Investments, Economics, Renewables and Population Versus Carbon Emissions in ASEAN and Larger Asian Countries: China, India and Pakistan

Abstract

1. Introduction

2. Literature Review

2.1. Regional Characteristics

2.2. Methodological Limitations in the Literature

2.3. Present Research Advancements

3. Theoretical Framework

4. Methodology

4.1. Data Preprocessing

4.2. Cross-Sectional Dependence

4.3. First-Generation PURT

4.3.1. LLC PURT

4.3.2. Fisher-Type PURT

4.4. Panel ARDL

4.5. Dumitrescu–Hurlin Panel Causality Test

5. Results

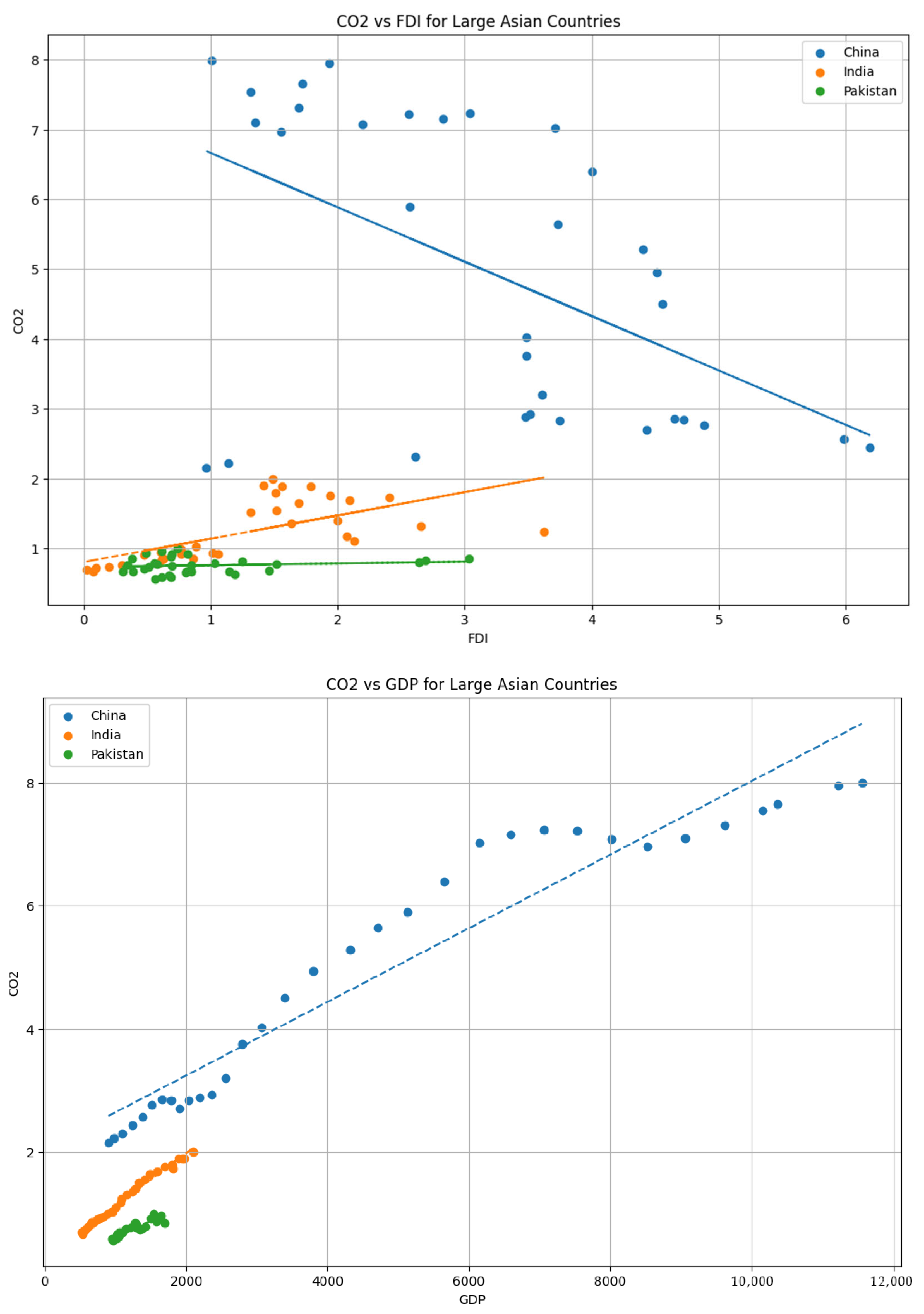

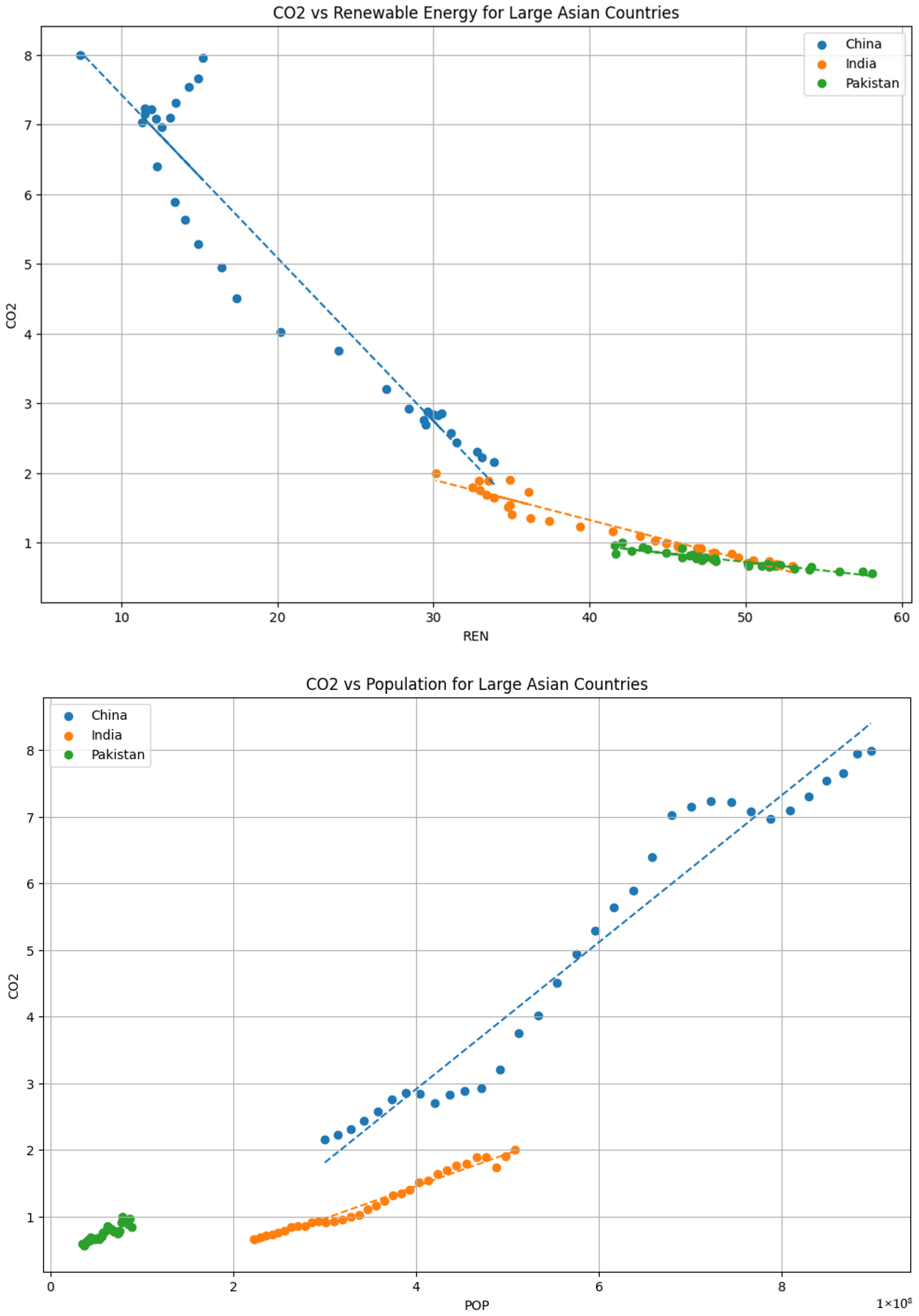

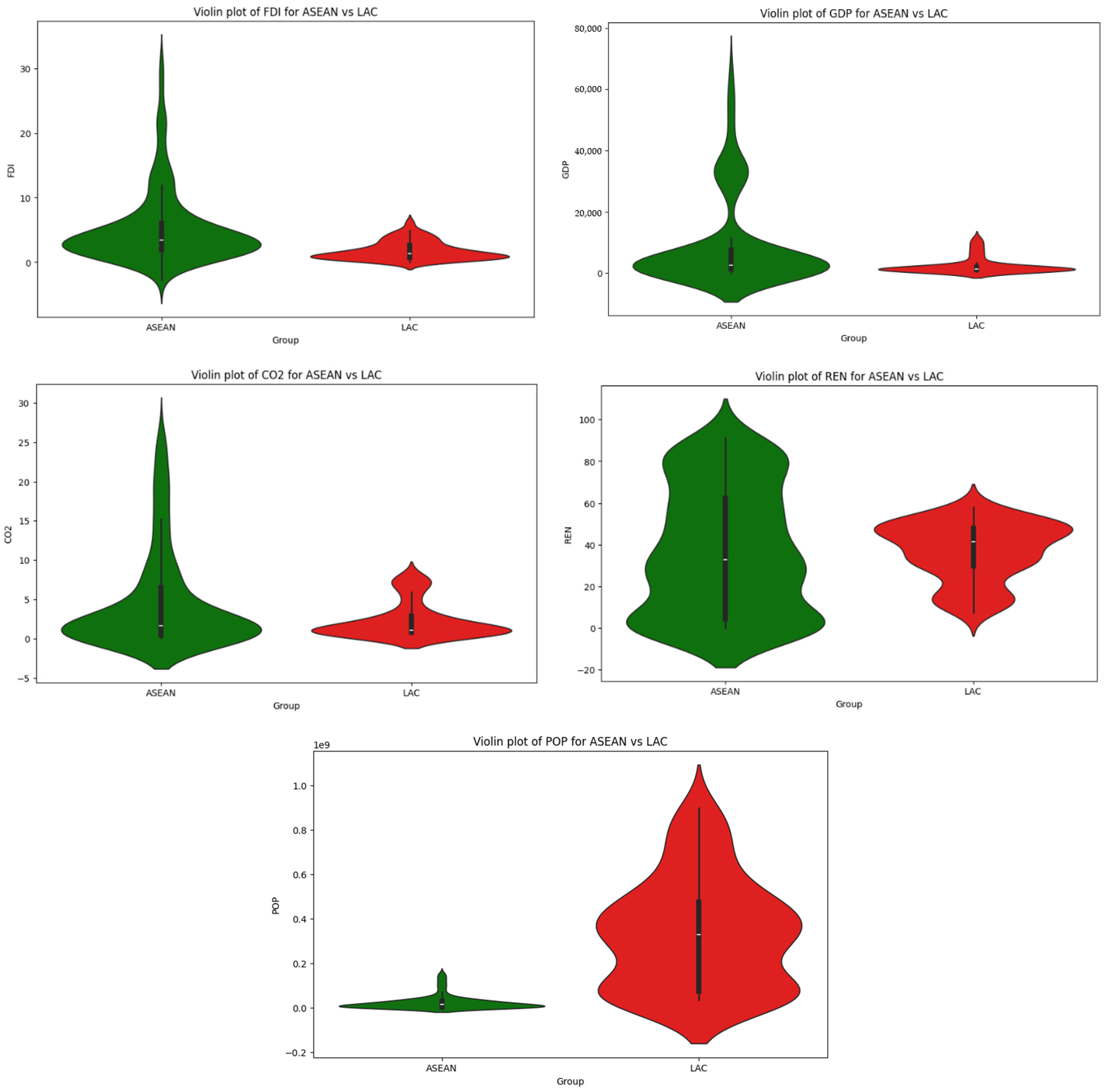

5.1. Input Data Analysis

5.2. Empirical Results

6. Discussion

7. Conclusions and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Sadiq, M.; Ngo, T.Q.; Pantamee, A.A.; Khudoykulov, K.; Thi Ngan, T.; Tan, L.P. The Role of Environmental Social and Governance in Achieving Sustainable Development Goals: Evidence from ASEAN Countries. Econ. Res. Istraz. 2022, 36, 170–190. [Google Scholar] [CrossRef]

