics concentrate on government fiscal revenue (GFR) and government institutional capacity (GIC) [

5,

19,

30,

35]. Areas with low GFR tend to use the PPP model to provide public goods or services, and PPP projects are typically tiny, which might easily cause private enterprises to be concerned about their income stability [

26]. A favorable DB might help to mitigate the resistance effect of limited financial resources on PPP projects [

48]. The preparation and implementation of PPP projects are represented by the capacity of government institutions [

8,

29]. The government may efficiently integrate market resources, launch high-quality PPP projects, and leverage private capital through standardized and orderly PPP operations, which have a positive feedback impact on the DB.

Second, enterprise characteristics encompass a range of behavioral activities, such as enterprise operational costs, innovation capability, revenue capability, and financing capability [

31,

32]. According to the principal–agent theory, the two parties achieve the same aim through information search, negotiation, contract design, and other activities, all of which require the consumption of scarce economic resources; therefore, market allocation is ineffective [

49]. Reducing ineffective agency activity is the key to increasing private enterprises’ participation. A good DB provides a sound market mechanism and property rights protection; perfect information for enterprise operation lowers the cost of the enterprise search for the local market and interpersonal behavior information ensures contract fulfillment and increases private enterprise participation enthusiasm [

41]. In the same DB, enterprises with a high credit level and high innovation ability can fully utilize their advantages in terms of resource integration, leverage the benefits of market size and investment, compensate for a lack of project characteristics, and have a stronger willingness to participate in PPP projects. As a result, PEP3P is a process in which the features of the government and enterprises, DB, and project characteristics, as well as other elements, simultaneously constrain, complement and substitute, match, and interact.

The study is led by concurrent method theory and creates a three-dimensional research framework consisting of seven conditional variables and one outcome variable, based on references and stakeholder perspectives. Due to the condition number constraints of the fsQCA technique, we only evaluate the seven criteria that have been widely addressed in other literature and are acknowledged by experts, without considering additional factors, such as government corruption, the project cycle, project incentive system, and so on. Secondary factors for the features of the participating subjects are determined to be government financial revenue (GFR), government institute capacity (GIC), enterprise credit level (ECL), and enterprise technology level (ETL) [

5,

30]. The area of DB is a comprehensive index of external factors and conditions, such as the government affairs environment, market environment, legal environment, and cultural environment, which are engaged in the market entities’ economic activities. The DB plays a moderating role in the relationship between government financial resources and PPP project investment and is regarded as an important indicator influencing private enterprise participation [

26,

41]. Secondary indicators of project characteristics are determined to be project investment scale (PIS) and project risk allocation (PRA), when combined with the division of project features [

11,

17]. As a result, this paper selects the above seven conditional variables from the four aspects of government characteristics, enterprise characteristics, doing business, and project characteristics, to construct a configuration analysis model using the fsQCA method to drive private enterprises to participate in PPP projects and reveal the complex causal relationship between different conditions.

Figure 1 depicts the theoretical model framework.

3.2. NCA and fsQCA

Once the theoretical model framework was established, we explored the necessity of specific conditions for results and which combinations of conditions lead to PEP3P. Inferring such systematic patterns among several factors is infeasible with traditional deductive correlation-based approaches [

50,

51]. However, the combination of NCA and QCA is the preferred method for addressing this type of research question [

52,

53]. NCA focuses on a single condition that is necessary but is not always sufficient, whereas QCA focuses on combinations of conditions (configurations) that are sufficient but are not always necessary [

54]. Although QCA focuses on sufficient configurations, it may also evaluate a single necessary condition, but there is a limitation in terms of quantitative analysis [

55]. The combination of these two approaches will explain the necessary conditions and causality adequately [

55].

The first step toward identifying the conditions is whether it is necessary to condition PEP3P with NCA. The necessary condition analysis (NCA) method clarifies the necessary but not sufficient conditions of various organizational determinants for predictable outcomes [

54]. Necessary conditions are those that must be present but alone are not sufficient to produce the outcome of interest, while sufficient conditions (or combinations thereof) are sufficient but not necessary (because of multiple causal pathways) to produce the outcome of interest [

54,

56,

57]. Compared to traditional data analysis, which is the additive model, NCA is able to express the necessary causality as a multiplicative phenomenon [

54]. Thus, before the intended outcome may be realized, these necessary conditions must be removed [

54].

Then, we determined which combinations of factors result in PEP3P. For this type of research question, QCA is the preferred strategy [

57,

58]. QCA is a hybrid method that incorporates the benefits of both qualitative (case-based research) and quantitative analysis (variable-oriented research). QCA, on the other hand, is based on the investigation of sufficient and necessary conditions to create an outcome and uses small-to medium-level case studies to explain various concurrent causalities [

59]. This technique aids in the research of equifinality, or the existence of several combinations of variables that result in the same outcome [

45]. FsQCA is one of the main QCA technologies and was selected for this study. This approach combines the inferential power from “large n” data sets with in-depth case knowledge [

60] and involves the scoring of causal and outcome conditions for each case, based on the extent of its membership in a set of cases sharing a particular characteristic [

56]. A range of continuous values from 0 to 1 is used to score both the causal conditions and outcome measures. Cases with a score of 0 are considered to be “fully out” of a set of cases with a given characteristic, while cases with a score of 1 are considered to be “fully in” the set [

61].

3.3. Data

3.3.1. Sample and Data Collection

According to the National PPP Comprehensive Information Platform management database project’s 2021 semi-annual report, the database contained 4138 municipal engineering projects, accounting for 40.9 percent of the total. We chose the sewage treatment industry as a research object to avoid industry disparities and maintain timeliness. Between 2018 and 2019, 355 municipal engineering sewerage treatment projects entered the execution stage. Based on three criteria, we chose 102 sewage treatment projects at the implementation stage as examples because of the diversity of cases, representativeness of instances, and comprehensiveness and rigor of data. We utilized the “National PPP Comprehensive Information Platform Project Management Database” to gather project-specific information, including the project name, project location (province, city, county), project investment amount, value for money score sheet, shareholder name, shareholder capital contribution, and shareholder equity ratio. The GFR and DB scores for the project’s location were obtained from provincial statistical yearbooks, as well as data released by the Guangdong-Hong Kong-Macao Greater Bay Area Research Institute and the 21st Century Economic Research Institute. Through docking with the enterprise basic information and annual report on the Tianyancha website, we acquired enterprise-related data, including the enterprise nature, enterprise punishment data, enterprise punishment history, and enterprise patent information.

