Digital Finance, Financing Constraints, and Green Innovation in Chinese Firms: The Roles of Management Power and CSR

Abstract

1. Introduction

2. Literature Review and Research Hypothesis

3. Research Design and Sample Selection

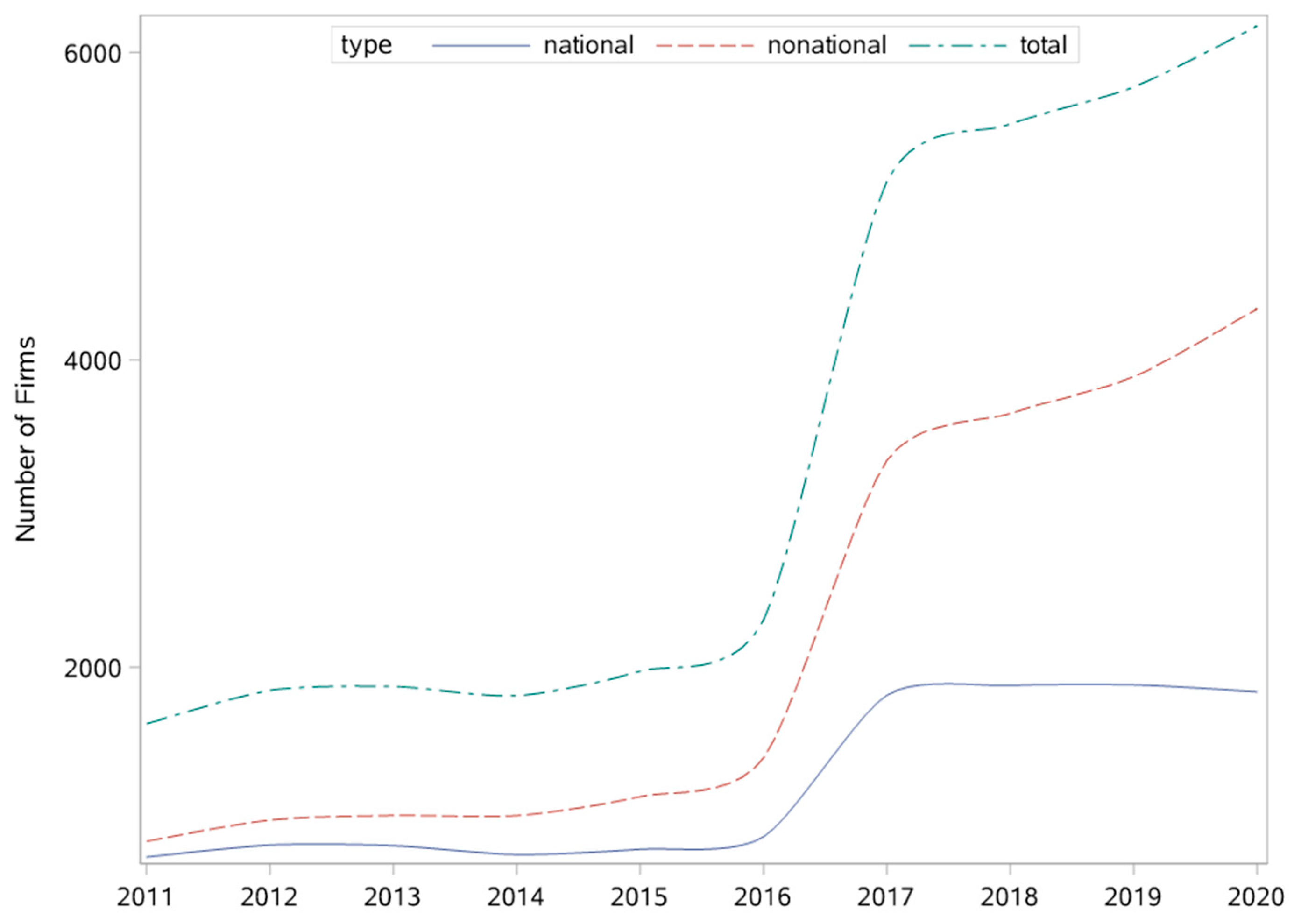

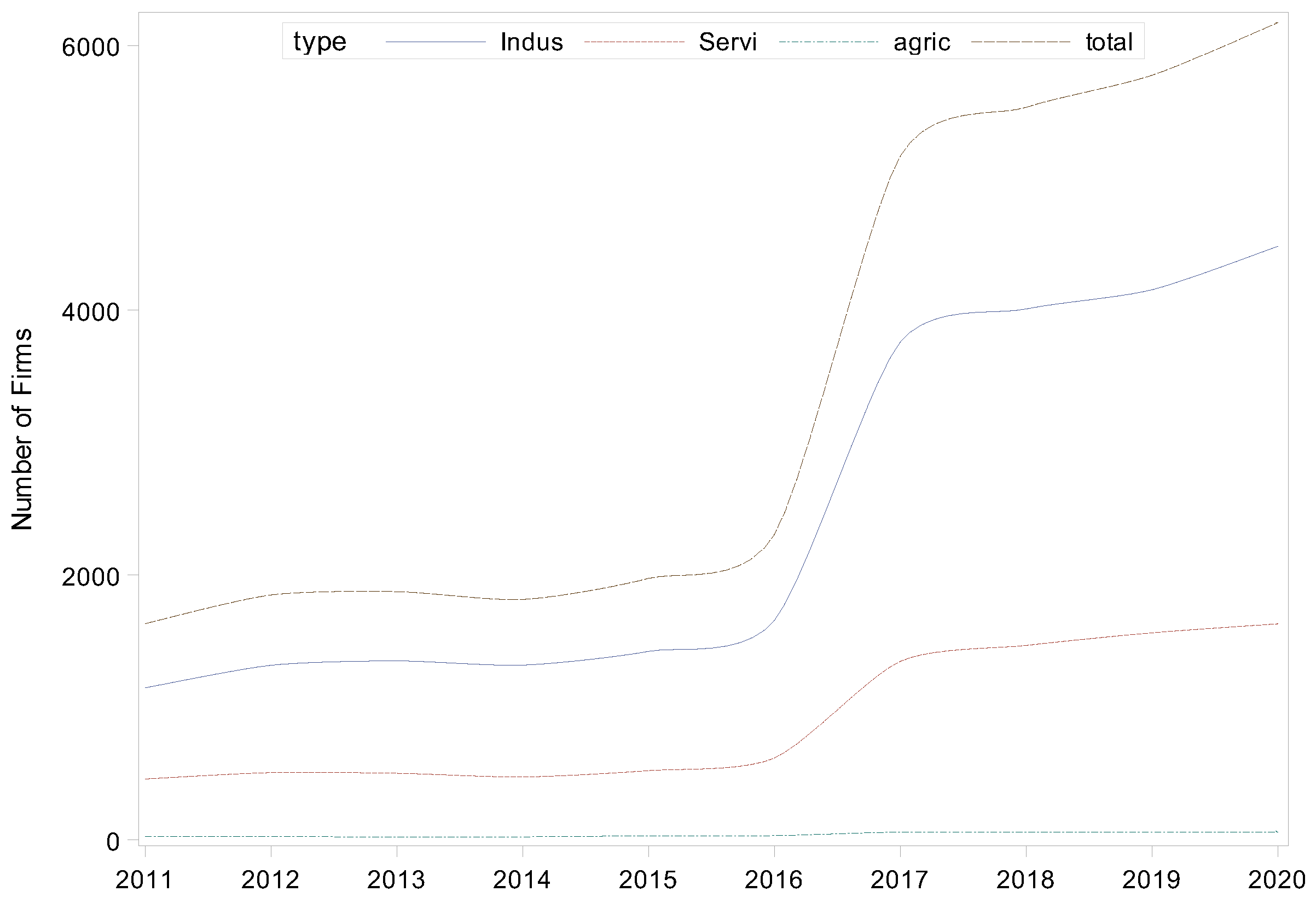

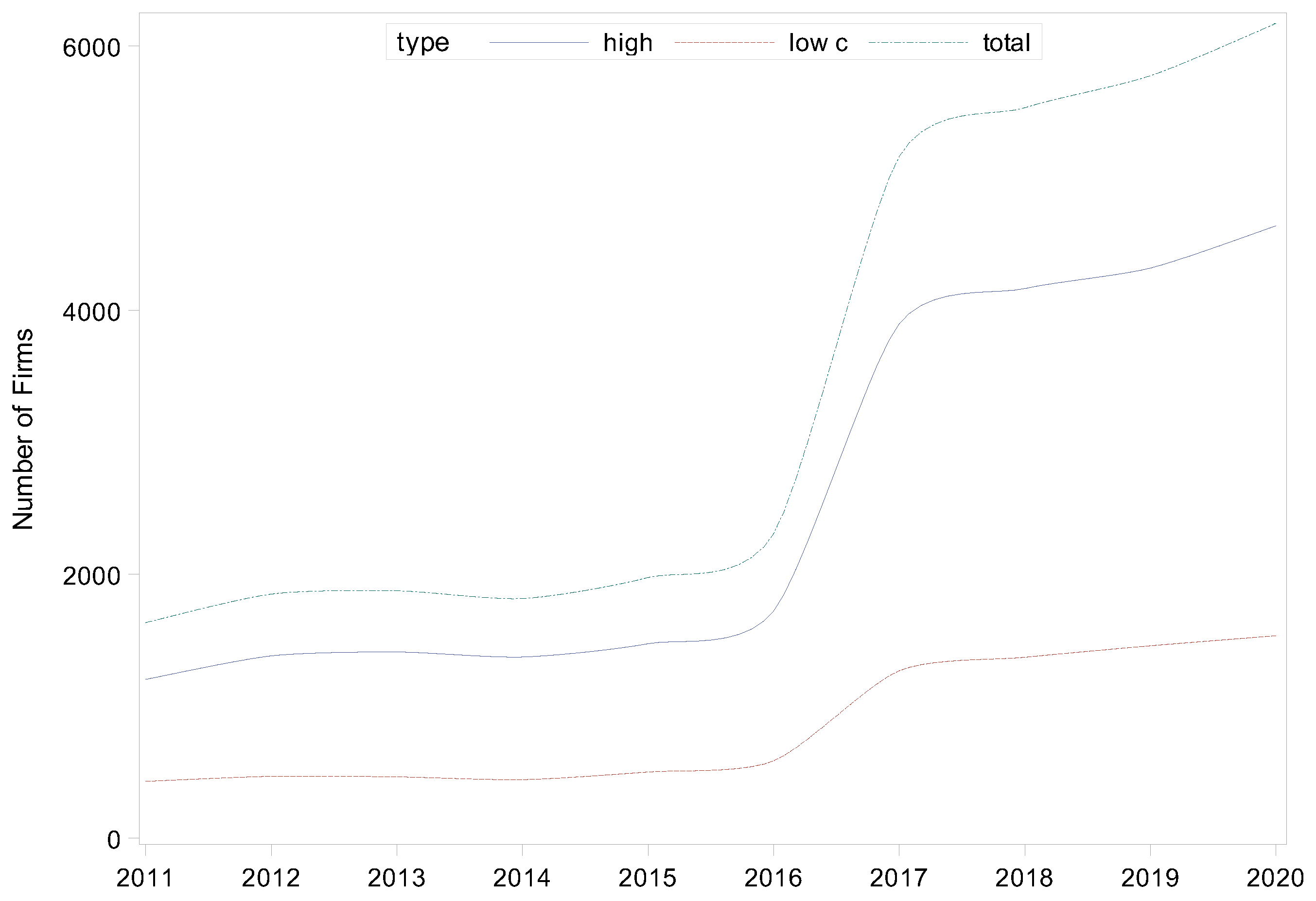

3.1. Data and Sample Selection

3.2. Definition of Variables

3.2.1. Dependent Variables

3.2.2. Economic Consequences Explanatory Variables

3.2.3. Independent Variables

3.2.4. Moderator Variables

3.2.5. Control Variables

3.2.6. Model Construction

4. Empirical Results and Analysis

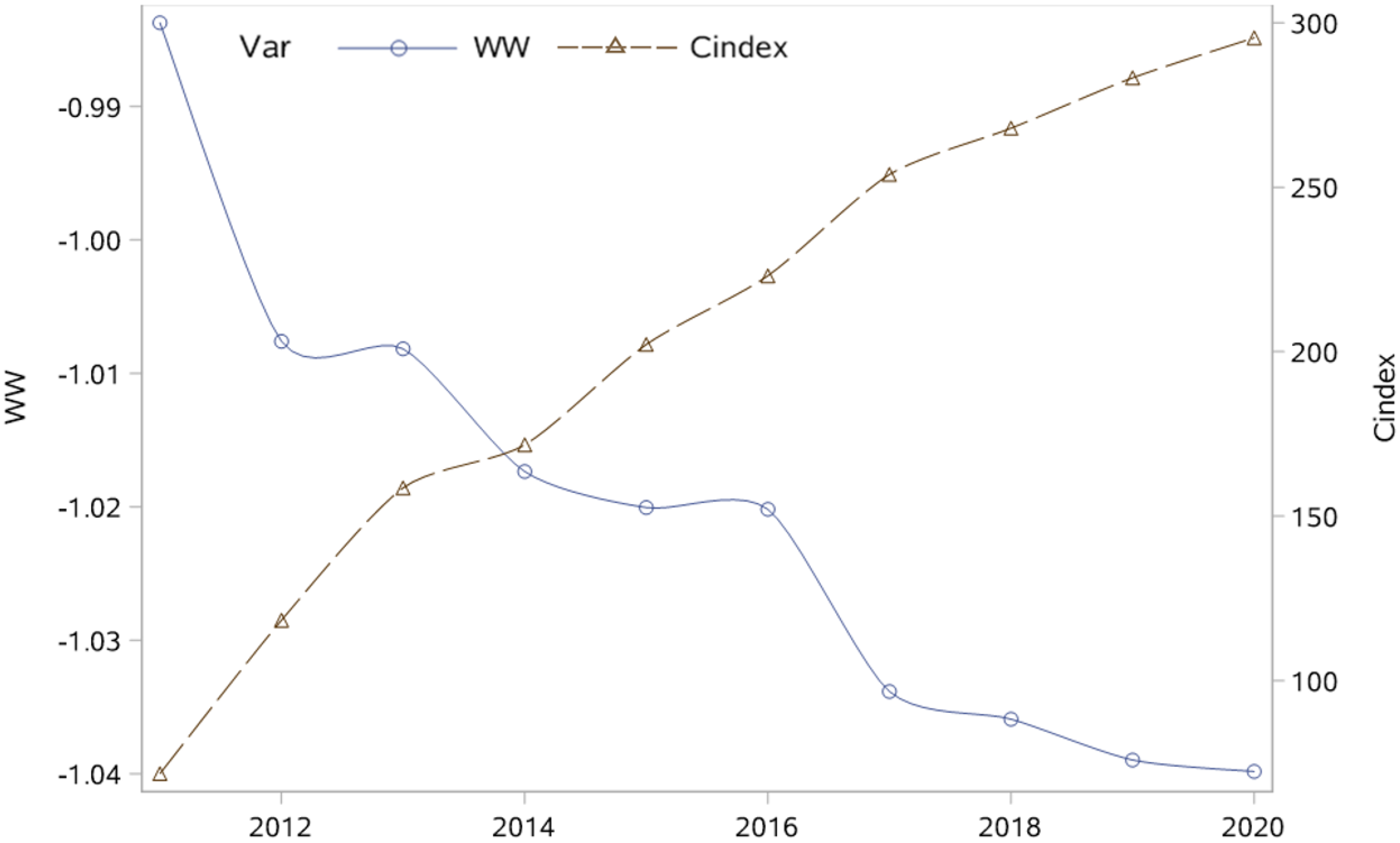

4.1. Descriptive Statistics Analysis

4.2. Basic Regression Analyses

4.3. An Analysis of the Moderating Role of Management Power on Digital Finance and Financing Constraints

4.4. Analysing the Moderating Role of Corporate Social Responsibility on Digital Finance and Financing Constraints

4.5. Endogeneity Test

5. Further Testing

5.1. Base Regression Robustness Test

5.2. Analysis of the Impact of Digital Finance on Corporate Finance Constraints in Different Contexts

5.2.1. Impact Analysis of Heterogeneity Based on the Nature of Corporate Property Rights

5.2.2. Impact Analysis of Heterogeneity Based on Industry

5.2.3. Heterogeneous Impact Analysis Based on High-Carbon- Versus Low-Carbon-Emitting Industries

5.3. An Analysis of the Impact of Different Contexts on Digital Finance, Management Power, and Financing Constraints

5.3.1. Impact Analysis of Heterogeneity Based on the Nature of Firms’ Property Rights

5.3.2. Impact Analysis of Heterogeneity Based on Industry Development

5.3.3. Heterogeneity Impact Analysis Based on Regional Development

5.4. An Analysis of the Impact of Different Contexts on Digital Finance, Corporate Social Responsibility, and Financing Constraints

5.5. A Test of the Economic Consequences of Green Innovation for Firms

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Sun, G.; Fang, J.; Li, J.; Wang, X. Research on the Impact of the Integration of Digital Economy and Real Economy on Enterprise Green Innovation. Technol. Forecast. Soc. Change 2024, 200, 123097. [Google Scholar] [CrossRef]

- Li, C.; Huo, P.; Wang, Z.; Zhang, W.; Liang, F.; Mardani, A. Digitalization Generates Equality? Enterprises’ Digital Transformation, Financing Constraints, and Labor Share in China. J. Bus. Res. 2023, 163, 113924. [Google Scholar] [CrossRef]

- Bai, M.; Cai, J.; Qin, Y. Ownership Discrimination and Private Firms Financing in China. Res. Int. Bus. Financ. 2021, 57, 101406. [Google Scholar] [CrossRef]

- Chiappini, R.; Montmartin, B.; Pommet, S.; Demaria, S. Can Direct Innovation Subsidies Relax SMEs’ Financial Constraints? Res. Policy 2022, 51, 104493. [Google Scholar] [CrossRef]

- Tudose, M.B.; Georgescu, A.; Avasilcai, S. Global Analysis Regarding the Impact of Digital Transformation on Macroeconomic Outcomes. Sustainability 2023, 15, 4583. [Google Scholar] [CrossRef]

- Campanella, F.; Serino, L.; Battisti, E.; Giakoumelou, A.; Karasamani, I. FinTech in the Financial System: Towards a Capital-Intensive and High Competence Human Capital Reality? J. Bus. Res. 2023, 155, 113376. [Google Scholar] [CrossRef]

- Curran, D. Connecting Risk: Systemic Risk from Finance to the Digital. Econ. Soc. 2020, 49, 239–264. [Google Scholar] [CrossRef]

- Chen, Y.; Yang, S.; Li, Q. How Does the Development of Digital Financial Inclusion Affect the Total Factor Productivity of Listed Companies? Evidence from China. Financ. Res. Lett. 2022, 47, 102956. [Google Scholar] [CrossRef]

