From Budgets to Biodiversity: How Fiscal Decentralization Shapes Environmental Sustainability in Pakistan

Abstract

1. Introduction

Research Gap

2. Data and Methodology

2.1. Unit Root Test

2.2. Cointegration Test

2.3. Autoregressive Distributive Lag Model

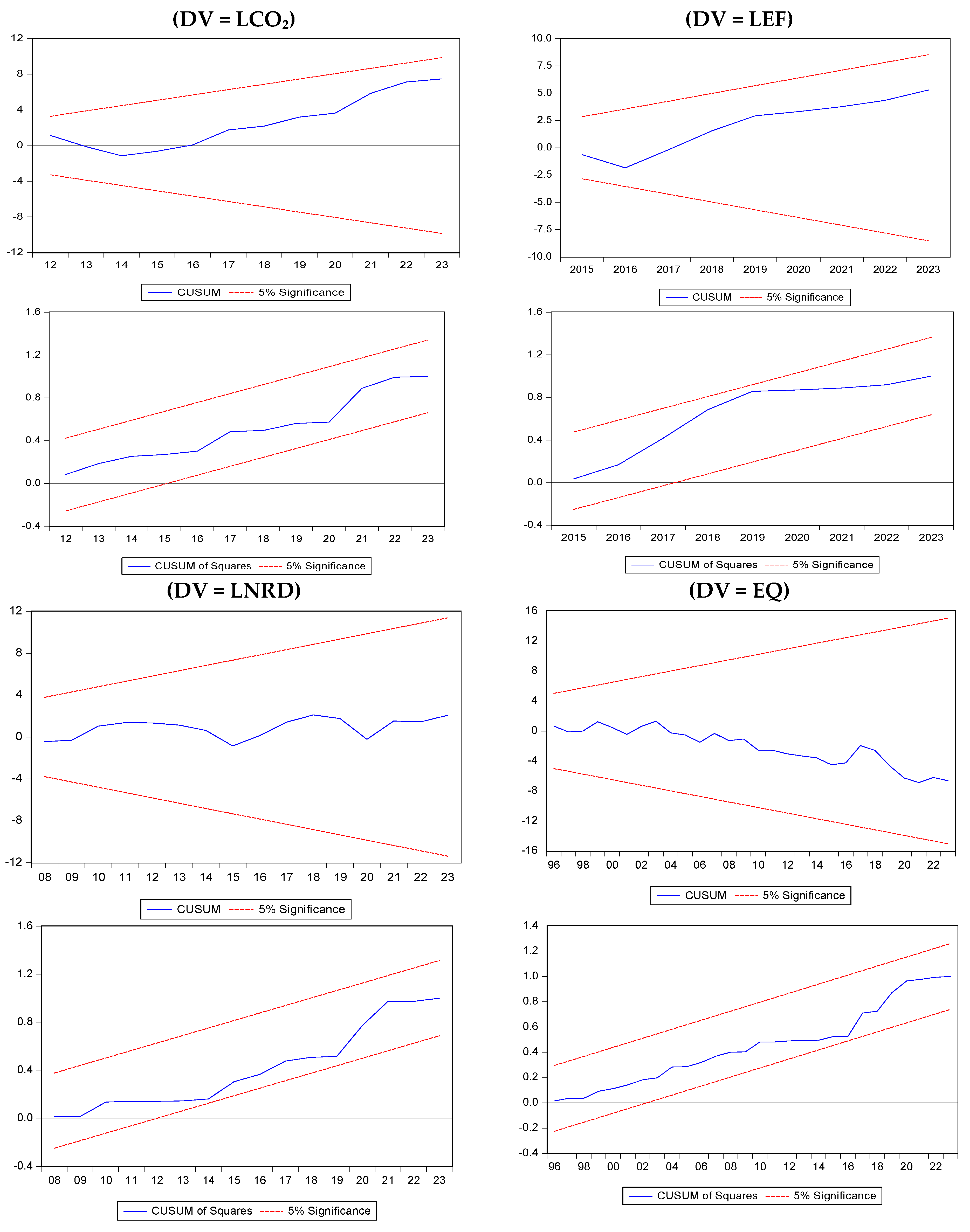

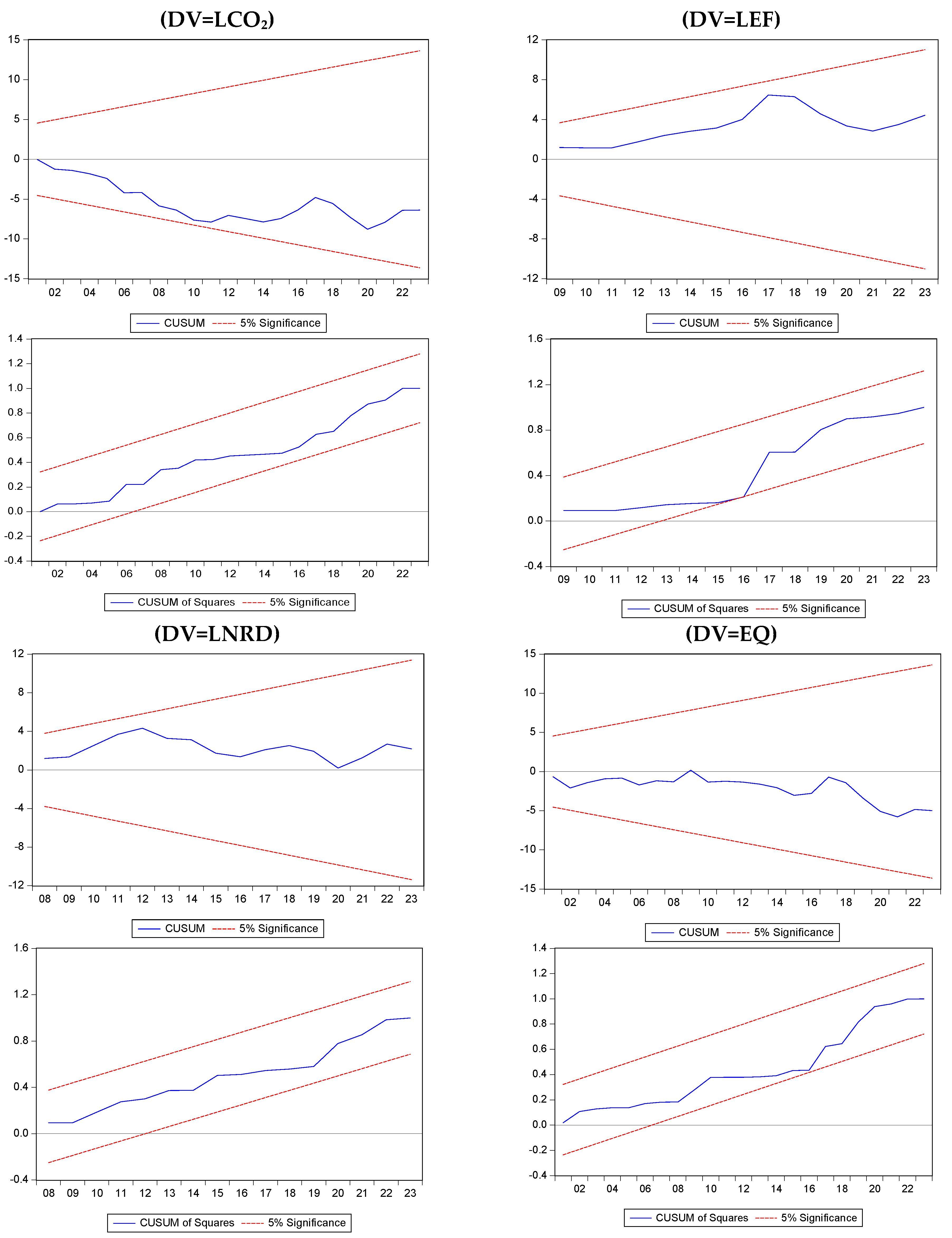

2.4. Stability Test

2.5. Diagnostic Test

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variable | (DV = LOC2) | (DV = LEF) | (DV = LNRD) | (DV = EQ) |

|---|---|---|---|---|

| LFD | 0.053 *** (0.001) | −0.083 *** (0.000) | 0.075 ** (0.014) | 1.864 ** (0.028) |

| LTI | - | −0.018 ** (0.038) | −0.123 *** (0.000) | −0.400 ** (0.032) |

| LFDI | 0.039 *** (0.002) | 0.060 *** (0.000) | 0.278 *** (0.000) | 1.309 *** (0.002) |

| LPOP | 6.247 * (0.075) | 9.226 *** (0.001) | 19.760 *** (0.009) | 435.991 ** (0.019) |

| LTRADE | −0.113 ** (0.047) | −0.197 *** (0.000) | 0.928 *** (0.000) | 4.364 *** (0.004) |

| CointEq(−1) * | −0.191 | −0.590 | −0.979 | −0.599 |

| Variable | (DV = LCO2) | (DV = LEF) | (DV = LNRD) | (DV = EQ) |

|---|---|---|---|---|

| LRD | 0.004 (0.024) | 0.005 ** (0.038) | 0.013 (0.128) | 0.123 ** (0.035) |

| LTI | 0.049 ** (0.015) | −0.016 (0.116) | −0.337 *** (0.004) | −0.405 (0.101) |

| LFDI | 0.131 *** (0.003) | 0.139 *** (0.000) | 0.167 ** (0.028) | 3.082 *** (0.000) |

| LPOP | 19.70 *** (0.004) | 0.035 *** (0.071) | 3.247 *** (0.001) | 1.235 ** (0.014) |

| LTRADE | −0.125 (0.102) | −0.323 ** (0.011) | 1.140 ** (0.010) | −6.975 * (0.006) |

| CointEq(−1) * | −0.892 | −0.757 | −0.677 | −0.607 |

| Variable | (DV = LCO2) | (DV = LEF) | (DV = LNRD) | (DV = EQ) |

|---|---|---|---|---|

