1. Introduction

The land market is essential to the economy of each nation, significantly impacting food production and security, environmental sustainability, and poverty reduction [

1,

2,

3]. As a limited resource, land is vital for preserving ecosystems, and the increasing worries about soil degradation, desertification, and biodiversity loss [

4] highlight the necessity of maintaining a delicate balance to ensure sustainable land-use practices.

Historically, land has been considered a safe-haven asset [

5,

6], a resource whose importance could be crucial in specific economic circumstances [

7].

The price of agricultural land is influenced by a complex interplay of economic, social, political, and environmental factors, varying significantly across different geographic regions due to differences in land ownership structures, policy frameworks, and market regulations.

In countries like the United States, according to data published by United States Department of Agriculture (USDA), farm real estate was 84% of the total value of the country’s farm assets in the 2009 balance sheet of the sector [

8]. Over the last decade, farmland values have surged to historic levels, with the average price of both irrigated and non-irrigated cropland increasing by 107% between 2009 and 2023 [

9].

Similarly, in European Union countries, the unit price of arable land saw a 3% rise from 2021 to 2022 [

10]. In countries like Italy, farmland prices have experienced fluctuations, with a 20% decrease in real land prices between 2000 and 2022, despite an overall increase in property transactions (1.7% in 2021) and total transaction area (7.5%) [

11].

In 2020, according to the Rural Land Management Rights Transfer Market Insight Series Report, the average farmland price in China was CNY 11,000 ha [

12], equivalent to about EUR 1500 Ha.

The agricultural land market in India is almost inactive, with few transactions recorded transparently and limited knowledge of prices. Despite the limited farmland sales, rising income and credit availability have led to a rapid increase in agricultural land prices in various regions of India, making them high compared to international standards [

13].

Global demand for agricultural land has been driven by multiple factors, including concerns over inflation and economic uncertainty, which have increased interest in land as a safe-haven asset [

14]. Moreover, the increasing demand for land-based products such as food and bioenergy has intensified competition for land [

15]. This has contributed to an escalation in farmland prices, further driven by the growing participation of non-agricultural investors. Key factors behind this trend include low interest rates and concerns about potential high inflation [

16].

Despite being fundamentally important, the land market often takes a back seat to urban real estate, neglecting the vital role of land in sustaining welfare [

17]. The transition of land from agricultural to non-agricultural uses, combined with instances of land abandonment, has placed considerable pressure on the availability of cultivable land.

However, recent developments deriving from the 17 Sustainable Development Goals (SDGs) outlined in the UN’s Agenda 2030 aim to tackle various agricultural challenges and promote sustainability in the sector [

18].

Several of these 17 SDGs reflect the importance of a sustainable approach to agriculture, integrating environmental, social, and economic aspects to promote a more resilient, equitable, and ecologically sustainable agricultural sector able to guarantee food security for the entire population. Additionally, ensuring safe and equitable access to land remains a crucial component [

19].

However, the real estate market still faces challenges related to transaction transparency, which is indispensable to monitor and analyze changes in demand–supply relationships across time to obtain reliable real estate valuations [

20].

The opacity of the land market—defined as a normal business practice in some places [

21]—is derived from insufficient information about market prices [

22,

23], due to both limited transactions and the traditional caution of industry operators [

24]. Overall, prices, contracts, rights, and land-use plan data should thus be publicly available to help public institutions and local people monitor land market trends and the effect size of the fiscal policies adopted. Moreover, if this information were available, it would be very useful for those who want to invest in the agricultural sector [

1], considering that agricultural lands are one of the principal sources of guarantees for mortgage loans [

8]. In this sense, a reliable valuation becomes crucial to prevent a financial crisis in the banking sector [

25].

It is important to consider the limited uniformity of land as a valuable asset possessing unique characteristics that reduce homogeneity, making it challenging to generalize the market at progressively broader territorial levels, such as regional and national levels [

14]. Each parcel of land is potentially different from others, and considering all the features that make up the land asset, it is difficult to find two absolutely identical pieces of land with the same value.

The value of agricultural land is influenced by a complex interplay of economic, social, political, and institutional factors such as inflation, economic and demographic development, and fiscal policies. These macroeconomic-level factors explain why land values vary over time and across large geographic regions. Additionally, specific intrinsic characteristics, i.e., microlevel, such as topography, soil composition, and hydrology, and structural attributes further contribute to the variability in land values within the same area and at any given moment [

26]. As Nickerson et al. (2012) [

8] suggested, many factors influencing farmland values are specific to individual parcels.

However, despite the recognized importance of these determinants, the agricultural land market remains highly opaque, fragmented, and subject to speculation, raising concerns about its long-term stability and accessibility.

Given the increasing competition for land resources and the pressing need for sustainable land management, understanding the drivers of land price formation is more critical than ever. A lack of standardized valuation methodologies and transparent market data creates uncertainty for stakeholders, including policymakers, investors, and farmers. This uncertainty can lead to market inefficiencies, price distortions, and inequalities in land access, particularly in regions where regulatory frameworks are weak or inconsistent.

To address these challenges, this research sought to provide a structured and comprehensive understanding of the intrinsic and extrinsic factors influencing agricultural land pricing. Unlike previous fragmented studies, this work systematically synthesizes the existing literature through a systematic literature review (SLR) following the PRISMA 2020 guidelines [

27] to ensure a rigorous and comprehensive review of relevant literature. Notably, to the best of our knowledge, no such systematic review has been carried out on this topic before.

The findings of this research could be useful to support more accurate and equitable land valuation, helping to prevent speculation, mitigate market volatility, and enhance decision-making in both public policy and private investment.

Understanding the impact of land characteristics on pricing is also crucial for those considering investments in the agricultural sector, as it directly influences economic returns and land productivity. Beyond identifying key price determinants, this study aimed to answer several fundamental questions. Which countries have shown sustained interest in studying agricultural land price formation? What economic or policy-related concerns have driven research in this field? In empirical studies, what types of data and methodologies have been utilized?

Addressing these questions is essential for advancing knowledge in land economics and developing strategies that promote a fair, transparent, and sustainable agricultural land market in an era of increasing economic and environmental uncertainty.

2. Materials and Methods

The SLR conducted in this study followed the PRISMA 2020 guidelines, employing the PRISMA flow diagram to ensure transparency in the review process. Data were extracted from two prominent research databases, Scopus and Web of Science (WoS), known for their comprehensive coverage and suitability for bibliometric analysis [

28].

To gather relevant studies, a query was formulated using a Boolean algorithm tailored to the research objectives. This query was then applied and refined in the “Advanced search” functionalities of both Scopus and WoS, aiming to identify studies that addressed the intrinsic and extrinsic factors influencing agricultural land market prices comprehensively.

The search query used in Scopus was: TITLE-ABS ((agricultural land* OR land* OR farmland*) W/5 (price* OR valu* OR appraisal) AND (characteristic* OR factor*)) KEY (land-price* OR land-market OR land-value* OR agricultural land-price* OR agricultural land-valu* OR farmland-valu* OR farmland-price* OR assess* OR valuation*) SUBJAREA (econ OR agri).

