1. Introduction

The need to take on climate change has made all developed and growing countries start using less carbon paths. The Paris Agreement, along with subsequent national commitments, has established clear decarbonization targets, including achieving carbon neutrality by the middle of the 21st century. Carbon Capture and Storage (CCS) has emerged as a crucial technological solution to facilitate deep decarbonization, particularly in sectors such as coal-fired power generation, cement production, and metallurgy [

1]. Recognized by the Intergovernmental Panel on Climate Change (IPCC) as essential to meet climate goals in most 1.5 °C and 2 °C pathways, CCS allows for the capture of CO

2 emissions at the source and secure geological storage, preventing their release into the atmosphere [

2].

Kazakhstan presents a unique scenario for the implementation of CCS. As the predominant economy in Central Asia, Kazakhstan’s economic framework is heavily reliant on fossil fuels, with coal constituting over 70% of electricity production, alongside energy-intensive sectors including oil and gas, metallurgy, and mining. As a result, Kazakhstan’s carbon intensity per unit of GDP remains one of the highest in the OECD [

3]. Notwithstanding the implementation of a strategy aimed at attaining carbon neutrality by 2060 in February 2023, Kazakhstan’s short-term climate policies are inadequate to fulfill its obligations under the Paris Agreement [

4]. The country’s updated Nationally Determined Contribution, submitted in June 2023, retained modest targets of reducing greenhouse gas (GHG) emissions by 15% unconditionally and 25% conditionally by 2030 compared to 1990 levels [

5]. These targets could be rated as “insufficient”, requiring significant policy improvements to align with the 1.5 °C pathway.

Kazakhstan’s reliance on fossil fuels is further reinforced by ongoing subsidies for coal and natural gas production, which accounted for approximately 6% of GDP in 2021 [

6]. Although recent reforms aim to phase out inefficient subsidies and modernize energy infrastructure through initiatives such as the “tariff for investment” program, these measures are still at an early stage [

7]. Furthermore, plans for new coal power plants announced in late 2022 risk deepening carbon lock-in and increasing transition risks unless complemented by aggressive decarbonization policies [

8].

Despite these challenges, Kazakhstan possesses significant geological potential for CCS deployment. Deep saline aquifers and depleted oil and gas reservoirs in the Tengiz fields and Caspian Basin provide enormous storage capacity [

9]. However, high capital costs, limited technical expertise, and a lack of regulatory frameworks have hindered progress beyond feasibility studies and pilot projects. For example, while CCS is technically feasible in sectors like coal-fired power generation or natural gas processing at Karachaganak and Tengiz fields, its economic viability is constrained without robust market mechanisms or international financial support.

This paper argues that CCS alone cannot succeed without adequate market signals and regulatory frameworks. Economic viability remains a major barrier—capture and storage are capital-intensive processes that require mechanisms for cost recovery such as carbon pricing or dedicated public funding. In this context, emissions trading systems (ETSs) and carbon finance tools such as voluntary carbon markets and green bonds could play a pivotal role in enabling CCS deployment in Kazakhstan.

The primary objective of this study is to conduct a comprehensive assessment of Kazakhstan’s current environmental situation, with a particular focus on its ETS. The study also aims to explore potential improvements and enhancements to Kazakhstan’s ETS (KazETS) to better align with international climate goals. This analysis is grounded in a thorough review of national emissions data, global best practices and experiences from CCS projects, and the regulatory evolution of ETS schemes both within Kazakhstan and globally. By drawing comparisons between Kazakhstan’s efforts and successful international carbon pricing frameworks, the paper offers a practical and actionable perspective on how emerging carbon pricing mechanisms can effectively support the implementation of high-impact mitigation technologies in middle-income economies. Through this analysis, the study seeks to provide valuable insights for policymakers and stakeholders in Kazakhstan as they work to refine their climate strategy and achieve long-term decarbonization objectives.

2. Current Situation in Kazakhstan

2.1. GHG Emissions

Kazakhstan is among the top five CO

2 emitters in the Eurasian region, driven by a fossil-fuel-dominant energy mix and carbon-intensive industrial sectors. According to the Bureau of National Statistics, the country’s GHG emissions were equal to 353 MtCO

2e in 2022 as shown in

Table 1 [

10], with energy production accounting for more than 79.9% of total emissions [

11]. Coal remains the primary fuel source for electricity generation, with over 70% of national power supplied by coal-fired thermal power plants [

12]. According to CEIC, this results in Kazakhstan’s CO

2 emissions per capita surpassing the global average and those of many developing countries [

13].

