Balance or Synergies between Environment and Economy—A Note on Model Structures

Abstract

:1. Introduction

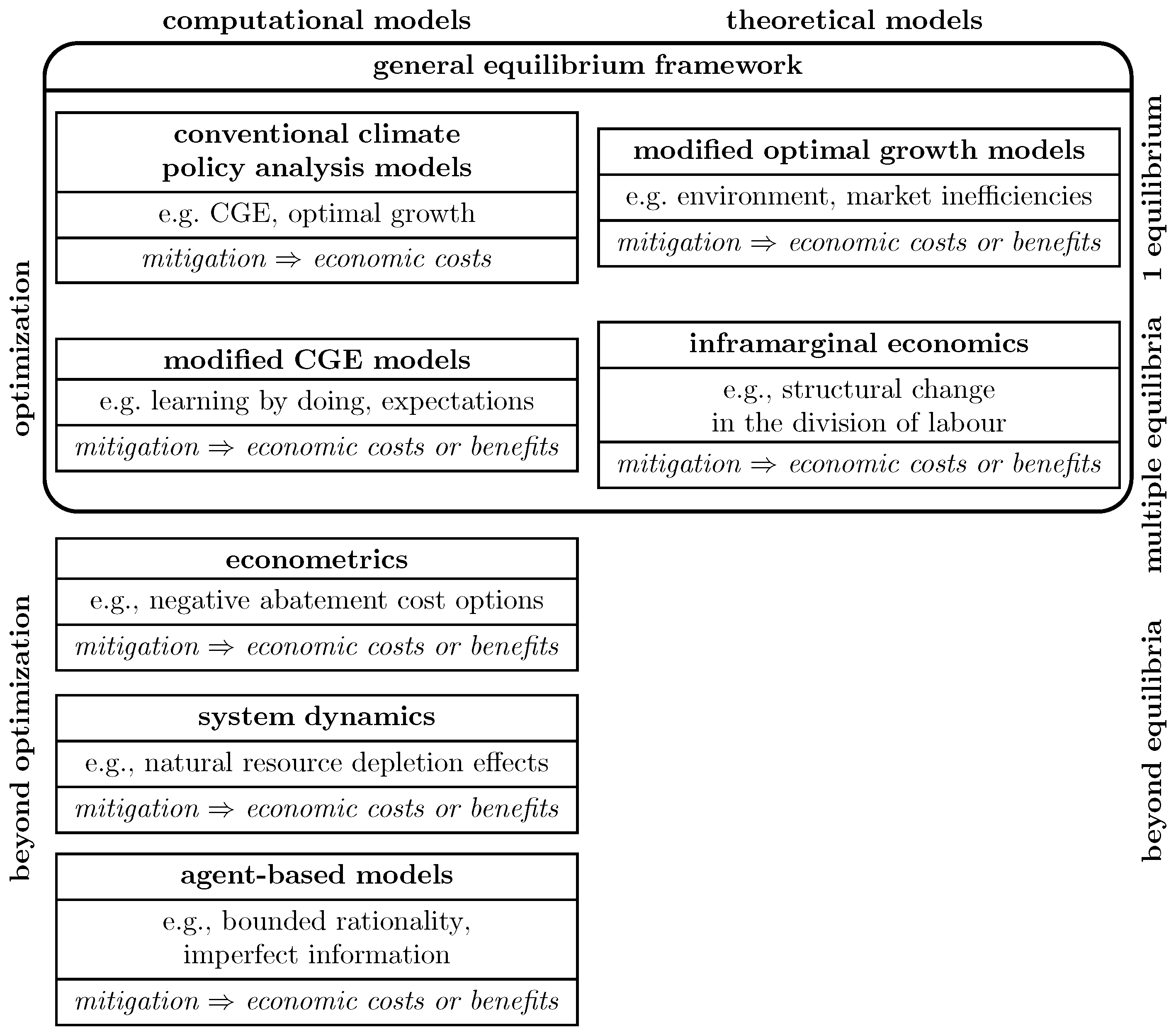

2. Material and Methods

3. A Spectrum of Modelling Approaches

3.1. The Most Common Approach for Modelling Climate Policy

3.2. Mechanisms that Lead to Lower Cost (or Even Net Benefit) Estimates

- The external effect of emissions: Greenhouse gas emissions from production (e.g., of electricity) constitute a negative externality: producers of emissions do not take into account the effect these have on later generations through climate change. According to standard economic theory, externalities lead to suboptimal economic equilibria; in particular, activities related to a negative externality are generally overprovided. This implies that a Pareto improvement should be possible by internalizing the externality (see, e.g., [15], Chapter 11). Foley [16] presents a theoretical model to show that both present and future generations can be better off with mitigation if the current generation compensates its increased investment in mitigation technology by reducing conventional investment, rather than reducing consumption. This is because, according to the standard model logic, utility increases with consumption, and thus a reduction in consumption would imply a sacrifice.See also [17,18,19] on this issue: Rezai and colleagues argue that the business-as-usual scenario commonly chosen as a reference is problematic. In the BAU case (an equilibrium of the economy with an externality), agents ignore the effects of their emissions. The competitive equilibrium diverges from the optimum because social costs of emitting are not taken into account. In the optimal case, agents are aware of these costs and choose the appropriate levels of mitigation. What is usually considered as BAU in the literature is labelled a “constrained optimal path” by Rezai and colleagues: agents know about the negative consequences of their emissions, but are constrained to “no mitigation”. Their only means to avoid emissions is to accumulate less capital, which will then result in less production and therefore less emissions. The choice by current generations to invest less results in the corresponding choice to consume more, meaning that, compared with the mitigation scenario, consumption is higher in this scenario.

