1. Introduction

Every year, one of the world’s best startup accelerators, YCombinator, publishes a list of about twenty topics considered most promising for building new startups. One of them is transportation and mobility, emphasizing two aspects: energy consumption and the amount of time people spend commuting [

1]. As the accelerator highlights these problems, they are the “hotspots” of exploration and implementation for innovation. While the “flying cars” envisioned by numerous literary scenarios remain in fantasy, science constantly provides new solutions, although less spectacular ones. Startups—ambitious, dynamic, and flexible ventures stimulated by technical and technological progress—are often first to adopt new ideas and operationalize them for business.

Simultaneously, sustainability-oriented transport and mobility solutions hunt for engineering and management innovations. In 2019, transportation consumed 29% of the total global final energy consumption, 4 pp higher than in 1990. However, the volume of energy consumed by transport almost doubled during this period (+83%) and was faster than the growth in global energy consumption (+60%) [

2]. In terms of CO

2 emissions, transport accounted for 24% of total global emissions in 2019, 2 pp more than in 1990. Since then, the volume of transport emissions has increased by 78% and, again, has grown faster than globally (+64%). Transportation represents 57% of the world’s oil demand (2019) [

2,

3].

Although transportation was one of the hardest affected industries by the COVID-19 pandemic in 2020 [

4], in 2021, the demand for passenger and freight transportation was overgrowing, with a limited supply of alternative fuels. The most notable growth comes in developing and emerging economies. A net-zero emissions scenario by 2050 requires that transport sector emissions fall by as much as 20% by 2030. The road and rail sectors need to advance infrastructure for zero-emission vehicles (ZEVs). Promoting low-carbon fuels is essential to decarbonize aviation, shipping, and heavy road transport [

5]. Since 2010, the number of electric cars has multiplied, with 16 million cars by the end of 2021 [

6]. Despite a worldwide slowdown in car sales, electric car registrations have been fueled by pandemia. As experts predict, ZEVs will account for more than one-third of the entire global fleet by 2040, meaning that 677 million passenger and commercial vehicles could be on the world’s roads [

6].

The aforementioned optimistic scenarios would happen if new cutting-edge technologies were successfully applied and deployed. Innovations and new technologies are primarily adopted by startups—an ambitious and dynamic form of organization stimulated by technical and technological progress. This study examines the contribution the innovative startups may bring to the greening process in transport systems by zooming in on the solutions they implement. The approach to transport and mobility innovation presented in this study has significant limitations. The transport sector is large and highly heterogeneous in many dimensions: organizational, functional, geographical, technological. For this reason, multiple sources of innovation can be identified [

7,

8]. The enormous financial resources that the largest corporations in this sector allocate to research and development in vehicles, infrastructure, and logistics result in potentially disruptive solutions on a large scale. Hence, we discuss many smaller-scale startups that can make relatively significant changes on a micro level. In a transportation market heavily dominated by large corporations, startups are about local or regional operations or cooperation with prominent partners. However, we are convinced that this is something worth exploring.

The first purpose of this study is to define startups as the new organizational form. The second is to investigate business models of transport, logistics, and electromobility startups in Poland in 2015–2019 and characterize these organizations and their activities. The research question guiding this study is whether more substantial public support for startups in this area is needed to accelerate the “greening” processes in transportation broadly.

This study contributes to the literature in two ways. First, it defines a startup as a new form of innovative, high-growing, ambitious and scalable organization. Second, it considers the value of startup organizations and their role in changing big industries such as automotive or energy.

2. Literature Review

A Scopus database search was performed to identify the literature related to the topic of this paper. First, the words forming the title of this paper were searched for in the titles, keywords, and abstracts of published papers. Then, the type of publication was restricted to articles, years of publication to the last five years (2018–2022), and subject areas to “Business, Management, and Accounting” and “Economics, Econometrics, and Finance”.

Table 1 shows the applied search query in detail.

