From Risk to Resilience: Willingness-to-Pay for Crop Insurance Among Paddy Farmers in the Kurunegala District, Sri Lanka

Abstract

1. Introduction

2. Materials and Methods

2.1. Theoretical Framework

- Ui = utility of the ith alternative;

- Vi = objective component of the ith alternative;

- ℇi = error component.

2.2. Study Area

2.3. Sample Size and Data Collection

2.4. Questionnaire Design

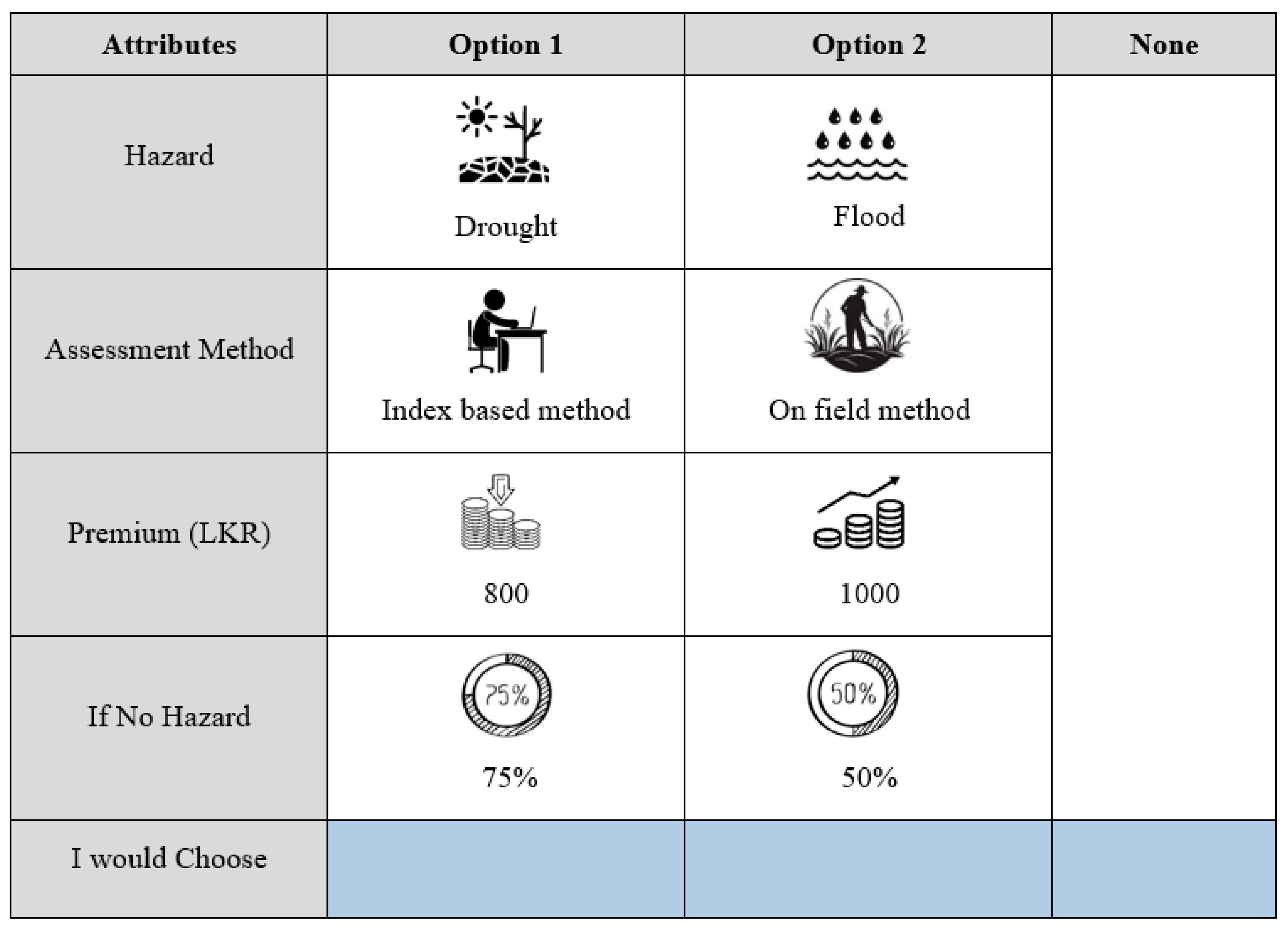

