The Dynamics of Urban Land Rent in Italian Regional Capital Cities

Abstract

:1. Introduction

2. Materials and Methods

3. Data

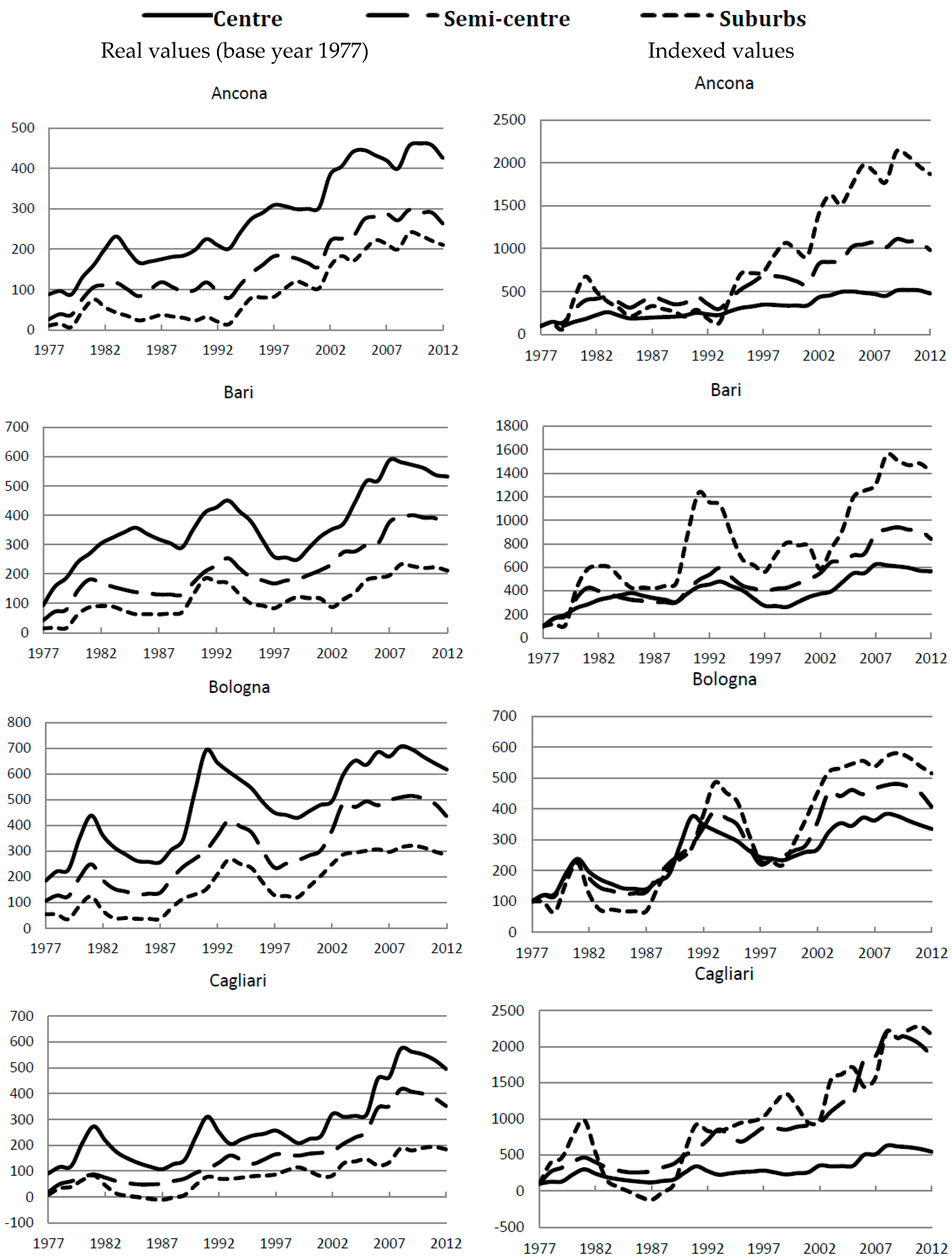

