The Impact of the Digital Economy on New Energy Vehicle Export Trade: Evidence from China

Abstract

1. Introduction

- (1)

- Based on provincial panel data, this paper uses the entropy method to construct an index system for digital economy development. It measures the digital economy level in each province and establishes a regression model using export data of new energy vehicles to conduct empirical tests.

- (2)

- By analyzing the internal relationship between the digital economy and new energy vehicle exports, this paper constructs a mechanism model. It identifies the direct impact pathways, potential mediating mechanisms, and regional heterogeneity through which the digital economy affects exports.

- (3)

- According to the empirical results, this paper proposes targeted policy recommendations to promote China’s new energy vehicle exports. These suggestions aim to support green, high-quality, and export-oriented industrial upgrading.

2. Literature Review

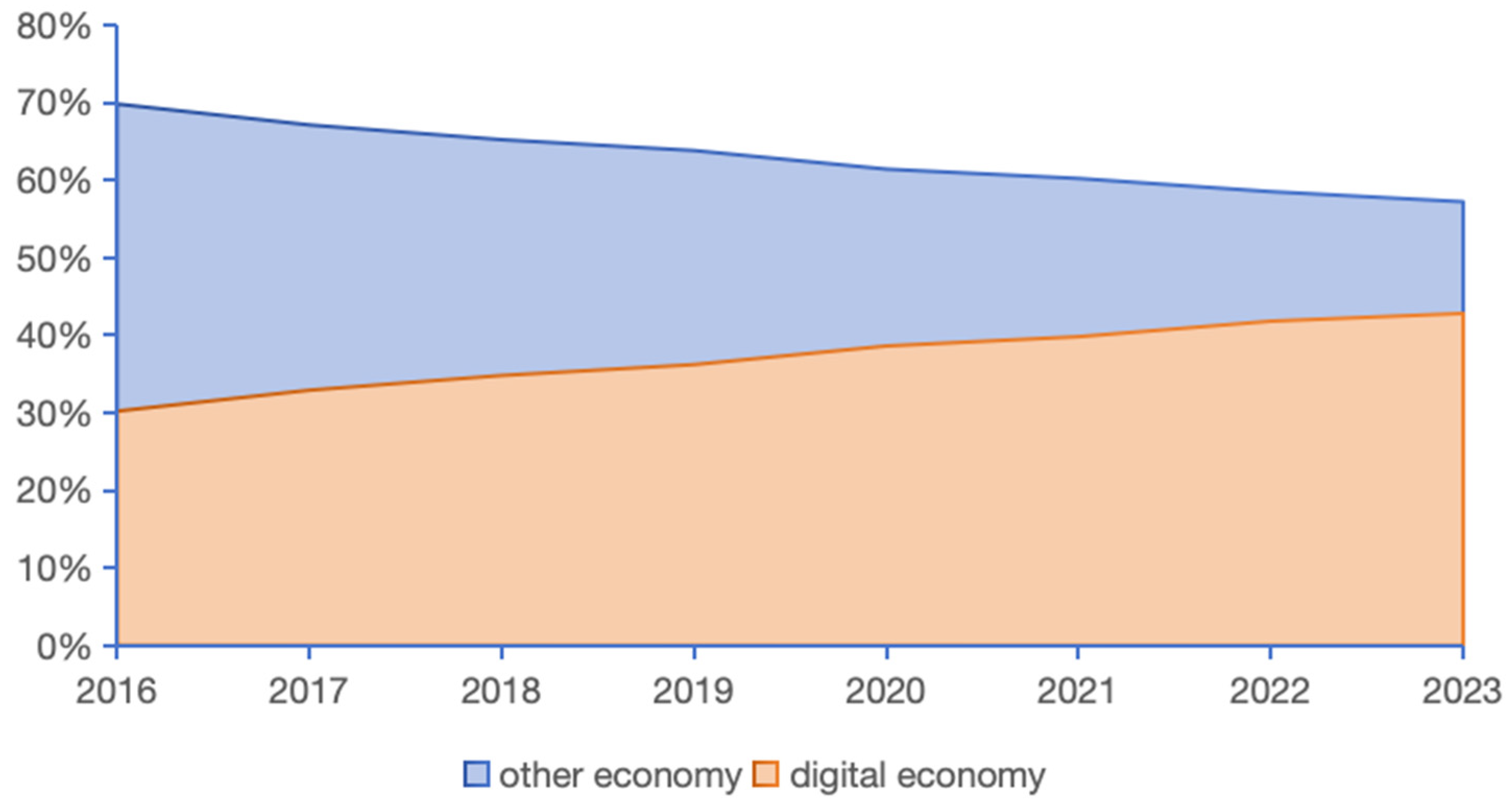

2.1. The Digital Economy

2.2. Factors Influencing the Export of New Energy Vehicles

2.3. Impact of Digital Economy Development on Export Trade

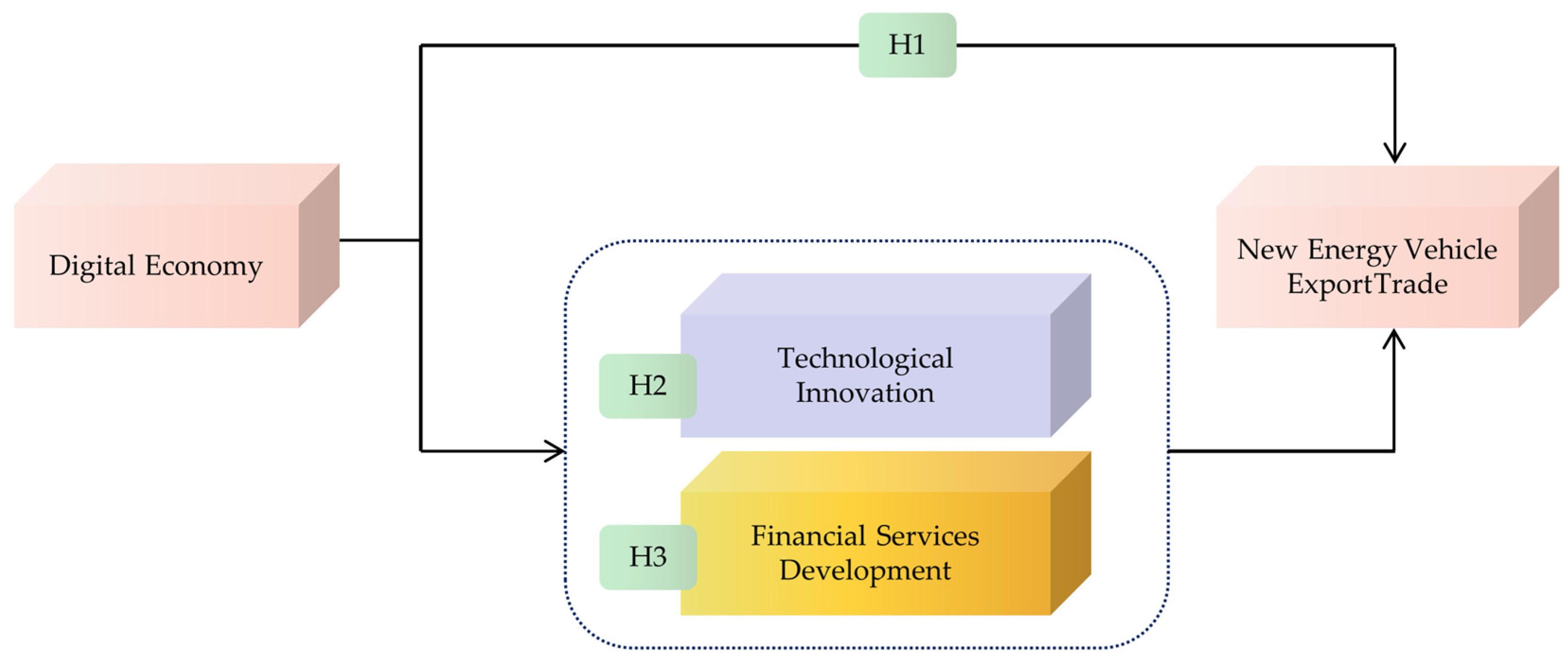

3. Theoretical Analysis

3.1. The Direct Impact of Digital Economy Development on China’s New Energy Vehicle Export Trade

3.2. The Indirect Impact of Digital Economy Development on China’s New Energy Vehicle Export Trade

3.2.1. Digital Economy, Technological Innovation, and New Energy Vehicle Export

3.2.2. Digital Economy, Financial Services Development, and New Energy Vehicle Export

4. Research Design

4.1. Sample Selection and Data Sources

4.1.1. Explanatory Variable

4.1.2. Explained Variable

4.1.3. Control Variables

- (1)

- Economic development level (Gdp). This paper follows Fan Xin (2020) [51] and uses per capita GDP to measure economic development level. Higher per capita GDP usually indicates stronger technological innovation capacity. It helps improve production efficiency and reduce production costs, thereby promoting new energy vehicle export.

- (2)

- Trade openness (Open). Based on the method by Niu Xiaoyu (2021), this paper uses the ratio of total annual import and export trade value to regional GDP for each province as the core indicator of trade openness [52]. This indicator effectively reflects the degree of regional integration into the global value chain and international economic cooperation. The data are sourced from provincial statistical yearbooks.

- (3)

- Urbanization level (Urb). This paper uses the proportion of the urban population in each region to measure the urbanization level. The data come from provincial statistical yearbooks. Yan (2019) [53] found a significant correlation between regional industrial agglomeration and local urbanization level. Higher urbanization rates lead to industrial concentration and scale effects, which promote export trade growth.

- (4)