2.5. Development of Choice Sets

2.6. Data Collection

2.7. Statistical Analysis

3. Results

3.1. Socio-Demographic Information of the Respondents

3.2. Farming Related Information

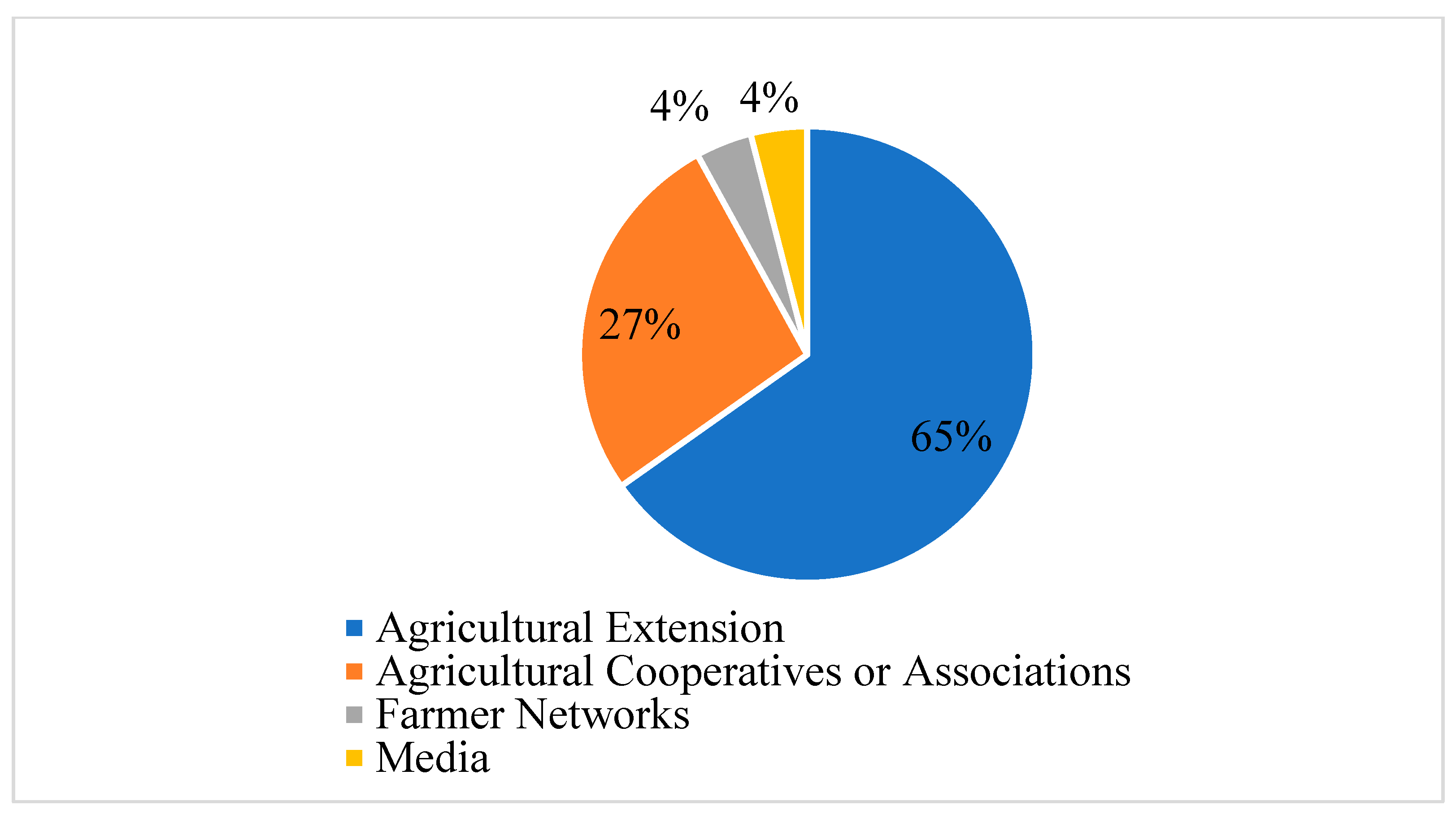

3.3. Awareness of Crop Insurance Schemes

3.4. Attitudes and Perceptions on Crop Insurance

3.5. Willingness-to-Pay for Crop Insurance Schemes

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AAIB | Agricultural and Agrarian Insurance Board |

