Abstract

The Internet of Things has driven the transformation of the traditional offline rental model to online rental platforms such as Zillow, Zigbang, and Lianjia. These platforms provide abundant housing options, detailed information, convenient communication, and greater price transparency. However, existing online rental platforms are still centralized and rely on third-party intermediaries for settlement, which raises concerns about the integrity of real estate data, transaction security, and price transparency. To improve the real estate leasing business, we propose leveraging the decentralized nature of blockchain technology. By eliminating intermediaries, we can ensure customer privacy and reduce transaction costs. This strategy revolves around smart contracts as a core component, automatically matching landlords and tenants based on their offers, achieving transparency, and maintaining anonymity for both parties. We introduce a novel auction system that combines the features of interactive auctions and sealed-bid auctions, enabling landlords and tenants to engage in range bidding. In this study, we developed a detailed algorithm to define how smart contracts function during the auction process. Through a cost analysis, we demonstrate the economic feasibility and provide a secure, transparent, and reliable approach for online auctions.

1. Introduction

The total asset scale of the global real estate market has exceeded USD 200 trillion, making it the largest single asset class worldwide. However, the operational dynamics within this sector are not only highly complex, but also come with significant costs, opaqueness, and inefficiency [1]. The commercial real estate industry has been progressing slowly in innovating its core business processes, facing an array of challenges. Currently, commercial brokers and other intermediary entities continue to grapple with outdated technologies, data sharing mechanisms, inefficient cash flow management, and real-time performance data issues. These problems collectively result in collusion among tenants, landlords, and investors, consequently yielding adverse impacts [1]. With the development of the traditional real estate market, many problems have gradually been exposed, such as a lack of transaction transparency, a lack of transparency in intermediary services, frequent leakage of user privacy, and limited rights [2]. However, the rapid development of the Internet at the beginning of the 21st Century has brought opportunities. Online rental models, with the advancement of technology and the popularity of the Internet, have rapidly risen and achieved significant growth in the past 10 to 15 years. It has a large enough list of properties, and users can freely change the prices of the properties [3].

Although online rental platforms leverage the convenience of the Internet and mobile apps, providing landlords and tenants with a more-convenient and -efficient rental experience, there are still problems with third-party organizations and personal privacy protection. The real estate industry faces multiple challenges including complex, time-consuming, and security-threatened property registration procedures. These problems can lead to high transaction costs, low efficiency, and even errors at times [4,5]. The control of transaction data by intermediary agencies makes the transaction process opaque, and end-users usually have limited access to this kind of information [6]. Intermediaries may control the market and may even monopolize the housing rental market [7]. To solve these problems, new technological means must be sought to improve transaction efficiency and security [8].

Blockchain technology is recognized as a pivotal component of the Industry 4.0 paradigm. It plays a crucial role in enhancing transparency in land registration and resource management, effectively mitigating instances of fraud and unlawful land seizures [9,10]. Forward-thinking companies are exploring the application of blockchain technology in the real estate sector. For instance, aassio is a blockchain-based platform that enables individuals to easily invest in, hold, purchase, or sell real estate with other cryptocurrencies or crypto assets. Furthermore, AgentMile aims to become the world’s first decentralized commercial real estate leasing platform driven by artificial intelligence (AI), and Properbuz plans to decentralize the USD 217 trillion global real estate market through the development of a blockchain-based decentralized protocol. These cases showcase the potential viability of blockchain technology in the real estate industry and have garnered industry attention. This, in turn, safeguards land rights and promotes sustainable resource utilization. Furthermore, the evolution of blockchain technology, coupled with smart contract advancements, offers substantial potential for the transformation of the existing real estate market [11]. On the one hand, blockchain technology can accelerate transactions and reduce costs by eliminating third-party verification [1]. On the other hand, online auctions provide a simplified communication model [12], allowing the bidding process to be completed in a few hours or days instead of weeks or even months [13,14]. In addition, smart contracts bring greater transparency and security to the transaction process [15]. Blockchain technology can help eliminate gender discrimination and achieve gender equality and inclusivity [16]. Simultaneously, smart contracts can also be checked for correctness by applying formal methods [17]. By using the newly developed smart contract transaction method, the system can automatically match the prices of landlords and tenants to determine the optimal transaction method [18]. This process is achieved with complete transparency on the blockchain. Therefore, all participants can view transaction records and identities. Also, the prices of participants are anonymized, effectively protecting personal privacy.

By using blockchain technology, we can establish a decentralized system to effectively solve the main problems of online rentals. Blockchain-based auctions can remove intermediary agencies [19], reduce transaction costs, and enhance trust [20]. Smart contracts can be programmed to automatically execute business rules and logic when predefined conditions are met [21,22,23]. Combining the characteristics of double-auctions and sealed auctions, we can achieve anonymous and transparent automated auction processes.

It should be noted that, although blockchain and smart contract technology have obvious advantages, there are also possible risks and challenges. For example, auction participants may collude to manipulate auction results. When it comes to the auction process, potential collusion between sellers, buyers, and auctioneers is a concern, including potential collusion between auctioneers and sellers, auctioneers and buyers, and sellers and buyers. The decentralized nature of blockchain plays a crucial role in preventing collusion between auctioneers and sellers, as well as between auctioneers and buyers. This is because there are clear conflicts of interest between sellers and buyers, as they pursue different objectives. Sellers seek to sell their goods at the highest possible price, while buyers aim to purchase at the lowest possible price, making collusion between sellers and buyers less likely. However, vigilance is still necessary because, in certain situations, buyers may engage in strategic cooperation to manipulate auction outcomes and gain unfair profits. In such cases, blockchain technology and smart contracts may need further refinement to address potential risks. Additionally, the conflicts of interest between landlords and tenants also help offset potential collusion motives. Therefore, we must remain vigilant to ensure fairness and transparency in the auction and rental processes [24].

In summary, we can achieve higher transaction efficiency, reduced transaction costs, enhanced anti-fraud capabilities, and privacy enhancement through the application of blockchain and smart contract technology [25]. This technology has great application potential and development prospects. In this study, we will explore its actual application to and impact on the rental market more deeply.

The primary objective of this paper is to propose a blockchain-based solution to address the shortcomings in existing real estate leases. The main contributions of this paper are summarized as follows:

- We propose a solution founded upon the Ethereum blockchain framework, wherein the said solution harnesses Ethereum smart contracts in conjunction with decentralized storage systems to capture the interplay between lessors and lessees. This orchestration safeguards the integrity of data, augments transparency, and obviates the necessity for intermediary agents.

- We propound on a conceptual framework and algorithmic elucidation delineating the operational mechanics underpinning the enunciated blockchain methodology. Furthermore, we provide detailed algorithmic representations to describe the underpinnings of the blockchain-driven scope auction framework.

- We empirically probed the robustness and feasibility of the scope auction system.

