Impact of Innovation Quality on the Growth Performance of Entrepreneurial Enterprises: The Role of Knowledge Capital

Abstract

1. Introduction

2. Literature Review and Theoretical Hypothesis

2.1. Theoretical Basis and Literature Review

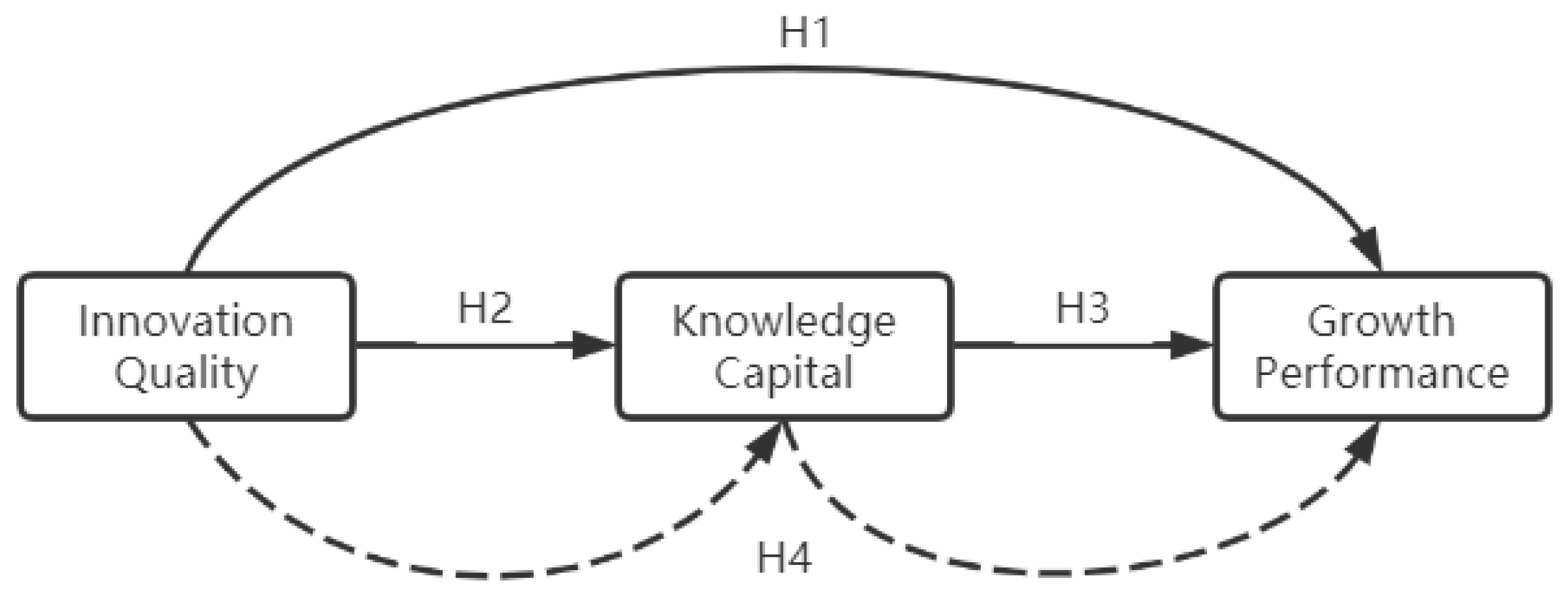

2.2. Proposal of Research Hypothesis

2.2.1. Innovation Quality and Growth Performance

2.2.2. Innovation Quality and Knowledge Capital

2.2.3. Knowledge Capital and Growth Performance

2.2.4. The Mediating Effect of Knowledge Capital

3. Construction and Calculation of the Knowledge Capital Index System

3.1. The Construction of the Evaluation Index System

3.2. Knowledge Capital Index Measurement Based on Principal Component Analysis

3.2.1. Principal Component Analysis

3.2.2. Knowledge Capital Index Measurement

- Test the suitability for principal component analysis. Firstly, the KMO test and Bartlett test were conducted according to the four capital composition indicators. The test results showed that the KMO values of the four subjects were greater than 0.5, and the significance was less than 0.005, indicating that the four indexes of HRC, IRC, IFC and RC can be analyzed by principal component.

