Circular Economy: Challenges and Opportunities in the Construction Sector of Kazakhstan

Abstract

:1. Introduction

2. Methods

2.1. Context of the Study

2.2. Data Collection

2.3. Data Analysis

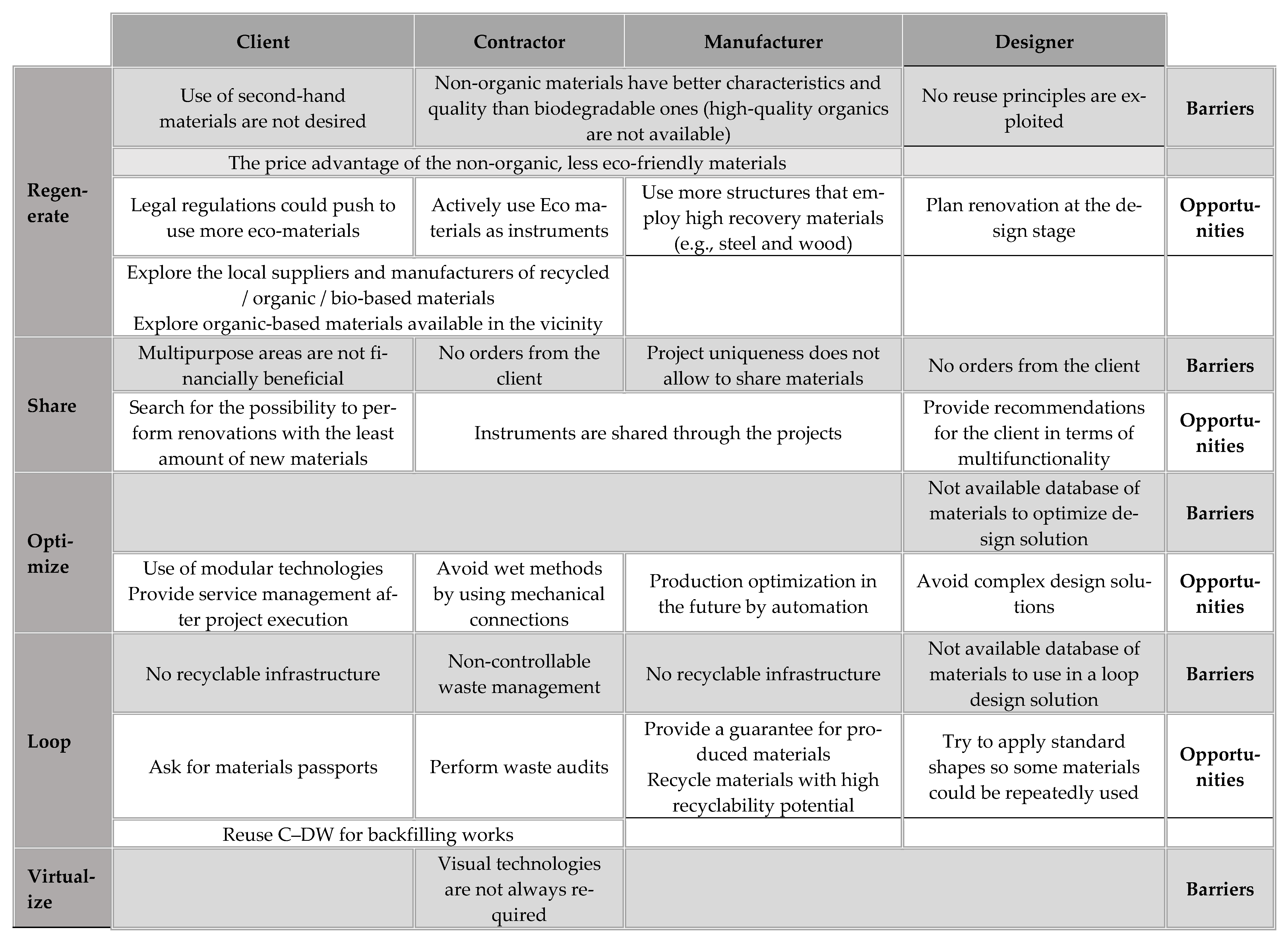

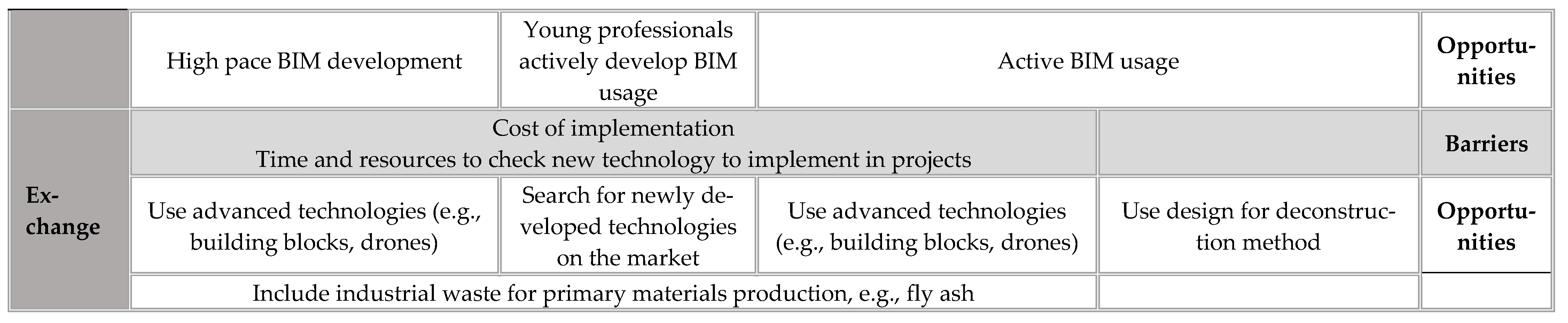

3. Results

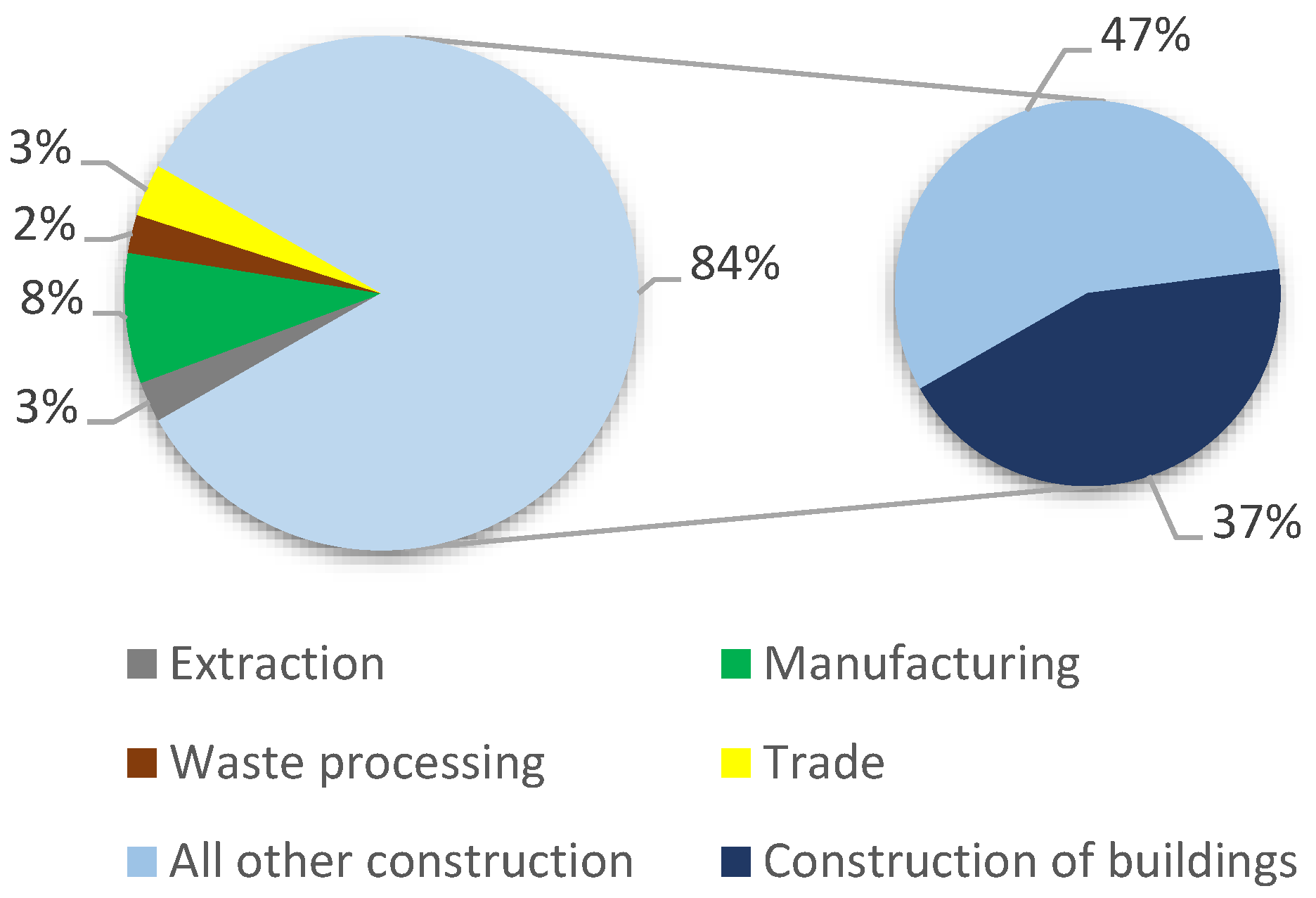

3.1. Overview of Kazakhstan Construction Sector

3.2. Survey Results

3.2.1. The Level of CE Concept General Awareness in Kazakhstan

3.2.2. Construction Materials

3.2.3. Design for Disassembly

3.2.4. Buildings Multifunctionality

3.2.5. Construction and Demolition Waste Minimization

3.2.6. BIM

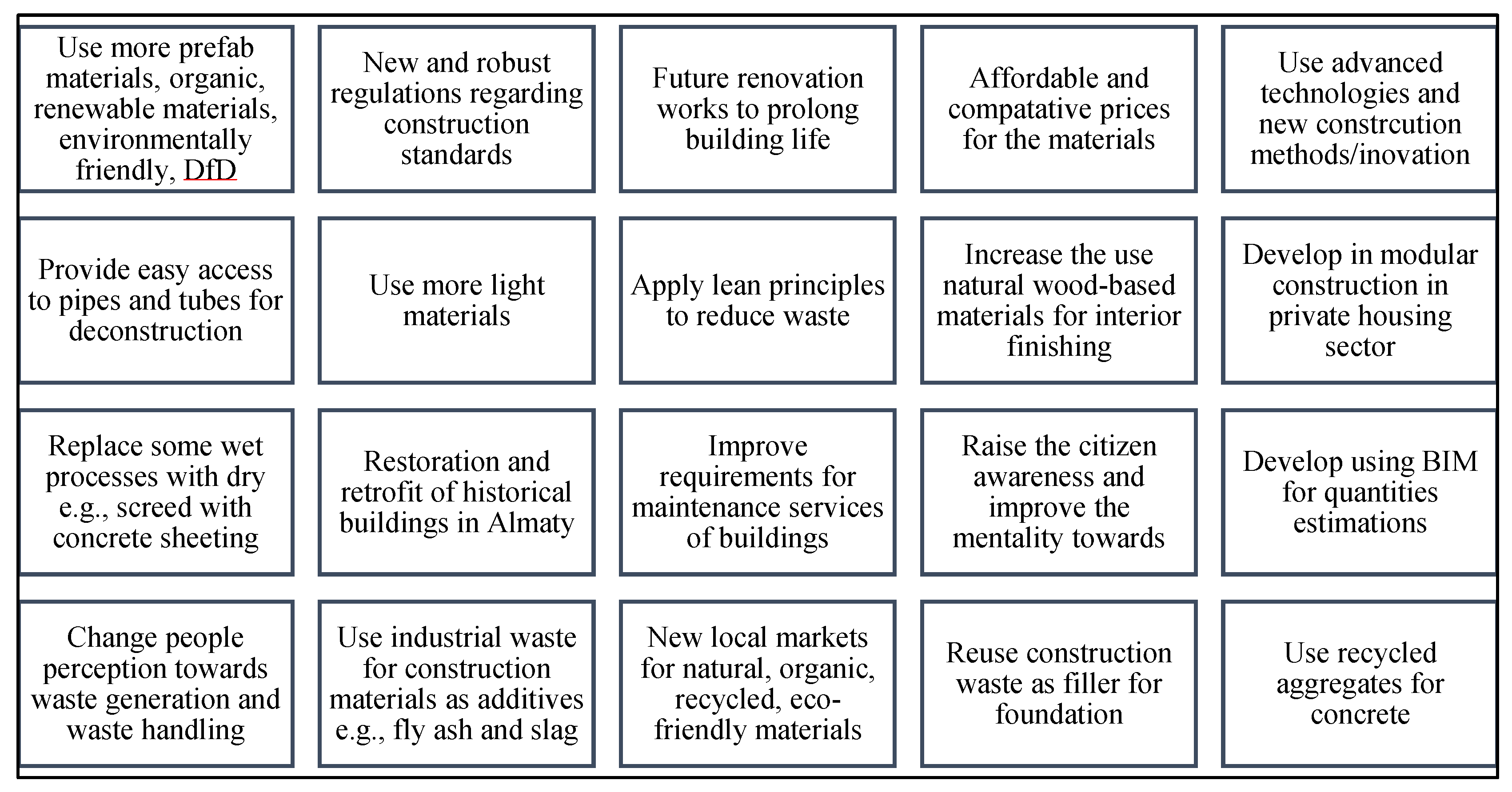

3.2.7. Barriers and Opportunities out of ReSOLVE Scope

4. Discussion and Implications

4.1. Construction Trends in Kazakhstan

4.2. Barriers and Opportunities to CE

4.3. Policy Recommendations

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Appendix A

| ReSOLVE Framework | |||||||

| REgenerate | Share | Optimize | Loop | Virtualize | Exchange | ||