3.3.2. Measures

Any fuzzy set can be seen as a continuous variable that has been purposefully calibrated to indicate the degree of membership of a well-defined set [

61]. Therefore, calibration is regarded as the process of assigning case membership values. Direct calibration was used to determine the fuzzy set (or clear set) of outcome variables and numerous antecedent conditions, based on applicable theories and substantive knowledge [

46,

61].

Table 1 shows the descriptive statistical analysis and calibration score values for the outcome variables and various antecedent conditions, demonstrating that there are no abnormal values.

Outcome variable: The project shareholders’ information for 2018–2019 was obtained from the National PPP Comprehensive Information Platform management database. We measured the involvement of private enterprises in terms of the nature of the enterprise and the percentage of private enterprises’ equity. Company law’s eight equity lines were used to determine a fuzzy set of private enterprise participation. The absolute controlling interest is 67 percent, which translates to 100 percent authority, while the temporary meeting equity is 10 percent. To avoid a contradiction between the fuzzy membership threshold and the original data, a small modification was made [

61]. The full non-membership threshold value was 10.00, the crossover point was 50.01, and the full membership threshold value was 66.99.

Antecedent conditions of participating subjects: GFR and GIC are characteristic of government qualities, while ECL and ETL are characteristic of enterprises. GFR data focused on the city and county levels to eliminate disparities caused by administrative unit inconsistencies. GIC was determined by the project’s value-for-money expert score, which was averaged after excluding the highest and lowest scores from a single project. If multiple projects were in the same city or county, the GIC score was averaged once again. We chose the sum of the administrative fines and historical administrative penalties to measure DB. Corporate administrative punishment represents the government’s method of evaluating untrustworthy firms’ behavior, and indirectly reflects their credit, funding, and profitability [

62]. Company innovation capability was expressed by the number of authorized and effective patents [

63] because the level of enterprise patents has a long-term promoting effect on a company’s innovation level [

64]. Three calibration points for GFR, GIC, and ETL were expressed by quartiles of the descriptive statistics of the case samples (25%, 50%, and 75%, as follows). For ECL, we adopted a dichotomy: the value is 0 if the firm had an administrative penalty or a historical administrative penalty; otherwise, the value is 1.

Conditions antecedent to the DB: Improving the DB was crucial in fostering enterprise transformations and upgrading, and ongoing improvement will promote high-quality development [

48,

65]. There are currently two approaches for measuring the DB. The first way is to create a DB indicator based on the existing mature report and its research objectives, while the second method is to directly measure the DB in the mature report. This method is known as the “marketization index” of DB [

66]. The overall score from the DB study for 2020 for the 296 cities in China above ground level, published in a report from the Greater Bay Area Guangdong-Hong Kong-Macao and the 21st Century Economic Research Institute, was used to calculate DB scores. Three calibration points for DB were expressed by quartiles of the descriptive statistics of the case samples.

Antecedent conditions of project characteristics: The amount of money invested in a project influences its size, which is a crucial issue for participating companies to consider [

11,

14]. Many variables, including political risks, market potential risks, and reasonable risk allocation, limit private company participation in PPP projects. Enterprises more actively participate in PPP as a result of the more complete identification of project risks and a reasonable allocation of risks between the government and social capital [

31]. The risk allocation scores were calculated by averaging the expert scores in the evaluation of the value for money of each project, after removing the highest and lowest scores. Three calibration points for PIS and PRA were expressed by the quartiles of the descriptive statistics of the case samples.

4. Results Analysis and Discussion

4.1. Results

4.1.1. Results from NCA

Before we reached our “analytic moment”, we needed to conduct a necessary conditions analysis for mature PPP market performance [

61]. First, we used NCA to find the necessary antecedent condition. The effect size (ES) is a measurement of how much a necessary condition limited the outcomes. The larger the value of the effect size, the greater the restriction and the impact of a necessary condition on the outcome.

The ES has the following expression:

where C is the ceiling area, S is the range, and

d is the effect size. The required condition effect size ranges from 0 to 1, with “0 <

d < 0.1” denoting a “low effect”, “0.1 <

d < 0.3” denoting a “medium effect”, and “0.3 <

d < 0.5” denoting a “high effect” [

54]. The effect size was measured and expressed using both piecewise ceiling envelopment (CE) and continuous ceiling regression (CR). The effect sizes of each antecedent condition are reported in

Table 2, and the relevant data were the calibration data. For the NCA approach to work, two elements must be met at the same time. First, the effect size should be no less than 0.1(

d > 0.1); second, the Monte Carlo simulation permutation test should demonstrate that the effective amount is statistically significant (

p < 0.05) [

54]. As a result, the effect size of each antecedent condition was 0, and the significance of the effect size was minor. Thus, each antecedent condition is not necessary for private enterprises to participate in PPP projects, and there will be no bottleneck for private enterprises.

Following this analysis, the fsQCA method was utilized to test the necessity of the antecedent conditions; antecedent conditions with a consistency level of more than 0.9 are considered necessary conditions, based on the discrimination criteria from the previous study.

Table 3 shows the result of the necessary analysis of antecedent conditions performed with fsQCA3.0. All antecedents and the negation of the antecedent conditions have a

p-value of less than 0.9, and the test results are consistent with the NCA. These conditions are not necessary to entice private enterprises to participate in PPP projects. This finding gives credibility to Proposition 1, which anticipates that no single condition is a necessary condition for private enterprise participation in PPP.