- Hao, J.; Peng, M.; He, W. Digital Finance Development and Bank Liquidity Creation. Int. Rev. Financ. Anal. 2023, 90, 102839. [Google Scholar] [CrossRef]

- Bu, Y.; Du, X.; Wang, Y.; Liu, S.; Tang, M.; Li, H. Digital Inclusive Finance: A Lever for SME Financing? Int. Rev. Financ. Anal. 2024, 93, 103115. [Google Scholar] [CrossRef]

- Lu, H.; Cheng, Z. Digital Inclusive Finance and Corporate ESG Performance: The Moderating Role of Executives with Financial Backgrounds. Financ. Res. Lett. 2024, 60, 104858. [Google Scholar] [CrossRef]

- Mu, W.; Liu, K.; Tao, Y.; Ye, Y. Digital Finance and Corporate ESG. Financ. Res. Lett. 2023, 51, 103426. [Google Scholar] [CrossRef]

- Ren, X.; Zeng, G.; Zhao, Y. Digital Finance and Corporate ESG Performance: Empirical Evidence from Listed Companies in China. Pac.-Basin Financ. J. 2023, 79, 102019. [Google Scholar] [CrossRef]

- Ji, Y.; Shi, L.; Zhang, S. Digital Finance and Corporate Bankruptcy Risk: Evidence from China. Pac.-Basin Financ. J. 2022, 72, 101731. [Google Scholar] [CrossRef]

- Li, C.; Wang, Y.; Zhou, Z.; Wang, Z.; Mardani, A. Digital Finance and Enterprise Financing Constraints: Structural Characteristics and Mechanism Identification. J. Bus. Res. 2023, 165, 114074. [Google Scholar] [CrossRef]

- Ma, K. Digital Inclusive Finance and Corporate Green Technology Innovation. Financ. Res. Lett. 2023, 55, 104015. [Google Scholar] [CrossRef]

- Li, G.; Wu, H.; Jiang, J.; Zong, Q. Digital Finance and the Low-Carbon Energy Transition (LCET) from the Perspective of Capital-Biased Technical Progress. Energy Econ. 2023, 120, 106623. [Google Scholar] [CrossRef]

- Feng, S.; Zhang, R.; Li, G. Environmental Decentralization, Digital Finance and Green Technology Innovation. Struct. Change Econ. Dyn. 2022, 61, 70–83. [Google Scholar] [CrossRef]

- Kaplan, S.N.; Zingales, L. Do Investment-Cash Flow Sensitivities Provide Useful Measures of Financing Constraints? Q. J. Econ. 1997, 112, 169–215. [Google Scholar] [CrossRef]

- Stiglitz, J.; Weiss, A. Credit Rationing in Markets with Imperfect Information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Fama, E. Agency Problems and the Theory of the Firm. J. Political Econ. 1980, 88, 288–307. [Google Scholar] [CrossRef]

- Fama, E.; Jensen, M. Agency Problems and Residual Claims. J. Law Econ. 1983, 26, 327–349. [Google Scholar] [CrossRef]

- Hart, O.; Moore, J. Property-Rights and the Nature of the Firm. J. Political Econ. 1990, 98, 1119–1158. [Google Scholar] [CrossRef]

- Didier, T.; Levine, R.; Llovet Montanes, R.; Schmukler, S.L. Capital Market Financing and Firm Growth. J. Int. Money Financ. 2021, 118, 102459. [Google Scholar] [CrossRef]

- Donald, D.C. Smart Precision Finance for Small Businesses Funding. Eur. Bus. Organ. Law Rev. 2020, 21, 199–217. [Google Scholar] [CrossRef]

- Sun, G.; Li, T.; Ai, Y.; Li, Q. Digital Finance and Corporate Financial Fraud. Int. Rev. Financ. Anal. 2023, 87, 102566. [Google Scholar] [CrossRef]

- Sheng, T. The Effect of Fintech on Banks’ Credit Provision to SMEs: Evidence from China. Financ. Res. Lett. 2021, 39, 101558. [Google Scholar] [CrossRef]

- Xuan, S.; Ge, W.; Yang, P.; Zhang, Y. Exploring Digital Finance, Financial Regulations and Carbon Emission Nexus: New Insight from Resources Efficiency, Industrial Structure and Green Innovation in China. Resour. Policy 2024, 88, 104452. [Google Scholar] [CrossRef]

- Bebchuk, L.A.; Fried, J.M. Pay without Performance: Overview of the Issues. AMP 2006, 20, 5–24. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate Social Responsibility: A Theory of the Firm Perspective. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar] [CrossRef]

