1. Introduction

Escalating regulatory requirements and stakeholder pressures have propelled corporate environmental initiatives to evolve from compliance obligations into pivotal sources of strategic competitive advantage [

1]. Grounded in Mitchell et al.’s [

2] PLU (power, legitimacy, and urgency) theoretical framework, recent empirical evidence demonstrates the significant influence of power, legitimacy, and urgency attributes in corporate sustainability decision making [

3]. However, existing research exhibits two critical limitations. First, the interactive mechanisms of PLU attributes and their systemic impacts on organizational pressure transmission remain theoretically underdeveloped. Second, within Industry 4.0 contexts, the transformative mechanisms through which AI-driven analytical technologies and Internet of Things (IoT)-enabled circular economy systems mediate external pressures and corporate environmental strategies remain inadequately explored [

4].

Proactive environmental practices (PEPs), as voluntary environmental measures exceeding regulatory compliance [

5], have demonstrated strategic value in addressing resource scarcity and reducing operational costs [

6]. However, existing research (

Table 1) exhibits a disproportionate focus on large corporations while neglecting small and medium-sized enterprises (SMEs), leaving unclear the mechanisms for balancing multiple stakeholder demands under resource constraints. This research gap holds significant scholarly merit, given that SMEs currently account for 90% of global enterprises and rely more heavily on adaptive strategies such as micro-innovation for sustainable development. While contemporary digital technologies enhance corporate capacity to quantify stakeholder demands (e.g., web-based public opinion monitoring), their potential to reconfigure traditional power dynamics remains underexplored. This study integrates the attention-based view (ABV) to construct a pressure–attention–action translation model, offering novel theoretical perspectives for explaining corporate environmental decision making mechanisms.

This study addresses the core research question: Under what conditions do enterprises voluntarily allocate resources to implement ultra-regulatory proactive environmental practices (PEPs) when confronting pluralistic stakeholder pressures arising from asymmetric power structures, legitimacy conflicts, and urgency differentials? Building upon stakeholder theory [

2] and the attention-based view [

11], we propose that dynamic PLU (power, legitimacy, and urgency) configurations influence corporate resource reconfiguration through cognitive mechanisms. Although existing research confirms that stakeholder pressures drive environmental actions [

9], two critical gaps persist: (1) an insufficient theoretical explanation of the mechanisms governing resource-constrained pressure modulation in small and medium-sized enterprises (SMEs), and (2) unverified mediating effects driving corporate decision making. Our research objectives focus on theorizing the contingent relationship between PLU pressures and firm scale while revealing organizational thresholds for reshaping managerial attention allocation and resource deployment [

12].

In this study, an innovative framework for corporate environmental decision making is developed by integrating PLU dynamic mechanisms [

2] with the attention-based view [

11], proposing three theoretical innovations. First, we identify nonlinear synergistic effects among PLU attributes. Under high-urgency conditions, legitimacy significantly amplifies power’s influence on decision making, challenging conventional linear assumptions. We further reveal that temporal pressures compel firms to prioritize responses to stakeholders demonstrating “high power–high legitimacy” configurations. Second, we demonstrate scale-mediated pathways in resource availability utilization. While small and medium-sized enterprises (SMEs) compensate for resource gaps through strategic reallocation under intensive pressures, large corporations leverage organizational slack to buffer such constraints [

13], validating heterogeneous resource deployment patterns across firm sizes. Third, we propose a salience empowerment model showing that urgency-driven dynamics can reconfigure traditional power structures. For instance, community residents enhance claim legitimacy through social media tools, challenging static PLU framework assumptions and providing new evidence for stakeholder theory.

The contributions are twofold: we integrate stakeholder theory with resource-based theory to establish a contingency model explaining how firms expand resource efficacy through adaptive mechanisms; and we elucidate legitimacy empowerment strategies that enhance decision making influence, challenging static conceptions of stakeholder salience while providing novel tools for strategic agility in pressure transformation.

