European Pesticide Tax Schemes in Comparison: An Analysis of Experiences and Developments

Abstract

:1. Introduction

2. Methodology for Pesticide Policy Analysis

3. Fiscal Instruments Established in Europe

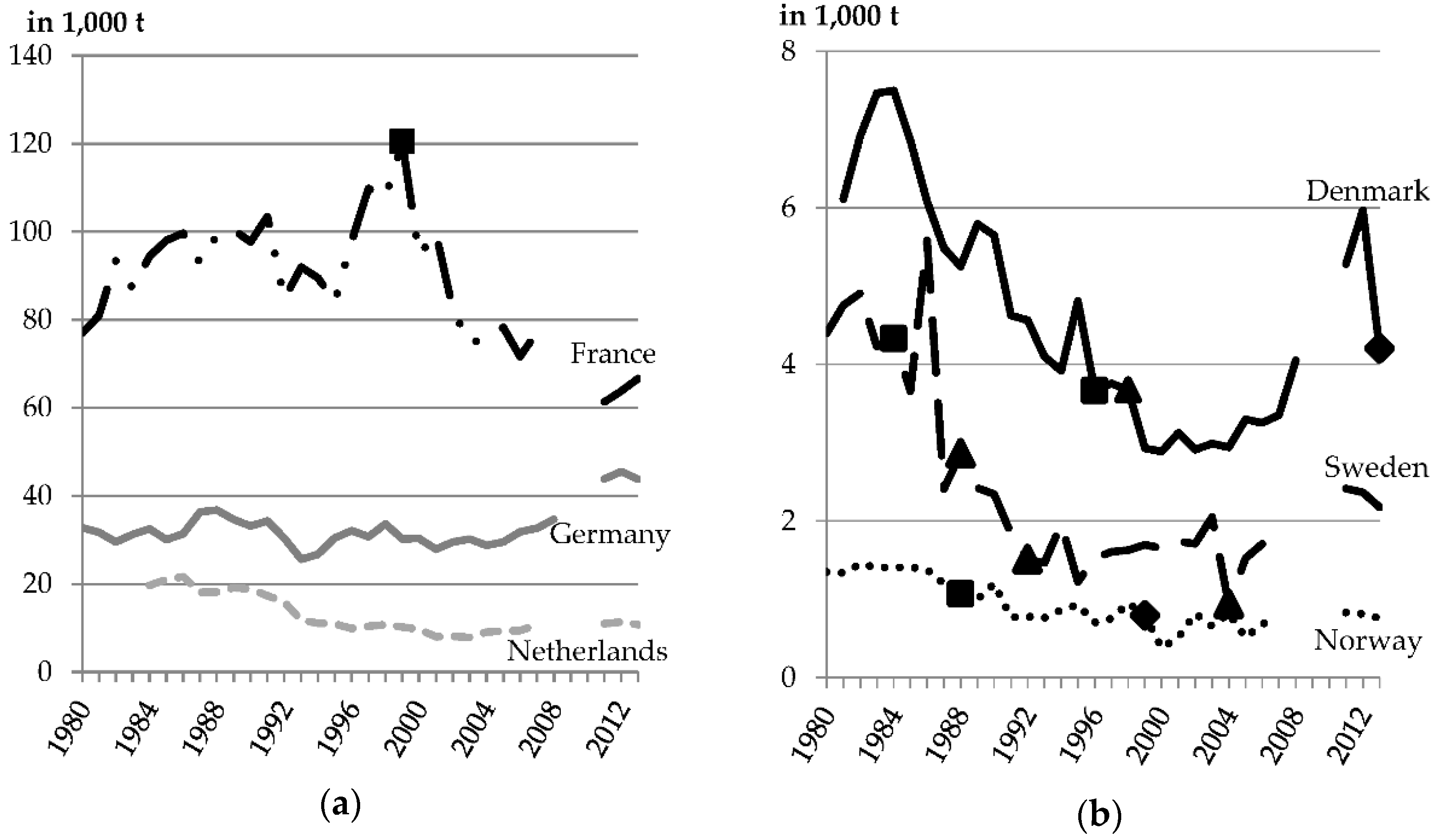

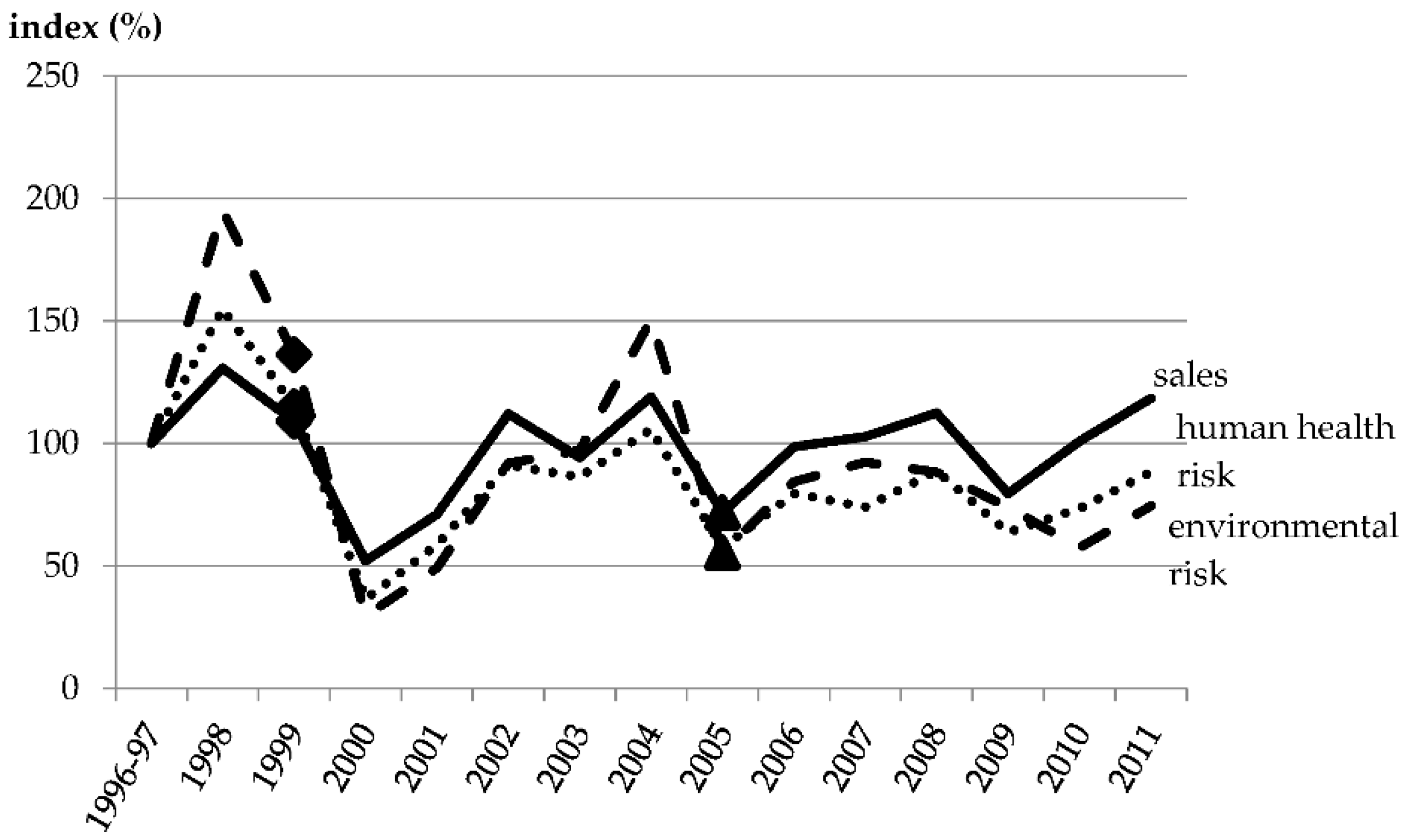

3.1. Sweden

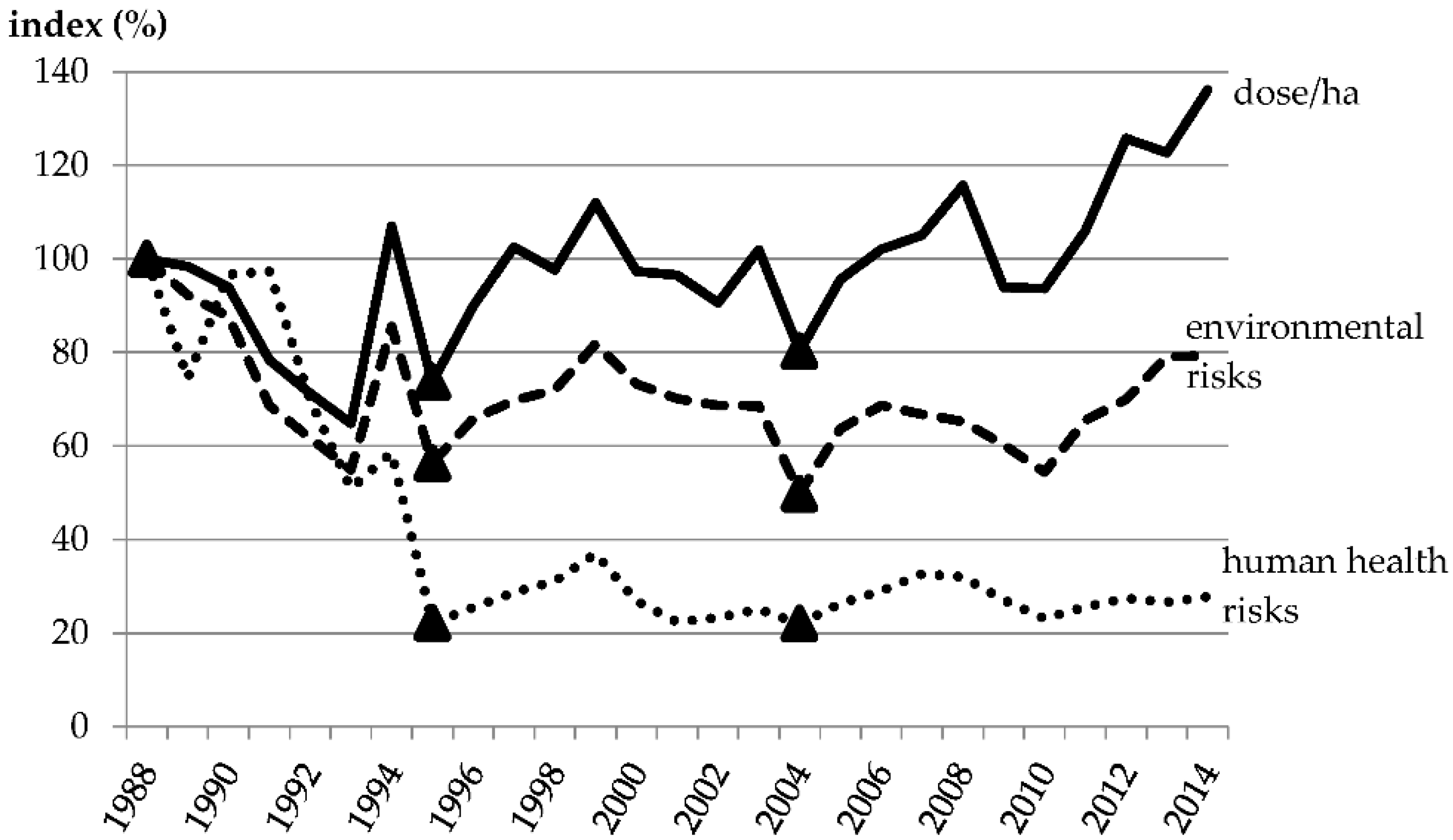

3.2. Norway

3.3. Denmark

3.4. France

3.5. Tax Discussions in Other European Countries

4. Analysis of Implementation and Objective Achievement

5. Discussion and Conclusions

Supplementary Materials

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| AS | active substance |

| DKK | Danish krone |

| ha | hectare |

| NAP | national action plan |

| NOK | Norwegian krone |

| SAD | standard area dose |

| SEK | Swedish krona |

| TGAP | taxe générale sur les activités polluantes |

| VAT | value added tax |

References

- ARCADIS Belgium. Vergroening van de Fiscaliteit. Bijlage 2: Groslijst Vergroeningsopties; ARCADIS Belgium nv/sa: Brussels, Belgium, 2014; pp. 42–46. [Google Scholar]

