Can Technological, Organisational and Environmental Factors Reduce Costs Through Green Innovation in the Construction Industry? Comparison of State-Owned and Private Enterprises

Abstract

1. Introduction

2. Literature Review

2.1. TOE Framework

2.2. Green Innovation Adoption

2.3. Contextual Factors of Green Innovation Adoption

2.4. Green Innovation Adoption and Cost Reduction

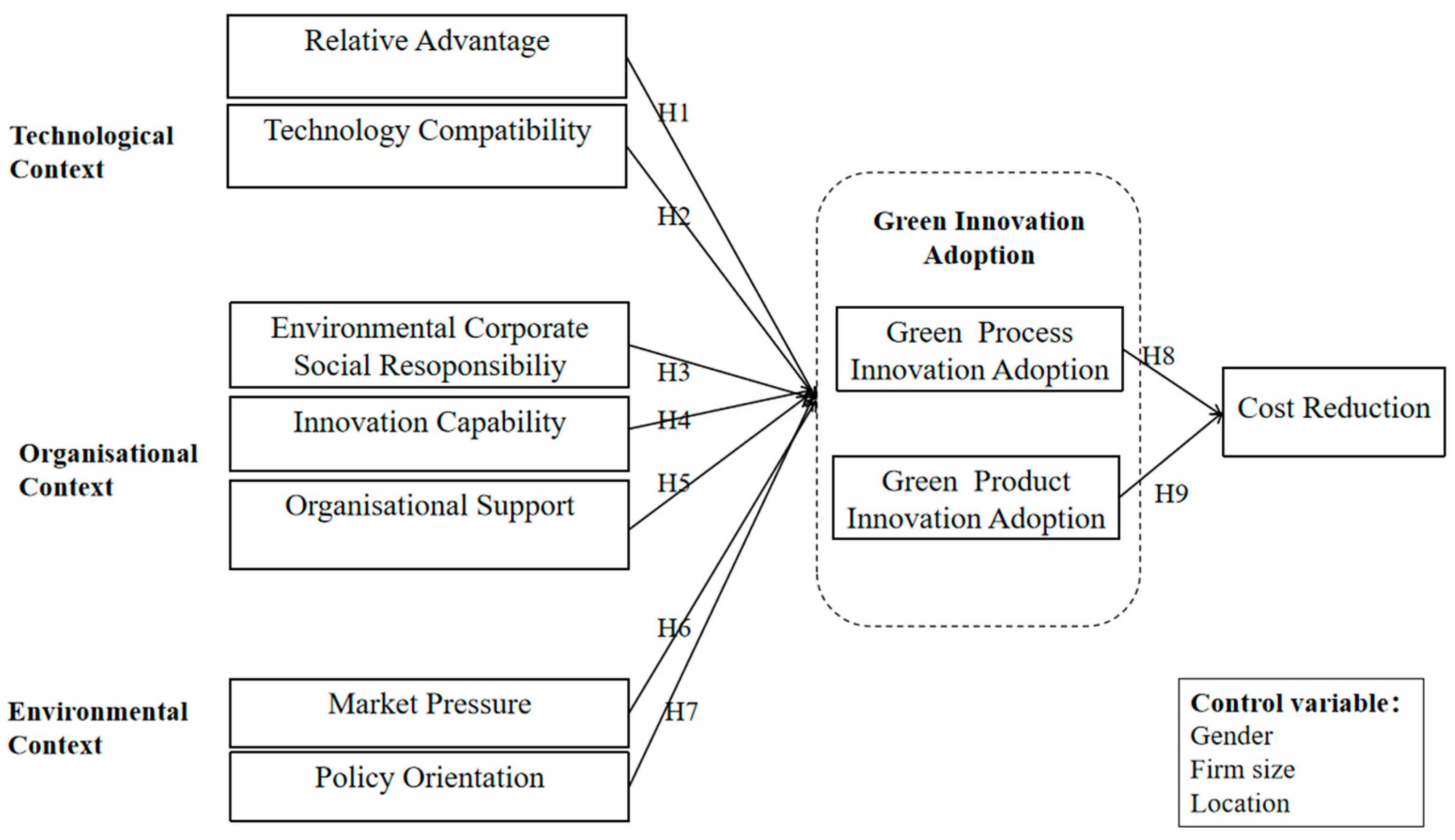

3. Hypotheses’ Development

3.1. Technological Context

3.2. Organisational Context

3.3. Environmental Context

3.4. Green Innovation and Cost Reduction

4. Research Method

4.1. Sample and Sampling Method

4.2. Instrument

5. Results

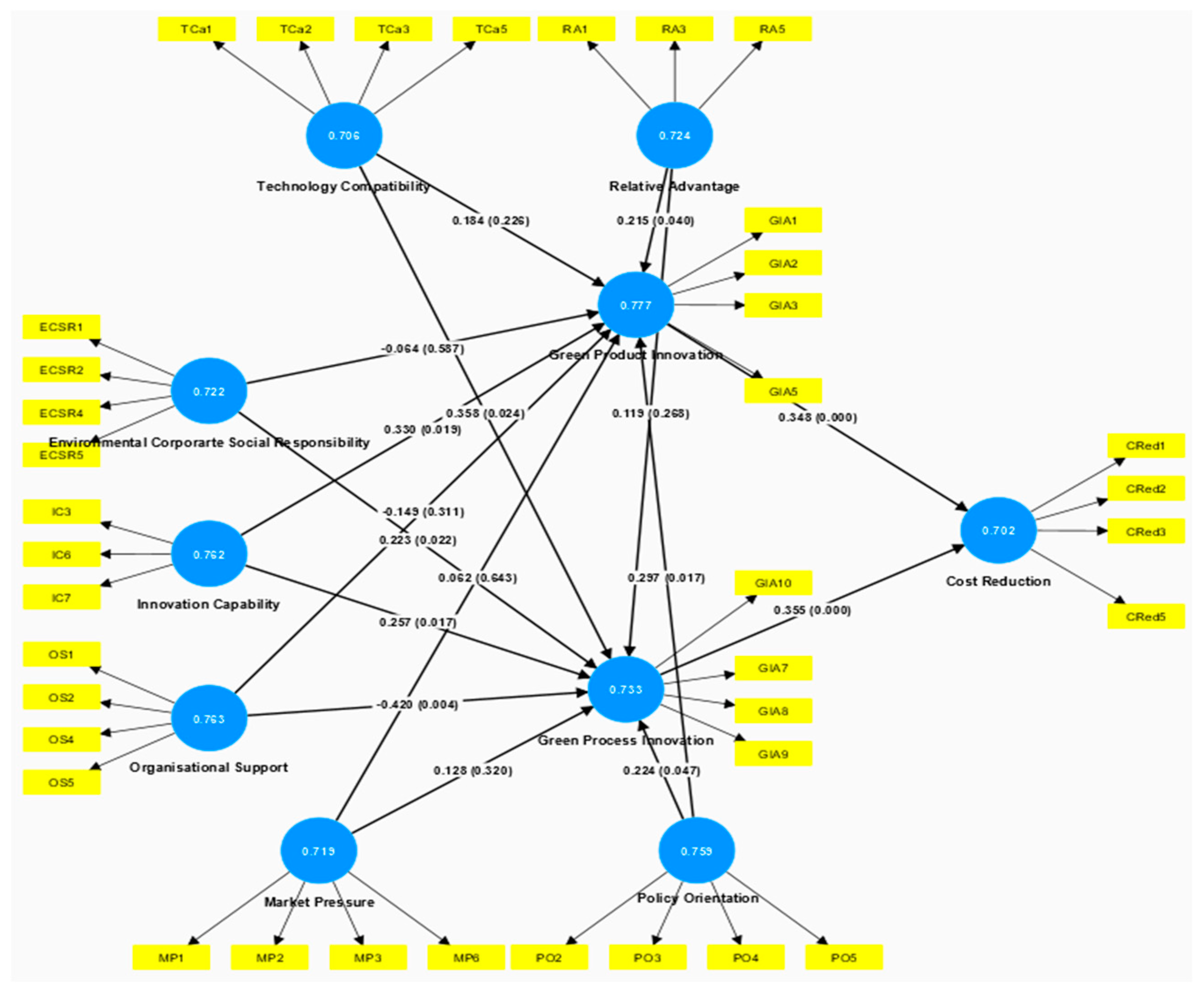

5.1. Measurement Model Analysis (SOEs)

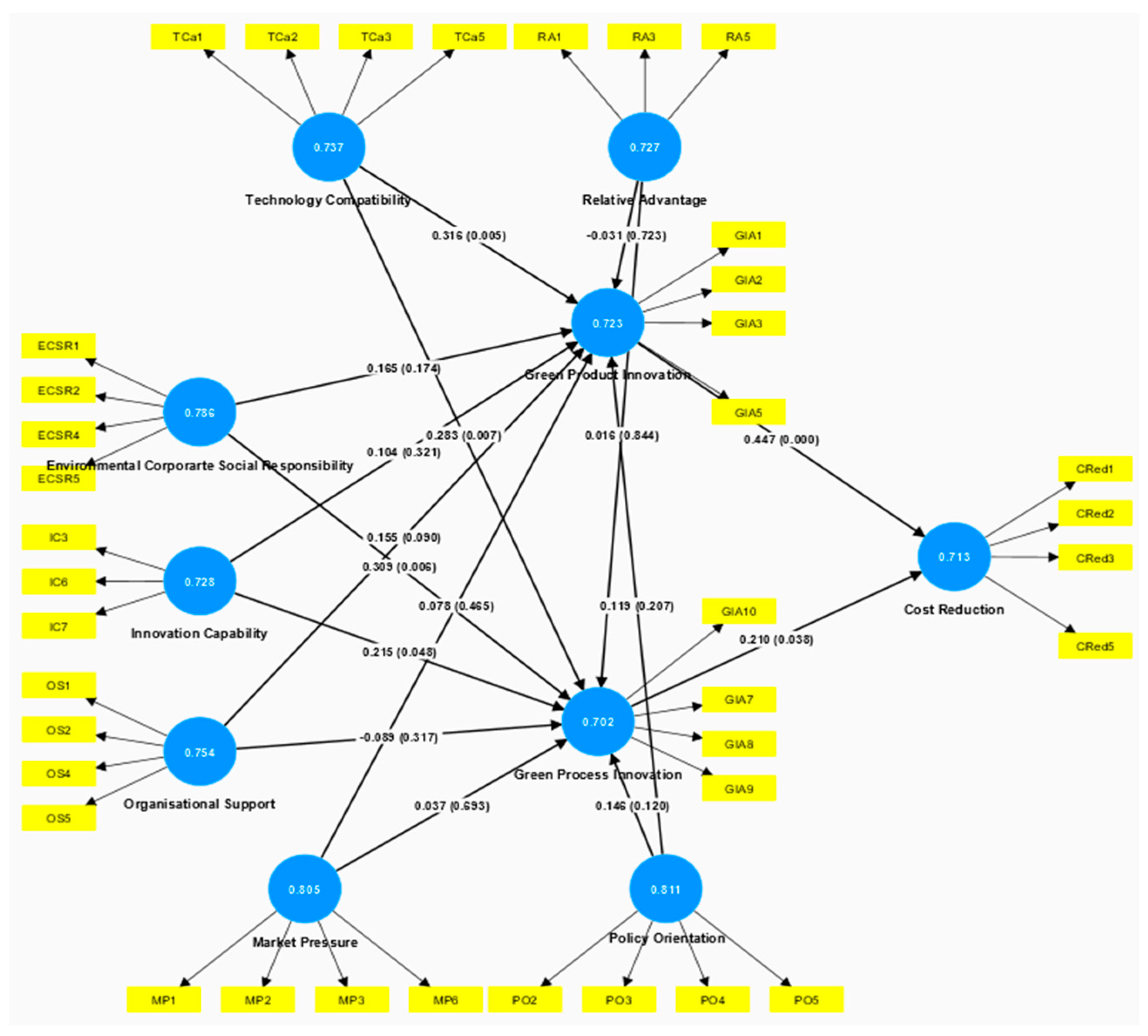

5.2. Measurement Model Analysis (Private Enterprises)

5.3. Structural Model Comparison Analysis Between State-Owned and Private Enterprises

5.4. Multiple-Group Analysis

6. Discussion

6.1. Discussion and Implications

6.1.1. Theoretical Implications

6.1.2. Discussion and Managerial Implications

6.2. Limitations and Recommendations of Research

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | Items | Sources | |

|---|---|---|---|

| Cost Reduction | CRed1: After applying green innovation, the cost for materials purchasing of the company has decreased over the last 3 years. | [74] | |

| CRed2: After applying green innovation, the cost for energy consumption of the company has decreased during the last 3 years. | |||

| CRed3: After applying green innovation, the cost on waste disposal of the company has decreased during the last 3 years. | |||

| CRed5: After applying green innovation, the fine for environmental accidents of the company has decreased during the last 3 years. | |||

| Green Innovation Adoption | Green Product Innovation | GIA1: Our firm’s emphasis on developing new green products (such as green buildings). | [75,76] |

| GIA2: Our firm develops new green products to recycle. | |||

| GIA3: Our firm develops new green products that easily decompose their materials. | |||

| GIA5: Our firm develops new green products to use as little energy and resources as possible. | |||

| Green Process Innovation | GIA7: Our firm has a recycling system in the construction process. | [75,77,78] | |

| GIA8: Our firm updates operating processes to meet the standards of environmental law. | |||

| GIA9: Our firm uses innovative technologies in its operating processes to save energy and resources (e.g., water, electricity, fuel). | |||