The structure of this work is as follows: Section 2 introduces the real estate leasing market, the principles of blockchain smart contracts, and various auction methods. Section 3 places distinct emphasis on the interval price auction paradigm. Section 4 provides a particular focus, detailing the modus operandi of the implementation, whilst Section 5 validates the code through testing procedures. Finally, Section 6 discusses this work and draws the conclusions, while pointing out future prospects.

2. Background

This section focuses on the key concepts of blockchain technology and smart contracts and shows how these technologies can be used to make the rental process transparent and more efficient.

2.1. Real Estate Rent

The global real estate market is vast; yet, the real estate leasing market suffers from a series of issues and limitations that affect the satisfaction of tenants, landlords, and investors, as well as the efficiency of the market. In the existing real estate rental market, complex processes, a lack of transparency and trust, high intermediary fees and transaction costs, illegal and false information, and transaction uncertainty and disputes have presented numerous challenges to the market [5]. Firstly, the existing real estate rental market operates in an extremely complex manner. From tenant search and contract signing to payment and lease management, multiple parties and cumbersome processes are involved, resulting in inefficiencies and high costs [1,26]. Tenants need to communicate with multiple intermediaries and landlords, which not only wastes time, but also increases transaction risk and the possibility of information asymmetry [27].

Secondly, the existing real estate rental market lacks transparency and trust [28]. Tenants and landlords struggle to obtain accurate market information and housing conditions. Tenants often do not have access to real housing history and landlord credit information, and it is difficult for landlords to assess tenants’ credit status and ability to pay. This information asymmetry has led to transaction uncertainty and the possibility of disputes, affecting the normal operation of the rental market.

Thirdly, high intermediary fees and transaction costs have become a major burden on the real estate leasing market. Intermediaries in the real estate rental market play an important role, but the high intermediary fees and transaction costs they charge have become a burden for owners and tenants. These fees not only increase the cost of living for tenants, but also make it difficult for landlords to obtain reasonable returns. In addition, as a third-party, the intermediary agency needs a certain amount of time and manpower to review and manage the lease contract, further delaying the completion of the transaction.

Additionally, there is much illegal and false information in the existing real estate rental market. Some unscrupulous intermediaries or individuals deliberately publish false housing information to mislead tenants and try to make huge profits from it. It is often difficult for tenants to discern authenticity, leading to increased risk in leasing transactions. Additionally, false information creates trust issues for landlords, making it difficult for them to find suitable tenants [29].

Finally, due to the problems and uncertainties in the real estate leasing market, transaction disputes occur from time to time. Issues such as payment disputes, inconsistent interpretation of contracts, and even a breach of contract and legal proceedings can arise between tenants and landlords. These disputes increase the risk and cost of transactions, while also weakening the stability and attractiveness of the market.

In order to solve the problems and limitations of the real estate rental market, the introduction of blockchain technology and smart contracts is considered an innovative solution [30]. The decentralization and credibility of blockchain technology and the automatic execution function of smart contracts can provide higher market transparency, reduce the risk of information asymmetry and false information, reduce transaction costs, and enhance transaction security and reliability [31]. By adopting blockchain technology and smart contracts, the leasing process can be simplified, intermediary links can be reduced, data security and privacy protection can be strengthened, and the efficiency of the market and the interests of participants can be improved [32,33].

In summary, the existing real estate rental market has issues such as complexity, a lack of transparency and trust [34], high intermediary fees and transaction costs, illegal and false information, and transaction uncertainty and disputes. The introduction of blockchain technology and smart contracts provides innovative solutions to these problems to promote the innovation and development of the real estate rental market.

2.2. Blockchain and Smart Contracts

Blockchain technology has sparked a revolution in the financial sector, particularly in the transformation of electronic auctions and banking services based on Ethereum. The success of this transformative change can be attributed to the transparency, integrity, and stability offered by blockchain [22], which collectively contribute to the rise of new financial models.

Blockchain is a decentralized distributed data system where each data block contains the encrypted hash of the previous block [35,36], ensuring data integrity and tamper resistance [37]. By eliminating the need for intermediaries, blockchain technology reduces transaction costs while enhancing transparency and security [38,39]. At the same time, data security plays a vital role in blockchain technology. In detail, it is divided into the following parts:

1. Distributed ledger technology: The core feature of blockchain is its distributed ledger, where each participating node possesses an identical copy of the data. This means that the data do not rely on a single central server, but are distributed across the entire network, enhancing data security. Even if one node is compromised, other nodes still have access to the data.

2. Encryption technology: Blockchain employs robust encryption technology to safeguard data confidentiality. Transaction data are encrypted, and only users with the correct encryption keys can unlock and access the data. This ensures that sensitive information remains inaccessible to unauthorized users.

3. Immutability: Once the data are added to the blockchain, they are nearly impossible to tamper with. Each block contains the hash of the previous block, and any alteration to the data would change the hash, triggering alerts from other nodes in the network. This feature enhances data security.

4. Smart contract security: Smart contracts, which are self-executing contracts with their code stored on the blockchain, undergo rigorous code quality checks and audits to prevent vulnerabilities and malicious operations. This is a critical step in ensuring data security.

5. Permissions and privacy: Some blockchain networks offer permission and privacy controls, ensuring that only authorized users can view and access specific data. This is especially important for enterprise applications and safeguarding sensitive information.

Furthermore, blockchain has found applications in various fields such as finance, artificial intelligence, the Internet of Things, and the supply chain [40,41,42].

Smart contracts, acting as software agents within the blockchain network, enable the feasibility of Ethereum-based auctions. Through these scripts, which automatically execute the protocol terms, the transaction process is automated, eliminating the need for trusted third-parties in traditional auction models [43]. Ethereum, as a blockchain platform that supports smart contracts [44], currently has a transaction processing capacity of 15 transactions per second (TPS), which will further improve with the introduction of Ethereum 2.0 [45,46].

In electronic auctions running on Ethereum, common auction models include sealed-bid auctions, double-auctions, English auctions, and Dutch auctions, each with specific advantages, disadvantages, and application scenarios [47]. Sealed-bid auctions, in particular, are widely used on Ethereum due to their bids being closer to the actual value of the goods, making them worthy of further exploration.

Although blockchain auctions offer numerous advantages, such as providing a fair competitive environment, transaction transparency, and traceability, they also face challenges such as network congestion, information asymmetry, and excessive competition. Additionally, it is crucial to conduct in-depth research on ensuring auction quality on the blockchain to prevent the emergence of low-quality products or services.

Overall, blockchain and smart contracts provide an innovative and efficient solution for traditional financial transaction models, particularly auctions. However, the implementation of these new models still faces various challenges that require further research and improvement to fully leverage the potential of blockchain and smart contracts. The Ethereum blockchain platform supports smart contracts, and we utilized the Solidity programming language for the blockchain auction implementation [48].

2.3. Auction Mechanisms

Auctions can be broadly categorized based on the auction mechanisms and the corresponding contexts. Table 1 introduces several commonly used auctions, including double-auctions, sealed-bid auctions, and reverse auctions.

Table 1.

Each auction mechanism and suitable scenarios.