The search query used in WoS was: TI = ((agricultural land* OR land* OR farmland*) NEAR/5 (price* OR valu* OR appraisal) AND (characteristic* OR factor*)) OR AB = ((agricultural land* OR land* OR farmland*) NEAR/5 (price* OR valu*) AND (characteristic* OR factor*)) AND KP = (land-price* OR land-market OR land-valu* OR agricultural land-price* OR agricultural land-valu* OR farmland-valu* OR farmland-price* OR assess* OR valuation*) AND SU = (Econ* OR Agri*).

Searches were performed in December 2024.

Initially, during the identification phase, queries were tailored to search for key terms within the titles and abstracts. It should also clearly be stated that the Boolean operator “W/n” (in Scopus) and “NEAR/n” (in WoS) in combination with the terms reported in the queries were inserted to refine the search, since it is usual that these terms are near. The terms sought in titles and abstracts were chosen to focus the research as much as possible on the intended goal. Subsequently, the search was refined by adding terms identified like keywords, KW. These KW, which include terms commonly used in this field, were added to capture as wide a sample of articles as possible.

Furthermore, the search was refined by applying filters related to specific subject areas of interest, specifically economic and agricultural sciences, SA. Non-English records were excluded, and no temporal limits were imposed.

Following the identification phase, which involved removing duplicates and addressing inaccessible reports, one researcher assessed the eligibility of records based on the exclusion criteria: (i) off-topic, (ii) pertaining to non-agricultural land uses, and (iii) territorial studies not focusing on parcel-level analysis.

Subsequently, during the screening phase, three researchers independently reviewed the full texts of eligible records. They collected data using a predefined matrix, which included: authors; year of publication; paper type; journal; journal ranking; citations in Scopus and WoS databases; publisher; country; research objective; data type; data source; sample size; methodology; characteristics (parcel-level and macrolevel).

Additional exclusion criteria were applied in this screening phase. Studies were excluded if they did not address the factors influencing land prices or values, focused solely on macro indicators or socioeconomic factors without considering site-specific characteristics, or primarily dealt with land rent, credit, leasing, or auction markets unrelated to agricultural land dynamics. Studies investigating non-agricultural uses such as residential, urban, or industrial lands were also excluded.

Through this rigorous process, studies falling into the aforementioned categories were removed, resulting in the selection of articles for inclusion in the systematic literature review.

Concerning the use of meta-analysis, the main objective of this systematic review was to provide a narrative overview of the studies that dealt with the topic, rather than a quantitative synthesis of them. Given this and the nature of the available data, the application of a meta-analysis was considered inappropriate, since meta-analysis is a statistical approach to quantitative data for estimating the effect size of a specific intervention using highly homogeneous studies in terms of designs, sample size, or outcomes [

29].

3. Results and Discussion

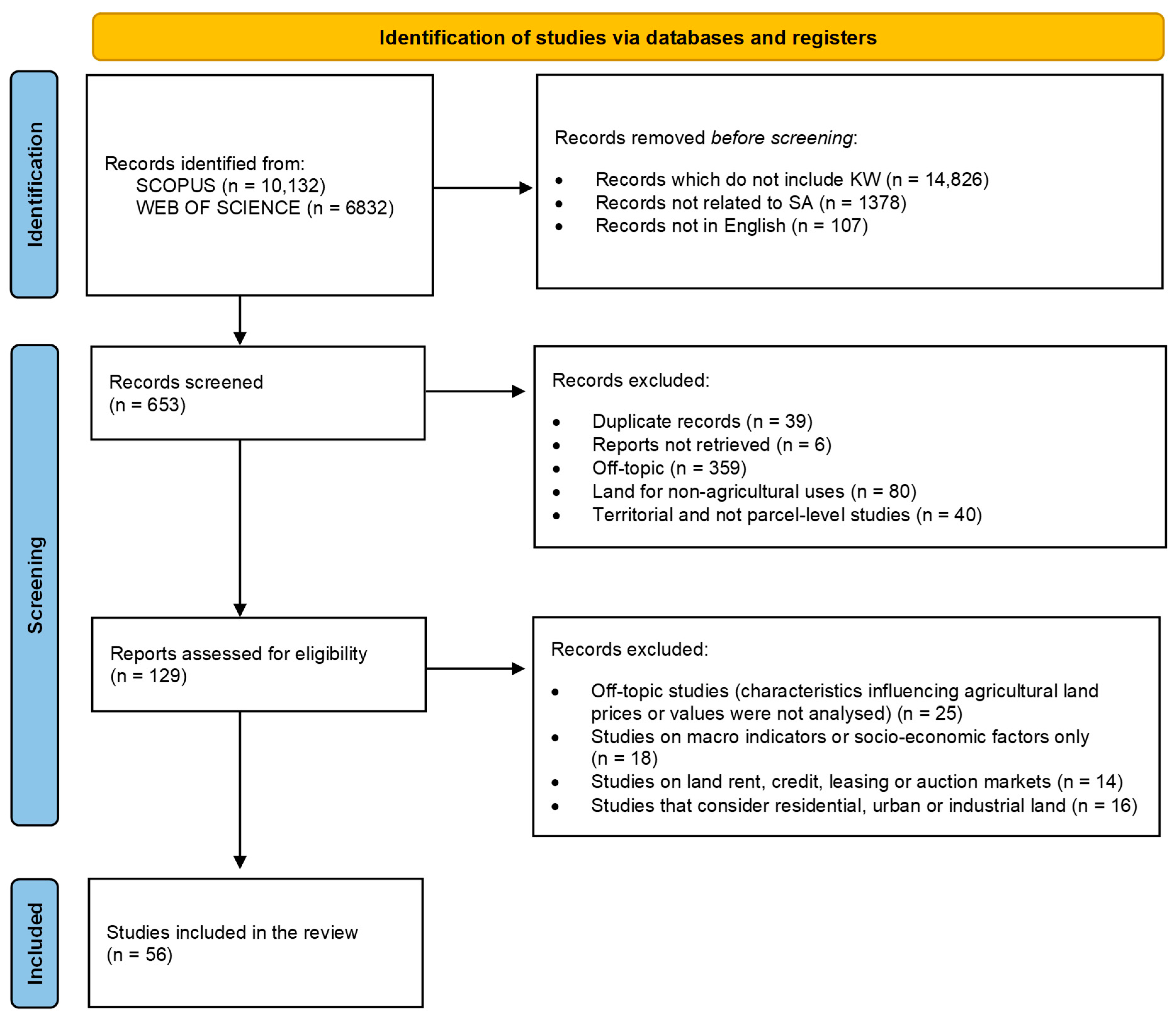

The SLR followed the PRISMA 2020 guidelines (

Figure 1). Initially, 10,132 records from Scopus and 6832 from WoS were identified. After excluding records without key terms (14,826), those not related to agricultural land (1378), and non-English records (107), 653 records remained (475 from Scopus, 178 from WoS). Among these, 39 duplicates were found, and six reports could not be accessed.

Upon reviewing titles and abstracts, 359 records were deemed irrelevant. Subsequently, 120 records were excluded: 80 were related to non-agricultural land uses, and 40 were territorial studies not focused on parcel-level analysis. This left 129 reports for eligibility assessment.

After full-text evaluation, 25 studies were found to be off-topic, not addressing factors influencing agricultural land prices. Additionally, 18 studies focused solely on macro indicators or socioeconomic factors, 14 on land rent, credit, leasing, or auction markets, and 16 on residential, urban, or industrial lands. Consequently, 56 studies were included in the final SLR analysis.

