Manufacturing, Exports, and Sustainable Growth: Evidence from Developing Countries

Abstract

:1. Introduction

2. Theoretical Background and Literature Review

2.1. Theoretical Background

2.2. Literature Review

2.2.1. Manufacturing and Growth

2.2.2. Export and Growth

2.2.3. Some Closely Related Studies

3. Data and Methodology

3.1. Data Source and Description

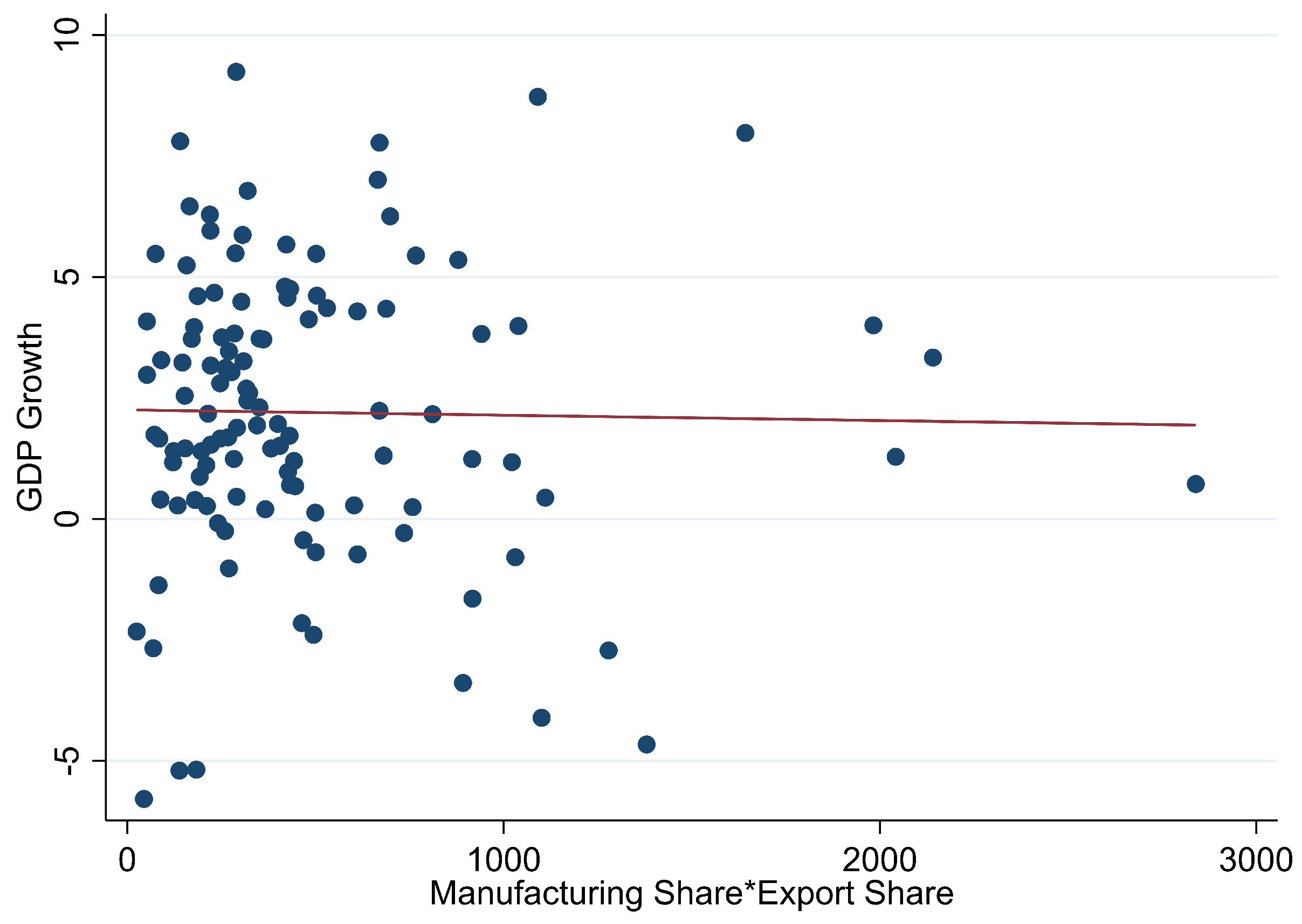

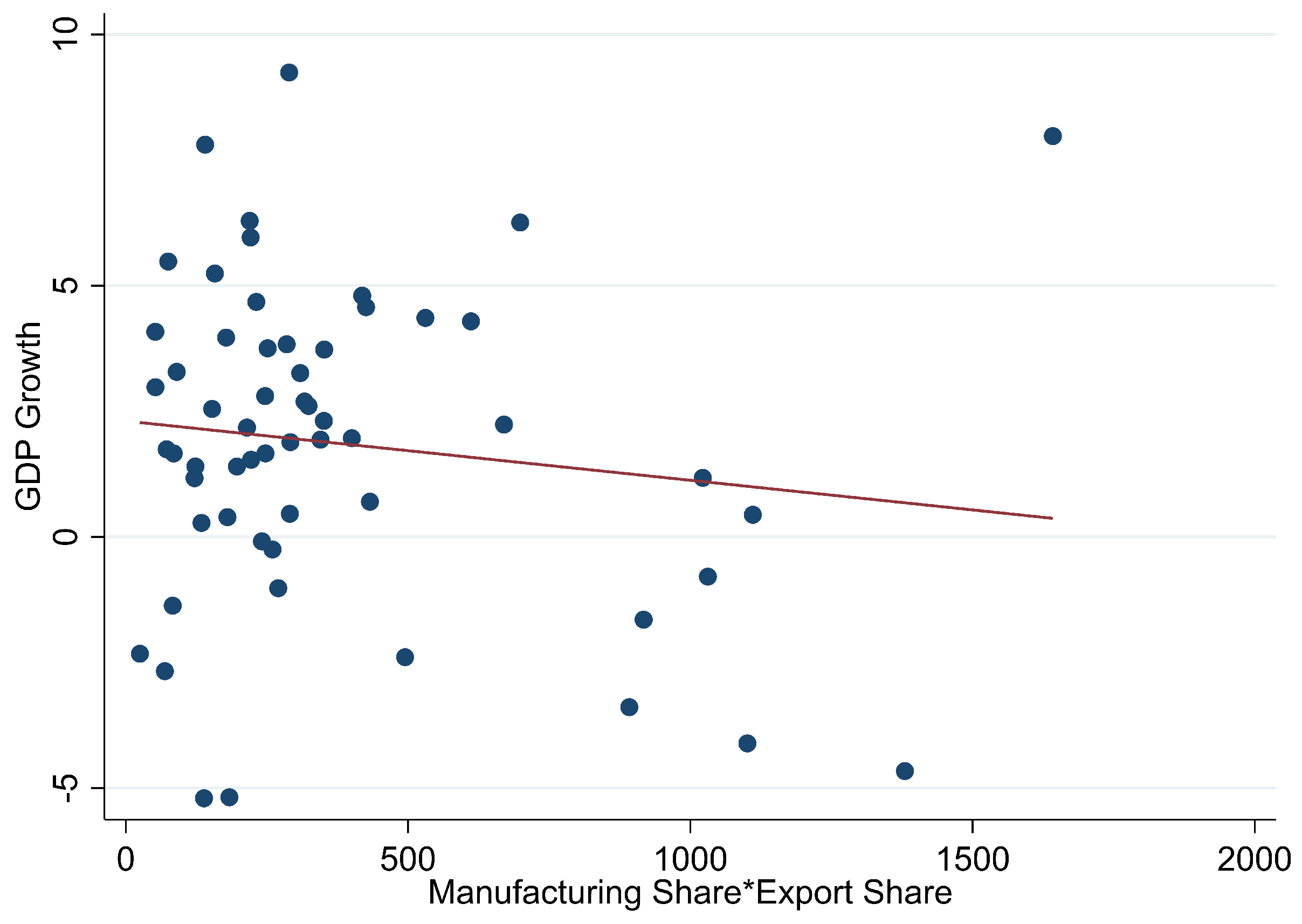

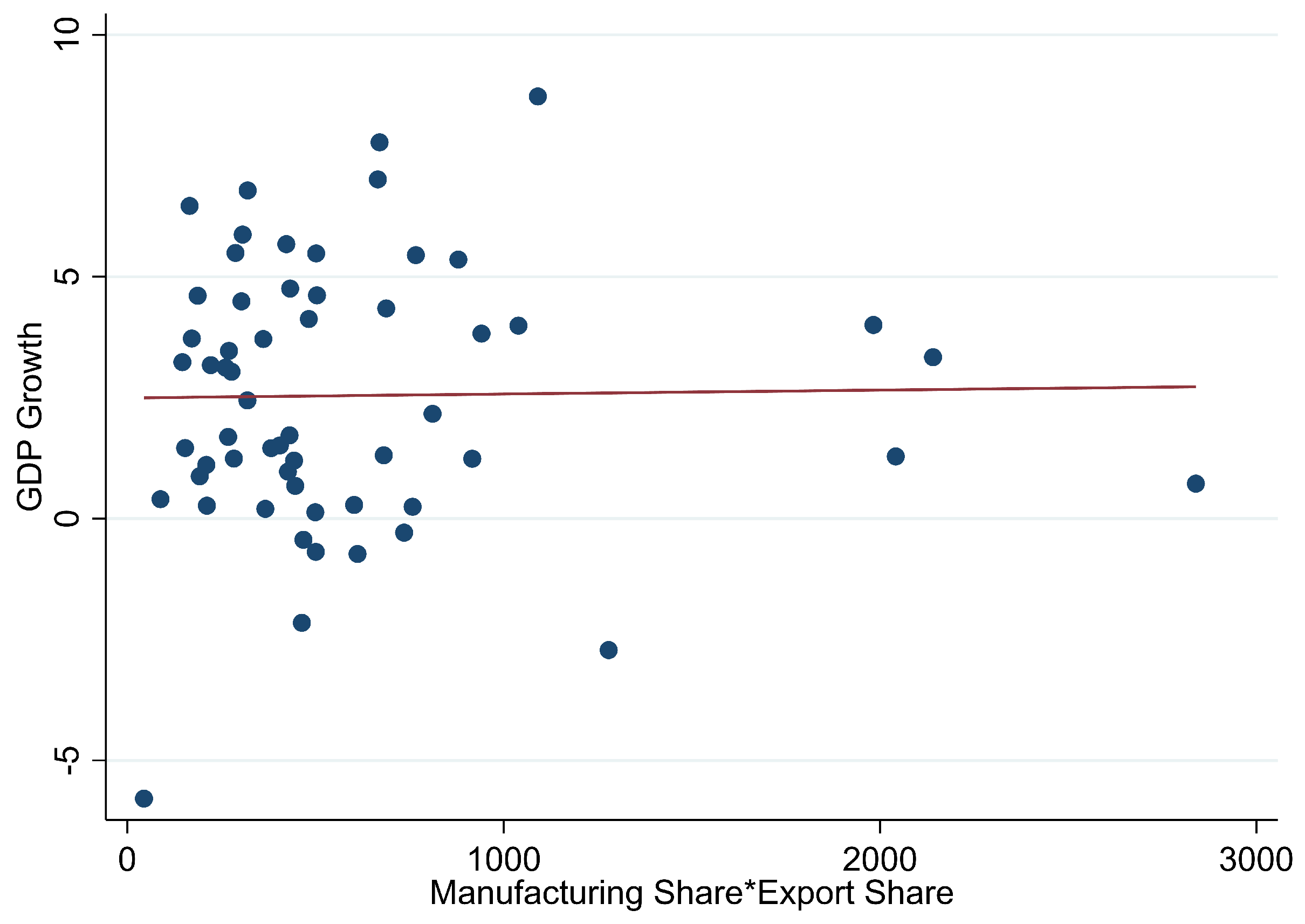

3.2. Research Question and Motivation

3.3. Empirical Model and Approach

3.3.1. Model

3.3.2. Approach

4. Estimation Results

4.1. Main Regressions

4.1.1. Main Results of Interest

4.1.2. Other Regressors

4.2. Robustness Check

4.2.1. Dealing with Endogeneity

4.2.2. Adding the Share of Imports in GDP and Related Regressors

