Evaluating Time Irreversibility Tests Using Geometric Brownian Motions with Stochastic Resetting

Abstract

1. Introduction

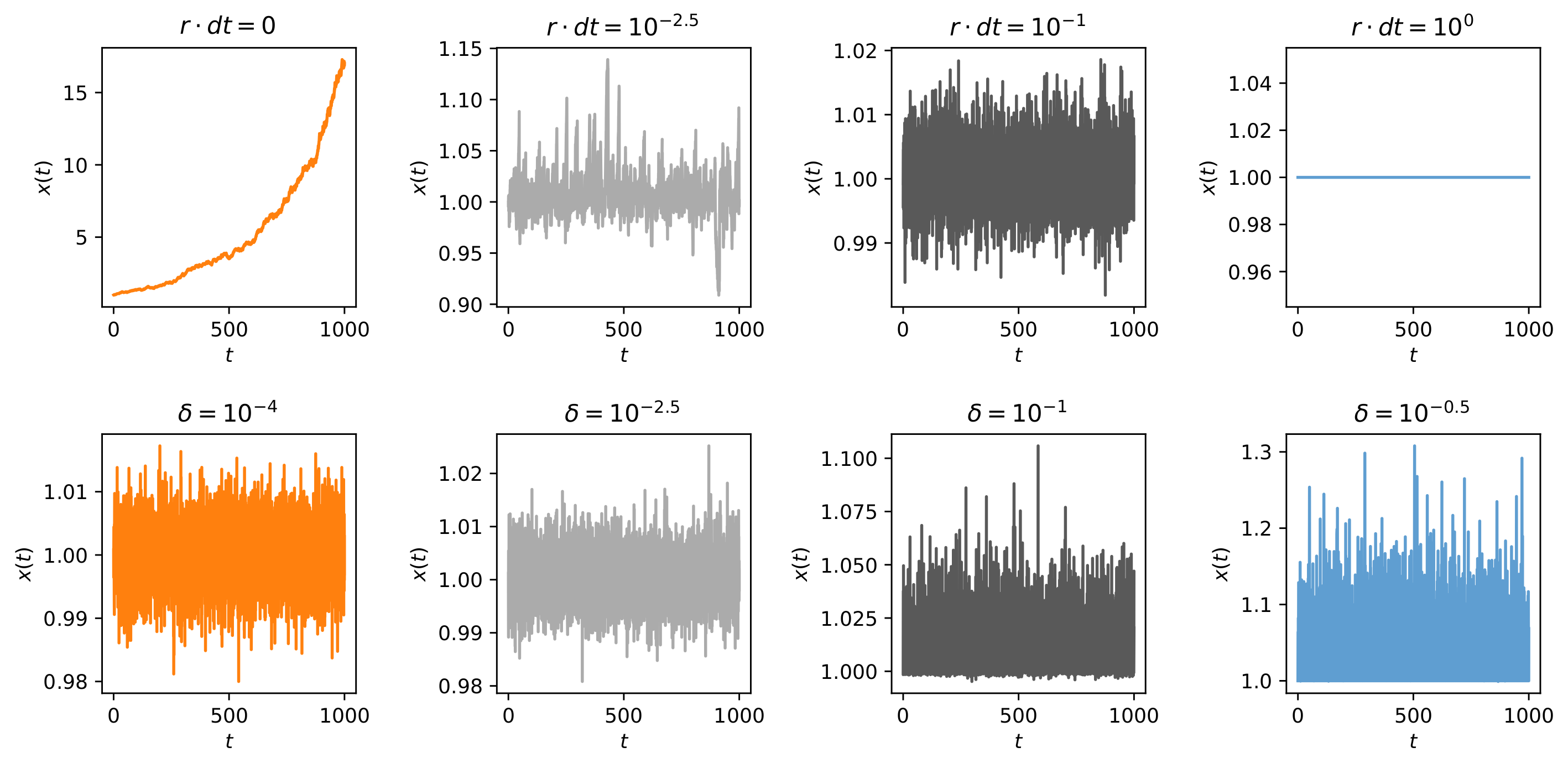

2. The Geometric Brownian Motion Under Stochastic Resetting

3. Tests for Time Irreversibility

- Pomeau’s test. To the best of our knowledge, this test was the first one ever proposed for the study of real-world time series. It is based on the evaluation of a function asymmetric with respect to time:with being a lag constant [17]. is then compared against the values obtained for a large set of randomly shuffled time series, in order to extract a p-value. We here consider .

