China’s Chrome Demand Forecast from 2025 to 2040: Based on Sectoral Predictions and PSO-BP Neural Network

Abstract

1. Introduction

2. Research Methodology

2.1. Analysis of Influencing Factors of Chromium Demand

2.2. Methodology

2.2.1. Departmental Demand Forecasting

2.2.2. PSO-BP Model

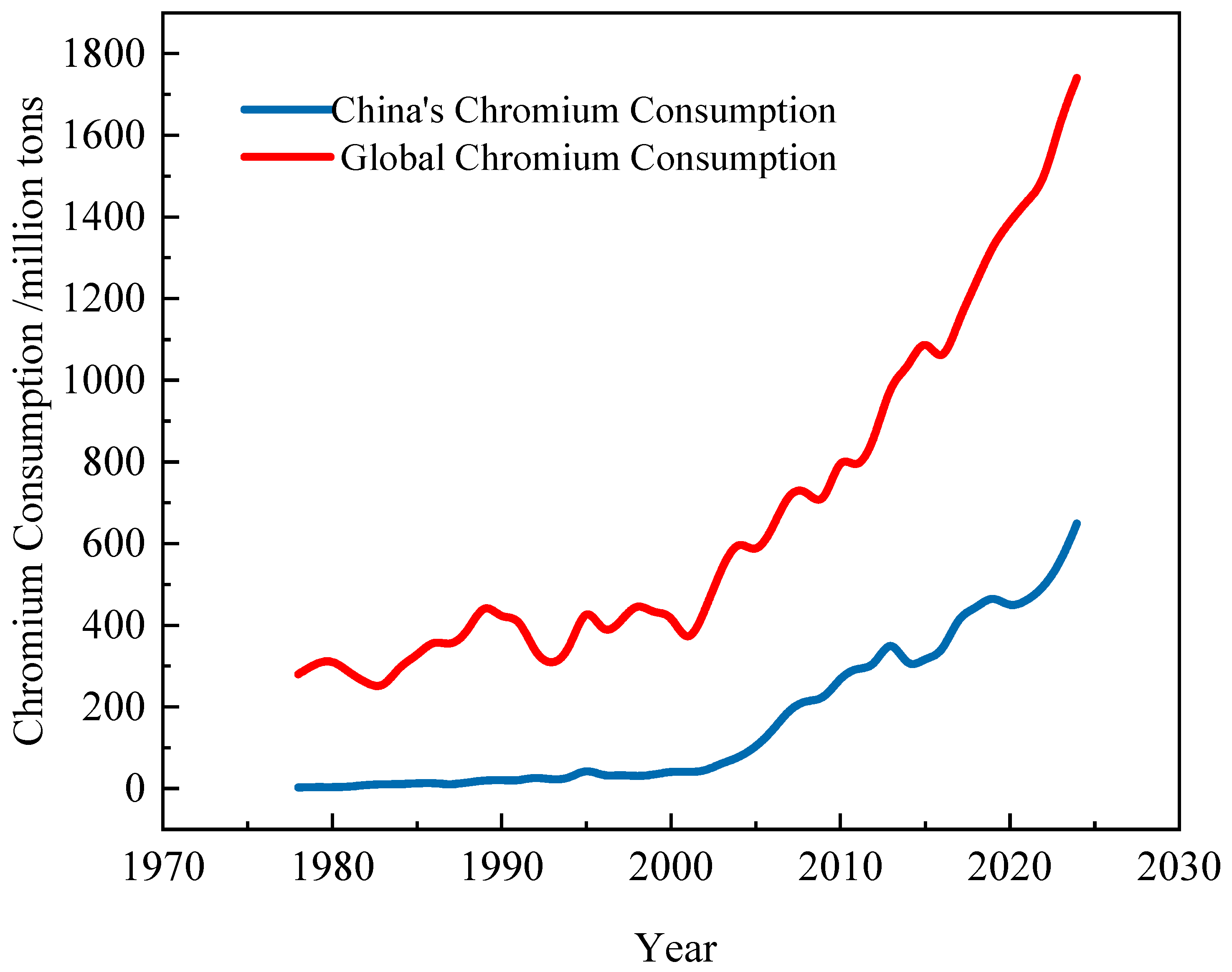