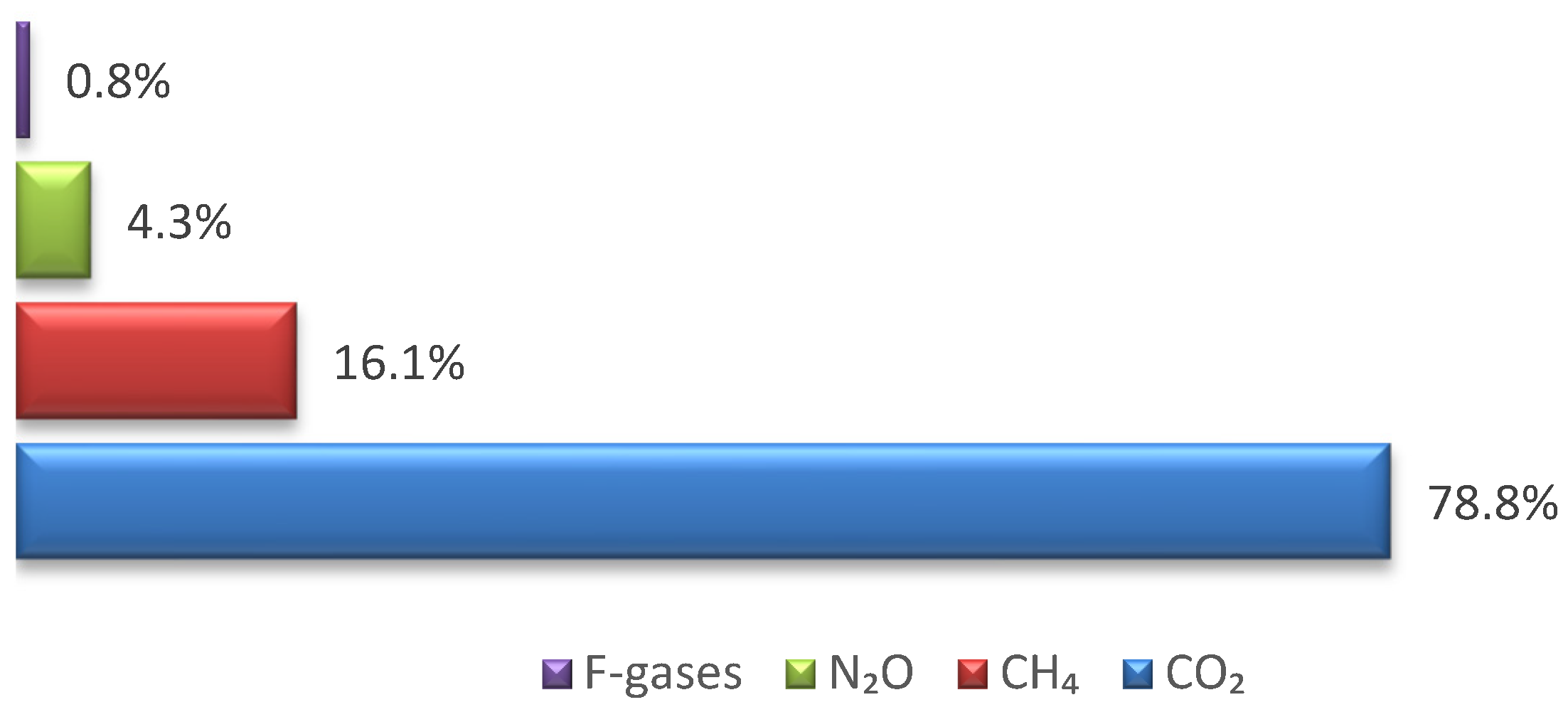

In 2022, CO

2 was the main greenhouse gas emitted by human activities in Kazakhstan, making up 78.8% of the total GHG emissions as demonstrated in

Figure 1 [

11]. The primary source of CO

2 and overall GHG emissions was the burning of fossil fuels, mainly for electricity generation and heating.

2.2. Renewable Energy Development

Kazakhstan’s commitment to the Paris Agreement includes an unconditional target to reduce emissions by 15% by 2030 from 1990 levels. To support this objective, the government adopted the Carbon Neutrality Strategy 2060 in 2021, which outlines a long-term vision for transitioning to a low-carbon economy. The strategy prioritizes energy efficiency, large-scale deployment of renewable energy, electrification of transport, development of green hydrogen, and the gradual phase-out of coal-fired power generation [

14]. However, implementation has been slow. Emissions have rebounded since 2021 due to post-pandemic economic recovery and the persistent reliance on fossil fuels in electricity generation and heavy industry.

In 2024, the installed capacity of renewable energy sources (RESs) in Kazakhstan reached 2903.54 MW, more than 16 times higher than the figure for 2014 (178 MW). However, the share of RESs in total electricity generation remains limited, accounting for only 6.43% in 2024 [

15]. While Kazakhstan has made progress in expanding renewable energy capacity, the rate of growth remains insufficient to meet medium- and long-term emission reduction targets. To accelerate progress, the government introduced the Energy Sector Development Concept 2035 in 2023 [

16]. This framework sets interim goals, including increasing the share of renewable electricity to 15% by 2030 and up to 50% by 2050. It is supported by a shift from feed-in tariffs to auction-based procurement mechanisms, grid modernization plans, and enhanced access to international climate finance mechanisms. Nevertheless, critical challenges persist, including regulatory uncertainty, limited transmission infrastructure for integrating variable renewables, and financial risks that hinder private sector participation.

In this context, CCS presents an important complementary mitigation option. CCS can enable substantial emissions reductions in hard-to-abate industrial sectors where electrification or fuel switching is not currently feasible. As part of an integrated decarbonization strategy, CCS supports near-term climate goals while providing a technological bridge to deeper reductions in the longer term.

3. Carbon Capture Technologies

CCS has recently emerged as an integral technology for decarbonizing hard-to-abate sectors and mitigating global greenhouse gas emissions. As of mid-2025, more than 700 CCS projects at varying stages of development have been announced worldwide, with an aggregate projected CO

2 capture capacity exceeding 430 million tonnes (Mt) per year by the end of the decade [

17]. CCS systems are typically deployed in one of several configurations—post-combustion, pre-combustion, and oxy-fuel combustion being the chief among them.

3.1. Pre-Combustion Carbon Capture

Pre-combustion carbon capture involves the removal of CO

2 prior to the combustion of the fuel. The process typically begins with the conversion of fossil fuels such as coal, natural gas, or biomass into a synthesis gas (syngas), which is composed primarily of carbon monoxide (CO) and hydrogen (H

2). This conversion is achieved through gasification or reforming techniques under high temperatures and pressures. Following the production of syngas, a water–gas shift reaction is employed to convert CO into CO

2 and additional hydrogen. This results in a gas mixture rich in hydrogen and CO

2. At this stage, CO

2 is separated using physical solvents due to the high partial pressure of CO

2 in the gas stream, which enhances efficiency and lowers the energy requirement for separation. The hydrogen-rich stream, now free from CO

2, can then be combusted in a gas turbine or used directly in industrial processes or fuel cells. This method is inherently well suited for integration into Integrated Gasification Combined Cycle power plants and hydrogen production facilities [

18,

19].

The principal advantage of pre-combustion capture lies in the higher concentration and pressure of CO

2, which facilitates easier separation and reduces the energy penalty associated with capture. Additionally, this approach enables the production of hydrogen, a low-carbon energy carrier. However, pre-combustion systems are generally limited to new installations as retrofitting existing power plants with gasification infrastructure is economically and technically challenging. The high capital costs and system complexity also remain significant barriers to widespread deployment [

20].

3.2. Post-Combustion Capture

Post-combustion capture is currently the most commercially mature and widely applied carbon capture method, particularly suitable for retrofitting existing fossil-fuel-based power generation and industrial facilities such as cement and steel plants. In this approach, CO

2 is captured from flue gases generated after the combustion of fossil fuels in air. These flue gases typically contain 10–15% CO

2 at atmospheric pressure, along with nitrogen, water vapor, and other minor components [

21].

The most common technique for CO

2 removal in post-combustion systems is chemical absorption using aqueous solutions of amine-based solvents, such as monoethanolamine or methyl diethanolamine. Flue gas is passed through an absorber column where CO

2 reacts with the solvent. The CO

2-rich solvent is then transferred to a regeneration column (stripper), where it is heated to release a concentrated stream of CO

2, regenerating the solvent for reuse. Other technologies include physical absorption and solid adsorption using materials like activated carbon or zeolites and calcium looping cycles that exploit reversible reactions between calcium oxide and carbon dioxide at high temperatures [

22].

Post-combustion systems offer considerable advantages, including compatibility with existing infrastructure, moderate technological complexity, and proven operational experience in pilot and commercial-scale facilities such as Boundary Dam Power Station in Canada [

23]. Nevertheless, this capture route suffers from significant energy penalties associated with solvent regeneration, solvent degradation, corrosion, and the low partial pressure of CO

2 in flue gas, which reduces capture efficiency. These factors contribute to higher operational costs and require careful design and optimization to ensure economic viability.

