6.1. Theoretical Implications

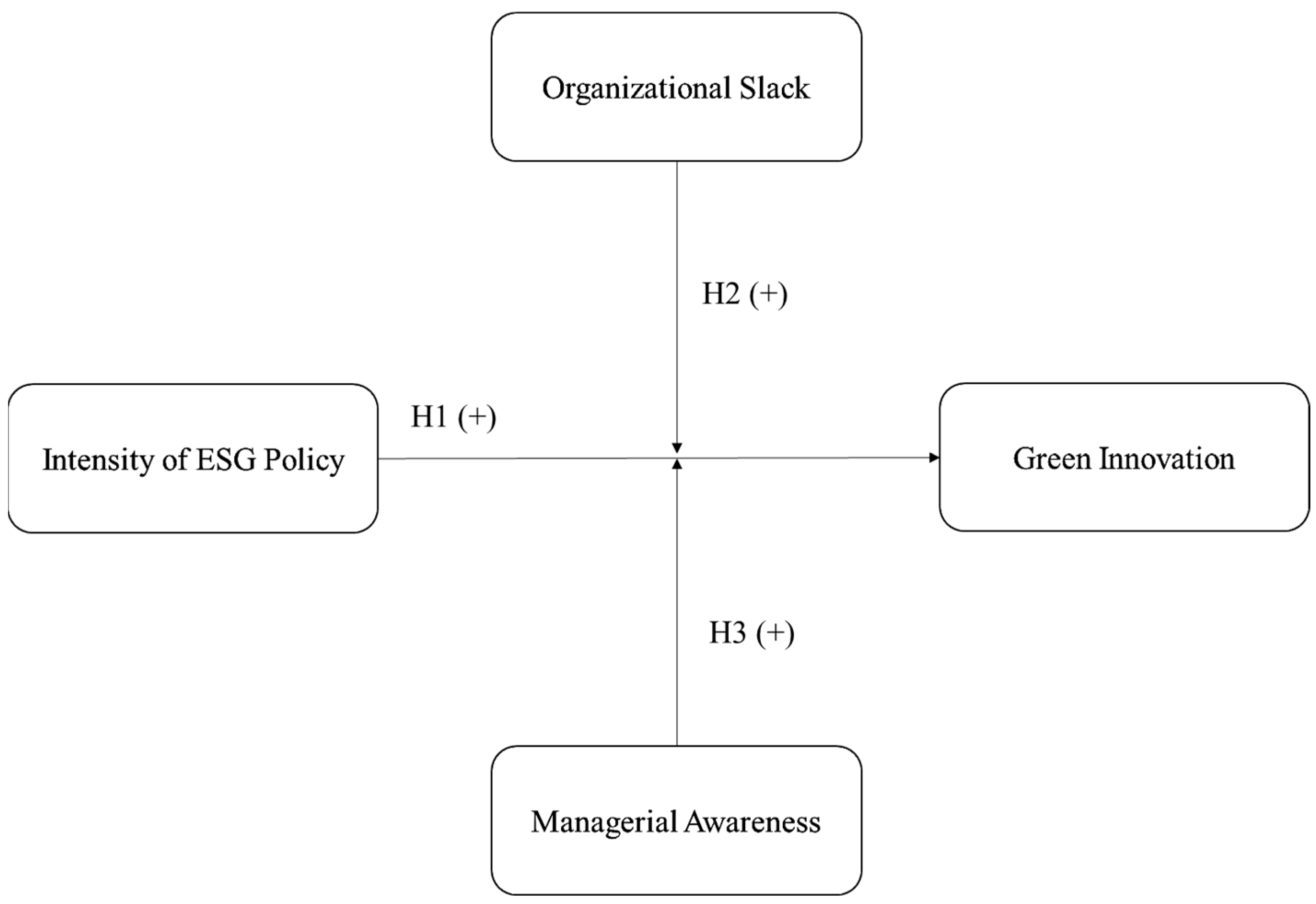

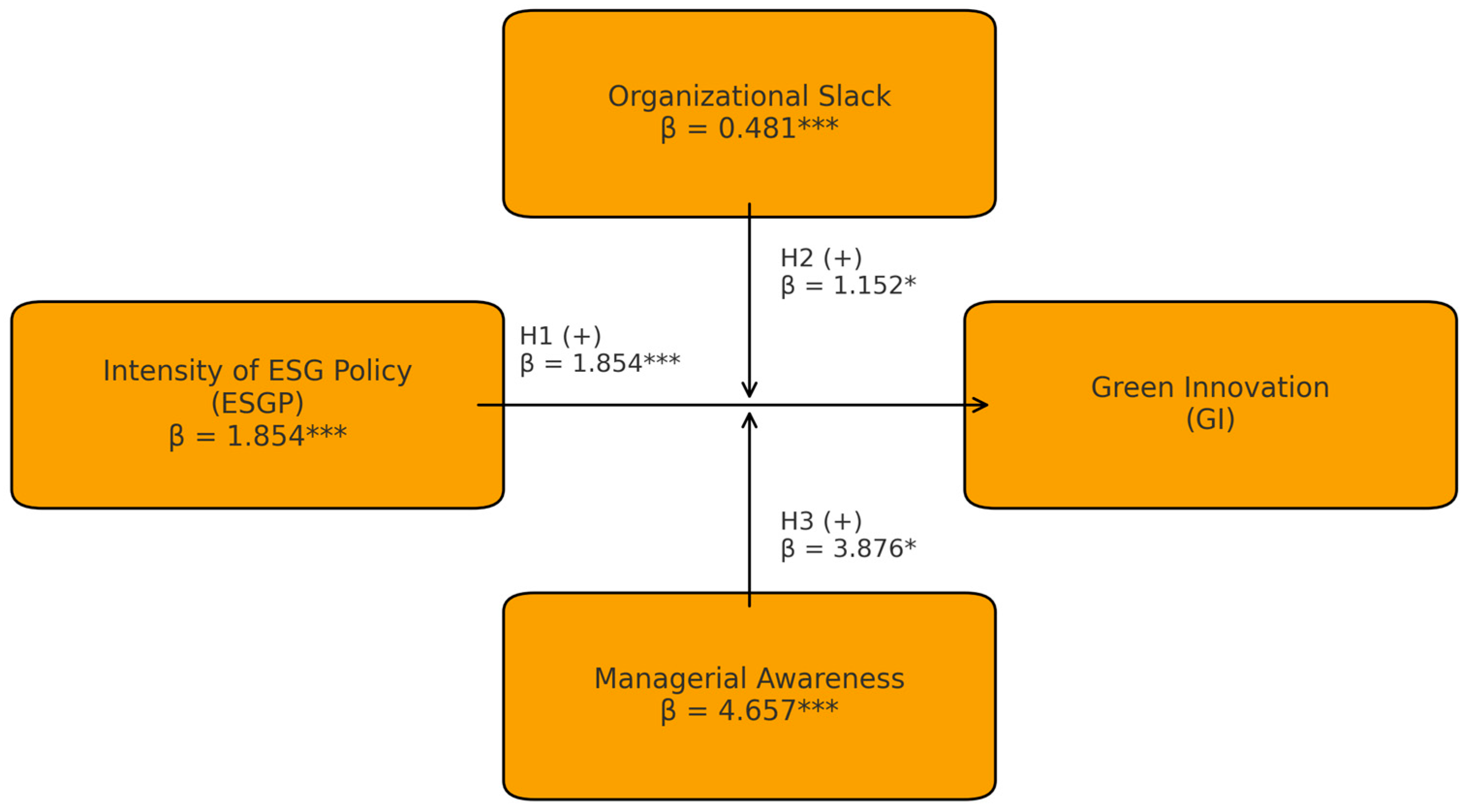

Our study provides several important contributions to the literature. First, this study contributes to policy studies and ESG research by providing empirical evidence of the relationship between ESG policy intensity and green innovation. Based on stakeholder theory and policy study rationales, our findings suggest that a higher intensity of ESG policy is positively associated with a firm’s green innovation, providing strong empirical support for this link within the context of an emerging economy like China. Most previous studies related to ESG have focused on ESG scores or indices and their impact on green innovation. However, the intensity of ESG policies and their effects on green innovation have rarely been explored. To the best of our knowledge, only Yan et al. (2024) explored the relationship [

