1. Introduction

In the B2B market, many firms form a buyer group to jointly purchase products from their suppliers (referred to as “group buying”). The motivation for these firms to engage in group buying is that they can pool the demands of all members, obtain quantity discounts from their suppliers at a lower wholesale price, and thus increase their profits. The use of the group buying strategy is widely observed in business practice. For example, the appliance retailer Filco purchases cooperatively with Selective Consolidated Dealers Co-Op to obtain an additional 4% to 6% rebate from their upstream suppliers [

1,

2]. As another example, the air-conditioning retailer Kelon and the washing machine retailer LittleSwan jointly set up an e-commerce system to purchase raw materials, which brings them a 10% to 15% saving in purchasing costs [

3]. Although group buying reduces wholesale prices and purchasing costs for retailers, it also intensifies retail competition in the final market. To this end, retailers can employ strategic inventory to alleviate the competitive pressures caused by group buying. Most firms hold typical inventory such as pipeline inventory, speculative inventory, and safety inventory in order to better cope with supply or demand uncertainty. However, strategic inventory is purchased and held by a retailer with the sole purpose of enhancing bargaining power with his supplier in the future [

4,

5,

6]. In this paper, we intend to study group buying with strategic inventory, which can not only help retailers and suppliers make decisions, but also fill the gaps in previous research on group buying and strategic inventory. Therefore, we hope to shed light on the following research questions: (1) How will strategic inventory under group buying affect the operational decisions of the retailers and their supplier? (2) How will the competition among the retailers with strategic inventory affect the profits of all members of the supply chain?

Motivated by the above questions, we consider a two-tier distribution channel where two competing retailers purchase homogeneous products together from a supplier and compete in the final market by selling to consumers in two periods. The retailers may hold strategic inventory from period 1 to period 2. We consider a Stackelberg game where the supplier is the leader and the retailers are the followers. The supplier first sets her discount rate, and then the retailers simultaneously decide their purchasing quantities. We build models of the supplier and the retailers under group buying with and without strategic inventory, and use backward induction to obtain the equilibrium outcomes of the retail prices, wholesale prices, retail quantities, purchasing quantities, strategic inventory levels, profits, and consumer surplus. By comparing the equilibrium outcomes under group buying with and without strategic inventory, we explore the effect of strategic inventory on the retailers, the supplier, the supply chain, and consumers.

By analyzing the strategic inventory levels of the retailers under group buying with strategic inventory in equilibrium, we obtain the condition for the existence of strategic inventory. Specifically, the retailers will hold strategic inventory under group buying only when the holding cost is low or the basic wholesale price is high. We also show that the retailers’ strategic inventory levels are related to the basic wholesale price, the holding cost, and the competition intensity. A lower base wholesale price, a higher holding cost, or intensified retail competition leads to lower strategic inventory levels. Moreover, by analyzing the equilibrium profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, in the two periods under group buying with strategic inventory, we show the impacts of the holding cost and the competition intensity on them. We find that a higher holding cost is detrimental to the retailers, the supply chain, and consumers, but it is beneficial to the supplier. On the other hand, intensified competition is detrimental to all members of the supply chain.

Furthermore, by comparing the profits and consumer surplus in two periods under group buying with and without strategic inventory, we explore the effect of strategic inventory on the profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, in the two periods. We find that, contrary to the common view that inventory should be reduced or not held, the retailers have incentives to hold strategic inventory because strategic inventory benefits them. The supplier also prefers that because strategic inventory benefits her. In addition, strategic inventory can improve supply chain performance and consumer surplus. The higher the holding cost, the less the profits of the retailers and the supply chain, as well as consumer surplus, increase, while the more the supplier’s profit increases. The higher the competition intensity, the less the profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, increase.

In this paper, we make the following major contributions. First, we construct a two-period model under group buying, while the existing studies only study group buying in one period. Second, the existing studies on group buying only focus on joint purchasing of several retailers, but do not consider the existence of strategic inventory. In contrast, our study is the first paper to study group buying in the presence of strategic inventory. Finally, we examine the impact of strategic inventory on the operational decisions of a supplier and two retailers in a competing environment, while existing studies on strategic inventory only focus on the non-competitive environment.

The remainder of this paper is organized as follows.

Section 2 reviews the related literature.

Section 3 introduces our two-period model.

Section 4 presents an equilibrium analysis of group buying with and without strategic inventory.

Section 5 draws the corresponding results by comparing the two strategies. The discussion and conclusion are provided in

Section 6.

2. Literature Review

Our paper is related to two streams of literature, that is, group buying and strategic inventory. In this section, we review them, respectively.

As an innovative transaction mode, group buying has witnessed rapid growth in recent years. Extensive studies of group buying have appeared in the literature [

7,

8,

9]. For example, Chen and Roma [

10] consider that two competing retailers individually or cooperatively purchase products from a manufacturer and compete in the final market by selling to customers. He et al. [

11] consider a supply chain consisting of a supplier and two competing retailers with fairness concerns, and study the optimal decisions for the players under individual purchasing and group buying. Zhang and Liu [

12] investigate the effects of pricing and ordering in group buying, and consider the joint decision on the pricing and ordering of short-life-cycle products in a competing market. Jain and Hazra [

13] consider that two symmetric buyers procure their capacity from a common supplier or from different geographies, and explore how factors in downstream-market-competition and upstream-agglomeration-scale economies affect the buyers’ purchasing strategies. Hu and Zhou [

14] consider a two-tier supply chain consisting of an upstream technology service provider and two competing retailers, and study the strategic choices of the retailers and the provider. The above studies on group buying focus on the benefits that buyers obtain but ignore the suppliers’ response to group buying. Subsequently, Zhou and Xie [

15] take the supplier’s response into consideration, and consider that two symmetric competing retailers individually or cooperatively purchase products from a supplier. Similar to Zhou and Xie [

15], our work also takes into account the supplier’s response.