| A/L | Advanced Level |

| AM | Assessment Method |

| ATI | Attitudes toward Insurance |

| CC | Climate Change |

| CLM | Conditional Logit Model |

| CSA | Climate-Smart Agriculture |

| FAO | Food and Agriculture Organization |

| GDP | Gross Domestic Product |

| HZD | Hazard |

| LKR | Sri Lankan Rupees |

| MWTP | Marginal Willingness to Pay |

| NGO | Non-Governmental Organization |

| NHR | No Hazard Return |

| OR | Odds Ratio |

| O/L | Ordinary Level |

| PREM | Premium |

| RII | Relative Importance Index |

| SE | Standard Error |

| WTP | Willingness to Pay |

References

- United Nations Framework Convention on Climate Change. 2008. Available online: https://unfccc.int/resource/ccsites/zimbab/conven/text/art01.htm (accessed on 10 April 2024).

- Hitz, S.; Smith, J. Estimating Global Impacts from Climate Change. Glob. Environ. Change 2004, 14, 201–218. [Google Scholar] [CrossRef]

- Enete, A.A.; Amusa, T.A. Challenges of Agricultural Adaptation to Climate Change in Nigeria: A Literature Review; Report No. 4; Institute Veolia Environment: Paris, France, 2010. [Google Scholar]

- Knutson, C.; Hayes, M.; Phillips, T. How Climate Change Will Affect Crops; National Drought Mitigation Center; University of Nebraska: Lincoln, NE, USA, 2010. [Google Scholar]

- Aryal, J.P.; Sapkota, T.B.; Rahut, D.B.; Marenya, P.; Stirling, C.M. Climate Risks and Adaptation Strategies of Farmers in East Africa and South Asia. Sci. Rep. 2021, 11, 10489. [Google Scholar] [CrossRef]

- Thomas, R.J. Opportunities to Reduce the Vulnerability of Dryland Farmers in Central and West Asia and North Africa to Climate Change. Agric. Ecosyst. Environ. 2008, 126, 36–45. [Google Scholar] [CrossRef]

- Akpan, A.I.; Zikos, D. Rural Agriculture and Poverty Trap: Can Climate-Smart Innovations Provide Breakeven Solutions to Smallholder Farmers? Environments 2023, 10, 57. [Google Scholar] [CrossRef]

- Gregory, P.J.; Ingram, J.S.I.; Brklacich, M. Climate Change and Food Security. Philos. Trans. R. Soc. Lond. B Biol. Sci. 2005, 360, 2139–2148. [Google Scholar] [CrossRef] [PubMed]

- Pagliacci, F.; Defrancesco, E.; Mozzato, D.; Bortolini, L.; Pezzuolo, A.; Pirotti, F. Drivers of Farmers’ Adoption and Continuation of Climate-Smart Agricultural Practices: A Study from Northeastern Italy. Sci. Total Environ. 2020, 710, 136345. [Google Scholar] [CrossRef]

- Mutengwa, C.S.; Mnkeni, P.; Kondwakwenda, A. Climate-smart agriculture and food security in Southern Africa: A review of the vulnerability of smallholder agriculture and food security to climate change. Sustainability 2023, 15, 2882. [Google Scholar] [CrossRef]

- Binswanger-Mkhize, H.P. Is There Too Much Hype about Index-Based Agricultural Insurance? J. Dev. Stud. 2012, 48, 187–200. [Google Scholar] [CrossRef]

- Wang, H.; Liu, H.; Wang, D. Agricultural Insurance, Climate Change, and Food Security: Evidence from Chinese Farmers. Sustainability 2022, 14, 9493. [Google Scholar] [CrossRef]

- Department of Census and Statistics. Gross Domestic Product (GDP) by Production Approach First Quarter of 2025; Department of Census and Statistics: Colombo, Sri Lanka, 2025.

