Can Biogas Plants Become a Significant Part of the New Polish Energy Deal? Business Opportunities for Poland’s Biogas Industry

Abstract

:1. Introduction

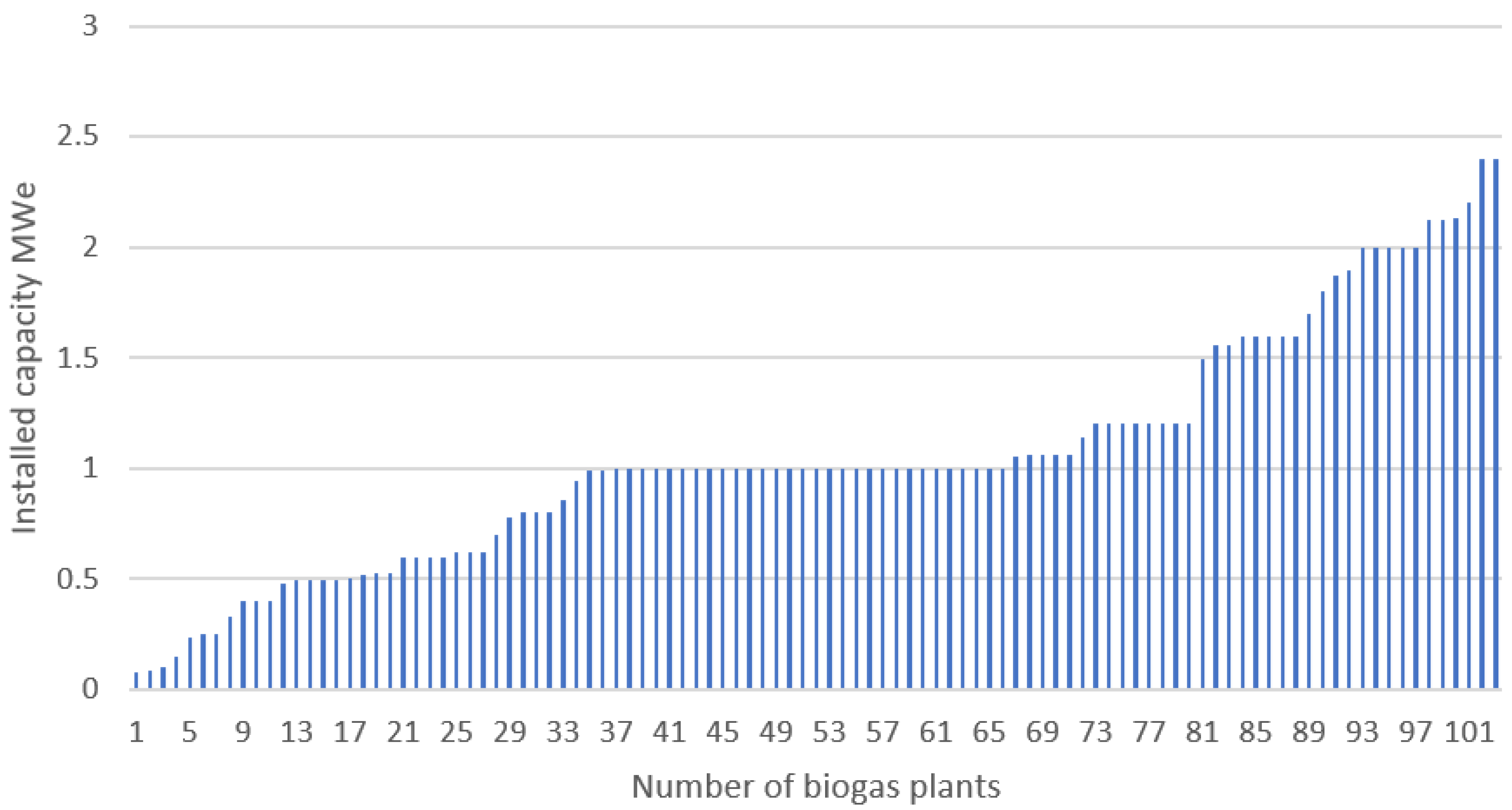

2. The Agricultural Biogas Sector in Poland

3. A Biogas Plant Operation Model

3.1. The National Biogas Electricity Sales Support System

3.2. The Cost and Revenue Structure of an Agricultural Biogas Plant

3.2.1. Operating Costs

- Costs of on-site energy consumption: estimated at 10% of the amount generated. Electricity can also be purchased at a lower price than the sale price of renewable energy from an external supplier. For the purposes of the analysis, a flat rate of EUR 54 (PLN 240) per 1 MWh was adopted.

- Taxes and fees: these include property tax on land and buildings, insurance, and third-party liability for outages. After analysing the financial statements of the existing plants, the annual cost was set at EUR 22.5 thousand (PLN 100,000).

- Payroll: 2–3 employees are needed to supervise the technological process and an extra 2 to perform maintenance duties. The average gross salary of each was assumed to be EUR 1800 (PLN 8000), which adds up to EUR 86.3–108 thousand (PLN 384,000–480,000) per year.

- External services: these may be considered separately or together with remuneration, depending on the adopted business model. In our model, we assume that the biogas plant takes advantage of some form of outsourcing, and the external services cost EUR 225 thousand (PLN 1,000,000) annually, which is slightly less than what the empirical data suggest.

- Financial costs: these are closely related to the financial structure of the investment and operating activities (e.g., interest due).

- Depreciation: annual depreciation rates are set separately for each asset component in accordance with the applicable regulations. On average, for the sake of simplification, the annual depreciation rate was set at 5% for the entire biogas plant.