- Fast, N.J.; Sivanathan, N.; Mayer, N.D.; Galinsky, A.D. Power and Overconfident Decision-Making. Organ. Behav. Hum. Decis. Process. 2012, 117, 249–260. [Google Scholar] [CrossRef]

- Malmendier, U.; Tate, G. CEO Overconfidence and Corporate Investment. J. Financ. 2005, 60, 2661–2700. [Google Scholar] [CrossRef]

- Yang, X. Managerial Power and Ambidextrous Innovation: The Moderating Role of Absorptive Capacity and Resource Slack. J. Technol. Transf. 2024, 49, 1471–1495. [Google Scholar] [CrossRef]

- Gao, K.; Wang, L.; Liu, T.; Zhao, H. Management Executive Power and Corporate Green Innovation—Empirical Evidence from China’s State-Owned Manufacturing Sector. Technol. Soc. 2022, 70, 102043. [Google Scholar] [CrossRef]

- Lin-Hi, N.; Blumberg, I. The Link Between (Not) Practicing CSR and Corporate Reputation: Psychological Foundations and Managerial Implications. J. Bus. Ethics 2018, 150, 185–198. [Google Scholar] [CrossRef]

- Dhaliwal, D.; Li, O.Z.; Tsang, A.; Yang, Y.G. Corporate Social Responsibility Disclosure and the Cost of Equity Capital: The Roles of Stakeholder Orientation and Financial Transparency. J. Account. Public Policy 2014, 33, 328–355. [Google Scholar] [CrossRef]

- Yuan, B.; Cao, X. Do Corporate Social Responsibility Practices Contribute to Green Innovation? The Mediating Role of Green Dynamic Capability. Technol. Soc. 2022, 68, 101868. [Google Scholar] [CrossRef]

- García-Sánchez, I.; Hussain, N.; Martínez-Ferrero, J.; Ruiz-Barbadillo, E. Impact of Disclosure and Assurance Quality of Corporate Sustainability Reports on Access to Finance. Corp. Soc. Responsib. Environ. 2019, 26, 832–848. [Google Scholar] [CrossRef]

- Liu, Z.; Li, W.; Hao, C.; Liu, H. Corporate Environmental Performance and Financing Constraints: An Empirical Study in the Chinese Context. Corp. Soc. Responsib. Environ. 2021, 28, 616–629. [Google Scholar] [CrossRef]

- Hao, J.; He, F. Corporate Social Responsibility (CSR) Performance and Green Innovation: Evidence from China. Financ. Res. Lett. 2022, 48, 102889. [Google Scholar] [CrossRef]

- Chen, C.; Shi, S.; Song, X.; Zheng, S.X. Financial Constraints and Cross-Listing. J. Int. Financ. Mark. Inst. Money 2021, 71, 101290. [Google Scholar] [CrossRef]

- Whited, T.M.; Wu, G.J. Financial Constraints Risk. Rev. Financ. Stud. 2006, 19, 531–559. [Google Scholar] [CrossRef]

- Wurlod, J.-D.; Noailly, J. The Impact of Green Innovation on Energy Intensity: An Empirical Analysis for 14 Industrial Sectors in OECD Countries. Energy Econ. 2018, 71, 47–61. [Google Scholar] [CrossRef]

- Lian, G.; Xu, A.; Zhu, Y. Substantive Green Innovation or Symbolic Green Innovation? The Impact of ER on Enterprise Green Innovation Based on the Dual Moderating Effects. J. Innov. Knowl. 2022, 7, 100203. [Google Scholar] [CrossRef]

- Bronzini, R.; Piselli, P. The Impact of R&D Subsidies on Firm Innovation. Res. Policy 2016, 45, 442–457. [Google Scholar] [CrossRef]

- Yang, T.; Zhang, X. FinTech Adoption and Financial Inclusion: Evidence from Household Consumption in China. J. Bank. Financ. 2022, 145, 106668. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Finkelstein, S. The Effects of Ownership Structure on Conditions at the Top: The Case of CEO Pay Raises. Strateg. Manag. J. 1995, 16, 175–193. [Google Scholar] [CrossRef]

- Glaser, M.; Lopez-De-Silanes, F.; Sautner, Z. Opening the Black Box: Internal Capital Markets and Managerial Power. J. Financ. 2013, 68, 1577–1631. [Google Scholar] [CrossRef]

- Wu, L.; Shao, Z.; Yang, C.; Ding, T.; Zhang, W. The Impact of CSR and Financial Distress on Financial Performance—Evidence from Chinese Listed Companies of the Manufacturing Industry. Sustainability 2020, 12, 6799. [Google Scholar] [CrossRef]

- Wang, J.; Liu, Y.; Wang, W.; Wu, H. How Does Digital Transformation Drive Green Total Factor Productivity? Evidence from Chinese Listed Enterprises. J. Clean. Prod. 2023, 406, 136954. [Google Scholar] [CrossRef]

- Kong, T.; Sun, R.; Sun, G.; Song, Y. Effects of Digital Finance on Green Innovation Considering Information Asymmetry: An Empirical Study Based on Chinese Listed Firms. Emerg. Mark. Financ. Trade 2022, 58, 4399–4411. [Google Scholar] [CrossRef]

- Shahzad, M.; Qu, Y.; Zafar, A.U.; Rehman, S.U.; Islam, T. Exploring the Influence of Knowledge Management Process on Corporate Sustainable Performance through Green Innovation. J. Knowl. Manag. 2020, 24, 2079–2106. [Google Scholar] [CrossRef]

- Yang, P.; Lv, Y.; Chen, X.; Lv, J. Digital Finance, Natural Resource Constraints and Firms’ Low-Carbon Behavior: Evidence from Listed Companies. Resour. Policy 2024, 89, 104637. [Google Scholar] [CrossRef]

- Zhou, Y.; Tian, L.; Yang, X. Schumpeterian Endogenous Growth Model under Green Innovation and Its Enculturation Effect. Energy Econ. 2023, 127, 107109. [Google Scholar] [CrossRef]

- Gao, Q.; Cheng, C.; Sun, G. Big Data Application, Factor Allocation, and Green Innovation in Chinese Manufacturing Enterprises. Technol. Forecast. Soc. Change 2023, 192, 122567. [Google Scholar] [CrossRef]

- Dian, J.; Song, T.; Li, S. Facilitating or Inhibiting? Spatial Effects of the Digital Economy Affecting Urban Green Technology Innovation. Energy Econ. 2024, 129, 107223. [Google Scholar] [CrossRef]

- Azarnert, L.V. Migration, Child Education, Human Capital Accumulation, and a Brain Dilution Tax. J. Demogr. Econ. 2025, 1–18. [Google Scholar] [CrossRef]

- Azarnert, L.V. Integrated Public Education, Fertility and Human Capital. Educ. Econ. 2014, 22, 166–180. [Google Scholar] [CrossRef]

- Chen, W. Digital Economy Development, Corporate Social Responsibility and Low-Carbon Innovation. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1664–1679. [Google Scholar] [CrossRef]

- Li, X.; Shao, X.; Chang, T.; Albu, L.L. Does Digital Finance Promote the Green Innovation of China’s Listed Companies? Energy Econ. 2022, 114, 106254. [Google Scholar] [CrossRef]

| Variable Type | Variable Names | Variable Symbols | Variable Definitions |

|---|---|---|---|

| Dependent variables | Financing constraints | WW | Drawing on Whited and Wu (2006) [42] and others, the construction of the WW index. |

| Economic consequences: explanatory variables | Substantive green innovations | Gpi1 | ln (number of green inventions independently filed in the year + 1) |

| Signature Green Innovations | Gpu1 | ln (number of green utility models filed independently in the year + 1) | |

| Independent variables | Digital Finance Index Municipal | Cindex | Digital finance metropolitan-level aggregate indexes are standardised |

| Digital Finance Coverage Breadth Municipal | Ccoverage | Standardising the breadth of digital finance coverage at the municipal level | |

| Depth of digital finance use at the municipal level | Cusage_depth | Digital finance local municipalities use depth to do standardisation | |

| Digital Finance Digitisation Municipal | cdigital | Digital finance digitisation at the municipal level for standardisation | |

| digital finance | Index | Provincial digital finance aggregate indexes are standardised | |

| The breadth of coverage of secondary indicators on digital finance | Coverage | Digital Finance Provincial Breadth of Coverage Index Normalised | |

| Depth of use of secondary indicators on digital finance | Us-age_depth | Digital Finance Provincial Depth of Usage Index Normalised | |

| Level of digitization of secondary indicators of digital finance | Digital | Digital Finance Provincial Level of Digitization Index Normalised | |

| Moderator variable | Management Power | Power | A composite indicator of management power intensity (Power) is constructed by principal component regression on five indicators. |

| Corporate Social Responsibility | CSR | Rankin’s CSR Rating Score Measure | |

| Enterprise size | Size | Operating income in natural logarithms | |

| Control variables | Business performance | Roa | Average year-end net profit/total assets |

| Earnings on net assets | Roe | Net profit/average shareholder equity | |

| Financial leverage | Lev | Total liabilities/total assets at the end of the year | |

| Ownership properties | SOE | It takes the value of 1 if the actual controller is a state-owned property and vice versa. | |

| Growth Capacity | Growth | Growth in operating income/total operating income of the previous year | |

| Tobin’s Q | TobinQ | The market value of the company/replacement cost of assets | |

| Board Size | Board | The number of board members is taken as a natural logarithm. | |

| Audit Quality | Big4 | Auditors from the Big Four accounting firms in China take the value of 1, and vice versa, 0. | |

| Percentage of Independent Directors | Indep | Number of independent directors/total number of board members | |

| Years of Establishment | FirmAge | ln (current year-year of establishment + 1) | |

| Cash flow ratios | Cashflow | Net cash flows from operations/total assets | |

| Degree of digitisation of the enterprise | wdigitaltrans | The text in the annual report was analysed for word frequency, counting the number of times the keywords appeared in the text. | |

| City GDP | Cgdp | Standardised data processing of regional GDP | |

| Year | Year | Year fixed effects | |

| Industry | Ind | Industry fixed effect |

| Variables | MEAN | STD | MIN | Q1 | MEDIAN | Q3 | MAX |

|---|---|---|---|---|---|---|---|

| CINDEX | 0.670 | 0.264 | 0.000 | 0.497 | 0.722 | 0.874 | 1.000 |

| CCOVERAGE | 0.551 | 0.237 | 0.000 | 0.371 | 0.572 | 0.712 | 1.000 |

| CUSAGE_DEPTH | 0.478 | 0.265 | 0.000 | 0.270 | 0.463 | 0.685 | 1.000 |

| CDIGITAL | 0.526 | 0.308 | 0.000 | 0.318 | 0.395 | 0.919 | 1.000 |

| INDEX | 0.543 | 0.289 | 0.000 | 0.300 | 0.586 | 0.802 | 1.000 |

| COVERAGE | 0.521 | 0.303 | 0.000 | 0.256 | 0.571 | 0.746 | 1.000 |

| USAGE_DEPTH | 0.566 | 0.249 | 0.000 | 0.375 | 0.582 | 0.798 | 1.000 |

| DIGITAL | 0.482 | 0.280 | 0.000 | 0.269 | 0.519 | 0.687 | 1.000 |

| WW | −1.026 | 0.071 | −1.258 | −1.069 | −1.022 | −0.977 | −0.795 |

| POWER | −0.064 | 1.319 | −5.286 | −1.006 | 0.170 | 1.134 | 3.013 |

| CSR | 4.643 | 2.570 | 0.000 | 2.000 | 5.000 | 7.000 | 8.000 |

| SIZE | 22.189 | 1.291 | 19.563 | 21.248 | 22.003 | 22.929 | 26.398 |

| ROA | 0.043 | 0.067 | −0.368 | 0.016 | 0.041 | 0.075 | 0.241 |

| ROE | 0.065 | 0.164 | −4.320 | 0.032 | 0.075 | 0.125 | 2.379 |

| LEV | 0.414 | 0.204 | 0.028 | 0.249 | 0.404 | 0.566 | 0.909 |

| GROWTH | 0.163 | 0.394 | −0.658 | −0.021 | 0.104 | 0.260 | 4.429 |

| BOARD | 8.663 | 1.738 | 5.000 | 7.000 | 9.000 | 9.000 | 15.000 |

| TOBINQ | 1.992 | 1.332 | 0.809 | 1.231 | 1.583 | 2.237 | 17.676 |

| INDEP | 37.565 | 5.288 | 30.000 | 33.330 | 36.360 | 42.860 | 60.000 |

| SOE | 0.363 | 0.481 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 |

| BIG4 | 0.056 | 0.231 | 0.000 | 0.000 | 0.000 | 0.000 | 1.000 |

| FIRMAGE | 2.908 | 0.329 | 0.693 | 2.708 | 2.944 | 3.135 | 4.143 |

| CASHFLOW | 0.047 | 0.074 | −0.888 | 0.009 | 0.047 | 0.088 | 0.876 |

| WDIGITALTRANS | 3.725 | 1.518 | 0.000 | 2.639 | 3.497 | 4.595 | 7.170 |

| CGDP | 0.507 | 0.243 | 0.000 | 0.313 | 0.480 | 0.708 | 1.000 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Intercept | 0.030 *** | 0.029 *** | 0.031 *** | 0.028 *** |