The double-auction is a mechanism implemented on the blockchain to achieve information symmetry among participants, ensuring the confidentiality of bids [49]. The transaction outcomes are publicly recorded on the blockchain, promoting trustworthiness and enabling auditability. This type of auction effectively addresses concerns such as low-price transactions and the lack of real-time bidding.

The sealed-bid auction, also known as blind bidding, involves the auctioneer keeping bid information confidential until the designated deadline [47]. In a first-price sealed-bid auction (FPSBA), bidders have a single opportunity to submit their bids, and the winner is determined based on the evaluation of the bids. On the other hand, the second-price sealed-bid auction, often referred to as the Vickrey auction, closely resembles the FPSBA, except that the winning bidder pays the second-highest bid rather than their own bid amount [50].

The reverse auction is a mechanism wherein the buyer selects the optimal bid on a blockchain. Through the utilization of smart contracts, buyers can directly interact with sellers, ensuring transaction transparency and verifiability [51]. This type of auction effectively addresses issues related to excessive competition and the potential presence of low-quality products or services.

3. An Overview of Interval Pricing Auction

The interval pricing auction is an innovative method for property auctioning, incorporating the strengths of both the double-auction and sealed auction. The implementation of the double-auction on blockchain has provided buyers and sellers with a fair competitive environment, where all transaction records are permanently stored on the blockchain, ensuring transaction transparency and traceability. Correspondingly, sealed auctions achieve information symmetry by executing on the blockchain, protecting the confidentiality of bids, and publicly recording transaction results on the blockchain to ensure their credibility and auditability.

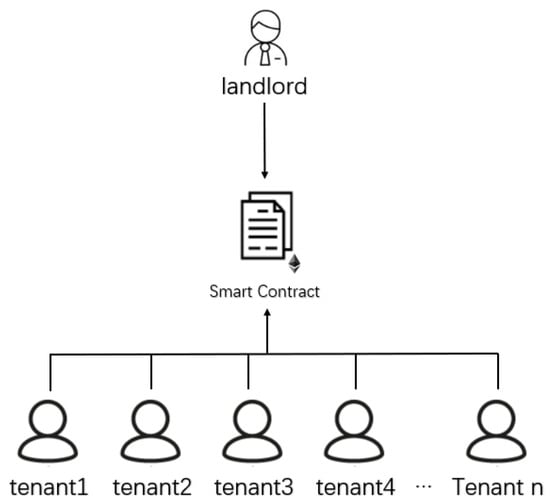

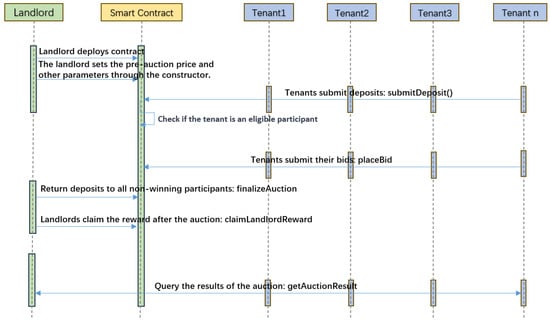

Figure 1 depicts a blockchain-based range price auction model, which primarily consists of the landlord (i.e., the seller), the tenant (i.e., the buyer), and the Ethereum smart contract. The landlord’s role is to announce when the auction will be open to all interested bidders. Moreover, the provided information includes the auction start time, end time, minimum price, maximum price, deposit amount, and threshold for refunding the deposit. The landlord is also responsible for initiating the auction contract and deploying it on the blockchain network. Potential tenants participate in the auction by submitting a deposit at the beginning of the auction. Eligible tenants compete with each other through range bidding until the auction concludes. Buyers evaluate each other based on necessary credentials, such as their qualifications and transaction record history. Smart contracts are coded using Solidity 0.8.0 within an open-source tool called Remix. The Remix IDE supports the deployment, debugging, and testing of Ethereum contracts. The contracts within this framework are designed to cater to open-range-price auctions.

Figure 1.

A systematic overview of the range price auction process using smart contracts.

In the design of interval pricing auctions, both buyers’ and sellers’ interests are maximized. The buyers (tenants) stipulate their acceptable price range—lowest and highest price—while the sellers (landlords) set their expected price range—highest anticipated price and lowest acceptable price. Furthermore, the system introduces a market reference price (), where residents can collectively inquire about the price of housing in a specific area. Under this system, tenants may desire to rent a house at a low price or might be willing to pay a high price for satisfactory property; concurrently, landlords will weigh tax considerations, avoiding setting their highest expected price too high.

If the price range provided by the tenant overlaps with the price range provided by the landlord, the tenant offering the highest price will win. If there is no overlap in price range, the system will calculate the average price () between the highest price offered by the tenant and the lowest price from the landlord and notify the relevant tenants and landlords in an attempt to facilitate a deal.

To ensure the fairness of the auction, the time is predetermined and all participants are notified 10 min before the auction starts. Each participant needs to deposit a security deposit equivalent to one month’s rent, calculated based on the market reference price. If participants cancel their participation 30 min before the start of the auction, the full deposit will be refunded. If they cancel 10 min before the start, half of the deposit will be deducted. If they cancel after the auction has started, their deposit will be fully deducted, with this part of the deposit distributed to the landlord and winning tenant as extra compensation.

Tenants who wish to participate in the auction need to pay a deposit and gas fees, allowing for the pre-screening of high-quality tenants. Furthermore, if a tenant is satisfied with the property, he/she will naturally strive to bid successfully because, only by winning can they benefit. Therefore, the key to successful competition is to increase his/her maximum bid. Deliberately placing low bids not only wastes his/her time, but also incurs unnecessary gas fees, rendering participation in the auction meaningless. Furthermore, our model shares similarities with the “total demand law” and, in the case of discrete and heterogeneous houses, demonstrates that, when houses are substitutes, this law can maximize the interests of tenants [52]. Simultaneously, landlords aim to rent out their properties as much as possible while maximizing their own profits. Consequently, landlords set a minimum price they can accept and their desired maximum price (without setting it exceptionally high to avoid excessive tax burdens). This leads to a strategic process where all participants share a common goal: hoping for a successful transaction and making a fair evaluation of the property. Range pricing auctions enable both parties to maximize their interests to the fullest extent.

Based on different auction methods utilizing blockchain technology, each method has its own advantages and disadvantages. Double-auctions and sealed auctions have their limitations: double-auctions may face network congestion and information asymmetry, while sealed auctions may lead to low-price transactions and are unable to achieve real-time bidding. These problems make these two models not very suitable for the current real estate rental market. To address these problems, interval pricing auctions were introduced. The new perspective proposed in this article possesses unique advantages. It effectively addresses issues such as low-cost transactions, network congestion, and information asymmetry. Simultaneously, it protects the confidentiality of bids while maximizing profits for both buyers and sellers. Additionally, this new perspective also exhibits a certain level of scalability, which other auction methods lack.

