Retirement Expectations in Germany—Towards Rising Social Inequality?

Abstract

1. Introduction

1.1. The Reforms of the German Pension System

1.2. Expected Retirement Age in Germany

2. Materials and Methods

3. Results

4. Discussion

Funding

Conflicts of Interest

Appendix A

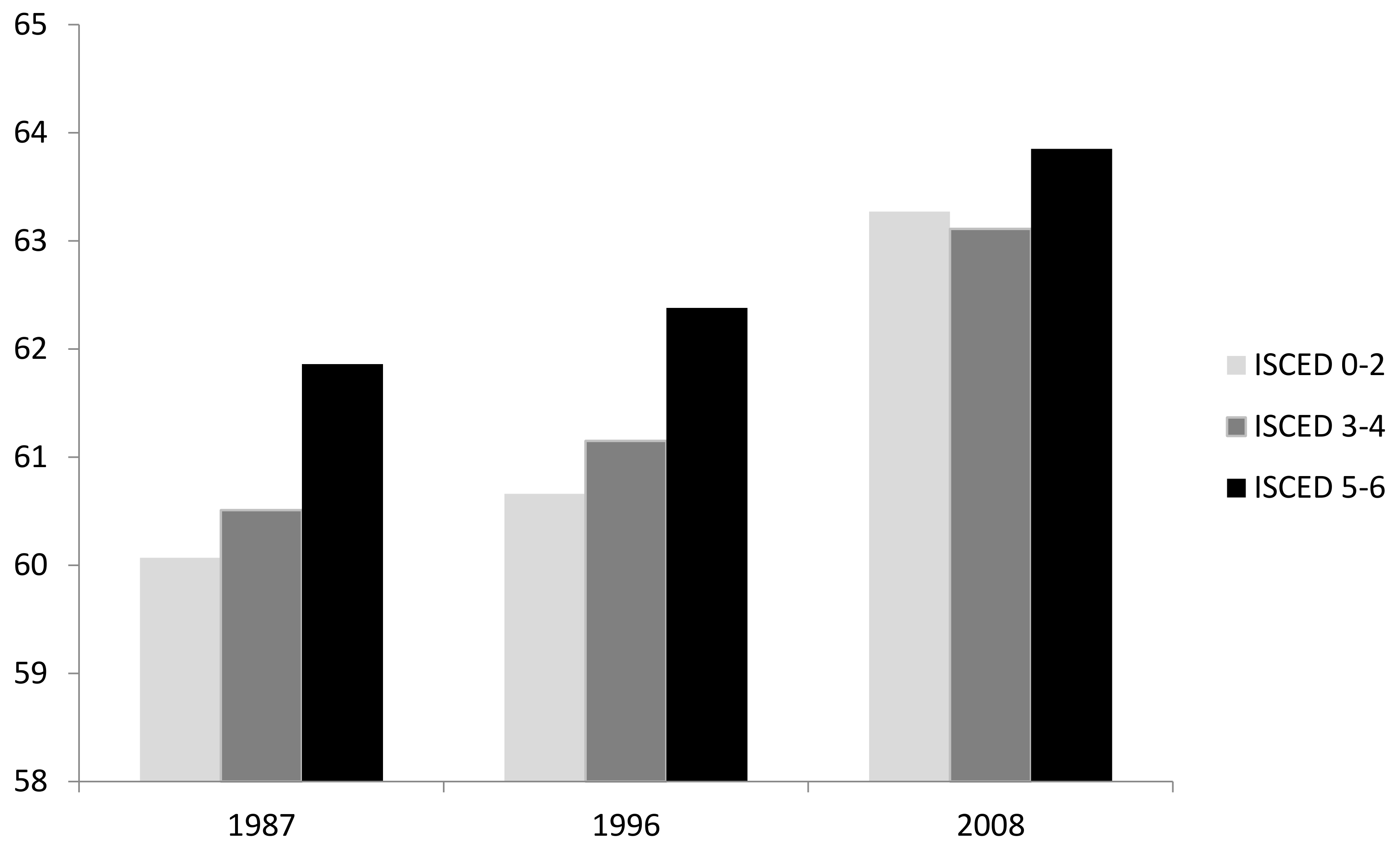

| 1987 | 1996 | 2008 | |

|---|---|---|---|

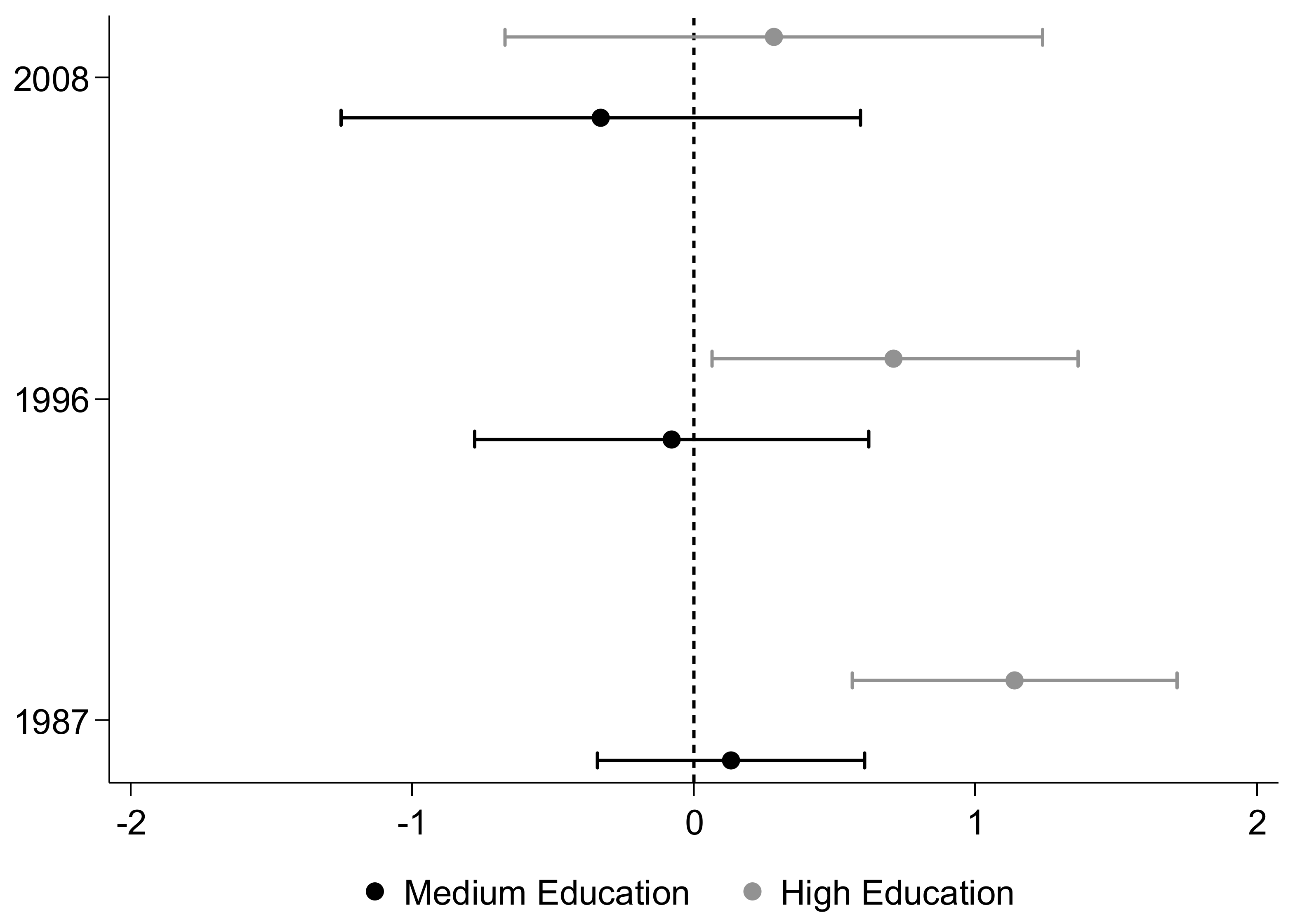

| Education (Ref: ISCED 0–2) | |||

| ISCED 3–4 | 0.39 (0.32) | −0.13 (0.37) | −0.22 (0.48) |

| ISCED 5–6 | 1.68 (0.38) ** | 0.66 (0.41) † | 0.45 (0.50) |

| Women (Ref: Man) | −1.60 (0.30) ** | −1.08 (0.22) ** | −0.68 (0.19) ** |

| Partner (Ref: No Partner) | −0.41 (0.25) | −0.65 (0.29) ** | −0.75 (0.25) ** |

| Occupational Position (Ref: Blue-Collar) | |||

| White-Collar | 0.33 (0.23) * | 0.57 (0.23) † | 0.00 (0.26) |

| Public Servant | 0.33 (0.36) | −0.30 (0.40) | −0.33 (0.36) |

| Self-Employed | 2.45 (0.35) ** | 1.87 (0.34) ** | 1.55 (0.32) ** |

| Occupational Pension (Ref: No Occ.Pension) | −0.48 (0.39) | −0.59 (0.20) ** | −0.44 (0.18) * |

