1. Introduction

In the global quest to achieve a sustainable human existence, the goal of transitioning to renewable energy (RE) sources as a critical component. This central role is enshrined in the United Nations Sustainable Development Goals as SDG 7—“Affordable and clean energy” [

1]. In the last few decades, great strides have been made in addressing the technological barriers to RE adoption, and many assert that the lingering challenges are primarily social, economic, and political challenges [

2,

3,

4,

5], as well as issues related to the diffusion and cost of RE technologies [

6,

7].

While we agree that technological issues persist [

8] and socio-political barriers are many, we argue that another dimension of the transition to RE has received less attention, namely, the strategic economic behaviours states engage in—what we conceptualize here as geoeconomics—within RE markets and supply chains. Even assuming that social and economic barriers to an RE transition are overcome and that required technology becomes both pervasive and cost-effective, RE systems still require raw materials that are subject to supply constraints and the geopolitics of global trade [

9,

10,

11]. It is within this dimension that further challenges to RE transitions exist [

12,

13] and must be better understood. Thus, our study focused on this key set of RE transition challenges, with particular emphasis on the growing dominance in this dimension of The People’s Republic of China (hereafter, China).

China’s dominance in the RE market is well-documented [

14,

15]. However, a comprehensive framework is needed to understand how this dominance occurs, its purposes, and its outcomes. This study aims to demonstrate how China has positioned itself as a central and indispensable player in the RE market as a part of a broader geoeconomic strategy, distinct from conventional geopolitical manoeuvring. To achieve this, it will examine China’s objectives, its strategic positioning, and the implications for its relationship with the European Union (EU). The EU, being the second largest RE producer after China [

14], is a significant actor. In this study, RE refers specifically to solar and wind energy due to their prominence among cleaner energy sources [

15].

This study finds that China’s strategic positioning within global trade and investment networks enables it to exert significant control over critical elements of the RE market, similar to the role of chokepoints in geopolitics. However, unlike geopolitical chokepoints, which often rely on territorial control or military dominance, geoeconomic chokepoints involve economic instruments such as trade, investment, and institutional integration. By controlling key aspects of the RE market and addressing bottlenecks in trade and investment through institutional mechanisms, China is able to influence the global economic landscape surrounding RE development. The findings reveal that China’s approach does not focus on eliminating competitors (i.e., it is not a zero-sum game); instead, it seeks to assert market control through cooperation and interdependence. This creates a paradox where competition coexists with mutual dependencies, fostering market integration and the resilience of trade networks.

To analyse China’s dominance in the RE market, its goals, and methods, this study first draws a geoeconomics framework along with the relevant literature (

Section 2). This definition is then applied to the RE market, highlighting its distinction from RE geopolitics (

Section 3). Subsequently, how China has positioned itself as a central and indispensable player in the RE market is analysed (

Section 4). Specifically, the study examines how the EU case reflects China’s strategies (

Section 5). Finally, the study concludes with a synthesis of the findings (

Section 6). Both accessible statistical data and online policy documents are used in this research. In order to obtain these, English pages on publicly accessible websites of the relevant parties (China and the EU) were searched. These included government portals, state-affiliated media (e.g., Xinhuanet, DW), and institutions involved in energy governance (e.g., European Commission, China’s NEA). The selection was based on relevance to our framework, recency, and credibility. Additionally, statistical data and reports on the determinants of the relevant markets (solar and wind) and the position of the parties in these markets were collected from reliable international sources such as the International Energy Agency (IEA), Global Wind Energy Council (GWEC), and Eurostat. In addition to these types of primary sources, secondary sources such as academic articles, commentaries, and news were also used. The data obtained were refined to fit the framework of the study, that is, to reflect our definition of geoeconomic logic based on finding the interaction between economic power, territorial strategies, and institutional mechanisms. During the content analysis, the words, themes, and concepts in the primary sources are extracted from the most fundamental actions that countries can take—institutionalisation, trade, and investment—within the scope of our framework. This posits that states seek to strengthen or centre themselves by aligning with territorial and capital logics in their grand strategies (see

Section 2) and aim to create dependencies in others. While the reliance on English-language sources may limit access to some domestic narratives, particularly in the Chinese case, our focus remains on outward-facing strategies and international signalling, for which these sources are most relevant. The analysis helps to investigate the meanings of these actions in the RE market and explores their implications for sustainability.

2. Geoeconomics and State Power

The term geoeconomics is commonly associated with Luttwak’s works in the early 1990s [

16,

17]. Luttwak’s basic approach was that economic means started to replace traditional military means in the post-Cold War era. The “logic of conflict” was going to stay, but “with the methods of commerce” [

16] (p. 17). However, there are different interpretations [

18,

19,

20,

21] and there is “no widely shared” definition of geoeconomics (for a comprehensive categorization of the geoeconomics approaches, see [

22]) [

23,

24,

25]. Regarding its standpoint relative to geopolitics, geoeconomics “is often treated as a sub-variant of geopolitics” [

26] (p. 605). It can be seen as recasting rather than replacing geopolitical calculations [

27] (pp. 24–25), or as having a dialectical relationship with geopolitics, representing a “unity-in-difference” [

28] (p. 417), or helping geopolitical goals as strategies [

29], or dialectically intertwining with geopolitics [

30,

31].

Geoeconomics, in which geo-disciplines serve the national interest [

16], has also been interpreted as part of a much larger imperial strategy [

32]. While this conceptual debate can be traced back to the mid-1920s [

32], its contemporary form has been shaped by the US, which established a durable system benefiting other states as well [

18]. The post-Cold War resurgence of geoeconomics has been shaped by a “Washington-rooted provincialism” and repurposed as “a conceptual antidote to China’s ambition and the precariousness of American hegemony” [

32] (p. 11). Despite of post-US hegemony discussion, we remain in an era of US-led global economic integration, characterized by neoliberal capitalist conventions that have also transformed the foundations of global security, foreign policy, and statecraft [

33], and as such, Sinocentric order is also advocated as engaging dialectically with state and corporate power [

34]. (The current paradigm is still “transnational liberalism”, which is shaped by the interaction between finance and industrial interests. The revival of state capitalism or the rise of China does not present a significant challenge to the current paradigm).