- Hu, X.; Ali, N.; Malik, M.; Hussain, J.; Fengyi, J.; Nilofar, M. Impact of Economic Openness and Innovations on the Environment: A New Look into Asean Countries. Pol. J. Environ. Stud. 2021, 30, 3601–3613. [Google Scholar] [CrossRef]

- Megaravalli, A.V.; Sampagnaro, G. Macroeconomic Indicators and Their Impact on Stock Markets in ASIAN 3: A Pooled Mean Group Approach. Cogent Econ. Financ. 2018, 6, 1432450. [Google Scholar] [CrossRef]

- Udeagha, M.C.; Muchapondwa, E. Achieving Regional Sustainability and Carbon Neutrality Target in Brazil, Russia, India, China, and South Africa Economies: Understanding the Importance of Fiscal Decentralization, Export Diversification and Environmental Innovation. Sustain. Dev. 2023, 31, 2620–2635. [Google Scholar] [CrossRef]

- Lou, C. Geopolitical “Entanglements” and the China-India-Pakistan Nuclear Trilemma. J. Peace Nucl. Disarm. 2022, 5, 281–295. [Google Scholar] [CrossRef]

- Wong, K.N.; Tan, B.W.; Goh, S.K. A Nexus between Intra-ASEAN Outward FDI, Intra-ASEAN Exports and Economic Growth of ASEAN-10: Evidence Using Panel Causality Analysis. Asia-Pac. J. Bus. Adm. 2023, 15, 489–508. [Google Scholar] [CrossRef]