| LED | 0.008 ** (0.038) | −0.005 * (0.083) | 0.085 *** (0.000) | −0.467 (0.134) |

| LTI | −0.053 *** (0.005) | −0.037 * (0.095) | −0.051 (0.262) | −0.384 (0.409) |

| LFDI | 0.099 *** (0.000) | 0.063 *** (0.000) | 0.132 ** (0.050) | 2.703 *** (0.002) |

| LPOP | 0.019 ** (0.041) | 9.822 *** (0.004) | 22.89 *** (0.000) | 0.903 (0.134) |

| LTRADE | −0.038 ** (0.452) | −0.288 *** (0.001) | 0.881 ** (0.013) | −2.908 ** (0.023) |

| CointEq(−1) * | −0.687 | −0.980 | −0.722 | −0.795 |

| Model 1 | |||||||

| Equation (1) | Equation (2) | Equation (3) | Equation (4) | ||||

| F-statistic | Obs*R-squared | F-statistic | Obs*R-squared | F-statistic | Obs*R-squared | F-statistic | Obs*R-squared |

| 0.430 (0.948) | 12.167 (0.838) | 0.529 (0.889) | 17.133 (0.703) | 0.669 (0.778) | 12.336 (0.653) | 0.207 (0.956) | 1.214 (0.943) |

| Model 2 | |||||||

| Equation (1) | Equation (2) | Equation (3) | Equation (4) | ||||

| F-statistic | Obs*R-squared | F-statistic | Obs*R-squared | F-statistic | Obs*R-squared | F-statistic | Obs*R-squared |

| 0.807 (0.614) | 8.921 (0.542) | 0.730 (0.676) | 7.339 (0.601) | 0.448 (0.930) | 8.741 (0.847) | 0.335 (0.929) | 2.834 (0.899) |

| Model 3 | |||||||

| Equation (1) | Equation (2) | Equation (3) | Equation (4) | ||||

| F-statistic | Obs*R-squared | F-statistic | Obs*R-squared | F-statistic | Obs*R-squared | F-statistic | Obs*R-squared |

| 0.559 (0.815) | 5.926 (0.747) | 0.714 (0.742) | 13.93 (0.603) | 0.619 (0.813) | 10.89 (0.694) | 0.397 (0.922) | 4.489 (0.877) |

| Model 1 | |||||||

| Equation (1) | Equation (2) | Equation (3) | Equation (4) | ||||

| F-statistic | Obs*R-squared | F-statistic | Obs*R-squared | F-statistic | Obs*R-squared | F-statistic | Obs*R-squared |