- Extract principal components. The p-value can be selected by the cumulative contribution rate or characteristic value of the principal component. HRC group and RC group extracted two principal components whose characteristic value is greater than 1, and the IRC group and IFC group also extracted two principal components according to the principle of the cumulative contribution rate.

- Calculate the principal components. The calculation formula of HRC index, IRC index, IFC index and RC index is obtained by weight calculation of each principal component. The negative value of the coefficient in the calculation result is due to the standardization of the principal component analysis. Details are shown in Table 2 below.

4. Research Methods and Model Design

4.1. Sample Selection and Data Source

4.2. About Variables

4.2.1. Explanatory Variables

4.2.2. Explained Variables

4.2.3. Mediator Variables and Control Variables

4.3. Regression Equation Model

4.4. Mediation Effect Model

5. Empirical Analysis

5.1. Descriptive Statistics

5.2. Correlation Analysis and the Regression Results

5.3. Test of the Intermediary Role

5.4. Robustness Test Based on Alternative Variables

6. Research Conclusions and Discussion

6.1. Main Results and Implications

- The innovation quality of entrepreneurial enterprises has a positive role in promoting the growth and performance of enterprises. This is consistent with the mainstream conclusion of current relevant studies that technological innovation can improve enterprise performance, and the research conclusion of this paper further verifies the important role of innovation quality in the growth of enterprises. With the improvement of innovative quality, the growth and development of enterprises will be more optimistic, which is reflected in the growth performance. The government and relevant departments should implement the new development concept, encourage enterprises to carry out high-quality innovation activities and create a good environment for innovation. Enterprises must try constant innovations, give full play to the innovation subject, and make competitive and innovative advantages so as to provide corresponding products/services in the face of personalized and changeable market demand, and finally achieve innovation-driven economic development. Relatively speaking, entrepreneurial enterprises themselves pay much attention to innovation; meanwhile, they should control the innovation quality. By increasing the proportion of high-quality innovation output, they should increase competitiveness and occupy the market, which is conducive to the improvement of enterprise benefits and promote the long-term sustainable development of enterprises.

- There is a positive relationship between the innovation quality and knowledge capital of entrepreneurial enterprises, which is reflected in the accumulation and growth of knowledge capital with the improvement of innovation quality. Existing studies point out that high-quality innovation activities increase knowledge acquisition to some extent, but this study further indicates that the growth of knowledge capital cannot be separated from the improvement of innovation quality. Therefore, from the present research conclusion, the quality of innovation covers the incremental information of knowledge capital, which can reflect the situation of knowledge capital to a certain extent. The improvement of the innovation quality output has won more market opportunities for enterprises and increased the investment in human capital, and the R&D productivity, current assets turnover and accounts receivable turnover will also be improved accordingly, thus increasing the accumulation of knowledge capital. In addition, enterprises should lay emphasis on the balanced development of knowledge capital components to achieve greater value and benefits.

- There is also a significant positive correlation between the knowledge capital of entrepreneurial enterprises and their growth performance. The expansion and accumulation of enterprise knowledge capital create favorable conditions for the development and growth of enterprises and promote the growth of the strength and scale of the enterprise. In other words, corporate knowledge capital not only promotes the improvement of corporate financial performance but also facilitates the growth of corporate growth performance. Thus, the optimal and rational allocation of knowledge capital is the driving force of the long-term development of enterprises. Therefore, enterprise managers need to make reasonable knowledge capital investments considering their own resources, competitive ability and industry position, create a good internal environment of knowledge sharing, focus on the accumulation of knowledge capital and develop a capital management strategy conducive to the sustainable development of enterprise, so as to obtain a competitive position continuously. In addition, a reasonable and perfect knowledge capital management system is an important prerequisite to give full play to the role of knowledge capital, build a knowledge capital evaluation mechanism and evaluate the knowledge capital of enterprises comprehensively and reasonably based on the long-term development of enterprises.

- (1)

- Lay stress on the cultivation of talents, establish a reasonable salary mechanism and career development planning, strive to enhance staff’s sense of identity, belonging and happiness, stop the outflow of talent and control the personnel flow.

- (2)

- Reasonable R&D investment where the R&D personnel and development costs should take the management increase into consideration and make reasonable allocations.

- (3)

- Introduce advanced technical facilities, promote the circulation and sharing of knowledge and enhance the working efficiency of employees.