3.1. Years

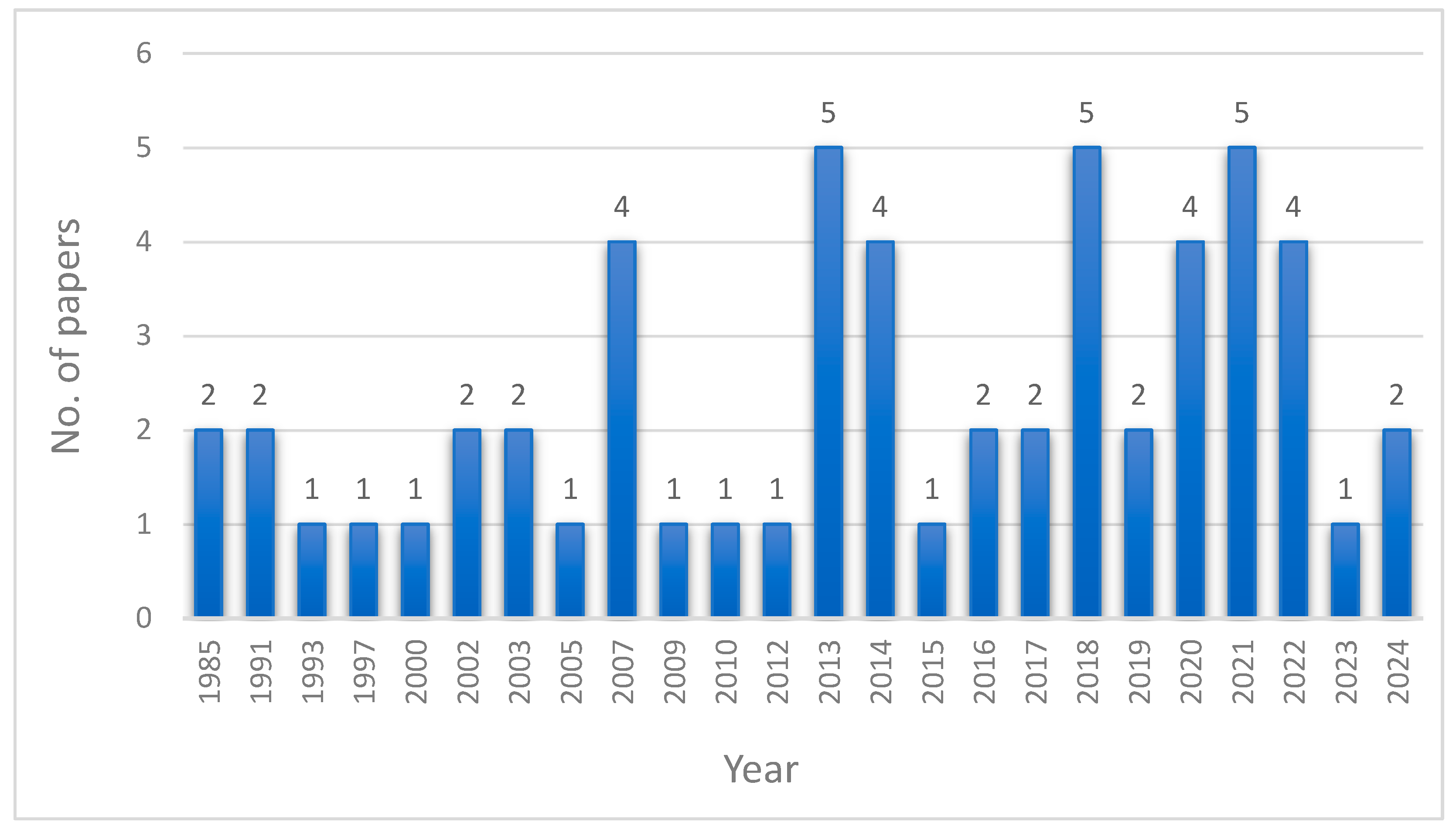

The time frame in which the studies included in this SLR were published spans from 1985 to 2024, as set out in

Figure 2, in which the number of publications for each year is reported. It is noteworthy that the first detected papers date back almost 40 years ago, indicating that the topic was already beginning to arouse interest. From 2013, temporal continuity of the studies can be observed, with annual variability. On the whole, the annual scientific production on the topic is rather limited, even though a moderate increase seems to be underway, since 23 studies have been published in the last seven years under observation (2018–2024)—over 41% of the overall number.

3.2. Countries

Research on the topic is geographically diverse, with studies conducted across various countries and with varying degrees of representation (

Figure 3). The breakdown by continent of the 56 scientific papers sees Europe in first place with 22 articles, followed by the Americas with 16, then Asia with 11, and finally Oceania and Africa, which contribute with 3 and 2 studies, respectively. The United States of America makes a substantial contribution with sixteen studies conducted, highlighting a significant interest in the subject since the first period under observation (1985–1997). The Czech Republic stands out with five studies, indicating a research focus on this topic within the region. Turkey follows with four studies. Italy and Germany carried out two studies each, but one additional study was conducted in conjunction between the two countries. In several other countries, such as Brazil, Chile, China, Croatia, England, Estonia, France, Greece, India, Indonesia, Ireland, Malaysia, New Zealand, Pakistan, the Philippines, Slovakia, South Africa, Spain, Taiwan, Tanzania, and Ukraine, one or two studies at most were carried out.

3.3. Paper Type and Journal Ranking

Out of the 56 studies included in the review, the majority (91%) were research papers, while conference papers and working papers represent 5% and 4% of the total, respectively. Concerning journal ranking, this analysis showed that eighteen studies (34%) fall into the Q1 (top quartile) category. Fifteen studies (about 27%) are placed in Q2 (second quartile). Eight studies (14%) fall into Q3 (third quartile), and only three studies (5%) in Q4 (fourth quartile). Furthermore, for eleven studies (about 20%), this information is “not available.” The reason could be that either they were conference papers or the ranking for that journal was not available in the year of the paper’s publication. Moreover, in terms of a merely quantitative relevance of the topic in the scientific literature, the most cited paper has 84 (Scopus) and 78 (WoS) citations, while the least cited one has no citations in either database.

3.4. Data Types and Data Source

The data analysis revealed several relevant trends regarding the types of data and sources used in the studies included in the SLR, reported in

Table 1.

Firstly, there is a clear emphasis on prices, constituting about 57% of the data, primarily sourced from institutions, deeds, surveys among buyers and sellers, and real estate agencies.

Additionally, it is noteworthy to highlight the significant contribution of values, representing about 28% of the data. These data mainly originate from institutional sources, advertisements in magazines, and surveys among appraisers, real estate experts, and farmers, offering a picture of agricultural real estate valuation from different perspectives and stressing the need for more public sources and direct involvement of farmers in the context of property valuation.

It must be stressed that in some papers, the concepts of price and value often overlap, not showing a clear distinction between the two.

Actually, the two terms express two different concepts. According to the International Valuation Standards [

84], land value refers to the assessed or appraised worth of land, often derived through valuation models that consider both its physical characteristics and contextual variables. It reflects the land’s potential to generate income or fulfill a specific function (e.g., agricultural production). Conversely, the land price is the monetary amount agreed upon in an actual transaction between buyer and seller. While often related, land prices may deviate from land values due to speculation, market distortions, or incomplete information.