| 0.430 (0.948) | 12.167 (0.838) | 0.529 (0.889) | 17.133 (0.703) | 0.669 (0.778) | 12.336 (0.653) | 0.207 (0.956) | 1.214 (0.943) |

| Model 2 | |||||||

| Equation (1) | Equation (2) | Equation (3) | Equation (4) | ||||

| F-statistic | Obs*R-squared | F-statistic | Obs*R-squared | F-statistic | Obs*R-squared | F-statistic | Obs*R-squared |

| 0.807 (0.614) | 8.921 (0.542) | 0.730 (0.676) | 7.339 (0.601) | 0.448 (0.930) | 8.741 (0.847) | 0.335 (0.929) | 2.834 (0.899) |

| Model 3 | |||||||

| Equation (1) | Equation (2) | Equation (3) | Equation (4) | ||||

| F-statistic | Obs*R-squared | F-statistic | Obs*R-squared | F-statistic | Obs*R-squared | F-statistic | Obs*R-squared |

| 0.559 (0.815) | 5.926 (0.747) | 0.714 (0.742) | 13.93 (0.603) | 0.619 (0.813) | 10.89 (0.694) | 0.397 (0.922) | 4.489 (0.877) |

| Component | Eigenvalue | Difference | Proportion | Cumulative |

| PC1 | 1.172 | 0.215 | 0.390 | 0.390 |

| PC2 | 0.957 | 0.087 | 0.319 | 0.710 |

| PC3 | 0.869 | - | 0.289 | 1.000 |

| Principal Component (Eigenvectors) | ||||

| Variable | PC1 | PC2 | PC3 | - |

| EF | 0.499 | 0.789 | 0.356 | - |

| CO2 | −0.654 | 0.074 | 0.752 | - |

| NR | 0.567 | −0.608 | 0.553 | - |

| Correlation | EF | CO2 | NR |

| EF | 1.000 | ||

| CO2 | −0.093 | 1.0000 | |

| NR | 0.043 | −0.116 | 1.0000 |

| KMO | 0.526 |

| Statistic | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| F-Statistic | 5.650 *** | 3.796 ** | 35.96 *** | 3.695 ** |

| Statistic | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | Model 10 | Model 11 | Model 12 |

|---|---|---|---|---|---|---|---|---|

| ADF | −6.54 | −7.50 ** | −8.17 *** | −6.27 | −7.71 *** | −6.72 * | −8.16 *** | −6.92 *** |

| Zt | −6.64 * | −7.62 ** | −8.67 *** | −6.25 | −7.83 *** | −7.16 ** | −8.49 *** | −7.26 *** |

| B.P | 2015 | 2013 | 2014 | 2000 | 2008 | 2007 | 2010 | 2002 |

References

- Majeed, A.; Wang, L.; Zhang, X.; Muniba; Kirikkaleli, D. Modeling the dynamic links among natural resources, economic globalization, disaggregated energy consumption, and environmental quality: Fresh evidence from GCC economies. Resour. Policy 2021, 73, 102204. [Google Scholar] [CrossRef]

- Adebayo, T.S.; AbdulKareem, H.K.; Bilal; Kirikkaleli, D.; Shah, M.I.; Abbas, S. CO2 behavior amidst the COVID-19 pandemic in the United Kingdom: The role of renewable and non-renewable energy development. Renew. Energy 2022, 189, 492–501. [Google Scholar] [CrossRef]

- Ahmed, Z.; Wang, Z. Investigating the impact of human capital on the ecological footprint in India: An empirical analysis. Environ. Sci. Pollut. Res. 2019, 26, 26782–26796. [Google Scholar] [CrossRef]

- Oates, W.E. An essay on fiscal federalism. J. Econ. Lit. 1999, 37, 1120–1149. [Google Scholar] [CrossRef]

- Chang, Y.; Wu, P. Influence of fiscal decentralization, fintech, and mineral resources on green productivity of G5 countries. Resour. Policy 2023, 89, 104509. [Google Scholar] [CrossRef]

- Chen, X.; Chang, C.-P. Fiscal decentralization, environmental regulation, and pollution: A spatial investigation. Environ. Sci. Pollut. Res. 2020, 27, 31946–31968. [Google Scholar] [CrossRef] [PubMed]

- He, Q. Fiscal decentralization and environmental pollution: Evidence from Chinese panel data. China Econ. Rev. 2015, 36, 86–100. [Google Scholar] [CrossRef]

- Yang, Y.; Yang, X.; Tang, D. Environmental regulations, Chinese-style fiscal decentralization, and carbon emissions: From the perspective of moderating effect. Stoch. Environ. Res. Risk Assess. 2021, 35, 1985–1998. [Google Scholar] [CrossRef]

- Millimet, D.L. Assessing the empirical impact of environmental federalism. J. Reg. Sci. 2003, 43, 711–733. [Google Scholar] [CrossRef]

- Cutter, W.B.; De Shazo, J. The environmental consequences of decentralizing the decision to decentralize. J. Environ. Econ. Manag. 2007, 53, 32–53. [Google Scholar] [CrossRef]

- Khan, Z.; Ali, S.; Dong, K.; Li, R.Y.M. How does fiscal decentralization affect CO2 emissions? The roles of institutions and human capital. Energy Econ. 2021, 94, 105060. [Google Scholar] [CrossRef]

- Shah, A. Fiscal decentralization and macroeconomic management. Int. Tax Public Financ. 2006, 13, 437–462. [Google Scholar] [CrossRef]

- Khan, Z.; Taimoor, H.; Kirikkaleli, D.; Chen, F. The role of fiscal decentralization in achieving environmental sustainability in developing and emerging economies. Front. Environ. Sci. 2023, 10, 1102929. [Google Scholar] [CrossRef]

- Muskanan, M. The effectiveness of the internal controlling system implementation in fiscal decentralization application. Procedia Soc. Behav. Sci. 2014, 164, 180–193. [Google Scholar] [CrossRef][Green Version]

- Xu, M. Research on the relationship between fiscal decentralization and environmental management efficiency under competitive pressure: Evidence from China. Environ. Sci. Pollut. Res. 2021, 29, 23392–23406. [Google Scholar] [CrossRef] [PubMed]

- Batterbury, S.P.; Fernando, J.L. Rescaling governance and the impacts of political and environmental decentralization: An introduction. World Dev. 2006, 34, 1851–1863. [Google Scholar] [CrossRef]