- Rambukwella, R.N.K.; Vidanapathirana, R.P.; Somaratne, T.G. Evaluation of Crop Insurance Scheme in Sri Lanka; Research Study No. 122; Hector Kobbekaduwa Agrarian Research and Training Institute: Colombo, Sri Lanka, 2007. [Google Scholar]

- Agricultural and Agrarian Insurance Board. Impact Assessment Report on Floods in the Maha Season. 2023. Available online: http://www.statistics.gov.lk/Agriculture/StaticalInfo/PaddyStatistic (accessed on 10 April 2024).

- Udayanga, N.W.B.A.; Najim, M.M.M. Climate Change Impacts on Agricultural Sector in Sri Lanka: Necessity of Precision Agricultural Technologies. In Climate-Smart and Resilient Food Systems and Security; Springer Nature: Cham, Switzerland, 2024; pp. 323–342. [Google Scholar]

- Weerasekara, S.; Wilson, C.; Lee, B.; Hoang, V.N. Impact of Natural Disasters on the Efficiency of Agricultural Production: An Exemplar from Rice Farming in Sri Lanka. Clim. Dev. 2022, 14, 133–146. [Google Scholar] [CrossRef]

- Hazell, P.; Timu, A.G. What’s Holding Back Private Sector Agricultural Insurance? International Food Policy Research Institute: Washington, DC, USA, 2025. [Google Scholar]

- Rambukwella, R.; Vidanapathirana, R.; Champika, P.J.; Priyadarshana, D. Performance of Weather Index Insurance (WII) Scheme in Sri Lanka; Hector Kobbekaduwa Agrarian Research and Training Institute: Colombo, Sri Lanka, 2020. [Google Scholar]

- Singh, P.; Agrawal, G. Development, Present Status and Performance Analysis of Agriculture Insurance Schemes in India: Review of Evidence. Int. J. Soc. Econ. 2020, 47, 461–481. [Google Scholar] [CrossRef]

- Panda, A.; Sharma, U.; Ninan, K.N.; Patt, A. Adaptive Capacity Contributing to Improved Agricultural Productivity at the Household Level: Empirical Findings Highlighting the Importance of Crop Insurance. Glob. Environ. Change 2013, 23, 782–790. [Google Scholar] [CrossRef]

- Raschky, P.; Chantarat, S. Natural Disaster Risk Financing and Transfer in ASEAN Countries. In Oxford Research Encyclopedia of Natural Hazard Science; Oxford University Press: New York, NY, USA, 2020. [Google Scholar]

- Heenkenda, S. Agricultural Risk Management Through Index-based Microinsurance Exploring the Feasibility of Demand Perspective. Vidyodaya J. Humanit. Soc. Sci. 2011, 3, 127–154. [Google Scholar] [CrossRef]

- Aheeyar, M.; Amarasinghe, U.A.; Amarnath, G.; Alahacoon, N.; Prasad, S.; Dissanayake, A. Assessment of Farmers’ Willingness to Pay for Bundled Climate Insurance Solutions in Sri Lanka; International Water Management Institute (IWMI): Colombo, Sri Lanka, 2025. [Google Scholar]

- Yallarawa, Y.S.; Prasada, D.V. Demand for crop insurance by tea smallholders in Badulla district: An analysis of willingness-to-pay. Trop. Agric. Res. 2020, 31, 1–10. [Google Scholar] [CrossRef]

- Berges, M.; Casellas, K. Consumers’ Willingness to Pay for Milk Quality Attributes. In Proceedings of the International Association of Agricultural Economists Conference, Beijing, China, 16–22 August 2009; pp. 16–22. [Google Scholar]

- Mandeville, K.L.; Lagarde, M.; Hanson, K. The Use of Discrete Choice Experiments to Inform Health Workforce Policy: A Systematic Review. BMC Health Serv. Res. 2014, 14, 367. [Google Scholar] [CrossRef] [PubMed]

- Aizaki, H. Basic Functions for Supporting an Implementation of Choice Experiments in R. J. Stat. Softw. 2012, 50, 1–24. [Google Scholar] [CrossRef]

- Lancaster, K.J. A New Approach to Consumer Theory. J. Polit. Econ. 1966, 74, 132–157. [Google Scholar] [CrossRef]

- McFadden, D. The Measurement of Urban Travel Demand. J. Public Econ. 1974, 3, 303–328. [Google Scholar] [CrossRef]

- Manike, M.M.A.P.; Rajendran, M. Analysis of Rainfall Distribution in Kurunegala District, Sri Lanka. Asian J. Res. Agric. For. 2024, 10, 48–60. [Google Scholar] [CrossRef]

- Department of Census and Statistics. Paddy Statistics—Yala Season 2024 (Metric Units); Department of Census and Statistics of Sri Lanka: Colombo, Sri Lanka, 2025.