| GIA10: Our firm reduces the emission of hazardous substances or waste during the construction process. | |||

| Technology Compatibility | TCa1: The technologies adopted for green innovation meet our operational needs. | [13,79] | |

| TCa2: The technologies adopted for green innovation match the requirements of suppliers/customers. | |||

| TCa3: The technologies adopted for green innovation are compatible with our existing green practices. | |||

| TCa5: The technologies adopted for green innovation are easy to integrate with a company’s existing system. | |||

| Relative Advantage | RA1: The technologies adopted for green innovation increase operational efficiency. | [13] | |

| RA3: The technologies adopted for green innovation reduce the cost of resources. | |||

| RA5: The technologies adopted for green innovation can provide higher economic benefits. | |||

| Organisational support | OS1: Our firm has the infrastructure to implement the technologies adopted for green innovation. | [33,73] | |

| OS2: Our firm has skilled workers to manage green innovation. | |||

| OS4: Our firm provides rewards for employees’ green behaviour. | |||

| OS5: Top management in my firm provides adequate resources to support green innovation. | |||

| Innovation Capability | IC3: Our firm has the courage to try new ways of taking green action. | [57,80] | |

| IC6: Our firm commits to green innovation implementation. | |||

| IC7: Our firm has a long-term strategy to invest in green innovation. | |||

| Environmental Corporate Social Responsibility | ECSR1: We are committed to not using natural resources that are in danger of depletion. | [39,81] | |

| ECSR2: Our firm participates in activities that aim to protect and improve the quality of the natural environment. | |||

| ECSR4: Our firm conforms to the requirements of environmental management. | |||

| ECSR5: Our firm respects and protects the natural environment. | |||

| Market Pressure | MP1: Our down/upper stream suppliers expect our firm to adopt green innovation. | [82] | |

| MP2: Our shareholders/investors expect our firm to adopt green innovation. | |||

| MP3: Our customers expect us to adopt green innovation. | |||

| MP6: Customer green demands stimulate us in our environmental efforts. | |||

| Policy Orientation | PO2: The government provides financial support for adopting green innovation. | [102] | |

| PO3: The government provides technical assistance for adopting green innovation. | |||

| PO4: The government provides tax-saving measures for adopting green innovation. | |||

| PO5: There is legislation that protects companies to adopting green technologies. | |||