The method used in this study is predicated on the idea that states will engage in strategic competition in two distinct domains: geopolitics and geoeconomics [

26]. Unlike geopolitics, which focuses primarily on military might or political influence (while this definition may be considered a limited conceptualization [

19,

20], it offers a practical strategic framework, as the focus of this study is on foreign and security policy rather than an analysis of the capitalist world economy. Furthermore, the shift to “strategic capitalism” fills the noted inadequacies in this conceptualization [

35]), geoeconomics emphasizes the distinct yet interconnected roles of economic leverage, resilience in supply chains, and technological innovation in shaping a nation’s global standing. Whereas geopolitical strategies may involve territorial defence or coercive diplomacy, geoeconomic strategies are more likely to revolve around shaping dependencies through non-military tools. This approach, which captures the relations between economic space and the national interest, allows us to understand how economic power subtly reshapes international influence without triggering costly counter-reactions in an interdependent world. This does not mean that geopolitics has disappeared. These two strategies are pursued in separate spheres.

Therefore, the logic of power is distinct in the economic and politico-military realms. (Contemporary geoeconomics places more emphasis on economic strength than military might, in contrast to mercantilist nations that used force to accomplish their commercial objectives. Examples of these include Portugal’s hegemony in the spice trade, British piracy against Spain, and US naval pressure on Japan. States no longer use force to enforce their trade policies [

36]). While the geopolitical logic pertains to the management and preservation of territorial integrity, the geoeconomic logic encompasses a broader array of economic practices, strategies, and ideas, operating both within territories and across borders [

28]. Eventually, both methods are ways of achieving grand strategies [

37]. Amid the interdependence found within the network of translocal relations, the quest for sovereignty persists [

38]. Although the global production network (GPN) is also closely intertwined with inter-firm relationships [

39], our focus will be on state strategies. States that try to make room for themselves here also contribute to the global financial and monetary systems. Efforts to expand influence/hegemony can be made by making moves across the territory.

Geoeconomics is “the geostrategic use of economic power” [

40] (p. 137), but its functioning also needs clarification. There is a distinction between the capitalist logic of power (accumulation and mobility of capital) and the territorial logic of power (configurations of power around the sovereign state). (Unlike Harvey, we do not focus on territorial power in geopolitics or its military-security aspects but instead apply territorial and capital logics as key spheres in understanding how geoeconomics operates. Therefore, further investigation is required to examine the systemic paradoxes (with respect to RE) generated by the interaction of territorial and capitalist logics) [

41]. While political, diplomatic, economic, and military strategies are employed by state apparatuses to serve territorial interests, capital continuously moves across and through spaces and borders in pursuit of ongoing accumulation, reflecting a more process-oriented approach [

42] (pp. 204–205). Within this framework, economic activities are as territorial as political ones, since powerful economic actors often aim to establish territorial monopolies, and many transnational corporations maintain strong national bases [

43] (p. 155). Sovereign power is maintained and reproduced through territoriality and the accumulation of capital [

44]. One domain is characterized by a political nature that is territorial, while another domain has an economic nature that is both territorial (e.g., state capitalism) and deterritorial (involving the accumulation of wealth and knowledge across borders). (Although this study concentrates on the international level rather than the transnational or domestic levels, the firm-level integration and its complexities [

45] or agent-centered model [

46] merit further exploration in future research. For insights on GPN related to solar technology, see Mulvaney [

47], and for wind technology, refer to Afewerki et al. [

48].) The objective is to expand influence (i.e., territorialize power) while acknowledging and sustaining the global market (i.e., capital continuum).

The stability of cooperation and interdependence is maintained through dominance established via institutionalized adaptation and arrangements. Integration in the production, technology, and institutional spheres connects local and global dimensions in geoeconomics [

23]. Institutions play a critical role in stabilizing and creating global and transnational interactions: “Institutions, broadly defined, affect the patterns of cooperation that emerge” [

49] (p. 9). Therefore, analysing geoeconomic policy must begin with institutionalized organization. However, institutions alone are not sufficient. Countries also require tools for geoeconomic centralization, such as trade, which enables mutual interaction, and investment, which provides unilateral leverage to enhance influence.

In this framework, China’s policies as a rising global economic power are important to analyse, particularly in light of critiques of geoeconomic othering and the broader debates on state capitalism [

34]. China uses the flows of trade, capital, and know-how to its advantage rather than assaulting the market and free trade as Luttwak would not expect [

50]. This study views China as a geoeconomic architect of a new market order, using economic tools to shape long-term interdependencies. It is not surprising for a country that aims to expand its sphere of influence as much as the US, because aligning with capital logic and integrating into it will eventually support territorial ambitions [

35] (p. 5). Chinese state capitalism serves as a unique geoeconomic tool enabling asymmetric relations [

24]. As a result of geoeconomic strategies, there has been the foundation of the Asian Infrastructure Investment Bank (AIIB), the Belt and Road Initiative (BRI), and many more bilateral and multilateral outbound financing instruments (it is argued that this produces a centrifugal force [

51]) [

52] (p. 166). According to this framework, we expect that China’s geoeconomic strategies in the RE market enhance its global influence by providing leverage in economic power, territorial strategies, and institutional mechanisms.

After presenting the geoeconomics literature, we will discuss China’s standing as a preeminent geoeconomics practitioner [

53]. Unlike Poon et al. [

54], who employed a geoeconomic lens to focus on oil/gas and solar energy trade to examine the shifting metageography of the Asia-Pacific in competition with the US, our analysis will explore China’s overall market dominance in solar and wind energy and specifically examine its relationship with the EU.

3. Re-Framing Renewable Energy: From Geopolitics to Geoeconomics

Renewables are not finite, and every area can access at least some renewable types, although some areas are luckier [

55]. They are abundant and variable rather than concentrated and exhaustible [

56]. This has led to a debate on the geopolitics of RE [

55,

57,

58,

59] or the new energy geopolitics [

60] or the geopolitics of energy system transformation [

61]. While the geography factor factors a little more in fossil fuels, the effect of geography (weather, topography, etc.) in RE production still exists, but technical-technological factors are more effective.

First, clean energy technologies need rare earth elements [

62]. For example, wind power depends on neodymium, dysprosium, samarium, praseodymium, etc., while solar PV depends on indium, gallium, tellurium, etc. The key problem with rare earth minerals and metals is that they are even more geographically concentrated than fossil fuels [

63]. Dependency on rare earths creates its own geopolitics. Second, while the fossil fuel market has an issue with transporting fuels, renewables have the matter of transporting electricity, which is constrained by the grid [

55]. This brings its own geopolitical problems [

64,

65], which has also reflected in the countries’ interconnected and interdependent projects, such as the “Asia Super Grid” (a proposed project aimed at integrating power grids across Northeast Asia to facilitate cross-border electricity trade and enhance renewable energy deployment, particularly from Mongolia’s wind resources), or the failed “Desertec” project (initially envisioned as a large-scale initiative to generate solar power in North Africa for export to Europe, which faced political, financial, and logistical challenges, ultimately leading to its failure). Third, there is an existent and potential risk related to cyber-security, which can affect electric grids [

64,

66]. Lastly, capital for investment and technology to produce energy from RE sources has become central in the geopolitics of renewables, as financial power creates new asymmetries in the energy market [

64]. Although renewable energy is often perceived as decentralized due to its distributed generation potential, key aspects, such as capital concentration, technology ownership, and supply chain control, remain highly centralized. The cost of technology, its accessibility, and its acceptance by various stakeholders are critical factors shaping the geopolitical landscape of renewables [

67].