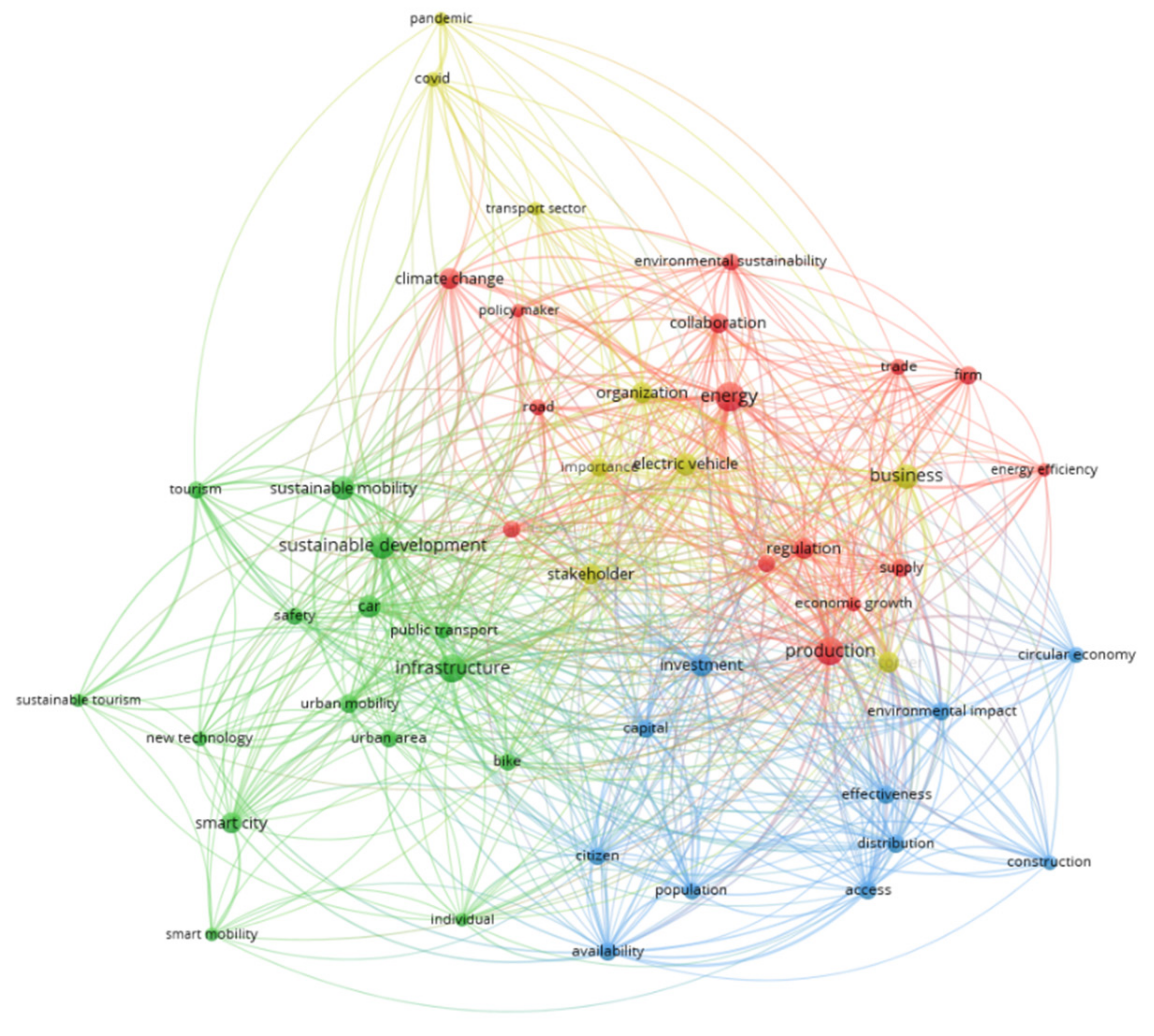

A database of 238 papers was obtained. This database was analyzed with the help of the VOSviewer version 1.6.18 program, which, based on 50 selected phrases, the so-called “items”, proposed 4 clusters of closely related literature (

Figure 1):

Cluster 1 (red) focused on energy, production, climate change, supply, technology innovation, and regulation; we call this cluster “economic”;

Cluster 2 (green), focused on infrastructure, sustainable mobility/development, smart city, car; we call it “urban-infrastructure”;

Cluster 3 (blue), the least thematically distinct, deals with issues universal to other clusters: investment, effectiveness, environmental impact, circular economy, capital, availability; in other words; it is not considered a thematic cluster;

Cluster 4 (yellow), the most recent, explores the issue of transportation in the era of the COVID-19 pandemic, with dominant themes: COVID/pandemic, business, stakeholder, organization, and electric vehicle.

Sénquiz-Díaz [

9,

10] analyzes the relationship between logistics, transport infrastructure, and facilitation of trade and exports performance, falling into Cluster 1. Similar issues are considered by [

11], but on a micro-scale, i.e., a single enterprise. Problems combining Cluster 1 and 2 appear in [

12]. The authors analyze the mechanisms for the diffusion of electric and hybrid cars from the perspective of energy companies and the government. On the other hand, Cluster 2 can be represented by a highly cited article on urban sustainability and business ecosystem innovation in the example of Shanghai [

13]. The paper indicates a robust coevolution mechanism between the transformation towards a more sustainable city at the macro level and business ecosystem innovation towards a greener and more intelligent transportation at the mezo-level. The authors suggest that the two levels of transformation mutually influence and reinforce sustainable values and practices. In this context [

14] considers the role of innovation in sustainable tourism and transport and points to directions that can contribute to and even accelerate sustainable tourism and transport development. Shalender [

15] highlights the need to develop an entrepreneurial orientation and robust business models for electric vehicles. In Cluster #4, the authors of [

16] reflect on the future of airports and the air transport industry based on revenue generation sources, cost control strategies, and the integration of innovation for variable demand and capacity during and after COVID-19. The transport context also appears in a deeply reflective article [

17] on the recovery of G20 economies after the COVID-19 pandemic, by the economist Edward Barbier. The context of green innovation, infrastructure, development of smart grids, transport systems, charging station networks, and sustainable cities appears.

In

Figure 2 the density of publications in each cluster is visualized. There is a strong presence of papers in three areas: energy, production, and infrastructure. In turn, the analysis of the topics changing over time has shown a shift from: urban area, investment, firm, and road issues, towards: infrastructure, (sustainable) tourism, organization, and business, up to the most popular ones in the most recent papers dealing mainly with: COVID, pandemic, stakeholder, smart city, construction, and trade.

We noted that the terms “business model” and “startup” did not occur as a topic (“item”) in our Scopus literature research, which may mean that these subjects are poorly or not at all explored in the context of sustainable transport. Hence, we believe that our study can contribute significant value to the literature on this topic.

3. A Startup Definition

Sustainability-oriented transport and mobility solutions are of intense interest to innovative startups. In a classical, literal sense, startups are newly registered business entities. Until recently, understanding a startup as a new venture, activity, and an entrepreneurial debut prevailed. Currently, we understand startups in a new sense, although there is still no consensus on a standard definition of this phenomenon.

To begin with, startups are not smaller versions of large companies [

18]. Startups are a particular form of nascent companies distinguished from classic new ventures. Being a startup is not a destination but an operation model for up to ten years.

Let us consider three main attributes that will help characterize and define startups compared to other forms of organization.

The first is innovation. Not every new company is a startup, but every startup has an element of novelty. While the traditional business grows primarily through geographic expansion, acquiring customers from competitors, and cost optimization, startups focus activities and resources on exploring and implementing innovation. Innovation in startups takes on various intensities. Startups are academic spin-offs bringing disruptive technologies to market (e.g., ICEYE) or companies creating new services (e.g., Klarna), applying new business models (Airbnb), improving existing solutions (e.g., GoTo, DocPlanner), or adapting them to local conditions (e.g., Didi). Innovation can be found in any business model element, such as the revenue pattern. It is worth recalling the classic example of aircraft engine manufacturer Rolls-Royce, which has implemented a revolutionary subscription payment model for its product, called engine-as-a-service. This model involved charging the airline operator only for hours “flown” in the air [

19]. It started a global trend of changing from product-oriented to service-oriented business models, now called product-as-a-service, or more generally “servitization” [

20].