- Diks’ test. The second numerical test to be proposed to detect irreversibility in data, it is based on extracting vectors representing subsets of the original time series, e.g., non-overlapping sub-windows with embedding dimension m and embedding delay , and on estimating the distance between these and their time-reversed counterpart through an unbiased estimator under the null hypothesis of independence [18]. We here use and .

- BDS statistics. Initially proposed by Broock, Dechert and Scheinkman as a test to check for the presence of low-dimensional chaos in economic and financial data [19,20], it was later used also for the detection of irreversibility. Given a time series composed of T observations, the statistic is defined aswith being the sample correlation integral at embedding dimension m and scaling parameter r and the estimated standard deviation of the statistic under the null hypothesis of independence. Under the null hypothesis of independent (and hence, time symmetrical) data, is distributed asymptotically as . We here consider the standard value .

- Visibility Graphs. A recently proposed family of approaches to analyse time series is the one based on representing these as complex networks [21,22], whose nodes correspond to the individual data points, and pairs of nodes are connected when they fulfil some geometrical rule. We here consider the so-called directed Horizontal Visibility Graphs (dHVGs) as a representative of this family, in which pairs of nodes are connected if the line joining the corresponding values is not obstructed by another intermediate point, or, in other words, if these nodes can “see” each other [23]. A time series is then reversible if the distributions of in- and out-degrees (i.e., respectively, the number of links arriving to and departing from a given node) are the same according to an Epps–Singleton test [24].

- Permutation pattern test. Independently proposed by several groups [25,26,27,28], these tests are based on representing the time series as sequences of permutation patterns, i.e., (usually short) patterns describing the order that has to be applied to sort them in increasing order [29], for then comparing the distributions obtained in the original and time-reversed versions. We here consider embedding dimensions of and compare the frequency of appearance of time-symmetric patterns using a binomial test as suggested in Ref. [25].

- Ternary Coding test. Conceptually similar to the previous one, the Ternary Coding test is based on the idea of representing a time series as a sequence of symbols and then evaluating the difference in their frequency under a time-reversal operation [30]. Specifically, a time series is firstly differentiated as and secondly transformed according toThe full test is constructed by splitting the time series into D non-overlapping segments and evaluating if the difference in the frequency of the three symbols is statistically significant. We here consider .

- Costa index. Costa and coauthors proposed this test in the context of the study of heartbeat dynamics [31], and it involves comparing the number of times the time series increases or decreases—i.e., vs. . A p-value is further calculated by comparing such asymmetry with the one obtained in randomly shuffled time series.

- Continuous Ordinal Patterns (COPs). Continuous Ordinal Patterns elaborate on the idea of permutation patterns previously introduced and are based on fixing a short pattern of size D for a whole time series and calculating the distance of each sub-window in the original time series to such a reference pattern [32]. In other words, the original time series is transformed into a new one measuring how well the COP under study describes it through time. An irreversibility metric can then be constructed by finding the COP maximising the distance between the original and the time-reversed time series, the distance being evaluated through a two-sample Kolmogorov–Smirnov test. We here consider .