3. Global and Chinese Chromium Resource Consumption Structure and History Analysis

4. Prediction of Chromium Demand Based on Departmental Needs Method

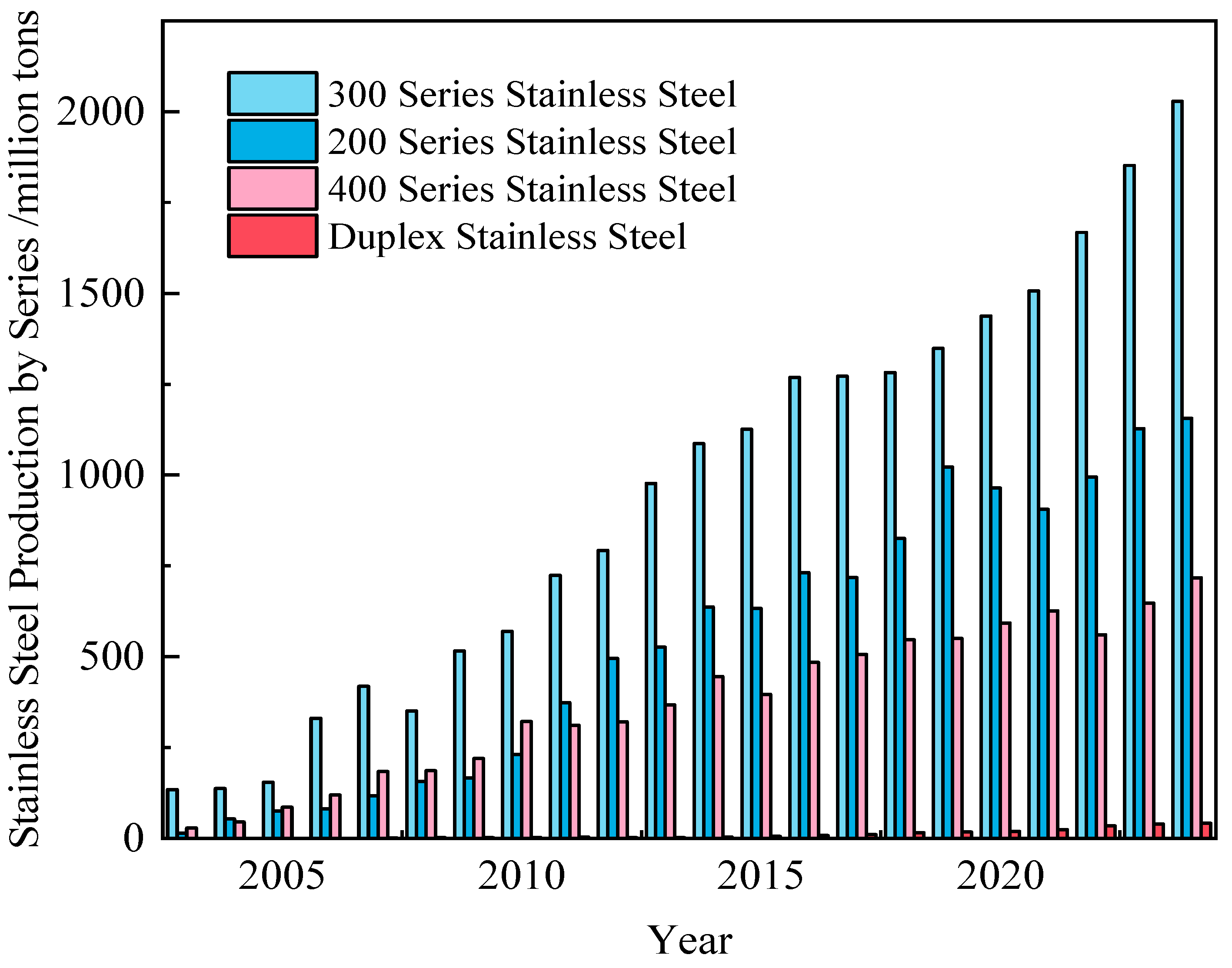

4.1. Demand Forecast for the Chromium-Stainless Steel Sector

4.1.1. Prediction of 200 Series

4.1.2. Prediction of 300 Series

4.1.3. Prediction for 400 Series