The business model concept also allows entirely non-profit ventures to be accepted, where the business model is designed to increase the value of the entire venture (e.g., WhatsApp). Breakthrough innovations allow startups to challenge and ultimately change the market status quo, create entirely new markets, and often threaten corporations with a seemingly stable and unthreatened market position (e.g., Rivian, Tesla).

Therefore, innovation in a startup is a necessary element. However, it can refer to any business model element [

21] and does not necessarily mean implementing a breakthrough innovation—although only such solutions give a chance for spectacular success. In other words, replicative ventures, copying existing solutions but implementing some elements of originality, are also considered startups. It is worth mentioning that original implementations rarely lead market “pioneers” to succeed. The modification of existing models is significantly more successful in business:

Google was not the first search engine;

Facebook was the first social networking platform;

American Express was the first payment card.

The second attribute is the business model, which determines the way and pace of a startup’s growth. A business model is a rationale for how an organization creates and delivers value to the customer and monetizes that value [

22,

23,

24,

25]. In pragmatic terms, a business model helps transform ideas into businesses and hypotheses into facts [

26,

27]. Startups go quickly from failure to failure, adapting, iterating on, and improving their initial ideas as they continually learn from customers [

28,

29,

30]. Hence, the fundamental difference between startups and incumbents is that the latter exploit a well-known business model, while startups look for one. This distinction led Steve Blank to formulate the most popular definition of a startup as a temporary organization designed to search for a repeatable and scalable business model [

28].

The critical feature of startup business models is scalability. The strong growth of metrics (number of customers, users, or traffic) in scalable models is over-proportional to the scale of assets involved. In effect, the number of customers per employee or per unit of capital is much higher than in classical businesses. In addition, this growth rate is fast, with relatively low employment and a small supply of capital (at least up to a certain point). “Fast” is a relative term and depends on the stage of development; at the first sale, the rate of double-digit month-to-month is expected, then correspondingly slower. As Paul Graham, founder of the YCombinator, said: “the startup is growth” [

31]. Achieving such a high pace is the result of a combination of many circumstances, which include, first and foremost, a unique offering compared to the competition, ambitious leaders, strategic management, and excellent staff [

32], but a “stroke of luck” does not hurt either [

33].

The third attribute of startups and the critical element that enables scalable business models to emerge is digital technologies that activate the levers of exponential growth. These technologies allow the creation and delivery of core customer value (often virtual) and automate activities previously performed by humans or machines. Today this is mainly enabled by ICT through platform station, digitalization, virtualization, and machine learning. In the future, it may be other technologies such as blockchain, 5G, quantum computing, or something else.

In addition to the above contexts, three additional circumstances of startups operating deserve attention. The first is that startups operate under high uncertainty, mainly about who the customer is and what value that customer is willing to pay for [

34]. The second context means that startups are not “rich” but suffer from a scarcity of human and financial resources. This problem prompts startups to use lean and agile management methodologies aimed at an efficiency [

35].

Last, perhaps the key driver for startups is an ambitious and bold vision, which on the one hand, demonstrates the nature and importance of leadership. On the other hand, startups are often expansive and focused on global markets.

The European Startup Monitor [

36] authors follow a similar pattern and define a startup as a company that meets three conditions: is younger than ten years, has an innovative product (service or business model), aims to scale.

To sum up, startups are ventures whose business model is shaped by innovation, rapid growth, and high ambition. Startups design and validate their business models under uncertainty and limited resources. The business model should enable the scalability of the venture, which is achieved by leveraging digital technologies or other technical and organizational solutions.

The above considerations allow the first objective of this paper to be met, which was to define startups as a new organizational form. A startup can be defined as an organization aiming to:

transform into a scale-up by up to 10 years;

design and validate its business models under uncertainty and limited resources;

shape its business model by innovation, rapid growth, and high ambition;

scale, achieved by leveraging digital technologies or other technical and organizational solutions.

With the startup’s main attributes listed, it is possible to identify the derived characteristics that distinguish two categories of ventures, startups and new non-startup companies: [

37]

financing startups: own funds and VC-type funds, non-startup companies: own funds and banks;

management methodologies and tools startups: the lean startup (business modeling, customer and agile development), non-startup companies: business plan, benchmarking, processes optimization;

innovativeness startups: market-driving, non-startup companies: market-driven;

development model startups: iterative aimed to achieve hyper scalability, non-startup companies: operational improvement for survival and incremental growth;

customer focus startups: creating new markets and needs, non-startup companies: existing customers, taken away from or forgotten by competitors.

The characteristics that differentiate startups and non-startups are not the same for early-stage and more advanced ventures. In the early stages, the key features of a startup are innovation, unknown demand, and limited resources. Later, the pursuit of hyper scalability and the company’s high valuation resulting from external capital commitment is more important. Between these stages, the above-average rapid growth of critical parameters is expected: number of transactions, users, customers, and revenue. The attributes of a startup organization can also be divided into external and internal. External may include uncertain demand, market opportunity, and a chance for significant funding at a later stage of development. Internal contains limited resources, high team operational capabilities, strong leadership, and a hyper scalable business model. The latter is achieved by automating operations through the use of digital technologies. As they grow, several startups transform into various forms of organizations, losing the startup character. Some become corporations, others medium or large companies, or are acquired by big market players or competitors. Business culture holds an important role in startup development, including significant knowledge and experience exchange mechanisms within local hubs, so-called startup hubs, where startups create communities and complex innovation ecosystems [

38].

Recognizing the startup as different from traditional business forms [

37] will preserve and confirm the validity of the existing management achievements—business planning and budgeting of new traditional ventures. It will allow them to coexist due to the empirical justification of the different identities of the two research subjects, rather than contesting each other due to the “temporal obsolescence of knowledge”. In the field of entrepreneurship, there is a phenomenon of polarization of the research subject. The demarcation line is mainly determined by the nature and pace of the venture’s growth [

39,

40,

41].

Successful startups, called “scale-ups” (scale-up: to expand the scope of a business rapidly), penetrate the classic market economy structures through incorporation or transform themselves into powerful corporations.

