Analyzing Performance in Wholesale Trade Romanian SMEs: Framing Circular Economy Business Scenarios

Abstract

1. Introduction

2. Literature Review

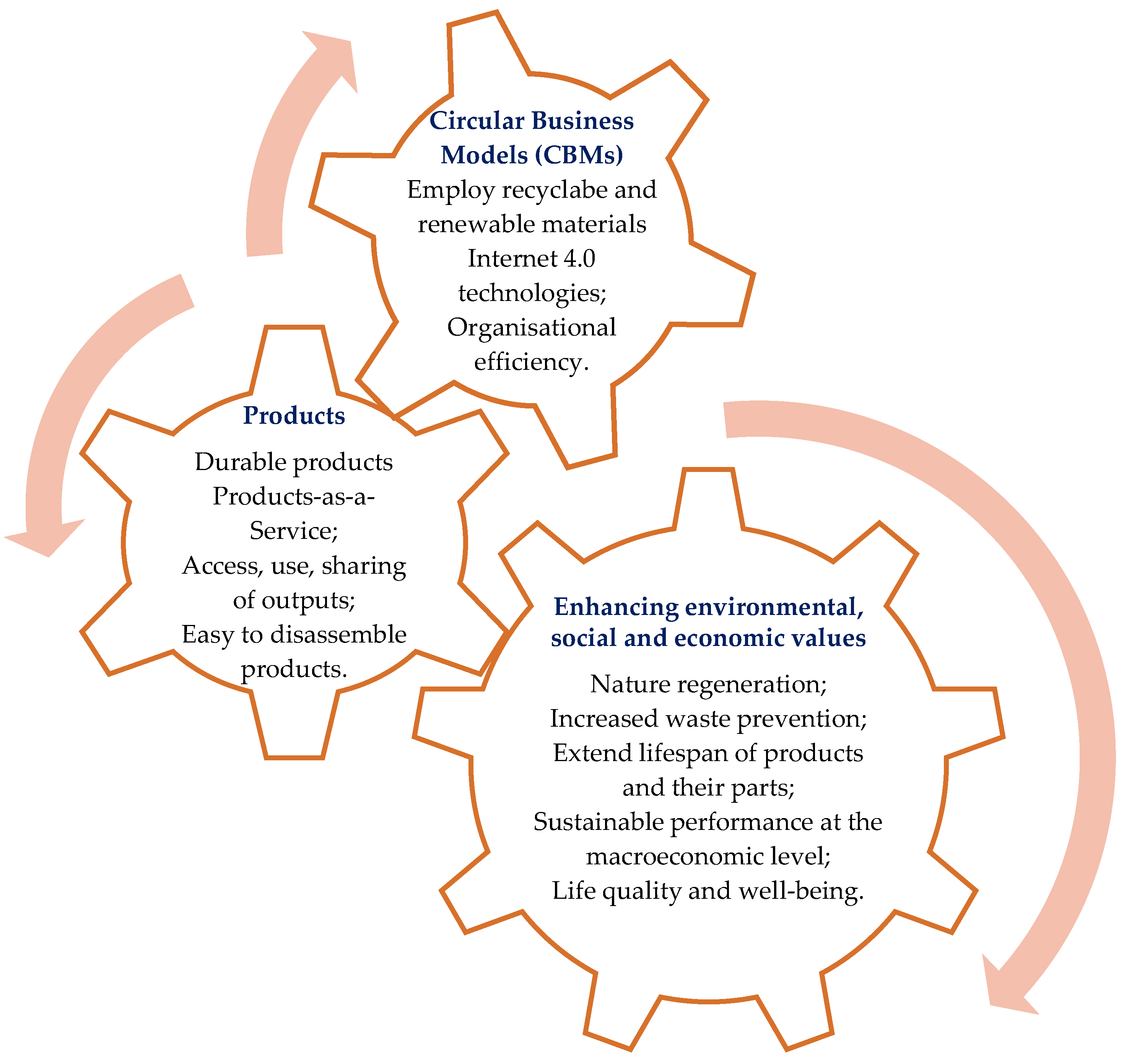

2.1. The Circular Economy and the Sustainable Supply Chain

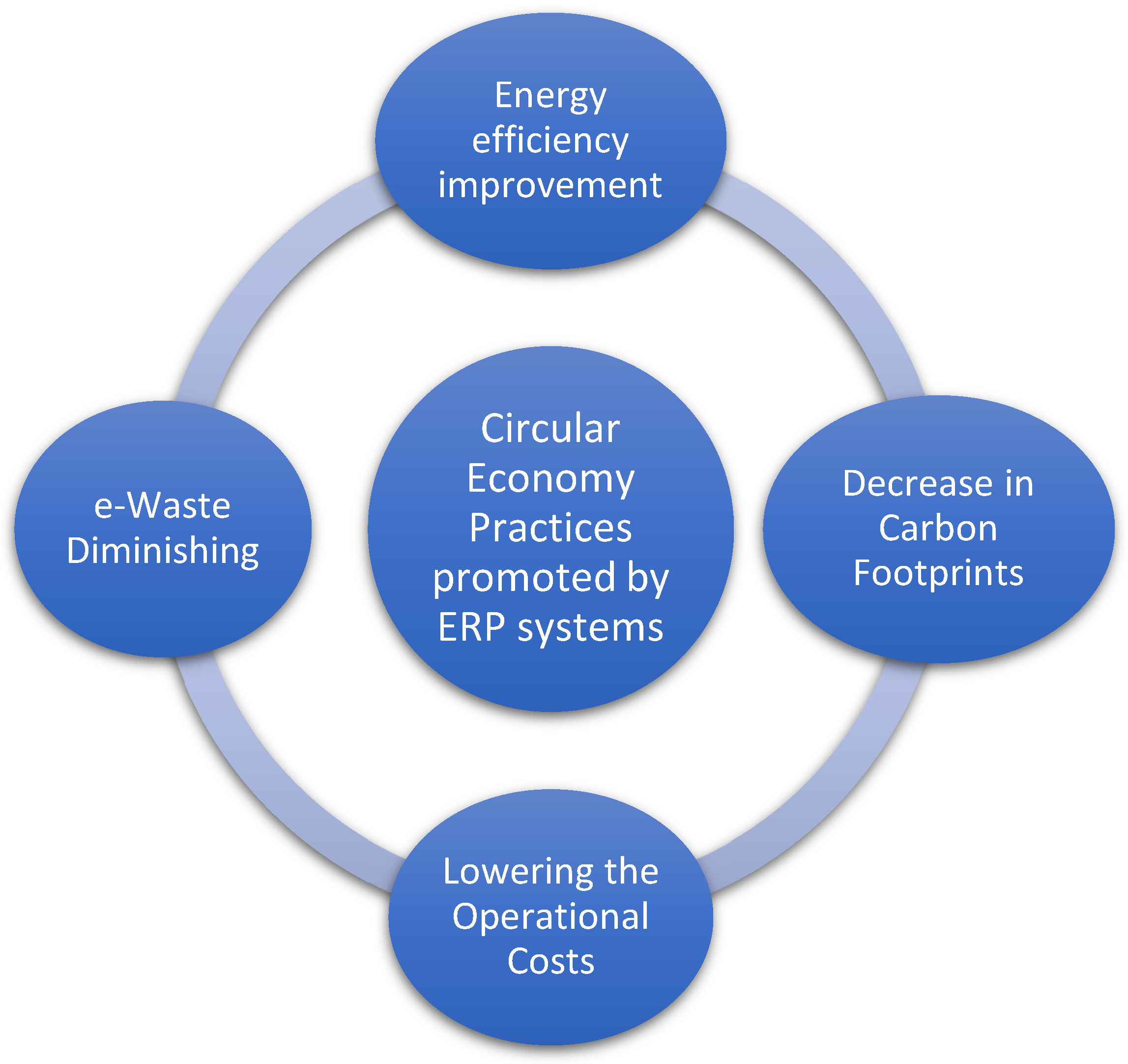

2.2. Digitalization Trends and the Circular Economy

3. Material and Methods

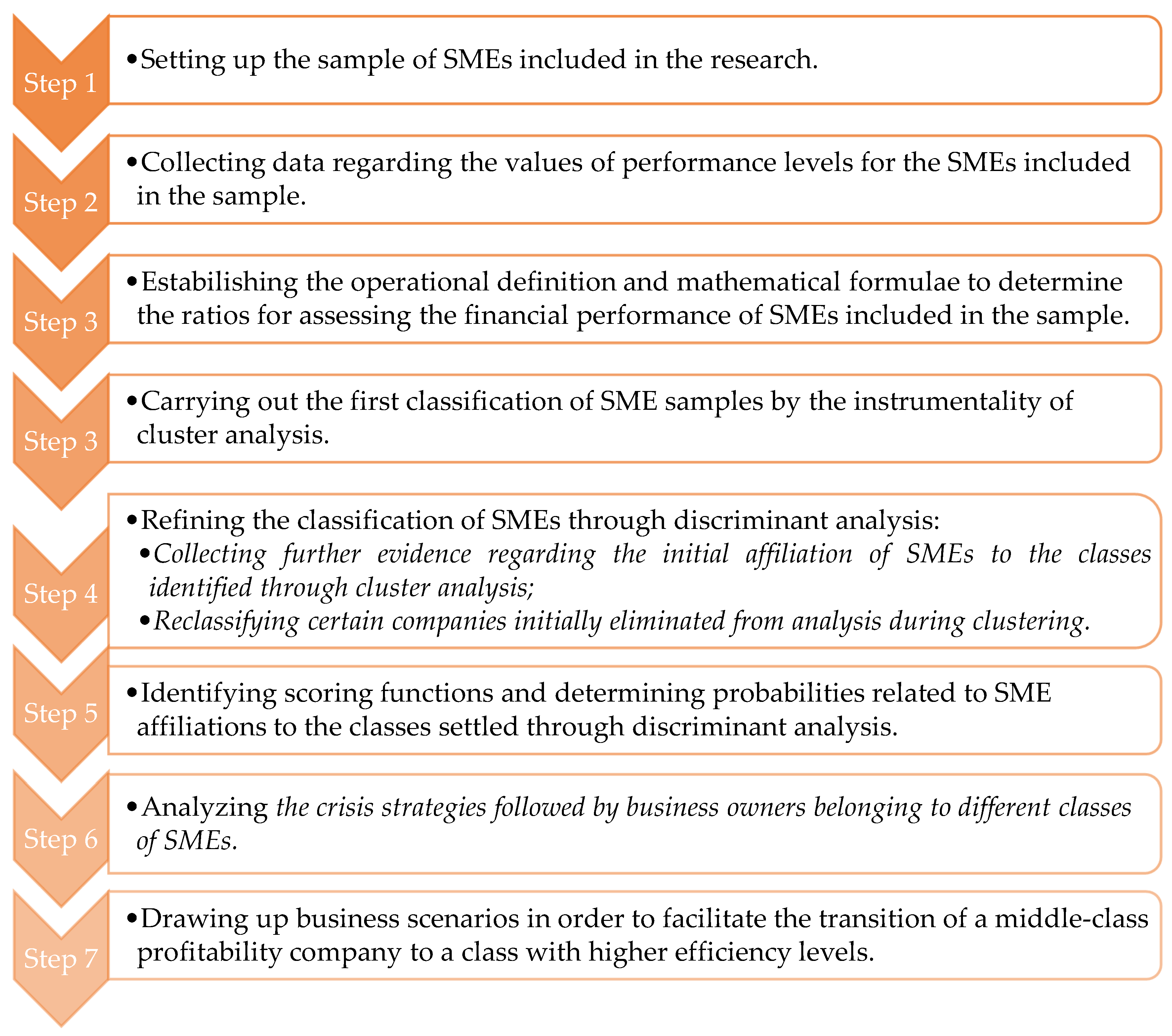

3.1. The Design of the Research

3.2. The Sampling Procedure

4. Results

4.1. Cluster Analysis

