1. Introduction

1.1. Background and Motivation

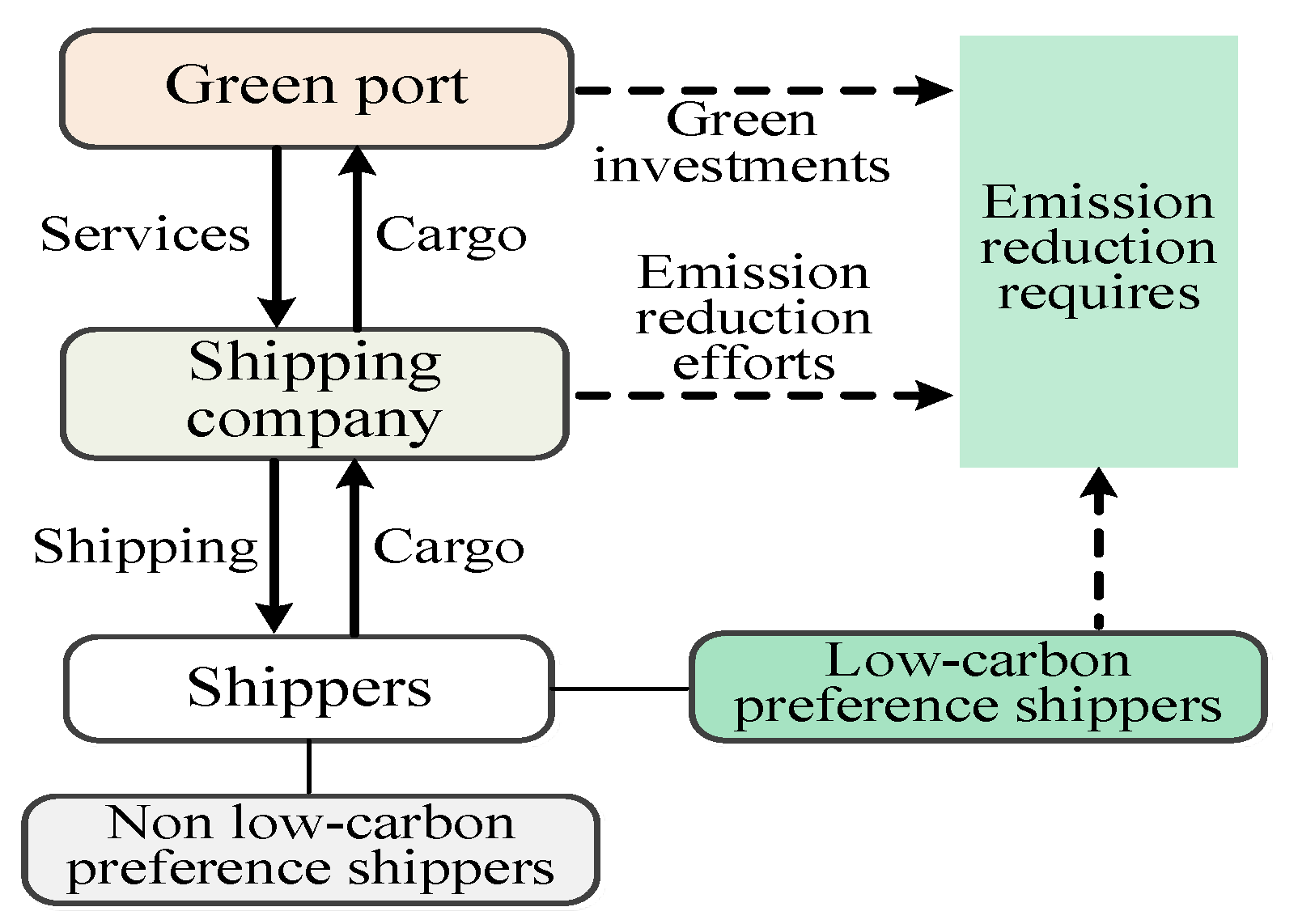

As the backbone of global commerce, shipping dominates over 80% of worldwide freight, driving trade, economic expansion, and societal advancement [

1,

2]. The symmetrically interconnected network of ports (nodes) and shipping routes (edges) underpins global trade, yet its structural symmetry in connectivity contrasts sharply with operational asymmetries in environmental impact. Ship operations emit pollutants and greenhouse gases disproportionately, creating ecological imbalances [

3]. The International Maritime Organization (IMO) reports annual CO

2 emissions exceeding one billion metric tons (3% of global CO

2 output), which are projected to rise to 5% by 2050 [

4]. The EU’s 2024 Emissions Trading System mandates CO

2 monitoring for vessels over 5000 tons, challenging the industry to reconcile network symmetry (efficient connectivity) with operational asymmetry (uneven emissions). However, the multi-actor nature of the shipping network leads to significant information asymmetry and a dilemma for emissions reduction strategies. Ports have difficulty in tracking real-time ship emissions data, shipping companies lack trust in port green infrastructure, and cargo owners are unable to verify carbon footprint declarations in the transportation chain. This information barrier not only creates the risk of “greenwashing” but also makes it difficult to implement a coordinated emissions reduction mechanism. In this context, there is an urgent need for a technical tool that can realize real-time data sharing, tamper-proof process, and accurate traceability of responsibility, in order to solve the trust and collaboration problems in the emissions reduction network.

Blockchain technology, with its distributed ledger and smart contract characteristics, provides a new path for building a cross-organizational and highly credible carbon emissions monitoring network. For example, the Hong Kong GSBN-COSCO initiative (launched in 2024) employs blockchain to issue traceable green certificates, enhancing transparency in a graph-like supply chain where nodes (ports) and edges (routes) must align for sustainability. This technology enables combinatorial optimization of emissions strategies, akin to fault diagnosis in interconnected networks [

5], identifying critical nodes (e.g., high-emission ports) and optimizing edge-level coordination [

6]. However, decarbonization costs [

7] and interdependencies between ports and shipping firms introduce asymmetric incentives, necessitating symmetric collaboration to balance economic and environmental objectives [

8].

In the context of the increasingly stringent environmental policies of the IMO, green investments by port and shipping enterprises have become critical to enhancing competitiveness [

9]. Some scholars have analyzed shipping companies’ “on-chain” decisions by constructing a Stackelberg static equilibrium [

10]; others have discussed introducing a carbon tax or a carbon trading mechanism [

11] and considering consumers’ preferences for logistics services and information [

12]. These studies further provide references for promoting blockchain technology investment in emissions reduction strategies. Existing research on blockchain applications primarily focuses on technological roles and implementation challenges [

13], neglecting the topic of integration into dynamic symmetry–asymmetry trade-offs within port-shipping networks. Therefore, by exploring blockchain’s application in this context, we address a critical research gap. Our work not only leverages graph-theoretic symmetry to model emissions reduction trajectories but also introduces algorithmic complexity principles to optimize node-level (port) and edge-level (shipping route) decisions. This approach aligns with the restricted connectivity challenges of multiprocessor-like logistics systems, advancing the diagnosability of emission-critical nodes while harmonizing economic–environmental symmetry in maritime supply chains.

1.2. Research Questions and Innovations

Given the dual challenges of emissions reduction and digital transformation in the global shipping industry, we address the symmetry–asymmetry interplay in blockchain-driven supply chains through the following research questions:

Q1: How can symmetry-driven dynamic strategies enhance emissions reductions and blockchain investments, accounting for shippers’ asymmetric preferences (low-carbon vs. non-low-carbon) and their impact on node-edge interactions (ports as nodes, shipping routes as edges) in maritime networks?

Q2: How does blockchain’s distributed symmetric architecture reshape optimal emissions decisions, and what are the dynamic trajectories of emissions levels, service quality, demand, and profits under graph-theoretic equilibria (e.g., Stackelberg models with asymmetric leader–follower roles)?

Q3: What threshold conditions (e.g., cost symmetry, profit asymmetry) enable blockchain investments to achieve win–win outcomes for ports and shipping firms, and how do factors like restricted connectivity (e.g., port-shipping dependencies) and node-level diagnosability (e.g., emission-critical ports) influence these thresholds?

Q4: Which member (port or shipping firm) should lead blockchain investments to maximize network-wide symmetry in emissions reduction and service levels, considering their asymmetric roles as nodes (decision hubs) vs. edges (operational links) in the supply chain graph?

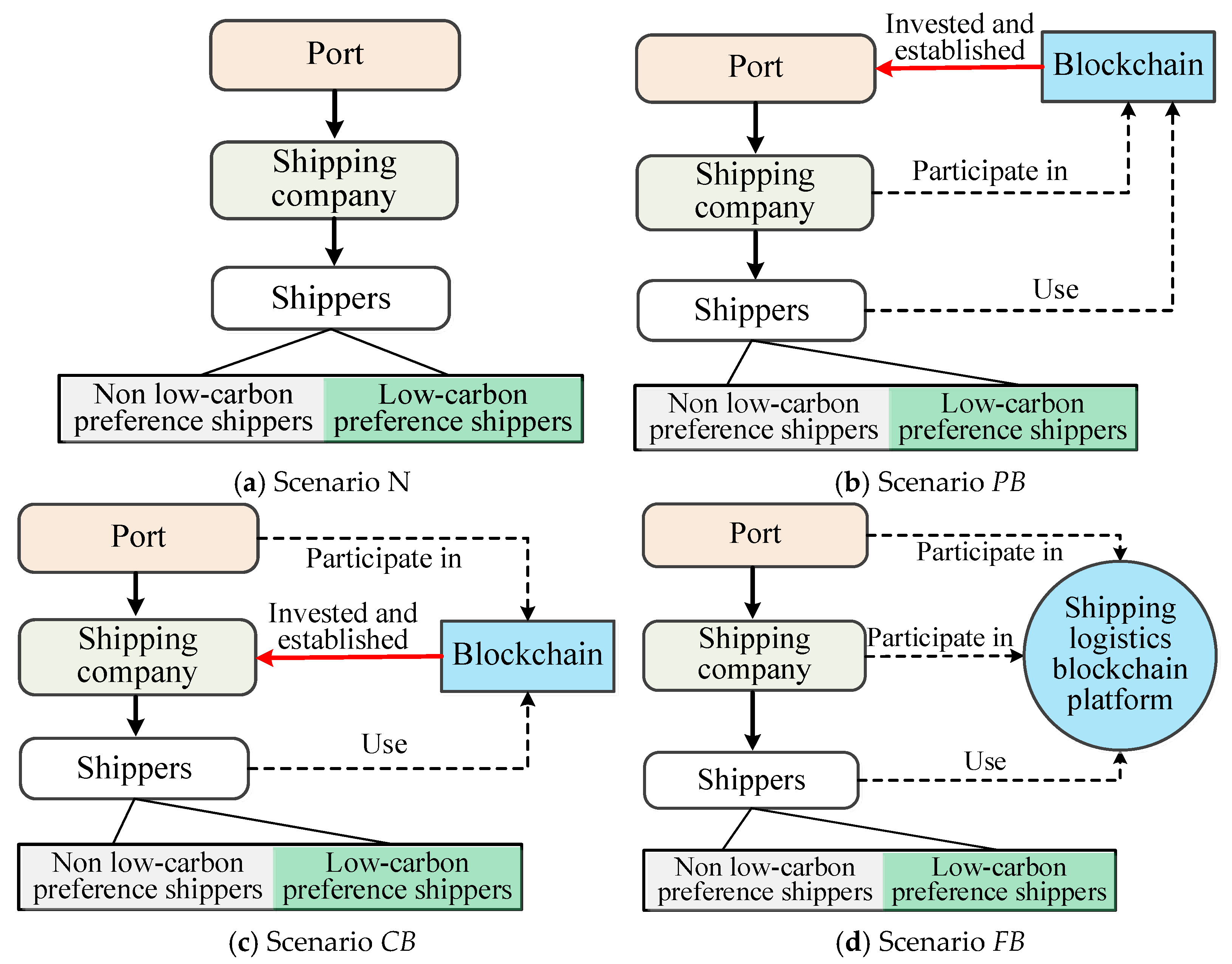

To address these questions, we developed a Stackelberg model within a shipping supply chain involving a port operator (leader) and a shipping firm (follower), framing their interactions as asymmetric node–edge dynamics in a graph-theoretic network (ports as nodes, shipping routes as edges). The port entity establishes green investment criteria, while shipping entities optimize emissions reduction initiatives under restricted connectivity constraints. We analyze four blockchain scenarios (N, PB, CB, FB) through sensitivity, comparative, and numerical analyses, incorporating blockchain green certification levels to assess how consumer trust symmetry influences emissions reductions.

The main innovations of this paper are threefold, as follows:

(1) Research Content: We pioneer the integration of blockchain investment levels with emissions strategies, segmenting cargo owners into asymmetric preference types (low/non-low-carbon) to model node-level heterogeneity in a graph-like supply chain. By unveiling the impact of shipping costs, cargo owner nature, and low-carbon coefficients, we demonstrate that port-led blockchain achieves profit symmetry under low operational costs, while shipping firms leverage asymmetric service sensitivity in high-freight environments. Joint platforms balance symmetry–asymmetry trade-offs through fee-trust synergy, akin to optimizing restricted connectivity in multiprocessor systems.