References

- Zhao, Z.; Zhao, Y.; Lv, X.; Li, X.; Zheng, L.; Fan, S.; Zuo, S. Environmental Regulation and Green Innovation: Does State Ownership Matter? Energy Econ. 2024, 136, 107762. [Google Scholar] [CrossRef]

- Li, X.; Liu, X.; Huang, Y.; Li, J.; He, J.; Dai, J. Evolutionary Mechanism of Green Innovation Behavior in Construction Enterprises: Evidence from the Construction Industry. Eng. Constr. Archit. Manag. 2024, 31, 159–178. [Google Scholar] [CrossRef]

- Meena, C.S.; Kumar, A.; Jain, S.; Rehman, A.U.; Mishra, S.; Sharma, N.K.; Bajaj, M.; Shafiq, M.; Eldin, E.T. Innovation in Green Building Sector for Sustainable Future. Energies 2022, 15, 6631. [Google Scholar] [CrossRef]

- Agrawal, R.; Agrawal, S.; Samadhiya, A.; Kumar, A.; Luthra, S.; Jain, V. Adoption of Green Finance and Green Innovation for Achieving Circularity: An Exploratory Review and Future Directions. Geosci. Front. 2024, 15, 101669. [Google Scholar] [CrossRef]

- Gao, Y.; Hafsi, T. Government Intervention, Peers’ Giving and Corporate Philanthropy: Evidence from Chinese Private SMEs. J. Bus. Ethics 2015, 132, 433–447. [Google Scholar] [CrossRef]

- Jiang, W.; Wang, A.X.; Zhou, K.Z.; Zhang, C. Stakeholder Relationship Capability and Firm Innovation: A Contingent Analysis. J. Bus. Ethics 2020, 167, 111–125. [Google Scholar] [CrossRef]

- Pan, X.; Chen, X.; Sinha, P.; Dong, N. Are Firms with State Ownership Greener? An Institutional Complexity View. Bus. Strategy Environ. 2020, 29, 197–211. [Google Scholar] [CrossRef]

- Wang, K.; Jiang, W. State Ownership and Green Innovation in China: The Contingent Roles of Environmental and Organizational Factors. J. Clean. Prod. 2021, 314, 128029. [Google Scholar] [CrossRef]

- Khan, M.A.; Meng, B.; Ullah, I. Uncertainty and Green Innovation Nexus: The Moderating Influence of Ownership Structure and Product Market Competition. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 3262–3277. [Google Scholar] [CrossRef]

- Wang, Y.; Hu, J.; Hu, Y.; Wang, Y. Which Is More Effective: The Carrot or the Stick? Environmental Policy, Green Innovation and Enterprise Energy Efficiency–A Quasi-Natural Experiment from China. Front. Environ. Sci. 2022, 10, 870713. [Google Scholar] [CrossRef]

- Lee, B.; Park, S.K. A Study on the Competitiveness for the Diffusion of Smart Technology of Construction Industry in the Era of 4th Industrial Revolution. Sustainability 2022, 14, 8348. [Google Scholar] [CrossRef]

- Li, Y.; Yaacob, M.H.; Xie, T. Effects of China’s Low Carbon Pilot City Policy on Corporate Green Innovation: Considering the Mediating Role of Public Environmental Concern. Financ. Res. Lett. 2024, 65, 105641. [Google Scholar] [CrossRef]

- Zhang, Y.; Sun, J.; Yang, Z.; Wang, Y. Critical Success Factors of Green Innovation: Technology, Organization and Environment Readiness. J. Clean. Prod. 2020, 264, 121701. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovation, 4th ed.; The Free Press: New York, NY, USA, 1983. [Google Scholar]

- Mohammed, F.; Alzahrani, A.I.; Alfarraj, O.; Ibrahim, O. Cloud Computing Fitness for E-Government Implementation: Importance-Performance Analysis. IEEE Access 2017, 6, 1236–1248. [Google Scholar] [CrossRef]

- Afum, E.; Agyabeng-Mensah, Y.; Baah, C.; Asamoah, G.; Yaw Kusi, L. Green Market Orientation, Green Value-Based Innovation, Green Reputation and Enterprise Social Performance of Ghanaian SMEs: The Role of Lean Management. J. Bus. Ind. Mark. 2023, 38, 2151–2169. [Google Scholar] [CrossRef]

- Na, S.; Heo, S.; Han, S.; Shin, Y.; Roh, Y. Acceptance Model of Artificial Intelligence (AI)-Based Technologies in Construction Firms: Applying the Technology Acceptance Model (TAM) in Combination with the Technology–Organisation–Environment (TOE) Framework. Buildings 2022, 12, 90. [Google Scholar] [CrossRef]

- Chittipaka, V.; Kumar, S.; Sivarajah, U.; Bowden, J.L.H.; Baral, M.M. Blockchain Technology for Supply Chains Operating in Emerging Markets: An Empirical Examination of Technology-Organization-Environment (TOE) Framework. Ann. Oper. Res. 2023, 327, 465–492. [Google Scholar] [CrossRef]

- Ali, A.; Ma, L.; Shahzad, M.; Musonda, J.; Hussain, S. How Various Stakeholder Pressure Influences Mega-Project Sustainable Performance through Corporate Social Responsibility and Green Competitive Advantage. Environ. Sci. Pollut. Res. 2023, 31, 67244–67258. [Google Scholar] [CrossRef]

- Aish, K.; Ehsan Assistant Professor, S.; Haider Zaidi Assistant Professor, A. Nexus of Environmental Corporate Social Responsibility (ECSR) and Green Dynamic Capability and Their Role in Green Technological Innovation. Sustain. Futures 2025, 9, 100647. [Google Scholar] [CrossRef]

- Bataineh, M.J.; Sánchez-Sellero, P.; Ayad, F. The Role of Organizational Innovation in the Development of Green Innovations in Spanish Firms. Eur. Manag. J. 2024, 42, 527–538. [Google Scholar] [CrossRef]

- Qi, G.; Jia, Y.; Zou, H. Is Institutional Pressure the Mother of Green Innovation? Examining the Moderating Effect of Absorptive Capacity. J. Clean. Prod. 2021, 278, 123957. [Google Scholar] [CrossRef]

- Alyahya, M.; Aliedan, M.; Agag, G.; Abdelmoety, Z.H. Exploring the Link between Sustainable Development Practices, Institutional Pressures, and Green Innovation. Sustainability 2022, 14, 4312. [Google Scholar] [CrossRef]

- Tran, N.K.H. Customer Pressure and Creating Green Innovation: The Role of Green Thinking and Green Creativity. Sustain. Futures 2024, 7, 100177. [Google Scholar] [CrossRef]

- Thomas, A.; Scandurra, G.; Carfora, A. Adoption of Green Innovations by SMEs: An Investigation about the Influence of Stakeholders. Eur. J. Innov. Manag. 2021, 25, 44–63. [Google Scholar] [CrossRef]

