Public–Private Partnerships for Higher Education Institutions in the United States

Abstract

1. Introduction

- conduct a systematic collection and analysis of PPP projects in higher education institutions in the United States;

- conduct a gap analysis to provide recommendations for future projects and lessons learned from past ones.

2. Background

2.1. Public–Private Partnerships in Higher Education Institutions

- front-office, which includes student affairs and enrolment;

- back-office, which includes supporting operations such as finance;

- facilities, which are the physical assets such as halls, cafeterias, and dorms.

- lack of required financing (due to budget cuts);

- inexperience of an institution in this development type or with the targeted population that the development is being built for;

- experience of the private sector;

- risk mitigation (transfer to the private sector);

2.2. PPP Governance in Higher Education Institution Projects

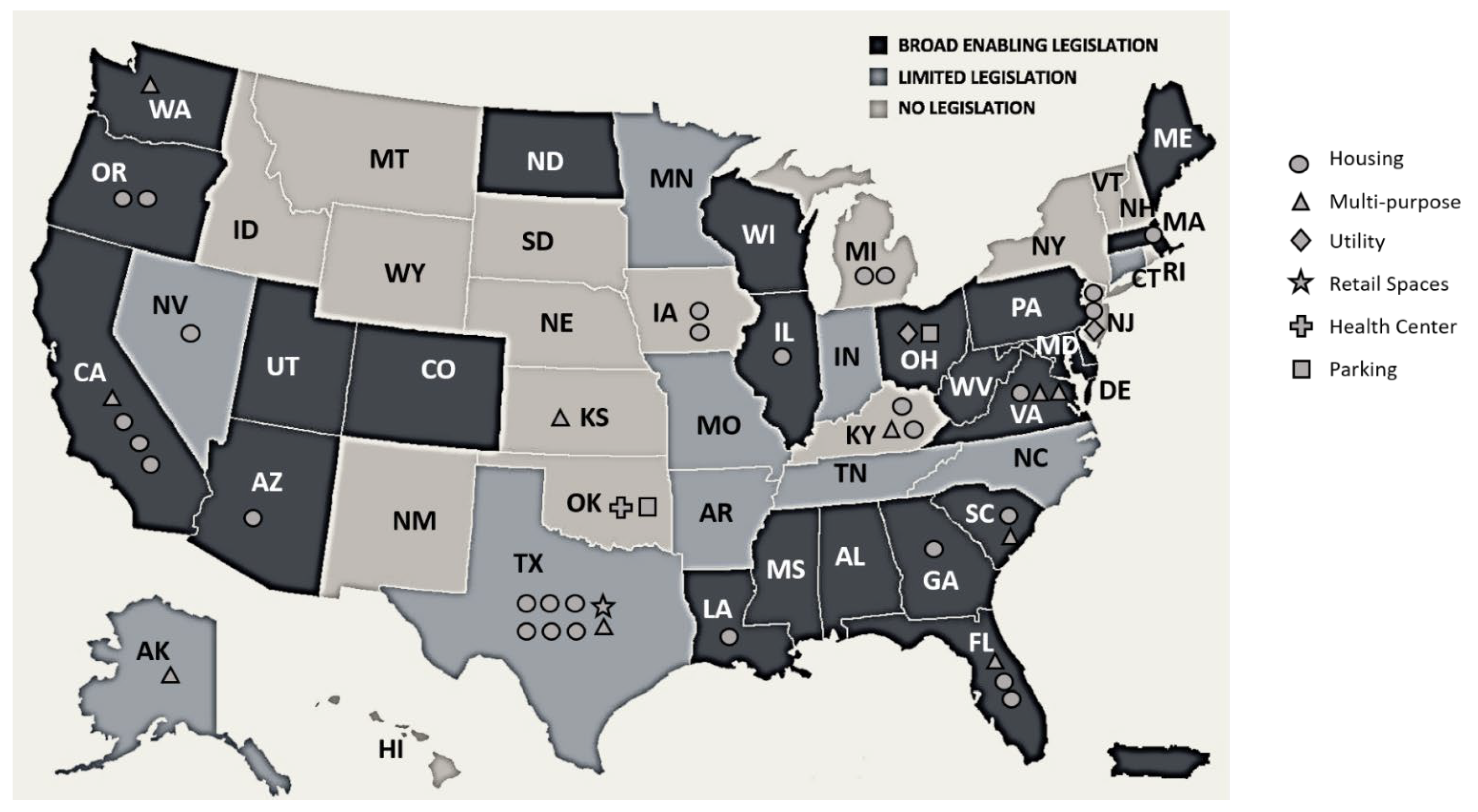

2.3. PPP Legislation

2.4. PPP Contractual Frameworks

2.5. Advantages of Public–Private Partnerships for Higher Education Institutions

- perceived lower cost to the public institution;

- possibility for unaffected credit rating and investments off the balance sheet;

- single contract (with one private party), which makes it easier to track, manage, and divide responsibilities and risks;

- better method for entry into a new market (such as housing or energy) without any previous experience;

- quicker execution and utilization of the private entity’s experience;

- an efficient method to meet the growing university needs.

2.6. Challenges That Face PPPs for Higher Education Institutions

- potential for void contracts;

- university ceding high levels of control of the development;

- complexity of deals;

- multi-parties involved and possibility of disagreement;

- limitation on future developments so as not to affect the current project (for example, a new housing project that would compete with the current one and possibly reduce its revenue);

- lack of a consistent legal framework.

3. Research Methods

3.1. Systematic Literature Review

- R.Q.1 What are the trends of PPP use for higher education institutions in the United States?

- R.Q.2 What are the benefits and challenges observed in these types of projects?

- R.Q.3 What are the recommendations for future projects and lessons learned from past ones?

