Business Model of Peer-to-Peer Energy Trading: A Review of Literature

Abstract

:1. Introduction

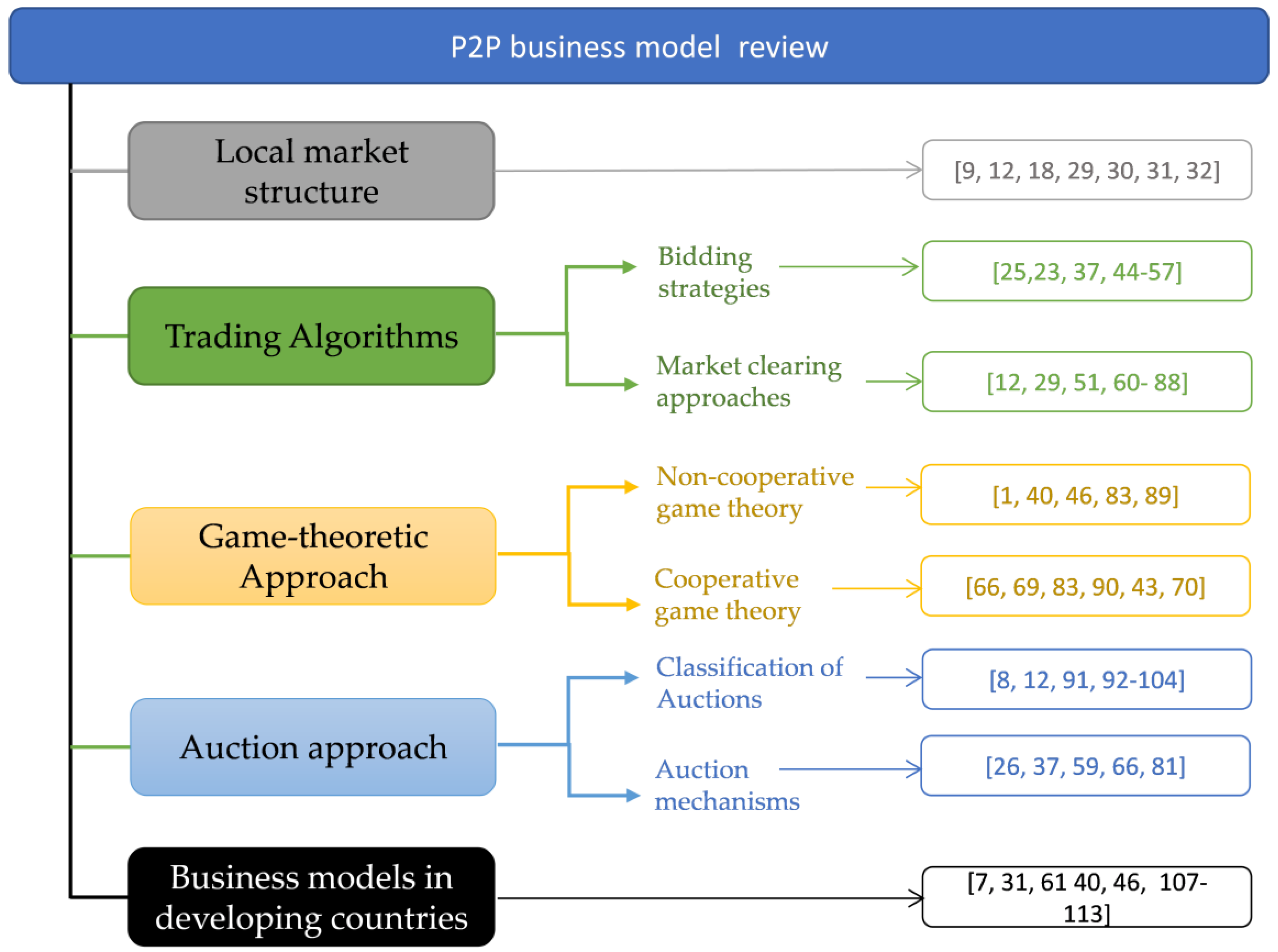

- This paper reviews the innovative trading mechanisms used in the P2P energy market to investigate its efficiency and applicability.

- It intensively surveys the main dimensions of the business model: market-clearing approaches and bidding strategies that researchers used to build a business layer of local electricity exchange between peers.

- Reviewing the P2P trading policies of developing countries is considered a critical issue due to very constrained policies in the energy sector and insufficient articles and reviews of such innovative trading mechanisms.

- This review covers a comprehensive classification aspect of the auction methods applied in several sectors, especially in energy trading.

- It offers recommendations for future work directions for business model development and energy trading policies in developing countries.

