Abstract

This study investigates whether tourism and energy consumption degrade or improve environmental quality in the world’s ten most-visited nations over 2000–2023 and whether financial development, trade openness, and technological innovation moderate these effects. Using complementary panel estimators—Driscoll–Kraay fixed effects for cross-sectionally robust inference, two-step feasible GLS for efficiency under heteroskedasticity and autocorrelation, and Lewbel IV–2SLS to address potential endogeneity—the analysis yields three consistent patterns. The study employed three models to investigate these associations. The results show that renewable energy consumption consistently reduces emissions, while trade openness is strongly associated with lower CO2. Financial development becomes emission-reducing when paired with technological innovation. Tourism intensity is neutral to modestly negative once controls are applied, and urbanization is weakly negative or statistically insignificant. The study formulated well-coordinated policies based on these findings.

1. Introduction

Environmental sustainability now defines a core policy and research challenge as climate change reshapes ecosystems, economies, and public health with unprecedented speed and scale, evidenced by NASA and the World Meteorological Organization confirming 2024 as the warmest year in the instrumental record at roughly 1.47–1.55 °C above the nineteenth-century baseline, while atmospheric CO2 at Mauna Loa climbed to about 425 ppm on recent monthly averages and peaked near 430 ppm in May 2025, representing the largest year-over-year jump on record in that month [1]. International tourism has returned to and slightly exceeded pre-pandemic levels, with a year in which global arrivals reached ~1.4–1.5 billion. France (~100–102 m), Spain (~94 m), the United States (~72.4 m), Italy (~60–61 m), Türkiye (~59–61 m), Mexico (~45 m), the United Kingdom (~42.6 m), Germany (record inbound overnights; top-tier EU inbound), Thailand (~36 m), and Japan (~36.9 m) satisfy this threshold [2]. Clean energy finance is expanding at a record pace, with total energy investment set to reach about USD 3.3 trillion in 2025 and roughly USD 2.2 trillion directed to renewables, grids, storage, nuclear, efficiency, and electrification, meaning that clean technologies attract around twice the capital going to fossil fuels, and this shift is visible in tourism hubs through rapid wind and solar deployment, grid upgrades, and electrified mobility [3].

Deployment data reinforce the momentum, since renewables produced about forty-seven percent of EU electricity in 2024, the United Kingdom generated more than half of its electricity from renewables for the first time in 2024, and China more than doubled combined wind and solar capacity in the three years to 2024, which influences several of the world’s most visited cities [4]. Yet, a persistent gap remains because greenhouse gas concentrations continue to rise, and annual renewable additions, while strong, must accelerate further to align with tripling goals this decade, which poses a focused research problem on whether the top tourism economies can sequence policy and investment to reconcile growing visitor demand with credible near-term emission declines on the pathway to carbon neutrality [5].

Beyond the above factors that significantly influence CO2 trends in these countries, financial development has also been identified as an important determinant. The association between CO2 emissions and financial development is theoretically ambivalent and empirically context-dependent. On the one hand, deeper and more accessible financial systems can raise emissions by expanding credit, lowering capital costs, and stimulating energy-intensive production and consumption, which amplifies the scale effect of growth [6,7,8]. On the other hand, mature financial sectors can improve environmental quality by mobilizing long-term capital for cleaner technologies, facilitating green innovation, and easing firms’ adoption of energy-efficient equipment, thereby strengthening the technique and composition effects [9,10,11]. Thus, FD can significantly influence CO2 trends in the selected nations.

Moreover, technological innovation is reshaping the environment; when effectively deployed, it can significantly expand renewable energy, improve energy efficiency, and enhance ecological quality by limiting CO2. Technological innovation shapes CO2 emissions through competing channels that make its net effect empirical rather than automatic. Process and product innovations that raise energy efficiency, expand renewable generation, and improve storage generally depress emissions by shifting the technique and composition of production toward cleaner inputs and lower-carbon technologies, with evidence that policy-induced innovation and patenting in renewables are associated with measurable decarbonization over time [12,13]. At the same time, innovation can increase energy services affordability and expand output, creating rebound effects that partially offset efficiency gains, especially where energy prices are low or carbon externalities are weakly priced [12,14].

Based on these important facts, it is essential to examine the drivers of CO2 emissions by asking the following research questions:

- (a)

- What is the effect of tourism on CO2 emissions?

- (b)

- Does renewable energy have a significant impact on CO2 emissions?

- (c)

- How does technological innovation shape the trend of CO2 emissions?

- (d)

- What is the relationship between financial development and CO2 emissions?

- (e)

- Does urban population growth increase/decrease CO2 emissions?

This study advances the literature by examining, for the first time, how technological innovation, trade, and financial development jointly shape the tourism–CO2 emissions nexus across the ten most-visited countries worldwide. Prior research has largely treated these drivers in isolation or focused on narrower country sets, leaving a blind spot where tourism dynamics, market openness, and financial intermediation interact with innovation to influence environmental outcomes. Because these destinations account for a sizable share of global tourism flows and a meaningful portion of emissions growth, identifying the channels through which policy can temper the environmental footprint of tourism has direct relevance for national strategies and for countries with similar structural traits. The study therefore provides actionable guidance on how to leverage cleaner technologies, greener trade composition, and finance that allocates capital toward low-carbon upgrades in tourism-intensive economies.

Methodologically, the study confronts an important but underexplored issue—estimator sensitivity in the signs and magnitudes of trade, finance, and innovation effects. While results are consistently clear that higher income and deeper industrialization raise emissions and that renewable energy mitigates them, estimates for trade openness, financial development, and technological innovation often diverge across panel-robust approaches. Few papers explicitly reconcile why coefficients reverse or shift when moving between Driscoll–Kraay, two-step feasible GLS, and Lewbel IV–2SLS frameworks. This study addresses that gap by placing alternative identification strategies on a common specification grid and by advocating transparent instrument diagnostics, including weak-instrument checks, over-identification tests, and heteroskedasticity-based instrument validity assessments for Lewbel designs. By clarifying when and why results flip, the analysis sharpens inference, strengthens policy credibility, and sets a replicable benchmark for future research on tourism, markets, innovation, and the environment.