41]. The measurement of ESG policy intensity, through refined techniques such as text mining, overcomes this research gap and offers empirical insights into how ESG policy intensity drives green innovation.

Our findings indicate that stronger ESG policies lead to better green innovation performance. In other words, when governments express a strong commitment to ESG policies, firms respond by improving their green innovation. This result aligns with our hypotheses and previous research. According to policy studies, when the intensity of government policies increases, their enforcement and coercive power are strengthened, leading businesses to more actively fulfill their environmental responsibilities. As governments provide clearer policy direction and expectations, firms are more likely to adopt innovative technologies and environmentally friendly management strategies.

This aligns with the Porter hypothesis and stakeholder theory, which argue that strong regulations can enhance a firm’s competitiveness [

42]. In other words, “the greater the ESG policy intensity, the greater the green innovation.” Unlike most previous studies, this research fills a gap by empirically testing the impact of ESG policy intensity on green innovation using refined measures. This constitutes a significant academic contribution to ESG research.

Second, our study contributes to both ESG research and management studies by empirically testing the moderating role of organizational slack and managerial awareness. We investigate which variables moderate the relationship between ESG policy intensity and green innovation—something that has been largely overlooked in prior research. By integrating slack resource theory and Upper Echelons Theory, we show that these two moderating variables strengthen the relationship between ESG policy intensity and green innovation.