- Foreign direct investment (Fdi). This paper analyzes the intensity of foreign capital inflow based on the percentage of foreign direct investment in regional GDP. The data are from provincial statistical yearbooks. Chen (2019) argues that technology spillover effects brought by foreign direct investment could enhance corporate innovation and management, thus promoting industrial structure optimization and export trade development [54].

- (5)

- Industrialization level (Industry). The level of industrialization is measured by the proportion of industrial added value to regional GDP, following the World Bank’s method. Data come from the China Statistical Yearbook. Zhu (2017) argues that improving industrialization could optimize the new energy vehicle supply chain, reduce production costs, and enhance export competitiveness [55].

4.1.4. Mediating Variables

- (1)

- Technological innovation (Lnip). Technology level is a key factor in enhancing export competitiveness. Especially with the rise of the digital economy, its value continues to emerge. The development of the digital economy could accelerate technological progress and drive innovation. Zhao (2021) [56] points out that technological innovation could promote product quality upgrading, thereby improving export stability and competitiveness. Therefore, technological innovation is used as a mediating variable, measured by the logarithm of the number of patent grants.

- (2)

- Financial services development (Fin). Digital financial services, such as supply chain finance and insurtech, reduce trade risks and improve transaction efficiency. Thus, financial services development is chosen as a mediating variable. Following Zhou (2004), it is measured using the ratio of the sum of deposits and loans of financial institutions to GDP in each province [57]. The data come from the China Financial Yearbook. The specific variables and their descriptions are presented in Table 2.

4.2. Research Model

4.2.1. Baseline Regression Model

4.2.2. Mediating Effect Model

4.3. Descriptive Statistics

4.4. Correlation Analysis

4.5. Multicollinearity Test

5. Results

5.1. Regression Results

5.2. Mechanism Test

5.2.1. The Role of Technological Innovation

5.2.2. The Role of Financial Services

5.3. Robustness Tests

5.3.1. Alternative Measurement of Digital Economy Development Level

5.3.2. Bootstrap Test

5.3.3. Changing the Regression Model

5.4. Heterogeneity Test

5.4.1. Analysis Based on Eastern, Central, and Western Regions

5.4.2. Heterogeneity Analysis According to Coastal and Inland Geographic Features

6. Discussion, Conclusions, Implications, and Research Limitations

6.1. Discussion

- (1)

- The results indicate that the digital economy significantly enhances new energy vehicle export performance. This effect is achieved through reductions in transaction costs, improved logistics efficiency, and expanded access to international markets. These findings suggest that government investment in digital infrastructure—such as broadband networks, data platforms, and cross-border e-commerce systems—remains crucial. In practice, export-oriented new energy vehicle enterprises are especially sensitive to improvements in digital connectivity. These upgrades, in turn, directly enhance their competitiveness in global markets.