| (3.66) | (3.50) | (3.64) | (3.28) | |

| Cindex | −0.008 *** | |||

| (−2.81) | ||||

| Ccoverage | −0.005 * | |||

| (−2.02) | ||||

| Cusage_depth | −0.009 *** | |||

| (−4.74) | ||||

| Cdigital | −0.005 ** | |||

| (−2.68) | ||||

| Size | −0.047 *** | −0.047 *** | −0.047 *** | −0.047 *** |

| (−124.89) | (−124.63) | (−122.53) | (−122.21) | |

| ROA | −0.155 *** | −0.156 *** | −0.155 *** | −0.156 *** |

| (−23.01) | (−23.42) | (−22.68) | (−23.92) | |

| Lev | 0.025 *** | 0.026 *** | 0.025 *** | 0.025 *** |

| (13.50) | (13.66) | (13.26) | (13.33) | |

| Growth | −0.043 *** | −0.043 *** | −0.043 *** | −0.043 *** |

| (−48.38) | (−48.34) | (−48.44) | (−48.37) | |

| TobinQ | 0.002 *** | 0.002 *** | 0.002 *** | 0.002 *** |

| (9.47) | (9.48) | (9.62) | (9.70) | |

| Board | −0.002 | −0.002 | −0.002 | −0.002 |

| (−1.30) | (−1.27) | (−1.31) | (−1.20) | |

| Big4 | −0.002 * | −0.002 * | −0.002 * | −0.002 * |

| (−1.93) | (−1.92) | (−1.90) | (−1.89) | |

| Indep | −0.001 | −0.001 | −0.001 | −0.001 |

| (−1.03) | (−1.05) | (−1.07) | (−1.09) | |

| SOE | −0.001 | −0.001 | −0.001 | −0.001 |

| (−1.34) | (−1.25) | (−1.55) | (−1.22) | |

| FirmAge | 0.004 *** | 0.004 *** | 0.004 *** | 0.004 *** |

| (2.95) | (2.96) | (3.05) | (3.00) | |

| ROE | −0.003 * | −0.003 * | −0.004 * | −0.004 * |

| (−1.71) | (−1.71) | (−1.79) | (−1.73) | |

| Cashflow | −0.098 *** | −0.098 *** | −0.097 *** | −0.098 *** |

| (−32.56) | (−32.47) | (−32.27) | (−32.25) | |

| Wdigitaltrans | 0.002 *** | 0.002 *** | 0.002 *** | 0.002 ** |

| (2.78) | (2.76) | (2.78) | (2.69) | |

| Cgdp | −0.001 | −0.002 | <0.001 | −0.003 *** |

| (−0.43) | (−1.06) | (−0.17) | (−2.85) | |

| year | YES | YES | YES | YES |

| ind | YES | YES | YES | YES |

| R2 | 87.12% | 87.11% | 87.13% | 87.11% |

| Adj R2 | 87.07% | 87.06% | 87.08% | 87.06% |

| N | 26,381 | 26,381 | 26,381 | 26,381 |

| F-value | 764.382 *** | 951.594 *** | 731.767 *** | 659.997 *** |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Intercept | 0.034 *** | 0.035 *** | 0.034 *** | 0.035 *** |

| (5.73) | (5.92) | (5.74) | (5.95) | |

| Cindex | <0.001 | |||

| (0.03) | ||||

| Ccoverage | −0.006 *** | |||

| (−6.13) | ||||

| Cusage_depth | −0.001 | |||

| (−1.58) | ||||

| Cdigital | −0.003 *** | |||

| (−4.16) | ||||

| Cindex*Power | 0.001 | |||

| (1.23) | ||||

| Ccoverage*Power | 0.002 *** | |||

| (3.72) | ||||

| Cusage_depth*Power | 0.001 *** | |||

| (2.59) | ||||

| Cdigital*Power | 0.001 * | |||

| (1.92) | ||||

| Power | −0.002 *** | −0.003 *** | −0.002 *** | −0.002 *** |

| (−4.52) | (−6.60) | (−6.54) | (−5.64) | |

| Size | −0.047 *** | −0.047 *** | −0.047 *** | −0.047 *** |

| (−234.91) | (−234.65) | (−235.13) | (−234.99) | |

| ROA | −0.155 *** | −0.155 *** | −0.155 *** | −0.155 *** |

| (−30.82) | (−30.59) | (−30.85) | (−30.89) | |

| Lev | 0.026 *** | 0.025 *** | 0.025 *** | 0.025 *** |

| (21.14) | (20.75) | (21.10) | (21.10) | |

| Growth | −0.043 *** | −0.043 *** | −0.043 *** | −0.043 *** |

| (−51.78) | (−51.75) | (−51.78) | (−51.80) | |

| TobinQ | 0.002 *** | 0.002 *** | 0.002 *** | 0.002 *** |

| (14.18) | (14.21) | (14.20) | (14.05) | |

| Board | −0.006 *** | −0.006 *** | −0.006 *** | −0.006 *** |

| (−4.48) | (−4.78) | (−4.42) | (−4.44) | |

| Big4 | −0.003 *** | −0.002 *** | −0.003 *** | −0.003 *** |

| (−3.72) | (−3.33) | (−3.77) | (−3.70) | |

| Indep | <0.001 *** | <0.001 *** | <0.001 *** | <0.001 *** |

| (4.14) | (4.01) | (4.16) | (4.04) | |

| SOE | −0.002 *** | −0.002 *** | −0.002 *** | −0.002 *** |

| (−4.00) | (−4.23) | (−3.97) | (−4.32) | |

| FirmAge | 0.004 *** | 0.004 *** | 0.004 *** | 0.004 *** |

| (7.24) | (7.33) | (7.22) | (7.38) | |

| ROE | −0.004 * | −0.004 * | −0.004 * | −0.003 * |

| (−1.86) | (−1.88) | (−1.89) | (−1.86) | |

| Cashflow | −0.098 *** | −0.098 *** | −0.098 *** | −0.097 *** |

| (−34.92) | (−34.93) | (−34.90) | (−34.75) | |

| Wdigitaltrans | <0.001 | <0.001 | <0.001 | <0.001 |

| (−1.02) | (−0.91) | (−1.00) | (−0.81) | |

| Cgdp | −0.007 *** | −0.003 *** | −0.007 *** | −0.006 *** |

| (−5.42) | (−3.41) | (−8.10) | (−6.31) | |

| year | YES | YES | YES | YES |

| ind | YES | YES | YES | YES |

| R2 | 87.12% | 87.14% | 87.12% | 87.13% |

| Adj R2 | 87.07% | 87.09% | 87.07% | 87.07% |

| N | 26,371 | 26,371 | 26,371 | 26,371 |

| F-value | 17,118.588 *** | 17,209.631 *** | 17,112.658 *** | 17,104.265 *** |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Intercept | 1.036 | 0.461 | 1.296 * | −0.208 |