5. Materials and Methods

Mixed methods were used in this study. For defining the concept of a startup, literature analysis was used. For the research on startups, quantitative and descriptive methods were used. A simple mathematical and statistical analysis on the long-term database “Polish Startups” was conducted. Descriptive methods enriched via web scraping to supplement the data were used to present the most compelling cases.

Our empirical data is derived from a survey among digital startups held annually in Poland between 2015 and 2019 by the Startup Poland Foundation [

67]. During the 5-year research period, the survey was completed by over four thousand Polish startups. Anonymized data from these surveys are available at the Startup Poland Foundation.

A respondent of a survey was an operating team which:

creates or applies new technological solutions to create products or services that can be attributed to one of the following areas: IT/ICT, energy/industrial/material/biomedical technologies,

has a scalable business model.

There were 204 startups (about 5% of the total population) identified as operating in the transport, mobility, or logistics (category for 2015–2019) or electromobility (new category added in 2019) industries.

The following conditions for the examined startups were verified:

This stage was accomplished using a handmade web scraping method [

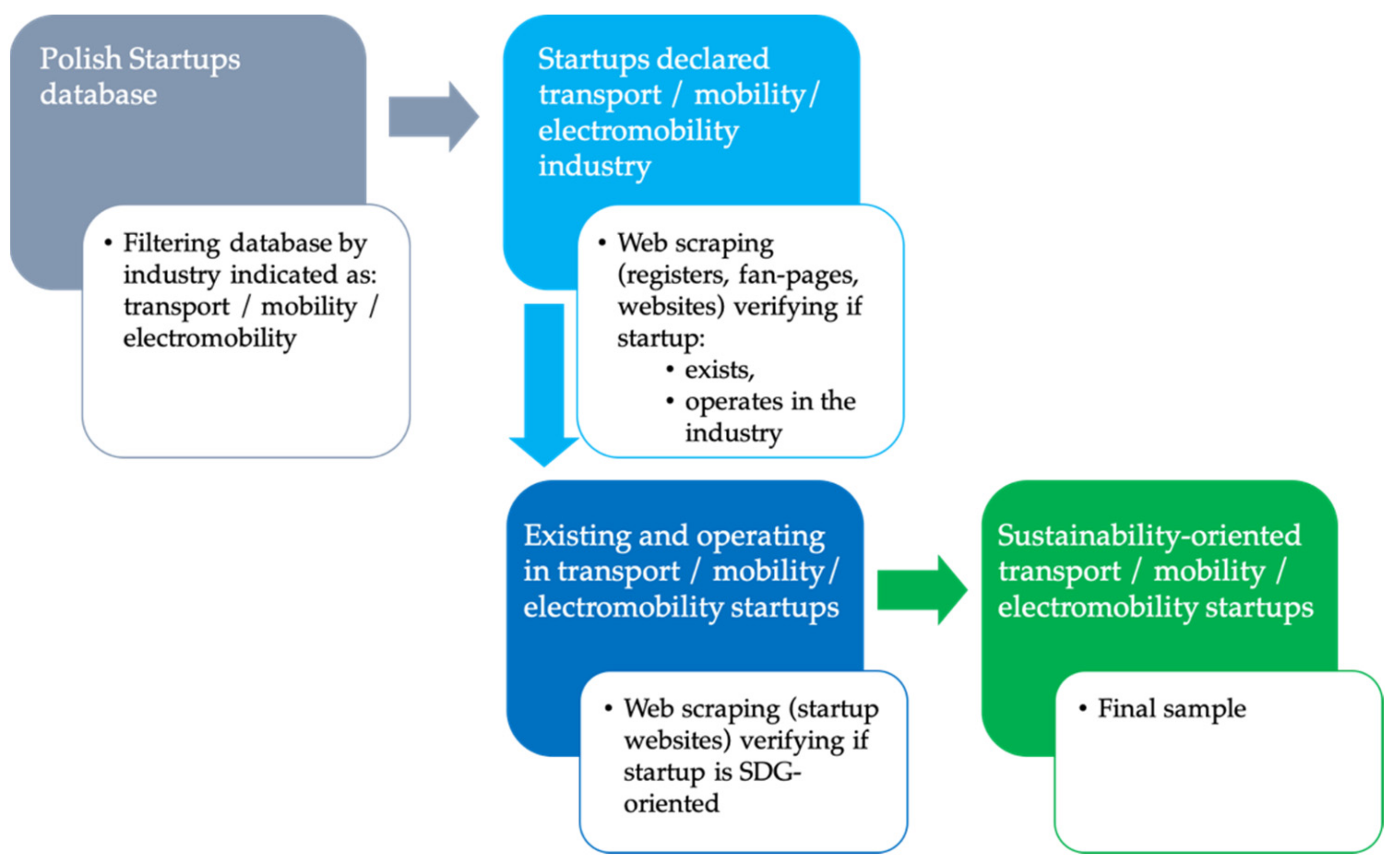

68]. Using the Google search engine, it was checked if the project exists. No website at all and website or fan-page outdated was considered a closure. Then, the existing websites were reviewed to confirm that the company’s activities were related to the areas under study, and finally, projects implementing the Sustainable Development Goals (SDGs) were identified. The process is visualized in

Figure 3.

The size of both samples of existing and verified transport and logistics or electromobility startups (56 startups) and SDG-oriented (30 startups) is not impressive (

Table 2), but it is balanced by the high level of startups that belong to them. A descriptive statistical analysis will precede the presentation of the most compelling cases.

In the next step, the quantitative data analysis from the “Polish Startups” survey was combined with the web scraping of selected startups. The latter was conducted on a group of SDG- and transport-oriented startups to collect information about their business models. Osterwalder’s ontology was then used [

24,

69] to map the most critical components of business models, notably the main value proposition and revenue model [

7]. Some startups operate in hybrid models, in which case we assigned them to the dominant one. The value propositions of each business model were categorized using the keywords described in

Section 6.1. The business models were then cross-referenced with the “Revenue” information from the “Polish Startups” survey.