5. Discussion

5.1. Export-Led Deindustrialization and the Growth Impediment (i.e., )

5.2. Asymmetric Impact on Deindustrialization and Growth across per Capita Income Levels (i.e., )

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kaldor, N. Marginal Productivity and the Macro-Economic Theories of Distribution: Comment on Samuelson and Modigliani. Rev. Econ. Stud. 1966, 33, 309–319. [Google Scholar] [CrossRef]

- Kaldor, N. Strategic Factors in Economic Development; New York State School of Industrial and Labor Relations, Cornell University: Ithaca, NY, USA, 1967. [Google Scholar]

- Pacheco-López, P.; Thirlwall, A.P. A New Interpretation of Kaldor’s First Growth Law for Open Developing Economies. Rev. Keynes. Econ. 2014, 2, 384–398. [Google Scholar] [CrossRef]

- United Nations Brundtland Commission. Report of the World Commission on Environment and Development: Our Common Future. 1987. Available online: http://www.un-documents.net/our-common-future.pdf (accessed on 12 December 2021).

- Campbell, O.; Asaleye, A.J. Financial sector reforms and output growth in manufacturing: Empirical evidence from Nigeria. Am. Int. J. Contemp. Res. 2016, 6, 112–125. [Google Scholar]

- Szirmai, A. Industrialization as an engine of growth in developing countries, 1950–2005. Struct. Chang. Econ. Dyn. 2012, 23, 406–420. [Google Scholar] [CrossRef] [Green Version]

- Fagerberg, J.; Verspagen, B. ‘Modern Capitalism’ in the 1970s and 1980s. In Growth, Employment and Inflation; Setterfield, M., Ed.; Palgrave Macmillan: London, UK, 1999; pp. 113–126. [Google Scholar]

