How Does the Carbon Emission Trading Policy Enhance Corporate Green Technology Innovation? Evidence from Advanced Manufacturing Enterprises

Abstract

1. Introduction

2. Literature Review

3. Theoretical Analysis and Research Hypotheses

3.1. Impact of Carbon Emission Trading Policy on Corporate Green Technology Innovation

3.2. Mediating Effect of R&D Investment

3.3. Regulatory Effect of Carbon Quota Price

4. Research Design

4.1. Sample Selection and Data Sources

4.2. Variable Measurement

4.2.1. Explained Variable: Enterprise Green Technology Innovation

4.2.2. Core Explanatory Variable: Carbon Emission Trading Policy

4.2.3. Mediating Variable: R&D Investment Intensity

4.2.4. Moderating Variable: Carbon Quota Price

4.2.5. Control Variables

4.3. Model Specification

5. Empirical Results and Analysis

5.1. Descriptive Statistical Analysis

5.2. Benchmark Regression

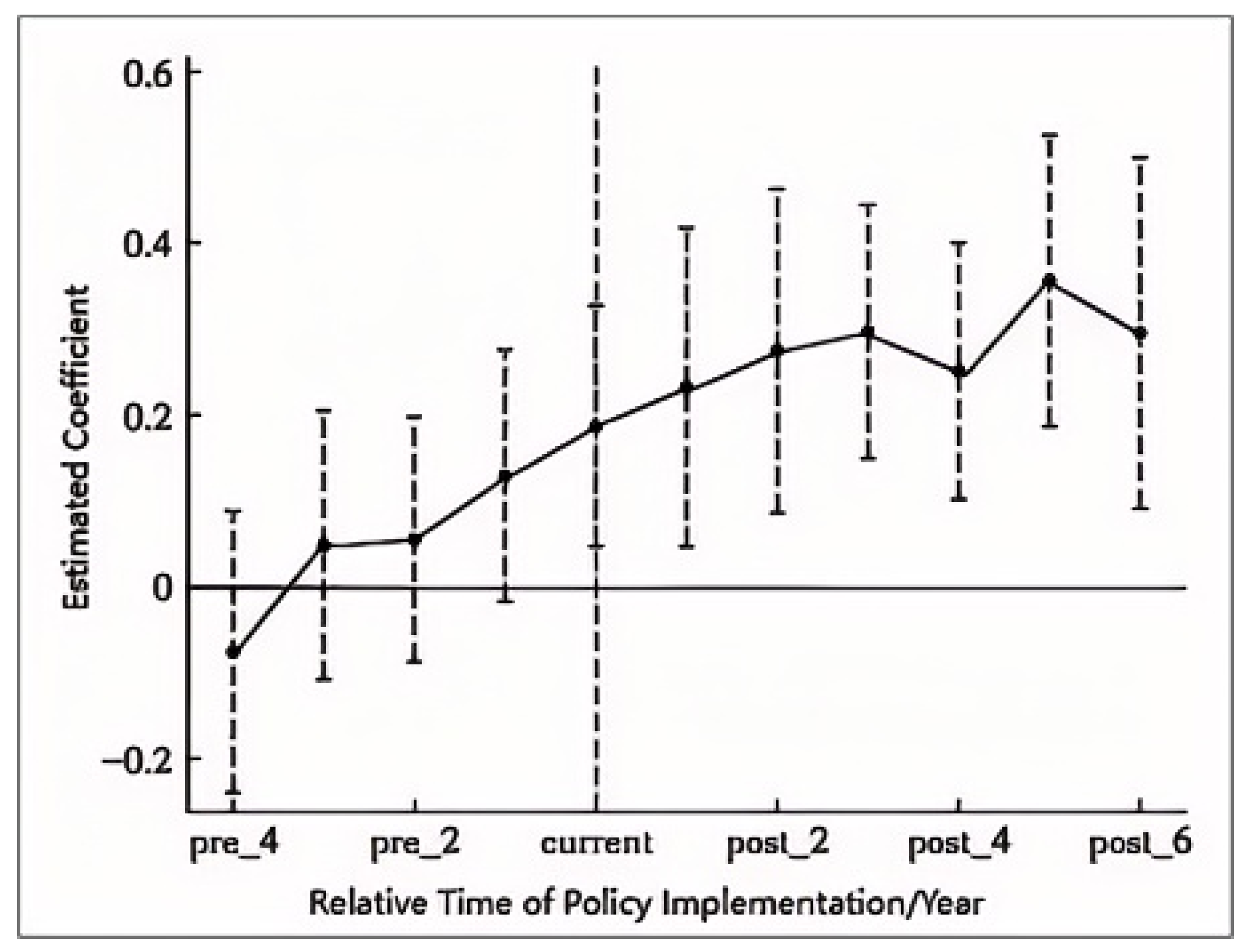

5.3. Robustness Tests

5.3.1. Placebo Test for Policy Timing

5.3.2. Endogeneity Test

5.3.3. Replacing the Explained Variable

5.3.4. Winsorization and Re-Processing of Outliers

5.4. Mechanism Impact Test

5.4.1. Mediating Role of R&D Investment

5.4.2. Test of Carbon Quota Price Moderating Effect

5.5. Heterogeneity Analysis

6. Conclusions and Policy Implications

6.1. Research Conclusions

6.2. Policy Implications

6.2.1. Optimize the Carbon Trading System to Strengthen Sustainability-Oriented Market Signals

6.2.2. Improve R&D Support Policies to Bridge the Sustainability Gap in Innovation Resources

6.2.3. Implement Differentiated Policies to Promote Inclusive and Sustainable Innovation

6.3. Research Limitations and Future Directions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Li, G.; Wang, X.; Su, S.; Su, Y. How green technological innovation ability influences enterprise competitiveness. Technol. Soc. 2019, 59, 101136. [Google Scholar] [CrossRef]

- Zhang, W.; Li, G.; Guo, F. Does carbon emissions trading promote green technology innovation in China? Appl. Energy 2022, 315, 119012. [Google Scholar] [CrossRef]