| Metric Family | Metrics | Reference | Parameters |

|---|---|---|---|

| Classical time series analysis | Pomeau’s test | [17] | |

| Diks’ test | [18] | ||

| BDS Statistics | [19,20] | ||

| Network-based | Visibility Graphs | [23] | - |

| Symbolic analysis | Permutation patterns test | [25] | |

| Ternary Coding test | [30] | ||

| Others | Costa index | [31] | - |

| Continuous Ordinal Patterns | [32] |

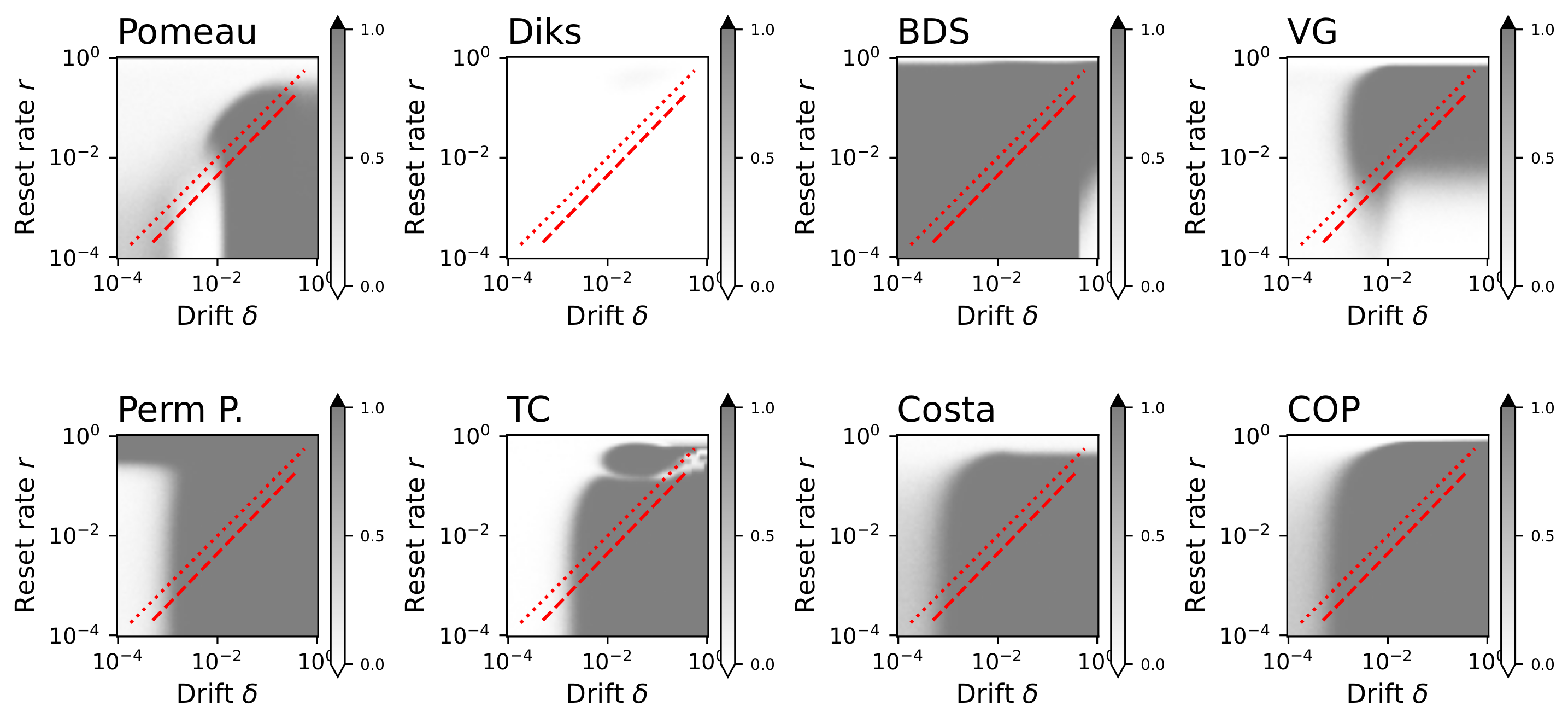

4. Results

4.1. Main Model Parameters

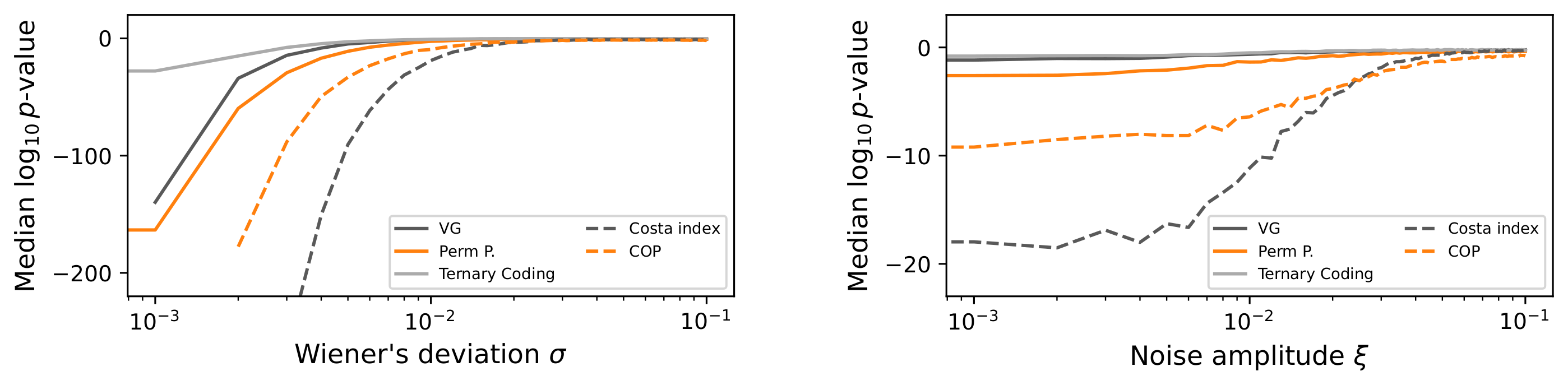

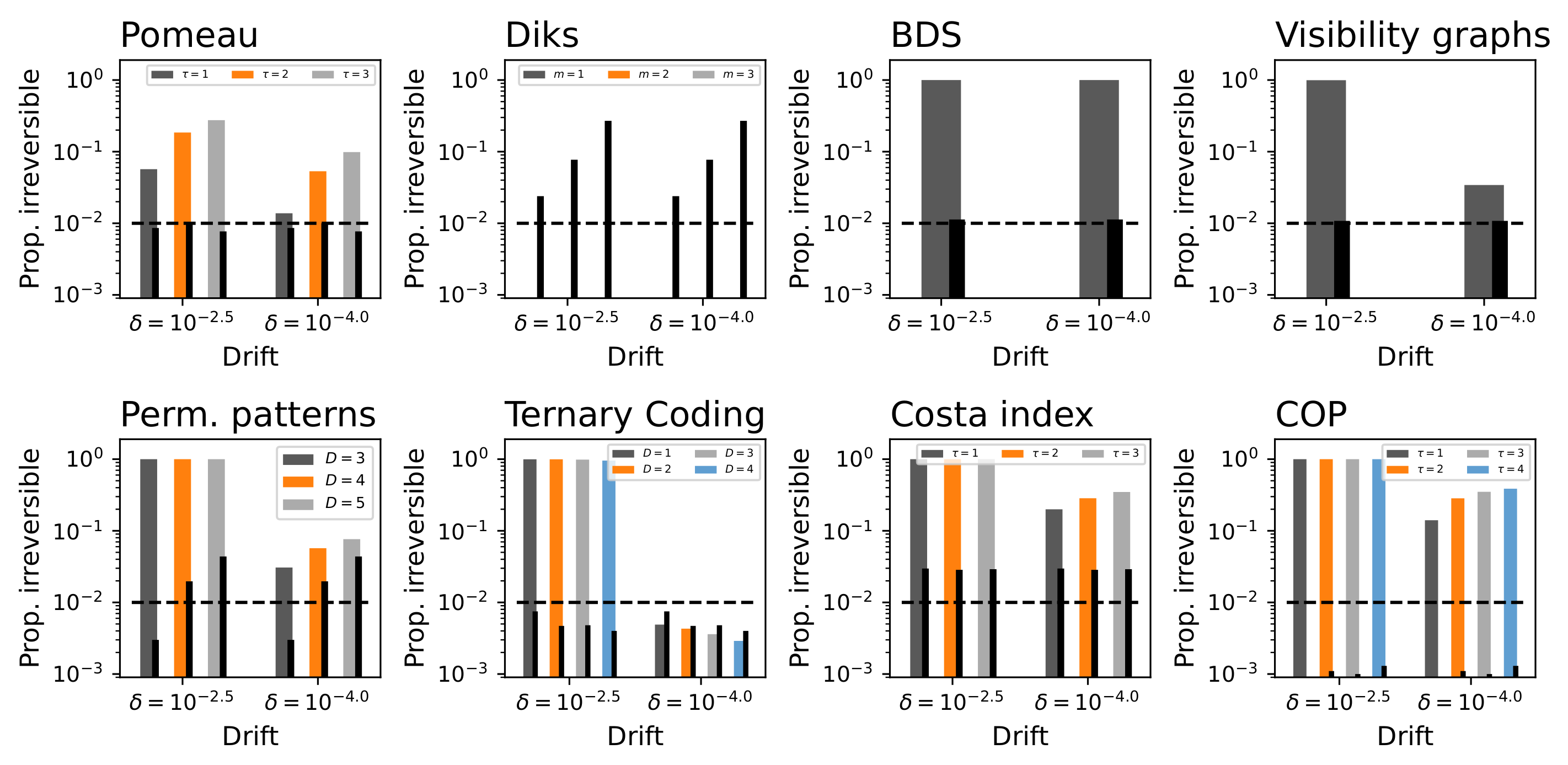

4.2. Noisy Dynamics and False Positives