4.1.4. Prediction of Duplex Stainless Steel

4.2. Chromium Demand Forecast

5. Chromium Demand Prediction Based on PSO-BP Neural Network Model

5.1. Chromium Gray Correlation Analysis

5.2. PSO-BP Neural Network Model Construction

5.2.1. Parameter Setting and Data Preprocessing

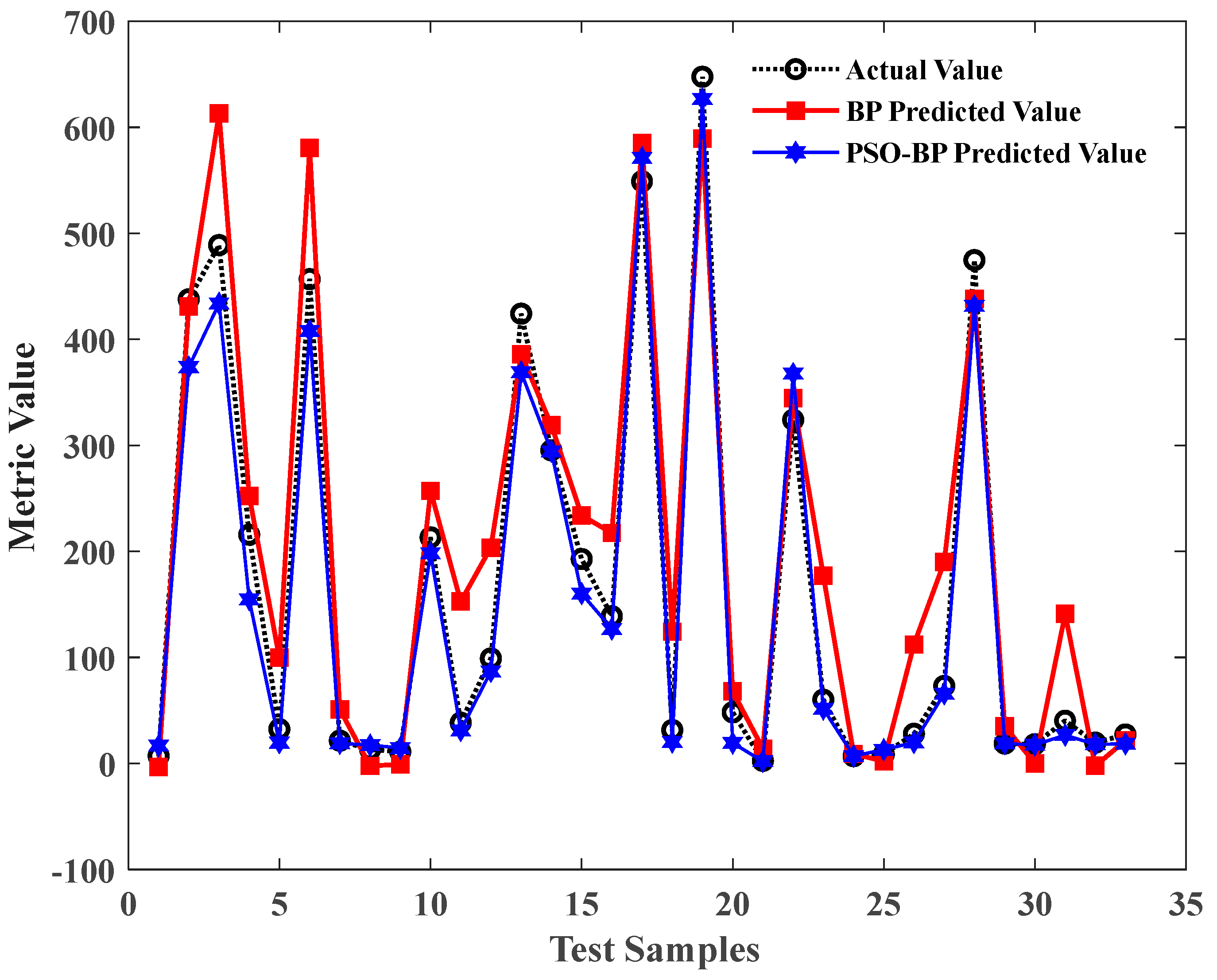

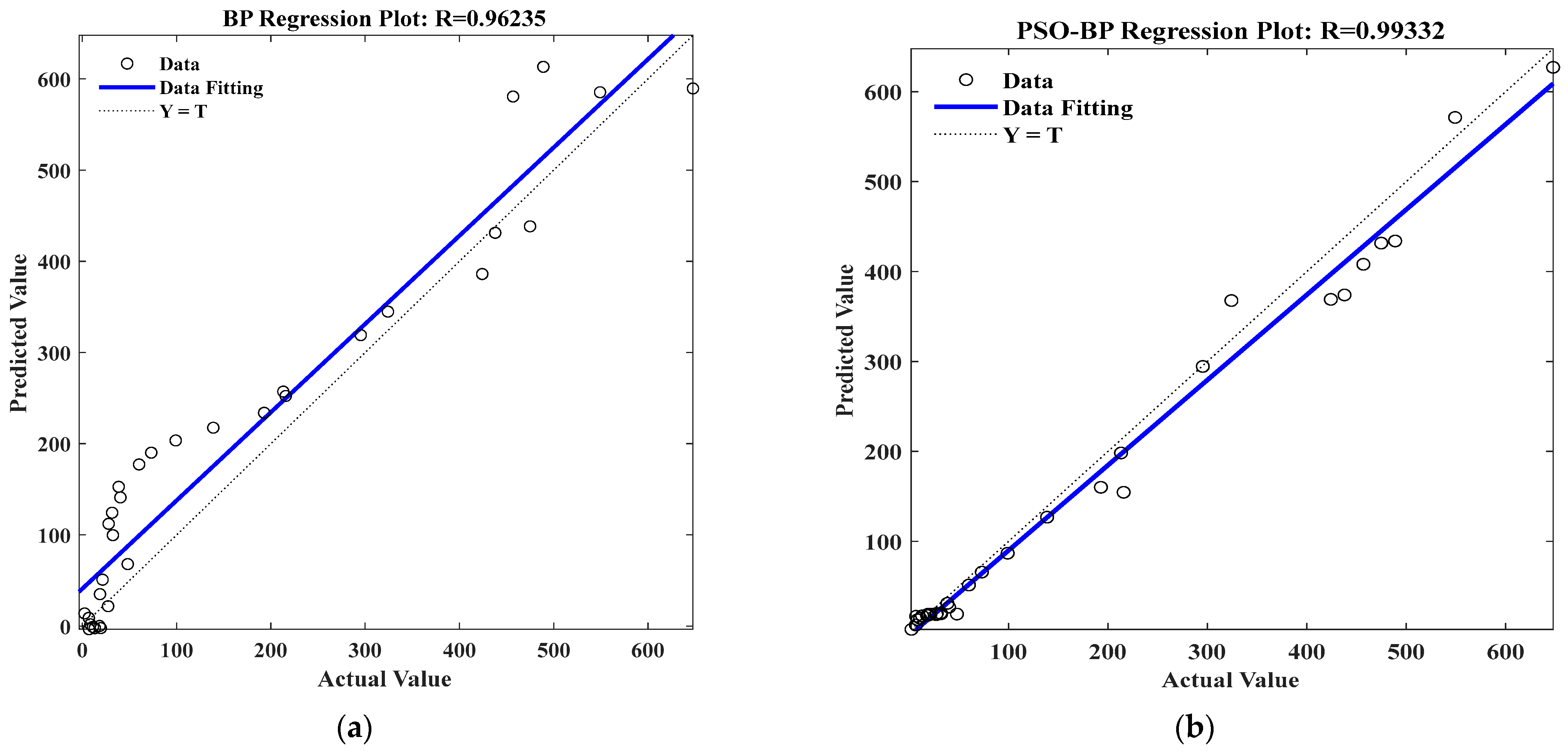

