The Impact of the Great Recession on Perceived Immigrant Threat: A Cross-National Study of 22 Countries

Abstract

1. Introduction

2. Theoretical Background

2.1. The Great Recession around the World

2.2. The Great Recession and Perceived Immigrant Threat

3. Data and Methods

3.1. Data

3.2. Individual-Level Variables

3.2.1. Dependent Variable

3.2.2. Individual-Level Control Variables

3.3. Country-Level Variables

3.3.1. The Quasi-Lag of the Dependent Variable

3.3.2. Key Independent Variable

3.3.3. Country-Level Control Variables

3.4. Analytical Approach

4. Analysis

4.1. Individual-Level Determinants of Perceived Immigrant Threat

4.2. The Impact of the Great Recession

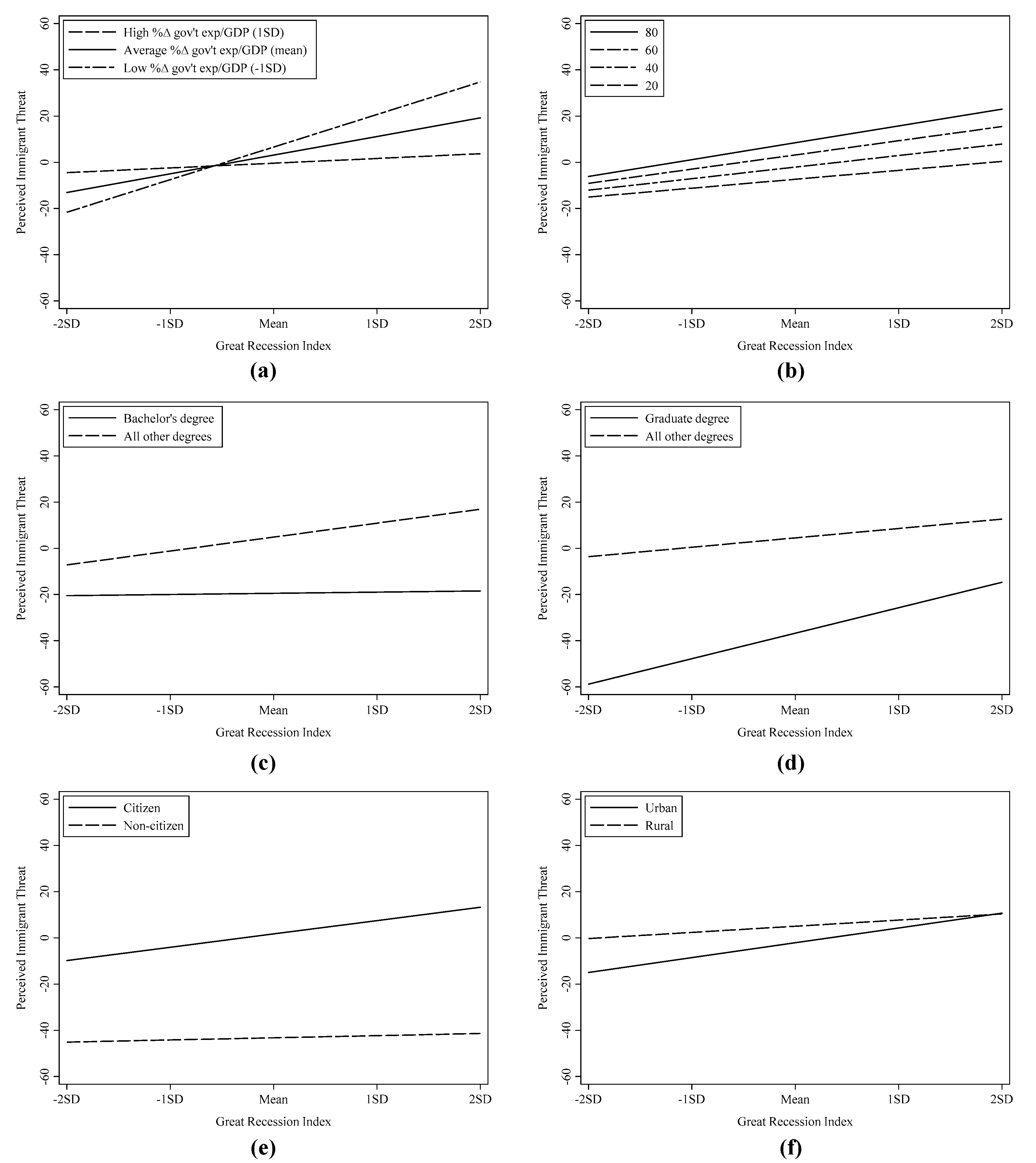

4.3. Interaction Effects of the Great Recession

5. Discussion

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Variable | Description | Source |

|---|---|---|

| Level-1 Variables (Individual Level) | ||

| Dependent Variable | ||

| Perceived immigrant threat | Average of seven z-transformed variables as follows: The following six Likert items: (1) “Immigrants increase crime rates”; (2) “Immigrants are generally good for [COUNTRY’S] economy”; (3) “Immigrants take jobs away from people who were born in [COUNTRY]”; (4) “Immigrants improve [COUNTRY’S NATIONALITY] society by bringing new ideas and cultures”; (5) “Legal immigrants to [COUNTRY] who are not citizens should have the same rights as [COUNTRY NATIONALITY] citizens”; (6) “[COUNTRY] should take stronger measures to exclude illegal immigrants” using these responses (1 = Disagree Strongly, 2 = Agree, 3 = Neither Agree nor Disagree, 4 = Agree to 5 = Agree Strongly); and (7) “Do you think the number of immigrants to [COUNTRY] nowadays should be… (1 = increased a lot, 2 = increased a little, 3 = remain the same as it is, 4 = reduced a little, 5 = reduced a lot).” Items 2, 4, and 5 were re-keyed so that higher values reflect higher levels of perceived immigrant threat. | a |

| Control variables | ||

| Female | 1 = female, 0 = male | a |

| Age | Respondent’s age | a |

| Income | Country-specific distribution for respondents’ household income are transformed to deciles | a |