- (4)

- Maintain a good relationship with customers and suppliers. On the one hand, the growth and development of enterprises cannot be separated from customers’ consumption of products/services. On the other hand, the close relationship with suppliers can broaden the channels for enterprises to obtain information, knowledge and resources. In short, entrepreneurial enterprises need to put more emphasis on knowledge capital and promote the value appreciation and sustainable development of enterprises.

6.2. Research Significance

6.3. Research Limitations and Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Yu, D.; Liu, J. Knowledge capital, organizational character and future orientation of innovation-oriented firms. Sci. Technol. Prog. Countermeas. 2020, 37, 115–124. [Google Scholar]

- Zhang, M.; Jian, L. Research on the efficiency of industry-university-research collaborative innovation in high-tech industries: A dynamic analysis based on industry. Contemp. Econ. Manag. 2010, 43, 25–33. [Google Scholar]

- Park, E.; Kwon, S.J. Effects of innovation types on firm performance: An empirical approach in South Korean manufacturing industry. Int. J. Bus. Innov. Res. 2018, 15, 215–230. [Google Scholar] [CrossRef]

- Zhu, X.Z. Dialectically view the quantity and quality of Chinese patents. Proc. Chin. Acad. Sci. 2013, 28, 435–441. [Google Scholar]

- Yu, D.K.; Yan, H.L. The formation path of core competitiveness and competitive advantage: The integrated interpretation of knowledge capital and organizational personality. Sci. Technol. Prog. Countermeas. 2019, 36, 122–131. [Google Scholar]

- Yang, H.; Chen, X.; Wang, H. Research on the relationship between educational background and corporate performance of entrepreneurial enterprises. Sci. Res. Manag. 2015, 36, 216–223. [Google Scholar]

- Zhang, S.X.; Fang, X.J.; Li, J. Research on the Influence of R&D Investment on Growth of GEM Listed Companies: Based on the regulatory role of ownership structure. Sci. Technol. Manag. Res. 2017, 37, 143–149. [Google Scholar]

- Wu, H.; Hu, S. Digital Transformation, Technological innovation and High-quality Development of Enterprises. J. Zhongnan Univ. Econ. Law 2023, 136–145. [Google Scholar]

- Coad, A.; Rao, R. Firm growth and R&D expenditure. Econ. Innov. New Technol. 2010, 19, 127–145. [Google Scholar]

- Huo, X.P. Innovation Input and firm Growth: Inhibition or Promotion? Soc. Sci. 2019, 38–45. [Google Scholar]

- Yang, H.X.; Wang, S. Research on the Influence of technological innovation ability on the growth of small and medium-sized enterprises: A case study of listed companies in small and medium-sized board manufacturin.X.g industry. Collect. Dongyue Essays 2013, 34, 106–111. [Google Scholar]

- Chen, M.L.; Wang, X.; Hao, J.; Mao, R. A study on the interaction of entrepreneurial characteristics and human capital on entrepreneurial performance. J. Xi‘Shiyou Univ. (Soc. Sci. Ed.) 2022, 31, 28–38. [Google Scholar]

- Sheng, Y.H.; Lu, L. Research on inverted N-shaped relationship between R&D investment and firm performance. Nanjing Soc. Sci. 2016, 32–38. [Google Scholar]

- Zhang, Z.Q.; Qiao, Y.D.; Liu, X. Research on the spatial-temporal agglomeration effect of innovation quality in Zhongguancun Science Park. Sci. Technol. Prog. Countermeas. 2020, 37, 51–59. [Google Scholar]

- Bei, J. Economics Research on “high-quality development”. China Ind. Econ. 2018, 1, 5–18. [Google Scholar]

- Chi, R.Y.; Yu, J.; Ruan, H.P. Research on the Influence of firm size and R&D Investment on innovation Performance: Based on the perspective of credit environment and knowledge stock. East China Econ. Manag. 2020, 34, 43–54. [Google Scholar]

- Wu, C.P.; Tang, D. Intellectual property protection law enforcement, technological innovation and enterprise performance—Evidence from Chinese listed companies. Econ. Res. 2016, 51, 125–139. [Google Scholar]

- Shan, C.X.; Li, Q.; Ding, L. Intellectual Property Protection, Innovation Drive and High Quality Development of Manufacturing Industry: A Moderated mediation Effect Analysis. Econ. Probl. 2023, 51–59. [Google Scholar]