- Federal Department of Economic Affairs, Education and Research (EAER). Bedarfsabklärung Eines Aktionsplans zur Risikoreduktion und Nachhaltigen Anwendung von Pflanzenschutzmitteln—Bericht in Erfüllung des Postulates 12.3299 von Frau Nationalrätin Tiana Angelina Moser vom 16. März 2012; Eidgenössisches Departement für Wirtschaft, Bildung und Forschung WBF: Berne, Switzerland, 2014. [Google Scholar]

- Hof, B.; Koopmans, C.; Rougoor, W.; van der Voort, J. Effecten en Vormgeving van een Heffing op Gewasbeschermingsmiddelen; Rapport nr. 2013-39; SEO Economisch Onderzoek: Amsterdam, The Netherlands, 2013. [Google Scholar]

- Möckel, S.; Gawel, E.; Kästner, M.; Liess, M.; Knillmann, S.; Bretschneider, W. Einführung einer Abgabe auf Pflanzenschutzmittel in Deutschland. In Studien zu Umweltökonomie und Umweltpolitik; Gawel, E., Ed.; Duncker & Humblot: Berlin, Germany, 2015; Volume 10, pp. 1–305. [Google Scholar]

- Oskam, A.J.; Vijftigschild, R.A.N.; Graveland, C. Additional EU Policy Instruments for Plant Protection Products. A Report within the Second Phase of the Programme: Possibilities for Future EC Environmental Policy on Plant Protection Products; Wageningen Agricultural University: Wageningen, The Netherlands, 1997. [Google Scholar]

- Hoevenagel, R.; van Noort, E.; de Kok, R. Study on a European Union wide Regulatory Framework for Levies on Pesticides; EIM Small Business Research and Consultancy, Haskoning: Zoetermeer, The Netherlands, 1999. [Google Scholar]

- Ecotec Research & Consulting; Centre for Social Science Research on the Environment (CESAM); Centre for Agriculture and Environment (CLM); University of Gothenburg; University College Dublin (UCD); Institute for European Environmental Policy (IEEP). Study on the Economic and Environmental Implications of the Use of Environmental Taxes and Charges in the European Union and its Member States; Ecotec Research & Consulting: Brussels, Belgium; Birmingham, UK, 2001. [Google Scholar]

- Gregoriou, P.; Manuneas, T.; Pashardes, P. Agricultural Support Policies and Optimum Tax and Levy Scheme for Pesticide Use in Farm Production; Economic Analysis Papers No. 03-09; Economics Research Centre, University of Cyprus: Nicosia, Cyprus, 2009. [Google Scholar]

- Skevas, T.; Oude Lansink, A.G.J.M.; Stefanou, S.E. Designing the emerging EU pesticide policy: A literature review. NJAS Wagening. J. Life Sci. 2013, 64–65, 95–103. [Google Scholar] [CrossRef]

- Lefebvre, M.; Langrell, S.R.H.; Gomez-y-Paloma, S. Incentives and policies for integrated pest management in Europe: A review. Agron. Sustain. Dev. 2015, 35, 27–45. [Google Scholar] [CrossRef]

- Reus, J.A.W.A.; Weckseler, H.J.; Pak, G.A. Towards a Future EC Pesticide Policy—An Inventory of Risks of Pesticide Use, Possible Solutions and Policy Instruments; Centre for Agriculture and Environment (CLM): Utrecht, The Netherlands, 1994. [Google Scholar]

- Falconer, K.E. Managing diffuse environmental contamination from agricultural pesticides: An economic perspective on issues and policy options, with particular reference to Europe. Agric. Ecosyst. Environ. 1998, 69, 37–54. [Google Scholar] [CrossRef]

- Popp, J.; Pető, K.; Nagy, J. Pesticide productivity and food security. A review. Agron. Sustain. Dev. 2013, 33, 243–255. [Google Scholar] [CrossRef]

- Zilberman, D.; Millock, K. Financial incentives and pesticide use. Food Policy 1997, 22, 133–144. [Google Scholar] [CrossRef]

- Eurostat. A Common Methodology for the Collection of Pesticide Usage Statistics within Agriculture and Horticulture; Office for Official Publications of the European Communities: Luxembourg City, Luxembourg, 2008. [Google Scholar]

- Van Bol, V.; Claeys, S.; Debognie, P.; Godfriaux, J.; Pussemier, L.; Steurbaut, W.; Maraite, H. Pesticide Indicators. Pestic. Outlook 2003, 14, 159–163. [Google Scholar] [CrossRef]

- European Commission. VAT Rates Applied in the Member States of the European Union—Situation at 1st September 2015. Available online: http://ec.europa.eu/taxation_customs/resources/documents/taxation/vat/how_vat_works/rates/vat_rates_en.pdf (accessed on 7 January 2016).

- Organisation for Economic Co-operation and Development (OECD). OECD Environmental Performance Reviews: Finland; OECD Publishing: Paris, France, 2009. [Google Scholar]

- Notisum AB. Rättsnätet—Lag (1984:410) om Skatt på Bekämpningsmedel; Sweden, 2015. Available online: http://www.notisum.se/rnp/sls/lag/..%5Cfakta%5Ca9840410.htm (accessed on 7 January 2016).