3.2.2. Sales Revenue

3.3. Investment Costs Structure

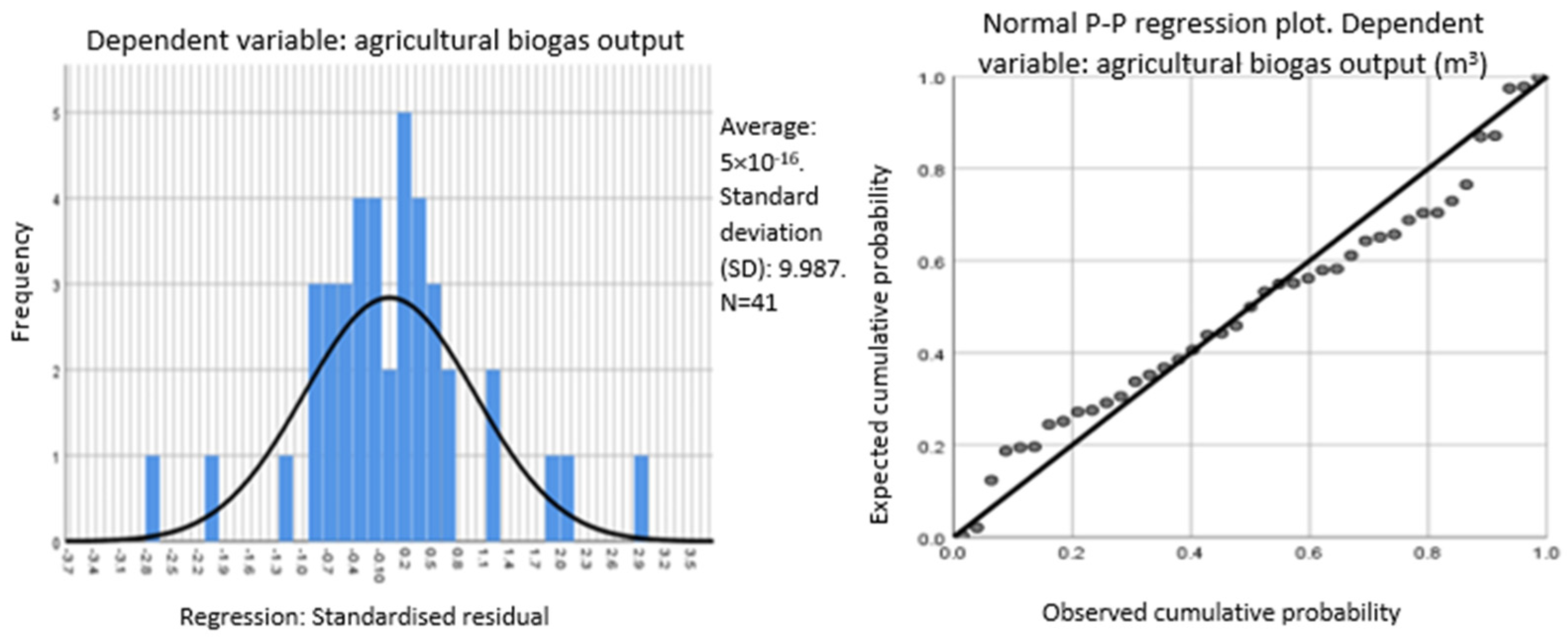

3.4. Biogas Potential

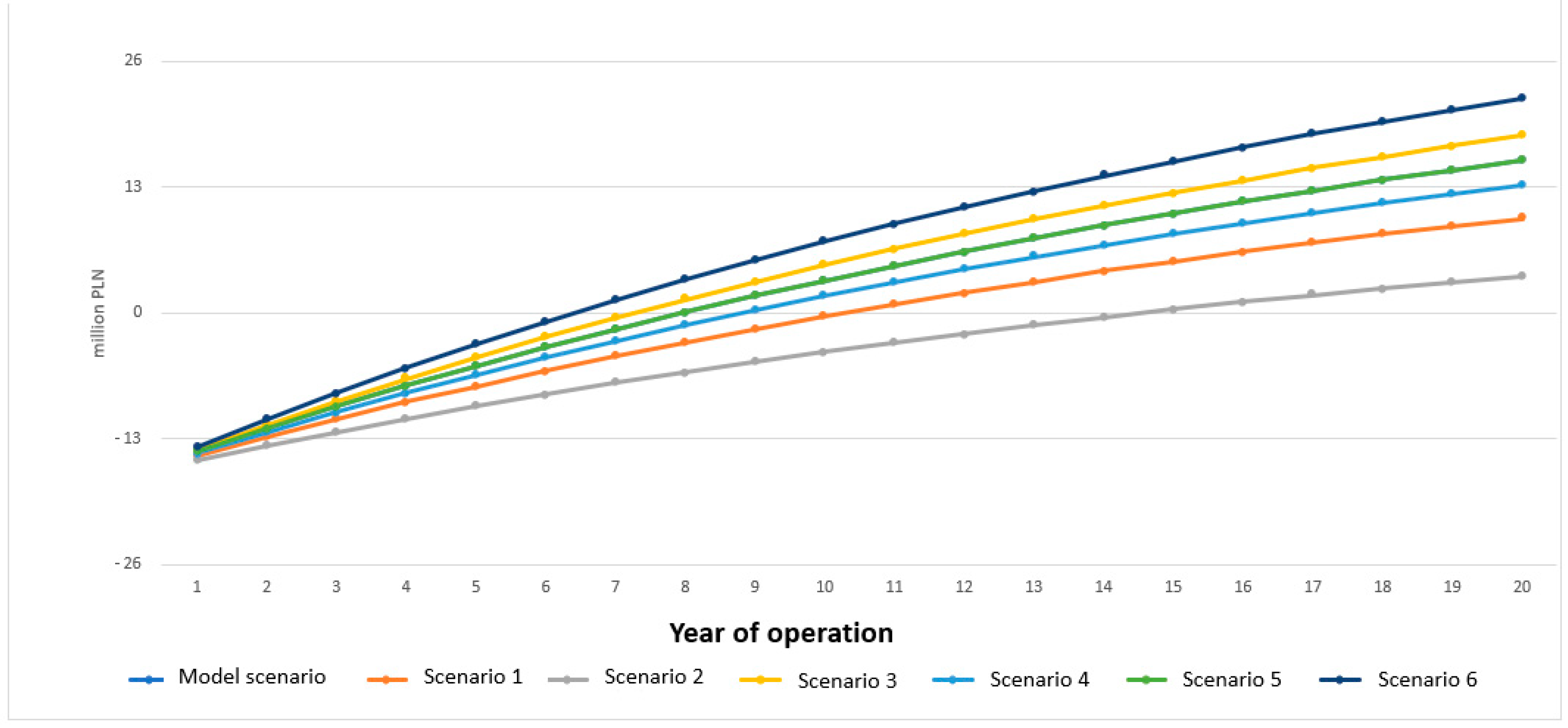

4. The Economic Efficiency Model

- A.

- Technical factors and output

- B.

- Substrate availability

- C.

- Digestate use and disposal

Simulations: Breakeven Analysis

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Herran, D.S.; Tachiiri, K.; Matsumoto, K. Global energy system transformations in mitigation scenarios considering climate uncertainties. Appl. Energy 2019, 243, 119–131. [Google Scholar] [CrossRef]

- EIA. International Energy Outlook 2019; The U.S. Energy Information Administration: Washington, DC, USA, 2019.

- Rozakis, S.; Bartoli, A.; Dach, J.; Jędrejek, A.; Kowalczyk-Juśko, A.; Mamica, Ł.; Pochwatka, P.; Pudelko, R.; Shu, K. Policy Impact on Regional Biogas Using a Modular Modeling Tool. Energies 2021, 14, 3738. [Google Scholar] [CrossRef]