Many factors, such as fairness-concern behavior [

11], asymmetry information [

2,

16], contract type [

17], and bargaining power [

18], may affect retailers’ optimal choices under group buying. He et al. [

11] study the impact of the fairness-concern behavior of retailers on the optimal decisions for the players under individual purchasing and group buying, and show that fairness-concern behavior does not always hurt the profit of the supplier. Yan et al. [

2] consider that two retailers with asymmetric demand information individually or jointly purchase products from a supplier, and study the retailers’ preferences for individual purchasing and group buying. They find that the informed retailer may forego group buying due to the loss of an information advantage, while the uninformed retailer may also reject group buying. Normann et al. [

16] study the impact of communication among buyer group members, and find that communication strongly reduces competition, and buyer groups lead to lower outputs when the buyer group can exclude a single firm. Dana [

17] studies the impact of group buying as a strategic commitment on buyers’ purchasing strategies, and finds that even small buyer groups composed of buyers with heterogeneous preferences can intensify price competition among rival sellers by committing to exclusively purchasing products from one seller. Li [

18] studies the impacts of group buying, buyer heterogeneity, and sellers’ bargaining power on buyers’ purchasing strategies. He shows that buyers benefit from group buying only if sellers’ bargaining power relative to the buyer group is low or if buyers’ preferences toward sellers are sufficiently differentiated.

In addition, some literature considers that retailers do not jointly purchase products, but outsource to a third party—a Group Purchasing Organization (GPO)—for unified procurement. For example, Yang et al. [

19] study whether a supplier cooperates with a GPO to offer quantity discounts and what price generates the most profits. They show that the size of the GPO membership significantly affects the supplier’s decision to sign with the GPO. Soleimani et al. [

20] consider a GPO and a two-tier supply chain consisting of two competing manufacturers and a supplier offering a quantity discount, and study the procurement strategies of the manufacturers. They find that a GPO with a low purchasing cost may harm the manufacturers. Ahmadi et al. [

21] study the optimal decision for a retailer to join a GPO or individually purchase products. They show that the GPO benefits consumers, the retailer, and other members of the supply chain. By reviewing the existing studies on strategic inventory, it can be found that existing studies have explored the impact of group buying from many aspects, but they do not consider the existence and impact of strategic inventory under group buying. With the rapid development of e-commerce in recent years, more and more research has focused on group buying from the perspective of consumers (e.g., [

22,

23,

24,

25]). Unlike them, we consider the group buying decisions of firms.

Our work is also related to the growing stream of literature on strategic inventory. Anand et al. [

4] first propose strategic inventory as a tool for negotiation and bargaining with upstream suppliers. Since then, several papers have investigated strategic inventory in different settings, including the competitive setting (e.g., [

26,

27,

28,

29,

30]) and the non-competitive setting (e.g., [

31,

32,

33,

34]). Arya and Mittendorf [

35] find that a retailer may hold excess inventory to convey a lower willingness to pay in future interactions, and thereby strategically undercut future wholesale prices. Arya et al. [

36] study trade-offs in centralization versus decentralization decisions in light of firms’ strategic use of inventory to influence supplier pricing. Hartwig et al. [

37] find that strategic inventory has a double-positive effect, both reducing wholesale prices and dampening the double-marginalization effect. Mantin and Jiang [

38] explore the implication of strategic inventory when it is sold as an inferior substitute in the second period. Dey et al. [

31] analyze the impact of power structures and strategic inventory on the development-intensive and marginal-cost-intensive green product types under three procurement strategies. Moon et al. [

39] present a two-period supply chain model under demand induced by selling price and investment effort in the presence of strategic inventory. Antoniou and Fiocco [

40] investigate a producer’s strategic incentive to hold inventory in response to the possibility of buyer stockpiling. Roy et al. [

41] investigate the implication of a lack of observability on the use of strategic inventory in a supply chain consisting of a retailer and a manufacturer. Mantin and Veldman [

42] show that strategic inventory may be harmful to supply chain agents in the presence of process improvement. Wang et al. [

43] investigate the impact of competition and strategic inventory on the performance of a supply chain including two competing suppliers and one retailer. So far, the existing studies have explored the effects of strategic inventory in different settings. However, these studies do not consider strategic inventory under group buying, and our study is the first paper to study group buying in the presence of strategic inventory.