- Landsbygdsdepartementet—Ministry of Rural Affairs. National Action Plan for the Sustainable Use of Plant Protection Products for the Period 2013–2017; Landsbygdsdepartementet: Stockholm, Sweden, 2013. [Google Scholar]

- Larsson, M.; Boström, G.; Gönczi, M.; Kreuger, J. Kemiska Bekämpningsmedel i Grundvatten 1986–2014—Sammanställning av Resultat och Trender i Sverige under tre Decennier, Samt Internationella Utblickar; Havs och Vattenmyndigheten Rapport 2014:15, CKB Rapport 2014:1; Havs och Vattenmyndigheten, KompetensCentrum för Kemiska Bekämpningsmedel (CKB): Uppsala, Sweden, 2014. [Google Scholar]

- Spikkerud, E. Taxes as a tool to reduce health and environmental risk from pesticide use in Norway. In Evaluating Agri-Environmental Policies: Design, Practice and Results; OECD, Ed.; OECD Publishing: Paris, France, 2005; pp. 281–290. [Google Scholar]

- Eurostat. Agri-Environmental Indicators—Farm Management—Pesticide Sales; Luxembourg, 2016. Available online: http://ec.europa.eu/eurostat/data/database (accessed on 12 April 2016).

- Bergkvist, P. Pesticide Risk Indicators at National Level and Farm Level—A Swedish Approach; Nr 6/04; Kemikalieinspektionen: Sundbyberg, Sweden, 2004. [Google Scholar]

- Statskontoret. Effekter på Priset för Handelsgödsel när Skatten på Kväve i Handelsgödsel Avskaffas—en Delrapport; Regeringen—Jordbruksdepartementet: Stockholm, Sweden, 2010. [Google Scholar]

- Baeumer, K. Allgemeiner Pflanzenbau, 3rd ed.; UTB für Wissenschaft—Verlag Eugen Ulmer: Stuttgart, Germany, 1992. [Google Scholar]

- Naturvårdsverket. Dataunderlag—Växtskyddsmedel—Dataunderlag—Växtskyddsmedel; 2016. Available online: http://www.miljomal.se/Miljomalen/Alla-indikatorer/Indikatorsida/Dataunderlag-for-indikator/?iid=139&pl=1&t=Land&l=SE (accessed on 24 March 2016).

- Spikkerud, E.; Haraldsen, T.; Abdellaue, A.; Holmen, M.T. Guidelines for a Banded Pesticide Tax Scheme, Differentiated According to Human Health and Environmental Risks; Norwegian Food Safety Authority—National Centre of Plants and Vegetable Foods: Brumunddal, Norway, 2005. [Google Scholar]

- Mattilsynet—Norwegian Food Safety Authority. Miljøavgift for Plantevernmidler (Februar 2014); 2014. Available online: http://www.mattilsynet.no/language/english/plants/plant_protection_products/taxes_for_plant_protection_products.17427 (accessed on 7 January 2016).

- Strøm Prestvik, A.; Netland, J.; Hovland, I. Evaluering av Avgiftssystemet for Plantevernmidler i Norge; 2013. Available online: http://www.mattilsynet.no/planter_og_dyrking/plantevernmidler/mattilsynet_evaluerer_avgiftssystemet_for_plantevernmidler.12116 (accessed on 7 January 2016).

- Stortingets administrasjon. Statsbudsjettet for 2015—Saldert Budsjett Vedtatt i Stortinget Høsten 2014; Stortingets Administrasjon—Konstitusjonell Avdeling: Oslo, Norway, 2015. [Google Scholar]

- Gianessi, L.; Rury, K.; Rinkus, A. An evaluation of pesticide use reduction policies in Scandinavia. Outlooks Pest Manag. 2009, 20, 1–7. [Google Scholar] [CrossRef]

- Landbruksdepartementet—Ministry of Agriculture. Action Plan on Reducing Risk Connected to the Use of Pesticides (2004—2008)); Publication number M—0727 E; Landbruksdepartementet, 2004. Available online: https://www.regjeringen.no/globalassets/upload/lmd/vedlegg/brosjyrer_veiledere_rapporter/action_plan_on_reducing_risk_connected_to_the_use_of_pesticides_2004_2008.pdf (accessed on 7 January 2016).

- Norwegian Agricultural Inspection Service. OECD Survey of National Pesticide Risk Indicators, 1999–2000. Available online: http://www.oecd.org/chemicalsafety/pesticides-biocides/1934217.pdf (accessed on 7 January 2016).

- Landbruks- og matdepartementet—Ministry of Agriculture and Food. Handlingsplan for Redusert Risiko ved Bruk av Plantevernmidler (2010—2014)); National Action Plan from 18 September 2009. Available online: https://www.regjeringen.no/globalassets/upload/lmd/vedlegg/handlingsplan_plantervern_2010_2014.pdf (accessed on 7 January 2016).

- Mattilsynet—Norwegian Food Safety Authority. National Monitoring Program for Residues of Pesticides in Food, Melding nr. 4/2013, nr. 5/2013, nr. 7/2014; Mattilsynet: Brumunddal, Norway, 2014; Available online: http://www.mattilsynet.no/language/english/sok/?search=plantevernmidler+ (accessed on 7 January 2016).

- Bechmann, M.; Stenrød, M.; Pengerud, A.; Grønsten, H.A.; Deelstra, J.; Eggestad, H.O.; Hauken, M. Erosjon og tap av Næringsstoffer og Plantevernmidler fra Jordbruksdominerte Nedbørfelt—Sammendragsrapport fra Program for Jord- og Vannovervåking i Landbruket (JOVA) for 1992–2013; Rapport Volume 9; Bioforsk: Ås, Norway, 2014. (In Norwegian) [Google Scholar]

- Øgaard, A.F.; Skaalsveen, K. Resultater fra Program for Jord- og Vannovervåking i Landbruket (JOVA) for 1992–2014; NIBIO—Norsk Institutt for Bioøkonomi: Ås, Norway, 2015. [Google Scholar]

- Strøm Prestvik, A.; NIBIO—Norwegian Institute of Bioeconomy Research, Ås, Akershus, Norway. Personal communication, 2015.