- Timmer, M.P.; de Vries, G.J. Structural change and growth accelerations in Asia and Latin America: A new sectoral data set. Cliometrica 2009, 3, 165–190. [Google Scholar] [CrossRef] [Green Version]

- Palley, T.I. The rise and fall of export-led growth. Investig. Econ. 2012, 71, 141–161. [Google Scholar]

- Williamson, J. Democracy and the “Washington consensus”. World Dev. 1993, 21, 1329–1336. [Google Scholar] [CrossRef]

- Irwin, D.A. The rise and fall of import substitution. World Dev. 2021, 139, 105306. [Google Scholar] [CrossRef]

- Palma, G. Four sources of ‘de-industrialization’ and a new concept of Dutch Disease. Beyond Reforms Struct. Dyn. Macroecon. Vulnerability 2005, 3, 71–116. [Google Scholar]

- Tregenna, F. Deindustrialisation, structural change and sustainable economic growth. In MERIT Working Papers; Maastricht Economic and Social Research Institute on Innovation and Technology (MERIT), United Nations University: Maastricht, The Netherlands, 2015. [Google Scholar]

- Rodrik, D. Premature deindustrialization. J. Econ. Growth. 2016, 21, 1–33. [Google Scholar] [CrossRef]

- Pieper, U.E. Deindustrialisation and the Social and Economic Sustainability Nexus in Developing Countries: Cross-country Evidence on Productivity and Employment. J. Dev. Stud. 2000, 36, 66–99. [Google Scholar] [CrossRef]

- Deaton, A. Commodity prices and growth in Africa. J. Econ. Perspect. 1999, 13, 23–40. [Google Scholar] [CrossRef] [Green Version]

- Rowthorn, R.; Ramaswamy, R. Growth, Trade, and Deindustrialization. IMF Staff Pap. 1999, 46, 18–41. [Google Scholar] [CrossRef]

- Tregenna, F. Deindustrialisation and premature deindustrialization. In Elgar Handbook of Alternative Theories of Economic Development; Elgar: Cheltenham, UK, 2016. [Google Scholar]

- Tregenna, F. Characterising deindustrialisation: An analysis of changes in manufacturing employment and output internationally. Camb. J. Econ. 2009, 33, 433–466. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef] [Green Version]

- Corden, W.M. Exchange Rate Policy and the Resources Boom. Econ Rec. 1982, 58, 18–31. [Google Scholar] [CrossRef]

- Chang, H.J.; Andreoni, A. Bringing Production Back into Development: An introduction. Eur. J. Dev. Res. 2021, 33, 165–178. [Google Scholar] [CrossRef] [PubMed]

- Amsden, A. Editorial: Bringing production back in—Understanding Government’s economic role in late industrialization. World Dev. 1997, 25, 469–480. [Google Scholar] [CrossRef]

- Corden, W.M. Booming Sector and Dutch Disease Economics: Survey and Consolidation. Oxf. Econ. Pap. 1984, 36, 359–380. [Google Scholar] [CrossRef]

- Corden, W.M.; Neary, J.P. Booming Sector and De-Industrialisation in a Small Open Economy. Econ. J. 1982, 92, 825–848. [Google Scholar] [CrossRef] [Green Version]

- Ros, J. Development Theory and the Economics of Growth; University of Michigan Press: Ann Arbor, MI, USA, 2000. [Google Scholar]

- Auty, R.M. Resource-Based Industrialization: Sowing the Oil in Eight Developing Countries; Oxford University Press: Oxford, UK, 1990. [Google Scholar]

- Gelb, A.H. Oil Windfalls: Blessing or Curse? Oxford University Press: Oxford, UK, 1988. [Google Scholar]

- Sachs, J.D.; Warner, A.M. Sources of slow growth in African economies. J. Afr. Econ. 1997, 6, 335–376. [Google Scholar] [CrossRef] [Green Version]

- Gylfason, T. Resources, Agriculture and Economic Growth in Economies in Transition. Kyklos 2000, 53, 337–361. [Google Scholar] [CrossRef]

- Di John, J. Oil abundance and violent political conflict: A critical assessment. J. Dev. Econ. 2007, 43, 961–986. [Google Scholar] [CrossRef]

- Auty, R.M. The political economy of resource-driven growth. Eur. Econ. Rev. 2001, 45, 839–846. [Google Scholar] [CrossRef]

- Woolcock, M.; Pritchett, L.; Isham, J. The social foundations of poor economic growth in resource-rich countries. In Resource Abundance and Economic Development; Auty, R.M., Ed.; Oxford University Press: Oxford, UK, 2001; pp. 76–92. [Google Scholar]

- Tornell, A.; Lane, P.R. The voracity effect. Am Econ Rev. 1999, 89, 22–46. [Google Scholar] [CrossRef]

- Ross, M.L. The political economy of the resource curse. World Polit. 1999, 51, 297–322. [Google Scholar] [CrossRef]