5.2.2. Model Training and Evaluation

5.2.3. Model Comparison and Analysis Prediction

5.2.4. PSO-BP Model Prediction Results

6. Analysis of the Forecast Results

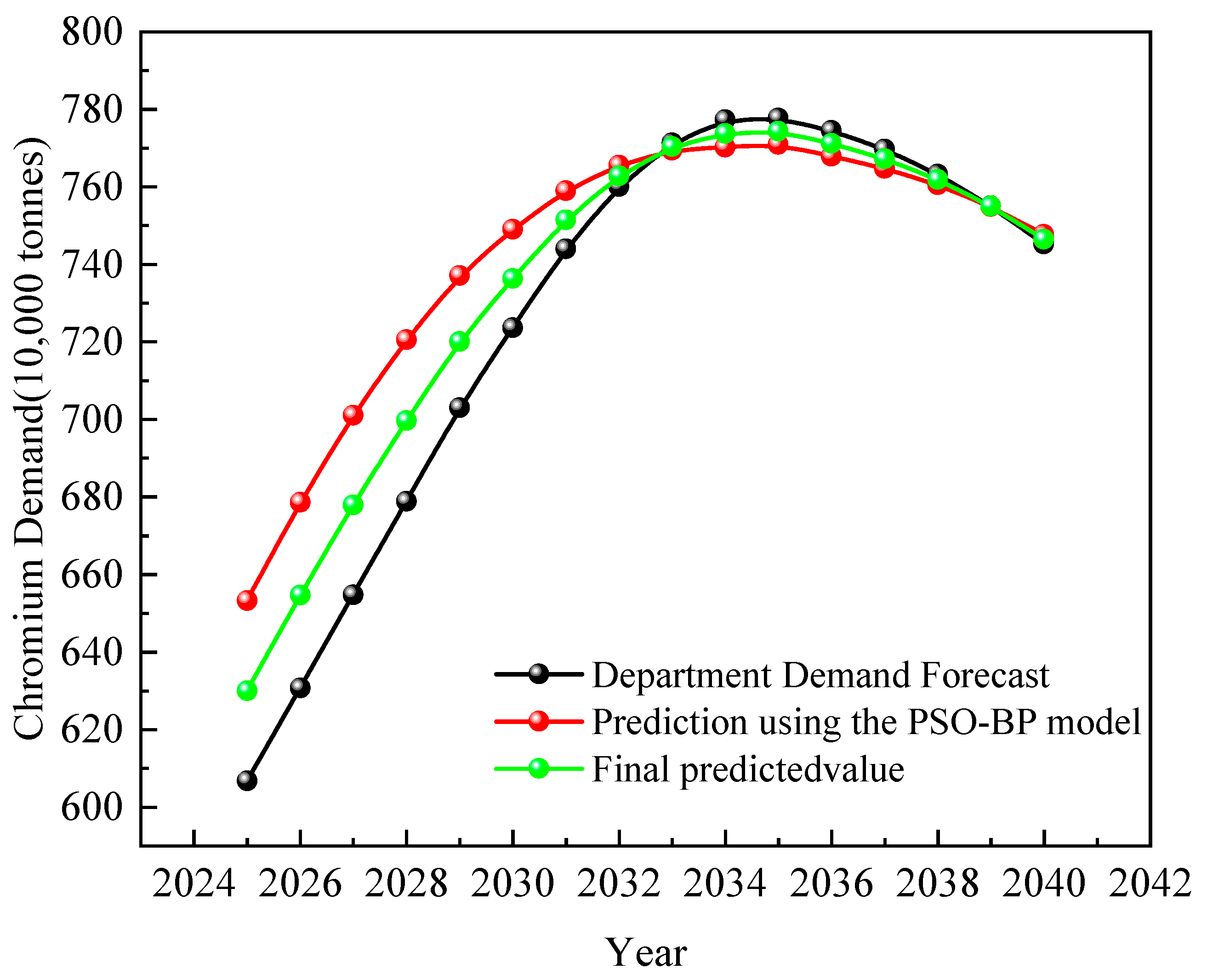

6.1. Prediction Results

6.2. Robustness Analysis of Prediction Results

6.2.1. Methodology

6.2.2. Validation Steps

- (1)