(2) Research Perspective: Transitioning from static to dynamic analysis, we design two symmetry-driven state equations for emissions reduction (node dynamics) and service quality (edge dynamics), revealing time-proportional convergence to symmetric steady states—mirroring graph neural networks (GNNs) in resolving algorithmic complexity for interconnected systems. This approach diagnoses critical nodes (e.g., high-emission ports) and optimizes edge-level coordination, advancing fault diagnosability in maritime networks.

(3) Research Methodology: We introduce optimal control theory to shipping supply chains, solving Hamilton–Jacobi–Bellman equations to derive emissions trajectories. This framework integrates combinatorial algorithms for node–edge optimization, addressing uncertainty in graph properties (e.g., fluctuating demand) and enhancing network reliability through dynamic symmetry–asymmetry equilibria.

1.3. Paper Organization and Structure

This paper is structured as follows. The literature is examined in

Section 2. In

Section 3 and

Section 4, hypotheses are formulated and models are developed.

Section 5 presents parametric sensitivity analysis and comparative analysis of model results.

Section 6 introduces the shipper green trust coefficient, designs new shipper utility and demand functions, and reanalyzes blockchain scenarios’ impacts on shipping supply chain optimization under revised settings, expanding research boundaries to better align with real-world conditions.

Section 7 employs MATLAB R2023a for numerical experiments, validating theoretical conclusions through empirical results to enhance research credibility.

Section 8 summarizes this paper’ s contributions and discusses their implications. Note: All proofs are in

Supplementary S1, and the critical points are in

Supplementary S2.

5. Model Analysis

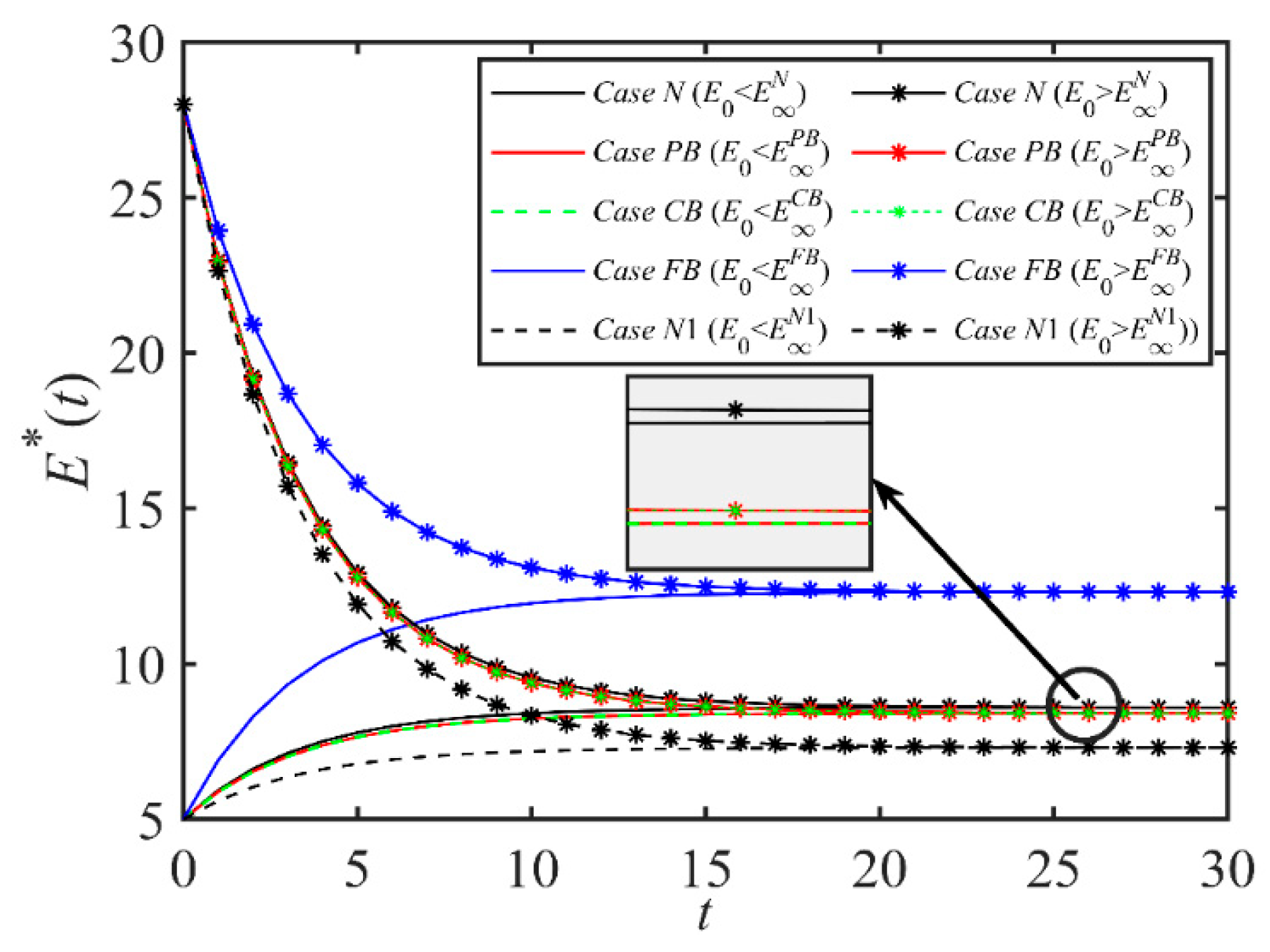

5.1. Dynamic Emissions Reduction Operational Strategy

This section investigates strategic recommendations for port and shipping businesses by analyzing the optimal dynamic changes in demand, emissions reduction level, and other relevant factors, thereby supporting the development of sustainable and technologically adaptive growth strategies for the shipping industry.

Proposition 1.

N Scenario:

- (i)

When t < tthN, we find that if , then

; otherwise ; where tthN is the time node in (0, +∞);

- (ii)

When t ≥ tthN, we have ;

- (iii)

We confirm that the relevantimportant critical points in Scenario N can be found in Supplementary S2.