| Education attainment | a | |

| Less than high school (ref.) | 1 = less than upper secondary, 0 = else | a |

| High school degree | 1 = upper secondary, 0 = else | a |

| Associate’s degree | 1 = postsecondary, 0 = else | a |

| Bachelor’s degree | 1 = lower tertiary, 0 = else | a |

| Graduate degree | 1 = higher tertiary, 0 = else | a |

| Citizen | 1 = citizen, 0 = non-citizen | a |

| Unemployed | 1 = unemployed, 0 = working full-time or part-time, self-employed, housewife, retired, student, other | a |

| Urban | 1 = urban, 0 = rural | a |

| Level-2 Variables (Country Level) | ||

| Quasi-lag of dependent variable | ||

| Perceived Immigrant Threat(t−10) | Country mean of the seven averaged z-transformed variables for 2003 as identified for the perceived immigrant threat variable above | b |

| Key independent variable | ||

| Great Recession Index | Average of four z-transformed values shown below: | |

| Housing crash | Percent change in the housing price index (the prices of residential properties sold indexed to 2010 price = 100) from the peak value in either 2007 or 2008 to the average value for 2007–2010 | c, d, e |

| Financial crisis | Percent change in value added by finance (production of finance and insurance sector in Gross Domestic Product) from the peak value in either 2007 or 2008 to the average value for 2007–2010 | f |

| Economic decline | Percent change in real Gross Domestic Product from the peak value in either 2007 or 2008 to the averaged value for 2007–2010 | g |

| Employment loss | Percent change in employment from the peak value in either 2007 or 2008 to the average value for 2007–2010 | h |

| Control variables | ||

| Globalization | ||

| Global capital | Natural logarithm of the sum of four standardized indicators (market value, sales, profits, and assets) for all firms in the Forbes Global 2000 headquartered in a country | i |

| Outward FDI/GDP | Foreign Direct Investment outflows as a percent of Gross Domestic Product | j |

| Inward FDI/GDP | Foreign Direct Investment inflows as a percent of Gross Domestic Product | j |

| FDI balance/GDP | (FDI outflows—FDI inflows) as a percent of Gross Domestic Product | j |

| Exports/GDP | Exports of all goods and services as a percent of Gross Domestic Product | k |

| Imports/GDP | Imports of all goods and services as a percent of Gross Domestic Product | k |

| Trade balance/GDP | (Exports—Imports) as a percent of Gross Domestic Product | k |

| Immigrant stock | Foreign-born persons as a percent of the population | l, m |

| Labor market conditions | ||

| Unemployment | The percent of unemployed persons in the labor force | n |

| Union density | The percent of paid workers belonging to unions | o, p |

| Labor productivity | The value of GDP divided by total working hours of employed persons (2015 US$) | q |

| State capacity | ||

| Government expenditures/GDP | Total government expenditure as a percent of Gross Domestic Product | r |

| Economic competition | ||

| Income inequality | Gini index | s |

| GDP per capita | Output-side real Gross Domestic Product divided by population (Purchasing Power Parity, thousands of 2011 US$) | t |

| Population (logged) | Natural logarithm of population (millions of people) | u |

Notes

- 1

- While some research shows that levels of immigration are associated with favorable attitudes toward the welfare state [67], these studies are mostly conducted at the national level. Studies in a variety of national settings at the subnational level that capture nuanced differences among states, counties, or cities generally show a negative effect of immigrant levels on support for the welfare state [5,6,7,8,9].

- 2

- Among the countries in our sample, Ireland and Latvia entered into recession in Q1-2008, followed by France, Germany, Hungary, Japan, Taiwan, and United Kingdom in Q2-2008; Denmark, Finland, Norway, Portugal, Slovenia, Spain, Sweden, and Switzerland in Q3-2008; and Czech Republic, South Korea, the Philippines, and Russia fell in Q4-2008; and Slovakia in Q1-2009 [24].

- 3

- Ten countries were dropped from the analysis because of missing data on variables needed to derive the 10-year quasi-lag of the dependent variable from the ISSP (see below for details about this variable). Israel was also dropped because separate samples were created in the ISSP for Jews and Arabs that could not be reconstituted into a nationally representative sample. Israel also presents unique problems in the investigation of this topic which further supports the decision to drop it from this sample.

- 4

- Countries in the sample include: Czech Republic, Denmark, Finland, France, Germany, Hungary, Ireland, Japan, Latvia, Norway, Philippines, Portugal, Russia, Slovakia, Slovenia, South Korea, Spain, Sweden, Switzerland, Taiwan, United Kingdom, and United States.

- 5

- Data for the financial crisis could not be found for the Philippines, Russia, and Taiwan, so we averaged the other three components to create the GRI for these countries.

References

- Ceobanu, A.M.; Escandell, X. Comalyses of Public Attitudes Toward Immigrants and Immigration Using Multinational Survey Data: A Review of Theories and Research. Annu. Rev. Sociol. 2010, 36, 309–328. [Google Scholar] [CrossRef]

- Kaya, Y.; Karakoç, E. Civilizing vs Destructive Globalization? A Multi-Level Analysis of Anti-Immigrant Prejudice. Int. J. Comp. Sociol. 2012, 53, 23–44. [Google Scholar] [CrossRef]

- Redbird, B.; Grusky, D.B. Distributional Effects of the Great Recession: Where Has All the Sociology Gone? Annu. Rev. Sociol. 2016, 42, 185–215. [Google Scholar] [CrossRef]

- Polavieja, J.G. Labour-Market Competition, Recession and Anti-Immigrant Sentiments in Europe: Occupational and Environmental Drivers of Competitive Threat. Socio-Econ. Rev. 2016, 14, 395–417. [Google Scholar] [CrossRef]

- Eger, M.A.; Breznau, N. Immigration and the Welfare State: A Cross-Regional Analysis of European Welfare Attitudes. Int. J. Comp. Sociol. 2017, 58, 440–463. [Google Scholar] [CrossRef]

- Breznau, N.; Eger, M.A. Immigrant Presence, Group Boundaries, and Support for the Welfare State in Western European Societies. Acta Sociol. 2016, 59, 195–214. [Google Scholar] [CrossRef]