2. Electricity Market Development

2.1. Existing Policies

2.2. Current Research Directions of P2P

3. Local Market Structure

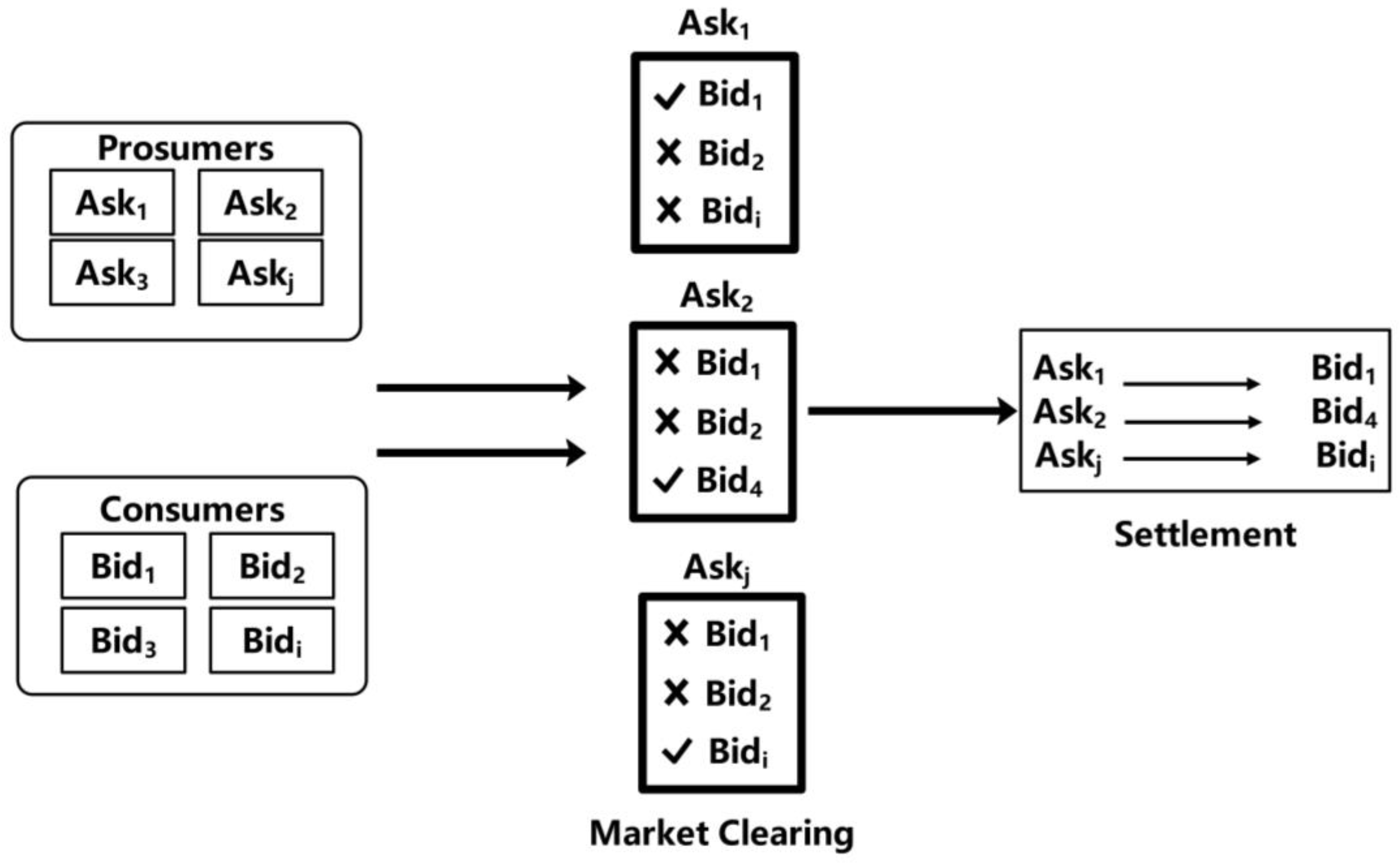

4. Trading Algorithms

4.1. Bidding Strategies

4.1.1. Comparable Bidding Methods

4.1.2. Learning-Based Bidding Methods

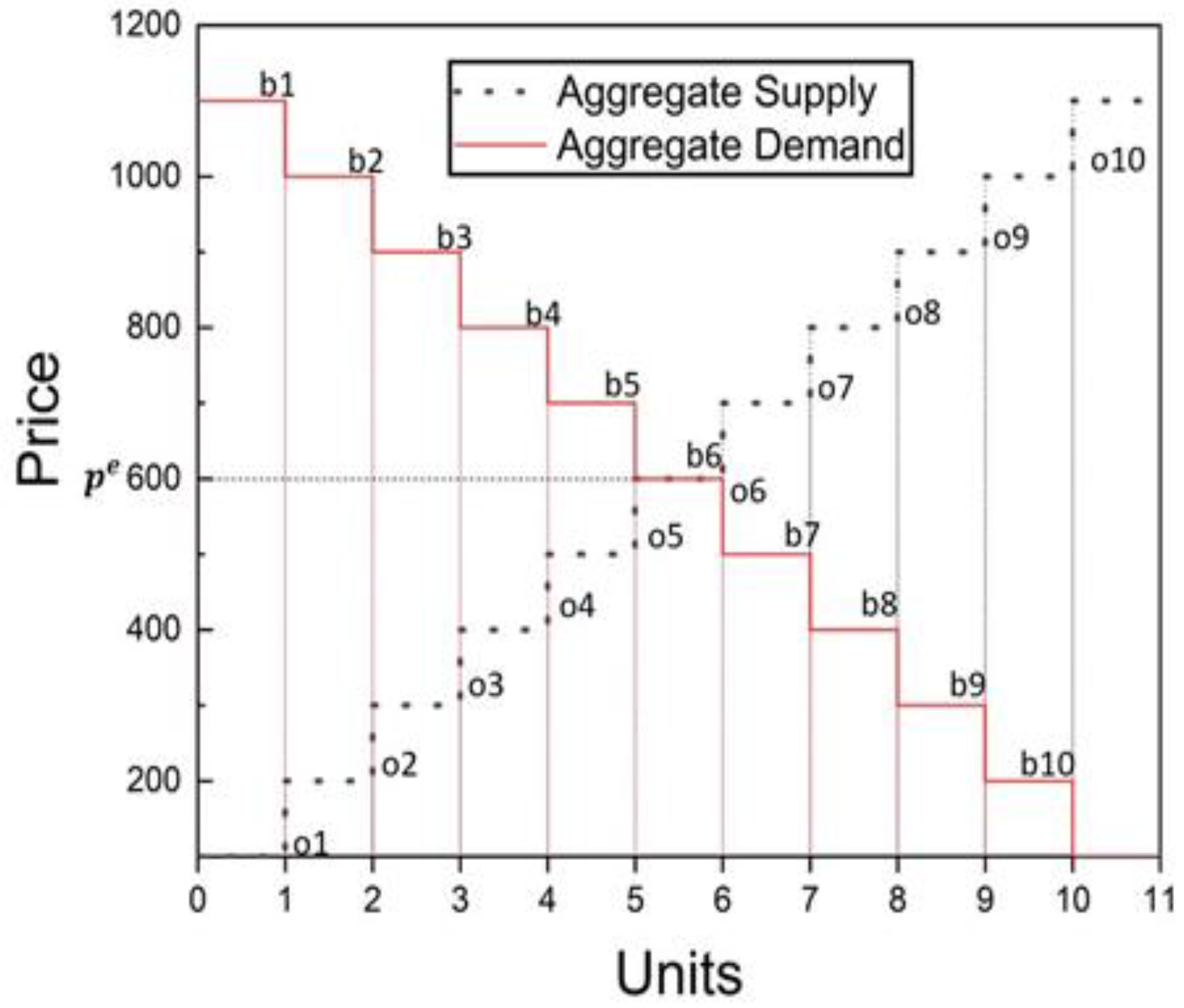

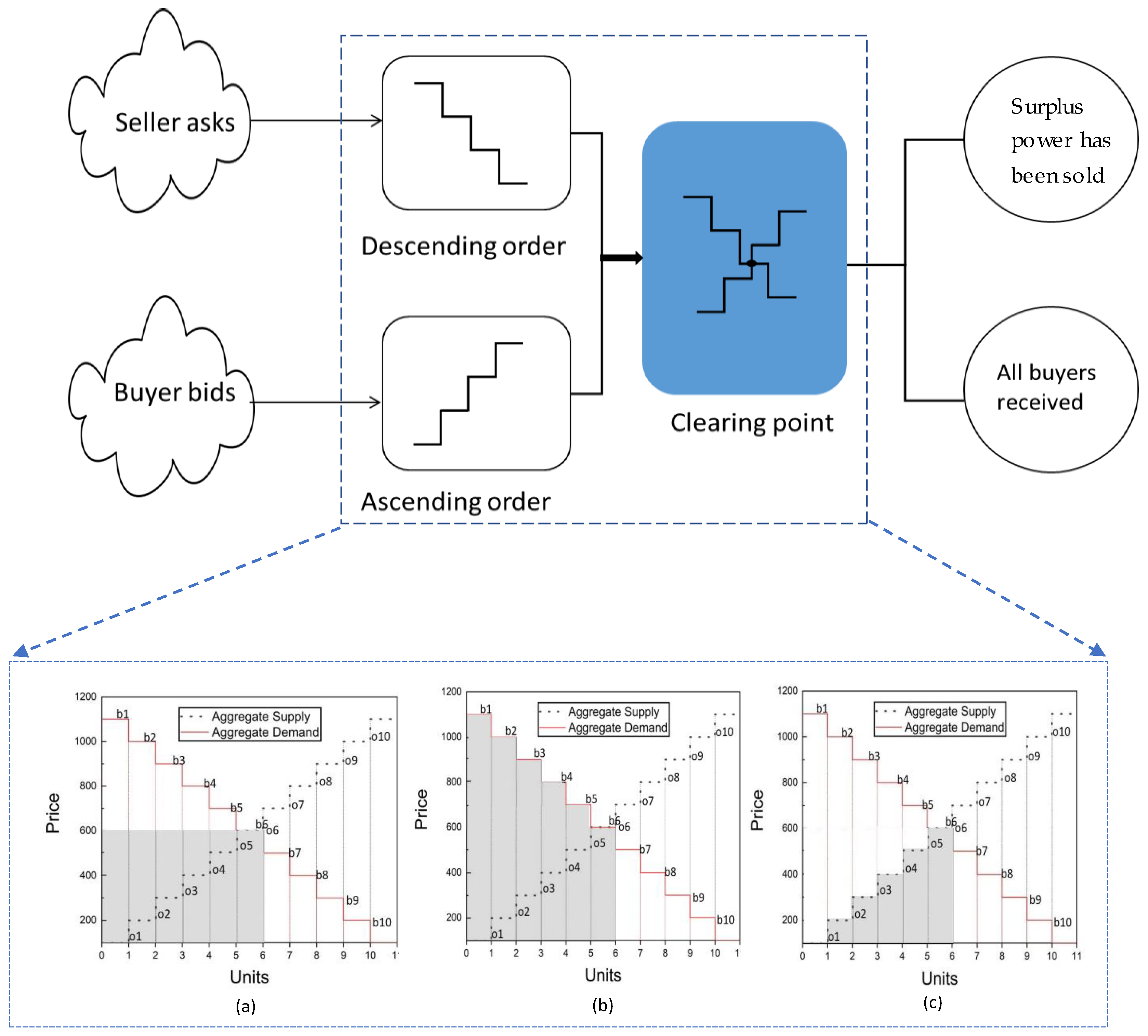

4.2. Market Clearing Approaches

5. Game-Theoretic Approach

5.1. Non-Cooperative Game Theory

5.2. Cooperative Game Theory

- Coalition graph game handles communication between the participants and functions to derive low-complexity distributed algorithms for those who want to form a network graph. It also investigates the formed network properties, for example, stability and efficiency [83].

- The coalition formation game studies the network’s structure, including adaptability, properties, and coalition cost.

- Canonical coalition game is the tool that distributes cooperation gains between players with fairness.

6. Auction Approach

6.1. Classification of Auctions

- Ascending-Bid AuctionThis type of auction is called an English auction, in which it starts its operation by specifying the starting price at the seller side. The starting price is considered a low price where it will be increased continuously until matching the available bids, in which the highest bid is the one who is granted the offered item.

- Descending-Bid AuctionIn a Descending-bid or Dutch auction, the starting price is considered a high price, and it decreases continuously until a bid matches the specified price.

- First-Price Sealed-Bid AuctionIn this type, the participating bidders present their bids once in a single-round auction in which they cannot modify their bids subsequently. After submitting all bids, the seller or auctioneer specifies the winning bidder who offered the highest bid, and the seller will grant a price that equals the highest bid.

- Second-Price Sealed-Bid AuctionThis type of auction is similar to the First-price sealed-bid auction except that the winning bidder will pay an amount equal to the second-highest available bid.

6.2. Auction Mechanisms

7. Business Models in Developing Countries

8. Future Work

