Abstract

Agriculture is one of the many sectors facing significant risks from climate change. To manage potential crop losses, whether climate-related or not, farmers widely rely on crop insurance to increase their resilience. However, farmers in Sri Lanka demonstrate a limited acceptance of crop insurance schemes. This study aimed to investigate the perceptions and Willingness-to-Pay (WTP) for crop insurance schemes among the paddy farmers in Kurunegala district. A total of 248 paddy farmers from the Kurunegala district were recruited as the study sample using the stratified random sampling approach. A pre-tested structured questionnaire and choice cards were used for primary data collection. The Conditional Logit Model (CLM) was used for data analysis. Around 77.8% of respondents were males engaged only in paddy farming, while the majority (62.5%) received an income of LKR 50,000 to 75,000. Complications experienced during the claim form-filling process (mean = 4.6), gaps in covering all crops on the crop land (mean = 4.6), and poor service quality (mean = 4.5) were perceived as the major limitations in existing crop insurance schemes. Outcomes of the CLM indicated that farmers with a positive attitude toward crop insurance significantly prefer plans with drought coverage (β = 0.823; p < 0.05), on-field assessments (β = 0.251; p < 0.05), and higher no-hazard returns (β = 0.318; p < 0.05) while showing a notable sensitivity to premium costs (β = −0.590; p < 0.05). The model also revealed an apparent willingness to switch from the status quo when presented with better-designed alternatives. The findings emphasized the need to implement responsive crop insurance schemes to enhance climate resilience and ensure the sustainability of paddy production in Sri Lanka.

1. Introduction

Any change that is triggered directly or indirectly by anthropogenic activities, leading to alterations in the composition of the global atmosphere over a prolonged period, has been defined as Climate Change (CC) by the United Nations Framework Convention on Climate Change [1]. CC has triggered profound impacts worldwide, including rising atmospheric temperatures, altered precipitation patterns, sea level rise, and an increase in the frequency of extreme natural disasters, such as hurricanes, floods, and droughts [2]. Climate change is the most serious environmental threat, adversely affecting agricultural productivity by disrupting crop cycles, hindering crop growth and development, reducing yields, inducing thermal stress, and exacerbating pest and disease outbreaks [3,4].

Climate change is expected to cause notably large production losses in South Asia and Sub-Saharan Africa. This threat makes farmers in these regions particularly vulnerable, driving up their risk perceptions and making investments in high-value crops less appealing. Such pressure could lead to severe financial strain on farmers, potentially driving them into poverty traps [5,6]. Such situations could lead to severe economic pressures on the farmers, entrapping them in poverty traps [7]. Climate change increases the frequency and severity of extreme weather events, which increases production risk and income variability among medium-scale and smallholder farmers. Often, increased risk reduces farmers’ willingness or ability to make productivity-enhancing investments, undermining their resilience and long-term livelihood security. Numerous studies have demonstrated significant impacts on crop productivity, thereby hindering the struggle to ensure food security and eradicate hunger [8]. To address the combined challenges of food security and climate change, a sustainable approach to agriculture was adopted through the concept of Climate-Smart Agriculture (CSA) in 2010 [9]. This approach promotes integrated practices that aim to ensure food security while adapting agricultural systems to a changing climate [9,10]. Among diverse strategies suggested under CSA, crop insurance has emerged as one of the most effective CC adaptation strategies, enabling farmers to transfer financial risks to a third party [11].

Agricultural insurance is a widely utilized risk management tool that supports farmers in dealing with variations in yield and climate-related shocks. It functions as a risk-transfer mechanism that can smooth consumption and incomes aftershocks, reduce downside risk, and encourage technology adoption, thereby enhancing resilience by lowering the probability of distress sales and debt traps [11,12]. Currently, crop insurance is practiced in more than 70 countries in the world, supporting the stabilisation of income, reducing volatility, and strengthening against CC impacts [12]. Often, crop insurance schemes operate in the form of indemnity-based insurance, where the loss is paid, or index-based insurance, where the payment is based on the weather or yield indices [11]. One of the main shortcomings of index-based schemes is that their payments can diverge from real losses, a phenomenon known as basis risk [12].

In theory, when farmers perceive higher climatic risk and if index triggers are well-designed and trusted, the acceptance of crop insurance schemes should increase, as insurance reduces vulnerability and supports resilience-building investments [5,12]. However, empirical research indicates that while farmers globally express interest in insurance, the actual adoption rate remains low, particularly in developing countries. Similar to many developing countries in the region, agriculture serves as a major pillar of the Sri Lankan economy. According to the Central Bank, the agriculture and fisheries sector contributed approximately 7.6% to Sri Lanka’s Gross Domestic Product (GDP) in the first quarter of 2025 [13]. Paddy production is one of the main productions and a staple food in Sri Lanka. Paddy is cultivated in all districts of Sri Lanka, primarily during the two monsoon seasons, namely the Yala and Maha seasons [14]. It is estimated that about 708,000 ha of land are under paddy cultivation [15]. Farmers have experienced substantial damage and losses in paddy production due to severe climate shocks, such as droughts and floods, over recent years [16]. According to recent reports from the Agricultural and Agrarian Insurance Board (AAIB), droughts have damaged approximately 58,766 acres of paddy, with the highest damage reported in the Kurunegala district. Meanwhile, extensive floods have damaged approximately 47,000 acres of paddy fields, directly impacting 20,064 farmers during the 2023 Maha season [15]. Therefore, Sri Lanka’s paddy cultivation urgently needs sustainable adaptation strategies to mitigate the adverse effects of CC and to sustain food security [16,17].

Several recent studies have highlighted that many subsidised programs in Sub-Saharan Africa and South Asia have unsatisfactory enrollment rates, which in many cases are associated with low levels of trust, low-quality services, and the absence of clear assessment procedures [5,6,14]. Price has been recognized as a significant obstacle, while other non-price aspects, such as payout predictability, transparency, and difficulties in claiming procedures, tend to play more important roles [18]. Dissatisfaction with the claiming process and low awareness have been identified as the primary impediments to the acceptance of crop insurance schemes in Ghana [18,19]. Meanwhile, offering no-claim bonuses or No-Hazard Return (NHR) benefits, which aims to provide farmers with a partial refund or rollover of premiums in seasons without crop damage, has been proposed as an incentive to foster loyalty and mitigate the perceived loss of premiums during hazard-free years [20,21].

The most extensive public crop insurance programme is in India, known as the “Pradhan Mantri Fasal Bima Yojana (PMFBY)”. Recent studies have shown that poor service quality and delays in receiving payouts, rather than the premium level, are more significant factors in affecting the adoption of crop insurance among Indian farmers [21]. Meanwhile, the confidence of farmers in damage assessment techniques, type of coverage, and payment schedule has also been recognized as a crucial factor influencing farmers’ decisions [22]. The WTP for crop insurance indicates the value that a farmer attaches to the risk cover offered by it. It is typically influenced by the expected utility theory, trust, experience, and the design characteristics of the insurance scheme [22].