- Fox, C. Three Worlds of Relief: Race, Immigration, and Public and Private Social Welfare Spending in American Cities, 1929. Am. J. Sociol. 2010, 116, 453–502. [Google Scholar] [CrossRef] [PubMed]

- Eger, M.A. Even in Sweden: The Effect of Immigration on Support for Welfare State Spending. Eur. Sociol. Rev. 2010, 26, 203–217. [Google Scholar] [CrossRef]

- Schmidt-Catran, A.W.; Spies, D.C. Immigration and Welfare Support in Germany. Am. Sociol. Rev. 2016, 81, 242–261. [Google Scholar] [CrossRef]

- Hainmueller, J.; Hopkins, D.J. Public Attitudes Toward Immigration. Annu. Rev. Political Sci. 2014, 17, 225–249. [Google Scholar] [CrossRef]

- Schoon, E.W.; Anderson, K.F. Rethinking the Boundaries: Competitive Threat and the Asymmetric Salience of Race/Ethnicity in Attitudes toward Immigrants. Socius Sociol. Res. A Dyn. World 2017, 3, 1–14. [Google Scholar] [CrossRef]

- Dancygier, R.M.; Donnelly, M.J. Sectoral Economies, Economic Contexts, and Attitudes toward Immigration. J. Politics 2013, 75, 17–35. [Google Scholar] [CrossRef] [PubMed]

- Ruist, J. How the Macroeconomic Context Impacts on Attitudes to Immigration: Evidence from within-Country Variation. Soc. Sci. Res. 2016, 60, 125–134. [Google Scholar] [CrossRef] [PubMed]

- Gorodzeisky, A. Who Are the Europeans That Europeans Prefer? Economic Conditions and Exclusionary Views toward European Immigrants. Int. J. Comp. Sociol. 2011, 52, 100–113. [Google Scholar] [CrossRef]

- Hjerm, M. Do Numbers Really Count? Group Threat Theory Revisited. J. Ethn. Migr. Stud. 2007, 33, 1253–1275. [Google Scholar] [CrossRef]

- Meuleman, B.; Davidov, E.; Billiet, J. Changing Attitudes toward Immigration in Europe, 2002–2007: A Dynamic Group Conflict Theory Approach. Soc. Sci. Res. 2009, 38, 352–365. [Google Scholar] [CrossRef] [PubMed]

- Mewes, J.; Mau, S. Globalization, Socio-Economic Status and Welfare Chauvinism: European Perspectives on Attitudes toward the Exclusion of Immigrants. Int. J. Comp. Sociol. 2013, 54, 228–245. [Google Scholar] [CrossRef]

- Pichler, F. Foundations of Anti-Immigrant Sentiment: The Variable Nature of Perceived Group Threat across Changing European Societies, 2002–2006. Int. J. Comp. Sociol. 2010, 51, 445–469. [Google Scholar] [CrossRef]

- Schlueter, E.; Meuleman, B.; Davidov, E. Immigrant Integration Policies and Perceived Group Threat: A Multilevel Study of 27 Western and Eastern European Countries. Soc. Sci. Res. 2013, 42, 670–682. [Google Scholar] [CrossRef] [PubMed]

- Kuntz, A.; Davidov, E.; Semyonov, M. The Dynamic Relations between Economic Conditions and Anti-Immigrant Sentiment: A Natural Experiment in Times of the European Economic Crisis. Int. J. Comp. Sociol. 2017, 58, 392–415. [Google Scholar] [CrossRef]

- Wallace, M.; Figueroa, R. Determinants of Perceived Immigrant Job Threat in the American States. Sociol. Perspect. 2012, 55, 583–612. [Google Scholar] [CrossRef]

- Financial Crisis Inquiry Commission. The Financial Crisis Inquiry Report; U.S. Government Printing Office: Washington, DC, USA, 2011; ISBN 978-0160877278.

- National Bureau of Economic Research. The NBER’s Business Cycle Dating Committee. Available online: http://www.nber.org/cycles/recessions.html (accessed on 5 January 2017).

- Claessens, S.; Dell’Ariccia, G.; Igan, D.; Laeven, L. Cross-Country Experiences and Policy Implications from the Global Financial Crisis. Econ. Policy 2010, 25, 267–293. [Google Scholar] [CrossRef]

- Guillén, M.F.; Suárez, S.L. The Global Crisis of 2007–2009: Markets, Politics, and Organizations. Res. Sociol. Organ. 2010, 30, 257–279. [Google Scholar] [CrossRef]

- Wallace, M.; Kwak, J. Bad Jobs in a Troubled Economy: The Impact of the Great Recession in America’s Major Metropolitan Areas. Res. Sociol. Work 2017, 31, 125–155. [Google Scholar] [CrossRef]

- Baker, D. Speculation and Asset Bubbles. In The Handbook of The Political Economy of Financial Crises; Wolfson, M.H., Epstein, G.A., Eds.; Oxford University Press: New York, NY, USA, 2013; pp. 47–60. ISBN 978-0190240936. [Google Scholar]

- Fligstein, N.; Goldstein, A. The Roots of the Great Recession. In The Great Recession; Grusky, D.B., Western, B., Wimer, C., Eds.; The Russell Sage Foundation: New York, NY, USA, 2011; pp. 21–55. ISBN 978-0871544216. [Google Scholar]

- Ivanova, M.N. Money, Housing and World Market: The Dialectic of Globalised Production. Camb. J. Econ. 2011, 35, 853–871. [Google Scholar] [CrossRef]

- Claessens, S.; Kose, A.M.; Terrones, M.E. The Global Financial Crisis: How Similar? How Different? How Costly? J. Asian Econ. 2010, 21, 247–264. [Google Scholar] [CrossRef]

- Grusky, D.B.; Western, B.; Wimer, C. The Consequences of the Great Recession. In The Great Recession; Grusky, D.B., Western, B., Wimer, C., Eds.; Russell Sage Foundation: New York, NY, USA, 2011; pp. 3–20. ISBN 978-0871544216. [Google Scholar]

- Petev, I.D.; Pistaferri, L.; Saporta-Eksten, T. An Analysis of Trends, Perceptions, and Distributional Effects in Consumption. In The Great Recession; Grusky, D.B., Western, B., Wimer, C., Eds.; The Russell Sage Foundation: New York, NY, USA, 2011; pp. 161–195. ISBN 978-0871544216. [Google Scholar]

- World Trade Organization (WTO). World Trade Report 2008: Trade in a Globalizing World. Available online: https://www.wto.org/english/res_e/booksp_e/anrep_e/world_trade_report08_e.pdf (accessed on 12 May 2018).