3.3. Oxy-Fuel Combustion Capture

Oxy-fuel combustion capture involves burning fossil fuels in a pure oxygen environment rather than air. As a result, combustion produces a flue gas primarily composed of CO

2 and water vapor, simplifying the process of CO

2 separation. The water vapor is easily condensed, leaving a high-purity CO

2 stream suitable for compression and storage [

24].

The core component of oxy-fuel systems is the air separation unit (ASU), which supplies high-purity oxygen typically via cryogenic distillation. The fuel is combusted in a modified boiler or furnace designed to accommodate higher flame temperatures and different heat transfer characteristics associated with oxygen-rich environments. The resulting CO

2-rich flue gas, after dehydration, can be compressed and transported to a storage site or used in enhanced oil recovery (EOR) [

25].

The main advantage of oxy-fuel combustion is the high concentration of CO

2 in the flue gas, which reduces the complexity and energy demand of downstream separation processes. It also eliminates nitrogen from the combustion process, reducing NOx emissions. However, the energy-intensive nature of oxygen production in ASUs, combined with the need for specialized combustion systems and heat exchangers, increases the capital and operating costs of this approach [

22]. Further advancements in low-energy air separation technologies are needed to enhance the commercial feasibility of oxy-fuel systems.

3.4. Recent Advancements in CO2 Capture Technologies

A range of innovative carbon capture technologies is emerging to overcome the limitations of conventional methods. Chemical looping combustion is one such approach that uses metal oxide particles to transfer oxygen to the fuel in a two-reactor system, enabling inherent CO

2 separation without the need for an air separation unit. This process offers high efficiency and low-energy penalties [

26].

Membrane-based separation systems represent another area of active research. These systems exploit the selective permeability of certain materials to separate CO

2 from gas mixtures. Membranes made of polymers, ceramics, or facilitated transport materials are being developed to achieve high selectivity and flux, particularly at high temperatures and pressures. Hybrid systems that combine membranes with absorption or adsorption units are also under investigation [

27].

Cryogenic capture is suitable for gas streams with high CO2 concentrations and involves cooling the gas below the freezing point of CO2 to facilitate phase separation. Though energy-intensive, advances in refrigeration cycles and heat integration can make cryogenic systems more efficient. Direct air capture (DAC) is also gaining attention as a means of removing CO2 from the ambient atmosphere. While DAC is currently associated with high energy consumption and cost, it holds promise for achieving negative emissions when combined with geological storage.

In parallel, material innovations such as the development of nano-structured adsorbents, metal–organic frameworks, and ionic liquids are improving capture performance and reducing regeneration costs. Process intensification strategies, including modular designs and heat integration, are being employed to reduce capital costs and enhance scalability [

25].

These advancements collectively offer pathways to lower the cost and energy burden of carbon capture, increasing the viability of CCS across a broader range of industrial applications and geographic regions.

4. CO2 Storage

4.1. Storage Options

The successful execution of a CCS project depends on the availability of appropriate geological reservoirs for safe and efficient CO

2 storage. Geological storage involves injecting compressed CO

2 into underground rock formations that can safely contain it for thousands to millions of years. There are three principal types of geological storage reservoirs: deep saline aquifers, depleted oil and gas fields, and unmineable coal seams [

28].

Deep saline aquifers offer the largest theoretical global storage potential. These formations consist of porous rock saturated with highly saline water and are typically located more than 800 m below the surface, where temperature and pressure conditions keep CO

2 in a supercritical state [

29]. The global CO

2 storage capacity in saline aquifers is estimated to range from 1000 to 10,000 gigatonnes (Gt) CO

2, depending on geological assumptions and reservoir quality [

30]. For example, IPCC identifies deep saline formations as capable of meeting long-term storage needs for most climate stabilization scenarios.

Depleted oil and gas reservoirs provide another well-characterized and accessible storage option, particularly attractive due to existing infrastructure (wells, pipelines, and facilities) and detailed subsurface data from decades of production history. These reservoirs have already proven their ability to trap hydrocarbons for millions of years, making them geologically suitable for CO

2 storage. Global estimates suggest these formations could accommodate around 900 GtCO

2, although the technically and economically feasible portion is substantially lower [

31].

Unmineable coal seams represent a third category of geological storage, relying on the process of adsorption, whereby CO

2 adheres to the internal surfaces of the coal matrix. This storage pathway is typically combined with enhanced coal bed methane recovery, where injected CO

2 displaces methane that can be harvested as a byproduct. However, coal seams have a limited total storage capacity and are geographically constrained, with global estimates ranging between 150 and 200 GtCO

2 [

32].

4.2. Kazakhstan’s Carbon Storage Potential

Kazakhstan is well suited for CCS projects because of its large sedimentary basins, which are rich in high-quality reservoirs. These geological formations, including hydrocarbon reservoirs, saline aquifers, and coal seams, provide the required qualities for efficient CO

2 sequestration. Abuov et al. [

33] estimate Kazakhstan’s effective CO

2 storage capacity at about 583 Gt, with almost 539 Gt of this capacity located in the Precaspian, Mangyshlak, South Torgay, and Ustyurt sedimentary basins. The total capacity is mostly made up of deep saline aquifers, which can store notable amounts of CO

2. The stable tectonic environment, extensive oil and gas infrastructure, and existence of deep carbonate and clastic reservoirs all point to Precaspian Basin as the most suitable for geological CO

2 storage. Estimated to have an effective storage capacity of roughly 462 Gt, this basin is more than enough to manage the annual CO

2 emissions from nearby industrial sites. Famous for its high-quality reservoirs, the Mangyshlak Basin has a usable storage capacity of about 43 Gt. Defined by well-established oil and gas infrastructure, it has large structural and stratigraphic traps suitable for CO

2 sequestration. Its Jurassic sandstone formations’ presence makes the South Torgay Basin particularly suitable for CO

2 disposal. Its estimated effective storage capacity is 5 Gt, and its geographical proximity to several major CO

2 emission sources helps to facilitate CO

2-EOR. The Ustyurt Basin, situated in the Buzachi region, shows notable CO

2 storage potential in its Jurassic layers. Though some areas, particularly the Triassic section, remain underexplored, the basin’s estimated effective storage capacity is 29 Gt.

The overall CO

2 storage potential in these basins is not only crucial for mitigating Kazakhstan’s GHG emissions but also provides an opportunity for economic growth through EOR, a process in which CO

2 injection into oil fields increases oil recovery rates [

34]. This dual benefit—reducing CO

2 emissions while increasing oil production—makes CCS a key technology for Kazakhstan’s energy strategy in line with its commitments under the Paris Agreement.

