Company-Level Factors of Non-Financial Reporting Quality under a Mandatory Regime: A Systematic Review of Empirical Evidence in the European Union

Abstract

:1. Introduction

2. Literature Review

- We specifically analyze the impact of Directive 2014/95/EU (NFRD) because this represents the mandatory regime in the EU regarding non-financial reporting;

- We address non-financial reporting quality in relation to company-level factors in a mandatory setting, starting with 2017 as the year when the NFRD entered into force;

- Our proposed thematic categories refer to company size, financial performance, corporate governance, market performance, and sustainability performance;

- The research objective is novel, as we focus on the relationship between company-level factors and non-financial reporting quality. Based on the results highlighted in Table 1, there are no previous studies that aim to address the same research objective as our study;

- We focus on European Union countries, under a mandatory and uniform regime. This approach ensures maximum comparability of the reviewed aspects. This is because reporting frameworks and regulatory requirements may differ significantly between countries on different continents;

- We used a consistent mapping of company-level variables to ensure the comparability of the reviewed studies.

| Study | Research Objective | Review Method | Countries/Continents | Years Used in Sample | Non-Financial Reporting Frameworks Analyzed | Journal (IF 2022) |

|---|---|---|---|---|---|---|

| Benvenuto et al. (2023) [14] | Developing a unitary and compact understanding of the concept of Sustainability Reporting in the multi-theory context | Systematic literature review (qualitative) | Not mentioned | Not mentioned. The focus is on corporate sustainability since 2010. | Not mentioned. Some studies included in the sample are based on the Global Reporting Initiative Standards | Heliyon (IF = 4) |

| Crous et al. (2022) [32] | Comparison between the impact of the different types of reporting and financial sustainability | Systematic literature review (qualitative), thematic analysis, inter-textual coherence process, synthesized coherence | Not mentioned | 2015–2020 | Integrated Reporting Framework, Global Reporting Initiative Standards ESG reporting—not mentioning the specific frameworks | EuroMed Journal of Business (IF = 5.2) |

| Di Vaio et al. (2020) [34] | Investigation of the role of human resources in non-financial reporting | Systematic literature review, bibliometric analysis, content analysis | Not mentioned | 2013–2019 | EU Directive 2014/95/EU, Sustainable Development Goals | Journal of Cleaner Production (IF = 11.1) |

| Dragomir and Dumitru (2023) [18] | Systematize the results of studies on the relationship between corporate governance and integrated reporting quality | Meta-analysis | Not mentioned | 2015–2022 | Integrated Reporting Framework | Meditari Accountancy Research (IF = 3.5) |

| Fiandrino et al. (2022) [23] | Analyze, classify, and interpret different insights that emerged during the consultation process of NFRD, on the disclosure quality of non-financial information | Integrative literature review, content analysis, critical analysis (qualitative) | Not mentioned | 2016–2021 | EU Directive 2014/95/EU | Journal of Applied Accounting Research (IF = 3) |

| Manes-Rossi et al. (2020) [35] | Understanding of different reporting formats that public sector organizations adopt to report different dimensions of performance to internal and external stakeholders | Structured literature review, comprehensive review, manual coding, critical analysis | Oceania, North America, South America, Africa, Asia, UK, and other European countries included but not specified | 2002–2019 | GRI Standards, Integrated Reporting Framework | Journal of Public Budgeting, Accounting & Financial Management (IF = 3.1) |

| Opferkuch et al. (2021) [36] | Exploring how companies could include circular economy within their corporate sustainability reports | Systematic literature review, content analysis, cross-referencing methodology | Not mentioned | 2012–2020 | Guidelines on non-financial reporting (2017/C215/01)—linked to EU Directive 2014/95/EU, CDP, Climate Disclosure Standards Board (CDSB), GRI Standards, Integrated Reporting Framework | Business Strategy and the Environment (IF = 13.4) |

| Velte and Stawinoga (2017) [12] | Determining the factors that contribute to integrated reporting implementation and quality | Systematic literature review (qualitative) | South Africa, Australia, USA, Denmark, Netherlands, Italy, Malawi, New Zealand, UK | 2012–2016 | GRI Standards, Integrated Reporting framework | Journal of Management Control (IF = 3.3) |

| Velte and Stawinoga (2020) [13] | Influence of corporate social responsibility (CSR) and chief sustainability officer on CSR reporting, CSR assurance and CSR performance | Systematic analysis, vote counting, content analysis, comprehensive analysis | Australia, USA, Canada, China, Malaysia, India, Pakistan, Turkey, UK, Spain, France, Germany, Italy, Netherlands, and other European countries included but not specified | Pre-2017—with 47 out of 48 studies (one starts with 1997) and 2017 (only one study out of 48) | Not mentioned | Journal of Management Control (IF = 3.3) |

| Velte (2023) [15] | Analysis of the impact of sustainable board governance on corporate social responsibility in the European capital market | Structured and integrative literature review, vote counting, content-analysis, comprehensive analysis | France, Germany, Italy, Poland, Spain, Sweden, UK, and other European countries included but not specified | 2009, 2011, 2013, 2015–2021 | EU Green Deal | Journal of Global Responsibility (IF = 1.6) |