- Baland, J.M.; Francois, P. Rent-seeking and resource booms. J. Dev. Econ. 2000, 61, 527–542. [Google Scholar] [CrossRef]

- Auty, R.M. Natural resource rent-cycling outcomes in Botswana, Indonesia and Venezuela. Int. Soc. 2005, 57, 33–44. [Google Scholar] [CrossRef]

- Gylfason, T. Natural resources, education, and economic development. Eur. Econ. Rev. 2001, 45, 847–859. [Google Scholar] [CrossRef]

- Easterly, W.; Levine, R. It’s Not Factor Accumulation: Stylized Facts and Growth Models; Central Bank of Chile: Santiago, Chile, 2002; Volume 6, pp. 61–114. [Google Scholar]

- Torvik, R. Natural resources, rent seeking and welfare. J. Dev. Econ. 2002, 67, 455–470. [Google Scholar] [CrossRef] [Green Version]

- Usui, N. Dutch disease and policy adjustments to the oil boom: A comparative study of Indonesia and Mexico. Resour. Policy. 1997, 23, 151–162. [Google Scholar] [CrossRef]

- Acemoglu, D.; Johnson, S.; Robinson, J.A. The colonial origins of comparative development: An empirical investigation. Am Econ Rev. 2001, 91, 1369–1401. [Google Scholar] [CrossRef]

- Fagerberg, J.; Verspagen, B. Technology-gaps, innovation-diffusion and transformation: An evolutionary interpretation. Res. Policy. 2002, 31, 1291–1304. [Google Scholar] [CrossRef]

- Dasgupta, S.; Singh, A. Manufacturing, Services and Premature Deindustrialization in Developing Countries: A Kaldorian Analysis. In Advancing Development; Palgrave Macmillan: London, UK, 2007; pp. 435–454. [Google Scholar]

- Naudé, W.; Szirmai, A.; Lavopa, A. Industrialization Lessons from BRICS: A Comparative Analysis; IZA Discussion Paper No. 7543; IZA Institute of Labor Economics: Bonn, Germany, 2013. [Google Scholar]

- Rodrik, D. Growth After the Crisis. In Aftermath; New York University Press: New York, NY, USA, 2001. [Google Scholar]

- Szirmai, A.; Verspagen, B. Manufacturing and economic growth in developing countries, 1950–2005. Struct. Chang. Econ. Dyn. 2015, 34, 46–59. [Google Scholar] [CrossRef] [Green Version]

- Kathuria, V.; Raj, R.N. Is manufacturing an engine of growth in India? Analysis in the post nineties. In Proceedings of the Frontier Issues in Technology, Development and Environment, Chennai, India, 19–21 March 2010; pp. 22–23. [Google Scholar]

- Thomas, J.J. Why is Manufacturing Not the Engine of India’s Economic Growth, Examining Trends, 1959–60 to 2008/9; Mimeo: New Delhi, India, 2009. [Google Scholar]

- Dasgupta, S.; Singh, A. Will Services be the new engine of Indian economic growth? Dev. Chang. 2005, 36, 1035–1057. [Google Scholar] [CrossRef]

- Awokuse, T.O. Exports, economic growth and causality in Korea. Appl. Econ. Lett. 2005, 12, 693–696. [Google Scholar] [CrossRef]

- Awokuse, T.O. Causality between exports, imports, and economic growth: Evidence from transition economies. Econ. Lett. 2007, 94, 389–395. [Google Scholar] [CrossRef]

- Bigsten, A.; Gebreeyesus, M. Firm productivity and exports: Evidence from Ethiopian manufacturing. J. Dev. Stud. 2009, 45, 1594–1614. [Google Scholar] [CrossRef]

- Sheridan, B.J. Manufacturing exports and growth: When is a developing country ready to transition from primary exports to manufacturing exports? J. Macroecon. 2014, 42, 1–13. [Google Scholar] [CrossRef]

- Levin, A.; Raut, L.K. Complementarities between exports and human capital in economic growth: Evidence from the semi-industrialized countries. Econ. Dev. Cult. Chang. 1997, 46, 155–174. [Google Scholar] [CrossRef]

- Naudé, W.; Bosker, M.; Matthee, M. Export specialisation and local economic growth. World Econ. 2010, 33, 552–572. [Google Scholar] [CrossRef]

- Isaiah Zayone, T.; Henneberry, S.R.; Radmehr, R. Effects of agricultural, manufacturing, and mineral exports on Angola’s economic growth. Energies 2020, 13, 1494. [Google Scholar] [CrossRef] [Green Version]

- Shah, S.F.A.; Qyyum, M.A.; Qadeer, K.; Lee, M. Sustainable economic growth and export diversification potential for Asian LNG-exporting countries: LNG–petrochemical nexus development using product space model. Energy 2021, 236, 121334. [Google Scholar] [CrossRef]