It can be predicted that the application of blockchain and smart contract technologies can enhance the transparency of the leasing market, improve transaction efficiency, reduce transaction costs, prevent fraudulent behavior, and protect user privacy; hence, these technologies have huge potential for application [53,54].

4. Case Study Verification through Implementation in Blockchain

In this section, we delve into and articulate a sequence of algorithms that were devised to facilitate our blockchain-based leasing transaction model. These algorithms elucidate the functioning of our proposed solution and guide the development of smart contracts.

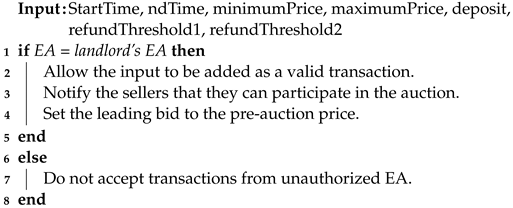

4.1. Algorithm 1: Landlord Provides Auction Details

Algorithm 1 outlines the detailed information that the landlord must provide as input to initiate the auction process. This includes the direct link to the file hashes stored in a decentralized storage system. This step is exclusively executed by the landlord’s address. Additionally, the provided information comprises the auction’s start time, end time, minimum price, maximum price, deposit amount, and time thresholds for refunding the deposit: 30 min before the auction, tenants can fully withdraw the deposit, and 10 min before the auction, tenants can withdraw 50% of the deposit. Subsequently, the tenants in the network are notified to participate.

| Algorithm 1: Landlord provides auction details |

|

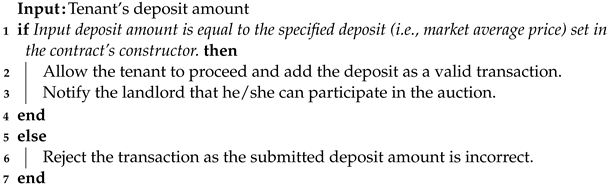

4.2. Algorithm 2: Tenant Deposit Submission

Algorithm 2 provides a detailed explanation of how tenants can participate by submitting their deposit through the submitDeposit function. The deposit amount is predetermined by the contract’s constructor, representing the market’s average price, and is thoroughly validated within this function to ensure the accuracy of the submitted amount. Only tenants who have successfully submitted the required deposit are eligible to proceed with their active participation in the auction.

| Algorithm 2: Tenant deposit submission |

|

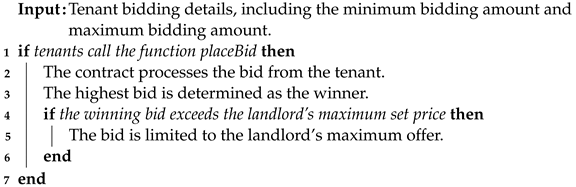

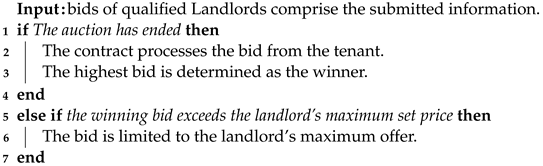

4.3. Algorithm 3: Tenant Bidding Phase

Algorithm 3 demonstrates the bidding phase in the auction, where tenants can participate in the bidding process by calling the function placeBid. Each tenant must provide both a minimum bidding amount and a maximum bidding amount. The highest bidder will be determined as the winner. If the winning bidder’s bid exceeds the landlord’s maximum set price, the bid will be limited to the landlord’s maximum offer.

| Algorithm 3: Tenant bidding phase |

|

4.4. Algorithm 4: Auction Closure and Handling

Algorithm 4 provides a detailed explanation of how, upon the conclusion of the auction, the landlord can utilize the finalizeAuction function to process the bidding outcomes. This function facilitates the refund of the deposit to the participants who were not successful in winning the auction, while designating the participant with the highest bid as the auction’s winner. The victorious bidder will subsequently become the ultimate buyer of the auctioned item and will be required to make a payment equivalent to his/her highest bidding amount.

| Algorithm 4: Auction closure and handling |

|

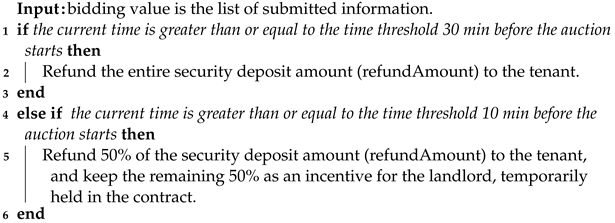

4.5. Algorithm 5: Tenant Gets Back Security Deposit

Algorithm 5 outlines the process for tenants to retrieve their security deposit after the auction. Unsuccessful tenants can request a refund by calling the withdrawRefund function. Additionally, there are two time thresholds for early deposit withdrawal: one allows tenants to reclaim the full deposit 30 min before the auction begins, and the other allows tenants to withdraw only 50% of the deposit 10 min before the auction starts. In the latter case, the remaining 50% will be awarded to the landlord as an incentive.

| Algorithm 5: Tenant gets back security deposit |

|

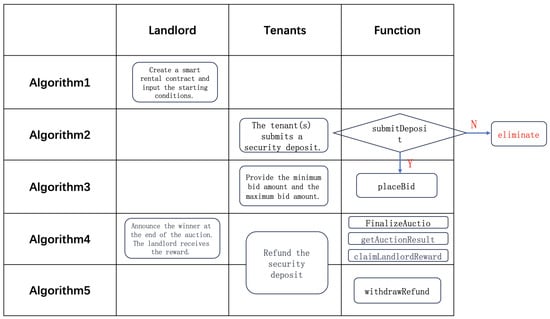

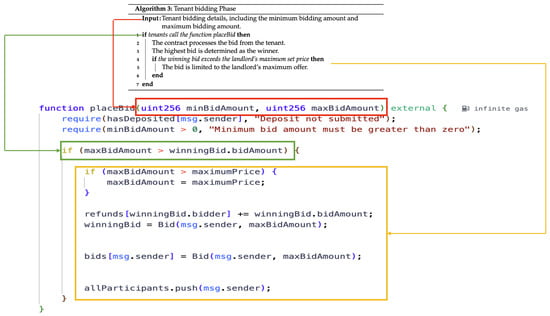

Table 2 and Figure 2 describe the functions used to implement the proposed algorithm to implement a range price auction process converted into a smart contract. The developed smart contract can be found in the GitHub repository. By comparing the smart contract Solidity code and Algorithm 3 explanation in Figure 3 in the GitHub repository, one can gain a complete understanding of Algorithm 3 and its significance in the code. Furthermore, the sequence diagram depicted in Figure 4 captures the interactions among different stakeholders. Each participant in the blockchain network holds an EA, enabling them to interact with each other by invoking the designated functions as illustrated in Table 2 Firstly, the landlord must provide details such as the start time, end time, and deposit before the smart contract is created, as shown in Figure 4. Tenants then submit their deposits using the submitDeposit() function. Subsequently, eligible tenants engage in range price bidding by calling the placeBid() function. Tenants use the finalizeAuction function to refund deposits to all unsuccessful participants. If a tenant wishes to withdraw his/her deposit at a different time during the auction, he/she can utilize the withdrawRefund() function. Only after the auction concludes can the landlord claim his/her reward by invoking the claimLandlordReward() function. After the auction ends, anyone can call the getAuctionResult() function to view the winning bid.