Our work differs from the above papers on group buying and strategic inventory in two important dimensions. First, the existing studies on group buying focus only on the joint purchasing strategy of several retailers in one period, but do not consider the existence of strategic inventory. For example, related to our work, Chen and Roma [

10] study a two-tier distribution channel consisting of one manufacturer and two competing retailers. In contrast, we consider two competing retailers holding strategic inventory in two periods, and examine the impact of strategic inventory on the optimal decisions of the upstream supplier and the downstream retailers. Second, we consider the setting where two competing retailers cooperatively purchase products from a supplier, while existing studies on strategic inventory focus only on the non-competitive environment. For example, related to our work, Anand et al. [

4] consider the impact of strategic inventory on the operating decisions of a supplier and a buyer in a dynamic model. In contrast, we consider the impact of strategic inventory on the operational decisions of a supplier and two retailers in a competing environment. We find that strategic inventory achieves a win–win outcome for the supplier and the retailers. In addition, strategic inventory can improve supply chain performance and consumer surplus. In short, our work makes a contribution to enriching the literature on group buying and strategic inventory in supply chains.

3. Model

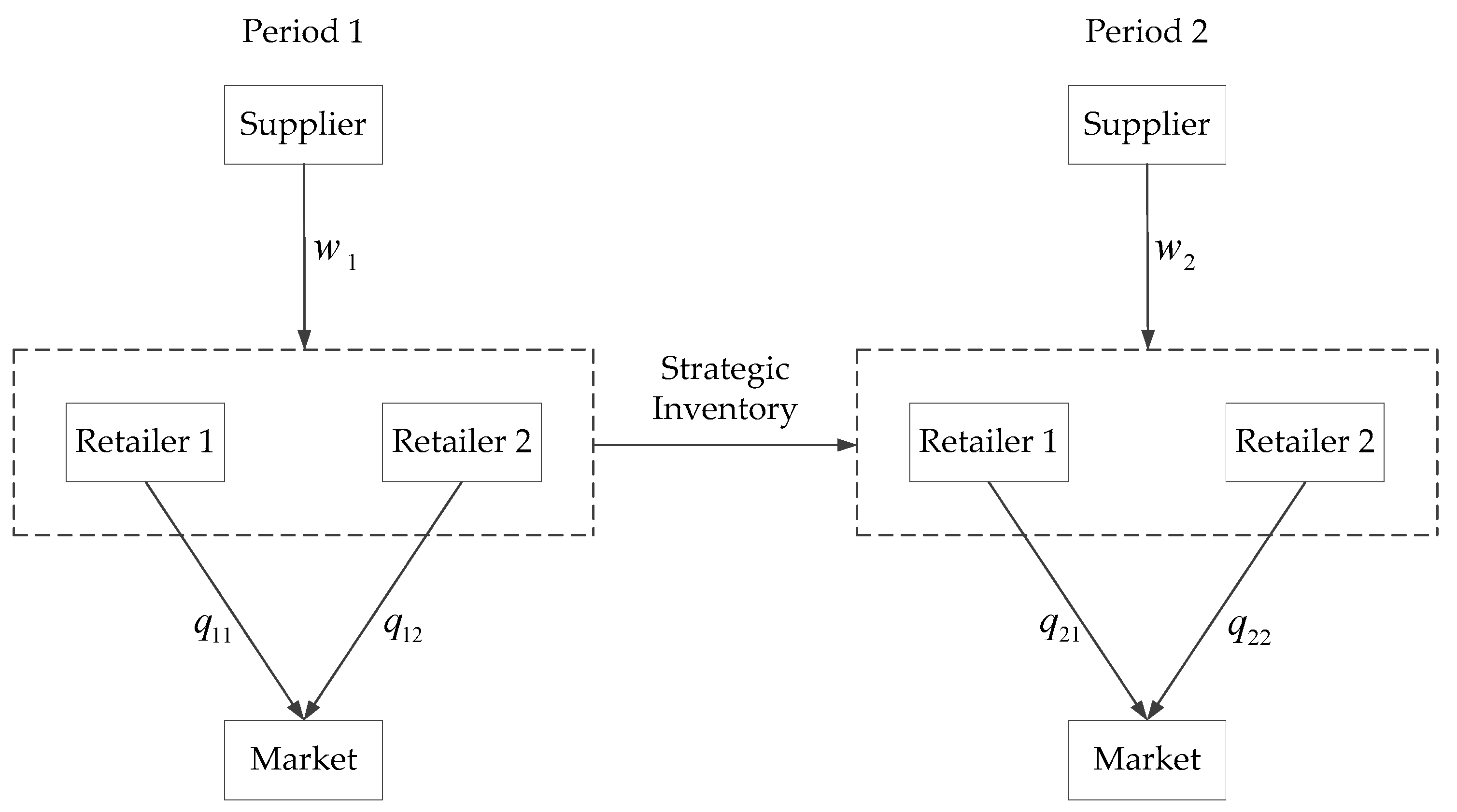

We consider a two-tier distribution channel where two competing retailers purchase homogeneous products together from a supplier and compete in the final market by selling to consumers in two periods. The retailers may hold strategic inventory from period 1 to period 2. The model framework is shown in

Figure 1. Specifically, the retailers jointly purchase

and

from the supplier and sell

and

to the market in period 1, and then the retailers’ strategic inventories in period 2 are

and

, respectively. Similarly, the retailers purchase

and

from the supplier and sell

and

to the market in period 2. The purpose of group buying by the retailers is to obtain lower wholesale prices, and a group buying strategy can only be implemented if the retailers agree to cooperate. We normalize the operational costs for the supplier and the retailers to zero, and assume that the unit holding cost for strategic inventory is

. According to Li et al. [

6], we consider a linear inverse demand function

where

and

.

is the market base.

is the substitutability between the retailers and represents the competition intensity.

and

are the retail price and quantity of retailer

in period

, respectively.