- Mady, K.; Abi, M.; Halim, S.A.; Omar, K.; Battour, M.; Abdelkareem, R.S. Environmental Pressures and Eco-Innovation in Manufacturing SMEs: The Mediating Effect of Environmental Capabilities. Int. J. Innov. Sci. 2023; ahead-of-print. [Google Scholar] [CrossRef]

- Tu, Y.; Wu, W. How Does Green Innovation Improve Enterprises’ Competitive Advantage? The Role of Organizational Learning. Sustain. Prod. Consum. 2021, 26, 504–516. [Google Scholar] [CrossRef]

- Singh, S.K.; Del Giudice, M.; Chiappetta Jabbour, C.J.; Latan, H.; Sohal, A.S. Stakeholder Pressure, Green Innovation, and Performance in Small and Medium-Sized Enterprises: The Role of Green Dynamic Capabilities. Bus. Strategy Environ. 2022, 31, 500–514. [Google Scholar] [CrossRef]

- Junaid, M.; Zhang, Q.; Syed, M.W. Effects of Sustainable Supply Chain Integration on Green Innovation and Firm Performance. Sustain. Prod. Consum. 2022, 30, 145–157. [Google Scholar] [CrossRef]

- Wong, C.Y.; Wong, C.W.Y.; Boon-itt, S. Effects of Green Supply Chain Integration and Green Innovation on Environmental and Cost Performance. Int. J. Prod. Res. 2020, 58, 4589–4609. [Google Scholar] [CrossRef]

- Tornatzky, L.G.; Fleischer, M. The Processes of Technological Innovation; Lexington Books: Blue Ridge Summit, PA, USA, 1990. [Google Scholar]

- Bryan, J.D.; Zuva, T. A Review on TAM and TOE Framework Progression and How These Models Integrate. Adv. Sci. Technol. Eng. Syst. J. 2021, 6, 137–145. [Google Scholar] [CrossRef]

- Phoong, S.W.; Phoong, S.Y.; Ho, S.T. Technology, Organisation and Environment Factor on Mobile Payment Implementation: Focus on SMEs in Malaysia. Int. J. Mob. Commun. 2022, 20, 519–540. [Google Scholar] [CrossRef]

- Abdul, Q.; Jiang, X. Environmental Protection Policy and Green Innovation in China. Appl. Econ. Lett. 2024, 32, 2040–2044. [Google Scholar] [CrossRef]

- Wang, M.; Li, Y.; Li, J.; Wang, Z. Green Process Innovation, Green Product Innovation and Its Economic Performance Improvement Paths: A Survey and Structural Model. J. Environ. Manag. 2021, 297, 113282. [Google Scholar] [CrossRef] [PubMed]

- Hammond, S.F.; Gajendran, T.; Savage, D.A.; Maund, K. Unpacking the Problems behind the Limited Green Construction Adoption: Towards a Theoretical Model. Eng. Constr. Archit. Manag. 2020, 28, 833–844. [Google Scholar] [CrossRef]

- Call, D.R.; Herber, D.R. Applicability of the Diffusion of Innovation Theory to Accelerate Model-Based Systems Engineering Adoption. Syst. Eng. 2022, 25, 574–583. [Google Scholar] [CrossRef]

- Hosseinikhah Choshaly, S. Applying Innovation Attributes to Predict Purchase Intention for the Eco-Labeled Products: A Malaysian Case Study. Int. J. Innov. Sci. 2019, 11, 583–599. [Google Scholar] [CrossRef]

- Li, W.; Bhutto, M.Y.; Waris, I.; Hu, T. The Nexus between Environmental Corporate Social Responsibility, Green Intellectual Capital and Green Innovation towards Business Sustainability: An Empirical Analysis of Chinese Automobile Manufacturing Firms. Int. J. Environ. Res. Public Health 2023, 20, 1851. [Google Scholar] [CrossRef]

- Aas, T.H.; Breunig, K.J. Conceptualizing Innovation Capabilities: A Contingency Perspective. J. Entrep. Manag. Innov. 2017, 13, 7–24. [Google Scholar] [CrossRef]

- Li, B.; Lei, Y.; Hu, M.; Li, W. The Impact of Policy Orientation on Green Innovative Performance: The Role of Green Innovative Capacity and Absorptive Capacity. Front. Environ. Sci. 2022, 10, 842133. [Google Scholar] [CrossRef]

- Ståhl, T.; Rütten, A.; Nutbeam, D.; Kannas, L. The Importance of Policy Orientation and Environment on Physical Activity Participation—A Comparative Analysis between Eastern Germany, Western Germany and Finland. Health Promot. Int. 2002, 17, 235–246. [Google Scholar] [CrossRef]

- Ooi, S.K.; Memon, C.A. The Role of CSR Oriented Organisational Culture in Eco-Innovation Practices. World Rev. Entrep. Manag. Sustain. Dev. 2020, 16, 538–556. [Google Scholar] [CrossRef]

- Stojčić, N. Social and Private Outcomes of Green Innovation Incentives in European Advancing Economies. Technovation 2021, 104, 102270. [Google Scholar] [CrossRef]

- You, D.; Zhang, Y.; Yuan, B. Environmental Regulation and Firm Eco-Innovation: Evidence of Moderating Effects of Fiscal Decentralization and Political Competition from Listed Chinese Industrial Companies. J. Clean. Prod. 2019, 207, 1072–1083. [Google Scholar] [CrossRef]

- Chai, K.C.; Zhu, J.; Lan, H.R.; Jin, C.; Lu, Y.; Chang, K.C. Research on the Mechanism of China’s Energy Saving and Emission Reduction Policy on Green Innovation in Enterprises. Front. Environ. Sci. 2022, 10, 930534. [Google Scholar] [CrossRef]

- Gualandris, J.; Kalchschmidt, M. Customer Pressure and Innovativeness: Their Role in Sustainable Supply Chain Management. J. Purch. Supply Manag. 2014, 20, 92–103. [Google Scholar] [CrossRef]

- Elgin, C. The Profit Paradox: Inseparability of Maximization and Prioritization in Corporate Strategy. 2025. Available online: https://hal.science/hal-04937328v1 (accessed on 20 June 2025).

- Becker, B. Green Innovation Strategies, Innovation Success, and Firm Performance—Evidence from a Panel of Spanish Firms. Sustainability 2023, 15, 1656. [Google Scholar] [CrossRef]

- Barforoush, N.; Etebarian, A.; Naghsh, A.; Shahin, A. Green Innovation a Strategic Resource to Attain Competitive Advantage. Int. J. Innov. Sci. 2021, 13, 645–663. [Google Scholar] [CrossRef]

- Christiansen, V.; Haddara, M.; Langseth, M. Factors Affecting Cloud ERP Adoption Decisions in Organizations. Procedia Comput. Sci. 2021, 196, 255–262. [Google Scholar] [CrossRef]

- Min, S.; So, K.K.F.; Jeong, M. Consumer Adoption of the Uber Mobile Application: Insights from Diffusion of Innovation Theory and Technology Acceptance Model. J. Travel Tour. Mark. 2019, 36, 770–783. [Google Scholar] [CrossRef]

- Chang, C.H. The Influence of Corporate Environmental Ethics on Competitive Advantage: The Mediation Role of Green Innovation. J. Bus. Ethics 2011, 104, 361–370. [Google Scholar] [CrossRef]

- Li, D.; Wang, L.F. Does Environmental Corporate Social Responsibility (ECSR) Promote Green Product and Process Innovation? Manag. Decis. Econ. 2022, 43, 1439–1447. [Google Scholar] [CrossRef]