- Journal articles were identified using pre-identified sources from Scopus such as ASCE library and Science Direct. Google Scholar was also used for cross-referencing and multiple refinements of the search were also conducted to search for the projects. The keywords used in this paper were “Higher Education Institutions” and “public–private partnership”, “social infrastructure”, “Public–Private Partnerships for Higher Education Institutions”, and “Higher Education Projects in the United States”. Over 600 articles on PPPs were identified, which were narrowed down to 90 relevant articles for review and further analysis as only studies in English that were published from 2010 onwards were selected to proceed to the next review stage. The articles were then evaluated by reading the abstract of each article for inclusion/exclusion. Exclusion was mainly for articles that discussed projects outside the United States or those that did not discuss projects for higher education institutions.

- Online PPP databases were searched, such as the World Bank database, Infra PPP database, and P3 Bulletin.

- Websites of well-known private parties in the PPP area were searched including Plenary Group, American Campus Communities, JLL, and Corvias. Some of these companies had separate sections for education projects. This was used as a secondary search to identify projects.

- Magazines and newspaper articles were also targeted to identify projects. An example is Forbes.com, where PPPs such as those for Wayne State University and the University System of Georgia were identified [37].

- Finally, university websites were searched to cross-reference projects found in magazines and newspaper articles and to gather more information on the identified projects. For example, after identifying Wayne State University’s PPP project in the previous step, a search was conducted on the university website to gather more details.

- This resulted in the identification of 60 PPP projects conducted for U.S. higher education institutions from 1994 to 2018 (date of project signing). There were several projects before 1994, but this study limited the years studied to only after 1994 due to data unavailability. These projects were found among 54 universities. This study investigated contract structures, stakeholders, types and sizes of facilities, and budgets and durations of the projects that have been objectively sorted through SLR.

3.2. Literature Review of Previous PPP Surveys

3.3. Questionnaire Surveys

- President and CEO of a university property foundation with over 25 years of experience serving higher education institutions.

- Vice president for finance and administration with over 25 years serving in this position

- Vice President for student life with over 20 years of experience in university housing and operations

- Associate Vice President Facilities Management and Campus Services with over 30 years of experience in facilities management and operations

- Associate Vice President for Capital Budgeting & Facilities Operations with over 30 years of experience

- Associate Vice President of Facilities Management with over 20 years of experience

- Associate Vice President for Business and Auxiliary Operations and Chief Housing Officer with over 25 years of experience

- Chancellor with over 20 years of experience in university operations and capital planning.

- Associate Vice Chancellor with over 15 years of experience in facilities management

4. Systematic Literature Review

4.1. Analysis of the Systematic Literature Review

- geographical characteristics;

- type of project. The total number of projects collected was 60.

- housing;

- mixed-use (a combination of housing/commercial/retail use);

- utility;

- commercial/retail space;

- health center;

- parking.

- provides a framework for public and private contracting;

- provides a basis for contractual terms, thus reducing transaction acts and negotiation time;

- indicates the state’s commitment to private sector participation in projects in general;

- attracts the private sector due to legislation availability.

- relying on the private sector for their experience,

- shifting to a delivery method that reduces their risk and investment,

- lack of financial resources,

- value-for-money attained,

4.2. Discussion of the SLR

4.2.1. Reasons behind PPP Adoption

4.2.2. Benefits Realized by the Universities

- faster delivery and slightly higher quality. In some cases private financing was not the university’s main goal, hence the project was able to be delivered quicker than was possible using university debt;

- effective and efficient delivery;

- unaffected capacity debt;

- better streamlined processes and more decisions made by third-parties and not university staff;

- less expensive than debt financing by the university;

- consolidated selection and contracting period;

- delivered a project (housing) that the university did not want to deliver/construct itself;

- public institution not concerning themselves with the operation and maintenance of a development, since it is the developer’s responsibility;

- entering into a new market sector with reduced risks to the university.

4.2.3. Challenges Faced by the Universities

5. Questionnaire Survey

5.1. Analysis of the Questionnaire Survey

5.1.1. Facility Type

5.1.2. Duration

5.1.3. Project Status

5.1.4. Reasons for Choosing PPP

5.1.5. Mode of Recouping Investment by Private Entity

5.1.6. Project Financing

5.1.7. Future Use

5.2. Discussion of the Questionnaire Surveys

6. Lessons Learned and Recommendations for Future Projects

7. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ministry of Housing and Urban Affairs; Government of India. Public Private Partnership Models for Affordable Housing. 2014. Available online: http://mohua.gov.in/upload/uploadfiles/files/PPP%20Models%20for%20Affordable%20Housing.pdf (accessed on 14 January 2020).

- Casady, C.B.; Geddes, R.R. Asset Recycling for Social Infrastructure in the United States. Public Work. Manag. Policy 2020, 25, 281–297. [Google Scholar] [CrossRef]

- Moskalyk, A. The Role of Public- Private Partnerships in Funding Social Housing in Canada; Canadian Policy Research Networks: Ottawa, ON, Canada, 2008; Available online: http://archives.enap.ca/bibliotheques/2008/11/030077697.pdf (accessed on 16 February 2020).

- U.S. Department of Education. CARES Act: Higher Education Emergency Relief Fund. 2020. Available online: https://www2.ed.gov/about/offices/list/ope/caresact.html (accessed on 15 July 2020).

- Yuen, V. Mounting Peril for Public Higher Education During the Coronavirus Pandemic. Center for American Progress. 2020. Available online: https://www.americanprogress.org/issues/education-postsecondary/reports/2020/06/11/485963/mounting-peril-public-higher-education-coronavirus-pandemic/ (accessed on 28 January 2021).

- Ruf, J. Higher Ed Groups Reiterate Request to Senate for $46 Billion More to Colleges. 2020. Available online: https://diverseeducation.com/article/179282/ (accessed on 10 February 2021).