4.3. CO2 Retention Mechanisms and Risk Management

The effectiveness and safety of geological storage depend on both the physical and chemical mechanisms of CO2 retention and the robustness of monitoring and verification (M&V) and risk management strategies. Several trapping mechanisms operate within subsurface formations to immobilize CO2 over different time scales and spatial domains.

Structural or physical trapping occurs when CO

2 accumulates beneath an impermeable caprock, such as shale or anhydrite, which prevents the upward migration of gas. This is often the first mechanism to act following injection, providing immediate containment. Residual or capillary trapping immobilizes CO

2 in the pore spaces of reservoir rock through capillary forces that inhibit further migration [

35]. Solubility trapping involves the gradual dissolution of CO

2 into formation brine, which reduces its buoyancy and mobility, effectively integrating it into the aqueous phase of the subsurface system. Mineral trapping, the most permanent form of sequestration, occurs when dissolved CO

2 reacts with reservoir minerals to form solid carbonates such as calcite or magnesite. While mineralization is slow (requires decades to centuries), it ensures irreversible containment [

36].

These mechanisms often act sequentially, with structural and residual trapping dominating early timescales and solubility and mineral trapping increasing in importance over the long term. The relative effectiveness of each depends on the reservoir characteristics, injection strategy, and operational parameters [

36].

To guarantee the integrity of storage operations, comprehensive M&V frameworks are deployed. Seismic surveys allow for imaging of CO

2 plume evolution, identifying any unintended migration. Wellbore logging and pressure sensors track subsurface behavior in real time, while soil gas sampling and satellite remote sensing are employed to detect surface emissions. Risk management begins with detailed site characterization using 3D geological modeling and continues through the injection and post-injection phases with simulations of CO

2 migration and fault integrity assessments [

37].

Regulatory regimes in jurisdictions such as the United States and the European Union require operators to establish detailed M&V plans, maintain financial assurance instruments, and engage in long-term site stewardship following injection [

38]. Such frameworks are essential to safeguard environmental and public health while building societal trust in CCS deployment.

A particularly pressing concern in carbon storage is the risk of CO2 leakage, also known as carbon leakage, which refers to the unintended migration of stored CO2 to the surface or into adjacent formations. While the probability of leakage is low in well-selected and properly managed sites, its consequences can be significant—compromising climate benefits, threatening ecosystems, and raising legal and liability issues.

In the context of Kazakhstan’s energy-exporting industries, carbon leakage presents additional strategic and economic risks. The country’s reliance on oil, gas, and coal exports makes it vulnerable to carbon border adjustment mechanisms (CBAMs) and environmental tariffs from trading partners. Failure to ensure robust carbon storage practices may undermine Kazakhstan’s competitiveness in international markets, especially as the EU and other major economies tighten emissions-related trade policies. Moreover, any leakage from storage operations could damage Kazakhstan’s credibility in global climate negotiations, weaken investor confidence in low-carbon projects, and provoke domestic opposition to CCS infrastructure.

Addressing these risks will require the establishment of national CO

2 storage standards, integration with emissions trading mechanisms, and the development of institutional capacities for inspection and enforcement. Transparent disclosure of M&V data, community engagement, and alignment with international protocols such as ISO 27914 [

39] will also be critical. Through these measures, Kazakhstan can both mitigate the risks of leakage and position itself as a responsible actor in the emerging global carbon economy.

5. Utilization of Captured CO2

While CCS focuses on the permanent geological storage of captured CO

2, Carbon Capture, Utilization, and Storage (CCUS) expands the framework by incorporating the beneficial use of CO

2 as a resource. CCUS offers an integrated approach to reducing greenhouse gas emissions by coupling CO

2 capture with commercial and industrial applications, thereby improving the economic viability of decarbonization efforts. The utilization component of CCUS has gained increasing attention in recent years, particularly in power generation, where emerging technologies such as supercritical CO

2 (sCO

2) power cycles are being explored for their potential to enhance thermal efficiency, reduce emissions, and transform the role of captured CO

2 from a waste stream into a productive input [

40].

5.1. CO2 Utilization Pathways

CO2 utilization encompasses a wide range of processes, typically categorized into four major areas: (1) enhanced hydrocarbon recovery, (2) conversion into fuels and chemicals, (3) mineralization into stable carbonates, and (4) use as a working fluid in power and industrial processes.

Traditional applications include EOR, where CO

2 is injected into depleted reservoirs to mobilize additional hydrocarbons. Similarly, enhanced coal bed methane techniques utilize CO

2 injection to displace methane from coal seams. These processes not only facilitate additional resource extraction but also serve as a form of temporary or long-term CO

2 storage [

41].

In the chemical and materials domain, captured CO2 can be transformed into value-added products such as methanol, urea, polymers, and building materials through catalytic or electrochemical reactions. However, these pathways often face energy and scalability constraints, and many require low-cost renewable electricity to achieve lifecycle climate benefits.

Another promising category is mineral carbonation in which CO

2 reacts with metal oxides in industrial wastes or natural silicate rocks to form stable carbonate minerals. This process offers permanent storage and material production, though the kinetics are slow and require process intensification for industrial deployment [

42].

Finally, most relevant to the power sector, captured CO

2 can be utilized directly in thermodynamic cycles to generate electricity more efficiently, particularly in the form of sCO

2 power cycles [

43].

5.2. Supercritical CO2 Power Cycles

sCO2 power cycles represent a novel class of closed-loop thermodynamic systems that use CO2 above its critical point (31.1 °C and 7.38 MPa) as the working fluid. In this supercritical state, CO2 exhibits properties of both a gas and a liquid, enabling high-density, low-viscosity flow with excellent heat transfer characteristics.

These cycles are typically based on a Brayton cycle configuration, similar to those used in gas turbines, but with significant enhancements due to the properties of sCO

2. The working fluid is compressed, heated via a heat exchanger or combustor, expanded through a turbine to generate electricity, and then cooled and recompressed. The compactness of the fluid allows for smaller turbomachinery, high thermal efficiency, and reduced system footprint compared to steam Rankine cycles [

44].

Notably, sCO

2 cycles offer thermal efficiencies exceeding 45–50%, particularly at turbine inlet temperatures between 500 and 700 °C. These efficiency levels surpass traditional subcritical and supercritical steam cycles, especially at smaller scales (<300 MW), making sCO

2 an attractive candidate for modular power plants and industrial heat recovery. Moreover, sCO

2 cycles can be integrated with CO

2 capture systems, either by utilizing captured CO

2 as the working fluid or by optimizing the heat integration between capture and power generation subsystems [

45].

Research and development in sCO

2 technology has accelerated in the past decade, driven by national laboratories, academic institutions, and industry. Key milestones include the STEP Demo Project (Supercritical Transformational Electric Power) in San Antonio, Texas, backed by the U.S. Department of Energy, which is a 10 MW pilot plant aiming to demonstrate the operability and efficiency of a full sCO

2 Brayton cycle under real conditions. It is expected to achieve turbine inlet temperatures of up to 715 °C with a net efficiency above 50% [

46]. In Europe, the SCARABEUS project is investigating alternative CO

2 mixtures to enhance cycle performance at lower temperatures, targeting applications in concentrated solar power and nuclear systems [

47].