Therefore, it is formally correct to use the term “price” only if the data are extracted from sales deeds or official registers that report the price of transactions. In the text, we apply the term “value” when the authors explicitly referred to the use of land values in their studies. Conversely, we adopted the term “price” when the data referred to actual land sale transactions.

Furthermore, there is substantial consideration of ecological aspects in 4% of the studies, which use data on evaluated soil ecological units (ESEUs) and capitalized rental income weighted for soil quality classes to determine land property values, predominantly obtained from institutional sources. This reflects a growing awareness of environmental impact on real estate valuation and profitability.

Geospatial factors that influence land values (2%) and the guidelines for developing a farm valuation support system (2%) were investigated through surveys among real estate experts, farmers, and appraisers, adding a social dimension to the analysis, integrating subjective perceptions into the context of valuation.

Finally, about 5% of the publications used cadastral parcels as data on which to conduct analysis.

In four studies, the data source is not specified at all.

3.5. Methodology

Among the methodological approaches adopted in the studies included in the SLR, the quantitative approach is prevalent: about 86% of the studies applied econometric models and 2% statistical coefficients. In these cases, econometric models are suitable for understanding the variables and the relatively complex relationships among these affecting land prices or values. An analysis of these models can provide crucial information on the key variables driving the land market.

However, there is also a diversification in the methodology adopted. Studies using algorithms account for about 4%, indicating an alternative approach to analyzing complex data efficiently [

30,

31]. At the same time, the use of methods such as fuzzy logic [

32] and multicriteria analysis [

33,

34] suggests on the one hand an approach that can handle uncertainty and nuance in the variables, particularly useful with ambiguous or not fully defined data, and on the other a technique that considers and weighs multiple criteria in the valuation, especially in situations where the decision involves multiple perspectives and objectives.

It is also noteworthy to include the method of standardized capitalized rental income [

35], a traditional approach based on the capitalization of income generated by property rents.

In summary, the diversity in methodology reflects the breadth and complexity of real estate research, with scholars approaching the topic with a varied range of analytical tools. This eclectic approach enriches the understanding of the real estate sector, offering not only a quantitative perspective but also computational considerations, fuzzy logic, and multicriteria analysis, thus contributing to a more comprehensive view of market dynamics and the key factors driving changes.

Considering that the majority of the studies (86%) employed econometric models, it seems appropriate to delve deeper into this topic. To this end, from the full-text analysis on 48 of the 56 studies, relevant information was extracted, primarily related to functional forms and estimation methods.

Regarding functional forms, the most frequently adopted were linear and log-linear (semi-logarithmic) models. Several authors included both linear and semi-logarithmic forms in their studies and employed statistical tests (such as the Box–Cox test) to determine which one offered the best fit (e.g., [

36,

37,

38,

39,

40]). Nevertheless, in many cases, the semi-logarithmic form was chosen to mitigate heteroscedasticity problems [

38,

41,

42,

43,

44,

45,

46], setting unit land price as the dependent variable [

25].

Maddison (2000) [

47] adopted a linear-log form, specifying that some independent variables had been transformed, as did [

48], who applied quadratic and square root transformations to the independent variables to analyze non-linear relationships with the dependent variable. Double-log transformation was preferred over other functional forms in six studies [

37,

49,

50,

51,

52,

53].

Among estimation methods, the most commonly used included classical techniques such as ordinary least squares (OLS) and more sophisticated approaches like general linear modeling (GLM) [

45], generalized least squares (GLS) [

54], stepwise regression [

48], truncated regression [

55,

56], and the maximum likelihood method (MLM) [

57,

58]. Some authors [

16,

59,

60] opted for quantile regression, as it is less sensitive to outliers and allows for exploration of the heterogeneity of the effects of explanatory variables across different levels of the land value distribution [

59].

A difference-in-difference (DiD) approach was employed by [

61] to understand the effect of solar power promotion policies on farmland prices.

To address problems related to the geographic distribution of phenomena such as spatial autocorrelation and spatial heterogeneity, spatial econometric models were applied. These models incorporate a spatial weight matrix to capture correlations between geographically proximate observations [

39,

62,

63]. Before using spatial econometric models, Moran’s I test is typically applied to verify the presence of spatial autocorrelation [

62,

63,

64]. For instance, Demetriou (2016) [

64] initially used OLS, but the estimates showed spatial autocorrelation in the residuals. This prompted the choice to employ geographically weighted regression (GWR) to model spatial variation in coefficients. Patton and McErlean (2003) [

49], after conducting a Lagrange multiplier test to identify spatial dependencies, addressed them using the spatial lag model (SAR) and the spatial error model (SEM).

Both models were estimated using heteroscedasticity-robust instrumental variables to ensure consistent estimates in the presence of heteroscedastic errors. In the SEM, spatial dependence is modeled in the errors, while in the SAR, it is modeled by including a spatially lagged dependent variable as a regressor.

Delbecq et al. (2014) [

53] modeled spatial heterogeneity using the smooth transition spatial error model, employing a logistic function to represent the transition from urban to rural regimes. Lehn and Bahrs (2018) [

16] incorporated a spatially lagged variable into the model using a weight matrix based on the queen contiguity criterion. The spatial component was modeled using an SAR, including spatiotemporal lag variables as exogenous factors.

A more advanced approach was recently proposed by [

63], who employed a spatial lag of X (SLX) model estimated using the generalized spatial two-stage least-squares method.