| Survey questions | Are you aware of the circular economy term and how it applies to the construction industry? | X | X | X | X | X | X |

| Is the demolition and/ or deconstruction process of the structure (e.g., DfD concept) at the end of its life cycle considered at the design stage? | X | X | X | X | |||

| Different materials have different life cycles; do you consider this for the building layering? E.g., insulation, plaster, and facade in the exterior side of the building to be nearly the same life-cycle, and plaster/drywall/wallpaper in the interior to be nearly the same life-cycle. | X | X | |||||

| To what extent the design incorporates the materials that are high-value recyclable where possible, e.g., steel, gypsum drywalls, plywood, wooden blocks, etc., over low-grade recyclable materials (e.g., concrete, bricks, etc.)? quantity wise for all material in all projects during last ten years | X | X | X | X | |||

| Do you try to avoid “wet” building methods (e.g., welding, sealing, gluing) over dry methods (bolting, coupling, mechanical connections)? If yes, how? If no, what are the barriers? | X | X | X | ||||

| How often are structures designed from prefabricated blocks, modules that can be easily disassembled at the end of their life cycle? (quantity-wise in all projects during last ten years) | X | X | X | X | |||

| During the design stage, is the floor space optimized by designing for multipurpose areas (for public and residential spaces), e.g., the dining area can be used as office space or conference space etc. | X | X | X | ||||

| Does the design consider the potential to reduce waste of construction materials and set objectives to minimize waste where possible? | X | X | X | ||||

| To what extent used/second-hand/worn/refurbished materials from existing or existing buildings are used in the design of new buildings? | X | X | X | X | |||

| To what extent is the restoration, refurbishing, and adaptation of the existing structure preferred instead of its demolition for a new project? (quantity-wise in all projects during last ten years) | X | X | X | X | |||

| Do you use building information modeling (BIM) during design and optimize materials used where possible? | X | X | X | ||||

| To what extent biomaterials or organic materials (or Eco materials in more general) are selected in the architecture/design of the projects? | X | X | |||||

References

- Bao, Z.; Lu, W.; Chi, B.; Yuan, H.; Hao, J. Procurement innovation for a circular economy of construction and demolition waste: Lessons learnt from Suzhou, China. Waste Manag. 2019, 99, 12–21. [Google Scholar] [CrossRef] [PubMed]

- Gower, R.; Schröder, P. Virtuous circle: How the circular economy can create jobs and save lives in low and middle-income countries. Tearfund 2016, 6. Available online: https://www.researchgate.net/publication/306562812_Virtuous_Circle_how_the_circular_economy_can_create_jobs_and_save_lives_in_low_and_middle-income_countries (accessed on 16 October 2021).