4.1.2. Results from the fsQCA

When employing fsQCA for conditional configuration analysis, the configuration consistency level is typically greater than 0.80 [

48]. The sample size determines the frequency threshold. The frequency threshold for small samples is 1. The frequency threshold is bigger than 1 for large samples. According to the prior literature’s sample circumstances and discrimination criteria, the consistency was set at 0.85, and the frequency threshold was set at 1. Based on the attribution relationship between the simplified and intermediate solutions, we determined the core condition and edge condition of a single intermediate solution. The antecedent condition of both the simplified and intermediate solutions is the core condition, and only the antecedent condition of the intermediate solution is the edge condition. In counterfactual analysis, where there were insufficient evidence and theories to determine the precise direction of the antecedent conditions influencing results, it was assumed that the existence or absence of a single antecedent condition can drive private enterprises to participate in PPP projects. According to the fsQCA,

Table 4 shows four paths for private enterprises to participate in PPP projects, namely, M1, M2, M3, and M4, indicating that private enterprises can participate in PPPs in a variety of different ways. This conclusion supports Proposition 2, which states that there is no single best configuration that predicts private company involvement in PPP but, rather, that different and equally effective configurations exist.

Table 4 shows that the overall solution and single solution consistency levels are greater than 0.80, the overall solution consistency is 0.91, and the overall coverage is 0.116, indicating that these four configuration paths explain 11.6 percent of the reasons for PEP3P. Configuration M1 shows that the existence of ETL is a core condition, but the presence of PRA is a peripheral condition. The configuration’s consistency is 0.864, its unique coverage is 0.024, and its raw coverage is 0.041. As a result, a high degree of technology is a crucial guarantee for private enterprises to participate in PPP projects. The core conditions in the M2 configuration are the ETL and DB. This configuration’s consistency is 0.891, has a unique coverage rate of 0.018, and a raw coverage rate of 0.034. As a result, improving technical innovation skills is an important condition for encouraging private enterprises to become important players in PPP projects in areas with better DB. Configuring M3 and M2 involves the same core existence conditions, and GIC, PIS, and PRA are important auxiliary variables. There is a consistency of 0.918, a unique coverage rate of 0.045, and a rate of raw coverage of 0.031. This demonstrates that enterprises with higher levels of technical innovation prefer to invest in locations with superior DB to attain the dual goals of government financial support and project seeking. The existence of GFR, ETL, DB, PIS, and PRA are all core conditions in configuration M4, which has a consistency of 0.930, unique coverage of 0.023, and raw coverage of 0.035. Thus, enterprises with high levels of technological capacity choose to participate in high-quality PPP projects in locations with superior business conditions, to fulfill the goal of local financial support. GRF, on the other hand, is absent in the configuration paths of M1, M2, and M3, which support Proposition 3, which predicts that single causal conditions may be present or absent in PEP3P configurations, depending on how they combine with other causal conditions.

4.1.3. Robustness Test

The robustness of the results is evaluated by varying the level of consistency. The results are considered robust if changing the consistency level results in a clear subset relationship between the setups.

Table 5 reveals the results of the robustness tests. The consistency level was enhanced from 0.85 to 0.87, and the entire solution’s consistency level was somewhat improved from 0.914 to 0.929. Although the configuration M1 no longer exists, it is still a subset of the original configuration. The M2 configuration has undergone a slight tweak. The GIC has switched from a lack of core conditions to a lack of edge conditions, but the underlying mechanism is the same; namely, that enterprises choose to participate in PPP projects in regions with stronger DB. The antecedent forms of other configurations are the same. As a result, after increasing the consistency criteria, the study results have not altered significantly; thus, the research findings are robust.

4.2. Discussion

4.2.1. The Configuration Paths for Private Enterprises to Participate in PPP

The PPP model that motivates private enterprises to participate in PPPs is further classified into three types, based on the core and peripheral conditions of the four conditional configurations: “enterprise technology-led” and driven (M1), the “DB-led” pulling type (M2 and M3), and “project characteristics-led” push type (M4). The three driving modes indicate the diverse and complex motivations that drive private enterprises to participate in this type of investment.

The “enterprise technology-led” driven configuration demonstrates that higher levels of technical innovation can be leveraged to compensate for a lack of corporate credit, achieving the goal of generating predictable investment returns by focusing on high-quality projects. Companies with stronger technological innovation skills have a more comprehensive organizational structure, a larger production scale, more efficient management capabilities, and more willingness to engage in PPP activities [

32]. The sewage treatment PPP industry is constantly improving sewage treatment technology. Currently, the newly constructed sewage treatment plants in cities and towns have achieved a Class A pollution standard, and the previous Class B standard needs to be upgraded. As the sewage treatment industry improves its technical innovation capabilities, enterprises must ensure technological advancements through R&D and knowledge transformation, which helps to regulate the agents’ trust relationship and improve project performance [

67]. For example, Beijing Bishuiyuan Technology Co., Ltd. is ranked fourth on the list of cumulative capital participation in PPP projects, and independently researches and develops more than 50 core sewage treatment technologies to obtain a competitive advantage in the corporate world. Guangxi Boschke Environmental Technology Co., Ltd. has a skilled R&D team and a scientific research platform that can provide advanced technical assistance to PPP project participants.

Based on the results of the “DB-led” pull configuration, it is evident that creating a sound DB is essential to entice private firms to participate in PPP projects. There are two alternative paths for private firms to participate through this form of participation, with the core roles of ETL and DB playing a key part in both tracks. This reveals that enterprises with a higher potential for technical innovation are more inclined to participate in PPP projects launched in places with a more favorable DB. An uncertain business climate may lead to increasing non-productive and tax expenditures among enterprises, raising the cost of productive resources and diminishing private enterprise enthusiasm [

48]. Private firm engagement in PPP projects is hampered to some extent by financing difficulties and high finance costs. Great DB can relieve corporate financial limitations, enhance technology diffusion and transfer, and eventually improve the innovation capabilities of private enterprises and stimulate corporate investment [

26]. In superior DB, private enterprises tend to have fewer restrictions. Property rights protection, policy support, and more transparency increase the willingness and opportunities for private enterprises to participate [

68]. As a result, private enterprises with higher levels of technological innovation choose to participate in PPP projects in regions with a stronger DB to reduce risk uncertainty.