6. Results

The second objective of the paper is to examine the business models of transportation, logistics, and electromobility startups in Poland and characterize these organizations and their activities. Four steps were undertaken to address the second research objective:

startups’ areas of activity identification (

Section 6.1),

description of additional startups’ attributes (

Section 6.4),

These steps are intended in the next section of the paper to allow for a final discussion to answer the paper’s research questions, which concern business model innovation and the extent of public support for these initiatives.

The analysis covers two populations of startups, with the second population contained within the first. The first population (Group no. 1) is existing and verified transport and logistics or electromobility startups, and the second population (Group no. 2) is SDG-oriented transport and logistics or electromobility startups.

6.1. Areas of Startup Activity

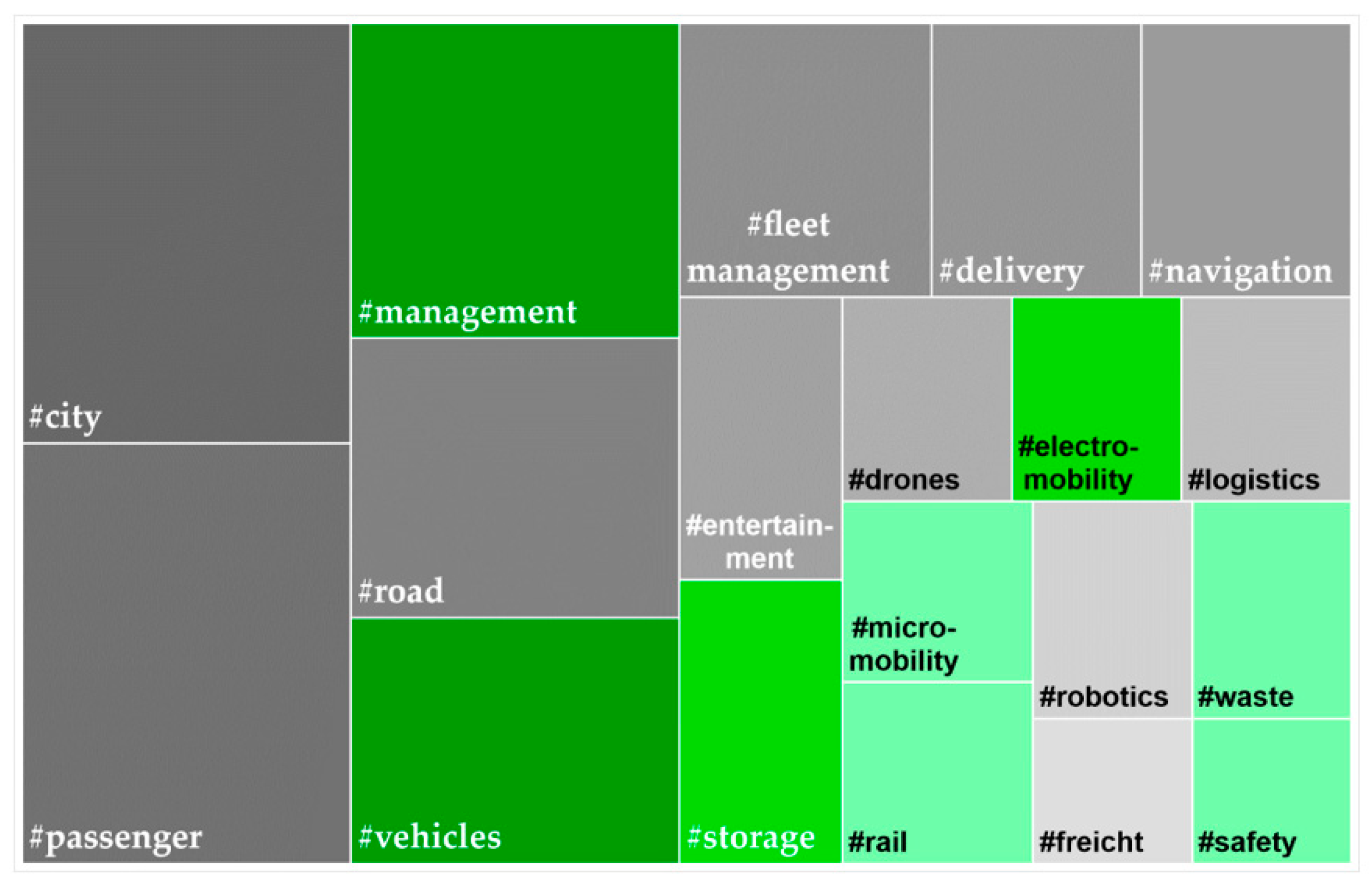

As a first step, the activity areas of the studied startups were analyzed. For this purpose, each startup was assigned with two keywords representing the core of its business. For example, startup KOLEO, which is a platform for selling train tickets to customers of different operators, was assigned keywords: #passenger and #rail; startup ProperGate, which is a smart delivery management system providing real-time information and control of materials on complex construction sites, was assigned keywords: #logistics and #management; Stava, which helps restaurants grow by optimizing food delivery, was given keywords: #city #delivery, etc. This resulted in a set of 26 keywords, 7 of which appeared only once in the transport group. This left 19 keywords that were assigned to a minimum of two startups in the study population (

Table 3).

Figure 4 visualizes the frequency proportions of the analyzed keywords.

Generally, among startup activities, the most popular are #city and #passenger followed by #management #road #vehicles, and #fleet management. However, the green color indicates activities more popular among green-oriented startups. These include #transport management, #vehicles, #storage, #electro-mobility, #micro-mobility, #rail transport, #waste management, and #safety.