2. Empirical Literature

2.1. Financial Development and Economic Growth on CO2 Emissions

Drawing on a wide range of settings and methods, scholars consistently identify two main insights regarding this interrelationship. First, EG generally raises CO2 emissions through scale effects unless cleaner techniques and structural change become strong enough to offset energy-intensive expansion; this pattern appears in country studies for China using ARDL cointegration, in Gulf Cooperation Council analyses, and in broader European and cross-country panels [8,15,16]. Second, the effect of FD is context-dependent because it works through competing channels: expanded credit and investment can scale carbon-intensive capacity and raise emissions, while deeper intermediation can also finance efficiency upgrades, green innovation, and portfolio reallocation toward low-carbon sectors [6,17,18]. Evidence from global panels using system GMM often finds a positive average FD–CO2 link, especially where institutions are weaker and energy systems remain fossil-heavy [6,19], whereas studies on transition economies, MENA, or high-renewable samples more frequently report that FD improves environmental performance by easing technology adoption and shifting the composition of finance [20,21,22]. Sub-national work for China shows the mechanism explicitly, where FD has a direct emissions-increasing effect via easier credit but an indirect emissions-reducing effect through technological upgrading, with the net outcome depending on provincial conditions [8,23].

2.2. Renewable Energy and Technological Innovations on CO2 Emissions

Across diverse samples and methods, the literature shows that expanding REC and strengthening TI consistently mitigate CO2, while the magnitude varies with income level, policy strength, and structural conditions. Global and multi-country panels report that a higher share of renewables is linked with lower emissions and that the reduction can be stronger in advanced- and upper-middle-income economies, with some nonlinear responses across development stages [24,25,26]. Dynamic estimates indicate that increases in clean energy production reduce emissions in both the short- and long-run, and that asymmetric adjustments can shape country-specific outcomes [27]. Evidence from the G7 confirms that renewable deployment combined with eco-innovation depresses emissions, which aligns with sectoral analyses showing innovation-driven reductions in transport-related CO2 for Mediterranean economies and long monthly time series for the United States linking renewable use with lower emissions [28,29]. The innovation channel operates through multiple mechanisms, including improvements in energy efficiency shifts in industrial composition and knowledge diffusion with provincial- and city-level studies for China documenting gains in carbon efficiency, lower emissions intensity, and spatial spillovers from innovative hubs to surrounding regions [30,31].

2.3. Tourism on CO2 Emissions

The tourism–emissions literature shows a predominant scale effect whereby expanding arrivals, nights, and transport activity raise carbon outputs, with long-run cointegration between tourism activity and CO2 reported for the European Union and several destination economies that rely heavily on travel services [24,32]. Studies that separate tourism arrivals from tourism receipts uncover composition effects, since headcount growth is frequently carbon-intensive through aviation and surface mobility, while higher receipts can coincide with shifts toward higher-value and potentially less energy-intensive products and services, yielding mixed or even mitigating impacts in some panels once heterogeneity and cross-sectional dependence are addressed [33,34]. Transport remains the dominant channel, as multi-country analyses link inbound flows to higher transport-sector emissions, especially where modal shares tilt toward air travel and where energy mixes are fossil-heavy, reinforcing the importance of demand management and cleaner fuels in aviation and ground transport [35,36]. Evidence across regions points to nonlinearities that resemble an environmental Kuznets pattern for some samples, with richer destinations showing partial decoupling when environmental regulation, energy efficiency, and service composition improve, while several Middle East and North Africa economies still exhibit positive tourism–CO2 associations under weaker governance and carbon-intensive energy structures [37].

3. Data and Methods

3.1. Data

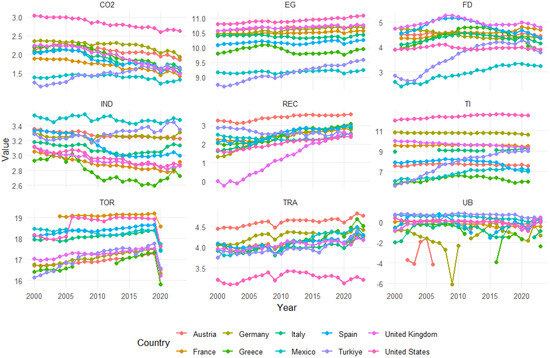

This study examines the drivers of environmental quality across the world’s ten most-visited nations from 2000 to 2023—France, Spain, the United States, China, Italy, Türkiye, Mexico, Thailand, Germany, and the United Kingdom—using territorial CO2 emissions as the proxy for environmental quality. The explanatory set includes trade openness (TRA), economic growth (EG), financial development (FD), tourism intensity (TOR), renewable energy consumption (REC), urban population growth (UB), technological innovation (TI), and industrialization (IND). Variable definitions, measurements, and abbreviations are reported in Table 1, which ensures transparent replication and consistent interpretation across countries and years. Our unit of analysis is national territory due to the availability of consistent macro variables (CO2, trade, finance, innovation) and national tourism accounts, while acknowledging that “destination” is typically sub-national. Figure 1 presents the log trend of the variables.

Table 1.

Data source and measurement.

Figure 1.

Trend of Variables.

3.2. Empirical Methods

3.2.1. Driscoll–Kraay (Panel FE with DK Standard Errors)

Driscoll–Kraay (panel FE with DK standard errors) approach is introduced by [38]. Model with unit and time effects

within (FE) estimator

where stacks unit and, if included, time dummies.

Driscoll–Kraay covariance for large panels

with HAC-type long-run covariance

and kernel weights (e.g., Bartlett) with truncation . DK -tests use this variance.

3.2.2. Two-Step Feasible GLS

Model

where allows panel-specific variances and cross-sectional correlation within each time .

Step 1 OLS and residuals . Estimate by stacking time-specific covariance matrices

Step 2 FGLS estimator

with covariance

3.2.3. Lewbel IV–2SLS

This approach is introduced by [39]. Structural equation with endogenous regressors and exogenous

reduced form for each endogenous variable

Lewbel instruments exploit heteroskedasticity of . Let and be reduced-form residuals. Construct additional instruments

Stack . The 2SLS estimator is

with robust (e.g., White or cluster) covariance used for inference.

We combine Driscoll–Kraay fixed effects to obtain inference that is robust to heteroskedasticity, serial correlation, and cross-sectional dependence; two-step feasible GLS to improve efficiency when errors are heteroskedastic and autocorrelated; and Lewbel IV–2SLS to mitigate potential endogeneity using higher-moment instruments generated from the data. Using these complementary estimators—each relying on different identifying assumptions—allows triangulation of results and strengthens the credibility of the three consistent patterns reported. The study employed three models to investigate these associations.