- Department of Census and Statistics. Paddy Statistics—Maha Season 2023/2024 (Metric Units); Department of Census and Statistics of Sri Lanka: Colombo, Sri Lanka, 2025.

- Cochran, W.G. Sampling Techniques, 3rd ed.; John Wiley & Sons: New York, NY, USA, 1977. [Google Scholar]

- Akter, S.; Krupnik, T.J.; Khanam, F. Climate Change Skepticism and Index versus Standard Crop Insurance Demand in Coastal Bangladesh. Reg. Environ. Change 2017, 17, 2455–2466. [Google Scholar] [CrossRef] [PubMed]

- Suresh, N.; Sreedaya, G.S. Perception of Farmers towards Crop Insurance Schemes in Kerala, India. Asian J. Agric. Ext. Econ. Sociol. 2022, 40, 437–447. [Google Scholar] [CrossRef]

- Ankrah, D.A.; Kwapong, N.A.; Eghan, D.; Adarkwah, F.; Boateng-Gyambiby, D. Agricultural Insurance Access and Acceptability: Examining the Case of Smallholder Farmers in Ghana. Agric. Food Secur. 2021, 10, 19. [Google Scholar] [CrossRef]

- Bhushan, C.; Singh, G.; Rattani, V.; Kumar, V. Insuring Agriculture in Times of Climate Change; Centre for Science and Environment: New Delhi, India, 2016. [Google Scholar]

- Afroz, R.; Akhtar, R.; Farhana, P. Willingness to Pay for Crop Insurance to Adapt Flood Risk by Malaysian Farmers: An Empirical Investigation of Kedah. World J. Agric. Res. 2017, 7, 1–9. [Google Scholar]

- Mahul, O.; Stutley, C.J. Government Support to Agricultural Insurance: Challenges and Options for Developing Countries; World Bank Publications: Washington, DC, USA, 2010. [Google Scholar]

- Wehnert, B. Agricultural Insurance Experience in Ghana. In Agricultural Insurance in Practice; Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ): Bonn, Germany, 2018. [Google Scholar]

- Cai, J.; de Janvry, A.; Sadoulet, E. Social Networks and the Decision to Insure. Am. Econ. J. Appl. Econ. 2015, 7, 81–108. [Google Scholar] [CrossRef]

- Giné, X.; Townsend, R.; Vickery, J. Patterns of Rainfall Insurance Participation in Rural India. World Bank. Econ. Rev. 2008, 22, 539–566. [Google Scholar] [CrossRef]

- Luo, T.; Yang, H.; Zhao, J.; Sun, J. Farmers’ Social Networks and the Fluctuation in Their Participation in Crop Insurance: The Perspective of Information Diffusion. Emerg. Mark. Financ. Trade 2020, 56, 1–19. [Google Scholar] [CrossRef]

- Ginder, M.; Spaulding, A.D.; Tudor, K.W.; Winter, J.R. Factors Affecting Crop Insurance Purchase Decisions by Farmers in Northern Illinois. Agric. Financ. Rev. 2009, 69, 113–125. [Google Scholar] [CrossRef]

- Bozzola, M.; Finger, R. Stability of Risk Attitude, Agricultural Policies and Production Shocks: Evidence from Italy. Eur. Rev. Agric. Econ. 2021, 48, 477–501. [Google Scholar] [CrossRef]

- He, J.; Rejesus, R.; Zheng, X.; Yorobe, J., Jr. Advantageous Selection in Crop Insurance: Theory and Evidence. J. Agric. Econ. 2018, 69, 646–668. [Google Scholar] [CrossRef]

- Chen, X.; Jiang, Y.; Wang, T.; Zhou, K.; Liu, J.; Ben, H.; Wang, W. Enhancing Farmer Resilience Through Agricultural Insurance: Evidence from Jiangsu, China. Agriculture 2025, 15, 1473. [Google Scholar] [CrossRef]