6.2. Business Models

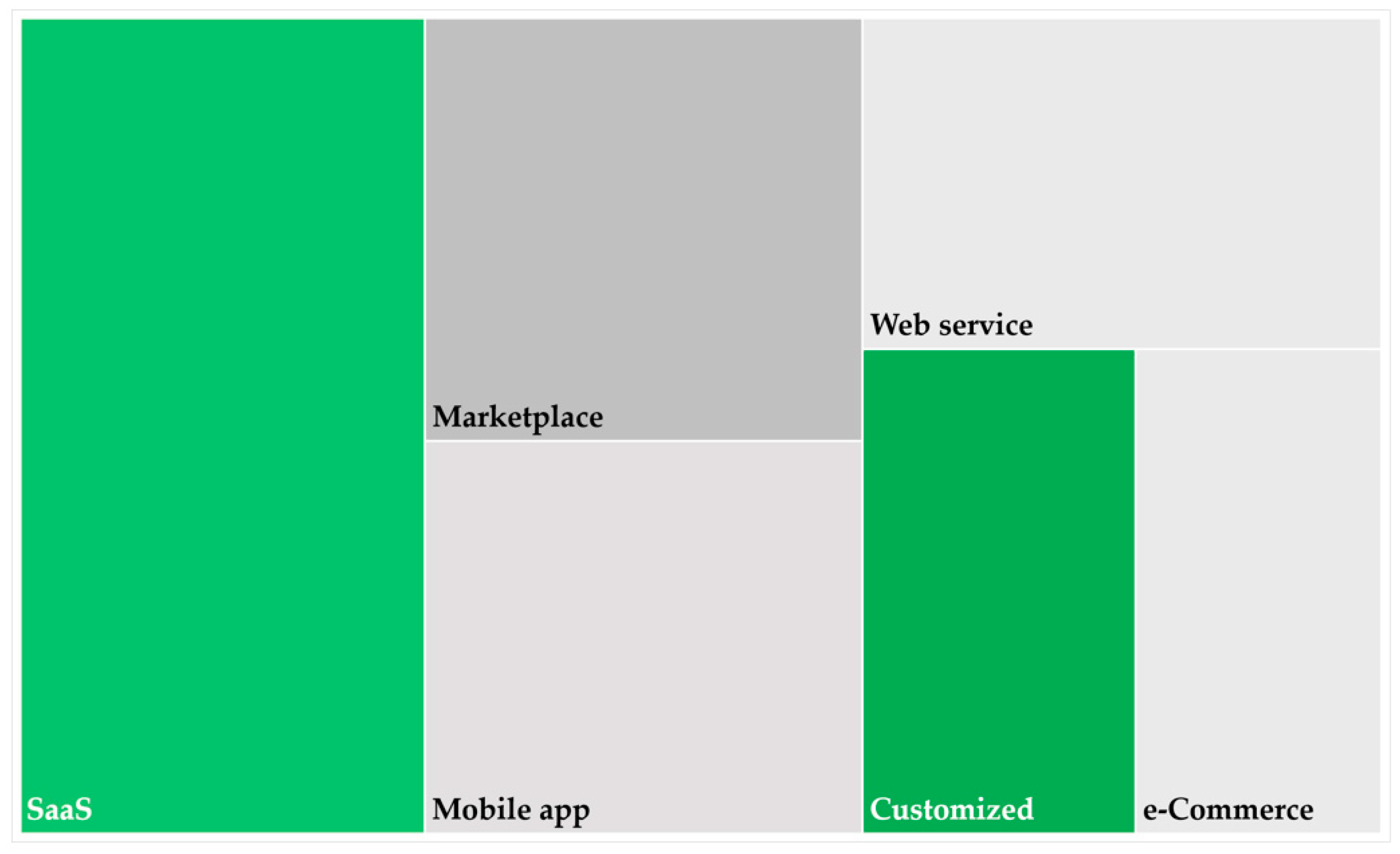

An equivalent comparison was made for the business models implemented by the surveyed startups (

Figure 5).

The most popular business model in the study group is software-as-a-service (SaaS). It is a widespread model of digital services offered on the cloud [

70,

71]. For example, it is used by startup Quotiss, which operates in the container shipping industry. They have built a simple and intelligent way to simplify the rate management in container shipping, not just for one specific shipping line but for any company out there on the container shipping market. The idea is a bright software solution that will automate freight rates in container shipping. Quotiss structures the process from freight procurement freight sales to performance measurements. That is why they call it a “sales automation platform”. A second example is a car fleet management system, EcoLogic. It helps reduce fleet maintenance costs and facilitates company fleet management and is a solution that uses big data and machine learning. It is a system to handle the entire fleet, from car management to GPS monitoring and fuel cards. The system helps reduce fuel consumption and thus the emission of harmful substances. The model uses both SaaS and mobile apps that drivers use. Startup Vooom, on the other hand, represents mobility as a service model in the formula of a web service and mobile app. The company makes money by offering a so-called “mobility budget” in the B2B model, in the form of a corporate benefit for employees that can be used for any means of transportation in the city, from a single mobile app. The goal is to convince employees to give up their private cars and switch to public transport. The app takes into account the transportation preferences associated with the COVID pandemic. Startup Indrive, on the other hand, operates on a web service model. It implements lasting change among drivers through education, eliminating unsafe driving behaviors. It may be achieved by using technologies that enable real-time analysis of driving style data. Startup Jadezabiore is a marketplace service described as a “BlablaCar” for parcels. Private or professional drivers can earn money by delivering parcels along their route. The marketplace model also includes Let’s Deliver, a platform for fast urban deliveries. ZEME Technologies offers industrial waste management and transport in the form of a marketplace. The KOLEO solution offers passenger rail tickets, which falls into the e-commerce category. However, it is not a simple transfer of commerce to the Internet, as integrating the systems of multiple passenger rail operators in Poland is a demanding and challenging task. Finally, QuickerSim Automotive is a framework that allows complex mathematical calculations for vehicle designers, customized each time to the needs of a particular customer.

6.3. Sustainable Business Models

Business models mapping of sustainability-oriented transport and mobility startups has been summarized in

Table 4.