- Levey, R.L.; Connors, A.W.; Martin, L.L. Public University Use of Social Infrastructure Public–Private Partnerhips (P3s): An Exploratory Examination. Public Work. Manag. Policy 2020, 25, 298–311. [Google Scholar] [CrossRef]

- Hodge, G.; Greve, C.; Biygautane, M. Do PPP’s work? What and how have we been learning so far? Public Manag. Rev. 2018, 20, 1105–1121. [Google Scholar] [CrossRef]

- Geddes, R.R.; Reeves, E. The favourability of U.S. PPP enabling legislation and private investment in transportation infrastructure. Util. Policy 2017, 48, 157–165. [Google Scholar] [CrossRef]

- EY-Parthenon. Public-Private Partnerships: What is Right for Your Institution? 2017. Available online: https://cdn.ey.com/echannel/parthenon/pdf/perspectives/EY-Parthenon-P3s-business-ofHighered.pdf (accessed on 20 January 2020).

- Casady, C.; Eriksson, K.; Levitt, R.E.; Scott, W.R. Examining the State of Public-Private Partnership (PPP) Institutionalization in the United States. 2018. Available online: https://ssrn.com/abstract=3317770 (accessed on 20 January 2020).

- Liu, J.; Love PE, D.; Sing MC, P.; Smith, J.; Matthews, J. PPP Social Infrastructure Procurement: Examining the Feasibility of a Lifecycle Performance Measurement Framework. J. Infrastruct. Syst. 2017, 23, 04016041. [Google Scholar] [CrossRef]

- Patrinos, H.A.; Barreara-Osorio, F.; Guaqueta, J. The Role and Impact of Public-Private Partnerships in Education; IBRD/World Bank: Washington, DC, USA, 2009. [Google Scholar]

- O’Neil, J.; Horner, D. Rebuilding the Ivory Towers Project Finance International Global Infrastructure Report. 2016. Available online: https://www.hunton.com/images/content/3/4/v2/3420/Rebuilding-the-Ivory-Towers.pdf (accessed on 14 January 2020).

- Abdel Aziz, A.M. Successful delivery of public-private partnerships for infrastructure development. J. Constr. Eng. Manag. 2007, 133, 918–931. [Google Scholar] [CrossRef]

- Warasthe, R. The Role of Public-Private Partnerships in Higher Education How Tertiary Institutions in emerging Economies benefit from Public-Private Partnerships. 2017. Available online: https://sciendo.com/es/article/10.1515/cplbu-2017-0001 (accessed on 14 January 2020).

- Schanck, G.; Lamont, T. Private Public Partnerships at the University of California. 2013. Available online: https://www.ucop.edu/real-estate-services/_files/documents/ppp_at_uc.pdf (accessed on 6 February 2021).

- Byrd, C. Public-Private Partnerships for Higher Education Infrastructure: A Multiple-Case Study of Public-Private Partnership Models. Master’s Thesis, Virginia Polytechnic and State University, Blacksburg, VA, USA, 2013. [Google Scholar]

- Serrano, D.; Suarez, G.; Bas, O.; Cruzado, I. Feasibility Study for the Construction of Multi-Story Parking through a Public Private Partnership the University of Puerto Rico at Mayagüez. Construction Research Congress 2016. Available online: https://ascelibrary.org/doi/10.1061/9780784479827.035 (accessed on 28 January 2020).

- U.S. Department of Housing and Urban Development. UC Davis Opens Doors to West Village, Aims to Be Largest Zero Net Energy Facility in U.S. Available online: https://archives.huduser.gov/scrc/sustainability/newsletter_010312_1.html (accessed on 10 November 2020).

- Cole, B.K. Building Social Infrastructure through Public-Private Partnerships: The Case of Student Housing in Public Higher Education. Ph.D. Dissertation, Clemson University, Clemson, SC, USA, 2012. [Google Scholar]

- University System of Georgia, USG Facts. Available online: https://www.usg.edu/news/usgfacts (accessed on 10 August 2020).

- Casady, C.; Geddes, R. Private Participation in US Infrastructure: The Role of PPP Units; American Enterprise Institute: Washington, DC, USA, 2016. [Google Scholar]

- O’Shea, C.; Palcic, D.; Reeves, E. Using PPP to Procure Social Infrastructure: Lessons from 20 Years of Experience in Ireland. Public Work. Manag. Policy 2020, 25, 201–213. [Google Scholar] [CrossRef]

- Casady, C.B.; Geddes, R.R. Private Participation in US Infrastructure: The Role of Regional PPP Units. In Public–Private Partnerships for Infrastructure Development; Levitt, R.E., Scott, W.R., Garvin, M.J., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2019; pp. 224–242. [Google Scholar]

- Geddes, R.R.; Wagner, B.L. Why do U.S. states adopt public–private partnership enabling legislation? J. Urban Econ. 2013, 78, 30–41. [Google Scholar] [CrossRef]

- Martin, L.L. State public-private partnership (P3) legislation and P3 project implementation. J. Public Procure. 2019, 19, 55–67. [Google Scholar] [CrossRef]

- Martin, L.L. Public-private partnerships (P3s) for social infrastructure. In Public-Private Partnerships: Construction, Protection and Rehabilitation of Critical Infrastructure; Clark, R., Hakim, S., Eds.; Springer: Berlin/Heidelberg, Germany, 2019; pp. 113–124. [Google Scholar]

- Dochia, S.; Parker, M. Introduction to Public Private Partnerships with Availability Payments. 2009. Available online: http://www.pwfinance.net/document/research_reports/9%20intro%20availability.pdf (accessed on 28 January 2020).

- Khallaf, R.; Kang, K.; Hastak, M. Analysis of the Use of PPPs in Higher Education Institutions through Systematic Literature Review; Construction Research Congress 2018; ASCE: New Orleans, LA, USA, 2018. [Google Scholar]

- Lewandowski, A.; Bielat, K. Repleneshing Housing Stock through Public-Private Partnerships; Custom Research Brief, The Advisory Board Company: Washington, DC, USA, 2010. [Google Scholar]

- American Campus Communities. Public-Private Partnerships Turn Financial Challenges into Educational Opportunities. 2016. Available online: https://www.americancampus.com/for-universities/financing (accessed on 14 January 2020).

