Go Cashless! Mobile Payment Apps Acceptance in Developing Countries: The Jordanian Context Perspective

Abstract

1. Introduction

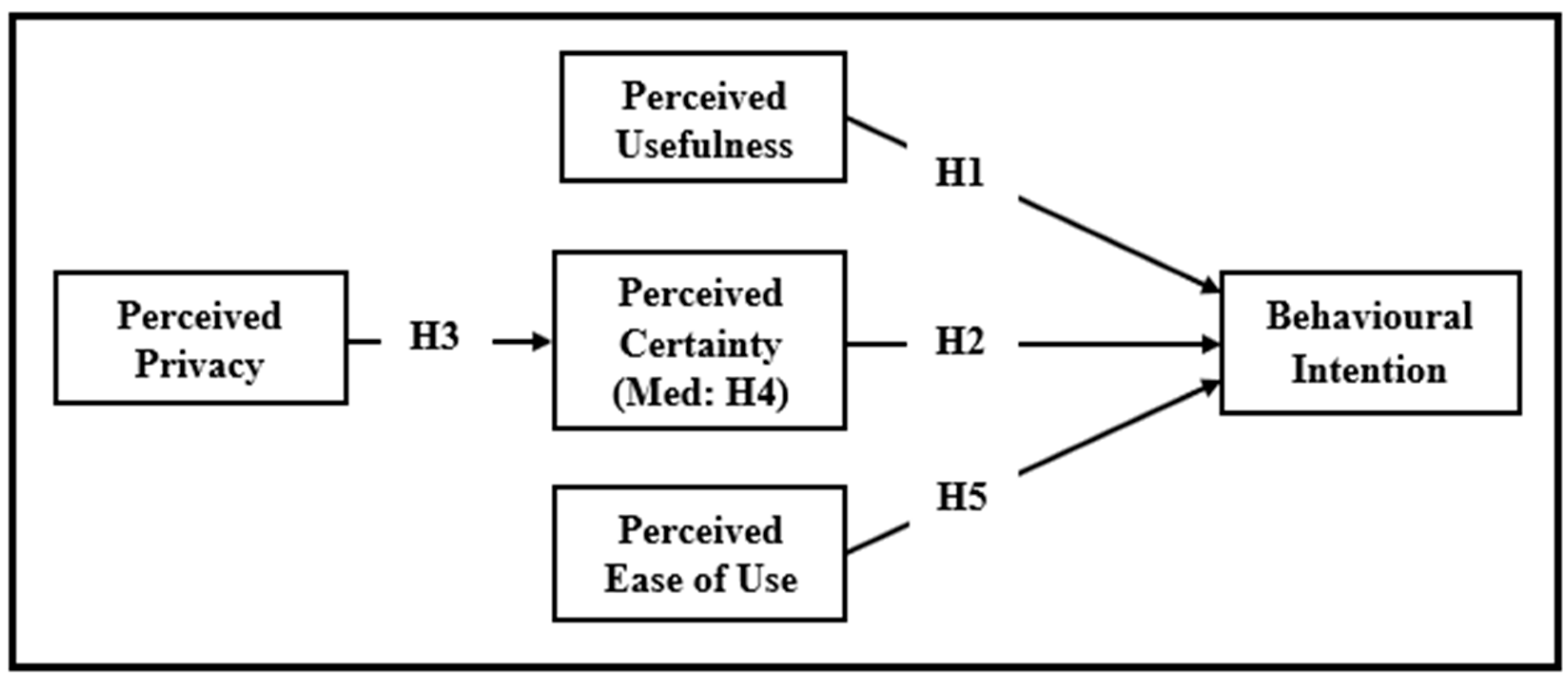

2. Theoretical Background and Hypothesis Development

2.1. Perceived Usefulness

2.2. Perceived Certainty

2.3. Perceived Ease of Use

3. Research Methodology

4. Evaluation of the Model Quality for PLS-SEM

4.1. PLS-SEM Measurement Model

4.1.1. Convergent Validity

4.1.2. Discriminant Validity

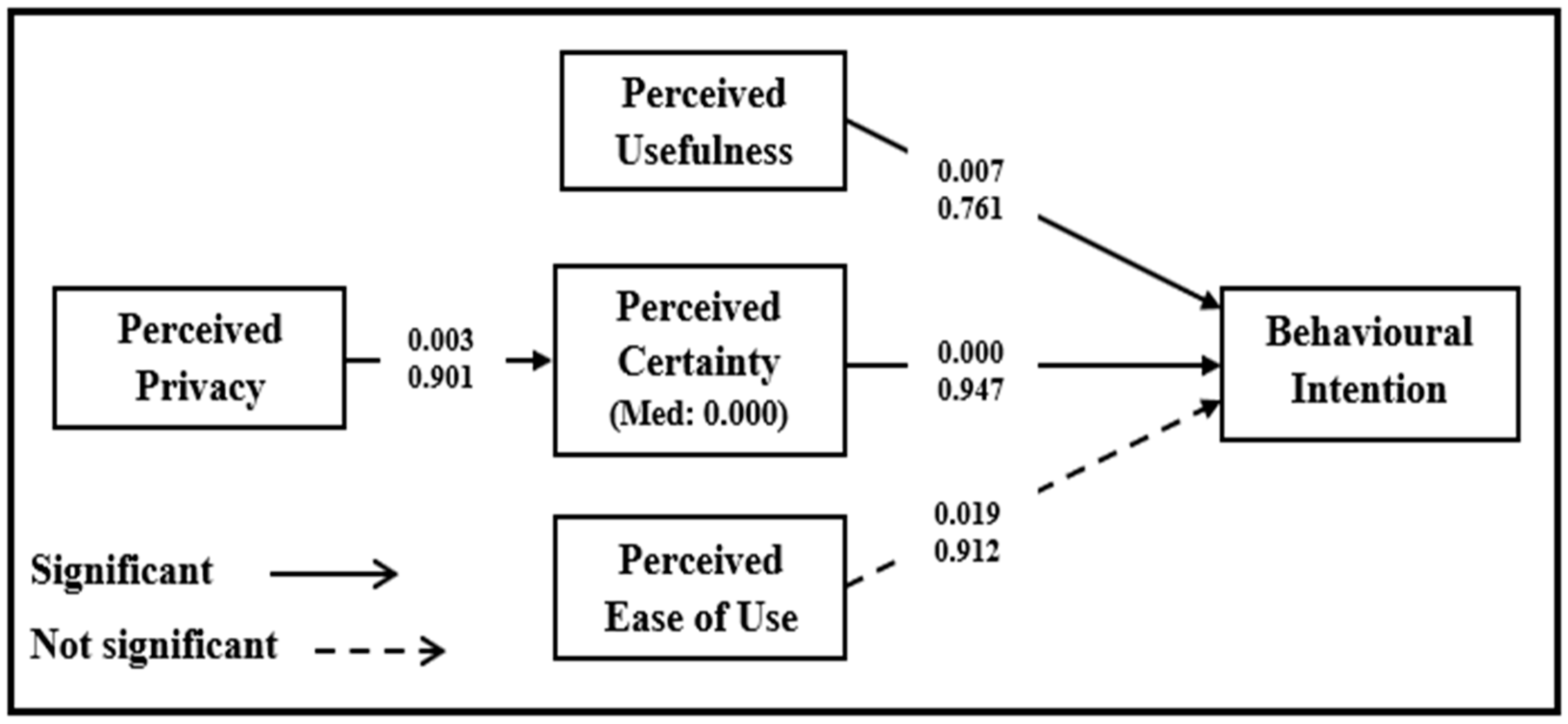

4.2. PLS-SEM Structural Model

5. Research Discussion

6. Research Implications

6.1. Theoretical Implications

6.2. Managerial Implications

7. Conclusions, Limitations, and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Al-Adwan, A.; Sammour, G. What Makes Consumers Purchase Mobile Apps: Evidence from Jordan. J. Theor. Appl. Electron. Commer. Res. 2020, 16, 562–583. [Google Scholar] [CrossRef]

- Al-Adwan, A.S.; Nofal, M.; Akram, H.; Albelbisi, N.A.; Al-Okaily, M. Towards a Sustainable Adoption of E-Learning Systems: The Role of Self-Directed Learning. J. Inf. Technol. Educ. Res. 2022, 21, 245–267. [Google Scholar]

- Shaikh, A.A.; Alamoudi, H.; Alharthi, M.; Glavee-Geo, R. Advances in mobile financial services: A review of the literature and future research directions. Int. J. Bank Mark. 2022; ahead of print. [Google Scholar] [CrossRef]