4. Results

4.1. Basic Statistical Information

Table 2 presents an unbalanced panel in which most variables have 240 observations, while a few series are shorter; for example, FD has 234, TOR 200, REC 220, UB 221, and TI 213, which signals missing values that matter for estimation. The location and spread point to log scaling for the economic quantities, since many means and ranges align with typical logged macro indicators. CO2 centers near 1.946 with a moderate standard deviation of 0.426 and ranges from 1.138 to 3.045, suggesting meaningful cross-section and time variation. TRA averages 4.067 with standard deviation 0.344, consistent with moderate dispersion in trade openness. EG sits around 10.214 with standard deviation 0.601, which fits the behavior of logged GDP per capita. FD shows a mean of 4.248 and a relatively larger spread of 0.631, hinting at heterogeneity in private credit intensity. TOR records a mean of 17.752 and standard deviation 0.827 across 200 observations, pointing to sizable differences in tourism intensity. REC has a mean of 2.373 and standard deviation 0.665 with a minimum slightly below zero, a pattern often seen when very small percentages are logged or when measurement noise appears. UB shows a mean near −0.294 with standard deviation 0.957 and a wide range from −6.098 to 0.853, indicating substantial variability and occasional sharp downturns. TI averages 8.765 with the largest dispersion among the variables at 1.873, reinforcing the idea of strong cross-country or temporal swings in tourism. IND is the most stable, with a mean of 3.112 and a standard deviation of 0.224.

Table 2.

Descriptive statistics.

Table 3 presents the correlation results. CO2 co-moves strongly with EG and TI, suggesting that higher emissions align with higher income and tourism intensity, while it falls as TRA rises. EG rises with FD but declines with IND, and FD also declines with IND. REC increases with TRA yet decreases with CO2 and TI. UB is broadly countercyclical, moving negatively with CO2, TRA, EG, FD, and TI, but modestly positive with TOR and IND. UB behaves broadly countercyclically, with negatives against CO2, TRA, EG, FD, and TI, and small positives with TOR and IND.

Table 3.

Correlation results.

4.2. Cross-Section Independence

Table 4 reports Pesaran’s CD test for cross-sectional independence, where the null hypothesis is that panels are cross-sectionally independent ( = 0 across units). Given the starred CD-statistics (**, ***) for every variable, the null is rejected throughout—at the 1% level for CO2, TRA, EG, TOR, REC, TI, and IND, and at the 5% level for FD and UB—indicating pervasive cross-sectional dependence. The large mean ρ and mean |ρ| for TRA (0.75/0.75) and TOR (0.77/0.78) point to especially strong, system-wide comovement, while variables like UB (0.07/0.38) and TI (0.09/0.48) show weaker average correlations but still statistically significant dependence across units.

Table 4.

Cross-section independence (CD) test.

4.3. Stationarity Test Results

Table 5 presents CADF unit-root tests, where the null is non-stationarity. At levels, most series fail to reject the null (e.g., CO2, TRA, EG, FD, TOR, REC, UB, TI), implying that they are I(1); the exception is IND, which rejects at 5% (−2.258 **) and is stationary in levels. After first differencing, all variables reject the unit-root null—typically at 1% (e.g., CO2 −3.400 ***, TRA −2.865 ***, EG −3.233 ***, REC −3.010 ***, UB −4.320 ***, TI −5.378 ***, IND −3.181 ***) and at 5% for FD (−2.488 **) and TOR (−2.672 **)—indicating stationarity of the differenced series (I(1) processes for those that were non-stationary in levels).

Table 5.

CADF test.

4.4. Driscoll–Kraay Results

Table 6 reports three Driscoll–Kraay panel regressions of CO2 emissions (CO2) on different focal drivers—trade (TRA, Model 1), technological innovations (TI, Model 2), and financial development (FD, Model 3)—alongside a consistent set of controls. Driscoll–Kraay standard errors make the inference robust to heteroskedasticity, serial correlation, and cross-sectional dependence, so the starred coefficients can be trusted under common panel data pathologies.

Table 6.

Effects of TRA, TI, and FD on CO2 emissions (Driscoll–Kraay results).

In Model (1), TRA is positive and highly significant (0.266 ***, SE = 0.034), indicating that greater trade openness is associated with higher CO2. This suggests scale and composition effects of trade dominate any efficiency gains in this sample. The fit is strong (R2 = 0.92; 185 obs.), and the positive, precise links of EG (0.754 ***) and IND (0.367 ***) reinforce that higher income levels and industrialization raise emissions, while REC exerts a sizable mitigating effect (−0.156 ***). Model (2) focuses on TI and shows a positive, statistically significant association with CO2 (0.055 **, SE = 0.020). This implies the prevailing innovation mix is not yet sufficiently green: technology may be expanding production and energy use faster than it improves efficiency. Compared with Model (1), the fit drops (R2 = 0.86; 178 obs.), but the control pattern is stable—EG and IND remain strongly emission-increasing, REC remains emission-reducing, while tourism (TOR) and urbanization (UB) stay statistically insignificant. Model (3) centers on FD and finds a positive, highly significant effect (0.070 ***, SE = 0.020). Deeper finance appears to ease credit constraints for carbon-intensive activity (industry, construction, conventional energy), lifting emissions unless steered toward low-carbon projects. The overall explanatory power is still high (R2 = 0.81; 181 obs.). Again, EG (0.573 ***) and IND (0.434 ***) are robustly positive, REC (−0.153 ***) is robustly negative, while TOR and UB remain near zero and insignificant, suggesting limited direct emissions effects from tourism intensity and short-run urban population growth in this specification.

Across all three models, two consistent messages emerge. First, income and industrialization systematically raise CO2, while renewable energy consumption consistently and meaningfully lowers it, pointing to a reliable abatement lever. Second, the focal variables each add an emissions-increasing margin: trade openness, the current composition of technological innovation, and financial deepening all correlate with higher emissions in this panel. Policy-wise, the results argue for coupling trade and finance with stringent green standards and directing innovation toward energy-efficient and renewable technologies; doing so would amplify the recurring mitigation role of REC and temper the scale effects arising from EG, IND, TRA, TI, and FD.

4.5. Two-Step (Feasible) Generalized Least Squares (Robustness Check) Results

Table 7 reports three TGLS robustness models for CO2, estimated to address heteroskedasticity and contemporaneous correlation across panels as a cross-check on the Driscoll–Kraay results. Across all models, EG and IND remain strongly and positively associated with emissions, while the fit remains high (R2 ≈ 0.92/0.86/0.81). TOR is mostly neutral to negative, and UB is weakly negative or insignificant, suggesting limited direct pressure on emissions once other factors are held constant. In Model (1), trade openness (TRA) turns negative and highly significant (−0.774 ***, SE = 0.042), implying that—under TGLS weighting—greater trade is linked to lower CO2, possibly reflecting cleaner import composition, technology diffusion, or efficiency gains that dominate scale effects. Controls behave plausibly: EG (0.722 ***) and IND (0.956 ***) raise emissions, TOR lowers them (−0.129 ***), UB is mildly mitigating (−0.019 **), and REC is statistically nil, yielding a very high R2 = 0.92 (185 obs.).