- Claeys, G.; Tagliapietra, S.; Zachmann, G. How to make the European Green Deal work. Bruegel Policy Contrib. 2019, 13, 17. [Google Scholar]

- Cegielska, K.; Noszczyk, T.; Kukulska, A.; Szylar, M.; Hernik, J.; Dixon-Gough, R.; Jombach, S.; Valánszki, I.; Kovács, K.F. Land use and land cover changes in post-socialist countries: Some observations from Hungary and Poland. Land Use Policy 2018, 78, 1–18. [Google Scholar] [CrossRef]

- Kampas, A.; Rozakis, S.; Faber, A.; Mamica, Ł. Assessing the Green Growth Trajectory through Resource and Impact Decoupling Indices: The Case of Poland. Polish J. Environ. Stud. 2021, 30, 2573–2587. [Google Scholar] [CrossRef]

- Pirelli, T.; Chiumenti, A.; Morese, M.M.; Bonati, G.; Fabiani, S.; Pulighe, G. Environmental sustainability of the biogas pathway in Italy through the methodology of the Global Bioenergy Partnership. J. Clean. Prod. 2021, 318, 128483. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, H.; Kang, Y. Will Poland fulfill its coal commitment by 2030? An answer based on a novel time series prediction method. Energy Rep. 2020, 6, 1760–1767. [Google Scholar] [CrossRef]

- Yaqoob, H.; Teoh, Y.H.; Din, Z.U.; Sabah, N.U.; Jamil, M.A.; Mujtaba, M.; Abid, A. The potential of sustainable biogas production from biomass waste for power generation in Pakistan. J. Clean. Prod. 2021, 307, 127250. [Google Scholar] [CrossRef]

- Dobslaw, D.; Engesser, K.-H.; Störk, H.; Gerl, T. Low-cost process for emission abatement of biogas internal combustion engines. J. Clean. Prod. 2019, 227, 1079–1092. [Google Scholar] [CrossRef]

- Czekała, W. Biogas as a Sustainable and Renewable Energy Source. In Clean Fuels for Mobility; Di Blasio, G., Agarwal, A.K., Belgiorno, G., Shukla, P.C., Eds.; Springer: Singapore, 2022; pp. 201–214. [Google Scholar]

- Pilarski, G.; Kyncl, M.; Stegenta, S.; Piechota, G. Emission of Biogas from Sewage Sludge in Psychrophilic Conditions. Waste Biomass-Valorization 2019, 11, 3579–3592. [Google Scholar] [CrossRef]