- Saraan, M.A.B.; Suriani, S.; Nasir, M. The Effect of Foreign Direct Investment and Foreign Exchange Reserves on Economic Growth in ASEAN Countries. Int. J. Financ. Econ. Bus. 2023, 2, 67–83. [Google Scholar] [CrossRef]

- Indeo, F. ASEAN-EU Energy Cooperation: Sharing Best Practices to Implement Renewable Energy Sources in Regional Energy Grids. Glob. Energy Interconnect. 2019, 2, 393–401. [Google Scholar] [CrossRef]

- Syladeth, S.; Guoqing, S.; Yu, Q. Resettlement Policies and Implementation Management: A Case of Hydropower Resettlement Management in Laos. Int. J. Bus. Econ. Manag. Work. 2016, 3, 25–32. [Google Scholar]

- Susilowati, I.; Mu’min, M.S.; Qudsyina, H.; Wahyuni, H.A.; Rismawati, S.; Kusumawardhani, H.A.; Miah, M.R. Nexus Between Economic Growth, Renewable Energy, Industry Value Added and CO2 Emissions in ASEAN. J. Ekon. Pembang. Kaji. Masal. Ekon. Dan Pembang. 2023, 24, 265–281. [Google Scholar] [CrossRef]

- Supriyanto; Adawiyah, W.R.; Arintoko; Rahajuni, D.; Kadarwati, N. Economic Growth and Environmental Degradation Paradox in ASEAN: A Simultaneous Equation Model with Dynamic Panel Data Approach. Environ. Econ. 2022, 13, 171–184. [Google Scholar] [CrossRef]