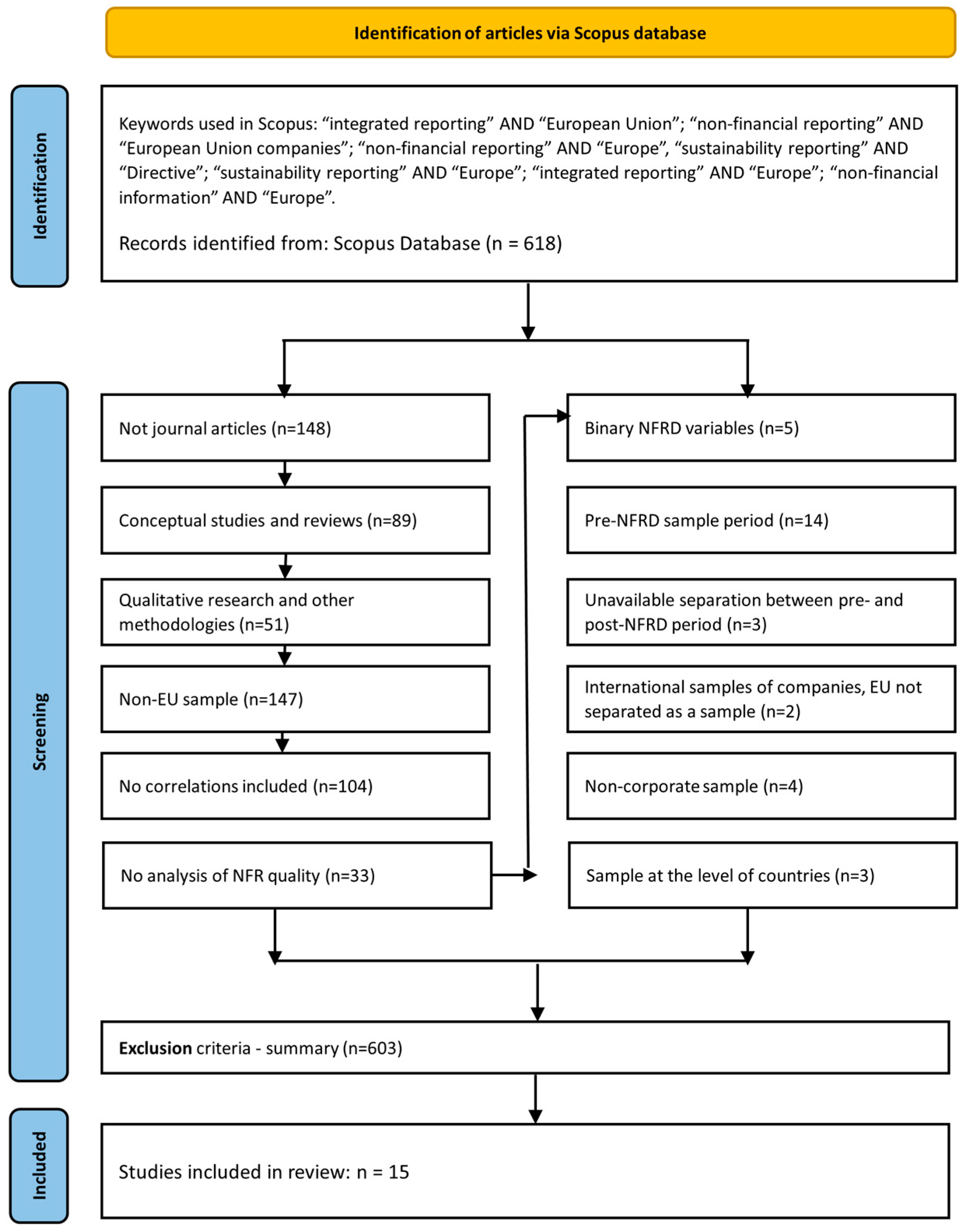

3. Methodology

3.1. Sample Selection

- Articles investigating the variable “non-financial reporting quality” (NFRQ) in correlation with other variables, also including a correlation matrix;

- Articles describing the NFRQ variable used in the analysis, ensuring alignment with our research objectives;

- Articles relying on content analysis of annual reports to measure NFRQ as a scale variable (not a binary variable);

- The sample referring exclusively to EU countries.

- Articles discussing countries that are not part of the EU;

- Articles categorized as critical reviews, systematic reviews, conceptual frameworks, grounded theories, theoretical explorations;

- Articles with qualitative methodologies such as case studies, comparative studies, exploratory studies, legal studies, interpretative approaches, historical analysis, interviews, regulatory analysis;

- Samples that do not focus on companies located in EU countries. For the UK, we accounted for its EU membership until 2019, considering the three-year application period of the directive (2017–2019);

- Sample periods before 2017 (the date of entering into force of the NFRD) or sample period not clearly divided;

- Samples of universities or governmental organizations.

3.2. Data Selection and Analysis

| Study | Theories | Companies/Firm-Year Obs. | Countries | Years Used in Sample | NFRQ Variable with Min–Max Range in Brackets | NFRQ Source | In Correlation with (Abbrev. in Table 3) |

|---|---|---|---|---|---|---|---|

| A1. Beretta et al. (2023) [39] | IMT, IIT | 29/116 | Italy | 2017–2020 | ESG disclosure Score (0–0.2987): percentage of the number of text units dedicated to ESG issues over the total number of text units | Companies’ websites | ABOD, BSZ, FBOD, SZTA |

| A2. Carmo and Ribeiro (2022) [40] | IT | 34/34 | Portugal | 2016–2018 | NFII2018 (6–33): non-Financial Information Index in 2018 | Sustainability Reports and Integrated Reports | SZTA |

| A3. Cosma et al. (2022) [38] | LT, ST | 101/not available | Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Hungary, Portugal, Spain, Sweden, United Kingdom | 2018 | CC score (1–11): Climate Change score based on the TCFD document with 11 areas relating to the topic that companies should make public as described in the Appendix | Websites | BIND, BSZ, EPI, FBOD, ROE, SCO, SZE |

| A4. Dragomir et al. (2022) [41] | AT, ST | 63/63 | Romania | 2018 | NFRQ (8–114): non-financial reporting quality | Annual reports | BCR, CRR, DTER, GOV, QCR, SO, SZE, TOVR |