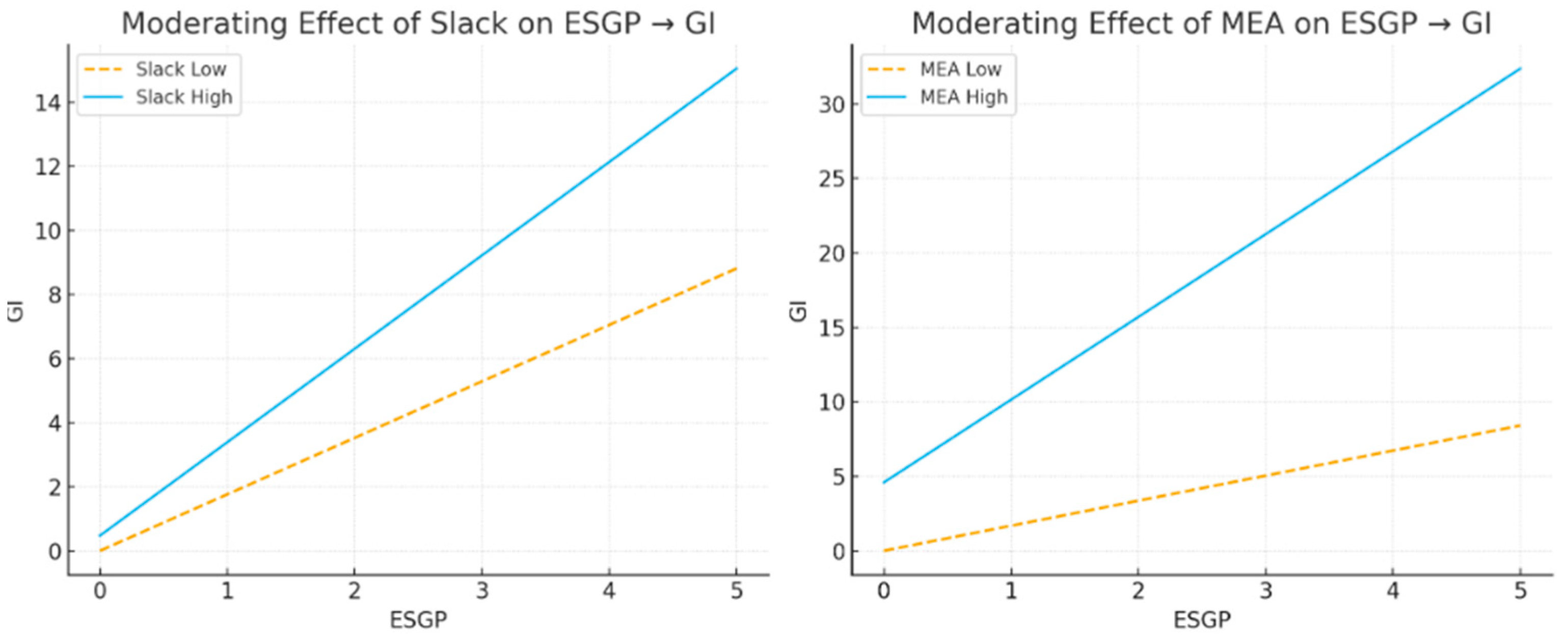

Our findings align with prior research on innovation. We found that organizational slack encourages green innovation. Previous studies have shown that firms with slack resources are more likely to experiment with innovative ideas and adopt new technologies, especially those requiring higher investments [

43]. Organizational slack provides the flexibility necessary for firms to engage in green technology and strategies that may otherwise be unaffordable [

44]. In this sense, our findings suggest that organizational slack does not just enable firms to undertake expensive and risky green innovation initiatives; it also plays a crucial role in helping firms meet the challenges posed by ESG policies [

45].

As such, organizational slack enables firms to better comply with ESG policies and take on the risks required for green innovation. By providing a buffer against the uncertainty and resource constraints typically associated with green innovation, slack resources allow firms to invest in long-term, transformative projects that align with ESG objectives. Our results imply that firms with abundant organizational slack can absorb the costs and risks associated with green R&D, helping them meet the expectations set by ESG policies while maintaining operational stability. As a result, organizational slack facilitates the smooth integration of ESG goals into business strategies, ultimately facilitating green innovation.

Additionally, our findings show that management’s understanding of its responsibility toward ESG also strengthens the relationship between ESG policy intensity and green innovation. Through text mining, we extracted insights from CEO messages on CSR, ESG, and sustainability. Our results show that managerial awareness and cognition positively moderate the relationship. This aligns with Upper Echelons Theory, which asserts that the characteristics, experiences, and mindset of top management teams (TMT) influence organizational strategies and performance.

Our results suggest that when CEOs have a high commitment toward ESG policies, firms are more likely to pursue green innovation, as their strategic decisions align with environmental responsibility. When top management actively engages with ESG issues, firms tend to adopt more innovative, environmentally friendly strategies, thus promoting green innovation. The results also present a significant contribution by integrating ESG policy intensity and management theory to explore the mechanisms that enhance green innovation. Our refined methodology, including the use of text mining to capture CEO awareness, represents a novel approach in ESG research, where such methods are rarely applied.

Finally, our study contributes to the literature by answering whether ESG policies are effective in emerging economies. In policy studies, there has been an ongoing debate regarding the effectiveness of strong regulatory policies versus market-based incentives in emerging economies [

10], where ESG and CSR policies are still in the nascent stages. Some argue that in such economies, government interventions and strong policies are more efficient at driving green innovation [

17,

46,

47]. In contrast, neoclassical economists argue that such policies increase corporate costs, hindering innovation [

48,

49,

50].