- Liu, D.; Wan, D.F.; Wu, Z.G. Can China’s GEM market identify the quality of innovation? Sci. Res. Manag. 2016, 37, 46–54. [Google Scholar]

- Mardani, A.; Nikoosokhan, S.; Moradi, M.; Doustar, M. The Relationship Between Knowledge Management and Innovation Performance. J. High Technol. Manag. Res. 2018, 29, 12–26. [Google Scholar] [CrossRef]

- Chen, Z.; Liu, Y.M. Government subsidies, enterprise innovation and high-quality development of manufacturing enterprises. Reform 2019, 8, 140–151. [Google Scholar]

- Zhao, W.; Liang, Z.Y.; Zhang, Y.N.; Xiao, T. Innovation openness, knowledge acquisition and growth of high-tech enterprises. Sci. Technol. Manag. Res. 2020, 42, 128–136. [Google Scholar]

- Luo, F.K.; Fu, K.; Wang, J. Corporate income tax, capital structure, and R & D Expenditure. Sci. Res. Manag. 2016, 37, 44–52. [Google Scholar]

- Zhang, J.G.; Yang, W.S. Knowledge capital and technological innovation. Theor. Explor. 2004, 62–64. [Google Scholar]

- Zhang, Z.G.; Chen, Z.M. Research on the relationship between open innovation, absorption ability and innovation performance. Sci. Res. Manag. 2015, 36, 49–56. [Google Scholar]

- Nah, F.F.-H.; Siau, K.; Tian, Y. Knowledge management mechanisms of financial service sites. Commun. ACM 2005, 48, 117–123. [Google Scholar] [CrossRef]

- Penrose, E.T. The Theory of the Growth of the Firm; Oxford University Press: Oxford, UK, 1959. [Google Scholar]

- Alchian, A. Uncertainty, Evolution, and Economic Theory. J. Political Econ. 1950, 58, 211–221. [Google Scholar] [CrossRef]

- Yu, D.K.; Xiao, H.; Peng, J.; Bo, Q.S. A study on the interaction effect of knowledge capital and personality traits on enterprise performance. Sci. Technol. Prog. Countermeas. 2016, 33, 146–155. [Google Scholar]

- Chahal, H.; Bakshi, P. Measurement of intellectual capital in the Indian banking sector. Vikalpa 2016, 41, 61–73. [Google Scholar] [CrossRef]

- Chen, Y. Study on the Relationship between Enterprise Intellectual Capital and Growth Performance from the Perspective of Knowledge Dynamic Ability; Zhejiang Normal University: Jinhua, China, 2020. [Google Scholar] [CrossRef]

- Bu, H.; Cui, X.L.; Han, X.; Xu. Corporate structural capital, dual innovation and Market value. Friends Account. 2022, 676, 96–102. [Google Scholar]

- Anthony, A.B. American Capitalism the Concept of Countervailing Power, by John Kenneth Galbraith; Houghton Mifflin: Boston, MA, USA, 1956. [Google Scholar]

- Liebowitz, J.; Suen, C.Y. Developing knowledge management metrics for measuring intellectual capital. J. Intellect. Cap. 2000, 1, 54–67. [Google Scholar] [CrossRef]

- Qiu, Y.F.; Pan, X.W.; Gu, J. Analysis of knowledge capital composition and its technical evaluation. China Soft Sci. 2002, 116–120. [Google Scholar]

- Cheng, H.F.; Chen, C. Knowledge capital and total factor productivity in the open economy—International experience and enlightenment from China. Econ. Res. 2017, 52, 21–36. [Google Scholar]

- Hu, Z.; Zhao, X.Y.; Zhang, T.; Wu, Q.S. Research on the distribution characteristics of regional knowledge capital from an innovation-driven perspective—Based on China 2004–2014 panel data. China Society of Management Modernization, Fudan Management Award Foundation. In Proceedings of the 12th (2017) Annual Conference of Chinese Management Science, China Society of Management Modernization and Fudan Management Award Foundation: China Society of Management Modernization, Beijing, China, 23–25 July 2017; pp. 37–46. [Google Scholar]

- Yuan, Y.J.; Sun, X.H.; Bai, D. Evaluation of the value creation potential of intellectual capital in software enterprises in China. Ind. Econ. China 2005, 44–50. [Google Scholar]

- Zheng, F. Index system and quantitative evaluation model of knowledge capital evaluation. Ind. Econ. China 2000, 63–66. [Google Scholar]