- Kraus, S.; Rehman, S.U.; García, F.J.S. Corporate Social Responsibility and Environmental Performance: The Mediating Role of Environmental Strategy and Green Innovation. Technol. Forecast. Soc. Change 2020, 160, 120262. [Google Scholar] [CrossRef]

- Borah, P.S.; Dogbe, C.S.K.; Pomegbe, W.W.K.; Bamfo, B.A.; Hornuvo, L.K. Green Market Orientation, Green Innovation Capability, Green Knowledge Acquisition and Green Brand Positioning as Determinants of New Product Success. Eur. J. Innov. Manag. 2021, 26, 364–385. [Google Scholar] [CrossRef]

- Ceptureanu, S.I.; Ceptureanu, E.G.; Popescu, D.; Orzan, O.A. Eco-Innovation Capability and Sustainability Driven Innovation Practices in Romanian SMEs. Sustainability 2020, 12, 7106. [Google Scholar] [CrossRef]

- Akunyumu, S.; Fugar, F.D.K.; Adinyira, E.; Danku, J.C. A Review of Models for Assessing Readiness of Construction Organisations to Innovate. Constr. Innov. 2021, 21, 279–299. [Google Scholar] [CrossRef]

- Panuwatwanich, K.; Stewart, R.A. Evaluating Innovation Diffusion Readiness among Architectural and Engineering Design Firms: Empirical Evidence from Australia. Autom. Constr. 2012, 27, 50–59. [Google Scholar] [CrossRef]

- Shafait, Z.; Huang, J. Examining the Impact of Sustainable Leadership on Green Knowledge Sharing and Green Learning: Understanding the Roles of Green Innovation and Green Organisational Performance. J. Clean. Prod. 2024, 457, 142402. [Google Scholar] [CrossRef]

- Chen, X.; Yi, N.; Zhang, L.; Li, D. Does Institutional Pressure Foster Corporate Green Innovation? Evidence from China’s Top 100 Companies. J. Clean. Prod. 2018, 188, 304–311. [Google Scholar] [CrossRef]

- Lin, R.-J.; Chen, R.-H.; Ho, T.-M. Market Demand, Green Innovation, and Firm Performance: Evidence from Hybrid Vehicle Industry. In Proceedings of the 2013 International Conference on Technology Innovation and Industrial Management, Phuket, Thailand, 29–31 May 2013. [Google Scholar]

- Song, M.; Zheng, W.; Wang, S. Measuring Green Technology Progress in Large-Scale Thermoelectric Enterprises Based on Malmquist–Luenberger Life Cycle Assessment. Resour. Conserv. Recycl. 2017, 122, 261–269. [Google Scholar] [CrossRef]

- Zhang, D.; Zheng, M.; Feng, G.F.; Chang, C.P. Does an Environmental Policy Bring to Green Innovation in Renewable Energy? Renew. Energy 2022, 195, 1113–1124. [Google Scholar] [CrossRef]

- Lin, W.L.; Cheah, J.H.; Azali, M.; Ho, J.A.; Yip, N. Does Firm Size Matter? Evidence on the Impact of the Green Innovation Strategy on Corporate Financial Performance in the Automotive Sector. J. Clean. Prod. 2019, 229, 974–988. [Google Scholar] [CrossRef]

- Dai, R.; Zhang, J. Green Process Innovation and Differentiated Pricing Strategies with Environmental Concerns of South-North Markets. Transp. Res. E Logist. Transp. Rev. 2017, 98, 132–150. [Google Scholar] [CrossRef]

- Aastvedt, T.M.; Behmiri, N.B.; Lu, L. Does Green Innovation Damage Financial Performance of Oil and Gas Companies? Resour. Policy 2021, 73, 102235. [Google Scholar] [CrossRef]

- Wang, N.; Zhang, J.; Zhang, X.; Wang, W. How to Improve Green Innovation Performance: A Conditional Process Analysis. Sustainability 2022, 14, 2938. [Google Scholar] [CrossRef]

- Kock, N.; Hadaya, P. Minimum Sample Size Estimation in PLS-SEM: The Inverse Square Root and Gamma-Exponential Methods. Inf. Syst. J. 2018, 28, 227–261. [Google Scholar] [CrossRef]

- Hidayat, M.; Bachtiar, N.; Sjafrizal; Primayesa, E. The Influence of Investment, Energy Infrastructure, and Human Capital Towards Convergence of Regional Disparities in Sumatra Island, Indonesia; Using Oil and Gas Data and Without Oil and Gas. Int. J. Energy Econ. Policy 2023, 13, 139–149. [Google Scholar] [CrossRef]

- Medase, S.K. Product Innovation and Employees’ Slack Time. The Moderating Role of Firm Age&size. J. Innov. Knowl. 2020, 5, 151–174. [Google Scholar]

- Ha, N.M.; Nguyen, P.A.; Luan, N.V.; Tam, N.M. Impact of Green Innovation on Environmental Performance and Financial Performance. Environ. Dev. Sustain. 2024, 26, 17083–17104. [Google Scholar] [CrossRef]

- Lin, C.Y.; Ho, Y.H. Determinants of Green Practice Adoption for Logistics Companies in China. J. Bus. Ethics 2011, 98, 67–83. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J. The Moderating Effects of Institutional Pressures on Emergent Green Supply Chain Practices and Performance. Int. J. Prod. Res. 2007, 45, 4333–4355. [Google Scholar] [CrossRef]

- Peng, X.; Liu, Y. Behind Eco-Innovation: Managerial Environmental Awareness and External Resource Acquisition. J. Clean. Prod. 2016, 139, 347–360. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, J.; Xue, Y.; Yang, J. Impact of Environmental Regulations on Green Technological Innovative Behavior: An Empirical Study in China. J. Clean. Prod. 2018, 188, 763–773. [Google Scholar] [CrossRef]

- Chiou, T.-Y.; Chan, H.K.; Lettice, F.; Chung, S.H. The Influence of Greening the Suppliers and Green Innovation on Environmental Performance and Competitive Advantage in Taiwan. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 822–836. [Google Scholar] [CrossRef]

- Singh, S.K.; Giudice, M.D.; Chierici, R.; Graziano, D. Green Innovation and Environmental Performance: The Role of Green Transformational Leadership and Green Human Resource Management. Technol. Forecast. Soc. Change 2020, 150, 119762. [Google Scholar] [CrossRef]

- Mouakket, S.; Aboelmaged, M. Drivers and Outcomes of Green Information Technology Adoption in Service Organizations: An Evidence from Emerging Economy Context. J. Sci. Technol. Policy Manag. 2022, 13, 898–924. [Google Scholar] [CrossRef]

- Faulks, B.; Song, Y.; Waiganjo, M.; Obrenovic, B.; Godinic, D. Impact of Empowering Leadership, Innovative Work, and Organizational Learning Readiness on Sustainable Economic Performance: An Empirical Study of Companies in Russia during the COVID-19 Pandemic. Sustainability 2021, 13, 12465. [Google Scholar] [CrossRef]

- Hussain, Y.; Abbass, K.; Usman, M.; Rehan, M.; Asif, M. Exploring the Mediating Role of Environmental Strategy, Green Innovations, and Transformational Leadership: The Impact of Corporate Social Responsibility on Environmental Performance. Environ. Sci. Pollut. Res. 2022, 29, 76864–76880. [Google Scholar] [CrossRef]

- Chou, C.J.; Chen, K.S.; Wang, Y.Y. Green Practices in the Restaurant Industry from an Innovation Adoption Perspective: Evidence from Taiwan. Int. J. Hosp. Manag. 2012, 31, 703–711. [Google Scholar] [CrossRef]