| Constant | 58.69 (0.37) | 62.12 (0.46) | 63.81 (0.55) |

| Number of Observations | 612 | 767 | 1187 |

| Selection coefficients | |||

| Education (Ref: ISCED 0–2) | |||

| ISCED 3–4 | 0.27 (0.15) ** | 0.20 (0.20) * | 0.42 (0.18) * |

| ISCED 5–6 | 0.57 (0.18) ** | 0.43 (0.21) ** | 0.52 (0.19) ** |

| Women (Ref: Man) | −0.46 (0.05) ** | −0.20 (0.11) † | −0.14 (0.09) † |

| Age Groups (Ref: 50–55) | |||

| 56–60 | −0.98 (0.24) ** | −0.69 (0.23) ** | −0.57 (0.21) ** |

| 61–65 | −1.23 (0.45) ** | −1.01 (0.34) ** | −0.78 (0.29) ** |

| Rho | 0.64 | 0.61 | 0.55 |

| Sigma | 1.05 | 2.78 | 3.14 |

References

- German Federal Statistical Office. Bevölkerungs- und Haushaltsentwicklung im Bund und in den Ländern. In Demografischer Wandel in Deutschland, 1; Statistische Ämter des Bundes und der Länder: Wiesbaden, Germany, 2011. [Google Scholar]

- De Tavernier, W.; Roots, A. When do people want to retire? The preferred retirement age gap between Eastern and Western Europe explained. Stud. Transit. States Soc. 2015, 7, 7–20. [Google Scholar]

- Domonkos, S. Promoting a higher retirement age: A prospect-theoretical approach. Int. J. Soc. Welf. 2015, 24, 133–144. [Google Scholar] [CrossRef]

- Harper, S. The Challenges of the Twenty-Frist-Century Demography. In Challenges of Aging: Retirement, Pensions, and Intergenerational Justice; Torp, C., Ed.; Palgrave Macmillan UK: Basingstoke, UK, 2015; pp. 17–30. [Google Scholar]

- Naumann, E. Increasing conflict in times of retrenchment? Attitudes towards healthcare provision in Europe between 1996 and 2002. Int. J. Soc. Welf. 2014, 23, 276–286. [Google Scholar] [CrossRef]

- Naumann, E. Do increasing reform pressures change welfare state attitudes? An experimental study on population ageing, pension reform preferences, political knowledge and ideology. Ageing Soc. 2015, 37, 266–294. [Google Scholar] [CrossRef]

- Leve, V.; Naegele, G.; Sporket, M. Retirement at 67—Prerequisites for the ability of older female jobholders to continue working. Z. Gerontol. Geriatr. 2009, 42, 287–291. [Google Scholar] [CrossRef] [PubMed]