- Choi, T.-M. Mobile-App-Online-Website Dual Channel Strategies: Privacy Concerns, E-Payment Convenience, Channel Relationship, and Coordination. IEEE Trans. Syst. Man Cybern. Syst. 2020, 51, 7008–7016. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Alqudah, H.; Al-Qudah, A.A.; Al-Qadi, N.S.; Elrehail, H.; Al-Okaily, A. Does financial awareness increase the acceptance rate for financial inclusion? An empirical examination in the era of digital transformation. Kybernetes, 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Statista. Forecast Number of Mobile Devices Worldwide from 2020 to 2025 (in Billions). Available online: https://www.statista.com/statistics/245501/multiple-mobile-device-ownership-worldwide/#:~:text=The%20number%20of%20mobile%20devices%20is%20expected%20to%20reach%2018.22,devices%20compared%20to%202020%20levels (accessed on 24 September 2022).

- DIGITAL 2020: JORDAN. Mobile Connections in Jordan. 2020. Available online: https://datareportal.com/reports/digital-2020-jordan (accessed on 18 August 2022).

- Almajali, D.A. Determinants of Online Behavior Among Jordanian Consumers: An Empirical Study of OpenSooq. Interdiscip. J. Inf. Knowl. Manag. 2022, 17, 339–359. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Alalwan, A.A.; Al-Fraihat, D.; Alkhwaldi, A.F.; Rehman, S.U.; Al-Okaily, A. Investigating antecedents of mobile payment systems’ decision-making: A mediated model. Glob. Knowl. Mem. Commun. 2022; ahead of print. [Google Scholar] [CrossRef]

- Central Bank of Jordan. Jordan Financial Stability Report-2017. Available online: http://www.cbj.gov.jo/Pages/viewpage.aspx?pageID=45 (accessed on 17 June 2020).

- Al Hanandeh, A.; Bahou, M. Interview with The Jordanian Official Television—Good Morning Program—Encourage Citizens to Make Electronic Payment, 2016, February 5 [Video File]. Available online: https://www.youtube.com/watch?v=aX9e0ac9NOc&t=939s (accessed on 5 January 2020).

- Central Bank of Jordan. Jordan Financial Stability Report-2014. Available online: http://www.cbj.gov.jo/EchoBusV3.0/SystemAssets/PDFs/EN/FINANCIAL%20STABILITY%20REPORT%202016.pdf (accessed on 22 June 2020).

- Al-Qudah, A.A.; Hamdan, A.; Al-Okaily, M.; Alhaddad, L. The impact of green lending on credit risk: Evidence from UAE’s banks. Environ. Sci. Pollut. Res. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Karjaluoto, H.; Shaikh, A.A.; Leppäniemi, M.; Luomala, R. Examining consumers’ usage intention of contactless payment systems. Int. J. Bank Mark. 2019, 38, 332–351. [Google Scholar] [CrossRef]

- Liu, Z.; Ben, S.; Zhang, R. Factors affecting consumers’ mobile payment behavior: A meta-analysis. Electron. Commer. Res. 2019, 19, 575–601. [Google Scholar] [CrossRef]

- Al-Bashayreh, M.; Almajali, D.; Altamimi, A.; Masa’deh, R.E.; Al-Okaily, M. An Empirical Investigation of Reasons Influencing Student Acceptance and Rejection of Mobile Learning Apps Usage. Sustainability 2022, 14, 4325. [Google Scholar] [CrossRef]

- Al-Okaily, A.; Al-Okaily, M.; Teoh, A.P. Evaluating ERP systems success: Evidence from Jordanian firms in the age of the digital business. VINE J. Inf. Knowl. Manag. Syst. 2021; ahead of print. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Alghazzawi, R.; Alkhwaldi, A.F.; Al-Okaily, A. The effect of digital accounting systems on the decision-making quality in the banking industry sector: A mediated-moderated model. Glob. Knowl. Mem. Commun. 2022; ahead of print. [Google Scholar] [CrossRef]

- Sharma, S.K.; Sharma, M. Examining the role of trust and quality dimensions in the actual usage of mobile banking services: An empirical investigation. Int. J. Inf. Manag. 2018, 44, 65–75. [Google Scholar] [CrossRef]

- Angelina, C.; Rahadi, R.A. A Conceptual Study on the Factors Influencing Usage Intention Of E-Wallets in Java, Indonesia. Int. J. Account. 2020, 5, 19–29. [Google Scholar]