| (1.56) | (0.64) | (1.92) | (−0.25) | |

| Cindex | 0.222 ** | |||

| (2.37) | ||||

| Ccoverage | 0.315 *** | |||

| (5.30) | ||||

| Cusage_depth | 0.175 ** | |||

| (2.08) | ||||

| Cdigital | 0.410 *** | |||

| (5.43) | ||||

| Cindex*csr | −0.018 *** | |||

| (−12.15) | ||||

| Coverage*csr | −0.014 *** | |||

| (−11.55) | ||||

| Cusage_depth*csr | −0.019 *** | |||

| (−11.34) | ||||

| Cdigital*csr | −0.012 *** | |||

| (−11.87) | ||||

| Csr | 0.065 *** | 0.045 *** | 0.069 *** | 0.036 *** |

| (9.59) | (8.05) | (8.90) | (7.66) | |

| Size | −0.065 | −0.065 | −0.064 | −0.067 |

| (−1.32) | (−1.31) | (−1.30) | (−1.36) | |

| Roa | −0.006 | −0.006 | −0.006 | −0.006 |

| (−1.06) | (−1.07) | (−1.06) | (−1.08) | |

| Lev | 0.035 *** | 0.035 *** | 0.035 *** | 0.035 *** |

| (5.85) | (5.83) | (5.84) | (5.83) | |

| Growth | <0.001 | <0.001 | <0.001 | <0.001 |

| (1.13) | (1.08) | (0.86) | (0.79) | |

| SOE | 0.291 *** | 0.295 *** | 0.286 *** | 0.293 *** |

| (8.80) | (8.80) | (8.68) | (8.59) | |

| TobinQ | 0.013 ** | 0.013 ** | 0.013 ** | 0.012 ** |

| (2.36) | (2.36) | (2.37) | (2.36) | |

| Big4 | −0.075 | −0.081 | −0.069 | −0.112 ** |

| (−1.40) | (−1.50) | (−1.29) | (−2.00) | |

| Board | −0.029 *** | −0.029 *** | −0.029 *** | −0.027 *** |

| (−3.60) | (−3.56) | (−3.62) | (−3.37) | |

| Indep | 0.875 *** | 0.889 *** | 0.868 *** | 0.928 *** |

| (3.93) | (3.99) | (3.89) | (4.17) | |

| FirmAge | −0.003 ** | −0.003 ** | −0.003 ** | −0.003 ** |

| (−2.48) | (−2.50) | (−2.42) | (−2.31) | |

| ROE | <0.001 | <0.001 | <0.001 | <0.001 |

| (0.93) | (0.95) | (0.93) | (0.95) | |

| wdigitaltrans | 0.006 *** | 0.006 *** | 0.006 *** | 0.006 *** |

| (3.75) | (3.59) | (3.82) | (3.56) | |

| Cashflow | −0.097 *** | −0.097 *** | −0.097 *** | −0.097 *** |

| (−24.32) | (−24.37) | (−24.38) | (−24.37) | |

| Cgdp | −0.001 | −0.001 | −0.001 | −0.001 |

| (−1.44) | (−1.42) | (−1.51) | (−1.47) | |

| Year | 0.003 | 0.004 | −0.002 | −0.007 *** |

| Ind | (0.78) | (0.70) | (−0.51) | (−4.11) |

| R2 | 49.87% | 49.75% | 49.86% | 49.69% |

| Adj R2 | 49.78% | 49.66% | 49.77% | 49.60% |

| N | 17,238 | 17,238 | 17,238 | 17,238 |

| F-value | 340.966 *** | 333.295 *** | 339.573 *** | 331.206 *** |

| Variables | 1st Stage | WW | 1st Stage | WW | |

|---|---|---|---|---|---|

| Intercept | 0.023 ** | 0.028 *** | Intercept | −0.616 *** | 0.024 *** |

| (2.34) | (3.88) | (−18.58) | (4.44) | ||

| X | −0.004 *** | X | −0.005 *** | ||

| (−5.21) | (−4.39) | ||||

| lag_var | 0.975 *** | internetrate | 0.016 *** | ||

| (798.98) | (191.65) | ||||

| lag_indvar | −0.035 *** | ||||

| (−4.73) | |||||

| Size | <0.001 | −0.047 *** | 0.004 *** | −0.047 *** | |

| (0.15) | (−181.10) | (3.56) | (−240.59) | ||

| ROA | −0.003 | −0.157 *** | 0.155 *** | −0.156 *** | |

| (−0.41) | (−20.12) | (5.51) | (−31.02) | ||

| ROE | 0.006 *** | −0.007 ** | −0.025 ** | −0.003 * | |

| (2.65) | (−2.25) | (−2.40) | (−1.83) | ||

| Lev | 0.001 | 0.025 *** | −0.073 *** | 0.025 *** | |

| (0.82) | (16.05) | (−10.75) | (20.82) | ||

| Growth | 0.001 | −0.041 *** | −0.001 | −0.043 *** | |

| (0.94) | (−40.45) | (−0.43) | (−52.25) | ||

| TobinQ | <0.001 ** | 0.002 *** | −0.001 | 0.002 *** | |

| (2.29) | (10.98) | (−0.80) | (14.80) | ||

| Board | <0.001 | −0.002 | −0.021 *** | −0.001 | |

| (0.04) | (−1.55) | (−3.29) | (−1.40) | ||

| Big4 | 0.004 *** | −0.001 | 0.025 *** | −0.002 *** | |

| (3.36) | (−1.53) | (5.23) | (−3.23) | ||

| SOE | <0.001 | −0.001 | −0.016 *** | −0.001 ** | |

| (0.06) | (−1.22) | (−6.86) | (−2.43) | ||

| Indep | <0.001 | <0.001 | −0.002 *** | <0.001 | |

| (−1.36) | (−0.08) | (−7.18) | (0.91) | ||

| FirmAge | 0.001 | 0.003 *** | −0.007 ** | 0.004 *** | |

| (0.77) | (4.87) | (−2.26) | (8.02) | ||

| Cashflow | 0.009 ** | −0.098 *** | 0.025 * | −0.097 *** | |

| (2.11) | (−27.05) | (1.65) | (−34.65) | ||

| wdigitaltrans | <0.001 | <0.001 | −0.006*** | <0.001 | |

| (−0.72) | (−1.05) | (−3.95) | (−1.32) | ||

| Cgdp | 0.012 *** | −0.005 *** | 0.296 *** | −0.005 *** | |

| (8.54) | (−4.16) | (56.69) | (−4.23) | ||

| year | YES | YES | YES | YES | |

| ind | YES | YES | YES | YES | |

| R2 | 98.45% | 87.19% | 61.66% | 87.11% | |

| N | 15,071 | 15,071 | 17,328 | 17,328 | |

| F-value | 11,399.175 *** | 1160.012 *** | 1466.440 *** | 17,472.714 *** |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Intercept | 0.056 *** | 0.061 *** | 0.031 *** | 0.061 *** |