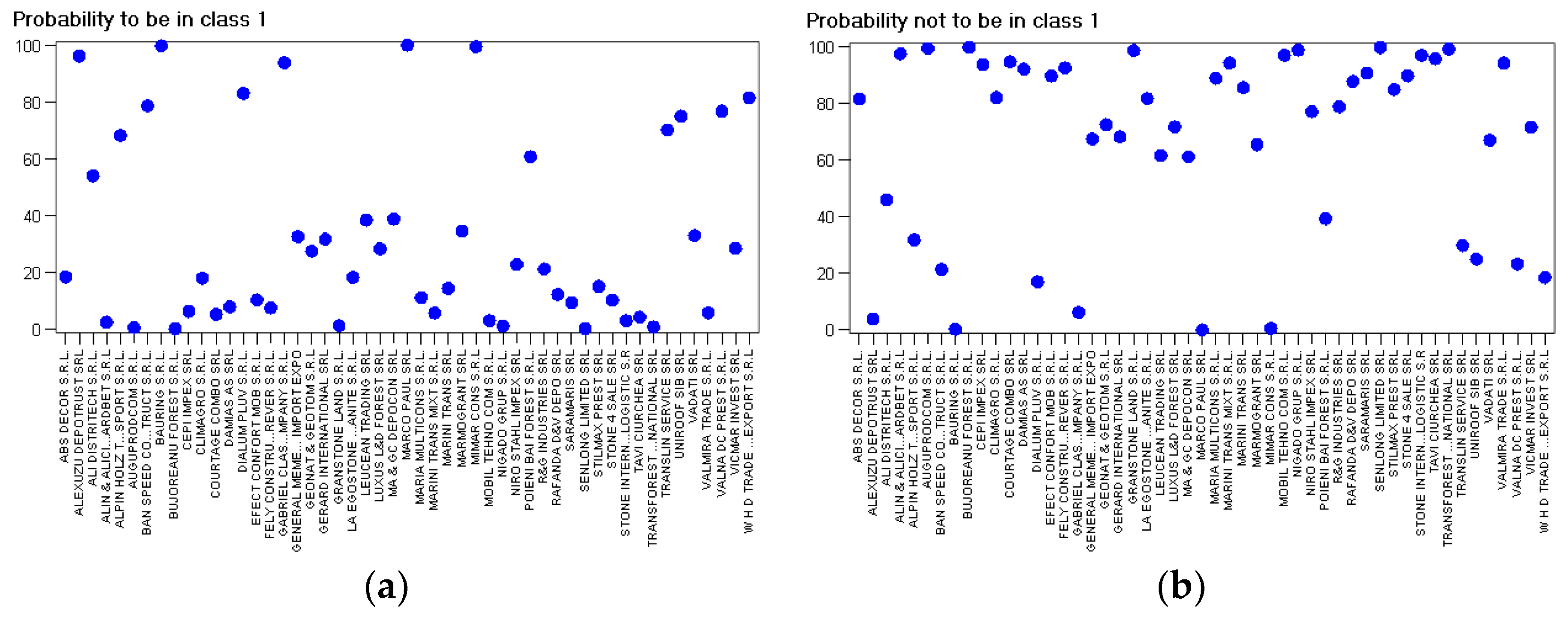

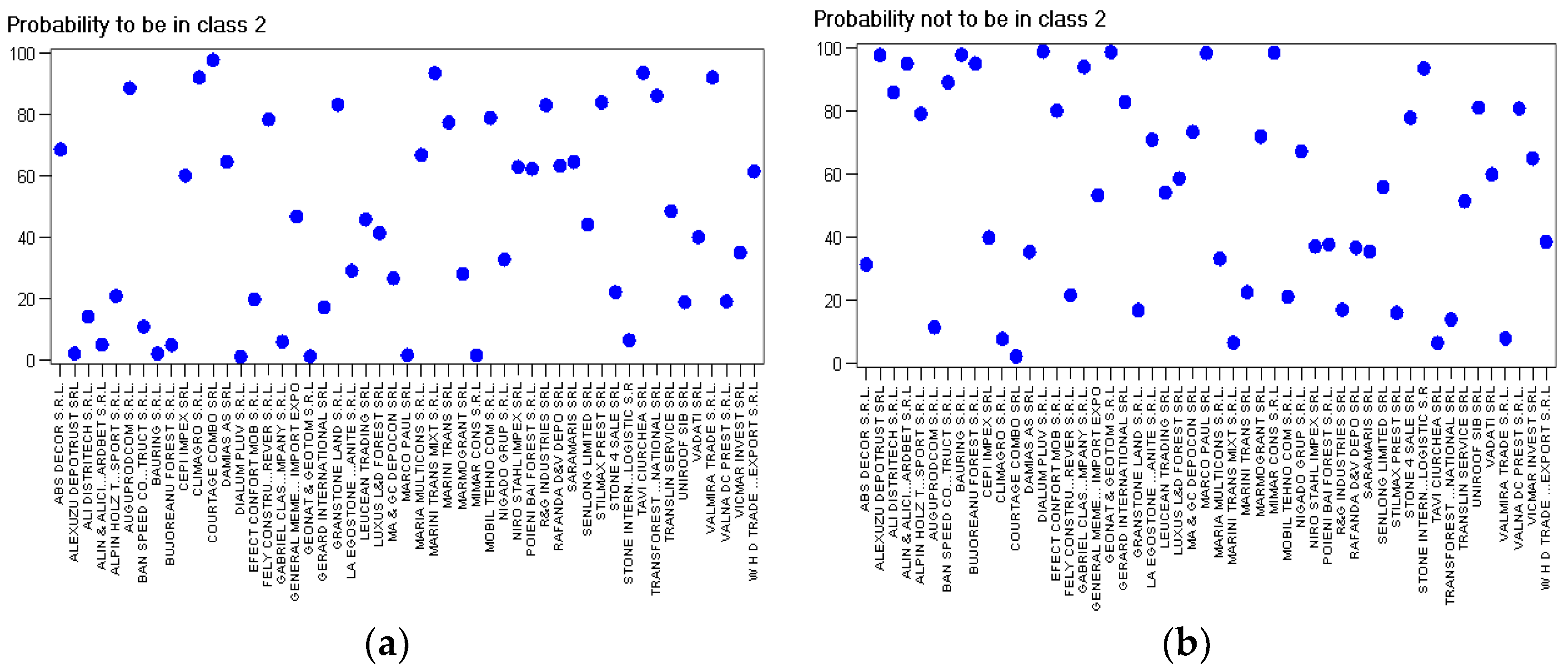

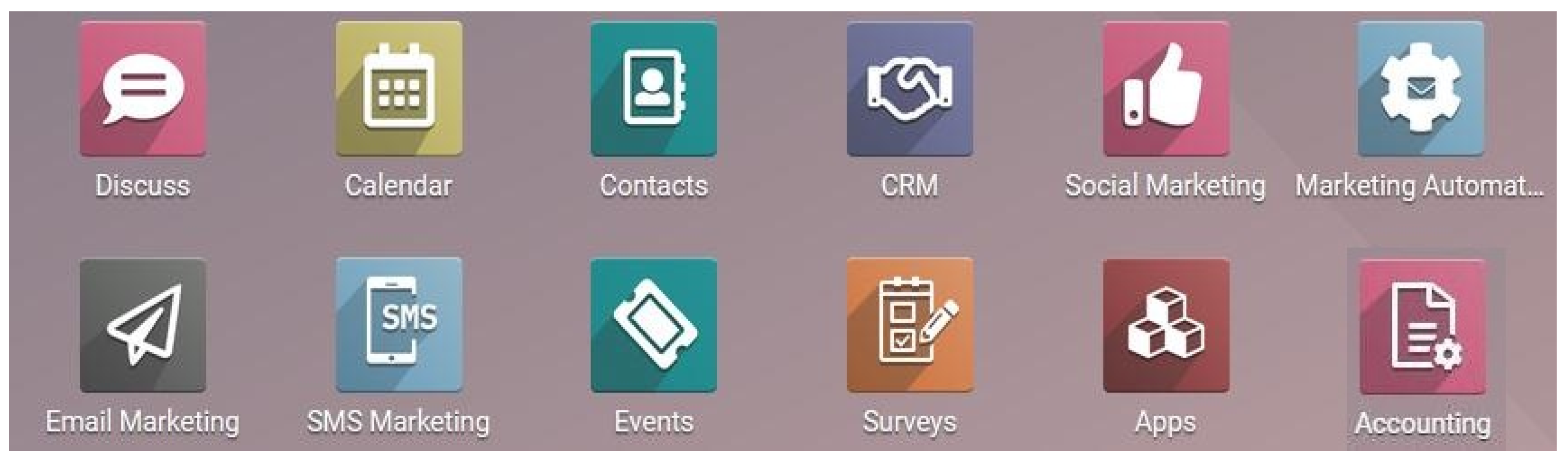

4.2. Discriminant Analysis

- Calculating the MANOVA indicators based on a series of statistical data;

- Calculating the coefficients of discrimination functions;

- Calculating the affiliation probability of each object to a class and choosing the classes matching maximal probabilities;

- Comparing the classification resulting through implementing discriminant analysis with the initial classification of the objects.