- Reitzig, M.G. On the Effectiveness of Novelty and Inventive Step as Patentability Requirements-Structural Empirical Evidence Using Patent Indicators; Copenhagen Business School Lefic Center for Law, Economics, and Financial Institutions Working Paper: Copenhagen, Denmark, 2005; (2003-01). [Google Scholar]

- Burke, P.F.; Reitzig, M. Measuring patent assessment quality—Analyzing the degree and kind of (in) consistency in patent offices’ decision making. Res. Policy 2007, 36, 1404–1430. [Google Scholar] [CrossRef]

- Yang, Z.N.; Hou, Y.F.; Geng, H. Depth and breadth of knowledge, social connection and high-quality enterprise innovation—Evidence from manufacturing enterprises. Macro Qual. Res. 2021, 9, 28–47. [Google Scholar]

- Chen, W.; Chen, Y.Z.; Yang, B. Service-oriented manufacturing industry, knowledge capital and technological innovation. Sci. Res. Manag. 2021, 42, 17–25. [Google Scholar]

- Yu, D.K.; Li, J. The explanatory power of innovation quality to regional high-quality development: The comparative perspective of innovation investment scale. Sci. Technol. Prog. Countermeas. 2021, 38, 40–49. [Google Scholar]

- Ardishvili, A.; Cardozo, S.; Harmon, S. Towards a Theory of New Venture Growth. In Proceedings of the Babson Entrepreneurship Research Conference, Ghent, Belgium, 1998; pp. 21–23. [Google Scholar]

- Zhang, J.; Lu, G.Z. Empirical study on the performance relationship between entrepreneur human capital and private small and medium-sized Enterprises. J. Shandong Univ. (Philos. Soc. Sci. Ed.) 2010, 113–117. [Google Scholar]

- Wang, L.; Dang, X.H. Residual control, residual claim and corporate growth performance—Empirical study on the governance structure of state-owned listed companies based on incomplete contract theory. Soft Sci. China 2008, 128–138. [Google Scholar]

- Zhu, Z.D. Entrepreneurial orientation, entrepreneurial patchwork and new enterprise performance: An empirical study of a regulatory effect model. Manag. Rev. 2015, 27, 57–65. [Google Scholar]

- Wen, Z.L.; Zhang, L.; Hou, J.T.; Liu, H.Y. Mediation effect test program and its application. Acta Psychol. Sinica 2004, 614–620. [Google Scholar]

| Measure Objective | First-Level Indicator | Second-Level Indicator | Calculation Formula |

|---|---|---|---|

| Knowledge capital (KC) | Human Resource Capital (HRC) | Salary–income ratio (sir) | Payroll payable/operating income |

| Staff profitability (sp) | Net profit/total number of staff members | ||

| Total salaries of the top three executives (ep) | Excluding the allowances | ||

| Staff retention rate (srr) | (1-number of retired staff)/total number of staff | ||

| Innovation and Research Capital (IRC) | Research personnel input (rpi) | Number of research personnel/total number of staff | |

| Research–expenditure ratio (rer) | Research input/management expenses | ||

| Research–productivity (rii) | Average operating profit in the past 2 years/average research and development Investment in the last 2 years | ||

| Research power (rp) | R&D investment/operating profit | ||

| Innovative Facilities Capital (IFC) | Current asset turnover (cat) | Operating income/average occupied amount of current capital | |

| Inventory turnover (ito) | Operating cost/average inventory occupied amount | ||

| Management expense ratio (mer) | Administrative expenses/operating income | ||

| Relationship Capital (RC) | Customer concentration ratio (ccr) | The sales ratio of the top five customers to the total annual sales ratio | |

| Supplier concentration ratio (scr) | The ratio of the purchase amount of the top five suppliers to the total annual purchase amount | ||

| Accounts receivable turnover (art) | Accounts receivable/average occupancy amount of operating revenue | ||

| Sales expense ratio (ser) | Sales expense/operating revenue |

| Order | Calculation Formula |

|---|---|

| Formula (1) | HRC = −0.143 ∗ sir + 0.465 ∗ sp + 0.205 ∗ ep + 0.729 ∗ srr |

| Formula (2) | IRC = 0.313 ∗ rii + 0.317 ∗ rpi + 0.066 ∗ rer + 0.304 ∗ rp |

| Formula (3) | IFC = 0.609 ∗ cat + 0.698 ∗ ito − 0.307 ∗ mer |

| Formula (4) | RC = 0.175 ∗ ccr + 0.498 ∗ ser + 0.514 ∗ scr − 0.187 ∗ art |

| Variable Types | Variable Symbols | Variable Names | Calculation Specification |