Table 2.

Description of functions used in the smart contract.

Figure 2.

Smart lease contract flow chart.

Figure 3.

Translation of Algorithm 3 into a smart contract code.

Figure 4.

Sequence diagram showing function calls and events during an automatic range price auction.

5. Test Scenarios

In this section, we provide a comprehensive exposition and demonstration of our newly proposed smart contract, as depicted in the code snippet below. Through this contract, our aim was to realize a decentralized rental auction model, leveraging blockchain technology to enhance transaction transparency, security, and efficiency. We will progressively elucidate the various aspects of the smart contract, starting from the deployment by the landlord to tenant bidding, the refund rules, and the generation of the auction results.

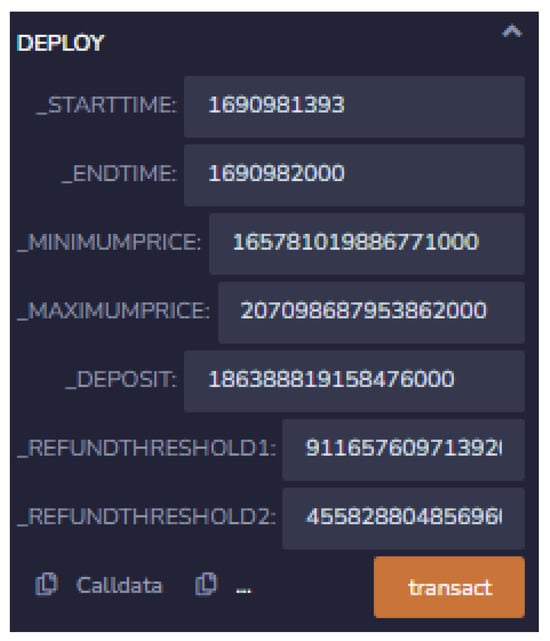

Landlord deploys the smart contract: To initiate the auction process, the landlord is required to deploy the smart contract. In Figure 5, we illustrate the process of the landlord deploying the smart contract. The landlord needs to specify the following parameters:

Figure 5.

Landlord deploys smart contract.

Start time (STARTTIME): The commencement time of the auction, calculated using Solidity’s Unix Epoch time. End time (ENDTIME): The conclusion time of the auction, likewise calculated using Unix Epoch time. Minimum acceptable value (MINIMUMPRICE): (The unit we used in this process is gas). The minimum bid amount the landlord is willing to accept. Maximum acceptable value (MAXIMUMPRICE): The maximum bid amount the landlord is willing to accept. Deposit amount (DEPOSIT): The deposit amount tenants need to submit before participating in the auction to demonstrate their serious intent. Additionally, the landlord is required to manually configure refund thresholds, namely the following two thresholds:

REFUNDTHRESHOLD1: If a tenant withdraws within 30 min before the auction starts, he/she is eligible for a full refund of his/her deposit. REFUNDTHRESHOLD2: If a tenant withdraws within 10 min before the auction starts, he/she can claim back half of his/her deposit. These parameter settings provide the foundation for the entire auction process, ensuring the fairness and controllability of the contract.

Tenant bidding and refund rules: Qualified buyers need to submit a deposit before the auction starts to be eligible for bidding. Subsequently, tenants can place bids during the auction by calling the placeBid function. This function takes two parameters: the minimum bid amount (minBidAmount) and the maximum bid amount (maxBidAmount). The contract determines the winner based on these bids.

Our contract establishes a winning condition: If a new bid’s maximum amount surpasses the current winning bid, the current winner’s deposit is refunded, and the winning bid is updated. It is important to note that the winning bid cannot exceed the landlord’s set maximum acceptable value.

Regarding refund rules, we provide a detailed explanation. Based on the refund threshold settings, if a tenant withdraws within 30 min before the auction starts, he/she can retrieve his/her full deposit (_REFUNDTHRESHOLD1). If a tenant withdraws within 10 min before the auction starts, he/she can claim back half of his/her deposit (_REFUNDTHRESHOLD2). These rules ensure participants have reasonable withdrawal options, ensuring fairness and incentivizing participation.

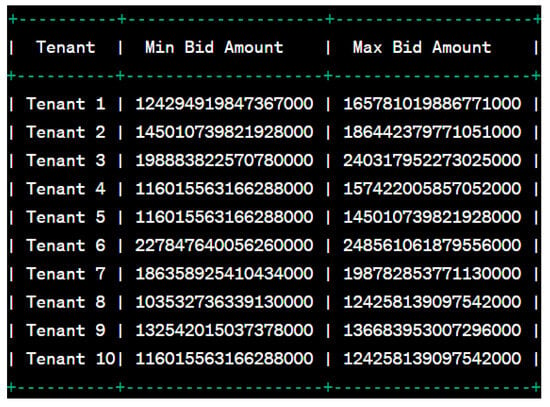

5.1. Auction Data Simulation

During our auction testing phase, we simulated ten tenants, each assigned a range of maximum and minimum bid amounts they were willing to pay (The unit we used in this process is gas). Figure 6 displays the simulated scenarios of these tenants, representing various bidding strategies.

Figure 6.

The maximum and minimum bid amount each tenant is willing to pay.

5.2. Gas Cost

We assumed that the peer-to-peer network operates under normal conditions, with supply and demand for block space in an equilibrium state. Furthermore, gas consumption for each function was calculated in accordance with the specifications outlined in the Ethereum Yellow Paper. Furthermore, we considered the gas fees paid by both the landlord and tenants throughout the auction process. In the Ethereum network, every operation requires the payment of gas fees, such as executing and deploying smart contracts. Consequently, every line of code in Solidity incurs a certain amount of gas cost. There are two primary components to consider: execution cost and transaction cost. Ethereum gas is a unit used to measure the computational workload required for transaction execution. It is essential to understand that Ethereum gas consists of two main components: the gas limit and the gas price [55].

The gas limit represents the total gas allocated to a smart contract and primarily affects execution, ensuring it is sufficient for all operations. On the other hand, the gas price is related to the gas consumed by the contract and directly influences the speed at which transactions are added to the blockchain. Higher gas prices accelerate transaction confirmation. During periods of high network traffic, the average gas price tends to increase as miners compete to include transactions in the next block. As shown in Table 3, we summarize the gas fee situations for both parties. It is important to note that each tenant needs to submit a deposit upfront before participating in the auction, an essential measure to ensure active participation. Table 4 shows the gas cost results for each function of the real-time testing scope of the auction. The submitDeposit() function generated a gas cost of 52,473 when Tenant 6 submitted the deposit. The placeBid() function simulates the average gas fee generated by ten tenants bidding within a price range, which was 147,678. The finalizeAuction() function simulates the average gas fee generated by the other nine tenants among the ten tenants, who receive refunds for unsuccessful bids, and the average gas fee was 133,466. The withdrawRefund() function simulates the average gas fee generated by the ten tenants when they withdraw their deposits at various times during the auction, and the average gas fee was 35,918. The claimLandlordReward() function, used by the landlord to claim the reward at the end of the auction, had a gas cost of 0 since there were no breaches in the simulation. The getAuctionResult() function, used by the landlord to view the winning bid results, had a gas cost of 4785.