Similar to many other countries in the region, two main types of crop insurance schemes are being practiced in Sri Lanka: Standard crop insurance schemes and index-based crop insurance [19]. The Standard crop insurance refers to a type of insurance coverage designed to protect farmers against financial losses resulting from crop damage or failure due to various perils. The assessment of crop losses is typically based on physical inspections conducted by insurance assessors or adjusters [20]. In contrast, index-based crop insurance schemes tend to address the limitations of conventional Standard crop insurance by relying on specific weather-related parameters (rainfall, temperature, humidity) as proxy measures of crop losses [12]. The significance of implementing a comprehensive agricultural insurance policy has been identified as a key requirement in many countries, including Sri Lanka. Therefore, in 1999, the AAIB was established in Sri Lanka, which is the responsible government agency for undertaking the government crop insurance programmes [14].

Additionally, several private insurance companies, such as Ceylinco General Insurance and Sanasa General Insurance, have introduced crop insurance schemes in Sri Lanka [19]. The government of Sri Lanka introduced a fully subsidized agricultural insurance programme in the 2018 Yala season, under which farmers are exempted from paying premiums. This scheme, which is administered by the Agricultural and Agrarian Insurance Board (AAIB), covers six major crops: paddy, onion, potato, maize, soybean, and chilli with a compensation level of LKR 40,000 per acre in the event of crop damage [15].

Despite the presence of the Agricultural and Agrarian Insurance Board (AAIB) and substantial climate-driven crop risks, the adoption of crop insurance by farmers in Sri Lanka remains low [14,22,23]. Previous studies have indicated several reasons for this, including financial constraints—particularly among farmers cultivating crops not covered by the fully subsidized government insurance scheme or those seeking additional coverage through private insurance providers—as well as limited familiarity with insurance, low financial literacy, and a lack of trust in insurance institutions [14]. Meanwhile, several recent studies have highlighted numerous operational gaps in insurance delivery [14,18]. As highlighted by Heenkenda [23], the affordability of insurance premiums, especially for farmers cultivating crops not covered by the fully subsidized government insurance scheme or those seeking additional coverage through private insurance providers, remains a major challenge in Sri Lanka. In addition, the limited range of crop coverage and the complexities involved in the claiming process have also been identified as significant challenges to the adoption of Sri Lankan crop insurance schemes. Recent fieldwork has indicated that approaches to assessing damages, such as the use of index triggers, diminish confidence and satisfaction with crop insurance schemes among farmers [14]. A recent pilot study conducted by the International Water Management Institute (IWMI) explored the potential for bundled climate insurance schemes in five districts in Sri Lanka, including Kurunegala [24]. The findings of this project revealed that farmers are willing to pay a premium for a no-hazard return option, and that, in most cases, they would prefer on-field appraisals of their farms and crop damages over using weather-index models. Bundling insurance with farm support services has been identified as a primary strategy for transitioning insurance programs to be a financially viable and sustainable adaptation strategy [24].

Therefore, understanding the farmers’ behaviours and attitudes towards crop insurance and the potential of such programmes in emerging climate-induced vulnerabilities is important to enhance the welfare of the local farming communities. In particular, understanding the factors that drive the demand among farmers to uptake crop insurance would be key to promoting crop insurance in vulnerable communities in the Sri Lankan context. To date, only a few studies have examined the feasibility of crop insurance as an agricultural risk management tool in Sri Lanka [22,23,24,25]. Most of the available studies have been conducted a long time ago and have a limited focus on the farmers’ perceptions of the significance of specific crop insurance characteristics in Sri Lanka. Further, empirical studies on crop insurance programmes in Sri Lanka are scarce. A recent study conducted by Aheeyar et al. [24] has utilized the Contingent Valuation Model (CVM) to assess the WTP for bundled crop insurance schemes among Sri Lankan farmers. However, the CVM approach is insufficient for estimating the Marginal Willingness-to-Pay (MWTP) for specific insurance characteristics. While previous studies have provided valuable insights into the mechanisms of crop insurance and their significance, a limited understanding exists of how specific crop insurance characteristics influence farmers’ enrollment decisions in Sri Lanka.

Paddy farming remains a key pillar in the Sri Lankan agricultural sector, which is highly affected by the floods and droughts [21,24]. Therefore, the current study aimed to employ a Discrete Choice Experiment (DCE) based approach to estimate the WTP of paddy farmers towards crop insurance schemes, with a special focus on their perceptions of specific insurance characteristics that shape their enrollment into crop insurance schemes. Under this, the impact of four major attributes of crop insurance—hazard coverage, assessment method, premium, and no-hazard return—on the willingness of paddy farmers to adopt crop insurance schemes was investigated. The outcomes of this study would be essential for policymakers and insurance companies to address the inconsistencies and operational challenges of the existing crop insurance schemes and design reliable, transparent, and tailored crop insurance schemes to meet the practical needs of paddy farmers in Sri Lanka and other similar developing countries.

2. Materials and Methods

2.1. Theoretical Framework

Decision-makers’ views on different attributes can typically be assessed using two approaches: Stated Preference and Revealed Preference methods [26]. This study specifically employed the Discrete Choice Experiment (DCE), a widely used Stated Preference technique. The DCE involves presenting participants with choice cards that feature predefined key attributes and their associated levels to explore how the study population perceives these factors [27]. The choice experiments can be connected to circumstances where an individual selects one alternative from a set of other options [28].

The choice experiments have a theoretical basis with Lancaster’s model of consumer choice and Random Utility theory [29]. According to Lancaster’s Consumer Theory, it is assumed that the utility of a product stems from different product attributes. Meanwhile, the Random Utility theory explains the dominance judgments between pairs of offerings [30], where a rational consumer will maximize the utility added by their choice, as represented in Equation (1).

where:

- Ui = utility of the ith alternative;

- Vi = objective component of the ith alternative;

- ℇi = error component.

In the context of this study, Lancaster’s Consumer Theory implies that farmers derive utility not from ‘crop insurance’ as a whole, but from its attributes, such as the extent of hazard coverage, premium level, damage assessment procedure, and no-hazard return benefits. Random Utility Theory further suggests that farmers choose the insurance alternative that provides the highest perceived utility, relative to remaining uninsured (status quo). Therefore, the empirical framework of this study employed a DCE to present farmers with alternative insurance profiles that vary systematically across these attributes. The resulting choices are modelled using the Conditional Logit Model (CLM), allowing for estimation of the marginal utility associated with each attribute and computing corresponding MWTP values.