Table 7.

Effects of TRA, TI, and FD on CO2 emissions (TGLS results).

Model (2) centers on TI and, consistent with the main estimates, finds a positive and precise link to emissions (0.079 ***, SE = 0.011). This suggests the current innovation mix expands activity and energy use faster than it reduces carbon intensity. EG (0.470 ***) and IND (0.354 ***) remain emission-increasing, while TOR, UB, and REC remain statistically insignificant. The explanatory power remains strong (R2 = 0.86; 178 obs.), and the pattern mirrors the baseline except for the estimator’s different error structure. Model (3) pivots to FD and shows a negative, significant coefficient (−0.096 ***, SE = 0.037), in contrast to the positive Driscoll–Kraay estimate. With TGLS, deeper finance appears associated with lower emissions—potentially because it facilitates cleaner capital formation or because TGLS better down-weights high-variance, carbon-intensive episodes. Notably, REC becomes a strong mitigator here (−0.129 ***), while TOR is again negative (−0.090 ***), and EG (0.658 ***) and IND (0.311 ***) retain positive signs (R2 = 0.81; 181 obs.).

In summary, the TGLS robustness check confirms the core message that EG and IND reliably raise CO2, while REC can mitigate (especially in Model 3), but it also reveals estimator-sensitive findings for TRA and FD (negative under TGLS, positive or weaker in Driscoll–Kraay). Policy-wise, this argues for coupling trade and finance with explicit green standards to ensure their decarbonizing potential is realized, and for redirecting innovation toward clean technologies so its scale effects are offset by genuine efficiency gains. The sign flips highlight the value of multiple estimators; thus, necessitating the use of the Lewbel IV–2SLS estimator.

4.6. Lewbel IV–2SLS Results

Table 8 presents Lewbel IV–2SLS estimates. Using Lewbel IV–2SLS is warranted because TRA, FD, and TI are plausibly endogenous with CO2. Reverse causality can arise when cleaner or dirtier economies shape trade patterns, financial deepening, and innovation choices. Omitted variables such as environmental policy strictness or sectoral composition can bias ordinary least squares. Lewbel’s method builds internal instruments from heteroskedasticity in the data by interacting mean-centered exogenous regressors with their residual variation, which can supply relevance while remaining uncorrelated with the structural error under standard conditions. This approach is well suited to macro panel settings where external instruments are scarce, and it complements Driscoll–Kraay and TGLS checks by directly targeting endogeneity.

Table 8.

Effects of TRA, TI, and FD on CO2 emissions (Lewbel IV–2SLS results).

A key and robust pattern is the negative link between TRA and CO2. TRA is strongly negative in Model 1 at −0.843 with triple stars, and even more negative in Model 2 at −1.177 with triple stars. This suggests that cleaner import composition, diffusion of efficient technologies, and competitive pressure that raises efficiency outweigh scale effects when we correct for bias. EG remains positive and precise across all models, with coefficients between about 0.58 and 0.77 with triple stars, confirming that higher income aligns with higher emissions in this panel.

The FD and TI coefficients reveal interaction-sensitive effects. FD is mildly positive in Model 1 at 0.050, yet turns strongly negative in Model 3 at −0.185 once TI is included, which hints that deeper finance can lower emissions when paired with a supportive innovation environment that channels credit to cleaner capital. TI lowers emissions in Model 2 at −0.072 but becomes positive in Model 3 at 0.073, consistent with the idea that innovation can expand activity and energy use unless finance and policy steer it toward low-carbon deployment. IND is positive and sizeable in Models 1 and 2 but loses significance in Model 3, pointing to mediation through FD and TI pathways.

Other controls show stable signals. TOR is consistently emission-reducing, with coefficients between −0.087 and −0.166 with triple stars, which may reflect service-oriented activity and efficiency gains in major destinations. UB is negative and significant in Models 1 and 2, yet becomes insignificant when FD and TI are modeled together. REC is mixed, with a small positive in Model 1, near zero in Model 2, and an insignificant estimate in Model 3, suggesting that renewable uptake alone does not guarantee immediate territorial emission cuts without complementary finance, technology, and grid readiness.

4.7. Diagnostics Results

Table 9 shows that the Lewbel instruments are both relevant and valid across all three models. Under-identification is rejected (Kleibergen–Paap LM χ2 = 28.4–34.2, p < 0.001), confirming the system is identified. Weak-ID robust strength is adequate, since the Kleibergen–Paap rk Wald F statistics (20.3–27.6) exceed the Stock–Yogo 10% critical value of 16.38; Model 3 is comparatively weaker but still above threshold, and Cragg–Donald F values are similarly strong. Over-identification tests do not reject instrument validity, with small and insignificant Hansen and Sargan J statistics (p = 0.28–0.52). Together, these diagnostics support consistent IV estimates for all specifications.

Table 9.

Diagnostic test results.

4.8. Discussion of Findings

This section presents the discussion regarding the findings obtained from the three estimators. The strong negative link between trade openness and emissions in Models 1–2 is consistent with the idea that, for mature, service-heavy destinations, composition and technique effects dominate the scale effect. Openness reshapes the import mix toward cleaner intermediate goods, encourages the diffusion of efficient capital, and exposes firms to global competition and standards, all of which lower pollution intensity. Classic theory and evidence separate trade’s impacts into scale, composition, and technique channels, with openness often reducing local pollutant intensities through cleaner technologies and stricter standards that travel with supply chains [40]. This helps explain the increasingly negative TRA coefficient once biases are addressed. At the same time, several studies, including [41,42,43], warn that trade can raise emissions through the scale channel or pollution-haven dynamics in specific contexts, reminding us that the sign is ultimately empirical and context-specific where enforcement is weak.

The flip in the finance coefficient once innovation is modeled—mildly positive in Model 1 but clearly negative in Model 3—signals that finance alone can expand carbon-intensive activity, yet in the presence of strong innovation channels, it reallocates credit toward cleaner capital and processes. Cross-country panel work shows that financial development can either raise or cut CO2 depending on whether it primarily fuels scale or enables green investment and innovation. Several studies, including [7,44,45], find that finance paired with innovation dampens emissions, whereas finance without such direction can amplify them.