- Climate change damages: Mitigation cost estimates should ideally be derived from a business-as-usual case, with accurate climate change damage estimates and a mitigation scenario where these damages can be reduced or avoided. However, as such damage estimates are difficult or even impossible to obtain given long time scales and immense uncertainty, the mitigation scenario is often compared to a BAU scenario without damages caused by climate change. It is obvious that the mitigation scenario fares less well in the latter comparison, such that costs rather than benefits are more likely to be found. This point closely relates to the previous one. In both cases, future climate damages play a role. The perspective is a little different, though: accounting for an externality, the BAU case should not be assumed optimal. When accounting for climate damages, one can theoretically consider an optimal BAU scenario that can be expected to lead to a worse result with the inclusion of climate change damages than without, and may therefore also have a worse result than a mitigation scenario that avoids these damages (see [20,21] and references therein for a short sketch of the issue and available literature).

- Environment and natural resources: The environment and natural resources are often modelled only insofar as they are influenced by the economic system, but not explicitly as factors that, in turn, influence the economy. Introducing direct or indirect effects of the impact of the environment on economic activity may bring to light additional positive effects of environmental policy on the economic system [22,23,24]. Not only may the state of the environment itself be valued (in modelling terms, the state of the environment is an input to the utility function), increased environmental quality may also benefit the economic system—for example, if the positive effects of an improved environment on health lead to higher labour productivity [22]. For natural resources, the UNEP Green Economy Report provides examples of how environmental policy can lead to economic (among other) benefits [25]: Under business–as–usual, natural resource depletion and high energy costs lead to falling long–term growth rates, whereas natural resource use is mostly decoupled from economic growth for scenarios with additional green investments.

- Effects of environmental policy: Other than throught the enhancement of environmental quality that then influences the economic system, environmental policy itself can influence the economy positively or negatively [22,23,25]. Positive influences may occur by increasing market efficiency (correcting market failures, influencing behaviours, e.g., for energy efficiency), through a stimulus effect (green investments, e.g., for infrastructure) or via an innovation effect (driving investments into R&D and innovation).