- Miljøministeriet—Ministry of Environment. The Agricultural Pesticide Load in Denmark 2007–2010; Environmental Review No. 2/2012; Miljøministeriet: Copenhagen, Denmark, 2012. [Google Scholar]

- Pedersen, A.B.; Nielsen, H.Ø.; Andersen, M.S. The Danish pesticide tax. In Use of Economic Instruments in Water Policy—Insights from International Experience; Lago, M., Mysiak, J., Gómez, C.M., Delacámara, G., Maziotis, A., Eds.; Springer International Publishing: Cham, Switzerland, 2015; pp. 73–87. [Google Scholar]

- Miljøministeriet—Ministry of Environment. Background and Content of the New Pesticide Tax. In Proceedings of the International Seminar on a New Danish Pesticide Tax, Danish Environmental Protection Agency, Copenhagen, Denmark, 30 May 2013.

- Hansen, L.F. New Pesticide Tax and Indicator in Denmark—National Action Plans. In Proceedings of the International Seminar on a New Danish Pesticide Tax, Danish Environmental Protection Agency, Copenhagen, Denmark, 30 May 2013.

- Schou, J.S.; Streibig, J.C. Pesticide taxes in Scandinavia. Pestic. Outlook 1999, 10, 227–229. [Google Scholar]

- Skatteministeriet. Afgifter—Provenuet af Afgifter og Moms 2009–2016; Denmark, 2015. Available online: http://www.skm.dk/skattetal/statistik/provenuoversigter/afgifter-provenuet-af-afgifter-og-moms-2009-2016 (accessed on 15 February 2016).

- Natur- og Landbrugskommissionen. Natur- og Landbrugskommissionens Statusreport: Bilag 10—Pesticidafgifter Opkrævning og Anvendelse; Natur- og Landbrugskommissionen: Copenhagen, Denmark, 2012. [Google Scholar]

- Miljøministeriet, Ministeriet for Fødevarer, Landbrug og Fiskeri—Ministry of the Environment, Ministry of Food, Agriculture and Fisheries. Protect Water, Nature and Human Health—Pesticide Strategy 2013–2015; Danish Ministry of the Environment Information Centre: Copenhagen, Denmark, 2013. [Google Scholar]

- Jørgensen, L.N.; Ørum, J.E. Farmers’ Possibilities for Shifting to Pesticides with Lower Load and Manage Resistance—Fungicides and Insecticides. In International Seminar on a New Danish Pesticide Tax, Danish Environmental Protection Agency, Copenhagen, Denmark, 30 May 2013.

- Nørring, N.P. Pesticide Taxation: Does It Work? In International Seminar on a New Danish Pesticide Tax, Danish Environmental Protection Agency, Copenhagen, Denmark, 30 May 2013.

- Eurostat. Exchange Rates—Bilateral Exchange Rates—Euro/ECU Exchange Rates; Luxembourg, 2015. Available online: http://ec.europa.eu/eurostat/data/database (accessed on 12 April 2016).

- Kemikalieinspektionen (KEMI). Databaser—Bekämpningsmedelsregistret, Sundbyberg, Sweden, 2015. Available online: http://webapps.kemi.se/BkmRegistret/Kemi.Spider.Web.External/ (accessed on 7 January 2016).

- Ministère de l'Écologie, du Développement Durable et de l’Énergie (MEDDE). Montant par Produit Pour l’année 2015. Redevance Phyto & Traçabilité des Ventes; France, 2015. Available online: http://redevancephyto.developpement-durable.gouv.fr/distributeur/montantparproduit (accessed on 7 January 2016).

- Miljø- og Fødevareministeriet. Afgift på Sprøjtemidler—Hent Listen over Afgifter pr. 12. Februar 2015; Copenhagen, Denmark, 2015. Available online: http://mst.dk/virksomhed-myndighed/bekaempelsesmidler/sproejtemidler/bruger/pesticidafgift/ (accessed on 7 January 2016).

- SEGES P/S. Middeldatabasen; Aarhus, Denmark, 2015. Available online: https://www.middeldatabasen.dk/default.asp (accessed on 7 January 2016).

- Aubertot, J.-N.; Barbier, J.-M.; Carpentier, A.; Gril, J.-J.; Guichard, L.; Lucas, P.; Savary, S.; Voltz, M.; Savini, I. Pesticides, Agriculture and the Environment—Reducing the Use of Pesticides and Limiting Their Environmental Impact; INRA and Cemagref: Rennes and Lyon, France, 2005. [Google Scholar]

- Ministère de l’Agriculture et de la Pêche (MAP). Avis Relatif à la Liste des Substances Dangereuses du Plan Interministériel de Réduction des Risques Liés aux Pesticides. Journal Officiel de la République Française, NOR: AGRG0602464V, 2016. Available online: http://www.legifrance.gouv.fr/jo_pdf.do?id=JORFTEXT000000423707 (accessed on 7 January 2016). (In French)

- Organisation for Economic Co-operation and Development (OECD). OECD Economic Surveys: France 2011; OECD Publishing: Paris, France, 2011. [Google Scholar]

- République Française. Agences de l’eau—Annexe au Projet de loi de Finances Pour 2015; 2014. Available online: http://www.performance-publique.budget.gouv.fr/sites/performance_publique/files/farandole/ressources/2015/pap/pdf/jaunes/Jaune2015_agences_eau.pdf (accessed on 7 January 2016).

