1. Introduction

The conflict between global economic gains and environmental protection has intensified recently, bringing issues such as climate change, environmental pollution, and sustainable development to the forefront of national and international agendas. Consequently, the concept of global sustainability has deepened. Corporate ESG performance assessing firms across environmental, social, and governance dimensions has increasingly become a key standard in evaluating corporate sustainable development and long-term value [

1]. Driven by rising demands for corporate social responsibility, green and environmentally friendly strategies have grown more important within corporate planning and investment decisions [

2]. With greater flows of financial capital toward ESG-related fields, global responsible investment has strengthened consideration of investee firms’ environmental, social, and governance performance [

3], and investors increasingly prefer firms with strong ESG records [

4]. By September 2024, 5348 institutions worldwide had signed the Principles for Responsible Investment (PRI), with assets under management exceeding USD 128 trillion. However, Chinese institutions accounted for only 2.45% of this number. Export compliance has also become a new driver of ESG adoption. Recently, the European Union has introduced new regulations, such as the Corporate Sustainability Reporting Directive (CSRD), integrating ESG requirements into global supply chains to address climate change and strengthen supply chain governance.

China has also advanced ESG-related disclosure requirements. In April 2024, under the unified guidance of the China Securities Regulatory Commission, the Shanghai, Shenzhen, and Beijing stock exchanges jointly issued Guidelines for Corporate Sustainability Reporting, aiming to align domestic practices with those of the International Sustainability Standards Board (ISSB) [

5]. Increasingly stringent regulatory and societal expectations have compelled firms to strengthen ESG construction and disclosure. Data from SynTao Green Finance’s China Responsible Investment Annual Report 2024 show that, as of September 2024, 42.14% of listed firms in China had issued ESG reports, and more than 90% of them had ratings of B- or above. Nevertheless, Chinese listed companies still lag behind international peers overall, facing weak incentives for disclosure and limited internal capacity for sustainability. Existing research on corporate ESG performance has mostly focused on the economic benefits of ESG investment and external driving forces. In this context, it is essential to explore how firms amidst policy momentum and market pressures can leverage internal mechanisms to transform strategies, operations, and technological capabilities in ways that effectively implement ESG principles and align social value creation with sustained economic gains.

Against the backdrop of rapid digitalization, the digital economy has become a major driver of high-quality economic growth in China. Applications of big data, artificial intelligence (AI), and blockchain have enabled financial institutions to make significant advances in digital transformation and financial innovation, becoming an important engine for enhancing services to the real economy. The rise of digital finance is reshaping modern economies. For corporations, this disruption presents a unique opportunity: it can act as a catalyst for the internal changes necessary to achieve sustainability goals. In 2023, the National Financial Work Conference introduced the goal of building a financially strong nation. In 2025, the Fifteenth Five-Year Plan in China identified digital finance, technology finance, and green finance as key pillars in achieving this vision. The plan stresses the need for the digital and real economies to work together, for technological and industrial innovation to work together, and for smart manufacturing to go along with green and low-carbon development. This top-level design aims to deeply integrate information technology, sustainability principles, and the financial system to drive high-quality economic development. Digital finance (DF) represents a new financial ecosystem that deeply integrates digital technologies with traditional financial services. Leveraging advanced tools such as big data and AI, DF enables the low-cost collection, integration, and processing of large volumes of data [

6] while enhancing connectivity between financial institutions and other economic actors and expanding the boundaries of financial services [

7]. This helps to offset the allocative bias inherent in traditional finance, overcome geographic and time constraints, and substantially improve service efficiency.