- Lingyan, M.; Zhao, Z.; Malik, H.A.; Razzaq, A.; An, H.; Hassan, M. Asymmetric impact of fiscal decentralization and environmental innovation on carbon emissions: Evidence from highly decentralized countries. Energy Environ. 2021, 33, 752–782. [Google Scholar] [CrossRef]

- Guo, S.; Wen, L.; Wu, Y.; Yue, X.; Fan, G. Fiscal decentralization and local environmental pollution in China. Int. J. Environ. Res. Public Health 2020, 17, 8661. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nasir, M.A.; Roubaud, D. Environmental degradation in France: The effects of FDI, financial development, and energy innovations. Energy Econ. 2018, 74, 843–857. [Google Scholar] [CrossRef]

- Ahmad, N.; Youjin, L.; Žiković, S.; Belyaeva, Z. The effects of technological innovation on sustainable development and environmental degradation: Evidence from China. Technol. Soc. 2022, 72, 102184. [Google Scholar] [CrossRef]

- Chien, F.; Ajaz, T.; Andlib, Z.; Chau, K.Y.; Ahmad, P.; Sharif, A. The role of technology innovation, renewable energy and globalization in reducing environmental degradation in Pakistan: A step towards sustainable environment. Renew. Energy 2021, 177, 308–317. [Google Scholar] [CrossRef]

- Ayobamiji, A.A.; Kalmaz, D.B. Reinvestigating the determinants of environmental degradation in Nigeria. Int. J. Econ. Policy Emerg. Econ. 2020, 13, 52–71. [Google Scholar] [CrossRef]

- Burki, U.; Tahir, M. Determinants of environmental degradation: Evidenced-based insights from ASEAN economies. J. Environ. Manag. 2022, 306, 114506. [Google Scholar] [CrossRef]

- Preston, S.H. The effect of population growth on environmental quality. Popul. Res. Policy Rev. 1996, 15, 95–108. [Google Scholar] [CrossRef]

- Cropper, M.; Griffiths, C. The interaction of population growth and environmental quality. Am. Econ. Rev. 1994, 84, 250–254. [Google Scholar]

- Khan, I.; Hou, F.; Le, H.P. The impact of natural resources, energy consumption, and population growth on environmental quality: Fresh evidence from the United States of America. Sci. Total Environ. 2021, 754, 142222. [Google Scholar] [CrossRef]

- Managi, S.; Hibiki, A.; Tsurumi, T. Does trade openness improve environmental quality? J. Environ. Econ. Manag. 2009, 58, 346–363. [Google Scholar] [CrossRef]

- Bernard, J.; Mandal, S.K. The impact of trade openness on environmental quality: An empirical analysis of emerging and developing economies. WIT Trans. Ecol. Environ. 2016, 203, 195–208. [Google Scholar]

- Xia, S.; You, D.; Tang, Z.; Yang, B. Analysis of the spatial effect of fiscal decentralization and environmental decentralization on carbon emissions under the pressure of officials’ promotion. Energies 2021, 14, 1878. [Google Scholar] [CrossRef]

- Samuelson, P.A. The pure theory of public expenditure. Rev. Econ. Stat. 1954, 36, 387. [Google Scholar] [CrossRef]

- Tiebout, C.M. A pure theory of local expenditures. J. Political Econ. 1956, 64, 416–424. [Google Scholar] [CrossRef]

- Bodman, P.M.; Campbell, H.F.; Heaton, K.A.; Hodge, A. Fiscal Decentralisation, Macroeconomic Conditions and Economic Growth in Australia; School of Economics, Macroeconomics Research Group: Cambridge, UK, 2009. [Google Scholar]

- Glazer, A. Local regulation may be excessively stringent. Reg. Sci. Urban Econ. 1999, 29, 553–558. [Google Scholar] [CrossRef]

- Levinson, A. Environmental regulatory competition: A status report and some new evidence. Natl. Tax J. 2003, 56, 91–106. [Google Scholar] [CrossRef]

- Stigler, G.J. Perfect competition, historically contemplated. J. Politi-Econ. 1957, 65, 1–17. [Google Scholar] [CrossRef]

- Hayek, F.A. The Use of Knowledge in Society, in Modern Understandings of Liberty and Property; Routledge: Oxfordshire, UK, 2013; pp. 27–38. [Google Scholar]

- Silva, E.C.; Caplan, A.J. Transboundary pollution control in federal systems. J. Environ. Econ. Manag. 1997, 34, 173–186. [Google Scholar] [CrossRef]

- Ji, X.; Umar, M.; Ali, S.; Ali, W.; Tang, K.; Khan, Z. Does fiscal decentralization and eco-innovation promote sustainable environment? A case study of selected fiscally decentralized countries. Sustain. Dev. 2020, 29, 79–88. [Google Scholar] [CrossRef]

- Carniti, E.; Cerniglia, F.; Longaretti, R.; Michelangeli, A. Decentralization and economic growth in Europe: For whom the bell tolls. Reg. Stud. 2018, 53, 775–789. [Google Scholar] [CrossRef]

- Shan, S.; Ahmad, M.; Tan, Z.; Adebayo, T.S.; Li, R.Y.M.; Kirikkaleli, D. The role of energy prices and non-linear fiscal decentralization in limiting carbon emissions: Tracking environmental sustainability. Energy 2021, 234, 121243. [Google Scholar] [CrossRef]

- Heutel, G. How should environmental policy respond to business cycles? Optimal policy under persistent productivity shocks. Rev. Econ. Dyn. 2012, 15, 244–264. [Google Scholar] [CrossRef]

- Annicchiarico, B.; Di Dio, F. Environmental policy and macroeconomic dynamics in a new Keynesian model. J. Environ. Econ. Manag. 2015, 69, 1–21. [Google Scholar] [CrossRef]

- Cheng, Z.; Zhu, Y. The spatial effect of fiscal decentralization on haze pollution in China. Environ. Sci. Pollut. Res. 2021, 28, 49774–49787. [Google Scholar] [CrossRef]

- Chen, G.; Xu, J.; Qi, Y. Environmental (de) centralization and local environmental governance: Evidence from a natural experiment in China. China Econ. Rev. 2022, 72, 101755. [Google Scholar] [CrossRef]