However, certain experiences, such as tensions over technology transfer and the race to improve renewable energy capacity, should be analysed through a geoeconomic rather than geopolitical lens, as they pertain to economic influence and industrial competition rather than “conflict over renewable energy infrastructure” [

64] (p. 15). Instead of framing the issues of ownership, financing, and project management as merely turning “geopolitics into business politics” [

55] (p. 279), it is crucial to recognize that technological knowledge advances through investment and industrial development. This process not only expands a state’s international influence but also bolsters its territorial authority. As a result, “the use of asymmetric vulnerabilities as strategic leverage” would diminish [

36] (p. 4). States can further enhance their global and transnational presence through the strategic flow of information and capital, key components of geoeconomic strategies. Thus, the energy market transition heavily depends on investments and technological advancements, where rivalry is evident (i.e., territorial logic), but always contributes to the market indirectly (i.e., capital logic). This dynamic illustrates the interplay between territorial and capital logics, where states pursue industrial dominance and strategic autonomy while remaining embedded in the global market’s interdependent flow.

Global production and information networks have established intricate systems marked by asymmetric power dynamics, where the US and Western industrialized nations act as central hubs of connectivity. China is the only country with the potential and ambition to disrupt existing structures and establish itself as the centre of the global economy. This shift could have significant consequences for global energy transition and climate policy [

68]. In 2023, the “new three” (xin-sanyang) industries—solar cells, lithium batteries, and electric vehicles (EVs)—experienced significant growth (i.e., shaping a nation’s global stand), with exports surging by 30% compared to the previous year [

15]. This strong performance positioned these sectors as major contributors to China’s overall trade. In response to these initiatives, the US launched the Build Back Better Framework domestically, and advocated for the creation of a new infrastructure initiative known as Build Back Better World (B3W), aimed at countering China’s BRI with a strong emphasis on green technologies and infrastructure.

Sanctions, as geoeconomic measures [

40], can be imposed by one or multiple countries. However, unless they are collectively enforced by the entire global community, the targeted country will always have alternative options available. For example, after the oil sanctions imposed on Russia, China has reached a very high level of trade in the countries that buy Russian oil [

69]. Thus, sanctions emphasize the territorial aspect of geoeconomics; however, because their outcomes are relatively less effective, they will not be the focus of this study (for RE-related sanctions, refer to

Supplementary Materials).

Demonstrating how China has positioned itself as a central and indispensable player in the RE market will illustrate its geoeconomic strategy (

Section 4). This can be further elucidated through the examination of a significant case, such as its relationship with the EU (

Section 5).

4. The Rise of China in the Global Renewable Energy Market: Geoeconomic Implications

Harvey [

70] argues that capital’s success is heavily dependent on the ability to overcome spatial barriers, and the creation of stable infrastructures to support the movement of commodities, finance, and production. In geoeconomic terms, by building secure, state-backed infrastructures (such as manufacturing plants, supply chains, and energy networks), China has accelerated its ability to move capital and resources, creating a new form of economic leverage that strengthens its geopolitical influence. China’s rise in the RE market also highlights its mastery of “geographical mobility,” as its firms have expanded globally while benefiting from the state’s provision of fixed infrastructure costs, allowing them to reduce dependence on localized inputs and increase production efficiency.

There is a power shift to Asia, specifically to China and India, in the energy market [

65]. Cheaper costs (i.e., labour costs and relatively weak exchange rate to euro and dollar) for the construction of RE infrastructure, systems, or technology make them competitive in the market. For example, solar photovoltaics (PV) production costs in China are 60% lower than in the US and 50% lower than in Europe [

71]. Moreover, a considerable amount of government subsidies, which have been gained from a strong export position in the economic market, would be oriented toward renewable investments. China stands out not only in Asia but also in the world when it comes to investing in RE. In 2023, China commissioned an amount of solar PV equivalent to the entire global capacity added in 2022, while its wind energy additions increased by 66% year-on-year [

15]. Additionally, China alone achieved almost half of the global solar investment for in 2023 [

15]. China accounted for three-quarters of global clean technology manufacturing investment, down from 85% in 2022, as investment in the US and Europe accelerated (there is an oligopolistic market here; China, Europe, the US, and India in total have more than 80% of the global share) [

15]. In 2023, China reached a record high of 290 GW in new wind installations, which accounted for over 80% of the country’s newly installed power generation capacity and contributed more than half of the global added renewable capacity [

72]. By 2022, nine of the world’s top ten solar PV manufacturers were situated in China, with the remaining manufacturer located in the US. The US is currently concentrating on strengthening resilience across various domains, including PV deployment, the pricing of PV systems and components, PV manufacturing, and PV imports [

73].

From 2013 to 2021, China held 56% of cumulative Development Financing Institutions financing [

15] as part of capital logic within its territory. China’s ambitious attempts primarily aim to peak carbon emissions by 2030 and achieve carbon neutrality by 2060, aligning with the EU’s 2050 target and emphasizing the need for a “revolution in energy” [

74]. At the same time, China views these efforts as a means to strengthen its national power and expand its international influence, a goal explicitly stated by policymakers [

75]. Long-term investment and growth (capital logic) is part of a goal to gain a position in the international arena (territorial logic). China’s total RE capacity is 1,453,701 MW, compared to the EU’s 640,449 MW, and a global total of 3,864,522 MW by 2023 [

14].