- Further work needs to be done to compare the P2P, community-based, and hybrid framework in the case of a larger number of participants to ensure fairness amongst players and employ optimal clearing algorithms, particularly when they communicate asynchronously. Information exchange among players and building communication structures for players is another area of future research so that participants communicate with each other securely and feasibly.

- Socio-economic factors need further work to study the customer preferences and their energy demand, expressing human behavior, the extent of its rational decisions, and the effects of people’s preferences on the performance of the market. This also should be conducted on the behavior of both prosumers and consumers so that the prosumer of high quality should be prioritized, and feeding households with low income prioritized as well. Further, the complex mutuality between social, political, and economic market objectives should be investigated to expand the market structure and bidding strategies.

- Distributed methods’ scalability is still a heated issue that shall be addressed and enhanced to deal with an enormous number of players. So, research should be intensively focused on using these methods in building a trading platform for multiple buyers’ and multiple sellers’ negotiation. Moreover, diverse types of auctions and bidding strategies have to be evaluated to find the proper mechanism with extra attention to the intelligent bidding strategy, dynamic auction, and smart contracts to balance the P2P network under supply and demand variation.

- Further studies are essential to develop a suitable business model for developing countries regarding electricity pricing strategies for trading energy with restricted policies, particularly between nano-grids. This grid type is common in developing nations where strong mini-grids or microgrids are unavailable or weakly constructed.

- One of the main barriers to be addressed in developing countries is that centralized utilities control the whole market and refuse the installation of decentralized trading markets. So, to get existing utilities’ cooperation, it must be ensured by extensive research that the proposed trading policies and trading strategies such as the P2P energy market will not adversely affect their profits. In addition, these traditional utilities also need to be taken into consideration, ensuring the viability of the energy trading market because players use their existing networks to transmit energy.

9. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Soto, E.A.; Bosman, L.B.; Wollega, E.; Leon-Salas, W.D. Peer-to-peer energy trading: A review of the literature. Appl. Energy 2021, 283, 116268. [Google Scholar] [CrossRef]

- Li, Z.; Bahramirad, S.; Paaso, A.; Yan, M.; Shahidehpour, M. Blockchain for decentralized transactive energy management system in networked microgrids. Electr. J. 2019, 32, 58–72. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Cheng, M.; Zhou, Y.; Long, C. A Bidding System for Peer-to-Peer Energy Trading in a Grid-connected Microgrid. Energy Procedia 2016, 103, 147–152. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Long, C.; Cheng, M. Review of Existing Peer-to-Peer Energy Trading Projects. Energy Procedia 2017, 105, 2563–2568. [Google Scholar] [CrossRef]

- Park, C.; Yong, T. Comparative review and discussion on P2P electricity trading. Energy Procedia 2017, 128, 3–9. [Google Scholar] [CrossRef]

- Thomas, A.; Abraham, M.P.; Arya, A.G.M. Review of Peer-To-Peer Energy Trading for Indian Scenario: Challenges and Opportunities. In Proceedings of the ICCISc 2021–2021 International Conference on Communication, Control and Information Sciences, Idukki, India, 16–18 June 2021; Institute of Electrical and Electronics Engineers Inc. (IEEE): New York, NY, USA, 2021. [Google Scholar] [CrossRef]

- Abdella, J.; Tari, Z.; Anwar, A.; Mahmood, A.; Han, F. An Architecture and Performance Evaluation of Blockchain-Based Peer-to-Peer Energy Trading. IEEE Trans. Smart Grid 2021, 12, 3364–3378. [Google Scholar] [CrossRef]

- Sousa, T.; Soares, T.; Pinson, P.; Moret, F.; Baroche, T.; Sorin, E. Peer-to-peer and community-based markets: A comprehensive review. Renew. Sustain. Energy Rev. 2019, 104, 367–378. [Google Scholar] [CrossRef] [Green Version]

- Tushar, W.; Yuen, C.; Saha, T.K.; Morstyn, T.; Chapman, A.C.; Alam, M.J.E.; Hanif, S.; Poor, H.V. Peer-to-peer energy systems for connected communities: A review of recent advances and emerging challenges. Appl. Energy 2021, 282, 116131. [Google Scholar] [CrossRef]

- Thukral, M.K. Emergence of blockchain-technology application in peer-to-peer electrical-energy trading: A review. Clean Energy 2021, 5, 104–123. [Google Scholar] [CrossRef]

- Khorasany, M.; Mishra, Y.; Ledwich, G. Market framework for local energy trading: A review of potential designs and market clearing approaches. IET Gener. Transm. Distrib. 2018, 12, 5899–5908. [Google Scholar] [CrossRef] [Green Version]

- Dudjak, V.; Neves, D.; Alskaif, T.; Khadem, S.; Pena-Bello, A.; Saggese, P.; Bowler, B.; Andoni, M.; Bertolini, M.; Zhou, Y.; et al. Impact of local energy markets integration in power systems layer: A comprehensive review. Appl. Energy 2021, 301, 117434. [Google Scholar] [CrossRef]

- Azim, M.I.; Tushar, W.; Saha, T.K. Investigating the impact of P2P trading on power losses in grid-connected networks with prosumers. Appl. Energy 2020, 263, 114687. [Google Scholar] [CrossRef]

- Christoforidis, G.C.; Panapakidis, I.P.; Papadopoulos, T.A.; Papagiannis, G.K.; Koumparou, I.; Hadjipanayi, M.; Georghiou, G.E. A Model for the Assessment of Different Net-Metering Policies. Energies 2016, 9, 262. [Google Scholar] [CrossRef]

- Murdan, A.P.; Jeetun, A.K. Simulation of a Single Phase Grid-tied PV System under Net-Metering Scheme. In Proceedings of the 2021 IEEE Power and Energy Conference at Illinois, PECI 2021, Urbana, IL, USA, 1–2 April 2021; Institute of Electrical and Electronics Engineers Inc.: New York, NY, USA, 2021. [Google Scholar] [CrossRef]

- Zainuddin, H.; Salikin, H.R.; Shaari, S.; Hussin, M.Z.; Manja, A. Revisiting Solar Photovoltaic Roadmap of Tropical Malaysia: Past, Present and Future. Pertanika J. Sci. Technol. 2021, 29, 1567–1578. [Google Scholar] [CrossRef]

- Khorasany, M. Market Design for Peer-to-Peer Energy Trading in a Distribution Network with High Penetration of Distributed Energy Resources. Ph.D. Thesis, Queensland University of Technology, Queensland, Australia, 2019. [Google Scholar]

- Morstyn, T.; Teytelboym, A.; McCulloch, M.D. Bilateral Contract Networks for Peer-to-Peer Energy Trading. IEEE Trans. Smart Grid 2019, 10, 2026–2035. [Google Scholar] [CrossRef]

- Guerrero, J.; Sok, B.; Chapman, A.C.; Verbič, G. Electrical-distance driven peer-to-peer energy trading in a low-voltage network. Appl. Energy 2021, 287, 116598. [Google Scholar] [CrossRef]

- Paudel, A.; Sampath, L.P.M.I.; Yang, J.; Gooi, H.B. Peer-to-Peer Energy Trading in Smart Grid Considering Power Losses and Network Fees. IEEE Trans. Smart Grid 2020, 11, 4727–4737. [Google Scholar] [CrossRef]

- Nikolaidis, A.I.; Charalambous, C.A.; Mancarella, P. A Graph-Based Loss Allocation Framework for Transactive Energy Markets in Unbalanced Radial Distribution Networks. IEEE Trans. Power Syst. 2018, 34, 4109–4118. [Google Scholar] [CrossRef]

- Guerrero, J.; Chapman, A.C.; Verbic, G. Decentralized P2P Energy Trading Under Network Constraints in a Low-Voltage Network. IEEE Trans. Smart Grid 2018, 10, 5163–5173. [Google Scholar] [CrossRef] [Green Version]

- An, J.; Lee, M.; Yeom, S.; Hong, T. Determining the Peer-to-Peer electricity trading price and strategy for energy prosumers and consumers within a microgrid. Appl. Energy 2019, 261, 114335. [Google Scholar] [CrossRef]

- Guerrero, J.; Chapman, A.C.; Verbic, G. Trading Arrangements and Cost Allocation in P2P Energy Markets on Low-Voltage Networks. In Proceedings of the 2019 IEEE Power & Energy Society General Meeting, Atlanta, GA, USA, 4–8 August 2019. [Google Scholar] [CrossRef]

- Narayanan, A.; Haapaniemi, J.; Kaipia, T.; Partanen, J. Economic impacts of power-based tariffs on peer-to-peer electricity exchange in community microgrids. In Proceedings of the International Conference on the European Energy Market, EEM, Lodz, Poland, 27–29 June 2018. [Google Scholar]

- Baroche, T.; Pinson, P.; Latimier, R.L.G.; Ben Ahmed, H. Exogenous Cost Allocation in Peer-to-Peer Electricity Markets. IEEE Trans. Power Syst. 2019, 34, 2553–2564. [Google Scholar] [CrossRef] [Green Version]

- Mengelkamp, E.; Garttner, J.; Weinhardt, C. The role of energy storage in local energy markets. In Proceedings of the 2017 14th International Conference on the European Energy Market (EEM), Dresden, Germany, 6–9 June 2017; Institute of Elec-trical and Electronics Engineers (IEEE): New York, NY, USA, 2017; pp. 1–6. [Google Scholar]