- Fredriksson, P.G.; List, J.A.; Millimet, D.L. Bureaucratic corruption, environmental policy and inbound US FDI: Theory and evidence. J. Public Econ. 2003, 87, 1407–1430. [Google Scholar] [CrossRef]

- Sigman, H. Decentralization and environmental quality: An international analysis of water pollution levels and variation. Land Econ. 2013, 90, 114–130. [Google Scholar] [CrossRef]

- Hao, Y.; Chen, Y.-F.; Liao, H.; Wei, Y.-M. China’s fiscal decentralization and environmental quality: Theory and an empirical study. Environ. Dev. Econ. 2019, 25, 159–181. [Google Scholar] [CrossRef]

- Chan, Y.T. Are macroeconomic policies better in curbing air pollution than environmental policies? A DSGE approach with carbon-dependent fiscal and monetary policies. Energy Policy 2020, 141, 111454. [Google Scholar] [CrossRef]

- Zhou, C.; Zhang, X. Measuring the efficiency of fiscal policies for environmental pollution control and the spatial effect of fiscal decentralization in China. Int. J. Environ. Res. Public Health 2020, 17, 8974. [Google Scholar] [CrossRef]

- Phan, C.T.; Jain, V.; Purnomo, E.P.; Islam, M.; Mughal, N.; Guerrero, J.W.G.; Ullah, S. Controlling environmental pollution: Dynamic role of fiscal decentralization in CO2 emission in Asian economies. Environ. Sci. Pollut. Res. 2021, 28, 65150–65159. [Google Scholar] [CrossRef]

- Elheddad, M.; Djellouli, N.; Tiwari, A.K.; Hammoudeh, S. The relationship between energy consumption and fiscal decentralization and the importance of urbanization: Evidence from Chinese provinces. J. Environ. Manag. 2020, 264, 110474. [Google Scholar] [CrossRef]

- Khattak, S.I.; Ahmad, M.; Khan, Z.U.; Khan, A. Exploring the impact of innovation, renewable energy consumption, and income on CO2 emissions: New evidence from the BRICS economies. Environ. Sci. Pollut. Res. 2020, 27, 13866–13881. [Google Scholar] [CrossRef]

- Usman, M.; Hammar, N. Dynamic relationship between technological innovations, financial development, renewable energy, and ecological footprint: Fresh insights based on the STIRPAT model for Asia Pacific Economic Cooperation countries. Environ. Sci. Pollut. Res. 2020, 28, 15519–15536. [Google Scholar] [CrossRef]

- Mensah, C.N.; Long, X.; Boamah, K.B.; Bediako, I.A.; Dauda, L.; Salman, M. Correction to: The effect of innovation on CO2 emissions across OECD countries from 1990 to 2014. Environ. Sci. Pollut. Res. 2021, 28, 19535. [Google Scholar] [CrossRef] [PubMed]

- Yang, B.; Jahanger, A.; Ali, M. Remittance inflows affect the ecological footprint in BICS countries: Do technological innovation and financial development matter? Environ. Sci. Pollut. Res. 2021, 28, 23482–23500. [Google Scholar] [CrossRef]

- Ahmad, M.; Jiang, P.; Majeed, A.; Umar, M.; Khan, Z.; Muhammad, S. The dynamic impact of natural resources, technological innovations and economic growth on ecological footprint: An advanced panel data estimation. Resour. Policy 2020, 69, 101817. [Google Scholar] [CrossRef]

- Yu, Y.; Du, Y. Impact of technological innovation on CO2 emissions and emissions trend prediction on ‘New Normal’economy in China. Atmos. Pollut. Res. 2019, 10, 152–161. [Google Scholar] [CrossRef]

- Moldan, B.; Janoušková, S.; Hák, T. How to understand and measure environmental sustainability: Indicators and targets. Ecol. Indic. 2012, 17, 4–13. [Google Scholar] [CrossRef]

- Huo, J.; Peng, C. Depletion of natural resources and environmental quality: Prospects of energy use, energy imports, and economic growth hindrances. Resour. Policy 2023, 86, 104049. [Google Scholar] [CrossRef]

- Nasreen, S.; Khan, F.I.; Nghiem, X.-H. The effects of financial development and technological progress on environmental sustainability: Novel evidence from Asian countries. Environ. Sci. Pollut. Res. 2023, 30, 53712–53724. [Google Scholar] [CrossRef]

- Halkos, G.E.; Paizanos, E.A. The effect of government expenditure on the environment: An empirical investigation. Ecol. Econ. 2013, 91, 48–56. [Google Scholar] [CrossRef]

- Memon, J.A.; Ali, M.; Wang, Y. Does fiscal decentralization curb the ecological footprint in pakistan? Front. Environ. Sci. 2022, 10, 964212. [Google Scholar] [CrossRef]

- Li, X.; Younas, M.Z.; Andlib, Z.; Ullah, S.; Sohail, S.; Hafeez, M. Examining the asymmetric effects of Pakistan’s fiscal decentralization on economic growth and environmental quality. Environ. Sci. Pollut. Res. 2020, 28, 5666–5681. [Google Scholar] [CrossRef]

- Hossain, M.R.; Rej, S.; Awan, A.; Bandyopadhyay, A.; Islam, S.; Das, N.; Hossain, E. Natural resource dependency and environmental sustainability under N-shaped EKC: The curious case of India. Resour. Policy 2022, 80, 103150. [Google Scholar] [CrossRef]

- Islam, M.; Shahbaz, M.; Sultana, T.; Wang, Z.; Sohag, K.; Abbas, S. Changes in environmental degradation parameters in Bangladesh: The role of net savings, natural resource depletion, technological innovation, and democracy. J. Environ. Manag. 2023, 343, 118190. [Google Scholar] [CrossRef]

- Clemente, J.; Montañés, A.; Reyes, M. Testing for a unit root in variables with a double change in the mean. Econ. Lett. 1998, 59, 175–182. [Google Scholar] [CrossRef]

- Johansen, S. Identifying restrictions of linear equations with applications to simultaneous equations and cointegration. J. Econ. 1995, 69, 111–132. [Google Scholar] [CrossRef]

- Gregory, A.W.; Hansen, B.E. Residual-based tests for cointegration in models with regime shifts. J. Econ. 1996, 70, 99–126. [Google Scholar] [CrossRef]