This study proposes a practical framework comprising three components: (1) the development of a PLU prioritization decision making tool that dynamically optimizes resource allocation priorities through the quantitative assessment of stakeholder attributes (e.g., urgency scoring generated from environmental monitoring); (2) the implementation of a circular economy hub model for small and medium-sized enterprises (SMEs) to enhance resource efficiency via collaborative networks, while large corporations are advised to establish green innovation budgets to strengthen strategic resilience; and (3) the creation of scale-sensitive environmental policy systems.

2. Theoretical Background and Hypothesis Development

2.1. Stakeholder Attributes (Power, Legitimacy, Urgency) and Corporate Behavior

2.1.1. Theoretical Foundation Framework

Stakeholder theory elucidates how corporations allocate resources among competing interests through descriptive, instrumental, and normative dimensions. Its core premise posits that firms prioritize satisfying critical stakeholders who influence organizational survival [

14]. Extending this premise, the attention-based view (ABV) emphasizes how managers’ dynamic perceptions of external pressures (e.g., regulatory shifts, consumer activism) guide resource allocation [

15]. Unlike static stakeholder classifications, ABV reveals the path dependency of decision making, where historical resource commitments persistently constrain future environmental strategy selection [

11], thereby generating cumulative effects in environmental behaviors.

2.1.2. Interactive Mechanisms of the PLU Framework

The PLU framework by Mitchell et al. [

2] deconstructs stakeholder salience through three-dimensional dynamic interplay:

Power: A stakeholder’s capacity to compel corporate decision making changes, encompassing coercive, utilitarian, and normative dimensions [

16,

17]. For instance, the RE100 Alliance leverages market influence to drive renewable energy adoption, exemplifying environmental governance effects through utilitarian power.

Legitimacy: The socially constructed recognition of claim appropriateness [

18]. The EU Carbon Border Adjustment Mechanism (CBAM) demonstrates regulatory efficacy over corporate behavior by internalizing carbon costs, showcasing policy legitimacy in action [

19].

Urgency: Temporal sensitivity and criticality of claims [

20]. CBAM’s 2026 mandatory reporting deadline exemplifies urgency mechanisms, demonstrating how temporal constraints amplify policy instrument effectiveness.

2.1.3. Interactive Formation of Asymmetric Pressure Gradients

The dynamic interplay of these three attributes generates asymmetric pressure gradients. Government agencies possess power and legitimacy advantages, though urgency may fluctuate with regulatory implementation timelines, while non-governmental organizations (NGOs) lacking formal power can elevate issue urgency perception through media mobilization to influence decision making. This dynamic compels enterprises to establish systematic stakeholder salience evaluation mechanisms, enabling real-time PLU attribute quantification and prioritization. For instance, viral social media dissemination amplifies grassroots organizational influence, thereby disrupting traditional governance structures dominated by governments and corporations.

2.1.4. Strategic Corporate Responses to Stakeholder Pressures

Corporate environmental strategy selection is moderated by two critical factors [

21]. The first is resource flexibility—large enterprises utilize budgetary slack to buffer PLU pressures while maintaining core operational stability [

22], whereas SMEs achieve resource optimization through circular economy hubs via collaborative networks. The second is attention orchestration—under the ABV framework, firms establish tri-dimensional PLU evaluation mechanisms to prioritize resource allocation for high-salience stakeholders (e.g., ESG investors). Large corporations demonstrate faster decision–response speeds due to resource abundance compared to SMEs.

However, two critical paradoxes emerge. The legitimacy paradox manifests when compliance mechanisms such as CBAM’s carbon cost internalization potentially incite conflicting stakeholder opposition [

19], and the urgency inflation phenomenon occurs as social media compresses environmental technology decision cycles, risking technology lock-in effects [