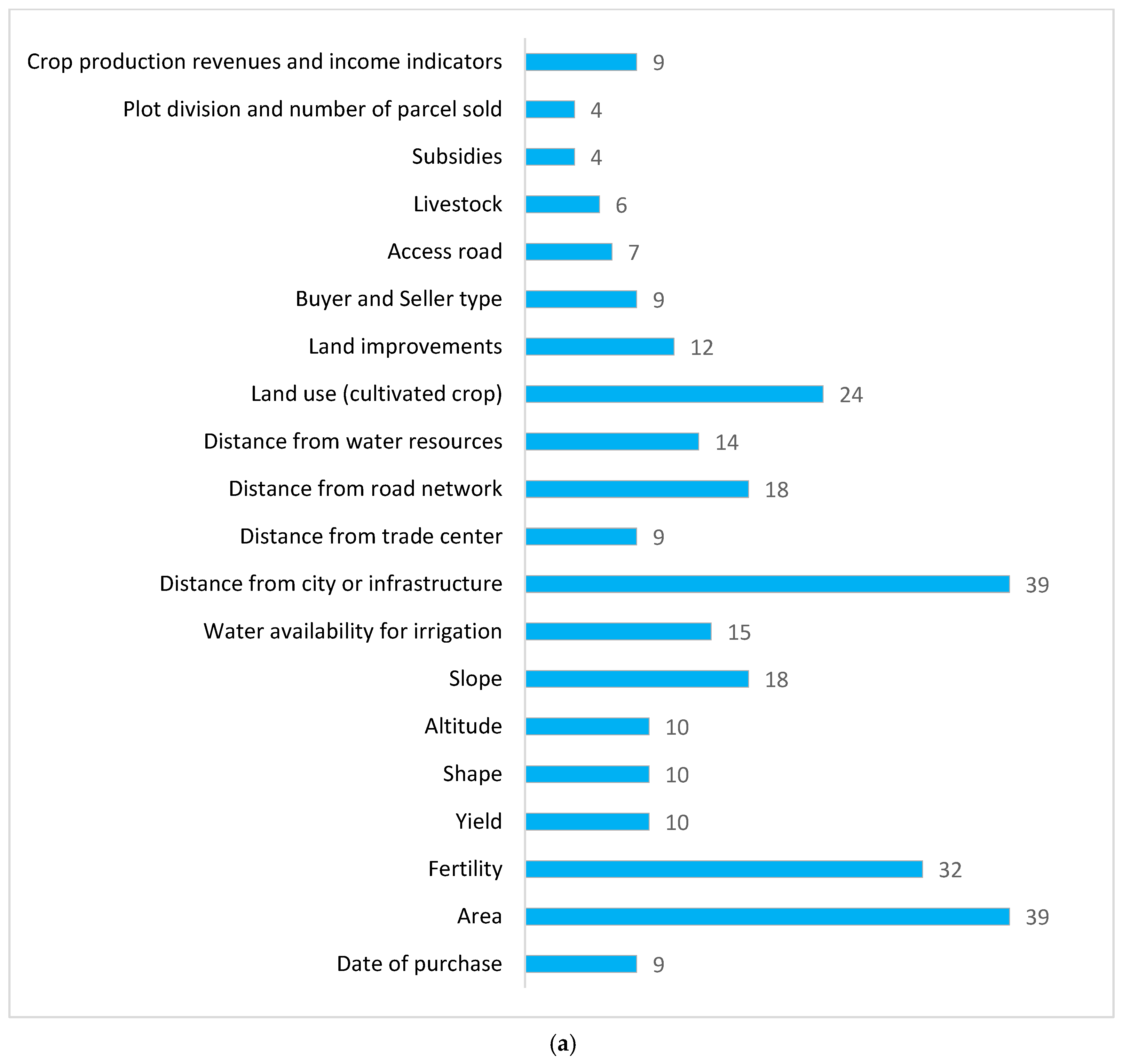

3.6. Type of Determinants Studied and Summary of Findings

The determinants found in studies included in the SLR were subdivided into two broad categories: parcel-level characteristics (

Figure 4a) and macrolevel characteristics (

Figure 4b). As the focus of this work was the study of parcel-level characteristics, most of the papers analyzed included also macrolevel characteristics in their analyses. These macrolevel factors should be part of the assessment process, since they contribute to the market value formation of agricultural land in combination with the parcel-level characteristics.

However, various studies revealed that evaluating agricultural lands is complex, requiring the examination of numerous factors that often vary according to the market segments analyzed. In certain contexts, it can be extremely complex to identify the factors that contribute to market value formation [

25]. In this sense, some authors underlined the importance of data quality and not aggregated data in research studies on these mechanisms.

Moreover, as reported by [

55]: “It is difficult to determine the value of parcel characteristics embedded in agricultural land since such characteristics are not directly traded and priced in explicit markets.”.

Understanding the effects captured through specific variables or their proxies is intriguing.

3.6.1. Soil Quality Characteristics

Farmland market values are largely determined by soil quality [

35,

46,

65] and agricultural productivity-related factors [

66].

Land productivity had a positive impact on the market value per acre [

44,

48,

51,

64,

67], contributing substantially to model explanatory power [

68] and suggesting higher values for land with better soils [

40]. Soil quality can also positively influence land consolidation project success [

34], as the fragmentation phenomenon reduces price [

25].

Uematsu et al. (2013) [

59] found that soil productivity is negatively correlated with land value in lower quantiles, possibly because owners might not fully exploit its potential as they are off-farm workers. However, soil productivity is positively correlated with land value in higher quantiles, where more productive lands are more expensive. Similar results were reached by [

45], who discovered an increase in farmland prices only in the most fertile land, mirroring the demand from farmers.

Maasikamäe et al. (2015) [

69] observed multicollinearity between arable land ratio and soil productivity, noting that: “the arable land fields are bigger if the soil productivity is higher”.

Boisvert et al. (1997) [

36] added that soil productivity, measured by crop yields such as maize, positively affects market values and rental rates, with rental rates being a more precise agricultural productivity indicator due to their higher elasticity compared to value elasticity. This discrepancy could partly be attributed to the inclusion of a speculative component in total land value estimates, reflecting the potential for non-agricultural uses since residential and commercial potential drives up land values [

41].

Delbecq et al. (2014) [

53] found that soil quality—seen as a crop productivity index—has a positive and greater impact in urban fringe areas than in rural areas, indicating that land near cities is valued for both agricultural productivity and potential urban development.

One of the most important characteristics of rural land, especially in market segments where the buyer is a farmer, direct grower, or a field worker, is soil fertility, since it reflects land productivity.

Soil fertility is a complex measure involving several physical, chemical, and biological characteristics [

43]. In this regard, Naudé et al. (2012) [

31] attempted to develop a simple measure to reflect soil fertility through an algorithm integrating soil-specific data, including effective soil depth, texture, and a combination of soil series attributes to generate a soil-type fitness index. This index reveals the agricultural suitability of different land types for various crops.

Ali et al. (2018) [

41] combined soil texture, fertility, water for irrigation, land surface, salinity, and waterlogging into a single dummy variable (fertile or unfertile land) that positively and significantly influences prices, highlighting the importance of soil quality for agricultural productivity. The study suggests policy interventions to protect fertile agricultural lands from urban encroachment and pollution.

Vural and Fidan (2009) [

38] applied the hedonic price method, inserting several soil quality characteristics obtained from the farmland records, finding that the pH, saturated water, potassium, and organic matter positively affect land prices.

Peterson (1986) [

43] identified organic matter as a key indicator of soil health closely correlated with soil fertility. However, nationwide data on the organic matter content of soils in their so-called natural state—i.e., without fertilizers—are lacking. Therefore, ref. [

43] measured fertility by the average pounds of nitrogen per acre in the upper 40 inches of soil, as nitrogen closely correlates with organic matter. The results showed that soil nitrogen content explains land price variation, somewhat surprising given the increased use of commercial fertilizers.

Slaboch and Čechura (2020) and Slaboch and Malý (2022) [

70,

71] suggest that climate, slope, exposure, skeletonization, and soil profile depth mainly influence the evaluated soil ecological unit price in the Czech Republic.

In addition, soil quality could include other variables such as moisture, indicators of agrochemical soil properties, groundwater level, and soil salinization type [

36].

Research carried out by [

72] highlighted that water erosion and anthropogenic factors negatively affect soil quality and consequently influence land prices.

From a soil structural point of view, Giuffrida et al. (2023) [

63] found that land with low permeability is more expensive, probably because it is related to lower costs for irrigation and soil tillage. Moreover, it could be an index of good agronomic characteristics of the soil, which reflect higher productivity.

Nevertheless, since the advent of urbanization, additional factors have begun to influence land price [

60] and soil quality became irrelevant to lands used for residential, commercial, and industrial purposes [

32,

45]. Indeed, Borchers et al. (2014) and Vasquez et al. (2002) [

52,

66] found that multiple non-agricultural attributes of farmland, such as development potential, contribute to the market value and price.

In this regard, ref. [

73] argued that agricultural land prices are influenced by potential future residential rent and anticipated conversion dates.

3.6.2. Plot Size, Orography, and Morphology

Surface area is one of the most commonly employed characteristics in studies on agricultural land valuation. It defines the extent of a land parcel, indirectly influencing agronomic choices. Depending on the size of the plot, a farmer may decide to adopt an intensive cropping system (such as orchard plantations, which do not require large land areas), an extensive system (such as cereal crops, which necessitate vast surfaces to generate income), or opt for a diversification strategy in crop selection.