The supplier offers a quantity discount contract, whose wholesale price depends on the retailers’ demands. According to Schotanus et al. [

44], we consider a linear quantity discount function

where

is the base wholesale price.

and

are the purchasing quantities.

is the discount rate, and

is the discount level. In practice, a supplier usually adjusts the discount rate at different stages of product lifecycle and at times of sales promotions [

11,

45]. Therefore, we assume that

is a decision variable of the supplier.

In this paper, we consider a Stackelberg game, where the supplier is the leader and the retailers are the followers. The game sequence is as follows.

In period 1:

Stage 1: The supplier sets discount rate .

Stage 2: Simultaneously, retailer 1 chooses retail quantity and strategic inventory level , and retailer 2 chooses retail quantity and strategic inventory level .

In period 2:

Stage 1: The supplier establishes discount rate .

Stage 2: Simultaneously, retailer 1 chooses retail quantity and retailer 2 chooses retail quantity .

We consider the case of symmetric retailers, then

,

,

, and

. The retailers have two alternative group buying strategies: with and without strategic inventory. For ease of exposition, we use the superscripts

and

on variables to indicate the two strategies, respectively. Throughout this paper, we use backward induction to derive the subgame-perfect equilibrium outcomes. For clarity, the decision variables and model parameters used in this paper are listed in

Table 1. All proofs of lemmas and propositions are provided in

Appendix A.

4. Equilibrium Analysis

4.1. Group Buying without Strategic Inventory

To facilitate comparison, we begin with the analysis of group buying without strategic inventory in this subsection. Under group buying without strategic inventory, the decisions of the supplier and the retailers in each period are independent. Thus, retailer ’s purchasing quantity is equal to his retail quantity in period , i.e., .

Using backward induction, given that retailer

chooses retail quantity

, retailer

chooses retail quantity

to maximize his profit:

where the first term

represents retailer

’s sales revenue, and the second term

represents his purchasing cost.

Solving the first-order condition of (3) yields retailer

’s retail quantity in period

as follows:

Given that retailer

chooses retail quantity

, the supplier chooses discount rate

to maximize her profit:

where the first term

represents the supplier’s wholesale revenue from retailer 1, and the second term

represents her wholesale revenue from retailer 2.

Substituting (4) into (5) and solving the first-order condition, we obtain the equilibrium discount rates, retail prices, wholesale prices, retail quantities, and profits of the retailers and the supplier in each period under group buying without strategic inventory, as shown in Lemma 1 below.

Lemma 1. Under group buying without strategic inventory, a unique equilibrium exists, for which the equilibrium outcomes in each period are shown in Table 2: According to Lemma 1, we further obtain the equilibrium profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, in the two periods, as shown in Lemma 2 below.

Lemma 2. Under group buying without strategic inventory, a unique equilibrium exists, in which the profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, in the two periods are as follows:

4.2. Group Buying with Strategic Inventory

In this subsection, to examine the effect of strategic inventory, we analyze group buying with strategic inventory. Using backward induction, at stage 2 in period 2, given that retailer

chooses retail quantity

, retailer

chooses retail quantity

to maximize his profit:

where the first term

represents retailer

’s sales revenue in period 2, and the second term

represents his purchasing cost in period 2.

Solving the first-order condition of (7) yields

Given this, at stage 1 in period 2, the supplier sets discount rate

to maximize her profit:

where the first term

represents the supplier’s wholesale revenue from retailer 1 in period 2, and the second term

represents her wholesale revenue from retailer 2 in period 2.

Substituting (8) into (9) and solving the first-order condition yields

Given the best responses in period 2, we continue to solve the game in period 1. At stage 2 in period 1, retailer

chooses retail quantity

and strategic inventory

to maximize his profit:

where the first term

represents retailer

’s sales revenue in period 1, the second term

represents his purchasing cost in period 1, the third term

reflects his holding cost in period 1, and the fourth term

represents his profit in period 2.

Solving the first-order condition of (11) yields

Given this, at stage 1 in period 1, the supplier chooses discount rate

to maximize her profit:

where the first term

represents the supplier’s wholesale revenue from retailer 1 in period 1, the second term

represents her wholesale revenue from retailer 2 in period 1, and the third term

represents her profit in period 2.

Substituting (12) into (13) and solving the first-order condition, we obtain the equilibrium discount rates, retail prices, wholesale prices, strategic inventory, retail quantities, and profits of the retailers and the supplier in each period under group buying with strategic inventory, as shown in Lemma 3 below.

Lemma 3. Under group buying with strategic inventory, a unique equilibrium exists, for which the equilibrium outcomes in each period are shown in Table 3: According to Lemma 3, we further obtain the equilibrium profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, in the two periods, as shown in Lemma 4 below.

Lemma 4. Under group buying with strategic inventory, a unique equilibrium exists, in which the profits of the retailers, the supplier, and the supply chain as well as consumer surplus in the two periods are as follows:

4.2.1. The Condition for the Existence of Strategic Inventory

In equilibrium, the holding cost and the base wholesale price affect the retailers’ decision on whether to hold strategic inventory under group buying, as summarized in Proposition 1 below.