The sign change for TI between Models 2 and 3 aligns with rebound logic, where innovation widens economic scope and energy use unless guided by finance and policy toward deployment of low-carbon technologies [46,47]. This interaction-sensitive pattern echoes recent evidence that environmental and green technological innovation lowers CO2 in the long run, while short-run effects can be neutral or even positive, absent supportive diffusion and financing [48,49].

Tourism intensity’s emission-reducing association for these major destinations, captured by the consistently negative TOR coefficients, is plausible because top markets tend to be service-oriented with efficient infrastructure, stringent standards, and relatively clean power mixes for urban cores. High inbound volumes can also spur operational efficiency, load factors, and public-transport investments that lower per-visitor footprints. Still, global accounting work shows tourism’s aggregate footprint grew rapidly in 2009–2019, and several studies find tourism raises CO2 in developing settings or exhibits inverted-U dynamics [50,51]. In other words, some studies also find a negative association as services and efficiency dominate [33,52], while at the global supply-chain level, tourism demand still drives substantial upstream emissions [53]. This tension explains why TOR appears carbon-reducing in this sample even as broader literature urges tourism decarbonization [32].

Industry’s positive association in Models 1–2 but loss of significance in Model 3 suggests that part of the industrial channel is mediated by finance-and-innovation pathways [54,55]. Where industry remains material- and heat-intensive, more output means more CO2; when FD and TI are explicitly included, the direct effect of industry share can attenuate if cleaner finance and innovation explain the variation that once loaded on industry. Recent studies document that industrialization tends to lift emissions unless offset by cleaner electricity and technology upgrades, and that the exact magnitude varies with the carbon intensity of national power and sectoral mix—factors that differ across the top destinations [51]. Urbanization’s initially negative association, turning insignificant once FD and TI enter, is also coherent with evidence that compact, transit-rich cities can lower per-capita emissions, but the effect is sensitive to grid carbon intensity and industrial structure.

Economic growth remains positively associated with emissions across all three models, which fits evidence that higher income and activity levels lift energy demand and carbon output until structural changes and deep decarbonization policies take hold [43,56]. Likewise, several studies document that growth phases typically raise territorial emissions before peaking, after which further growth can coincide with declines if industry, power mix, and technologies shift sufficiently [57,58]. The positive, precisely estimated EG coefficients here therefore look like the pre- or early-peak part of that pathway in many top tourist nations, notwithstanding later prospects for decoupling once clean power and electrification scale.

Finally, the mixed and statistically weak pattern for renewable energy shares—small positive in Model 1, near zero in Model 2, and insignificant in Model 3—signals timing and systems constraints. Renewables can reduce CO2 when they actually displace fossil generation and when grids can absorb variable output; in short windows or without storage and transmission upgrades, measured territorial reductions may lag capacity additions [42,59]. This discovery also corroborates the findings of [58,60], which find that renewables generally cut emissions. Yet [61,62] note curtailment and grid bottlenecks that blunt near-term gains, which helps explain why REC alone is not a silver bullet in the models without the complementary roles of finance, technology diffusion, and grid modernization.

5. Conclusions and Policy Recommendations

5.1. Conclusions

This study explores the effects of tourism and energy consumption on environmental quality, and examines the moderating roles of financial development, trade, and technological innovation, using data for the top ten most-visited nations from 2000 to 2023. The analysis employs a series of panel estimators, including Driscoll–Kraay, two-step feasible generalized least squares, and Lewbel IV–2SLS. The results show that across estimators, two patterns are stable—EG and IND raise CO2, while REC generally mitigate it, with magnitudes that depend on model choice and grid readiness. Driscoll–Kraay indicates that TRA, TI, and FD are each positively linked to emissions. In addition, the two-step feasible GLS estimator discloses a negative effect of TRA and FD on CO2. Furthermore, Lewbel IV–2SLS, which addresses endogeneity, strengthens the case that TRA reduces CO2 and that FD lowers emissions when paired with TI, while TI itself is interaction-sensitive and can either abate or raise emissions depending on deployment and guidance. Tourism intensity (TOR) is neutral to negative, and urbanization (UB) is weakly negative or insignificant after controls.

5.2. Policy Implications

(a) Leverage openness for cleaner supply chains: Since trade openness lowers emissions in mature, service-heavy destinations, governments should double down on “clean-trade” instruments: green public procurement for imported intermediates, carbon-intensity disclosure for importers, and preferential tariffs/financing for low-carbon capital goods. Border carbon adjustments (or equivalent embodied-carbon rules) can reinforce technique and composition effects while minimizing pollution-haven risks. Customs and export-credit agencies should tie support to verifiable energy-efficiency and environmental-management standards in supplier networks.

(b) Make finance work only when paired with innovation: Because finance cuts emissions when it channels resources into innovation (but can raise them otherwise), regulators should align credit creation with green tech deployment. Practical steps: green taxonomies with science-based thresholds; priority-lending quotas or lower risk weights for verified low-carbon projects; results-based incentives for banks that expand loans to electrification, heat-pump/process heat upgrades, and grid-flexibility solutions. Public development banks should crowd-in private capital via blended-finance structures and IP-sharing facilities to speed the diffusion of clean technologies to SMEs.

(c) Guard against rebound—steer innovation to deployment and diffusion: Innovation can increase energy use unless steered. Policy should couple R&D support with market-making: targeted subsidies and carbon prices that reward adoption (not just patents), time-limited investment tax credits for proven abatement tech, and standards that require best-available low-carbon options in buildings, transport fleets, and industrial retrofits. Tie innovation grants to deployment milestones and interoperable standards, and fund extension services/testing labs so that firms translate TI into measurable efficiency gains rather than scale-driven rebounds.

(d) Decarbonize high-volume tourism systems, not just firms: Tourism intensity appears carbon-reducing in top destinations with efficient infrastructure; therefore, scale that model. Priorities: mandate lifecycle-based standards for hotels/venues, expand electrified mass transit and inter-modal hubs serving tourist corridors, and introduce transparent destination-level carbon dashboards and certification that reward load-factor optimization and waste/energy reductions. Use congestion pricing and sustainable aviation fuel (SAF) blending mandates where feasible; recycle revenues into transit, grid upgrades in tourist regions, and nature-based offsets tied to local ecosystems.

(e) Tackle industry and growth with clean power, grids, and targeted retrofits: Industry’s emissions fall when finance and innovation are explicit in the model—so integrate industrial policy with green finance and power-sector reform. Focus on three enablers: (i) accelerate clean electricity (renewables + firming with storage, demand response, flexible low-carbon generation), (ii) modernize grids (transmission, interconnection, curtailment reduction) so renewable additions actually displace fossil output, and (iii) fund heat- and materials-efficiency retrofits (electrified process heat, CCUS where hard-to-abate). Because growth remains emission-raising, pair carbon pricing with sectoral standards and time-bound transition pathways; densify cities around transit to preserve urban efficiency gains, and use just-transition funds to help firms and workers pivot into low-carbon activities.