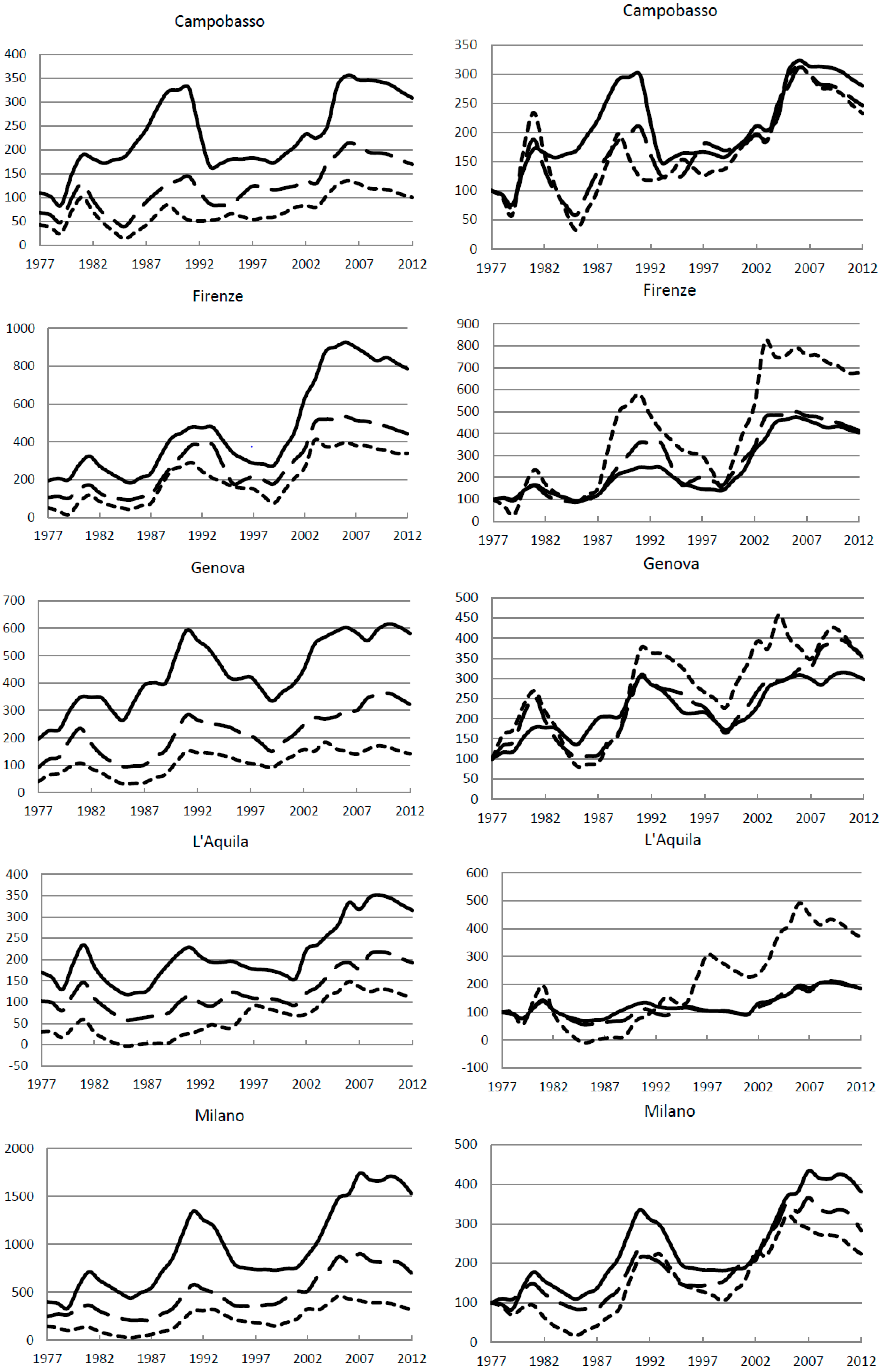

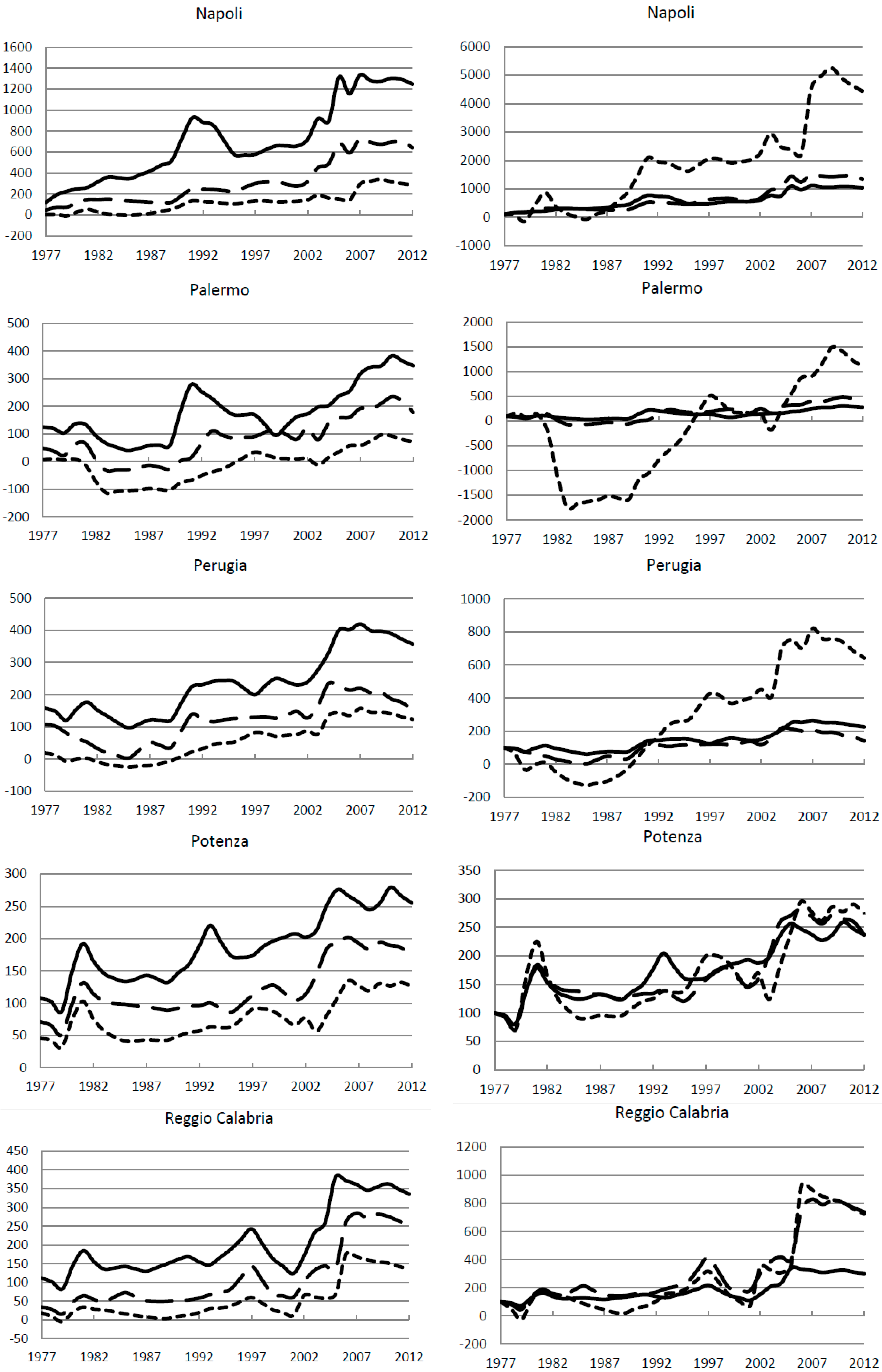

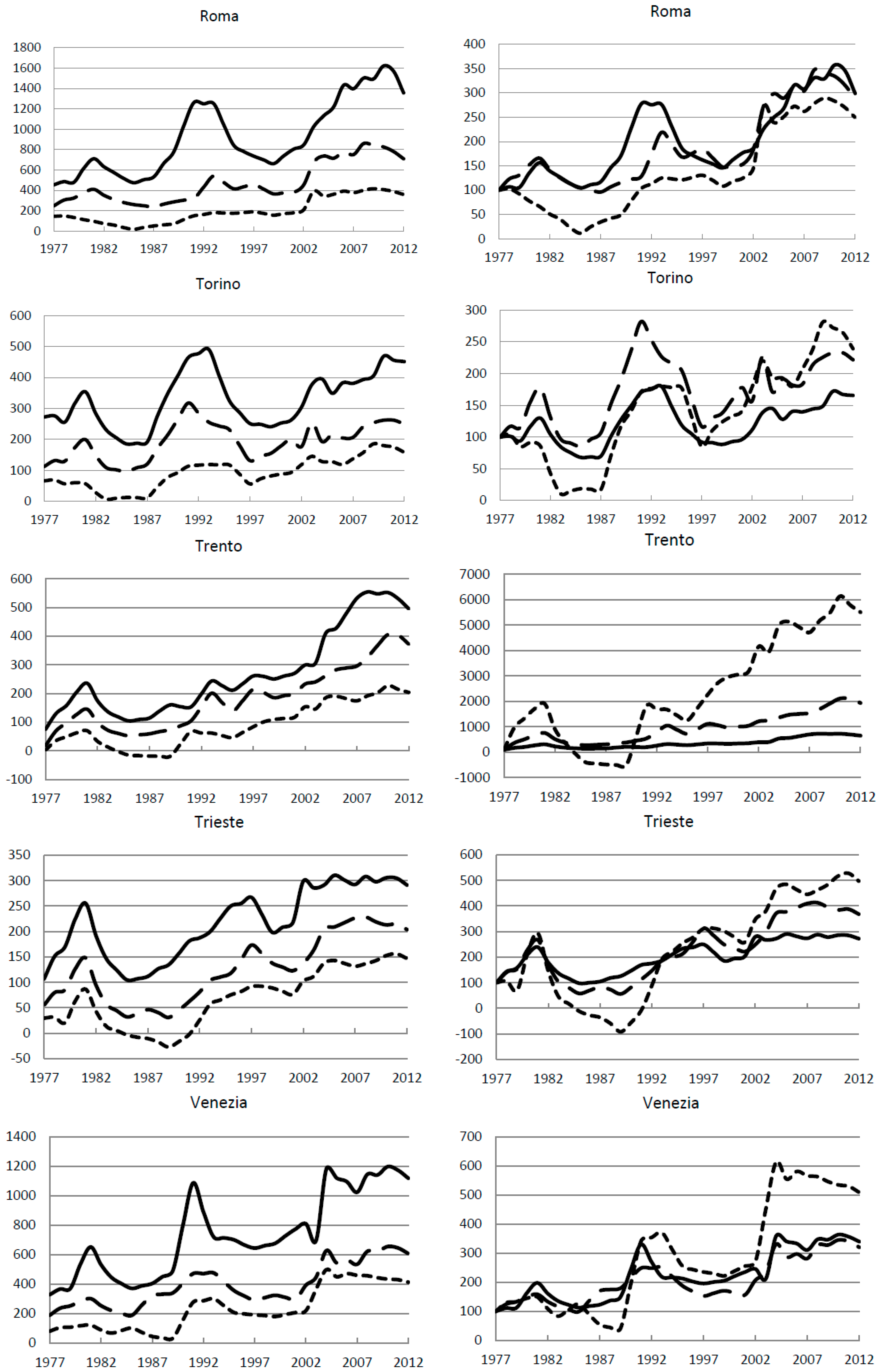