2.2. Study Area

The Kurunegala District, located in the North Western Province of Sri Lanka, has a population of 1,760,829 and spans an area of 4816 square kilometers. Around 625 km2 of the Kurunegala district remains under paddy cultivation [15,31]. It spans three agro-ecological zones: DL1, IL1, and IL3, encompassing both the dry and intermediate zones of Sri Lanka. Regions belonging to the dry zone receive an average rainfall < 1750 mm, while the intermediate zone is characterized by a mean annual rainfall of 1750 mm to 2500 mm [31]. Kurunegala District has long been recognized as one of Sri Lanka’s most significant paddy-producing regions [24]. Its agro-ecological conditions, combined with an extensive network of both major and minor irrigation schemes, contribute to its paddy production. According to the Department of Census and Statistics, Kurunegala produced approximately 210,243 metric tons of paddy from 56,697 hectares during the Yala 2024 season, along with 268,234 metric tons of paddy during the Maha 2023/24 season. Therefore, the Kurunegala District often accounts for around 10% of Sri Lanka’s total paddy production [32,33]. These figures highlight the pivotal role of the Kurunegala District in ensuring national paddy production. Recent studies have shown that the Kurunegala District is a highly vulnerable area to climate change, particularly in terms of droughts [15,27].

2.3. Sample Size and Data Collection

This study was conducted from March to December 2024. A total of 250 paddy farmers representing 8 Divisional Secretariat Divisions in the Kurunegala District were selected as the sample based on the Cochran’s formula with finite population correction [34]. The sampling frame was derived from the farmer registry of the Department of Agrarian Development (DAD), which contains information on land extent, ownership, and irrigation source for all registered paddy farmers. A stratified random sampling approach was employed based on the irrigated nature of the paddy fields (major and minor irrigation schemes), as irrigation type is a key determinant of drought exposure, productivity, and insurance participation. This stratification ensured proportional representation of farmers from both irrigation systems within the study sample.

2.4. Questionnaire Design

A pre-tested interviewer-administered structured questionnaire and a planned set of choice cards were used as the data collection tools. The survey questionnaire consisted of five major sections: (a) socio-demographic data (age, gender, education level, and monthly income, etc.); (b) farming-related data (land ownership, experience in farming and extent of the farm land); (c) farmer awareness on crop insurance schemes; (d) perception of farmers toward crop insurance; and (e) choice cards.

2.5. Development of Choice Sets

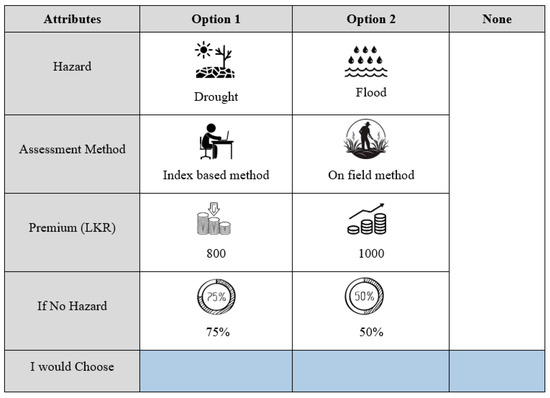

The most essential attributes and their corresponding levels regarding crop insurance schemes were identified through a literature review and preliminary focus group discussions. Choice cards were prepared using these significant attributes and respective attribute levels. Four attributes, each with two levels, were considered in this study (Table 1), each resulting in sixteen possible choice profiles. An orthogonalization procedure was carried out using SPSS to identify the main interactions (Figure 1).

Table 1.

Attributes and Levels.

Figure 1.

A Sample Choice Card.

Flood and drought represented the two most significant hazards experienced in paddy production. Meanwhile, the ‘assessment method’ referred to the method used to assess crop damage after a hazard occurred. This included two options: index-based assessment and on-field assessment (physical verification of the crop damage). The third attribute’ premium’ referred to the amount of premium that is charged from the farmer per acre of paddy per season, which was assigned with Sri Lankan Rupees (LKR): LKR800 and LKR1000 as the levels in the monetary attribute. The fourth attribute, ‘No Hazard Return (NHR)’, represented the benefit a farmer would receive if no crop damage occurred during the insured season. Under this option, a proportion of the insured amount either 50% or 75% would be refunded or rolled over to the next season, allowing farmers to gain a partial benefit even in hazard-free years.

Four choice cards were developed, each comprising two alternative crop-insurance schemes and one opt-out (‘no-insurance’) option. The number of cards was intentionally limited to four to reduce cognitive burden and respondent fatigue while ensuring adequate variation across the attribute levels. The order of presentation was randomized among respondents. Prior to the survey, a pilot test confirmed that this number of choice sets was appropriate for maintaining respondent engagement and comprehension.

2.6. Data Collection

Data were collected through face-to-face interviews conducted by trained enumerators using a structured questionnaire (described under Section 2.4) and choice cards. The choice sets were randomized across questionnaires to minimize order bias. Informed written consent was obtained from all respondents prior to data collection. For each participant, responses to the DCE were recorded alongside the information obtained through the questionnaire.

2.7. Statistical Analysis

All the collected data were entered into SPSS (version 23), adhering to standard data entry procedures. Descriptive statistics were used to analyze the socio-demographic factors, farming-related formation, and awareness of farmers on crop insurance. A CLM was fitted to analyze the data derived from the choice experiment. The indirect utility arising from the crop insurance attributes can be represented as in Equation (2):

where Vij represents the utility that respondent i derives from alternative j. Each Z variable corresponds to a dummy-coded attribute. The term ATIi captures the individual’s attitude toward crop insurance. SQij is a dummy for the status quo option. Respondents who exhibited a positive attitude towards crop insurance were more likely to choose non-status quo options. The status quo option in each choice card represented the no-insurance alternative, reflecting the decision to remain uninsured under real-life conditions. The model’s parameters were used to calculate the MWTP using Equation (3). The MWTP can be considered as the marginal welfare measure that seeks a change in any of the attributes. Furthermore, it can be elicited as the amount the respondent is willing to pay to switch to an identical product with an additional attribute level. It is calculated by dividing the estimated coefficient (β) of the respective attribute by the monetary attribute while holding all other variables constant.

3. Results

3.1. Socio-Demographic Information of the Respondents

The socio-demographic characteristics of the respondents are given in Table 2. Out of the 248 respondents, the majority were males (77.8%), compared to females (22.2%). Most respondents (48.8%) belonged to the 61 years or older age group, followed by the 45- to 60-year age group (37.1%). A relatively higher portion of respondents had completed Ordinary Level (O/L) as their highest educational qualification (34.3%). Interestingly, 31% of the farmers were illiterate or had only completed primary education (Table 2). Around 32.7% of the study population consisted of full-time workers, followed by another 17.7% who were engaged in self-employment. The majority of respondents had 3 to 4 dependents (60.1%) in their families. Regarding the total monthly income, 62.5% of respondents had an income between Rs. 50,001 and Rs. 75,000, followed by another 20.2% with an income level of Rs. 25,000 to Rs. 50,000 (Table 2).