According to the configuration results of the “project feature-led” pushing type, the internal character factors of the project and the level of GFR also play key roles, based on the two core conditions of ETL and DB. This model combines the dual advantages of “technology-led enterprise” and “DB-led” types. Private enterprises are willing to invest in larger-scale PPP projects under the pull of a reasonable PRA and the support of the GFR, but more companies prefer to invest in projects with small initial investment scales [

69]. Only when the external environment becomes better will private enterprises choose projects with a relatively significant investment scale. Because private firms have fewer financial resources and negotiation advantages than state-owned enterprises, when private enterprises select larger projects, they are more inclined to choose projects with reasonable risk allocation [

70]. When local governments have insufficient financial resources, the private sector will be worried about the government’s ability to perform contract work [

26]. Higher GFR guarantees encourage private enterprises to trust the government’s ability to fulfill contracts, generating a pulling effect on private firms’ participation in PPP projects. A better DB improves the funding platform for private enterprise participation, reduces transaction costs, and decreases uncertainty regarding potential dangers. Reasonable PRA and the government’s financial income guarantee enable private enterprises to participate in large-scale PPP projects.

4.2.2. The Differences in Configuration Paths between High and Low Participation in PPP by Private Enterprise

Finally, the paper tries to analyze the configuration paths for the low participation of private enterprises in PPP projects. In other words, state-owned enterprises constitute a high proportion of project equity and identify the asymmetry of causality. This fuzzy-set analysis demonstrates that four configuration routes can result in the low participation of private enterprises in PPP projects, based on the assumption that the existence or nonexistence of each antecedent condition would induce the poor participation of private enterprises. The consistency of both the single solution and the overall solution is greater than 0.85, which explains 20.7 percent of the private enterprises’ low participation. The findings show that the combination of antecedent conditions that drive high participation in PPP projects by private firms and limit the low participation of private enterprises has an obvious asymmetry. That is, the negative combination of conditions that drive the high participation of private firms is not the combination of conditions that limit the low participation of private firms. This finding points to asymmetric effects, as posited by Proposition 4. The four configuration options for the low participation of private firms all reveal that the existence of ECL and PIS are the core conditions for the low involvement of private enterprises. This demonstrates private firms’ disadvantages in terms of enterprise credit and investment, which must be compensated for when they fully exploit their technological advantages. FM2 indicates that GFR is the core condition for state-owned firms to participate in PPP projects, and the core condition for private enterprises to participate in PPP projects, demonstrating that GFR is critical for all participants.

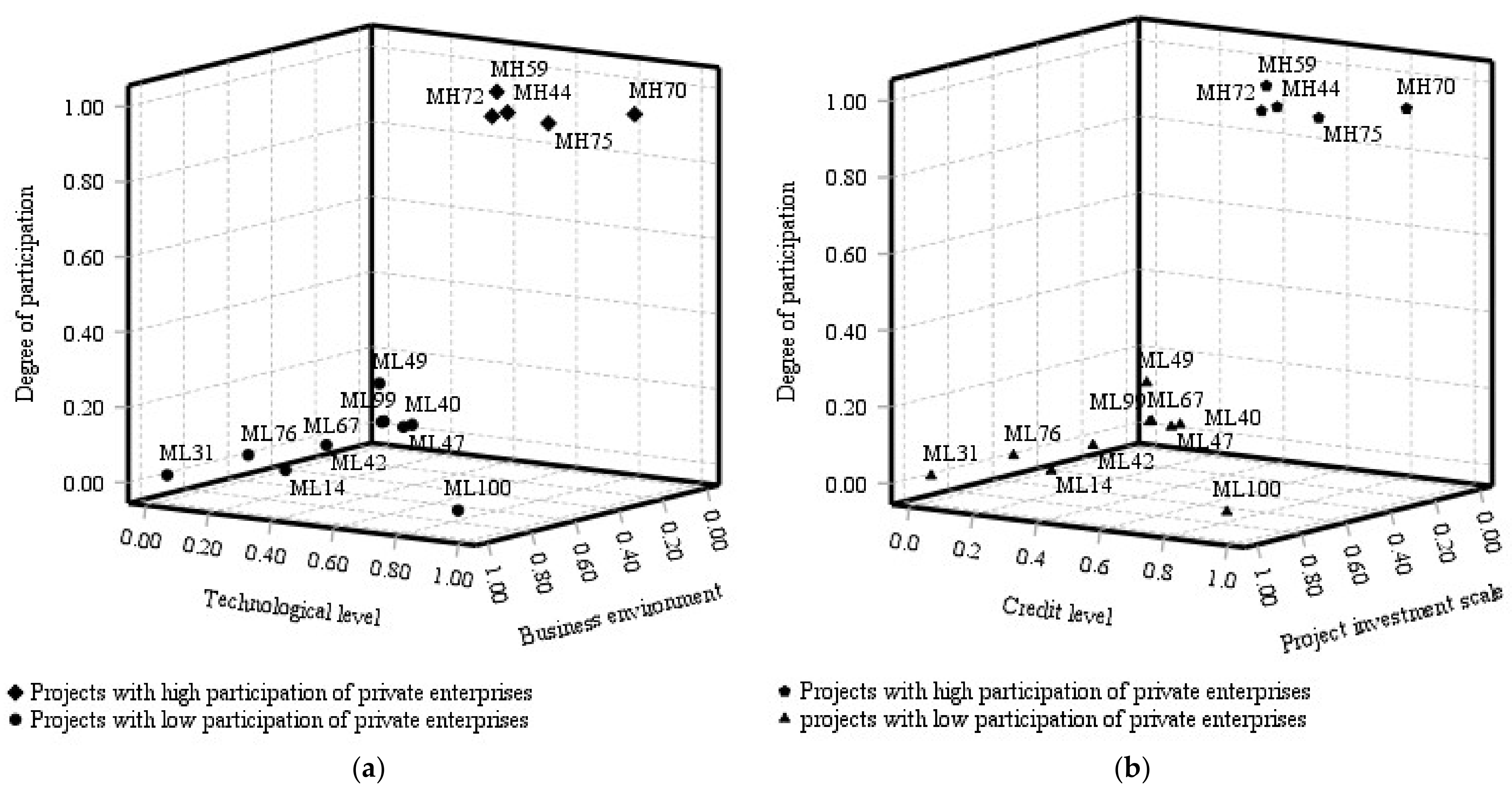

When viewed from the perspective of the individual conditions (horizontal) of the overall configuration, there is a significant difference in the core conditions regarding the high participation of private firms and the low participation of private enterprises.