Proposition 1. Under group buying with strategic inventory:

- (i)

when , we have ; otherwise, ;

- (ii)

increases with , but decreases with or .

Proposition 1(i) indicates the condition that the retailers hold strategic inventory under group buying in equilibrium. That is, whether the retailers hold strategic inventory under group buying depends on the tradeoff between the holding cost and the base wholesale price. Specifically, only when the holding cost is low or the basic wholesale price is high (i.e., ) will the retailers hold strategic inventory under group buying (i.e., ). Proposition 1(ii) shows that the retailers’ strategic inventory levels are related to the basic wholesale price, the holding cost, and the competition intensity. If the supplier offers a high base wholesale price, the retailers will hold more strategic inventory in order to improve their bargaining power. However, intuitively, the higher the holding cost, the less willing the retailers are to hold strategic inventory. In addition, intensified retail competition between the retailers leads to a lower retail price, and thus a higher retail quantity, which further reduces their strategic inventory levels.

4.2.2. The Impact of Holding Cost and Competition Intensity

By analyzing the equilibrium profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, in the two periods under group buying with strategic inventory, we obtain Proposition 2 below.

Proposition 2. Under group buying with strategic inventory:

- (i)

as increases, , , and decrease, while increases;

- (ii)

as increases, , , , and decrease.