- Bommelaer, O.; Devaux, J. Le Financement de la Gestion des Ressources en eau en France (Actualisation de Janvier 2012); Études & Documents Nr. 62; Commissariat Général au Développement Durable: La Défense, France, 2012. (In French) [Google Scholar]

- Ministère de l’Agriculture et de la Pêche (MAP). Écophyto 2018; République Française: Paris, France, 2008. (In French) [Google Scholar]

- Ministère de l’Agriculture, de l’Agroalimentaire et de la Forêt (MAAF); Ministère de l’Écologie, du Développement durable et de l’Énergie (MEDDE). Plan Écophyto II; République Française: Paris, France, 2015. [Google Scholar]

- Barzman, M.; Dachbrodt-Saaydeh, S. Comparative analysis of pesticide action plans in five European countries. Pest Manag. Sci. 2011, 67, 1481–1485. [Google Scholar] [CrossRef] [PubMed]

- Belassen, V. Les Certificats D’économie de Produits Phytosanitaires: Quelle Contrainte et Pour qui; Working Paper 2015/4; CESAER INRA—Centre d’Economie et Sociologie appliquées à l’Agriculture et aux Espaces Ruraux: Dijon, France, 2015. (In French) [Google Scholar]

- Tweede Kamer. Fiscaliteit, landbouw- en Natuurbeleid, Kamerstuk 28207 nr. 3, Lijst van Vragen en Antwoorden, Vergaderjaar 2002–2003, Den Haag, The Netherlands, 2003. Available online: https://zoek.officielebekendmakingen.nl/dossier/28207/kst-28207-3?resultIndex=12&sorttype=1&sortorder=4 (accessed on 7 January 2016).

- Tweede Kamer. Fiscaliteit, Landbouw- en Natuurbeleid, Kamerstuk 28207, nr. 5, Verslag van een Notaoverleg, Vergaderjaar 2003–2004, Den Haag, The Netherlands, 2003. Available online: https://zoek.officielebekendmakingen.nl/dossier/28207/kst-28207-5?resultIndex=10&sorttype=1&sortorder=4 (accessed on 7 January 2016).

- Boon, P.E.; van Donkersgoed, G.; Noordam, M.; te Biesebeek, J.D.; van de Ven–van den Hoogen, B.M.; van Klaveren, J.D. Evaluatie van de nota Duurzame gewasbescherming—Deelrapport Voedselveiligheid; RIVM Rapport 320038001/2012; Rijksinstituut voor Volksgezondheid en Milieu: Bilthoven, The Netherlands, 2012. [Google Scholar]

- Skevas, T.; Stefanou, S.E.; Oude Lansink, A. Can economic incentives encourage actual reductions in pesticide use and environmental spillovers? Agric. Econ. 2012, 43, 267–276. [Google Scholar] [CrossRef]

- Van Eerdt, M.; van Dam, J.; Tiktak, A.; Vonk, M.; Wortelboer, R.; van Zeijts, H. Evaluatie van de Nota Duurzame Gewasbescherming; PBL-Publicatienummer 500158001; Planbureau voor de Leefomgeving: Den Haag, The Netherlands, 2012. [Google Scholar]

- Centraal Bureau voor de Statistiek (CBS); Planbureau voor de Leefomgeving (PBL); Wageningen UR. Afzet van Chemische Gewasbeschermingsmiddelen in de Land- en Tuinbouw, 1985–2013. Available online: http://www.compendiumvoordeleefomgeving.nl/indicatoren/nl0015-Afzet-gewasbeschermingsmiddelen-in-de-land--en-tuinbouw.html?i=11-61 (accessed on 7 January 2016).

- Gren, I.-M. Cost efficient pesticide reductions: A study of Sweden. Environ. Resour. Econ. 1994, 4, 279–293. [Google Scholar] [CrossRef]

- Gren, I.-M. Regulating the farmers’ use of pesticides in Sweden. In Economic Incentives and Environmental Policies—Principles and Practice; Opschoor, H., Turner, K., Eds.; Kluwer Academic Publishers: Dordrecht, The Netherlands, 1994; pp. 153–173. [Google Scholar]

- Jacquet, F.; Butault, J.P.; Guichard, L. An economic analysis of the possibility of reducing pesticides in French field crops. Ecol. Econ. 2011, 70, 1638–1648. [Google Scholar] [CrossRef]

- Falconer, K.; Hodge, I. Using economic incentives for pesticide usage reductions: Responsiveness to input taxation and agricultural systems. Agric. Syst. 2000, 63, 175–194. [Google Scholar] [CrossRef]

- Benbrook, C.M.; Sexson, D.L.; Wyman, J.A.; Stevenson, W.R.; Lynch, S.; Wallendal, J.; Diercks, S.; van Haren, R.; Granadino, C.A. Developing a pesticide risk assessment tool to monitor progress in reducing reliance on high-risk pesticides. Am. J. Potato Res. 2002, 79, 183–199. [Google Scholar] [CrossRef]

- Gutsche, V.; Strassemeyer, J. SYNOPS—A model to assess the environmental risk potential of pesticides. J. für Kulturpflanzen. 2007, 59, 197–210. [Google Scholar]

- Eurostat. Agriculture—Organic Farming—Number of Certified Registered Organic Operators by Type of Operators; Luxembourg, 2016. Available online: http://ec.europa.eu/eurostat/data/database (accessed on 12 April 2016).

| Reus et al. [11] (p. 64ff.) | Oskam et al. [5] (p. 42ff.) | Falconer [12] (p. 49) |

|---|---|---|

| Effectiveness | Effectiveness | Effectiveness |

| Efficiency | Efficiency | Efficiency |

| Feasibility and maintainability | Enforceability | Maintainability |

| Polluter pays principle | Homogeneity | Polluter pays principle |

| Economic consequences for farmers | No income and property rights disturbance | Economic consequences for farmers |

| Support among farmers | Acceptability | Ability to differentiate policies |

| Charge | Imposition Point | Use/Refunding of Revenues | ||

|---|---|---|---|---|

| Tax Base | Tax Rate | Organization | Target | |

| Wholesale price, retail price, active substances, environmental risk, human health risk Tax on all pesticides, specific pesticides | Fixed, differentiated Tariff level either high, medium, or low, percentage, flat | Industry, wholesalers, retailers, farmers | States, federal states, agricultural sector, farmers involved, other organizations | State budget/deficit reduction, Common Agricultural Policy, direct payments/ha, crop premiums, innovation programs for industry and agriculture, supporting alternative techniques, other |