| (2.79) | (3.63) | (3.74) | (3.20) | |

| Index | −0.006 * | |||

| (−2.03) | ||||

| Coverage | −0.006 ** | |||

| (−2.70) | ||||

| Usage_depth | −0.001 | |||

| (−1.48) | ||||

| Digital | −0.007 ** | |||

| (−2.16) | ||||

| Size | −0.047 *** | −0.047 *** | −0.047 *** | −0.047 *** |

| (−124.72) | (−124.62) | (−125.01) | (−126.72) | |

| Roa | −0.156 *** | −0.155 *** | −0.156 *** | −0.156 *** |

| (−23.56) | (−23.34) | (−24.19) | (−23.79) | |

| Lev | 0.025 *** | 0.025 *** | 0.025 *** | 0.025*** |

| (12.50) | (12.53) | (12.53) | (12.74) | |

| Growth | −0.043 *** | −0.043 *** | −0.043 *** | −0.043 *** |

| (−48.62) | (−48.48) | (−48.76) | (−48.71) | |

| TobinQ | 0.002 *** | 0.002 *** | 0.002 *** | 0.002 *** |

| (9.85) | (9.99) | (9.96) | (9.85) | |

| Board | −0.002 | −0.002 | −0.002 | −0.002 |

| (−1.29) | (−1.31) | (−1.28) | (−1.31) | |

| Big4 | −0.002 * | −0.002 * | −0.002 * | −0.002 * |

| (−1.78) | (−1.79) | (−1.76) | (−1.74) | |

| Dual | −0.001 | −0.001 | −0.001 | −0.001 |

| (−1.33) | (−1.30) | (−1.32) | (−1.28) | |

| SOE | −0.001 | −0.001 | −0.001 | −0.001 |

| (−1.41) | (−1.51) | (−1.26) | (−1.28) | |

| FirmAge | 0.004 *** | 0.004 *** | 0.004 *** | 0.004 *** |

| (3.27) | (3.29) | (3.23) | (3.16) | |

| ROE | −0.004 * | −0.004 * | −0.004 * | −0.004 * |

| (−1.78) | (−1.79) | (−1.74) | (−1.71) | |

| Cashflow | −0.097 *** | −0.097 *** | −0.097 *** | −0.097 *** |

| (−32.75) | (−32.81) | (−32.46) | (−32.56) | |

| wdigitaltrans | <0.001 | <0.001 | <0.001 | <0.001 |

| (−0.98) | (−0.99) | (−1.02) | (−0.91) | |

| Gdp | −0.003 * | −0.002 | −0.006 *** | −0.004 *** |

| (−1.98) | (−1.66) | (−4.04) | (−2.98) | |

| year | YES | YES | YES | YES |

| ind | YES | YES | YES | YES |

| R2 | 87.11% | 87.11% | 87.10% | 87.11% |

| Adj R2 | 87.06% | 87.06% | 87.05% | 87.06% |

| N | 26,388 | 26,388 | 26,388 | 26,388 |

| F-value | 2512.242 *** | 13,165.411 *** | 720.693 *** | 1373.644 *** |

| Group 1 | (1) | (2) | (3) | (4) | |

|---|---|---|---|---|---|

| Panel A national | |||||

| Intercept | 0.035 * | 0.035 * | 0.036 * | 0.035 * | |

| (1.96) | (1.95) | (2.01) | (1.92) | ||

| Cindex | −0.011 ** | ||||

| (−2.26) | |||||

| Ccoverage | −0.008 | ||||

| (−1.24) | |||||

| Cusage_depth | −0.009 ** | ||||

| (−2.26) | |||||

| Cdigital | −0.001 | ||||

| (−0.53) | |||||

| Size | −0.047 *** | −0.047 *** | −0.047 *** | −0.047 *** | |

| (−82.47) | (−82.82) | (−84.02) | (−83.84) | ||

| ROA | −0.174 *** | −0.175 *** | −0.174 *** | −0.175 *** | |

| (−12.98) | (−13.03) | (−12.88) | (−12.85) | ||

| ROE | −0.004 | −0.004 | −0.004 | −0.004 | |

| (−0.93) | (−0.89) | (−0.95) | (−0.92) | ||

| Lev | 0.030 *** | 0.030 *** | 0.030 *** | 0.030 *** | |

| (8.21) | (8.18) | (8.38) | (8.34) | ||

| Growth | −0.043 *** | −0.043 *** | −0.043 *** | −0.043 *** | |

| (−25.30) | (−25.35) | (−25.22) | (−25.31) | ||

| TobinQ | 0.002 *** | 0.002 *** | 0.002 *** | 0.002 *** | |

| (5.56) | (5.57) | (5.75) | (5.66) | ||

| Board | −0.004 | −0.004 | −0.005 | −0.004 | |

| (−1.55) | (−1.54) | (−1.57) | (−1.51) | ||

| Big4 | −0.004 * | −0.004 ** | −0.004 * | −0.004 ** | |

| (−2.01) | (−2.06) | (−1.98) | (−2.05) | ||

| SOE | |||||

| Indep | <0.001 | <0.001 | <0.001 | <0.001 | |

| (−0.38) | (−0.37) | (−0.34) | (−0.29) | ||

| FirmAge | 0.004 | 0.004 | 0.004 | 0.004 | |

| (1.50) | (1.43) | (1.48) | (1.31) | ||

| Cashflow | −0.094 *** | −0.094 *** | −0.093 *** | −0.094 *** | |

| (−19.07) | (−19.05) | (−18.99) | (−18.78) | ||

| wdigitaltrans | −0.001 ** | −0.001 ** | −0.001 ** | −0.001 ** | |

| (−2.12) | (−2.17) | (−2.19) | (−2.27) | ||

| Cgdp | 0.003 | 0.001 | <0.001 | −0.006*** | |

| (0.62) | (0.14) | (−0.13) | (−3.11) | ||

| year | YES | YES | YES | YES | |

| ind | YES | YES | YES | YES | |

| R2 | 88.49% | 88.48% | 88.49% | 88.47% | |

| Adj R2 | 88.39% | 88.38% | 88.39% | 88.37% | |

| N | 10,822 | 10,822 | 10,822 | 10,822 | |

| F-value | 1078.871 *** | 216.362 *** | 206.040 *** | 2833.742 *** | |

| Panel B nonational | |||||

| Intercept | 0.009 | 0.009 | 0.009 | 0.008 | |

| (0.98) | (0.98) | (1.02) | (0.84) | ||

| Cindex | −0.008 *** | ||||

| (−2.88) | |||||

| Ccoverage | −0.009 ** | ||||

| (−2.41) | |||||

| Cusage_depth | −0.006 *** | ||||

| (−2.95) | |||||

| Cdigital | −0.001 | ||||

| (−1.04) | |||||

| Size | −0.047 *** | −0.047 *** | −0.047 *** | −0.047 *** | |

| (−121.99) | (−122.73) | (−120.77) | (−120.82) | ||

| ROA | −0.156 *** | −0.156 *** | −0.156 *** | −0.157 *** | |

| (−19.94) | (−19.90) | (−20.19) | (−21.07) | ||

| ROE | <0.001 | <0.001 | <0.001 | <0.001 | |

| (−0.03) | (−0.02) | (−0.05) | (−0.01) | ||

| Lev | 0.021 *** | 0.021 *** | 0.021 *** | 0.021 *** | |

| (10.93) | (10.89) | (10.93) | (10.70) | ||

| Growth | −0.043 *** | −0.043 *** | −0.043 *** | −0.043 *** | |

| (−36.19) | (−36.25) | (−36.08) | (−36.25) | ||

| TobinQ | 0.002 *** | 0.002 *** | 0.002 *** | 0.002 *** | |

| (11.01) | (10.88) | (11.13) | (11.04) | ||

| Board | 0.002 | 0.002 | 0.002 | 0.002 | |

| (0.80) | (0.84) | (0.78) | (0.82) | ||

| Big4 | 0.001 | 0.001 | 0.001 | 0.001 | |

| (0.77) | (0.78) | (0.76) | (0.75) | ||

| SOE | |||||

| Indep | <0.001 * | <0.001 * | <0.001 * | <0.001 * | |

| (1.82) | (1.87) | (1.76) | (1.80) | ||

| FirmAge | 0.004 *** | 0.004 *** | 0.004 *** | 0.004 *** | |

| (3.25) | (3.26) | (3.29) | (3.35) | ||

| Cashflow | −0.097 *** | −0.097 *** | −0.097 *** | −0.098 *** | |

| (−27.46) | (−27.36) | (−27.59) | (−27.53) | ||

| wdigitaltrans | <0.001 | <0.001 | <0.001 | <0.001 | |

| (0.24) | (0.33) | (0.13) | (0.13) | ||

| Cgdp | 0.004 | 0.005 | 0.001 | −0.003 ** | |

| (1.21) | (1.22) | (0.48) | (−2.14) | ||

| year | YES | YES | YES | YES | |

| ind | YES | YES | YES | YES | |

| R2 | 85.15% | 85.15% | 85.15% | 85.13% | |

| Adj R2 | 85.06% | 85.06% | 85.05% | 85.04% | |

| N | 15,566 | 15,566 | 15,566 | 15,566 | |

| F-value | 3046.106 *** | 7437.613 *** | 335.405 *** | 911.899 *** |

| Group 2 | (1) | (2) | (3) | (4) | |

|---|---|---|---|---|---|

| Panel A Industry | |||||

| Intercept | 0.010 | 0.009 | 0.011 | 0.007 | |

| (0.95) | (0.92) | (1.05) | (0.74) | ||

| Cindex | −0.009 ** | ||||

| (−2.61) | |||||

| Ccoverage | −0.008 * | ||||

| (−1.92) | |||||

| Cusage_depth | −0.007 ** | ||||

| (−2.67) | |||||

| Cdigital | <0.001 | ||||

| (−0.19) | |||||

| Size | −0.047 *** | −0.047 *** | −0.047 *** | −0.047 *** | |

| (−81.39) | (−82.63) | (−80.91) | (−81.84) | ||

| ROA | −0.175 *** | −0.175 *** | −0.174 *** | −0.175 *** | |

| (−20.46) | (−20.47) | (−20.51) | (−20.81) | ||

| ROE | <0.001 | <0.001 | <0.001 | <0.001 | |

| (−0.09) | (−0.04) | (−0.12) | (−0.06) | ||

| Lev | 0.025 *** | 0.026 *** | 0.025 *** | 0.025 *** | |

| (9.88) | (9.94) | (9.89) | (9.97) | ||

| Growth | −0.043 *** | −0.043 *** | −0.043 *** | −0.043 *** | |

| (−41.79) | (−41.90) | (−41.83) | (−42.00) | ||

| TobinQ | 0.002 *** | 0.002 *** | 0.002 *** | 0.002 *** | |

| (9.45) | (9.55) | (9.53) | (9.75) | ||

| Board | −0.001 | −0.001 | −0.001 | −0.001 | |

| (−0.58) | (−0.56) | (−0.61) | (−0.56) | ||

| Big4 | −0.002 | −0.002 | −0.002 | −0.002 | |

| (−1.46) | (−1.46) | (−1.48) | (−1.50) | ||

| SOE | <0.001 | <0.001 | <0.001 | <0.001 | |

| (−0.24) | (−0.15) | (−0.21) | (0.13) | ||

| Indep | <0.001 | <0.001 | <0.001 | <0.001 | |

| (−0.05) | (−0.01) | (−0.07) | (0.04) | ||

| FirmAge | 0.004 ** | 0.004 ** | 0.004 ** | 0.004 ** | |

| (2.56) | (2.57) | (2.55) | (2.53) | ||

| Cashflow | −0.096 *** | −0.097 *** | −0.096 *** | −0.097 *** | |

| (−22.70) | (−22.55) | (−22.47) | (−22.06) | ||

| wdigitaltrans | <0.001 | <0.001 | <0.001 | <0.001 | |

| (−0.95) | (−0.89) | (−1.08) | (−1.19) | ||

| Cgdp | 0.003 | 0.003 | <0.001 | −0.005 ** | |

| (0.82) | (0.59) | (0.18) | (−2.11) | ||

| year | YES | YES | YES | YES | |

| ind | YES | YES | YES | YES | |

| R2 | 87.31% | 87.30% | 87.30% | 87.29% | |

| Adj R2 | 87.26% | 87.26% | 87.26% | 87.24% | |

| N | 18,920 | 18,920 | 18,920 | 18,920 | |

| F-value | 802.167 *** | 597.111 *** | 683.271 *** | 755.259 *** | |

| Panel B Services Industry | |||||

| Intercept | 0.023 | 0.023 | 0.023 | 0.022 | |

| (1.34) | (1.37) | (1.37) | (1.35) | ||

| Cindex | −0.013 *** | ||||

| (−3.10) | |||||

| Ccoverage | −0.012 ** | ||||

| (−2.44) | |||||

| Cusage_depth | −0.009 ** | ||||

| (−2.52) | |||||

| Cdigital | −0.002 | ||||

| (−0.98) | |||||

| Size | −0.047 *** | −0.047 *** | −0.047 *** | −0.047 *** | |

| (−90.16) | (−88.92) | (−89.57) | (−88.34) | ||

| ROA | −0.106 *** | −0.106 *** | −0.106 *** | −0.107 *** | |

| (−8.74) | (−8.83) | (−8.74) | (−9.19) | ||

| ROE | −0.016 *** | −0.016 *** | −0.016 *** | −0.016 *** | |

| (−3.11) | (−3.10) | (−3.12) | (−3.11) | ||

| Lev | 0.023 *** | 0.023 *** | 0.023 *** | 0.023 *** | |

| (6.02) | (6.01) | (6.09) | (6.01) | ||

| Growth | −0.044 *** | −0.044 *** | −0.044 *** | −0.044 *** | |

| (−35.36) | (−35.34) | (−35.40) | (−35.36) | ||

| TobinQ | 0.002 *** | 0.002 *** | 0.002 *** | 0.002 *** | |

| (4.21) | (4.15) | (4.32) | (4.30) | ||

| Board | <0.001 | <0.001 | <0.001 | <0.001 | |

| (0.02) | (0.06) | (0.03) | (0.13) | ||

| Big4 | −0.002 | −0.002 | −0.002 | −0.002 | |

| (−1.16) | (−1.14) | (−1.15) | (−1.09) | ||

| SOE | −0.003 ** | −0.003 ** | −0.003 ** | −0.003 ** | |

| (−2.48) | (−2.50) | (−2.42) | (−2.31) | ||

| Indep | <0.001 | <0.001 | <0.001 | <0.001 | |

| (0.93) | (0.95) | (0.93) | (0.95) | ||

| FirmAge | 0.006 *** | 0.006 *** | 0.006 *** | 0.006 *** | |

| (3.75) | (3.59) | (3.82) | (3.56) | ||

| Cashflow | −0.097 *** | −0.097 *** | −0.097 *** | −0.097 *** | |

| (−24.32) | (−24.37) | (−24.38) | (−24.37) | ||

| wdigitaltrans | −0.001 | −0.001 | −0.001 | −0.001 | |

| (−1.44) | (−1.42) | (−1.51) | (−1.47) | ||

| Cgdp | 0.003 | 0.004 | −0.002 | −0.007 *** | |

| (0.78) | (0.70) | (−0.51) | (−4.11) | ||

| year | YES | YES | YES | YES | |

| ind | YES | YES | YES | YES | |

| R2 | 87.81% | 87.80% | 87.80% | 87.78% | |

| Adj R2 | 87.71% | 87.71% | 87.70% | 87.68% | |

| N | 7120 | 7120 | 7120 | 7120 | |

| F-value | 1546.361 *** | 2996.937 *** | 1627.783 *** | 3821.828 *** | |