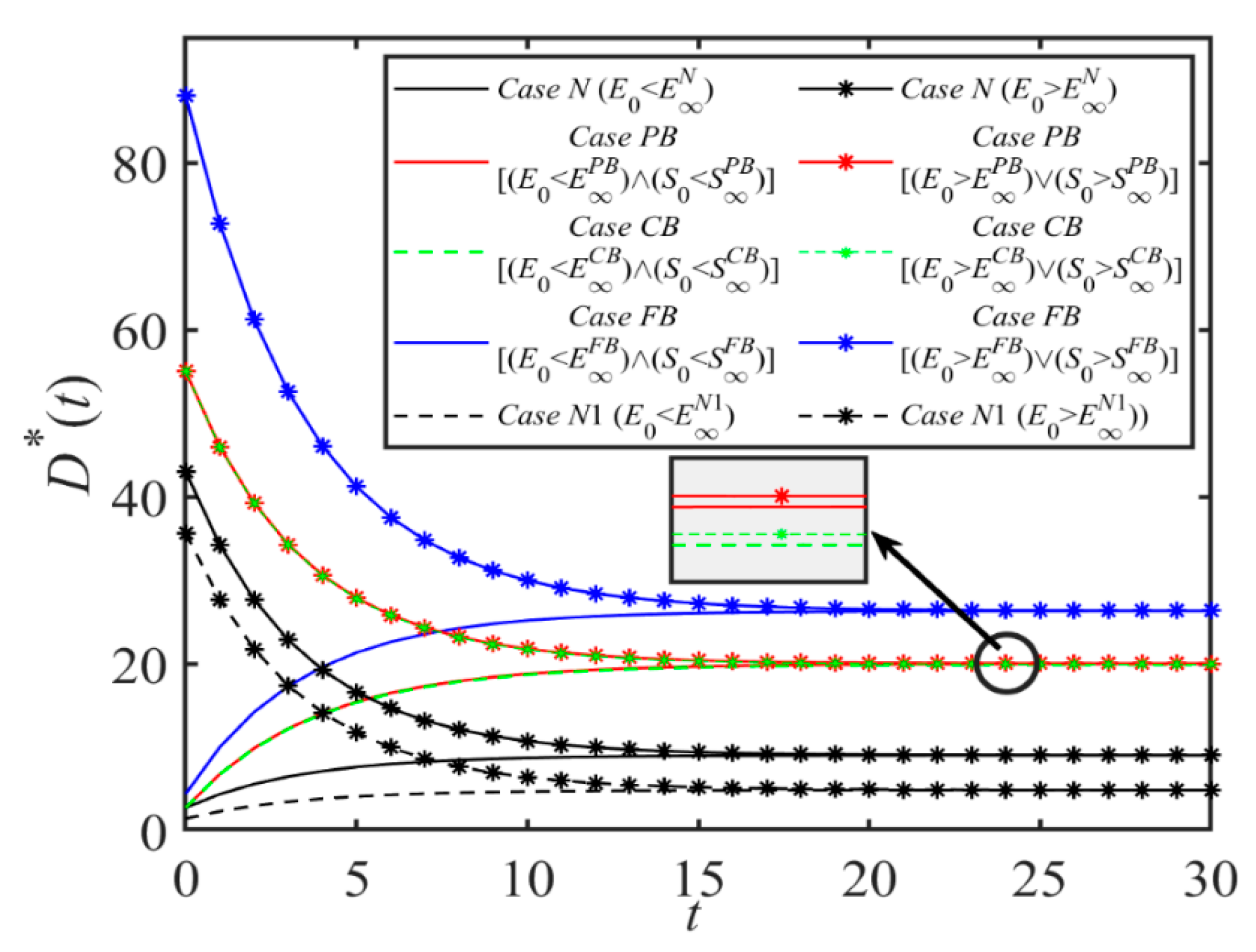

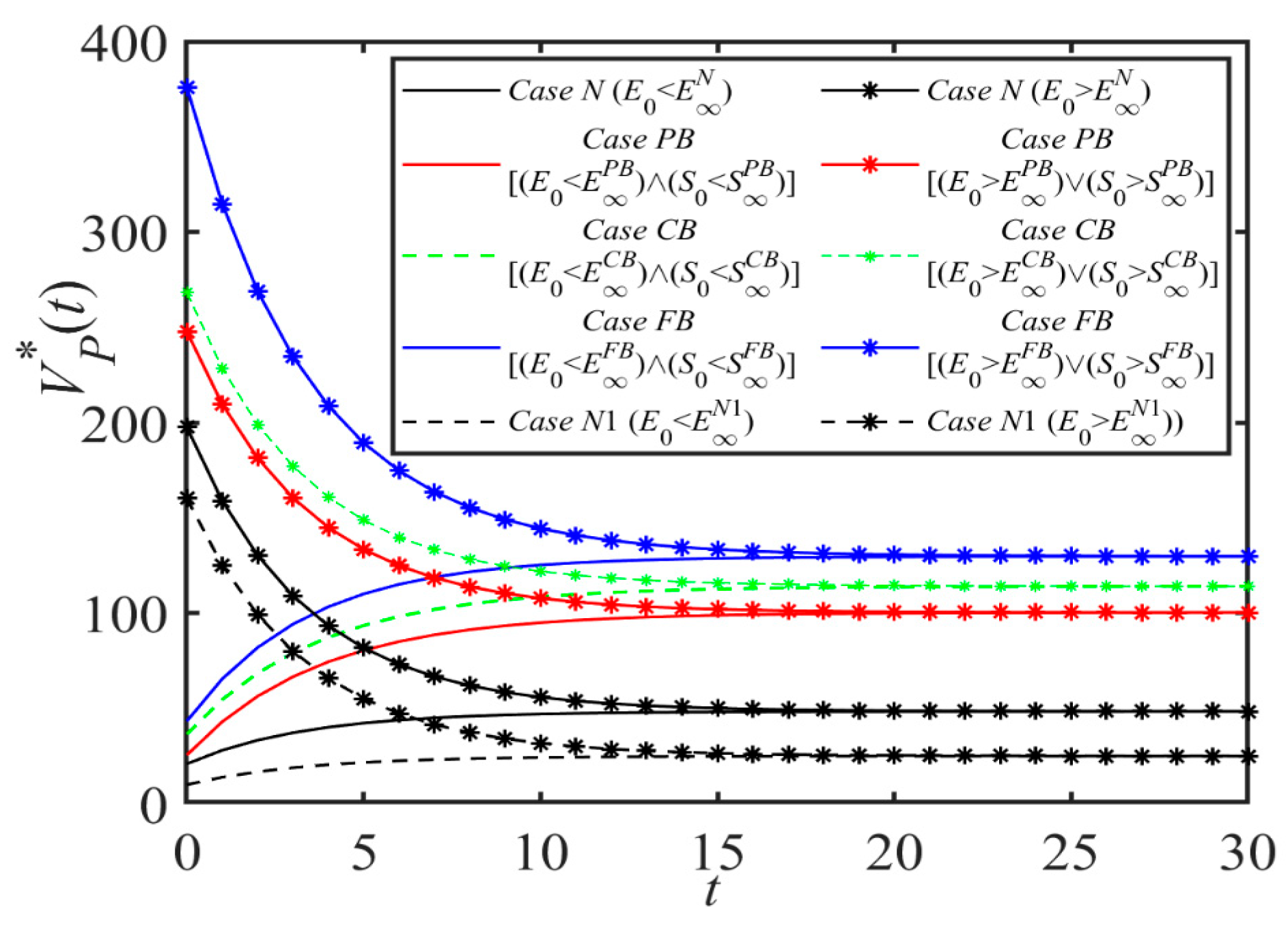

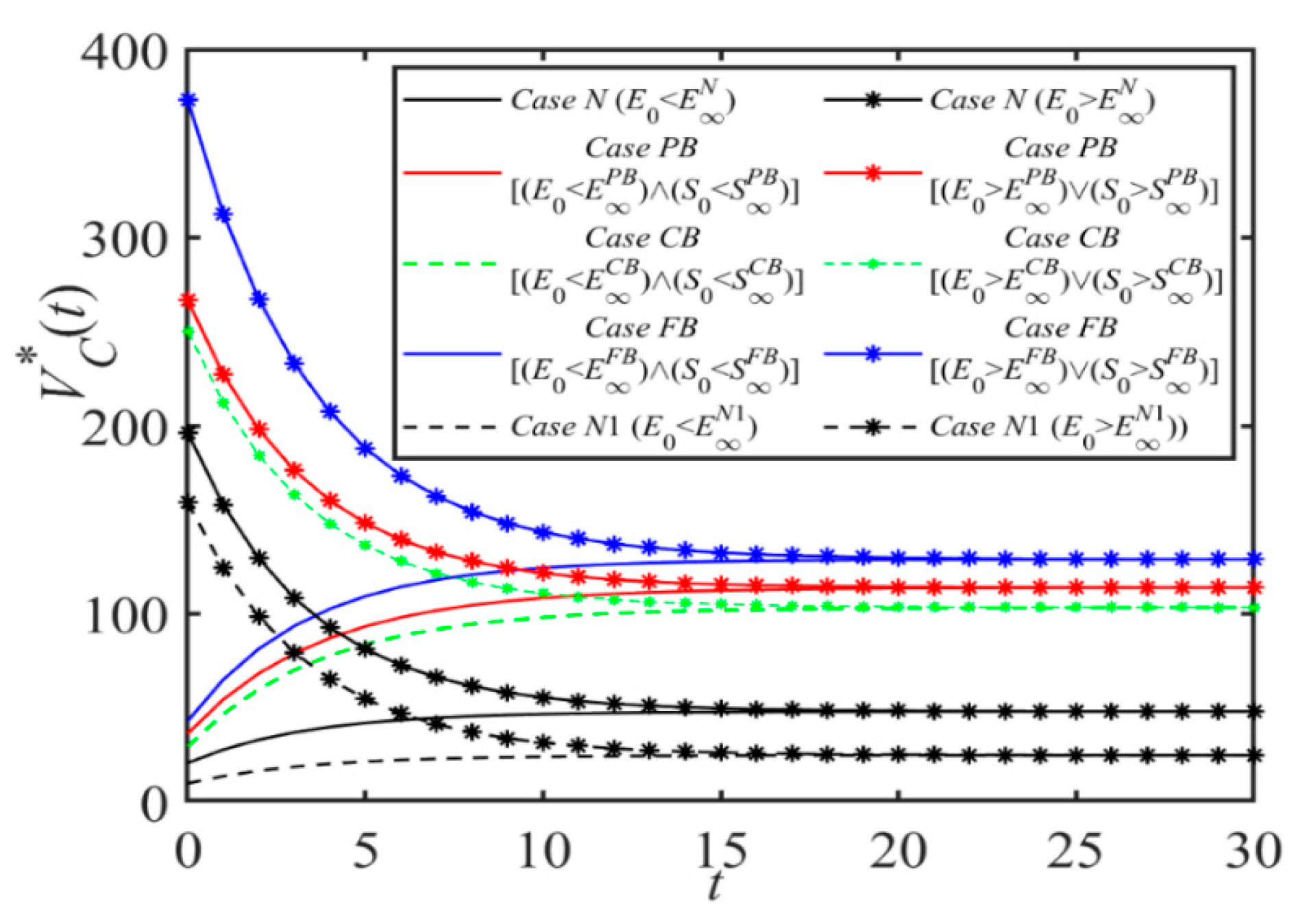

Proposition 1 shows the relationships between the emissions reduction level EN, shipping demand DN, expected discounted profit of shipping company VCN, expected discounted profit of port company VPN, and time t. We find that when time t is sufficiently small, EN, DN, VCN, VPN increase with t if the initial emissions reduction level E0, cost coefficient k, h, c of the shipping supply chain are small. This indicates a trend where companies aim to elevate emission cuts and boost demand, concurrently lowering costs, thereby enhancing profitability. It is also worth noting that the evolution of EN, DN, VCN, VPN with time t will eventually converge to a steady state, regardless of the changes in other parameters. This is because in the long run, companies will strive to increase their level of emissions reduction and increase their profits by reducing costs while increasing demand. In this process, companies constantly adjust their own decisions, such as emissions reduction efforts and green investment levels, to achieve a balance between costs and benefits. When a relatively stable state is reached, levels of emissions reductions, demand, and profits also tend to be stable.

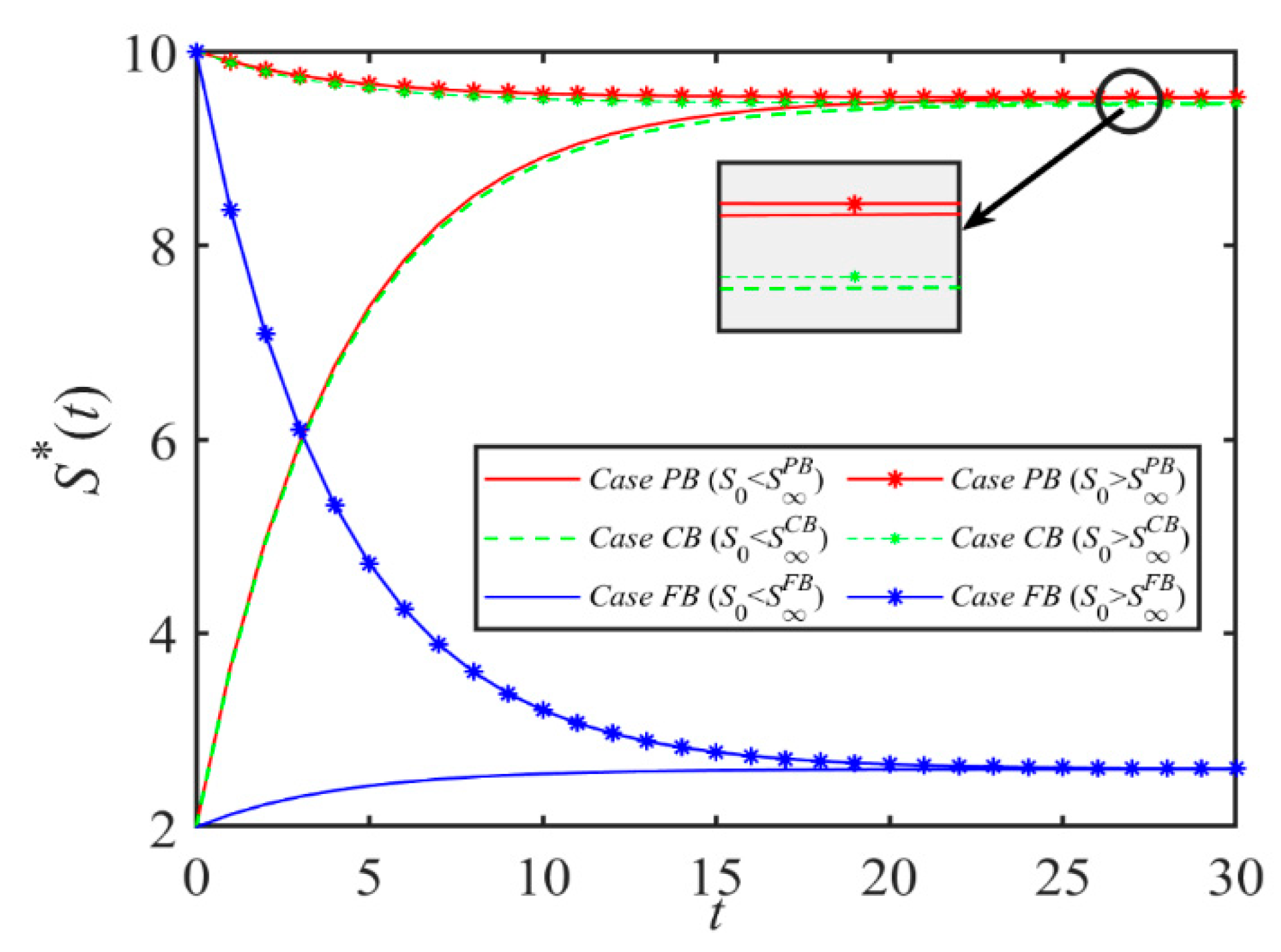

Proposition 2. PB Scenario:

- (i)

When t < tth0PB, we find that if , then ; otherwise,; When t ≥ tth0PB, we have ; where tth0PB is the time node in (0, +∞);

- (ii)

When t < tth1PB, we find that if , then ; otherwise,; When t ≥ tth1PB, we have ; where tth1PB is the time node in (0, +∞);

- (iii)

When t <max{tth0PB, tth1PB}, we find that if , then DPB(t), VCPB(t), and VPPB(t) will inevitably increase with time t; When t ≥ max{tth0PB, tth1PB}, we have ∂ DPB/∂ t = 0, ∂ VCPB/∂ t = 0, and ∂VPPB/∂ t = 0; Otherwise, DPB(t), VCPB(t), and VPPB(t) may increase or decrease with time t, depending on the rate of increase or decrease in the state equations EPB(t) and SPB(t);

- (iv)

We confirm that the relevant important critical points in Scenario PB can be found in Supplementary S2.

Proposition 2 states that in the PB scenario, the dynamic evolution process of emissions reduction level EPB, shipping service level SPB, demand DPB, and related profit function with time has obvious regularity. When time t is small enough, we find that the shipping service level SPB is proportional to t if the initial shipping service level S0, η, ω, c0 decrease, or if r, β, φ increase. This is because in this case, the benefits of ports investing in blockchain technology, such as improved efficiency in customs clearance and enhanced transparency in logistics, can notably improve shipping service quality due to alterations in initial conditions and variables, which in turn lead to a positive correlation between service levels and time. When t is less than the maximum value between two critical values, DPB(t), VCPB(t), and VPPB(t) increase with time t if the condition that both E0 and S0 decrease is satisfied. Moreover, when t is infinite, its dynamic evolution will eventually converge to the steady state. The port company achieves a greater degree of emissions reduction by introducing blockchain technology. At the same time, the application of these technologies also improves service levels, thereby increasing profits.

Proposition 3. CB Scenario:

- (i)

When t < tth0CB, we find that if , then ; otherwise,; When t ≥ tth0CB, we have ; where tth0PB is the time node in (0, +∞);

- (ii)

When t < tth1CB, we find that if , then ; otherwise,; When t ≥ tth1CB, we have ; where tth1CB is the time node in (0, +∞);

- (iii)

When t <max{tth0CB, tth1CB}, we find that if , then DCB(t), VCCB(t), and VPCB(t) will inevitably increase with time t; When t ≥ max{tth0CB, tth1CB}, we have ∂ DCB/∂ t = 0, ∂ VCCB/∂ t = 0, and ∂VPCB/∂ t = 0; Otherwise, DPB(t), VCCB(t), and VPCB(t) may increase or decrease with time t, depending on the rate of increase or decrease in the state equations ECB(t) and SCB(t);

- (iv)

We confirm that the relevant important critical points in Scenario CB can be found in Supplementary S2.

Proposition 3 is similar to Proposition 2. When t is sufficiently small and certain conditions are satisfied, ECB, SCB, DCB(t), VCCB(t), and VPCB(t) increase with t, with a vice versa decrease. All of these eventually converge to the steady state as time t evolves. Proposition 3 (iii) states that when t < max{tth0CB, tth1CB}, if the initial emissions reduction level and service level meet certain conditions, DCB(t), VCCB(t) and VPCB(t) are proportional to time t.

Although blockchain adoption by shipping companies increases investment costs, it enhances supply chain management efficacy. Through blockchain technology, companies gain real-time cargo tracking, optimize routes, and improve handling efficiency, thereby reducing operational costs. Simultaneously, blockchain improves transparency and operational efficiency, enabling shippers to monitor cargo status more accurately, which strengthens trust and supports emissions reduction initiatives. Furthermore, elevated service levels and customer satisfaction attract more clients, expand market share, and boost profits. These dynamics demonstrate the CB scenario’s positive impacts: blockchain investments create synergistic relationships across supply chain factors, offering critical insights for corporate decision-making.