|---|---|---|---|

| Explained variable | ROA | Return of assets | Net profit/average total assets |

| Explanatory variable | IP | Invention patents | Total number of inventions acquired by the company that year |

| Mediating variable | KC | Knowledge capital | The index formula of knowledge capital mentioned above (5) |

| Controlled variable | Ga | Growth ability | Operating profit increase/operating income |

| Oc | Ownership concentration | The sum of the shareholding ratio of the top Three shareholders of the company | |

| Lev | Liability/asset ratio | Total liabilities/total assets | |

| Age | Enterprise age | The establishment date to the present date of the sample observation |

| Model Number | Model Formula |

|---|---|

| Model 1 | ROAf,t = β0 + β1 ∗ IPf,t + β2 ∗ Gaf,t + β3 ∗ Ocf,t + β4 ∗ Levf,t + β5 ∗ Agef,t + ξf,t |

| Model 2 | KCf,t = β0 + β1 ∗ IPf,t + β2 ∗ Gaf,t + β3 ∗ Ocf,t + β4 ∗ Levf,t + β5 ∗ Agef,t + ξf,t |

| Model 3 | ROAf,t = β0 + β1 ∗ KCf,t + β2 ∗ Gaf,t + β3 ∗ Ocf,t + β4 ∗ Levf,t + β5 ∗ Agef,t + ξf,t |