In the renewable market, solar and wind energy received the most investment with a very serious margin relative to the others. Here, China is the world leader in wind and solar power generation by more than 40% of global production for each by 2023 [

14]. Related to this, China also has dominancy in the global supply chain as having the largest wind turbine manufacturers, and solar cell and module manufacturers. China’s share in all manufacturing stages of solar panel exceeds 80%, which leads to overconcentration. This is more than double China’s share of global PV demand [

76]. In 2021, the value of China’s solar PV exports exceeded USD 30 billion, accounting for nearly 7% of China’s trade surplus over the past five years [

76]. In this market, US leadership ended over a decade ago [

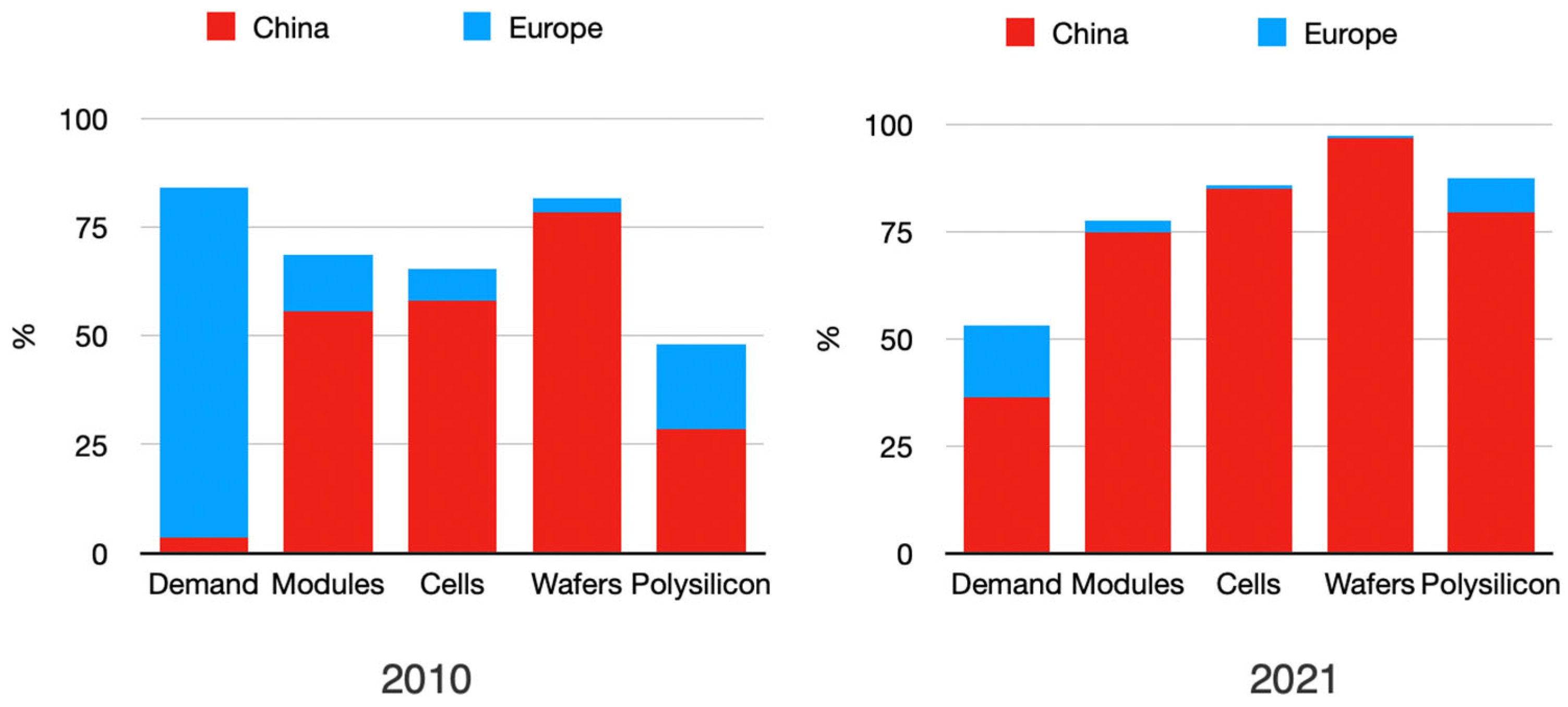

77]. When compared to 2010, China accounted for about 80% of global polysilicon production as of 2021, which was 28.6% in 2010 [

76]. The evolving balance over time reflects the strategic actions of the territorial power aiming to strengthen its capital influence.

China plans to install 58% of the new wind capacity, which is expected to potential through 2025 [

72]. Out of the 90 GW of new wind installations in 2022, nearly 57 GW was produced and assembled in China [

72]. However, wind market is more complex than the solar one since wind turbines can have up to 22 major components and 8000 subcomponents, which create more distributed supply chains and stronger local markets. (There is even an oligopoly (i.e., China, Europe, India, the US, and Brazil) market here (i.e., centralization within decentralization)) [

78]. However, there is still a wind turbine supply chain. China produces 80% of gearboxes, 82% of converters, 73% of generators, and 82% of castings for wind energy by 2023 [

72]. Global dependence on China in the RE sector, which is related to solar panels and wind turbine production, is high in the following areas: gearboxes, generators, power converters, castings, and rare earth materials.

China has strategically positioned itself at the heart of global free trade and investment, thereby driving the growth and flow of capital. In the realm of RE, China operates geoeconomically in a manner similar to a geopolitical chokepoint within a grand strategy. By exerting control over critical elements of the RE market and addressing key bottlenecks in trade and investment through institutional moves, China has become a pivotal force in global geoeconomics.

On the one hand, in the solar market, the Chinese fraction of global manufacturing capacity for polysilicon, ingots, wafers, and cells and modules is 80%, 97%, 85%, and 75%, respectively [

76]. Based on the manufacturing capacity under construction, China’s share of global polysilicon, ingot, and wafer production will soon reach almost 95% [

76]. Those silicon wafers that are produced in China are made into solar cells, which then are incorporated into modules, but China does not aim to have the entire production chain domestically. About 75% of the silicon solar cells incorporated into modules installed in the US are made by Chinese subsidiaries located in just three countries: Vietnam, Malaysia, and Thailand [

79]. (Antidumping and countervailing duties were applied in 2022 in response to this (see

Supplementary Materials)). On the other hand, in the wind market, nearly half of gearbox factories, which is one of the subcomponents of wind energy, are in China, while more than 60% of 2019 rare earth production of rare earth magnets, which is one of the processed materials of wind energy, was in China [

80]. This strong position in China’s solar and wind energy has so far been achieved with the support of the central government. While the government terminates the national subsidies after various trade war samples, provincial governments are still providing tax incentives and low-cost financing to RE projects [

81].