- Frerichs, F.; Naegele, G. Active ageing in employment—Prospects and policy approaches in Germany. In Ageing Labour Forces. Promises and Prospects; Taylor, P., Ed.; Edward Elgar Publishing: Northampton, MA, USA, 2008; pp. 174–203. [Google Scholar]

- Moehring, K. Employment histories and pension incomes in Europe: A multilevel analysis of the role of institutional factors. Eur. Soc. 2015, 17, 3–26. [Google Scholar] [CrossRef]

- Ebbinghaus, B.; Hofäcker, D. Overcoming Early Retirement in Europe. Comp. Popul. Stud. 2013, 38, 807–840. [Google Scholar]

- Dietz, M.; Walwei, U. Germany—No country for old workers? Z. Arbeitsmarktforsch. 2011, 44, 363–376. [Google Scholar] [CrossRef]

- Brussig, M. Changes in labour market participation of older employees in Germany. The perspective of labour market research. Z. Gerontol. Geriatr. 2009, 42, 281–286. [Google Scholar] [CrossRef] [PubMed]

- Wong, J.D.; Hardy, M.A. Women’s Retirement Expectations: How Stable Are They? J. Gerontol. B Psychol. Sci. Soc. Sci. 2013, 64, 77–86. [Google Scholar] [CrossRef] [PubMed]

- Örestig, J.; Strandh, M.; Stattin, M. A Wish Come True? A Longitudinal Analysis of the Relationship between Retirement Preferences and the Timing of Retirement. J. Popul. Ageing 2013, 6, 99–118. [Google Scholar] [CrossRef]

- Cobb-Clark, D.A.; Stillmann, S. The Retirement Expectations of Middle-aged Australians. Econ. Rec. 2009, 85, 146–163. [Google Scholar] [CrossRef]

- Örestig, J.; Larsson, D.; Stattin, M. Retirement Preferences before and after Pension Reform: Evidence from Swedish Natural Experiment. 2013. Available online: http://urn.kb.se/resolve?urn=urn:nbn:se:umu:diva-80804 (accessed on 6 February 2017).

- De Grip, A.; Fouarge, D.; Montizaan, R.M. How Sensitive are Individual Retirement Expectations to Raising the Retirement Age? Economist 2013, 161, 225–251. [Google Scholar] [CrossRef]

- Hofäcker, D.; Naumann, E. The emerging trend of work beyond retirement age in Germany. Z. Gerontol. Geriatr. 2015, 48, 473–479. [Google Scholar] [CrossRef] [PubMed]

- Hochfellner, D.; Burkert, C. Employment in retirement. Continuation of a working career or essential additional income? Z. Gerontol. Geriatr. 2013, 46, 242–250. [Google Scholar] [CrossRef] [PubMed]

- Buchholz, S.; Rinklake, A.; Blossfeld, H.P. Reversing Early Retirement in Germany. A Longitudinal Analysis of the Effects of Recent Pension Reforms on the Timing of the Transition to Retirement and on Pension Income. Comp. Popul. Stud. 2013, 38, 881–906. [Google Scholar]

- Rinklake, A.; Buchholz, S. Increasing inequalities in Germany: Older people’s employment lives and income conditions since the mid-1980s. In Ageing Populations, Globalization and the Labour Market. Comparing Late Working Life and Retirement in Modern Societies; Blossfeld, H.-P., Buchholz, S., Kurz, K., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2011; pp. 35–64. [Google Scholar]

- Ebbinghaus, B. Reforming Early Retirement in Europe, Japan and the USA; Oxford University Press: Oxford, UK, 2008. [Google Scholar]

- Radl, J. Retirement Timing and Social Stratification. In A Comparative Study of Labor Market Exit and Age Norms in Western Europe; De Gruyter Open: Berlin, Germany, 2014. [Google Scholar]

- Bönke, T.; Schröder, C.; Schulte, K. Income and Inequality in the Long Run: The Case of German Elderly. Ger. Econ. Rev. 2009, 11, 487–510. [Google Scholar] [CrossRef]