5.3. Managerial Implications

For executives in trade-exposed, service-heavy firms (airlines, hotels, logistics, retail), treat openness as a lever for cleaner value chains. Embed lifecycle carbon criteria into procurement and vendor onboarding; require suppliers to disclose energy mix, process efficiency, and third-party certifications, and weigh awards toward low-carbon intermediates and equipment. Operationally, standardize energy-management playbooks across sites (sub-metering, energy-use intensity targets, heat recovery, EV/light-duty electrification, load shifting). Build “clean contract” clauses—price-adjusters tied to embodied-carbon thresholds and service-level metrics that reward continuous efficiency gains. Managers should deploy supplier scorecards and periodic audits, and publish a simple scope-3 dashboard to align internal teams and vendors around measurable, year-on-year intensity reductions.

For CFOs and finance leaders, make capital allocation contingent on innovation that actually deploys, not just patents. Create a green CapEx lane with hurdle-rate reductions for verified abatement projects (e.g., electrified process heat, heat pumps, VFDs, storage, on-site PV/PPAs), and link borrowing costs or bonuses to delivered tCO2e reductions. Use blended financing and risk-sharing (e.g., performance guarantees, energy-as-a-service) to accelerate SME adoption in your supply base. Establish “rebound guards”: pair productivity-boosting IT and automation with explicit energy-intensity and absolute-emissions KPIs, and require post-investment M&V so innovations do not quietly drive up total energy demand. Train controllers to track avoided costs from curtailed curtailment, load flexibility, and demand response so grid-friendly operations show up in P&L.

For operations and industrial managers, integrate growth plans with a retrofit and clean-power roadmap. Sequence quick wins (compressed-air leak fixes, heat integration, motor upgrades) before deep retrofits (electrified boilers/kilns, CCUS where applicable), and align major overhauls with procurement cycles to minimize downtime. In tourism hubs, prioritize high-load-factor transit, fleet electrification, and building performance standards; use real-time occupancy to optimize HVAC and water systems. Sign long-tenor green PPAs or virtual PPAs to de-risk energy costs and ensure renewables truly displace fossil power; coordinate with grid operators on flexible scheduling to reduce curtailment. Finally, equip teams with a concise KPI set—energy-use intensity, share of clean electricity, abatement cost per tCO2e, supplier compliance rate—and review it monthly so strategy, finance, and operations stay locked on measurable decarbonization while safeguarding service quality and margins.

5.4. Limitations and Future Directions

This study faces several limitations that suggest concrete avenues for future work. First, key constructs rely on aggregate proxies—e.g., patents for technological innovation, arrivals for tourism intensity, and territorial CO2 rather than consumption-based or sector-resolved emissions—potentially masking composition effects (aviation vs. lodging; renewables that do not fully displace fossil power due to grid constraints). Second, although Driscoll–Kraay, FGLS, and Lewbel IV reduce common panel pathologies, estimator sensitivity and residual endogeneity remain possible given unobserved policy, energy-mix, and institutional heterogeneity. Third, cross-sectional dependence and nonlinear dynamics may be richer than captured; future research should employ common correlated effects (CCE), panel quantile and threshold models, and spatial spillover designs to recover state- and neighbor-dependent responses. Fourth, pandemic and post-pandemic structural breaks may distort trends; break-robust estimation and regime-switching approaches are warranted. Finally, richer data—sectoral (transport/buildings/industry), firm-level finance linked to green taxonomies, policy stringency indices, and consumption-based CO2—would enable moderated mediation tests of how trade, finance, and innovation jointly transmit to emissions; quasi-experimental designs (e.g., SAF mandates, border-carbon adjustments, green credit guidelines) and validated external instruments can strengthen causal inference and guide targeted decarbonization in tourism-intensive economies.

Author Contributions

Conceptualization, X.Y. and Q.Q.; methodology, X.Y.; software, X.Y.; validation, X.Y., Q.Q. and Z.A.; formal analysis, X.Y.; investigation, X.Y.; resources, Q.Q. and Z.A.; data curation, X.Y.; writing—original draft preparation, X.Y.; writing—review and editing, X.Y., Q.Q. and Z.A. All authors have read and agreed to the published version of the manuscript.

Funding

This study received no funding.

Data Availability Statement

Data will be made available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- NASA. Temperatures Rising: NASA Confirms 2024 Warmest Year on Record—NASA. Available online: https://www.nasa.gov/news-release/temperatures-rising-nasa-confirms-2024-warmest-year-on-record/ (accessed on 18 October 2025).

- WMO. WMO Confirms 2024 as Warmest Year on Record at About 1.55 °C Above Pre-Industrial Level. World Meteorological Organization. Available online: https://wmo.int/news/media-centre/wmo-confirms-2024-warmest-year-record-about-155degc-above-pre-industrial-level (accessed on 18 October 2025).

- IEA. CO2 Emissions in 2023 Executive Summary. 2025. Available online: https://www.iea.org/reports/co2-emissions-in-2023/executive-summary (accessed on 14 May 2025).

- Eurostat. Electricity from Renewable Sources Reaches 47% in 2024. Available online: https://ec.europa.eu/eurostat/web/products-eurostat-news/w/ddn-20250319-1 (accessed on 18 October 2025).

- IEA. Renewable Electricity—Renewables 2025—Analysis. IEA. Available online: https://www.iea.org/reports/renewables-2025/renewable-electricity (accessed on 18 October 2025).