4. Empirical Analysis of Results

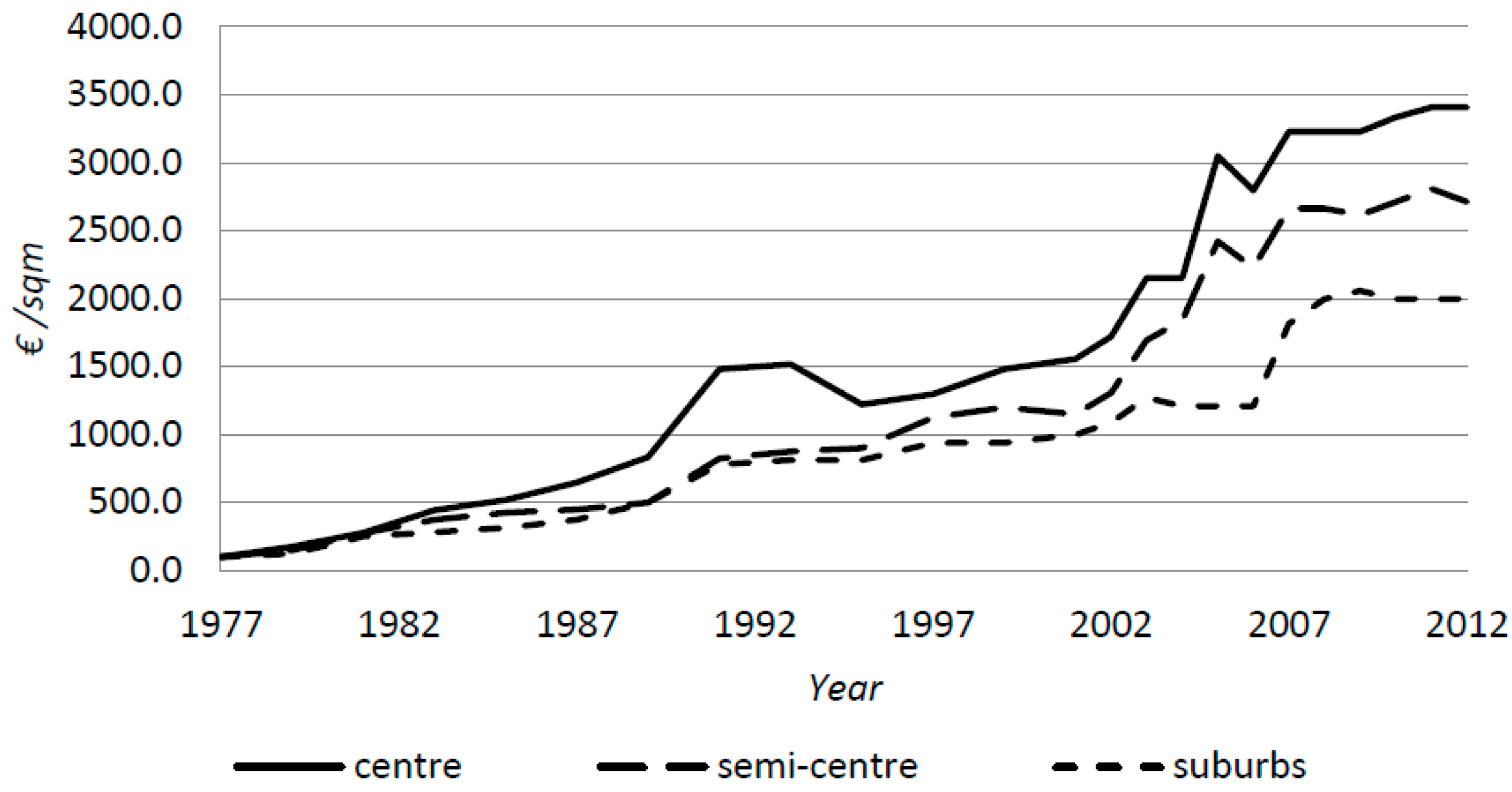

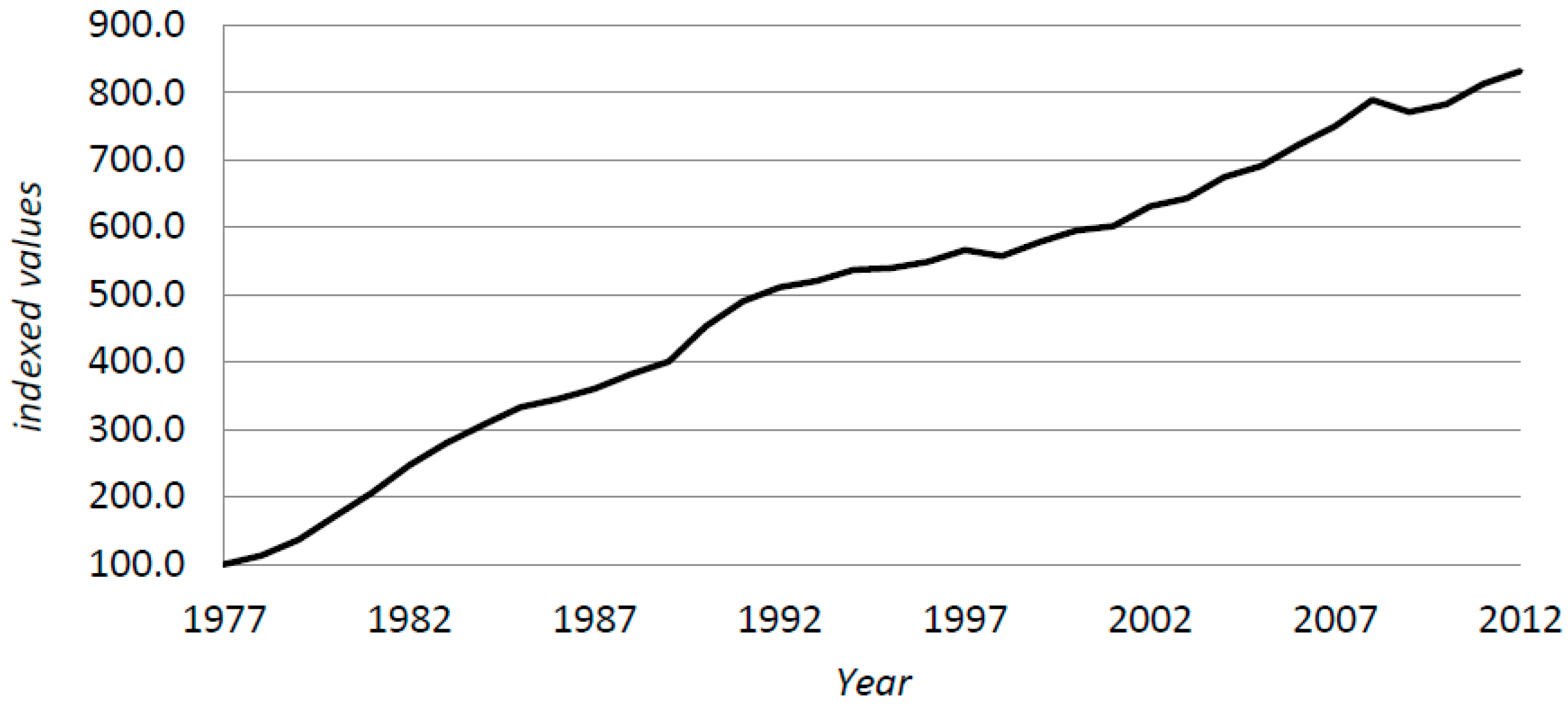

4.1. General Considerations