Key research areas include materials development for turbine blades and heat exchangers that can withstand high temperatures and CO

2-rich environments; advanced turbomachinery designs capable of operating at high rotational speeds and tight tolerances in compact configurations; cycle optimization for different heat sources, including fossil fuels, biomass, nuclear, geothermal, and solar thermal systems; and integration with carbon capture, particularly in oxy-fuel combustion systems where the flue gas is already CO

2-rich and can be recycled within the sCO

2 loop [

48].

Kazakhstan’s current energy mix is dominated by fossil fuels, particularly coal and natural gas, which are responsible for significant CO2 emissions. Retrofitting existing power plants with CCS and integrating sCO2 cycles could provide an effective pathway for reducing emissions while maintaining energy security. The country’s industrial base and growing interest in clean technology investments create favorable conditions for pilot deployments of sCO2-based systems. Furthermore, the modularity and high efficiency of sCO2 cycles make them suitable for decentralized applications in oil and gas fields, where captured CO2 from gas processing could be reused on-site for power generation. This is particularly relevant for Kazakhstan’s western regions, where methane-rich operations and CO2-rich associated gas are prevalent.

Despite its promise, the large-scale deployment of sCO

2 power cycles faces several challenges. These include the need for high-temperature materials resistant to oxidation and corrosion in supercritical CO

2; thermodynamic instabilities and control challenges at part-load or transient operation; and limited commercial experience, which raises uncertainty in investment decisions [

49]. However, as pilot projects mature and component technologies evolve, sCO

2 systems are expected to become more viable, particularly when integrated with CCUS to enhance overall system performance and climate impact.

6. Overview of CCS/CCUS Advantages and Disadvantages

CCS/CCUS has emerged as an essential component of global climate mitigation strategies, particularly for hard-to-abate industrial sectors and fossil-fuel-based power generation. These technologies are featured prominently in scenarios from the IPCC, the International Energy Agency, and numerous national decarbonization plans as a necessary complement to renewable energy deployment, energy efficiency, and behavioral change. While CCS/CCUS offers a range of technical and climate-related advantages, its deployment is associated with substantial economic, environmental, and systemic limitations. A critical review of these benefits and challenges is necessary to understand their role in a net-zero emissions future.

6.1. CCS/CCUS Advantages

A key advantage of CCS is its ability to significantly reduce CO

2 emissions from stationary sources, including coal and natural gas power plants, cement kilns, steel furnaces, ammonia production, and refineries. High capture rates allow the existing infrastructure to be decarbonized without the need for complete technological replacement [

50].

CCUS extends this advantage by enabling the productive use of captured CO

2. Utilization pathways include EOR, where CO

2 is injected into mature oil reservoirs to increase hydrocarbon recovery; conversion into synthetic fuels, methanol, and chemicals; and mineralization into solid carbonates for use in construction materials [

51]. These applications offer potential economic returns, offsetting a portion of the capture and transport costs, and contribute to the development of a circular carbon economy.

Another strategic strength of CCS/CCUS is its technological neutrality. Unlike renewable energy systems that require new infrastructure and grid integration, CCS can be retrofitted onto existing industrial facilities and power stations. It also supports low-carbon hydrogen production through steam methane reforming with carbon capture (“blue hydrogen”), enabling decarbonization in sectors such as heavy transport, aviation, and industrial heating [

52].

CCS/CCUS also play a unique role in negative emissions strategies. When combined with bioenergy or DAC, technology can result in net removal of CO

2 from the atmosphere [

50]. This capability is crucial for offsetting residual emissions from sectors where full decarbonization is technically or economically unfeasible. Furthermore, CCS infrastructure such as transport pipelines and geological storage sites can be shared across sectors and emitters, promoting economies of scale.

6.2. CCS/CCUS Disadvantages and Limitations

Despite its potential, CCS/CCUS faces several critical disadvantages and implementation barriers. One of the primary barriers is the capital-intensive nature of these projects. The need for advanced technologies to capture, transport, and store CO

2 at scale demands considerable investment. These technologies require cutting-edge infrastructure, such as high-capacity pipelines for CO

2 transport, sophisticated monitoring systems to ensure the safety of stored CO

2, and secure storage sites deep underground. The development and deployment of these technologies involve high upfront costs, which can be a deterrent for both private and public investors, especially in countries where financial resources may be limited [

53,

54]. Moreover, the financial burden associated with CCUS projects is not limited to the initial capital costs. There are ongoing operational costs, including maintenance of the CO

2 capture facilities, transportation infrastructure, and monitoring systems to ensure the long-term integrity of storage sites.

Additionally, CCS imposes an energy penalty on host facilities. Power plants equipped with post-combustion capture technologies typically lose 8–12% of their efficiency [

55], depending on the solvent system and operating parameters. This load requires additional fuel input and may counteract part of the environmental benefit unless supplied by low-carbon energy.

From an environmental and safety standpoint, the risk of CO2 leakage from storage reservoirs while considered low with proper site selection and monitoring remains a concern. Long-term liability induced seismicity from pressurized injections, and potential groundwater contamination are challenges that require rigorous site characterization, modeling, and regulatory oversight. Moreover, CCUS raises lifecycle emissions concerns in some utilization pathways. For example, when CO2 is used in EOR, the combustion of the additional recovered oil can emit more CO2 than is stored unless stringent carbon accounting rules are applied.

Another critical limitation is the low commercial maturity and limited deployment of CCS globally. As of 2024, fewer than 50 large-scale CCS facilities are in operation worldwide, capturing a combined total of less than 50 Mt of CO

2 per year [

56], well below the 1.2–1.5 billion tonnes per year needed by 2030 in many 1.5 °C-aligned scenarios. This deployment gap reflects both cost barriers and policy shortfalls.

Finally, public acceptance remains a barrier in some regions. Concerns about underground injections, lack of trust in corporate transparency, and fears of local environmental damage can result in delays or cancellations of storage projects. Building social licenses require transparent communication, community engagement, and robust environmental safeguards.

7. Carbon Policies

By guiding economic systems towards low-carbon development paths, effective carbon policy helps to reach climate goals and reduce GHG emissions. Market-based tools at the core of such policy frameworks use economic incentives to encourage sector-wide emission reductions. Among the most often used of these tools are carbon taxes and ETS.

Many nations all around have included ETS and carbon tax programs into their climate action plans. Although these systems all seek to internalize the environmental costs of carbon emissions, their execution varies greatly in terms of structure, coverage, and regulatory design. These variations show the particular socio-economic situation, institutional capacity, and climate policy goals of each country.