Proposition 4. FB Scenario:

- (i)

When t < tth0FB, we find that if , then ; otherwise,; When t ≥ tth0FB, we have ; where tth0FB is the time node in (0, +∞);

- (ii)

When t < tth1FB, we find that if , then ; otherwise,; When t ≥ tth1FB, we have ; where tth1FB is the time node in (0, +∞);

- (iii)

When t <max{tth0FB, tth1FB}, we find that if , then DFB(t), VCFB(t), VPFB(t), and VFFB(t) will inevitably increase with time t; When t ≥ max{tth0CB, tth1CB}, we have ∂ DFB/∂ t = 0, ∂ VCFB/∂ t = 0, ∂VPFB/∂ t = 0, and ∂VFFB/∂ t = 0; Otherwise, DFB(t), VCFB(t), VPFB(t), and VFFB(t) may increase or decrease with time t, depending on the rate of increase or decrease in the state equations EFB(t) and SFB(t);

- (iv)

We confirm that the relevant important critical points in Scenario FB can be found in Supplementary S2.

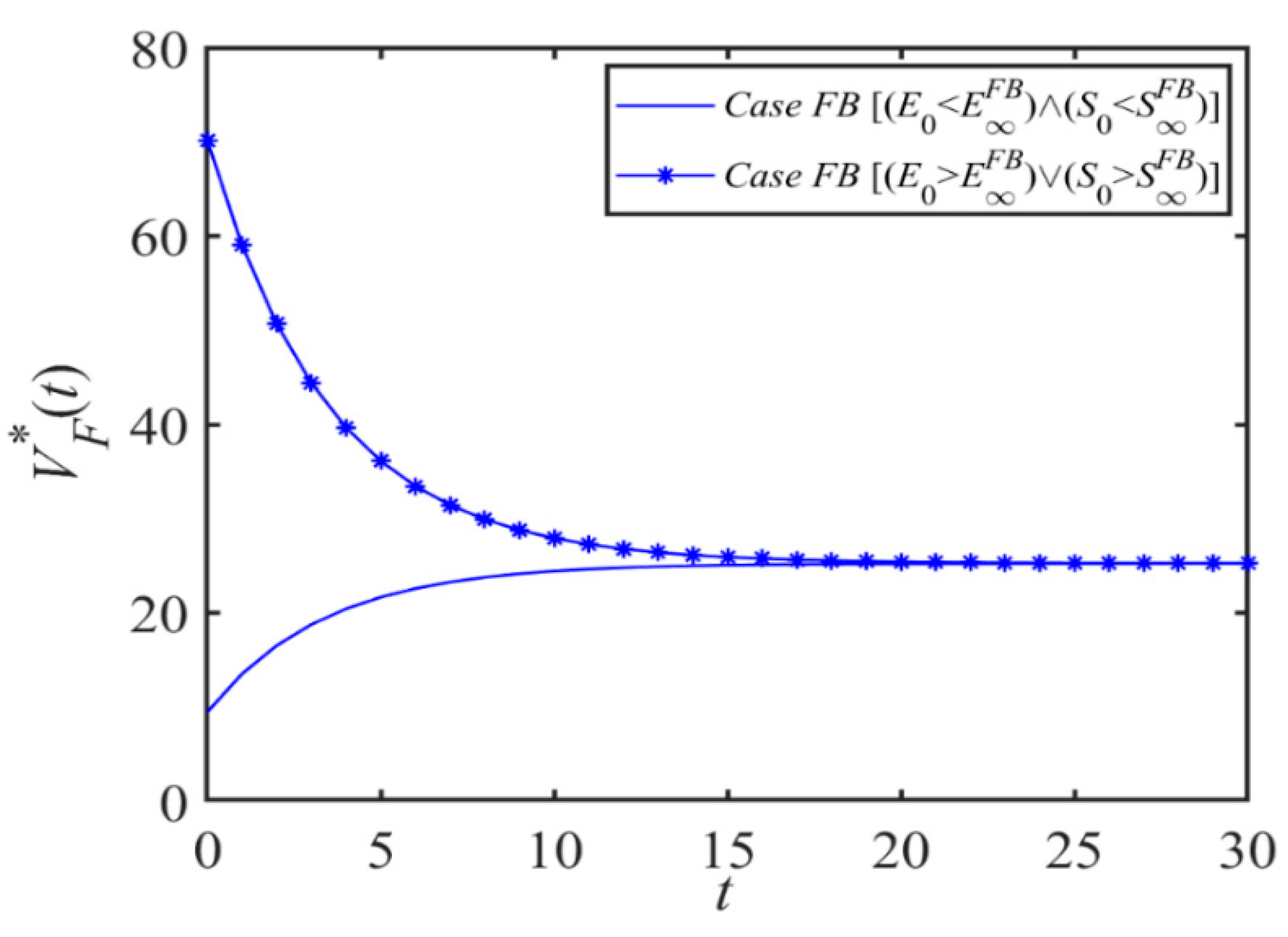

Proposition 4 indicates that EFB is proportional to t if E0, k, h, cb, c0, c1 are satisfied when t < tth0FB is sufficiently small. Unlike Proposition 3, Proposition 4 considers the blockchain usage fee charged by shipping logistics blockchain platform cb, and EFB is also proportional to t when cb < cbth0FB. The reverse is inversely proportional. When t < tth1FB, the shipping service level SFB is proportional to t if S0, cb, η, ω, c2 is smaller or β, φ is larger; otherwise, it is inversely proportional. In addition, when t is less than the maximum value between two critical values, DFB(t), VCFB(t), and VPFB(t) increase with time t if the condition that both E0 and S0 decrease is satisfied. When t is infinitely large, its dynamic evolution will eventually converge to the steady state.

This proposition demonstrates that blockchain technology provides a secure, transparent, efficient, and convenient shared-service network platform for port and shipping enterprises. Through blockchain platforms, diversified services and multi-tier functional frameworks can be implemented across controlled processes, enabling online-offline collaboration for cargo operations, dynamic logistics chain tracking, operational efficiency improvements, and overall cost reduction. For instance, the Shanghai Blockchain Paperless Order Exchange Platform has established a high-reliability alliance chain infrastructure, integrating all port and shipping logistics stakeholders as nodes. This system facilitates blockchain-based recording of user profiles, logistics data, and business interactions.