China exemplifies a model of economic and political engagement termed a “new type of international relations,” emphasizing the integration of global supply chains, trade, and political alliances [

82]. Our geoeconomic framework explains this orientation by illustrating how China achieves a distinct win (i.e., territorializing power) within a broader win-win context (i.e., capital logic). This investment and trade connectivity functions as a mechanism to consolidate power, not only within the BRI, a widely discussed case, but also across other regions, including the EU. Therefore, China is heading for a central role in the solar PV and wind turbine GPN, in a system of “spatially fragmented and discontinuously territorial” character of economic structure [

83] (p. 220). China also aims to reduce its dependence on imports while maintaining dominance in export markets across various sectors, particularly high-end industries. (For example, through its “Dual Circulation Strategy,” China aims to enhance domestic aggregate demand and promote high-quality development across various sectors, particularly in less prosperous areas of the country. While continuing to maintain its presence in international export markets, the strategy places greater emphasis on strengthening domestic production and consumption rather than focusing solely on global market dominance). In return, the US now has increasing concerns about resilience in global supply chains [

68].

5. EU–China Relations: Cooperation with Dominance and Competition Without a Zero-Sum Game

“China needs the EU as much as the EU needs China” [

84] (p. 6).

“We need to focus on de-risk—not decouple.” [

85].

The EU and US follow China (31.1%) in RE production by 12.8% and 11.4% of the global share, respectively [

14]. The EU is the second-largest wind, by 20.1% of the global share, and solar, 16.3% of the global share, producer following China in 2023 [

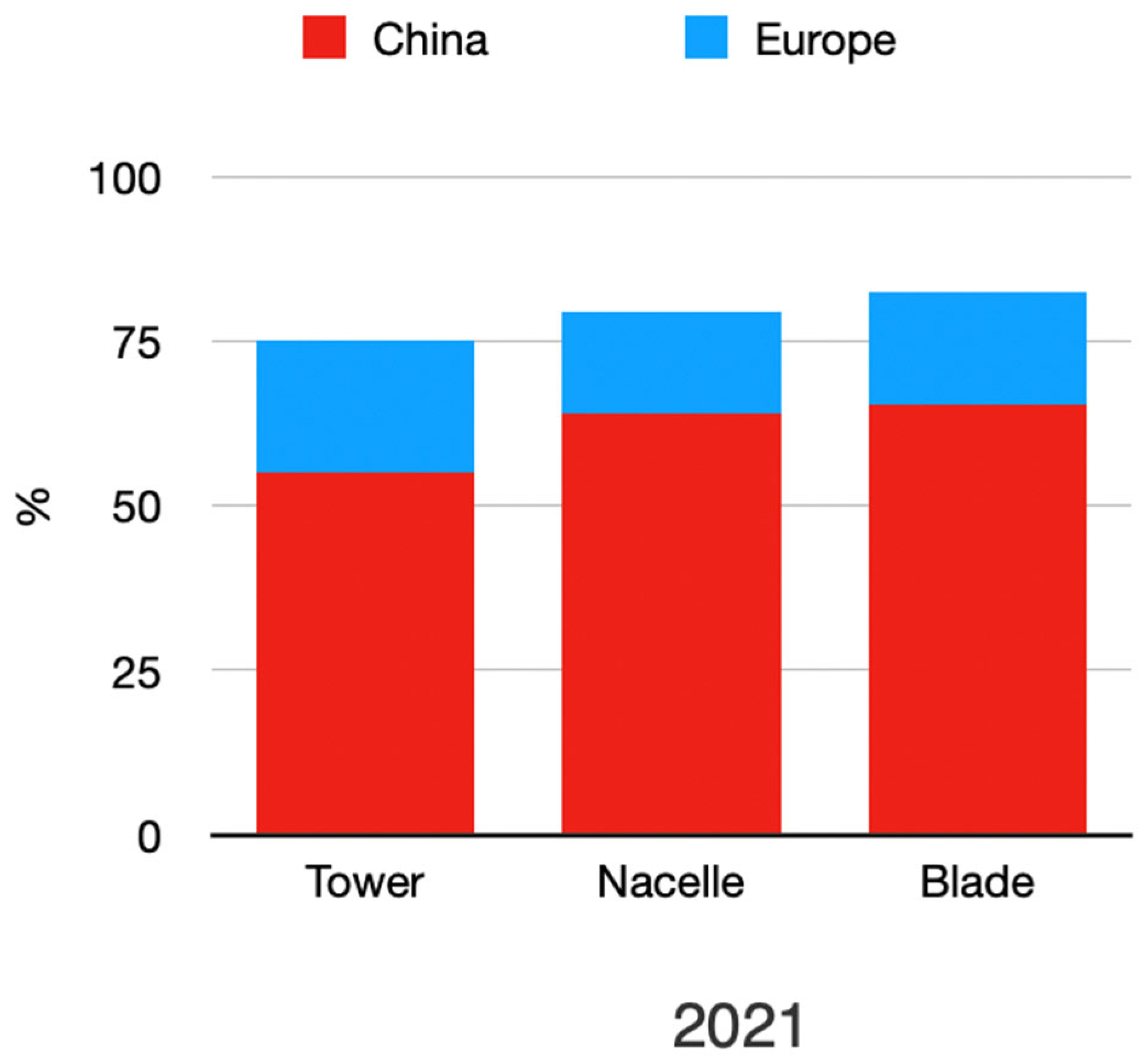

14]. The EU and China are the two largest RE markets. Europe has the second-largest wind turbine manufacturing capacity by around 18% following China [

72]. However, China serves as the primary manufacturing base for wind turbine components and is a global export hub for generators, blades, and gearboxes. Meanwhile, Europe ranks as the second-largest global supplier of generators and blades, with the US following closely behind [

86].

While the EU is a pertinent example of the area where China is seeking to expand its influence, the analysis should encompass the relevant spheres of geoeconomics. There will be three levels of analysis: global institutionalized regimes (global energy and environmental governance), trade, and investment. The first level addresses the formation and stability of the global RE market and narrative (i.e., capital logic). The second and third levels focus on how states can assert their own territorial logic through trade and investment. This division reflects the interplay of capital logic and territorial logic as the components of geoeconomics.