- Adams, K.T.; Osmani, M.; Thorpe, T.; Thornback, J. Circular economy in construction: Current awareness, challenges and enablers. Proc. Inst. Civ. Eng. Waste Resour. Manag. 2017, 170, 15–24. [Google Scholar] [CrossRef] [Green Version]

- Business in the Community (BITC). Advancing Circular Construction: Case Studies from the Building and Infrastructure sectors; BITC: London, UK, 2020. [Google Scholar]

- Built-Env-Co.Project. Circularity in the Built Environment: Case Studies a Compilation of Case Studies from the CE100; Built-Env-Co.Project: Cowes, UK, 2016. [Google Scholar]

- Chang, Y.-T.; Hsieh, S.-H. A Preliminary Case Study on Circular Economy in Taiwan’s Construction. IOP Conf. Ser. Earth Environ. Sci. 2019, 225, 012069. [Google Scholar] [CrossRef] [Green Version]

- Guerra, B.C.; Leite, F. Circular economy in the construction industry: An overview of United States stakeholders’ awareness, major challenges, and enablers. Resour. Conserv. Recycl. 2021, 170, 105617. [Google Scholar] [CrossRef]

- Press Service of the Prime Minister of the Republic of Kazakhstan. Kazakhstan, the Volume of Production of Building Materials Increased 3.3 Times. PrimeMinister.kz, 2020. Available online: https://primeminister.kz/ru/news/v-kazahstane-obem-proizvodstva-stroitelnyh-materialov-uvelichilsya-v-33-raza-miir-rk-2161319 (accessed on 2 September 2021).

- Turkyilmaz, A.; Guney, M.; Karaca, F.; Bagdatkyzy, Z.; Sandybayeva, A.; Sirenova, G. A comprehensive construction and demolition waste management model using PESTEL and 3R for construction companies operating in Central Asia. Sustainability 2019, 11, 1593. [Google Scholar] [CrossRef] [Green Version]

- Press Service of the Prime Minister of the Republic of Kazakhstan. Housing Construction in Kazakhstan in 2020: Trends and Features. 2021. Available online: https://primeminister.kz/en/news/reviews/housing-construction-in-kazakhstan-in-2020-trends-and-features (accessed on 26 June 2021).

- Forbes.kz 17 Million Square Meters of Housing Are Promised to Be Built in 2021 in Kazakhstan. Available online: https://forbes.kz/news/2021/02/16/newsid_244035/?utm_source=forbes&utm_medium=incut&utm_campaign=news (accessed on 2 September 2021).

- InBusiness.kz. Askar Mamin Instructed to Scale Modular Housing Construction in the Republic of Kazakhstan. 2021. Available online: https://inbusiness.kz/ru/news/askar-mamin-poruchil-masshtabirovat-modulnoe-domostroenie-v-rk (accessed on 21 June 2021).

- Metabolic Analysis and Circular Economy Strategies for Almaty, Kazakhstan. Shifting Paradigms. 2019. Available online: https://www.shiftingparadigms.nl/projects/almaty/ (accessed on 1 September 2021).

- Zikrina, Z.; Urazayeva, F.; Cscp, N.V.; Fraser, M.; Douma, A.; Raspail, N. Almaty Circular Economy; Emerging Markets Sustainability Dialogue Challenge Fund: Almaty, Kazakhstan, 2019. [Google Scholar]

- FABRICations. Almaty Circular Economy—Kazakhstan. 2019. Available online: https://www.fabrications.nl/portfolio-item/almaty-circular-economy-kazakhstan/ (accessed on 1 September 2021).