- Layek, D.; Koodamara, N.K. Motivation, Work Experience, and Teacher Performance: A Comparative Study. Acta Psychol. 2024, 245, 104217. [Google Scholar] [CrossRef]

- Gefen, D.; Straub, D.; Gefen, D.; Straub, D. A Practical Guide to Factorial Validity Using PLS-Graph: Tutorial and Annotated Example. Commun. Assoc. Inf. Syst. 2005, 16, 91–109. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a Silver Bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Murtaza, S.H.; Khan, A.; Mustafa, S.M. Eco-Centric Success: Stakeholder Approaches to Sustainable Performance via Green Improvisation Behavior and Environmental Orientation in the Hotel Industry. Bus. Strategy Environ. 2024, 33, 7273–7286. [Google Scholar] [CrossRef]

- Urbach, N.; Ahlemann, F. Structural Equation Modeling in Information Systems Research Using Partial Least Squares. J. Inf. Technol. Theory Appl. 2010, 11, 5–40. [Google Scholar]

- Sharma, M.; Joshi, S.; Luthra, S.; Kumar, A. Impact of Digital Assistant Attributes on Millennials’ Purchasing Intentions: A Multi-Group Analysis Using PLS-SEM, Artificial Neural Network and FsQCA. Inf. Syst. Front. 2024, 26, 943–966. [Google Scholar] [CrossRef]

- Xu, A.; Wei, C.; Zheng, M.; Sun, L.; Tang, D. Influence of Perceived Value on Repurchase Intention of Green Agricultural Products: From the Perspective of Multi-Group Analysis. Sustainability 2022, 14, 15451. [Google Scholar] [CrossRef]

- Stucki, T.; Woerter, M.; Arvanitis, S.; Peneder, M.; Rammer, C. How Different Policy Instruments Affect Green Product Innovation: A Differentiated Perspective. Energy Policy 2018, 114, 245–261. [Google Scholar] [CrossRef]

- Chen, Z.; Hao, X.; Chen, F. Green Innovation and Enterprise Reputation Value. Bus. Strategy Environ. 2022, 32, 1698–1718. [Google Scholar] [CrossRef]

- Bitat, A. Environmental Regulation and Eco-Innovation: The Porter Hypothesis Refined. Eurasian Bus. Rev. 2018, 8, 299–321. [Google Scholar] [CrossRef]

- Shi, Y.; Li, Y. An Evolutionary Game Analysis on Green Technological Innovation of New Energy Enterprises under the Heterogeneous Environmental Regulation Perspective. Sustainability 2022, 14, 6340. [Google Scholar] [CrossRef]

- Huang, X.; Liu, W.; Zhang, Z.; Zou, X.; Li, P. Quantity or Quality: Environmental Legislation and Corporate Green Innovations. Ecol. Econ. 2023, 204, 107684. [Google Scholar] [CrossRef]

- Cheng, Y.; Du, K.; Yao, X. Stringent Environmental Regulation and Inconsistent Green Innovation Behavior: Evidence from Air Pollution Prevention and Control Action Plan in China. Energy Econ. 2023, 120, 106571. [Google Scholar] [CrossRef]

- Dugoua, E.; Dumas, M. Green Product Innovation in Industrial Networks: A Theoretical Model. J. Environ. Econ. Manag. 2021, 107, 102420. [Google Scholar] [CrossRef]

- Zhang, D. Environmental Regulation, Green Innovation, and Export Product Quality: What Is the Role of Greenwashing? Int. Rev. Financ. Anal. 2022, 83, 102311. [Google Scholar] [CrossRef]

- Moshood, T.D.; Rotimi, J.O.B.; Rotimi, F.E. Combating Greenwashing of Construction Products: A Critical Analysis of Environmental Product Declarations. arXiv 2024. [Google Scholar] [CrossRef]

- Lin, C.-Y.; Ho, Y.-H.; Chiang, S.-H. Organizational Determinants of Green Innovation Implementation in the Logistics Industry. Int. J. Organ. Innov. 2009, 2, 3. [Google Scholar]

- Hong, W.C.H.; Chi, C.Y.; Liu, J.; Zhang, Y.F.; Lei, V.N.L.; Xu, X.S. The Influence of Social Education Level on Cybersecurity Awareness and Behaviour: A Comparative Study of University Students and Working Graduates. Educ. Inf. Technol. 2023, 28, 439–470. [Google Scholar] [CrossRef]

- Liu, X.; He, J.; Xiong, K.; Liu, S.; He, B.J. Identification of Factors Affecting Public Willingness to Pay for Heat Mitigation and Adaptation: Evidence from Guangzhou, China. Urban. Clim. 2023, 48, 101405. [Google Scholar] [CrossRef]

- Thomas, M.; Costa, D.; Oliveira, T. Assessing the Role of IT-Enabled Process Virtualization on Green IT Adoption. Inf. Syst. Front. 2016, 18, 693–710. [Google Scholar] [CrossRef]

| Demographic Characteristics | Percentage of Sample (SOE) (%) (n = 134) | Percentage of Sample (Private Enterprise) (%) (n = 143) |

|---|---|---|

| Gender | ||

| Male | 47 | 46.1 |

| Female | 52.9 | 53.8 |

| Position | ||

| Entrepreneur/owner | 0.7 | 4.8 |

| Top manager | 8.9 | 13.2 |

| Middle manager | 41.7 | 42.6 |

| Operational manager | 2.9 | 3.4 |

| Project manager | 8.2 | 4.8 |

| Supervisor | 14.1 | 11.1 |

| Others | 23.1 | 19.5 |

| Location | ||

| East | 57.4 | 51 |

| Central | 22.3 | 30 |

| West | 11.9 | 13.9 |

| Northeast | 8.2 | 4.8 |

| Firm Age | ||

| Less than 3 years | 7.4 | 7.6 |

| 3–5 years | 16.4 | 18.1 |

| 6–10 years | 14.9 | 25.8 |

| 11–15 years | 14.1 | 20.9 |

| Over 15 years | 47 | 39 |

| Firm Size | ||

| Large enterprises | 26.8 | 15.3 |

| Medium enterprises | 58.9 | 61.5 |

| Small enterprises | 12.6 | 17.4 |

| Micro enterprises | 1.4 | 5.5 |

| Latent Variables | Indicators | Loadings | Cronbach’s Alpha | AVE | VIF-Inner Model | VIF-Outer Model |