- Da Silva, E.R.; Shinohara, A.C.; Nielsen, C.P.; de Lima, E.P.; Angelis, J. Operating Digital Manufacturing in Industry 4.0: The role of advanced manufacturing technologies. Procedia CIRP 2020, 93, 174–179. [Google Scholar] [CrossRef]

- Wang, H.; Cui, H.; Zhao, Q. Effect of green technology innovation on green total factor productivity in China: Evidence from spatial durbin model analysis. J. Clean. Prod. 2021, 288, 125624. [Google Scholar] [CrossRef]

- Huang, W.; Wang, Q.; Li, H.; Fan, H.; Qian, Y.; Klemeš, J.J. Review of recent progress of emission trading policy in China. J. Clean. Prod. 2022, 349, 131480. [Google Scholar] [CrossRef]

- Miao, C.; Duan, M.; Zuo, Y.; Wu, X. Spatial heterogeneity and evolution trend of regional green innovation efficiency—An empirical study based on panel data of industrial enterprises in China’s provinces. Energy Policy 2021, 156, 112370. [Google Scholar] [CrossRef]

- Feng, C.; Shi, B.; Kang, R. Does environmental policy reduce enterprise innovation?—Evidence from China. Sustainability 2017, 9, 872. [Google Scholar] [CrossRef]

- Chen, S.; Shi, A.N.; Wang, X. Carbon Emission Curbing Effects and Influencing Mechanisms of China’s Emission Trading Scheme: The Mediating Roles of Technique Effect, Composition Effect and Allocation Effect. J. Clean. Prod. 2020, 264, 121700. [Google Scholar] [CrossRef]

- Liu, Z.; Sun, H. Assessing the impact of emissions trading scheme on low-carbon technological innovation: Evidence from China. Environ. Impact Assess. Rev. 2021, 89, 106589. [Google Scholar] [CrossRef]

- Lyu, X.; Shi, A.; Wang, X. Research on the impact of carbon emission trading system on low-carbon technology innovation. Carbon Manag. 2020, 11, 183–193. [Google Scholar] [CrossRef]

- Lv, M.; Bai, M. Evaluation of China’s carbon emission trading policy from corporate innovation. Financ. Res. Lett. 2021, 39, 101565. [Google Scholar] [CrossRef]