- Nazir, M.R.; Tan, Y.; Nazir, M.I. Financial Innovation and Economic Growth: Empirical Evidence from China, India and Pakistan. Int. J. Financ. Econ. 2021, 26, 6036–6059. [Google Scholar] [CrossRef]

- Qian, X.Y.; Liang, Q.M.; Liu, L.J.; Zhang, K.; Liu, Y. Key Points for Green Management of Water-Energy-Food in the Belt and Road Initiative: Resource Utilization Efficiency, Final Demand Behaviors and Trade Inequalities. J. Clean. Prod. 2022, 362, 132386. [Google Scholar] [CrossRef]

- Ahmed, S.; Mahmood, A.; Hasan, A.; Sidhu, G.A.S.; Butt, M.F.U. A Comparative Review of China, India and Pakistan Renewable Energy Sectors and Sharing Opportunities. Renew. Sustain. Energy Rev. 2016, 57, 216–225. [Google Scholar] [CrossRef]

- Setyawati, D.; Nadhila, S. ASEAN’s Clean Power Pathways: 2024 Insights; EMBER: London, UK, 2024. [Google Scholar]

- Rehman, E.; Rehman, S. Modeling the Nexus between Carbon Emissions, Urbanization, Population Growth, Energy Consumption, and Economic Development in Asia: Evidence from Grey Relational Analysis. Energy Rep. 2022, 8, 5430–5442. [Google Scholar] [CrossRef]

- Rahman, Z.U.; Cai, H.; Ahmad, M. A New Look At The Remittances-Fdi-Energy-Environment Nexus In The Case Of Selected Asian Nations. Singap. Econ. Rev. 2023, 68, 157–175. [Google Scholar] [CrossRef]

- Sandu, S.; Yang, M.; Mahlia, T.M.I.; Wongsapai, W.; Ong, H.C.; Putra, N.; Ashrafur Rahman, S.M. Energy-Related CO2 Emissions Growth in ASEAN Countries: Trends, Drivers and Policy Implications. Energies 2019, 12, 4650. [Google Scholar] [CrossRef]

- Shabir, M.; Gill, A.R.; Ali, M. The Impact of Transport Energy Consumption and Foreign Direct Investment on CO2 Emissions in ASEAN Countries. Front. Energy Res. 2022, 10, 994062. [Google Scholar] [CrossRef]

- Khusna, V.A.; Kusumawardani, D. Decomposition of Carbon Dioxide (CO2) Emissions in ASEAN Based on Kaya Identity. Indones. J. Energy 2021, 4, 101–114. [Google Scholar] [CrossRef]

- Danmaraya, I.A.; Danlami, A.H. Impact of Hydropower Consumption, Foreign Direct Investment and Manufacturing Performance on CO2 Emissions in the ASEAN-4 Countries. Int. J. Energy Sect. Manag. 2022, 16, 856–875. [Google Scholar] [CrossRef]

- Chienwattanasook, K.; Chavaha, C.; Lekhawichit, N.; Jermsittiparsert, K. The Impact of Economic Growth, Globalization, and Financial Development on CO2 Emissions in Asean Countries. Acad. Strateg. Manag. J. 2021, 20, 1–14. [Google Scholar]

- Chandran, V.G.R.; Tang, C.F. The Impacts of Transport Energy Consumption, Foreign Direct Investment and Income on CO2 Emissions in ASEAN-5 Economies. Renew. Sustain. Energy Rev. 2013, 24, 445–453. [Google Scholar] [CrossRef]

- Shah, M.I.; AbdulKareem, H.K.K.; Ishola, B.D.; Abbas, S. The Roles of Energy, Natural Resources, Agriculture and Regional Integration on CO2 Emissions in Selected Countries of ASEAN: Does Political Constraint Matter? Environ. Sci. Pollut. Res. 2023, 30, 26063–26077. [Google Scholar] [CrossRef] [PubMed]

- Eriandani, R.; Anam, S.; Prastiwi, D.; Triani, N.N.A. The Impact of Foreign Direct Investment on CO2 Emissions in ASEAN Countries. Int. J. Energy Econ. Policy 2020, 10, 584–592. [Google Scholar] [CrossRef]

- Ab-Rahim, R.; Xin-Di, T. Determinants of CO2 Emissions in ASEAN+3 Countries. J. Entrep. Bus. 2021, 4, 38–49. [Google Scholar] [CrossRef]

- Pratama, A.S.; Pudjihardjo, M.; Manzilati, A.; Pratomo, D.S. Effect of Economic Growth, Industrialization, Population Growth, and Renewable Energy on CO2 Emissions in the Long and Short Term in ASEAN 5. J. Econ. Financ. Manag. Stud. 2021, 4, 1149–1158. [Google Scholar] [CrossRef]

- Munir, Q.; Lean, H.H.; Smyth, R. CO2 Emissions, Energy Consumption and Economic Growth in the ASEAN-5 Countries: A Cross-Sectional Dependence Approach. Energy Econ. 2020, 85, 104571. [Google Scholar] [CrossRef]

- Chontanawat, J. Relationship between Energy Consumption, CO2 Emission and Economic Growth in ASEAN: Cointegration and Causality Model. Energy Rep. 2020, 6, 660–665. [Google Scholar] [CrossRef]