Figure 2 compares the core conditions of the high and low participation of private firms in typical PPP project cases.

Figure 2a indicates that the ETL and DB exist as core conditions in many configurations of high participation by private enterprises.

Figure 2b indicates that in different configurations of the low participation of private firms, ECL and PIS appear as core conditions. The study shows that the ETL and DB play an important role in driving PEP3P, whereas the ECL and PIS seriously restrict private enterprise participation. This corresponds to the actual situation. Private enterprises, as opposed to state-owned enterprises, have a greater innovative capability and more sensitive market insight, to increase their competitiveness, along with lower expenses. Meanwhile, they require a favorable DB to compensate for their shortcomings in financing and negotiating with the government. Because of their greater corporate credit level, state-owned firms are more likely to obtain credit funds, have more negotiating power with the government, and have more experience operating public utilities. They have a higher risk tolerance than private firms and are more likely to invest in large-scale PPP initiatives.

5. Recommendations

Managerial and policy implications, as well as several recommendations, can be drawn from the aforementioned findings. First, governments and top management need to improve local DB, which will attract private enterprises to participate in PPP. They need to strengthen the legal, policy, and market environment to support private firm growth while protecting their property rights and interests in conformity with the law. The government needs to make certain that private enterprises have equal access to resources and factors in line with the law, that they engage in an open, fair, and just manner, and that they are equally protected by the law.

Second, the government needs to improve the institute’s capacity for PPP management and to build standardized communication channels between the government and the private sector to reduce the information asymmetry between the two, which is conducive to opportunity. The government should encourage high-quality private-sector development, assist companies in basic research and scientific and technological innovation, and participate in the research and development of vital core technologies and major national scientific and technological initiatives.

Third, credit constraints restrict private enterprises from participating in PPP. Improving project cooperation performance capacity and reducing unnecessary administrative penalties will help increase the right to speak in the project bidding, construction, implementation, and assessment process, reduce the risk of negotiation and renegotiation, and lay down a good credit foundation for future PPP participation.

Finally, enterprises choose those PPP projects begun in regions with superior “doing business,” based on their objective conditions and market developments, rather than investing blindly, to avoid the problem of investment failure or low investment efficiency. Besides this, private enterprises constantly increase the ability of technical innovation to fulfill each project’s new criteria. The PPP sewage treatment project establishes a production technology threshold objectively. Only when it reaches and exceeds the technical threshold set by the project’s initiator can private enterprises choose to invest in the project and realize the expected benefits. Small and medium enterprises with scientific research weaknesses might improve their power by partnering with external scientific research organizations, such as universities and research institutes.

6. Conclusions

This paper explores the configuration paths of PEP3P from the viewpoints of participator characteristics, DB, and project characteristics, and integrates the motivation of PEP3P into the same framework. First, we identified the extent to which traditional factors play a role in PEP3P. Then, we collected the relevant data from 102 PPP sewage treatment projects that entered the implementation stage in 2018–2019. Next, we explored the configuration paths of PEP3P by combining NCA and fsQCA. Finally, we compared the differences between these pathways’ antecedent conditions and configurations. Relevant research conclusions do not deny the interpretation results of existing theories on private enterprise participation in PPP, but rather show the core conditions and complex interaction mechanisms affecting private enterprise’s involvement in PPP projects from a configuration perspective, providing a new clue for leveraging private capital and enriching private enterprise PPP investment theory. The following conclusions are drawn from the study.

First, no single antecedent condition is a necessary condition for PEP3P, and the combined effect of different factors commonly form diversified causal configuration paths of PEP3P. The configuration results of PEP3P show that there are four equivalent configurations paths and three participation modes: the “enterprise technology leading” driven-type, “DB leading” pull-type, and “project character leading” push-type. ETL is the core motivator for PEP3P under the three types of participation. The good DB helps investment optimization under the “DB leading” pull-type method and encourages private enterprise involvement. With the double advantage of high technological innovation ability and good DB, a reasonable PRA helps private enterprises to participate in investment on a much larger scale of PPP projects. It also confirms the importance of FFR for the participation of private enterprises to form an effective pull and provides a more abundant theoretical basis for PEP3P.

Second, PTL and DB, respectively, are the most important internal driving forces and external pulling power for PEP3P by comparing the antecedent configurations of the three modes, which broadens the theoretical perspective of private enterprises in terms of participating in PPP projects in China. The findings indicate that the rationality of PRA effectively encourages private enterprises to participate in PPP projects with larger investment scales, revealing the relationship between internal project characteristics and PEP3P. There is an obvious asymmetry between the configuration paths of the high participation and low participation of private enterprises. ETL and DB are important internal driving forces and give external traction for PEP3P, while the ECL and PIS are important factors that restrict private enterprises from participating in PPP.

The results of this study cannot be generalized and are constrained by some limitations. First, only typical sewage treatment projects that are PPP projects have been selected as research objects, and the configuration effects of PEP3P in other industries will be examined more in the future. Second, at present, the participants in this theoretical framework are primarily the government and enterprises, but PPP projects involve a wide range of subjects. We will also investigate the incentive path for private enterprise participation in PPP by considering members of the public, suppliers, financial institutions, and other stakeholders. Third, while the antecedent conditions of enterprise characteristics primarily involve ECL and ETL, the connotations of enterprise characteristics are quite rich. A consideration of enterprise credit level and technical skill alone may overlook the broader explanation of other dimensions of enterprise characteristics for PEP3P. Further research that involves more enterprise characters may provide a more scientific understanding of private enterprises involved in PPP.