Table 2.

Socio-demographic Characteristics of the Study Population.

3.2. Farming Related Information

Table 3 shows the farming-related data of the study sample. The majority of farmers cultivated paddy in their own lands (69.6%), while only 30.4% cultivated hired paddy lands. Further, most of the farms cultivated 1 to 4 acres of paddy lands in extent (54.4%), followed by <1 acre of land (39.6%). From the total sample, 59.3% of respondents had more than 20 years of farming experience, while only 3.6% of the farmers had <5 years of experience in paddy cultivation (Table 3).

Table 3.

Farming Related Data.

3.3. Awareness of Crop Insurance Schemes

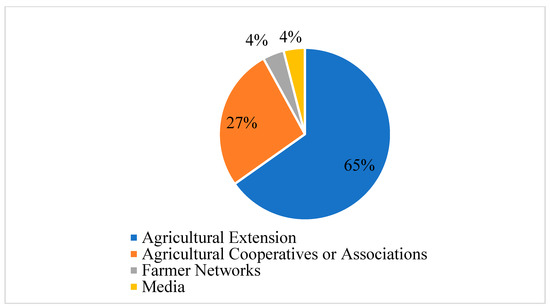

The entire study population (100%) was aware of crop insurance schemes. The majority (65%) of paddy farmers in the Kurunegala district relied on agricultural extension officers (from either the government or private sector) to acquire information regarding crop insurance schemes, followed by agricultural cooperatives or associations (27%), as shown in Figure 2.

Figure 2.

Preferred Information Sources on Crop Insurance Schemes.

3.4. Attitudes and Perceptions on Crop Insurance

A higher fraction of the farmers disagreed (40.8%) or strongly disagreed (44.8%) with the fact that only large farmers can afford crop insurance schemes (Table 4). Further, the majority of the farmers accepted that crop insurance helps to alleviate financial stress during periods of crop failure or low yields (80%), farmers participating in crop insurance schemes are more resilient to the impacts of climate change (75.6%) and crop insurance schemes promote long-term sustainability and viability of farming communities (79.2%), as shown in Table 4. Meanwhile, 37.6% of the respondents strongly agreed that crop insurance schemes should be mandatory for farmers, while the rest (62.4%) agreed. Therefore, it was evident that paddy farmers in the Kurunegala district perceive the crop insurance scheme to be important and effective. However, all respondents strongly believed that the premium rates of crop insurance schemes are too high (100%). In comparison, around 24% of respondents felt that crop insurance does not adequately cover the crop losses of small and marginal farmers. In addition, the majority of respondents were dissatisfied with the damage assessment method used in crop insurance schemes (54%) and the timeliness of claim payments (95.2%).

Table 4.

Farmer Perceptions toward the Importance of Crop Insurance Schemes.

Farmer perceptions on the limitations of existing crop insurance schemes are summarized in Table 5. The majority of farmers perceived that the claim form filling process is complicated (mean = 4.6), all crops in the crop land should be covered by crop insurance schemes (mean = 4.6), and the service quality should be improved (mean = 4.5). Further, the lack of an organized system to disseminate information (mean = 4.3) and the necessity of elevating the awareness and understanding of farmers regarding crop insurance schemes (mean = 3.1) were reported as major limitations. A higher fraction of the farmers believed that the damage assessment should be carried out at the individual field level (mean = 4.3) and that the premium amount should be calculated based on the number of risk factors (mean = 3.9).

Table 5.

Farmer Perceptions on the Limitations of Existing Crop Insurance Schemes.

3.5. Willingness-to-Pay for Crop Insurance Schemes

The findings of CLM demonstrated how the features of different crop insurance plans and farmers’ attitudes toward crop insurance can influence their choices between different crop insurance plans (Table 6). The CLM demonstrated a good overall fit to the data. The pseudo R2 was calculated at 0.051, which is acceptable in discrete choice modeling, where lower pseudo R2 values are common due to the complexity of human decision-making. Furthermore, the Wald chi-square test was highly significant (χ2 = 34.57, p < 0.001), confirming that the set of explanatory variables included in the model significantly improves the model fit. These values collectively emphasize that the model is statistically significant and that the selected interaction terms and status quo options meaningfully contribute to explaining variations in insurance choices.

Table 6.

Outcomes of the Conditional Logit Model (CLM).

The results revealed that several variables significantly influence farmers’ insurance choices, particularly among those with a positive attitude toward crop insurance. The interaction between positive attitudes toward crop insurance (ATI) and drought coverage (HZD_2) was positive and statistically significant, suggesting that farmers with favourable views on crop insurance strongly prefer plans that cover drought risks [Coefficient (r) = 0.823; Odds Ratio (OR) = 2.277]. Similarly, the interaction with on-field assessment methods (AM_2) was also significant and positive (r = 0.251; OR = 1.285), indicating a higher preference for more direct and trustworthy verification processes. This implies that farmers tend to believe that on-field verification is more accurate and fairer, which increases their confidence in the claiming process. The model further revealed a significant negative interaction (r = −0.590; OR = 0.554) between ATI and higher premiums (PREM_1), suggesting that farmers are sensitive to cost increases. This suggests that even farmers who support insurance are less likely to choose expensive plans. Affordability remains a key concern, and high premiums may act as a barrier, regardless of the perceived value of the coverage.

Additionally, the interaction with a 75% no-hazard return (NHR_1) was significantly positive (r = 0.318; OR = 1.374), implying that these farmers value receiving a tangible benefit, even in seasons with no crop damage. This feature might make the insurance feel less like a “wasted expense” for farmers in periods with no crop damage. Interestingly, the status quo option (SQ) showed a significant adverse effect (r = −0.733), suggesting that respondents who support crop insurance are more inclined to move away from their current plans when better alternatives are available. This implies openness to adopting new insurance products by the farmers, as long as they are offered with clear improvements in value, coverage, or credibility.

4. Discussion

Crop insurance is widely used as a risk transfer tool to enhance the resilience of farmers against climate change. It was noted that the entire study population was aware of crop insurance schemes, primarily due to the efforts of agricultural extension officers and agricultural cooperatives or associations. Few previous studies conducted in different parts of the world have also reported a similar condition [35,36]. As suggested by the findings, the majority of paddy farmers in Kurunegala District perceive that crop insurance helps alleviate financial stress during periods of crop failure or low yields, enhancing resilience against the impacts of climate change, and contributing to the long-term sustainability and viability of farming communities. Hence, it is evident that crop insurance schemes are accepted as an important mechanism to mitigate financial risks associated with crop loss by the local farming communities. These results align with recent studies conducted in Sri Lanka and many other countries, where farmers have recognized crop insurance as a key instrument for coping with climate variability and agricultural risks [24,37,38].