- Manninen, K.; Koskela, S.; Antikainen, R.; Bocken, N.; Dahlbo, H.; Aminoff, A. Do circular economy business models capture intended environmental value propositions? J. Clean. Prod. 2018, 171, 413–422. [Google Scholar] [CrossRef] [Green Version]

- McKinsey Center for Business and Environment. The Circular Economy: Moving from Theory to Practice; McKinsey Center for Business and Environment: New York, NY, USA, 2016. [Google Scholar]

- Frue, K. PEST Analysis Ultimate Guide: Definition, Template, Examples. 2020. Available online: https://pestleanalysis.com/pest-analysis/ (accessed on 20 June 2021).

- Agency for Strategic Planning and Reforms of the Republic of Kazakhstan Bureau of National Statistics. Acting Legal Entities of All Size, Forms of Ownership, and Organizational and Legal Forms in Kazakhstan (as of May 2021). Available online: https://stat.gov.kz/ (accessed on 1 September 2021).

- Information on the Reduction, Recycling and Reuse of Waste. EGov. Government Services and Information Online. 2021. Available online: https://egov.kz/cms/ru/articles/ecology/waste_reduction_recycling_and_reuse (accessed on 30 August 2021).

- Press Service of the Prime Minister of the Republic of Kazakhstan. Mortgage on Favorable Terms and Construction of Affordable Housing—Development of Housing Construction in Kazakhstan. 2020. Available online: https://primeminister.kz/ru/news/reviews/ipoteka-po-vygodnym-usloviyam-i-stroitelstvo-dostupnogo-zhilya-razvitie-zhilishchnogo-stroitelstva-v-kazahstane-2861641 (accessed on 26 June 2021).

- Coalition for Green Economy and Development G-Global. ‘Green’ Economy as a Conscious Choice of Kazakhstan. Available online: https://greenkaz.org/index.php/press-centr/novosti-v-strane/item/3106-zelenaya-ekonomika-kak-osoznannyj-vybor-kazakhstana (accessed on 30 June 2021).

- Electronic labor stock “Enbek.kz”. 2020. Available online: https://www.enbek.kz/atlas/ru/4/download-pdf (accessed on 17 October 2021).

- KURSIV. The Volume of Construction Work in Kazakhstan Since the Beginning of the Year Increased by 13.1%. 2021. Available online: https://kursiv.kz/news/otraslevye-temy/2021-04/obem-stroitelnykh-rabot-v-kazakhstane-s-nachala-goda-uvelichilsya-na (accessed on 26 June 2021).

- Press Service of the Prime Minister of the Republic of Kazakhstan. In 2021, Three New Projects will be Launched that Will Increase the Production of the Manufacturing Industry. 2021. Available online: https://primeminister.kz/ru/news/v-2021-godu-budut-zapushcheny-tri-novyh-proekta-kotorye-uvelichat-obemy-proizvodstva-obrabatyvayushchey-otrasli-miir-162536 (accessed on 30 August 2021).

- Forbes.kz. One Citizen of Kazakhstan Accounts for 21.9 sq. m of Living Space. 2020. Available online: https://forbes.kz/process/property/na_odnogo_kazahstantsa_prihoditsya_219_kv_m_jilploschadi (accessed on 26 June 2021).

- Moura, M.C.P.; Smith, S.J.; Belzer, D.B. 120 Years of U.S. Residential Housing Stock and Floor Space. PLoS ONE 2015, 10, e0134135. [Google Scholar] [CrossRef] [PubMed]

- ENTRANZE. Average Floor Area per Capita. Available online: https://entranze.enerdata.net (accessed on 26 June 2021).

- KURSIV. What Will Be the Construction Market in the Near Future. 2019. Available online: https://kursiv.kz/news/vlast-i-biznes/2019-06/kakim-budet-stroitelnyy-rynok-blizhayshego-buduschego (accessed on 26 June 2021).

- Alimova, K. The Construction Market Is Experiencing an Acute Shortage of Personnel. InBusiness.kz, 2020. Available online: https://inbusiness.kz/ru/news/rynok-stroitelstva-perezhivaet-ostryj-deficit-kadrov (accessed on 26 June 2021).