The integration of CCS with ETS is underpinned by fundamental principles of environmental and welfare economics. ETS is a market-based mechanism designed to reduce greenhouse gas emissions by placing a price on carbon. A key attribute of ETS is its technology neutrality, meaning it does not prescribe how emission reductions must be achieved but rather allows regulated entities to select the most cost-effective abatement strategies available.

Within this framework, CCS operates on equal footing with other mitigation measures such as fuel switching, energy-efficiency improvements, and renewable energy deployment. If CCS emerges as a cost-competitive option under prevailing carbon prices, it can be naturally incentivized by ETS market dynamics. This alignment ensures that firms respond efficiently to carbon price signals, selecting the least-cost compliance options based on their marginal abatement costs. From a welfare economics perspective, ETS enables an economy-wide least-cost path to achieving aggregate emission targets by allocating reduction efforts to sectors and technologies where they are most economically efficient—such as CCS in carbon-intensive industries.

The European Union has one of the most well-known ETS programs, called the European Union Emissions Trading System (EU ETS). It applies to a lot of different industries, such as manufacturing, aviation, and power generation. This system sets a cap on emissions and allows companies to buy and sell carbon allowances. The EU ETS has been a very important part of lowering pollution in the EU. The U.S. state of California has its own Cap-and-Trade system that is tied to the carbon market in Quebec. This ETS covers a lot of different areas, like transportation, energy, and industrial emissions. It has significantly aided the state in reducing carbon emissions.

In contrast, countries such as Sweden and Canada have adopted carbon taxes as a primary tool for emission reduction [

57]. Sweden’s carbon tax is one of the highest in the world, aimed at reducing the use of fossil fuels and encouraging a shift to renewable energy. Canada, on the other hand, has implemented a federal carbon tax, which applies to provinces that do not have their own carbon pricing systems in place [

58].

Kazakhstan introduced its ETS in 2013, covering 47% of the country’s emissions from various sectors. While still in the early stages, KazETS is expected to play an increasingly important role in supporting the country’s transition to a low-carbon economy.

7.1. EU ETS

EU ETS is a key part of the EU’s climate policy. Its goal is to support the EU’s ambitious environmental goals while also lowering greenhouse gas emissions in a cost-effective way. The EU ETS was set up in 2005 and works on the “cap-and-trade” principle. Each sector, like power production, manufacturing, aviation, and, starting in 2024, maritime transport, is limited in how much pollution they can produce [

59]. Companies can either get or buy emission allowances, which let them put out one tonne of CO

2 equivalent. These allowances can then be traded between companies. Companies that lower their emissions where it costs them the least can sell the allowances they do not need, while companies that go over their limits must buy more allowances or face penalties.

To meet the EU’s higher climate goals, the system has been through major changes. The limit has been raised so that emissions must be 62% lower by 2030 than they were in 2005. This shows that the EU is committed to taking stronger action on climate change [

59]. Adding maritime transportation is a significant move forward; shipping companies must now track, report, and prove their emissions, gradually giving up some of their exemptions starting in 2025 (for 40% of emissions that year), rising to 70% in 2026, and finally being exempt from all limits by 2027 [

60,

61]. This step-by-step plan aims to make shipping’s environmental costs more visible and encourage cleaner technologies in a sector that is notoriously hard to change.

Along with the original EU ETS, a new Emissions Trading System (ETS 2) will start in 2027. It will focus on emissions from buildings, transport, and other areas that were not covered by the EU ETS before. This adds to the EU’s climate strategy and covers about 40% of all emissions. It works with the current system to deal with emissions from regular activities such as transport and energy use [

62].

Financially, the EU ETS has become a major source of revenue for climate action. The European Environment Agency [

63] claims that it gathered in approximately 43.6 billion euros in 2023. These are funds and national budgets that member states use to support green energy, energy efficiency, and new low-carbon technologies. These investments allow companies to cut down on their carbon emissions and move towards an environmentally healthy economy. The system also has ways to stop carbon leakage, which happens when companies move to countries with less strict environmental laws. This is done by gradually reducing free allowances, especially for sectors such as flight, where they will be completely eliminated by 2026 [

64]. CBAM makes processes further fair by charging more for certain imported goods because of carbon emissions. This protects EU businesses and encourages the world to cut down on emissions.

About 38% to 40% of the EU’s total emissions are covered by the EU ETS. It has already contributed to lower emissions from industry and power plants by 47% compared to 2005 levels [

65,

66]. The cap is lowered every year, which limits the number of allowances available and raises the price of carbon. In 2023, the price of carbon will be around USD 90 per tonne of CO

2, which is an attractive financial incentive for reducing emissions [

67]. Companies must keep track of their emissions, report them again annually, and give up enough credit to cover them. If they fail, they will be fined 100 euros per extra tonne. The strong registry infrastructure of the system makes sure that selling allowances remain accessible and protected.

7.2. U.S.A. ETS

The United States manages ETS in a decentralized way, with different regional programs instead of a single government program. With this approach, different states and regions may customize their systems serving to their needs, economic situations, and climate goals. The Cap-and-Trade Program in California, the Regional Greenhouse Gas Initiative (RGGI), and the Cap-and-Invest Program in Washington State are some of the most well-known examples of these types of regional programs. The “cap-and-trade” idea is what all these schemes are based on [

68].

The Cap-and-Trade Program in California, which started in 2013, is one of the most advanced and well-known regional carbon pricing programs in the U.S. Since it began, the program has generated about USD 28 billion, which is used as funding for a wide range of social and environmental projects that strive to halt climate change [

69]. It raised USD 5.13 billion [

70] solely for the fiscal year of 2023–2024. The Greenhouse Gas Reduction Fund (GGRF) received these funds. The GGRF supports projects that focus on clean transportation, renewable energy, energy efficiency, and climate resilience.

By November 2023, more than USD 11 billion had been allocated to 578,568 projects, yielding an anticipated reduction of approximately 109.2 MtCO

2e in greenhouse gas emissions. A significant feature of California’s policy is its dedication to environmental justice. Over USD 8.1 billion of the total cash has been allocated to disadvantaged and low-income communities, aiding in the mitigation of pollution and the advancement of climate equality [

71].

RGGI is another significant emission trading system, covering 11 northeastern states in the U.S. This program focuses on power sector emissions, with a cap on CO

2 emissions from electricity generation. By the end of 2023, RGGI had conducted 62 auctions, selling 1.37 billion CO

2 allowances and generating USD 7.2 billion in revenue [

72]. This revenue has been invested in a range of climate-related projects, including renewable energy development, energy-efficiency programs, and infrastructure upgrades aimed at reducing energy consumption.