- Nkoro, E.; Uko, A.K. Autoregressive Distributed Lag (ARDL) cointegration technique: Application and interpretation. J. Stat. Econom. Methods 2016, 5, 63–91. [Google Scholar]

- Kripfganz, S.; Schneider, D.C. ardl: Estimating autoregressive distributed lag and equilibrium correction models. Stata J. Promot. Commun. Stat. Stata 2023, 23, 983–1019. [Google Scholar] [CrossRef]

- Ploberger, W.; Krämer, W.; Kontrus, K. A new test for structural stability in the linear regression model. J. Econ. 1989, 40, 307–318. [Google Scholar] [CrossRef]

- Shukur, G. The robustness of the systemwise breusch-godfrey autocorrelation test for non-normal distributed error terms. Commun. Stat. Simul. Comput. 2000, 29, 419–448. [Google Scholar] [CrossRef]

- Dufour, J.-M.; Khalaf, L.; Bernard, J.-T.; Genest, I. Simulation-based finite-sample tests for heteroskedasticity and ARCH effects. J. Econ. 2004, 122, 317–347. [Google Scholar] [CrossRef]

- Sheikh, S.R. Pakistan Needs to go Beyond the 18th Amendment to End the Military’s Role in Politics. 2023. Available online: https://www.himalmag.com/politics/pakistan-military-beyond-18th-amendment-constitution-politics (accessed on 14 February 2024).

- Mishra, B.R.; Arjun; Tiwari, A.K. Exploring the asymmetric effect of fiscal decentralization on economic growth and environmental quality: Evidence from India. Environ. Sci. Pollut. Res. 2023, 30, 80192–80209. [Google Scholar] [CrossRef]

- Du, K.; Li, P.; Yan, Z. Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol. Forecast. Soc. Chang. 2019, 146, 297–303. [Google Scholar] [CrossRef]

- Cantner, U.; Dettmann, E.; Giebler, A.; Guenther, J.; Kristalova, M. The impact of innovation and innovation subsidies on economic development in German regions. Reg. Stud. 2019, 53, 1284–1295. [Google Scholar] [CrossRef]

- Awosusi, A.A.; Adebayo, T.S.; Kirikkaleli, D.; Altuntaş, M. Role of technological innovation and globalization in BRICS economies: Policy towards environmental sustainability. Int. J. Sustain. Dev. World Ecol. 2022, 29, 593–610. [Google Scholar] [CrossRef]

- Danish; Wang, B.; Wang, Z. Imported technology and CO2 emission in China: Collecting evidence through bound testing and VECM approach. Renew. Sustain. Energy Rev. 2018, 82, 4204–4214. [Google Scholar] [CrossRef]

- Hashmi, S.H.; Hongzhong, F.; Fareed, Z.; Bannya, R. Testing non-linear nexus between service sector and CO2 emissions in Pakistan. Energies 2020, 13, 526. [Google Scholar] [CrossRef]

- Wu, L.; Kaneko, S.; Matsuoka, S. Driving forces behind the stagnancy of China’s energy-related CO2 emissions from 1996 to 1999: The relative importance of structural change, intensity change and scale change. Energy Policy 2005, 33, 319–335. [Google Scholar] [CrossRef]

- Chhabra, M.; Giri, A.K.; Kumar, A. Do trade openness and institutional quality contribute to carbon emission reduction? Evidence from BRICS countries. Environ. Sci. Pollut. Res. 2023, 30, 50986–51002. [Google Scholar] [CrossRef]

- Xiaoman, W.; Majeed, A.; Vasbieva, D.G.; Yameogo, C.E.W.; Hussain, N. Natural resources abundance, economic globalization, and carbon emissions: Advancing sustainable development agenda. Sustain. Dev. 2021, 29, 1037–1048. [Google Scholar] [CrossRef]

| Variable | Indicator | Measurement | Source | References | Mean | ST.D | Min | Max | JB |

|---|---|---|---|---|---|---|---|---|---|

| EQ | Environment quality | Index | Authors’ calculation | Authors’ calculation | 2.940 | 1.000 | 1.872 | 2.132 | 1.217 (0.544) |

| LCO2 | Carbon emission | CO2 emissions (metric tons per capita) | WDI | [39,40] | −0.355 | 0.156 | −0.681 | −0.085 | 0.992 (0.608) |

| LEF | Ecological footprints | Global per hectare | Global Footprint Network | [62] | −0.260 | 0.045 | −0.349 | −0.167 | 0.871 (0.646) |

| LNRD | Natural resource depletion | Natural resources depletion (% of GNI) | WDI | 0.213 | 0.319 | −0.464 | 0.767 | 1.553 (0.460) | |

| LFD | Fiscal decentralization | FD = decentralized revenue/1-non-decentralized expenditure | Authors’ calculation | [62] | 8.441 | 0.348 | 6.907 | 9.465 | 200 (0.000) |

| LTI | Technological Innovation | Patent on environmental related technologies | OECD | [62] | 2.146 | 0.998 | −0.443 | 4.615 | 0.527 (0.768) |

| LPOP | Population | Population, total | WDI | 18.97 | 0.220 | 18.56 | 19.30 | 2.395 (0.301) | |

| LTRADE | Trade openness | Trade (% of GDP) | WDI | [62] | 3.409 | 0.160 | 3.066 | 3.650 | 1.887 (0.389) |

| LFDI | Foreign direct investment | Foreign direct investment, net inflows (% of GDP) | WDI | [29] | −0.237 | 0.553 | −1.172 | 1.110 | 3.354 (0.186) |

| LRD | Revenue decentralization | Authors’ calculation | 3.407 | 2.957 | 0.347 | 8.647 | 4.437 (0.108) | ||

| LED | Expenditure decentralization | Authors’ calculation | 8.151 | 9.031 | 0.195 | 24.814 | 6.004 (0.049) |

| LCO2 | LEF | LNRD | EQ | LFD | LRD | LED | LTI | LNFDI | LPOP | LTRADE | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LCO2 | 1 | ||||||||||