- Perwithosuci, W.; Mafruhah, I.; Gravitiani, E. The Effect of Population, GDP, Oil Consumption, and FDI on CO2 Emissions in ASEAN 5 Developing Countries. Int. J. Econ. Bus. Manag. Res. 2020, 4, 211–220. [Google Scholar]

- Cabañero, J.G. Do Financing Sources Affect CO2 Emissions? The Case of Growing ASEAN. Southeast Asian J. Econ. 2023, 11, 159–187. [Google Scholar]

- Breusch, T.S.; Pagan, A.R. The Lagrange Multiplier Test and Its Applications to Model Specification in Econometrics. Rev. Econ. Stud. 1980, 47, 239–253. [Google Scholar] [CrossRef]

- Pesaran, M.H. General Diagnostic Tests for Cross Section Dependence in Panels General Diagnostic Tests for Cross Section Dependence in Panels. Available online: https://docs.iza.org/dp1240.pdf (accessed on 19 July 2025).

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit Root Tests in Panel Data: Asymptotic and Finite-Sample Properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A Comparative Study of Unit Root Tests with Panel Data and a New Simple Test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Hurlin, C.; Mignon, V. Second Generation Panel Unit Root Tests; University of Orleans, Working Paper: Orléans, France, 2007. [Google Scholar]

- Dickey, D.A.; Fuller, W.A. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar] [CrossRef] [PubMed]

- Choi, I. Unit Root Tests for Panel Data. J. Int. Money Financ. 2001, 20, 249–272. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y. Cointegration and Speed of Convergence to Equilibrium. J. Econom. 1996, 71, 117–143. [Google Scholar] [CrossRef]

- Dumitrescu, E.I.; Hurlin, C. Testing for Granger Non-Causality in Heterogeneous Panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Ansari, M.A. Re-Visiting the Environmental Kuznets Curve for ASEAN: A Comparison between Ecological Footprint and Carbon Dioxide Emissions. Renew. Sustain. Energy Rev. 2022, 168, 112867. [Google Scholar] [CrossRef]

- Numan, U.; Ma, B.; Meo, M.S.; Bedru, H.D. Revisiting the N-Shaped Environmental Kuznets Curve for Economic Complexity and Ecological Footprint. J. Clean. Prod. 2022, 365, 132642. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.R. FDI and the Capital Intensity of “Dirty” Sectors: A Missing Piece of the Pollution Haven Puzzle. Rev. Dev. Econ. 2005, 9, 530–548. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. Renewable Energy Consumption and Economic Growth: Evidence from a Panel of OECD Countries. Energy Policy 2010, 38, 656–660. [Google Scholar] [CrossRef]

- Tran, T.; Bui, H.; Vo, A.T.; Vo, D.H. The Role of Renewable Energy in the Energy–Growth–Emission Nexus in the ASEAN Region. Energy Sustain. Soc. 2024, 14, 17. [Google Scholar] [CrossRef]

| Ref. | Objective | Countries | Methods | Years | Variables | Main Findings |

|---|---|---|---|---|---|---|

| [18] | Analyze the growth of energy-related CO2 emissions in ASEAN | ASEAN countries | Decomposition analysis | 1971–2016 | CO2 emissions, energy efficiency, energy fuel mix | Growth of CO2 emissions slowed in major emitters due to energy efficiency and fuel mix changes, but not enough to counteract rising emissions overall. |

| [19] | Assess the impact of FDI and energy consumption in the transport sector on CO2 emissions | Indonesia, Malaysia, Philippines, Singapore, Thailand | NARDL, Environmental Kuznets Curve (EKC) | 1980–2019 | CO2 emissions, FDI, transport sector energy consumption, income | EKC holds only for Singapore; FDI and transport energy impact CO2 emissions, with transport energy being more impactful. |

| [20] | Examine the impact of population, GDP, energy intensity and carbon intensity on CO2 emissions | ASEAN countries | Logarithmic Mean Division Index (LMDI) | 1990–2017 | CO2 emissions, population, GDP, energy intensity, carbon intensity | Population and economic activity increase emissions in most countries; energy intensity reduces emissions in lower-middle-income countries but increases in higher-income ones. |

| [21] | Examine the impacts of hydropower consumption, FDI and manufacturing performance on CO2 emissions | ASEAN-4 countries | Autoregressive distributive lag bound test | 1980–2015 | CO2 emissions, hydropower consumption, FDI, manufacturing performance | Hydropower consumption negatively impacts CO2 emissions only in Malaysia; manufacturing impacts emissions in all countries; FDI impacts emissions in Malaysia and the Philippines. |

| [22] | Investigate the impact of economic growth, globalization and financial development on CO2 emissions | ASEAN countries | Fixed-effects model, Discroll–Kraay standard error | 2004–2018 | CO2 emissions, economic growth, globalization, financial development | Economic growth, globalization and FDI positively impact CO2 emissions; recommended policies for efficient energy use to control emissions. |

| [23] | Assess the impact of transport sector’s energy consumption and FDI on CO2 emissions | ASEAN-5 countries | Cointegration, Granger causality | 1971–2008 | CO2 emissions, transport energy consumption, FDI, income | EKC not applicable to ASEAN-5; bi-directional causality between GDP and CO2 emissions in Indonesia and Thailand; transport energy and FDI impact emissions in Malaysia and Thailand. |