- Model Reconstruction

- (2)

- Error Metric Calculation

- (3)

- Inter-window Consistency Test

6.2.3. Validation Results and Analysis

- (1)

- Prediction Error Results

- (2)

- Consistency Check

6.2.4. Robustness Conclusions

7. Conclusions

- (1)

- The forecasting results of the Department Demand Forecasting Method and the PSO-BP Neural Network Model indicate that China’s chromium demand will continue to grow in the next decade. This trend is consistent with existing studies to a certain extent, yet differences also exist. Zheng Minggui [23] applied a gray neural network to predict that China’s chromium demand would keep growing from 2020 to 2030, but did not predict chromium demand beyond 2030. This study conducts medium- and long-term forecasting of chromium demand: the average annual growth rate of chromium demand will drop to 2.1% during 2025–2035; China’s chromium demand will reach 7.7437 million tons in 2035, entering the peak period of chromium consumption; after 2035, affected by the industrial structure upgrading of the stainless steel industry and market saturation, the demand will decrease at an average annual rate of 0.7%. Therefore, China’s chromium demand presents a trend of slow growth followed by a slow decline after reaching the peak. Combined with the consistent results of the two forecasting methods, this study integrates qualitative and quantitative approaches to achieve more accurate predictions. The predicted chromium demand values are 6.2996 million tons in 2025, 7.3635 million tons in 2030, 7.7437 million tons in 2035, and 7.4650 million tons in 2040, respectively.

- (2)

- The upgrade of stainless steel products is the primary driving force that directly impacts chromium demand. The 300 series (with a chromium content of 18%) is the mainstay of demand, with a production amount reaching 33.8721 million tons by 2040, thus supporting long-term chromium consumption. Under policy influence, the production of the 200 series stainless steel (with a chromium content of 15%) is reduced to 2.0005 million tons by 2024, significantly decreasing its dependence on chromium. Conversely, duplex stainless steel (with a chromium content of 22%) is experiencing explosive growth in the new energy equipment sector, while demand in certain traditional sectors is dwindling.

- (3)

- By incorporating driving variables such as gross domestic product, urbanization rate, and total value of the secondary industry, and optimizing the weights of the BP neural network using particle swarm optimization, the model’s error has significantly decreased, with the RMSE dropping from 34.1638 to 21.5566 and the R2 rising from 0.9577 to 0.9880, This is consistent with the PSO-BP applied by Wang et al. [17] in forecasting for new energy vehicles, which further verifies the effectiveness of the particle swarm optimization (PSO) algorithm in improving the accuracy of the BP neural network.

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zeng, X.; Yuan, C.; Xu, H.; Han, J.; Tian, Y. Research on the situation of China’s chromium resource industry and its related strategies. Resour. Ind. 2015, 17, 39–44. [Google Scholar] [CrossRef]

- Liu, X.; Chen, Q.; Zhang, Y.; Gao, T.M. Analysis of China’s chromium demand forecast and resource supply security situation. Resour. Sci. 2015, 37, 933–943. [Google Scholar]

- Lu, Z. Analysis of the supply situation of chrome ore in China country and suggestions for guarantees. Metall. Econ. Manag. 2024, 2, 28–30. [Google Scholar]

- Zeng, X.; Yuan, C.; Xu, H.; Han, J.; Tian, Y. Current status and investment suggestions for chromium ore development in the world. China Min. 2015, 24, 16–22. [Google Scholar] [CrossRef]

- Zhang, Z.; Pan, Z.; Che, D.; Yan, Q.; Wu, Q. Characteristics of chromium ore resources in China and analysis of chromium supply and demand situation from 2021 to 2035. China Geol. 2024, 51, 1191–1209. [Google Scholar]

- Liu, Q.; Sha, J.; Yan, J.; Zhang, G.; Fan, S.; He, G. Risk assessment and countermeasures of chromium resource supply in China. Resour. Sci. 2018, 40, 516–525. [Google Scholar]

- Pan, Z.; Zhang, Z.; Wang, X.; Yang, Y.; Zhang, Z. Analysis of the current situation and future trend of recycled chromium resources in China. China Min. 2018, 27, 17–21. [Google Scholar]

- Lü, P.; Gao, Y.; Zhang, Y.; Zhang, D. Kazakhstan chromite resource endowment, supply pattern and China–Kazakhstan production capacity cooperation suggestions. Northwest Geol. 2022, 55, 297–305. [Google Scholar] [CrossRef]

- Zhao, P. The stainless steel industry explores new development paths. China Metall. News 2025, 003. [Google Scholar] [CrossRef]