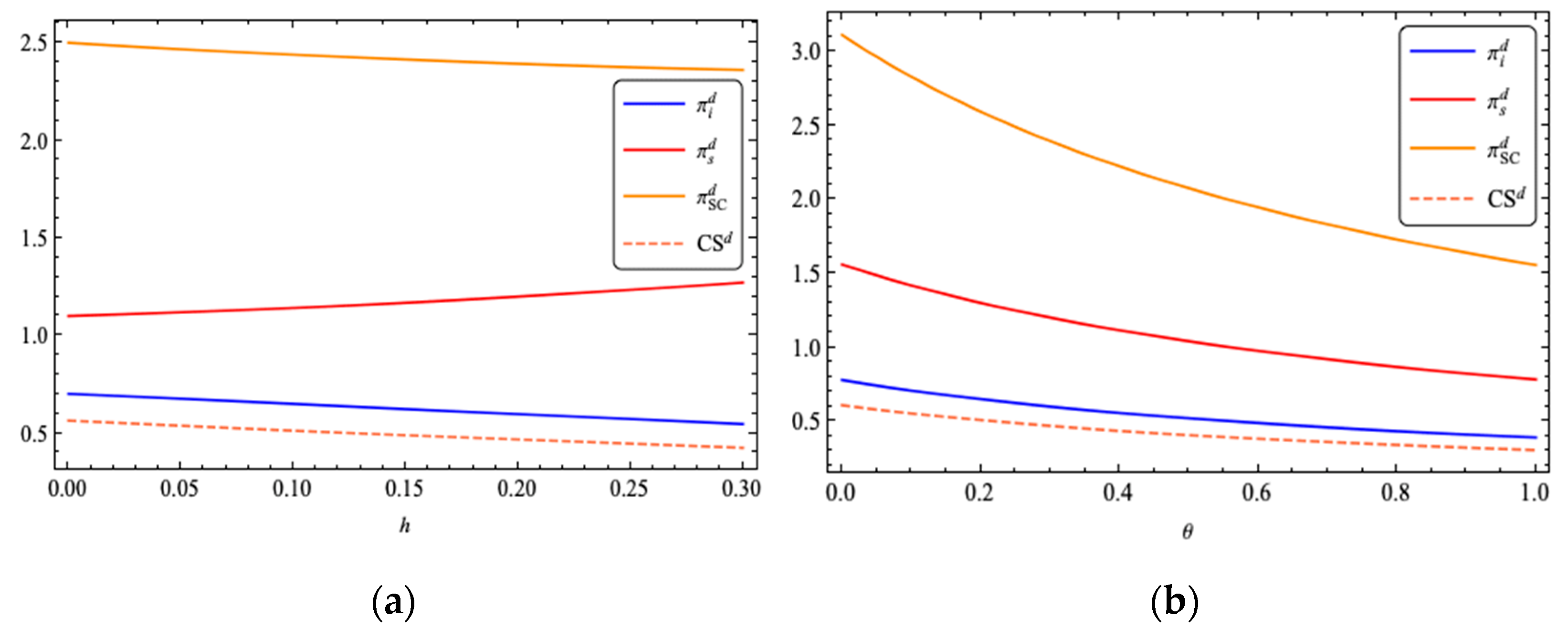

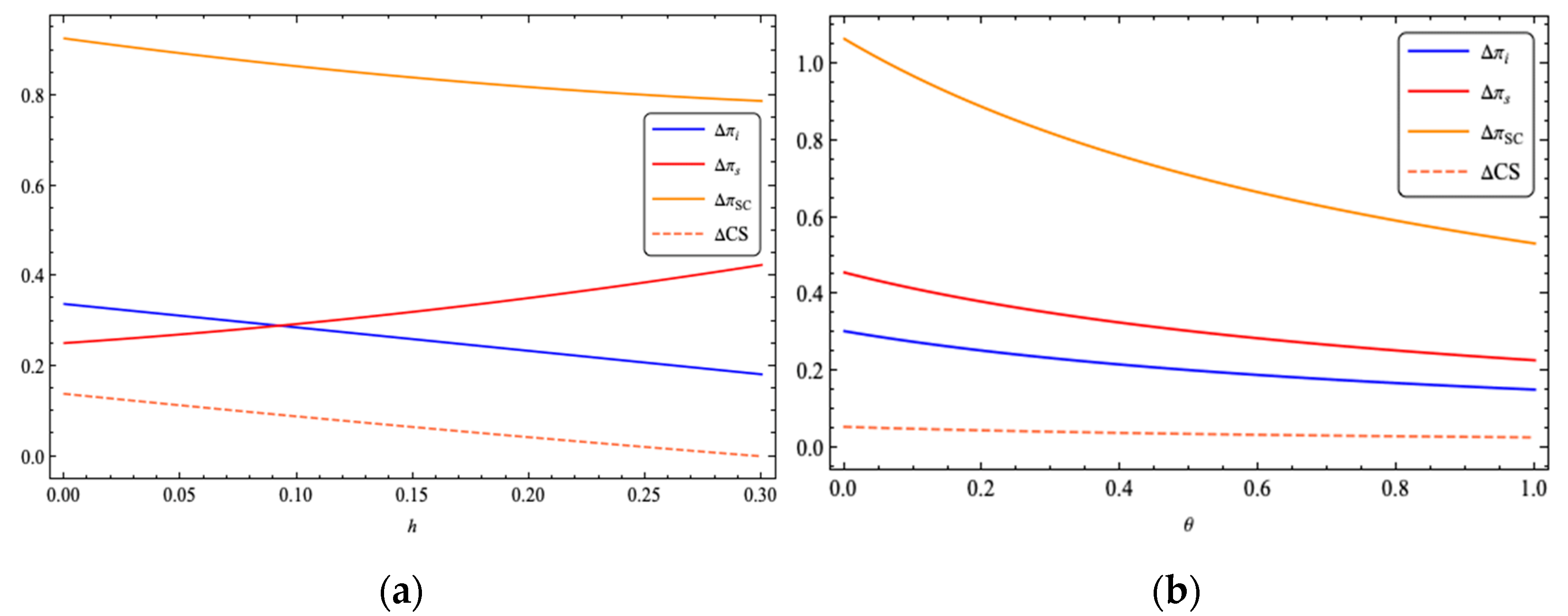

Proposition 2 shows the impact of the holding cost and the competition intensity on the profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, in the two periods when the retailers hold strategic inventory under group buying. As the holding cost increases, the retailers have less incentive to hold strategic inventory, and thus may cooperatively purchase less products from the supplier. Accordingly, the supplier will charge a higher wholesale price and earn more, and the retailers will set a higher retail price for the consumers. Therefore, the profits of the retailers and the supply chain, as well as consumer surplus, decrease, while the supplier’s profit increases, which indicates that a higher holding cost is detrimental to the retailers and the supply chain, as well as consumers, while beneficial to the supplier, as demonstrated in

Figure 2a.

Figure 2a demonstrates the impact of the holding cost on the firms’ profits and consumer surplus in the two periods when

,

, and

.

We also find that intensified competition in the final market leads to smaller retail quantities, which leads to lower consumer surplus. The retailers’ profits are worse off due to smaller retail quantities and unchanged retail prices. Moreover, purchasing quantities decrease and wholesale prices remain unchanged with the competition intensity, which leads to a lower profit of the supplier. Therefore, the profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, decrease, which indicates that intensified competition is detrimental to the retailers, the supplier, the supply chain, and consumers, as demonstrated in

Figure 2b.

Figure 2b demonstrates the impact of the competition intensity on the firms’ profits and consumer surplus in the two periods when

,

, and

.

5. Comparing Strategies and Results

To show the effect of strategic inventory more clearly, we further compare the equilibrium outcomes and profits under group buying with and without the possibility of strategic inventory.

5.1. Comparing Equilibrium Outcomes

By comparing the discount levels in each period under group buying with and without strategic inventory, we obtain Proposition 3 below. Here, we define the notations and to represent the differences in the discount levels in each period under group buying with and without strategic inventory, respectively.

Proposition 3. Comparing the discount levels in each period under group buying with and without strategic inventory:

- (i)

and ;

- (ii)

as increases, increases, while decreases;

- (iii)

as increases, decreases, while increases.