- McBride, B. Percent Job Losses: Great Recession and Great Depression. Available online: http://www.calculatedriskblog.com/2012/02/percent-job-losses-great-recession-and.html (accessed on 27 February 2017).

- Mayda, A.M. Who Is Against Immigration? A Cross-Country Investigation of Individual Attitudes toward Immigrants. Rev. Econ. Stat. 2006, 88, 510–530. [Google Scholar] [CrossRef]

- Steele, L.G. Income Inequality, Equal Opportunity, and Attitudes About Redistribution. Soc. Sci. Q. 2015, 96, 444–464. [Google Scholar] [CrossRef]

- Feasel, E.M.; Muzumder, D. Understanding Attitudes toward Globalization at the Individual and National Level. Int. J. Bus. Humanit. Technol. 2012, 2, 192–210. [Google Scholar] [CrossRef]

- Noland, M. Popular Attitudes, Globalization and Risk. Int. Financ. 2005, 8, 199–229. [Google Scholar] [CrossRef]

- Mayda, A.M.; Rodrik, D. Why Are Some People (and Countries) More Protectionist than Others? Eur. Econ. Rev. 2005, 49, 1393–1430. [Google Scholar] [CrossRef]

- Wallace, M.; Gauchat, G.; Fullerton, A.S. Globalization, Labor Market Transformation, and Metropolitan Earnings Inequality. Soc. Sci. Res. 2011, 40, 15–36. [Google Scholar] [CrossRef]

- Wallace, M.; Gauchat, G.; Fullerton, A.S. Globalization and Earnings Inequality in Metropolitan Areas: Evidence from the USA. Camb. J. Reg. Econ. Soc. 2012, 5, 377–396. [Google Scholar] [CrossRef]

- Scheve, K.; Slaughter, M.J. Public Opinion, International Economic Integration, and the Welfare State. In Globalization and Egalitarian Redistribution; Bardhan, P., Bowles, S., Wallerstein, M., Eds.; Russell Sage Foundation: New York, NY, USA, 2006; pp. 217–260. ISBN 978-0691125190. [Google Scholar]

- Hanson, G.H.; Scheve, K.; Slaughter, M.J. Public Finance and Individual Preferences over Globalization Strategies. Econ. Politics 2007, 19, 1–33. [Google Scholar] [CrossRef]

- Mayda, A.M.; O’Rourke, K.; Sinnott, R. Risk, Government and Globalization: International Survey Evidence. NBER Work. Pap. 2007. [Google Scholar] [CrossRef]

- Espenshade, T.J.; Hempstead, K. Contemporary American Attitudes Toward U.S. Immigration. Int. Migr. Rev. 1996, 30, 535. [Google Scholar] [CrossRef] [PubMed]

- Quillian, L. Prejudice as a Response to Perceived Group Threat: Population Composition and Anti-Immigrant and Racial Prejudice in Europe. Am. Sociol. Rev. 1995, 60, 586. [Google Scholar] [CrossRef]

- DiPrete, T.A.; Forristal, J.D. Multilevel Models: Methods and Substance. Annu. Rev. Sociol. 1994, 20, 331–357. [Google Scholar] [CrossRef]

- Guo, G.; Zhao, H. Multilevel Modeling for Binary Data. Annu. Rev. Sociol. 2000, 26, 441–462. [Google Scholar] [CrossRef]

- Snijders, T.A.B.; Bosker, R.J. Multilevel Analysis: An Introduction to Basic and Advanced Multilevel Modeling, 2nd ed.; Sage: Thousand Oaks, CA, USA, 2012; ISBN 978-1849202015. [Google Scholar]

- Maas, C.J.M.; Hox, J.J. Sufficient Sample Sizes for Multilevel Modeling. Methodology 2005, 1, 86–92. [Google Scholar] [CrossRef]

- McNeish, D. Small Sample Methods for Multilevel Modeling: A Colloquial Elucidation of REML and the Kenward-Roger Correction. Multivar. Behav. Res. 2017, 52, 661–670. [Google Scholar] [CrossRef] [PubMed]

- Vallas, S.P.; Zimmerman, E.; Davis, S.N. Enemies of the State? Testing Three Models of Anti-Immigrant Sentiment. Res. Soc. Stratif. Mobil. 2009, 27, 201–217. [Google Scholar] [CrossRef]

- Kunovich, R.M. Social Structural Position and Prejudice: An Exploration of Cross-National Differences in Regression Slopes. Soc. Sci. Res. 2004, 33, 20–44. [Google Scholar] [CrossRef]

- Organization for Economic Cooperation and Development (OECD). Trends in International Migration, 2003 ed.; OECD: Paris, France, 2004; ISBN 978-9264019447. [Google Scholar]

- Isaksen, J.V.; Jakobsen, T.G.; Filindra, A.; Strabac, Z. The Return of Prejudice in Europe’s Regions: The Moderated Relationship between Group Threat and Economic Vulnerability. Natl. Ethn. Politics 2016, 22, 249–277. [Google Scholar] [CrossRef]

- Crepaz, M.M.L.; Damron, R. Constructing Tolerance. Comp. PPolitical Stud. 2009, 42, 437–463. [Google Scholar] [CrossRef]

- Reeskens, T.; van Oorschot, W. Disentangling the ‘New Liberal Dilemma’: On the Relation between General Welfare Redistribution Preferences and Welfare Chauvinism. Int. J. Comp. Sociol. 2012, 53, 120–139. [Google Scholar] [CrossRef]

- Card, D. Immigration and Inequality. Am. Econ. Rev. 2009, 99, 1–21. [Google Scholar] [CrossRef]

- Organization for Economic Cooperation and Development (OECD). Trends in International Migration, 2002 ed.; OECD: Paris, France, 2003; ISBN 978-9264199507. [Google Scholar]

- Wallace, M.; Wu, Q. Immigration and the Quality of Life in U.S. Metropolitan Areas. Unpublished Paper. 2018. [Google Scholar]

- United Nations, Department of Economics and Social Affairs, Population Division. Trends in International Migrant Stock: The 2017 Revision. Available online: http://www.un.org/en/development/desa/population/migration/data/estimates2/estimates17.shtml (accessed on 4 July 2018).