- Li, M.; Kong, Y. Natural gas price forecasting based on time series model. Oil Gas New Energy 2023, 35, 61–66. [Google Scholar] [CrossRef]

- Li, H.; Liu, Q.; Chen, Y.; Han, M.; Wu, X. Forecast and analysis of China’s natural gas demand trend. Nat. Gas Technol. Econ. 2025, 19, 82. [Google Scholar]

- Li, R.; Jin, L.; Sun, L.; Zhao, J.; Chen, S.; Zheng, L. Forecasting the development trend of big data algorithms in China’s petroleum and petrochemical field based on time series statistical method. Oil Drill. Prod. Technol. 2024, 46, 525–548. [Google Scholar] [CrossRef]

- Shi, Y.; Peng, B. Forecasting coal throughput of Ningbo Port based on GM (1,1) and KPCA-GA-BP. Shipp. Manag. 2024, 46, 6–10+43. [Google Scholar] [CrossRef]

- Chen, Z.; Zhu, Q.; Zou, X.; Wu, H.; Xing, K.; Tang, X. Research on the development trend of nickel resource industry chain under the “Dual Carbon” background. China Min. Mag. 2024, 33, 54–63. [Google Scholar] [CrossRef]

- Yuan, W.; Zheng, M. Scenario analysis of China’s bauxite resource demand based on BP neural network. Resour. Ind. 2014, 16, 132–137. [Google Scholar] [CrossRef]

- Gong, T.; Zheng, M. Scenario analysis of China’s copper mineral resource demand based on BP neural network. Nonferrous Met. Sci. Eng. 2014, 5, 99–106. [Google Scholar] [CrossRef]

- Wang, X.; Hao, T.; Ma, C. Sales forecasting model of new energy vehicles based on PSO-BP neural network. Sci. Technol. Eng. 2024, 24, 13467–13474. [Google Scholar] [CrossRef]

- Jiang, B.; Zhang, J.; Fu, J.; Ding, G.; Zhang, Y. Research on check-in baggage flow prediction for airport departure passengers based on improved PSO-BP neural network combination model. Aerospace 2024, 11, 953. [Google Scholar] [CrossRef]

- Xiong, F.; Gong, X.; Qiu, T.; Xu, X.; Gui, W. Genesis of different types of minerals in pod-shaped chromite and their constraints on the mineralization process. Bull. Miner. Rock Geochem. 2025, 44, 1–16. [Google Scholar] [CrossRef]

- Wang, X.; Liu, C.; Wang, A. Characteristics, supply-demand situation and enterprise competition of global chromium ore resource. China Min. 2025, 34, 449–457. [Google Scholar] [CrossRef]

- Zhang, Z.; Zhang, Z.; Pan, Z.; Wu, Q.; Xu, H. Analysis of China’s supply safety by global chromium ore resource countries. China Min. 2019, 28, 69–76. [Google Scholar] [CrossRef]

- Li, J.; Zhou, N.; Hu, P.; Wu, Y.; Cheng, J. Evolution of trade network pattern of chromium ore in global and analysis of competitiveness. China Min. 2024, 33, 48–58. [Google Scholar] [CrossRef]

- Zheng, M.; Yuan, X. Forecast of China’s chrome ore demand from 2020 to 2030 based on a gray neural network. Resour. Dev. Mark. 2018, 34, 747–752. [Google Scholar] [CrossRef]

- Zhang, W. Analysis and forecast of world chromium ore resource demand. Resour. Ind. 2016, 18, 87–91. [Google Scholar] [CrossRef]

- Zheng, M.; Li, Q. Scenario prediction of China’s oil resource demand from 2020–2030. Adv. Earth Sci. 2020, 35, 286–296. [Google Scholar] [CrossRef]

- Wu, Q.; Zhang, Z.; Pan, Z.; Zhang, Z.; Xu, H. Forecast of China’s vanadium resource demand from 2020 to 2035. China Min. 2021, 30, 48–56. [Google Scholar] [CrossRef]

- Qiu, Q. Research on investor age prediction based on PSO-BP algorithm. Mod. Comput. 2024, 30, 61–65. [Google Scholar]

- Zhou, P.; Ma, J.; Ma, Y.; Wang, N.; Liu, L.; Han, L. Water consumption model of transpiration based on BP neural network and particle swarm optimization algorithm. Ningxia Eng. Technol. 2025, 1–5. [Google Scholar]

- Wang, J.; Chen, H.; Wang, L. Prediction of China’s silicon wafer price: A GA-PSO-BP model. Mathematics 2025, 13, 2453. [Google Scholar] [CrossRef]

- Zhang, Z.; Zhou, W. Prediction of transpiration of reference crops based on PSO-BP neural network. Water-Sav. Irrig. 2014, 11, 87–90+95. [Google Scholar] [CrossRef]

- Wu, T. Impact and Prediction Analysis of Transportation on Urban Carbon Emission Based on PSO-BP Neural Network. Master’s Thesis, China University of Mining and Technology, Xuzhou, China, 2022. [Google Scholar] [CrossRef]