The connection between digital finance and corporate sustainability is an emerging yet fragmented research field. Evidence indicates a positive association: by mitigating information asymmetry and financing constraints [

8], digital finance can improve corporate ESG performance [

9,

10]. Digital finance increases transparency, enabling stakeholders to monitor firms more effectively [

11], optimize financial resource allocation, and enhance external oversight efficiency, thereby reshaping financing models and strategic decision-making [

12]. It also holds managers accountable for their ESG commitments [

13,

14]. Simultaneously, digital finance lowers transaction costs and improves credit evaluation, democratizing capital access and providing efficient financing channels for long-term, capital-intensive ESG projects such as green technology adoption [

15,

16] and supply chain upgrades [

17]. Nevertheless, most research examines only singular mechanisms by which digital finance enhances ESG performance. Some studies show digital finance accelerates digital transformation, thereby improving operational efficiency and data-driven governance, which in turn raises ESG performance [

18,

19]. Others focus on digital finance, directing capital toward environmental R&D [

20] and stimulating green innovation and improving environmental performance [

21]. This method implicitly treats internal digital process reengineering and externally oriented green product innovation as separate and parallel processes, overlooking potential digital finance driven interlinkages and reinforcing synergies. Such synergies merit further analysis to expand the theoretical scope of digital finance and ESG interactions and to inform comprehensive strategies that fully leverage fintech’s enabling capacity.