- Pan, X.; Shen, Z.; Song, M.; Shu, Y. Enhancing green technology innovation through enterprise environmental governance: A life cycle perspective with moderator analysis of dynamic innovation capability. Energy Policy 2023, 182, 113773. [Google Scholar] [CrossRef]

- Peng, B.; Zheng, C.; Wei, G.; Elahi, E. The cultivation mechanism of green technology innovation in manufacturing industry: From the perspective of ecological niche. J. Clean. Prod. 2020, 252, 119711. [Google Scholar] [CrossRef]

- Anderson, B.; Di Maria, C. Abatement and Allocation in the Pilot Phase of the EU ETS. Environ. Resour. Econ. 2011, 48, 83–103. [Google Scholar] [CrossRef]

- Du, G.; Yu, M.; Sun, C.; Han, Z. Green innovation effect of emission trading policy on pilot areas and neighboring areas: An analysis based on the spatial econometric model. Energy Policy 2021, 156, 112431. [Google Scholar] [CrossRef]

- Yu, H.; Jiang, Y.; Zhang, Z.; Shang, W.-L.; Han, C.; Zhao, Y. The impact of carbon emission trading policy on firms’ green innovation in China. Financ. Innov. 2022, 8, 55. [Google Scholar] [CrossRef]

- Song, Y.; Liang, D.; Liu, T.; Song, X. How China’s current carbon trading policy affects carbon price? An investigation of the Shanghai Emission Trading Scheme pilot. J. Clean. Prod. 2018, 181, 374–384. [Google Scholar] [CrossRef]

- Liu, L.; Chen, C.; Zhao, Y.; Zhao, E. China’s carbon-emissions trading: Overview, challenges and future. Renew. Sustain. Energy Rev. 2015, 49, 254–266. [Google Scholar] [CrossRef]

- Zhao, X.; Wu, L.; Li, A. Research on the efficiency of carbon trading market in China. Renew. Sustain. Energy Rev. 2017, 79, 1–8. [Google Scholar] [CrossRef]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development; United Nations: New York, NY, USA, 2015. [Google Scholar]

- Xuan, D.; Ma, X.; Shang, Y. Can China’s policy of carbon emission trading promote carbon emission reduction? J. Clean. Prod. 2020, 270, 122383. [Google Scholar] [CrossRef]

- Jia, L.; Zhang, X.; Wang, X.; Chen, X.; Xu, X.; Song, M. Impact of carbon emission trading system on green technology innovation of energy enterprises in China. J. Environ. Manag. 2024, 360, 121229. [Google Scholar] [CrossRef]

- Wu, Q.; Wang, Y. How does carbon emission price stimulate enterprises’ total factor productivity? Insights from China’s emission trading scheme pilots. Energy Econ. 2022, 109, 105990. [Google Scholar] [CrossRef]

- Zhang, W.; Li, J.; Li, G.; Guo, S. Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China. Energy 2020, 196, 117117. [Google Scholar] [CrossRef]

- Pan, X.; Li, M.; Xu, H.; Guo, S.; Guo, R.; Lee, C.T. Simulation on the effectiveness of carbon emission trading policy: A system dynamics approach. J. Oper. Res. Soc. 2021, 72, 1447–1460. [Google Scholar] [CrossRef]

- Jung, S.; Kwak, G. Firm characteristics, uncertainty and research and development (R&D) investment: The role of size and innovation capacity. Sustainability 2018, 10, 1668. [Google Scholar] [CrossRef]

- Rodríguez-Pose, A.; Crescenzi, R. Research and development, spillovers, innovation systems, and the genesis of regional growth in Europe. LSE Res. Online Doc. Econ. 2008, 42, 51–67. [Google Scholar] [CrossRef]

- Li, M.; Gao, X. Implementation of enterprises’ green technology innovation under market-based environmental regulation: An evolutionary game approach. J. Environ. Manag. 2022, 308, 114570. [Google Scholar] [CrossRef]

- Wang, N.; Shang, K.; Qin, D.D. Carbon quota allocation modeling framework in the automotive industry based on repeated game theory: A case study of ten Chinese automotive enterprises. Energy 2023, 279, 128093. [Google Scholar] [CrossRef]