- Fosu, A.K. Primary Exports and Economic Growth in Developing Countries. World Econ. 1996, 19, 465–475. [Google Scholar] [CrossRef]

- Xu, Z. Effects of Primary Exports on Industrial Exports and GDP: Empirical Evidence. Rev. Dev. Econ. 2000, 4, 307–325. [Google Scholar] [CrossRef]

- Michaely, M. Exports and growth: An empirical investigation. J. Dev. Econ. 1977, 4, 49–53. [Google Scholar] [CrossRef]

- Tyler, W.G. Growth and export expansion in developing countries: Some empirical evidence. J. Dev. Econ. 1981, 9, 121–130. [Google Scholar] [CrossRef]

- Marconi, N.; de Borja Reis, C.F.; de Araújo, E.C. Manufacturing and economic development: The actuality of Kaldor’s first and second laws. Struct. Chang. Econ. Dyn. 2016, 37, 75–89. [Google Scholar] [CrossRef]

- Roodman, D.M. A note on the theme of too many instruments. Oxf. Bull. Econ. Stat. 2009, 71, 135–158. [Google Scholar] [CrossRef]

- Brito, R.D.; Bystedt, B. Inflation targeting in emerging economies: Panel evidence. J. Dev. Econ. 2010, 91, 198–210. [Google Scholar] [CrossRef]

- Mankiw, N.G.; Romer, D.; Weil, D.N. A contribution to the empirics of economic growth. Q. J. Econ. 1992, 107, 407–437. [Google Scholar] [CrossRef]

- Jones, C.I. Time series tests of endogenous growth models. Q. J. Econ. 1995, 110, 495–525. [Google Scholar] [CrossRef] [Green Version]

- Bond, S.; Leblebicioǧlu, A.; Schiantarelli, F. Capital accumulation and growth: A new look at the empirical evidence. J. Appl. Econ. 2010, 25, 1073–1099. [Google Scholar] [CrossRef] [Green Version]

- Su, D.; Yang, Y. Manufacturing as the key engine of economic growth for middle-income economies. J. Asia. Pac. Econ. 2017, 22, 47–70. [Google Scholar] [CrossRef] [Green Version]

- Lan, X. Embedded Power: Chinese Government and Economic Development; Horizon Books and Shanghai People’s Publishing House: Shanghai, China, 2021. (In Chinese) [Google Scholar]

- Hanushek, E.A.; Kim, D. Schooling, Labor Force Quality, and Economic Growth; Working Paper No. 5399; National Bureau of Economic Research: Cambridge, MA, USA, 1995. [Google Scholar]

- Lee, J.W.; Barro, R.J. Schooling quality in a cross-section of countries. Economica 2001, 68, 465–488. [Google Scholar] [CrossRef]

- Dessus, S. Human Capital and Growth: The Recovered Role of Education Systems. In Policy Research Working Paper 2632; The World Bank: Washington, DC, USA, 1999. [Google Scholar]

- Buysse, K.D.L. Human Capital and Growth in OECD Countries: The Role of Public Expenditure on Education. In The impact of Fiscal Policy; Banca d’Italia, Research Department, Public Finance Workshop: Perugia, Italia, 2002. [Google Scholar]

- Panagariya, A. Miracles and debacles: In defence of trade openness. World Econ. 2004, 27, 1149–1171. [Google Scholar] [CrossRef]

- Song, H. New Challenges to the Export Oriented Growth Model. In Moving toward a New Development Model for East Asia: The Role of Domestic Policy and Regional Cooperation; ERIA Research Project Report 10; Economic Research Institute for ASEAN and East Asia (ERIA): Jakarta, Indonesia, 2011. [Google Scholar]

- Sargan, J.D. The Estimation of Economic Relationships using Instrumental Variables. Econometrica 1958, 26, 393–415. [Google Scholar] [CrossRef]

- Hansen, L.P. Large Sample Properties of Generalized Method of Moments Estimators. Econometrica 1982, 50, 1029–1054. [Google Scholar] [CrossRef]

- Andersen, T.G.; Sørensen, B.E. GMM Estimation of a Stochastic Volatility Model: A Monte Carlo Study. J. Bus. Econ. Stat. 1996, 14, 328–352. [Google Scholar]

- Bowsher, C.G. On testing overidentifying restrictions in dynamic panel data models. Econ. Lett. 2002, 77, 211–220. [Google Scholar] [CrossRef] [Green Version]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econom. 1998, 87, 115–143. [Google Scholar] [CrossRef] [Green Version]

- Labra Lillo, R.; Torrecillas, C. Estimando datos de panel dinámicos. Un enfoque práctico para abordar paneles largos. Rev. Colomb. Estad. 2018, 41, 31–52. [Google Scholar] [CrossRef] [Green Version]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error-components models. J. Econom. 1995, 68, 29–51. [Google Scholar] [CrossRef] [Green Version]