| Panel C Agriculture | |||||

| Intercept | −0.018 | −0.031 | 0.011 | 0.011 | |

| (−0.27) | (−0.43) | (0.16) | (0.18) | ||

| Cindex | −0.048 ** | ||||

| (−2.14) | |||||

| Ccoverage | −0.047 *** | ||||

| (−3.17) | |||||

| Cusage_depth | −0.005 | ||||

| (−0.35) | |||||

| Cdigital | 0.014 | ||||

| (1.29) | |||||

| Size | −0.045 *** | −0.044 *** | −0.046 *** | −0.046 *** | |

| (−11.92) | (−11.83) | (−12.62) | (−13.01) | ||

| ROA | −0.252 *** | −0.261 *** | −0.245 *** | −0.248 *** | |

| (−6.10) | (−5.93) | (−6.52) | (−6.65) | ||

| ROE | 0.018 ** | 0.020 ** | 0.017 * | 0.016 ** | |

| (2.38) | (2.55) | (2.12) | (2.13) | ||

| Lev | 0.034 *** | 0.035 *** | 0.035 *** | 0.034 *** | |

| (3.18) | (3.62) | (3.07) | (3.01) | ||

| Growth | −0.035 *** | −0.035 *** | −0.035 *** | −0.034 *** | |

| (−9.09) | (−8.93) | (−8.70) | (−8.89) | ||

| TobinQ | −0.001 | −0.002 | −0.002 | −0.002 | |

| (−0.79) | (−0.92) | (−0.95) | (−1.07) | ||

| Board | −0.021 | −0.022 | −0.020 | −0.021 | |

| (−1.28) | (−1.37) | (−1.17) | (−1.22) | ||

| Big4 | −0.047 *** | −0.054 *** | −0.049 *** | −0.053 *** | |

| (−4.83) | (−6.12) | (−4.09) | (−5.02) | ||

| SOE | −0.012 * | −0.013 ** | −0.010 | −0.009 | |

| (−2.09) | (−2.37) | (−1.72) | (−1.48) | ||

| Indep | <0.001 | <0.001 | <0.001 | <0.001 | |

| (0.18) | (0.15) | (0.14) | (−0.27) | ||

| FirmAge | 0.004 | 0.005 | 0.005 | 0.007 | |

| (0.41) | (0.48) | (0.47) | (0.57) | ||

| Cashflow | −0.042 | −0.043 | −0.045 | −0.044 | |

| (−1.29) | (−1.35) | (−1.26) | (−1.25) | ||

| wdigitaltrans | 0.006 ** | 0.006 ** | 0.005 ** | 0.005 ** | |

| (2.73) | (2.39) | (2.35) | (2.42) | ||

| Cgdp | 0.055 ** | 0.058 *** | 0.014 | 0.007 | |

| (2.44) | (3.55) | (1.28) | (1.06) | ||

| year | YES | YES | YES | YES | |

| ind | YES | YES | YES | YES | |

| R2 | 88.56% | 88.66% | 88.34% | 88.54% | |

| Adj R2 | 87.56% | 87.67% | 87.32% | 87.54% | |

| N | 348 | 348 | 348 | 348 | |

| F-value | 334.513 *** | 41.094 *** | 193.218 *** | 1067.947 *** |

| Group 3 | (1) | (2) | (3) | (4) | |

|---|---|---|---|---|---|

| Panel A High-Carbon-Emission Industries | |||||

| Intercept | 0.017 | 0.017 | 0.014 | 0.018 | |

| (1.50) | (1.47) | (1.28) | (1.57) | ||

| Ccindex | −0.003 * | ||||

| (−1.95) | |||||

| Ccoverage | −0.005 ** | ||||

| (−2.14) | |||||

| Cusage_depth | <0.001 | ||||

| (−0.22) | |||||

| Cdigital | −0.004 *** | ||||

| (−3.22) | |||||

| Size | −0.047 *** | −0.047 *** | −0.047 *** | −0.047 *** | |

| (−83.97) | (−82.65) | (−82.96) | (−85.25) | ||

| ROA | −0.175 *** | −0.174 *** | −0.175 *** | −0.174 *** | |

| (−21.00) | (−20.74) | (−21.03) | (−22.22) | ||

| ROE | <0.001 | <0.001 | <0.001 | <0.001 | |

| (0.11) | (0.04) | (0.04) | (0.03) | ||

| Lev | 0.026 *** | 0.025 *** | 0.025 *** | 0.025 *** | |

| (10.33) | (10.14) | (9.99) | (9.95) | ||

| Growth | −0.043 *** | −0.043 *** | −0.043 *** | −0.043 *** | |

| (−43.58) | (−43.66) | (−43.61) | (−43.72) | ||

| TobinQ | 0.002 *** | 0.002 *** | 0.002 *** | 0.002 *** | |

| (10.29) | (10.31) | (10.41) | (10.08) | ||

| Board | −0.002 | −0.002 | −0.001 | −0.002 | |

| (−0.72) | (−0.70) | (−0.65) | (−0.71) | ||

| Big4 | −0.002 | −0.002 | −0.002 | −0.002 | |

| (−1.41) | (−1.40) | (−1.48) | (−1.48) | ||

| SOE | <0.001 | <0.001 | <0.001 | <0.001 | |

| (−0.04) | (−0.18) | (−0.06) | (−0.42) | ||

| Indep | <0.001 | <0.001 | <0.001 | <0.001 | |

| (0.11) | (0.07) | (0.12) | (0.12) | ||

| FirmAge | 0.004 ** | 0.004 ** | 0.004 ** | 0.004 *** | |

| (2.53) | (2.58) | (2.62) | (2.77) | ||

| Cashflow | −0.097 *** | −0.097 *** | −0.097 *** | −0.096 *** | |

| (−22.38) | (−22.40) | (−22.20) | (−22.54) | ||

| wdigitaltrans | <0.001 | <0.001 | −0.001 | <0.001 | |

| (−1.38) | (−1.42) | (−1.57) | (−1.41) | ||

| Cgdp | −0.003 | −0.002 | −0.005 ** | −0.004 ** | |

| (−1.47) | (−0.82) | (−2.08) | (−2.45) | ||

| year | YES | YES | YES | YES | |

| ind | YES | YES | YES | YES | |

| R2 | 87.56% | 87.57% | 87.56% | 87.58% | |

| Adj R2 | 87.52% | 87.52% | 87.51% | 87.54% | |

| N | 19,757 | 19,757 | 19,757 | 19,757 | |

| F-value | 612.534 *** | 1344.707 *** | 1090.377 *** | 2216.489 *** | |

| Panel B Low-carbon-emission industries | |||||

| Intercept | 0.041 ** | 0.042 ** | 0.040 ** | 0.041 ** | |

| (2.48) | (2.49) | (2.37) | (2.36) | ||

| Cindex | −0.006 ** | ||||

| (−2.41) | |||||

| Ccoverage | −0.012 *** | ||||

| (−3.44) | |||||

| Cusage_depth | −0.005 ** | ||||

| (−2.18) | |||||

| Cdigital | −0.004 | ||||

| (−1.39) | |||||

| Size | −0.048 *** | −0.048 *** | −0.048 *** | −0.048 *** | |

| (−93.61) | (−93.83) | (−93.31) | (−90.80) | ||

| ROA | −0.114 *** | −0.114 *** | −0.115 *** | −0.115 *** | |

| (−9.83) | (−9.58) | (−9.97) | (−9.98) | ||

| ROE | −0.013 ** | −0.012 ** | −0.012 ** | −0.012 ** | |

| (−2.40) | (−2.36) | (−2.38) | (−2.27) | ||

| Lev | 0.022 *** | 0.022 *** | 0.022 *** | 0.022 *** | |

| (5.65) | (5.73) | (5.58) | (5.59) | ||

| Growth | −0.044 *** | −0.044 *** | −0.044 *** | −0.044 *** | |

| (−35.05) | (−35.18) | (−34.95) | (−34.97) | ||

| TobinQ | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | |

| (3.15) | (3.27) | (3.26) | (3.15) | ||

| Board | −0.001 | −0.001 | −0.001 | −0.001 | |

| (−0.17) | (−0.24) | (−0.19) | (−0.25) | ||

| Big4 | −0.003 | −0.003 | −0.003 | −0.003 | |

| (−1.37) | (−1.49) | (−1.33) | (−1.35) | ||

| SOE | −0.003 *** | −0.003 *** | −0.004 *** | −0.004 *** | |

| (−2.83) | (−3.01) | (−2.85) | (−2.92) | ||

| Indep | <0.001 | <0.001 | <0.001 | <0.001 | |

| (1.03) | (1.01) | (0.96) | (0.90) | ||

| FirmAge | 0.006 *** | 0.006 *** | 0.006 *** | 0.006 *** | |

| (2.88) | (3.15) | (2.96) | (2.93) | ||

| Cashflow | −0.096 *** | −0.095 *** | −0.095 *** | −0.095 *** | |

| (−22.21) | (−22.14) | (−22.97) | (−22.14) | ||

| wdigitaltrans | −0.001 | −0.001 | −0.001 | −0.001 | |

| (−0.59) | (−0.65) | (−0.68) | (−0.64) | ||

| Cgdp | −0.006 ** | −0.003 | −0.007 *** | −0.008 *** | |

| (−2.38) | (−1.02) | (−2.78) | (−3.13) | ||

| year | YES | YES | YES | YES | |

| ind | YES | YES | YES | YES | |

| R2 | 87.07% | 87.11% | 87.07% | 87.07% | |

| Adj R2 | 86.97% | 87.01% | 86.97% | 86.97% | |

| N | 6631 | 6631 | 6631 | 6631 | |

| F-value | 1044.360 *** | 2848.043 *** | 23,179.985 *** | 13,132.190 *** | |

| Variables | Nature of Company Ownership | Industry Developments | Degree of Regional Development | |||

|---|---|---|---|---|---|---|

| State-Owned Enterprises | Non-State-Owned Enterprises | High-Tech Industries | Traditional Industries | Highly Developed Regions | Low-Development Regions | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Intercept | 4.174 *** | 8.662 *** | 7.061 *** | 5.713 *** | −0.833 | 7.003 *** |

| (7.24) | (8.52) | (4.94) | (8.68) | (−0.39) | (8.45) | |

| Cindex | −0.333 *** | −0.699 *** | −0.598 *** | −0.463 *** | 0.408 | −0.456 *** |

| (−3.06) | (−3.80) | (−3.28) | (−3.08) | (1.09) | (−4.50) | |

| Cindex*Power | 0.198 *** | 0.354 *** | 0.075 | 0.371 *** | 0.390 ** | 0.228 *** |

| (3.50) | (3.64) | (0.72) | (4.81) | (2.50) | (3.27) | |

| (−4.15) | (−3.79) | (−1.03) | (−5.03) | (−2.78) | (−3.51) | |

| size | −0.066 | −0.179 *** | −0.159 ** | −0.122 * | −0.026 | −0.190 *** |

| (−1.37) | (−2.60) | (−2.16) | (−1.87) | (−0.45) | (−3.44) | |

| roa | −0.067 *** | −0.005 | −0.056 *** | −0.006 | −0.002 | −0.048 *** |

| (−5.00) | (−1.03) | (−6.72) | (−1.05) | (−0.66) | (−10.50) | |

| lev | 0.032 *** | 0.034 *** | 0.027 *** | 0.038 *** | 0.025 *** | 0.040 *** |

| (4.10) | (3.99) | (3.28) | (4.52) | (3.21) | (5.61) | |

| growth | <0.001 *** | <0.001 *** | −0.004 | <0.001 * | 0.003 ** | <0.001 * |

| (5.05) | (6.70) | (−0.28) | (1.85) | (2.10) | (1.81) | |

| SOE | 0.257 *** | 0.232 *** | 0.039 | 0.243 *** | ||

| (4.19) | (6.24) | (0.67) | (6.07) | |||

| TobinQ | 0.076 ** | 0.008 ** | 0.005 | 0.046 * | 0.045 * | 0.008 |

| (2.42) | (2.48) | (1.58) | (1.81) | (1.91) | (1.60) | |

| board | −0.016 ** | −0.072 *** | −0.014 | −0.038 *** | −0.030 ** | −0.024 *** |

| (−2.03) | (−4.27) | (−0.76) | (−3.94) | (−1.98) | (−2.76) | |

| big4 | −0.132 ** | −0.311 *** | −0.069 | −0.176 *** | −0.024 | −0.296 *** |

| (−2.06) | (−3.16) | (−0.54) | (−2.68) | (−0.34) | (−3.68) | |

| Indep | 0.552 * | 0.427 | 1.286 *** | 0.752 *** | 0.817 ** | 0.685 *** |

| (1.96) | (1.03) | (2.63) | (2.80) | (2.01) | (2.64) | |

| FirmAge | 0.004 ** | 0.004 ** | 0.004 ** | 0.004 *** | 0.006 *** | 0.006 *** |

| (2.53) | (2.58) | (2.62) | (2.77) | (3.82) | (3.56) | |

| Cashflow | −0.097 *** | −0.097 *** | −0.097 *** | −0.096 *** | −0.097 *** | −0.097 *** |

| (−22.38) | (−22.40) | (−22.20) | (−22.54) | (−24.38) | (−24.37) | |

| wdigitaltrans | <0.001 | <0.001 | −0.001 | <0.001 | −0.001 | −0.001 |

| (−1.38) | (−1.42) | (−1.57) | (−1.41) | (−1.51) | (−1.47) | |

| Cgdp | −0.006 ** | −0.003 | −0.007 *** | −0.008 *** | −0.006 ** | −0.003 |

| (−2.38) | (−1.02) | (−2.78) | (−3.13) | (−2.38) | (−1.02) | |

| year | −0.003 | −0.002 | −0.005 ** | −0.004 ** | −0.002 | −0.007 *** |

| ind | (−1.47) | (−0.82) | (−2.08) | (−2.45) | (−0.51) | (−4.11) |

| R2 | 55.09% | 40.48% | 45.33% | 47.00% | 36.42% | 55.46% |

| AdjR2 | 54.91% | 40.27% | 45.01% | 46.87% | 36.05% | 55.34% |

| N | 7744 | 8881 | 4406 | 12,219 | 5390 | 11,235 |

| F-value | 582.628 *** | 150.830 *** | 79.539 *** | 216.664 *** | 61.860 *** | 240.626 *** |

| Variables | Nature of Company Ownership | Industry Developments | Level of Regional Development | |||

|---|---|---|---|---|---|---|

| Nationalised Business | Non-State Enterprise | High-Tech Industries | Traditional Industries | Highly Developed Regions | Low-Development Regions | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Intercept | 1.678 ** | 0.825 | 3.493 ** | −0.008 | −7.692 *** | 2.932 *** |

| (2.33) | (0.67) | (2.31) | (−0.01) | (−3.68) | (2.74) | |

| Cindex | −0.001 | 0.244 | −0.136 | 0.246 ** | 1.339 *** | 0.097 |

| (−0.01) | (1.60) | (−0.77) | (2.11) | (3.97) | (1.04) | |

| Cindex*csr | −0.007 *** | −0.026 *** | −0.015 *** | −0.017 *** | −0.024 *** | −0.014 *** |