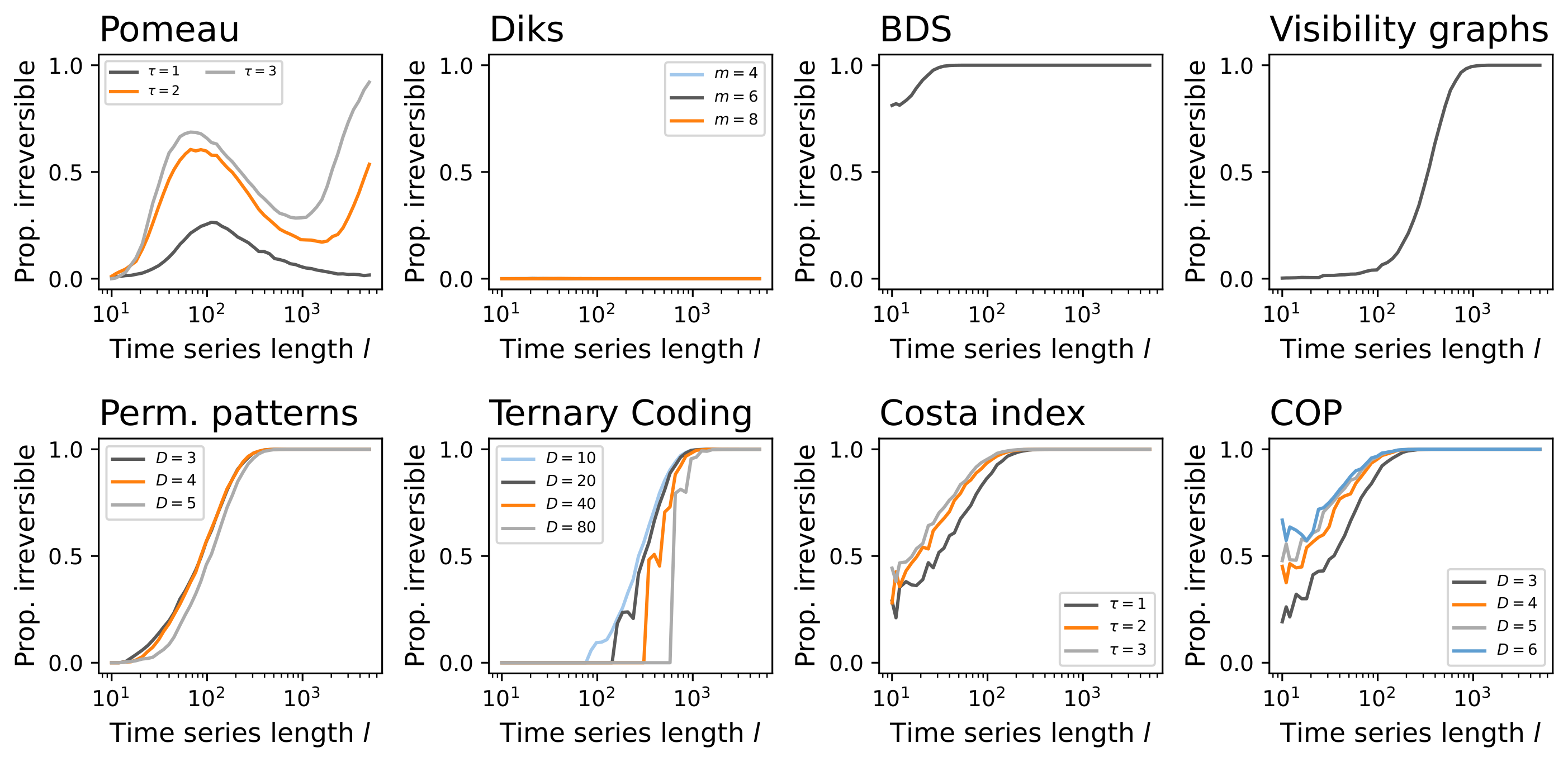

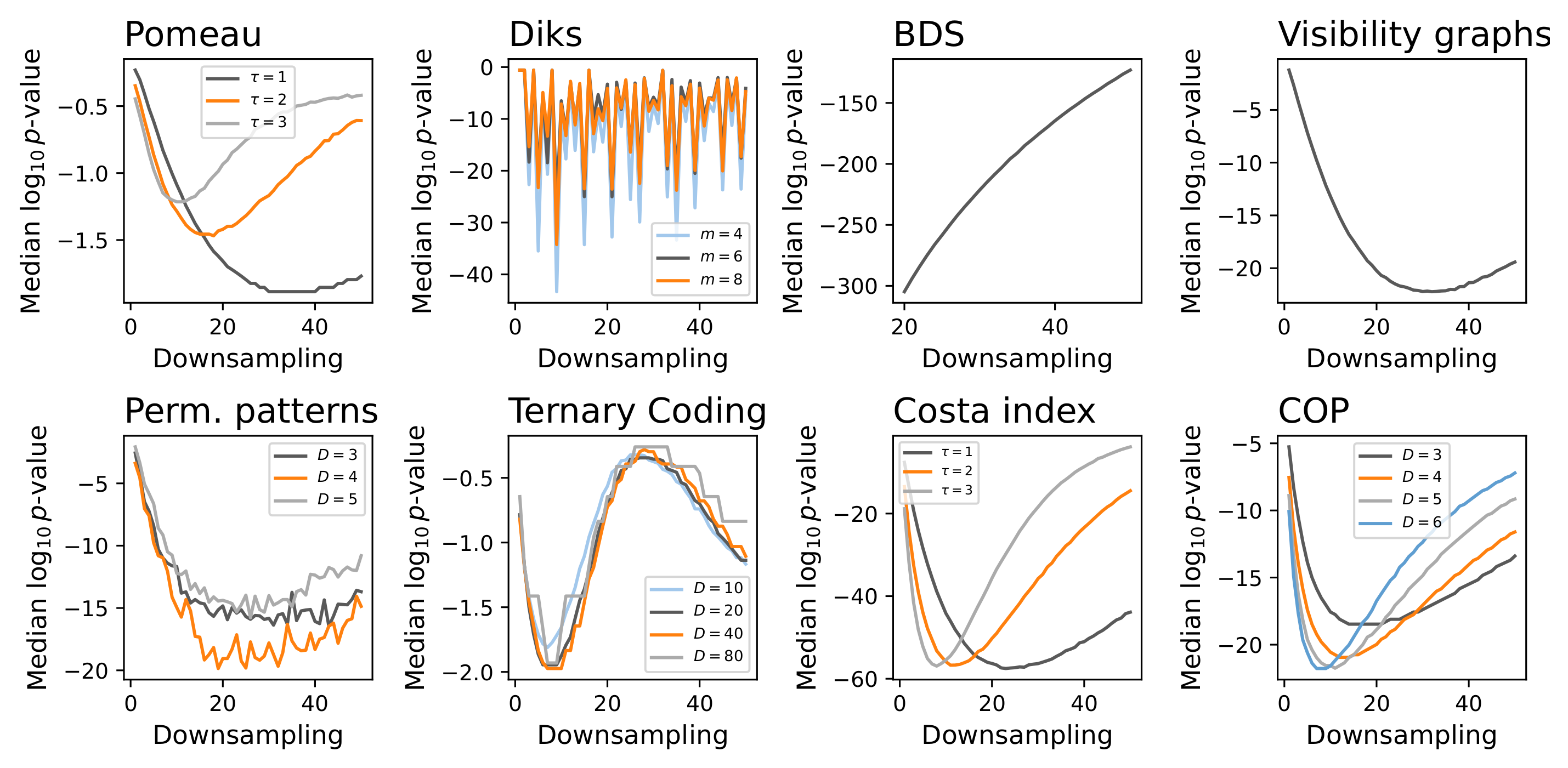

4.3. Multi-Scale

4.4. What Are Irreversibility Tests Detecting?

5. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| srGBM | Geometric Brownian motion with stochastic resetting |

| BDS | Broock, Dechert and Scheinkman |

| VG | Visibility Graph |

| dHVG | Directed Horizontal Visibility Graph |

| COP | Continuous Ordinal Patterns |

References

- Hollinger, H.B.; Zenzen, M. The Nature of Irreversibility: A Study of Its Dynamics and Physical Origins; Springer Science & Business Media: Dordrecht, The Netherlands, 2012; Volume 28. [Google Scholar]