- European PPP Expertise Center. PPP Motivations and Challenges for the Public Sector Why (Not) and How. 2015. Available online: https://www.eib.org/attachments/epec/epec_ppp_motivations_and_challenges_en.pdf (accessed on 16 February 2021).

- Oktavianus, A.; Mahani, I. 2018. A Global Review of Public Private Partnerships Trends and Challenges for Social Infrastructure. In MATEC Web of Conferences (Volume 147, p. 06001). EDP Sciences. 2018. Available online: https://www.matec-conferences.org/articles/matecconf/abs/2018/06/matecconf_sibe2018_06001/matecconf_sibe2018_06001.html (accessed on 16 February 2021).

- Le, P.T.; Kirytopoulos, K.; Chileshe, N.; Rameezdeen, R. Taxonomy of risks in PPP transportation projects: A systematic literature review. Int. J. Constr. Manag. 2022, 22, 166–181. [Google Scholar] [CrossRef]

- Khallaf, R.; Naderpajouh, N.; Hastak, M. Systematic Literature Review as a Methodology for Identifying Risks. In Proceedings of the 9th International Conference on Construction in the 21st Century (CITC-9) 2017, Dubai, United Arab Emirates, 5–7 March 2017. [Google Scholar]

- Fang, H. Universities Are Increasingly Asking Private Developers to Build Their Student Housing. 2017. Available online: https://www.forbes.com/sites/bisnow/2017/06/16/universities-are-increasingly-asking-private-developers-to-build-their-student-housing/?sh=7450a5b31f32 (accessed on 14 January 2020).

- Xu, Y.; Yeung, J.F.; Chan, A.P.; Chan, D.W.; Wang, S.Q.; Ke, Y. Developing a risk assessment model for PPP projects in China—A fuzzy synthetic evaluation approach. Autom. Constr. 2010, 19, 929–943. [Google Scholar] [CrossRef]

- Ika, L.A.; Diallo, A.; Thuillier, D. Critical success factors forWorld Bank projects: An empirical investigation. Int. J. Proj. Manag. 2012, 30, 105–116. [Google Scholar] [CrossRef]

- Luthra, S.; Garg, D.; Haleem, A. The impacts of critical success factors for implementing green supply chain management towards sustainability: An empirical investigation of Indian automobile industry. J. Clean. Prod. 2016, 121, 142–158. [Google Scholar] [CrossRef]

- Gupta, A.K.; Trivedi, M.K.; Kansal, R. Risk variation assessment of Indian road PPP projects. Int. J. Sci. Environ. Technol. 2013, 2, 1017–1026. [Google Scholar]

- Kavishe, N.; Chileshe, N. Critical success factors in public-private partnerships (PPPs) on affordable housing schemes delivery in Tanzania: A qualitative study. J. Facil. Manag. 2018, 17, 188–207. [Google Scholar] [CrossRef]

- Helmy, R.; Khourshed, N.; Wahba, M.; Bary, A.A.E. Exploring critical success factors for public private partnership case study: The educational sector in Egypt. J. Open Innov. Technol. Mark. Complex. 2020, 6, 142. [Google Scholar] [CrossRef]

- Ke, Y.; Wang, S.; Chan, A.P.; Lam, P.T. Preferred risk allocation in China’s public–private partnership (PPP) projects. Int. J. Proj. Manag. 2010, 28, 482–492. [Google Scholar] [CrossRef]

- Zhao, Z.Y.; Zuo, J.; Zillante, G.; Wang, X.W. Critical success factors for BOT electric power projects in China: Thermal power versus wind power. Renew. Energy 2010, 35, 1283–1291. [Google Scholar] [CrossRef]

- Komendantova, N.; Patt, A.; Barras, L.; Battaglini, A. Perception of risks in renewable energy projects: The case of concentrated solar power in North Africa. Energy Policy 2012, 40, 103–109. [Google Scholar] [CrossRef]

- Rady, A.M.A. The Assessment of Public Private Partnership Program in Egypt. Ph.D. Dissertation, KDI School, Sejong, Korea, 2012. [Google Scholar]

- Ezeldin, A.S.; Badran, Y. Risk decision support system for public private partnership projects in Egypt. Int. J. Eng. Innov. Technol. 2013, 3, 479–486. [Google Scholar]

- Badran, Y. Risk Analysis and Contract Management for Public Private Partnership Projects in Egypt. Master’s Thesis, American University in Cairo, New Cairo, Egypt, 2013. [Google Scholar]

- Fitzpatrick, A.; Zovaro, V.; Draia, S. Public-private partnerships in the middle East and North Africa. In A Handbook for Policy Makers; Organization for Economic Cooperation and Development: Paris, France, 2014. [Google Scholar]

- Maqbool, R. Efficiency and effectiveness of factors affecting renewable energy projects: An empirical perspective. Energy 2018, 158, 944–956. [Google Scholar] [CrossRef]

- Maqbool, R.; Sudong, Y. Critical success factors for renewable energy projects; empirical evidence from Pakistan. J. Clean. Prod. 2018, 195, 991–1002. [Google Scholar] [CrossRef]

- Zhao, Z.Y.; Chen, Y.L. Critical factors affecting the development of renewable energy power generation: Evidence from China. J. Clean. Prod. 2018, 184, 466–480. [Google Scholar] [CrossRef]

- Ahmadabadi, A.A.; Heravi, G. The effect of critical success factors on project success in Public-Private Partnership projects: A case study of highway projects in Iran. Transp. Policy 2019, 73, 152–161. [Google Scholar] [CrossRef]

- Debela, G.Y. Critical success factors (CSFs) of public–private partnership (PPP) road projects in Ethiopia. Int. J. Constr. Manag. 2022, 22, 489–500. [Google Scholar] [CrossRef]