| [24] | Examine the effects of energy, natural resources, agriculture, political constraint and regional integration on CO2 emissions | Cambodia, Malaysia, Indonesia, Thailand | CCEMG, AMG | 1990–2019 | CO2 emissions, renewable energy, fossil fuel energy, natural resources, agriculture, political constraint | RES reduces CO2 emissions, fossil fuels increase them; agriculture impacts negatively, political constraint induces emissions, regional integration impact is not significant. |

| [25] | Examine the sector-specific FDI and CO2 emissions | ASEAN countries | Panel Granger causality tests | 1980–2018 | CO2 emissions, sector-specific FDI | FDI in polluting industries increases CO2 emissions; no robust evidence that FDI in other sectors impacts emissions. |

| [26] | Investigate the determinants of CO2 emissions in ASEAN+3 countries | ASEAN+3 countries | Panel unit root test, cointegration test, VECM | 1991–2010 | CO2 emissions, energy consumption, GDP, urbanization, trade openness, transportation | Economic growth, energy consumption and trade openness are determinants of CO2 emissions. |

| [27] | Examine the dynamic relationship between CO2 emissions and GDP, industrialization, population growth and RES | ASEAN-5 countries | VECM | 2007–2016 | CO2 emissions, economic growth, industrialization, population growth, renewable energy | Long-term: population growth and RESs significantly affect CO2 emissions; short-term: industrialization and RESs affect emissions. |

| [28] | Re-examine the relationship between CO2 emissions, energy consumption and economic growth | ASEAN-5 countries | Panel test of Granger non-causality | 1980–2016 | CO2 emissions, energy consumption (EC), economic growth | Unidirectional causality from GDP to CO2 for Malaysia, Philippines, Singapore, Thailand; GDP to EC in Indonesia, Malaysia, Thailand; EC to GDP in Singapore; bi-directional causality in the Philippines; EKC hypothesis supported. |

| [29] | Examine the dynamic relationship between energy consumption, CO2 emissions and economic output | ASEAN countries | Cointegration and causality models | 1971–2015 | CO2 emissions, energy consumption, economic output | Long-run relationship and causality between energy consumption, economic output and CO2 emissions; policies to reduce energy consumption can reduce CO2 emissions without much impact on GDP. |

| [30] | Examine the effect of population, GDP, oil consumption and FDI on CO2 emissions | ASEAN-5 countries | Fixed-effects model | 1985–2017 | CO2 emissions, population, GDP, oil consumption, FDI | Population, GDP and oil consumption positively affect CO2 emissions; FDI negatively affects emissions. |

| [31] | Investigate the impact of financing sources on carbon emissions | Indonesia, Laos, Malaysia, Philippines, Thailand, Vietnam | Pooled mean group estimation, dynamic fixed effects | 1986–2018 | CO2 emissions, domestic credit, government expenditure, FDI, foreign aid | Long-run relationship among variables; government expenditure and FDI increase emissions, foreign aid reduces emissions in both short and long run. |

| Tests | Statistic | p-Value |

|---|---|---|

| Breusch–Pagan LM | 262.60 | 0.000 *** |

| Pesaran-scaled LM | 22.93 | 0.000 *** |

| Pesaran CD | 6.40 | 0.000 ** |

| Tests | Statistic | p-Value |

|---|---|---|

| Breusch–Pagan LM | 33.76 | 0.000 *** |

| Pesaran-scaled LM | 12.56 | 0.000 *** |

| Pesaran CD | 5.71 | 0.000 *** |

| At levels | |||||

| CO2 | GDP | REN | POP | FDI | |

| Unit root (Common Unit Root Process) | |||||

| LLC | −0.79 (0.212) | −2.63 (0.004) *** | 1.22 (0.889) | −4.17 (0.000) *** | −3.87 (0.000) *** |

| Unit root (Individual Unit Root Process) | |||||

| ADF-Fisher Chi-square | 17.03 (0.650) | 7.67 (0.993) | 20.53 (0.424) | 86.90 (0.000) *** | 59.28 (0.000) *** |

| At first difference | |||||

| Unit root (Common Unit Root Process) | |||||

| LLC | −6.43 (0.000) *** | −7.04 (0.000) *** | −4.99 (0.000) *** | −3.81 (0.000) *** | −9.38 (0.000) *** |

| Unit root (Individual Unit Root Process) | |||||

| ADF-Fisher Chi-square | 128.55 (0.000) *** | 105.01 (0.000) *** | 86.18 (0.000) *** | 31.16 (0.053) * | 165.29 (0.000) *** |

| At levels | |||||

| CO2 | GDP | REN | POP | FDI | |

| Unit root (Common Unit Root Process) | |||||

| LLC | −0.82 (0.203) | −0.86 (0.192) | −1.35 (0.088) * | −2.83 (0.002) *** | −1.87 (0.030) ** |

| Unit root (Individual Unit Root Process) | |||||

| ADF-Fisher Chi-square | 2.27 (0.893) | 1.38 (0.966) | 3.26 (0.775) | 9.11 (0.167) | 13.73 (0.032) ** |