- Naegele, G. Older workers and older worker policies in Germany. In Older Workers in an Ageing Society: Critical Topics in Research and Policy; Taylor, P., Ed.; Edward Elgar Publishing: Cheltenham, UK, 2014; pp. 39–61. [Google Scholar]

- Buchholz, S. Men’s late careers and career exits in West Germany. In Globalization, Uncertainty and Late Careers in Society; Blossfeld, H.-P., Buchholz, S., Hofäcker, D., Eds.; Routledge: Abingdon, UK, 2006; pp. 55–77. [Google Scholar]

- Hofäcker, D.; Neumann, I.; Hess, M. Generationenpolitiken für “Junge” und “Alte”. Neue Z. Familienr. 2015, 23, 1108–1110. [Google Scholar]

- Rürup, B. The German Pension System: Status Quo and Reform Options; University of Chicago Press: Chicago, IL, USA, 2002. [Google Scholar]

- Corneo, C.; Schröder, C. Bewertung der Riester-Rente: Volkswirtschaftliche Kriterien und Anforderungen an die Daten. Z. Sozial. 2012, 2, 235–257. [Google Scholar]

- Duell, N.; Vogler-Ludwig, K. European Employment Observatory EEO Review: Employment Policies to Promote Active Ageing, Germany. 2012. Available online: http://www.economix.org/pdf/EEO%20Review%20Germany-Older%20Workers.pdf (accessed on 26 April 2017).

- Naegele, G.; Walker, A. Age management in organizations in the European Union. In The SAGE handbook of Workplace Learning; Malloch, M., Cairns, L., Evans, K., O’Connor, B., Eds.; SAGE: London, UK, 2011; pp. 251–268. [Google Scholar]

- Naegele, G.; Sporket, M. Altern in der Arbeitswelt. Z. Gerontol. Geriatr. 2009, 42, 279–280. [Google Scholar] [CrossRef] [PubMed]

- Hofäcker, D. In line or at odds with active ageing policies? Exploring patterns of retirement preferences in Europe. Aging Soc. 2015, 35, 1529–1556. [Google Scholar] [CrossRef]

- Zappalà, S.; Depolo, M.; Fraccaroli, F.; Guglielmi, D.; Sarchielli, G. Postponing job retirement? Psychosocial influences on the preference for early or late retirement. Career Dev. Int. 2008, 13, 150–167. [Google Scholar] [CrossRef]

- Esser, I. Continued Work or Retirement; Institute for Future Studies: Stockholm, Sweden, 2005. [Google Scholar]

- Szinovacz, M.E.; Martin, L.; Davey, A. Recession and Expected Retirement Age: Another Look at the Evidence. Gerontologist 2014, 54, 245–257. [Google Scholar] [CrossRef] [PubMed]

- Sargent-Cox, K.A.; Anstey, K.J.; Kendig, H.; Skladzien, E. Determinants of Retirement Timing Expectations in the United States and Australia: A Cross-National Comparison of the Effects of Health and Retirement Benefit Policies on Retirement Timing Decision. J. Aging Soc. Policy 2012, 24, 291–308. [Google Scholar] [CrossRef] [PubMed]

- Wagner, G.G.; Frick, J.R.; Schupp, J. The German Socio-Economic Panel Study (SOEP)—Scope, Evolution and Enhancements. Schmollers Jahrb. 2007, 127, 161–191. [Google Scholar] [CrossRef]

- Motel-Klingbiel, A.; Wurm, S.; Tesch-Römer, C. Altern im Wandel. Befunde des Deutschen Alterssurveys (DEAS); Kohlhammer: Stuttgart, Germany, 2010. [Google Scholar]

- Ekerdt, D.J.; Rose, C.L.; Bosse, R.; Costa, P.T. Longitudinal change in preferred age of retirement. J. Occup. Psychol. 1976, 49, 161–169. [Google Scholar] [CrossRef]

- Micheel, F.; Roloff, J.; Wickenheiser, I. Die Bereitschaft zur Weiterbeschäftigung im Ruhestandsalter im Zusammenhang mit sozioökonomischen Merkmalen. Comp. Popul. Stud. 2010, 35, 833–868. [Google Scholar]