- Khodeir, L. Evaluating the role of project management education towards enhancing architecture students competency skills. JES J. Eng. Sci. 2019, 46, 754–766. [Google Scholar] [CrossRef]

- Korayem, I.M.; Ogunlana, S.O. The “Water-Specific PPP Risk Model”: A Case Study in Egypt. In Public Private Partnerships; Springer: Cham, Switzerland, 2019; pp. 233–260. [Google Scholar]

- Donastorg, A.; Renukappa, S.; Suresh, S. Evaluating critical success factors for implementing renewable energy strategies in the Dominican Republic. Renew. Energy 2020, 149, 329–335. [Google Scholar]

- Odhiambo, K.O.; Rambo, C.; Okelo, S.L. Market risk factors and performance of public private partnership renewable energy projects: The case of geothermal renewable energy projects in Kenya. Int. J. Res. Bus. Soc. Sci. 2020, 9, 366–376. [Google Scholar] [CrossRef]

- Khahro, S.H.; Ali, T.H.; Hassan, S.; Zainun, N.Y.; Javed, Y.; Memon, S.A. Risk Severity Matrix for Sustainable Public-Private Partnership Projects in Developing Countries. Sustainability 2021, 13, 3292. [Google Scholar] [CrossRef]

- Smirnova, E.; Kot, S.; Kolpak, E.; Shestak, V. Governmental support and renewable energy production: A cross-country review. Energy 2021, 230, 120903. [Google Scholar] [CrossRef]

- Wang, B.; Rasool, S.F.; Zhao, Y.; Samma, M.; Iqbal, J. Investigating the nexus between critical success factors, despotic leadership, and success of renewable energy projects. Environ. Sci. Pollut. Res. 2022, 29, 10388–10398. [Google Scholar] [CrossRef] [PubMed]

- Zaman, S.; Wang, Z.; Rasool, S.F.; uz Zaman, Q.; Raza, H. Impact of critical success factors and supportive leadership on sustainable success of renewable energy projects: Empirical evidence from Pakistan. Energy Policy 2022, 162, 112793. [Google Scholar] [CrossRef]

- Palinkas, L.A.; Horwitz, S.M.; Green, C.A.; Wisdom, J.P.; Duan, N.; Hoagwood, K. Purposeful sampling for qualitative data collection and analysis in mixed method implementation research. Adm. Policy Ment. Health Ment. Health Serv. Res. 2015, 42, 533–544. [Google Scholar] [CrossRef] [PubMed]

- Guest, G.; Bunce, A.; Johnson, L. How many interviews are enough? An experiment with data saturation and variability. Field Methods 2006, 18, 59–82. [Google Scholar] [CrossRef]

- Sandelowski, M. Sample size in qualitative research. Res. Nurs. Health 1995, 18, 179–183. [Google Scholar] [CrossRef] [PubMed]

- Patton, M.Q. Qualitative Evaluation and Research Methods, 2nd ed.; Sage: Newbury Park, CA, USA, 1990. [Google Scholar]

- van Rijnsoever, F.J. (I Can’t get no) saturation: A simulation and guidelines for sample sizes in qualitative research. PLoS ONE 2017, 12, e0181689. [Google Scholar] [CrossRef]

- FHWA (Federal Highway Administration). State P3 Legislation. 2018. Available online: https://www.fhwa.dot.gov/ipd/p3/legislation/ (accessed on 26 January 2020).

- Albalate, D.; Bel, G.; Geddes, R.R. Do Public-Private-Partnership-Enabling Laws Increase Private Investment in Transportation Infrastructure? J. Law Econ. 2020, 63, 43–70. [Google Scholar] [CrossRef]

- Gilroy, L. Modernizing and Expanding Pennsylvania’s Transportation Infrastructure through Public-Private Partnerships. Testimony submitted to the Pennsylvania House Republican Policy Committee. 31 December 2009. Available online: http://reason.org/wp-content/uploads/files/testimony_pennsylvania_transportation_public_private_partnerships.pdf (accessed on 14 January 2020).

- Istrate, E.; Puentes, R. Moving Forward on Public–Private Partnerships: U.S. and International Experience with PPP Units, BrookingsRockefeller Project on State and Metropolitan Innovation. Available online: https://www.brookings.edu/wp-content/uploads/2016/06/1208_transportation_istrate_puentes.pdf (accessed on 3 April 2021).

- Othman, K.; Khallaf, R. Identification of the Barriers and Key Success Factors for Renewable Energy Public-Private Partnership Projects: A Continental Analysis. Buildings 2022, 12, 1511. [Google Scholar] [CrossRef]

- Hanson Bridgett Public Policy Forum. P3 Projects at University Campuses. 2012. Available online: https://www.hansonbridgett.com/-/media/Files/Publications/P3-Projects-University-Campuses.pdf (accessed on 14 March 2020).

- Jones Lang LaSalle IP, Inc. Higher Education Perspective. 2016. Available online: http://img04.en25.com/Web/JLLAmericas/%7B492a07b5-6c45-444e-a1d5-608f9313b3d2%7D_Are-you-best-leveraging-your-university-real-estate.pdf (accessed on 14 March 2020).

- UC Merced News. Merced 2020 Project Wins Gold for Social Infrastructure. 2017. Available online: https://news.ucmerced.edu/news/2017/merced-2020-project-wins-gold-social-infrastructure (accessed on 1 February 2021).

- McCown Gordon Construction. Public-Private Partnerships in Higher Education Spurred by Uncertainties in Government Funding. 2020. Available online: https://mccowngordon.com/white-paper-higher-education-p3-for-buildings/ (accessed on 7 June 2020).

- Demirel H, Ç.; Leendertse WVolker, L.; Hertogh, M. Flexibility in PPP contracts–Dealing with potential change in the pre-contract phase of a construction project. Constr. Manag. Econ. 2017, 35, 196–206. [Google Scholar] [CrossRef]

- Martin, L.L. Public-Private Partnerships (P3s): What Local Government Managers Need to Know. International City/County Management Association. 2017. Available online: https://icma.org/sites/default/files/18-109%20Public-Private%20Partnerships-P3s%20White%20Paper_web%20FINAL.pdf (accessed on 14 March 2020).