An analysis of the business models of SDG-oriented transport startups shows significant heterogeneity in these models. The most profitable cases are not a convergent group in business models, although SaaS and a web service can generally be identified as the models that most frequently generate revenue in the transport sector. Meanwhile, Customized services are the most popular in the surveyed segment of SDG-oriented startups. It can be assumed that in this segment, the element of profitability is not the primary motivator for undertaking an entrepreneurial initiative. On the other hand, the most profitable ventures of this group are iTaxi (Polish UBER), Ecologic (car fleet management system), and ProperGate (smart logistics/delivery for complex construction sites). A question on the relationship (if any) between profitability, the business model, and sustainability arises. Is sustainability at the core of the business model or only a customer relationships element? Deepening the research in this direction may yield exciting results regarding startups’ actual sources and intentions that fit into the sustainability trend.

6.4. Other Startup Characteristics

The study group of startups is too tiny to do advanced statistical analysis. However, we have some exciting metrics to help us describe this population (

Table 5).

First, in the transport and logistics segment, sell to business customers (B2B) prevails over individual customers (B2C), which is in line with general startup characteristics. Startups are micro-companies, i.e., 70% of them consist only of a team of founders or up to ten employees. Approximately 40% of the surveyed startups have a regular income, which is similar to the entire population of surveyed startups [

67].

Second, about 40% of the surveyed startups (33% in SDG-oriented group no. 2) finance themselves exclusively from their funds, among which more than half have obtained financing from domestic or foreign venture capital funds. Among SDG-oriented startups, this is precisely the case for every third respondent. Less than 20% of startups cooperate with corporations, but this share is higher in SDG-oriented group (27%). These collaborations may include co-development, technology licensing, R&D, joint marketing and sales initiatives, and other forms of cooperation.

One in three startups has customers abroad.

The remaining characteristics relate to the founders. As for their age, SDG-oriented startups are founded by younger and older people than in the transport and logistics group. People in their 30 s dominate the latter, and every third founder has a technical educational background. Most of them have already run a startup before. One in five founders is a woman, one in three is a scientist, i.e., a person with a Ph.D. (the transport industry is “science-intensive”). One in four startups patents their solutions. When asked about their most pressing needs, similar to the general startup population, they point to cash and skilled workers [

67].

6.5. The Most Appealing Cases

The researched startups can be divided into two groups. The first is startups that take on the toughest challenges in designing completely new solutions for equipment, vehicles, and infrastructure (especially electromobility). The second is those that operate in managing transport processes, fleet and passenger transport—especially micro-mobility in cities and public transport.

Startup “Born Electric” from Lodz works on the development of electric drives, electric energy storage systems, and autonomous driver assistance systems, along with software. In 2017, the company received a grant from the European Institute of Innovation and Technology (EIT). Enelion from Gdansk has developed an intelligent charging system for electric vehicles serving developers or housing communities. The system autonomously optimizes power consumption from the grid, so the costs are at the lowest level and take care of the system’s internal balance. The company also offers solutions for individual customers (e.g., single-family houses). The Fibratech project from Gdynia has created a hybrid composite-metal car wheel using carbon fiber. It is supposed to be 15% lighter and 30% stiffer than the lightest aluminum wheels, which have remained virtually unchanged for several decades. The weight reduction is essential because of the not inconsiderable fuel savings in internal combustion vehicles and the potential for the extended driving range in electric vehicles. The company has filed a patent in the international procedure and has developed a solution prototype.

Nowak Innovations from Rzeszow owns an automatic emergency door opening system (AEDO) and an emergency seat belt system (SECS). These systems, patented internationally, are designed to simplify and speed up evacuation and rescue procedures for victims trapped inside damaged vehicles (e.g., during the fire). Honey, a Krakow-based company founded by AGH University of Science and Technology graduates, implements a project of an electric off-road motorcycle. At the same time, MorAmp, a Warsaw-based startup, has designed an intelligent and durable aluminum electric scooter with an extended mileage (up to 60 km) and short charging time (less than 1 h). The “hardware” vehicle-infrastructure projects list should be closed with a visionary project associated with the Warsaw University of Technology—Hyperloop. It is an entirely new means of transport, allowing the movement of people (or cargo) at a speed close to the speed of sound. The vehicle moves without contact with the ground, using magnetic levitation and air bearings. The vacuum railroad (hyperloop) will require new, unique infrastructure. Hyper Poland (a new name of the company is Nevomo) was registered in 2017 after students built a prototype vehicle sent to California for testing during the SpaceX Hyperloop Pod Competition.

Numerous startups are emerging in Poland that produce devices and software to manage, analyze, and control vehicle fleets online in real-time, as exemplified by Drivebox from Wroclaw. In turn, the forwarding system, created by the company Quotiss, supports the commercial process in the container shipping industry from procurement to sales and provides full business analytics based on the collected data. Quotiss has developed an algorithm that drastically reduces the forwarder’s work time by simplifying and visualizing the price structure of different carriers and automating the forwarding process. Similarly, the TREO.pl portal from Kielce automates the valuation of palletized groupage transport in the EU.

A separate group is courier applications, such as PickPack or Let’s Deliver, operating within the same-day delivery service. At the same time, Stava from Rzeszow specializes in the narrow segment of meal delivery. WheelMe application allows the locating of—in several dozen Polish cities—all vehicles to be rented (cars, scooters, scooters, and bikes) on one map. The application assistant can also suggest vehicle selection depending on the road conditions, weather conditions, and air pollution level. On the other hand, Smart Schedules is an application that improves Google Maps in terms of information about the availability of passenger transport, providing information about the real-time arrival of a given vehicle.

Finally, the application Zegluj (meaning “sail” in polish) from Olsztyn (Polish sailing region’s capital) is worth mentioning. It mainly provides navigation around Polish lakes and information on dangerous areas, water signs, sailing routes, gas stations, catering spots, and other exciting events in the most popular sailing spots.

7. Discussion

A specific feature of the transport and mobility sector is that the discussion about the direction of its development is focused and dominated by technical and technological aspects [

72]. Meanwhile, digitalization and sustainability pressures create opportunities to build entirely new business models around innovative forms of mobility for passengers and freight [

72,

73]. New business models are challenging to implement in industries with a technology-oriented mindset. Managers may underestimate the importance of the business model as a critical resource of the company, no less required as product or service features [

28,

30].