Table 3.

Comparison of gas fee for landlord and Tenant 6.

Table 4.

Consumed gas cost for different functions of the auction contract.

5.3. Comparison of Test Results

In conclusion, at the end of the auction, according to our test data, Tenant 6 emerged as the winning bidder. This result is derived from the internal logic of the contract, undergoing sound evaluation of the winning criteria and refund rules. Significantly, the gas fees incurred by Tenant 6 and the landlord during the entire auction process were notably lower than the costs typically associated with traditional offline intermediaries. This underscores the advantages of our new model, leveraging blockchain technology to achieve lower transaction costs and enhanced efficiency. Real estate brokerage fees around the world typically range from 5% to 6% of the property’s value. This implies that, in practice, the cost of brokerage fees increases proportionally with the property value, resulting in relatively high fees when there is an intermediary involved. In contrast, when utilizing blockchain, one only needs to pay fees associated with the issuance of smart contracts, independent of the property value. This makes real estate rentals much more cost effective.

At the same time, we conducted a comparison with similar types of smart contracts. In the paper titled “A Blockchain-Based Housing Rental System [56]”, the solution for the smart contract-based renting problem was built upon Ethereum smart contracts, IPFS, and Oraclize services. Specifically, IPFS is used to store housing listing information, and the hash values of this information are stored on the blockchain. The smart leasing contract is written to operate on the blockchain and manage rental transactions, while Oraclize serves as the trigger for generating rental invoices. This system ensures the authenticity and traceability of housing information, providing a legal foundation for future transactions. The aim of this paper was to propose a decentralized housing rental system based on blockchain technology, facilitating information sharing, tracking, visibility, and the storage of rental transaction records through smart contracts to protect the interests of both tenants and landlords.

However, this paper placed a greater emphasis on the entire rental process from start to finish. Nevertheless, from the authors’ viewpoint, the Lease Agreement Producer Contract (LAPC) section of this paper shares similar functionalities, making a thorough comparison worthwhile. The development of a blockchain-based rental system has already been completed, and the smart contract code for this system has been uploaded to GitHub. For the sake of comparison, we also used the November 2018 Ethereum to USD exchange rate, which was approximately 1 Ether ≈ USD 179.56, as a reference point. The minimum gas price for executing transactions is 1 GWEI, where 1 GWEI = 0.000000001. Therefore, from Table 5, it is evident that the new perspective we have introduced excels in terms of the gas efficiency, error rate, learning curve, and participation of both parties in the range price auction lease smart contract:

Table 5.

Gas fee comparison.

1. Concise code design: In comparison to the Solidity code in the reference literature, our implementation features a more-streamlined code design. This not only enhances maintainability, but also reduces code complexity, consequently lowering gas costs.

2. Fewer functions and features: Relative to the reference code, our implementation maintains fewer functions and features, resulting in a significant reduction in gas costs. The reduction in functions and features not only enhances performance, but also reduces transaction execution costs.

3. Higher gas efficiency: Due to the factors mentioned above, our code exhibits greater gas efficiency. This implies that users incur lower transaction fees, making our solution more appealing.

These distinctions and advantages render our approach competitive in terms of gas costs, while delivering improved performance and efficiency.

6. Conclusions

In this paper, we explored the significant opportunities presented by a novel situational auction mechanism based on blockchain technology, the range price auction model, within the context of the real estate rental market. Our investigation was centered on enhancing transparency, data integrity, and data traceability across three crucial dimensions, while concurrently fostering fair competition and thwarting collusion.

We introduced a blockchain-based smart contract framework that combines the advantages of sealed bidding and double-auction techniques to derive a range price auction, specifically tailored to address the existing challenges in the real estate rental market. By capitalizing on Ethereum smart contracts to autonomously execute transactions, we effectively eradicated the necessity for intermediaries. The intricate amalgamation of the system architecture, algorithms, and comprehensive testing not only elucidated our innovative concept, but also laid the groundwork for future enhancements. Our framework is poised to upgrade to Version 2.0, accommodating a multitude of landlords and tenants, thereby further elevating transaction efficiency.

Currently, we used a single landlord, multiple tenants model. In the future, we plan to expand to a multi-landlord and multi-tenant model while optimizing our transaction algorithms for increased efficiency. Furthermore, smart contracts can be modified or extended in the future to meet new requirements or introduce new features without disrupting existing functionality. Compared to conventional offline real estate transactions, our solution demonstrated a substantial reduction in both transaction costs and duration. Harnessing the inherent attributes of blockchain, we established a foundation of transparency, traceability, and security. Additionally, our smart-contract-driven approach instills bidder confidence by guaranteeing a level playing field throughout the auction process, thus safeguarding the authenticity of every bid submitted.

Vulnerabilities or errors within a smart contract can lead to potentially severe consequences. Hence, it is of utmost importance to employ formal methods to guarantee the accurate configuration of smart contracts. Recent studies have extensively addressed the specification and verification of smart contracts using cutting-edge formal methods [17,57]. To facilitate the commercialization of smart contracts within the real estate rental market and establish a sustainable environment, it is essential to consider conducting security-focused verification using formal methods as a significant area for future research. At the same time, vulnerabilities or errors within a smart contract can lead to potentially severe consequences. Hence, it is of utmost importance to employ formal methods to guarantee the accurate configuration of smart contracts. Recent studies have extensively addressed the specification and verification of smart contracts using cutting-edge formal methods. To facilitate the commercialization of smart contracts within the real estate rental market and establish a sustainable environment, it is essential to consider conducting security-focused verification using formal methods as a significant area for future research [58]. To facilitate further exploration and reproducibility, the complete smart contract code is made publicly accessible on GitHub (GitHub is a database of open-source code, and readers interested in smart contract code and related resources are encouraged to find more information in this GitHub Repository accessed on 30 August 2023).