| At first difference | |||||

| Unit root (Common Unit Root Process) | |||||

| LLC | −4.82 (0.000) *** | −378 (0.000) *** | −3.27 (0.000) *** | −2.39 (0.008) *** | −3.83 (0.000) ** |

| Unit root (Individual Unit Root Process) | |||||

| ADF-Fisher Chi-square | 41.58 (0.000) *** | 31.80 (0.000) *** | 34.27 (0.000) *** | 10.88 (0.092) * | 44.94 (0.000) *** |

| At levels | |||||

| CO2 | GDP | REN | POP | FDI | |

| CIPS | −3.06 (<0.01) | −2.50 (<0.05) | −1.64 (≥0.10) | −2.22 (<0.10) | −3.00 (<0.01) |

| At first difference | |||||

| CIPS | −6.49 (<0.01) | −2.76 (<0.01) | −3.81 (<0.01) | −3.12 (<0.01) | −4.53 (<0.01) |

| At levels | |||||

| CO2 | GDP | REN | POP | FDI | |

| CIPS | −2.22 (<0.10) | −1.13 (≥0.10) | −3.08 (<0.01) | −1.24 (≥0.10) | −2.82 (<0.01) |

| At first difference | |||||

| CIPS | −3.68 (<0.01) | −2.31 (<0.10) | −4.95 (<0.01) | −2.42 (<0.05) | −5.00 (<0.01) |

| Indicator | Coefficient | Marginal Effect | t-Statistic (Prob. *) |

|---|---|---|---|

| Long-Run Equation | Long Run | ||

| GDP | 0.46 | 4.53 (0.000 ***) | |

| REN | −0.08 | −3.79 (0.000 ***) | |

| POP | 0.10 | 0.68 (0.495) | |

| FDI | 0.06 | 5.07 (0.000 ***) | |

| Short-Run Equation | |||

| COINTEQ01 | −0.37 | −2.35 (0.019 **) | |

| D(CO2(-1)) | −0.12 | −0.89 (0.373) | |

| D(CO2(-2)) | −0.07 | −0.52 (0.539) | |

| D(CO2(-3)) | −0.02 | −0.18 (0.855) | |

| D(GDP) | −0.45 | −0.51 (0.606) | |

| D(GDP(-1)) | −0.63 | −0.74 (0.454) | |

| D(GDP(-2)) | 1.36 | 1.94 (0.053 *) | |

| D(REN) | −1.06 | −1.80 (0.072 *) | |

| D(REN(-1)) | −1.26 | −1.87 (0.063 *) | |

| D(REN(-2)) | 0.04 | 0.09 (0.926) | |

| D(POP) | 4.49 | 0.33 (0.739) | |

| D(POP(-1)) | −9.48 | −0.46 (0.644) | |

| D(POP(-2)) | 2.98 | 0.27 (0.787) | |

| D(FDI) | −0.03 | −1.15 (0.251) | |

| D(FDI(-1)) | −0.06 | −1.73 (0.085 *) | |

| D(FDI(-2)) | −0.04 | −1.26 (0.207) | |

| C | −1.49 | −2.12 (0.035 **) |

| Indicator | Coefficient | Marginal Effect | t-Statistic (Prob. *) |

|---|---|---|---|

| Long-Run Equation | Long Run | ||

| GDP | 0.20 | 41.50 (0.000 ***) | |

| REN | −0.56 | −143.07 (0.000 ***) | |

| POP | 0.17 | 18.65 (0.000 ***) | |

| FDI | 0.01 | 34.36 (0.000 ***) | |

| Short-Run Equation | |||

| COINTEQ01 | −1.18 | −2.51 (0.018 **) | |

| D(CO2(-1)) | −0.005 | −0.03 (0.970) | |

| D(GDP) | 0.43 | 0.91 (0.370) | |

| D(GDP(-1)) | 0.76 | 3.40 (0.002 ***) | |

| D(GDP(-2)) | 0.15 | 0.49 (0.623) | |

| D(GDP(-3)) | 1.06 | 1.69 (0.101) | |

| D(GDP(-4)) | −0.39 | −1.59 (0.122) | |

| D(REN) | 0.09 | 0.25 (0.804) | |

| D(REN(-1)) | −0.28 | −1.79 (0.084 *) | |

| D(REN(-2)) | −0.11 | −0.73 (0.467) | |

| D(REN(-3)) | −0.12 | −0.39 (0.693) | |

| D(REN(-4)) | −0.05 | −0.17 (0.862) | |

| D(POP) | −29.24 | −1.00 (0.326) | |

| D(POP(-1)) | 20.07 | 0.75 (0.456) | |

| D(POP(-2)) | −3.15 | −0.14 (0.887) | |

| D(POP(-3)) | −11.62 | −1.22 (0.232) | |

| D(POP(-4)) | −19.34 | −0.73 (0.468) | |

| D(FDI) | 0.04 | 1.24 (0.225) | |

| D(FDI(-1)) | 0.03 | 0.68 (0.500) | |

| D(FDI(-2)) | −0.002 | −0.16 (0.867) | |

| D(FDI(-3)) | 0.02 | 2.28 (0.030 **) | |

| D(FDI(-4)) | 0.006 | 1.16 (0.254) | |

| C | −2.03 | −4.18 (0.000 ***) |

| Null Hypothesis (H0) | W-Stat. | Zbar-Stat. | Prob. | Conclusion |

|---|---|---|---|---|