5. Discussion

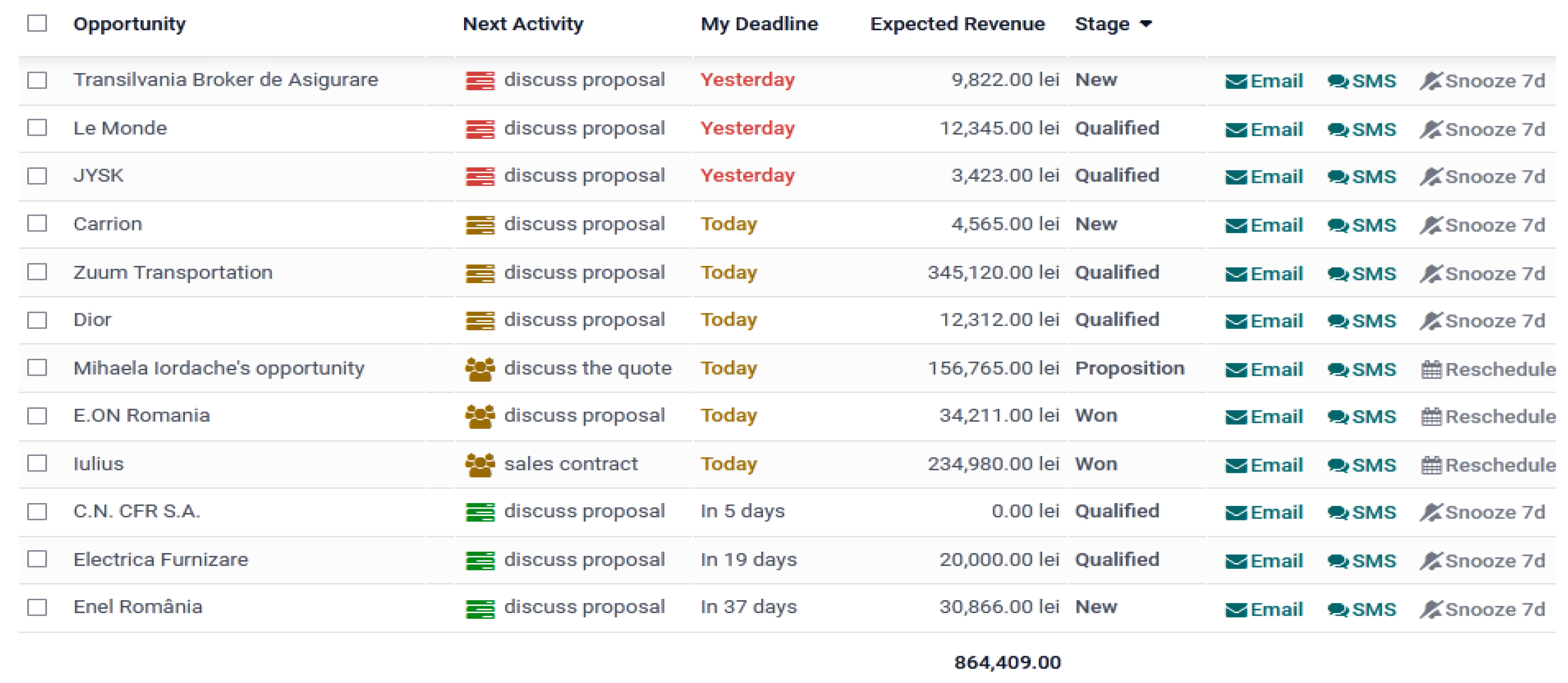

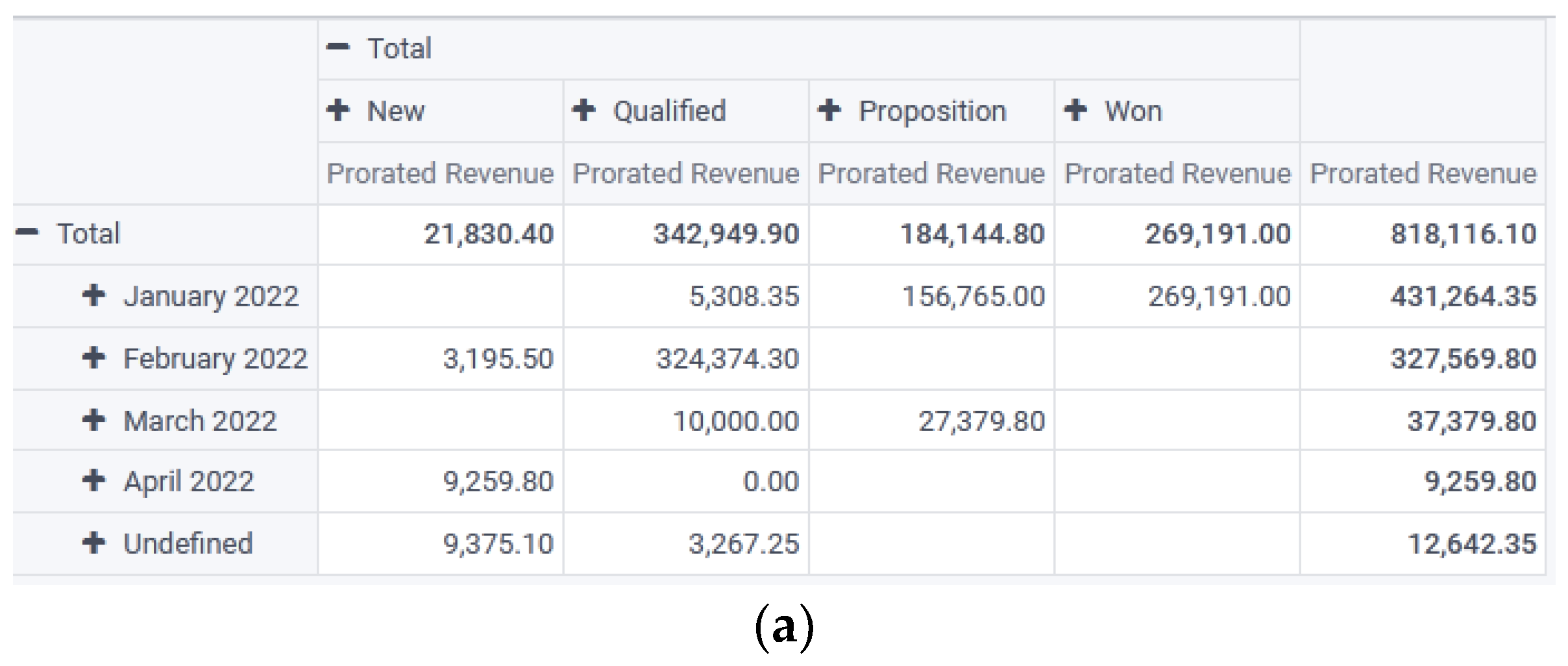

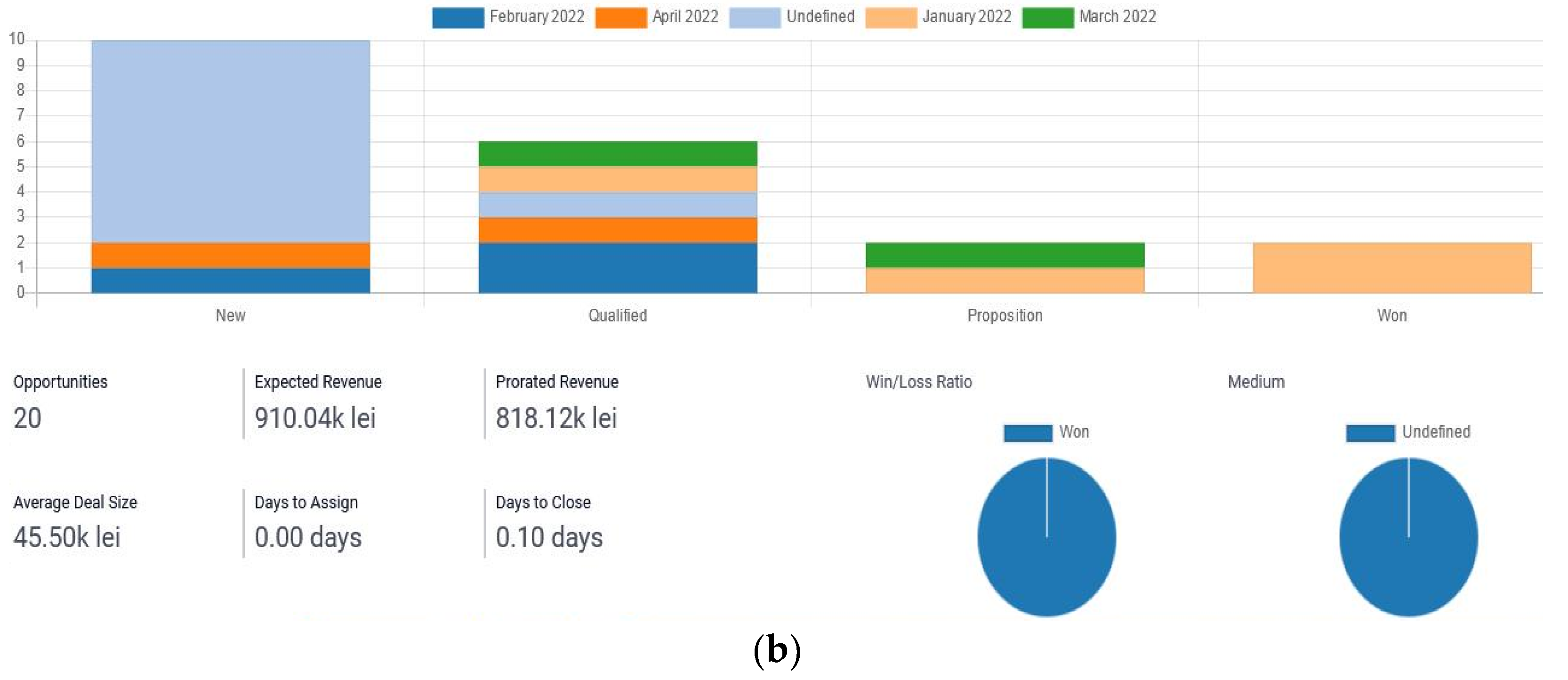

6. Drawing up a Business Scenario for a Small Company in Order to Improve Efficiency and to Support the Circular Economy Goals

7. Conclusions, Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Company | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 |

|---|---|---|---|---|---|---|---|---|---|

| R&G Industries SRL | 20.22 | 28.12 | 7.46 | 38.17 | 52.22 | 8.68 | 8.14 | 84.23 | 61.83 |

| Damias AS SRL | 2.61 | 7.31 | 0.64 | 70.86 | 9.86 | 0.79 | 0.75 | 67.24 | 29.14 |

| Marini Trans SRL | 4.08 | 22.05 | 2.15 | 84.07 | 40.99 | 2.5 | 2.2 | 83.57 | 15.93 |

| Vadati SRL | 14.88 | 36.72 | 4.9 | 66.11 | 11.55 | 5.85 | 5.12 | 73.96 | 33.89 |

| Abs Decor SRL | 16.42 | 29.82 | 12.15 | 52.22 | 21.45 | 14.01 | 4.76 | 64.14 | 47.78 |

| Stilmax Prest SRL | 13.05 | 13.11 | 9.46 | 14.48 | 52.88 | 11 | 10.61 | 96.97 | 85.52 |

| Saramaris SRL | 13.77 | 12.88 | 5.05 | 9.57 | 7.26 | 5.97 | 5.06 | 59.66 | 90.43 |

| General Memento UM Import Export SRL | 14.65 | 16.69 | 4.94 | 24.37 | 18.96 | 5.73 | 4.92 | 96.35 | 75.63 |

| Cepi Impex SRL | 1.28 | 2.71 | 0.66 | 58.61 | 0.15 | 0.76 | 0.61 | 62.65 | 41.39 |

| Fely Construct Forever SRL | 11.31 | 3.89 | 0.31 | 76.46 | 20.16 | 3.82 | 0.32 | 65.21 | 23.54 |