- UN Habitat. Public-Private Partnerships in Housing and Urban Developments. 2011. Available online: https://unhabitat.org/sites/default/files/download-manager-files/Public-Private%20Partnership%20in%20Housing%20and%20Urban%20Development.pdf (accessed on 26 November 2020).

- Dewulf, G.; Garvin, M.J. 2019. Responsive governance in PPP projects to manage uncertainty. Constr. Manag. Econ. 2020, 38, 383–397. [Google Scholar] [CrossRef]

- PwC. Public-Private Partnerships in the US: The State of the Market and the Road Ahead. 2016. Available online: https://www.pwc.com/us/en/capital-projects-infrastructure/publications/assets/pwc-us-public-private-partnerships.pdf (accessed on 14 March 2020).

- Gao, R.; Liu, J. Selection of government supervision mode of PPP projects during the operation stage. Constr. Manag. Econ. 2019, 37, 584–603. [Google Scholar] [CrossRef]

- Liu, J.; Gao, R.; Cheah CY, J.; Luo, J. 2016. Evolutionary game of investors’ opportunistic behaviour during the operational period in PPP projects. Constr. Manag. Econ. 2017, 35, 137–153. [Google Scholar] [CrossRef]

- Jayasuriya, S.; Zhang, G.; Yang, R.J. Exploring the impact of stakeholder management strategies on managing issues in PPP projects. Int. J. Constr. Manag. 2020, 20, 666–678. [Google Scholar] [CrossRef]

| Study | Scope | Number of Responses |

|---|---|---|

| [44] | Understanding the nature of PPP projects in China to propose the appropriate risk allocation across the different sectors. | The survey was sent to 203 experts and 47 experts completed the survey and sent it back (23% response rate) |

| [38] | Developing a risk assessment model for transportation PPP projects in China. | A total of 98 responses were collected out of the 580 invitations that were sent to experts in the area (17% response rate). |

| [45] | Understand the main barriers for renewable energy PPP projects in China. | A total of 73 responses were collected out of the 105 invitations that were sent to experts in the area (70% response rate). |

| [39] | Understand and identify the success factor for the World Bank PPP projects across the globe | A total of 178 responses were collected out of the 1421 invitations that were sent to the World Bank experts (12.5% response rate). |

| [46] | Analyze and study the nature of renewable energy PPP projects in the North African region | The analysis was conducted based on the responses of 18 experts. |

| [47] | Analyze and identify the main barriers for PPP projects in Egypt. | The analysis was conducted based on the responses of 23 experts. |

| [48,49] | Analyze and identify the main barriers for PPP projects in Egypt. | The analysis was conducted based on the responses of 25 experts. |

| [41] | Understand the impact of the construction period on the success of transportation PPP projects in India. | A total of 8 responses were collected out of the 30 invitations that were sent to the experts (27% response rate). |

| [50] | Understand the nature of PPP projects in the MENA region. | The analysis was conducted based on the responses of 50 experts from Egypt, 19 from Jordan, and 20 from Tunisia. |

| [51] | Analyze the factors affecting renewable energy projects in Pakistan | The analysis was conducted based on the responses of 273 employees who were involved in renewable energy projects. |

| [52] | Analyze the key success factors for renewable energy projects in Pakistan | A total of 272 responses were collected out of the 450 invitations that were sent to experts in the area (60% response rate). |

| [53] | Understand the main barriers for renewable energy PPP projects in China. | A total of 216 responses were collected out of the 369 invitations that were sent to experts in the area (59% response rate). |

| [54] | Understand the main barriers for PPP projects in Iran. | A total of 48 responses were collected out of the 51 invitations that were sent to experts in the area (94% response rate). |

| [55] | Understand the nature of transportation PPP projects in Ethiopia. | A total of 52 responses were collected out of the 85 invitations that were sent to experts in the area (61% response rate). |

| [42] | Analyze the nature of housing PPP projects in Tanzania. | The analysis was conducted based on the responses of 10 experts. |

| [56] | Understand the barriers and key success factors for PPP projects in Egypt. | A total of 55 responses were collected out of the 80 invitations that were sent to experts in the area (69% response rate). |

| [57] | Understand the nature of water-specific PPP projects in Egypt to propose the appropriate risk allocation | The analysis was conducted based on the responses of 53 experts. |

| [58] | Understand the nature of renewable energy PPP projects in the Dominican Republic. | The analysis was conducted based on the responses of 25 experts. |

| [43] | Understand the nature of PPP projects in the educational sector in Egypt. | The analysis was conducted based on the responses of 13 experts. |

| [59] | Understand the nature of PPP projects in the renewable energy sector in Kenya. | A total of 263 responses were collected out of the 769 invitations that were sent to experts in the area (34% response rate). |

| [60] | Understand the main factors affecting PPP projects in developing countries (Egypt, India, China, and Pakistan). | The analysis was conducted based on the responses of 42 experts. |

| [61] | Understand the main factors affecting renewable energy PPP projects in China, India, and Russia. | The analysis was conducted based on the responses of 57 experts in total. |

| [62] | Understand the main factors affecting renewable energy PPP projects in Pakistan. | A total of 516 responses were collected out of the 750 invitations that were sent to experts in the area (69% response rate). |

| [63] | Understand the main factors affecting renewable energy PPP projects in Pakistan. | A total of 376 responses were collected out of the 408 invitations that were sent to experts in the area (92% response rate). |

| Institution | Project Name | Description | Cost | Year |

|---|---|---|---|---|

| City University of New York | The Towers at CCNY | Development of a student housing project. | $43 M | 2006 |

| Eastern Kentucky University | Housing Project | Construction of two residence halls. | $75 M | 2016 |