| Tax Category i | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

|---|---|---|---|---|---|---|---|---|

| Pesticide characteristics | Human health risks | Both risks low | One low and one medium risk | One low and one high risk or both risks medium | One medium and one high risk | Both risks high | Concentrated products for hobby use | Ready-to-use products for hobby use |

| Environ-mental risks | ||||||||

| Factor i (* NOK 25/ha) | 0.5 | 3 | 5 | 7 | 9 | 50 | 150 | |

| Tax (NOK/ha) | 12.5 | 75 | 125 | 175 | 225 | 1250 | 3750 | |

| Type2 | Product Name (Depending on Country) | Active Substance | Sweden | Norway | Denmark | France | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| €/kg or L (SEK/kg or L) | €/ha (SEK/ha) | €/kg or L (NOK/kg or L) | €/ha (NOK/ha) | €/kg or L (DKK/kg or L) | €/ha (DKK/ha) | €/kg or L | €/ha | |||

| F | Acanto® 250 SC/Aproach® | Picoxystrobin 250 g/L | 0.91 | 0.91 | 14.45 | 14.45 | 13.54 | 13.54 | 0.50 | 0.50 |

| (SAD in NO = 1000 mL) | (8.50) | (8.50) | (125.00) | (125.00) | (101.00) | (101.00) | ||||

| F | Amistar® | Azoxystrobin 250 g/L | 0.91 | 0.91 | 8.67 | 8.67 | 5.50 | 5.50 | 1.28 | 1.28 |

| (SAD in NO = 1000 mL/ha) | (8.50) | (8.50) | (75.00) | (75.00) | (41.00) | (41.00) | ||||

| F | Comet® | Pyraclostrobin 250 g/L | 0.91 | 0.91 | 8.67 | 8.67 | 13.00 | 13.00 | 1.28 | 1.28 |

| (SAD in NO = 1000 g/ha) | (8.50) | (8.50) | (75.00) | (75.00) | (97.00) | (97.00) | ||||

| F | Stereo® 312.5 EC | Cyprodinil 250 g/L | 1.14 | 1.71 | 9.63 | 14.45 | 20.91 | 31.37 | - | - |

| (SAD in NO = 1500 mL/ha) | Propiconazole 62.5 g/L | (10.63) | (15.94) | (83.33) | (125.00) | (156.00) | (234.00) | |||

| F | Switch® 62.5 WG | Cyprodinil 375 g/kg | 3.64 | 1.82 | 28.90 | 14.45 | 14.34 | 7.17 | 1.25 | 0.63 |

| (SAD in NO = 500 g/ha) | Fludioxonil 250 g/kg | (34.00) | (17.00) | (250.00) | (125.00) | (107.00) | (53.50) | |||

| F | Talius® | Proquinazid 200 g/L | - | - | 57.80 | 14.45 | - | - | 1.02 | 0.26 |

| (SAD in NO = 250 mL/ha) | (500.00) | (125.00) | ||||||||

| GR | Moddus® M/Moxa® | Trinexapac-ethyl 250 g/L | 0.91 | 0.36 | 3.61 | 1.45 | 4.42 | 1.77 | 0.50 | 0.20 |

| (SAD in NO = 400 mL/ha) | (8.50) | (3.40) | (31.25) | (12.50) | (33.00) | (13.20) | ||||

| H | Ally® Class 50 WG/Allié® Express | Metsulfuron-methyl 100 g/kg | 1.82 | 0.09 | 28.90 | 1.45 | - | - | 1.00 | 0.05 |

| (SAD in NO = 50g/ha) | Carfentrazone-ethyl 400 g/kg | (17.00) | (0.85) | (250.00) | (12.50) | |||||

| H | Basagran® SG | Bentazone 870 g/kg | 3.17 | 5.07 | 5.42 | 8.67 | 15.15 | 24.24 | 1.74 | 2.78 |

| (SAD in NO = 1600 g/ha) | (29.58) | (47.33) | (46.88) | (75.00) | (113.00) | (180.80) | ||||

| H | Boxer® | Prosulfocarb 800 g/L | 2.91 | 14.56 | 2.89 | 14.45 | 16.62 | 83.11 | - | - |

| (SAD in NO = 5000 mL/ha) | (27.20) | (136.00) | (25.00) | (125.00) | (124.00) | (620.00) | ||||

| H | Express® Gold SX/CDQ® SX | Tribenuron-methyl 222.2 g/kg | - | - | 42.50 | 1.45 | 16.76 | 0.57 | - | - |

| (SAD in NO = 34 g/ha) | Metsulfuron-methyl 111.1 g/kg | (367.65) | (12.50) | (125.00) | (4.25) | |||||

| H | Gratil® 75 WG | Amidosulfuron 750 g/kg | 2.73 | 0.16 | 144.51 | 8.67 | - | - | 1.50 | 0.09 |

| (SAD in NO = 60 g/ha) | (25.50) | (1.53) | (1250.00) | (75.00) | ||||||

| H | Hussar® OD | Iodosulfuron 100 g/L | - | - | 14.45 | 1.45 | 6.30 | 0.63 | - | - |

| (SAD in NO = 100 mL/ha) | (125.00) | (12.50) | (47.00) | (4.70) | ||||||

| H | MaisTer® | Foramsulfuron 300 g/kg | 1.13 | 0.17 | 9.63 | 1.45 | 11.13 | 1.67 | - | - |

| (SAD in NO = 150 g/ha) | Iodosulfuron 10 g/kg | (10.54) | (1.58) | (83.33) | (12.50) | (83.00) | (12.45) | |||

| H | Roundup® Max/Roundup® 680 | Glyphosate 680 g/kg | 2.48 | 4.95 | 0.72 | 1.45 | 9.79 | 19.57 | 1.36 | 2.72 |

| (SAD in NO = 2000 g/ha) | (23.12) | (46.24) | (6.25) | (12.50) | (73.00) | (146.00) | ||||