- Green investments take effect via different mechanisms in different sectors. While in the primary sectors (agriculture, fishing, forests, and water) investments in natural capital are directed towards restoring and maintaining ecosystem services as well as making management more sustainable and equitable, for secondary sectors such as energy, transport, and manufacturing, investments target opportunities for saving energy and resources [25].

- Technical change: The representation of technical change in models as exogenous, endogenous, or as induced by policy, and its implications for the assessment of mitigation costs has been widely discussed in the literature (see, [20,26] for summaries and references therein for the literature). Let us emphasize here the mechanisms of learning–by–doing (e.g., [27,28]), and directed technical change [29]: Investment not only increases production via the direct effect of capital accumulation, but also via an indirect effect on producivity. Investments in green technologies can, therefore, increase technical change in green sectors, helping them to catch up with conventional technologies.

- Positive externalities from additional investment: There also is a positive externality involved in knowledge accumulation, and, hence, in technical change: Benefits of increasing productivity not only accrue to the investors themselves. If the social benefits of investment are not taken into consideration by single investors, as is often the case, market outcomes generally underprovide investment. Large investments are needed for decarbonizing the economy, and investment levels are currently low in most OECD countries. Hence, triggering additional investment (be it public, private, or a combination of these) is a mechanism that can make green growth feasible (e.g., [5,30]). In combination with other mechanisms, investment-oriented climate policy presents a green growth opportunity [31].

- Irrational behaviour and imperfect information: The behaviour of individual agents is represented as optimization under perfect foresight in general equilibrium style models. The inherent assumption in optimization approaches—that the reference scenario achieves the economic optimum—implies the assumption that all investment opportunities with a positive return are known and realized in the optimal scenario. Hence, following this model logic, there are no untapped investment opportunities, and any additional investments will be made at a net cost. If agents in a model may not know all investment opportunities, or if they behave suboptimally, negative cost options may result.

- Negative cost options: The literature indicates that a considerable amount of investments into GHG emission reductions can be realized at net negative costs (i.e., net benefits) [32]. Especially energy–efficiency investments, such as building insulation, lighting, air–conditioning, and more fuel–efficient vehicles, are reported as net negative abatement cost options. Increasing efficiency is, as mentioned above, recognized as one mechanism through which environmental policy can have positive economic effects [22].

- Financial market inefficiencies are another issue related to investments. The general equilibrium framework does not have money; prices are relative prices. Since all resources are optimally employed by assumption in the BAU case, as mentioned above, there are no untapped financial resources for additional investments, nor are there positive investment opportunities that are not funded in these models. When such inefficiencies are included in a model together with net negative cost investment opportunities, positive macroeconomic effects of mitigation measures can be found, as has been shown in [33,34,35].

- Expectation dynamics: Not only the individual behaviour of agents matters, but also their interaction in networks. The general equilibrium framework dispenses with these networks by construction: the market as a single central point for the exchange of goods makes networks between agents unnecessary. When solving a system of equations for those prices that balance aggregate supply and demand, the question of who trades with whom is never asked. Representing both the imperfect foresight of real-world agents via expectations and the fact that agents interact and may influence each other—considering the dynamics of expectations in networks of agents—is another mechanism that (in combination with other mechanisms) may lead to positive economic effects of climate policy [31,36].

3.3. Model Structures that Lead to Lower Cost (or Even Net Benefit) Estimates

4. Discussion

5. Conclusions and Outlook

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| BAU | business as usual |

| GCD | gross domestic product |

| CGE | computable general equilibrium |

| UNEP | United Nations Environment Programme |

| R&D | research and development |

| OECD | Organisation for Economic Co-operation and Development |

| GHG | greenhouse gas |

| ABM | agent-based model |

References

- IPCC. Climate change 2014: Mitigation of climate change. In Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2014. [Google Scholar]