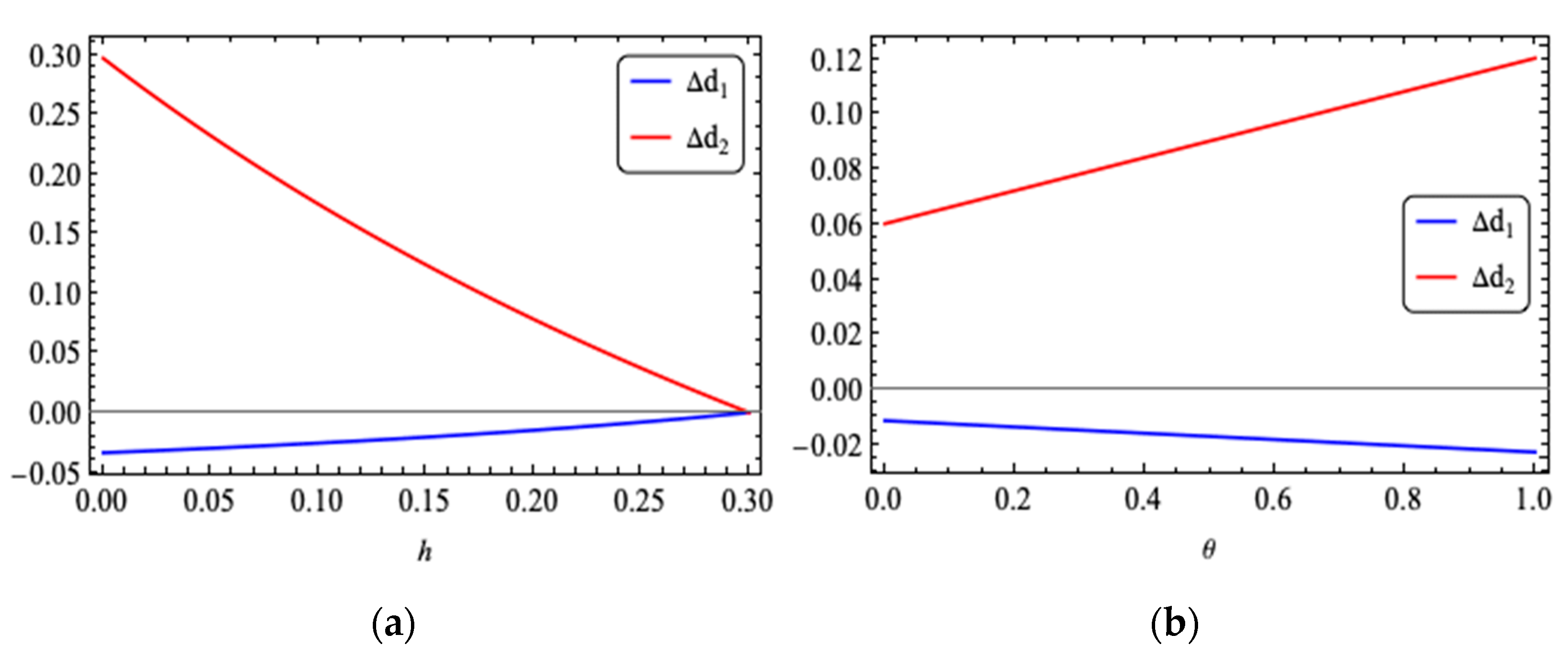

Proposition 3(

i) shows the effect of group buying with and without strategic inventory on the discount levels offered by the supplier to the retailers in each period. Specifically, compared with group buying without strategic inventory, the discount level in period 1 is lower (i.e.,

), while that in period 2 is higher (i.e.,

) when the retailers hold strategic inventory under group buying (i.e.,

). An explanation is that the retailers increase their purchases due to strategic inventory, which leads to a lower discount from the supplier. Proposition 3(

ii,

iii) show the impacts of the holding cost and the competition intensity on discount level changes in each period, respectively. Specifically, Proposition 3(

ii) indicates that the higher the holding cost, the less the discount level in period 1 decreases and the less the discount level in period 2 increases, as demonstrated in

Figure 3a.

Figure 3a demonstrates the impact of the holding cost on discount level changes in each period when

,

, and

. Proposition 3(

iii) indicates that the higher the competition intensity, the more the discount level in period 1 decreases and the more the discount level in period 2 increases, as demonstrated in

Figure 3b.

Figure 3b demonstrates the impact of the competition intensity on discount level changes in each period when

,

, and

.

By comparing the wholesale prices, retail prices, purchasing quantities, and retail quantities in each period under group buying with and without strategic inventory, we obtain Proposition 4 below.

Proposition 4. Comparing the wholesale prices, retail prices, purchasing quantities, and retail quantities in each period under group buying with and without strategic inventory:

- (i)

and ;

- (ii)

and ;

- (iii)

and ;

- (iv)

and .

Proposition 4 shows the effect of strategic inventory on the wholesale prices, retail prices, purchasing quantities, and retail quantities in each period. Specifically, in period 1, since the supplier initially holds the wholesale price constant (i.e., ), the retailers do not change the retail price (i.e., ) and the retail quantity does not change (i.e., ). However, in order to hold strategic inventory, the retailers will increase the purchasing quantity (i.e., ). In period 2, the retailers reduce the purchasing quantity from the supplier because they already hold strategic inventory (i.e., ). The supplier will reduce the wholesale price in order to increase the retailers’ incentive to purchase more products (i.e., ). This indicates that strategic inventory forces the supplier to lower wholesale prices in period 2, so that the retailers’ profit margin exceeds the holding cost, which benefits the retailers. On the other hand, a lower wholesale price set by the supplier also reduces the retailers’ retail prices (i.e., ), and thus consumers buy more products from the retailers (i.e., ). In addition, in order to sell all products at the end of period 2, including products purchased in period 2 and strategic inventory, the retailers will clear at a lower retail price.

5.2. Comparing Profits and Consumer Surplus

By comparing the profits of the retailers and the supplier in each period under group buying with and without strategic inventory, we state Proposition 5 below. Here, we define the notations , , , and to represent the differences in the profits of the retailers and the supplier in each period under group buying with and without strategic inventory, respectively.

Proposition 5. Comparing the profits of the retailers and the supplier in each period under group buying with and without strategic inventory:

- (i)

and ;

- (ii)

and ;

- (iii)

as or increases, , , and decrease, while increases.