| I | Biscaya® OD 240 | Thiacloprid 240 g/L | 0.87 | 0.35 | 36.13 | 14.45 | 16.09 | 6.43 | 1.22 | 0.49 |

| (SAD in NO = 400 mL/ha) | (8.16) | (3.26) | (312.50) | (125.00) | (120.00) | (48.00) | ||||

| I | Calypso® 480 SC | Thiacloprid 480 g/L | 1.75 | 0.35 | 101.16 | 20.23 | - | - | 2.45 | 0.49 |

| (SAD in NO = 200 mL/ha) | (16.32) | (3.26) | (875.00) | (175.00) | ||||||

| I | Confidor® 70 WG | Imidacloprid 700 g/kg | 2.55 | 0.51 | 7.23 | 1.45 | 5.23 | 1.05 | - | - |

| (SAD in NO = 200 g/ha) | (23.80) | (4.76) | (62.50) | (12.50) | (39.00) | (7.80) | ||||

| I | Karate® 5 CS/Karate® Foret | Lambda- cyhalothrin 50 g/L | 0.18 | 0.03 | 96.34 | 14.45 | - | - | 0.26 | 0.04 |

| (SAD in NO = 150 mL/ha) | (1.70) | (0.26) | (833.33) | (125.00) | ||||||

| I | Steward® 30 WG | Indoxacarb 300 g/kg | 1.09 | 0.27 | 57.80 | 14.45 | 102.01 | 25.50 | 1.53 | 0.38 |

| (SAD in NO = 250 g/ha) | (10.20) | (2.55) | (500.00) | (125.00) | (761.00) | (190.25) | ||||

| State | Charge | Imposition Point | Use/Refunding of Revenues | ||

|---|---|---|---|---|---|

| Tax Base | Tax Rate | Organization | Target | ||

| Sweden | Active substances | fix | Industry, importers/wholesalers | Swedish state | State budget |

| All pesticides | low/medium tariff, flat tax | ||||

| Norway | Active substances, environmental risk, human health risk | differentiated | Industry, importer/wholesalers | Norwegian state | State budget |

| All pesticides | low—medium—high tariffs | ||||

| Denmark | Active substances, environmental risk, human health risk | differentiated | Wholesalers/importers | Danish state—different ministries | State budget, agricultural fund, green growth measures, administration |

| All pesticides | low—medium—high tariffs | ||||

| France | Active substances, human health risk, (environmental risk) | differentiated | Retailers/distributor | Agricultural and environmental sector water utility and sewage treatment operators | Measures of the NAP, cleaning of water |

| All pesticides | low—medium tariffs | ||||

| Criteria for Analysis (Section 2) | Country’s Tax Scheme | |||

| Sweden fix, SEK 34/kg AS | Norway differentiated, 7 categories | Denmark differentiated, individual tax | France differentiated, 3 categories | |

| Main objective of NAP | NAP 2013–2017 (1) No violations of residue limits (2) Reduce pesticides’ input | NAP 2010–2014 (1) 70% of farmers apply integrated pest management (2) No violations of residue limits | NAP 2013–2015 40% load reduction | NAP 2008–2018 50% use reduction from 2008 to 2018 and from 2015 to 2025 |

| Effectiveness | ± (1, 2) in principle possible but tax level too low to cause large reduc-tions, no further long-term reduc-tions after the last tax increases | (1) ±/+ farmers use less hazardous pesti-cides, but same amount (2) ± farmers use same amount or more pesticides | + very high taxes on high load pesti-cides (use reduction) | ±/+ overall relatively low taxes for all three categories but nevertheless use reduction since implementation of tax |

| Efficiency | − (1, 2) additional burden for farmers but no reduction in use | (1) ± less hazardous pesticides are relatively cheap (2) − more costs but same amount used | ± farmers can choose for low taxed pesticides; some products may disappear—potential resistance problems | ±/+ relatively low additional costs for farmers but use reduction is achieved |

| Feasibility, maintainability and enforceability | + easy to enforce | −/± for some products complicated tax determination | ± rather complicated scheme | + easy to enforce |

| Polluter pays principle, ability to differentiate taxation | − fix tax scheme, only choice to not pay is not using pesticides at all | +/± seven different categories; disputes about tax calculation | + individual taxation, almost no tax for products with low load | −/± only three categories; few choices can be made; revenues for water operators |

| No economic consequences for farmers, homogeneity | ± relatively low tax per ha, especially for low dose products; only few intensive pesticide users in Sweden (few fruit and vegetable farming) | − also when choosing less hazardous pesticides a tax is charged, probably less effective plant protection; no return to the sector | ± reduction of property tax on agri-cultural land; revenues returned to sector; high tax when some products have to be used, maybe production losses or changes otherwise, hereby potential for tax savings compared to old tax scheme | ± low tax per ha; tax revenues flow only partly back into the agricultural sector (e.g., via environmental programs) |

| Support among farmers, acceptability | − despite relatively low tax burden, some cost increases occur; no tax in most other European countries | − tax burden also when choosing for less hazardous pesticides; no tax in most other European countries | − some products may be too expensive to use, e.g., insecticides; no tax in most other European countries | − despite relatively low tax burden, some cost increases occur; few categories; no tax in most other European countries |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Böcker, T.; Finger, R. European Pesticide Tax Schemes in Comparison: An Analysis of Experiences and Developments. Sustainability 2016, 8, 378. https://doi.org/10.3390/su8040378

Böcker T, Finger R. European Pesticide Tax Schemes in Comparison: An Analysis of Experiences and Developments. Sustainability. 2016; 8(4):378. https://doi.org/10.3390/su8040378

Chicago/Turabian StyleBöcker, Thomas, and Robert Finger. 2016. "European Pesticide Tax Schemes in Comparison: An Analysis of Experiences and Developments" Sustainability 8, no. 4: 378. https://doi.org/10.3390/su8040378

APA StyleBöcker, T., & Finger, R. (2016). European Pesticide Tax Schemes in Comparison: An Analysis of Experiences and Developments. Sustainability, 8(4), 378. https://doi.org/10.3390/su8040378