The most thoroughly examined characteristic was by far the parcel area. Its importance is clear, with 38 studies dedicated to exploring the relationship between the size of agricultural properties and their economic value. This result highlights the broad interest in understanding how the size of a piece of land may influence its economic valuation.

An increase in farm size positively influences land market values [

16,

42] and the per-acre value [

39] and is one of the main factors that increases the market price [

56], probably due to the ease of farming [

36].

A study conducted by [

59] used the value of production per owned acre as a proxy of farm size, finding a positive correlation with farmland values at all examined quantiles.

Several authors [

44,

51,

55,

64,

65,

74,

75] found that larger plots tend to have a lower market value per unit area.

The analysis of [

40] revealed that plot size has a convex effect on unitary land asking prices. This means that intermediate-sized plots tend to be more valuable per unit area compared to very small or very large plots. Also, in [

46,

68], the lot size initially has a positive coefficient, but this effect is attenuated by a negative coefficient on the quadratic term, indicating diseconomies of scale.

Ritter et al. (2020) [

46] incorporated both inverse and linear terms of size into their model, obtaining the expected positive signs. This supports the notion that very small plots have a price premium, and there is a linear value increase for intermediate plot sizes, as “it cannot be expected that the price per unit of land is independent of the transaction volume” [

46]. They further demonstrate that for arable land, both the linear and quadratic terms are statistically significant, with the linear term showing a positive sign and the quadratic term showing a negative sign, as anticipated. However, for grassland, these relationships are reversed, with a negative linear term and a positive quadratic term. These results indicate a significant difference in the functional form when analyzing grassland values.

Conversely, in [

48], the farm size and the relative squared term showed negative and positive signs, respectively.

A different perspective is provided by [

16], who found out that changes in population and utilized agricultural area (UAA) negatively influence land values, with more pronounced effects in the upper quantiles, maybe due to greater speculation and conversion of agricultural land in urban areas.

Conversely, in [

53], outcomes showed a negative effect of parcel size in both urban fringe areas and rural areas.

Czyżewski et al. (2017) [

58] highlighted that under the Single Area Payment Scheme system, Common Agriculture Payment support can still act as a stimulus to increase farm size, since on a larger scale of agricultural activity, these incentive programs become more effective.

For several studies, it is important to assess the contribution of geo-morphologic factors on land prices or values.

Orographic and morphological characteristics are purely qualitative, so quantifying their contribution to the market value formation mechanism is often difficult. What we know is that these factors influence not only the productive qualities of the soil but also the degree of difficulty in managing the land in terms of agricultural work.

The slope of the land has a negative relationship with land market values, indicating that less sloped lands tend to have higher values [

25,

40,

64].

Samarasinghe and Greenhalgh (2013) [

39] found that steep and very steep slopes were valued about 37% and 52% less, respectively, than similar land in flatter areas. In [

16], terrain slope showed more pronounced negative effects in the lower part of the distribution, suggesting that this factor limits the market value of less expensive land more significantly.

Uematsu et al. (2013) [

59] found that plains are negatively correlated with farmland values at all quantiles, while tablelands are negatively correlated only at lower quantiles. Plains with hills or mountains have no significant impact, but hills or mountains are positively correlated with farmland values at all quantiles. In vineyards, “slope can modify microclimate and positively influence grape quality” [

25].

In combination with the slope, the average elevation of farmland has a highly negative effect on its market values, a consistent finding in other hedonic studies. Higher elevations are associated with greater diurnal temperature variations, which negatively affect agricultural productivity [

47].

The shape of the parcel has a modest effect [

58], while [

25] found that shape does not have a significant effect, likely because its role is less important for small plots.

However, small and deformed parcels may affect agricultural productivity according to [

31]. This is in line with [

61], for whom “top-quality farmland is larger and more uniformly shaped”.

3.6.3. Water Availability, Floods, and Wetlands

Water source as a well or in general irrigation availability is an added value for agricultural land [

31,

55,

64,

73,

76]. Their presence enhances the model explanatory power proposed by [

68] and adds significant value across various crops [

50], even if depending on regional agricultural needs [

34]. Xu and co-authors [

55,

65] noted that, in increasing order, center pivot, sprinkler, and rill irrigation systems contribute to increased land market prices.

Coelli et al. (1991) [

37] estimated the implicit marginal price of water provided through the “scheme” in rural areas using the hedonic pricing technique.

The results show that water scheme has a significant market price, with a positive impact on agricultural land prices. Unsurprisingly, scheme connection is valued more highly in areas without suitable groundwater. Water marketing rights have shown a positive and significant impact also [

67,

77], confirming the importance of these rights in the context of irrigation and land market value.

Ismail et al. (2016) [

42] explored the impact of floods on land property market prices in Malaysia using their duration, with a specific focus on distinguishing between urban and rural areas. The study reveals that prolonged floods significantly lower land prices due to crop damage and reduced productivity, leading to decreased demand. Land located near rivers tends to have lower market prices due to an increased flood risk associated with river proximity.

Samarasinghe and Greenhalgh (2013) [

39] found that moderate flood risks increase land value by 5%, while severe risks decrease it by 10%. Their study [

39] also indicated that plant-available water increases land value when rooting depth is less than one meter. Rooting depth alone does not impact significantly land value—its effect depends on drainage and water availability. Slightly gravelly soils are valued higher than non-gravelly soils if the rooting depth is over 0.8 m. Otherwise, non-gravelly soils are more valuable.

Moreover, according to [

63], land prices decrease in zones where the hydraulic risk is low, avoiding flood phenomena.

Reynolds and Regalado (2002) [

73] showed that different types of wetlands can have different effects on land prices. In particular, on the one hand, wetlands can make agricultural production unfeasible without a drainage system. On the other hand, the presence of wetlands could be seen as an aesthetic attribute by some individuals who might be willing to pay a higher unitary price. The authors outline that their study probably underestimates the social benefits of wetlands, since this component is not captured in property sales prices.

3.6.4. Cover Land, Land Improvements, and Livestock

Land use in terms of cultivated crops (24 studies) can be an important indicator of its versatility and potential.

Land use plays a key role in determining land values [

36], since “the ability of a land to support diversified activities makes it more versatile and, therefore, more valuable” [

56].

The interaction between land use and the territorial zone in which the farm is located influences land values [

39]. Fallow lands are assessed at lower per-acre values compared to cultivated lands, potentially reflecting reverse causality if less productive lands are those left fallow [

40].

Prices for grassland are generally lower than arable land prices by about 26% [

46], suggesting that pastureland prices might better reflect natural and recreational amenities [

52]. The production of high-value crops such as fruits and vegetables is a luxury attribute for farmland values with an effect that is higher at higher quantiles [

59], as well as designation-of-origin certification [

50], and an intensive use of land might reflect larger future income flows [

74].

An element that emerged in [

25] is the effect of the planting expectations of a vineyard on the price of arable land and woods.

Instead, surprising results come from [

48], where land cover-type variables did not have a significant relationship to farmland price per acre, suggesting that buyers prioritize soil productivity over land cover information.

In some of the 56 papers analyzed, land use in terms of cultivated crop is not considered because the surveys are focused on the same crop type (arable land, vineyard, pastureland, etc.).