Author Contributions

Writing—original draft, Q.G.; Funding acquisition, H.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Soongsil University, grant number 201810001841.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Latifi, S.; Zhang, Y.; Cheng, L.C. Blockchain-based real estate market: One method for applying blockchain technology in commercial real estate market. In Proceedings of the 2019 IEEE International Conference on Blockchain (Blockchain), Atlanta, GA, USA, 14–17 July 2019; pp. 528–535. [Google Scholar]

- Gupta, A.; Rathod, J.; Patel, D.; Bothra, J.; Shanbhag, S.; Bhalerao, T. Tokenization of real estate using blockchain technology. In Proceedings of the Applied Cryptography and Network Security Workshops: ACNS 2020 Satellite Workshops, AIBlock, AIHWS, AIoTS, Cloud S&P, SCI, SecMT, and SiMLA, Rome, Italy, 19–22 October 2020; pp. 77–90. [Google Scholar]

- Yu, Y.; Dong, Y.; Guo, X. Pricing for sales and per-use rental services with vertical differentiation. Eur. J. Oper. Res. 2018, 270, 586–598. [Google Scholar] [CrossRef]

- Tilbury, J.L.; de la Rey, E.; van der Schyff, K. Business process models of blockchain and South African real estate transactions. In Proceedings of the 2019 International Conference on Advances in Big Data, Computing and Data Communication Systems (icABCD), Winterton, South Africa, 5–6 August 2019; pp. 1–7. [Google Scholar]

- Spielman, A. Blockchain: Digitally Rebuilding the Real Estate Industry. Ph.D. Thesis, Massachusetts Institute of Technology, Cambridge, MA, USA, 2016. [Google Scholar]

- Monfared, R.P. A Component-Based Approach to Design and Construction of Change Capable Manufacturing Cell Control Systems. Ph.D. Thesis, Loughborough University, Loughborough, UK, 2000. [Google Scholar]

- Zhuang, W.; Chen, J.; Fu, X. Joint dynamic pricing and capacity control for hotels and rentals with advanced demand information. Oper. Res. Lett. 2017, 45, 397–402. [Google Scholar] [CrossRef]

- Catchlove, P. Smart Contracts: A New Era of Contract Use. 2017. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3090226 (accessed on 30 August 2023).

- Ali, S.M.; Appolloni, A.; Cavallaro, F.; D’Adamo, I.; Di Vaio, A.; Ferella, F.; Gastaldi, M.; Ikram, M.; Kumar, N.M.; Martin, M.A.; et al. Development Goals towards Sustainability. Sustainability 2023, 15, 9443. [Google Scholar] [CrossRef]

- Bennett, R.; Miller, T.; Pickering, M.; Kara, A.K. Hybrid approaches for smart contracts in land administration: Lessons from three blockchain proofs-of-concept. Land 2021, 10, 220. [Google Scholar] [CrossRef]

- Dijkstra, M. Blockchain: Towards Disruption in the Real Estate Sector: An Exploration on the Impact of BlockchainTechnology in the Real Estate Management Process. Master’s Thesis, Delft University of Technology, Delft, The Netherlands, 2017. [Google Scholar]

- Wouda, H.P.; Opdenakker, R. Blockchain technology in commercial real estate transactions. J. Prop. Invest. Financ. 2019, 37, 570–579. [Google Scholar] [CrossRef]

- Wyld, D.C. Reverse Auctioning: Saving Money and Increasing Transparency; IBM Center for the Business of Government: Washington, DC, USA, 2011.

- Baum, A. PropTech 3.0: The Future of Real Estate; University of Oxford: Oxford, UK, 2017. [Google Scholar]

- Lin, I.C.; Liao, T.C. A survey of blockchain security issues and challenges. Int. J. Netw. Secur. 2017, 19, 653–659. [Google Scholar]

- Di Vaio, A.; Hassan, R.; Palladino, R. Blockchain technology and gender equality: A systematic literature review. Int. J. Inf. Manag. 2023, 68, 102517. [Google Scholar] [CrossRef]

- Krichen, M.; Lahami, M.; Al-Haija, Q.A. Formal methods for the verification of smart contracts: A review. In Proceedings of the 2022 15th International Conference on Security of Information and Networks (SIN), Sousse, Tunisia, 11–13 November 2022; pp. 1–8. [Google Scholar]

- Zheng, Z.; Xie, S.; Dai, H.N.; Chen, X.; Wang, H. Blockchain challenges and opportunities: A survey. Int. J. Web Grid Serv. 2018, 14, 352–375. [Google Scholar] [CrossRef]

- Buterin, V. A next-generation smart contract and decentralized application platform. White Pap. 2014, 3, 2-1. [Google Scholar]

- Hawlitschek, F.; Notheisen, B.; Teubner, T. The limits of trust-free systems: A literature review on blockchain technology and trust in the sharing economy. Electron. Commer. Res. Appl. 2018, 29, 50–63. [Google Scholar] [CrossRef]

- Hartman, J.H.; Murdock, I.; Spalink, T. The Swarm scalable storage system. In Proceedings of the 19th IEEE International Conference on Distributed Computing Systems (Cat. No. 99CB37003), Austin, TX, USA, 5 June 1999; pp. 74–81. [Google Scholar]

- Hewa, T.; Ylianttila, M.; Liyanage, M. Survey on blockchain based smart contracts: Applications, opportunities and challenges. J. Netw. Comput. Appl. 2021, 177, 102857. [Google Scholar] [CrossRef]

- Swan, M. Blockchain thinking: The brain as a decentralized autonomous corporation [commentary]. IEEE Technol. Soc. Mag. 2015, 34, 41–52. [Google Scholar] [CrossRef]

- Wu, S.; Chen, Y.; Wang, Q.; Li, M.; Wang, C.; Luo, X. CReam: A smart contract enabled collusion-resistant e-auction. IEEE Trans. Inf. Forensics Secur. 2018, 14, 1687–1701. [Google Scholar] [CrossRef]

- Galal, H.S.; Youssef, A.M. Trustee: Full privacy preserving vickrey auction on top of ethereum. In Proceedings of the Financial Cryptography and Data Security: FC 2019 International Workshops, VOTING and WTSC, St. Kitts, St. Kitts and Nevis, 18–22 February 2019; pp. 190–207. [Google Scholar]

- Shepard, J. Digital transactions in real estate marketing. J. World Econ. Res. 2020, 9, 120–124. [Google Scholar] [CrossRef]

- Kauffman, R.J.; Wood, C.A. Running up the bid: Detecting, predicting, and preventing reserve price shilling in online auctions. In Proceedings of the 5th International Conference on Electronic Commerce, Pittsburgh, PA, USA, 30 September–3 October 2003; pp. 259–265. [Google Scholar]

- Danielsen, B.; Harrison, D.; Van Ness, R.; Warr, R. Liquidity, accounting transparency, and the cost of capital: Evidence from real estate investment trusts. JRER 2014, 36, 221–252. [Google Scholar] [CrossRef]

- Malik, S.; Foxcroft, T. Real Estate Agents Caught Breaking the Rules on Marketplace’s Hidden Camera. CBC News, 3 November 2016. [Google Scholar]

- Kejriwal, S.; Mahajan, S. Blockchain in Commercial Real Estate: The Future Is Here; Deloitte Center for Financial Services: London, UK, 2016. [Google Scholar]

- Levy, K.E. Book-smart, not street-smart: Blockchain-based smart contracts and the social workings of law. Engag. Sci. Technol. Soc. 2017, 3, 1–15. [Google Scholar] [CrossRef]