- Singh, S.; Srivastava, R. Predicting the intention to use mobile banking in India. Int. J. Bank Mark. 2018, 36, 357–378. [Google Scholar] [CrossRef]

- Belanche, D.; Guinalíu, M.; Albás, P. Customer adoption of p2p mobile payment systems: The role of perceived risk. Telemat. Inform. 2022, 72, 101851. [Google Scholar] [CrossRef]

- Türker, C.; Altay, B.C.; Okumuş, A. Understanding user acceptance of QR code mobile payment systems in Turkey: An extended TAM. Technol. Forecast. Soc. Chang. 2022, 184, 121968. [Google Scholar] [CrossRef]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong, J.Y.; Xu, X. Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Q. 2012, 36, 157–178. [Google Scholar] [CrossRef]

- Al-Omoush, K.S.; Al Attar, M.K.; Saleh, I.H.; Alsmadi, A.A. The drivers of E-banking entrepreneurship: An empirical study. Int. J. Bank Mark. 2019, 38, 485–500. [Google Scholar] [CrossRef]

- Al-Qudah, A.A.; Al-Okaily, M.; Alqudah, G.; Ghazlat, A. Mobile payment adoption in the time of the COVID-19 pandemic. Electron. Commer. Res. 2022; ahead of print. [Google Scholar] [CrossRef]

- Egger, F.N.; Abrazhevich, D. Security & Trust: Taking Care of the Human Factor. In Electronic Payment Systems; Observatory Newsletter: Switzerland, 2001; Available online: http://www.ecommuse.com/research/publications/epso.htm (accessed on 15 September 2020).

- Alalwan, A.; Dwivedi, Y.K.; Rana, N. Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. Int. J. Inf. Manag. 2017, 37, 99–110. [Google Scholar] [CrossRef]

- Al-Emran, M.; Teo, T. Do knowledge acquisition and knowledge sharing really affect e-learning adoption? An empirical study. Educ. Inf. Technol. 2019, 25, 1983–1998. [Google Scholar] [CrossRef]

- Rita, P.; Oliveira, T.; Estorninho, A.; Moro, S. Mobile services adoption in a hospitality consumer context. Int. J. Cult. Tour. Hosp. Res. 2018, 12, 143–158. [Google Scholar] [CrossRef]

- Krejcie, R.V.; Morgan, D.W. Determining Sample Size for Research Activities. Educ. Psychol. Meas. 1970, 30, 607–610. [Google Scholar] [CrossRef]

- Casaló, L.V.; Flavián, C.; Guinalíu, M. The role of security, privacy, usability and reputation in the development of online banking. Online Inf. Rev. 2007, 31, 583–603. [Google Scholar] [CrossRef]

- Gefen, D.; Karahanna, E.; Straub, D.W. Trust and TAM in Online Shopping: An Integrated Model. MIS Q. 2003, 27, 51–90. [Google Scholar] [CrossRef]

- Brislin, R.W. The Wording and Translation of Research Instruments; Sage Publications: London, UK, 1986. [Google Scholar]

- Aws, A.L.; Ping, T.A.; Al-Okaily, M. Towards business intelligence success measurement in an organization: A conceptual study. J. Syst. Manag. Sci. 2021, 11, 155–170. [Google Scholar]

- Al-Okaily, M.; Al-Okaily, A. An empirical assessment of enterprise information systems success in a developing country: The Jordanian experience. TQM J. 2022; ahead of print. [Google Scholar] [CrossRef]

- Sekaran, U. Research Methods for Business: A Skill Building Approachss; John Wiley & Sons: New York, NY, USA, 2003. [Google Scholar]

- Foddy, W.; Mantle, J. Constructing Questions for Interviews and Questionnaires—Theory and practice in social research. Physiotherapy 1994, 80, 382. [Google Scholar] [CrossRef]

- Valerie, F. Re-discovering the PLS approach in management science. Management 2012, 15, 101–123. [Google Scholar]

- Hair, J.F.; Hult, J.G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); SAGE Publications: New York, NY, USA, 2014. [Google Scholar]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Structural equation models with unobservable variables and measurement error: Algebra and statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Alampay, E.A.; Moshi, G.C.; Ghosh, I.; Peralta, M.L.; Harshanti, J. The Impact of Mobile Financial Services in Low and Lower-Middle-Mncome Countries; International Development Research Centre (IDRC): Ottawa, ON, Canada; Department for International Development (DfID): London, UK, 2017. [Google Scholar]