| Variable | Cases | Minimum | Maximum | Average | Standard Deviation |

|---|---|---|---|---|---|

| IP | 220 | 0.000 | 162.000 | 12.250 | 20.310 |

| KC | 220 | 12.246 | 15.431 | 14.083 | 0.554 |

| ROA | 220 | −0.627 | 0.180 | 0.027 | 0.080 |

| Ga | 220 | −1.315 | 0.9442 | 0.119 | 0.270 |

| Oc | 220 | 5.651 | 68.038 | 40.988 | 13.045 |

| Lev | 220 | 0.028 | 0.832 | 0.316 | 0.172 |

| Age | 220 | 6.000 | 29.750 | 15.202 | 4.670 |

| IP | ROA | Ga | Oc | Lev | Age | |

|---|---|---|---|---|---|---|

| IP | 1 | |||||

| ROA | 0.160 * | 1 | ||||

| 0.017 | ||||||

| Ga | 0.017 | 0.320 ** | 1 | |||

| 0.797 | 0.000 | |||||

| Oc | −0.074 | 0.180 ** | 0.039 | 1 | ||

| 0.272 | 0.008 | 0.565 | ||||

| Lev | 0.159 * | −0.065 | 0.165 * | −0.021 | 1 | |

| 0.018 | 0.340 | 0.014 | 0.760 | |||

| Age | 0.097 | −0.023 | −0.201 ** | −0.163 * | −0.194 ** | 1 |

| 0.152 | 0.732 | 0.003 | 0.016 | 0.004 |

| Variable | Model 1 | Model 2 | Model 3 | |||

|---|---|---|---|---|---|---|

| ROA | KC | ROA | ||||

| IP | 0.001 ** | 0.001 ** | 0.007 ** | 0.005 ** | ||

| (3.381) | (2.762) | (3.191) | (2.841) | |||

| KC | 0.061 ** | 0.043 ** | ||||

| (3.626) | (3.765) | |||||

| Ga | 0.075 ** | 0.093 ** | 0.098 | 0.049 | 0.069 ** | 0.093 ** |

| (3.275) | (4.170) | (1.051) | (0.356) | (3.117) | (4.114) | |

| Oc | −0.001 | 0.001 ** | −0.013 | −0.002 | −0.000 | 0.001 |

| (−0.691) | (1.483) | (−0.801) | (−0.355) | (−0.128) | (1.433) | |

| Lev | −0.280 * | −0.056 | 0.028 | 0.234 | −0.282 * | −0.056 |

| (−2.386) | (−1.441) | (0.103) | (0.676) | (−2.601) | (−1.287) | |

| Age | −0.004 | 0.001 | 0.073 | −0.003 | −0.008 * | 0.001 |

| (−0.894) | (0.411) | (2.388) | (−0.180) | (−2.194) | (0.660) | |

| Intercept | 0.195 | −0.032 | 13.411 ** | 14.068 ** | −0.629 * | −0.634 ** |

| (1.873) | (−0.796) | (12.136) | (41.458) | (−2.572) | (−3.980) | |

| Personal effect | Yes | No | Yes | No | Yes | No |

| Time effect | No | Yes | No | Yes | No | Yes |

| R2 | 0.208 | 0.123 | 0.352 | 0.144 | 0.268 | 0.156 |

| N | 220 | 220 | 220 | 220 | 220 | 220 |

| F | 6.385 | 5.463 | 7.745 | 2.635 | 5.293 | 7.027 |

| p | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Way | c | A | b | a ∗ b | c’ | Personal Effect | Time Effect | Result |

|---|---|---|---|---|---|---|---|---|

| Innovation quality–knowledge capital–growth performance | 0.001 ** | 0.007 ** | 0.061 ** | 0.000 | 0.001 * | Control | Non-control | Partly intermediary |

| 0.001 ** | 0.005 ** | 0.043 ** | 0.000 | 0.001 * | Non-control | Control | Partly intermediary |

| Variable | Model 1′ | Model 3′ | ||

|---|---|---|---|---|

| ROE | ROE | |||

| IP | 0.001 ** | 0.001 ** | ||

| (3.473) | (2.822) | |||

| KC | 0.090 ** | 0.061 ** | ||

| (3.272) | (3.712) | |||

| Ga | 0.118 ** | 0.155 ** | 0.108 ** | 0.155 ** |

| (3.689) | (4.151) | (3.509) | (4.085) | |

| Oc | −0.002 | 0.002 | −0.001 | 0.002 |

| (−0.983) | (1.440) | (−0.519) | (1.411) | |

| Lev | −0.372 | 0.006 | −0.375 * | 0.006 |

| (−1.837) | (0.087) | (−1.979) | (0.084) | |

| Age | −0.007 | 0.001 | −0.014 ** | 0.002 |

| (−1.186) | (0.505) | (−2.553) | (0.775) | |

| Intercept | 0.344 ** | −0.071 | −0.871 * | −0.935 ** |

| (2.196) | (−1.142) | (−2.230) | (−4.237) | |

| Personal effect | Yes | No | Yes | No |

| Time effect | No | Yes | No | Yes |

| R2 | 0.185 | 0.082 | 0.239 | 0.108 |

| N | 220 | 220 | 220 | 220 |

| F | 7.625 | 7.197 | 5.905 | 7.955 |

| p | 0.000 | 0.000 | 0.000 | 0.000 |

| Way | c | a | b | a ∗ b | c’ | Personal Effect | Time Effect | Result |

|---|---|---|---|---|---|---|---|---|

| Innovation quality–knowledge capital–growth performance | 0.001 ** | 0.007 ** | 0.090 ** | 0.000 | 0.001 * | Control | Non-control | Partly intermediary |

| 0.001 ** | 0.005 ** | 0.061 ** | 0.000 | 0.001 * | Non-control | Control | Partly intermediary |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chu, H.; Wang, H.; Wang, Z. Impact of Innovation Quality on the Growth Performance of Entrepreneurial Enterprises: The Role of Knowledge Capital. Sustainability 2023, 15, 8207. https://doi.org/10.3390/su15108207

Chu H, Wang H, Wang Z. Impact of Innovation Quality on the Growth Performance of Entrepreneurial Enterprises: The Role of Knowledge Capital. Sustainability. 2023; 15(10):8207. https://doi.org/10.3390/su15108207

Chicago/Turabian StyleChu, Hanfang, Hanxin Wang, and Zhaoyun Wang. 2023. "Impact of Innovation Quality on the Growth Performance of Entrepreneurial Enterprises: The Role of Knowledge Capital" Sustainability 15, no. 10: 8207. https://doi.org/10.3390/su15108207

APA StyleChu, H., Wang, H., & Wang, Z. (2023). Impact of Innovation Quality on the Growth Performance of Entrepreneurial Enterprises: The Role of Knowledge Capital. Sustainability, 15(10), 8207. https://doi.org/10.3390/su15108207