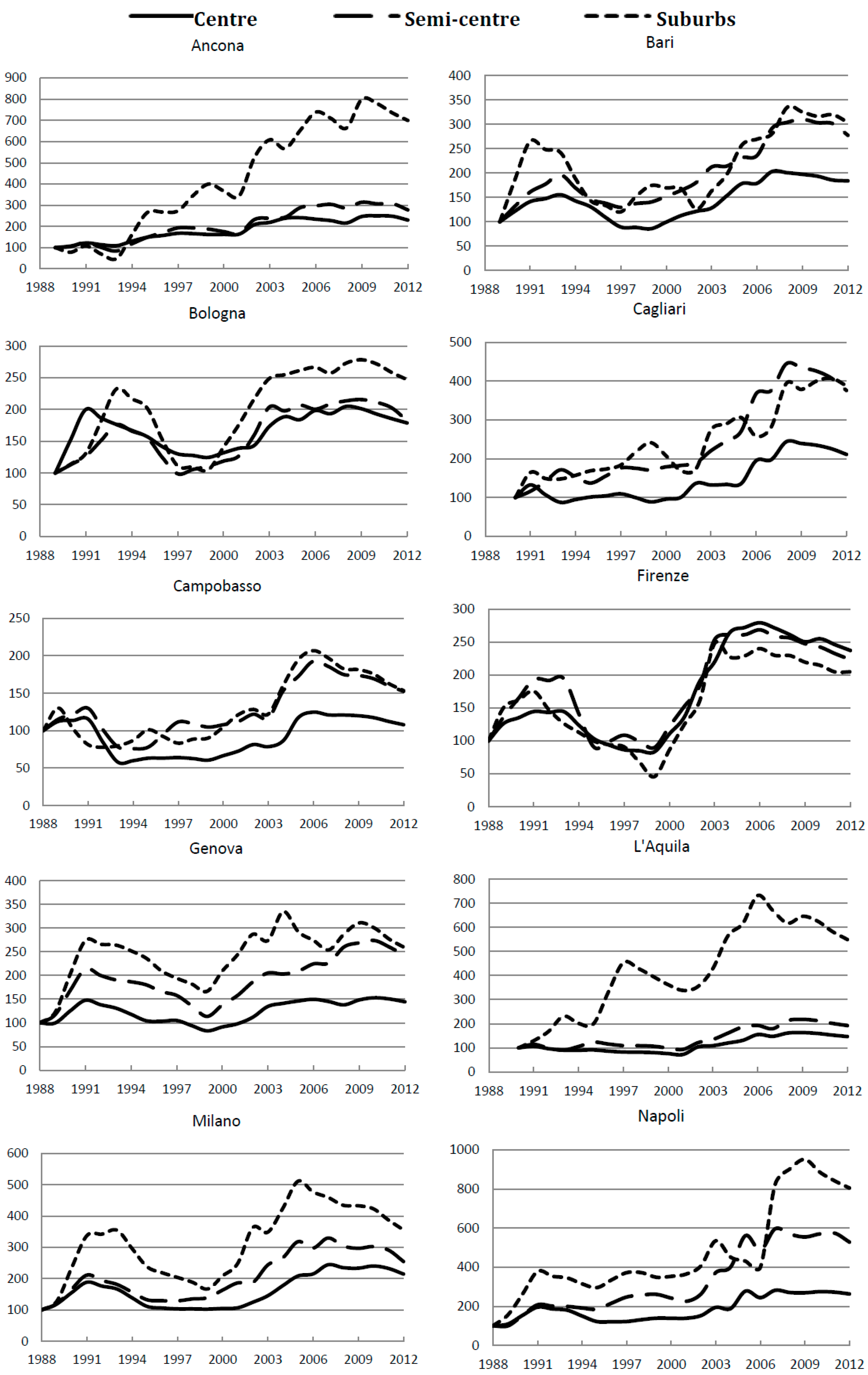

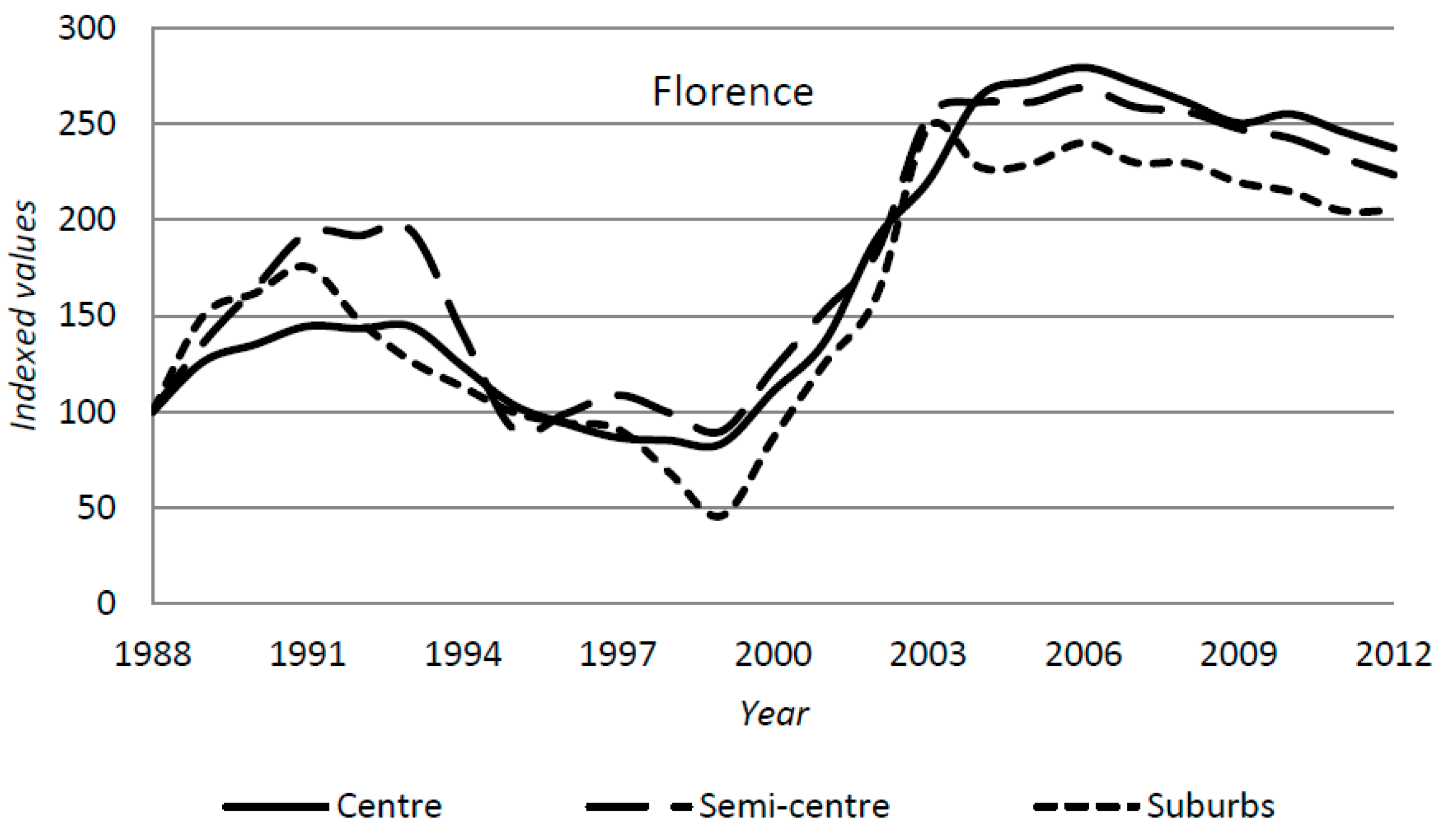

4.2. Local Aspects and Peculiarities

5. Conclusions

Author Contributions

Conflicts of Interest

Appendix A

References

- Smith, A. An Inquiry into the Nature and Causes of the Wealth of Nations; Methuen & Co., Ltd.: London, UK, 1776. [Google Scholar]

- Ricardo, D.; Gonner, E.C.K. The Principles of Political Economy and Taxation; World Scientific: Singapore, 1819. [Google Scholar]