| Luxus L&D Forest SRL | 20.63 | 25 | 5.03 | 30.5 | 4.29 | 5.98 | 5.28 | 71.76 | 69.5 |

| Climagro SRL | 29.77 | 6.15 | 0.71 | 56.35 | 58.72 | 7.87 | 0.78 | 88.11 | 43.65 |

| MA&GC Depocon SRL | 14.28 | 17.96 | 6.05 | 29.06 | 1.81 | 6.78 | 6.47 | 94.4 | 70.94 |

| Translin Service SRL | 43.1 | 87.13 | 12.91 | 53.94 | 39.11 | 13.87 | 14.79 | 58.61 | 46.06 |

| Marmogrant SRL | 22.23 | 23.09 | 21.2 | 7.64 | 9.62 | 22.11 | 26.63 | 92.52 | 92.36 |

| Marini Trans Mixt SRL | 10.57 | 29.35 | 11.78 | 66.65 | 61.73 | 12.72 | 13.28 | 63.44 | 33.35 |

| Bauring SRL | 85.1 | 115.97 | 9.12 | 32.38 | 6.44 | 9.89 | 9.95 | 94.29 | 67.62 |

| Valmira Trade SRL | 1.15 | 3.14 | 0.37 | 70.48 | 55.06 | 0.46 | 0.37 | 85.75 | 29.52 |

| Valna DC Prest SRL | 8.29 | 82.58 | 5.07 | 91.62 | 7.1 | 6.07 | 5.4 | 82.03 | 8.38 |

| Mobil Tehno Com SRL | 0.66 | 1.91 | 0.25 | 69.61 | 9.88 | 0.29 | 0.25 | 50.45 | 30.39 |

| Poieni Bai Forest SRL | 39.8 | 51.83 | 4.92 | 35.38 | 41.98 | 5.85 | 5.22 | 80.14 | 64.62 |

| Rafanda D&V Depo SRL | 10.99 | 12.54 | 3.28 | 31.85 | 13.45 | 4.21 | 3.4 | 70.79 | 68.15 |

| Transforest International SRL | 2.38 | 7.1 | 10.78 | 66.54 | 1.47 | 10.78 | 9.37 | 15.88 | 33.46 |

| Courtage Combo SRL | −0.12 | 2.82 | −0.16 | 104.27 | 89.63 | −0.16 | −0.12 | 99.79 | −4.27 |

| Augurprodcom SRL | 7.08 | 11.37 | 8.88 | 43.87 | 0.77 | 9.85 | 9.79 | 3.99 | 56.13 |

| Niro Stahl Impex SRL | 5.48 | 18.88 | 4.13 | 76.66 | 33.71 | 5.13 | 4.35 | 96.04 | 23.34 |

| Gerard International SRL | 69.23 | 70.99 | 42.19 | 4.75 | 0.36 | 43.2 | 74.74 | 24.85 | 95.25 |

| Uniroof SIB SRL | 23.64 | 61.74 | 9.18 | 65.23 | 17.27 | 10.11 | 10.21 | 91.55 | 34.77 |

| Gabriel Class Company SRL | 13.82 | 106.06 | 7.38 | 88.51 | 20.93 | 8.36 | 7.95 | 99.98 | 11.49 |

| Vicmar Invest SRL | 26.69 | 26.46 | 17.57 | 3.2 | 2.13 | 18.3 | 19.4 | 71.59 | 96.8 |

| Alpin Holz Transport SRL | 19.15 | 54.29 | 7.79 | 67.8 | 16.03 | 8.54 | 8.52 | 92.88 | 32.2 |

| Alexuzu Depotrust SRL | 13.23 | 118.41 | 7.89 | 90.09 | 4.3 | 8.89 | 8.66 | 93.85 | 9.91 |

| Ban Speed Construct SRL | 32.68 | 60.16 | 23.95 | 50.91 | 15.57 | 26.51 | 32.6 | 100 | 49.09 |

| Tavi Ciurchea SRL | 6.41 | 12.36 | 19.4 | 55.3 | 68.27 | 22.51 | 25.03 | 84 | 44.7 |

| Leucean Trading SRL | 10.59 | 28.15 | 4.7 | 68.62 | 26.46 | 5.63 | 4.89 | 97.81 | 31.38 |

| Nigado Grup SRL | 18.55 | 27.77 | 49.71 | 35.57 | 17.96 | 51.54 | 102.43 | 48.66 | 64.43 |

| WHD Trade General Export SRL | 25.27 | 95.71 | 11.43 | 75.73 | 79.24 | 12.43 | 13 | 100 | 24.27 |

| Marco Paul SRL | 143.38 | 188.84 | 35.74 | 28.03 | 0 | 37.7 | 22.53 | 30.46 | 71.97 |

| Stone 4 Sale SRL | 35.26 | 33.92 | 40.25 | 0 | 0.05 | 41.84 | 69.21 | 53.35 | 100 |

| Maria Multicons SRL | 0.96 | 10.04 | 11.02 | 13.46 | 24.5 | 1.22 | 6.22 | 86.72 | 86.54 |

| Dialum Pluv SRL | 13.14 | 96.4 | 41.09 | 86.72 | 0 | 42.17 | 62.72 | 100 | 13.28 |

| La Egostone Granite SRL | 0.75 | 3.67 | 13.02 | 83.43 | 0.1 | 16.02 | 15.49 | 95.97 | 16.57 |

| Senlong Limited SRL | −115.19 | 58.96 | −74 | 298.11 | 4.91 | −72.97 | −42.58 | 36.85 | −198.11 |

| Granstone Land SRL | 0.59 | −3.9 | 0.78 | 232.58 | 1.84 | 0.09 | 0.86 | 25.73 | −132.58 |

| Stone International Logistic SRL | −0.95 | 17.13 | −385.93 | 156.98 | 24.98 | −37.6 | −26.85 | 79.17 | −56.98 |

| Ali Distritech SRL | 41.33 | −0.74 | 0.27 | 375.88 | 4.53 | 5.51 | 28.43 | 98.56 | −275.88 |

| Geonat&Geotom SRL | 97.25 | 99.66 | 69.36 | 3.7 | 85.76 | 70.29 | 233.46 | 100 | 96.3 |

| Mimar Cons SRL | −46.47 | 255.22 | −123.67 | 118.36 | 81.91 | −122.67 | −55.54 | 95.18 | −18.36 |

| Efect Confort Mob SRL | −32.48 | 6.9 | −5.95 | 147.9 | 0 | −58.52 | −3.75 | 98.81 | −47.9 |

| Alin&Alicia Gardbet SRL | 0.16 | 35.12 | 625.15 | 63.61 | 5.92 | 7.78 | 282.16 | 99.63 | 36.39 |

| Bujoreanu Forest SRL | −4.87 | −7.01 | −444.02 | 25.53 | 88.92 | −413.88 | −31.4 | 100 | 74.47 |

Appendix B

| Resubstitution Results | Validation Results | |||||

|---|---|---|---|---|---|---|

| Company | Class 1 (%) | Class 2 (%) | Class 3 (%) | Class 1 (%) | Class 2 (%) | Class 3 (%) |

| R&G Industries SRL | 21.29 | 82.91 | 28.15 | 12.14 | 86.6 | 30.05 |

| Damias AS SRL | 8.02 | 64.6 | 56.12 | 8.49 | 62.95 | 57.73 |

| Marini Trans SRL | 14.49 | 77.32 | 19.27 | 15.39 | 76.38 | 20.11 |

| Vadati SRL | 33.09 | 40.08 | 47.39 | 34 | 37.37 | 48.18 |

| Abs Decor SRL | 18.49 | 68.6 | 46.57 | 19.32 | 67.7 | 47.68 |

| Stilmax Prest SRL | 15.26 | 83.84 | 51.36 | 17.21 | 88.64 | 40.48 |

| Saramaris SRL | 9.48 | 64.47 | 85.22 | 10.3 | 68.58 | 84.07 |

| General Memento UM Import Export SRL | 32.65 | 46.74 | 73.84 | 35.8 | 50.14 | 70.61 |