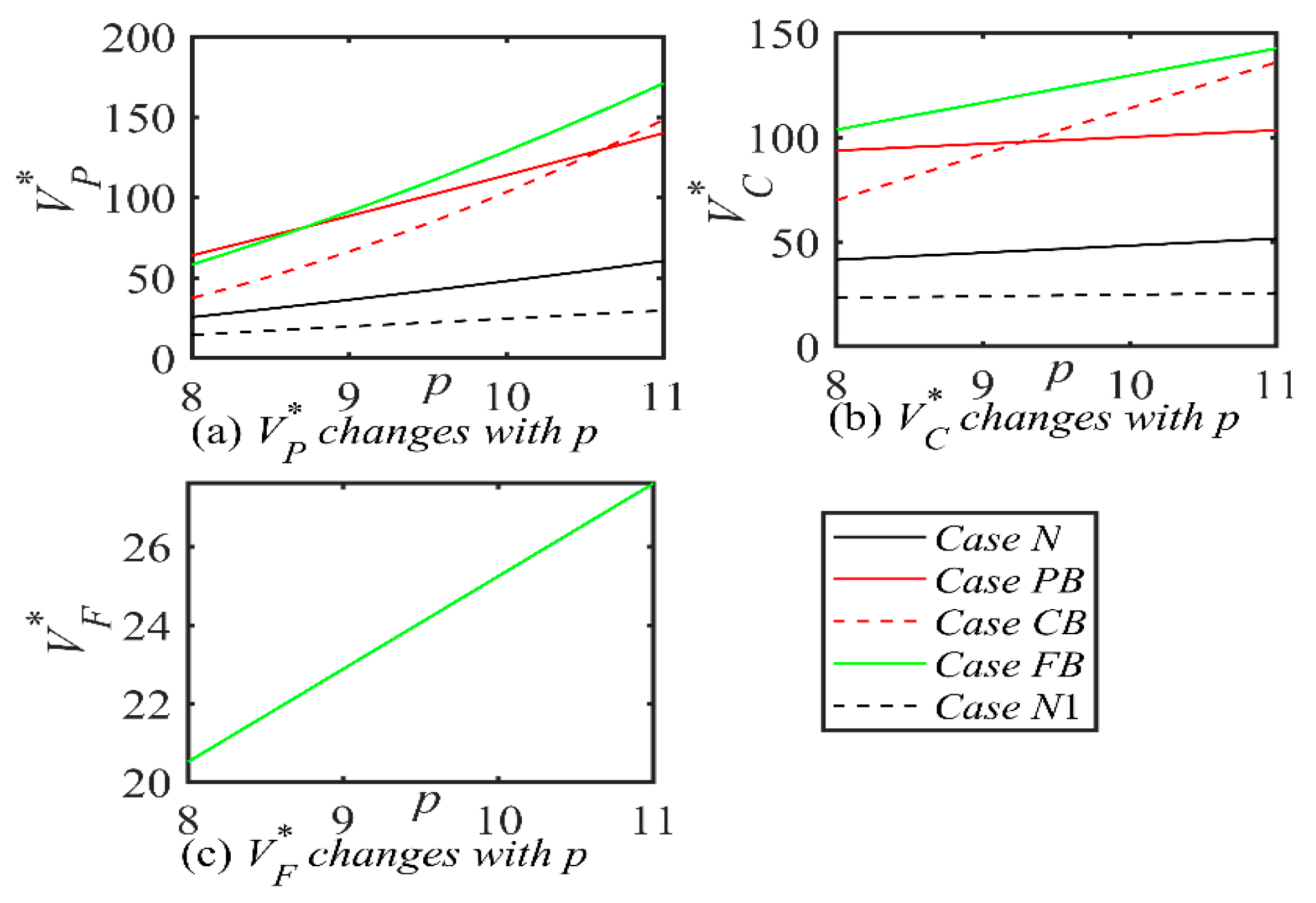

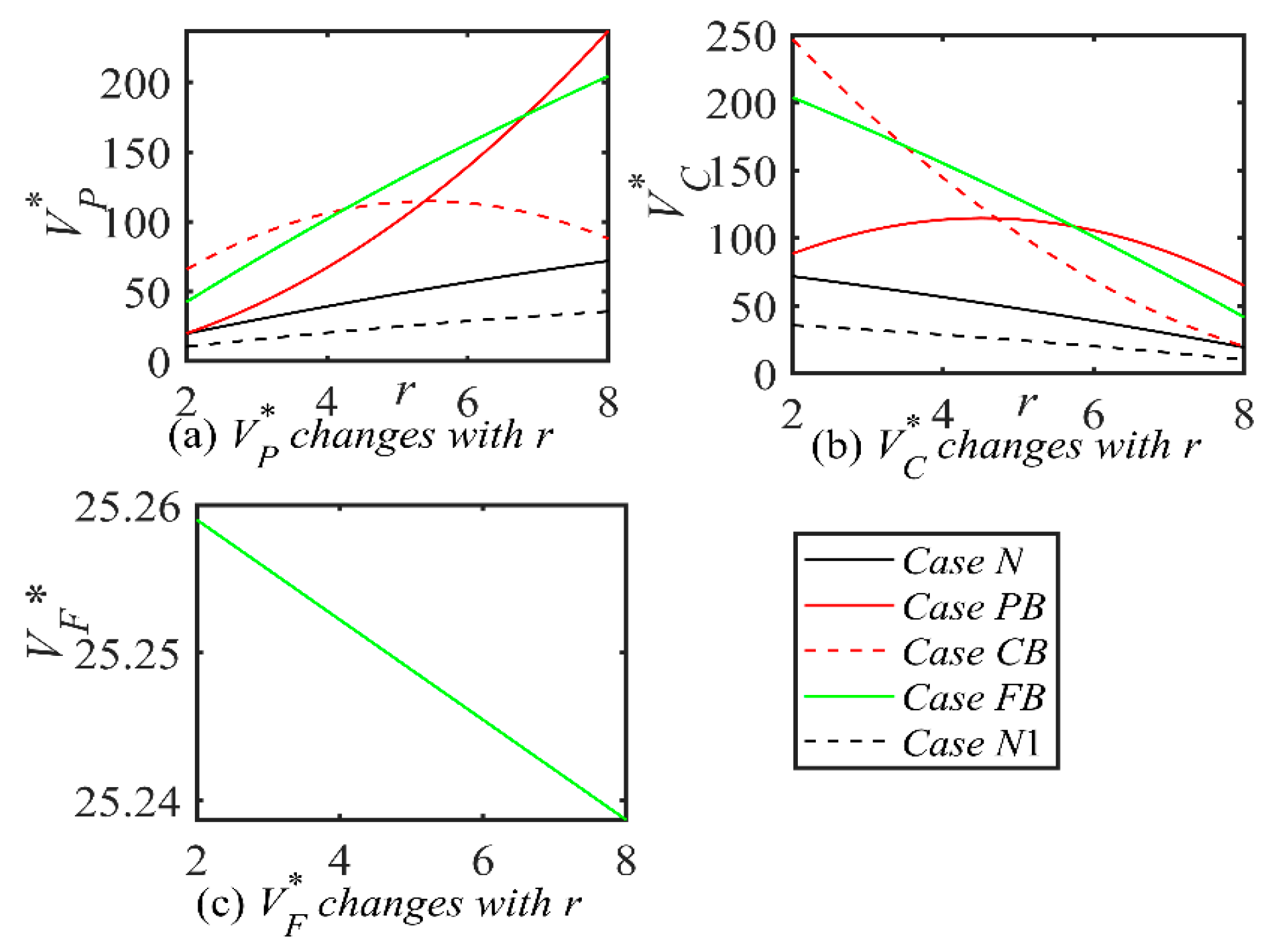

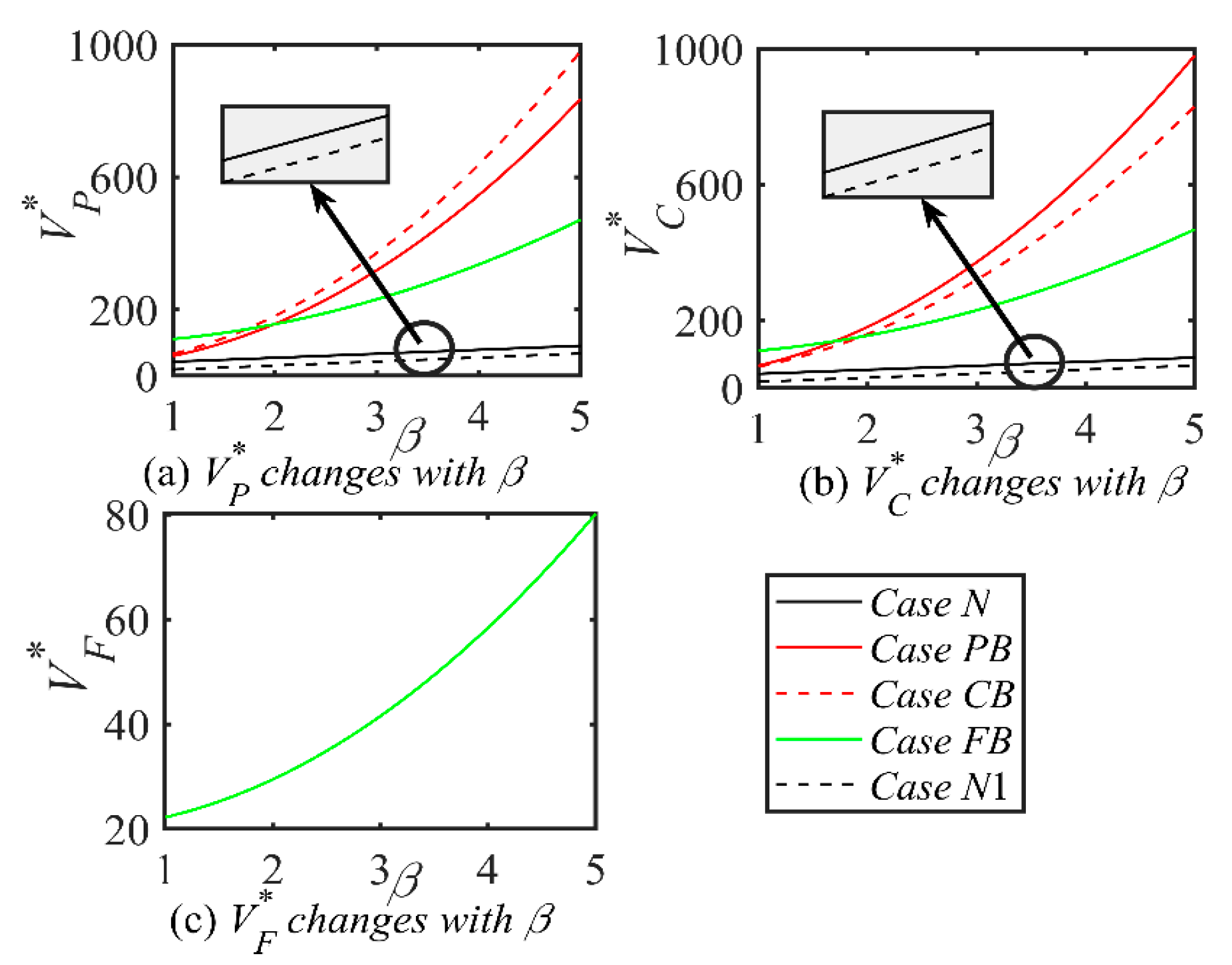

5.2. Parameter Analysis

As detailed in

Section 5.1, the port’s vessel emission rates (

VERs) stabilize across various scenarios, reaching equilibrium without further temporal fluctuations. Consequently, this section conducts a steady-state parametric analysis of port

VERs, offering valuable insights into the enduring effects of government policies aimed at encouraging emissions reductions by port operators.

Proposition 5. In different Scenarios, the impacts of shipping price p and port service fee r on the optimal decisions are analyzed as follows:

- (i)

,

;

- (ii)

,

;

- (iii)

,

;

- (iv)

,

;

- (v)

,

;

- (vi)

,

;

i = N, PB, CB, FB; j = PB, CB, FB.

See Supplementary S2 for relevant important critical points regarding Proposition 5. Proposition 5 shows that the shipping company’s emissions reduction efforts ai* are positively correlated with p and negatively correlated with r. This means that shipping companies will see their costs increase as they undertake emissions reduction efforts. In order to cover these additional costs, shipping companies may increase their shipping fees. Improving operational efficiency through emissions reduction measures reduces the cost of services provided by shipping companies at ports. The port’s green investment level gi* is not correlated with p but is positively correlated with r, which suggests that the port will increase the service fee to increase the level of green investment. In the PB and FB cases, blockchain investment level bj* is not correlated to p. In CB, bj* is positively correlated with p. So bj* has a different relationship with r in the three scenarios. Emissions reduction level Ei* is positively correlated with p. If θ is large enough, Ei* is positively related to r. The shipping service level Sj* is positively or negatively correlated or is uncorrelated with p and r under certain conditions. In addition, when α is large enough, shipping demand Di* is positively related to p. When θ is large enough, DN,PB,FB are positively correlated with r, and DCB is positively correlated with r when φ is small enough. This suggests that the relationship between shipping demand and p and r is also affected by relevant influencing factors, so shipping companies and ports need to better cope with the uncertainty of shipping demand, improve competitiveness, and maintain sustainable development in the changing market environment.

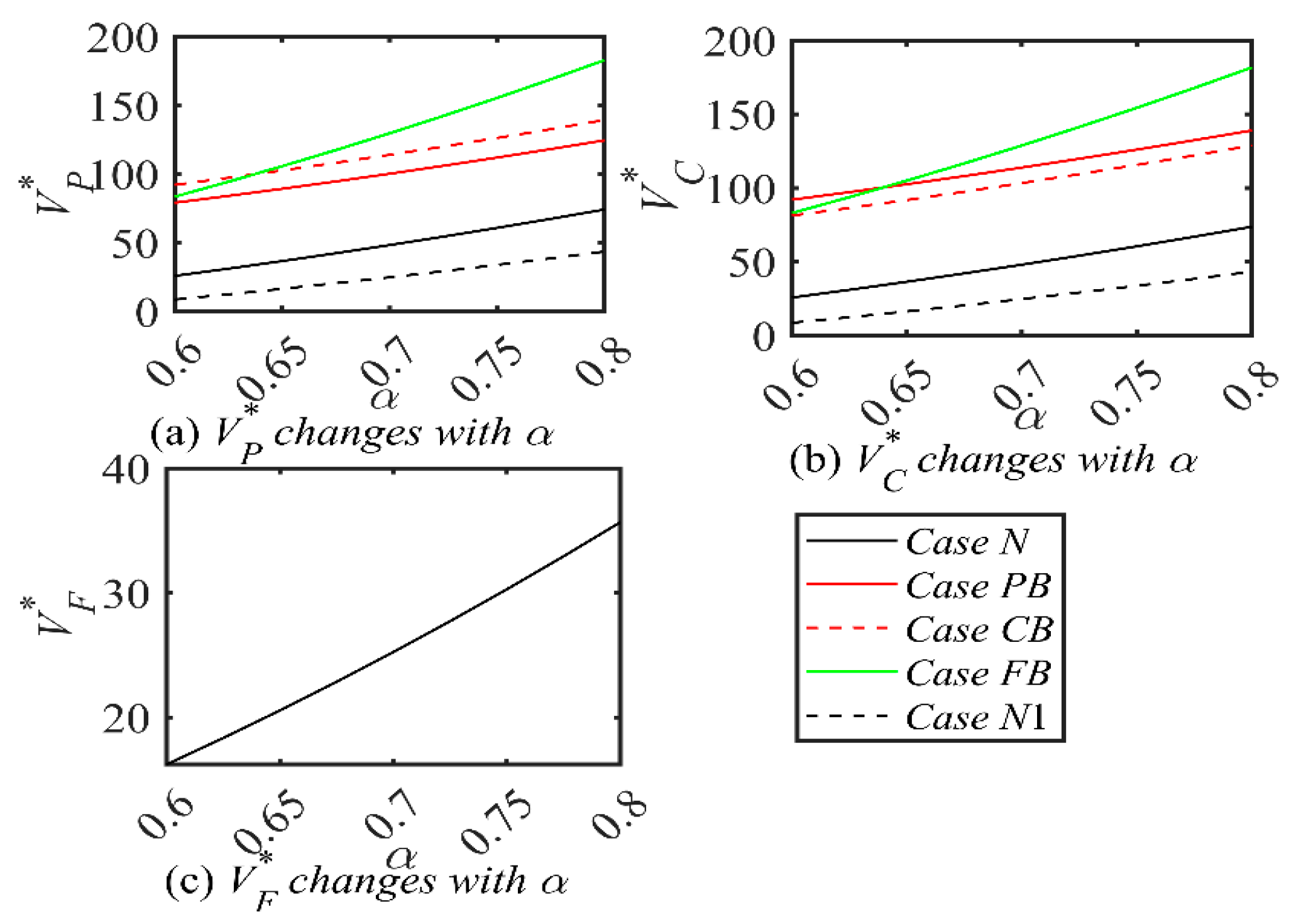

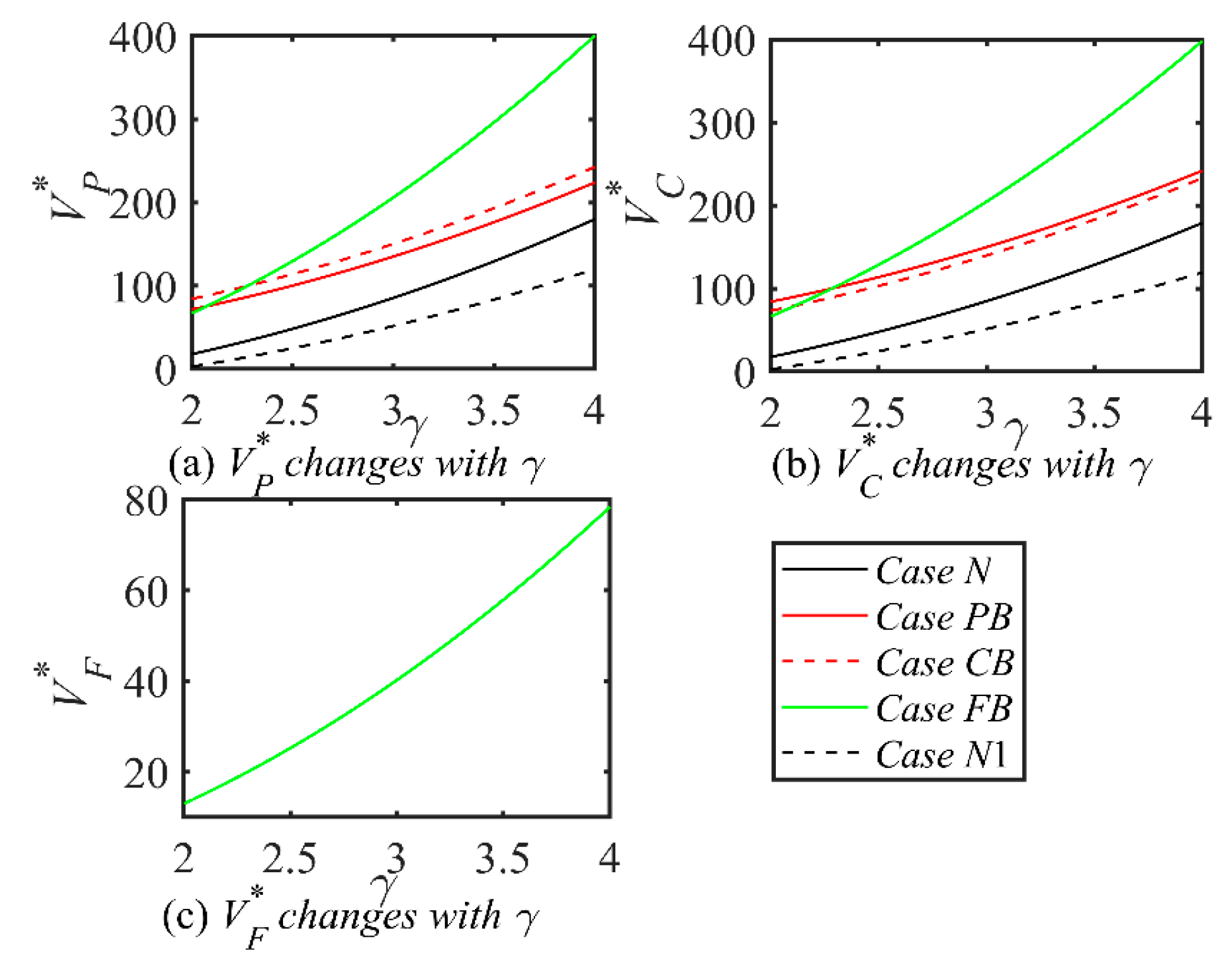

Proposition 6. In different Scenarios, the impacts of parameters related to low-carbon-preference shippers (i.e., α, β, γ) on the optimal decisions are analyzed as follows:

- (i)

, , ;

- (ii)

, , ;

- (iii)

, , ;

- (iv)

, , ;

- (v)

, , ;

- (vi)

, , ;

where i = N, PB, CB, FB; j = PB, CB, FB.