Despite widespread awareness and positive attitudes, only a limited fraction of farmers had adopted crop insurance schemes in Sri Lanka. According to Bhushan et al. [38], only 25 million farmers in India have insured their crops, while around 95 million farmers have not purchased any crop insurance schemes. A previous study conducted in Ghana has also reported a similar trend among the farmers [37]. The discrepancy between favourable perception and limited adoption underscores a significant implementation gap. Although there is theoretical acceptability, real-world factors, most of which concern cost, trust, and design mismatch, limit actual enrollment of farmers in crop insurance schemes. Accordingly, it has far-reaching consequences: not only could well-publicized, knowledgeable insurance programmes fail to translate awareness into action, thus decreasing resilience against climate change, but this tendency can also hinder efforts to build resilience.

Regardless of the acknowledged benefits, several concerns regarding accessibility and affordability to insurance schemes were underscored by the local paddy farmers. All respondents perceived that premium rates are too high, and about 24% reported that crop insurance does not adequately cover losses for small and marginal farmers. These findings align with similar concerns reported in other Asian contexts, where high premiums have been identified as a significant barrier to promoting crop insurance among low-income farmers [39,40]. This not only highlights the affordability factor but also suggests an imbalance between cost and perceived value, underscoring the need to reassess data-driven pricing and explore targeted subsidies or layered premium structures to make it more inclusive.

Furthermore, the findings of this study also highlighted dissatisfaction of farmers with certain administrative aspects of crop insurance schemes. Complications experienced during the claim form-filling process, gaps in coverage for all crops on the land, and poor service quality were reported as the major limitations in existing crop insurance schemes. Additionally, more than half (54%) of respondents were dissatisfied with the damage assessment method used in current insurance schemes, and 95.2% experienced issues in the payment of claims. These issues reflect operational inefficiencies, which may erode the credibility of insurance providers. Therefore, reforming the claiming process, simplifying paperwork, and ensuring timely, transparent payouts are essential not only for improving satisfaction but also for increasing trust and future enrollment.

Similar challenges have been identified, including complexities in crop insurance schemes, financial illiteracy, and a lack of trust in crop insurance, which have been noted as major obstacles to promoting crop insurance [41,42]. A recent study conducted in Ghana has identified gaps in knowledge regarding crop insurance, inaccessibility to crop insurance schemes in certain areas, and higher costs as the major drawbacks for purchasing crop insurance schemes [41]. Comparable behaviors have been documented in previous research, suggesting that these issues can often undermine farmers’ trust in crop insurance schemes, thereby reducing their uptake [24,43,44]. Therefore, these results strongly suggest that although farmers value crop insurance for its risk-mitigation potential, structural and procedural shortcomings, along with high premiums, remain key obstacles against wider acceptance.

Interestingly, around 37.6% of farmers strongly agreed, and 62.4% agreed that crop insurance should be mandatory in Sri Lanka. These findings suggest a strong recognition among farmers of the value of crop insurance, a pattern observed in several countries such as Malaysia and India, where farmers have demonstrated a high propensity to enroll in insurance schemes when the perceived benefits outweighed the costs [39,43]. However, such attempts to compel crop insurance for local farmers should be accompanied by systemic reforms to ensure product value, efficiency in delivery, and user confidence to prevent a backlash or the exclusion of the most vulnerable populations. Several recent studies have highlighted that both farmer characteristics and contextual factors significantly influence the decisions regarding adoption of crop insurance schemes. Education level, farm size, credit orientation, and decision-making ability have been reported to shape up farmers perceptions on crop insurance schemes in Kerala [36]. Similarly, a study conducted in Northern Illinois has identified premium as the most influential factor in crop insurance purchase decisions, along with farm size and crop type [45]. These insights affirm the importance of farmer segmentation and personalization in insurance design highlighting that a “one-size-fits-all” model may fail to resonate across diverse user groups.

Attitudes of the farmers toward crop insurance, on-field assessments, higher no-hazard returns, and premium costs denoted significant impacts on the farmer willingness to purchase crop insurance schemes in Sri Lanka. The positive coefficient received for the hazard attribute indicates that farmers perceive hazard-related coverage (such as protection against floods or droughts) to be highly important. In other words, they are willing to pay more for insurance that safeguards their crops against these risks, which conditions their willingness to pay for insurance. This agrees with the findings of Akter et al. [35], which indicate that insurance adoption rates were significantly correlated with farmers’ perceptions on extreme impacts of climate change in Bangladesh. Several recent studies have underscored that higher risk perceptions among farmers often lead to elevated adoption rates of crop insurance [37,46,47]. Essentially, farmers are willing to invest more in insurance if it safeguards their crops against these risks. This is also an indication regarding the importance of insurance design and damage assessment method that should be adopted by insurance providers in order to promote crop insurance [35]. By doing so, insurance providers can better evaluate the effectiveness of insurance interventions and make informed decisions to enhance coverage and mitigate risks.

The positive coefficients associated with the ‘if no hazard’ attribute indicated that farmers find value in having insurance coverage even when there is no immediate hazard (e.g., during normal growing conditions). This indicates a moderately demanded return on investment, even in years when there was no risk of a hazard. Implementing a no claim return or rollover benefit can notably alleviate dropout levels, increase retention, and reduce perceptions of wasted premiums, particularly during minimal-loss years. This feature is comparatively unexplored within the context of Sri Lankan schemes and thus provides a useful design innovation to enhance uptake. Local farmers are willing to pay more for this kind of assurance, which ensures continuity and encourages long-term risk management in the given protection schemes. Provision of a safety net for farmers during hazard-free seasons by the rolling over part of the insured amount could be the major reason behind this observation [36]. The negative coefficient for the premium attribute suggests that farmers do not willing to pay higher premium rates. In other words, higher premiums mean increased financial burden on farmers. If premiums are too high, farmers may choose to forgo insurance altogether, leaving them vulnerable to crop losses [45]. This has been a common finding in several previous studies conducted in developing counties such as India and Ghana with similar settings [36,37,40]. However, if premiums are set too low, insurers may struggle to cover claims adequately. Conversely, high premiums should ideally correlate with comprehensive coverage. In Sri Lanka, smallholders and marginalized farmers may struggle with high premiums [24].

The negative coefficient for the assessment method attribute suggested that farmers may be less inclined toward certain assessment methods. This implied that farmers tend to prefer alternative ways of evaluating risk or determining insurance payouts. This underscores the necessity of demand side affordability checks and cost sharing mechanisms via government or donor subsidies, especially for smallholder farmers. Notably, this finding should be understood together with the aspiration of farmers to receive increased coverage and quality of services, which conveys a value-for-money issue but not price rejection.