- (2)

- The empirical results also verify the existence of dual mediating effects: technological innovation and financial services. These channels indicate that the digital economy facilitates direct improvements in export outcomes. Moreover, it enhances the enabling environment in which green industries operate. Therefore, policymakers should strengthen support systems by increasing subsidies for digital R&D and providing tax incentives for digital adoption. At the enterprise level, firms should integrate digital technologies such as blockchain for supply chain transparency and artificial intelligence for international market forecasting. Financial institutions should also develop customized services that cater specifically to the financing needs of green exporters.

- (3)

- Significant regional differences emerge from the analysis. In eastern regions—where digital infrastructure is more developed—the digital economy enhances exports by improving service quality and driving innovation. In contrast, the inland regions, though traditionally disadvantaged, experience a stronger marginal benefit from digital development. This suggests that strengthening basic digital capabilities and institutional support in these regions can yield disproportionately large gains. As such, tailored regional strategies are required: developed regions should move toward advanced digital applications, while developing regions should focus on foundational capacity-building. Interprovincial collaboration and regional digital integration platforms may also help narrow the development gap and promote balanced export growth.

- (4)

- This paper adopts a robust empirical strategy, incorporating the entropy method, mediation models, and regional heterogeneity analysis. This analytical framework validates the core hypotheses. In addition, it provides a model that can be applied to other green sectors. Industries such as smart transportation, battery manufacturing, and renewable energy equipment may benefit from similar digital transformation strategies. The approach is particularly valuable for emerging economies seeking to enhance export competitiveness through digital means.

6.2. Conclusions

6.3. Implications

- (1)

- The regression results reveal that the digital economy significantly promotes new energy vehicle exports, with technological innovation serving as a key mediating channel. Promoting digital transformation is thus essential for enhancing export competitiveness. The integration of IoT, big data, and AI improves production efficiency and product quality while reducing costs. Smart factories enable automated manufacturing and real-time monitoring. Digital tools also enhance supply chain management by making material flows visible and improving response speed. AI forecasts supply and demand, helping reduce risk and increase efficiency. In R&D, technologies such as CAD, simulation software, and machine learning support faster, smarter design. AI can optimize batteries and motors, improving energy efficiency and power density. Cloud platforms facilitate data sharing across departments, boosting development efficiency. Big data helps firms analyze usage behavior and adapt designs to user needs. The development of intelligent connected vehicles is also critical. Vehicle-to-everything networks support real-time data sharing, safer driving, and personalized in-car experiences. Remote management and customized settings enhance convenience and user satisfaction. Overall, digital technologies enhance the entire value chain, which in turn drives export growth.

- (2)

- The empirical results show that the digital economy significantly boosts China’s new energy vehicle exports. This effect is stronger in regions with a higher level of openness. This suggests that outward-oriented cooperation and digital infrastructure work together to amplify export performance. Chinese automakers should expand globally by building service networks, strengthening R&D, and sharing resources. Joint efforts in technology and talent development can reduce costs and increase export scale. The government should offer policy support to guide firms toward innovation, branding, and market diversification. Improvements in cross-border finance, logistics, and after-sales systems are also essential for raising service quality and responsiveness. Moreover, China should increase its role in setting international trade rules. New energy vehicles, as a strategic global industry, should target developing countries and Belt and Road markets. Active participation in free trade zones and bilateral agreements can ensure institutional support. Companies should also utilize WTO mechanisms to safeguard their interests. International cooperation and standardization are key. Firms should engage in joint innovation in batteries, smart driving, and connectivity. They must take part in international standard-setting bodies such as ISO, IEC, and 5GAA. The government should back these efforts through policy and funding, promoting global recognition of Chinese technology and supporting cross-border R&D centers.

- (3)

- The mechanism analysis reveals that financial services and digital infrastructure are key mediating factors through which the digital economy promotes new energy vehicle exports. Therefore, developing a data-driven intelligent marketing system could further amplify the positive impact of the digital economy on export performance. Enterprises need to establish comprehensive big data platforms covering R&D, production, sales, and service, enabling real-time data collection and unified storage. Leveraging big data and AI enables firms to analyze consumer behavior and market demand. This capability helps optimize product design and enhance supply chain efficiency, thereby driving continuous technological innovation. Data sharing and collaboration among firms, research institutions, and government agencies further support industrial upgrading. Financial services facilitate digital marketing by providing funding, risk management, and secure cross-border payments, enhancing system efficiency. Data security and privacy must be ensured through encryption and access controls. Government support is essential to promote big data and digital finance infrastructure. Furthermore, expanding digital marketing channels is key to accessing global markets. Firms should utilize cross-border e-commerce platforms and social media to increase brand visibility and engage customers, especially in Europe, North America, and Southeast Asia. Technological innovation enhances product differentiation, providing compelling marketing content, while financial services ensure smooth international transactions. The synergy among digital marketing, innovation, and finance fosters sustainable export growth.

- (4)

- Heterogeneity analysis shows that China’s eastern region has advantages in digital finance, talent, and supportive policies. This results in a stronger impact of the digital economy on new energy vehicle exports there. Thus, institutional efforts should focus on digital financial infrastructure, talent development, and regional coordination. First, digital financial infrastructure is key to improving export finance services. Companies should adopt global payment innovations to shorten settlement times to T + 0.5, enhancing overseas payment efficiency. A dynamic credit evaluation system integrating customs certification, sales, and social media data can create digital credit passports for international recognition. Satellite remote sensing and machine learning can reduce bad debt risks and speed up financing approvals. Second, talent cultivation supports the integration of the digital economy with the vehicle industry. Education authorities should promote interdisciplinary courses in intelligent vehicles, batteries, and AI. School-enterprise partnerships can build practical training bases. Companies should run regular training to boost digital skills and innovation. Finally, balanced regional development requires local adaptation. The central government should fund digital infrastructure upgrades in central and western regions, including broadband and cloud platforms. Digital literacy programs via community training should be expanded. Regional digital platforms should offer technical support. These measures will integrate digital technology deeply into production and daily life, fostering high-quality economic growth.