| A5. Gerwing et al. (2022) [42] | AT | 220/540 | Germany | 2017 | MSRQ (26–65): mandatory sustainability reporting quality which includes: reporting format, cross-references, framework, business model, non-financial aspects, and materiality analysis | Standalone sustainability reports, annual reports, UNGC, Thomson Reuters DataStream | ASU, FSBD, FXBD, LTA, ROA, SCO, SREM, SZTA, VSE |

| A6. Hategan et al. (2021) [43] | ST | 758, 751, 754/758, 751, 754 | Romania | 2017–2019 | S (1–5): score that measures the transparency of non-financial information reports | listefirme.ro website, official website of the Romanian Ministry of Public Finance | FO, LST, PO, ROA, ROE, SZE |

| A7. Loprevite et al. (2020) [44] | ST | 132/44 | Italy | 2016–2018 | Di 2018 (not available): overall Disclosure Index 2018, examining the sustainability reports based on GRI guidelines | Sustainability reports | IES, SZTA |

| A8. Mihai and Aleca (2023) [45] | NI | 500/96 | Romania | 2021 | T (6–74): sustainability report score, computed only for separate sustainability reports based on the scores given to each specific GRI index | Topfirme.ro platform, sustainability reports | EXP, IES, INC, NP |

| A9. Mion and Loza Adaui (2019) [46] | NI | 66/132 | Italy, Germany | 2017 | SRQ index (0–20): sustainability reporting quality index | Reports published before and after the implementation of the directive | GRI, ROA, SZTA |

| A10. Moraru et al. (2020) [47] | NI | 34/34 | Romania | 2017 | OHS Global Reporting Index (15–100): Occupational Health and Safety Global Reporting Index computed based on the content of customized standard GRI 403—Occupational Health and Safety, version 2018 | Websites, non-financial reports, Sustainability reports publicly available | INC, LTA, ROE |

| A11. Păun et al. (2020) [48] | NI | 35/35 | Romania | 2017 | OHS Global Reporting Index (15–100): Occupational Health and Safety Global Reporting Index computed based on the content of standard GRI 403—Occupational Health and Safety, version 2018. | Websites, non-financial reports, Sustainability reports publicly available | MS, SZE |

| A12. Pizzi et al. (2021) [49] | LT | 210/210 | Italy | 2018 | SRS (0–91): Sustainable Development Goals Reporting Score measuring the degree of adherence to the GRI indicators required by the SDG Compass Guidelines | Records of the Italian Companies and Exchange Commission | BIND, BMTS, BSZ, ER, EXPT, FBOD, GRI, ROE, SCO, SZTA |

| A13. Schröder (2022) [22] | LT | 100/300 | Germany | 2017–2019 | NFRQ (0.52–3.45): non-financial reporting quality | Corporate websites | ASU, OPT, SZTA |

| A14. Sierra-Garcia et al. (2018) [50] | NI | 34/34 | Spain | 2017 | NFSC (3.70–10.00): composed of 5 sub-indices with 27 KPIs, linked to environmental, social, employment, human and anti-corruption/bribery matters | Sustainability reports, management reports and financial reports | IES, SCO, SZTA |

| A15. Vander Bauwhede and Van Cauwenberge (2022) [51] | LT, SGT | 660/1832 | All EU countries | 2017 | CSR_info (0–100): Information on corporate sustainability reporting | Refinitiv’s ESG database | ASU, BVS, EPS, EPSN, ESGS, IES, LTA, ROA, SP, SZTA |

| Category | Abbrev. | Meaning and Measurement | No. of Papers with NFRQ Corr. |

|---|---|---|---|

| Company size | EXP | Total expenses | 1 |

| INC | Total income | 2 | |

| SZE | Company size measured through total number of employees | 4 | |

| SZTA | Company size measured through total assets | 9 | |

| TOVR | Natural logarithm of the equivalent in Euro of sales | 1 | |

| Financial performance | BCR | Borrowed capital ratio computed as borrowed capital divided by capital employed | 1 |

| BVS | Book value of equity per share at the end of fiscal year, in EUR | 1 | |

| CRR | Current ratio computed as current assets divided by current liabilities | 1 | |

| DTER | Debt-to-equity ratio computed as total liabilities divided by shareholders’ equity | 1 | |

| LTA | Leverage measured by total liabilities divided by total assets | 3 | |

| NP | Net profit | 1 | |

| OPT | Business efficiency measured as the ratio of operating profits to operating turnover | 1 | |

| QCR | Quick ratio computed as current assets minus inventories, divided by current liabilities | 1 | |

| ROA | Return on assets | 4 | |

| ROE | Return on equity | 4 | |

| Corporate governance | ABOD | Age of the Board of Directors | 1 |

| ASU | Assurance from an external auditor of the non-financial report | 3 | |

| BIND | Share of independent directors in total board size | 2 | |

| BMTS | Board meetings during the year | 1 | |

| BSZ | Board size | 3 | |

| FBOD | Percentage of women on the Board of Directors | 3 | |

| FXBD | Percentage of female members in the executive board | 1 | |

| FO | Foreign ownership percentage | 1 | |

| FSBD | Percentage of female members in the supervisory board | 1 | |

| GOV | Corporate governance score | 1 | |

| PO | Private ownership | 1 | |

| SCO | Sustainability Committee | 4 | |

| SO | The percentage of state ownership | 1 | |

| SREM | Sustainability remuneration—takes value 1 if a firm has at least one sustainability component quantified in the executive remuneration | 1 | |

| Market performance | EPS | Earnings per share over fiscal year, in EUR | 1 |

| EPSN | Negative earnings per share over fiscal year, in EUR | 1 | |

| LST | Listed company | 1 | |

| MS | Market share as the determinant of the company’s market presence | 1 | |

| SP | Share price at the end of fiscal year, in EUR | 1 | |

| Sustainability performance | EPI | Environmental performance index | 1 |

| ER | Value of environmental risks in economic terms | 1 | |

| ESGS | Score for environmental, social and governance (ESG) performance | 1 | |

| EXPT | Number of years from the first non-financial report | 1 | |

| GRI | GRI Standards included in the non-financial report (1 if included) | 2 | |

| IES | Industry environmental sensitivity—refers to industries with a significant negative impact on the environment (1 = polluting industry, 0 = non-polluting industry) | 4 | |

| VSE | Voluntary sustainability experience, takes value of 1 if a firm has at least four years of sustainability experience prior to the mandate | 1 |