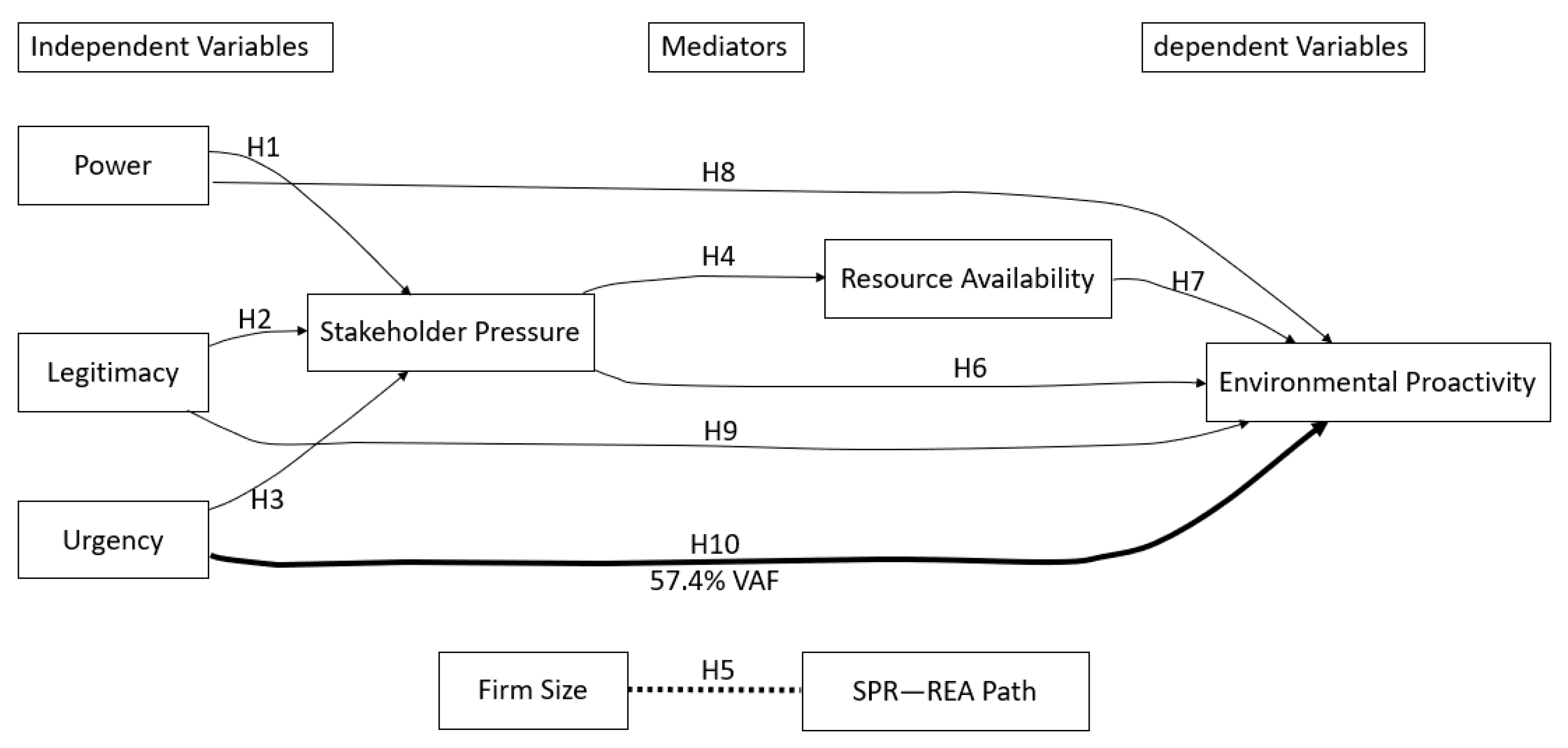

23]. While stakeholder salience assessment enhances decision making efficiency, it may simultaneously exacerbate short-termism tendencies. This study focuses on the three antecedents of stakeholder pressure, examining how company size moderates resource availability and drives proactive environmental decision making, as illustrated in

Figure 1.

Hypothesis 1. The power attributes of stakeholders positively influence the perceived stakeholder pressure of the company.

Hypothesis 2. The legitimacy attributes of stakeholders positively influence the perceived stakeholder pressure of the company.

Hypothesis 3. The urgency attribute of stakeholders positively influences the perceived stakeholder pressure of the company.