Author Contributions

Conceptualization, Y.S. and L.W.; methodology, Y.S.; software, L.W.; validation, Y.S.; formal analysis, L.W.; investigation, Y.S. and L.W.; resources, Y.S.; data curation, L.W.; writing—original draft preparation, Y.S. and L.W.; writing—review and editing, Y.S., L.W. and T.Z.; visualization, L.W.; supervision, Y.S.; project administration, Y.S.; funding acquisition, Y.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Humanities and Social Sciences Foundation of the Ministry of Education of China, grant number 20YJA630022; the Natural Science Foundation of Shandong Province, grant number ZR2021MG029; Social Science Planning Research Project of Shandong Province, grant number 20CGLJ28; and the Fundamental Research Funds for the Central Universities, grant number 19CX05026B.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available from the authors upon request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Zhao, J.Z.; Su, G.; Li, D. Financing China’s unprecedented infrastructure boom: The evolution of capital structure from 1978 to 2015. Public Money Manag. 2019, 39, 581–589. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Yeung, J.F.Y.; Yu, C.C.P.; Wang, S.Q.; Ke, Y.J. Empirical Study of Risk Assessment and Allocation of Public-Private Partnership Projects in China. J. Manag. Eng. 2011, 27, 136–148. [Google Scholar] [CrossRef] [Green Version]

- Zhang, S.; Chan, A.P.C.; Feng, Y.B.; Duan, H.X.; Ke, Y.J. Critical review on PPP Research—A search from the Chinese and International Journals. Int. J. Proj. Manag. 2016, 34, 597–612. [Google Scholar] [CrossRef]

- Cheng, Z.; Wang, H.; Xiong, W.; Zhu, D.; Cheng, L. Public–private partnership as a driver of sustainable development: Toward a conceptual framework of sustainability-oriented PPP. Environ. Dev. Sustain. 2021, 23, 1043–1063. [Google Scholar] [CrossRef]

- Li, Y.; Wang, X.Y. Risk assessment for public–private partnership projects: Using a fuzzy analytic hierarchical process method and expert opinion in China. J. Risk Res. 2018, 21, 952–973. [Google Scholar] [CrossRef]

- Li, N.; Song, Q. Public–Private Partnership in Developing China: Evolution, Institutionalization and Risks; Emerald Publishing Limited: Bingley, UK, 2017; pp. 113–139. [Google Scholar]

- Matos-Castaño, J.; Mahalingam, A.; Dewulf, G. Unpacking the Path-Dependent Process of Institutional Change for PPPs. Aust. J. Public Adm. 2014, 73, 47–66. [Google Scholar] [CrossRef]

- Opara, M.; Elloumi, F.; Okafor, O.; Warsame, H. Effects of the institutional environment on public-private partnership (P3) projects: Evidence from Canada. Account. Forum 2017, 41, 77–95. [Google Scholar] [CrossRef]

- Liu, J.; Gao, R.; Cheah, C.Y.J. Pricing Mechanism of Early Termination of PPP Projects Based on Real Option Theory. J. Manag. Eng. 2017, 33, 04017035. [Google Scholar] [CrossRef]

- Cui, C.; Liu, Y.; Hope, A.; Wang, J. Review of studies on the public–private partnerships (PPP) for infrastructure projects. Int. J. Proj. Manag. 2018, 36, 773–794. [Google Scholar] [CrossRef]

- Wang, D.; Wang, X.; Liu, M.; Liu, H.; Liu, B. Managing public–private partnerships: A transmission pattern of underlying dynamics determining project performance. Eng. Constr. Archit. Manag. 2021, 28, 1038–1059. [Google Scholar] [CrossRef]

- Zhang, Y.; Yuan, J.; Zhao, J.; Cheng, L.; Li, Q. Hybrid Dynamic Pricing Model for Transport PPP Projects during the Residual Concession Period. J. Constr. Eng. Manag. 2022, 148, 04021200. [Google Scholar] [CrossRef]

- Wang, Y.; Shao, Z.; Tiong, R.L. Data-Driven Prediction of Contract Failure of Public-Private Partnership Projects. J. Constr. Eng. Manag. 2021, 147, 04021089. [Google Scholar] [CrossRef]

- Shrestha, A.; Chan, T.-K.; Aibinu, A.A.; Chen, C.; Martek, I. Risk allocation inefficiencies in Chinese PPP water projects. J. Constr. Eng. Manag. 2018, 144, 04018013. [Google Scholar] [CrossRef]

- Liu, L.; Guo, Y.; Chen, C.; Martek, I. Determining Critical Success Factors for Public–Private Partnership Asset-Backed Securitization: A Structural Equation Modeling Approach. Buildings 2021, 11, 199. [Google Scholar] [CrossRef]

- Amadi, C.; Carrillo, P.; Tuuli, M. PPP projects: Improvements in stakeholder management. Eng. Constr. Archit. Manag. 2020, 27, 544–560. [Google Scholar] [CrossRef]

- Chan, A.P.; Lam, P.T.; Chan, D.W.; Cheung, E.; Ke, Y.J. Critical success factors for PPPs in infrastructure developments: Chinese perspective. J. Constr. Eng. Manag. 2010, 136, 484–494. [Google Scholar] [CrossRef]

- Aladağ, H.; Işik, Z. The Effect of Stakeholder-Associated Risks in Mega-Engineering Projects: A Case Study of a PPP Airport Project. IEEE Trans. Eng. Manag. 2020, 67, 174–186. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P.C. Review of studies on the Critical Success Factors for Public–Private Partnership (PPP) projects from 1990 to 2013. Int. J. Proj. Manag. 2015, 33, 1335–1346. [Google Scholar] [CrossRef]