- Jaeger, C.C.; Hasselmann, K.; Leipold, G.; Mangalagiu, D.; Tábara, J.D. Reframing the Problem of Climate Change: From Zero Sum Game to Win–Win Solutions; Routledge: Oxford, UK, 2012. [Google Scholar]

- Edenhofer, O.; Jakob, M.; Creutzig, F.; Flachsland, C.; Fuss, S.; Kowarscha, M.; Lessmann, K.; Mattaucha, L.; Siegmeier, J.; Steckel, J.C. Closing the emission price gap. Glob. Environ. Chang. 2015, 31, 132–143. [Google Scholar] [CrossRef]

- The Global Commission on the Economy and Climate. Better Growth, Better Climate: The New Climate Economy Report, Synthesis Report. Available online: http://newclimateeconomy.report/ (accessed on 4 August 2016).

- Romani, M.; Stern, N.; Zenghelis, D. The Basic Economics of Low-Carbon Growth in the UK; Policy Brief; Grantham Research Institute on Climate Change and the Environment and Centre for Climate Change Economics and Policy: London, UK, 2011. [Google Scholar]

- Organisation for Economic Co-operation and Development (OECD). Towards Green Growth; Organisation for Economic Co-operation and Development: Paris, France, 2011. [Google Scholar]

- Wolf, S.; Schütze, F.; Jaeger, C.C. The Possibility of Green Growth in Climate Policy Analysis Models—A Survey; GCF Working Paper; Global Climate Forum: Berlin, Germany, 2016. [Google Scholar]

- Arrow, K.J.; Debreu, G. Existence of an equilibrium for a competitive economy. Econometrica 1954, 22, 265–290. [Google Scholar] [CrossRef]

- Saari, D. Mathematical complexity of simple economics. Not. AMS 1995, 42, 222–230. [Google Scholar]

- Bowen, A.; Campiglio, E.; Tavoni, M. A macroeconomic perspective on climate change mitigation: Meeting the financing challenge. Clim. Chang. Econ. 2014. [Google Scholar] [CrossRef]

- Kirman, A.P. Whom or what does the representative individual represent? J. Econ. Perspect. 1992, 6, 117–136. [Google Scholar] [CrossRef]

- Hepburn, C.; Bowen, A. Prosperity with growth: Economic growth, climate change and environmental limits. In Handbook on Energy and Climate Change; Edward Elgar Publishing: Cheltenham, UK, 2013. [Google Scholar]

- Zhang, Y. Climate change and green growth: A perspective of division of labor. China World Econ. 2014, 22, 93–116. [Google Scholar] [CrossRef]

- Zysman, J.; Huberty, M. Religion and reality in the search for green growth. Intereconomics 2012, 3, 140–146. [Google Scholar] [CrossRef] [Green Version]

- Mas-Colell, A.; Whinston, M.D.; Green, J.R. Microeconomic Theory; Oxford University Press: New York, NY, USA, 1995. [Google Scholar]

- Foley, D. The economic fundamentals of global warming. In Twenty-First Century Macroeconomics: Responding to the Climate Challenge; Harris, J., Goodwin, N., Eds.; Edward Elgar Publishing: Cheltenham/Northampton, UK, 2009. [Google Scholar]

- Rezai, A.; Foley, D.K.; Taylor, L. Global warming and economic externalities. Econ. Theory 2012, 49, 329–351. [Google Scholar] [CrossRef] [Green Version]

- Rezai, A. The opportunity cost of climate policy: A question of reference. Scand. J. Econ. 2011, 113, 885–903. [Google Scholar] [CrossRef] [Green Version]

- Rezai, A. Recast the DICE and its policy recommendations. Macroecon. Dyn. 2010, 14, 275–289. [Google Scholar] [CrossRef]

- Rosen, R.A.; Guenther, E. The economics of mitigating climate change: What can we know? Technol. Forecast. Soc. Chang. 2015, 91, 93–106. [Google Scholar] [CrossRef]

- Rosen, R.A. Is the IPCC’s 5th Assessment a denier of possible macroeconomic benefits from mitigating climate change? Clim. Chang. Econ. 2016. [Google Scholar] [CrossRef]

- Hallegatte, S.; Heal, G.; Fay, M.; Treguer, D. From Growth to Green Growth—A Framework. Available online: http://www.nber.org/papers/w17841.pdf (accessed on 4 August 2016).