2.2. Resource Availability and Corporate Environmental Proactivity

The resource-based view (RBV) posits that the efficacy of proactive environmental practices (PEPs) hinges on transforming heterogeneous resources (financial/technological/human) into non-substitutable capabilities [

24,

25]. By strategically integrating renewable technology patents with circular supply chains, enterprises not only respond to stakeholder pressures, but cultivate differentiated competitive advantages. Industry 4.0-driven intelligent resource allocation systems necessitate dynamic capability deployment mechanisms [

26], enhancing organizational agility and regulatory adaptability.

Integrating the attention-based view with stakeholder theory reveals how firms prioritize high-salience issues (e.g., CBAM compliance) through structured decision protocols. Digital filtering mechanisms supplant traditional processes by enabling the quantitative assessment of urgency metrics (e.g., carbon emission deadlines) and legitimacy indicators (e.g., ESG ratings), thereby facilitating dynamic threshold adjustments of resource allocation. Contrary to resource dependence theory’s (RDT’s) static model, the ABV framework reconceptualizes environmental strategy as an ongoing negotiation between attentional bandwidth and external pressures. This optimization reduces compliance costs while amplifying green innovation outputs through refined resource distribution.

While RDT similarly addresses external pressure responses [

27], it conceptualizes firms as passive reactors constrained by power asymmetries (e.g., regulatory coercion). Conversely, the ABV adopted here reframes environmental strategy as an active cognitive negotiation between attentional bandwidth and stakeholder demands. This distinction is critical: RDT’s static resource exchange model cannot explain why firms with identical dependencies (e.g., Taiwanese electronics suppliers facing identical RE100 pressures) exhibit divergent proactivity levels—a variance accounted for by ABV’s emphasis on managerial attention orchestration, as shown in our PLU mediation effects.

2.3. Impact of Firm Size on Stakeholder Pressures and Resource Allocation

Firm size moderates pressure response mechanisms through structural visibility, resource endowment, and institutional embeddedness [

13]. Large enterprises face intensified ESG scrutiny due to high market exposure, necessitating budgetary slack to buffer compliance pressures [

10]. Consequently, their legitimacy-driven environmental investments predominantly stem from reputational management motivations. Conversely, small and medium-sized enterprises (SMEs) confront heightened environmental pressure focalization from supply chains and communities [

19], yet resource constraints engender strategic trade-off dilemmas between compliance costs and innovation investments.

While large corporations possess modular resource architectures (e.g., cross-departmental budgets supporting circular economies), hierarchical structures limit their environmental innovation to incremental improvements. Conversely, SMEs achieve scale economies in innovation through networked strategies such as resource-sharing partnerships. Structural rigidity in large firms induces decision latency, whereas SME resource flexibility enhances response speed.

Hypothesis 4. The greater the perceived pressure from stakeholders on a company, the more positively it will affect its resource availability.

Hypothesis 5. The larger the firm, the more likely it is to moderate the relationship between stakeholder pressure and enterprise resource availability.

2.4. Typology and Determinants of Proactive Environmental Practices

Proactive environmental practices (PEPs) denote corporate initiatives that surpass regulatory requirements by embedding sustainability into core strategic operations [

28]. These encompass two predominant forms: proactive technological innovation (e.g., carbon capture technology R&D for efficiency enhancement), and systemic collaborative networks (e.g., participation in cross-industry circular ecosystems to reduce industrial waste).

The adoption of PEPs is driven by dual mechanisms. The first is attentional agility: enterprises with dedicated sustainability departments demonstrate higher PLU pressure conversion efficiency than their non-specialized counterparts [

21], indicating that organizational attention focus determines environmental strategy responsiveness. The second is resource fluidity: small and medium-sized enterprises (SMEs) compensate for resource gaps through open innovation networks generating synergistic effects, whereas large corporations allocate supplementary R&D budgets to support high-risk PEP initiatives.