6.4. Research Limitations

- (1)

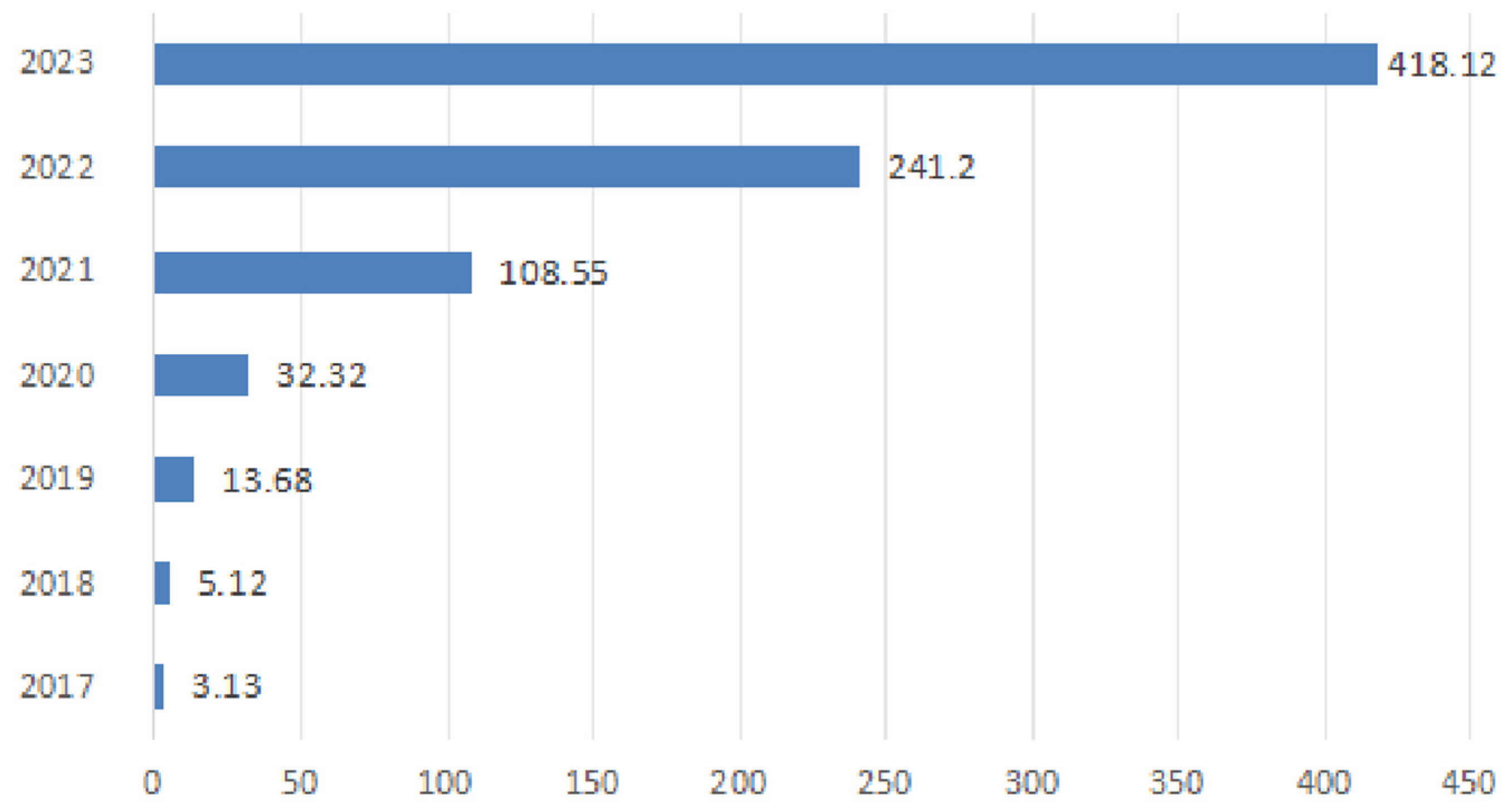

- The Ministry of Industry and Information Technology of China did not officially define new energy vehicles until 2017, despite the fact that the concept was first proposed. This was accomplished through the “Administrative Measures for the Access of New Energy Vehicle Production Enterprises and Products.” Consequently, it is challenging to acquire systematic and standardized export data of new energy vehicles from the General Administration of Customs of China prior to that year. This restricts the duration of the study.

- (2)

- The theoretical framework of the digital economy is still in its infancy, as it is a rapidly developing field. Current research on the specific impact of the digital economy on the export trade of new energy vehicles in China is still in the early stages. This paper continues to be devoid of a systematic and comprehensive theoretical framework.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, Q.J.; Li, W.Z.; Gong, Z.Y.; Fu, J.Y. The coupling and coordination between digital economy and green economy: Evidence from China. Emerg. Mark. Financ. Trade 2025, 61, 562–578. [Google Scholar] [CrossRef]

- Xu, J.; Li, W. Study on the impact of digital economy on innovation output based on dynamic panel data model. Eur. J. Innov. Manag. 2025, 28, 877–899. [Google Scholar] [CrossRef]

- Yang, D.X.; Wu, Q.G.; Qiu, L.S.; Chen, X.H.; Tan, L.; Tang, Y.N.; Wang, L.T. Study on tariff impact on new energy vehicle exports: Evidence from China's industrial chain perspective. Energy Sustain. Dev. 2025, 87, 101714. [Google Scholar] [CrossRef]

- Guo, X.; Sun, Y.; Ren, D. Life cycle carbon emission and cost-effectiveness analysis of electric vehicles in China. Energy Sustain. Dev. 2023, 72, 1–10. [Google Scholar] [CrossRef]