Proposition 6 reveals that ai*, gi*, Ei*, Di* are positively correlated with α, γ and uncorrelated with β. There is a positive correlation between shipping companies’ emissions reduction efforts and ports’ green investments, indicating that ports’ green infrastructure and technology investments enhance shipping companies’ low-carbon transportation outcomes. If the proportion of low-carbon-priority shippers rises, this reflects growing demand for low-carbon transportation, steering the industry toward a greener trajectory. However, bj*, Sj* are uncorrelated with α, γ and positively correlated with β. This suggests that the proportion of low-carbon-preference shippers and their low-carbon preferences do not significantly affect blockchain investment levels or shipping service levels under blockchain systems. The positive correlation indicates that as the application level of blockchain technology in shipping services increases, shippers’ satisfaction with transportation services also rises. In other words, higher blockchain adoption levels lead to greater shipper sensitivity to service quality as expectations for high-quality service are met.

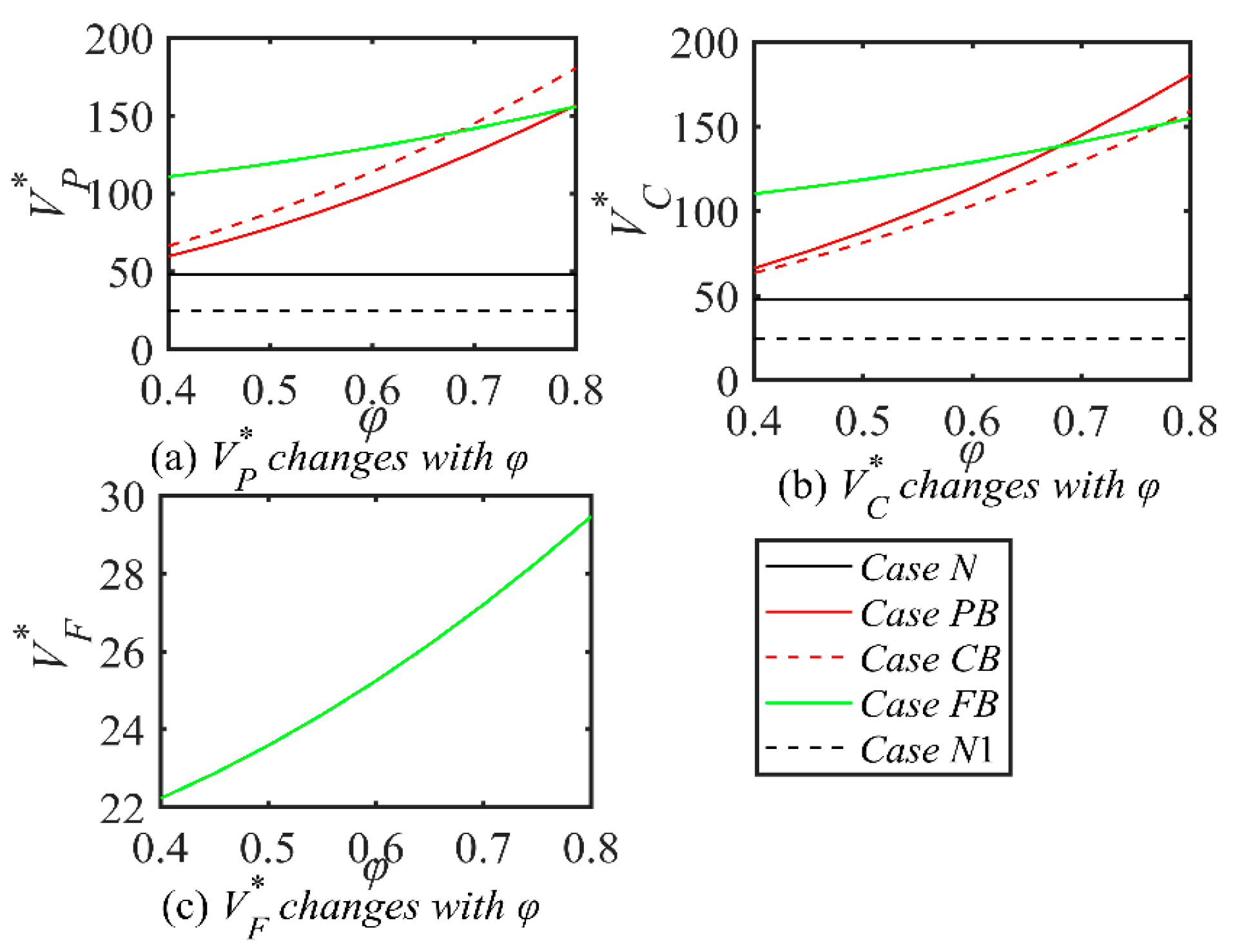

Proposition 7. In different Scenarios, the impacts of parameters related to port and shipping emissions reduction and shipping service (i.e., u, θ, φ) on the optimal decisions are analyzed as follows:

- (i)

, , ;

- (ii)

, , ;

- (iii)

, , ;

- (iv)

, , ;

- (v)

, , ;

- (vi)

, , ;

where i = N, PB, CB, FB; j = PB, CB, FB.

Proposition 7 shows that ai*, Ei*, Di* is positively correlated with u. Similarly, gi*, Ei*, Di* is positively correlated with θ. Furthermore, bj*, Sj* is positively correlated with φ. Where Di* is uncorrelated with φ in scenario N and positively correlated in the other scenarios. Proposition 7 (i)–(iii) illustrate that when ports, shipping companies, and blockchain technology have greater factors affecting the level of emissions reduction in the shipping supply chain, their respective investment levels are higher. The uncorrelation of Ei* and φ in Proposition 7 (iv) suggests that current blockchain investments are not being effectively used in emissions reduction efforts in the shipping supply chain, or that the application of blockchain technology is not yet mature enough to have a significant impact on emissions reductions. Proposition 7 (v) shows that the shipping service level Sj* is only related to the influence of the BIL on ERL φ. From the conclusions of Proposition 7 (iv) and Proposition 7 (v), (vi) can be introduced.

Proposition 8. In different Scenarios, the impacts of cost-related parameters on the shipping supply chain (i.e., k, h, η, ω, c0, c1, c2, cb) on the optimal decisions are analyzed as follows:

- (i)

, , , , , , , ;

- (ii)

, , , , , , , ;

- (iii)

, , , , , , , ;

- (iv)

, , , , , , , ;

- (v)

, , , , , , , ;

- (vi)

, , , ,

, , ,

;

i = N, PB, CB, FB; j = PB, CB, FB.

See Supplementary S2 for relevant important critical points regarding Proposition 8. Proposition 8 shows how cost factors influence optimal choices across scenarios. For example, in Proposition 8 (i), ai* is not correlated with k, η, c0, c2 and is uncorrelated with ω in each scenario. In Proposition 8 (ii), the port’s green investment level gi* is uncorrelated with h, η, c1, c2 and uncorrelated with ω in a given scenario. An increase in k results in a decrease in the port’s green investment level gi*, suggesting that an increase in the green cost factor will squeeze the budget for blockchain investments. Meanwhile, the tightening of regulatory policies can be indirectly manifested in the increase of port green investment cost coefficient k in the model, which explains why in reality, some ports prioritize meeting compliance requirements over adopting blockchain technologies. In Proposition 8 (iii), the blockchain investment level bj* is uncorrelated with k and correlated with h. Ei* in Proposition 8 (iv) is uncorrelated with k, h, c1, cb. Sj* in Proposition 8 (v) is uncorrelated with k, h uncorrelated with c0, c1 in each scenario, and positively correlated with cb. In addition, the shipping demand Di* in Proposition 8 (vi) is uncorrelated with η, ω, c1 in the given scenario. Normally, an increase in the cost coefficient leads to a decrease in the optimal decision because the larger the input cost parameter is, the greater the input cost becomes. However, through the above analysis, we find that cost coefficients may be uncorrelated or even positively correlated with the optimal decision under certain circumstances, which may be attributed to the dynamics of the cost-revenue trade-off. When the rate of revenue increase matches the rate of cost coefficient growth, the firm’s optimal decision may remain unchanged. Although the cost coefficient increases, it can attract more shippers who prioritize information technology and service quality. This is beneficial to the port’s sustainable development in the long run, resulting in a positive correlation between the cost coefficient and the optimal decision.

5.3. Effects of Blockchain Technology

Our analysis of port

VER parameters in

Section 5.2’s steady-state examination revealed multiple advantages for both ports and shipping firms engaging in emissions reduction initiatives. Building on these findings, this section contrasts various blockchain scenarios against non-blockchain approaches, demonstrating how such technological integration can significantly enhance emissions reduction efforts.

Proposition 9. Effects of blockchain technology established by the port company on the optimal decisions of the shipping supply chain are as follows:

(i) ; (ii) ; (iii) ; (iv) ;

(v);

See Supplementary S2 for relevant important critical points regarding Proposition 9. Proposition 9 analyzes changes in emissions reduction levels and service levels when ports invest in blockchain platforms compared with non-blockchain scenarios. Proposition 9 (i) demonstrates that neither blockchain investment nor non-investment affects shipping companies’ emissions reduction efforts. From Proposition 9 (ii) and (iii), it can be observed that ports’ investment in blockchain technology reduces both the green investment level and emissions reduction level in the shipping supply chain compared to non-blockchain scenarios. This finding is unexpected due to the fact that in the PB scenario, ports are responsible for blockchain investments while shipping companies adjust their strategies as followers. The port’s investment in the blockchain may have taken away resources that would have been used for green investment. The Cost Assumptions section mentions that both the cost of green investment and the cost of blockchain investment are quadratic functions, which implies increasing marginal costs. The port allocates its budget between the two. An increase in blockchain investment may lead to a decrease in green investment. Proposition 9 (iv) indicates that shipping service levels under blockchain technology become higher when ω is sufficiently small, i.e., when blockchain unit operating costs remain low. When the blockchain unit operating cost ω exceeds a critical value ωth2, the level of blockchain investment bj* by ports and shipping companies drops significantly, even if the technology has perfect functionality. This maps to the reality of IBM-Maersk TradeLens’ dilemma, where small and medium-sized shipping companies have low adoption rates due to excessive technology licensing fees. In other words, elevated ω in the model directly affects the quality of service S(t) and the demand D(t) through the decline in bj*. According to Proposition 9 (v), transportation demand under blockchain technology exceeds that of non-blockchain scenarios beyond a specific threshold. This is because technological advancements following blockchain implementation reduce operational costs, aligning increased market demand with market dynamics and consequently expanding market share.