- Xu, Z.; Wang, X.; Xiao, Y.; Yuan, J. Modeling and performance evaluation of PPP projects utilizing IFC extension and enhanced matter-element method. Eng. Constr. Archit. Manag. 2020, 27, 1763–1794. [Google Scholar] [CrossRef]

- Aghion, P.; Tirole, J. Formal and Real Authority in Organizations. J. Political Econ. 1997, 105, 1–29. [Google Scholar] [CrossRef]

- Zhang, Z.; Jia, M.; Wan, D. Allocation of control rights and cooperation efficiency in public-private partnerships: Theory and evidence from the Chinese pharmaceutical industry. Int. J. Health Care Financ. Econ. 2009, 9, 169. [Google Scholar] [CrossRef] [PubMed]

- Gao, R.; Liu, J. Selection of government supervision mode of PPP projects during the operation stage. Constr. Manag. Econ. 2019, 37, 584–603. [Google Scholar] [CrossRef]

- Huemann, M.; Silvius, G. Projects to create the future: Managing projects meets sustainable development. Int. J. Proj. Manag. 2017, 35, 1066–1070. [Google Scholar] [CrossRef]

- Sadka, E. Public-Private Partnerships—A Public Economics Perspective*. CESifo Econ. Stud. 2007, 53, 466–490. [Google Scholar] [CrossRef]

- Shen, Y.Y.; Li, Z. The Impact of Local Fiscal Capacity on Private Sector articipation in PPP Projects and Its Mechanism. Public Financ. Res. 2021, 433, 116–129. (In Chinese) [Google Scholar]

- Jooste, S.F.; Scott, W.R. The Public–Private Partnership Enabling Field:Evidence From Three Cases. Adm. Soc. 2012, 44, 149–182. [Google Scholar] [CrossRef]

- Muhammad, Z.; Johar, F. A conceptual framework for evaluating the success of public-private partnership (PPP) projects. Adv. Sci. Lett. 2017, 23, 9130–9134. [Google Scholar] [CrossRef]

- Soecipto, R.M.; Verhoest, K. Contract stability in European road infrastructure PPPs: How does governmental PPP support contribute to preventing contract renegotiation? Public Manag. Rev. 2018, 20, 1145–1164. [Google Scholar] [CrossRef]

- Yang, T.; Long, R.; Cui, X.; Zhu, D.; Chen, H. Application of the public–private partnership model to urban sewage treatment. J. Clean. Prod. 2017, 142, 1065–1074. [Google Scholar] [CrossRef]

- Wang, Y.; Cui, P.; Liu, J. Analysis of the risk-sharing ratio in PPP projects based on government minimum revenue guarantees. Int. J. Proj. Manag. 2018, 36, 899–909. [Google Scholar] [CrossRef]

- Wu, Y.; Song, Z.; Li, L.; Xu, R. Risk management of public-private partnership charging infrastructure projects in China based on a three-dimension framework. Energy 2018, 165, 1089–1101. [Google Scholar] [CrossRef]

- Ahmadabadi, A.A.; Heravi, G. The effect of critical success factors on project success in Public-Private Partnership projects: A case study of highway projects in Iran. Transp. Policy 2019, 73, 152–161. [Google Scholar] [CrossRef]

- Ahmadabadi, A.A.; Heravi, G. Risk assessment framework of PPP-megaprojects focusing on risk interaction and project success. Transp. Res. Part A-Policy Pract. 2019, 124, 169–188. [Google Scholar] [CrossRef]

- Valipour, A.; Yahaya, N.; Md Noor, N.; Kildienė, S.; Sarvari, H.; Mardani, A. A fuzzy analytic network process method for risk prioritization in freeway PPP projects: An Iranian case study. J. Civ. Eng. Manag. 2015, 21, 933–947. [Google Scholar] [CrossRef] [Green Version]

- Rosell, J.; Saz-Carranza, A. Determinants of public–private partnership policies. Public Manag. Rev. 2020, 22, 1171–1190. [Google Scholar] [CrossRef]

- Liu, J.; Love, P.E.; Smith, J.; Regan, M.; Davis, P.R. Life cycle critical success factors for public-private partnership infrastructure projects. J. Manag. Eng. 2015, 31, 04014073. [Google Scholar] [CrossRef]

- Reynaers, A.-M.; Grimmelikhuijsen, S. Transparency in Public–Private Partnerships: Not So Bad After All? Public Adm. 2015, 93, 609–626. [Google Scholar] [CrossRef] [Green Version]

- Ma, H.; Zeng, S.; Lin, H.; Zeng, R. Impact of Public Sector on Sustainability of Public–Private Partnership Projects. J. Constr. Eng. Manag. 2020, 146, 04019104. [Google Scholar] [CrossRef]

- Zhang, L.; Sun, X.; Xue, H. Identifying critical risks in Sponge City PPP projects using DEMATEL method: A case study of China. J. Clean. Prod. 2019, 226, 949–958. [Google Scholar] [CrossRef]

- Shen, Y.Y.; Guo, F.; Li, Z. Local Fiscal Capacity, Business Environment and Attracting PPP Investment. Financ. Trade Econ. 2020, 41, 68–84. (In Chinese) [Google Scholar]

- Holmstrom, B.; Milgrom, P. Aggregation and Linearity in the Provision of Intertemporal Incentives. Econometrica 1987, 55, 303–328. [Google Scholar] [CrossRef]

- Shi, S.; Yin, Y.; Guo, X. Optimal choice of capacity, toll and government guarantee for build-operate-transfer roads under asymmetric cost information. Transp. Res. Part B-Methodol. 2016, 85, 56–69. [Google Scholar] [CrossRef] [Green Version]

- Dirk, B.-S.; Meur, G.D.; Rihoux, B.; Ragin, C.C. Qualitative Comparative Analysis (QCA) as an Approach; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2009; pp. 1–18. [Google Scholar]

- Ragin, C.C. Redesigning Social Inquiry: Fuzzy Sets and Beyond; University of Chicago Press: Chicago, IL, USA, 2008. [Google Scholar]