- Igliński, B.; Kiełkowska, U.; Piechota, G.; Skrzatek, M.; Cichosz, M.; Iwański, P. Can energy self-sufficiency be achieved? Case study of Warmińsko-Mazurskie Voivodeship (Poland). Clean Technol. Environ. Policy 2021, 23, 2061–2081. [Google Scholar] [CrossRef]

- Igliński, B.; Buczkowski, R.; Iglińska, A.; Cichosz, M.; Piechota, G.; Kujawski, W. Agricultural biogas plants in Poland: Investment process, economical and environmental aspects, biogas potential. Renew. Sustain. Energy Rev. 2012, 16, 4890–4900. [Google Scholar] [CrossRef]

- Budzianowski, W.M. Sustainable biogas energy in Poland: Prospects and challenges. Renew. Sustain. Energy Rev. 2012, 16, 342–349. [Google Scholar] [CrossRef]

- Chodkowska-Miszczuk, J.; Szymańska, D. Agricultural biogas plants—A chance for diversification of agriculture in Poland. Renew. Sustain. Energy Rev. 2013, 20, 514–518. [Google Scholar] [CrossRef]

- Szymańska, D.; Chodkowska-Miszczuk, J. Endogenous resources utilization of rural areas in shaping sustainable development in Poland. Renew. Sustain. Energy Rev. 2011, 15, 1497–1501. [Google Scholar] [CrossRef]

- Przesmycka, A.; Podstawska, M. Ekonomiczna efektywność inwestycji w biogazownie rolnicze (Economic efficiency of investments in agricultural biogas plants). Rocz. Nauk. Stowarzyszenia Ekon. Rol. I Agrobiz. 2016, XVIII, 176–182. [Google Scholar]

- Kowalczyk-Juśko, A.; Listosz, A.; Flisiak, M. Spatial and social conditions for the location of agricultural biogas plants in Poland (case study). E3S Web Conf. 2019, 86, 00036. [Google Scholar] [CrossRef] [Green Version]

- Piechota, G.; Igliński, B. Biomethane in Poland—Current Status, Potential, Perspective and Development. Energies 2021, 14, 1517. Available online: https://www.mdpi.com/1996-1073/14/6/1517/htm#B1-energies-14-01517 (accessed on 20 December 2021). [CrossRef]

- Rzeznik, W.; Mielcarek, P. Agricultural biogas plants in Poland. In Proceedings of the 17th International Scientific Conference Engineering for Rural Development, Jelgava, Latvia, 23–25 May 2018; pp. 1760–1765. [Google Scholar]

- Koryś, K.A.; Latawiec, A.E.; Grotkiewicz, K.; Kuboń, M. The Review of Biomass Potential for Agricultural Biogas Production in Poland. Sustainability 2019, 11, 6515. [Google Scholar] [CrossRef] [Green Version]

- Dandikas, V.; Heuwinkel, H.; Lichti, F.; Drewes, J.E.; Koch, K. Predicting methane yield by linear regression models: A validation study for grassland biomass. Bioresour. Technol. 2018, 265, 372–379. [Google Scholar] [CrossRef]

- Zabolotnyy, S.; Melnyk, M. The Financial Efficiency of Biogas Stations in Poland. In Renewable Energy Sources: Engineering, Technology, Innovation: ICORES 2017; Werle, S., Mudryk, K., Eds.; Springer Proceedings in Energy; Springer: Cham, Germany, 2018; pp. 83–93. [Google Scholar]

- Igliński, B.; Piechota, G.; Iwański, P.; Skarzatek, M.; Pilarski, G. 15 Years of the Polish agricultural biogas plants: Their history, current status, biogas potential and perspectives. Clean Technol. Environ. Policy 2020, 22, 281–307. [Google Scholar] [CrossRef]