- Qi, D.; Li, J.; Dong, L.; Yu, J. Research on the corrosion resistance of 200 series stainless steel. Iron Steel Vanadium Titan. 2010, 31, 72–76. [Google Scholar]

- Chen, W.; Chen, J.; Ren, C.; Wang, H.; Wang, H. Impact analysis of fault-bearing slope based on orthogonal and grey correlation analysis. Nonferrous Met. (Min. Sect.) 2025, 77, 153–158+165. [Google Scholar] [CrossRef]

- Zhao, Y. Research on Financial Asset Return Forecasting Model Considering Multi-Source Errors. Ph.D. Thesis, South China University of Technology, Guangzhou, China, 2024. [Google Scholar] [CrossRef]

- Guo, X. Research on Volatility Forecasting of EU Carbon Trading Market. Ph.D. Thesis, Southwest Jiaotong University, Chengdu, China, 2022. [Google Scholar] [CrossRef]

- Yu, L.; Lei, K. Research on international oil price forecasting based on pattern matching and deep learning. J. China Univ. Pet. (Soc. Sci. Ed.) 2023, 39, 51–59. [Google Scholar] [CrossRef]

- Li, K.; Tan, Z. Differential analysis of urban emergency management capabilities based on CV value. J. Wuhan Univ. Technol. (Inf. Manag. Eng. Ed.) 2018, 40, 129–135. [Google Scholar]

| Evaluation Item | Relevance | Ranking |

|---|---|---|

| Gross Domestic Product of the Secondary Sector | 0.969 | 1 |

| Gross Domestic Product | 0.966 | 2 |

| Stainless Steel Production | 0.915 | 3 |

| Urbanization rate | 0.843 | 4 |

| Population | 0.842 | 5 |

| Population per 10,000 | Urbanization Rate % | Secondary Industry Output Value/Ten Thousand Yuan | Stainless Steel Production/10,000 tons | China’s GDP per 10,000 Yuan | Chromium Consumption/10,000 tons |