The assessment of claims and payouts is a critical aspect of insurance operations [40]. However, the effectiveness of these assessments depends not only on technical accuracy, but also on farmers’ trust in the process. In general, both public and private insurance providers employ specific criteria to evaluate claims. These criteria may include yield assessments, damage surveys, and other relevant factors [40]. The findings of the current study clearly emphasized that farmers are having concerns about the damage assessment process, which is common to many other countries in the world [35,36,48]. Despite being significant, this attribute might reduce farmers’ willingness to engage in insurance schemes. These concerns range from transparency and fairness to the consistency of assessments across different incidents. Unfortunately, both public and private entities face credibility challenges [40,48]. As reported in previous studies, farmers often question the impartiality, expertise, and reliability of the assessors, leading to poor clarity and uniformity in the assessment criteria [24,49]. Normally, an insurance policy holder desires clear guideline on how assessments are conducted, what data are considered, and how decisions are reached, to ensure transparency and reduce dissatisfaction. Further, investigations are needed to understand why these have a negative preference, and to suggest a credible assessment mechanism.

Despite providing paddy farmer’s acceptance of crop insurance and driving factors behind the adoption rate, this study faced several limitations. Only the paddy farmers in the Kurunegala District were considered in this study, which could limit the generalizability of the findings to other regions, crops, or socio-economic contexts. In addition, reliance on self-reported responses in the choice modeling could introduce hypothetical or social desirability biases. Even though, face-to-face interviews were conducted to minimize misunderstanding of choice cards, some respondents may still have interpreted hypothetical scenarios differently depending on their prior experience with climate hazards or insurance participation. This is a common limitation in similar studies. Seasonal variations and timing of data collection of this study could also have influenced risk perception and WTP, as farmers’ attitudes often vary before and after major cultivation cycles.

Although the conditional logit model effectively identified key attributes influencing insurance decisions, unobserved factors such as informal coping strategies, individual risk perceptions, and institutional support may influence the farmer intention to accept crop insurance schemes. Moreover, the model assumed homogeneous preferences and independence of irrelevant alternatives, which may overlook variations in farmer heterogeneity and local-level risk behaviour. Future studies could apply mixed logit or latent class approaches to capture these differences more accurately and provide deeper behavioral insights. Therefore, further studies with expansions in the geographic scope are recommended, which incorporate longitudinal data, qualitative insights to comprehensively understand the farmer decision-making and strengthen the evidence base for policy design. Consideration of institutional factors such as government relief policies, market incentives, and administrative delays would also enhance the robustness and external validity of future analyses.

Addressing these limitations, the findings of this study underscore the necessity of designing crop insurance schemes that balance affordability, comprehensive coverage, along with transparent claiming and damage assessment procedures. Simplifying claiming procedures, improving damage assessment methods, offering field-level verifications, and incorporating tangible benefits such as no-hazard returns could further enhance trust and participation of paddy farmers in crop insurance. Tailored premium structures and targeted awareness programmes for small and medium scale farmers would further improve adoption of crop insurance, ensuring inclusivity and equity. Development of context-specific insurance products that reduce financial barriers, improve credibility, and provide reliable risk coverage, policymakers and insurers can strengthen farmers’ resilience, sustain agricultural livelihoods, and support climate-smart adaptation strategies in Sri Lanka and similar agricultural settings [40,42].

5. Conclusions

Despite being recognized as a key tool for managing risk, a higher fraction of paddy farmers in the Kurunegala district were reluctant to purchase agricultural insurance schemes. Complications experienced in the claim form filling process, limited coverage of crops and poor service quality were identified as the major limitations in existing crop insurance schemes. The results further revealed that climate hazards, premium levels, and compensation for ‘if no hazard’ periods were the most influential attributes determining farmers’ WTP. Among these, the positive significance of the hazard attribute clearly indicated farmers’ higher preference for insurance products that protect against flood and drought events, while the negative coefficient for premium levels emphasized cost sensitivity and affordability concerns. Furthermore, the positive response to compensation in hazard-free periods suggested that farmers value continuity and fairness in returns, revealing their preference for insurance schemes that provide year-round assurance rather than seasonal risk coverage. The high value placed on continuity of coverage, even during hazard-free periods, underscores the importance of designing schemes that provide tangible benefits across all conditions. Conversely, concerns over assessment methods can reduce willingness to participate, emphasizing the need for transparent and credible claims procedures.

Although the present study was based on paddy farmers in the Kurunegala District, the identified behavioural patterns, such as sensitivity to premiums, preference for multi-hazard coverage, and trust-related concerns, reflect broader dynamics observed among smallholder farmers in other districts of Sri Lanka and many developing-country contexts. Hence, these insights extend beyond the specific regional and crop setting, offering implications for similar agricultural systems exposed to comparable climatic and institutional challenges.

Despite the introduction of new agricultural insurance schemes over time, the aforementioned inconsistencies and operational challenges have limited their effectiveness. Therefore, many farmers continue to rely on ad hoc relief measures to manage crop risks, underscoring the need for reliable, transparent, and tailored crop insurance schemes to meet the practical needs of paddy farmers. Developing responsive, context-specific crop insurance programmes that reduce financial barriers, enhance trust, and provide reliable risk coverage is essential to strengthen farmers’ resilience, sustain agricultural livelihoods, and support climate-smart adaptation strategies in Sri Lanka.

From a policy perspective, strengthening crop insurance adoption requires a multi-pronged approach that integrates institutional reform, technological innovation, and capacity building. Policymakers should prioritize the development of affordable premium structures, supported by targeted subsidies or risk-sharing mechanisms for smallholder farmers. Simplifying claim procedures through digital platforms, mobile-based applications, and automated weather-indexed payout systems can substantially improve efficiency and reduce transaction delays. Enhancing transparency in damage assessments through community-based verification or independent audit mechanisms would play a pivotal role in rebuilding farmer confidence in insurance providers. In parallel, continuous awareness and financial literacy programmes are needed to enable farmers to better understand insurance principles, coverage options, and long-term benefits. Establishing stronger coordination among government institutions, private insurers, and local agricultural officers will ensure inclusivity, reduce administrative bottlenecks, and expand coverage to marginalized farming communities. By adopting such comprehensive reforms, Sri Lanka can transition from a reactive disaster-compensation model toward a proactive, sustainable, and climate-resilient agricultural insurance framework.