- Keles, C.; Cruz, F.; Hoque, S. Digital technologies and circular economy in the construction sector: A review of lifecycle applications, integrations, potential, and limitations. Buildings 2025, 15, 553. [Google Scholar] [CrossRef]

- Liu, B.; Wang, F. The impact of the global digital economy on carbon emissions: A review. Sustainability 2025, 17, 5044. [Google Scholar] [CrossRef]

- Yang, J.; Tan, F. Exploring the progress of global digital economy research: A bibliometric study via r-tool. Environ. Dev. Sustain. 2025, 27, 5447–5477. [Google Scholar] [CrossRef]

- Oloyede, A.; Faruk, N.; Noma, N. Measuring the impact of the digital economy in developing countries: A systematic review and meta-analysis. Heliyon 2023, 9, e17654. [Google Scholar] [CrossRef] [PubMed]

- Yu, W.; Zhang, L.; Yang, C. The impact of the digital economy on enterprise innovation behavior: Based on CiteSpace knowledge graph analysis. Front. Psychol. 2023, 14, 1031294. [Google Scholar] [CrossRef] [PubMed]

- Li, H.; Zhang, J. Several insights into the definition of the digital economy. Enterp. Econ. 2021, 40, 13–22. [Google Scholar]

- Ma, F.; Zhang, Z. Government digital governance of emerging industries: A case study of the national monitoring and management platform for new energy vehicles. Manag. Rev. 2021, 33, 94–105. [Google Scholar]

- Al-Zoubi, W.K. Economic development in the digital economy: A bibliometric review. Economies 2024, 12, 53. [Google Scholar] [CrossRef]

- Xu, L.; Wang, K. A review of the connotation and measurement index system of the digital economy. Stat. Decis. 2024, 40, 5–11. [Google Scholar]

- Wang, W.; Zhang, S. An empirical test of how the digital economy drives the modernization of the agricultural industrial chain. Stat. Decis. 2024, 40, 22–27. [Google Scholar]

- Zhang, J.; Wang, B. Digital economy development and the improvement of green total factor productivity. Audit. Econ. Res. 2023, 38, 107–115. [Google Scholar]

- Zhao, Y.M.; Zhou, Y.X. Measurement method and application of a deep learning digital economy scale based on a big data cloud platform. J. Organ. End User Comput. 2022, 34, 1–17. [Google Scholar] [CrossRef]

- Xia, L.; Han, Q.; Yu, S. Industrial intelligence and industrial structure change: Effect and mechanism. Int. Rev. Econ. Financ. 2024, 93, 1494–1506. [Google Scholar] [CrossRef]

- Ye, L.; Xue, X. The impact of digital trade on the technological complexity of manufacturing exports. J. Int. Bus. Stud. 2025, 46, 88–102. [Google Scholar]

- Song, L.; Li, K.; Gao, Q. The impact of digital technology innovation on the domestic value-added ratio of corporate exports: Empirical evidence from China's manufacturing industry. Int. Bus. Trade Res. 2025, 41, 4–21. [Google Scholar]

- Xin, D.; Qiu, Y. Artificial intelligence, stability of industrial and supply chains, and corporate export resilience. Econ. Theory Bus. Manag. 2025, 45, 37–54. [Google Scholar]

- Li, X.; Liu, Y.; Yang, J. Technological innovation and new energy vehicle sales: An empirical test based on the theory of innovation-induced demand. J. Dalian Univ. Technol. 2022, 43, 31–41. [Google Scholar]

- Jiang, F.; Yuan, X.; Hu, L.; Xie, G.; Zhang, Z.; Li, X.; Hu, J.; Wang, C.; Wang, H. A comprehensive review of energy storage technology development and application for pure electric vehicles. J. Energy Storage 2024, 86, 111159. [Google Scholar] [CrossRef]

- Bian, X.; Panyagometh, A. The influence of perceived ESG and policy incentives on consumers’ intention to purchase new energy vehicles: Empirical evidence from China. Innov. Mark. 2023, 19, 187–198. [Google Scholar] [CrossRef]

- Tu, C.; Yang, C. Key factors influencing consumers’ purchase of electric vehicles. Sustainability 2019, 11, 3863. [Google Scholar] [CrossRef]

- Cong, H.; Zou, D.; Gao, B. Trade network pattern of new energy vehicles and its influencing factors among countries along the Belt and Road. Econ. Geogr. 2021, 41, 109–118. [Google Scholar]

- Zhao, X.; Mao, Y.; Li, X. Energy prices and new energy vehicle consumption: From the perspective of consumer expectations. Soft Sci. 2025, 39, 136–144. [Google Scholar]

- Beltozar-Clemente, S.; Iparraguirre-Villanueva, O.; Pucuhuayla-Revatta, F.; Sierra-Liñan, F.; Zapata-Paulini, J.; Cabanillas-Carbonell, M. Contributions of the 5G network with respect to decent work and economic growth (sustainable development goal 8): A systematic review of the literature. Sustainability 2023, 15, 15776. [Google Scholar] [CrossRef]

- Turskis, Z.; Šniokienė, V. IoT-Driven transformation of circular economy efficiency: An overview. Math. Comput. Appl. 2024, 29, 49. [Google Scholar] [CrossRef]

- Ali, J.; Zafar, M.H.; Hewage, C.; Hassan, S.R.; Asif, R. The advents of ubiquitous computing in the development of smart cities—A review on the Internet of things (IoT). Electronics 2023, 12, 1032. [Google Scholar] [CrossRef]

- Cui, X.; Zhang, Z.; Huang, A. Mechanism test of how the digital economy promotes the upgrading of manufacturing value chain position. Stat. Decis. 2025, 41, 24–29. [Google Scholar]

- Yan, L.; Tai, L.; Zhong, C. How does the Internet affect the intensive and extensive margins of corporate exports: From the perspectives of trade costs and local market effects. Int. Bus. Trade Res. 2022, 38, 38–52. [Google Scholar]