- Sorin, E.; Bobo, L.; Pinson, P. Consensus-Based Approach to Peer-to-Peer Electricity Markets With Product Differentiation. IEEE Trans. Power Syst. 2019, 34, 994–1004. [Google Scholar] [CrossRef] [Green Version]

- Khorasany, M.; Mishra, Y.; Ledwich, G. Hybrid trading scheme for peer-to-peer energy trading in transactive energy markets. IET Gener. Transm. Distrib. 2020, 14, 245–253. [Google Scholar] [CrossRef]

- Kokchang, P.; Junlakarn, S.; Audomvongseree, K. Business model and market designs for solar prosumer on peer to peer energy trading in Thailand. IOP Conf. Ser. Earth Environ. Sci. 2020, 463, 012127. [Google Scholar] [CrossRef]

- Khorasany, M.; Mishra, Y.; Ledwich, G. A Decentralized Bilateral Energy Trading System for Peer-to-Peer Electricity Markets. IEEE Trans. Ind. Electron. 2020, 67, 4646–4657. [Google Scholar] [CrossRef] [Green Version]

- Zhou, Y.; Wu, J.; Long, C.; Ming, W. State-of-the-Art Analysis and Perspectives for Peer-to-Peer Energy Trading. Engineering 2020, 6, 739–753. [Google Scholar] [CrossRef]

- Moret, F.; Baroche, T.; Sorin, E.; Pinson, P. Negotiation algorithms for peer-to-peer electricity markets: Computational properties. In Proceedings of the 2018 Power Systems Computation Conference (PSCC), Dublin, Ireland, 11–15 June 2018. [Google Scholar]

- Morstyn, T.; Teytelboym, A.; Hepburn, C.; McCulloch, M.D. Integrating P2P Energy Trading With Probabilistic Distribution Locational Marginal Pricing. IEEE Trans. Smart Grid 2020, 11, 3095–3106. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Lin, J.; Pipattanasomporn, M.; Rahman, S. Comparative analysis of auction mechanisms and bidding strategies for P2P solar transactive energy markets. Appl. Energy 2019, 255, 113687. [Google Scholar] [CrossRef]

- Chen, K.; Lin, J.; Song, Y. Trading strategy optimization for a prosumer in continuous double auction-based peer-to-peer market: A prediction-integration model. Appl. Energy 2019, 242, 1121–1133. [Google Scholar] [CrossRef]

- Vytelingum, P.; Ramchurn, S.D.; Voice, T.D.; Rogers, A.; Jennings, N.R. Trading Agents for the Smart Electricity Grid. Available online: www.ifaamas.org (accessed on 21 September 2021).

- Bhatti, B.A.; Broadwater, R. Energy trading in the distribution system using a non-model based game theoretic approach. Appl. Energy 2019, 253, 113532. [Google Scholar] [CrossRef]

- Leong, C.H.; Gu, C.; Li, F. Auction Mechanism for P2P Local Energy Trading considering Physical Constraints. Energy Procedia 2019, 158, 6613–6618. [Google Scholar] [CrossRef]

- Long, C.; Zhou, Y.; Wu, J. A game theoretic approach for peer to peer energy trading. Energy Procedia 2019, 159, 454–459. [Google Scholar] [CrossRef]

- Huang, H.; Nie, S.; Lin, J.; Wang, Y.; Dong, J. Optimization of Peer-to-Peer Power Trading in a Microgrid with Distributed PV and Battery Energy Storage Systems. Sustainability 2020, 12, 923. [Google Scholar] [CrossRef] [Green Version]

- PankiRaj, J.S.; Yassine, A.; Choudhury, S. An Auction Mechanism for Profit Maximization of Peer-to-Peer Energy Trading in Smart Grids. Procedia Comput. Sci. 2019, 151, 361–368. [Google Scholar] [CrossRef]

- Wang, J.; Wang, Q.; Zhou, N.; Chi, Y. A Novel Electricity Transaction Mode of Microgrids Based on Blockchain and Continuous Double Auction. Energies 2017, 10, 1971. [Google Scholar] [CrossRef] [Green Version]

- Wang, N.; Xu, W.; Xu, Z.; Shao, W. Peer-to-Peer Energy Trading among Microgrids with Multidimensional Willingness. Energies 2018, 11, 3312. [Google Scholar] [CrossRef] [Green Version]

- Yu, Q.; Meeuw, A.; Wortmann, F. Design and implementation of a blockchain multi-energy system. Energy Informatics 2018, 1, 311–318. [Google Scholar] [CrossRef] [Green Version]

- Gomes, L.; Vale, Z.A.; Corchado, J.M. Multi-Agent Microgrid Management System for Single-Board Computers: A Case Study on Peer-to-Peer Energy Trading. IEEE Access. 2020, 8, 64169–64183. [Google Scholar] [CrossRef]

- Okwuibe, G.C.; Wadhwa, M.; Brenner, T.; Tzscheutschler, P.; Hamacher, T. Intelligent bidding strategies in local electricity markets: A simulation-based analysis. In Proceedings of the 2020 IEEE Electric Power and Energy Conference, EPEC, Edmonton, AB, Canada, 9–10 November 2020; Institute of Electrical and Electronics Engineers Inc.: New York, NY, USA, 2020. [Google Scholar] [CrossRef]

- Esmat, A.; de Vos, M.; Ghiassi-Farrokhfal, Y.; Palensky, P.; Epema, D. A novel decentralized platform for peer-to-peer energy trading market with blockchain technology. Appl. Energy 2021, 282, 116123. [Google Scholar] [CrossRef]

- Alam, M.R.; St-Hilaire, M.; Kunz, T. An optimal P2P energy trading model for smart homes in the smart grid. Energy Effic. 2017, 10, 1475–1493. [Google Scholar] [CrossRef]

- Chakraborty, S.; Baarslag, T.; Kaisers, M. Automated peer-to-peer negotiation for energy contract settlements in residential cooperatives. Appl. Energy 2020, 259, 114173. [Google Scholar] [CrossRef] [Green Version]

- Wang, N.; Xu, W.; Shao, W.; Xu, Z. A Q-Cube Framework of Reinforcement Learning Algorithm for Continuous Double Auction among Microgrids. Energies 2019, 12, 2891. [Google Scholar] [CrossRef] [Green Version]

- Zang, H.; Kim, J. Reinforcement Learning Based Peer-to-Peer Energy Trade Management Using Community Energy Storage in Local Energy Market. Energies 2021, 14, 4131. [Google Scholar] [CrossRef]

- Chen, T.; Su, W. Indirect Customer-to-Customer Energy Trading With Reinforcement Learning. IEEE Trans. Smart Grid 2019, 10, 4338–4348. [Google Scholar] [CrossRef]