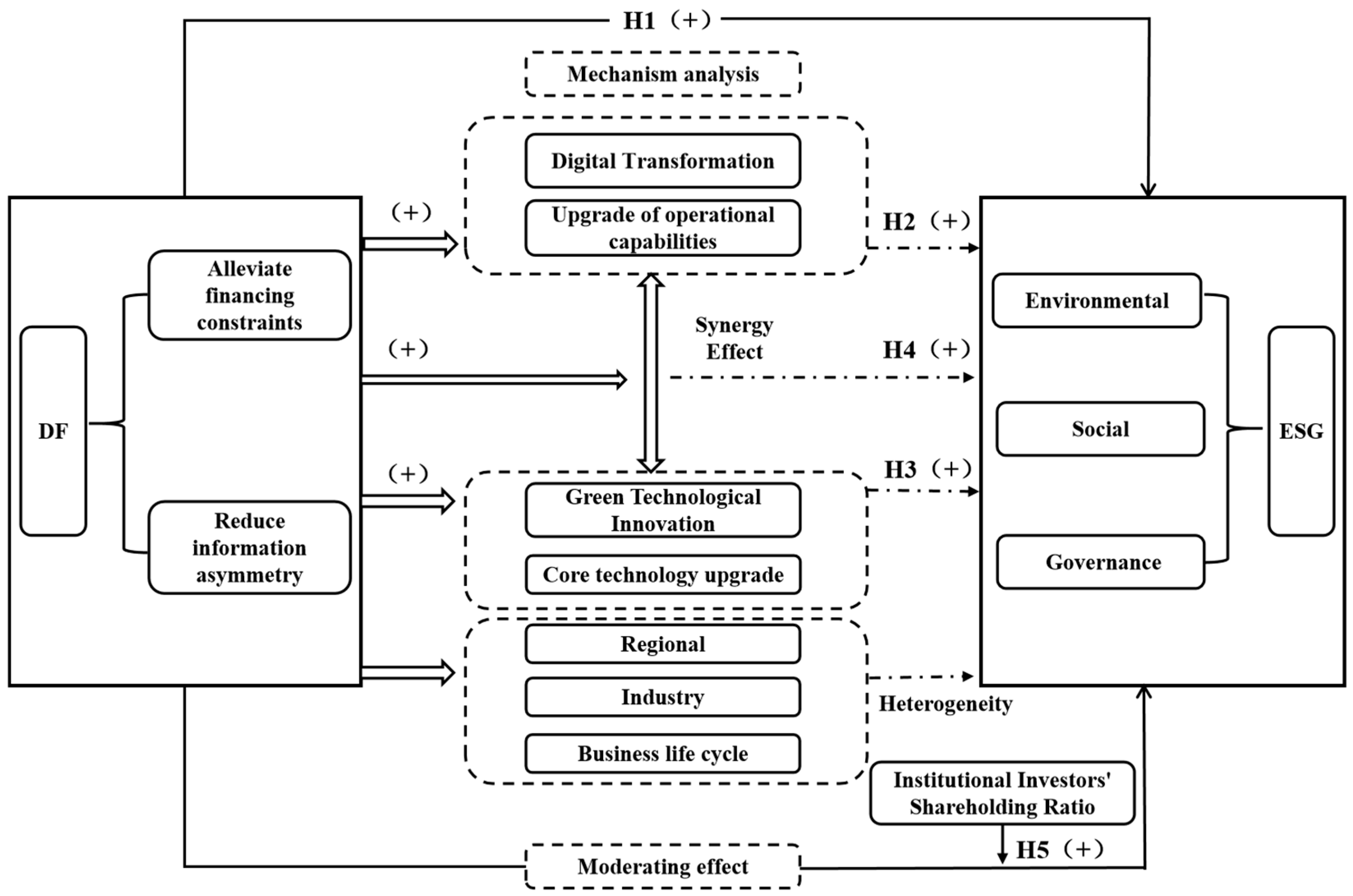

Based on the data of Chinese A-share listed firms from 2011 to 2023, we examine digital finance’s role in empowering corporate ESG performance by integrating and testing the dual driving effects of digital transformation and green innovation in a dual-engine theoretical framework. We posit that digital finance offers both capital and data-driven incentives, enabling firms to upgrade internal operational structures through digital transformation and to develop sustainable products and processes via technological innovation. The coordinated advancement of technological upgrading and managerial transformation produces organizations that are both smarter and greener, transforming fintech advantages into robust and sustainable ESG improvements. We further introduce external governance pressure as a moderating factor, proxied by institutional ownership. Active institutional investors can act as amplifiers, channeling the technological and financial dividends unleashed by DF directly toward long-term ESG objectives [

22]. Moreover, heterogeneity analyses based on firm lifecycle, geographic location, and industry characteristics shed light on the dynamic evolutionary logic of DF-driven ESG performance and refine the measurement of digital finance’s contributions to environmental responsibility, social commitment, and governance optimization. These insights provide policymakers with a framework for coordinated governance that aligns digital transformation with ESG objectives.

This study offers a threefold contribution: First, at the theoretical level, it develops a dual-engine synergy framework, demonstrating that digital transformation and green innovation operate as parallel yet mutually reinforcing drivers, thereby extending beyond existing literature’s focus on single mediating mechanisms and deepening understanding of how digital technologies and financial resources systematically empower corporate sustainability. Second, at the methodological level, it offers robust causal evidence by exploiting the FinTech Innovation Regulatory Pilot Policy in China, employing the staggered difference-in-differences model and supplementing it with the Bartik instrumental variable approach to ensure credible results. Third, at the practical and policy level, it identifies boundary conditions and dimensions of heterogeneity in DF’s empowerment effects, providing tailored, actionable guidance for government and corporate strategies that integrate digital and green development.

The paper unfolds as follows:

Section 2 outlines the theoretical foundations and proposes the research hypotheses.

Section 3 describes the overall research design, encompassing criteria for sample selection, procedures for data acquisition, and model specification.

Section 4 delivers the empirical analysis, including the core regression results, approaches for mitigating endogeneity in the quasi-natural experiment setting, and a series of robustness verifications.

Section 5 investigates the underlying mechanisms together with heterogeneity across firms and regions.

Section 6 interprets the main findings in depth.

Section 7 concludes with research conclusions and suggestions.

6. Discussion

This study documents that digital finance enhances corporate ESG performance through the “dual-engine” mechanism of digital transformation and green technological innovation. It provides systematic empirical evidence on the deep coupling between digital finance and corporate sustainable development.

First, at the theoretical level, we conceptualize digital transformation and green technological innovation as two mutually reinforcing “engines”. The extant literature has largely focused on single channels. One strand stresses that digital finance mitigates financing constraints and thereby improves ESG performance [

8,

10]. A second strand highlights the direct stimulating effect of digital finance on green technological innovation [

21,

36]. A third line of work, taking a digital transformation perspective, examines how digital capabilities improve ESG performance [

18,

38]. However, most studies implicitly treat internal managerial transformation and external green innovation as two parallel mechanisms, and thus overlook their potential complementarities and synergistic effects.