| GDP n.c.i CO2 | 7.11 | 6.64 | 3 × 10−11 *** | GDP→CO2 |

| CO2 n.c.i GDP | 2.66 | 0.67 | 0.500 | |

| REN n.c.i CO2 | 6.31 | 5.57 | 3 × 10−8 *** | REN→CO2 |

| CO2 n.c.i REN | 3.23 | 1.43 | 0.150 | |

| POP n.c.i CO2 | 9.61 | 10.00 | 0.000 *** | POP→CO2 |

| CO2 n.c.i POP | 2.82 | 0.88 | 0.374 | |

| FDI n.c.i CO2 | 1.51 | −0.87 | 0.383 | |

| CO2 n.c.i FDI | 2.79 | 0.84 | 0.397 | |

| REN n.c.i GDP | 2.34 | 0.24 | 0.810 | REN→GDP |

| GDP n.c.i REN | 6.72 | 6.12 | 9 × 10−10 *** | GDP→REN |

| POP n.c.i GDP | 10.27 | 10.88 | 0.000 *** | POP→GDP |

| GDP n.c.i POP | 10.08 | 10.63 | 0.000 *** | GDP→REN |

| FDI n.c.i GDP | 2.14 | −0.02 | 0.981 | |

| GDP n.c.i FDI | 4.52 | 3.16 | 0.001 *** | GDP→FDI |

| POP n.c.i REN | 5.02 | 3.83 | 0.000 *** | POP→REN |

| REN n.c.i POP | 4.21 | 2.75 | 0.005 *** | REN→POP |

| FDI n.c.i REN | 2.66 | 0.67 | 0.500 | |

| REN n.c.i FDI | 3.76 | 2.14 | 0.031 ** | REN→FDI |

| FDI n.c.i POP | 3.64 | 1.99 | 0.046 ** | FDI→POP |

| POP n.c.i FDI | 6.12 | 5.30 | 1 × 10−7 *** | POP→FDI |

| Null Hypothesis (H0) | W-Stat. | Zbar-Stat. | Prob. | Conclusion |

|---|---|---|---|---|

| GDP n.c.i CO2 | 2.68 | 0.38 | 0.703 | |

| CO2 n.c.i GDP | 2.73 | 0.41 | 0.677 | |

| REN n.c.i CO2 | 3.99 | 1.34 | 0.178 | |

| CO2 n.c.i REN | 2.31 | 0.10 | 0.913 | |

| POP n.c.i CO2 | 9.44 | 5.35 | 9 × 10−8 *** | POP→CO2 |

| CO2 n.c.i POP | 4.69 | 1.85 | 0.063 * | CO2→POP |

| FDI n.c.i CO2 | 1.21 | −0.69 | 0.485 | |

| CO2 n.c.i FDI | 7.70 | 4.07 | 5 × 10−5 *** | CO2→FDI |

| REN n.c.i GDP | 5.22 | 2.25 | 0.024 ** | REN→GDP |

| GDP n.c.i REN | 3.44 | 0.93 | 0.349 | |

| POP n.c.i GDP | 6.99 | 3.55 | 0.000 *** | POP→GDP |

| GDP n.c.i POP | 2.65 | 0.35 | 0.721 | |

| FDI n.c.i GDP | 1.65 | −0.37 | 0.708 | |

| GDP n.c.i FDI | 12.15 | 7.34 | 2 × 10−13 *** | GDP→FDI |

| POP n.c.i REN | 6.90 | 3.48 | 0.000 *** | POP→REN |

| REN n.c.i POP | 6.01 | 2.83 | 0.004 *** | REN→POP |

| FDI n.c.i REN | 3.38 | 0.89 | 0.368 | |

| REN n.c.i FDI | 5.04 | 2.11 | 0.034 ** | REN→FDI |

| FDI n.c.i POP | 3.73 | 1.14 | 0.250 | |

| POP n.c.i FDI | 12.55 | 7.64 | 2 × 10−14 *** | POP→FDI |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oprea, S.-V.; Bâra, A.; Georgescu, I.A. Investments, Economics, Renewables and Population Versus Carbon Emissions in ASEAN and Larger Asian Countries: China, India and Pakistan. Sustainability 2025, 17, 6628. https://doi.org/10.3390/su17146628

Oprea S-V, Bâra A, Georgescu IA. Investments, Economics, Renewables and Population Versus Carbon Emissions in ASEAN and Larger Asian Countries: China, India and Pakistan. Sustainability. 2025; 17(14):6628. https://doi.org/10.3390/su17146628

Chicago/Turabian StyleOprea, Simona-Vasilica, Adela Bâra, and Irina Alexandra Georgescu. 2025. "Investments, Economics, Renewables and Population Versus Carbon Emissions in ASEAN and Larger Asian Countries: China, India and Pakistan" Sustainability 17, no. 14: 6628. https://doi.org/10.3390/su17146628

APA StyleOprea, S.-V., Bâra, A., & Georgescu, I. A. (2025). Investments, Economics, Renewables and Population Versus Carbon Emissions in ASEAN and Larger Asian Countries: China, India and Pakistan. Sustainability, 17(14), 6628. https://doi.org/10.3390/su17146628