- Al-Okaily, M. Assessing the effectiveness of accounting information systems in the era of COVID-19 pandemic. VINE J. Inf. Knowl. Manag. Syst. 2021; ahead-of-print. [Google Scholar] [CrossRef]

- Potnis, D.D.; Gaur, A.; Singh, J.B. Analysing slow growth of mobile money market in India using a market separation perspective. Inf. Technol. Dev. 2019, 26, 369–393. [Google Scholar] [CrossRef]

- Abdelrahman, E.S.A. The Challenges of Islamic Trade Finance in Promoting SMEs in IsDB Member Countries. In Empowering the Poor through Financial and Social Inclusion in Africa; Palgrave Macmillan: Cham, Switzerland, 2022; pp. 103–117. [Google Scholar]

- Alsmadi, A.A.; Shuhaiber, A.; Alhawamdeh, L.N.; Alghazzawi, R.; Al-Okaily, M. Twenty Years of Mobile Banking Services Development and Sustainability: A Bibliometric Analysis Overview (2000–2020). Sustainability 2022, 14, 10630. [Google Scholar] [CrossRef]

- Andronie, M.; Lăzăroiu, G.; Ștefănescu, R.; Ionescu, L.; Cocoșatu, M. Neuromanagement Decision-Making and Cognitive Algorithmic Processes in the Technological Adoption of Mobile Commerce Apps. Oeconomia Copernic. 2021, 12, 863–888. [Google Scholar] [CrossRef]

- Barbu, C.; Florea, D.; Dabija, D.-C.; Barbu, M. Customer Experience in Fintech. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1415–1433. [Google Scholar] [CrossRef]

- Kliestik, T.; Valaskova, K.; Lazaroiu, G.; Kovacova, M.; Vrbka, J. Institute of Technology and Business in České Budějovice Remaining Financially Healthy and Competitive: The Role of Financial Predictors. J. Compet. 2020, 12, 74–92. [Google Scholar] [CrossRef]