- Sławiński, K.; Piskier, T.; Bujaczek, R. Ocena przydatności kalkulatorów biogazowni przy planowaniu budowy biogazowni rolniczej (Assessment of the usefulness of biogas calculators in planning the construction of an agricultural biogas plant). Inżynieria Rolnicza 2012, 4, 369–375. [Google Scholar]

- Chomczyńska, M.; Pawłowska, M.; Szczepaniak, O.; Duma, E. Biogas Generation from Maize and Cocksfoot Growing in Degraded Soil Enriched with New Zeolite Substrate. Energies 2022, 15, 377. [Google Scholar] [CrossRef]

- Szymańska, D.; Lewandowska, A. Biogas Power Plants in Poland—Structure, Capacity, and Spatial Distribution. Sustainability 2015, 7, 16801–16819. [Google Scholar] [CrossRef] [Green Version]

- Polish Council of Ministers. Energy Policy of Poland Until 2040/ 2021. Available online: https://webcache.googleusercontent.com/search?q=cache:mhkuiUHjbAMJ:https://www.gov.pl/attachment/62a054de-0a3d-444d-a969-90a89502df94+&cd=4&hl=pl&ct=clnk&gl=pl (accessed on 20 December 2021).

- Olejniczak, K. Monitoring i ewaluacja. Zarządzanie strategiczne rozwojem. In Monitoring i ewaluacja. we współpracy z Karol Olejniczak; Ministerstwo Rozwoju Regionalnego: Warsaw, Poland, 2012. [Google Scholar]

- Winquist, E.; Rikkonen, P.; Pyysiäinen, J.; Varho, V. Is biogas an energy or a sustainability product?-Business opportunities in the Finnish biogas branch. J. Clean. Prod. 2019, 233, 1344–1354. [Google Scholar] [CrossRef]

- Wiśniewski, G.; Curkowski, A.; Pejas, B. Scenariusz Średnich Kosztów Energii Elektrycznej do Roku 2050 Oraz Cen W Taryfach Za Energię Elektryczną Dla Wybranych Grup Odbiorców Do Roku 2030 (Scenario of Average Costs of Electricity until 2050 and Prices in Electricity Tariffs for Selected Groups of Consumers until 2030). Energetyka–Społeczeństwo–Polityka 2017, 6, 53–80. Available online: https://www.ceeol.com/search/article-detail?id=731496 (accessed on 17 December 2021).

- Energy Policy of Poland until 2040: Warsaw; Ministry of Climate and Environment: Warsaw, Poland, 2021.

- Loizou, E.; Jurga, P.; Rozakis, S.; Faber, A. Assessing the Potentials of Bioeconomy Sectors in Poland Employing Input-Output Modeling. Sustainability 2019, 11, 594. [Google Scholar] [CrossRef] [Green Version]

- Sejm, R.P. Nowelizacja Ustawy o Zasadach Prowadzenia Polityki Rozwoju (Amendment of the Act on the Principles of Development Policy), Ustawa Dz.U. 2021 poz. 1057. 2021. Available online: http://www.glogow.pl/investin_en/index.php/biezace-wydarzenia-ciekawostki/155-the-amendment-to-the-act-on-the-principles-of-development-policy-is-waiting-for-the-president-s-signature (accessed on 17 December 2021).

- Brauers, H.; Oei, P.-Y. The political economy of coal in Poland: Drivers and barriers for a shift away from fossil fuels. Energy Policy 2020, 144, 111621. [Google Scholar] [CrossRef]

- GUS-Bank Danych Lokalnych. Cena Zakupu/Sprzedaży Użytków Rolnych Za 1 Ha w Obrocie Prywatnym (Purchase/Sale Price of Agricultural Land Per 1 Ha in Private Trade: Quarterly Data): Dane Kwartalne. Available online: https://bdl.stat.gov.pl/BDL/dane/podgrup/temat (accessed on 20 December 2021).

- World Energy Council. Poland. Available online: https://www.worldenergy.org/impact-communities/members/entry/poland (accessed on 20 December 2021).