Our findings suggest that high ESG policy standards positively influence green innovation performance in emerging economies. Specifically, in these economies, government intervention remains a significant driver of green innovation. This is consistent with the principle that government policies in emerging economies provide important incentives for firms to innovate, especially since these countries often face resource limitations and slower technological development. Strong government policies offer a crucial stimulus for firms to adopt green technologies and strategies. Our results confirm that government intervention plays a vital role in driving green innovation in these economies [

17], aligning with extant research, which emphasizes the importance of government policy in fostering green innovation. While our findings are most applicable to economies with similar regulatory and institutional characteristics, future research could explore whether the observed effects generalize to other contexts. Nevertheless, our study offers valuable insights into the role of ESG policy intensity in emerging economies and contributes to a deeper understanding of how ESG policies shape green innovation.

6.2. Practical Implications

While rooted in the Chinese context, the findings of this study offer potentially valuable insights for policymakers and corporate managers in other emerging economies facing similar sustainability transitions. Governments and regulatory bodies should steadfastly promote and optimize the ESG policy framework. Our study affirms the central role of comprehensive ESG policies in driving the green transition of the real economy. Governments should maintain policy consistency and stability to send clear, long-term green development signals to the market. Further enhancements could include refining ESG disclosure standards to improve policy transparency and enforcement. They should also shift from a “one-size-fits-all” approach to “precision policymaking.” Our moderation results are a crucial reminder that policy effectiveness is highly heterogeneous across firms. This calls for policy design that goes beyond universality to address firms’ specific circumstances. For instance, for SMEs or firms in specific sectors that have strong innovative intent but lack resources, the government could establish specialized green innovation funds, offer R&D tax incentives, and build industry–university–research collaboration platforms to help them overcome resource barriers, thus ensuring policy is both inclusive and equitable. In terms of external validity, the findings of this study are most applicable in contexts that resemble China in terms of policy enforcement, ESG disclosure practices, and a government-driven regulatory environment. In contrast, countries that differ significantly in institutional characteristics—such as the level of rule of law, financial market development, corporate governance structures, or market competition—may experience weaker or stronger effects than those documented in this study. These institutional variations can either attenuate or amplify the relationship between ESG policy intensity and green innovation. Future research would therefore benefit from comparative analyses across diverse institutional settings to more fully assess the generalizability of our results.

Focus on “policy communication” and “cognitive guidance.” Managerial cognition is a critical link in policy implementation. Therefore, the government’s role should extend beyond issuing documents. It should actively communicate the strategic value and business opportunities of ESG to the corporate world through high-level forums, official media campaigns, and collaborations with industry associations and business schools. This can help shift managerial mindsets from a cost-based “passive compliance” perspective to a value-creation “proactive leadership” one.

For corporate managers and boards of directors, view ESG as a strategic opportunity, not a compliance burden. This study suggests that proactively responding to ESG policies can be a viable path toward generating long-term competitive advantages, turning regulatory pressure into a strategic opportunity. Firms should deeply embed the ESG philosophy into their corporate governance, strategic planning, and daily operations, using external pressure as a catalyst for internal transformation. Proactively build and manage “organizational slack” as a strategic resource. Boards and executive teams should move beyond the traditional view of slack as mere “inefficiency” and instead consciously cultivate a moderate buffer of financial and human resources. This “strategic redundancy” serves not only as a shock absorber against risks but also as a vital power source that enables the firm to undertake long-term, high-risk innovative exploration in an uncertain environment.

Vigorously enhance the environmental awareness and strategic vision of the top management team. Corporations should make sustainability literacy and environmental awareness a key criterion in the selection, appointment, and evaluation of their senior executives. Firms can systematically elevate the cognitive level of their decision-makers by appointing independent directors with environmental expertise, organizing strategic workshops on sustainability, and linking executive compensation to sustainability performance. Ultimately, it is the vision and determination of its leaders that will decide whether a firm can thrive in the great tide of green transformation.