- Knoke, D.; Bohrnstedt, G.W.; Mee, A.P. Statistics for Social Analysis, 4th ed.; Wadsworth: Belmont, CA, USA, 2002; ISBN 978-0875814483. [Google Scholar]

- Pew Research Center. Faith on the Move: The Religious Affiliation of International Migrants. Available online: http://assets.pewresearch.org/wp-content/uploads/sites/11/2012/03/global-fact-sheet.pdf (accessed on 4 July 2018).

- Central Intelligence Agency. The World Factbook. Available online: https://www.cia.gov/library/publications/the-world-factbook/fields/2122.html (accessed on 4 July 2018).

- Solt, F. The Standardized World Income Inequality Database. Soc. Sci. Q. 2016, 97, 1267–1281. [Google Scholar] [CrossRef]

- Feenstra, R.C.; Inklaar, R.; Timmer, M.P. The next Generation of the Penn World Table. Am. Econ. Rev. 2015, 105, 3150–3182. [Google Scholar] [CrossRef]

- Brady, D.; Finnigan, R. Does Immigration Undermine Public Support for Social Policy? Am. Sociol. Rev. 2014, 79, 17–42. [Google Scholar] [CrossRef]

| Country | 2013 | 2003 |

|---|---|---|

| Russia | 0.409 | 0.403 |

| Czech Republic | 0.392 | 0.346 |

| Slovakia | 0.286 | 0.159 |

| Hungary | 0.248 | 0.321 |

| United Kingdom | 0.214 | 0.162 |

| Latvia | 0.157 | 0.117 |

| France | 0.092 | 0.006 |

| Finland | 0.049 | −0.039 |

| Norway | 0.014 | 0.133 |

| Denmark | 0.011 | −0.040 |

| Slovenia | −0.064 | 0.006 |

| Switzerland | −0.105 | −0.214 |

| Taiwan | −0.112 | 0.152 |

| Ireland | −0.141 | −0.109 |

| Spain | −0.154 | −0.344 |

| South Korea | −0.168 | −0.371 |

| Japan | −0.172 | 0.035 |

| Germany | −0.183 | 0.162 |

| Sweden | −0.184 | −0.187 |

| Philippines | −0.189 | −0.194 |

| Portugal | −0.202 | −0.242 |

| United States | −0.259 | −0.161 |

| Country | Great Recession Index | Housing Crash | Financial Crisis | Economic Decline | Employment Loss |

|---|---|---|---|---|---|

| Latvia | 3.075 | 2.741 | 3.148 | 3.213 | 3.200 |

| Ireland | 0.955 | 1.343 | −0.232 | 1.006 | 1.703 |

| Spain | 0.455 | 0.244 | 0.510 | −0.068 | 1.136 |

| Denmark | 0.315 | 0.900 | 0.008 | 0.058 | 0.292 |

| United Kingdom | 0.278 | 0.608 | 0.968 | −0.027 | −0.438 |

| Hungary | 0.232 | 0.355 | −0.147 | 0.437 | 0.281 |

| Russia | 0.199 | 0.218 | − | 0.742 | −0.365 |

| Slovenia | 0.155 | 0.042 | −0.065 | 0.858 | −0.213 |

| United States | 0.154 | 0.868 | −0.018 | −0.490 | 0.255 |

| Portugal | 0.145 | 0.009 | 0.993 | −0.455 | 0.032 |

| Slovakia | 0.081 | 0.693 | −1.019 | 0.243 | 0.407 |

| Finland | 0.018 | −0.582 | 0.056 | 0.549 | 0.050 |

| Czech Republic | −0.035 | −0.228 | 0.223 | 0.110 | −0.245 |

| Japan | −0.399 | −0.610 | −0.792 | 0.112 | −0.305 |

| Germany | −0.523 | −0.757 | −0.735 | −0.071 | −0.528 |

| Sweden | −0.548 | −0.833 | −0.782 | −0.256 | −0.323 |

| South Korea | −0.588 | −0.560 | 0.515 | −1.391 | −0.916 |

| France | −0.610 | −0.305 | −1.138 | −0.469 | −0.528 |

| Norway | −0.636 | −0.466 | −1.124 | −0.580 | −0.375 |

| Switzerland | −0.705 | −1.291 | −0.368 | −0.518 | −0.641 |

| Philippines | −1.150 | −0.227 | − | −1.472 | −1.751 |

| Taiwan | −1.473 | −2.160 | − | −1.532 | −0.729 |

| Individual Level (n = 18,433) | Mean | Standard Deviation | ||

| Dependent Variable | ||||

| Perceived immigrant threat | 0.00 | 0.65 | ||

| Control variables | ||||

| Female | 0.51 | 0.50 | ||

| Age | 48.24 | 16.57 | ||

| Income | 5.28 | 2.86 | ||

| Education | ||||

| Less than high school (ref.) | 0.28 | 0.45 | ||

| High school degree | 0.26 | 0.44 | ||

| Associate’s degree | 0.14 | 0.34 | ||

| Bachelor’s degree | 0.21 | 0.41 | ||

| Graduate degree | 0.11 | 0.31 | ||

| Citizen | 0.97 | 0.18 | ||

| Unemployed | 0.06 | 0.23 | ||

| Urban | 0.69 | 0.46 | ||

| Country Level (n = 22) | Mean | Standard Deviation | Mean | Standard Deviation |