The funds raised by RGGI have delivered substantial benefits. For instance, investments have resulted in an estimated USD 1.8 billion in lifetime energy bill savings and the avoidance of 7.5 million short tons of CO

2 emissions [

73]. Additionally, the program has helped mitigate the impact of energy price fluctuations on consumers, particularly in low-income communities.

Launched in 2023, Washington State’s Cap-and-Invest Program is the newest addition to the list of regional ETS initiatives in the United States. In its first year, the program raised over USD 2 billion, which was directed toward funding climate and air quality projects across the state [

74]. More than 100 initiatives were funded in the initial budget, contributing to the reduction of 191,000 metric tons of GHG emissions in its first year [

75].

7.3. Kazakhstan ETS

ETS in Kazakhstan was established in 2013, covering 47% of the country’s emissions from 212 facilities operated by 135 companies. Kazakhstan’s Emissions Trading System (KazETS) is a Cap-and-Trade mechanism targeting large industrial emitters in sectors such as power generation, mining, oil and gas, and manufacturing, with installations emitting ≥20,000 tCO

2/year required to participate, while smaller sources report emissions but are exempt from compliance [

76]. The operator of the KazETS is JSC “Zhasyl Damu,” a subsidiary of the Ministry of Ecology and Natural Resources.

The ETS initially began with a pilot phase in 2013, followed by a second phase from 2014 to 2015. A delay in updating the allocation mechanism resulted in the third phase being postponed until 2018. In 2021, the system entered a transitional phase, where new allocation principles were introduced. Presently, the KazETS is operating in its fifth phase, which started in 2022 and is set to continue until 2025 [

77]. It is important to note that carbon trading on the exchange was first introduced during the second phase (2014–2015). However, trading was suspended in 2022 due to legislative challenges that affected the market’s operation.

8. Challenges of KazETS

Although established in 2013, KazETS has encountered considerable obstacles in achieving substantial reductions in greenhouse gas emissions. The system has failed to offer adequate incentives or price signals to motivate industries to embrace low-carbon technologies or execute effective green initiatives. Analysis of historical trends in GHG emissions after the implementation of KazETS indicates a lack of significant reduction in emissions, implying that the system has not yet proven effective in realizing its intended environmental objectives. This raises questions regarding the effectiveness of the market mechanism and its capacity to motivate industries to reduce their carbon footprints.

The KazETS is mostly constrained by its sectoral coverage. The system currently covers 47% of the nation’s total CO2 emissions, although it neglects significant sources of greenhouse gas emissions, especially the transportation sector. In 2022, the transport sector accounted for 10% of greenhouse gas emissions in Kazakhstan’s energy sector; however, it remains unintegrated into the KazETS. This absence indicates a significant deficiency, particularly given the necessity of decarbonizing the transport sector to achieve Kazakhstan’s climate objectives.

The World Bank has proposed the expansion of the KazETS to include the transportation sector, methane emissions, and more industrial process pollutants. This extension might substantially improve the system’s effectiveness, resulting in a more liquid carbon market and an increased volume of transactions. After the discussions during a roundtable conference in March 2024, the Ministry of Ecology and Natural Resources suggested expanding the system to include more sectors and gases, potentially enhancing the dynamism of the carbon market. In particular, the inclusion of methane emissions is highly relevant, given its global warming potential 84–87 times higher than CO

2 over a 20-year period [

78], and its major contribution to near-term climate forcing. CH

4 is emitted in large volumes from Kazakhstan’s coal mining, oil and gas production, and flaring activities—sectors that spatially overlap with potential CCS and CCUS project locations. Integrating CH

4 mitigation into KazETS would not only improve climate impact per tonne regulated but also incentivize advanced technologies such as flaring reduction, methane recovery, and CH

4-to-CO

2 conversion for subsequent storage. Therefore, expanding KazETS to regulate methane aligns with international best practices and enhances the environmental integrity and cost-effectiveness of the system.

An important obstacle limiting the effectiveness of KazETS is the low price of carbon units. Currently, the price of a carbon unit in Kazakhstan is approximately USD 1, in a staggering contrast to the EUR 90 per tonne of CO

2 in the EU ETS as of 2023 [

79]. This gap can be primarily attributed to the full free allocation of allowances and the simplicity of obtaining additional allowances at no expense. The excess of free allowances has resulted in a consistently low carbon price, which has failed to stimulate the market activity necessary for the effectiveness of the system. For instance, over the years, the carbon price in Kazakhstan has remained constant at USD 1, leading to minimal trade volume and decreased transaction activity in the market.

The low carbon price presents multiple challenges. Firstly, it significantly reduces the incentives for companies to invest in low-carbon technologies as the expense of carbon emissions remains negligible. Secondly, it threatens Kazakhstan’s export competitiveness. The European Union plans to implement the CBAM in 2026, requiring all importers acquire carbon certificates corresponding to the carbon price in their country of origin [

80]. In 2023, the price difference between Kazakhstan’s carbon units and those of the EU is around USD 89 per tonne of CO

2. If Kazakhstan does not increase its carbon pricing, it could result in substantial expenses for its export businesses, particularly in aluminum, cement, and steel sectors. The World Bank indicates that the implementation of CBAM may result in payments between USD 7.3 million in 2026 and around USD 40 million by 2035 for Kazakhstan’s aluminum industry alone [

81]. Additional costs are going to be faced by other sectors, such as ammonia and cement. The price gap could harm Kazakhstan’s export competitiveness as European importers will be required to cover the carbon pricing differential under the CBAM system.

The total transaction volume in the KazETS carbon market is minimal, hence limiting its effectiveness. Since its beginning, the overall quantity of carbon unit buy–sell transactions has remained negligible. Between 2014 and 2022, a total of 169 transactions occurred, with 39 transactions in 2021, 46 in 2022, and 49 in 2023. The trade volume in financial terms is likewise minimal. In both 2021 and 2023, the total transaction volumes constituted only 2.7% of the total granted allowances for those years [

82].

The decreased transaction volume indicates insufficient market activity, thus illustrating the lack of financial incentives for individuals to participate in the carbon market. The consistently low price of carbon units slows participation as market participants doubt the system’s profitability.

9. Possible Improvements

Several changes and solutions are required to tackle the difficulties now confronting KazETS and strengthen its capacity to significantly lower GHG emissions. This section describes important reform elements that will improve the system and make it more effective, open, and market driven by using international knowledge and the present condition of KazETS. The following changes are suggested for KazETS’s relaunch:

Moving away from the present practice of free allocation of permits is absolutely necessary to solve the problem of low carbon pricing and minimal market activity. Rather, Kazakhstan should implement compensated allocation of carbon units, some of which would be allocated via an auctioning mechanism. This strategy will provide a fair market price for carbon units, hence encouraging industry to lower emissions and use low-carbon technology more strongly.