Author Contributions

Conceptualisation, V.K., L.U., and M.M.M.N.; methodology, L.U., V.K. and M.M.M.N.; software, B.A.A.; validation, B.A.A.; formal analysis, L.U., V.K. and N.S.; investigation, V.K., N.E., H.E. and L.U.; resources, B.A.A.; data curation, L.U., N.S. and V.K.; writing—original draft preparation, H.E., L.U., N.S., and V.K.; writing—review and editing, M.M.M.N., and B.A.A.; visualization, B.A.A. and M.M.M.N.; supervision, M.M.M.N. and B.A.A.; project administration, S.A.L.; funding acquisition, B.A.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Ongoing Research Funding Programme (ORF-2025-443), King Saud University, Riyadh, Saudi Arabia.

Institutional Review Board Statement

Ethical clearance for this study was obtained from the Ethics Review Committee (ERC) of the Faculty of Agriculture and Plantation Management, Wayamba University of Sri Lanka (ERC/2023/014; Approval Date: 15 December 2023). Informed written consent was acquired from the respondents before collection of data.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data supporting the conclusions of this article will be made available by the authors on request.

Acknowledgments

The authors wish to express their profound gratitude to all the participants for their immense support.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| AAIB | Agricultural and Agrarian Insurance Board |

| A/L | Advanced Level |

| AM | Assessment Method |

| ATI | Attitudes toward Insurance |

| CC | Climate Change |

| CLM | Conditional Logit Model |

| CSA | Climate-Smart Agriculture |

| FAO | Food and Agriculture Organization |

| GDP | Gross Domestic Product |

| HZD | Hazard |

| LKR | Sri Lankan Rupees |

| MWTP | Marginal Willingness to Pay |

| NGO | Non-Governmental Organization |

| NHR | No Hazard Return |

| OR | Odds Ratio |

| O/L | Ordinary Level |

| PREM | Premium |

| RII | Relative Importance Index |

| SE | Standard Error |

| WTP | Willingness to Pay |

References

- United Nations Framework Convention on Climate Change. 2008. Available online: https://unfccc.int/resource/ccsites/zimbab/conven/text/art01.htm (accessed on 10 April 2024).

- Hitz, S.; Smith, J. Estimating Global Impacts from Climate Change. Glob. Environ. Change 2004, 14, 201–218. [Google Scholar] [CrossRef]

- Enete, A.A.; Amusa, T.A. Challenges of Agricultural Adaptation to Climate Change in Nigeria: A Literature Review; Report No. 4; Institute Veolia Environment: Paris, France, 2010. [Google Scholar]

- Knutson, C.; Hayes, M.; Phillips, T. How Climate Change Will Affect Crops; National Drought Mitigation Center; University of Nebraska: Lincoln, NE, USA, 2010. [Google Scholar]

- Aryal, J.P.; Sapkota, T.B.; Rahut, D.B.; Marenya, P.; Stirling, C.M. Climate Risks and Adaptation Strategies of Farmers in East Africa and South Asia. Sci. Rep. 2021, 11, 10489. [Google Scholar] [CrossRef]

- Thomas, R.J. Opportunities to Reduce the Vulnerability of Dryland Farmers in Central and West Asia and North Africa to Climate Change. Agric. Ecosyst. Environ. 2008, 126, 36–45. [Google Scholar] [CrossRef]

- Akpan, A.I.; Zikos, D. Rural Agriculture and Poverty Trap: Can Climate-Smart Innovations Provide Breakeven Solutions to Smallholder Farmers? Environments 2023, 10, 57. [Google Scholar] [CrossRef]

- Gregory, P.J.; Ingram, J.S.I.; Brklacich, M. Climate Change and Food Security. Philos. Trans. R. Soc. Lond. B Biol. Sci. 2005, 360, 2139–2148. [Google Scholar] [CrossRef] [PubMed]

- Pagliacci, F.; Defrancesco, E.; Mozzato, D.; Bortolini, L.; Pezzuolo, A.; Pirotti, F. Drivers of Farmers’ Adoption and Continuation of Climate-Smart Agricultural Practices: A Study from Northeastern Italy. Sci. Total Environ. 2020, 710, 136345. [Google Scholar] [CrossRef]

- Mutengwa, C.S.; Mnkeni, P.; Kondwakwenda, A. Climate-smart agriculture and food security in Southern Africa: A review of the vulnerability of smallholder agriculture and food security to climate change. Sustainability 2023, 15, 2882. [Google Scholar] [CrossRef]

- Binswanger-Mkhize, H.P. Is There Too Much Hype about Index-Based Agricultural Insurance? J. Dev. Stud. 2012, 48, 187–200. [Google Scholar] [CrossRef]

- Wang, H.; Liu, H.; Wang, D. Agricultural Insurance, Climate Change, and Food Security: Evidence from Chinese Farmers. Sustainability 2022, 14, 9493. [Google Scholar] [CrossRef]

- Department of Census and Statistics. Gross Domestic Product (GDP) by Production Approach First Quarter of 2025; Department of Census and Statistics: Colombo, Sri Lanka, 2025.

- Rambukwella, R.N.K.; Vidanapathirana, R.P.; Somaratne, T.G. Evaluation of Crop Insurance Scheme in Sri Lanka; Research Study No. 122; Hector Kobbekaduwa Agrarian Research and Training Institute: Colombo, Sri Lanka, 2007. [Google Scholar]

- Agricultural and Agrarian Insurance Board. Impact Assessment Report on Floods in the Maha Season. 2023. Available online: http://www.statistics.gov.lk/Agriculture/StaticalInfo/PaddyStatistic (accessed on 10 April 2024).

- Udayanga, N.W.B.A.; Najim, M.M.M. Climate Change Impacts on Agricultural Sector in Sri Lanka: Necessity of Precision Agricultural Technologies. In Climate-Smart and Resilient Food Systems and Security; Springer Nature: Cham, Switzerland, 2024; pp. 323–342. [Google Scholar]

- Weerasekara, S.; Wilson, C.; Lee, B.; Hoang, V.N. Impact of Natural Disasters on the Efficiency of Agricultural Production: An Exemplar from Rice Farming in Sri Lanka. Clim. Dev. 2022, 14, 133–146. [Google Scholar] [CrossRef]

- Hazell, P.; Timu, A.G. What’s Holding Back Private Sector Agricultural Insurance? International Food Policy Research Institute: Washington, DC, USA, 2025. [Google Scholar]

- Rambukwella, R.; Vidanapathirana, R.; Champika, P.J.; Priyadarshana, D. Performance of Weather Index Insurance (WII) Scheme in Sri Lanka; Hector Kobbekaduwa Agrarian Research and Training Institute: Colombo, Sri Lanka, 2020. [Google Scholar]

- Singh, P.; Agrawal, G. Development, Present Status and Performance Analysis of Agriculture Insurance Schemes in India: Review of Evidence. Int. J. Soc. Econ. 2020, 47, 461–481. [Google Scholar] [CrossRef]