The next issue is the profitability of testing and implementing innovations other than those bought outright by large and solvent corporations. Innovative business models verified by startups are often related to supporting urban services such as public transport or micro-mobility in cities. Zipper [

74] has shown that although mobility-as-a-service applications have been downloaded by millions of users worldwide and enjoy political support, their profitability is mainly insufficient to survive. Many users do not necessarily generate high revenues. A similar situation is happening in the micro-mobility sector, where [

75] summarized investments of

$6 billion since 2018, and almost all significant investors are losing money there. Van Den Heuvel, Kao and Matyas [

72] have emphasized that the examples mentioned show how crucial it is for transport startups to have an innovative business model. Thus, it can be said that our study slightly confirms that more substantial public support for startups in this area is needed to accelerate the “greening” processes in transportation broadly. Our analysis also suggests that startups implementing proven business models, mainly in the SaaS model, achieve financial success (in our study’s adequate micro-scale). According to the business models map and the cases described, an exciting research direction is a relationship between profitability and the sustainability element in a business model. Our case studies analysis may suggest that in startups with a value proposition related to #vehicles, #electromobility, and #drones, the sustainability element is present as a core value proposition. The “hardware” nature of their offering may be the reason for this relationship. Unfortunately, these startups often struggle with low profitability due to high product development costs, especially in the early stages of development. In this case, public support or a strategic partnership would be highly recommended.

On the other hand, in business models based on services, e.g., #navigation, #fleet management, #delivery, and #storage, sustainability is instead an element of marketing these projects. This type of relationship does not mean startups do not contribute to the SDGs. In these cases, high profitability is much more likely.

At the beginning of this century, the challenge of sustainable transport was still relatively new in transition economies. The environmental aspects, especially concerning greenhouse gas emissions, congestion, and the economic calculation of benefits and costs (including the internalization of external costs), were then quite well recognized in the literature. Nevertheless, the social dimension of transport sustainability and the changes in people and goods mobility were unexplored and difficult to predict. Many lacked the imagination to see the power of the transformation and the coming megatrends in this regard. The rapid development of ICT, especially mobile and cloud services, the Internet of Things, artificial intelligence, and the emergence of entirely new business models (multi-sided platforms and mobile apps) have completely changed this situation. Today, we are witnessing a revolution in transportation and related services. The new form of organization, the startup, plays the role of a carrier and catalyst of these innovations. Micro-mobility has become a viable alternative to private and public transportation in cities. Electric vehicles have become a viable alternative to internal combustion vehicles for short and medium distances. The open innovation makes the largest corporations increasingly open to cooperating with flexible and cost-effective startups, notably attracting the younger generation’s brightest talents with their specific, open, and nomadic work culture.

Polish startups, working on solutions in the area of transport and mobility, are not particularly numerous, but their quality is not inferior to projects from more developed countries. However, much more prevalent among investors and venture capital funds are finance and insurance startups, analytics and business productivity solutions, tools for marketing services, or the Internet of Things products. It is incomparably easier to find a strategic partner or client in these industries and obtain investment funds. Startups working on new materials or vehicles count on public funding, which up to a certain level of technological readiness is usually insufficient to continue work effectively. Some of them emigrate from the country in search of more funding.

Returning to the challenges mentioned in the introduction, as perceived by YCombinator from Silicon Valley, reducing energy consumption is undoubtedly one of the main inspirations for most of the projects mentioned in this paper. However, in terms of the broader mobility problem along the “living-working” route, the second challenge requires a much more holistic view of the transport system, including urban planning and the available infrastructure. The still-popular “silo” or “branch” thinking about transportation problems makes it difficult to see the real problems that businesses, residents, and tourists face every day. A complex, integrated, multimodal transport system is still an unrealized dream and a business opportunity for many emerging startups.

9. Conclusions

Green innovations in transport concern mainly products and business models. Sustainability-oriented transport and mobility solutions are of intense interest to innovative startups. Startups are an innovative, ambitious, and dynamic form of scalable organization stimulated by technical and technological progress. Transport-oriented startups face challenges in designing new equipment, vehicles, infrastructure, electromobility, and operationalizing transport processes, especially micro-mobility and public transport.

Our contribution to the literature consists, first, of formulating a definition of a startup (

Section 3). We define “startups” as ventures whose business model is shaped by innovation, rapid growth, and high ambition. Startups develop and validate their business models under uncertainty and limited resources. Their business model should enable venture scalability, which is achieved through digital technologies or other technical and organizational solutions.

We discussed the most relevant trends in green transportation and mobility solutions in

Section 4. We also investigated Poland’s transport, logistics, and electromobility startups, their business models, and major areas of activity (

Section 6). Analyzing the profitability of the studied startups, we concluded that startups related to “hardware” projects need financial support. We hypothesized that these startups contribute most to the “greening” of transportation and mobility, but confirmation requires further in-depth research (

Section 7).

Hence, we recognize three main guidelines for future research. The first is to explore business models for better collaboration between startups and large companies—mainly in innovative hardware solutions [

66]. The second is an in-depth study of the viability of sharing economy business models for sustainable mobility [

7,

55]. Finally, the third attempts to assess how significant startups are in transportation and mobility sustainability processes.

A promising direction for further research in technology-based and SDG-oriented mobility is the enabling role of blockchain technology. It is worth citing [

76], which indicates the new use of crypto token systems as an incentive for city residents to use environmentally friendly transportation methods. The authors make an in-depth literature review showing transportation as one of the main areas of application of blockchain technology for cities, especially in vehicle information management, goods transportation, intelligent transportation systems, and urban transportation sustainability. Similarly, Kshetri [

77] has demonstrated that blockchain can play an essential role in promoting supply chain sustainability. At the same time, Centobelli et al. [

78] highlight blockchain’s role as a technological capability for improving control in the movement of waste and product return management activities. Additionally, author [

77] argues that blockchain’s characteristics are significant for enforcing sustainability standards in developing countries.

We are witnessing a green revolution in transport and related services. Innovative business models validated by startups can significantly accelerate it. Startups play an essential role as facilitators, even as they increasingly cooperate with large corporations. Finally, it is worth noting that a specific, open, and nomadic work culture in startups attracts the younger generation’s brightest talents.