- Von Thünen, J.H. Der Isolierte Staat in Beziehung auf Landwirtschaft und Nationalökonomie, oder Untersuchungen über den Einfluß, den die Getreidepreise, der Reichthum des Bodens und die Abgaben auf den Ackerbau ausüben; Perthes: Hamburg, Germany, 1826. [Google Scholar]

- Fratini, S.M. La Rendita Assoluta di Marx e le Equazioni di Prezzo di SRAFFA; Collana del Dipartimento di Economia—Università degli Studi Roma Tre: Rome, Italy, 2009. [Google Scholar]

- Alonso, W. Location and Land Use: Towards a General Theory of Land Rent; Harvard University Press: Cambridge, MA, USA, 1964. [Google Scholar]

- Wingo Jr, L. Transportation and Urban Land; Resources for the Future: Washington, DC, USA, 1961. [Google Scholar]

- Qina, Y.; Zhub, H.; Zhud, R. Changes in the distribution of land prices in urban China during 2007–2012. Reg. Sci. Urban Econ. 2016, 57, 77–90. [Google Scholar] [CrossRef]

- Coloia, A. Rendita di Posizione e Utilizzazione del Suolo Urbano. Riv. Int. Sci. Soc. Ser. III 1967, 38, 219–231. [Google Scholar]

- Solow, R.M. A Contribution to the Theory of Economic Growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Mills, E.S. An aggregative model of resource allocation in a metropolitan area. Am. Econ. Rev. 1967, 57, 197–210. [Google Scholar]

- Fujita, M. Urban Economic Theory: Land Use and City Size; Cambridge University Press: Cambridge, UK, 1989. [Google Scholar]

- Camagni, R. Economia Urbana: Principi e Modelli Teorici; La Nuova Italia Scientifica: Roma, Italy, 1992. [Google Scholar]

- Harvey, D.; Chatterjee, L. Absolute Rent and the Structuring of Space by Governmental and Financial Institutions. Antipode 1974, 6, 22–36. [Google Scholar] [CrossRef]

- Walker, R.A. Urban Ground Rent: Building a New Conceptual Framework. Antipode 1974, 6, 51–58. [Google Scholar] [CrossRef]

- Park, J. Land Rent Theory Revisited. Sci. Soc. 2014, 78, 88–109. [Google Scholar] [CrossRef]

- Magnani, I. Città. L’intreccio pubblico-privato nella formazione dell’ordine sociale spontaneo. Sci. Reg. 2006, 5, 117–127. [Google Scholar]

- Kuminoff, N.V.; Pope, J.C. The Value of Residential Land and Structures during the Great Housing Boom and Bust. Land Econ. 2013, 89, 1–29. [Google Scholar] [CrossRef]

- Manganelli, B. Maintenance, building depreciation and land rent. Appl. Mech. Mater. 2013, 357, 2207–2214. [Google Scholar] [CrossRef]

- Tocci, W. L’insostenibile Ascesa Della Rendita Urbana. Democrazia e Diritto 2009, 17–59. [Google Scholar] [CrossRef]

- Cremaschi, M. Rendita fondiaria e sviluppo urbano nella riqualificazione urbana: Per un’ipotesi interpretativa. In Proceedings of the atti del XXIV Convegno della Società Italiana di Scienza Politica, Venezia, Italy, 16–18 September 2010. [Google Scholar]

- Sapelli, G. La Crisi Economica Mondiale; Bollati Boringhieri: Torino, Italy, 2008; pp. 9–17. [Google Scholar]

- Rosenthal, S.S.; Helsley, R.W. Redevelopment and the Urban Land Price Gradient. J. Urban Econ. 1994, 35, 182–200. [Google Scholar] [CrossRef]

- McKinnish, T.; Walsh, R.; White, T.K. Who Gentrifies Low-Income Neighborhoods? J. Urban Econ. 2010, 67, 180–193. [Google Scholar] [CrossRef] [PubMed]

- Liu, C.; O’Sullivan, D. An abstract model of gentrification as a spatially contagious succession process. Comput. Environ. Urban Syst. 2016, 59, 1–10. [Google Scholar] [CrossRef]

- Wang, S.; Yang, Z.; Liu, H. Impact of urban economic openness on real estate prices: Evidence from thirty-five cities in China. China Econ. Rev. 2011, 22, 42–54. [Google Scholar] [CrossRef]

- Deo Bardhan, A.; Edelstein, R.H.; Leung, C. A note on globalization and urban residential rents. J. Urban Econ. 2004, 56, 505–513. [Google Scholar] [CrossRef]

- Parés-Ramos, I.K.; Álvarez-Berríos, N.L.; Mitchell Aide, T. Mapping Urbanization Dynamics in Major Cities of Colombia, Ecuador, Perú, and Bolivia Using Night-Time Satellite Imagery. Land 2013, 2, 37–59. [Google Scholar] [CrossRef]

- Garza, N. The spatial and long term evolution of land prices in a Latin American metropolis: The case of Bogotá, Colombia. Rev. Econ. Caribe 2016, 18, 11–35. [Google Scholar]

- Shiller, R.J. Understanding Recent Trends in House Prices and Home Ownership, National Bureau of Economic Research Working Paper Series, 13553. 2007. Available online: https://www.kansascityfed.org/publicat/sympos/2007/pdf/shiller_0415.pdf (accessed on 15 April 2017).