| Florida International University | Bayview Housing | Develop, finance, build, own, and operate a student housing complex. | $57.60 M | 2014 |

| George Mason University | Long & Kimmy Nguyen Engineering Building | Construction of 180,000 square feet building containing classrooms, research areas, and private lease space. | $61 M | 2007 |

| Kansas University | Central District Development Project | Construction of multiple facilities including: new science building, parking garage, utility plant, a 500 and a 700-bed housing and dining hall. | $350 M | 2016 |

| Louisiana State University (LSU) | Nicholson Gateway | Development of a housing project | $575 M | 2016 |

| Montclair State University | The Heights | Construction of a housing complex composed of 2000 beds. | $211 M | 2010 |

| Montclair State University | - | Design, construction, upgrade, and maintenance and operation of the university’s energy plant for a duration of 30 years. | $90 M | 2011 |

| Northeast Texas Community College | Residential Housing East | Construction of a new residence hall with 112 beds and a wellness center that includes a weight room and multipurpose room. | $5.8 M | 2016 |

| Northern Illinois University | - | Development of student housing including 120-bed residential units and commercial spaces. | $20 M | 2006 |

| Ohio State University | CampusParc | 50-year concession to operate, manage and rehabilitate a car park. | $483 M | 2012 |

| Ohio State University | - | Finance, improve, operate, and maintain energy systems (electric, gas, steam, heating and cooling). | $1.165 B | 2017 |

| Portland State University | University Pointe at College Station | Construction of a 16-storey housing hall under an 85-year lease. | $90 M | 2012 |

| Prairie View A&M | University Village | Construction of a housing complex composed of 2000 beds in three phases. Three additional phases were also added (2000, 2003, 2011) to construct new housing complexes as well as remodel existing ones. | $62 M | 1996 |

| Southern Oregon University Ashland | - | Construction of a 700-bed housing complex. | $40 M | 2011 |

| Tarleton State University | Heritage Hall | Construction of a housing complex with 514 beds for a 32-year ground lease. | $25 M | 2014 |

| Texas A&M College Station | Park West student housing | Construction of a student housing complex consisting of about 3400 beds. | $360 M | 2015 |

| Texas Woman’s University | Residential Village Project | Development of a student housing project that includes residential amenities such as lounge spaces, study areas, and community places. | $75.5 M | 2018 |

| University of Alaska Fairbank | Wood Center Dining Facility | Expansion to the existing Wood Center Building. | $28 M | 2012 |

| University of Arizona | - | Construction of two housing complexes that include commercial space. It includes new construction and renovations for a dormitory ($157 million), parking garage, recreation center and office building. | $300 M | 2017 |

| University of California | MT Zion Medical Offices Building | Demolition and building of new operating rooms and upgrade of existing facility. | $16 M | 2009 |

| University of California at Merced | 2020 Project | Development of 1680 beds in student housing, 1570 parking spaces, a 600 seat dining hall, a lab and buildings with offices and classrooms, a conference arena, a transit bus hub, a pool as well as athletic and recreational facilities | $1.138 B | 2016 |

| University of California | UCSF Neurosciences building | Development a new facility. | $357.6 M | 2016 |

| University of California | UC Davis West Village | Housing complex built to house about 4500 people, which is the largest planned “zero net energy” development in the U.S. This will be done through the use of solar power systems. | $280 M | 2010 |

| University of Houston-Victoria | - | Construction of a housing complex composed of 380 beds. | $20 M | 2015 |

| University of Iowa | Aspire at West Campus apartments—Phase 1 | Phase 1 includes designing, building, financing, owning, and operating a student housing complex for a 40-year ground lease. | $31 M | 2012 |

| University of Iowa | Aspire at West Campus apartments—Phase 2 | Phase 2 of the construction and involves the construction of 252 housing units for a 41-year lease | $34.5 M | 2015 |

| University of Kentucky | - | Upgrade and expansion of 9000 housing beds which is divided into five phases | $600 M | 2011 |

| University of Kentucky | - | Dining services. | $245 M | 2014 |

| University of Mary Washington | Eagle Village Mixed-use development | Development of housing, hotel, offices and commercial spaces. | $115 M | 2008 |

| University of Massachusetts Amherst campus | - | Student housing facility | $120 M | 2017 |

| University of Michigan at Flint | - | Renovate and transform a hotel into student housing. | $175 M | 2008 |

| University of Nevada at Reno | - | Construction of a housing complex composed of 132 units for a 42-year concession period. | $22 M | 2013 |

| University of Oklahoma | - | Improve, design, build, operate, and maintain utility systems for a 50-year concession period. | $718 M | 2010 |

| University of Oklahoma | Health Sciences Center | - | $128 | 2006 |

| University of South Carolina | 650 Lincoln | Design, build, finance, operate, and maintain an academic building and two housing residences for a 40-year lease. | $120 M | 2014 |

| University of South Carolina | Campus Village | Demolition and construction of a student housing facility. | $460 M | 2017 |

| University of South Florida | The Village | Development of a student housing project | $134 | 2015 |

| University of Texas at Dallas | Northside | Design, build, finance and operation of multiple facilities including a mixed-use housing and a retail space. | $52 M | 2015 |

| University of Texas at Dallas | Northside 2 | 61-year ground lease with the university as part of the public–private partnership agreement to develop Northside 2. | $67 | 2017 |

| University of Washington | South Lake Union Medical Research Complex | Biomedical research facility. Renovate an existing structure and construct a new structure for laboratory and conference space as well as administrative building. | $363 M | 2001 |

| University of West Florida | University Park Development | Consists of: a field house, leisure building, healthcare center, housing, student union, parking garage and bell tower. | >$500 M | 2013 |

| University System of Georgia | - | Develop ~3500 beds and manage ~6000 beds of on-campus housing for nine USG institutions for a duration of 65 years. | $517 M | 2014 |

| Virginia Commonwealth University | Gladding Residence Center Project | Develop a 360,000 square feet residence hall. | $96 M | 2016 |