- Subramanian, E.; Bichpuriya, Y.; Achar, A.; Bhat, S.; Singh, A.P.; Sarangan, V.; Natarajan, A. LEarn: A reinforcement learning based bidding strategy for generators in single sided energy markets. In Proceedings of the 10th ACM International Conference on Future Energy Systems, Phoenix, AZ, USA, 15 June 2019. [Google Scholar] [CrossRef]

- Chiu, W.Y.; Hu, C.W.; Chiu, K.Y. Renewable Energy Bidding Strategies Using Multiagent Q-Learning in Double-Sided Auctions. IEEE Syst. J. 2021, 1–2. [Google Scholar] [CrossRef]

- Yan, X.; Lin, J.; Hu, Z.; Song, Y. P2P trading strategies in an industrial park distribution network market under regulated electricity tariff. In Proceedings of the 2017 IEEE Conference on Energy Internet and Energy System Integration, Beijing, China, 26–28 November 2017. [Google Scholar]

- Yang, J.; Zhao, J.; Qiu, J.; Wen, F. A Distribution Market Clearing Mechanism for Renewable Generation Units With Zero Marginal Costs. IEEE Trans. Ind. Inform. 2019, 15, 4775–4787. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C. Evaluation of peer-to-peer energy sharing mechanisms based on a multiagent simulation framework. Appl. Energy 2018, 222, 993–1022. [Google Scholar] [CrossRef]

- Yap, Y.; Tan, W.; Wong, J.; Ahmad, N.A.; Wooi, C.; Wu, Y.; Ariffin, A.E. A two-stage multi microgrids p2p energy trading with motivational game-theory: A case study in malaysia. IET Renew. Power Gener. 2021, 15, 2615–2628. [Google Scholar] [CrossRef]

- Zhang, B.; Du, Y.; Lim, E.G.; Jiang, L.; Yan, K. Design and Simulation of Peer-to-Peer Energy Trading Framework with Dynamic Electricity Price. In Proceedings of the 2019 29th Australasian Universities Power Engineering Conference (AUPEC), Nadi, Fiji, 26–29 November 2019; Institute of Electrical and Electronics Engineers Inc. (IEEE): New York, NY, USA, 2020. [Google Scholar] [CrossRef]

- Liu, N.; Yu, X.; Wang, C.; Li, C.; Ma, L.; Lei, J. Energy-Sharing Model With Price-Based Demand Response for Microgrids of Peer-to-Peer Prosumers. IEEE Trans. Power Syst. 2017, 32, 3569–3583. [Google Scholar] [CrossRef]

- Hadiya, N.; Teotia, F.; Bhakar, R.; Mathuria, P.; Datta, A. A comparative analysis of pricing mechanisms to enable P2P energy sharing of rooftop solar energy. In Proceedings of the 2020 IEEE International Conference on Power Systems Technology, Bangalore, India, 2 November 2020. [Google Scholar] [CrossRef]

- Long, C.; Wu, J.; Zhang, C.; Thomas, L.; Cheng, M.; Jenkins, N. Peer-to-peer energy trading in a community microgrid. In Proceedings of the IEEE Power and Energy Society General Meeting, Chicago, IL, USA, 16–20 July 2017. [Google Scholar]

- Khorasany, M.; Mishra, Y.; Ledwich, G. Auction based energy trading in transactive energy market with active participation of prosumers and consumers. In Proceedings of the 2017 Australasian Universities Power Engineering Conference, AUPEC, Melbourne, VIC, Australia, 19–22 November 2017. [Google Scholar]

- Cherala, V.; Yemula, P.K. Peer-to-Peer Energy Sharing Model for Interconnected Home Microgrids. In Proceedings of the 2020 IEEE International Conference on Power Systems Technology (POWERCON), Bangalore, India, 14–16 September 2020; pp. 1–6. [Google Scholar]

- Block, C.; Neumann, D.; Weinhardt, C. A Market Mechanism for Energy Allocation in Micro-CHP Grids. Available online: http://www.sesam.uni-karlsruhe.de (accessed on 3 September 2021).

- Parag, Y.; Sovacool, B.K. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 16032. [Google Scholar] [CrossRef]

- Tushar, W.; Saha, T.K.; Yuen, C.; Morstyn, T.; McCulloch, M.D.; Poor, H.V.; Wood, K.L. A motivational game-theoretic approach for peer-to-peer energy trading in the smart grid. Appl. Energy 2019, 243, 10–20. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C.; Cheng, M.; Zhang, C. Performance Evaluation of Peer-to-Peer Energy Sharing Models. Energy Procedia 2017, 143, 817–822. [Google Scholar] [CrossRef]

- Chau, S.C.-K.; Xu, J.; Bow, W.; Elbassioni, K. Peer-to-peer energy sharing: Effective cost-sharing mechanisms and social efficiency. In Proceedings of the 10th ACM International Conference on Future Energy Systems, Phoenix, AZ, USA, 15 June 2019; Association for Computing Machinery, Inc.: New York, NY, USA, 2019; pp. 215–225. [Google Scholar] [CrossRef]

- Denysiuk, R.; Lilliu, F.; Recupero, D.R.; Vinyals, M. Peer-to-peer Energy Trading for Smart Energy Communities. Available online: http://www.eea.europa.eu/data-and-maps/indicators/ (accessed on 26 November 2021).

- Capodieci, N. P2P Energy Exchange Agent Platform Featuring a Game Theory Related Learning Negotiation Algorithm. Master Degree Thesis. 2011. Available online: https://www.semanticscholar.org/paper/P2P-energy-exchange-agent-platform-featuring-a-game-Capodieci/9c5f3011d1a654f9ce50cb2fe080d16e091fd9d5#paper-header (accessed on 21 January 2022).

- Angaphiwatchawal, P.; Sompoh, C.; Chaitusaney, S. A Multi-k double auction pricing mechanism for peer-to-peer energy trading market of prosumers. In Proceedings of the ECTI-CON 2021–2021 18th International Conference on Electrical Engineering/Electronics, Computer, Telecommunications and Information Technology: Smart Electrical System and Technology, Chiang Mai, Thailandnd, 19–22 May 2021. [Google Scholar] [CrossRef]

- Kumar Nunna, H.S.V.S.; Turarbek, M.; Kassymkhan, A.; Syzdykov, A.; Bagheri, M. Comparative Analysis of Peer-to-Peer Transactive Energy Market Clearing Algorithms. Proceedings of IECON 2020 The 46th Annual Conference of the IEEE Industrial Electronics Society, Singapore, 18–21 October 2020. [Google Scholar]

- Gerwin, C.; Mieth, R.; Dvorkin, Y. Compensation Mechanisms for Double Auctions in Peer-to-Peer Local Energy Markets. Curr. Sustain. Energy Rep. 2020, 7, 165–175. [Google Scholar] [CrossRef]