Proposition 10. Effects of blockchain technology established by the shipping company on the optimal decisions of the shipping supply chain are as follows:

(i) ; (ii) ; (iii) ; (iv) ;

(v) ;

See Supplementary S2 for relevant important critical points regarding Proposition 10. Proposition 10 analyzes shipping companies’ investment in blockchain technology. Proposition 10 (ii) demonstrates that blockchain investment decisions (whether to invest or not) do not affect the port’ s green investment level. From Proposition 10 (i) and (iii), it can be observed that a shipping company’ s blockchain investment reduces both the port’ s emissions reduction efforts and emissions reduction levels compared to non-blockchain scenarios. At first glance, this outcome appears to run counter to blockchain technology’s fundamental purpose. However, when shipping firms invest in blockchain systems, they incur substantial expenses—from acquiring specialized equipment to training personnel and covering various ancillary costs. These additional financial pressures have forced enterprises to reduce their budgets for research and development of emissions reduction technologies and equipment upgrading in the short term, thus objectively weakening their investment in environmental protection, and leading to a stage-by-stage decline in the effectiveness of emissions reduction. From Proposition 10 (iv), the shipping service level under blockchain technology is higher if ω is smaller, i.e., the blockchain unit operating cost is lower. This is because the lower blockchain unit operating costs allow shipping companies to leverage the benefits of blockchain technology more fully. According to Proposition 10 (v), the demand under blockchain technology is greater than the no blockchain scenario for a certain threshold. This is because as technological advances following blockchain investments bring down costs, the increase in market demand is in line with the changing patterns of the market, thus increasing market share.

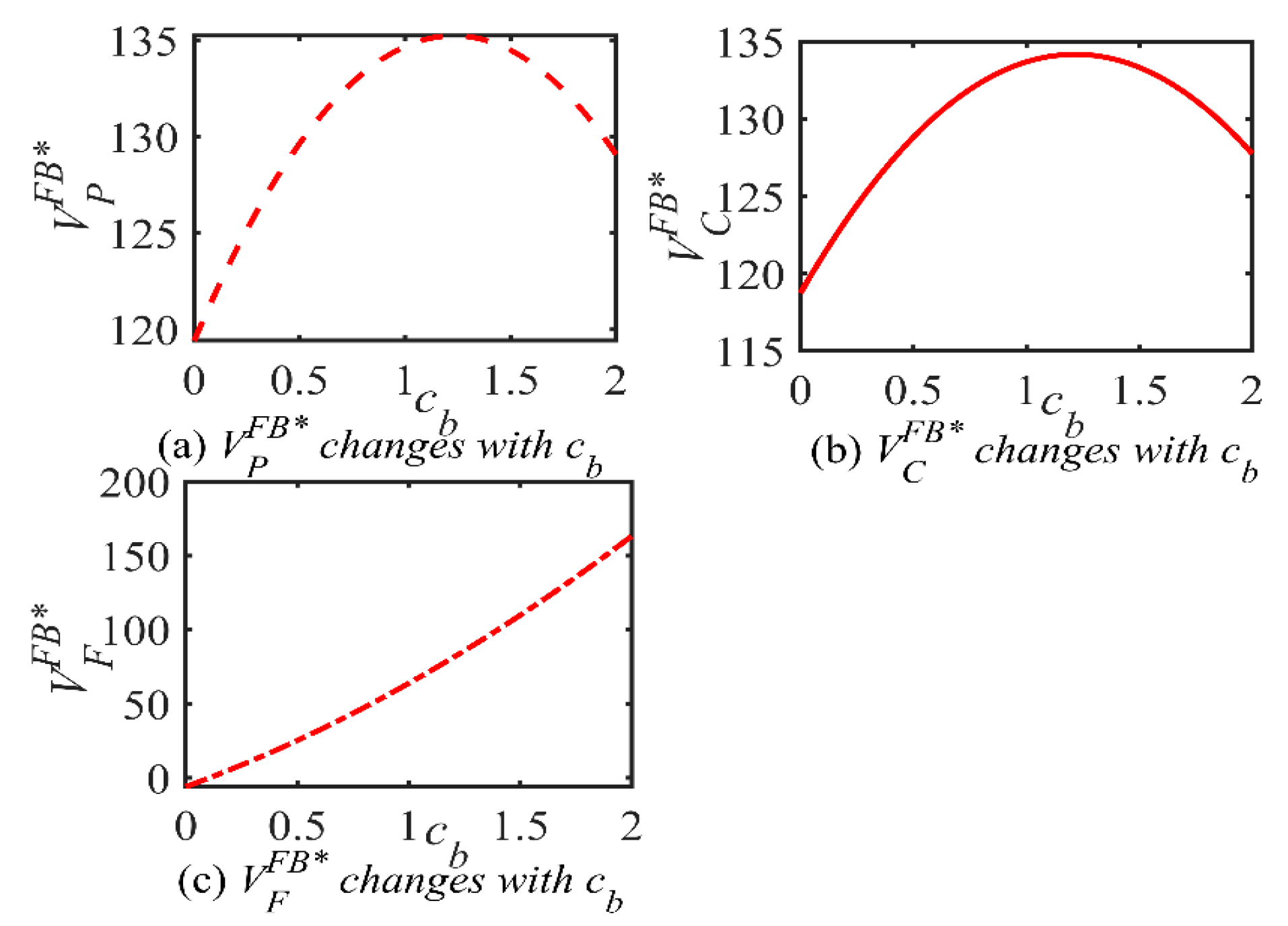

Proposition 11. Effects of the shipping logistics blockchain platform on the optimal decisions of the shipping supply chain are as follows:

- (i)

;

- (ii)

;

- (iii)

;

- (iv)

;

- (v)

;

Proposition 11 focuses on the impact of a shipping logistics blockchain platform on optimal decision-making in the shipping supply chain, comparing scenarios with and without blockchain technology. Proposition 11 (i)–(iii) illustrate that when the blockchain usage fee charged by the shipping logistics blockchain platform is low, the shipping company’s emissions reduction efforts, the port’s green investment level, and emissions reduction levels in the shipping supply chain are generally higher than in non-blockchain scenarios. This is because the lower blockchain usage fee lowers the threshold for port and shipping enterprises to use the technology, making them more willing to increase the application of blockchain technology at a manageable cost. When port and shipping companies join the shipping logistics blockchain platform, they can exchange data in real time and work together to formulate emissions reduction plans to further promote emissions reductions. From Proposition 11 (iv), it can be observed that blockchain platform operating costs decrease when ω is sufficiently small, i.e., when blockchain unit operating costs remain low. This enables improved shipping service levels following substantial blockchain technology investments. Blockchain’ s cost-efficient operations allow the platform to run with minimal expenses, paving the way for widespread adoption by port and shipping companies. This economic advantage makes the technology a viable solution for large-scale implementation across the industry. According to Proposition 11 (v), the demand under blockchain technology is greater than the no-blockchain case for a certain threshold. The application of blockchain technology can optimize supply chain management, improve transportation efficiency, and reduce operating costs. These cost reductions can translate into price advantages, attracting more customers to choose the shipping company’s services.

5.4. Blockchain Investment Strategy

Section 5.3 reveals that blockchain technology investments can boost demand under specific circumstances. Building on these findings, this section examines how operational approaches evolve when various stakeholders adopt blockchain solutions.

Proposition 12. The comparative analysis of the two blockchain scenarios PB and CB is as follows:

(i) ; (ii) ; (iii) ;

(iv) ;

(v) ;

(vi) ;

See Supplementary S2 for relevant important critical points regarding Proposition 12. Proposition 12 compares the differences in operational strategies between PB and CB blockchain scenarios. Proposition 12 (i) and (ii) state that if a port invests in blockchain technology, shipping companies will take more aggressive emissions reduction measures than under the CB model, while the port’ s green investment will be correspondingly lower. In the CB scenario, shipping companies as “edges” grasp core data such as ship emission trajectories and route efficiency, and ports as “nodes” rely on their shared information to adjust service strategies. This information symmetry structure of “strong edges and weak nodes” leads to a lower synergy efficiency of shipping emissions reduction efforts than in the PB scenario. In the PB scenario, the port, as the leading party of blockchain investment, has a guiding effect on the entire supply chain. Ports have improved supply chain transparency and collaboration through blockchain technology, prompting shipping companies to increase their efforts to reduce emissions to adapt to the new environment and remain competitive. As ports have focused on investing in blockchain technology, this has resulted in relatively fewer resources for green investment, which in turn has reduced the level of green investment. When the port service fee is higher, ports have higher levels of blockchain investment, emissions reductions, demand, and shipping service levels than shipping companies. When the port service fee is higher, the port’s level of blockchain investment, level of emissions reductions, level of de-demanding and level of shipping services are higher than those of the shipping company. This inconsistency with the common intuition that port-led investments better integrate resources and reduce costs is due to the fact that ports need to incur more blockchain infrastructure construction costs in PB scenarios, which in turn raises the cost of service. The more the port invests, the lower price makes consumer demand increase, which in turn leads to an increase in the level of emissions reduction and the level of service.

Proposition 13. The comparative analysis of the two blockchain scenarios PB and FB is as follows:

(i) ; (ii) ;

(iii) ;

(iv) ;

(v) ;

(vi) ;

See Supplementary S2 for relevant important critical points regarding Proposition 13. Proposition 13 analyzes the blockchain usage fee charged by shipping logistics blockchain platforms. When royalty fees are set at higher levels, emissions reduction efforts by shipping companies and green investment levels by ports under the PB scenario exceed those under the FB scenario. This occurs because shipping companies and ports proactively intensify emissions reduction initiatives to achieve cost savings. In the PB scenario, where the port leads blockchain investments, elevated user fees incentivize ports to prioritize operational efficiency improvements and energy consumption reduction as compensatory measures. These strategic adjustments further motivate shipping companies to enhance their emissions reduction efforts in alignment with the port’ s overarching sustainability goals. Conversely, in the FB scenario, despite joint participation by ports and shipping enterprises in the blockchain platform, high operational costs create significant pressure on cost-sharing mechanisms among stakeholders. This financial burden may partially inhibit enthusiasm for green investments and emissions reduction initiatives. When the fee is low, the port still bears the main investment cost. This may limit the port’s ability to invest in other emissions reduction related areas, resulting in a relatively low level of emissions reduction. However, ports have absolute control over the application of technology and service enhancement resulting in higher service levels. The multi-party consensus mechanism in the FB scenario ensures that the green investment effect of the port is synchronized with the emissions reduction efforts of the shipping companies in real time, forming a positive feedback mechanism of “node emission reduction–edge response”. In the PB scenario, the port, as the single dominant party, may ignore the actual operational constraints of the shipping company, resulting in a decrease in symmetric collaboration efficiency.

Proposition 14. The comparative analysis of the two blockchain scenarios CB and FB is as follows:

- (i)

;

- (ii)

;

- (iii)

- (iv)

;

- (v)

;

- (vi)

;

See Supplementary S2 for relevant important critical points regarding Proposition 14. Proposition 14 aligns with the conclusions derived from Proposition 13. The level of blockchain investment in the case of shipping companies investing in blockchain technology is higher than that in the case of port and shipping companies jointly participating in a shipping logistics blockchain platform when the fees charged are higher. Distinguished from the single-subject dominance of the PB or CB scenario, the FB scenario ensures complete symmetry of key parameters such as emissions reduction level E(t), service level S(t), and cost of blockchain usage cb through a multi-node consensus algorithm, eliminating “node–edge” or “edge–node” information privileges. In the CB scenario, as primary investors in blockchain infrastructure, shipping companies actively intensify their blockchain investments to offset high operational costs. Given the substantial capital commitment, these firms exhibit heightened expectations regarding investment returns. By increasing blockchain technology investments, they aim to achieve enhanced supply chain efficiency, thereby strengthening market competitiveness and securing greater profit margins. Conversely, in the FB scenario, despite collaborative participation by ports and shipping companies in the blockchain platform, the overall blockchain investment level remains comparatively subdued when confronted with high usage costs.

6. Extended Analysis

Earlier analyses overlooked how investing in blockchain technology directly affects carbon emissions in shipping transport. However, if we were to factor in the environmental credibility provided by blockchain-based green certification, how would this alter the outcome? In this section, the green trust coefficient of shippers

m = 1 −

is introduced into the

N case, indicating low-carbon preference shippers’ trust in the emissions reduction process in the shipping industry. Consequently, leveraging the inquiries, the differential game model of traditional shipping supply chain under scenario

N1 is constructed as follows:

The demand of shippers without blockchain is expressed as follows:

The demand of shippers with blockchain is expressed as follows:

Theorem 5. In scenario N1 where there is no blockchain and considering low-carbon-preference shippers are distrustful of shipping industry emissions reductions, the optimal green investment level gN1* of port company and the optimal emissions reduction effort aN1 shipping company in the shipping supply chain are as follows: Corollary 5. In scenario N1 where there is no blockchain and considering low-carbon-preference shippers are distrustful of shipping industry emissions reductions, the optimal dynamic trajectories of emissions reduction operation strategies for the shipping supply chain are as follows: Under blockchain technology = 1, by comparing PB, CB, and FB with N1, it can be inferred that when blockchain technology is utilized for green certification during the emissions reduction process of the shipping supply chain to boost shippers’ green trust, the impact of the blockchain technology established by port companies on the optimization decision of the shipping supply chain is as follows:

Proposition 15. When blockchain technology can be used for green certification in emissions reduction processes to enhance shippers’ green trust, the effects of blockchain technology established by the port company on the optimal decisions of the shipping supply chain are as follows:

(i) ; (ii) ;

(iii) ;

(iv) ;

See Supplementary S2 for relevant important critical points regarding Proposition 15. Proposition 15 (i) indicates that the emissions reduction efforts in the PB scenario are higher than those in the N1 scenario. In the PB scenario, after the port company invests in blockchain technology, the characteristics of blockchain make all aspects of the supply chain more transparent and traceable. Contrastingly, in the N1 scenario, the port’ s ability to oversee and handle the shipping firm is hamstrung by the absence of blockchain support. This shortfall diminishes the company’ s motivation to slash emissions, leaving efforts to reduce pollutants somewhat lackluster. Proposition 15 (ii), (iii) shows that when low-carbon-preference shippers have a higher level of distrust in the shipping industry’ s emissions reduction efforts, investing in blockchain can improve transparency and trust, thereby enhancing the level of emissions reduction. This suggests that even if initial trust is low, the transparency of the blockchain can significantly increase the effectiveness of mitigation, challenging the conventional wisdom that low trust is difficult to reverse. The shipping sector’ s faith in the efficacy of carbon-reduction measures among eco-conscious shippers significantly influences their selection of shipping options. In the N1 scenario, shippers’ lack of trust in the shipping industry’ s ability to reduce emissions could lead them to reduce their demand for shipping services or to opt for greener but more costly alternative modes of transport. Proposition 15 (iv) shows that when there are other factors influencing the scenario, investing in blockchain technology increases demand due to enhanced shipper trust.