This study reveals PEPs’ dual strategic nature, serving both as reactive pressure responses and active levers for reshaping industry norms (e.g., RE100 Alliance’s energy standard reconfiguration). Contrasting traditional resource-based view’s static analysis, we propose an attention-based view dynamic capability perspective, demonstrating PEPs’ explanatory power regarding competitive advantage while contributing novel theoretical insights to strategic management.

Hypothesis 6. The greater the perceived pressure from stakeholders, the more positively it will impact environmental positivity.

Hypothesis 7. The greater the resource availability in a company, the more positively it will influence environmental positivity.

Hypothesis 8 When a company focuses on stakeholders’ power attributes, it will positively influence environmental positivity. This relationship is mediated through stakeholder pressure and resource availability.

Hypothesis 9. When a company focuses on stakeholders’ legitimacy attributes, it will positively influence environmental positivity. This relationship is mediated through stakeholder pressure and resource availability.

Hypothesis 10. When a company focuses on urgent content related to stakeholders, it will positively influence environmental positivity. This relationship is mediated through stakeholder pressure and resource availability.

3. Methods

3.1. Data Sources and Sample

To verify our hypothesis, we included both service and manufacturing industries in the implementation of environmental practices. The questionnaire used in this study was developed based on established scales from previous research. The initial draft was first sent to managers in the chemical, machinery, information technology, pharmaceutical, food, banking, tourism, and hospitality industries for review. Additionally, a pilot test was conducted with 30 EMBA (Executive Master of Business Administration) students. Their feedback and suggestions were incorporated to improve the readability and clarity of the questionnaire, ensuring more accurate and honest responses.

3.2. Procedures for Collecting Data

Several steps were taken to reduce response bias and the effects of social desirability among participants. First, the cover letter of the questionnaire made it clear that the survey was for academic purposes only. Second, we ensured that all responses were anonymous and that the collected data would remain confidential. We targeted companies that had received government awards in the past five years, such as the Taiwan Quality Award, National Environmental Protection Award, and Innovation Research Award. To avoid duplicate data, we confirmed that these companies were still active. Data collection was conducted between January and April 2023 through an online survey system (Survey Cake), with a URL and QR code provided to reach 1986 companies. We received 581 responses, but 78 were excluded due to insufficient knowledge of environmental issues. The final sample size was 503 companies, with an adjusted response rate of 25.3%, which was used for further analysis.

To ensure the reliability of the survey data, we addressed potential limitations in several ways. First, standardized measurement criteria and Likert scales consistent with previous research were used to maintain objectivity. Second, the questionnaire was simplified and organized into categories to reduce any confusion for respondents. Lastly, anonymity was guaranteed for knowledgeable managers. These measures helped encourage honest and thoughtful responses, making the data a reliable source of information.

3.3. Descriptive Statistics

We conducted various statistical tests on the data.

Table 2 provides an overview of the respondents, further confirming the sample’s representativeness. The respondents in our study are categorized by gender, management level, industry type (manufacturing or service industry), firm age, and firm size. Therefore, the sample represents a broad range of companies.

3.4. Nonresponse Bias

To control for nonresponse bias, we employed several statistical methods. First, a

t-test mean analysis was used to check for any response bias, and the results showed no significant deviations across the responses. Additionally, we applied time trend extrapolation to test for response bias. This method assumes that nonresponders are more similar to late responders than early responders. As a result, we classified the first 25% of respondents as early responders and the last 25% as a proxy for nonresponders. Finally, we conducted Levene’s test to determine whether there were significant differences between these two groups. The results showed no statistically significant differences for any of the questions in the survey (as shown in

Table 3), indicating that our sample was both representative and statistically sound.

3.5. Common Method Bias

Several methods were employed to mitigate the potential threat of common method bias (CMB) in our research results [

29]. First, reverse-coded questions were included in the questionnaire to address potential bias. Second, we conducted Harman’s single-factor test. Third, we applied exploratory factor analysis (EFA) to examine the factor structure of the relevant variables. The results showed that the eigenvalues for all measured items were greater than 1.0, accounting for 69.51% of the total variance, with the first factor explaining only 31.45%, which is well below the 50.0% benchmark. We also performed a correlation coefficient analysis, confirming that the correlations between all variables were lower than the square root of the average variance extracted (AVE), further ruling out CMB concerns. Finally, we conducted a full collinearity assessment, and all variance inflation factor (VIF) values were below the threshold. Overall, these results indicate that common method bias does not pose a significant threat to our study.