- Weiss, G. Time-reversibility of linear stochastic processes. J. Appl. Probab. 1975, 12, 831–836. [Google Scholar] [CrossRef]

- Puglisi, A.; Villamaina, D. Irreversible effects of memory. Europhys. Lett. 2009, 88, 30004. [Google Scholar] [CrossRef]

- Fodor, É.; Nardini, C.; Cates, M.E.; Tailleur, J.; Visco, P.; Van Wijland, F. How far from equilibrium is active matter? Phys. Rev. Lett. 2016, 117, 038103. [Google Scholar] [CrossRef] [PubMed]

- Zanin, M.; Papo, D. Algorithmic approaches for assessing irreversibility in time series: Review and comparison. Entropy 2021, 23, 1474. [Google Scholar] [CrossRef]

- Stojkoski, V.; Sandev, T.; Kocarev, L.; Pal, A. Geometric Brownian motion under stochastic resetting: A stationary yet nonergodic process. Phys. Rev. E 2021, 104, 014121. [Google Scholar] [CrossRef]

- Burykin, A.; Costa, M.D.; Peng, C.K.; Goldberger, A.L.; Buchman, T.G. Generating signals with multiscale time irreversibility: The asymmetric weierstrass function. Complexity 2011, 16, 29–38. [Google Scholar] [CrossRef][Green Version]

- Nirei, M.; Souma, W. Income distribution and stochastic multiplicative process with reset event. In The Complex Dynamics of Economic Interaction: Essays in Economics and Econophysics; Springer: Berlin/Heidelberg, Germany, 2004; pp. 161–168. [Google Scholar]

- Stojkoski, V.; Sandev, T.; Basnarkov, L.; Kocarev, L.; Metzler, R. Generalised geometric Brownian motion: Theory and applications to option pricing. Entropy 2020, 22, 1432. [Google Scholar] [CrossRef]

- Stojkoski, V.; Jolakoski, P.; Pal, A.; Sandev, T.; Kocarev, L.; Metzler, R. Income inequality and mobility in geometric Brownian motion with stochastic resetting: Theoretical results and empirical evidence of non-ergodicity. Philos. Trans. R. Soc. A 2022, 380, 20210157. [Google Scholar] [CrossRef]

- Gerber, H.U.; Shiu, E.S. Geometric Brownian motion models for assets and liabilities: From pension funding to optimal dividends. N. Am. Actuar. J. 2003, 7, 37–51. [Google Scholar] [CrossRef]

- Reddy, K.; Clinton, V. Simulating stock prices using geometric Brownian motion: Evidence from Australian companies. Australas. Account. Bus. Financ. J. 2016, 10, 23–47. [Google Scholar]

- Damos, P.; Rigas, A.; Savopoulou-Soultani, M. Application of Markov Chains and Brownian Motion Models on Insect Ecology; Nova Science Publishers: Hauppauge, NY, USA, 2011; pp. 71–104. [Google Scholar]

- Jin, F.; Khandpur, R.P.; Self, N.; Dougherty, E.; Guo, S.; Chen, F.; Prakash, B.A.; Ramakrishnan, N. Modeling mass protest adoption in social network communities using geometric brownian motion. In Proceedings of the 20th ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, New York, NY, USA, 24–27 August 2014; pp. 1660–1669. [Google Scholar]

- Engen, S. Stochastic growth and extinction in a spatial geometric Brownian population model with migration and correlated noise. Math. Biosci. 2007, 209, 240–255. [Google Scholar] [CrossRef] [PubMed]

- Roduner, E.; Krüger, T.P. The origin of irreversibility and thermalization in thermodynamic processes. Phys. Rep. 2022, 944, 1–43. [Google Scholar] [CrossRef]

- Pomeau, Y. Symétrie des fluctuations dans le renversement du temps. J. Phys. 1982, 43, 859–867. [Google Scholar] [CrossRef]

- Diks, C.; Van Houwelingen, J.; Takens, F.; DeGoede, J. Reversibility as a criterion for discriminating time series. Phys. Lett. A 1995, 201, 221–228. [Google Scholar] [CrossRef]