Proposition 16. When blockchain technology can be used for green certification in emissions reduction processes to enhance shippers’ green trust, the effects of blockchain technology established by the shipping company on the optimal decisions of the shipping supply chain are as follows:

(i) ; (ii) ;

(iii) ;

(iv) ;

See Supplementary S2 for relevant important critical points regarding Proposition 16. Proposition 16 (i), (iii) show that the emissions reduction efforts in the CB scenario are higher than those in the N1 scenario. In the CB scenario, shipping companies’ investment in blockchain technology enables them to monitor and manage carbon emissions from ship operations more accurately. Blockchain technology can record a ship’s fuel consumption, sailing routes, and other operational data in real time, providing shipping companies with precise carbon emission analytics. Leveraging this data, shipping companies can systematically enhance the level of emissions reduction. In contrast, in the N1 scenario, shippers’ distrust of emissions reduction claims makes them more cautious about their choice of shipping services, which negatively impacts the business volume of shipping companies. Proposition 16 (iv) demonstrates that when other factors are considered, the CB scenario increases demand by strengthening shippers’ trust. In this scenario, blockchain technology not only contributes to emissions reduction but also offers significant advantages in improving service quality and customer experience.

Taken together, Propositions 15 and 16 point to the same fundamental insight: when environmentally conscious shippers grow increasingly skeptical about the shipping sector’s commitment to cutting emissions, blockchain investments yield substantially greater returns. The findings reveal a direct correlation—the deeper this distrust runs among eco-minded shipping clients, the more value blockchain technology delivers.

Proposition 17. When blockchain technology can be used for green certification in emissions reduction processes to enhance shippers’ green trust, the effects of the shipping logistics blockchain platform on the optimal decisions of the shipping supply chain are as follows:

(i) ; (ii) ;

(iii) ;

(iv)

Proposition 17 (i) and (ii) compare the emissions reduction efforts of shipping companies and the green investment levels of ports in the FB scenario versus the N1 scenario. When shippers’ distrust is higher, both the emissions reduction efforts of shipping companies and the green investment levels of ports in the FB scenario exceed those in the N1 scenario. In the FB scenario, ports and shipping companies jointly participate in the blockchain platform, and the abatement data jointly provided by multiple parties can strengthen customer selection and create a scale effect on the demand side. In the face of stringent emissions regulation, the FB scenario can meet compliance requirements more efficiently and avoid the cost of repeatedly interfacing with different regulatory systems due to the unified data format and multi-party consensus mechanism. However, in Proposition 17 (iii), the lower the degree of distrust that shippers have toward the shipping industry’ s emissions reduction efforts, the higher will be the levels of emissions reductions achieved through joint participation of ports and shipping enterprises in the shipping logistics blockchain platform. This is because shippers are more willing to provide incentives for low-carbon transportation services, such as reduced insurance rates and prioritized freight payments, thereby creating an effective mechanism to encourage ports and shipping companies to actively reduce emissions under the blockchain-enabled collaboration. In contrast, if the shippers do not trust these emissions reductions, ports and shipping companies may face market pressures, economic losses, and insufficient incentives to increase investments in emissions reduction. Additionally, in the FB scenario, blockchain technology’ s ability to enhance cargo owners’ trust can also lead to increased demand under specific conditions.

8. Conclusions

In this paper, we analyze four scenarios through a symmetry-aware dynamic model to investigate the impact of blockchain technology on shipping supply chain emissions reduction and operational strategies. Leveraging differential game theory and graph-theoretic principles, we frame ports as nodes and shipping firms as edges in a symmetrically interconnected network, constructing state equations for emissions reductions and service levels. By solving HJB equations, we derive optimal decisions under each scenario, revealing how structural symmetry (e.g., balanced port-shipping collaboration) and operational asymmetry (e.g., cost disparities) shape outcomes. Comparative and parametric analyses further demonstrate how blockchain’s distributed symmetric architecture enhances information symmetry, reduces node–edge coordination inefficiencies, and improves network diagnosability (e.g., identifying emission-critical ports).

8.1. Key Findings

This study derives the principal findings as follows. We find that under a symmetry-driven dynamic framework, emissions reduction efforts, service levels, demand, and profits exhibit trajectories akin to graph-theoretic equilibria increased rapidly before stabilizing (Propositions 1–4). In the NB scenario, low initial emissions levels prompt ports (nodes) and shipping firms (edges) to enhance performance through green investments, while blockchain’s distributed symmetric architecture optimizes node–edge collaboration by eliminating information asymmetry. Blockchain’s symmetric transparency reshapes emission decisions by enhancing shippers’ trust, indirectly improving performance through a low-carbon demand–investment–trust cycle (Propositions 5–8). Port- or shipping-led blockchain investments initially divert resources but long term, they enable node-level diagnosability (identifying emission-critical ports) and edge-level coordination. The port-led model is suitable for low-cost investment scenarios. When the blockchain operation cost is controlled within a reasonable range, the initial technology investment of the port will increase capital expenditure, but in the long run, it can realize profitability by improving customs clearance efficiency and attracting low-carbon cargo owners. Shipping company-led models are more valuable in high freight markets. A shipping company-owned blockchain platform could enhance customer trust by improving logistics transparency, allowing for service premiums and optimizing cost efficiency for abatement. Joint blockchain platforms achieve network-wide symmetry via multi-party data sharing, reducing regulatory costs through combinatorial optimization of emissions tracking. Threshold conditions for win–win outcomes depend on symmetry–asymmetry trade-offs between costs and benefits. Port-led investments thrive under cost symmetry (low blockchain operating costs), while shipping firms leverage asymmetric service premiums in high-freight environments (Propositions 9, 10 and 12). Joint platforms require synergistic symmetry between platform fees and trust, mirroring restricted connectivity optimization in multiprocessor systems (Propositions 11, 13, and 14). The core of the reason why blockchain platforms with joint participation can realize a “win–win” situation is that all parties have formed a stable cooperation mechanism of risk sharing and equal benefit sharing by reasonably sharing the cost of technological inputs and sharing the benefits of the data. In contrast, the stability of a single subject-led scenario (e.g., a port or shipping company building a blockchain alone) is highly dependent on whether the dominant party can control the cost of technological application within a reasonable range. If the cost borne by the dominant party is too high, it may lead to the withdrawal of the cooperating parties due to declining returns, destroying the balance of the system. Node–edge asymmetry dictates optimal blockchain leadership: ports (nodes) excel in cost control via customs efficiency and transparency, while shipping firms (edges) profit from demand-driven route optimization. Joint platforms, though constrained by multi-node costs, achieve resource symmetry through alliance chains (e.g., Shanghai Port’s paperless platform), balancing logistics costs and emissions efficiency via graph neural network-inspired coordination.

From the perspective of symmetry, the shipping supply chain, with the help of the distributed blockchain architecture, has achieved a deep transformation from information asymmetric game to system symmetrical collaboration. This transformation has fundamentally reshaped the decision-making logic and benefit distribution mechanism. Under the traditional model, port and shipping enterprises were trapped in the predicament of local optima due to information barriers. Emissions reductions investment and service improvement worked independently, making it difficult to form a synergy effect. Then, distributed book blockchain technology broke the data island, enabling the parties to operate based on real-time sharing of a transparent information strategy, promoting efforts and green investment to move from isolated decision-making to joint optimization of resource allocation efficiency. This symmetric reconstruction is not only an upgrade of technological application but also an innovation of the underlying collaboration mechanism in the supply chain. It enables port and shipping enterprises to strike a balance between emissions reductions targets and economic goals, drive decision-making coordination through information symmetry, and ultimately achieve a win–win situation of economic and environmental benefits for the entire system, providing a new paradigm with both theoretical value and practical significance for the sustainable transformation of the global shipping industry.

Furthermore, the unique contribution of this study lies in optimizing the two shipping supply chain network structures (Structure A and Structure B), supported by blockchain, through differential game theory, and deeply coupling the node–edge dynamics in graph theory with the game equilibrium strategy. By analyzing the reconstruction effect of blockchain platform nodes on the network topology, we reveal how the distributed symmetric architecture drives the traditional hierarchical channel strategy to evolve towards multi-party collaborative equilibrium through node diagnosability, edge coordination, and global connectivity optimization, providing a dynamic framework with both theoretical strictness and practical adaptability for intelligent decision-making in shipping emissions reduction.

8.2. Managerial Insights

From these key findings, the following managerial implications emerge:

First, the government should actively promote the standardized application of blockchain technology in the shipping industry, such as establishing a unified data-sharing interface and green certification system. Simultaneously, the government should take the lead in or subsidize the construction of a “Shipping Blockchain Public Service Platform” to provide basic services and lower the technical threshold for small and medium-sized enterprises. For example, regional alliance chains could be established relying on the “Yangtze River Economic Belt” and the “Guangdong–Hong Kong–Macao Greater Bay Area,” connecting hubs such as Shanghai Port and Ningbo–Zhoushan Port. These chains would enable real-time sharing and supervision of ship emission data, as well as blockchain-based processes for port charging, carbon trading, and other operations to enhance transparency.

Second, port enterprises should prioritize blockchain investment in low operating cost scenarios and attract low-carbon cargo owners by improving customs clearance efficiency (such as automatic customs declaration with smart contracts). Shipping companies should lead blockchain investment in scenarios with high sensitivity to market demand and improve service premium capabilities by optimizing route transparency (such as COSCO Shipping blockchain route tracking). At the same time, it should be noted that when ports or shipping companies build blockchain separately, they need to reserve sufficient cost buffer space in advance to cope with the increased cost of technical maintenance or service restoration caused by unexpected disruptions. If operating costs fluctuate greatly, shipping companies may consider building blockchain systems on their own in order to more flexibly adjust their transportation strategies in response to changes in costs, to maintain revenues by improving service transparency and efficiency during high-cost periods, and to expand their market share during low-cost periods. In addition, when investing in emissions reduction and blockchain technology, maritime companies must prioritize the equilibrium of cost containment and revenue management. By rationalizing shipping prices and port service charges, it ensures that the profitability of enterprises is maintained while the levels of emissions reductions and service are enhanced.

Third, shifting key parameters suggests an evolving port market landscape. In this case, port and shipping companies need to be keenly aware of these changes and optimize and adjust the cost of investing in blockchain technology in a timely way. Through continuous improvement, we can maximize the motivation of port enterprises to reduce emissions and enhance efficiency, so that they can maintain their competitiveness in the ever-changing market environment and achieve sustainable development.

8.3. Limitations and Future Research

This study has certain limitations. First, the model assumptions, although based on reality, are simplified and may not fully reflect the complexity of the shipping supply chain. For example, in reality, there are many participants with complex relationships, while the model only considers the case of one port and one shipping company. Second, this study only partially covers the factors that affect the decision to invest in and reduce emissions from blockchain technology. It ignores external factors such as macroeconomic fluctuations and policy instability, as well as internal factors such as management culture and the difficulty of technological integration within the enterprise. Third, the technical modeling of this study is based on the assumption of global interoperability of blockchain, but political and institutional constraints may significantly affect its applicability in reality. Future research needs to further internalize institutional variables such as multi-national data sovereignty rules and international carbon tariff games and construct a more politically flexible blockchain–emissions reduction collaborative model. In addition, the current work on blockchain-based shipping emissions reduction is still in the theoretical stage, with significant limitations, namely the lack of empirical-level validation. Future research needs to extend from theory to practice to promote blockchain technology to truly serve the realization of shipping emissions reduction goals, and fill the critical gap from theory to reality. Finally, this study examines how blockchain technology contributes to lowering carbon emissions, while also paving the way for future research into its broader applications across supply chain management systems.