- Si, J.; Deng, K.; Zhang, R. Does the Internet promote international trade? Evidence from the gravity model and micro-level enterprises. Syst. Eng.—Theory Pract. 2024, 44, 2915–2933. [Google Scholar]

- Jouanjean, M.A. Digital Opportunities for Trade in the Agriculture and Food Sectors; OECD Food, Agriculture and Fisheries Papers; OECD Publishing: Paris, France, 2019. [Google Scholar]

- Acemoglu, D.; LeLarge, C.; Restrepo, P. Competing with Robots: Firm-Level Evidence from France. NBER Working Paper; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Ning, K.; Chen, X.; Xiao, Y. Cross-border e-commerce, foreign investment and export trade resilience. Financ. Res. Lett. 2025, 82, 107595. [Google Scholar] [CrossRef]

- Wu, H.; Qiao, Y.; Luo, C. Cross-border e-commerce, trade digitisation and enterprise export resilience. Financ. Res. Lett. 2024, 65, 105513. [Google Scholar] [CrossRef]

- Chaney, T. The network structure of international trade. Am. Econ. Rev. 2014, 104, 3600–3634. [Google Scholar] [CrossRef]

- Wang, D.; Xu, P.; An, B.; Song, Y. How does the development of the digital economy in RCEP member countries affect China’s cross-border e-commerce exports? PLoS ONE 2024, 19, e0310975. [Google Scholar] [CrossRef] [PubMed]

- Zhou, K.; Lu, F.; Ruan, Y.; Jiang, X.; Yu, L. Research on the influence and mechanism of cross-border E-commerce on the quality of agricultural products exported by China. J. Glob. Inf. Manag. 2023, 31, 1–23. [Google Scholar] [CrossRef]

- Han, B.; Rizwanullah, M.; Luo, Y.; Atif, R. The role of cross-border E-commerce on the export of goods and services. Electron. Commer. Res. 2024, 24, 1367–1384. [Google Scholar] [CrossRef]

- Ma, S.; Fang, C.; Zhang, H. Can cross-border e-commerce overcome the constraints of geographical distance? Financ. Trade Econ. 2019, 40, 116–131. [Google Scholar]

- Shen, G.; Yuan, Z. The impact of corporate Internetization on innovation and exports of Chinese corporations. Econ. Res. J. 2020, 55, 33–48. [Google Scholar]

- Yao, H. Digitalization of Property Rights and the Fourth Pole of China’s Economy; Culture Development Press: Beijing, China, 2021. [Google Scholar]

- Lu, X.; Jiang, D. Industrial robot application and the mode selection of Chinese corporations' internationalization. Int. Bus. Trade Explor. 2025, 41, 38–56. [Google Scholar]

- Sun, M. The role of information technology in promoting the growth of the modern industrial economy. Mod. Ind. Econ. Informatiz. 2024, 14, 54–55+58. [Google Scholar]

- Li, X.; Zhang, C.; Li, D. The impact of the digital economy on technological innovation in the new energy vehicle industry. J. Xinyang Norm. Univ. 2024, 44, 44–50. [Google Scholar]

- Li, X.; Xu, F. Technological innovation and the transformation of China’s foreign trade development mode: An export structure optimization study from the value chain perspective. J. East China Norm. Univ. 2015, 47, 75–83+169. [Google Scholar]

- Wang, D.; Hu, X. Research progress in digital finance: Origin, impact, challenges and prospects. J. Southwest Univ. 2023, 49, 101–110. [Google Scholar]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring the development of digital inclusive finance in china: Index construction and spatial characteristics. Econ. Q. 2020, 19, 1401–1418. [Google Scholar]

- Jing, S.; Yang, L.; Zhao, Y. The impact of subsidy withdrawal on China’s new energy vehicle exports. Ind. Technol. Econ. 2023, 42, 134–141. [Google Scholar]

- Fan, X. Digital economy development, international trade efficiency, and trade uncertainty. Financ. Trade Econ. 2020, 41, 145–160. [Google Scholar] [CrossRef]

- Niu, X. A Study on the Impact of Digital Economy Development in ASEAN on China’s Export Trade. Master’s Thesis, Anhui University, Hefei, China, 2021. [Google Scholar]

- Yan, X.; Xu, S. Urbanization, marketization, and industrial structure upgrading. Ind. Econ. Rev. 2019, 10, 48–58. [Google Scholar]

- Chen, D.; Peng, M.; Liu, R. A study on the impact of FDI and environmental regulations on industrial structure upgrading. Jianghan Trib. 2019, 38, 84–93. [Google Scholar]

- Zhu, Z. Industrial transformation of Zhaoqing in the post-industrialization era: A case study of the new energy vehicle industry. Trop. Agric. Eng. 2017, 41, 56–59. [Google Scholar]

- Zhao, W.; Yang, J. Trade diversification and technological innovation as stabilizers of export volatility: The mechanism of trade barriers mitigating export volatility and the Chinese experience. West. Forum 2021, 31, 27–39. [Google Scholar]

- Zhou, L. Regional Financial Development and Economic Growth in China 1978–2000; Tsinghua University Press: Beijing, China, 2004. [Google Scholar]