- Variables that measure financial performance by aggregating more than one financial indicator or that are based on forecasts, not actual or past performance—for example, an indicator aggregating return on assets, return on equity, and operating ratio and earnings before interest and tax to net income;

- Variables that may be confounded with other constructs—for example, ownership structure that contains both private and state ownership, that were already included, at individual level, in our comprehensive analysis, through FO—Foreign ownership percentage, PO—Private ownership, SO—The percentage of state ownership, as detailed in Table 3;

- Country-level variables, such as those measuring government effectiveness, in relation to laws and regulations, because these variables do not represent company-level factors of NFRQ;

- Variables that measure stock market performance—for example, free float measured as a percentage of total traded shares at the end of the fiscal year, as these are not considered factors of NFRQ;

- Industry variables pointing to non-environmentally sensitive industries—for example, technology and telecommunications, consumer goods, consumer services industries;

- The company’s age (years of business activity)—for example, the number of years since the company’s inception, because this does not represent a criterion included in the NFRD that distinguishes companies that were required to adopt NFRD from those that did not meet the NFRD criteria;

- Variables that measure reporting experience without a clear focus on sustainability—for example, a variable that takes the value 1 if a company has a maximum of three years of sustainability reporting experience prior to the NFRD mandate;

- Variables that refer to periods before 2017 (pre-NFRD adoption)—for example, non-financial information index in 2016, or the existence of a sustainability report in 2016;

- Variables that describe the reporting format, but not its quality—for example, sustainability report page number, top-management statement about sustainability, or reference to sustainability in top-management statement of integrated report;

- Variables that describe the textual attributes of the report, such as numerical text units, sustainability report letter number, forward-looking text units;

- Variables that describe a combined report, where the non-financial report is not clearly distinguished from the financial report—for example, a variable that measures if the non-financial report is combined with the financial report;

- Variables that measure voluntary sustainability disclosures, as opposed to mandatory reporting under the scope of the NFRD—for example, a variable that takes value 1 if the company presents non-financial information and 0 otherwise, as we focus only on those that take the value 1 under a mandatory regime;

- Variables that are not clearly defined in the collected studies—for example, if details on calculation are not included.

4. Results

4.1. The Relationship between Company Size and NFRQ

4.2. The Relationship between Financial Performance and NFRQ

4.3. The Relationship between Corporate Governance and NFRQ

4.4. The Relationship between Market Performance and NFRQ

4.5. The Relationship between Sustainability Performance and NFRQ

5. Discussion and Conclusions

5.1. Main Contributions

5.2. Theoretical and Practical Implications

5.3. Limitations

5.4. Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Kaczmarek, J.; Alonso, S.L.N.; Sokołowski, A.; Fijorek, K.; Denkowska, S. Financial Threat Profiles of Industrial Enterprises in Poland. Oeconomia Copernic. 2021, 12, 463–498. [Google Scholar] [CrossRef]

- Valaskova, K.; Gajdosikova, D.; Belas, J. Bankruptcy Prediction in the Post-Pandemic Period: A Case Study of Visegrad Group Countries. Oeconomia Copernic. 2023, 14, 253–293. [Google Scholar] [CrossRef]

- Sarea, A.M. Web-Based Financial Reporting Disclosure: Evidence from Selected Banks in the Kingdom of Saudi Arabia (KSA). J. Cent. Bank. Theory Pract. 2020, 9, 183–197. [Google Scholar] [CrossRef]

- Venturelli, A.; Fasan, M.; Pizzi, S. Guest Editorial. Rethinking Non-Financial Reporting in Europe: Challenges and Opportunities in Revising Directive 2014/95/EU. J. Appl. Account. Res. 2022, 23, 1–7. [Google Scholar] [CrossRef]

- Zanellato, G.; Tiron-Tudor, A. How Cultural Dimensions Are Shaping Social Expectations: The Case of European State-Owned Enterprises’ Nonfinancial Reporting. J. Appl. Account. Res. 2022, 23, 99–121. [Google Scholar] [CrossRef]

- Dumitru, M.; Dyduch, J.; Gușe, R.-G.; Krasodomska, J. Corporate Reporting Practices in Poland and Romania—An Ex-Ante Study to the New Non-Financial Reporting European Directive. Account. Eur. 2017, 14, 279–304. [Google Scholar] [CrossRef]

- Aureli, S.; Salvatori, F.; Magnaghi, E. A Country-Comparative Analysis of the Transposition of the EU Non-Financial Directive: An Institutional Approach. Account. Econ. Law Conviv. 2020, 10, 20180047. [Google Scholar] [CrossRef]

- Kurpierz, J.R.; Smith, K. The Greenwashing Triangle: Adapting Tools from Fraud to Improve CSR Reporting. Sustain. Account. Manag. Policy J. 2020, 11, 1075–1093. [Google Scholar] [CrossRef]

- Doni, F.; Bianchi Martini, S.; Corvino, A.; Mazzoni, M. Voluntary versus Mandatory Non-Financial Disclosure: EU Directive 95/2014 and Sustainability Reporting Practices Based on Empirical Evidence from Italy. Meditari Account. Res. 2020, 28, 781–802. [Google Scholar] [CrossRef]