- Awokuse, T.O. Trade openness and economic growth: Is growth export-led or import-led? Appl. Econ. 2008, 40, 161–173. [Google Scholar] [CrossRef]

- Esfahani, H.S. Exports, imports, and economic growth in semi-industrialized countries. J. Dev. Econ. 1991, 35, 93–116. [Google Scholar] [CrossRef] [Green Version]

- Riezman, R.G.; Whiteman, C.H.; Summers, P.M. The engine of growth or its handmaiden? In Long-Run Economic Growth; Physica-Verlag HD: Berlin/Heidelberg, Germany, 1996; pp. 77–110. [Google Scholar]

- Thangavelu, S.M.; Rajaguru, G. Is there an export or import-led productivity growth in rapidly developing Asian countries? A multivariate VAR analysis. Appl. Econ. 2004, 36, 1083–1093. [Google Scholar] [CrossRef]

- Rowthorn, R.; Coutts, K. De-industrialisation and the Balance of Payments in Advanced Economies; Centre for Business Research, University of Cambridge: Cambridge, UK, 2013. [Google Scholar]

- Palma, J.G. Desindustrialización, desindustrialización ‘prematura’ y un Nuevo concepto del ‘síndrome holandés’. El Trimest. Econ. 2019, 86, 901–966. [Google Scholar] [CrossRef]

- Rodrik, D. Back to Fundamentals in Emerging Markets. Project Syndicate, 13 August 2015. [Google Scholar]

| Variable | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| gdpg | 687 | 2.51 | 2.82 | −9.49 | 9.97 |

| ms | 687 | 13.15 | 6.34 | 0.45 | 47.69 |

| gee | 687 | 4.27 | 1.77 | 0.75 | 13.73 |

| exp | 687 | 37.19 | 22.89 | 2.39 | 168.78 |

| lnpop | 687 | 15.92 | 1.81 | 9.89 | 20.96 |

| lgdppc | 687 | 5196.08 | 5859.28 | 224.34 | 49,491.59 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| lgdpg | 0.3011 *** | 0.3185 *** | 0.0856 * | 0.0787 | −0.2109 |