- Abbasi, F.; Riaz, K. CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy 2016, 90, 102–114. [Google Scholar] [CrossRef]

- Andrew, A.A.; Adebayo, T.S.; Lasisi, T.T.; Muoneke, O.B. Moderating roles of technological innovation and economic complexity in financial development-environmental quality nexus of the BRICS economies. Technol. Soc. 2024, 78, 102581. [Google Scholar] [CrossRef]

- Jalil, A.; Feridun, M. The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Econ. 2011, 33, 284–291. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Olanrewaju, V.O.; Uzun, B. Achieving access to clean fuels and technologies for cooking in rural and urban areas of India: A wavelet quantile-based approach. Energy Sources Part B Econ. Plan. Policy 2025, 20, 2479173. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Tang, C.F.; Ozturk, I. Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ. Sci. Pollut. Res. 2015, 22, 14891–14900. [Google Scholar] [CrossRef]

- Cetin, M.A.; Bakirtas, I. The long-run environmental impacts of economic growth, financial development, and energy consumption: Evidence from emerging markets. Energy Environ. 2020, 31, 634–655. [Google Scholar] [CrossRef]

- Chhabra, M.; Giri, A.K.; Kumar, A. Do technological innovations and trade openness reduce CO2 emissions? Evidence from selected middle-income countries. Environ. Sci. Pollut. Res. 2022, 29, 65723–65738. [Google Scholar] [CrossRef]

- Lin, B.; Ma, R. Green technology innovations, urban innovation environment and CO2 emission reduction in China: Fresh evidence from a partially linear functional-coefficient panel model. Technol. Forecast. Soc. Change 2022, 176, 121434. [Google Scholar] [CrossRef]

- Shahbaz, M.; Raghutla, C.; Song, M.; Zameer, H.; Jiao, Z. Public-private partnerships investment in energy as new deter-minant of CO2 emissions: The role of technological innovations in China. Energy Econ. 2020, 86, 104664. [Google Scholar] [CrossRef]

- Magazzino, C. The relationship between CO2 emissions, energy consumption and economic growth in Italy. Int. J. Sustain. Energy 2016, 35, 844–857. [Google Scholar] [CrossRef]

- Salahuddin, M.; Gow, J.; Ozturk, I. Is the long-run relationship between economic growth, electricity consumption, carbon dioxide emissions and financial development in Gulf Cooperation Council Countries robust? Renew. Sustain. Energy Rev. 2015, 51, 317–326. [Google Scholar] [CrossRef]

- Anwar, A.; Sinha, A.; Sharif, A.; Siddique, M.; Irshad, S.; Anwar, W.; Malik, S. The nexus between urbanization, renewable energy consumption, financial development, and CO2 emissions: Evidence from selected Asian countries. Environ. Dev. Sustain. 2022, 24, 6556–6576. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye, Q.M.A.; Tiwari, A.K.; Leitão, N.C. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef]

- Batool, Z.; Raza, S.M.F.; Ali, S.; Abidin, S.Z.U. ICT, renewable energy, financial development, and CO2 emissions in de-veloping countries of East and South Asia. Environ. Sci. Pollut. Res. 2022, 29, 35025–35035. [Google Scholar] [CrossRef] [PubMed]

- Dogan, E.; Seker, F. Determinants of CO2 emissions in the European Union: The role of renewable and non-renewable energy. Renew. Energy 2016, 94, 429–439. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Tamazian, A.; Rao, B.B. Do economic, financial and institutional developments matter for environmental degra-dation? Evidence from transitional economies. Energy Econ. 2010, 32, 137–145. [Google Scholar] [CrossRef]

- Achuo, E.; Kakeu, P.; Asongu, S. Financial development, human capital and energy transition: A global comparative analysis. Int. J. Energy Sect. Manag. 2024, 19, 59–80. [Google Scholar] [CrossRef]

- Bano, S.; Liu, L.; Khan, A. Dynamic influence of aging, industrial innovations, and ICT on tourism development and re-newable energy consumption in BRICS economies. Renew. Energy 2022, 192, 431–442. [Google Scholar] [CrossRef]

- Chien, F.; Paramaiah, C.; Joseph, R.; Pham, H.C.; Phan, T.T.H.; Ngo, T.Q. The impact of eco-innovation, trade openness, financial development, green energy and government governance on sustainable development in ASEAN countries. Renew. Energy 2023, 211, 259–268. [Google Scholar] [CrossRef]

- Geng, J.B.; Ji, Q. Technological innovation and renewable energy development: Evidence based on patent counts. Int. J. Glob. Environ. Issues 2016, 15, 217. [Google Scholar] [CrossRef]

- Zambrano-Monserrate, M.A. Clean energy production index and CO2 emissions in OECD countries. Sci. Total Environ. 2024, 907, 167852. [Google Scholar] [CrossRef]

- Çakar, N.D.; Gedikli, A.; Erdoğan, S.; Yıldırım, D.Ç. A comparative analysis of the relationship between innovation and transport sector carbon emissions in developed and developing Mediterranean countries. Environ. Sci. Pollut. Res. Int. 2021, 28, 45693–45713. [Google Scholar] [CrossRef] [PubMed]

- Aliani, K.; Borgi, H.; Alessa, N.; Hamza, F.; Albitar, K. The impact of green innovation and renewable energy on CO2 emissions in G7 nations. Heliyon 2024, 10, e31142. [Google Scholar] [CrossRef]

- Godil, D.I.; Yu, Z.; Sharif, A.; Usman, R.; Khan, S.A.R. Investigate the role of technology innovation and renewable energy in reducing transport sector CO2 emission in China: A path toward sustainable development. Sustain. Dev. 2021, 29, 694–707. [Google Scholar] [CrossRef]

- Lin, B.; Zhu, J. Determinants of renewable energy technological innovation in China under CO2 emissions constraint. J. Environ. Manag. 2019, 247, 662–671. [Google Scholar] [CrossRef]

- Lee, J.W.; Brahmasrene, T. Investigating the influence of tourism on economic growth and carbon emissions: Evidence from panel analysis of the European Union. Tour. Manag. 2013, 38, 69–76. [Google Scholar] [CrossRef]

- Irfan, M.; Ullah, S.; Razzaq, A.; Cai, J.; Adebayo, T.S. Unleashing the dynamic impact of tourism industry on energy con-sumption, economic output, and environmental quality in China: A way forward towards environmental sustainability. J. Clean. Prod. 2023, 387, 135778. [Google Scholar] [CrossRef]

- Koçak, E.; Ulucak, R.; Ulucak, Z.Ş. The impact of tourism developments on CO2 emissions: An advanced panel data estimation. Tour. Manag. Perspect. 2020, 33, 100611. [Google Scholar] [CrossRef]

- Abbasi, K.R.; Lv, K.; Radulescu, M.; Shaikh, P.A. Economic complexity, tourism, energy prices, and environmental deg-radation in the top economic complexity countries: Fresh panel evidence. Environ. Sci. Pollut. Res. 2021, 28, 68717–68731. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Fereidouni, H.G.; Mohammed, A.H. The effect of tourism arrival on CO2 emissions from transportation sector. Anatolia 2015, 26, 230–243. [Google Scholar] [CrossRef]

- Tang, C.F.; Abosedra, S. The impacts of tourism, energy consumption and political instability on economic growth in the MENA countries. Energy Policy 2014, 68, 458–464. [Google Scholar] [CrossRef]