5.1. Climate Change Mitigation and Global Governance

Bilateral energy relations of the sides started in 1994 with the EU–China Energy Dialogue. The EU–China Dialogue on Energy and Transport Strategies kept up the good momentum in 2005. Later in the process, the Chinese National Energy Administration, which later transformed into the National Energy Commission in 2010, as an EU counterpart of the dialogues was founded in 2008, while the EU adopted its first package of climate and energy measures, the so-called “20/20/20 targets”, in 2008. Then, the Europe–China Clean Energy Centre (EC2) was launched to assist China’s efforts to develop a low-carbon and more energy-efficient economy. Big steps in bilateral energy relations and separate parallel developments in each country have led to a much higher level of cooperation as the fourth energy dialogue was held at the Minister level for the first time in 2010. The year 2012 was the breakthrough since both sides signed the Joint Declaration on Energy Security [

87]. It was followed by the mention of strategic partnership on the roadmap for “cooperation” in 2013 [

88]. Energy was the second most important area of cooperation between China and the EU [

89]. This progress is driven by shared energy security concerns, the need for low-carbon transitions, and mutual goals in global governance and climate leadership.

Firstly, both sides have

energy security issues. They still rely on fossil fuel imports [

90]. On China’s side, more than 70% of its imported oil comes through the Strait of Malacca, a geopolitical chokepoint. On the EU side, the EU still relies on fossil fuel imports and there is not a strong diversification. By 2021, EU-27’s 44% of gas imports, 25.3% of crude oil and LNG imports, and 52.5% of hard coal imports came from Russia [

91]. Thus, the low-carbon transition is a necessity because there are also environmental consequences of fossil fuels consumption.

Secondly, the EU targets to export its market rules to other countries and internationalize its norms via bilateral and multilateral cooperation. Global governance and working in a multilateral context are part of this. It can be observed in

climate change and the

global liberal market spheres. There is a reality of climate change, and the EU has been a global leader in tackling it for many years. Additionally, the EU has been a strong promoter of the global trade regime, such as the creation of the World Trade Organization (WTO), in which China has also become a participant [

92]. The EU is aware of China’s increasing power as “a beneficiary of the rules-based international order” [

84] (p. 13) and seeks “to pursue dialogues with China on standards, regulation and conformity assessment procedures in key sectors” [

84] (p. 8). The EU’s approach to China has made an impact as the Chinese government renewed the emphasis on “going global”, which means “seeking a bigger role and exerting greater influence on an evolving system of global governance” [

84] (p. 20). China is expected to contribute “to the sustainable development of the global energy system” by engaging international institutions [

93]. The EU side attempts to persuade China to emulate EU policies and norms such as the Clean Energy Package [

94]. Such engagement with international institutions proves that states utilize these mechanisms to advance their interests.

In return, “China has transitioned from being a recipient to a key provider of development assistance, marking its growing influence as a lender and donor on the international stage” [

95]. It has actively engaged in negotiations under the United Nations Framework Convention on Climate Change (UNFCCC). The Paris Agreement, which is part of the convention, provides a clear example because of the US policymaking’s rapid shifts. In contrast to the US’s zigzag approach (e.g., engaging with the Paris Agreement, withdrawing, later reengaging, and then re-withdrawing), the EU and China reaffirmed their commitment to the agreement throughout the negotiation and implementation process [

96]. The leading environmentalist role of China, which is responsible for one-third of global emissions as the largest carbon emitter, has been welcomed by the EU side [

84]. China was seen as “a strategic partner on climate change and the clean energy transition” [

97]. Subsequently, the US and China have indeed begun to collaborate on climate issues [

98].

From the perspective of energy transition in relation to climate change, China’s announced “China Standard 2035”, originally intended for release at the start of 2021, aims to establish a regulatory framework to support its geoeconomically centralised role. While this process may not be primarily industry-driven as it is in the EU and US, it introduces a new norm-setting initiative, including “international green rules and standards,” encouraging Chinese overseas investments to exceed the regulations of host countries [

99] (p. 5). This pursuit of norm-setting is a key aspect of China’s geoeconomic strategy.

5.2. Trade

While the EU accounted for 26% of the world’s total manufacturing in 2000, this figure dropped to 21% by 2014. During the same period, China’s share surged from 7% to 25% [

100]. Additionally, the EU is concerned about losing capacity and leadership in key future technologies [

101]. Despite these concerns, both sides recognize each other’s capabilities and potential. The EU and China are two of the largest traders globally: the EU is China’s biggest trading partner, while China is the EU’s second-largest trading partner [

97]. However, their trade relations are marked by a growing bilateral deficit for the EU, which has been increasing year-on-year, indicating the need for careful management of this economic partnership.

Related to renewables, there are also strong trade relations between China and the EU. The EU’s institutional attempts which include finance and investment have paid off in solar and wind energy production. However, the EU imported 98% of its installed solar PV modules from China, while 59% of its wind turbine imports from China in 2023 [

102]. While EU had around EUR 21.803 billion trade deficit of panels, EUR 1.2 billion trade surplus of wind turbines made in 2021 (The majority of wind turbine buyers are the UK and US by 42% and 15%, respectively). The reason for such a large market difference between these two energy sources is that solar energy is the most promising whereas wind energy is the most mature one [

67]. The war in Ukraine has dramatically impacted EU–China trade related to renewables. In response to the Russian invasion of Ukraine (this also demonstrates that geopolitics cannot be supplanted by geoeconomics; rather, both can coexist concurrently), many EU countries announced plans to accelerate the deployment of renewables to reduce their dependence on Russian natural gas imports [

81]. However, intensified RE focus after the war has increased the imports from China. The amount of solar PV panels the EU imports from China has more than tripled since the war began [

102]. This increase in EU reliance on China illustrates the growing interdependence and China’s strategic positioning within the global RE market.

China provides around 80–90% of the world’s production of rare earth elements. China now provides 98% of the EU’s supply of rare earth elements [

103]. Thus, even if the EU prefers manufacturing its own wind turbines or solar PV panels, there will be a necessity for imports. For example, some elements, such as praseodymium, samarium, and neodymium, which are needed for wind power plants, reflect import dependency on China by 86%, 80%, and 80%, respectively [

104]. Currently, Europe holds less than 0.2% of global PV panel production capacities [

105] so the EU is not self-sufficient yet (see

Figure 1). Europe is the only actor that can balance China in wind energy production (see

Figure 2). Thus, China, which has become the chokepoint of the global RE market, clearly reflects this situation in its trade with the most powerful and ambitious actor of this market. While the transformation of the energy market, led by the EU as a major pioneer, is creating new interdependencies, the EU continues to rely on external sources and a limited number of actors, similar to its dependence on fossil fuels [

106]. In the changing market, the emphasis on reserves and access to fossil fuel energy resources has shifted to obtaining critical minerals. This shift is propelled by non-military strategies, investments in technology and innovation, and efforts to strengthen a nation’s role in the global market through enhanced integration and movement toward a central position. Thus, China’s has established “territorial monopoly”.