- Veltri, S. The Mandatory Non-Financial Disclosure in the European Union. In Mandatory Non-Financial Risk-Related Disclosure; Springer International Publishing: Cham, Switzerland, 2020; pp. 31–55. ISBN 978-3-030-47920-6. [Google Scholar]

- Khan, K.S.; Kunz, R.; Kleijnen, J.; Antes, G. Five Steps to Conducting a Systematic Review. J. R. Soc. Med. 2003, 96, 118–121. [Google Scholar] [CrossRef]

- Velte, P.; Stawinoga, M. Integrated Reporting: The Current State of Empirical Research, Limitations and Future Research Implications. J. Manag. Control 2017, 28, 275–320. [Google Scholar] [CrossRef]

- Velte, P.; Stawinoga, M. Do Chief Sustainability Officers and CSR Committees Influence CSR-Related Outcomes? A Structured Literature Review Based on Empirical-Quantitative Research Findings. J. Manag. Control 2020, 31, 333–377. [Google Scholar] [CrossRef]

- Benvenuto, M.; Aufiero, C.; Viola, C. A Systematic Literature Review on the Determinants of Sustainability Reporting Systems. Heliyon 2023, 9, e14893. [Google Scholar] [CrossRef] [PubMed]

- Velte, P. Does Sustainable Board Governance Drive Corporate Social Responsibility? A Structured Literature Review on European Archival Research. J. Glob. Responsib. 2023, 14, 46–88. [Google Scholar] [CrossRef]

- Samani, N.; Overland, C.; Sabelfeld, S. The Role of the EU Non-Financial Reporting Directive and Employee Representation in Employee-Related Disclosures. Account. Forum 2023, 47, 278–306. [Google Scholar] [CrossRef]

- Ivanović, V. The Key Characteristics of Financial Reporting in the European System of Central Banks. J. Cent. Bank. Theory Pract. 2013, 3, 47–69. [Google Scholar]

- Dragomir, V.D.; Dumitru, M. Does Corporate Governance Improve Integrated Reporting Quality? A Meta-Analytical Investigation. Meditari Account. Res. 2023, 31, 1846–1885. [Google Scholar] [CrossRef]

- Krištofík, P.; Lament, M.; Musa, H. The Reporting of Non-Financial Information and the Rationale for Its Standardisation. EM Ekon. Manag. 2016, 19, 157–175. [Google Scholar] [CrossRef]

- Hahn, R.; Reimsbach, D.; Wickert, C. Nonfinancial Reporting and Real Sustainable Change: Relationship Status—It’s Complicated. Organ. Environ. 2023, 36, 3–16. [Google Scholar] [CrossRef]

- Zarzycka, E.; Krasodomska, J. Non-Financial Key Performance Indicators: What Determines the Differences in the Quality and Quantity of the Disclosures? J. Appl. Account. Res. 2022, 23, 139–162. [Google Scholar] [CrossRef]

- Schröder, P. Mandatory Non-Financial Reporting in the Banking Industry: Assessing Reporting Quality and Determinants. Cogent Bus. Manag. 2022, 9, 2073628. [Google Scholar] [CrossRef]

- Fiandrino, S.; Gromis Di Trana, M.; Tonelli, A.; Lucchese, A. The Multi-Faceted Dimensions for the Disclosure Quality of Non-Financial Information in Revising Directive 2014/95/EU. J. Appl. Account. Res. 2022, 23, 274–300. [Google Scholar] [CrossRef]

- Caputo, F.; Leopizzi, R.; Pizzi, S.; Milone, V. The Non-Financial Reporting Harmonization in Europe: Evolutionary Pathways Related to the Transposition of the Directive 95/2014/EU within the Italian Context. Sustainability 2019, 12, 92. [Google Scholar] [CrossRef]

- Arif, M.; Gan, C.; Nadeem, M. Regulating Non-Financial Reporting: Evidence from European Firms’ Environmental, Social and Governance Disclosures and Earnings Risk. Meditari Account. Res. 2022, 30, 495–523. [Google Scholar] [CrossRef]

- Ştefănescu, C.A. Linking Sustainability and Non-Financial Reporting Directive 2014/95/EU through Isomorphism Lens. Meditari Account. Res. 2022, 30, 1680–1704. [Google Scholar] [CrossRef]

- Ştefănescu, C.A.; Tiron-Tudor, A.; Moise, E.M. EU Non-Financial Reporting Research–Insights, Gaps, Patterns and Future Agenda. J. Bus. Econ. Manag. 2020, 22, 257–276. [Google Scholar] [CrossRef]

- Krasodomska, J.; Simnett, R.; Street, D.L. Extended External Reporting Assurance: Current Practices and Challenges. J. Int. Financ. Manag. Account. 2021, 32, 104–142. [Google Scholar] [CrossRef]

- Krasodomska, J.; Zarzycka, E.; Zieniuk, P. Voluntary Sustainability Reporting Assurance in the European Union before the Advent of the Corporate Sustainability Reporting Directive: The Country and Firm-level Impact of Sustainable Development Goals. Sustain. Dev. 2023, sd.2744. [Google Scholar] [CrossRef]

- Aluchna, M.; Roszkowska-Menkes, M.; Kamiński, B. From Talk to Action: The Effects of the Non-Financial Reporting Directive on ESG Performance. Meditari Account. Res. 2022, 31, 1–25. [Google Scholar] [CrossRef]

- Baumüller, J.; Sopp, K. Double Materiality and the Shift from Non-Financial to European Sustainability Reporting: Review, Outlook and Implications. J. Appl. Account. Res. 2022, 23, 8–28. [Google Scholar] [CrossRef]