- Kapitanova, I. Digital Technologies and Trends in Construction Were Discussed by the Participants of Digital Almaty-2021. Zakon.kz, 2021. Available online: https://www.zakon.kz/5057237-tsifrovye-tehnologii-i-trendy-v.html (accessed on 26 June 2021).

- Tumashova, E. Will BIM Technologies Change the Construction Industry in Kazakhstan? Kapital.kz, 2018. Available online: https://kapital.kz/real_estate/66698/izmenyat-li-bim-tekhnologii-stroyotrasl-kazakhstana.html (accessed on 26 June 2021).

- Modular vs Monolithic. We Compare Modern Technologies for Building Houses. Informburo.kz 2020. Available online: https://informburo.kz/special/modulnoe-vs-monolitnoe-sravnivaem-sovremennye-tehnologii-stroitelstva-domov.html (accessed on 26 June 2021).

- Vidyanova, A. Industrial Waste Recycling: Trends and New Opportunities. Kapital.kz, 2020. Available online: https://kapital.kz/economic/91442/pererabotka-promyshlennykh-otkhodov-trendy-i-novyye-vozmozhnosti.html (accessed on 26 June 2021).

- Futas, N.; Rajput, K.; Schiano-Phan, R. Cradle to Cradle and Whole-Life Carbon assessment - Barriers and opportunities towards a circular economic building sector. In Proceeding of the BAMB-CIRCPATH “Buildings as Material Banks—A Pathway For A Circular Future”, Brussels, Belgium, 5–7 February 2019. [Google Scholar] [CrossRef]

- Hart, J.; Adams, K.; Giesekam, J.; Tingley, D.D.; Pomponi, F. Barriers and drivers in a circular economy: The case of the built environment. Procedia CIRP 2019, 80, 619–624. [Google Scholar] [CrossRef]

- Mahpour, A. Prioritizing barriers to adopt circular economy in construction and demolition waste management. Resour. Conserv. Recycl. 2018, 134, 216–227. [Google Scholar] [CrossRef]

- Densley Tingley, D.; Cooper, S.; Cullen, J. Understanding and overcoming the barriers to structural steel reuse, a UK perspective. J. Clean. Prod. 2017, 148, 642–652. [Google Scholar] [CrossRef]

- Akinade, O.; Oyedele, L.; Oyedele, A.; Davila Delgado, J.M.; Bilal, M.; Akanbi, L.; Ajayi, A.; Owolabi, H. Design for deconstruction using a circular economy approach: Barriers and strategies for improvement. Prod. Plan. Control 2020, 31, 829–840. [Google Scholar] [CrossRef]

- Sigrid Nordby, A. Barriers and opportunities to reuse of building materials in the Norwegian construction sector. In Proceedings of the BAMB-CIRCPATH “Buildings as Material Banks—A Pathway for A Circular Future”, Brussels, Belgium, 5–7 February 2019. [Google Scholar] [CrossRef]

- Debacker, W.; Manshoven, S. D1 Synthesis of the State-of- the-Art Key Barriers and Opportunities for Materials Passports and Reversible Building Design in the Current System; BAMB: Brussels, Belgium, 2016. [Google Scholar]

- Munaro, M.R.; Tavares, S.F.; Bragança, L. Towards circular and more sustainable buildings: A systematic literature review on the circular economy in the built environment. J. Clean. Prod. 2020, 260, 121134. [Google Scholar] [CrossRef]

- Rahla, K.; Mateus, R.; Bragança, L. Implementing Circular Economy Strategies in Buildings—From Theory to Practice. Appl. Syst. Innov. 2021, 4, 26. [Google Scholar] [CrossRef]

- Liu, Z.; Osmani, M.; Demian, P.; Baldwin, A. The Potential Use of BIM to Aid Construction Waste Minimisation; Creative Commons: Loughborough, UK, 2011. [Google Scholar]

- Mangialardo, A.; Micelli, E. Rethinking the Construction Industry Under the Circular Economy: Principles and Case Studies; Springer: Berlin, Germany, 2018. [Google Scholar] [CrossRef]