|---|---|---|---|---|---|---|

| Cost Reduction | CRed1 | 0.597 | 0.702 | 0.528 | 1.232 | |

| CRed2 | 0.791 | 1.539 | ||||

| CRed3 | 0.756 | 1.404 | ||||

| CRed5 | 0.748 | 1.321 | ||||

| ECSR | ECSR1 | 0.674 | 0.722 | 0.546 | 1.847 | 1.323 |

| ECSR2 | 0.796 | 1.524 | ||||

| ECSR4 | 0.797 | 1.566 | ||||

| ECSR5 | 0.679 | 1.270 | ||||

| Green Process Innovation | GIA1 | 0.755 | 0.733 | 0.556 | 1.919 | 1.507 |

| GIA2 | 0.781 | 0.781 | ||||

| GIA3 | 0.784 | 0.784 | ||||

| GIA5 | 0.776 | 0.776 | ||||

| Green Product Innovation | GIA7 | 0.754 | 0.777 | 0.599 | 1.919 | 1.492 |

| GIA8 | 0.799 | 1.487 | ||||

| GIA9 | 0.706 | 1.327 | ||||

| GIA10 | 0.720 | 1.399 | ||||

| Innovation Capability | IC3 | 0.863 | 0.762 | 0.677 | 2.709 | 1.646 |

| IC6 | 0.764 | 1.412 | ||||

| IC7 | 0.839 | 1.669 | ||||

| Market Pressure | MP1 | 0.745 | 0.719 | 0.541 | 2.600 | 1.436 |

| MP2 | 0.728 | 1.362 | ||||

| MP3 | 0.767 | 1.362 | ||||

| MP6 | 0.701 | 1.291 | ||||

| Organisational Support | OS1 | 0.780 | 0.763 | 0.584 | 3.251 | 1.518 |

| OS2 | 0.766 | 1.617 | ||||

| OS4 | 0.796 | 1.592 | ||||

| OS5 | 0.713 | 1.366 | ||||

| Policy Orientation | PO2 | 0.777 | 0.759 | 0.58 | 1.963 | 1.440 |

| PO3 | 0.756 | 1.522 | ||||

| PO4 | 0.718 | 1.377 | ||||

| PO5 | 0.794 | 1.549 | ||||

| Relative Advantage | RA1 | 0.799 | 0.724 | 0.644 | 1.890 | 1.412 |

| RA3 | 0.803 | 1.402 | ||||

| RA5 | 0.806 | 1.460 | ||||

| Technology Compatibility | TCa1 | 0.757 | 0.706 | 0.531 | 2.254 | 1.364 |

| TCa2 | 0.719 | 1.322 | ||||

| TCa3 | 0.779 | 1.498 | ||||

| TCa5 | 0.654 | 1.260 |

| Construct | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. CR | 0.727γ | |||||||||

| 2. ECSR | 0.453 | 0.739 | ||||||||

| 3. GPcI | 0.596 | 0.574 | 0.746 | |||||||

| 4. GpdI | 0.594 | 0.430 | 0.692 | 0.774 | ||||||

| 5. IC | 0.412 | 0.554 | 0.507 | 0.579 | 0.823 | |||||

| 6. MP | 0.539 | 0.577 | 0.566 | 0.560 | 0.684 | 0.736 | ||||

| 7. OS | 0.426 | 0.57 | 0.422 | 0.531 | 0.737 | 0.665 | 0.764 | |||

| 8. PO | 0.459 | 0.544 | 0.566 | 0.591 | 0.547 | 0.581 | 0.615 | 0.762 | ||

| 9. RA | 0.537 | 0.449 | 0.470 | 0.530 | 0.483 | 0.592 | 0.612 | 0.446 | 0.803 | |

| 10. TC | 0.573 | 0.557 | 0.611 | 0.545 | 0.471 | 0.594 | 0.642 | 0.590 | 0.582 | 0.729 |

| Construct | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. CR | ||||||||||

| 2. ECSR | 0.615 | |||||||||

| 3. GPcI | 0.806 | 0.781 | ||||||||

| 4. GpdI | 0.794 | 0.565 | 0.889 | |||||||

| 5. IC | 0.555 | 0.742 | 0.660 | 0.752 | ||||||

| 6. MP | 0.747 | 0.794 | 0.765 | 0.741 | 0.893 | |||||

| 7. OS | 0.575 | 0.774 | 0.549 | 0.682 | 0.898 | 0.887 | ||||

| 8. PO | 0.615 | 0.722 | 0.742 | 0.764 | 0.713 | 0.789 | 0.807 | |||

| 9. RA | 0.764 | 0.610 | 0.631 | 0.707 | 0.661 | 0.826 | 0.831 | 0.605 | ||

| 10. TC | 0.805 | 0.777 | 0.831 | 0.727 | 0.641 | 0.842 | 0.894 | 0.809 | 0.822 |

| Latent Variables | Indicators | Loadings | Composite Reliability (Cronbach’s Alpha) | AVE | VIF-Inner Model | VIF-Outer Model |

|---|---|---|---|---|---|---|

| Cost Reduction | CRed1 | 0.722 | 0.713 | 0.533 | 1.629 | |

| CRed2 | 0.773 | 1.587 | ||||

| CRed3 | 0.723 | 1.409 | ||||

| CRed5 | 0.701 | 1.178 | ||||

| Environmental Corporate Social Responsibility | ECSR1 | 0.707 | 0.786 | 0.610 | 2.508 | 1.340 |

| ECSR2 | 0.799 | 1.607 | ||||

| ECSR4 | 0.815 | 1.670 | ||||

| ECSR5 | 0.799 | 1.717 | ||||

| Green Process Innovation | GIA1 | 0.736 | 0.702 | 0.527 | 1.921 | 1.388 |

| GIA2 | 0.717 | 1.371 | ||||

| GIA3 | 0.771 | 1.454 | ||||

| GIA5 | 0.730 | 1.329 | ||||

| Green Product Innovation | GIA7 | 0.748 | 0.723 | 0.546 | 1.921 | 1.384 |

| GIA8 | 0.751 | 1.330 | ||||

| GIA9 | 0.677 | 1.292 | ||||

| GIA10 | 0.727 | 1.361 | ||||

| Innovation Capability | IC3 | 0.807 | 0.728 | 0.647 | 2.479 | 1.516 |

| IC6 | 0.816 | 1.466 | ||||

| IC7 | 0.791 | 1.357 | ||||

| Market Pressure | MP1 | 0.766 | 0.805 | 0.630 | 2.041 | 1.733 |

| MP2 | 0.790 | 1.709 | ||||

| MP3 | 0.815 | 1.780 | ||||

| MP6 | 0.802 | 1.750 | ||||

| Organisation Support | OS1 | 0.787 | 0.754 | 0.574 | 2.308 | 1.488 |

| OS2 | 0.773 | 1.413 | ||||

| OS4 | 0.720 | 1.427 | ||||

| OS5 | 0.748 | 1.454 | ||||

| Policy Orientation | PO2 | 0.773 | 0.811 | 0.639 | 1.985 | 1.749 |

| PO3 | 0.861 | 2.104 | ||||

| PO4 | 0.807 | 1.789 | ||||

| PO5 | 0.752 | 1.431 | ||||

| Relative Advantage | RA1 | 0.805 | 0.727 | 0.647 | 2.223 | 1.437 |

| RA3 | 0.808 | 1.429 | ||||

| RA5 | 0.799 | 1.422 | ||||

| Technology Compatibility | TCa1 | 0.802 | 0.737 | 0.559 | 2.241 | 1.512 |

| TCa2 | 0.727 | 1.331 | ||||

| TCa3 | 0.800 | 1.553 | ||||

| TCa5 | 0.650 | 1.284 |

| Construct | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. CR | 0.730 | |||||||||

| 2. ECSR | 0.540 | 0.781 | ||||||||

| 3. GPcI | 0.519 | 0.691 | 0.726 | |||||||

| 4. GpdI | 0.592 | 0.619 | 0.692 | 0.739 | ||||||

| 5. IC | 0.451 | 0.679 | 0.636 | 0.582 | 0.805 | |||||

| 6. MP | 0.427 | 0.641 | 0.560 | 0.556 | 0.601 | 0.793 | ||||

| 7. OS | 0.480 | 0.58 | 0.510 | 0.594 | 0.641 | 0.543 | 0.757 | |||

| 8. PO | 0.470 | 0.542 | 0.543 | 0.535 | 0.598 | 0.534 | 0.625 | 0.799 | ||

| 9. RA | 0.519 | 0.561 | 0.542 | 0.525 | 0.574 | 0.478 | 0.609 | 0.548 | 0.804 | |

| 10. TC | 0.613 | 0.621 | 0.635 | 0.639 | 0.528 | 0.56 | 0.567 | 0.454 | 0.655 | 0.748 |

| Construct | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. CR | ||||||||||