- Driscoll, J.C.; Kraay, A.C. Consistent Covariance Matrix Estimation with Spatially Dependent Panel Data. Rev. Econ. Stat. 1998, 80, 549–560. [Google Scholar] [CrossRef]

- Lewbel, A. Using Heteroscedasticity to Identify and Estimate Mismeasured and Endogenous Regressor Models. J. Bus. Econ. Stat. 2012, 30, 67–80. [Google Scholar] [CrossRef]

- Antweiler, W.; Copeland, B.R.; Taylor, M.S. Is Free Trade Good for the Environment? Am. Econ. Rev. 2001, 91, 877–908. [Google Scholar] [CrossRef]

- Cetin, M.; Seker, F.; Cavlak, H. The Impact of Trade Openness on Environmental Pollution: A Panel Cointegration and Causality Analysis. In Regional Economic Integration and the Global Financial System; IGI Global: Hershey, PA, USA, 2015; pp. 221–232. [Google Scholar] [CrossRef]

- Destek, M.A.; Sinha, A. Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: Evidence from organisation for economic Co-operation and development countries. J. Clean. Prod. 2020, 242, 118537. [Google Scholar] [CrossRef]

- Nguyen, H.T.; Van Nguyen, S.; Dau, V.-H.; Le, A.T.H.; Nguyen, K.V.; Nguyen, D.P.; Bui, X.-T.; Bui, H.M. The nexus between greenhouse gases, economic growth, energy and trade openness in Vietnam. Environ. Technol. Innov. 2022, 28, 102912. [Google Scholar] [CrossRef]

- Omri, A.; Kahouli, B.; Kahia, M. Environmental sustainability and health outcomes: Do ICT diffusion and technological innovation matter? Int. Rev. Econ. Finance 2024, 89, 1–11. [Google Scholar] [CrossRef]

- Wang, R.; Usman, M.; Radulescu, M.; Cifuentes-Faura, J.; Balsalobre-Lorente, D. Achieving ecological sustainability through technological innovations, financial development, foreign direct investment, and energy consumption in developing European countries. Gondwana Res. 2023, 119, 138–152. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Olanrewaju, V.O. Journey toward affordable and modern energy: Role of income inequality and techno-logical innovation. Environ. Prog. Sustain. Energy 2025, 44, e14555. [Google Scholar] [CrossRef]

- Chen, Y.; Lee, C.-C. Does technological innovation reduce CO2 emissions? Cross-country evidence. J. Clean. Prod. 2020, 263, 121550. [Google Scholar] [CrossRef]

- Ahmed, Z.; Ahmad, M.; Murshed, M.; Shah, M.I.; Mahmood, H.; Abbas, S. How do green energy technology in-vestments, technological innovation, and trade globalization enhance green energy supply and stimulate environmental sus-tainability in the G7 countries? Gondwana Res. 2022, 112, 105–115. [Google Scholar] [CrossRef]

- Chishti, M.Z.; Sinha, A. Do the shocks in technological and financial innovation influence the environmental quality? Evidence from BRICS economies. Technol. Soc. 2022, 68, 101828. [Google Scholar] [CrossRef]

- Akadiri, S.S.; Alola, A.A.; Uzuner, G. Economic policy uncertainty and tourism: Evidence from the heterogeneous panel. Curr. Issues Tour. 2020, 23, 2507–2514. [Google Scholar] [CrossRef]

- Ekwueme, D.C.; Lasisi, T.T.; Eluwole, K.K. Environmental sustainability in Asian countries: Understanding the criticality of economic growth, industrialization, tourism import, and energy use. Energy Environ. 2022, 34, 1592–1618. [Google Scholar] [CrossRef]

- Ngoc, B.H.; Hai, L.M. Time-frequency nexus between tourism development, economic growth, human capital, and income inequality in Singapore. Appl. Econ. Lett. 2024, 31, 259–264. [Google Scholar] [CrossRef]

- Leung, X.Y.; Zhong, Y.S.; Sun, J. The impact of social media influencer’s age cue on older adults’ travel intention: The moderating roles of travel cues and travel constraints. Tour. Manag. 2025, 106, 104979. [Google Scholar] [CrossRef]

- Amoah, J.O.; Alagidede, I.P.; Sare, Y.A. Industrialization and carbon emission nexus in Sub-Saharan Africa. The moder-ating role of trade openness. Cogent Econ. Finance 2024, 12, 2360803. [Google Scholar] [CrossRef]

- Yang, B.; Usman, M.; Jahanger, A. Do industrialization, economic growth and globalization processes influence the ecological footprint and healthcare expenditures? Fresh insights based on the STIRPAT model for countries with the highest healthcare expenditures. Sustain. Prod. Consum. 2021, 28, 893–910. [Google Scholar] [CrossRef]

- Acheampong, A.O. Economic growth, CO2 emissions and energy consumption: What causes what and where? Energy Econ. 2018, 74, 677–692. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Bekun, F.V.; Rjoub, H.; Agboola, M.O.; Agyekum, E.B.; Gyamfi, B.A. Another look at the nexus between economic growth trajectory and emission within the context of developing country: Fresh insights from a nonparametric cau-sality-in-quantiles test. Environ. Dev. Sustain. 2022, 25, 11397–11419. [Google Scholar] [CrossRef]

- Ahmad, M.; Dai, J.; Mehmood, U.; Houran, M.A. Renewable energy transition, resource richness, economic growth, and environmental quality: Assessing the role of financial globalization. Renew. Energy 2023, 216, 119000. [Google Scholar] [CrossRef]

- Adebayo, T.S. Environmental consequences of fossil fuel in Spain amidst renewable energy consumption: A new insights from the wavelet-based Granger causality approach. Int. J. Sustain. Dev. World Ecol. 2022, 29, 579–592. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Ağa, M.; Kartal, M.T. Analyzing the co-movement between CO2 emissions and disaggregated nonre-newable and renewable energy consumption in BRICS: Evidence through the lens of wavelet coherence. Environ. Sci. Pollut. Res. 2023, 30, 38921–38938. [Google Scholar] [CrossRef]

- Achour, H.; Belloumi, M. Investigating the causal relationship between transport infrastructure, transport energy consumption and economic growth in Tunisia. Renew. Sustain. Energy Rev. 2016, 56, 988–998. [Google Scholar] [CrossRef]

- Olanrewaju, V.O.; Kirikkaleli, D. Analyzing gas and oil efficiency’s role in environmental management: Does political risk matter? Energy Environ. 2024. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).