- Crous, C.; Battisti, E.; Leonidou, E. Non-Financial Reporting and Company Financial Performance: A Systematic Literature Review and Integrated Framework. EuroMed J. Bus. 2022, 17, 652–676. [Google Scholar] [CrossRef]

- Vitolla, F.; Raimo, N.; Campobasso, F.; Giakoumelou, A. Risk Disclosure in Sustainability Reports: Empirical Evidence from the Energy Sector. Util. Policy 2023, 82, 101587. [Google Scholar] [CrossRef]

- Di Vaio, A.; Palladino, R.; Hassan, R.; Alvino, F. Human Resources Disclosure in the EU Directive 2014/95/EU Perspective: A Systematic Literature Review. J. Clean. Prod. 2020, 257, 120509. [Google Scholar] [CrossRef]

- Manes-Rossi, F.; Nicolò, G.; Argento, D. Non-Financial Reporting Formats in Public Sector Organizations: A Structured Literature Review. J. Public Budg. Account. Financ. Manag. 2020, 32, 639–669. [Google Scholar] [CrossRef]

- Opferkuch, K.; Caeiro, S.; Salomone, R.; Ramos, T.B. Circular Economy in Corporate Sustainability Reporting: A Review of Organisational Approaches. Bus. Strategy Environ. 2021, 30, 4015–4036. [Google Scholar] [CrossRef]

- Caputo, F.; Pizzi, S.; Ligorio, L.; Leopizzi, R. Enhancing Environmental Information Transparency through Corporate Social Responsibility Reporting Regulation. Bus. Strategy Environ. 2021, 30, 3470–3484. [Google Scholar] [CrossRef]

- Cosma, S.; Leopizzi, R.; Nobile, L.; Schwizer, P. Revising the Non-Financial Reporting Directive and the Role of Board of Directors: A Lost Opportunity? J. Appl. Account. Res. 2022, 23, 207–226. [Google Scholar] [CrossRef]

- Beretta, V.; Demartini, M.C.; Sotti, F. Board Composition and Textual Attributes of Non-Financial Disclosure in the Banking Sector: Evidence from the Italian Setting after Directive 2014/95/EU. J. Clean. Prod. 2023, 385, 135561. [Google Scholar] [CrossRef]

- Carmo, C.; Ribeiro, C. Mandatory Non-Financial Information Disclosure under European Directive 95/2014/EU: Evidence from Portuguese Listed Companies. Sustainability 2022, 14, 4860. [Google Scholar] [CrossRef]

- Dragomir, V.D.; Dumitru, M.; Feleaga, L. The Predictors of Non-Financial Reporting Quality in Romanian State-Owned Enterprises. Account. Eur. 2022, 19, 110–151. [Google Scholar] [CrossRef]

- Gerwing, T.; Kajüter, P.; Wirth, M. The Role of Sustainable Corporate Governance in Mandatory Sustainability Reporting Quality. J. Bus. Econ. 2022, 92, 517–555. [Google Scholar] [CrossRef]

- Hategan, C.-D.; Pitorac, R.-I.; Milu, N.-D. Assessment of the Mandatory Non-Financial Reporting of Romanian Companies in the Circular Economy Context. Int. J. Environ. Res. Public. Health 2021, 18, 12899. [Google Scholar] [CrossRef] [PubMed]

- Loprevite, S.; Raucci, D.; Rupo, D. KPIs Reporting and Financial Performance in the Transition to Mandatory Disclosure: The Case of Italy. Sustainability 2020, 12, 5195. [Google Scholar] [CrossRef]

- Mihai, F.; Aleca, O.E. Sustainability Reporting Based on GRI Standards within Organizations in Romania. Electronics 2023, 12, 690. [Google Scholar] [CrossRef]

- Mion, G.; Loza Adaui, C.R. Mandatory Nonfinancial Disclosure and Its Consequences on the Sustainability Reporting Quality of Italian and German Companies. Sustainability 2019, 11, 4612. [Google Scholar] [CrossRef]

- Moraru, R.I.; Păun, A.P.; Dura, C.C.; Dinulescu, R.; Potcovaru, A.-M. Analysis of the Drivers of Occupational Health and Safety Performance Disclosures by Romanian Companies. Econ. Comput. Econ. Cybern. Stud. Res. 2020, 54, 197–214. [Google Scholar] [CrossRef]

- Păun, A.P.; Dura, C.C.; Mihăilescu, S.; Moraru, R.I.; Isac, C.A. OHS Disclosures Within Non-Financial Reports: The Romanian Case. Sustainability 2020, 12, 1963. [Google Scholar] [CrossRef]

- Pizzi, S.; Rosati, F.; Venturelli, A. The Determinants of Business Contribution to the 2030 Agenda: Introducing the SDG Reporting Score. Bus. Strategy Environ. 2021, 30, 404–421. [Google Scholar] [CrossRef]

- Sierra-Garcia, L.; Garcia-Benau, M.; Bollas-Araya, H. Empirical Analysis of Non-Financial Reporting by Spanish Companies. Adm. Sci. 2018, 8, 29. [Google Scholar] [CrossRef]

- Vander Bauwhede, H.; Van Cauwenberge, P. Determinants and Value Relevance of Voluntary Assurance of Sustainability Reports in a Mandatory Reporting Context: Evidence from Europe. Sustainability 2022, 14, 9795. [Google Scholar] [CrossRef]

- Liao, L.; Lin, T.; Zhang, Y. Corporate Board and Corporate Social Responsibility Assurance: Evidence from China. J. Bus. Ethics 2018, 150, 211–225. [Google Scholar] [CrossRef]

- Mahadeo, J.D.; Soobaroyen, T.; Hanuman, V.O. Board Composition and Financial Performance: Uncovering the Effects of Diversity in an Emerging Economy. J. Bus. Ethics 2012, 105, 375–388. [Google Scholar] [CrossRef]