- Fang, G.; Tian, L.; Liu, M.; Fu, M.; Sun, M. How to optimize the development of carbon trading in China—Enlightenment from evolution rules of the EU carbon price. Appl. Energy 2018, 211, 1039–1049. [Google Scholar] [CrossRef]

- Efstathiades, A.; Tassou, S.A.; Oxinos, G.; Antoniou, A. Advanced manufacturing technology transfer and implementation in developing countries: The case of the Cypriot manufacturing industry. Technovation 2000, 20, 93–102. [Google Scholar] [CrossRef]

- Cecere, G.; Corrocher, N.; Gossart, C.; Ozman, M. Technological pervasiveness and variety of innovators in Green ICT: A patent-based analysis. Res. Policy 2014, 43, 1827–1839. [Google Scholar] [CrossRef]

- Hao, J.; Li, C.; Yuan, R.; Ahmed, M.; Khan, M.A.; Oláh, J. The influence of the knowledge-based network structure hole on enterprise innovation performance: The threshold effect of R&D investment intensity. Sustainability 2020, 12, 6155. [Google Scholar]

- Chen, W. Carbon quota price and CDM potentials after Marrakesh. Energy Policy 2003, 31, 709–719. [Google Scholar] [CrossRef]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone: Oxford, UK, 1997. [Google Scholar]

- Aihua, L.; Miglietta, P.P.; Toma, P. Did carbon emission trading system reduce emissions in China? An integrated approach to support policy modeling and implementation. Energy Syst. 2022, 13, 437–459. [Google Scholar] [CrossRef]

- Yang, S. Carbon emission trading policy and firm’s environmental investment. Financ. Res. Lett. 2023, 54, 103695. [Google Scholar] [CrossRef]

- Zhonglin, W.; Baojuan, Y.E. Different Methods for Testing Moderated Mediation Models: Competitors or Backups? Acta Psychol. Sin. 2014, 46, 714. [Google Scholar] [CrossRef]

- Shan, H. Influence Mechanism of Smart City Pilot Policy on Enterprise Green Technology Innovation: Evidence from China. Sustainability 2025, 17, 959. [Google Scholar] [CrossRef]

- Wang, M.; Li, Y.; Li, J.; Wang, Z. Green process innovation, green product innovation and its economic performance improvement paths: A survey and structural model. J. Environ. Manag. 2021, 297, 113282. [Google Scholar] [CrossRef]

| Research Perspective | Representative References and Core Arguments | Key Focus Areas | Distinctions in Current Study |

|---|---|---|---|

| Supportive Perspectives | [7]: Policy inhibits non-green innovation but promotes green innovation. | Economic effects (e.g., cost efficiency) Technological effects (e.g., innovation output) | Provides holistic analysis of joint effects (R&D and carbon price) on long-term sustainability. Addresses gaps by incorporating environmental and social sustainability outcomes aligned with UN SDGs, not just economic/technological factors. |

| [8]: Policy reduces emissions by 13.39% annually, mediated by high-quality innovation. | |||

| [9]: Carbon trading enhances low-carbon innovation, competitiveness, and emission reduction. | |||

| [10]: Policy provides direct incentives for low-carbon technological innovation in firms. | |||

| [11]: Policy stimulates green innovation activities and boosts innovation capabilities. | |||

| [12]: Carbon trading strengthens environmental management to drive lifecycle green innovation. | |||

| [13]: Policy cultivates green innovation niches in manufacturing sectors. | |||

| Critical Perspectives | [14]: Firms prefer buying external tech over self-innovation under EU ETS. | Regulatory barriers (e.g., carbon price volatility) Firm-level constraints (e.g., heterogeneity in ownership/finances) | Focuses on advanced manufacturing heterogeneity, not treating manufacturing as monolithic. |

| [15]: Weak firm-level incentives due to implementation barriers limit direct policy effects. | |||

| [16]: Policy effectiveness varies by ownership/financial heterogeneity. | |||

| [17]: Carbon price volatility undermines long-term green investment and emission goals. | |||

| [18]: Market design flaws (e.g., quota allocation) reduce innovation incentives. | |||

| [19]: Low market efficiency weakens price signals and innovation mechanisms. | |||