| (0.0418) | (0.0434) | (0.0477) | (0.1784) | (0.1808) | |

| lms | 0.0481 | 0.0505 | 0.1002 | 0.0563 | 0.1376 |

| (0.0617) | (0.0610) | (0.0822) | (0.1104) | (0.1343) | |

| gee | −0.0313 | −0.004 | 0.0106 | 0.011 | 1.4483 ** |

| (0.0632) | (0.0647) | (0.1679) | (0.2206) | (0.5815) | |

| exp | 0.016 | 0.0157 | 0.0711 ** | 0.0848 * | 0.5620 ** |

| (0.0110) | (0.0106) | (0.0310) | (0.0454) | (0.2414) | |

| ms·exp | 0 | −0.0002 | −0.0059 ** | −0.0019 | −0.0444 *** |

| (0.0013) | (0.0012) | (0.0027) | (0.0040) | (0.0162) | |

| dev·ms·exp | 0.0003 | 0.0004 | 0.0036 * | 0.001 | 0.0287 ** |

| (0.0008) | (0.0008) | (0.0018) | (0.0034) | (0.0136) | |

| dev | −0.8315 | −0.8793 | −2.1782 | −0.8103 | −7.5818 * |

| (0.6854) | (0.6663) | (1.4379) | (2.0946) | (4.2614) | |

| lnpop | 0.1192 | 0.1096 | −3.3314 * | −13.5823 *** | −3.6083 |

| (0.0727) | (0.0728) | (1.9366) | (4.7181) | (6.9141) | |

| pctgdp | 0.1339 * | 0.1149 | 0.1388 | 0.7373 ** | 0.7287 * |

| (0.0704) | (0.0695) | (0.2081) | (0.3558) | (0.4204) | |

| lgdppc | −0.0001 *** | −0.0001 ** | −0.0006 *** | −0.0017 *** | −0.0006 |

| (0.0000) | (0.0000) | (0.0001) | (0.0005) | (0.0005) | |

| N | 687 | 687 | 687 | 506 | 506 |

| R-sq | 0.137 | 0.218 | 0.186 | ||

| Countries | 130 | 130 | 130 | 119 | 119 |

| Period FE | No | Yes | Yes | Yes | Yes |

| Country FE | No | No | Yes | Yes | Yes |

| IV’s | 23 | 37 | |||

| AR(1): p-value | 0.04 | 0.71 | |||

| AR(2): p-value | 0.54 | 0.07 | |||

| Sargan test: p-value | 0.30 | 0.14 | |||

| Hansen test: p-value | 0.26 | 0.48 |

| (1) | (2) | |

|---|---|---|

| lgdpg | −0.3796 | −0.3762 |

| (0.2728) | (0.2315) | |

| ms | 1.9918 | 0.7793 |

| (1.2223) | (0.7526) | |

| lms | 0.1343 | 0.2464 |

| (0.1520) | (0.5021) | |

| gee | 2.7429 ** | 1.3866 ** |

| (1.3602) | (0.6525) | |

| exp | 0.6394 ** | 0.3793 * |

| (0.2985) | (0.2164) | |

| ms·exp | −0.0560 ** | −0.0293 * |

| (0.0214) | (0.0161) | |

| dev·ms·exp | 0.0382 ** | 0.0193 |

| (0.0188) | (0.0138) | |

| dev | −8.9741 | 0.4352 |

| (5.8981) | (3.4561) | |

| lnpop | −2.0614 | 2.9121 |

| (9.1826) | (7.6075) | |

| pctgdp | 0.8483 * | 0.7136 * |

| (0.4713) | (0.4137) | |

| lgdppc | −0.0001 | 0 |

| (0.0008) | (0.0006) | |

| N | 506 | 423 |

| Countries | 119 | 119 |

| Period FE | Yes | Yes |

| Country FE | Yes | Yes |

| IV’s | 33 | 31 |

| AR(1): p-value | 0.76 | 0.48 |

| AR(2): p-value | 0.05 | 0.06 |

| Sargan test: p-value | 0.64 | 0.13 |

| Hansen test: p-value | 0.60 | 0.70 |

| (1) | (2) | (3) | |

|---|---|---|---|

| lgdpg | −0.223 | −0.2424 | −0.2223 |

| (0.3051) | (0.3712) | (0.3745) | |

| ms | 1.1124 | 2.0937 | 2.0275 |

| (1.1153) | (1.4944) | (1.3611) | |

| lms | 0.1458 | −0.0561 | −0.2314 |

| (0.1390) | (0.9705) | (0.9436) | |

| gee | 1.1501 * | 2.7787 | 2.6402 |

| (0.6084) | (1.7559) | (2.0362) | |

| imp | 0.1312 | −0.0083 | −0.0154 |

| (0.0856) | (0.1306) | (0.2117) | |

| exp | 0.5031 * | 0.7564 ** | 0.7039 |

| (0.2825) | (0.3783) | (0.5572) | |

| ms·exp | −0.0503 * | −0.0647 * | −0.0601 |

| (0.0299) | (0.0363) | (0.0517) | |

| ms·imp | 0.0008 | ||

| (0.0228) | |||

| dev·ms·exp | 0.0276 | 0.044 | 0.0406 |

| (0.0280) | (0.0358) | (0.0354) | |

| dev | −6.6908 | −11.3235 | −10.3341 |

| (7.9928) | (11.0051) | (10.7573) | |

| lnpop | −4.8535 | −2.0464 | −1.9394 |

| (10.0702) | (11.9631) | (11.3724) | |

| pctgdp | 0.7196 | 0.8033 | 0.759 |

| (0.4615) | (0.6759) | (0.6489) | |

| lgdppc | −0.0009 | −0.0004 | −0.0004 |

| (0.0010) | (0.0011) | (0.0010) | |

| N | 506 | 506 | 506 |

| Countries | 119 | 119 | 119 |

| Period FE | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes |

| IV’s | 25 | 24 | 24 |

| AR(1): p-value | 0.90 | 0.99 | 0.74 |

| AR(2): p-value | 0.07 | 0.08 | 0.13 |

| Sargan test: p-value | 0.84 | 0.88 | 0.56 |

| Hansen test: p-value | 0.89 | 0.92 | 0.80 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wan, X.; Kazmi, S.A.A.; Wong, C.Y. Manufacturing, Exports, and Sustainable Growth: Evidence from Developing Countries. Sustainability 2022, 14, 1646. https://doi.org/10.3390/su14031646

Wan X, Kazmi SAA, Wong CY. Manufacturing, Exports, and Sustainable Growth: Evidence from Developing Countries. Sustainability. 2022; 14(3):1646. https://doi.org/10.3390/su14031646

Chicago/Turabian StyleWan, Xi, Shehla Anjum Ajaz Kazmi, and Chun Yee Wong. 2022. "Manufacturing, Exports, and Sustainable Growth: Evidence from Developing Countries" Sustainability 14, no. 3: 1646. https://doi.org/10.3390/su14031646

APA StyleWan, X., Kazmi, S. A. A., & Wong, C. Y. (2022). Manufacturing, Exports, and Sustainable Growth: Evidence from Developing Countries. Sustainability, 14(3), 1646. https://doi.org/10.3390/su14031646