- Wen, Z.; Ye, B. Mediation effect analysis: Methodological and model development. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Chao, X.; Ren, B. An empirical analysis of China’s economic growth structure and the quality of economic growth. Contemp. Econ. Sci. 2011, 33, 50–56+123–124. [Google Scholar]

| Primary Indicator | Secondary Indicator | Tertiary Indicator | Weight | Data Source |

|---|---|---|---|---|

| Digital Economy Development Level | Digital Infrastructure | Number of Domain Names | 0.0647 | China Statistical Yearbook China City Statistical Yearbook |

| Number of IPv4 Addresses | 0.0609 | |||

| Number of Internet Broadband Access Ports | 0.0889 | |||

| Mobile Phone Penetration Rate | 0.0965 | |||

| Optical Cable Length per Unit Area | 0.0686 | |||

| Digital Industry Development | Number of Information Technology Enterprises | 0.3131 | China Statistical Yearbook | |

| Number of Enterprises with Websites per 100 Enterprises | 0.1027 | |||

| Proportion of Enterprises Engaged in E-commerce Transactions | 0.0614 | |||

| E-commerce Sales Volume | 0.0879 | |||

| Software Business Revenue | 0.0450 | |||

| Digital Inclusive Finance Index | Coverage Breadth Index | 0.0934 | Measuring the Development of Digital Inclusive Finance in China: Index Compilation and Spatial Characteristics | |

| Usage Depth Index | 0.0964 | |||

| Digitalization Level Index | 0.1017 |

| Variable | Code | Symbol | Source |

|---|---|---|---|

| Explained Variable | LnED | New Energy Vehicle Export Trade Volume | General Administration of Customs of China |

| Explanatory Variable | Digital | Digital Economy Development Level | Entropy Weight Method Calculation |

| Control Variables | Gdp | Economic Development Level | China Statistical Yearbook |

| Open | Trade Openness Degree | Statistical Yearbooks of Provinces and Autonomous Regions | |

| Urb | Urbanization Level | Statistical Yearbooks of Provinces and Autonomous Regions | |

| Industry | Industrialization Level | National Bureau of Statistics of China | |

| Fdi | Foreign Direct Investment | Statistical Yearbooks of Provinces and Autonomous Regions | |

| Mediating Variables | Lnip | Technological Innovation | Statistical Yearbooks of Provinces and Autonomous Regions |

| Fin | Financial Services Development Level | China Financial Yearbook |

| Variable | Obs. | Mean | Median | SD. | Min | Max |

|---|---|---|---|---|---|---|

| LnED | 203 | 16.23 | 16.71 | 3.516 | 7.467 | 0.747 |

| Digital | 203 | 0.188 | 0.140 | 0.130 | 0.0580 | 0.747 |

| Industry | 203 | 0.304 | 0.308 | 0.0730 | 0.101 | 0.498 |

| Open | 203 | 0.254 | 0.147 | 0.230 | 0.0270 | 0.977 |

| Gdp | 203 | 13,317 | 10,016 | 8980 | 5771 | 49,352 |

| Urb | 203 | 0.634 | 0.622 | 0.112 | 0.334 | 1.166 |

| Fdi | 203 | 0.0170 | 0.0140 | 0.0180 | 0 | 0.101 |

| Lnip | 203 | 10.11 | 10.09 | 1.195 | 7.394 | 12.40 |

| Fin | 203 | 3.608 | 3.387 | 1.177 | 1.279 | 8.164 |

| LnED | Digital | Industry | Open | Gdp | Fdi | Urb |

|---|---|---|---|---|---|---|

| LnED | 1 | |||||

| Digital | 0.538 *** | 1 | ||||

| Industry | 0.133 * | 0.0910 | 1 | |||

| Open | 0.461 *** | 0.704 *** | −0.166 ** | 1 | ||

| Gdp | 0.351 *** | 0.589 *** | −0.280 *** | 0.883 *** | 1 | |

| Fdi | 0.258 *** | 0.606 *** | −0.0290 | 0.542 *** | 0.374 *** | 1 |

| Urb | 0.389 *** | 0.442 *** | −0.0520 | 0.717 *** | 0.645 *** | 0.275 *** |

| Variable | VIF | 1/VIF |

|---|---|---|

| Open | 8.180 | 0.122 |

| Gdp | 5.330 | 0.188 |

| Digital | 2.570 | 0.389 |

| Urb | 2.190 | 0.456 |

| Fdi | 1.820 | 0.550 |

| Industry | 1.260 | 0.794 |

| Mean | VIF | 3.560 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| LnED | LnED | LnED | LnED | LnED | LnED | |

| Digital | 28.541 *** | 32.332 *** | 32.890 *** | 28.089 *** | 27.961 *** | 24.914 *** |

| (6.527) | (7.331) | (7.833) | (6.997) | (6.986) | (5.704) | |

| Industry | 22.112 *** | 25.571 *** | 28.652 *** | 26.954 *** | 25.394 *** | |

| (3.271) | (3.945) | (4.727) | (4.379) | (4.103) | ||

| Open | 22.595 *** | 15.666 *** | 14.365 *** | 12.082 ** | ||

| (4.352) | (3.126) | (2.831) | (2.313) | |||

| Gdp | 0.001 *** | 0.001 *** | 0.001 *** | |||

| (5.231) | (5.174) | (4.413) | ||||

| Fdi | −22.605 | −19.200 | ||||

| (−1.451) | (−1.229) | |||||

| Urb | 7.458 * | |||||

| (1.695) | ||||||

| _cons | 10.848 *** | 3.404 | −3.494 | −12.506 *** | −11.113 *** | −13.134 *** |

| (12.922) | (1.408) | (−1.251) | (−4.009) | (−3.415) | (−3.808) | |

| N | 203 | 203 | 203 | 203 | 203 | 203 |

| R2 | 0.198 | 0.245 | 0.320 | 0.414 | 0.421 | 0.431 |

| F | 42.597 | 27.843 | 26.811 | 30.049 | 24.617 | 21.221 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| LnED | Lnip | LnED | |

| Digital | 12.399 *** | 5.533 *** | 2.633 * |

| (4.948) | (9.570) | (0.947) | |

| Industry | 4.309 | 2.957 *** | −0.910 |

| (1.372) | (4.082) | (−0.304) | |

| Open | 4.862 * | 2.709 *** | 0.081 |

| (1.930) | (4.660) | (0.033) | |

| Gdp | −0.000 | −0.000 | −0.000 |

| (−1.561) | (−0.990) | (−1.261) | |

| Fdi | −28.736 * | −4.264 | −21.210 |

| (−1.921) | (−1.236) | (−1.543) | |

| Urb | 4.339 | −2.307 *** | 8.410 *** |

| (1.617) | (−3.726) | (3.308) | |

| Lnip | 1.765 *** | ||

| (6.226) | |||

| _cons | 10.163 *** | 9.168 *** | −6.019 ** |

| (5.841) | (22.839) | (−1.974) | |

| N | 203 | 203 | 203 |

| R2 | 0.347 | 0.699 | 0.456 |

| F | 17.384 | 76.019 | 23.309 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| LnED | Fin | LnED | |