For example, in the first and second stages of the EU ETS, carbon prices fell because 100% and 90% of the permits were issued for free, respectively, causing an oversupply of allowances. Starting in 2013, though, carbon prices started to grow slowly as the proportion of auctioned permits grew to 57%. From about USD 10 in the early phases to USD 90 per tonne in 2023, the EU’s method of auctioning permits has helped to drive up carbon costs.

The World Bank advises Kazakhstan to begin with 3% of carbon allowances auctioned and progressively raise this proportion to 10% by 2026–2030 [

81]. The electricity sector might be left out of paid allocation in the early phases to help reduce possible price increases for heating and electricity. Paid distribution might be established from 2030 with a subsidy system for the electricity industry to avoid consumer cost rises.

When capacity rises, free allocation from the reserve should also be abolished since it compromises the ETS’s objective of motivating emissions cuts. For example, 7.5 million free allowances were granted in 2021, which would have produced USD 7.5 million if sold. A carbon price raised by auction would help to reduce emissions and provide money for decarbonization initiatives, as shown in foreign markets where auctioning fosters improved price discovery.

As of 2023, Kazakhstan’s ETS allocated a total of 163,663,379 tCO2e, yet only 4,483,309 tCO2e (approximately 2.74%) was transacted on the market, and the average carbon price remained at a low level of around USD 1 per tonne. This reflects a lack of market scarcity and weak incentives for decarbonization. A more ambitious shift to 10% auctioning—approximately 16.4 million allowances—could elevate prices to USD 3–5 per tonne, based on evidence from other early-phase ETS markets, while also generating USD 50–80 million in annual revenue.

Only a portion of the nation’s CO2 emissions are currently covered by KazETS, leaving out important industries such as transportation, methane emissions, and specific industrial processes. By adding these industries, the efficiency of the system in promoting emissions reductions would be greatly increased.

Allowing financial institutions and brokers to participate is crucial in addition to sectoral expansion. These organizations would help build the infrastructure required for carbon trading and boost market liquidity. Additionally, by providing beneficial financial products such as carbon futures and derivatives, financial institutions can increase investor access to carbon markets and promote wider market participation.

The creation of a Carbon Fund could play a pivotal role in supporting Kazakhstan’s decarbonization efforts by providing financial resources for industries transitioning to low-carbon technologies. Revenue generated from the auctioning of carbon allowances could be directed into this fund, which would then be used to finance projects related to renewable energy, energy efficiency, carbon capture technologies, and other climate mitigation measures. Such a fund would not only incentivize the adoption of clean technologies but also drive the development of a green economy by funding projects that contribute to long-term environmental sustainability.

International examples provide valuable insights into the successful use of carbon auction revenues for climate action. In California, the GGRF has effectively utilized funds generated from auctioning carbon allowances to finance a wide array of clean energy and climate resilience projects. GGRF has supported over 578,000 initiatives [

70], including investments in clean transportation, energy-efficiency improvements, and climate adaptation measures, driving the state’s ambitious decarbonization agenda. Similarly, the EU ETS allocates carbon auction revenues to fund projects that promote sustainable development, such as renewable energy infrastructure and CCS/CCUS. These measures have led to substantial decreases in emissions while promoting innovation in low-carbon industries.

Based on these international experiences, Kazakhstan should establish its own Carbon Fund, reinvesting the revenue from carbon auctions into low-carbon and climate-resilient projects such as CCS, CCUS, etc. This fund would support the transition to a green economy by helping industries adopt cleaner technologies and stimulate innovation in renewable energy and energy efficiency. Such an initiative would not only strengthen the effectiveness of the KazETS but also position Kazakhstan as a leader in climate action in Central Asia.

The low transaction volume and low market participation of KazETS pose a significant challenge to the system’s ability to effectively reduce emissions. Kazakhstan should think about allowing several domestic and foreign trading platforms to access its carbon market in order to solve this problem. Allowing carbon units to be traded on various platforms would boost market liquidity, improve price discovery, and create a more dynamic and effective carbon market in addition to increasing the number of participants. Businesses would have more chances to participate in carbon trading in an active market, strengthening the financial incentives for reducing emissions.

International experience offers valuable insights into how expanding trading platforms can strengthen a carbon market. In California and Quebec, the carbon markets are linked across multiple platforms, which enhances market flexibility and provides businesses with a wider range of trading options. This integration has made it easier for businesses to buy and sell carbon allowances, increasing market engagement and liquidity.

Kazakhstan should explore the possibility of linking its carbon market to international trading platforms or creating multiple domestic platforms for carbon trading. This will attract more market participants and increase the frequency of transactions, contributing to better price discovery and market depth.

10. Conclusions

This review has comprehensively assessed the current state and strategic potential of CCS/CCUS technologies in the context of Kazakhstan and broader global developments. The findings reveal both substantial technological progress and enduring deployment challenges. Notable advancements include the emergence of next-generation CO2 capture methods, such as solid sorbents, advanced solvents, and membrane separation technologies, which are improving energy efficiency and reducing the cost of capture, particularly in industrial sectors.

In parallel, the development of sCO2 power cycles and novel utilization pathways including mineral carbonation, fuel and chemical synthesis, and enhanced oil recovery demonstrates the potential of CCUS to deliver both climate and economic co-benefits. Enhanced monitoring technologies and evolving standards for geological storage also contribute to the long-term security and environmental integrity of CO2 sequestration efforts. Methane mitigation, often overlooked in CCS discourse, is gaining relevance due to its high global warming potential and overlapping emission sources and deserves integration into future CCUS strategies.

This study also highlights the critical role of carbon policy in shaping deployment trajectories. ETS offers a technology-neutral framework to support cost-effective decarbonization. Sensitivity analysis of auction share scenarios shows how phased market reforms can raise carbon prices and generate revenue for reinvestment in low-carbon innovation, including CCS infrastructure. The integration of CCS within an evolving Kazakh ETS could significantly enhance abatement incentives and support the country’s climate commitments.

Despite these developments, economic feasibility, regulatory uncertainty, and public acceptance remain significant obstacles. High capital intensity limited industrial-scale demonstration projects, and institutional barriers continue to slow progress, especially in emerging markets. Addressing these gaps will require coordinated efforts across technology, finance, and governance.

The prospects for the development of CCS/CCUS technologies remain cautiously optimistic. Continued innovation in materials, systems integration, and digital monitoring can help overcome current technical bottlenecks. Equally important are strategic investments, stable regulatory frameworks, and international collaboration to ensure the bankability and scalability of CCS/CCUS solutions. Future research should prioritize lowering the levelized cost of CO2 abatement, improving cross-sectoral integration (e.g., with hydrogen and RES) and aligning national policies with international carbon markets.

Ultimately, CCS/CCUS holds the potential to become a cornerstone of global and national climate strategies. Its successful implementation will not only accelerate the transition to a low-carbon economy but also reinforce long-term environmental stewardship and industrial resilience in an increasingly carbon-constrained world.