| This Study | Constructs a unified “policy-R&D investment-carbon price-green innovation” framework, analyzing advanced manufacturing enterprises. | Integrated mediator-moderator analysis (R&D investment + carbon price) Sustainability linkage (environmental outcomes) | |

| Variable Type | Variable Name | Symbol | Measurement Method | Data Source |

|---|---|---|---|---|

| Explained variable | Enterprise green technology innovation | Gti | ln (number of authorized green invention patents + 1) | the State Intellectual Property Office database |

| Core explanatory variable | Carbon emission trading policy | Did | treat × post (treat: pilot enterprise dummy; post: policy implementation dummy) | Official Portal of the Chinese Government |

| Mediating variable | R&D investment intensity | Rdi | R&D investment/operating income | Wind Database CSMAR Database |

| Moderating variable | Carbon quota price | Price | Annual average transaction price of carbon quotas in the pilot city | National/Regional Emission Exchange |

| Control variables | Enterprise size | Size | Natural logarithm of total assets at the end of the year | Wind Database CSMAR Database |

| Enterprise age | Age | Observation year–year of enterprise establishment | ||

| Asset-liability ratio | Lev | Total liabilities at the end of the year/total assets at the end of the year | ||

| Property right nature | Soe | State-owned enterprise = 1, non-state-owned enterprise = 0 | ||

| Return on net assets | Roe | Net profit/average net assets | ||

| Total asset turnover | Turnover | Operating income/average total assets |

| Variable | Observations | Mean | Standard Deviation | Minimum | Median | Maximum |

|---|---|---|---|---|---|---|

| Gti | 8470 | 0.863 | 1.124 | 0.000 | 0.000 | 5.012 |

| Did | 8470 | 0.364 | 0.467 | 0.000 | 0.000 | 1.000 |

| Rdi | 8470 | 3.420 | 2.152 | 0.012 | 2.983 | 12.352 |

| Price | 8470 | 42.153 | 15.201 | 22.402 | 38.752 | 78.602 |

| Size | 8470 | 22.453 | 1.243 | 19.862 | 22.302 | 26.127 |

| Age | 8470 | 15.231 | 8.123 | 3.000 | 14.000 | 42.000 |

| Lev | 8470 | 42.128 | 19.253 | 8.452 | 40.223 | 85.672 |

| Soe | 8470 | 0.282 | 0.452 | 0.000 | 0.000 | 1.000 |

| Roe | 8470 | 8.253 | 6.782 | −15.201 | 7.862 | 32.452 |

| Turnover | 8470 | 0.682 | 0.331 | 0.113 | 0.623 | 2.152 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Did | 0.352 *** (3.89) | 0.328 *** (3.42) | 0.319 *** (3.31) | 0.305 *** (3.18) |

| Size | - | 0.121 ** (2.56) | 0.118 ** (2.43) | 0.115 ** (2.37) |

| Rdi | - | 0.043 *** (4.12) | 0.041 *** (3.98) | 0.040 *** (3.87) |

| Lev | - | −0.007 ** (−2.32) | −0.007 ** (−2.28) | −0.006 * (−1.96) |

| Soe | - | 0.088 (1.23) | 0.085 (1.19) | 0.082 (1.15) |

| Price × Did | - | - | - | 0.005 ** (2.26) |

| Year FE | Control | Control | Control | Control |

| Industry FE | Control | Control | Control | Control |

| Control Variables | No | Yes | Yes | Yes |

| Observations | 8470 | 8470 | 8470 | 8470 |

| Adj-R2 | 0.286 | 0.312 | 0.309 | 0.315 |

| Variables | (1) Placebo Test | (2) Endogeneity Test-IV | (3) Replaced Explained Variable | (4) Two-Way Winsorization |

|---|---|---|---|---|

| Did | 0.073 (0.81) | 0.401 *** (3.78) | 0.294 *** (3.17) | 0.331 *** (3.52) |

| Size | 0.119 ** (2.41) | 0.125 ** (2.52) | 0.123 ** (2.58) | 0.120 ** (2.45) |

| Rdi | 0.042 *** (4.05) | 0.038 *** (3.82) | 0.040 *** (3.92) | 0.041 *** (4.01) |