- Dipartimento delle Finanze e Agenzia del Territorio. Gli immobili in Italia 2012. Available online: http://www.agenziaentrate.gov.it/wps/content/Nsilib/Nsi/Agenzia/Agenzia+comunica/Prodotti+editoriali/Pubblicazioni+cartografia_catasto_mercato_immobiliare/Immobili+in+Italia/Gli+immobili+in+Italia+2012/ (accessed on 15 April 2017).

- Bank of Italy. Supplementi al Bollettino Statistico—La Ricchezza Delle Famiglie Italiane; Banca d’Italia: Rome, Italy, 2012; n. 65. [Google Scholar]

- Manganelli, B.; Morano, P.; Tajani, F. House Prices and Rents. The Italian Experience. WSEAS Trans. Bus. Econ. 2014, 11, 219–226. [Google Scholar]

- So, H.; Tse, R.; Ganesan, S. Estimating the influence of transport on house prices: Evidence from Hong Kong. J. Prop. Valuat. Invest. 1997, 15, 40–47. [Google Scholar] [CrossRef]

- Henneberry, J. Transport investment and house prices. J. Prop. Valuat. Invest. 1998, 16, 144–158. [Google Scholar] [CrossRef]

- Hsu, C.; Guo, S. CBD Oriented Commuters’ Mode and Residential Location Choices in an Urban Area with Surface Streets and Rail Transit Lines. J. Urban Plan. Dev. 2006, 132, 235–246. [Google Scholar] [CrossRef]

- Ozmen-Ertekin, D.; Ozbay, K.; Holguin-Veras, J. Role of Transportation Accessibility in Attracting New Businesses to New Jersey. J. Urban Plan. Dev. 2007, 133, 138–149. [Google Scholar] [CrossRef]

- Amato, F.; Martellozzo, F.; Nolè, G.; Murgante, B. Preserving cultural heritage by supporting landscape planning with quantitative predictions of soil consumption. J. Cult. Herit. 2017, 23, 44–54. [Google Scholar] [CrossRef]

- Di Palma, F.; Amato, F.; Nolè, G.; Martellozzo, F.; Murgante, B. A SMAP Supervised Classification of Landsat Images for Urban Sprawl Evaluation. ISPRS Int. J. Geo-Inf. 2016, 5, 109. [Google Scholar] [CrossRef]

- Amato, F.; Pontrandolfi, P.; Murgante, B. Supporting planning activities with the assessment and the prediction of urban sprawl using spatio-temporal analysis. Ecol. Inform. 2015, 30, 365–378. [Google Scholar] [CrossRef]

- Amato, F.; Maimone, B.A.; Martellozzo, F.; Nolè, G.; Murgante, B. The Effects of Urban Policies on the Development of Urban Areas. Sustainability 2016, 8, 297. [Google Scholar] [CrossRef] [Green Version]

- Monkkonen, P.; Ronconi, L. Land Use Regulations, Compliance and Land Markets in Argentina. Urban Stud. 2013, 50, 1951–1969. [Google Scholar] [CrossRef]

- Barton, E.S. Land rent and housing policy: A case study of the San Francisco Bay area rental housing market. Am. J. Econ. Sociol. 2011, 70, 845–873. [Google Scholar] [CrossRef] [PubMed]

- Rebelo, E.M. Land economic rent computation for urban planning and fiscal purposes. Land Use Policy 2009, 26, 521–534. [Google Scholar] [CrossRef]

| Year | Centre | Semi-Centre | Suburbs |

|---|---|---|---|

| 1989 | 100 | 100 | 100 |

| 1990 | 108 | 105 | 78 |

| 1991 | 122 | 125 | 108 |

| 1992 | 114 | 101 | 70 |

| 1993 | 109 | 84 | 49 |

| 1994 | 131 | 118 | 161 |

| 1995 | 149 | 149 | 265 |

| 1996 | 157 | 170 | 268 |

| 1997 | 168 | 193 | 274 |

| 1998 | 166 | 193 | 346 |

| 1999 | 162 | 187 | 400 |

| 2000 | 163 | 175 | 367 |

| 2001 | 164 | 166 | 344 |

| 2002 | 209 | 233 | 526 |

| 2003 | 219 | 239 | 609 |

| 2004 | 239 | 243 | 567 |

| 2005 | 241 | 289 | 655 |

| 2006 | 234 | 297 | 739 |

| 2007 | 227 | 304 | 709 |

| 2008 | 216 | 287 | 664 |

| 2009 | 247 | 314 | 800 |

| 2010 | 250 | 307 | 779 |

| 2011 | 248 | 307 | 735 |

| 2012 | 230 | 278 | 700 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Manganelli, B.; Murgante, B. The Dynamics of Urban Land Rent in Italian Regional Capital Cities. Land 2017, 6, 54. https://doi.org/10.3390/land6030054

Manganelli B, Murgante B. The Dynamics of Urban Land Rent in Italian Regional Capital Cities. Land. 2017; 6(3):54. https://doi.org/10.3390/land6030054

Chicago/Turabian StyleManganelli, Benedetto, and Beniamino Murgante. 2017. "The Dynamics of Urban Land Rent in Italian Regional Capital Cities" Land 6, no. 3: 54. https://doi.org/10.3390/land6030054