| LEF | −0.105 | 1 | |||||||||

| LNRD | −0.105 | 0.026 | 1 | ||||||||

| EQ | −0.092 | 0.999 | 0.021 | 1 | |||||||

| LFD | −0.139 | −0.227 | 0.059 | −0.230 | 1 | ||||||

| LRD | −0.603 | −0.089 | −0.400 | −0.095 | −0.020 | 1 | |||||

| LED | −0.033 | −0.276 | −0.261 | −0.267 | 0.022 | 0.370 | 1 | ||||

| LTI | −0.537 | 0.238 | 0.331 | 0.232 | −0.073 | 0.091 | −0.299 | 1 | |||

| LFDI | 0.086 | 0.484 | 0.156 | 0.482 | −0.401 | −0.034 | −0.293 | 0.225 | 1 | ||

| LPOP | 0.940 | −0.319 | 0.052 | −0.308 | −0.023 | −0.702 | −0.046 | −0.517 | −0.099 | 1 | |

| LTRADE | −0.408 | 0.029 | −0.083 | 0.025 | −0.274 | 0.613 | 0.022 | 0.338 | 0.362 | −0.497 | 1 |

| Variable | t-Statistic | Critical Value | B.P | t-Statistic | Critical Value | B.P | t-Statistic | Critical Value | B.P | t-Statistic | Critical p-Value 5% | B.P |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Zivot–Andrews structural break unit root test at level | ||||||||||||

| With intercept | With trend | Both intercept and trend | Clemente–Montanes–Reyes | |||||||||

| EQ | −4.165 | −4.80 | 2010 | −4.103 | −4.42 | 2000 | −4.181 | −5.08 | 2010 | −3.889 | −5.490 | 2007,2019 |

| LCO2 | −4.437 | −4.80 | 2010 | −4.056 | −4.42 | 2008 | −4.288 | −5.08 | 2010 | −3.852 | −5.490 | 2003,2015 |

| LEF | −4.141 | −4.80 | 2005 | −4.074 | −4.42 | 2000 | −4.202 | −5.08 | 2015 | −3.868 | −5.490 | 2007,2019 |

| LNRD | −4.504 | −4.80 | 3015 | −3.251 | −4.42 | 2005 | −2.832 | −5.08 | 2010 | −4.006 | −5.490 | 2000,2014 |

| LFD | −5.336 | −4.80 | 2003 | −4.779 | −4.42 | 2003 | −5.345 | −5.08 | 2005 | −0.341 | −5.490 | 2001,2006 |

| LTI | −4.725 | −4.80 | 2003 | −2.829 | −4.42 | 2014 | −4.350 | −5.08 | 2003 | −2.771 | −5.490 | 2003,2014 |

| LPOP | −4.577 | −4.58 | 2012 | −3.085 | −4.42 | 2008 | −3.034 | −5.08 | 2007 | −2.761 | −5.490 | 2001,2011 |

| LTRADE | −3.174 | −4.80 | 2005 | −2.968 | −4.42 | 2001 | −3.982 | −5.08 | 2005 | −2.267 | −5.490 | 1997,2006 |

| LFDI | −3.544 | −4.80 | 2004 | −2.629 | −4.42 | 2007 | −3.593 | −5.08 | 2004 | −4.449 | −5.490 | 2003,2010 |

| LRD | −7.615 | −4.80 | 1998 | −3.769 | −4.42 | 2003 | −7.485 | −5.08 | 1998 | −6.066 | −5.490 | 1999,2017 |

| LED | −3.409 | −4.80 | 2018 | −3.792 | −4.42 | 2016 | −3.700 | −5.08 | 2015 | −4.052 | −5.490 | 2002,2016 |

| Zivot–Andrews structural break unit root test at first difference | ||||||||||||

| EQ | −5.540 | −4.80 | 2002 | −5.347 | −4.42 | 2003 | −5.760 | −5.08 | 2018 | −6.172 | −5.490 | 2005,2015 |

| LCO2 | −5.504 | −4.80 | 2014 | −5.365 | −4.42 | 1998 | −5.478 | −5.08 | 2018 | −5.802 | −5.490 | 2008,2015 |

| LEF | −5.537 | −4.80 | 2013 | −5.342 | −4.42 | 2012 | −5.800 | −5.08 | 2018 | −6.094 | −5.490 | 2005,2015 |

| LNRD | −4.315 | −4.80 | 2006 | −4.479 | −4.42 | 2016 | −4.526 | −5.08 | 2015 | −5.633 | −5.490 | 2007,2013 |

| LFD | −6.021 | −4.80 | 2009 | −5.137 | −4.42 | 2008 | −5.932 | −5.08 | 2009 | −8.871 | −5.490 | 2006,2009 |

| LTI | −8.115 | −4.80 | 1998 | −8.606 | −4.42 | 2004 | −9.048 | −5.08 | 2006 | −6.028 | −5.490 | 1999,2003 |

| LPOP | 4.861 | −4.80 | 2018 | −3.035 | −4.42 | 2018 | −5.793 | −5.08 | 2018 | −5.555 | −5.490 | 2003,2013 |

| LTRADE | −6.389 | −4.80 | 2002 | −5.737 | −4.42 | 1999 | −6.974 | −5.08 | 2002 | −5.961 | −5.490 | 1998,2006 |

| LFDI | −5.858 | −4.80 | 2008 | −5.173 | −4.42 | 2012 | −5.502 | −5.08 | 2008 | −6.325 | −5.490 | 1998,2007 |

| LRD | −7.261 | −4.80 | 1998 | −6.508 | −4.42 | 1999 | −7.981 | −5.08 | 2001 | −8.700 | −5.490 | 1996,2016 |

| LED | −5.591 | −4.80 | 2001 | −5.131 | −4.42 | 2012 | −6.000 | −5.08 | 2001 | −6.477 | −5.490 | 1997,2016 |

| Hypothesis | Trace Statistics | 5% Critical Value | Max-Eigen Statistics | 5% Critical Value |

|---|---|---|---|---|

| None * | 483.890 *** | 197.370 | 140.725 *** | 58.433 |

| At most 1 * | 343.165 *** | 159.529 | 91.824 *** | 52.362 |

| At most 2 * | 251.340 *** | 125.615 | 74.050 *** | 46.231 |

| At most 3 * | 177.290 *** | 95.753 | 62.381 *** | 40.077 |

| At most 4 * | 114.909 *** | 69.818 | 48.948 *** | 33.876 |

| At most 5 * | 65.960 *** | 47.856 | 35.193 *** | 27.584 |

| At most 6 * | 30.767 ** | 29.797 | 19.874 * | 21.131 |

| At most 7 | 10.892 | 15.494 | 8.678 | 14.264 |

| Statistic | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| ADF | −5.89 * | −7.50 ** | −7.64 ** | −7.47 *** |