| 2. ECSR | 0.698 | |||||||||

| 3. GPcI | 0.696 | 0.890 | ||||||||

| 4. GpdI | 0.797 | 0.811 | 0.898 | |||||||

| 5. IC | 0.609 | 0.895 | 0.885 | 0.799 | ||||||

| 6. MP | 0.543 | 0.790 | 0.736 | 0.719 | 0.775 | |||||

| 7. OS | 0.647 | 0.745 | 0.697 | 0.792 | 0.872 | 0.694 | ||||

| 8. PO | 0.607 | 0.671 | 0.715 | 0.691 | 0.782 | 0.660 | 0.805 | |||

| 9. RA | 0.718 | 0.732 | 0.758 | 0.725 | 0.793 | 0.622 | 0.825 | 0.712 | ||

| 10. TC | 0.846 | 0.797 | 0.859 | 0.867 | 0.715 | 0.723 | 0.759 | 0.579 | 0.894 |

| No. | Variable Relationship | State-Owned | Private | ||||

|---|---|---|---|---|---|---|---|

| Path Coefficient | Results | f-Square | Path Coefficient | Results | f2 | ||

| H1a | RA → GPcI | Not significant | Rejected | - | Not significant | Rejected | - |

| H1b | RA → GPdI | 0.215 * | Supported | 0.050 | Not significant | Rejected | - |

| H2a | TCa → GPcI | 0.358 * | Supported | 0.128 | 0.283 ** | Supported | 0.088 |

| H2b | TCa → GPdI | Not significant | Rejected | - | 0.316 ** | Supported | 0.098 |

| H3a | ECSR → GPcI | 0.223 * | Supported | 0.060 | 0.309 ** | Supported | 0.093 |

| H3b | ECSR → GPdI | Not significant | Rejected | - | Not significant | Rejected | - |

| H4a | IC → GPcI | 0.257 * | Supported | 0.055 | 0.215 * | Supported | 0.046 |

| H4b | IC → GPdI | 0.330 * | Supported | 0.082 | Not significant | Rejected | - |

| H5a | OS → GPcI | −0.420 ** | Rejected | - | Not significant | Rejected | - |

| H5b | OS → GPdI | Not significant | Rejected | - | Not significant | Rejected | - |

| H6a | MP → GPcI | Not significant | Rejected | - | Not significant | Rejected | - |

| H6b | MP → GPdI | Not significant | Rejected | - | Not significant | Rejected | - |

| H7a | PO → GPcI | 0.224 * | Supported | 0.057 | Not significant | Rejected | - |

| H7b | PO → GPdI | 0.297 * | Supported | 0.092 | Not significant | Rejected | - |

| H8a | GPcI → CRed | 0.355 *** | Supported | 0.113 | 0.210 * | Supported | 0.037 |

| H8b | GPdI → CRed | 0.348 *** | Supported | 0.109 | 0.447 *** | Supported | 0.166 |

| Dependent Variable | Ownership | R2 | Q2 |

|---|---|---|---|

| Cost Reduction | SOE | 0.418 | 0.190 |

| Private enterprise | 0.374 | 0.176 | |

| Green Process Innovation | SOE | 0.554 | 0.273 |

| Private enterprise | 0.593 | 0.288 | |

| Green Product Innovation | SOE | 0.509 | 0.276 |

| Private enterprise | 0.547 | 0.273 |

| Variable | Original Correlation | 5.00% | Permutation p Value | Compositional Invariance? |

|---|---|---|---|---|

| Cost Reduction | 1.000 | 0.986 | 0.969 | Yes |

| ECSR | 0.999 | 0.994 | 0.858 | Yes |

| Green Process Innovation | 0.999 | 0.995 | 0.809 | Yes |

| Green Product Innovation | 1.000 | 0.997 | 0.761 | Yes |

| Innovation Capability | 0.997 | 0.996 | 0.087 | Yes |

| Market Pressure | 0.999 | 0.994 | 0.799 | Yes |

| Organisational Support | 0.995 | 0.991 | 0.227 | Yes |

| Policy Orientation | 0.998 | 0.994 | 0.516 | Yes |

| Relative Advantage | 1.000 | 0.992 | 0.997 | Yes |

| Technology Compatibility | 1.000 | 0.994 | 0.906 | Yes |

| Variable | Path Coefficients (SOE) | Path Coefficients (Private Enterprise) | Path Coefficients Difference | 2.50% | 97.50% | Permutation p Value |

|---|---|---|---|---|---|---|

| ECSR → GPcI | 0.309 | 0.223 | 0.086 | −0.296 | 0.292 | 0.577 |

| ECSR → GPdI | 0.165 | −0.064 | 0.229 | −0.382 | 0.380 | 0.247 |

| GPcI → CRed | 0.210 | 0.355 | −0.145 | −0.271 | 0.266 | 0.295 |

| GPdI → CRed | 0.447 | 0.348 | 0.099 | −0.256 | 0.264 | 0.465 |

| IC → GPcI | 0.215 | 0.257 | −0.042 | −0.308 | 0.310 | 0.794 |

| IC → GPdI | 0.104 | 0.330 | −0.226 | −0.395 | 0.399 | 0.301 |

| MP → GPcI | 0.037 | 0.128 | −0.091 | −0.293 | 0.289 | 0.544 |

| MP → GPdI | 0.078 | 0.062 | 0.016 | −0.334 | 0.334 | 0.926 |

| OS → GPcI | −0.089 | −0.420 | 0.331 | −0.319 | 0.330 | 0.045 |

| OS → GPdI | 0.155 | −0.149 | 0.304 | −0.379 | 0.383 | 0.124 |

| PO → GPcI | 0.146 | 0.224 | −0.078 | −0.281 | 0.278 | 0.600 |

| PO → GPdI | 0.119 | 0.297 | −0.178 | −0.358 | 0.345 | 0.334 |

| RA → GPcI | 0.016 | 0.119 | −0.103 | −0.273 | 0.263 | 0.488 |

| RA → GPdI | −0.031 | 0.215 | −0.245 | −0.295 | 0.278 | 0.097 |

| TCa → GPcI | 0.283 | 0.358 | −0.075 | −0.359 | 0.348 | 0.716 |

| TCa → GPdI | 0.316 | 0.184 | 0.132 | −0.390 | 0.379 | 0.515 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Peng, T.; Phoong, S.W.; Moghavvemi, S. Can Technological, Organisational and Environmental Factors Reduce Costs Through Green Innovation in the Construction Industry? Comparison of State-Owned and Private Enterprises. Sustainability 2025, 17, 9139. https://doi.org/10.3390/su17209139

Peng T, Phoong SW, Moghavvemi S. Can Technological, Organisational and Environmental Factors Reduce Costs Through Green Innovation in the Construction Industry? Comparison of State-Owned and Private Enterprises. Sustainability. 2025; 17(20):9139. https://doi.org/10.3390/su17209139

Chicago/Turabian StylePeng, Ting, Seuk Wai Phoong, and Sedigheh Moghavvemi. 2025. "Can Technological, Organisational and Environmental Factors Reduce Costs Through Green Innovation in the Construction Industry? Comparison of State-Owned and Private Enterprises" Sustainability 17, no. 20: 9139. https://doi.org/10.3390/su17209139

APA StylePeng, T., Phoong, S. W., & Moghavvemi, S. (2025). Can Technological, Organisational and Environmental Factors Reduce Costs Through Green Innovation in the Construction Industry? Comparison of State-Owned and Private Enterprises. Sustainability, 17(20), 9139. https://doi.org/10.3390/su17209139