| Quasi-lag of dependent variable | ||||

| Perceived Immigrant Threat(t−10) | 0.00 | 0.22 | ||

| Key independent variable | ||||

| Great Recession Index | −0.03 | 0.89 | ||

| Control variables | Levels 2013 | Changes (%Δ) 2003–2013 | ||

| Globalization | ||||

| Global capital | 6.71 | 3.24 | 15.10 | 18.01 |

| Outward FDI/GDP | 2.15 | 2.78 | 110.61 | 226.89 |

| Inward FDI/GDP | 1.88 | 4.06 | 7.87 | 122.60 |

| FDI balance/GDP | 0.27 | 2.49 | 121.98 | 472.21 |

| Exports/GDP | 50.08 | 25.08 | 24.82 | 25.42 |

| Imports/GDP | 45.78 | 21.45 | 21.08 | 23.46 |

| Trade balance/GDP | 4.30 | 5.87 | 2560.50 | 11690.20 |

| Immigrant stock | 9.73 | 6.63 | 32.58 | 43.01 |

| Labor market conditions | ||||

| Unemployment | 8.77 | 5.31 | 22.56 | 63.11 |

| Union density | 25.85 | 19.96 | −20.42 | 16.98 |

| Labor productivity | 48.02 | 18.30 | 19.97 | 13.83 |

| State capacity | ||||

| Government expenditures/GDP | 41.53 | 11.42 | 5.39 | 11.67 |

| Economic competition | ||||

| Income inequality | 31.17 | 6.08 | 2.40 | 3.98 |

| GDP per capita | 36.76 | 15.99 | 33.45 | 28.85 |

| Population (logged) | 3.05 | 1.38 | 1.41 | 2.71 |

| 1 | 2 | |

|---|---|---|

| Intercept | −0.274 | −0.640 |

| (4.383) | (4.200) | |

| Individual-Level Variables | ||

| Female | −1.425 | |

| (0.885) | ||

| Age | 0.254 *** | |

| (0.028) | ||

| Income | −0.523 ** | |

| (0.169) | ||

| High school degree | −9.642 *** | |

| (1.269) | ||

| Associate’s degree | −5.239 ** | |

| (1.682) | ||

| Bachelor’s degree | −22.539 *** | |

| (1.439) | ||

| Graduate degree | −41.552 *** | |

| (1.730) | ||

| Citizen | 45.859 *** | |

| (2.492) | ||

| Unemployed | 5.904 ** | |

| (1.973) | ||

| Urban | −7.726 *** | |

| (1.000) | ||

| Variance Components3 | ||

| Individual level | 3838.4) *** | 3530.6 *** |

| (40.0) | (36.8) | |

| Country level | 417.5 *** | 383.4) *** |

| (130.3) | (119.8) | |

| Model Fit Statistics | ||

| AIC | 204,533.2 | 202,989.7 |

| BIC | 204,556.7 | 203,091.4 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Intercept | −0.648 | −0.616 | −0.615 | −0.617 | −0.616 | −0.620 | −0.618 | −0.618 | −0.618 | −0.618 | −0.620 | −0.617 | −0.618 | −0.617 | −0.617 | −0.619 | −0.612 |

| (2.799) | (2.613) | (2.674) | (2.681) | (2.660) | (2.645) | (2.682) | (2.681) | (2.684) | (2.685) | (2.680) | (2.662) | (2.683) | (2.683) | (2.667) | (2.685) | (2.638) | |

| Country-Level Variables | |||||||||||||||||

| Perceived Immigrant | 0.688 *** | 0.657 *** | 0.646 *** | 0.654 *** | 0.649 *** | 0.655 *** | 0.651 *** | 0.650 *** | 0.657 *** | 0.657 *** | 0.646 *** | 0.658 *** | 0.656 *** | 0.656 *** | 0.650 *** | 0.658 *** | 0.655 *** |

| Threat(t−10) | (0.132) | (0.124) | (0.131) | (0.129) | (0.127) | (0.125) | (0.132) | (0.132) | (0.128) | (0.132) | (0.137) | (0.126) | (0.128) | (0.128) | (0.127) | (.128) | (0.125) |

| Great Recession | 6.009 * | 5.448 | 6.056 † | 6.715 * | 7.405 * | 5.886 † | 5.834† | 6.019† | 6.012 † | 6.431 † | 6.156 * | 5.955 † | 5.893 † | 6.162 * | 6.047 † | 5.063 | |

| Index | (3.029) | (3.345) | (3.115) | (3.324) | (3.604) | (3.173) | (3.214) | (3.118) | (3.220) | (3.603) | (3.097) | (3.135) | (3.213) | (3.107) | (3.180) | (3.286) | |

| Controls (Levels) | Global capital | Outward FDI/GDP | Inward FDI/GDP | FDI balance/GDP | Exports/GDP | Imports/GDP | Trade balance/GDP | Immigrant stock | Unemploy-ment | Union density | Labor product-ivity | Government expenditures/GDP | Income inequality | GDP per capita | Population (logged) | ||

| −0.359 | −0.212 | −0.414 | −0.944 | 0.022 | 0.029 | 0.027 | −0.003 | −0.145 | 0.077 | −0.020 | 0.035 | −0.222 | 0.011 | −1.660 | |||

| (0.981) | (1.003) | (0.726) | (1.280) | (0.116) | (0.139) | (0.472) | (0.442) | (0.625) | (0.137) | (0.152) | (0.250) | (0.453) | (0.177) | 2.112) | |||

| Variance Components | |||||||||||||||||

| Individual | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** |

| level | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) |

| Country level | 167.7 *** | 145.6 *** | 152.6 *** | 153.4 *** | 151.0 *** | 149.2 *** | 153.5 *** | 153.5 *** | 153.8 *** | 153.9 *** | 153.3 *** | 151.2 *** | 153.7 *** | 153.7 *** | 151.8 *** | 153.9 *** | 148.4 *** |

| (54.4) | (48.6) | (52.3) | (52.6) | (51.8) | (51.2) | (52.6) | (52.6) | (52.7) | (52.7) | (52.6) | (51.8) | (52.7) | (52.7) | (52.1) | (52.7) | (51.0) | |