- Heenkenda, S. Index-Based Microinsurance for Paddy Sector in Sri Lanka: An Evaluation of Demand Behavior. Ph.D. Dissertation, Nagoya University, Nagoya, Japan, 2011. [Google Scholar]

| Attribute | Levels |

|---|---|

| Hazard (HZD) | Flood (HZD_1) |

| Drought (HZD_2) | |

| Assessment Method (AM) | Index-based (AM_1) |

| On field (AM_2) | |

| Premium (per acre per season) (PREM) | LKR 1000 (PREM_1) |

| LKR 800 (PREM_2) | |

| No Hazard Return (per acre) (NHR) | 75% (NHR_1) |

| 50% (NHR_2) |

| Parameter | Category | Frequency | Percentage (%) |

|---|---|---|---|

| Gender | Female | 55 | 22 |

| Male | 195 | 78 | |

| Age (Years) | ≤30 | 4 | 1.6 |

| 31–44 | 31 | 12.4 | |

| 45–60 | 92 | 36.8 | |

| ≥61 | 123 | 49.2 | |

| Education Level | Illiterate/Up to Grade 5 | 79 | 31.6 |

| Ordinary Level (O/L) | 85 | 34 | |

| Advanced Level (A/L) | 59 | 23.6 | |

| Diploma/Degree | 26 | 10.4 | |

| Postgraduate | 1 | 0.4 | |

| Employment | Farming | 83 | 33.2 |

| Labor | 21 | 8.4 | |

| Self-Employed/Vendor | 44 | 17.6 | |

| Government Services | 39 | 15.6 | |

| Private Sector/NGO | 29 | 11.6 | |

| Housewife | 12 | 4.8 | |

| Retired | 22 | 8.8 | |

| Farming Type | Fulltime | 131 | 52.4 |

| Parttime | 119 | 47.6 | |

| Number of Dependents | None | 15 | 6 |

| 1–2 | 68 | 27.2 | |

| 3–4 | 150 | 60 | |

| More than 4 | 17 | 6.8 | |

| Monthly Household Income [Sri Lankan Rupees (LKR)] | Less than 25,000 | 8 | 3.2 |

| 25,000–50,000 | 51 | 20.4 | |

| 50,001–75,000 | 156 | 62.4 | |

| More than 75,000 | 35 | 14 |

| Parameter | Category | Frequency | Percentage (%) |

|---|---|---|---|

| Land Ownership | Own | 174 | 69.6 |

| Hired | 76 | 30.4 | |

| Extent of Farm Land (Acres) | <1 | 99 | 39.6 |

| 1–4 | 136 | 54.4 | |

| 5–9 | 15 | 6.0 | |

| Farming Experience (Years) | <5 | 9 | 3.6 |

| 5–9 | 16 | 6.4 | |

| 10–14 | 26 | 10.4 | |

| 15–19 | 51 | 20.4 | |

| >20 | 148 | 59.2 | |

| Are you a Member of Any Farmers’ Association? | Yes | 250 | 100.0 |

| No | 0 | 0 |

| Statement | Percentage Response (%) | ||||

|---|---|---|---|---|---|

| SD | D | N | A | SA | |

| Only large farmers can afford crop insurance schemes. | 44.8 | 40.8 | 7.2 | 3.6 | 3.6 |

| Crop insurance helps to alleviate financial stress during periods of crop failure or low yields | 0.0 | 0.0 | 20.0 | 64.0 | 16.0 |

| Farmers participating in crop insurance schemes are more resilient to the impacts of climate change. | 0.0 | 0.0 | 24.4 | 54.4 | 21.2 |

| Crop insurance schemes promote long-term sustainability and viability of farming communities. | 0.0 | 0.0 | 20.8 | 59.2 | 20.0 |

| Crop insurance should be made mandatory for all farmers. | 0.0 | 0.0 | 0.0 | 62.4 | 37.6 |

| Premium rates of crop insurance schemes are too high. | 0.0 | 0.0 | 0.0 | 0.0 | 100.0 |

| Crop insurance schemes employ a proper technique to assess the damage that occurs in the field. | 5.2 | 48.8 | 6.0 | 40.0 | 0.0 |