The presence of buildings and other improvements such as barns, windbreaks, and milking parlors has a positive and significant effect [

53,

55,

65,

73,

74], as well as building permission [

58], though [

74] found a small effect size of buildings on farmland price.

The livestock rate is positively correlated with farm values, suggesting that it is an indicator of soil and/or pasture quality [

68]. It has a stronger positive effect in the upper quantiles, reflecting the higher demand for agricultural land in regions with high livestock density [

16]. Specializing in livestock production negatively impacts farmland values and the impact is stronger at lower price ranges [

59].

In [

47], who considered variables such as milk production quota per acre, cottages per acre, and number of bedrooms per acre, it was found that professional valuations are a biased indicator of sale prices because surveyors overvalue the number of bedrooms and undervalue other characteristics.

3.6.5. Positional Factors, Location, and Natural Amenities

Positional factors have been the subject of an equal amount of attention (included in 39 studies), underlining how proximity to urban areas and infrastructure networks seems to play a significant role in determining land prices.

Rakhmatulloh et al. (2021) [

77] even went so far as to employ only variables related to the distance from various infrastructures (such as the city center, hospitals, schools, commercial centers, and recreational areas) in their econometric model to explain price variation in a suburban area of Indonesia.

Several studies found negative relationships between land market values and distance from residential zones [

41,

64], trade centers [

40,

41,

56,

76], road network and infrastructure [

25,

31,

35,

40,

42,

58,

63,

66,

76,

77], coastline [

35], and nearest city center [

40,

41,

42,

44,

48,

53,

55,

59,

63,

65,

68,

73,

74] or built-up area could be more accurate variables according to [

45].

Nevertheless, the impact of positional factors also depends on where buyers and sellers reside, which could affect their willingness to pay and be paid, respectively [

63].

In the temporal analysis carried out by [

54], the distance between the farm and the city center is the most important characteristic for both examined historical periods.

However, lands near airports in both urban and rural areas tend to have higher economic value due to strategic location benefits facilitating industrial management, production, and export activities via air transportation [

42].

On the contrary, according to the results obtained by [

63], proximity to airports has a strong negative effect on land prices, as it affects the building susceptibility of soils. These results show that on the one hand, that transportation and management costs are relevant factors in determining the price of agricultural land [

38], while on the other hand, the higher market price of land closer to city centers is due to positive impacts on surrounding land activities and development opportunities [

42]. Moreover, the proximity to another farm might drive up bids for smaller land parcels, as farmers seek to expand their holdings in a specific area [

35].

Sklenicka et al. (2013) [

45] discovered that the most influential factor affecting the spatial variability in farmland prices is closeness to a settlement area. This can theoretically be explained by the willingness of buyers to pay more for land adjacent to a village and bordering their existing parcels, as land fragmentation near villages tends to be higher. Nonetheless, the authors concluded that the primary driver for the significant rise in farmland prices is speculative interest, in relation to the potential for converting farmland and later selling it for non-agricultural purposes.

Ali et al. (2018) [

41] used the distance from a sugar mill as a proxy for air pollution, showing decreased land prices due to pollution concerns.

A comparison between rural areas and urban fringes was made by [

53,

73]. The former showed that the distance from the nearest urban center is not significant in urban fringe areas, but has a significant negative impact in rural areas. The latter find that agricultural land prices near the city center are three times higher than those in remote rural areas, and small residential lots are nine times more expensive than large development lots far from the city.

Another characteristic potentially relevant is the access to land via a registered road or path [

35,

64,

74] and the presence of paved roads [

51]. Sklenicka et al. (2013) [

45] found that there was an unwillingness to pay higher prices for inaccessible land, possibly due to the risk of future negotiation failures with neighboring landowners for access. The geographic zone in which land is located is pivotal in the appraisal process for understanding the vocation for agricultural activity, closeness to agroecological zones or natural amenities, share of protected areas, or the spread of hunting activity in the area. Lands located in high-demand zones may be sold at higher prices.

The presence of a sea view is one of the eight significant variables in the land valuation process that increases land value in Cyprus [

64].

Coastal areas and areas with lakes can be more scenic and pleasing and can be a luxury attribute of land, affecting farmland values only at higher quantiles [

59].

As [

59] expected, natural amenity is more a “luxury” than a “necessity” and has a larger impact on farmland values at a higher value range. Furthermore, recreational activities such as fishing and hunting have a positive impact on farmland values, but only at higher quantiles.

Instead, Lehn and Bahrs (2018) [

16] discovered that the percentage of nature reserves limits the market values of less expensive land.

The urbanization rate, as well as building permits, which reflect the degree of urban development in the region, potentially influence the supply and demand for agricultural land [

16,

58,

62,

73,

76], especially for people seeking more rural environments, for whom air quality [

41,

78] and noise pollution also count [

76].

3.6.6. Policies

Policy frameworks can shape agricultural land markets by influencing supply and demand dynamics. The results reveal two main categories of policies impacting land values, as follows.

- -

Direct Policies: These are policies, such as agricultural subsidies and area-based payments, that explicitly intervene in the land market and are often capitalized into farmland prices. A prominent case is the European Union’s Common Agricultural Policy (CAP). In Poland, ref. [

58] found that land located in agrotourism areas reached significantly higher market values (on average +43%) under the Single Area Payment Scheme (SAPS), illustrating how non-productive but policy-sensitive features can shape price differentials. Their multilevel hedonic model confirmed that EU payments constitute a key component of land valuation, particularly in rural regions with recreational amenities.

Similarly, ref. [

47] argued that CAP subsidies artificially inflate land prices, as direct payments are embedded in hedonic pricing models and treated as implicit land characteristics. In the United States, ref. [

59] employed quantile regression and showed that the capitalization of direct farm payments into land values varies across the price distribution: the effect becomes statistically significant from the median quantile (0.50) and increases in magnitude at higher quantiles, indicating a stronger influence on more valuable land parcels.

Lehn and Bahrs [

16], analyzing farmland in Germany using a similar quantile regression framework, included agrienvironmental payments in their model, but found no statistically significant effect. This outcome underscores how the influence of CAP-related instruments can differ considerably across national contexts depending on local land market dynamics and policy implementation mechanisms.

- -

Indirect Policies: These are broader policy mechanisms whose impact on land value is mediated through socioeconomic channels (such as tax, incentives, credit, territorial planning, etc.).

For instance, according to [

60], in Taiwan, the amendments made to the Agricultural Development Act after 2000 loosened the ownership requirements, allowing even non-farmers to purchase agricultural land provided that its agricultural use was maintained. The consequences of this change were significant. In particular, there was an increase in the price of agricultural land due to higher demand from investors and buyers not directly involved in farming activities. This led to a growing distortion between the actual agricultural value of land and its market price. Moreover, in many rural areas—such as in Yilan County in northeastern Taiwan—private residences (farmhouses) had spread across high-quality agricultural land, often without any real agricultural use.

Territorial policies about land-use regulations, planning, restrictions, zoning policies and infrastructure development can implicitly affect land values. Jafary et al. [

78] demonstrated that zoning regulations, land-use classifications, and proximity to infrastructure significantly shaped land market values in Melbourne (Australia). These findings suggest that regulatory spatial attributes heavily influence land appraisal outcomes.