| Model Fit Statistics | |||||||||||||||||

| AIC | 202,975.9 | 202,970.1 | 202,970.1 | 202,970.2 | 202,970.5 | 202,969.2 | 202,974.5 | 202,974.2 | 202,971.8 | 202,971.9 | 202,971.1 | 202,973.9 | 202,974.0 | 202,973.0 | 202,971.6 | 202,973.7 | 202,968.1 |

| BIC | 203,085.4 | 203,087.4 | 203,095.3 | 203,095.3 | 203,095.7 | 203,094.3 | 203,099.7 | 203,099.3 | 203,096.9 | 203,097.0 | 203,096.3 | 203,099.0 | 203,099.1 | 203,098.2 | 203,096.7 | 203,098.9 | 203,093.3 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Intercept | −0.619 | −0.616 | −0.616 | −0.623 | −0.618 | −0.617 | −0.630 | −0.624 | −0.628 | −0.619 | −0.621 | −0.622 | −0.618 | −0.622 | −0.618 |

| (2.675) | (2.682) | (2.676) | (2.612) | (2.568) | (2.598) | (2.595) | (2.474) | (2.623) | (2.683) | (2.644) | (2.677) | (2.678) | (2.476) | (2.661) | |

| Country-Level Variables | |||||||||||||||

| Perceived Immigrant | 0.655 *** | 0.663 *** | 0.664 *** | 0.676 *** | 0.636 *** | 0.659 *** | 0.657 *** | 0.725 *** | 0.604 *** | 0.671 *** | 0.653 *** | 0.640 *** | 0.645 *** | 0.573 *** | 0.684 *** |

| Threat(t−10) | (0.127) | (0.130) | (0.129) | (0.125) | (0.123) | (0.123) | (0.123) | (0.123) | (0.137) | (0.155) | (0.125) | (0.139) | (0.134) | (0.127) | (0.135) |

| Great Recession | 6.443 * | 6.029 † | 5.789 † | 6.764 * | 7.586 * | 6.173 * | 6.178 * | 6.744 * | 7.376 * | 6.141 † | 5.580 † | 6.743 † | 6.056 † | 5.756 * | 7.114 † |

| Index | (3.314) | (3.110) | (3.174) | (3.120) | (3.213) | (3.015) | (3.012) | (2.897) | (3.380) | (3.229) | (3.116) | (3.857) | (3.109) | (2.875) | (3.663) |

| Controls (%Δ) | Global capital | Outward FDI/GDP | Inward FDI/GDP | FDI balance/GDP | Exports/GDP | Imports/GDP | Trade balance/GDP | Immigrant stock | Unemploy-ment | Union density | Labor product-ivity | Government expenditures/GDP | Income inequality | GDP per capita | Population (logged) |

| 0.060 | −0.003 | −0.007 | −0.006 | −0.146 | −0.126 | 0.000 | 0.112 † | −0.047 | 0.032 | 0.150 | −0.097 | −0.210 | 0.169 † | 0.721 | |

| (0.162) | (0.012) | (0.023) | (0.006) | (0.112) | (0.113) | (0.000) | (0.063) | (0.051) | (0.206) | (0.199) | (0.304) | (0.728) | (0.095) | (1.286) | |

| Variance Components | |||||||||||||||

| Individual level | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** | 3530.6 *** |

| (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | |

| Country level | 152.7 *** | 153.5 *** | 152.9 *** | 145.4 *** | 140.4 *** | 143.8 *** | 143.4 *** | 129.9 *** | 146.7 *** | 153.7 *** | 149.1 *** | 153.0 *** | 153.1 *** | 130.2 *** | 151.1 *** |

| (52.3) | (52.6) | (52.4) | (49.9) | (48.2) | (49.3) | (49.2) | (44.7) | (50.3) | (52.7) | (51.1) | (52.4) | (52.5) | (44.9) | (51.8) | |

| Model Fit Statistics | |||||||||||||||

| AIC | 202,973.7 | 202,979.0 | 202,977.7 | 202,979.5 | 202,972.9 | 202,973.3 | 202,985.7 | 202,972.7 | 202,975.3 | 202,973.4 | 202,972.9 | 202,972.5 | 202,970.8 | 202,971.9 | 202,969.4 |

| BIC | 203,098.9 | 203,104.1 | 203,102.8 | 203,104.6 | 203,098.1 | 203,098.5 | 203,110.9 | 203,097.8 | 203,100.5 | 203,098.5 | 203,098.0 | 203,097.7 | 203,095.9 | 203,097.0 | 203,094.6 |

| 1 | 2 | 3 | 4 | 5 | 6 | |

|---|---|---|---|---|---|---|

| Intercept | 2.446 | −0.543 | −0.919 | −0.741 | −0.388 | −0.567 |

| (3.126) | (2.618) | (2.620) | (2.640) | (2.606) | (2.607) | |

| Individual-Level Variables | ||||||

| Age | 0.254 *** | 0.265 *** | 0.257 *** | 0.254 *** | 0.256 *** | 0.253 *** |

| (0.028) | (0.029) | (0.028) | (0.028) | (0.028) | (0.028) | |

| Bachelor’s degree | −22.470 *** | −22.687 *** | −24.492 *** | −22.611 *** | −22.451 *** | −22.381 *** |

| (1.437) | (1.442) | (1.532) | (1.437) | (1.437) | (1.437) | |

| Graduate degree | −41.540 *** | −41.680 *** | −41.756 *** | −41.017 *** | −41.545 *** | −41.538 *** |

| (1.728) | (1.729) | (1.728) | (1.730) | (1.728) | (1.727) | |

| Citizen | 45.820 *** | 45.915 *** | 45.827 *** | 45.805 *** | 45.100 *** | 46.027 *** |

| (2.492) | (2.492) | (2.491) | (2.490) | (2.509) | (2.491) | |

| Urban | −7.752 *** | −7.751 *** | −7.791 *** | −7.696 *** | −7.731 *** | −7.045 *** |