The trade relations between the sides have not always been peaceful. The European Commission [

108] found that Chinese companies were selling solar panels to Europe at nearly half their normal market value and receiving illegal subsidies. This led to the proposal of a phased anti-dumping tariff on solar PV panels imported from China in 2013 (the EU ended trade controls on solar power from China in 2018). A similar situation occurred with wind towers from China in 2021 [

109] (see

Supplementary Materials). The EU is becoming increasingly reliant on China in its efforts to cut greenhouse gas emissions and transition to green technologies, which is becoming a “problematic” issue for the future, according to the EU’s climate chief [

110]. The EU realizes that “the future of our [the EU’s] clean tech industry has to be made in Europe” [

111]. The EU is closely monitoring China’s “new development philosophy” of 2022, especially its transition from “great international circulation” to “dual circulation,” which emphasizes self-reliance while simultaneously establishing dependencies on China [

112].

China’s integration into the global RE market through institutional frameworks positions it as the hub of trade in this sector, driven by factors such as inexpensive labour and state-centred planning. This central role is evident even in its trade relations with the next largest actor. China does not rely on the EU but rather makes the EU dependent on itself as part of its geoeconomic strategy. It has created a distinct win (i.e., territorialization of economic power) within a broader win-win scenario. The industrial-technological grand strategy aims to target not only the Indo-Pacific and Middle East regions but also the US allies. The strategy of engaging with global norms and their creators is bolstered by these regional reflections.

5.3. Investment

There is an indirect push for solar and wind power by Beijing because the government still must prioritize fossil fuels, but two policy banks of China, CDB and CHEXIM, have impacted finance solar and wind power overseas. (One of the activities enhancing counter-resilience in the US is the mandate given by Congress to the US Export-Import Bank (EXIM) for its “China and Transformational Exports Program”). China, as official development finance (ODF) for energy providers, has included solar and wind energy in investments. In 2023, China added as much solar PV capacity as the global total in 2022, while its wind energy capacity grew by 66% compared to the previous year [

15]. Including solar and wind energy in investments allows China to achieve dual objectives: enhancing energy production in developing countries (contributing to global energy governance) and promoting environmental security (supporting global environmental governance) by facilitating the generation of cleaner energy. This strategy serves to reinforce China’s own territorial logic within the capital logic and extend it further. Currently, Beijing co-chairs a working group on setting global sustainable financial standards within the EU-led International Platform on Sustainable Finance and is a signatory of the International Energy Charter (investment, trade, and transit). This demonstrates China’s use of investment to further its geoeconomic influence.

However, the EU and China also have efforts to enter each other’s markets. Despite halting national-level offshore wind subsidies in early 2023, China’s local governments are stepping in to bridge the funding shortfall [

112] (pp. 49–50). Amid rising material costs and high energy prices, EU-based RE companies are experiencing financial challenges, while the leading contenders for entering this market are state-backed Chinese firms such as Goldwind’s becoming majority owner of Vensys. On the other hand, EU companies continue to face discrimination in the Chinese market [

113] such as forced technology transfer, or cybersecurity and data privacy regulations. The competitive landscape and the challenges faced by EU companies in the Chinese market, echoing the themes of competition and interdependence.

Europe captured more Chinese ODF than other regions for solar and wind projects by 43.7% of total funds [

114]. Bulgaria, Italy (the first EU country to officially join the BRI), and Romania have been leading receivers of Chinese funds to comply with the Renewable Energy Directive 2009/28/EC and the EU 2020 Energy strategy, which later transformed into the 2030 strategy. However, it is important to consider the impact of the European debt crisis, which began in 2008. Between 2010 and the end of 2012, the volume of Chinese investments in the EU increased fourfold, rising from EUR 6 billion to EUR 27 billion. By Q1 2024, Chinese FDI (Foreign Direct Investment) stocks in the EU-27 reached EUR 143 billion [

113]. The key sectors are automotive, health and biotech, and information and communication technology recently. Greenfield investments dominated China’s FDI in 2022 and 2023, replacing mergers and acquisitions as the primary mode. The fact that investment in RE technology is costly for EU-headquartered companies has enabled Chinese solar (Jinko Solar) and wind energy (Goldwind and Envision Energy) companies to become competitive in the EU market. This influx of Chinese investment into the EU reflects the growing economic interdependence and the “territorialization of power” through capital flows.

Where China provides finance cannot only be limited to debtor states. There is also cooperation established with Central and Eastern European countries (CEECs), as part of broader geoeconomic strategy of expanding influence, started in 2012. The number of projects initiated in these countries in the solar and wind fields alone is 21 [

115]. How useful CEECs will be is the subject of another study, but it is certain that China, which sees the framework as a part of the BRI, attaches importance to this as well. While it is not easy for central governments to take a Chinese-backed position while they have responsibilities to the EU, local governments are much more accessible to China [

116]. There are notable exceptions, such as Hungary, which is committed to reducing emissions and adhering to EU green energy mandates. The stances of CEEC countries towards China have varied along a spectrum, ranging from China-friendly to Sino-sceptical, largely due to China’s geoeconomic activities [

115]. Additionally, the Chinese firm CATL, the world’s largest car battery manufacturer, announced plans to build Europe’s largest gigafactory in Debrecen as part of a EUR 7.3 billion project [

117]. While the EU is trying to keep its relations with China strong, it states that it recognizes China’s “One China” policy, but at the same time requests to be treated “as a whole” [

84]. The unfair advantage given to China’s subsidiaries in projects in Spain, Greece, France, Romania, and Bulgaria caused the EU to open an investigation in 2024.

China’s geoeconomic policies endow it with significant power in the global market, including the RE sector. This power is leveraged by China as a one-way economic advantage over the EU, which remains largely reactive to the centrifugal forces exerted by China. Unlike global chokepoints in trade, the investment sphere directly reflects the impact of geoeconomic instruments in bilateral relations. Such outcomes, however, cannot be achieved without institutional initiatives or investments in technological information.