- The World Bank. Inclusive Green Growth. Available online: http://siteresources.worldbank.org/EXTSDNET/Resources/Inclusive_Green_Growth_May_2012.pdf (accessed on 4 August 2016).

- Withagen, C.; Smulders, S. Green Growth. Lessons from Growth Theory. Available online: http://documents.worldbank.org/curated/en/380011468340178901/pdf/wps6230.pdf (accessed on 4 August 2016).

- United Nations Environment Programme. Towards a Green Economy: Pathways to Sustainable Development and Poverty Eradication; United Nations Enviroment Programme: Nairobi, Kenya, 2011. [Google Scholar]

- Scrieciu, S.; Rezai, A.; Mechler, R. On the economic foundations of green growth discourses: The case of climate change mitigation and macroeconomic dynamics in economic modeling. WIREs Energy Environ. 2013, 2, 251–268. [Google Scholar] [CrossRef]

- Frankel, M. The production function in allocation and growth: A synthesis. Am. Econ. Rev. 1962, 52, 996–1022. [Google Scholar]

- Lucas, R. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The environment and directed technical change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef] [PubMed]

- Bowen, A.; Fankhauser, S.; Stern, N.; Zenghelis, D. An Outline of the Case for a ’Green’ Stimulus. Available online: http://eprints.lse.ac.uk/24345/1/An_outline_of_the_case_for_a_green_stimulus.pdf (accessed on 4 August 2016).

- Jaeger, C.C.; Schütze, F.; Fürst, S.; Mangalagiu, D.; Meißner, F.; Mielke, J.; Steudle, G.A.; Wolf, S. Investment-Oriented Climate Policy—An Opportunity for Europe; Global Climate Forum: Berlin, Germany, 2015. [Google Scholar]

- McKinsey & Company. Impact of the Financial Crisis on Carbon Economics; McKinsey & Company: New York, NY, USA, 2010. [Google Scholar]

- European Commission. Impact Assessment Accompanying the Document Directive of the European Parliament and of the Council on Energy Efficiency and Amending and Subsequently Repealing Directives 2004/8/EC and 2006/32/EC; Commission Staff Working Paper; SEC: Washington, DC, USA, 2011. [Google Scholar]

- Sijm, J.; Boonekamp, P.; Summerton, P.; Pollitt, H.; Billington, S. Investing EU ETS Auction Revenues into Energy Savings. Available online: http://www.ecn.nl/docs/library/report/2013/e13033.pdf (accessed on 4 August 2016).

- Jobs, Growth and Warmer Homes. Evaluating the Economic Stimulus of Investing in Energy Efficiency Measures in Fuel Poor Homes. Available online: https://www.e3g.org/docs/Jobs-growth-and-warmer-homes_Executive_Summary.pdf (accessed on 4 August 2016).

- Jaeger, C.C.; Paroussos, L.; Mangalagiu, D.; Kupers, R.; Mandel, A.; Tábara, J.D. A New Growth Path for Europe—Generating Prosperity and Jobs in the Low-Carbon Economy; Synthesis Report; Commissioned by the Federal Ministry for the Environment, Nature Conservation and Nuclear Safety; Global Climate Forum: Berlin, Germany, 2011. [Google Scholar]

- Shi, H.; Zhang, Y. How Could Mitigations Promote Economic Progress: A Theoretical Framework; Working Paper; Climate Change and Green Growth Project Development Research Centre of the State Council (DRC): Beijing, China, 2012. [Google Scholar]

- Zhang, Y.; Shi, H. From burden–sharing to opportunity–sharing: Unlocking the climate negotiations. Clim. Policy 2014, 14, 63–81. [Google Scholar] [CrossRef]

- Zhang, Y. Can China Achieve Green Growth? In China: A New Model for Growth and Development; Garnaut, R., Fang, C., Song, L., Eds.; ANU E Press, The Australian National University: Canberra, Australia, 2013. [Google Scholar]

- Introductory Statement to the Press Conference (with Q&A). Available online: https://www.ecb.europa.eu/press/pressconf/2016/html/is160721.en.html (accessed on 4 August 2016).