- Morel, J.C.; Charef, R. What are the barriers affecting the use of earth as a modern construction material in the context of circular economy? In Proceedings of the BAMB-CIRCPATH “Buildings as Material Banks—A Pathway for A Circular Future”, Brussels, Belgium, 5–7 February 2019. [Google Scholar] [CrossRef]

- Ding, Z.; Zhu, M.; Tam, V.W.Y.; Yi, G.; Tran, C.N.N. A system dynamics-based environmental benefit assessment model of construction waste reduction management at the design and construction stages. J. Clean. Prod. 2018, 176, 676–692. [Google Scholar] [CrossRef]

| Framework Element | Description | Source |

|---|---|---|

| Regenerate | “REgenerate” action describes the aspiration to restore the ecosystems, e.g., use renewable sources of energy. | [2,5,16,17] |

| Share | “Share” action calls to prolong the lifetime periods of the products through sharing them among several users. | |

| Optimize | “Optimize” action aims to improve the efficiency, e.g., use prefabrication methods to save time during construction and demolition; ensure efficient use of resources; and development of other smart design technologies. | |

| Loop | “Loop” action calls for better design that ensures long usage of the product, allowance for easy disassembly, and development of recycling opportunities | |

| Virtualize | “Virtualize” action aspires to increase the level of virtuality and dematerialization, e.g., BIM or smart devices. | |

| Exchange | “Exchange” action calls up to replace outdated activities and technologies with more innovative and efficient ones (e.g., materials or technologies). |

| Intermediate Material | Consumption | Import Rate (%) |

|---|---|---|

| Ready-mixed concrete | 20.2 Mt | 0.0% |

| Concrete products for construction purposes | 6.2 Mt | 2.2% |

| Prefabricated concrete structures | 1.1 Mt | 0.4% |

| Building solutions | 0.8 Mt | 0.8% |

| Prefabricated building metal structures | 0.1 Mt | 9.0% |

| Total | 28.3 Mt |

| Construction | Billion Tenge | % |

|---|---|---|

| Residential buildings | 392 | 12% |

| Non-residential buildings | 727 | 22% |

| Transportation infrastructure | 692 | 21% |

| Water infrastructure | 323 | 10% |

| Other civil infrastructure | 655 | 19% |

| Services for building construction | 574 | 17% |

| Total | 3363 | 100% |

| Political Factor | Financial support for the real estate development Strategy to develop renewable and alternative energy sources, reduce energy costs and CO2 emissions |

| Economic Factor | Construction is one of the leading economic industries The consistent growth of the construction capacities Increasing production rate of construction materials The steady increase of the construction materials prices |

| Social Factor | Urbanization process Residential construction growth Lack of qualified personnel |

| Technological Factor | Digitalization (blockchain, smart home, BIM) Modular construction Recycling mining waste and sub-products |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Torgautov, B.; Zhanabayev, A.; Tleuken, A.; Turkyilmaz, A.; Mustafa, M.; Karaca, F. Circular Economy: Challenges and Opportunities in the Construction Sector of Kazakhstan. Buildings 2021, 11, 501. https://doi.org/10.3390/buildings11110501

Torgautov B, Zhanabayev A, Tleuken A, Turkyilmaz A, Mustafa M, Karaca F. Circular Economy: Challenges and Opportunities in the Construction Sector of Kazakhstan. Buildings. 2021; 11(11):501. https://doi.org/10.3390/buildings11110501

Chicago/Turabian StyleTorgautov, Beibut, Asset Zhanabayev, Aidana Tleuken, Ali Turkyilmaz, Mohammad Mustafa, and Ferhat Karaca. 2021. "Circular Economy: Challenges and Opportunities in the Construction Sector of Kazakhstan" Buildings 11, no. 11: 501. https://doi.org/10.3390/buildings11110501

APA StyleTorgautov, B., Zhanabayev, A., Tleuken, A., Turkyilmaz, A., Mustafa, M., & Karaca, F. (2021). Circular Economy: Challenges and Opportunities in the Construction Sector of Kazakhstan. Buildings, 11(11), 501. https://doi.org/10.3390/buildings11110501