| Cepi Impex SRL | 6.41 | 60.05 | 73.33 | 6.86 | 56.33 | 76.28 |

| Fely Construct Forever SRL | 7.67 | 78.33 | 39.16 | 8.13 | 77.57 | 40.57 |

| Luxus L&D Forest SRL | 28.41 | 41.42 | 75.8 | 30.29 | 43.46 | 74.46 |

| Climagro SRL | 18.02 | 92.04 | 15.89 | 21.26 | 90.9 | 17.57 |

| MA&GC Depocon SRL | 38.93 | 26.72 | 83.37 | 44.21 | 29.47 | 80.55 |

| Translin Service SRL | 70.17 | 48.54 | 13.13 | 63.15 | 53.14 | 14.04 |

| Marmogrant SRL | 34.7 | 28.17 | 86.8 | 38.68 | 30.63 | 85.4 |

| Marini Trans Mixt SRL | 5.88 | 93.34 | 12.01 | 6.5 | 93.47 | 13 |

| Bauring SRL | 99.71 | 2.31 | 29.43 | 99.72 | 1.93 | 38.1 |

| Valmira Trade SRL | 5.88 | 91.99 | 19.47 | 6.38 | 91.28 | 21.12 |

| Valna DC Prest SRL | 76.77 | 19.25 | 29.6 | 73.96 | 10.75 | 31.37 |

| Mobil Tehno Com SRL | 3.15 | 78.78 | 56.47 | 3.31 | 77.16 | 59.47 |

| Poieni Bai Forest SRL | 60.72 | 62.29 | 25.12 | 54.8 | 65.78 | 26.62 |

| Rafanda D&V Depo SRL | 12.37 | 63.3 | 73.14 | 13.14 | 65.75 | 71.91 |

| Transforest International SRL | 0.96 | 85.99 | 62.43 | 0.82 | 81.37 | 73.17 |

| Courtage Combo SRL | 5.4 | 97.63 | 2.56 | 6.38 | 97.35 | 2.06 |

| Augurprodcom SRL | 0.78 | 88.41 | 72.26 | 0.57 | 82.53 | 86.22 |

| Niro Stahl Impex SRL | 22.94 | 62.85 | 30.41 | 24.41 | 60.35 | 31.8 |

| Gerard International SRL | 31.81 | 17.27 | 75.15 | 43.82 | 21.08 | 57.27 |

| Uniroof SIB SRL | 75 | 18.95 | 36.5 | 73.46 | 19.74 | 37.86 |

| Gabriel Class Company SRL | 93.76 | 6.13 | 17.68 | 92.84 | 6.35 | 19.2 |

| Vicmar Invest SRL | 28.53 | 35.08 | 88 | 31.25 | 37.63 | 87.28 |

| Alpin Holz Transport SRL | 68.23 | 20.97 | 39.4 | 65.65 | 21.86 | 40.89 |

| Alexuzu Depotrust SRL | 96.1 | 2.34 | 26.22 | 95.22 | 2.17 | 29.99 |

| Ban Speed Construct SRL | 78.62 | 11.02 | 51.34 | 75.73 | 11.6 | 54.44 |

| Tavi Ciurchea SRL | 4.35 | 93.41 | 19.04 | 4.71 | 92.4 | 21.45 |

| Leucean Trading SRL | 38.48 | 45.84 | 38.17 | 40.66 | 41.7 | 39.78 |

| Nigado Grup SRL | 1.31 | 32.86 | 79.2 | 1.16 | 41.43 | 65.89 |

| WHD Trade General Export SRL | 81.48 | 61.41 | 2.56 | 70.03 | 72.74 | 2.27 |

| Marco Paul SRL | 99.97 | 1.76 | 7.84 | 100 | 0.43 | 9.64 |

| Stone 4 Sale SRL | 10.41 | 22.23 | 91.29 | 11.88 | 24.99 | 89.7 |

| Maria Multicons SRL | 11.26 | 66.77 | 78.41 | 12.25 | 70.86 | 76.18 |

| Dialum Pluv SRL | 82.99 | 1.26 | 51.36 | 71.31 | 0.96 | 62.36 |

| La Egostone Granite SRL | 18.39 | 29.17 | 67.63 | 20.87 | 19.6 | 72.88 |

| Senlong Limited SRL | 0.44 | 44.16 | 0.92 | 0.07 | 88.78 | 0.14 |

| Granstone Land SRL | 1.455 | 83.03 | 2.01 | 1.19 | 95.44 | 1.43 |

| Stone International Logistic SRL | 3.16 | 6.61 | 41.17 | 3.25 | 7.4 | 80.49 |

| Ali Distritech SRL | 54.04 | 14.24 | 0.04 | 99.96 | 53.36 | 0 |

| Geonat&Geotom SRL | 27.57 | 1.45 | 23.96 | 96.44 | 0.11 | 80.49 |

| Mimar Cons SRL | 99.4 | 1.67 | 0.25 | 100 | 0.21 | 0 |

| Efect Confort Mob SRL | 10.43 | 19.92 | 24.3 | 12.38 | 23.17 | 28.33 |

| Alin&Alicia Gardbet SRL | 2.65 | 5.15 | 19.61 | 1.09 | 2.76 | 98.37 |

| Bujoreanu Forest SRL | 0.33 | 5.06 | 9.88 | 0 | 0.3 | 99.39 |

Appendix C

| Category | Cluster Analysis | Discriminant Analysis |

|---|---|---|

| Class 1 | R&G Industries SRL, Translin Service SRL, Bauring SRL, Valna DC Prest SRL, Poieni Bai Forest SRL, Uniroof SIB SRL, Gabriel Class Company SRL, Alpin Holz Transport SRL, Alexuzu Depotrust SRL, Ban Speed Construct SRL, WHD Trade General Export SRL, Marco Paul SRL, Dialum Pluv SRL | Translin Service SRL, Bauring SRL, Valna DC Prest SRL, Uniroof SIB SRL, Gabriel Class Company SRL, Alpin Holz Transport SRL, Alexuzu Depotrust SRL, Ban Speed Construct SRL, WHD Trade General Export SRL, Marco Paul SRL, Dialum Pluv SRL, Ali Distritech SRL, Geonat&Geotom SRL, Mimar Cons SRL |

| Class 2 | Damias AS SRL, Marini Trans SRL, Vadati SRL, Abs Decor SRL, Cepi Impex SRL, Fely Construct Forever SRL, Climagro SRL, Marini Trans Mixt SRL, Valmira Trade SRL, Mobil Tehno Com SRL, Transforest International SRL, Courtage Combo SRL, Augurprodcom SRL, Niro Stahl Impex SRL, Tavi Ciurchea SRL, Leucean Trading SRL, La Egostone Granite SRL | R&G Industries SRL, Damias AS SRL, Marini Trans SRL, Abs Decor SRL, Stilmax Prest SRL, Fely Construct Forever SRL, Climagro SRL, Marini Trans Mixt SRL, Valmira Trade SRL, Mobil Tehno Com SRL, Poieni Bai Forest SRL, Transforest International SRL, Courtage Combo SRL, Augurprodcom SRL, Niro Stahl Impex SRL, Tavi Ciurchea SRL, Leucean Trading SRL, Senlong Limited SRL, Granstone Land SRL |

| Class 3 | Stilmax Prest SRL, Saramaris SRL, General Memento UM Import Export SRL, Luxus L&D Forest SRL, MA&GC Depocon SRL, Marmogrant SRL, Rafanda D&V Depo SRL, Gerard International SRL, Vicmar Invest SRL, Nigado Grup SRL, Stone 4 Sale SRL, Maria Multicons SRL | Vadati SRL, Saramaris SRL, General Memento UM Import Export SRL, Cepi Impex SRL, Luxus L&D Forest SRL, MA&GC Depocon SRL, Marmogrant SRL, Rafanda D&V Depo SRL, Gerard International SRL, Vicmar Invest SRL, Nigado Grup SRL, Stone 4 Sale SRL, Maria Multicons SRL, La Egostone Granite SRL, Stone International Logistic SRL, Efect Confort Mob SRL, Alin&Alicia Gardbet SRL, Bujoreanu Forest SRL |

Appendix D

| Variable used in order to Assess Performance (2020) | ||

| No. | Code | Economic Performance Indicators |

| 1 | V1 | ROA—Return on Assets |

| 2 | V2 | ROE1—Return on Equity |

| 3 | V3 | ROS—Return on Sales |

| 4 | V4 | LEV—Total Liabilities Ratio |

| 5 | V5 | ARR—Accounts Receivables Ratio |

| 6 | V6 | GMR—Gross Profit Margin |

| 7 | V7 | ROE2—Return on Expenditures |

| 8 | V8 | CAR—Current Assets Ratio |

| 9 | V9 | ASFR—Assets Self-Financing Ratio |

| Proposed Variables in order to measure the impact on CE goals | ||

| Environmental Performance Indicators (2022) | ||

| 10 | V10 | REW—Reduction in e-waste |

| 11 | V11 | RCF—Reduction in CO2 emissions |

| 12 | V12 | REC—Reduction in energy consumption |

| Social Performance Indicators (2022) | ||

| 13 | V13 | AEP—Improved awareness on environmental protection issues |

| 14 | V14 | ICSR—Investments in corporate social responsibility programmes |

| 15 | V15 | IETE—Investments in employee training and education |

References

- European Comission. Annual Report on European SMEs. 2020/2021; Publications Office of the European Union: Luxembourg, 2021; Available online: https://ec.europa.eu/growth/smes/sme-strategy/sme-performance-review_ro (accessed on 22 April 2022).

- EuroCommerce for Retail&Wholesale. Wholesale at the Centre of Europe’s Economy. 2020. Available online: https://www.eurocommerce.eu/retail-and-wholesale-in-europe.aspx (accessed on 22 April 2022).

- European Comission. SME Country Fact Sheet. Romania. 2021. Available online: https://ec.europa.eu/growth/smes/sme-strategy/sme-performance-review_ro#sba-fact-sheets (accessed on 22 April 2022).

- European Comission. SME Country Fact Sheet. Romania. 2018. Available online: http://www.contragarantare.ro/webincident/fisiere/2019_raport_SBE_Factsheet_Romania_-_2018_IMM_CE_dra13u.pdf (accessed on 22 April 2022).

- Suciu Vodă, A.D.; Tudor, A.I.M.; Chițu, I.B.; Dovleac, L.; Brătucu, G. IoT Technolgies as Instruments for SMEs’ Innovation and Sustainable Growth. Sustainability 2021, 13, 6357. [Google Scholar] [CrossRef]

- Nandi, S.; Sarkis, J.; Aghaei Hervani, A.; Helms, M.M. Redesigning Supply Chains using Blockchain-Enabled Circular Economy and COVID-19 Experiences. Sustain. Prod. Consum. 2021, 27, 10–22. [Google Scholar] [CrossRef] [PubMed]

- Bahador, M.H.; Ibraim, S.S. Technology Innovations toward Sustainable Growth of Small and Medium Enterprise (SMEs): Aftermath COVID-19 Pandemic. Int. J. Acad. Res. Bus. Soc. Sci. 2021, 11, 1235–1241. [Google Scholar] [CrossRef]

- Obrad, C.; Circa, C. Determinants of Work Engagement among Teachers in the Context of Teleworking. Amfiteatru Econ. 2021, 23, 718–735. [Google Scholar] [CrossRef]

- Scutariu, A.L.; Șușu, S.; Huidumac-Petrescu, C.E.; Gogonea, R.M. A Cluster Analysis Concerning the Behavior of Enterprises with E-Commerce Activity in the Context of the COVID-19 Pandemic. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 3. [Google Scholar] [CrossRef]

- Grondys, K.; Slusarczyk, O.; Iqbal Hussain, H.; Androniceanu, A. Risk Assessment of the SME Sector Operations during the COVID-19 Pandemic. Int. J. Environ. Res. Public Health 2021, 18, 4183. [Google Scholar] [CrossRef]

- Lichtenthaler, U. A Conceptual Framework for Innovation and New Business Opportunities in the Post-Pandemic Period. J. Creat. Bus. Innov. 2021, 7, 74–89. [Google Scholar]

- Warner, K.S.; Wäger, M. Building Dynamic Capabilities for Digital Transformation: An Ongoing Process of Strategic Renewal. Long Range Plan. 2019, 52, 326–349. [Google Scholar] [CrossRef]

- Wirtz, B.W.; Pistoia, A.; Ullrich, S.; Gottel, V. Business Models: Origin, Development and Future Research Perspectives. Long Range Plan. 2015, 49, 36–54. [Google Scholar] [CrossRef]

- Botezat, A.E.; Dodescu, A.O.; Văduva, S.; Fotea, S.L. An Exploration of Circular Economy Practices and Performance Amonga Romanian Producers. Sustainability 2018, 10, 3191. [Google Scholar] [CrossRef]

- Oncioiu, I.; Căpușneanu, S.; Türkeș, M.C.; Topor, D.I.; Constantin, D.M.O.; Marin-Pantelescu, A.; Ștefan Hint, M. The Sustainability of Romania SMEs and Their Involvement in the Circular Economy. Sustainability 2018, 10, 2761. [Google Scholar] [CrossRef]

- Busu, M.; Trica, C.L. Sustainability of Circular Economy Indicators and Their Impact on Economic Growth of the European Union. Sustainability 2019, 11, 5481. [Google Scholar] [CrossRef]

- Vermeșan, H.; Mangău, A.; Tiuc, A.-E. Perspectives of Circular Economy in Romanian Space. Sustainability 2020, 12, 6819. [Google Scholar] [CrossRef]

- Dobre-Baron, O.; Nițescu, A.; Niță, D.; Mitran, C. Romania’s Perspectives on the Transition to the Circular Economy in an EU Context. Sustainability 2022, 14, 5324. [Google Scholar] [CrossRef]

- Dragoi, M.C.; Popescu, M.F.; Andrei, J.V.; Mieila, M. Developments of the Circular Economy in Romania under the New Sustainability Paradigm. Econ. Comput. Econ. Cybern. Stud. Res. 2018, 52, 125–138. [Google Scholar] [CrossRef]