- Ahn, H.; Kim, J.; Kim, J. Auction-based Truthful Distributed Resource Allocation for Smart Grid Systems. In Proceedings of the 2021 International Conference on Information Networking (ICOIN), Jeju, Island, 13–16 January 2021. [Google Scholar]

- Amin, W.; Huang, Q.; Afzal, M.; Khan, A.A.; Zhang, Z.; Umer, K.; Ahmed, S.A. Consumers’ preference based optimal price determination model for P2P energy trading. Electr. Power Syst. Res. 2020, 187, 106488. [Google Scholar] [CrossRef]

- Foti, M.; Vavalis, M. Blockchain based uniform price double auctions for energy markets. Appl. Energy 2019, 254, 113604. [Google Scholar] [CrossRef]

- Khorasany, M.; Mishra, Y.; Ledwich, G. Peer-to-peer market clearing framework for DERs using knapsack approximation algorithm. In Proceedings of the 2017 IEEE PES Innovative Smart Grid Technologies Conference Europe, ISGT-Europe, Turin, Italy, 26–29 September 2017. [Google Scholar]

- Kalysh, I.; Alimkhan, A.; Temirtayev, I.; Nunna, H.K.; Doolla, S.; Vipin, K. Dynamic programming based peer-to-peer energy trading framework for smart microgrids. In Proceedings of the 2019 IEEE 13th International Conference on Compatibility, Power Electronics and Power Engineering, CPE-POWERENG 2019, Sonderborg, Denmark, 23–25 April 2019. [Google Scholar] [CrossRef]

- Tushar, W.; Yuen, C.; Mohsenian-Rad, H.; Saha, T.; Poor, H.V.; Wood, K.L. Transforming Energy Networks via Peer-to-Peer Energy Trading: The Potential of Game-Theoretic Approaches. IEEE Signal Process. Mag. 2018, 35, 90–111. [Google Scholar] [CrossRef] [Green Version]

- Khorasany, M.; Paudel, A.; Razzaghi, R.; Siano, P. A New Method for Peer Matching and Negotiation of Prosumers in Peer-to-Peer Energy Markets. IEEE Trans. Smart Grid 2020, 12, 2472–2483. [Google Scholar] [CrossRef]

- Moret, F.; Pinson, P. Energy Collectives: A Community and Fairness Based Approach to Future Electricity Markets. IEEE Trans. Power Syst. 2018, 34, 3994–4004. [Google Scholar] [CrossRef] [Green Version]

- Nguyen, S.; Peng, W.; Sokolowski, P.; Alahakoon, D.; Yu, X. Optimizing rooftop photovoltaic distributed generation with battery storage for peer-to-peer energy trading. Appl. Energy 2018, 228, 2567–2580. [Google Scholar] [CrossRef]

- Liu, T.; Tan, X.; Sun, B.; Wu, Y.; Tsang, D.H. Energy management of cooperative microgrids: A distributed optimization approach. Int. J. Electr. Power Energy Syst. 2018, 96, 335–346. [Google Scholar] [CrossRef]

- Paudel, A.; Gooi, H.B. Pricing in Peer-to-Peer Energy Trading Using Distributed Optimization Approach. In Proceedings of the IEEE Power and Energy Society General Meeting, Atlanta, GA, USA, 4–8 August 2019. [Google Scholar]

- Saad, W.; Han, Z.; Poor, H.V.; Basar, T. Game-Theoretic Methods for the Smart Grid: An Overview of Microgrid Systems, Demand-Side Management, and Smart Grid Communications. IEEE Signal Process. Mag. 2012, 29, 86–105. [Google Scholar] [CrossRef]

- Han, L.; Morstyn, T.; McCulloch, M.D. Scaling Up Cooperative Game Theory-Based Energy Management Using Prosumer Clustering. IEEE Trans. Smart Grid 2020, 12, 289–300. [Google Scholar] [CrossRef]

- Chatterjee, R. A Brief Survey of the Theory of Auction. South Asian J. Macroecon. Public Financ. 2013, 2, 169–191. [Google Scholar] [CrossRef]

- Khorasany, M.; Mishra, Y.; Ledwich, G. Design of auction-based approach for market clearing in peer-to-peer market platform. J. Eng. 2019, 2019, 4813–4818. [Google Scholar] [CrossRef]

- Al-Agtash, S.; Alkhraibat, A.; Al Hashem, M.; Al-Mutlaq, N. Real-Time Operation of Microgrids. Energy Power Eng. 2021, 13, 51–66. [Google Scholar] [CrossRef]

- Klemperer, P. Auction Theory: A Guide to the Literature. J. Econ. Surv. 1999, 13, 227–286. [Google Scholar] [CrossRef]

- Hassan, M.U.; Rehmani, M.H.; Chen, J. DEAL: Differentially Private Auction for Blockchain-Based Microgrids Energy Trading. IEEE Trans. Serv. Comput. 2020, 13, 263–275. [Google Scholar] [CrossRef]

- Kim, J.; Lee, J.; Park, S.; Choi, J.K. Battery-Wear-Model-Based Energy Trading in Electric Vehicles: A Naive Auction Model and a Market Analysis. IEEE Trans. Ind. Inform. 2019, 15, 4140–4151. [Google Scholar] [CrossRef]

- Zhong, W.; Xie, K.; Liu, Y.; Yang, C.; Xie, S. Efficient auction mechanisms for two-layer vehicle-to-grid energy trading in smart grid. Proceedings of 2017 IEEE International Conference on Communications (ICC), Paris, France, 21–25 May 2017; IEEE: New York, NY, USA, 2017; pp. 1–6. [Google Scholar]

- Chattopadhyay, S.; Chatterjee, R. Understanding Auctions; Routledge: London, UK, 2019. [Google Scholar] [CrossRef]

- Kagel, J.H.; Levin, D. The winner’s curse and public information in common value auctions. In Common Value Auctions and the Winner’s Curse; Princeton University Press: Princeton, NY, USA, 2009; pp. 107–148. [Google Scholar] [CrossRef]

- Ahmed, M.O.; El-Adaway, I.H.; Coatney, K.T.; Eid, M.S. Construction Bidding and the Winner’s Curse: Game Theory Approach. J. Constr. Eng. Manag. 2016, 142, 04015076. [Google Scholar] [CrossRef]

- van Dinther, C. Adaptive Bidding in Single-Sided Auctions Under Uncertainty; Springer Science & Business Media: Berlin, Germany, 2007. [Google Scholar] [CrossRef]

- Tushar, W.; Saha, T.K.; Yuen, C.; Smith, D.; Poor, H.V. Peer-to-Peer Trading in Electricity Networks: An Overview. IEEE Trans. Smart Grid 2020, 11, 3185–3200. [Google Scholar] [CrossRef] [Green Version]