|---|---|---|---|---|---|

| 100,072.00 | 20.16 | 2269.00 | 23.48 | 4935.80 | 2.45 |

| 101,654.00 | 21.13 | 2397.60 | 23.65 | 5373.40 | 6.84 |

| 103,008.00 | 21.62 | 2663.00 | 23.83 | 6020.90 | 9.30 |

| 104,357.00 | 23.01 | 3124.70 | 24.00 | 7278.50 | 8.58 |

| 105,851.00 | 23.71 | 3886.40 | 19.00 | 9098.90 | 11.15 |

| 107,507.00 | 24.52 | 4515.10 | 20.14 | 10376.20 | 11.78 |

| 109,300.00 | 25.32 | 5273.80 | 21.35 | 12,174.60 | 7.05 |

| 111,026.00 | 25.81 | 6607.20 | 22.64 | 15,180.40 | 13.14 |

| 112,704.00 | 26.21 | 7300.70 | 24.00 | 17,179.70 | 18.22 |

| 114,333.00 | 26.41 | 774.10 | 16.40 | 18,872.90 | 19.54 |

| 115,823.00 | 26.37 | 9129.60 | 20.50 | 22,005.60 | 16.59 |

| 117,171.00 | 27.63 | 11,725.00 | 25.80 | 27,194.50 | 27.35 |

| 118,517.00 | 28.14 | 16,472.70 | 21.20 | 35,673.20 | 18.71 |

| 119,850.00 | 28.62 | 22,452.50 | 26.00 | 48,637.50 | 21.50 |

| 121,121.00 | 29.04 | 28,676.70 | 32.44 | 61,339.90 | 48.16 |

| 122,389.00 | 29.37 | 33,827.30 | 31.34 | 71,813.60 | 27.21 |

| 123,626.00 | 29.92 | 37,545.00 | 33.22 | 79,715.00 | 32.35 |

| 124,761.00 | 30.40 | 39,017.50 | 28.44 | 85,195.50 | 27.92 |

| 125,786.00 | 30.89 | 41,079.90 | 30.22 | 90,564.40 | 31.60 |

| 126,743.00 | 36.22 | 45,663.70 | 60.00 | 100,280.10 | 40.32 |

| 127,627.00 | 37.70 | 49,659.40 | 73.00 | 110,863.10 | 38.51 |

| 128,453.00 | 39.10 | 54,104.10 | 114.00 | 121,717.40 | 39.87 |

| 129,227.00 | 40.53 | 62,695.80 | 177.80 | 137,422.00 | 60.15 |

| 129,988.00 | 41.80 | 74,285.00 | 236.40 | 161,840.20 | 73.14 |

| 130,756.00 | 43.00 | 88,082.20 | 316.00 | 187,318.90 | 99.11 |

| 131,448.00 | 43.90 | 104,359.20 | 530.00 | 219,438.50 | 138.85 |

| 132,129.00 | 44.90 | 126,630.50 | 720.60 | 270,092.30 | 192.88 |

| 132,802.00 | 45.70 | 149,952.90 | 694.30 | 319,244.60 | 215.76 |

| 133,450.00 | 46.60 | 160,168.80 | 880.47 | 348,517.70 | 213.18 |

| 134,091.00 | 49.70 | 191,626.50 | 1125.60 | 412,119.30 | 271.39 |

| 134,916.00 | 51.30 | 227,035.10 | 1409.10 | 487,940.20 | 295.37 |

| 135,922.00 | 52.60 | 244,639.10 | 1608.70 | 538,580.00 | 290.89 |

| 136,726.00 | 53.73 | 261,951.60 | 1898.40 | 592,963.20 | 376.37 |

| 137,646.00 | 54.77 | 277,282.80 | 2169.20 | 643,563.10 | 287.39 |

| 138,326.00 | 56.10 | 281,338.90 | 2156.20 | 688,858.20 | 318.40 |

| 139,232.00 | 57.35 | 295,427.80 | 2493.78 | 746,395.10 | 324.17 |

| 140,011.00 | 58.52 | 331,580.50 | 2577.37 | 832,035.90 | 424.16 |

| 140,541.00 | 59.58 | 364,835.20 | 2670.68 | 919,281.10 | 437.93 |

| 141,008.00 | 60.60 | 380,670.60 | 2940.00 | 986,515.20 | 474.82 |

| 141,212.00 | 63.90 | 383,562.40 | 3013.90 | 1,013,567.00 | 440.73 |

| 141,253.00 | 64.72 | 451,544.10 | 3063.20 | 1,149,237.00 | 456.87 |

| 141,256.00 | 65.22 | 473,789.90 | 3197.50 | 1,204,724.00 | 488.93 |

| 141,223.00 | 66.16 | 482,588.50 | 3667.59 | 1,260,582.10 | 549.17 |

| 141,144.00 | 67.00 | 492,087.00 | 3944.11 | 1,349,084.00 | 647.70 |

| Model | Mean Absolute Error () | Root Mean Square () | Coefficient of Determination () |

|---|---|---|---|

| BP | 22.3839 | 34.1638 | 0.9577 |

| PSO-BP | 14.5382 | 21.5566 | 0.9880 |

| Window Number | Training Set Time Range | Test Set Time Range | Target Prediction Period |

|---|---|---|---|

| 1 | 1981–2014 | 2015–2019 | 2020–2024 |

| 2 | 1981–2016 | 2017–2021 | 2022–2024 |

| 3 | 1981–2018 | 2019–2023 | 2024 |

| Window Number | Department Demand Forecasting Method | PSO-BP Neural Network Model | Inter-Window Coefficient of Variation (CV%) | ||

|---|---|---|---|---|---|

| MAE (10,000 tons) | RMSE (10,000 tons) | MAE (10,000 tons) | RMSE (10,000 tons) | ||

| 1 | 18.26 | 23.51 | 12.89 | 16.73 | 8.2 |

| 2 | 16.94 | 21.87 | 11.56 | 15.29 | 7.5 |

| 3 | 15.78 | 19.63 | 10.32 | 13.85 | 6.9 |

| Mean Value | 17 | 21.67 | 11.59 | 15.29 | - |

| Forecasting Method | Window 1 Prediction (10,000 tons) | Window 2 Prediction (10,000 tons) | Window 3 Prediction (10,000 tons) | Deviation from Actual Value (%) |

|---|---|---|---|---|

| Department Demand Forecasting Method | 662.15 | 655.82 | 649.37 | 2.27–0.61 |

| PSO-BP Model | 658.37 | 651.29 | 648.15 | 1.70–0.11 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Du, B.; Feng, H.; Zhang, Z.; Liu, Q.; Zhu, H.; Liu, G.; Liu, L.; Han, X.; Zhao, X.; Li, S. China’s Chrome Demand Forecast from 2025 to 2040: Based on Sectoral Predictions and PSO-BP Neural Network. Sustainability 2025, 17, 9115. https://doi.org/10.3390/su17209115

Du B, Feng H, Zhang Z, Liu Q, Zhu H, Liu G, Liu L, Han X, Zhao X, Li S. China’s Chrome Demand Forecast from 2025 to 2040: Based on Sectoral Predictions and PSO-BP Neural Network. Sustainability. 2025; 17(20):9115. https://doi.org/10.3390/su17209115

Chicago/Turabian StyleDu, Baohua, Hongye Feng, Zhen Zhang, Qunyi Liu, Hongjian Zhu, Guwang Liu, Lei Liu, Xiuli Han, Xuguang Zhao, and Shuai Li. 2025. "China’s Chrome Demand Forecast from 2025 to 2040: Based on Sectoral Predictions and PSO-BP Neural Network" Sustainability 17, no. 20: 9115. https://doi.org/10.3390/su17209115

APA StyleDu, B., Feng, H., Zhang, Z., Liu, Q., Zhu, H., Liu, G., Liu, L., Han, X., Zhao, X., & Li, S. (2025). China’s Chrome Demand Forecast from 2025 to 2040: Based on Sectoral Predictions and PSO-BP Neural Network. Sustainability, 17(20), 9115. https://doi.org/10.3390/su17209115