- Trica, C.L.; Banacu, C.S.; Busu, M. Environmental Factors and Sustainability of the Circular Economy Model at the European Union Level. Sustainability 2019, 11, 1114. [Google Scholar] [CrossRef]

- Vuță, M.; Enciu, A.; Cioacă, S.I. Assessment of the Circular Economy’s Impact in the EU Economic Growth. Amfiteatru Econ. 2018, 20, 248–261. [Google Scholar] [CrossRef]

- Modoi, O.C.; Mihai, F.C. E-Waste and End-of-Life Vehicles Management and Circular Economy Initiatives in Romania. Energies 2022, 15, 1120. [Google Scholar] [CrossRef]

- Ghinea, C.; Gavrilescu, M. Solid Waste Management for Circular Economy: Challenges and Opportunities in Romania—The Case Study of Iasi County. Green. Ind. Netw. Stud. 2019, 6, 25–60. [Google Scholar] [CrossRef]

- Mihai, F.C.; Minea, I. Sustainable Alternative Routes versus Linear Economy and Resources Degradation in Eastern Romania. Sustainability 2021, 13, 10574. [Google Scholar] [CrossRef]

- Strat, V.A.; Teodor, C.; Săseanu, A.S. The Characterization of the Romanian Circular Economy’s Potential, at County Level. Amfiteatru Econ. 2018, 20, 278–293. [Google Scholar] [CrossRef]

- Albastroiu Nastase, I.; Negrutiu, C.; Felea, M.; Acatrinei, C.; Cepoi, A.; Istrate, A. Toward a Circular Economy in the Toy Industry: The Business Model of a Romanian Company. Sustainability 2022, 14, 22. [Google Scholar] [CrossRef]

- Gruia, R.; Florescu, G.-I.; Gaceu, L.; Oprea, O.B.; Ţane, N. Reducing Environmental Risk by Applying a Polyvalent Model of Waste Management in the Restaurant Industry. Sustainability 2021, 13, 5852. [Google Scholar] [CrossRef]

- Berechet, M.; Mirel, I.; Staniloiu, C.; Fischer, K. Carbon Footprint of Waste Management in Romania in the Context of Circular Economy. Environ. Eng. Manag. J. 2019, 18, 1289–1295. [Google Scholar] [CrossRef]

- Pintilie, N. Measuring the progress towards circular economy in European Union countries. Bus. Excell. Manag. 2021, 11, 19–35. [Google Scholar] [CrossRef]

- Androniceanu, A.; Kinnunen, J.; Georgescu, I. Circular economy as a strategic option to promote sustainable economic growth and effective human development. J. Int. Stud. 2021, 14, 60–73. [Google Scholar] [CrossRef]

- Manea, D.I.; Istudor, N.; Dinu, V.; Paraschiv, D.M. Circular Economy and Innovative Entrepreneurship, Prerequisites for Social Progress. J. Bus. Econ. Manag. 2021, 22, 1342–1359. [Google Scholar] [CrossRef]

- Drăgoi, A.-E. Eu Legal Framework for Circular Economy-Goals and Challenges. Euroinfo 2020, 4, 65–76. Available online: https://ideas.repec.org/a/iem/eurinf/v4y2020i3p65-76.html (accessed on 12 April 2022).

- Rada, E.C.; Cioca, L.I.; Ionescu, G. Energy Recovery from Municipal Solid Waste in EU: Proposals to Assess the Management Performance under a Circular Economy Perspective. In Proceedings of the 8th International Conference on Manufacturing Science and Education—Trends in New Industrial Revolution, Sibiu, Romania, 7–9 June 2017. [Google Scholar] [CrossRef]

- Giurea, R.; Precazzini, I.; Ragazzi, M.; Achim, M.I.; Cioca, L.I.; Conti, F.; Torretta, V.; Rada, E.C. Good Practices and Actions for Sustainable Municipal Solid Waste Management in the Tourist Sector. Resources 2018, 7, 51. [Google Scholar] [CrossRef]

- Lakatos, E.S.; Nan, L.M.; Bacali, L.; Ciobanu, G.; Ciobanu, A.M.; Cioca, L.I. Customer Satisfaction towards green Products: Empirical insights from Romania. Sustainability 2021, 13, 982. [Google Scholar] [CrossRef]

- Ghosh, S.K. Introduction to Circular Economy and Summary Analysis of Chapters. In Circular Economy: Global Perspective; Ghosh, S.K., Ed.; Springer: Singapore, 2020; pp. 1–24. [Google Scholar]

- Cui, M. Key Concepts and Terminology. In An Introduction to Circular Economy; Liu, L., Ramakrishna, S., Eds.; Springer: Singapore, 2020; pp. 17–34. [Google Scholar]

- Weetman, C.A. Circular Economy Hanndbook. How to Built a More Resilient, Competitive and Sustainable Business, 2nd ed.; Kogan Page: London, UK; New York, NY, USA; New Delhi, India, 2021. [Google Scholar]

- Chauhan, C.; Parida, V.; Dhir, A. Linking Circular Economy and Digitalisation Technologies: A Systematic Literature Review of Past Achievements and Future Promises. Technol. Forecast. Soc. Change 2022, 177, 121508. [Google Scholar] [CrossRef]

- Velenturf, A.P.M.; Purnell, P. Principles for A Sustainable Circular Economy. Sustain. Prod. Consum. 2021, 27, 1437–1457. [Google Scholar] [CrossRef]

- Gonçalves, B.d.S.M.; Carvalho, F.L.d.; Fiorini, P.d.C. Circular Economy and Financial Aspects: A Systematic Review of the Literature. Sustainability 2022, 14, 3023. [Google Scholar] [CrossRef]

- Cantú, A.; Aguiñaga, E.; Scheel, C. Learning from Failure and Success: The Challenges for Circular Economy Implementation in SMEs in an Emerging Economy. Sustainability 2021, 13, 1529. [Google Scholar] [CrossRef]

- Grădinaru, G.I.; Maricuț, A.C. From the Rebound Effect to the Perspective of Circular Economy: A Structure Changes Analysis Among EU Countries. Econ. Comput. Econ. Cybern. Stud. Res. 2022, 56, 257–272. [Google Scholar] [CrossRef]

- Al-Shboul, M.A.R.; Barber, K.D.; Garza-Reyes, J.A.; Kumar, V.; Abdi, M.R. The effect of supply chain management practices on supply chain and manufacturing firms’ performance. J. Manuf. Technol. Manag. 2017, 28, 577–609. [Google Scholar] [CrossRef]

- Dobre-Baron, O.; Nițescu, A. Trade Marketing—An Innovative Concept in Logistic Cooperation Between Manufacturers and Traders. Qual. Access Success J. 2019, 20, 451–456. [Google Scholar]

- Kazancoglu, Y.; Kazancoglu, I.; Sagnak, M. A New Holistic Conceptual Framework for Green Supply Chain Management Performance Assessment Based on Circular Economy. J. Clean. Prod. 2018, 195, 1282–1299. [Google Scholar] [CrossRef]

- Su, D.; Wu, Y.; Chai, Z. Advanced integrated manufacture by application of sustainable technology through product lifecycle: A circular economy approach. In Proceedings of the 2019 ACM International Conference Proceedings Series, London, UK, 19–21 September 2019; Available online: https://dl.acm.org/doi/10.1145/3358331.3358360 (accessed on 24 April 2022).

- Trevisan, A.H.; Zacharias, I.S.; Qinglan, L.; Miying, Y.; Janaina, M. Circular Economy and Digital Technologies: A review of the Current Research Streams. In Proceedings of the International Conference on Engineering Design, Gothenburg, Sweden, 16–20 August 2021. [Google Scholar]

- Rizos, V.; Behrens, A.; Van der Gaast, W.; Hofman, E.; Ioannou, A.; Kafyeke, T.; Flamos, A.; Rinaldi, R.; Papadelis, S.; Hirschnitz-Garbers, M.; et al. Implementation of Circular Economy Business Models by Small and Medium-Sized Enterprises (SMEs): Barriers and Enablers. Sustainability 2016, 8, 1212. [Google Scholar] [CrossRef]

- Lahti, T.; Wincent, J.; Parida, V. A Definition and Theoretical Review of the Circular Economy, Value Creation and Sustainable Business Models: Where are We Now and Where Should Research move in the Future? Sustainability 2018, 10, 2799. [Google Scholar] [CrossRef]

- Bressanelli, G.; Arodegari, F.; Perona, M.; Saccani, N. Exploring How Usage-Focused Business Models Enable Circular Economy through Digital Technologies. Sustainability 2018, 10, 639. [Google Scholar] [CrossRef]

- Kot, S. Sustainable Supply Chain Management in Small and Medium Enterprises. Sustainability 2018, 10, 1143. [Google Scholar] [CrossRef]

- Dura, C.; Isac, C. Using Taguchi Methods to Improve Production Process Quality: A Case Study. Total Qual. Manag. Bus. Excell. 2009, 20, 1189–1212. [Google Scholar] [CrossRef]

- Isac, A.; Isac, C. STEP Analysis of the Development of the Romanian Information Society. In Proceedings of the 16th International Conference Globalization and Post-Globalization Perspective—IECS 2009, Sibiu, Romania, 7–8 May 2009; pp. 91–97. [Google Scholar]

- Li, K.; Kim, D.J.; Lang, K.R.; Kauffman, R.J.; Naldi, M. How Should We Understand the Digital Economy in Asia? Critical Assessment and Research Agenda. Electron. Commer. Res. Appl. 2020, 44, 101004. [Google Scholar] [CrossRef] [PubMed]

- Piroșcă, G.I.; Șerban-Oprescu, G.L.; Badea, L.; Stanef-Puică, M.R.; Valdebenito, C.R. Digitalization and Labor Market—A Perspective within the Framework of Pandemic Crisis. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 2843–2857. [Google Scholar] [CrossRef]

- Agrawal, R.; Wankhede, V.A.; Kumar, A.; Upadhyay, A.; Garza-Reyes, J.A. Nexus of circular economy and sustainable performance in the era of digitalization. Int. J. Product. Perform. Manag. 2021, 71, 748–774. [Google Scholar] [CrossRef]

- Del Rio, P.; Kiefer, C.P.; Carrillo-Hermosilla, J.; Könöllä. The Circular Economy. Economic, Managerial and Policy Implications; Springer: Cham, Switzerland, 2021. [Google Scholar]

- Antikanien, M.; Usitalo, T.; Kivikyotö-Reponen, P. Digitalisation as an Enabler of Circular Economy. In Proceedings of the 10th CIRP Conference on Industrial-Product Service Systems, Linköping, Sweden, 29–31 May 2018. [Google Scholar]

- Pagoropoulos, A.; Pigosso, D.C.A.; MCAloone, T.C. The Emergent Role of Digital Technologies in the Circular Economy: A Review. Procedia CIRP 2017, 64, 19–24. [Google Scholar] [CrossRef]