3.6. Measures and Scales

3.6.1. Power, Legitimacy, Urgency

To assess the influence of the three key stakeholder attributes on the levels of pressure they exert, we used established scales for stakeholder power, legitimacy, and urgency [

30]. The evaluation focused on how these stakeholder attributes were represented in the items. A five-point Likert scale, ranging from 1 (strongly disagree) to 5 (strongly agree), was used for rating the items (see

Appendix A for the full questionnaire).

3.6.2. Stakeholder Pressure

We applied an existing scale for stakeholder pressure [

31], covering most of the measurement items found in other literature, with minor adjustments. Business managers were asked to respond using a single Likert scale, ranging from 1 (representing the lowest level of stakeholder pressure) to 5 (representing the highest level) (see

Appendix A for the full questionnaire).

3.6.3. Resource Availability

To evaluate resource deployment in high-pressure environments, we used an existing scale to measure resource availability [

25]. The scale captures various company resources, reflecting how resource deployment is influenced by pressure. We used a five-point Likert scale ranging from 1 (strongly disagree) to 5 (strongly agree) (see

Appendix A for the full questionnaire).

3.6.4. Proactive Environmental Practice

We reviewed scholars’ definitions of environmental proactivity based on three criteria: proactive behaviors that go beyond compliance (i.e., proactive behavior), behaviors that simply comply with legal requirements (i.e., reactive behavior), and active resistance to environmental regulations (i.e., proactive resistance). Additionally, we identified four key characteristics of environmental proactivity: a forward-looking approach, the development of new products or services, anticipation of future demand, and the use of harmful processes and products as selection criteria for determining measurement items [

32].

From there, we refined the content, drawing on 12 items derived from 71 literature sources identified through a meta-analysis conducted by scholars [

33]. Ultimately, we selected 12 items from the four categories of 24 environmental proactivity measures classified by scholars [

5]. These 12 items were evaluated using a six-point Likert scale, ranging from 0 (not implemented at all) to 5 (mostly implemented) (see

Appendix A for the full questionnaire).

3.6.5. Firm Size

Measuring firm size can be complex, as it involves various company characteristics. Simply counting the number of employees may not fully capture the intricacies of an enterprise. To address this, we used the logarithm of the total number of employees, based on Taiwan’s enterprise size classification standards, to measure firm size. In this study, we employed a binary variable to represent firm size. Small service companies (fewer than 50 employees) were assigned a value of 0, while large service companies (51 or more employees) were assigned a value of 1. Similarly, small manufacturing companies (fewer than 200 employees) were assigned a value of 0, while large manufacturing companies (201 or more employees) were assigned a value of 1 (see

Appendix A for the full questionnaire).

3.7. Control Variables

In this empirical study, we included firm age and industry category as control variables to assess the significance of firm characteristics in explaining environmental practices. Empirical evidence suggests that more experienced firms tend to adhere to stricter industry standards [

34]. As a result, our analysis controlled for firm age and industry category as covariates.

3.8. Analysis

In this study, we aimed to ensure that our sample size was sufficient for analysis. To achieve this, we used G Power 4 software to conduct a power analysis for an F-test involving four predictor factors related to the R2 of the endogenous structure. With an effect size of f2 = 0.149 f2 = 0.149, R2 = 0.13 R2 = 0.13, a significance level of 0.05, and an expected power of 0.80, our analysis required at least 104 samples. We collected 503 samples, exceeding the required threshold.

We then analyzed the reliability and validity of the measurement model, structural model, and hypothesis testing. This study focused on predicting proactive environmental practices for the collected survey data. Using SMART-PLS4 as the analytical software, we explored variable relationships and model structures to maximize the explanatory power of the endogenous variables [

35]. After performing reliability and validity analyses of the measurement model, we employed the PLS algorithm to generate path coefficients (β-values). We used the bootstrapping method to obtain t-values and model explanatory power (R) to evaluate the statistical significance and explanatory strength of the constructs in the structural model.