- Guerrero, J.; Chapman, A.; Verbic, G. A study of energy trading in a low-voltage network: Centralised and distributed approaches. In Proceedings of the 2017 Australasian Universities Power Engineering Conference, AUPEC 2017, Melbourne, Australia, 19–22 November 2017. [Google Scholar]

- Bokkisam, H.R.; Singh, S.; Acharya, R.M.; Selvan, M.P. Blockchain-based peer-to-peer transactive energy system for community microgrid with demand response management. CSEE J. Power Energy Syst. 2021, 1–8. [Google Scholar] [CrossRef]

- Thakur, S.; Hayes, B.P.; Breslin, J.G. Distributed double auction for peer to peer energy trade using blockchains. In Proceedings of the 2018 5th International Symposium on Environment-Friendly Energies and Applications, EFEA, Rome, Italy, 24–26 September 2018. [Google Scholar] [CrossRef]

- Satterthwaite, M.A.; Williams, S.R. The Bayesian Theory of the k-Double Auction. In The Double Auction Market Institutions, Theories, and Evidence; Routledge: London, UK, 2018. [Google Scholar] [CrossRef]

- Shrestha, A.; Bishwokarma, R.; Chapagain, A.; Banjara, S.; Aryal, S.; Mali, B.; Thapa, R.; Bista, D.; Hayes, B.P.; Papadakis, A.; et al. Peer-to-Peer Energy Trading in Micro/Mini-Grids for Local Energy Communities: A Review and Case Study of Nepal. IEEE Access 2019, 7, 131911–131928. [Google Scholar] [CrossRef]

- Etukudor, C.; Couraud, B.; Robu, V.; Früh, W.-G.; Flynn, D.; Okereke, C. Automated Negotiation for Peer-to-Peer Electricity Trading in Local Energy Markets. Energies 2020, 13, 920. [Google Scholar] [CrossRef] [Green Version]

- Leelasantitham, A. A Business Model Guideline of Electricity Utility Systems Based on Blockchain Technology in Thailand: A Case Study of Consumers, Prosumers and SMEs. Wirel. Pers. Commun. 2020, 115, 3123–3136. [Google Scholar] [CrossRef]

- Khan, I. Drivers, enablers, and barriers to prosumerism in Bangladesh: A sustainable solution to energy poverty? Energy Res. Soc. Sci. 2019, 55, 82–92. [Google Scholar] [CrossRef]

- Ma, Z.; Bloch-Hansen, K.; Buck, J.W.; Hansen, A.K.; Henriksen, L.J.; Thielsen, C.F.; Santos, A.; Jorgensen, B.N. Peer-to-Peer Trading Solution for Microgrids in Kenya. 2018 IEEE PES/IAS PowerAfrica 2018, 1–425. [Google Scholar] [CrossRef]

- Thomason, J.; Ahmad, M.; Bronder, P.; Hoyt, E.; Pocock, S.; Bouteloupe, J.; Donaghy, K.; Huysman, D.; Willenberg, T.; Joakim, B.; et al. Blockchain-Powering and Empowering the Poor in Developing Countries. In Transforming Climate Finance and Green Investment with Blockchains; Academic Press: Cambridge, MA, USA, 2018; pp. 137–152. [Google Scholar] [CrossRef]

- Ighravwe, D.E.; Babatunde, M.O. Selection of a mini-grid business model for developing countries using CRITIC-TOPSIS with interval type-2 fuzzy sets. Decis. Sci. Lett. 2018, 7, 427–442. [Google Scholar] [CrossRef]

| Bidding Strategy | Definition | References |

|---|---|---|

| Zero intelligence | Refers to the simplest bidding method when players provide bids and asks randomly. This is done mostly without any previous background regarding the performance of the market | [25,26,28,38,39] |

| Zero intelligence plus | The case when the bidding is performed according to the previous performance of the market, something like human behavior in the stock market. | [23,38] |

| Game theoretic bidding strategy | Sellers and buyers are modeled in a game that has two or more players. Each game player tries to win the game by making the optimal decision. | [3,37,40,41,42,43,44] |

| Adaptive Aggressiveness | Throughout the learning approach, quotations are automatically adjusted by market players based on the price of the market. | [39,45,46] |

| Inversed-Production Pricing | The prosumer predicts produced energy of their devices for 15 min intervals depending on data collected from their historical performance, then setting a price according to the relation of supply and demand. | [47] |

| Intelligently bidding agents | The agent’s action is intelligent and makes bidding decisions based on reinforcement learning. | [36,48,49,50,51,52,53,54,55,56,57] |

| Parallel Multidimensional willingness | Multidimensional variables such as the historical records of trading data and counter behavior are modeled to mimic the microgrid fluctuation during bidding processes. | [46] |

| Prediction–integration | The past recorded transaction data are used by extreme machine learning that figures out the response of the electricity market to the prosumer’s bidding. | [38] |

| Market Clearing Method | References |

|---|---|

| Double Auction (DA) | [36,39,59,62,67,68,69] |

| Supply and Demand Ratio (SDR) | [60,62,63,67] |

| Mid-Market Rate (MMR) | [43,60,62,64,67,70] |

| Bill sharing (BS) | [60,65,67,71] |

| Game theory | [7,61,72,73,74] |

| Average mechanism | [18,37,75] |

| Pay-as-bid k-DA | [18,37,39] |

| Generalized second-price | [18,76] |

| Vickery–Clarke–Groves (VCG) | [18,37,41,77,78] |

| Trade reduction | [18,37] |

| Uniform price rule | [26,79,80] |

| Knapsack approximation | [81,82] |

| Greedy algorithm | [18,83,84] |

| Distributed optimization | [19,29,51,85,86,87,88] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Muhsen, H.; Allahham, A.; Al-Halhouli, A.; Al-Mahmodi, M.; Alkhraibat, A.; Hamdan, M. Business Model of Peer-to-Peer Energy Trading: A Review of Literature. Sustainability 2022, 14, 1616. https://doi.org/10.3390/su14031616

Muhsen H, Allahham A, Al-Halhouli A, Al-Mahmodi M, Alkhraibat A, Hamdan M. Business Model of Peer-to-Peer Energy Trading: A Review of Literature. Sustainability. 2022; 14(3):1616. https://doi.org/10.3390/su14031616

Chicago/Turabian StyleMuhsen, Hani, Adib Allahham, Ala’aldeen Al-Halhouli, Mohammed Al-Mahmodi, Asma Alkhraibat, and Musab Hamdan. 2022. "Business Model of Peer-to-Peer Energy Trading: A Review of Literature" Sustainability 14, no. 3: 1616. https://doi.org/10.3390/su14031616

APA StyleMuhsen, H., Allahham, A., Al-Halhouli, A., Al-Mahmodi, M., Alkhraibat, A., & Hamdan, M. (2022). Business Model of Peer-to-Peer Energy Trading: A Review of Literature. Sustainability, 14(3), 1616. https://doi.org/10.3390/su14031616