- Paștiu, C.A.; Oncioiu, I.; Gârdan, D.A.; Maican, S.Ș.; Gârdan, I.P.; Muntean, A.C. The Perspective of E-Business Sustainability and Website Accessibility of Online Stores. Sustainability 2020, 12, 9780. [Google Scholar] [CrossRef]

- Ionescu, C.A.; Fülöp, M.T.; Topor, D.I.; Căpușneanu, S.; Breaz, T.O.; Stănescu, S.G.; Coman, M.D. The New Era of Business Digitization through the Implementation of 5G Technology in Romania. Sustainability 2021, 13, 13401. [Google Scholar] [CrossRef]

- Galleta, A.; Carnevale, L.; Celesti, A.; Fazio, M.; Villari, M. A Cloud-Based System for Improving Retention Marketing Loyalty Programs in Industry 4.0: A Study on Big Data Storage Implications. IEEE Access 2018, 6, 5485–5492. [Google Scholar] [CrossRef]

- Nițescu, A.; Dobre-Baron, O. Theoretical Delimitations Regarding the Management of Start-Up Business. Qual. Access Success J. 2017, 18, 354–357. [Google Scholar]

- Fogarassy, C.; Finger, D. Theoretical and practical approaches of circular economy for business models and technological solutions. Resources 2020, 9, 76. [Google Scholar] [CrossRef]

- Kotler, P.; Kartajaya, H.; Setiawan, I. Marketing 4.0: Moving from Traditional to Digital; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2016. [Google Scholar] [CrossRef]

- Dash, G.; Kiefer, K.; Paul, J. Marketing-to-Millennials: Marketing 4.0, Customer Satisfaction and Purchase Intention. J. Bus. Res. 2021, 122, 608–620. [Google Scholar] [CrossRef]

- Iuga, I.; Danciu, A.; Drigă, I. The Profile of the Foreign Investor in the Romanian Chemical Industry. Processes 2020, 8, 348. [Google Scholar] [CrossRef]

- Xu, L.D.; Xu, E.L.; Li, L. Industry 4.0: State of the Art and Future Trends. Int. J. Prod. Res. 2018, 56, 2941–2962. [Google Scholar] [CrossRef]

- Jara, A.J.; Parra, M.C.; Skarmeta, A.F. Marketing 4.0: A New Value Added to the Marketing through the Internet of Things. In Proceedings of the IEEE International Conference on Innovative Mobile and Internet Services in Ubiquitous Computing, Palermo, Italy, 4–6 July 2012. [Google Scholar] [CrossRef]

- Gilal, F.G.; Zhang, J.; Paul, J.; Gilal, N.G. The Role of Self Determination Theory in Marketing Science: An Integrative Review and Agenda for Research. Eur. Manag. J. 2019, 37, 29–44. [Google Scholar] [CrossRef]

- Radu, L.D. Green Cloud Computing: A Literature Survey. Symmetry 2017, 9, 295. [Google Scholar] [CrossRef]

- Penz, E.; Polsa, P. How do companies reduce their carbon footprint and how do they communicate these measures to stakeholders? J. Clean. Prod. 2018, 195, 1125–1138. [Google Scholar] [CrossRef]

- Cappiello, C.; Melià, P.; Plebani, P. Modeling CO2 Emissions to Reduce the Environmental Impact of Cloud Applications. In Lecture Notes in Business Information Processing. Proceedings of the International Conference on Advanced Information Systems Engineering, Ljubljana, Slovenia, 13–17 June 2016; Krogstie, J., Mouratidis, H., Su, J., Eds.; Springer: Cham, Switzerland, 2016; pp. 155–166. [Google Scholar]

- Roy, S.; Gupta, S. The Green Cloud Effective Framework: An Environment Friendly Approach Reducing CO2 Level. In Proceedings of the 1st International Conference on Non-Conventional Energy, Kalyani, India, 16–17 January 2014; IEEE: New York, NY, USA, 2014; pp. 233–236. [Google Scholar]

- Williams, D.R.; Thomond, P.; Mackenzie, I. The Greenhouse Gas Abatement Potential of Enterprise Cloud Computing. Environ. Model. Softw. 2014, 56, 6–12. [Google Scholar] [CrossRef]

- Costa, J.; Castro, R. SMEs Must Go OnLine—E-Commerce as an Escape Hatch for Resilience and Survivability. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 3043–3062. [Google Scholar] [CrossRef]

- Aswal, M.S. A Comparative Study of Resource Allocation Strategies for a Green Cloud. In Proceedings of the International Conference on Next Generation Computing Technologies (NGCT), Dehradun, India, 14–16 October 2016; IEEE: New York, NY, USA, 2016; pp. 621–625. [Google Scholar]

- Reddy, S.P.; Chandan, H.K.S. Energy Aware Scheduling of Real-Time and Non Real-Time Tasks on Cloud Processors (Green Cloud Computing). In Proceedings of the International Conference on Information Communication and Embedded Systems, Chennai, India, 27–28 February 2015; IEEE: New York, NY, USA, 2015; pp. 1–5. [Google Scholar]

- Okewu, E.; Misra, S.; Maskeliunas, R.; Damaševičius, R.; Fernandez-Sanz, L. Optimizing Green Computing Awareness for Environmental Sustainability and Economic Security as a Sochastic Optimization Problem. Sustainability 2017, 9, 1857. [Google Scholar] [CrossRef]

- Tarigan, Z.J.H.; Siagian, H.; Jie, F. Impact of Enhanced Enterprise Resource Planning (ERP) on Firm Performance through Green Supply Chain Management. Sustainability 2021, 13, 4358. [Google Scholar] [CrossRef]

- Khann, U.; Asim, M.; Manzoor, S. Improving Supply Chain Management of a Distribution Firm Using ERP System. Eur. J. Bus. Manag. Res. 2020, 5. Available online: https://www.ejbmr.org/index.php/ejbmr/article/view/248/138 (accessed on 25 April 2022).

- DaSilva, C.; Trkman, P.; Desouza, K.; Lindič, J. Disruptive Technologies: A Business Model Perspective on Cloud Computing. Technol. Anal. Strateg. Manag. 2013, 25, 1161–1173. [Google Scholar] [CrossRef]

- Gupta, S.; Kumar, S.; Kumar Singh, S.; Foropon, S.; Chandra, C. Role of Cloud ERP on the Performance of an Organization. Contingent Resource-Based View Perspective. Int. J. Logist. Manag. 2018, 29, 659–675. [Google Scholar] [CrossRef]

- Lin, Y.; Yu-Wu, L. Exploring the Role of Dynamic Capabilities in Firm Performance under the Resource Based View Framework. J. Bus. Res. 2014, 67, 407–413. [Google Scholar] [CrossRef]

- Mocanu, C.; Militaru, E.; Zamfir, A.M.; Maer-Matei, M.M. Circular Economy and Financial Performances of European SMEs. In Circular Economy and Sustainability. Management and Policy; Stefanakis, A., Nikolaou, I., Eds.; Elsevier: Amsterdam, The Netherland, 2022; Volume 1, pp. 71–86. [Google Scholar]

- Aranda-Usón, A.; Portillo-Tarragona, P.; Marín-Vinuesa, L.; Scarpellini, S. Financial Resources for the Circular Economy: A Perspective from Businesses. Sustainability 2019, 11, 888. [Google Scholar] [CrossRef]

- Zamfir, A.M.; Mocanu, C.; Grigorescu, A. Circular Economy and Decision Models Among European SMEs. Sustainability 2017, 9, 1507. [Google Scholar] [CrossRef]

- Sassanelli, C.; Rosa, P.; Rocca, T.; Terzi, S. Circular Economy Performance Assessment Methods: A Systematic Literature Review. J. Clean. Prod. 2019, 229, 440–453. [Google Scholar] [CrossRef]

- Digital Economy and Society Index. 2021. Available online: https://digital-strategy.ec.europa.eu/en/policies/countries-digitisation-performance (accessed on 15 December 2021).

- 2021–2027 Territorial Plan for just Transition in Hunedoara County. Available online: https://www.cjhunedoara.ro (accessed on 17 December 2021).

- Analysis of Digitization Demands at the Level of Enterprises Originating from the West Region. Available online: https://adrvest.ro (accessed on 17 December 2021).

- Cașotă, F. Digitalization Has Reduced the Negative Impact of the COVID-19 pandemic on SMEs, Start-Up. 2020. Available online: https://start-up.ro/digitalizarea-a-micsorat-impactul-negativ-al-pandemiei-covid-19-asupra-imm-urilor/ (accessed on 22 April 2022).

- Obrad, C. Advanced Data Analysis in Social Sciences (Analiza Avansată a Datelor în Științele Sociale); ProUniversitaria: Bucharest, Romania, 2021. [Google Scholar]

- Ajay, S.S.; Micah, B.M. Sampling Techniques & Determination of Sample Size in Applied Statistic Research: An Overview. Int. J. Econ. Commer. Manag. 2014, II, 1–22. [Google Scholar]

- Tatu, C.I. Analiza Datelor de Marketing (Marketing Data Analysis); Economic Bucharest University Publishing House: Bucharest, Romania, 2018. [Google Scholar]

- Saraçli, S.; Doğan, N.; Doğan, İ. Comparison of hierarchical cluster analysis methods by cophenetic correlation. J. Inequal. Appl. 2013, 2013, 203. [Google Scholar] [CrossRef]

- Wen, J.; Fang, X.; Cui, J.; Fei, L.; Yan, K.; Chen, Y.; Xu, Y. Robust Sparse Linear Discriminant Analysis. IEEE Trans. Circuits Syst. Video Technol. 2019, 29, 390–403. [Google Scholar] [CrossRef]

- Kovacs, J.; Kovacs, S.; Magyar, N.; Tanos, P.; Hatvani, I.G.; Anda, A. Classification into homogenous groups using combined and discriminant analysis. Environ. Model. Softw. 2014, 57, 52–59. [Google Scholar] [CrossRef]

- Li, L.; Doroslovački, M.; Loew, M.H. Discriminant Analysis Deep Neural Networks. In Proceedings of the 53rd Annual Conference on Information Sciences and Systems (CISS), Baltimore, MD, USA, 20–22 March 2019; pp. 1–6. [Google Scholar] [CrossRef]

- Gabor, R. Analiza Și Inferența Statistică a Datelor de Marketing (Analysis and Statistical Inference of Marketing Data); C.H. Beck Publishing House: Bucharest, Romania, 2016; pp. 57–73. [Google Scholar]

- Dinu, P.; Dinu, L. Using Internet as a Solution for Sales in Pandemic Crisis: E-Commerce. In Proceedings of the 31st DAAAM International Symposium, Mostar, Bosnia and Herzegovina, 21–24 October 2020; Katalinic, B., Ed.; DAAAM International: Vienna, Austria, 2020. [Google Scholar] [CrossRef]

- Apurva, P.; Sharareh, K. Impact of COVID-19 on Field and Office Workforce in Construction Industry. Proj. Leadersh. Soc. 2021, 2, 1235–1241. [Google Scholar] [CrossRef]

- Cotula, L. Towards a Political Economy of the COVID-19 crisis: Reflections on an Agenda for Research and Action. World Development. 2021, 138, 105235. [Google Scholar] [CrossRef]

- Priyono, A.; Moin, A.; Aini Oktaviani Putri, V.N. Identifying Digital Transformation Paths in the Business Model of SMEs during the COVID-19 Pandemic. J. Open Innov. Technol. Mark. Complex. 2020, 6, 104. [Google Scholar] [CrossRef]

- Financial Stability Report. National Bank of Romania. June 2020, Year V, No. 9. Available online: https://www.bnr.ro/ (accessed on 5 January 2022).