| Digital | 24.914 *** | 5.290 *** | 14.512 *** |

| (5.704) | (7.856) | (2.973) | |

| Industry | 25.394 *** | 2.958 *** | 19.578 *** |

| (4.103) | (3.100) | (3.219) | |

| Open | 12.082 ** | 0.746 | 10.615 ** |

| (2.313) | (0.926) | (2.121) | |

| Gdp | 0.001 *** | −0.000 *** | 0.001 *** |

| (4.413) | (−5.421) | (5.846) | |

| Fdi | −19.200 | −6.071 ** | −7.262 |

| (−1.229) | (−2.521) | (−0.477) | |

| Urb | 7.458 * | 2.283 *** | 2.969 |

| (1.695) | (3.366) | (0.684) | |

| Fin | 1.966 *** | ||

| (4.111) | |||

| _cons | −13.134 *** | 1.970 *** | −17.007 *** |

| (−3.808) | (3.705) | (−4.961) | |

| N | 203 | 203 | 203 |

| R2 | 0.431 | 0.446 | 0.483 |

| F | 21.221 | 22.525 | 22.325 |

| Variable | (1) | (2) |

|---|---|---|

| LnED | Fin | |

| Digital | 28.797 *** | 27.743 *** |

| (17.467) | (12.819) | |

| Industry | 7.901 * | |

| (1.693) | ||

| Open | 8.170 ** | |

| (2.049) | ||

| Gdp | 0.000 | |

| (1.593) | ||

| Fdi | 6.229 | |

| (0.508) | ||

| Urb | −3.134 | |

| (−0.891) | ||

| _cons | 6.880 *** | 1.817 |

| (12.607) | (0.634) | |

| N | 203 | 203 |

| R2 | 0.638 | 0.657 |

| F | 305.105 | 53.567 |

| Variable | Coefficient | Z | p | 95%Confidence Interval |

|---|---|---|---|---|

| Mediation Effect | 9.766106 | 4.39 | 0.000 | (6.094558, 14.88182) (p) |

| (6.101089, 14.99698) (BC) | ||||

| Direct Effect | 2.633364 | 0.99 | 0.321 | (−2.807706, 7.542252) (p) |

| (−2.825381, 7.40504) (BC) | ||||

| Replications | 1000 | |||

| Variable | (1) |

|---|---|

| LnED | |

| Digital | 24.9143 *** |

| (4.367) | |

| Industry | 25.3942 *** |

| (6.189) | |

| Open | 12.0818 ** |

| (5.223) | |

| Gdp | 0.0007 *** |

| (0.000) | |

| Fdi | −19.2000 |

| (15.620) | |

| Urb | 7.4581 * |

| (4.399) | |

| _cons | −13.1337 *** |

| (3.449) | |

| year | Yes |

| province | Yes |

| N | 203 |

| R2 | 0.4311 |

| Variable | Eastern Region | Central Region | Western Region |

|---|---|---|---|

| Digital | 20.971 *** | −23.466 * | −1.754 |

| (4.384) | (13.136) | (14.362) | |

| Industry | 43.952 *** | −4.918 | 18.800 |

| (13.375) | (6.880) | (12.214) | |

| Open | 6.655 | −25.648 ** | 38.715 ** |

| (5.250) | (12.640) | (14.860) | |

| Gdp | 0.001 *** | 0.000 | 0.000 |

| (0.000) | (0.000) | (0.001) | |

| Fdi | 5.764 | 6.910 | 103.803 * |

| (20.076) | (19.702) | (56.517) | |

| Urb | 0.788 | 132.142 *** | 78.559 *** |

| (4.142) | (19.900) | (18.724) | |

| _cons | −19.812 ** | −57.991 *** | −43.868 *** |

| (7.456) | (8.687) | (7.072) | |

| N | 77.000 | 56.000 | 70.000 |

| R2 | 0.471 | 0.817 | 0.652 |

| R2_a | 0.330 | 0.760 | 0.556 |

| Variable | Coastal Region | Inland Region |

|---|---|---|

| Digital | −10.819 ** | 38.099 ** |

| (−2.256) | (2.461) | |

| Industry | 16.194 | 13.874 * |

| (1.365) | (1.912) | |

| Open | 0.383 | 3.056 |

| (0.085) | (0.491) | |

| Gdp | 8.358 * | 3.214 |

| (1.840) | (1.333) | |

| Fdi | −22.126 | 56.286 ** |

| (−1.165) | (2.160) | |

| Urb | 18.481 | 15.835 |

| (1.502) | (0.783) | |

| _cons | −53.817 | −58.124 ** |

| (−1.122) | (−2.214) | |

| N | 77 | 126 |

| R2 | 0.859 | 0.722 |

| R2_a | 0.802 | 0.637 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lu, M.; Lu, C.; Du, W.; Wang, C. The Impact of the Digital Economy on New Energy Vehicle Export Trade: Evidence from China. Sustainability 2025, 17, 7423. https://doi.org/10.3390/su17167423

Lu M, Lu C, Du W, Wang C. The Impact of the Digital Economy on New Energy Vehicle Export Trade: Evidence from China. Sustainability. 2025; 17(16):7423. https://doi.org/10.3390/su17167423

Chicago/Turabian StyleLu, Man, Chang Lu, Wenhui Du, and Chenggang Wang. 2025. "The Impact of the Digital Economy on New Energy Vehicle Export Trade: Evidence from China" Sustainability 17, no. 16: 7423. https://doi.org/10.3390/su17167423

APA StyleLu, M., Lu, C., Du, W., & Wang, C. (2025). The Impact of the Digital Economy on New Energy Vehicle Export Trade: Evidence from China. Sustainability, 17(16), 7423. https://doi.org/10.3390/su17167423