- Brock, W.A.; Hsieh, D.A.; LeBaron, B.D. Nonlinear Dynamics, Chaos, and Instability: Statistical Theory and Economic Evidence; MIT Press: Cambridge, MA, USA, 1991. [Google Scholar]

- Rothman, P. The comparative power of the TR test against simple threshold models. J. Appl. Econom. 1992, 7, S187–S195. [Google Scholar] [CrossRef]

- Strogatz, S.H. Exploring complex networks. Nature 2001, 410, 268–276. [Google Scholar] [CrossRef]

- Boccaletti, S.; Latora, V.; Moreno, Y.; Chavez, M.; Hwang, D.U. Complex networks: Structure and dynamics. Phys. Rep. 2006, 424, 175–308. [Google Scholar] [CrossRef]

- Lacasa, L.; Nunez, A.; Roldán, É.; Parrondo, J.M.; Luque, B. Time series irreversibility: A visibility graph approach. Eur. Phys. J. B 2012, 85, 1–11. [Google Scholar] [CrossRef]

- Epps, T.; Singleton, K.J. An omnibus test for the two-sample problem using the empirical characteristic function. J. Stat. Comput. Simul. 1986, 26, 177–203. [Google Scholar] [CrossRef]

- Zanin, M.; Rodríguez-González, A.; Menasalvas Ruiz, E.; Papo, D. Assessing time series reversibility through permutation patterns. Entropy 2018, 20, 665. [Google Scholar] [CrossRef]

- Martínez, J.H.; Herrera-Diestra, J.L.; Chavez, M. Detection of time reversibility in time series by ordinal patterns analysis. Chaos Interdiscip. J. Nonlinear Sci. 2018, 28, 123111. [Google Scholar] [CrossRef] [PubMed]

- Li, J.; Shang, P.; Zhang, X. Time series irreversibility analysis using Jensen–Shannon divergence calculated by permutation pattern. Nonlinear Dyn. 2019, 96, 2637–2652. [Google Scholar] [CrossRef]

- Zunino, L.; Olivares, F.; Ribeiro, H.V.; Rosso, O.A. Permutation Jensen-Shannon distance: A versatile and fast symbolic tool for complex time-series analysis. Phys. Rev. E 2022, 105, 045310. [Google Scholar] [CrossRef] [PubMed]

- Bandt, C.; Pompe, B. Permutation entropy: A natural complexity measure for time series. Phys. Rev. Lett. 2002, 88, 174102. [Google Scholar] [CrossRef] [PubMed]

- Cammarota, C.; Rogora, E. Time reversal, symbolic series and irreversibility of human heartbeat. Chaos Solitons Fractals 2007, 32, 1649–1654. [Google Scholar] [CrossRef]

- Costa, M.; Goldberger, A.L.; Peng, C.K. Broken asymmetry of the human heartbeat: Loss of time irreversibility in aging and disease. Phys. Rev. Lett. 2005, 95, 198102. [Google Scholar] [CrossRef]

- Zanin, M. Continuous ordinal patterns: Creating a bridge between ordinal analysis and deep learning. Chaos Interdiscip. J. Nonlinear Sci. 2023, 33, 033114. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zanin, M.; Trajanovski, P.; Jolakoski, P.; Sandev, T.; Kocarev, L. Evaluating Time Irreversibility Tests Using Geometric Brownian Motions with Stochastic Resetting. Symmetry 2024, 16, 1445. https://doi.org/10.3390/sym16111445

Zanin M, Trajanovski P, Jolakoski P, Sandev T, Kocarev L. Evaluating Time Irreversibility Tests Using Geometric Brownian Motions with Stochastic Resetting. Symmetry. 2024; 16(11):1445. https://doi.org/10.3390/sym16111445

Chicago/Turabian StyleZanin, Massimiliano, Pece Trajanovski, Petar Jolakoski, Trifce Sandev, and Ljupco Kocarev. 2024. "Evaluating Time Irreversibility Tests Using Geometric Brownian Motions with Stochastic Resetting" Symmetry 16, no. 11: 1445. https://doi.org/10.3390/sym16111445

APA StyleZanin, M., Trajanovski, P., Jolakoski, P., Sandev, T., & Kocarev, L. (2024). Evaluating Time Irreversibility Tests Using Geometric Brownian Motions with Stochastic Resetting. Symmetry, 16(11), 1445. https://doi.org/10.3390/sym16111445