- Khatibi, S.; Nour, A.-N.I. The Impact of Corporate Governance on Firm Performance During the COVID19 Pandemic: Evidence from Malaysia. J. Asian Financ. Econ. Bus. 2021, 8, 943–952. [Google Scholar] [CrossRef]

- Hussain, S.; Nguyen, V.C.; Nguyen, Q.M.; Nguyen, H.T.; Nguyen, T.T. Macroeconomic Factors, Working Capital Management and Firm Performance—A Static and Dynamic Panel Analysis. Humanit. Soc. Sci. Commun. 2021, 8, 123. [Google Scholar] [CrossRef]

- Didier, T.; Huneeus, F.; Larrain, M.; Schmukler, S. Financing Firms in Hibernation During the COVID-19 Pandemic. J. Financ. Stab. 2021, 53, 100837. [Google Scholar] [CrossRef]

- Taiminen, H.M.; Karjaluoto, H. The Usage of Digital Marketing Channels in SMEs. J. Small Bus. Enterp. Dev. 2015, 22, 633–651. [Google Scholar] [CrossRef]

- Mário, F. Networking as a Marketing Tool in Small Companies: A Random and Informal Approach. J. Bus. Strategy 2018, 39, 47–55. [Google Scholar]

- Dobre, C.; Milovan, A.M.; Duțu, C.; Preda, G.; Agapie, A. The Common Values of Social Media Marketing and Luxury Brands. The Millennials and Generation Z Perspective. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 2532–2553. [Google Scholar] [CrossRef]

- Dumitriu, D.; Militaru, G.; Deselnicu, D.C.; Niculescu, A.; Popescu, M.A.M. A Perspective over Modern SMEs: Managing Brand Equity, Growth and Sustainability through Digital Marketing Tools and Techniques. Sustainability 2019, 11, 2111. [Google Scholar] [CrossRef]

- Franco, M.; Haase, H.; Pereira, A. Empirical Study about The Role of Social Networks in SME Performance. J. Syst. Inf. Technol. 2016, 18, 383–403. [Google Scholar] [CrossRef]

- Gómez-Llanez, C.Y.; Diaz-Leal, N.R.; Angarita-Sanguino, C.R. A Comparative Analysis of The ERP Tools, ODOO and Openbravo for Business Management. Aibi Rev. DeInvestig. Adm. E Ing. 2020, 8, 145–153. [Google Scholar] [CrossRef]

- Johansson, B.; Alajbegovic, A.; Alexopoulo, V.; Desalermos, A. Cloud ERP Adoption Opportunities and Concerns: The Role of Organizational Size. In Proceedings of the 2015 48th Hawaii International Conference on System Sciences, Kauai, HI, USA, 5–8 January 2015; Available online: https://lucris.lub.lu.se/ws/portalfiles/portal/1490283/7991296.pdf (accessed on 25 April 2022).

- Al-Saleem, S.M. A Comparative Analysis and Evaluation of Open Source ERP Systems. Int. J. Comput. Sci. Netw. Secur. 2017, 13, 24–28. [Google Scholar]

- Rosati, P.; Lynn, T. Measuring the Business Value of Infrastructure Migration to the Cloud. In Measuring the Business Value of Cloud Computing; Lynn, T., Mooney, J.G., Rosati, P., Fox, G., Eds.; Plagrave Studies in Business and Enabling Technologies: Cham, Switzerland, 2020; pp. 19–38. [Google Scholar]

- Wu, J.Y.; Chen, L.T. Odoo ERP Business Intelligence Tool for a Small Medium Enterprise: A Scenario Case Study. In Proceedings of the 11th International Conference on e-Education, e-Business, e-Management and e-Learning, Osaka, Japan, 10–12 January 2020. [Google Scholar] [CrossRef]

- Khan, S. Cloud Computing: Issues and Risks of Embracing the Cloud in a Business Environment. Int. J. Educ. Manag. Eng. 2019, 4, 44–56. [Google Scholar] [CrossRef]

- Çankaya, S.I.; Sezen, B. Effects of Green Supply Management Practices on Sustainability Performance. J. Manuf. Technol. Manag. 2019, 30, 98–121. [Google Scholar] [CrossRef]

- Dura, C.; Drigă, I. The Impact of Multinational Companies from Romania on Increasing the Level of Corporate Social Responsibility Awareness. Contemp. Econ. 2017, 11, 45–66. [Google Scholar] [CrossRef][Green Version]

| No. | Code | Profitability Ratios | Formula |

|---|---|---|---|

| 1 | V1 | ROA—Return on Assets | Gross profit/Total assets × 100 |

| 2 | V2 | ROE1—Return on Equity | Net profit/Shareholders’ Equity × 100 |

| 3 | V3 | ROS—Return on Sales | Net profit/Sales × 100 |

| 4 | V4 | LEV—Total Liabilities Ratio | Total Debts/Total Assets × 100 |

| 5 | V5 | ARR—Accounts Receivables Ratio | Trade Receivables/Total Assets × 100 |

| 6 | V6 | GMR—Gross Profit Margin | Gross profit/Turnover × 100 |

| 7 | V7 | ROE2—Return on Expenditures | Net profit/Expenditures × 100 |

| 8 | V8 | CAR—Current Assets Ratio | Inventory/Total Assets × 100 |

| 9 | V9 | ASFR—Assets Self-Financing Ratio | Equity/Total Assets × 100 |

| Variable | Mean | Standard Deviation | Skewness | Kurtosis | Bimodality |

|---|---|---|---|---|---|

| V1 | 20.6288 | 26.0453 | 3.1544 | 12.2175 | 0.7087 |

| V2 | 39.6450 | 41.4136 | 1.6465 | 2.8757 | 0.6075 |

| V3 | 11.7702 | 12.6182 | 1.6964 | 2.1605 | 0.7190 |

| V4 | 51.8826 | 28.1063 | −0.2455 | −0.9678 | 0.4861 |

| V5 | 22.9386 | 24.0296 | 1.1621 | 0.4861 | 0.6321 |

| V6 | 12.7567 | 12.9552 | 1.6477 | 1.9847 | 0.7120 |

| V7 | 15.2690 | 22.1950 | 2.5863 | 6.5872 | 0.7830 |

| V8 | 75.5629 | 24.2410 | −1.2664 | 1.2243 | 0.5842 |

| V9 | 48.1174 | 28.1063 | 0.2455 | −0.9678 | 0.4681 |

| Eigenvalue | Difference | Proportion | Cumulative | |

|---|---|---|---|---|

| 1 | 2437.75 | 594.92 | 0.4091 | 0.4091 |

| 2 | 1842.82 | 1187.95 | 0.3093 | 0.7184 |

| 3 | 654.87 | 130.18 | 0.1099 | 0.8284 |

| 4 | 524.68 | 139.22 | 0.0881 | 0.9164 |

| 5 | 385.47 | 286.66 | 0.0647 | 0.9811 |

| 6 | 98.81 | 86.74 | 0.0166 | 0.9977 |

| 7 | 12.07 | 10.44 | 0.0020 | 0.9997 |

| 8 | 1.63 | 1.63 | 0.0003 | 100 |

| 9 | 0 | 0 | 100 |

| Statistics | Class 1 | Class 2 | Class 3 |

|---|---|---|---|

| Wilks’ Lambda | 0.5465 | 0.6210 | 0.6593 |

| Pillai’s Trace | 0.4535 | 0.3789 | 0.3407 |

| Hottelling–Lawley Trace | 0.8299 | 0.6102 | 0.5168 |

| Roy’s Greatest Root | 0.8299 | 0.6102 | 0.5168 |

| Hottelling–Lawley Trace | 0.8299 | 0.6102 | 0.5168 |

| V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | |

|---|---|---|---|---|---|---|---|---|---|

| Class 1 | 36.14 | 102.64 | 8.05 | 90.38 | 26.08 | 9.52 | 29.84 | 90.68 | 9.62 |

| Class 2 | 5.5 | 20.98 | 1.88 | 81.73 | 34.56 | 3.14 | 3.65 | 67.4 | 18.27 |

| Class 3 | 12.56 | 20.7 | 0.78 | 44.01 | 12.89 | −15.15 | 31.4 | 76.71 | 55.99 |

| V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | |

|---|---|---|---|---|---|---|---|---|---|

| Class 1 | 36.14 | 102.64 | 8.05 | 90.38 | 26.08 | 9.52 | 29.84 | 90.68 | 9.62 |

| Marini Trans SRL | 4.08 | 22.05 | 2.15 | 84.07 | 40.99 | 2.50 | 2.20 | 83.57 | 15.93 |

| O1 | O2 | O3 | |

|---|---|---|---|

| Targeted Objectives | Decreasing inventories | Increasing sales | Optimizing resources consumption |

| Selected Modules | Costumer Relationship Marketing | Social Marketing SMS Marketing Email Marketing | Marketing automation Accounting |

| Dimension | Variables |

|---|---|

| Environmental Performance | Reduction in e-waste Reduction in CO2 emissions Reduction in energy consumption |

| Economic Performance | Sales growth Profitability ratios Reduction in operational costs |

| Social Performance | Improved awareness of environmental protection issues Improvements in investments in corporate social responsibility programs Improvements in investments in employee training and education Improvements in participation in environmental projects |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dura, C.C.; Iordache, A.M.M.; Ionescu, A.; Isac, C.; Breaz, T.O. Analyzing Performance in Wholesale Trade Romanian SMEs: Framing Circular Economy Business Scenarios. Sustainability 2022, 14, 5567. https://doi.org/10.3390/su14095567

Dura CC, Iordache AMM, Ionescu A, Isac C, Breaz TO. Analyzing Performance in Wholesale Trade Romanian SMEs: Framing Circular Economy Business Scenarios. Sustainability. 2022; 14(9):5567. https://doi.org/10.3390/su14095567

Chicago/Turabian StyleDura, Codruța Cornelia, Ana Maria Mihaela Iordache, Alexandru Ionescu, Claudia Isac, and Teodora Odett Breaz. 2022. "Analyzing Performance in Wholesale Trade Romanian SMEs: Framing Circular Economy Business Scenarios" Sustainability 14, no. 9: 5567. https://doi.org/10.3390/su14095567

APA StyleDura, C. C., Iordache, A. M. M., Ionescu, A., Isac, C., & Breaz, T. O. (2022). Analyzing Performance in Wholesale Trade Romanian SMEs: Framing Circular Economy Business Scenarios. Sustainability, 14(9), 5567. https://doi.org/10.3390/su14095567