Our findings show that fintech is fundamentally reshaping how information is produced and processed in financial markets [

73]. Digital finance is not merely a provider of capital; it also acts as a “glue” that connects the digitalization of internal operations with the development of external green technologies. Digital transformation enhances firms’ data-processing capability, process transparency, and governance efficiency, thereby providing more precise application scenarios and higher conversion efficiency for green innovation. In turn, green technological innovation, pursuing objectives such as carbon reduction, pollution abatement, and efficiency gains, feeds back to reshape the direction and boundaries of digital investment. This mechanism is consistent with the organizational ambidexterity view that stresses the complementarity between exploratory and exploitative innovation [

51], and echoes dynamic capability theory, which emphasizes the reconfiguration of resource bundles in response to technological change to secure sustainable competitive advantage [

50]. It also resonates with Banalieva and Dhanaraj’s [

74] evidence that the joint deployment of digital capabilities and green innovation enhances firms’ international competitiveness.

Moreover, the “digital and green integration” perspective complements recent evidence on the interplay between ESG and technology. Krueger et al. [

75] show that climate concerns are reshaping asset pricing and corporate strategy, while Pástor et al. [

76] document that ESG-oriented investors alter firms’ incentives to invest in green projects. At the firm level, we further revealed that digital finance serves as a pivotal “interface” linking capital-market preferences, technological trajectories, and ESG performance. By providing low-cost digital infrastructure and financing channels for green innovation, digital finance helps transform the dividends from capital and data into “smarter organizations” and “greener outputs,” thereby systematically empowering ESG performance. This, in turn, offers a coherent explanatory framework for the relation between ESG performance and long-term firm value [

77] and extends the resource-based view and dynamic capability framework to the intersection of the digital economy and sustainable development.