| The insurance claims are paid on time. | 86.8 | 8.4 | 4.8 | 0.0 | 0.0 |

| Crop insurance doesn’t adequately cover the crop losses of small and marginal farmers. | 2.8 | 2.4 | 7.2 | 67.6 | 20.0 |

| Statement | Percentage Response (%) | Mean | RII | ||||

|---|---|---|---|---|---|---|---|

| SD | D | N | A | SA | |||

| Crop insurance schemes lack a systematic approach to disseminating information. | 0.0 | 0.0 | 7.6 | 53.6 | 38.8 | 4.3 | 0.86 |

| The claim form-filling process is complicated. | 0.0 | 0.0 | 2.4 | 30.8 | 66.8 | 4.6 | 0.93 |

| Farmers should be made more educated regarding crop insurance schemes. | 0.0 | 0.0 | 86.4 | 13.6 | 0.0 | 3.1 | 0.63 |

| The premium amount should be calculated based on the number of risk factors. | 0.8 | 0.0 | 34.4 | 40.4 | 24.4 | 3.9 | 0.78 |

| Crop insurance schemes should cover all crops in the crop land. | 0.0 | 2.0 | 4.0 | 29.6 | 64.4 | 4.6 | 0.91 |

| Assessment must be done at the individual field level. | 0.0 | 3.2 | 7.2 | 48.0 | 41.6 | 4.3 | 0.86 |

| Service quality should be improved. | 0.0 | 0.0 | 11.2 | 32.0 | 56.8 | 4.5 | 0.89 |

| Attribute | Levels | SE | Coefficient | Odds Ratio | MWTP (LKR) |

|---|---|---|---|---|---|

| Alternative-Specific Constant (SQ) | Status quo | 0.214 | −0.733 * | 0.480 | – |

| Hazard (HZD) | Drought (HZD_2) | 0.204 | 0.823 * | 2.277 | Rs. 1112 |

| Assessment Method (AM) | On-field (AM_2) | 0.113 | 0.251 * | 1.285 | Rs. 344 |

| Premium (PREM) | Rs. 1000 (PREM_1) | 0.187 | −0.590 * | 0.554 | Reference |

| No-hazard Return (NHR) | 75% (NHR_1) | 0.127 | 0.318 * | 1.374 | Rs. 432 |

| Attitudes toward Insurance (ATI) | High vs. Low | – | Interaction only | – | Moderates all effects |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kuruppu, V.; Subashini, N.; Udayanga, L.; Erabadupitiya, N.; Ekanayake, H.; Najim, M.M.M.; Lekamge, S.A.; Alotaibi, B.A. From Risk to Resilience: Willingness-to-Pay for Crop Insurance Among Paddy Farmers in the Kurunegala District, Sri Lanka. Sustainability 2025, 17, 10389. https://doi.org/10.3390/su172210389

Kuruppu V, Subashini N, Udayanga L, Erabadupitiya N, Ekanayake H, Najim MMM, Lekamge SA, Alotaibi BA. From Risk to Resilience: Willingness-to-Pay for Crop Insurance Among Paddy Farmers in the Kurunegala District, Sri Lanka. Sustainability. 2025; 17(22):10389. https://doi.org/10.3390/su172210389

Chicago/Turabian StyleKuruppu, Virajith, Nirma Subashini, Lahiru Udayanga, Navoda Erabadupitiya, Hasini Ekanayake, Mohamed M. M. Najim, Savinda Arambawatta Lekamge, and Bader Alhafi Alotaibi. 2025. "From Risk to Resilience: Willingness-to-Pay for Crop Insurance Among Paddy Farmers in the Kurunegala District, Sri Lanka" Sustainability 17, no. 22: 10389. https://doi.org/10.3390/su172210389

APA StyleKuruppu, V., Subashini, N., Udayanga, L., Erabadupitiya, N., Ekanayake, H., Najim, M. M. M., Lekamge, S. A., & Alotaibi, B. A. (2025). From Risk to Resilience: Willingness-to-Pay for Crop Insurance Among Paddy Farmers in the Kurunegala District, Sri Lanka. Sustainability, 17(22), 10389. https://doi.org/10.3390/su172210389