| (1.000) | (1.000) | (1.000) | (.999) | (1.000) | (1.021) | |

| Country-Level Variables | ||||||

| Perceived Immigrant Threat(t−10) | 0.593 *** | 0.658 *** | 0.659 *** | 0.661 *** | 0.658 *** | 0.657 *** |

| (0.135) | (0.124) | (0.124) | (0.125) | (0.123) | (0.124) | |

| Great Recession Index (GRI) | 9.073 * | 3.050 | 6.768 * | 4.570 | 1.046 | 2.992 |

| (3.922) | (3.466) | (3.042) | (3.073) | (3.617) | (3.152) | |

| %Δ Government expenditures/GDP | −0.299 | |||||

| (0.313) | ||||||

| Interaction Effects | ||||||

| GRI × %Δ Government expenditures/GDP | −0.580 † | |||||

| (0.343) | ||||||

| GRI × Age | 0.064 † | |||||

| (0.036) | ||||||

| GRI × Bachelor’s degree | −6.196 *** | |||||

| (1.639) | ||||||

| GRI × Graduate degree | 7.819 *** | |||||

| (1.555) | ||||||

| GRI × Citizen | 5.437 * | |||||

| (2.184) | ||||||

| GRI × Urban | 4.210 *** | |||||

| (1.254) | ||||||

| Variance Components | ||||||

| Individual level | 3530.6 *** | 3530.2 *** | 3528.0 *** | 3525.9 *** | 3529.6 *** | 3528.6 *** |

| (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | (36.8) | |

| Country level | 138.0 *** | 146.1 *** | 146.1 *** | 148.6 *** | 144.5 *** | 144.8 *** |

| (48.9) | (48.8) | (48.8) | (49.6) | (48.3) | (48.4) | |

| Model Fit Statistics | ||||||

| AIC | 202,972.1 | 202,973.7 | 202,954.9 | 202,944.1 | 202,962.5 | 202,958.5 |

| BIC | 203,105.0 | 203,098.9 | 203,080.1 | 203,069.2 | 203,087.6 | 203,083.7 |

| Country | Africa | Asia | Europe | Latin America and the Caribbean | North America | Oceania | Others | Index of Qualitative Variation |

|---|---|---|---|---|---|---|---|---|

| Philippines | 1.5 | 40.9 | 8.5 | 0.8 | 19.4 | 2.6 | 26.4 | 0.837 |

| United Kingdom | 17.0 | 36.0 | 35.0 | 5.4 | 3.5 | 2.5 | 0.6 | 0.833 |

| Portugal | 41.6 | 3.7 | 33.6 | 19.0 | 1.6 | 0.1 | 0.4 | 0.789 |

| Spain | 17.0 | 5.8 | 37.7 | 38.7 | 0.7 | 0.1 | 0.0 | 0.788 |

| Sweden | 7.7 | 32.2 | 46.2 | 5.5 | 1.5 | 0.3 | 6.6 | 0.780 |

| Norway | 10.2 | 30.8 | 48.8 | 4.3 | 3.6 | 0.4 | 1.9 | 0.762 |

| United States | 3.4 | 25.5 | 11.2 | 52.7 | 2.0 | 0.4 | 4.8 | 0.747 |

| Denmark | 7.3 | 36.8 | 46.6 | 2.8 | 5.9 | 0.7 | 0.0 | 0.745 |

| France | 48.1 | 12.9 | 34.2 | 3.7 | 1.0 | 0.1 | 0.0 | 0.739 |

| Finland | 9.1 | 22.9 | 62.4 | 2.0 | 2.3 | 0.5 | 0.8 | 0.641 |

| Germany | 3.5 | 33.3 | 58.9 | 1.9 | 1.3 | 0.1 | 1.0 | 0.631 |

| Switzerland | 5.4 | 11.8 | 69.4 | 5.3 | 2.1 | 0.4 | 5.6 | 0.578 |

| Russia | 0.1 | 60.0 | 39.8 | 0.0 | 0.0 | 0.0 | 0.0 | 0.562 |

| Ireland | 6.3 | 9.9 | 76.2 | 1.6 | 4.8 | 1.2 | 0.0 | 0.470 |

| Slovenia | 16.4 | 5.2 | 75.3 | 2.6 | 0.4 | 0.2 | 0.0 | 0.470 |

| Japan | 0.3 | 76.9 | 2.5 | 13.6 | 2.8 | 0.6 | 3.3 | 0.452 |

| Czech Republic | 1.1 | 21.2 | 76.1 | 0.5 | 1.0 | 0.1 | 0.0 | 0.438 |

| Hungary | 1.3 | 7.7 | 85.8 | 0.7 | 2.2 | 0.3 | 2.1 | 0.300 |

| South Korea | 0.3 | 86.0 | 1.2 | 0.0 | 7.3 | 0.6 | 4.6 | 0.295 |

| Slovakia | 0.6 | 3.6 | 93.5 | 0.3 | 1.5 | 0.2 | 0.4 | 0.145 |

| Latvia | 0.0 | 5.7 | 93.9 | 0.1 | 0.3 | 0.1 | 0.0 | 0.134 |

| Taiwan | 0.0 | 94.3 | 0.9 | 0.0 | 2.9 | 0.2 | 1.6 | 0.127 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kwak, J.; Wallace, M. The Impact of the Great Recession on Perceived Immigrant Threat: A Cross-National Study of 22 Countries. Societies 2018, 8, 52. https://doi.org/10.3390/soc8030052

Kwak J, Wallace M. The Impact of the Great Recession on Perceived Immigrant Threat: A Cross-National Study of 22 Countries. Societies. 2018; 8(3):52. https://doi.org/10.3390/soc8030052

Chicago/Turabian StyleKwak, Joonghyun, and Michael Wallace. 2018. "The Impact of the Great Recession on Perceived Immigrant Threat: A Cross-National Study of 22 Countries" Societies 8, no. 3: 52. https://doi.org/10.3390/soc8030052

APA StyleKwak, J., & Wallace, M. (2018). The Impact of the Great Recession on Perceived Immigrant Threat: A Cross-National Study of 22 Countries. Societies, 8(3), 52. https://doi.org/10.3390/soc8030052