- Maestrini, V.; Luzzini, D.; Maccarrone, P.; Caniato, F. Supply chain performance measurement systems: A systematic review and research agenda. Int. J. Prod. Econ. 2017, 183, 299–315. [Google Scholar] [CrossRef]

- Christidis, K.; Devetsikiotis, M. Blockchains and smart contracts for the Internet of things. IEEE Access 2016, 4, 2292–2303. [Google Scholar] [CrossRef]

- Veuger, J. Trust in a viable real estate economy with disruption and blockchain. Facilities 2018, 36, 103–120. [Google Scholar] [CrossRef]

- Fernández-Caramés, T.M.; Fraga-Lamas, P. A Review on the Use of Blockchain for the Internet of Things. IEEE Access 2018, 6, 32979–33001. [Google Scholar] [CrossRef]

- Stamatellis, C.; Papadopoulos, P.; Pitropakis, N.; Katsikas, S.; Buchanan, W.J. A privacy-preserving healthcare framework using hyperledger fabric. Sensors 2020, 20, 6587. [Google Scholar] [CrossRef]

- Wei, P.; Wang, D.; Zhao, Y.; Tyagi, S.K.S.; Kumar, N. Blockchain data-based cloud data integrity protection mechanism. Future Gener. Comput. Syst. 2020, 102, 902–911. [Google Scholar] [CrossRef]

- Engelenburg, S.v.; Janssen, M.; Klievink, B. Design of a software architecture supporting business-to-government information sharing to improve public safety and security: Combining business rules, Events and blockchain technology. J. Intell. Inf. Syst. 2019, 52, 595–618. [Google Scholar] [CrossRef]

- Molina-Jimenez, C.; Sfyrakis, I.; Solaiman, E.; Ng, I.; Wong, M.W.; Chun, A.; Crowcroft, J. Implementation of smart contracts using hybrid architectures with on and off–blockchain components. In Proceedings of the 2018 IEEE 8th International Symposium on Cloud and Service Computing (SC2), Paris, France, 18–21 November 2018; pp. 83–90. [Google Scholar]

- Rejeb, A.; Keogh, J.G.; Treiblmaier, H. Leveraging the Internet of things and blockchain technology in supply chain management. Future Internet 2019, 11, 161. [Google Scholar] [CrossRef]

- Agrawal, T.K.; Kumar, V.; Pal, R.; Wang, L.; Chen, Y. Blockchain-based framework for supply chain traceability: A case example of textile and clothing industry. Comput. Ind. Eng. 2021, 154, 107130. [Google Scholar] [CrossRef]

- Salah, K.; Rehman, M.H.U.; Nizamuddin, N.; Al-Fuqaha, A. Blockchain for AI: Review and open research challenges. IEEE Access 2019, 7, 10127–10149. [Google Scholar] [CrossRef]

- Mohanta, B.K.; Panda, S.S.; Jena, D. An overview of smart contract and use cases in blockchain technology. In Proceedings of the 2018 9th International Conference on Computing, Communication and Networking Technologies (ICCCNT), Bengaluru, India, 10–12 July 2018; pp. 1–4. [Google Scholar]

- Wood, G. Ethereum: A secure decentralised generalised transaction ledger. Ethereum Proj. Yellow Pap. 2014, 151, 1–32. [Google Scholar]

- Kim, C. Confessions of a Sharding Skeptic. 2020. Available online: https://www.coindesk.com/sharding-eth-2-podcast (accessed on 5 October 2020.).

- Swan, M. Blockchain: Blueprint for a New Economy; O’Reilly Media, Inc.: Sebastopol, CA, USA, 2015. [Google Scholar]

- Galal, H.S.; Youssef, A.M. Verifiable sealed-bid auction on the ethereum blockchain. In Proceedings of the Financial Cryptography and Data Security: FC 2018 International Workshops, BITCOIN, VOTING, and WTSC, Nieuwpoort, Curaçao, 2 March 2018; pp. 265–278. [Google Scholar]

- Parizi, R.M.; Amritraj; Dehghantanha, A. Smart contract programming languages on blockchains: An empirical evaluation of usability and security. In Proceedings of the Blockchain–ICBC 2018: First International Conference, Held as Part of the Services Conference Federation, SCF 2018, Seattle, WA, USA, 25–30 June 2018; pp. 75–91. [Google Scholar]

- Damisa, U.; Nwulu, N.I.; Siano, P. Towards Blockchain-Based Energy Trading: A Smart Contract Implementation of Energy Double Auction and Spinning Reserve Trading. Energies 2022, 15, 4084. [Google Scholar] [CrossRef]

- Chen, Y.H.; Chen, S.H.; Lin, I.C. Blockchain based smart contract for bidding system. In Proceedings of the 2018 IEEE International Conference on Applied System Invention (ICASI), Bengaluru, India, 10–12 July 2018; pp. 208–211. [Google Scholar]

- Koirala, R.C.; Dahal, K.; Matalonga, S.; Rijal, R. A supply chain model with blockchain-enabled reverse auction bidding process for transparency and efficiency. In Proceedings of the 2019 13th International Conference on Software, Knowledge, Information Management and Applications (SKIMA), Island of Ulkulhas, Maldives, 26–28 August 2019; pp. 1–6. [Google Scholar]

- Hatfield, J.W.; Milgrom, P.R. Matching with contracts. Am. Econ. Rev. 2005, 95, 913–935. [Google Scholar] [CrossRef]

- Gupta, R.; Tanwar, S.; Al-Turjman, F.; Italiya, P.; Nauman, A.; Kim, S.W. Smart contract privacy protection using AI in cyber-physical systems: Tools, techniques and challenges. IEEE Access 2020, 8, 24746–24772. [Google Scholar] [CrossRef]

- Sahai, A.; Pandey, R. Smart contract definition for land registry in blockchain. In Proceedings of the 2020 IEEE 9th International Conference on Communication Systems and Network Technologies (CSNT), Gwalior, India, 10–12 April 2020; pp. 230–235. [Google Scholar]

- Albert, E.; Correas, J.; Gordillo, P.; Román-Díez, G.; Rubio, A. Gasol: Gas analysis and optimization for ethereum smart contracts. In International Conference on Tools and Algorithms for the Construction and Analysis of Systems; Springer International Publishing: Cham, Switzerland, 2020; pp. 118–125. [Google Scholar]

- Qi-Long, C.; Rong-Hua, Y.; Fei-Long, L. A Blockchain-based Housing Rental System. In Proceedings of the International Conference on Advances in Computer Technology, Information Science and Communications, Virtual Event, 15–17 March 2019; pp. 184–190. [Google Scholar]

- Abdellatif, T.; Brousmiche, K.L. Formal verification of smart contracts based on users and blockchain behaviors models. In Proceedings of the 2018 9th IFIP International Conference on New Technologies, Mobility and Security (NTMS), Paris, France, 26–28 February 2018; pp. 1–5. [Google Scholar]

- Di Vaio, A.; Varriale, L. Blockchain technology in supply chain management for sustainable performance: Evidence from the airport industry. Int. J. Inf. Manag. 2020, 52, 102014. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).