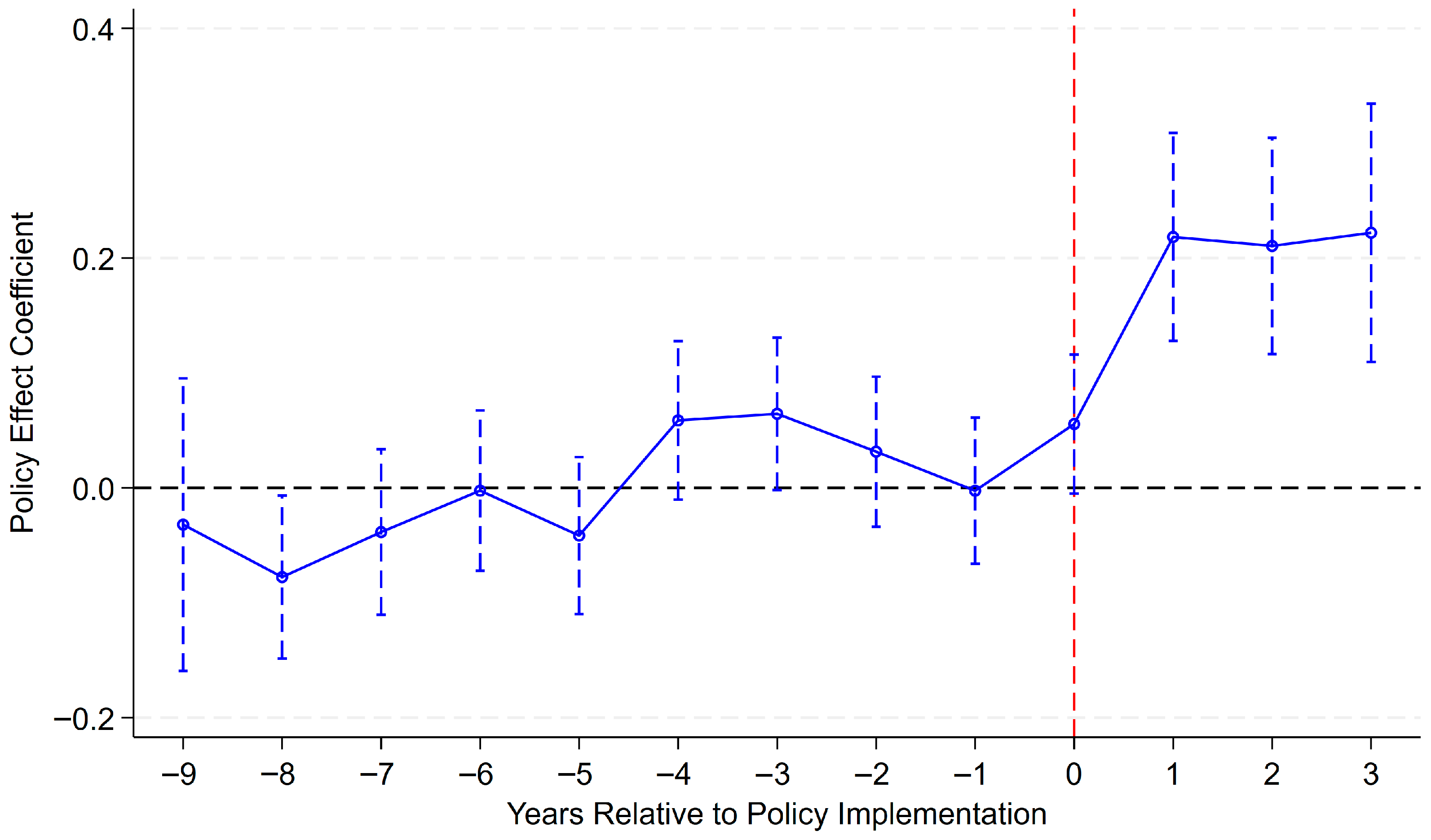

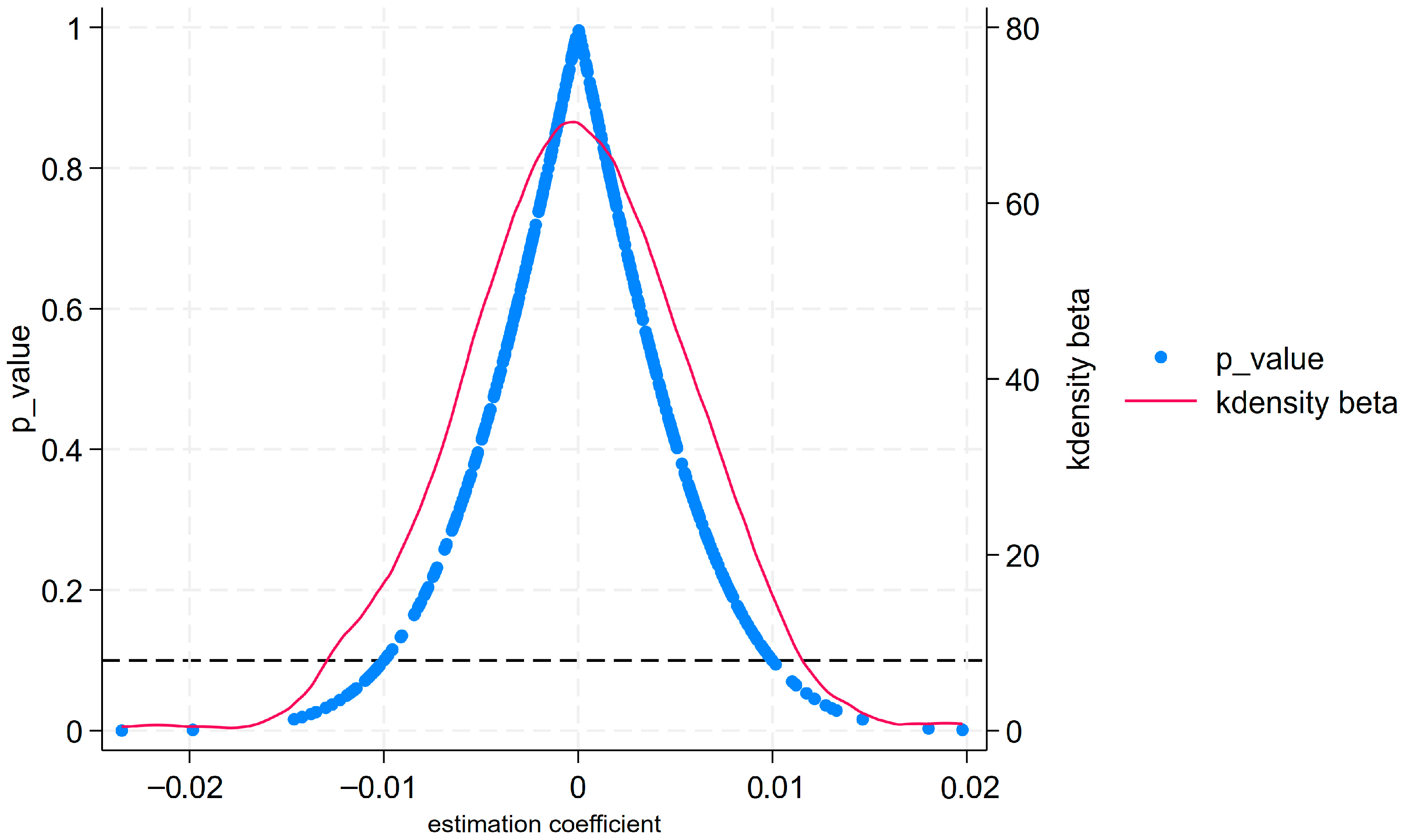

Second, in terms of causal identification, we exploited the exogenous shock from China’s Fintech Innovation Regulatory Pilot Policy and employed a staggered difference-in-differences design that explicitly accounts for treatment-timing heterogeneity. This approach helps address the endogeneity concerns that are pervasive in research on fintech and corporate behavior and is aligned with recent methodological advances and critiques of conventional DID estimators [

78]. Our results provide credible identification of the causal impact of digital finance on corporate ESG performance. The dynamic treatment analysis uncovers an “immediate onset, gradual strengthening, persistent significance” pattern, consistent with the notion that technological diffusion and organizational change require time to materialize [

79]. This pattern is also in line with macro-level evidence documenting substantial lagged effects of digital and green policies on carbon emissions and green innovation [

25,

46], and it offers a time-dimension perspective on how digital finance shapes firms’ long-term strategic adjustment.

Third, from a policy perspective, we found that digital finance exerts asymmetric effects across the three ESG pillars, with much stronger impacts on the environmental and governance dimensions than on the social dimension. This finding is consistent with evidence that environmental and governance indicators are more easily captured by digital tools and integrated into pricing mechanisms [

80], and it provides micro-level evidence that may help explain the “ESG rating disagreement” documented in the literature [

81]. Our results suggest that the comparative advantage of digital finance currently lies in measurable domains, such as carbon-emission data collection and disclosure, green supply-chain traceability, and related activities, whereas social dimensions, such as employee rights and community engagement, suffer from weaker data infrastructures and insufficient governance tools. We also reported that institutional investors are a key external force driving firms to improve their ESG performance, corroborating Dyck et al. [

22]. Digital finance enhances information transparency and provides more effective monitoring tools for institutional investors [

82], thereby reshaping firms’ stakeholder relationships and amplifying investors’ ability to influence corporate sustainability decisions.