- Fiss, P.C. Building Better Causal Theories: A Fuzzy Set Approach to Typologies in Organization Research. Acad. Manag. J. 2011, 54, 393–420. [Google Scholar] [CrossRef] [Green Version]

- Wu, P.-L.; Yeh, S.-S.; Huan, T.-C.; Woodside, A.G. Applying complexity theory to deepen service dominant logic: Configural analysis of customer experience-and-outcome assessments of professional services for personal transformations. J. Bus. Res. 2014, 67, 1647–1670. [Google Scholar] [CrossRef] [Green Version]

- Casady, C.B. Examining the institutional drivers of Public-Private Partnership (PPP) market performance: A fuzzy set Qualitative Comparative Analysis (fsQCA). Public Manag. Rev. 2021, 23, 981–1005. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Agency Theory: An Assessment and Review. Acad. Manag. Rev. 1989, 14, 57–74. [Google Scholar] [CrossRef]

- Fainshmidt, S.; Witt, M.A.; Aguilera, R.V.; Verbeke, A. The contributions of qualitative comparative analysis (QCA) to international business research. J. Int. Bus. Stud. 2020, 51, 455–466. [Google Scholar] [CrossRef] [Green Version]

- Park, Y.; Pavlou, P.A.; Saraf, N. Configurations for Achieving Organizational Ambidexterity with Digitization. Inf. Syst. Res. 2020, 31, 1376–1397. [Google Scholar] [CrossRef]

- Hauff, S.; Guerci, M.; Dul, J.; van Rhee, H. Exploring necessary conditions in HRM research: Fundamental issues and methodological implications. Hum. Resour. Manag. J. 2021, 31, 18–36. [Google Scholar] [CrossRef] [Green Version]

- Dul, J. Identifying single necessary conditions with NCA and fsQCA. J. Bus. Res. 2016, 69, 1516–1523. [Google Scholar] [CrossRef]

- Dul, J. Necessary Condition Analysis (NCA): Logic and Methodology of “Necessary but Not Sufficient” Causality. Organ. Res. Methods 2015, 19, 10–52. [Google Scholar] [CrossRef]

- Vis, B.; Dul, J. Analyzing Relationships of Necessity Not Just in Kind But Also in Degree: Complementing fsQCA With NCA. Sociol. Methods. Res. 2016, 47, 872–899. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Boudet, H.S.; Jayasundera, D.C.; Davis, J. Drivers of Conflict in Developing Country Infrastructure Projects: Experience from the Water and Pipeline Sectors. J. Constr. Eng. Manag. 2011, 137, 498–511. [Google Scholar] [CrossRef]

- Schneider, C.Q.; Wagemann, C. Set-Theoretic Methods for the Social Sciences: A Guide to Qualitative Comparative Analysis; Cambridge University Press: Cambridge, UK, 2012. [Google Scholar]

- Amoah, A.; Berbegal-Mirabent, J.; Marimon, F. Making the Management of a Project Successful: Case of Construction Projects in Developing Countries. J. Constr. Eng. Manag. 2021, 147, 04021166. [Google Scholar] [CrossRef]

- Fiss, P.C. A set-theoretic approach to organizational configurations. Acad. Manag. Rev. 2007, 32, 1180–1198. [Google Scholar] [CrossRef] [Green Version]

- Jordan, E.; Gross, M.E.; Javernick-Will, A.N.; Garvin, M.J. Use and misuse of qualitative comparative analysis. Constr. Manag. Econ. 2011, 29, 1159–1173. [Google Scholar] [CrossRef]

- Rihoux, B.; Ragin, C.C. Configurational Comparative Methods: Qualitative Comparative Analysis (QCA) and Related Techniques; SAGE Publications: Thousand Oaks, CA, USA, 2008. [Google Scholar]

- Meng, T.; Li, Q.; Dong, Z.; Zhao, F. Research on the Risk of Social Stability of Enterprise Credit Supervision Mechanism Based on Big Data. J. Organ. End User Comput. 2022, 34, 1–16. [Google Scholar] [CrossRef]

- Lee, J.-S.; Park, J.-H.; Bae, Z.-T. The effects of licensing-in on innovative performance in different technological regimes. Res. Policy 2017, 46, 485–496. [Google Scholar] [CrossRef]

- Feng, P.; Ke, S. Self-selection and performance of R&D input of heterogeneous firms: Evidence from China’s manufacturing industries. China Econ. Rev. 2016, 41, 181–195. [Google Scholar] [CrossRef]

- Zhu, S.J.; Zhang, F.L.; Wang, Z.X. How does quality of business environment affect the manufacturing servitization: Evidence from the firm level data. J. Macro-Qual. Res. 2021, 9, 37–51. (In Chinese) [Google Scholar]

- Wang, J.; Liu, W.; Zhu, W.Y. Entrepreneurship, Business Environment and Total Factor Productivity. Stat. Decis. 2021, 37, 166–171. (In Chinese) [Google Scholar]

- Yaling, D.; Meixian, L. An experimental research on the impact of trust on behavior of business model innovation in PPP projects: The moderating effects of innovation capacity of social capital. J. Ind. Eng. Eng. Manag. 2022, 36, 64–72. (In Chinese) [Google Scholar]

- El-Kholy, A.M.; Akal, A.Y. Assessing and allocating the financial viability risk factors in public-private partnership wastewater treatment plant projects. Eng. Constr. Archit. Manag. 2021, 28, 3014–3040. [Google Scholar] [CrossRef]

- Wang, Y.C.; Hu, Y.J. Research on Participation of Private Enterprises in PPP Project—Risk Analysis Based on Publicity. Soft Sci. 2019, 33, 89–94. (In Chinese) [Google Scholar]

- Acharya, B.; Lee, J.; Moon, H. Preference heterogeneity of local government for implementing ICT infrastructure and services through public-private partnership mechanism. Socio-Econ. Plan. Sci. 2022, 79, 101103. [Google Scholar] [CrossRef]

| Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).