- Katmon, N.; Mohamad, Z.Z.; Norwani, N.M.; Farooque, O.A. Comprehensive Board Diversity and Quality of Corporate Social Responsibility Disclosure: Evidence from an Emerging Market. J. Bus. Ethics 2019, 157, 447–481. [Google Scholar] [CrossRef]

- Byron, K.; Post, C. Women on Boards of Directors and Corporate Social Performance: A Meta-Analysis. Corp. Gov. Int. Rev. 2016, 24, 428–442. [Google Scholar] [CrossRef]

- Srinidhi, B.; Gul, F.A.; Tsui, J. Female Directors and Earnings Quality. Contemp. Account. Res. 2011, 28, 1610–1644. [Google Scholar] [CrossRef]

- Dienes, D.; Velte, P. The Impact of Supervisory Board Composition on CSR Reporting. Evidence from the German Two-Tier System. Sustainability 2016, 8, 63. [Google Scholar] [CrossRef]

- Mohamed Adnan, S.; Hay, D.; Van Staden, C.J. The Influence of Culture and Corporate Governance on Corporate Social Responsibility Disclosure: A Cross Country Analysis. J. Clean. Prod. 2018, 198, 820–832. [Google Scholar] [CrossRef]

- IAASB. A Framework for Audit Quality. Key Elements That Create an Environment for Audit Quality; International Auditing and Assurance Standards Board: New York, NY, USA, 2014. [Google Scholar]

- IAASB. Proposed International Standard on Sustainability Assurance 5000, General Requirements for Sustainability Assurance Engagements; The International Federation of Accountants (IFAC): New York, NY, USA, 2023. [Google Scholar]

- Radhouane, I.; Nekhili, M.; Nagati, H.; Paché, G. Is Voluntary External Assurance Relevant for the Valuation of Environmental Reporting by Firms in Environmentally Sensitive Industries? Sustain. Account. Manag. Policy J. 2020, 11, 65–98. [Google Scholar] [CrossRef]

- Simnett, R.; Huggins, A.L. Integrated Reporting and Assurance: Where Can Research Add Value? Sustain. Account. Manag. Policy J. 2015, 6, 29–53. [Google Scholar] [CrossRef]

- Snyder, H. Designing the Literature Review for a Strong Contribution. J. Decis. Syst. 2023, 1–8. [Google Scholar] [CrossRef]

- Beleneși, M.; Bogdan, V.; Popa, D.N. Disclosure Dynamics and Non-Financial Reporting Analysis. The Case of Romanian Listed Companies. Sustainability 2021, 13, 4732. [Google Scholar] [CrossRef]

- Danila, A.; Horga, M.-G.; Oprisan, O.; Stamule, T. Good Practices on ESG Reporting in the Context of the European Green Deal. Amfiteatru Econ. 2022, 24, 847. [Google Scholar] [CrossRef]

- Murè, P.; Spallone, M.; Mango, F.; Marzioni, S.; Bittucci, L. ESG and Reputation: The Case of Sanctioned Italian Banks. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 265–277. [Google Scholar] [CrossRef]

- Ullah, S.; Hussain, S.I.; Nabi, A.A.; Mubashir, K.A. Role of Regulatory Governance in Financial Stability: A Comparison of High and Low Income Countries. J. Cent. Bank. Theory Pract. 2022, 11, 207–226. [Google Scholar] [CrossRef]

- Mizik, T.; Gyarmati, G. Economic and Sustainability of Biodiesel Production—A Systematic Literature Review. Clean Technol. 2021, 3, 19–36. [Google Scholar] [CrossRef]

| A1. Beretta et al. (2023) [39] | |

|---|---|

| Variables—Original (Abbreviation and Definition) | Variables—Own Mapping (Abbreviation, Definition and Category Mapping) |

| Average_Age: Age of the Board of Directors | ABOD: Age of the Board of Directors, mapped under corporate governance category |

| Board_Size: Members of the Board of Directors | BSZ: Board size, mapped under corporate governance category |

| Female%: Percentage of women on the Board of Directors | FBOD: Percentage of women on the Board of Directors, mapped under corporate governance category |

| Total_Assets: Size | SZTA: Company size measured through total assets, mapped under Company size category |

| Variables Correlated with NFRQ | A1 (T4) | A2 (T12) | A3 (T6) | A4 (T3) | A5 (T7) | A6 (T5) | A7 (T6–2018) | A8 (T9) | A9 (T7) | A10 (T5, 6, 7 and 8) | A11 (T6 and 7) | A12 (T8) | A13 (T7) | A14 * (T7) | A15 ** (T4) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Company size | |||||||||||||||