- Eurostat. Supply, Transformation and Consumption of Renewables and Wastes. 2021. Available online: https://data.europa.eu/data/datasets/g1jpiyeuj4xmijqu6eq?locale=en (accessed on 20 December 2021).

- Ministerstwo Klimatu. Rozporządzenie Ministra Klimatu Z Dnia 24 Czerwca 2020 R. W Sprawie Zawartości Biokomponentów Powstałych W Wyniku Współuwodornienia (Regulation of the Minister of Climate of 24 June 2020 on the Content of Biocomponents Resulting from Co-Hydrogenation). Available online: https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20200001141 (accessed on 29 January 2021).

- Muradin, M.; Foltynowicz, Z. Potential for Producing Biogas from Agricultural Waste in Rural Plants in Poland. Sustainability 2014, 6, 5065–5074. [Google Scholar] [CrossRef] [Green Version]

- GRAMwZIELONE.pl. MDI Z Umowami Na Budowę Biogazowni Na Niemal 30 mln zł (MDI with Contracts for the Construction of a Biogas Plant for Almost PLN 30 Million). Available online: https://www.gramwzielone.pl/bioenergia/102062/mdi-z-umowami-na-budowe-biogazowni-za-niemal-30-mln-zl (accessed on 29 January 2021).

- Przykłady Obliczeniowe Biogaz Inwest (Calculation Examples Biogaz Inwest. IEO Institute of Renewable Energy); IEO: Warsaw, Poland, 2020.

- Zapałkowska, A.; Gacek, T. Ekonomiczne aspekty pozyskiwania i wykorzystywania biogazu (Economic aspects of obtaining and using biogas). Pol. J. Sustain. Dev. 2019, 23. [Google Scholar]

- Kajdan, T. Ciepło Z Biogazu W Lokalnych Instalacjach Suszarniczych (Heat from Biogas in Local Drying Installations). Magazyn Biomasa. 2016. Available online: https://magazynbiomasa.pl/cieplo-z-biogazowni/ (accessed on 15 December 2021).

| Animal Waste/Maize Silage | Investment Funding | Sale of Heat | Breakeven Point MWh | NPV (EUR Thousand) | |

|---|---|---|---|---|---|

| Model scenario | 80%/20% | 100% own capital | No | 4962 | 3373 |

| Scenario 1 | 60%/40% | 100% own capital | No | 5830 | 2200 |

| Scenario 2 | 40%/60% | 100% own capital | No | 7066 | 855 |

| Scenario 3 | 80%/20% | 60% subsidy | No | 4962 | 4152 |

| Scenario 4 | 80%/20% | 100% bank credit | No | 4962 | 2924 |

| Scenario 5 | 100% waste | 100% own capital | No | 4562 | 3374 |

| Scenario 6 | 100% waste | 100% own capital | Yes | 4562 | 3396 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mamica, Ł.; Mazur-Bubak, M.; Wróbel-Rotter, R. Can Biogas Plants Become a Significant Part of the New Polish Energy Deal? Business Opportunities for Poland’s Biogas Industry. Sustainability 2022, 14, 1614. https://doi.org/10.3390/su14031614

Mamica Ł, Mazur-Bubak M, Wróbel-Rotter R. Can Biogas Plants Become a Significant Part of the New Polish Energy Deal? Business Opportunities for Poland’s Biogas Industry. Sustainability. 2022; 14(3):1614. https://doi.org/10.3390/su14031614

Chicago/Turabian StyleMamica, Łukasz, Monika Mazur-Bubak, and Renata Wróbel-Rotter. 2022. "Can Biogas Plants Become a Significant Part of the New Polish Energy Deal? Business Opportunities for Poland’s Biogas Industry" Sustainability 14, no. 3: 1614. https://doi.org/10.3390/su14031614

APA StyleMamica, Ł., Mazur-Bubak, M., & Wróbel-Rotter, R. (2022). Can Biogas Plants Become a Significant Part of the New Polish Energy Deal? Business Opportunities for Poland’s Biogas Industry. Sustainability, 14(3), 1614. https://doi.org/10.3390/su14031614