- Cambridge Econometrics. E3ME Technical Manual, version 6.0; Cambridge Econometrics: Cambridge, UK, 2014. [Google Scholar]

- Cambridge Econometrics. Available online: http://www.camecon.com/Home.aspx (accessed on 4 August 2016).

- Millennium Institute. Available online: http://www.millennium-institute.org/integrated_planning/tools/T21/ (accessed on 4 August 2016).

- Moss, S.; Pahl-Wostl, C.; Downing, T. Agent-based integrated assessment modelling: The example of climate change. Integr. Assess. 2001, 2, 17–30. [Google Scholar] [CrossRef]

- Giupponi, C.; Borsuk, M.E.; de Vries, B.J.; Hasselmann, K. Innovative approaches to integrated global change modelling. Environ. Model. Softw. 2013, 44, 1–9. [Google Scholar] [CrossRef]

- Jaeger, C.C.; Fürst, S.; Mielke, J.; Schütze, F.; Steudle, G.A.; Wolf, S. STOEMSys—Towards a Sustainability Transition Open Economic Modelling System; Final Report; Global Climate Forum: Berlin, Germany, 2015. [Google Scholar]

- Reeg, M.; Nienhaus, K.; Roloff, N.; Pfenning, U.; Deissenroth, M.; Wassermann, S.; Hauser, W.; Weimer-Jehle, W.; Kast, T.; Klann, U. Weiterentwicklung Eines Agentenbasierten Simulationsmodells (AMIRIS) zur Untersuchung des Akteursverhaltens bei der Marktintegration von Strom aus Erneuerbaren Energien unter Verschiedenen Fördermechanismen; DLR, ZIRIUS, Thomas Kast Simulation Solutions, IZES: Stuttgart, Vilshofen, Saarbrücken, 2013. Available online: http://www.dlr.de/tt/Portaldata/41/Resources/dokumente/institut/system/publications/AMIRIS_Weiterentwicklung_Abschlussbericht.pdf (accessed on 4 August 2016). (In German)

- Chappin, E.; Dijkema, G. Agent-based modelling of energy infrastructure transitions. Int. J. Crit. Infrastruct. 2010, 6, 106–130. [Google Scholar] [CrossRef]

- Zhang, B.; Zhang, Y.; Bi, J. An adaptive agent-based modeling approach for analyzing the influence of transaction costs on emissions trading markets. Environ. Model. Softw. 2011, 26, 482–491. [Google Scholar] [CrossRef]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wolf, S.; Schütze, F.; Jaeger, C.C. Balance or Synergies between Environment and Economy—A Note on Model Structures. Sustainability 2016, 8, 761. https://doi.org/10.3390/su8080761

Wolf S, Schütze F, Jaeger CC. Balance or Synergies between Environment and Economy—A Note on Model Structures. Sustainability. 2016; 8(8):761. https://doi.org/10.3390/su8080761

Chicago/Turabian StyleWolf, Sarah, Franziska Schütze, and Carlo C. Jaeger. 2016. "Balance or Synergies between Environment and Economy—A Note on Model Structures" Sustainability 8, no. 8: 761. https://doi.org/10.3390/su8080761

APA StyleWolf, S., Schütze, F., & Jaeger, C. C. (2016). Balance or Synergies between Environment and Economy—A Note on Model Structures. Sustainability, 8(8), 761. https://doi.org/10.3390/su8080761