| (−5.52) | (−9.40) | (−5.17) | (−10.63) | (−8.04) | (−8.74) | |

| csr | 0.023 *** | 0.100 *** | 0.051 *** | 0.060 *** | 0.098 *** | 0.049 *** |

| (3.83) | (7.39) | (3.50) | (8.33) | (6.52) | (6.90) | |

| size | −0.034 | −0.032 | −0.111 | −0.022 | 0.063 | −0.137 ** |

| (−0.65) | (−0.45) | (−1.48) | (−0.31) | (1.05) | (−2.32) | |

| roa | −0.059 *** | −0.003 | −0.036 *** | −0.004 | −0.001 | −0.035 *** |

| (−4.28) | (−0.78) | (−4.28) | (−0.97) | (−0.44) | (−7.65) | |

| lev | 0.033 *** | 0.032 *** | 0.028 *** | 0.036 *** | 0.024 *** | 0.040 *** |

| (4.27) | (3.96) | (3.50) | (4.49) | (3.22) | (5.99) | |

| growth | <0.001 *** | <0.001 *** | −0.008 | <0.001 | 0.002 * | <0.001 |

| (4.47) | (4.09) | (−0.62) | (1.45) | (1.87) | (1.23) | |

| SOE | 0.375 *** | 0.259 *** | 0.183 *** | 0.264 *** | ||

| (5.94) | (7.05) | (3.15) | (6.89) | |||

| TobinQ | 0.087 *** | 0.011 ** | 0.007 ** | 0.053 ** | 0.050 ** | 0.010 * |

| (2.72) | (2.57) | (2.03) | (2.17) | (2.21) | (1.79) | |

| board | −0.019 ** | −0.056 *** | −0.005 | −0.038 *** | −0.036 ** | −0.020 ** |

| (−2.39) | (−3.58) | (−0.31) | (−4.10) | (−2.52) | (−2.37) | |

| big4 | −0.110 * | −0.242 *** | 0.087 | −0.145 ** | 0.060 | −0.279 *** |

| (−1.81) | (−2.61) | (0.68) | (−2.31) | (0.89) | (−3.63) | |

| Indep | 0.511 * | 0.621 | 1.298 *** | 0.626 ** | 0.540 | 0.802 *** |

| (1.89) | (1.59) | (2.74) | (2.42) | (1.39) | (3.13) | |

| FirmAge | 0.004 ** | 0.004 ** | 0.004 ** | 0.004 *** | 0.004 ** | 0.004 ** |

| (2.53) | (2.58) | (2.62) | (2.77) | (2.53) | (2.58) | |

| Cashflow | −0.097 *** | −0.097 *** | −0.097 *** | −0.096 *** | −0.097 *** | −0.097 *** |

| (−22.38) | (−22.40) | (−22.20) | (−22.54) | (−22.38) | (−22.40) | |

| wdigitaltrans | <0.001 | <0.001 | −0.001 | <0.001 | <0.001 | <0.001 |

| (−1.38) | (−1.42) | (−1.57) | (−1.41) | (−1.38) | (−1.42) | |

| Cgdp | −0.003 | −0.002 | −0.005 ** | −0.004 ** | −0.003 | −0.002 |

| (−1.47) | (−0.82) | (−2.08) | (−2.45) | (−1.47) | (−0.82) | |

| year | YES | YES | YES | YES | YES | YES |

| ind | YES | YES | YES | YES | YES | YES |

| R2 | 56.56% | 46.38% | 47.57% | 50.93% | 41.42% | 57.35% |

| AdjR2 | 56.40% | 46.20% | 47.28% | 50.82% | 41.09% | 57.24% |

| N | 8197 | 9041 | 4494 | 12,744 | 5559 | 11,679 |

| F-value | 735.626 *** | 191.907 *** | 103.356 *** | 274.762 *** | 83.831 *** | 306.446 *** |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Intercept | −2.154 *** | −2.178 *** | −1.809 *** | −1.310 *** |

| (−7.21) | (−5.59) | (−4.07) | (−4.90) | |

| Cindex | 0.953 ** | |||

| (2.04) | ||||

| Ccoverage | 1.184 *** | |||

| (3.25) | ||||

| Cusage_depth | 0.555 * | |||

| (1.86) | ||||

| Cdigital | −0.255 | |||

| (−0.77) | ||||

| Cindex*WW | 0.847 * | |||

| (1.74) | ||||

| Ccoverage*WW | 1.144 *** | |||

| (3.03) | ||||

| Cusage_depth*WW | 0.527 * | |||

| (1.75) | ||||

| Cdigital*WW | −0.360 | |||

| (−1.08) | ||||

| WW | −0.679 * | −0.730 ** | −0.369 | 0.063 |

| (−1.97) | (−2.66) | (−1.59) | (0.21) | |

| Size | 0.076 *** | 0.076 *** | 0.075 *** | 0.075 *** |

| (5.02) | (5.00) | (4.77) | (4.75) | |

| ROA | 0.169 | 0.176 | 0.189 | 0.181 |

| (1.16) | (1.20) | (1.27) | (1.20) | |

| Lev | 0.085 * | 0.085 * | 0.084 * | 0.093 * |

| (1.87) | (1.86) | (1.83) | (2.03) | |

| Growth | −0.035 ** | −0.035 ** | −0.035 ** | −0.033 ** |

| (−2.72) | (−2.75) | (−2.67) | (−2.56) | |

| TobinQ | 0.006 | 0.006 | 0.006 | 0.005 |

| (1.69) | (1.67) | (1.58) | (1.56) | |

| Board | 0.064 | 0.061 | 0.061 | 0.062 |

| (1.42) | (1.35) | (1.35) | (1.39) | |

| Big4 | 0.099 * | 0.101 * | 0.096 * | 0.094 |

| (1.78) | (1.79) | (1.73) | (1.68) | |

| Dual | 0.033 | 0.032 | 0.033 | 0.033 |

| (1.08) | (1.07) | (1.11) | (1.11) | |

| SOE | 0.020 | 0.022 | 0.020 | 0.023 |

| (0.92) | (1.05) | (0.96) | (1.12) | |

| FirmAge | −0.099 ** | −0.101 ** | −0.100 ** | −0.101 ** |

| (−2.46) | (−2.54) | (−2.49) | (−2.53) | |

| ROE | 0.059 | 0.061 * | 0.061 | 0.060 * |

| (1.68) | (1.73) | (1.70) | (1.72) | |

| Cashflow | 0.010 | 0.006 | 0.010 | 0.008 |

| (0.09) | (0.05) | (0.09) | (0.08) | |

| wdigitaltrans | −0.007 | −0.006 | −0.005 | −0.007 |

| (−0.71) | (−0.62) | (−0.55) | (−0.66) | |

| Gdp | 0.001 | 0.002 | 0.004 | −0.029 |

| (0.01) | (0.02) | (0.04) | (−0.40) | |

| Urban | −0.172 | −0.169 | −0.155 | −0.136 |

| (−0.98) | (−0.99) | (−0.91) | (−1.07) | |

| Industrylevel | 0.187 * | 0.160 | 0.181 * | −0.084 |

| (1.71) | (1.40) | (1.77) | (−0.70) | |

| Cgdp | 0.001 | 0.075 | 0.073 | 0.020 |

| (0.02) | (1.43) | (1.33) | (0.35) | |

| year | YES | YES | YES | YES |

| ind | YES | YES | YES | YES |

| R2 | 17.26% | 17.24% | 17.16% | 17.30% |

| Adj R2 | 16.92% | 16.89% | 16.82% | 16.96% |

| N | 26,381 | 26,381 | 26,381 | 26,381 |

| F-value | 130.795 *** | 129.372 *** | 93.856 *** | 148.687 *** |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Intercept | −2.327 *** | −2.267 *** | −1.919 *** | −1.343 *** |

| (−4.91) | (−4.51) | (−3.33) | (−4.53) | |

| Cindex | 0.679 | |||

| (1.67) | ||||

| Ccoverage | 0.720 | |||

| (1.54) | ||||

| Cusage_depth | 0.107 | |||

| (0.17) | ||||

| Cdigital | −0.656 ** | |||

| (−2.10) | ||||

| Cindex*WW | 0.666 | |||

| (1.59) | ||||

| Ccoverage*WW | 0.729 | |||

| (1.48) | ||||

| Cusage_Depth*WW | 0.073 | |||

| (0.12) | ||||

| Cdigital*WW | −0.824 ** | |||

| (−2.66) | ||||

| WW | −1.245 *** | −1.201 *** | −0.847 *** | −0.360 |

| (−3.88) | (−4.06) | (−3.29) | (−1.20) | |

| Size | 0.062 ** | 0.061 ** | 0.061 ** | 0.063 ** |

| (2.62) | (2.65) | (2.53) | (2.66) | |

| ROA | 0.361 * | 0.365 * | 0.367 * | 0.370 * |

| (1.80) | (1.83) | (1.85) | (1.80) | |

| Lev | 0.026 | 0.025 | 0.024 | 0.035 |

| (0.39) | (0.39) | (0.36) | (0.52) | |

| Growth | −0.065 *** | −0.065 *** | −0.064 *** | −0.062 *** |

| (−4.80) | (−4.82) | (−4.78) | (−4.80) | |

| Tobinq | 0.026 *** | 0.026 *** | 0.026 *** | 0.024 *** |

| (4.86) | (4.64) | (4.44) | (4.50) | |

| Board | 0.069 | 0.068 | 0.069 | 0.074 |

| (0.72) | (0.71) | (0.72) | (0.77) | |

| Big4 | 0.198 ** | 0.199 *** | 0.194 ** | 0.197 ** |

| (2.75) | (2.77) | (2.73) | (2.67) | |

| Indep | 0.002 | 0.002 | 0.002 | 0.002 |

| (1.02) | (1.03) | (1.02) | (0.97) | |

| SOE | 0.021 | 0.021 | 0.021 | 0.029 |

| (0.57) | (0.60) | (0.57) | (0.80) | |

| Firmage | −0.161 *** | −0.160 *** | −0.162 *** | −0.167 *** |

| (−4.12) | (−4.16) | (−4.21) | (−4.29) | |

| ROE | −0.032 | −0.032 | −0.033 | −0.035 |

| (−0.52) | (−0.51) | (−0.52) | (−0.57) | |

| Cashflow | −0.203 | −0.203 | −0.198 | −0.204 |

| (−1.48) | (−1.51) | (−1.48) | (−1.48) | |

| Wdigitaltrans | 0.047 *** | 0.047 *** | 0.046 *** | 0.045 *** |

| (9.57) | (9.03) | (9.24) | (9.76) | |

| Gdp | 0.132 | 0.147 | 0.123 | 0.089 |

| (1.37) | (1.53) | (1.44) | (1.43) | |

| Urban | −0.381 * | −0.387 ** | −0.356 * | −0.362 ** |

| (−1.94) | (−2.18) | (−1.92) | (−2.43) | |

| Industrylevel | 0.199 | 0.210 | 0.213 | −0.210 |

| (1.23) | (1.17) | (1.33) | (−1.45) | |

| Cgdp | 0.140 ** | 0.149 *** | 0.123 ** | 0.038 |

| (2.65) | (2.85) | (2.31) | (0.64) | |

| R2 | 6.87% | 6.87% | 6.84% | 7.22% |

| Adj R2 | 6.79% | 6.80% | 6.77% | 7.15% |

| N | 26,381 | 26,381 | 26,381 | 26,381 |

| F-Value | 619.892 *** | 440.918 *** | 318.435 *** | 351.201 *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Q.; Mao, Z. Digital Finance, Financing Constraints, and Green Innovation in Chinese Firms: The Roles of Management Power and CSR. Sustainability 2025, 17, 7110. https://doi.org/10.3390/su17157110

Zhang Q, Mao Z. Digital Finance, Financing Constraints, and Green Innovation in Chinese Firms: The Roles of Management Power and CSR. Sustainability. 2025; 17(15):7110. https://doi.org/10.3390/su17157110

Chicago/Turabian StyleZhang, Qiong, and Zhihong Mao. 2025. "Digital Finance, Financing Constraints, and Green Innovation in Chinese Firms: The Roles of Management Power and CSR" Sustainability 17, no. 15: 7110. https://doi.org/10.3390/su17157110

APA StyleZhang, Q., & Mao, Z. (2025). Digital Finance, Financing Constraints, and Green Innovation in Chinese Firms: The Roles of Management Power and CSR. Sustainability, 17(15), 7110. https://doi.org/10.3390/su17157110