| Wayne State University | - | Develop, finance and operate the school’s student housing. Originally set for $308 M but increased to $1.4 B. | $1.4 B | 2016 |

| Housing | Multi-Purpose | Utility | Retail | Health Centers | Parking | Total No. | Total Investment (Millions) | |

|---|---|---|---|---|---|---|---|---|

| Alaska | 1 | 1 | $28 | |||||

| Arizona | 1 | 1 | $300 | |||||

| California | 3 | 1 | 4 | $1791 | ||||

| Florida | 2 | 1 | 3 | $742 | ||||

| Georgia | 1 | 1 | $517 | |||||

| Illinois | 1 | 1 | $20 | |||||

| Iowa | 2 | 2 | $65.5 | |||||

| Kansas | 1 | 1 | $350 | |||||

| Kentucky | 2 | 1 | 3 | $920 | ||||

| Louisiana | 1 | 1 | $576 | |||||

| Massachusetts | 1 | 1 | $120 | |||||

| Michigan | 2 | 2 | $1575 | |||||

| Nevada | 1 | 1 | $22 | |||||

| New Jersey | 2 | 1 | 3 | $301 | ||||

| New York | 1 | $43 | ||||||

| Ohio | 1 | 1 | 2 | $1648 | ||||

| Oklahoma | 1 | 1 | 2 | $846 | ||||

| Oregon | 2 | 2 | $130 | |||||

| South Carolina | 1 | 1 | 2 | $580 | ||||

| Texas | 6 | 1 | 1 | 8 | $667 | |||

| Virginia | 1 | 2 | 3 | $272 | ||||

| Washington | 1 | 1 | $363 | |||||

| Total | 45 |

| Name of the University | PPP Type | Project Purpose | Contractual Cost of Project | Project Start Year | Project Completion Year | Status with Respect to Schedule | Status with Respect to Cost | Method of Recouping Investment by Private Entity | % of Financing by the University | Financing by Private Entity |

|---|---|---|---|---|---|---|---|---|---|---|

| Tarleton State University | Build-Lease-Transfer | Student Housing | $101 M–$200 M | 2014 | 2015 | Behind Schedule (third phase was behind schedule; first two were fine) | Below budget | Rent fees | 81–100% | Bonds |

| Northern Illinois University | Build-Lease-Transfer | Student Housing | $401 M–$ 600 M | 2010 | 2012 | Unaware of exact status | Unaware of exact status | Fees paid over the concession period. | 0–20% | Commercial financing |

| Southern Connecticut State University | Others (City to build and assume all operating cost and the University will use the school as a lab for education and communication disorders) | Others | $50 M–$100 M | 2018 | 2019 | On schedule | Below budget | State funded public school construction funds | 0–20% | State of Connecticut Public School Construction Bond Funds |

| UC Davis | Build-Own-Operate | Student Housing | $401 M–$ 600 M | 2019 | 2022 | Behind Schedule (due to feasibility and budget constraints) | Over budget | Rents | 0–20% | Bond financing |

| Texas Woman’s University | Design-Build-Finance-Operate | Mixed-use facility (e.g., a mixture of housing and retail spaces) | $50 M–$100 M | 2018 | 2019 | Ahead of schedule (The housing is ahead of schedule but the separate dining hall may fall being schedule | Over budget | Through rent for 40 years and also through an annual payment from dining. | 0–20% | Tax exempt bonding |

| Wayne State University | Design-Construct-Manage-Finance | Student Housing | $201 M–$400 M | 2017 | 2020 | On schedule | On budget | Bond holders repaid through revenue stream from rents. | 0–20% | Private placement bonds |

| University of South Florida | Build-Own-Operate | Mixed-use facility (e.g., a mixture of housing and retail spaces) | $101 M–$200 M | 2017 | 2018 | On schedule | On budget | Rent fees for a duration of 45 years after completion | Other | 70 percent, 30 percent equity |

| Louisiana State University | Design-Build-Finance-Operate | Mixed-use facility (e.g., a mixture of housing and retail spaces) | $401 M–$ 600 M | 2016 | 2021 | Ahead of schedule | Below budget | Development fee and operational fee | 0–20% | Bonds |

| University of Kansas | Design-Build-Operate-Transfer | Others (Science education; research, parking, central plant and housing) | $201 M–$400 M | 2015 | 2018 | Ahead of schedule | Over budget (Additional costs related to research equipment installation were not included.) | Project development fees; on-going fees for operations | 81–100% | LLC established and bonds rated based on university assets; bond sale managed to outside investor group with experience in University backed research facilities |

| University of Iowa | Others | Student Housing | $50 M–$100 M | 2012 | 2014 | Ahead of schedule | Below budget | Through apartment leasing to graduate student for duration of the ground lease from the University to developer (30 years) | Other (University provided the land via a ground lease to developer at zero cost, but no additional University funds were used. Developer takes 100% of risk) | 55% developers own equity and 45% financed |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khallaf, R.; Kang, K.; Hastak, M.; Othman, K. Public–Private Partnerships for Higher Education Institutions in the United States. Buildings 2022, 12, 1888. https://doi.org/10.3390/buildings12111888

Khallaf R, Kang K, Hastak M, Othman K. Public–Private Partnerships for Higher Education Institutions in the United States. Buildings. 2022; 12(11):1888. https://doi.org/10.3390/buildings12111888

Chicago/Turabian StyleKhallaf, Rana, Kyubyung Kang, Makarand Hastak, and Kareem Othman. 2022. "Public–Private Partnerships for Higher Education Institutions in the United States" Buildings 12, no. 11: 1888. https://doi.org/10.3390/buildings12111888

APA StyleKhallaf, R., Kang, K., Hastak, M., & Othman, K. (2022). Public–Private Partnerships for Higher Education Institutions in the United States. Buildings, 12(11), 1888. https://doi.org/10.3390/buildings12111888