Similar evidence emerges from Italy, where studies by [

25,

63] showed how different types of regulatory constraints and infrastructural improvements shaped land prices. Environmental restrictions, while aimed at conservation, can lower land market values, as shown by [

52] in the United States and [

16] in Germany, especially for lower-value plots.

These findings highlight the diverse and context-dependent effects of indirect policies on land valuation.

Among the indirect policies that influence land values, land consolidation programs represent a significant and complex case. Although these policies do not act directly on land market values, they reshape the physical, legal, and functional conditions of land parcels, often resulting in increased market attractiveness and value. Recent studies conducted in Cyprus, Turkey, and Croatia [

33,

34,

64] showed that such policies have led to more accurate land valuation, indirectly contributing to an increase in market value and to greater efficiency in the land market.

3.6.7. Socioeconomic Factors

Demographic dynamics, such as population, population density, and population development, play a crucial role in shaping the demand for agricultural land. A growing population can increase the demand for agricultural products, directly impacting the market value of the land as well as the education level and the GDP per capita. Another important territorial indicator is the human development index (HDI), which is a measure of social welfare based on income, life expectancy, and education level.

The population density is positively correlated with land market values and may reflect both the scarcity of available land and urban development pressure [

40,

45,

59]. It could be used as a proxy of accessibility and proximity to urban areas, and the positive correlation with land market values might signify the expected rise in land market prices due to heightened demand for non-agricultural purposes [

35].

The population density of the county where the farm is located is statistically significant in [

47]. This supports the hypothesis that proximity to the market is a crucial characteristic of farmland. Alternatively, it might suggest that farmland is being purchased with the expectation that housing construction will be permitted, with population density serving as a proxy for potential development profits. It could also be that population density reflects the influence of unmeasured amenities such as proximity to local schools or off-farm employment opportunities for the family of the farmer.

Changes in population positively influence land values, with more pronounced effects in the upper quantiles, indicating greater speculation and conversion of agricultural land in urban areas [

16]. Population growth has a significant impact only in urban fringe areas and not in rural areas, supporting the idea that proximity to urban areas increases the market price of agricultural land due to expectations of future development [

53].

Socioeconomic characteristics of the family, such as education, age, and origin, are not statistically significant individually or jointly. This suggests that family characteristics do not influence farm market values in the Brazilian land market under study [

68]. Instead, Boisvert et al. (1997) [

36] found that land values are also positively related to operators with a college education, leading them to manage farms better.

From an economic point of view, the median population income and number and density of farms [

16,

44,

50,

59] create an economic environment in which the purchasing power of land can also depend on the financial situation of individuals and competition between farmers.

Curtiss et al. (2013) [

44] examined how changes in farmland prices are also affected by buyer typologies. In particular, they found that non-agricultural buyers pay significantly higher unit prices on average for farmland with the same characteristics, valuing parcels closer to towns more highly. These buyers also tend to purchase land in municipalities experiencing significantly higher population growth and lower unemployment rates, likely because these areas are more attractive for living. These findings support the hypothesis that non-agricultural land investors have intentions related to land development and speculation. Additionally, cooperatives were found to pay significantly higher prices for land located farther from district towns and in areas experiencing negative demographic trends. Non-farm companies as buyers increase the price [

73]. Instead, according to [

25,

63], when the buyer is a company, the unit price is on average higher. More in detail, ref. [

63] explained that when buyers are direct farmers or professional agricultural entrepreneurs, the price is higher. One of the reasons could be that registration fees are paid in a fixed amount and not proportional to the declared value of the real estate.

Kostov (2010) [

79] explored how personal relationships and buyer characteristics can modify the implicit prices of land characteristics, though as correctly stated by [

80] in their study on land market in China: “In a well-functioning land market prices should not be influenced by buyer characteristics because all parties involved in the transaction have equal access to resources”.

The results support the hypothesis that social capital, represented by personal relationship characteristics, affects the terms of exchange in the agricultural land market. This implies that personal relationships between buyer and seller can lead to preferential treatments that influence the final price of the land. Additionally, buyer and personal relationship characteristics appear less relevant in markets of homogeneous products with many buyers and sellers. However, the price is 19% lower when buyers and sellers are relatives [

63].

3.6.8. Climate

Climatic data assume fundamental relevance, as factors such as temperature and precipitation impact agricultural productivity and consequently land market value.

Average rainfall is positively correlated, while temperature has a negative relationship with land prices [

40]. This indicates that favorable climatic conditions increase agricultural land market prices. Instead, ref. [

39] found that increased total rainfall tends to reduce agricultural land market values.

In [

47], three climate variables significantly impacted farm prices: the number of frost days in winter, summer temperatures, and summer relative humidity. The increase in land prices with more frost days in winter can be explained by the beneficial effect of cold snaps killing pests and vermin, which aids agricultural production. Conversely, high relative humidity negatively impacts land prices by promoting diseases such as mildew. Average wind speed in winter and the number of frost days in summer are also statistically significant.

Uematsu et al. (2013) [

59] showed that the mean temperature in July had a positive impact at a 0.25 quantile, while at the highest quantile, it had a negative impact. It is conceivable that a high average temperature in summer—perhaps indicative of drought condition that can result in crop loss and hence lower income from farming—can be detrimental to farmland values in a very high price range. Average relative humidity had no impact on farmland values except at the lowest quantile (0.10), where it had a positive and significant impact on farmland values. This may indicate the importance of humidity for agricultural production as a basic necessity for land parcels in the very low market value range.

4. Conclusions

This systematic literature review has highlighted the heterogeneity of factors influencing agricultural land prices, distinguishing between microlevel determinants and macrolevel drivers. The analysis of 56 selected studies shows that the approach to land value assessment varies considerably depending on territorial context and data availability.

Among the microeconomic factors, the surface area of the parcel, distance from urban centers and infrastructures, soil fertility, and topography were found to be among the most influential determinants in quantifying the value of land. On the macroeconomic level, however, demographic and social dynamics and economic and climate indicators play a crucial role in defining market trends and land demand in the long term. Moreover, findings indicate that the lack of transparency in agricultural land markets—combined with limited access to reliable transaction data—represents a significant constraint to the development of robust valuation models. In many cases, the absence of actual sale prices has led researchers to rely on estimated or perceived values, which may introduce bias into econometric analyses.

The relatively low number of citations obtained by the 56 articles analyzed clearly demonstrates that the mechanism of agricultural land price discovery is a topic studied by only a small part of the international academic community. This is also the effect of a general underestimation of the important role that the land market plays within the economy of a country. The agricultural land market plays a vital role in national economies, not only as a productive resource but also as a strategic asset in the context of food security, environmental protection, and long-term sustainability. Historically, urbanization, land fragmentation, and industrial expansion have dramatically altered land-use patterns, often pushing agricultural land toward abandonment or non-agricultural conversions. In this context, the land market must be seen not merely as a sectoral issue, but as a central element in sustainable development strategies.

In a global scenario where land availability is increasingly under pressure, improving the understanding of land price formation mechanisms is crucial—not only to support fair and efficient land allocation, but also to reduce the risks associated with speculation and market distortions. Future research should focus on the development of harmonized valuation models based on standardized and publicly accessible data. Comparative studies between different land valuation systems could offer valuable policy insights, and the integration of advanced tools such as machine learning and big-data analysis may open new avenues for identifying key price determinants and predicting market dynamics.