| Zt | −5.99 | −7.62 ** | −8.22 ** | −7.59 *** |

| B.P | 2009 | 2013 | 2014 | 2013 |

| Equations | Null Hypothesis: No Long-Run Relationships Exist | |||

|---|---|---|---|---|

| Model 1; K = 5 | Model 2; K = 5 | Model 3; K = 5 | Model 3; K = 5 | |

| F-Statistic | F-Statistic | F-Statistic | F-Statistic | |

| Equation (1) | 6.186 | 13.641 | 22.862 | 6.431 |

| Equation (2) | 7.082 | 21.011 | 60.521 | 17.452 |

| Equation (3) | 5.082 | 13.075 | 40.775 | 20.271 |

| Equation (4) | 8.031 | 25.192 | 34.283 | 16.042 |

| Critical Value Bounds | ||||

| Significance | I0 Bound | I1 Bound | ||

| 10% | 2.08 | 3.00 | ||

| 5% | 2.39 | 3.38 | ||

| 1% | 3.06 | 4.15 | ||

| Model 1 | |||||||

| Equations | Dependent Variables | Independent Variables | |||||

| LFD | LTI | LFDI | LPOP | LTRADE | CointEq(−1) * | ||

| Equation (1) | LCO2 | 0.157 ** (0.042) | −0.056 *** (0.00) | 0.092 *** (0.00) | 0.154 ** (0.046) | 0.238 ** (0.019) | −0.191 |

| Equation (2) | LEF | 0.111 ** (0.035) | −0.021 ** (0.036) | 0.134 *** (0.00) | 0.192 ** (0.018) | 0.112 ** (0.028) | −0.59 |

| Equation (3) | LNRD | 0.086 ** (0.03) | −0.264 *** (0.00) | 0.356 *** (0.00) | 0.114 *** (0.00) | 0.464 ** (0.018) | −0.979 |

| Equation (4) | EQ | 2.463 ** (0.045) | −0.489 ** (0.041) | 2.961 *** (0.00) | 4.246 ** (0.023) | 2.501 ** (0.034) | −0.599 |

| Model 2 | |||||||

| D.V | LRD | LTI | LFDI | LPOP | LTRADE | CointEq(−1) * | |

| Equation (1) | LCO2 | 0.002 (0.405) | −0.039 ** (0.01) | 0.103 *** (0.00) | 0.320 ** (0.016) | 0.170 ** (0.039) | −0.892 |

| Equation (2) | LEF | 0.003 ** (0.038) | −0.011 ** (0.089) | 0.094 *** (0.00) | 0.024 * (0.066) | 0.219 *** (0.006) | −0.757 |

| Equation (3) | LNRD | 0.022 ** (0.041) | −0.280 *** (0.001) | 0.256 *** (0.009) | 2.702 *** (0.00) | 0.949 ** (0.018) | −0.677 |

| Equation (4) | EQ | 0.084 ** (0.034) | −0.276 * (0.075) | 2.100 *** (0.00) | 0.841 *** (0.009) | 4.928 *** (0.007) | −0.607 |

| Model 3 | |||||||

| D.V | LED | LTI | LFDI | LPOP | LTRADE | CointEq(−1) * | |

| Equation (1) | LCO2 | 0.010 ** (0.046) | −0.070 *** (0.00) | 0.129 *** (0.00) | 0.024 ** (0.023) | −0.049 (0.442) | −0.687 |

| Equation (2) | LEF | 0.012 * (0.097) | −0.006 (0.544) | 0.056 ** (0.046) | 0.017 (0.136) | 0.206 ** (0.047) | −0.98 |

| Equation (3) | LNRD | 0.016 ** (0.053) | −0.398 *** (0.00) | 0.201 *** (0.022) | 3.704 *** (0.00) | 0.294 * (0.065) | −0.722 |

| Equation (4) | EQ | 0.155 ** (0.036) | −0.127 (0.425) | 0.897 ** (0.017) | 0.300 ** (0.032) | 1.950 *** (0.042) | −0.795 |

| Model 4 | |||||||

| D.V | LED | LTI | LFDI | LPOP | LTRADE | Structural break | |

| Equation (1) | LCO2 | 0.488 *** (0.001) | −0.116 *** (0.000) | 0.220 *** (0.000) | −0.217 *** (0.001) | −0.192 *** (0.007) | 0.292 *** (0.002) |

| Equation (2) | LEF | 0.023 ** (0.071) | −0.021 * (0.069) | 0.199 *** (0.000) | 0.136 *** (0.000) | 0.052 *** (0.001) | 0.042 ** (0.048) |

| Equation (3) | LNRD | 0.016 * (0.081) | 0.263 *** (0.000) | 14.82 *** (0.000) | 0.489 *** (0.000) | −0.124 ** (0.014) | −0.543 *** (0.000) |

| Equation (4) | EQ | 0.017 * (0.097) | −0.448 * (0.083) | 4.299 *** (0.000) | 3.040 *** (0.000) | 1.165 *** (0.001) | 0.888 * (0.061) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Memon, R.U.R.; Ahmed, F. From Budgets to Biodiversity: How Fiscal Decentralization Shapes Environmental Sustainability in Pakistan. Sustainability 2025, 17, 9561. https://doi.org/10.3390/su17219561

Memon RUR, Ahmed F. From Budgets to Biodiversity: How Fiscal Decentralization Shapes Environmental Sustainability in Pakistan. Sustainability. 2025; 17(21):9561. https://doi.org/10.3390/su17219561

Chicago/Turabian StyleMemon, Rafique Ur Rehman, and Farhan Ahmed. 2025. "From Budgets to Biodiversity: How Fiscal Decentralization Shapes Environmental Sustainability in Pakistan" Sustainability 17, no. 21: 9561. https://doi.org/10.3390/su17219561

APA StyleMemon, R. U. R., & Ahmed, F. (2025). From Budgets to Biodiversity: How Fiscal Decentralization Shapes Environmental Sustainability in Pakistan. Sustainability, 17(21), 9561. https://doi.org/10.3390/su17219561