Additionally, this study involved more complex models, including mediating and moderating variables. When incorporating mediating variables into the path model, we verified both direct and indirect path effects and assessed the proportion of explained variance attributed to the mediating variable (indirect effects) and the independent variable (direct effects). If the indirect effect was significant but did not substantially diminish the direct impact on the endogenous variable, the variance accounted for (VAF) might fall below 20%, indicating minimal mediation. If the VAF exceeded 80%, this would indicate complete mediation. A VAF between 20% and 80% suggests partial mediation. If the direction of the direct effect reverses, this signifies a suppressor effect.

We also investigated whether stakeholder pressure on resource availability was moderated by company size. To confirm whether the moderating variable influenced the path from the independent variable to the dependent variable, we performed moderation tests to validate the interaction effect.

5. Discussion and Conclusions

This study pioneers an integrated PLU-ABV-RBV framework to decode how firms translate stakeholder pressures into environmental actions under resource constraints. By dynamically linking power–legitimacy–urgency attributes with attentional mechanisms and scale effects, we provide three key advances: a contingency model explaining why legitimacy and urgency supersede power in driving proactivity; a resolution to the “SME paradox” in sustainability adoption; and empirically validated tools for real-time stakeholder prioritization. These contributions offer both theoretical precision and managerial utility beyond prior static stakeholder models.

5.1. Major Findings

This study empirically extends Mitchell et al.’s [

2] salience model by revealing differentiated PLU attribute impacts: legitimacy and urgency significantly drive pressure perception, whereas isolated power proves ineffective. These results empirically extend Crilly and Sloan’s [

37] “inside-out” legitimacy framework by revealing how urgency-laden contexts amplify normative pressures, thereby refining Mitchell et al.’s [

2] salience model in dynamic environments.

Breaking from traditional homogeneous pressure assumptions, we quantify PLU attribute differential effects through salience scoring. Empirical results demonstrate legitimacy’s explanatory power to significantly surpass other factors, compelling firms to prioritize institutional norm compliance [

2]. Crucially, legitimacy-driven pressures (e.g., CBAM compliance) and urgency-triggered imperatives (e.g., pollution crises) interact to induce corporate resource reallocation, thereby addressing critical gaps in stakeholder prioritization theory [

37].

This validates Ocasio’s [

15] proposition on attentional structuring while revealing scale-dependent resource decoupling—nuance absent from prior ABV–stakeholder integrations (e.g., Dal Maso et al. [

12]). While large enterprises leverage structural slack to buffer pressures, they must mitigate greenwashing risks arising from redundant environmental commitments. Conversely, SMEs constrained by agility reallocate operational budgets to urgent demands, necessitating pressure-tiered response mechanisms in policy design to prevent compliance cost overload [

23].

This study validates and extends the ABV-RBV integrated framework by revealing the scale’s dual moderating mechanism, demonstrating how organizational size moderates the decoupling of attention and resources, thereby providing size-sensitive amendments to the ABV. By challenging traditional RBV assumptions [

24], we found that external urgency pressure has led to the adjustment and relocation of enterprise resources, narrowing the gap in the adoption of proactive environmental practices between small and medium-sized enterprises and large companies.

That is to say, in situations with high emergency thresholds, the moderating effect of enterprise size will dissipate. Large firms utilize institutional slack to stabilize environmental strategies under critical pressure levels, while SMEs adopt networked agility strategies through external collaborations, compensating resource gaps with resource efficiency gains. Thus, urgency-driven resource reallocation becomes the primary catalyst for PEP adoption across organizational scales.