| Category | Coding | Frequency |

|---|---|---|

| Gender | Male | 143 |

| Female | 127 | |

| Total | 270 | |

| Age | Less than 30 | 54 |

| 30–40 | 138 | |

| 41–50 | 61 | |

| More than 50 | 17 | |

| Total | 270 | |

| Education Level | Bachelor’s | 155 |

| Master’s | 42 | |

| PhD | 11 | |

| Others | 62 | |

| Total | 270 | |

| Duration of Mobile Phone Use | Less than 3 | 23 |

| 3–6 | 56 | |

| 7–9 | 46 | |

| More than 9 | 145 | |

| Total | 270 | |

| Duration of Internet Use | Less than 3 | 38 |

| 3–6 | 59 | |

| 7–9 | 52 | |

| More than 9 | 121 | |

| Total | 270 | |

| Mobile Payment System Use Status | User | 22 |

| Non-User | 270 | |

| Total | 292 |

| Construct Name | Item Name | Item Loading | Cronbach’s Alpha | CR | AVE |

|---|---|---|---|---|---|

| >0.70 | ≥0.70 | ≥0.70 | ≥0.50 | ||

| Perceived Usefulness | PU1 | 0.810 | 0.813 | 0.761 | 0.757 |

| PU2 | Deleted | ||||

| PU3 | 0.839 | ||||

| PU4 | 0.848 | ||||

| Perceived Ease of Use | PEU1 | Deleted | 0.892 | 0.912 | 0.865 |

| PEU2 | 0.874 | ||||

| PEU3 | 0.943 | ||||

| PEU4 | 0.920 | ||||

| Perceived Privacy | PP1 | 0.904 | 0.881 | 0.901 | 0.708 |

| PP2 | 0.890 | ||||

| PP3 | 0.880 | ||||

| Perceived Certainty | PC1 | 0.893 | 0.938 | 0.947 | 0.872 |

| PC2 | 0.951 | ||||

| PC3 | 0.925 | ||||

| Behavioral Intention | BI1 | 0.931 | 0.945 | 0.961 | 0.845 |

| BI2 | 0.948 | ||||

| BI3 | 0.952 | ||||

| BI4 | 0.947 |

| Construct | HTMT < 0.90 | PC | PEU | BI | PU | PP |

|---|---|---|---|---|---|---|

| PC | Yes | 0.881 | ||||

| PEU | Yes | 0.613 | 0.946 | |||

| BI | Yes | 0.535 | 0.597 | 0.931 | ||

| PU | Yes | 0.686 | 0.663 | 0.690 | 0.785 | |

| PP | Yes | 0.471 | 0.425 | 0.504 | 0.525 | 0.907 |

| Item | PC | PEU | BI | PU | PP |

|---|---|---|---|---|---|

| BI1 | 0.594 | 0.524 | 0.943 | 0.631 | 0.480 |

| BI2 | 0.642 | 0.593 | 0.955 | 0.677 | 0.501 |

| BI3 | 0.545 | 0.536 | 0.941 | 0.628 | 0.455 |

| BI4 | 0.605 | 0.594 | 0.934 | 0.661 | 0.458 |

| PEU2 | 0.578 | 0.964 | 0.587 | 0.654 | 0.418 |

| PEU3 | 0.557 | 0.954 | 0.510 | 0.598 | 0.356 |

| PEU4 | 0.602 | 0.940 | 0.590 | 0.626 | 0.424 |

| PU1 | 0.580 | 0.460 | 0.577 | 0.820 | 0.466 |

| PU3 | 0.610 | 0.476 | 0.594 | 0.839 | 0.446 |

| PU4 | 0.502 | 0.647 | 0.511 | 0.798 | 0.353 |

| PP1 | 0.433 | 0.383 | 0.448 | 0.491 | 0.895 |

| PP2 | 0.448 | 0.419 | 0.439 | 0.449 | 0.930 |

| PP3 | 0.420 | 0.330 | 0.452 | 0.454 | 0.955 |

| PC1 | 0.891 | 0.520 | 0.669 | 0.669 | 0.485 |

| PC2 | 0.904 | 0.550 | 0.635 | 0.689 | 0.491 |

| PC3 | 0.912 | 0.494 | 0.506 | 0.534 | 0.366 |

| No. | Case No. | χ 1 Value |

|---|---|---|

| 1. | 244 | 44.872 |

| 2. | 129 | 43.570 |

| 3. | 141 | 38.981 |

| 4. | 123 | 35.481 |

| No. | Relationship | Standard Beta | T Value | p- Value | Sig. | Decision | |

|---|---|---|---|---|---|---|---|

| IV | DV | ||||||

| H1 | PU -----> BI | 0.216 | 2.901 | 0.007 | Sig. + | Supported | |

| H2 | PC -----> BI | 0.221 | 3.534 | 0.000 | Sig. + | Supported | |

| H3 | PP -----> PC | 0.113 | 3.805 | 0.003 | Sig. + | Supported | |

| H4 | PP -> PC -> BI | 0.321 | 7.436 | 0.000 | Sig. + | Supported | |

| H5 | PEU -----> BI | 0.055 | 0.282 | 0.019 | N.S. | Not supported | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Almajali, D.; Al-Okaily, M.; Al-Daoud, K.; Weshah, S.; Shaikh, A.A. Go Cashless! Mobile Payment Apps Acceptance in Developing Countries: The Jordanian Context Perspective. Sustainability 2022, 14, 13524. https://doi.org/10.3390/su142013524

Almajali D, Al-Okaily M, Al-Daoud K, Weshah S, Shaikh AA. Go Cashless! Mobile Payment Apps Acceptance in Developing Countries: The Jordanian Context Perspective. Sustainability. 2022; 14(20):13524. https://doi.org/10.3390/su142013524

Chicago/Turabian StyleAlmajali, Dmaithan, Manaf Al-Okaily, Khaleel Al-Daoud, Sulaiman Weshah, and Aijaz A. Shaikh. 2022. "Go Cashless! Mobile Payment Apps Acceptance in Developing Countries: The Jordanian Context Perspective" Sustainability 14, no. 20: 13524. https://doi.org/10.3390/su142013524

APA StyleAlmajali, D., Al-Okaily, M., Al-Daoud, K., Weshah, S., & Shaikh, A. A. (2022). Go Cashless! Mobile Payment Apps Acceptance in Developing Countries: The Jordanian Context Perspective. Sustainability, 14(20), 13524. https://doi.org/10.3390/su142013524