6. Conclusions

By adapting David Harvey’s concepts of territorial and capital logics, this study introduces a novel framework to interpret geoeconomics as the structural use of economic power by states, not merely as an instrument of geopolitical rivalry. States do not act with the motivation to eliminate the other in geoeconomics, which is the opposite picture provided by a geopolitics approach, but act with the motivation of controlling the market. There is no zero-sum game here because actors’ dependencies on each other support integration that would create a trade web, which works for everyone; however, there is also a reality of competition either with controlled competition [

118] or managed competition [

119] reflections. In other words, geoeconomics is the reflection of capitalist logic among nation-states; this competition of rivals supports international trade, money flow, and production because they behave as entrepreneurs. They aim to compete among themselves (in bilateral relations) and get ahead of each other as nation-states, without harming the market. The sanctions they use against each other as economic force do not deal a blow to the global trade network. Over time, this market logic produces a form of systemic power that expands and internationalizes through territorial and institutional mechanisms. Therefore, this study offers a framework to explain the economic instruments and objectives of states, their role within grand strategies, and the connection between the RE market and International Relations—independently of conflict and zero-sum logic—highlighting the limitations of a purely geopolitical perspective in fully understanding RE dynamics (see

Section 3).

This study finds that China has strategically positioned itself at the centre of the global RE market, becoming a pivotal player in shaping its future. By dominating the RE sector, China aims to solidify its economic power, viewing it as key to long-term strategic growth. China’s geoeconomic strategies expand its market control and challenge the EU’s authority, complicating bilateral relations and policymaking within the EU. Through investment and financial support, China increases its influence globally, turning its production capacity into a global trade network hub. This one-way interaction allows China to leverage geoeconomic strategies without eliminating competitors. Thus, China does not adopt the neoliberal “world policeman” role like the US [

18] (p. 109), which focuses on creating “commercial opportunities” within a global economic network. Instead, China pursues a grand strategy centred around shaping its “geographical pivots” policy, similar to the strategic approach seen in US policies. Therefore, unlike the framework proposed by Wigell and Vihma [

26], the aim is not simply for the non-West to unbalance the West, but rather for China to position itself at the centre. This demonstrates that the RE market cannot be analysed in isolation from International Relations and Political Economy concepts, nor can it be adequately explained solely through a geopolitical lens. In this way, the analysis has identified what China has undertaken and accomplished in pursuit of its goals and objectives as a national power through economic influence, territorial strategies, and institutional mechanisms.

The “cooperation–competition paradox” embedded in China’s approach has a dual effect on global sustainability: it fosters interdependence that could stabilize renewable energy deployment but also triggers defensive geoeconomic reactions from other powers, which may fragment global supply chains. This tension creates both opportunities and vulnerabilities for global sustainability goals. To mitigate this paradox and enhance the benefits, policymakers should pursue three complementary strategies: (1) strengthen global regulatory institutions such as the WTO to enforce fair and transparent rules related to the RE market such as critical minerals; (2) encourage multilateral coordination to ensure supply chain sustainability without separated regional blocs; and (3) support Global South countries in building institutional capacity and technological capabilities to diversify their partnerships and enhance local sustainability outcomes and inputs (e.g., foreign energy relations).

This analysis employed a structural political economy approach that integrates geoeconomic logics with insights from territorial and capital strategies. As outlined in the Introduction, this conceptual framework was not applied to measure state behaviour quantitatively, but to interpret strategic positioning and economic influence through a theoretically informed, qualitative lens. When examining the dynamics of international institutional mechanisms, mutual trade, and investment, framed as the basic components of the RE market, the method used has proven useful in understanding the following: by analysing the reports of both parties, it is possible to observe how they interpret each other and assess their effectiveness and influence in international RE cooperation (institutions); how they enhance their strategic positioning and construct mutual dependencies within a broader geoeconomic strategy (trade); and how, in the course of competition, they avoid open conflict while perceiving each other not as allies but as interdependent actors (investment).

Rather than framing the current transition in terms of post-US hegemony, this study highlights a structural divergence in the geoeconomic strategies of the US, China, and the EU. The US has pursued a dual logic: expanding and liberalizing its global trade and finance networks while simultaneously seeking national political advantages through military interventions [

120]. In contrast, aside from the recent unsafe military encounters initiated by China in the Indo-Pacific region [

121], there have been no significant military actions observed yet. Currently, China’s dual focus on national and transnational interests appears to align closely, leading to a more integrated approach. This alignment has prompted the US to transition from an expansionist role to one that emphasizes resilience in its geoeconomic strategies. This shift has drawn attention in the literature as a geoeconomic recalibration intended to preserve influence through industrial policy, trade barriers, and nearshoring strategies [

4,

6,

35,

40], signalling an ideological and strategic divergence in response to China’s rise. Moreover, the EU, as a promoter of global liberal norms [

122] in areas such as the energy market and climate change, and a US ally, has shown reluctance to distance itself from China. This dynamic reveals that China’s geoeconomic strategy is not just effective but also reshapes the norms and institutions of international political economy itself. Looking ahead, dependency on Chinese supply chains, particularly for critical minerals and low-cost technologies, may persist unless substantial diversification strategies are implemented. The current trend indicates a growing asymmetry: while both actors expand their RE capacity, China’s upstream dominance may deepen, whereas the EU’s strategic autonomy hinges on reducing import dependency and investing in regional supply resilience. China accounts for 60% of the expansion in global RE capacity to 2030 [

123]. This is also reflected in global trade. For example, China is expected to maintain more than 80% of global manufacturing capacity for all PV manufacturing segments by 2030 [

123] (p. 10).

China’s positioning in the market has prompted the US to respond with federal policies such as the Investment Tax Credit (ITC) and the Inflation Reduction Act (IRA) to strengthen its own position. However, while international measures have mostly focused on sanctions until recently, the clearest emphasis on access to critical minerals emerged during Donald Trump’s second term. At the same time, Global South countries—particularly resource-rich states in Africa and Latin America—have begun to reassess their dependencies on China’s demand and investment by diversifying partnerships [

124,

125]. This competition may cause geopolitical tensions, potentially harming global sustainability policies. Nonetheless, competitive efforts aligned with national interests, as long as they do not lead to political-military conflicts, could contribute to global sustainability efforts. The WTO, whose significance is in decline, could play a role in preventing sanctions and self-help decisions in national RE policies. An international organization such as the WTO can be revitalised to ensure free and fair international trade.

Future research can expand upon this framework (adaptation of territorial and capital logics, inspired by Harvey, to an approach that defines geoeconomics as a geostrategic use of economic power) by examining the policies of transnational and multinational corporations, and how their activities shape the RE market in the countries with which they engage.

The framework of this study has addressed the geoeconomic dynamics of the RE market through China–EU relations, but further research is required. This study has focused solely on national policies and the positioning of countries. However, further investigation is needed into the relationships that Chinese state-owned and private companies have established in other countries within this market—particularly in the EU and critical mineral-rich countries of the Global South that supply essential minerals to China—and how these relationships influence the energy market and policies, and, more importantly, sustainability efforts in these countries.