5.2. Theoretical Implications

This study pioneers an integrative PLU-ABV-RBV framework to explain variance in corporate environmental practices. Through structural equation modeling (SEM) validation, legitimacy demonstrates a significantly stronger influence on resource allocation than power, with normative demands (e.g., CBAM compliance) driving increased environmental investments and challenging conventional power-centric perspectives [

2]. We find that legitimacy claims capture more managerial attention than power-based demands, establishing an “attentional anchoring effect” and stakeholder ecosystem prediction model where legitimacy-driven decisions lag behind urgency-driven imperatives.

The research extends the RBV by demonstrating how external pressures superseding resource scale effects challenge the RBV’s fundamental premises, revealing scale threshold effects wherein even resource-constrained SMEs adopt proactive measures under critical pressure levels. This contradicts Udayasankar’s [

13] size-dependent CSR thesis by demonstrating urgency-driven resource fluidity in SMEs, thus advancing RBV through an ABV contingency lens.

Our findings further resolve a theoretical tension between the ABV and resource dependence theory (RDT). While RDT posits that power dependency determines resource allocation [

27], we demonstrate that legitimacy-driven attention precedes power-based responses (e.g., urgency amplifying community claims over investor demands). This cognitive turn challenges RDT’s transactional paradigm, revealing how the ABV’s attentional mechanisms reconfigure dependence into strategic agency—particularly for SMEs leveraging legitimacy–urgency synergies to offset power deficits.

5.3. Practical Implications

Enterprises should develop PLU (power, legitimacy, and urgency) assessment tools to guide resource allocation, prioritizing environmental budgets for high-legitimacy and high-urgency stakeholder groups to mitigate conflicts and preserve corporate reputation. Large corporations can institutionalize innovation through environmental incubators, reallocating dormant resources (e.g., R&D budgets) to drive proactive ESG investments that transcend regulatory compliance and overcome institutional inertia. Small and medium-sized enterprises (SMEs) should leverage organizational agility via circular economy alliances and network collaborations, pooling technological costs while enhancing green innovation adoption efficiency, demonstrating environmental adaptability under resource-constrained contexts [

10].

Regardless of organizational scale, firms must integrate stakeholder pressures into strategic calculus by clarifying priority demands and deploying rapid response mechanisms to strengthen environmental actions and reduce latent risks. This approach not only optimizes resource governance, but fosters cross-departmental synergies, consolidating competitive advantages in increasingly sustainability-driven markets.

5.4. Limitations and Future Research

This study is based on cross-sectional data from Taiwan’s manufacturing and service industries. Our findings must be interpreted within Taiwan’s unique institutional ecosystem characterized by extreme SME density, creating networked resilience but amplifying resource constraints [

13]; regulatory hybridity—stringent environmental laws enforced through developmental-state industrial policies (e.g., Green Factory Certification); and cultural embeddedness—Confucian stakeholder hierarchies emphasizing community legitimacy (e.g., supplier guanxi) may intensify urgency responses compared to individualistic contexts. While the framework retains theoretical validity, Western economies may exhibit weaker urgency effects in rigid corporate bureaucracies (e.g., EU firms with stakeholder boards), stronger power mediation where institutional investors dominate ESG agendas [

19], or reduced SME policy relevance given the lower SME contribution to GDP. The existing models have not fully incorporated internal decision making factors (such as managers’ risk preferences), and in the future, mixed methods may be combined to deepen micro mechanism analysis.

5.5. Conclusions

By integrating stakeholder theory, the attention-based view, and the resource-based view, this study delivers a dynamic decision model that clarifies when and how firms adopt environmental proactivity. Our framework demonstrates that legitimacy and urgency—not power—are primary pressure triggers; firm size moderates resource pathways, but urgency erodes scale advantages; and real-time PLU assessment enables strategic agility. For practitioners, this provides a scalable toolkit for transforming pressures into competitive actions, particularly for resource-constrained SMEs. This study advocates for the establishment of a dynamic policy framework that includes real-time PLU monitoring, while advancing an AI-based saliency assessment system to quantify stakeholder stress thresholds. It is crucial that we call for the empirical exploration of resource flexibility mechanisms (such as modular budget architecture) that interact with digital governance infrastructure, and we propose that these synergies can increase the adoption rate of sustainable practices in various industries.