- Heckman, J.J. Sample Selection Bias as a Specification Error. Econometrica 1979, 47, 153–161. [Google Scholar] [CrossRef]

- Hofäcker, D.; Hess, M.; Naumann, E. Changing retirement transitions in times of paradigmatic political change: Towards growing inequalities? In Challenges of Aging: Retirement, Pensions, and Intergenerational Justice; Torp, C., Ed.; Palgrave Macmillan UK: Basingstoke, UK, 2015; pp. 205–226. [Google Scholar]

- Honig, M. Retirement Expectations: Differences by Race, Ethnicity, and Gender. Gerontologist 1996, 36, 373–382. [Google Scholar] [CrossRef] [PubMed]

- Radl, J. Labour Market Exit and Social Stratification in Western Europe: The Effects of Social Class and Gender on the Timing of Retirement. Eur. Soc. Rev. 2013, 29, 654–668. [Google Scholar] [CrossRef]

- Schils, T. Early Retirement in Germany, the Netherlands, and the United Kingdom: A Longitudinal Analysis of Individual Factors and Institutional Regimes. Eur. Soc. Rev. 2008, 24, 315–329. [Google Scholar] [CrossRef]

- Naumann, E. Raising the retirement age: Retrenchment, feedback and attitudes. In How Welfare States Shape the Democratic Public: Policy Feedback, Participation, Voting and Attitudes; Kumlin, S., Stadelmann-Steffen, I., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2014; pp. 223–243. [Google Scholar]

- Scherger, S. Zwischen Privileg und Bürde. Erwerbstätigkeit jenseits der Rentengrenze in Deutschland und Großbritannien. Z. Sozial. 2013, 59, 137–166. [Google Scholar] [CrossRef]

- Hess, M. Expected and Preferred Retirement Age in Germany. Z. Gerontol. Geriatr. 2018, 51, 98–104. [Google Scholar] [CrossRef] [PubMed]

| 1987 | 1996 | 2008 | |

|---|---|---|---|

| Education (Ref: ISCED 0–2) | |||

| ISCED 3–4 | 0.19 (0.24) | −0.07 (0.35) | −0.32 (0.47) |

| ISCED 5–6 | 1.35 (0.29) *** | 0.71(39) * | 0.28 (0.48) |

| Women (Ref: Man) | −1.03 (0.22) *** | −1.09 (0.21) *** | −0.61 (0.18) *** |

| Partner (Ref: No Partner) | −0.44 (0.24) ** | −0.67 (0.29) *** | −0.78 (0.25) *** |

| Occupational Position (Ref: Blue-Collar) | |||

| White-Collar | 0.31 (0.22) ** | 0.58 (0.23) ** | 0.01 (0.24) |

| Public Servant | 0.35 (0.34) | −0.30 (0.40) | −0.31 (0.36) |

| Self-Employed | 2.50 (0.29) *** | 1.99 (0.33) *** | 1.67 (0.32) *** |

| Occupational Pension (Ref: No Occ.Pension) | −0.68 (0.34) *** | −0.60 (0.20) *** | −0.45 (0.19) ** |

| Constant | 61.01 (0.24) | 62.41 (0.44) | 64.47 (0.53) |

| Number of Observations | 638 | 767 | 1187 |

| R2 | 0.18 | 0.15 | 0.07 |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hess, M. Retirement Expectations in Germany—Towards Rising Social Inequality? Societies 2018, 8, 50. https://doi.org/10.3390/soc8030050

Hess M. Retirement Expectations in Germany—Towards Rising Social Inequality? Societies. 2018; 8(3):50. https://doi.org/10.3390/soc8030050

Chicago/Turabian StyleHess, Moritz. 2018. "Retirement Expectations in Germany—Towards Rising Social Inequality?" Societies 8, no. 3: 50. https://doi.org/10.3390/soc8030050

APA StyleHess, M. (2018). Retirement Expectations in Germany—Towards Rising Social Inequality? Societies, 8(3), 50. https://doi.org/10.3390/soc8030050