Furthermore, the ESG-enhancing effect of digital finance is heterogeneous across the firm lifecycle, regions, and industries. Firms in the introduction, growth, and maturity stages benefit the most, whereas firms in the decline stage exhibit limited marginal improvement. Likewise, firms located in the eastern and central regions and those in non–heavily polluting industries experience stronger positive effects, while firms in western regions and heavy-polluting industries benefit to a much smaller extent. These patterns are consistent with theories of the firm lifecycle and institutional environment. Firms at different lifecycle stages face distinct investment horizons and financing constraints, which shape their preferences over ESG projects [

83]; regional institutional quality and financial development affect the extent to which ESG information is priced in capital markets [

84]; and industry-level environmental regulation stringency and technological regimes determine the marginal costs and benefits of green innovation [

3]. In the absence of digital-finance policies tailored to local industrial structures, institutional environments, and technological bases, the dividends of digital finance may be released unevenly across space and industries, potentially evolving into an “ESG divide”. For corporate managers, our findings highlight the importance of strategically integrating digital transformation with green technological innovation and leveraging the low-cost capital and information advantages brought by digital finance. Then, firms can transform ESG from a “cost center” into a “value-creation center” and build sustainable competitive moats. This implication is consistent with evidence that firms with stronger corporate social responsibility profiles display greater resilience during crises and enjoy lower costs of capital [

85].

This research is subject to several constraints. First, our sample consists solely of Chinese A-share listed firms. China’s distinctive institutional setting and market conditions may limit the external validity of our findings. Future research could apply our framework to non-listed firms or to firms in other emerging markets and different institutional environments to examine its generalizability. Second, although we documented a synergistic effect of digital transformation and green technological innovation on ESG performance, we did not explicitly construct a measure of the degree of coupling between digitalization and greening. Further work could draw on measures of technological portfolio complementarities to develop a coupling index that captures the interaction intensity between specific digital technologies and green innovation activities and then explore the heterogeneous effects of different technology bundles. Such analyses would provide more granular guidance for firms seeking to design precise digital and green strategies.

7. Conclusions and Suggestions

Using panel data for Chinese A-share companies over the period 2011–2023, this paper examines how digital finance influences corporate ESG outcomes through a dual-channel transmission mechanism. The results demonstrate that digital finance has a marked positive effect on ESG performance, most notably in environmental protection and governance practices. Rather than arising through a single conduit, this improvement is driven by the interplay of two primary forces, digital transformation and green technological innovation, which reinforce each other, transforming the benefits of digital finance into sustained drivers of corporate sustainability. In addition, a higher proportion of institutional ownership intensifies this enabling effect. The impact is particularly evident in firms at the introduction, growth, and maturity stages of their lifecycle, as well as in enterprises located in eastern and central China and those active in relatively low-polluting sectors. Based on these findings, we outline policy measures aimed at fostering digital finance development, promoting technological synergies, and enhancing ESG practices across heterogeneous firm and regional contexts.

Firstly, policymakers should pursue differentiated industrial policies that combine regional coordination with targeted support. First, strengthen digital finance infrastructure in economically underdeveloped regions and foster corporate digital literacy. Second, guide FinTech innovation toward addressing critical pain points in the social dimension, such as employee welfare and supply chain responsibility. Third, provide incubation and support to firms in the introduction and growth stages, encouraging them to use digital finance tools to establish ESG disclosure frameworks. Then, incentivize mature firms to link ESG performance with eligibility for issuing green bonds via digital finance platforms and encourage industry leaders to employ frontier digital technologies to build transparent green supply chains.

Secondly, corporate managers should design an integrated “digital and green” strategy. Managers ought to view ESG as a core strategic lever for creating new growth trajectories by integrating digital transformation and green innovation at the top-level design stage. For example, firms can utilize energy consumption data collected through digital platforms to inform R&D in green technologies while leveraging market feedback on green products to refine digital marketing strategies. This approach can shift ESG from being a cost center to a value creation center, forming a closed loop of “data-driven technological innovation, market validation,” thus achieving both superior ESG performance and competitive advantage.

Finally, investors and other stakeholders should establish a lifecycle-based ESG evaluation framework. Institutional investors, as key actors in converting digital finance dividends into ESG outcomes, should proactively employ alternative data and AI analytics to monitor the ESG practices of investee firms. Through shareholder proposals, proxy voting, and other means, they should actively encourage the integration of digital transformation with sustainability objectives. By acting as engaged shareholders, investors can serve as important catalysts, accelerating the “digital and green integration” process in corporations.