| EXP | 0.254 * | ||||||||||||||

| INC | 0.249 * | −0.071 | |||||||||||||

| SZE | 0.457 ** | 0.700 ** | 0.221 ** | 0.357 | |||||||||||

| SZTA | 0.139 | 0.540 ** | 0.608 ** | 0.498 ** | 0.378 ** | 0.217 ** | 0.279 ** | 0.081 | −0.091 ** | ||||||

| TOVR | 0.709 ** | ||||||||||||||

| Financial performance | |||||||||||||||

| BCR | 0.344 ** | ||||||||||||||

| BVS | −0.049 * | ||||||||||||||

| CRR | −0.187 | ||||||||||||||

| DTER | 0.049 | ||||||||||||||

| LTA | 0.256 ** | −0.544 * | −0.056 * | ||||||||||||

| NP | 0.131 | ||||||||||||||

| OPT | 0.0027 | ||||||||||||||

| QCR | −0.185 | ||||||||||||||

| ROA | 0.006 | −0.021 | −0.281 * | −0.012 | |||||||||||

| ROE | 0.253** | 0.009 | 0.197 | 0.008 | |||||||||||

| Corporate governance | |||||||||||||||

| ABOD | 0.246 ** | ||||||||||||||

| ASU | 0.562 ** | 0.0661 | −0.072 ** | ||||||||||||

| BIND | 0.248 ** | 0.207 * | |||||||||||||

| BMTS | 0.053 | ||||||||||||||

| BSZ | 0.379 ** | 0.093 | 0.044 | ||||||||||||

| FBOD | 0.359 ** | 0.541 ** | 0.115 | ||||||||||||

| FXBD | 0.067 | ||||||||||||||

| FO | 0.329 ** | ||||||||||||||

| FSBD | 0.382 ** | ||||||||||||||

| GOV | 0.782 ** | ||||||||||||||

| PO | -0.054 * | ||||||||||||||

| SCO | 0.551 ** | 0.498 ** | 0.197 * | 0.266 | |||||||||||

| SO | −0.368 ** | ||||||||||||||

| SREM | 0.431 ** | ||||||||||||||

| Market performance | |||||||||||||||

| EPS | −0.102 ** | ||||||||||||||

| EPSN | −0.013 | ||||||||||||||

| LST | 0.212 ** | ||||||||||||||

| MS | 0.364 * | ||||||||||||||

| SP | −0.091 ** | ||||||||||||||

| Sustainability performance | |||||||||||||||

| EPI | 0.206 * | ||||||||||||||

| ER | 0.271 ** | ||||||||||||||

| ESGS | −0.072 ** | ||||||||||||||

| EXPT | 0.383 ** | ||||||||||||||

| GRI | 0.000 | 0.336 ** | |||||||||||||

| IES | −0.056 | 0.093 | −0.246 | 0.039 | |||||||||||

| VSE | 0.394 ** | ||||||||||||||

| Variables in Correlation with NFRQ | Expected Relationship | Significant Correlations | Empirical Support |

|---|---|---|---|

| Company size | Positive | + (large) in 4 studies + (medium) in 3 studies + (small) in 5 studies − (very small) in 1 study | Supported (positive) |

| Financial performance | |||

| Book value of equity per share | Not specified | − (very small) in 1 study | Inconclusive |

| Leverage (indebtedness) | Positive | + (medium) in 1 study + (small) in 1 study − (large) in 1 study − (very small) in 1 study | Inconclusive |

| Liquidity | Not specified | Not significant | No relationship |

| Profitability | Not specified | − (small) in 1 study (ROA) Not significant in 4 studies (ROA) + (small) in 1 study (ROE) Not significant in 3 studies (ROE) | Inconclusive |

| Corporate governance | |||

| Board independence | Positive | + (small) in 2 studies | Supported (positive) |

| Number of board meetings | Positive | Not significant | Not supported |

| Board size | Positive | + (medium) in 1 study | Supported (positive) |

| Average age of board members | Not specified | + (small) in 1 study | Weak positive relationship |

| Foreign ownership | Positive | + (medium) in 1 study | Supported (positive) |

| Gender diversity | Positive | + (very large) in 1 study + (medium) in 2 studies | Supported (positive) |

| Corporate governance quality | Positive | + (very large) in 1 study | Supported (positive) |

| Private ownership | Not specified | − (very small) in 1 study | Inconclusive |

| Existence of sustainability Committee | Positive | + (large) in 1 study + (medium) in 1 study + (small) in 1 study | Supported (positive) |

| State ownership | Negative | − (medium) in 1 study | Supported (negative) |

| Remuneration linked to sustainable development | Positive | + (medium) in 1 study | Supported (positive) |

| External assurance of non-financial information | Positive | + (large) in 1 study − (very small) in 1 study Not significant in 2 studies | Inconclusive |

| Market performance | |||

| Earnings per share | Not specified | − (small) in 1 study Not significant in 1 study | Inconclusive |

| Listed company | Not specified | + (small) in 1 study | Weak positive relationship |

| Market share | Not specified | + (medium) in 1 study | Medium positive relationship |

| Share price | Not specified | − (very small) in 1 study | Inconclusive |

| Sustainability performance | |||

| Environmental performance | Not specified | + (small) in 2 studies | Weak positive relationship |

| ESG score | Positive | − (very small) in 1 study | Inconclusive |

| Number of years from the first non-financial report | Not specified | + (medium) in 1 study | Medium positive relationship |

| GRI standards included in the non-financial report | Positive | + (medium) in 1 study | Supported (positive) |

| Voluntary sustainability experience | Positive | + (medium) in 1 study | Supported (positive) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Radu, O.M.; Dragomir, V.D.; Hao, N. Company-Level Factors of Non-Financial Reporting Quality under a Mandatory Regime: A Systematic Review of Empirical Evidence in the European Union. Sustainability 2023, 15, 16265. https://doi.org/10.3390/su152316265

Radu OM, Dragomir VD, Hao N. Company-Level Factors of Non-Financial Reporting Quality under a Mandatory Regime: A Systematic Review of Empirical Evidence in the European Union. Sustainability. 2023; 15(23):16265. https://doi.org/10.3390/su152316265

Chicago/Turabian StyleRadu, Oana Marina, Voicu D. Dragomir, and Ningshan Hao. 2023. "Company-Level Factors of Non-Financial Reporting Quality under a Mandatory Regime: A Systematic Review of Empirical Evidence in the European Union" Sustainability 15, no. 23: 16265. https://doi.org/10.3390/su152316265

APA StyleRadu, O. M., Dragomir, V. D., & Hao, N. (2023). Company-Level Factors of Non-Financial Reporting Quality under a Mandatory Regime: A Systematic Review of Empirical Evidence in the European Union. Sustainability, 15(23), 16265. https://doi.org/10.3390/su152316265