- Panda, A.; Sharma, U.; Ninan, K.N.; Patt, A. Adaptive Capacity Contributing to Improved Agricultural Productivity at the Household Level: Empirical Findings Highlighting the Importance of Crop Insurance. Glob. Environ. Change 2013, 23, 782–790. [Google Scholar] [CrossRef]

- Raschky, P.; Chantarat, S. Natural Disaster Risk Financing and Transfer in ASEAN Countries. In Oxford Research Encyclopedia of Natural Hazard Science; Oxford University Press: New York, NY, USA, 2020. [Google Scholar]

- Heenkenda, S. Agricultural Risk Management Through Index-based Microinsurance Exploring the Feasibility of Demand Perspective. Vidyodaya J. Humanit. Soc. Sci. 2011, 3, 127–154. [Google Scholar] [CrossRef]

- Aheeyar, M.; Amarasinghe, U.A.; Amarnath, G.; Alahacoon, N.; Prasad, S.; Dissanayake, A. Assessment of Farmers’ Willingness to Pay for Bundled Climate Insurance Solutions in Sri Lanka; International Water Management Institute (IWMI): Colombo, Sri Lanka, 2025. [Google Scholar]

- Yallarawa, Y.S.; Prasada, D.V. Demand for crop insurance by tea smallholders in Badulla district: An analysis of willingness-to-pay. Trop. Agric. Res. 2020, 31, 1–10. [Google Scholar] [CrossRef]

- Berges, M.; Casellas, K. Consumers’ Willingness to Pay for Milk Quality Attributes. In Proceedings of the International Association of Agricultural Economists Conference, Beijing, China, 16–22 August 2009; pp. 16–22. [Google Scholar]

- Mandeville, K.L.; Lagarde, M.; Hanson, K. The Use of Discrete Choice Experiments to Inform Health Workforce Policy: A Systematic Review. BMC Health Serv. Res. 2014, 14, 367. [Google Scholar] [CrossRef] [PubMed]

- Aizaki, H. Basic Functions for Supporting an Implementation of Choice Experiments in R. J. Stat. Softw. 2012, 50, 1–24. [Google Scholar] [CrossRef]

- Lancaster, K.J. A New Approach to Consumer Theory. J. Polit. Econ. 1966, 74, 132–157. [Google Scholar] [CrossRef]

- McFadden, D. The Measurement of Urban Travel Demand. J. Public Econ. 1974, 3, 303–328. [Google Scholar] [CrossRef]

- Manike, M.M.A.P.; Rajendran, M. Analysis of Rainfall Distribution in Kurunegala District, Sri Lanka. Asian J. Res. Agric. For. 2024, 10, 48–60. [Google Scholar] [CrossRef]

- Department of Census and Statistics. Paddy Statistics—Yala Season 2024 (Metric Units); Department of Census and Statistics of Sri Lanka: Colombo, Sri Lanka, 2025.

- Department of Census and Statistics. Paddy Statistics—Maha Season 2023/2024 (Metric Units); Department of Census and Statistics of Sri Lanka: Colombo, Sri Lanka, 2025.

- Cochran, W.G. Sampling Techniques, 3rd ed.; John Wiley & Sons: New York, NY, USA, 1977. [Google Scholar]

- Akter, S.; Krupnik, T.J.; Khanam, F. Climate Change Skepticism and Index versus Standard Crop Insurance Demand in Coastal Bangladesh. Reg. Environ. Change 2017, 17, 2455–2466. [Google Scholar] [CrossRef] [PubMed]

- Suresh, N.; Sreedaya, G.S. Perception of Farmers towards Crop Insurance Schemes in Kerala, India. Asian J. Agric. Ext. Econ. Sociol. 2022, 40, 437–447. [Google Scholar] [CrossRef]

- Ankrah, D.A.; Kwapong, N.A.; Eghan, D.; Adarkwah, F.; Boateng-Gyambiby, D. Agricultural Insurance Access and Acceptability: Examining the Case of Smallholder Farmers in Ghana. Agric. Food Secur. 2021, 10, 19. [Google Scholar] [CrossRef]

- Bhushan, C.; Singh, G.; Rattani, V.; Kumar, V. Insuring Agriculture in Times of Climate Change; Centre for Science and Environment: New Delhi, India, 2016. [Google Scholar]

- Afroz, R.; Akhtar, R.; Farhana, P. Willingness to Pay for Crop Insurance to Adapt Flood Risk by Malaysian Farmers: An Empirical Investigation of Kedah. World J. Agric. Res. 2017, 7, 1–9. [Google Scholar]

- Mahul, O.; Stutley, C.J. Government Support to Agricultural Insurance: Challenges and Options for Developing Countries; World Bank Publications: Washington, DC, USA, 2010. [Google Scholar]

- Wehnert, B. Agricultural Insurance Experience in Ghana. In Agricultural Insurance in Practice; Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ): Bonn, Germany, 2018. [Google Scholar]

- Cai, J.; de Janvry, A.; Sadoulet, E. Social Networks and the Decision to Insure. Am. Econ. J. Appl. Econ. 2015, 7, 81–108. [Google Scholar] [CrossRef]

- Giné, X.; Townsend, R.; Vickery, J. Patterns of Rainfall Insurance Participation in Rural India. World Bank. Econ. Rev. 2008, 22, 539–566. [Google Scholar] [CrossRef]

- Luo, T.; Yang, H.; Zhao, J.; Sun, J. Farmers’ Social Networks and the Fluctuation in Their Participation in Crop Insurance: The Perspective of Information Diffusion. Emerg. Mark. Financ. Trade 2020, 56, 1–19. [Google Scholar] [CrossRef]

- Ginder, M.; Spaulding, A.D.; Tudor, K.W.; Winter, J.R. Factors Affecting Crop Insurance Purchase Decisions by Farmers in Northern Illinois. Agric. Financ. Rev. 2009, 69, 113–125. [Google Scholar] [CrossRef]

- Bozzola, M.; Finger, R. Stability of Risk Attitude, Agricultural Policies and Production Shocks: Evidence from Italy. Eur. Rev. Agric. Econ. 2021, 48, 477–501. [Google Scholar] [CrossRef]

- He, J.; Rejesus, R.; Zheng, X.; Yorobe, J., Jr. Advantageous Selection in Crop Insurance: Theory and Evidence. J. Agric. Econ. 2018, 69, 646–668. [Google Scholar] [CrossRef]

- Chen, X.; Jiang, Y.; Wang, T.; Zhou, K.; Liu, J.; Ben, H.; Wang, W. Enhancing Farmer Resilience Through Agricultural Insurance: Evidence from Jiangsu, China. Agriculture 2025, 15, 1473. [Google Scholar] [CrossRef]

- Heenkenda, S. Index-Based Microinsurance for Paddy Sector in Sri Lanka: An Evaluation of Demand Behavior. Ph.D. Dissertation, Nagoya University, Nagoya, Japan, 2011. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).