| Lev | −0.006 * (−1.98) | −0.007 ** (−2.36) | −0.007 ** (−2.35) | −0.006 * (−2.01) |

| Soe | 0.083 (1.17) | 0.085 (1.21) | 0.087 (1.22) | 0.085 (1.19) |

| Year FE | Control | Control | Control | Control |

| Industry FE | Control | Control | Control | Control |

| Observations | 8470 | 7852 | 8470 | 8470 |

| Adj-R2 | 0.278 | 0.296 | 0.305 | 0.310 |

| Variables | (1) Total Effect Model | (2) First Stage | (3) Mediating Model |

|---|---|---|---|

| Did | 0.328 *** (3.42) | 0.215 *** (3.84) | 0.251 ** (2.56) |

| Rdi | - | - | 0.037 *** (3.72) |

| Size | 0.121 ** (2.56) | 0.083 * (1.82) | 0.118 ** (2.43) |

| Lev | −0.007 ** (−2.32) | −0.003 (−1.23) | −0.006 * (−1.96) |

| Control Variables | Control | Control | Control |

| Year FE | Control | Control | Control |

| Industry FE | Control | Control | Control |

| Observations | 8470 | 8470 | 8470 |

| Adj-R2 | 0.312 | 0.286 | 0.324 |

| Variables | Coefficient | Std. Error | t-Value | p-Value |

|---|---|---|---|---|

| Did | 0.218 ** | 0.098 | 2.22 | 0.026 |

| Price | 0.003 | 0.002 | 1.52 | 0.129 |

| Did × Price | 0.005 ** | 0.002 | 2.26 | 0.024 |

| Size | 0.117 ** | 0.049 | 2.39 | 0.017 |

| Rdi | 0.039 *** | 0.010 | 3.90 | 0.000 |

| Control Variables | Control | - | - | - |

| Year FE | Control | - | - | - |

| Industry FE | Control | - | - | - |

| Observations | 8470 | - | - | - |

| Adj-R2 | 0.318 | - | - | - |

| Variables | State-Owned Enterprises | Non-State-Owned Enterprises |

|---|---|---|

| Did | 0.286 ** (2.35) | 0.402 *** (3.87) |

| Size | 0.135 ** (2.41) | 0.108 * (1.96) |

| Rdi | 0.032 ** (2.78) | 0.045 *** (4.23) |

| Control Variables | Control | Control |

| Year | Control | Control |

| Industry | Control | Control |

| Observations | 2420 | 6050 |

| Adj-R2 | 0.298 | 0.332 |

| Variables | Large Enterprises | Small and Medium-Sized Enterprises |

|---|---|---|

| Did | 0.386 *** (3.92) | 0.253 ** (2.31) |

| Size | 0.157 ** (2.78) | 0.086 * (1.76) |

| Rdi | 0.048 *** (4.02) | 0.029 ** (2.63) |

| Control Variables | Control | Control |

| Year FE | Control | Control |

| Industry FE | Control | Control |

| Observations | 4230 | 4240 |

| Adj-R2 | 0.352 | 0.291 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xie, S.; Zhao, P.; Wang, S. How Does the Carbon Emission Trading Policy Enhance Corporate Green Technology Innovation? Evidence from Advanced Manufacturing Enterprises. Sustainability 2025, 17, 8199. https://doi.org/10.3390/su17188199

Xie S, Zhao P, Wang S. How Does the Carbon Emission Trading Policy Enhance Corporate Green Technology Innovation? Evidence from Advanced Manufacturing Enterprises. Sustainability. 2025; 17(18):8199. https://doi.org/10.3390/su17188199

Chicago/Turabian StyleXie, Shiheng, Pengbo Zhao, and Shuping Wang. 2025. "How Does the Carbon Emission Trading Policy Enhance Corporate Green Technology Innovation? Evidence from Advanced Manufacturing Enterprises" Sustainability 17, no. 18: 8199. https://doi.org/10.3390/su17188199

APA StyleXie, S., Zhao, P., & Wang, S. (2025). How Does the Carbon Emission Trading Policy Enhance Corporate Green Technology Innovation? Evidence from Advanced Manufacturing Enterprises. Sustainability, 17(18), 8199. https://doi.org/10.3390/su17188199