Proposition 5(i,ii) show the effect of strategic inventory on the profits of the retailers and the supplier in each period. Proposition 5(i) shows that the retailers’ profits in each period are higher (i.e., and ) when the retailers hold strategic inventory under group buying (i.e., ), that is, the retailers benefit from strategic inventory in each period, which is consistent with Proposition 4(i). Thus, the retailers have incentives to hold strategic inventory, which is contrary to the common view that inventory should be reduced or not held. Proposition 5(ii) shows that the supplier’s profit in period 1 is higher (i.e., ) while that in period 2 is lower (i.e., ) when the retailers hold strategic inventory under group buying (i.e., ). Therefore, the supplier benefits from strategic inventory in period 1 and suffers from strategic inventory in period 2, which is consistent with Proposition 4(i) and Proposition 4(iii).

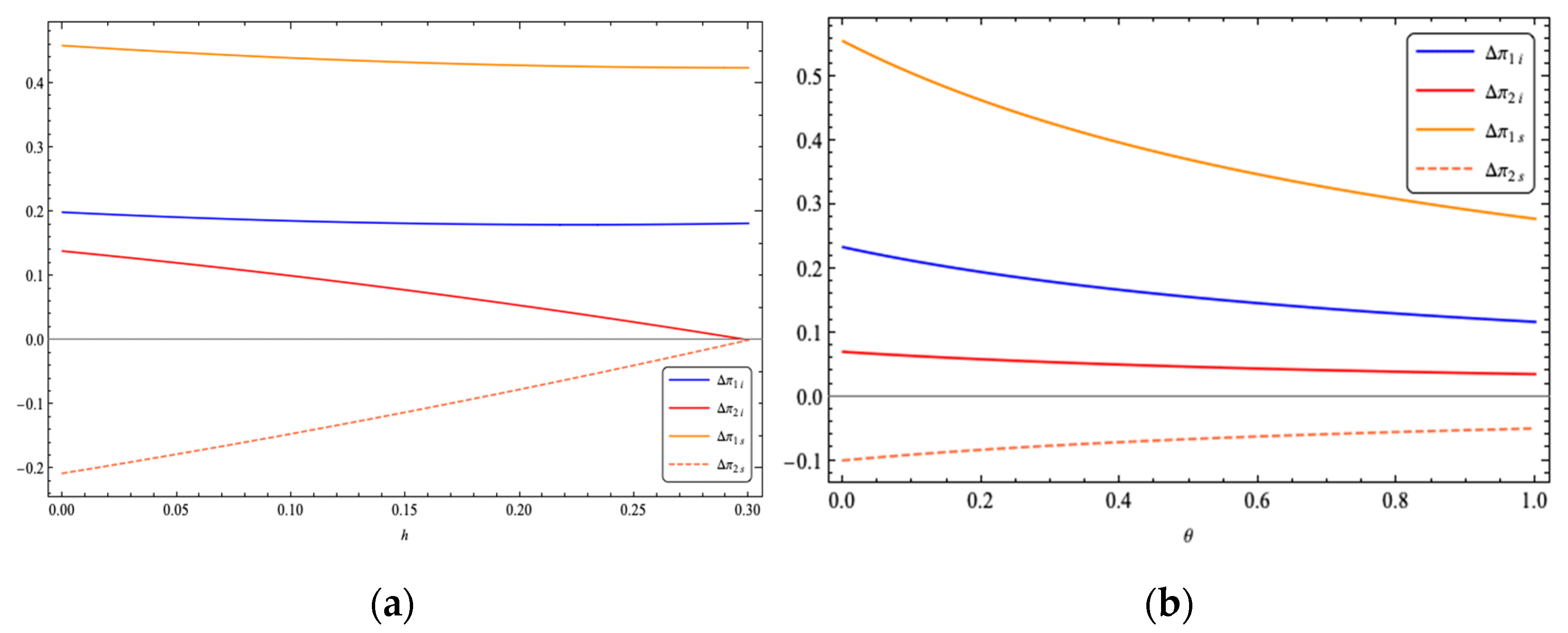

Proposition 5(

iii) shows the impacts of the holding cost and the competition intensity on the profit changes of the retailers and the supplier in each period. Specifically, the higher the holding cost or the competition intensity, the less the retailers’ profits in each period and the supplier’s profit in period 1 increase while the less the supplier’s profit in period 2 decreases, as demonstrated in

Figure 4a,b.

Figure 4a demonstrates the impact of the holding cost on profit changes in each period when

,

, and

.

Figure 4b demonstrates the impact of the competition intensity on profit changes in each period when

,

, and

.

By comparing the profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, in the two periods under group buying with and without strategic inventory, we obtain Proposition 6 below. Here, we define the notations , , , and to represent the differences in the profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, in the two periods under group buying with and without strategic inventory, respectively.

Proposition 6. Comparing the profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, in the two periods under group buying with and without strategic inventory:

- (i)

;

- (ii)

;

- (iii)

;

- (iv)

;

- (v)

as increases, , , and decrease, while increases;

- (vi)

as increases, , , , and decrease.

Proposition 6(i–iv) show the effect of strategic inventory on the profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, in the two periods. Proposition 6(i) shows that the retailers’ profits are higher (i.e., ) and the retailers benefit from strategic inventory in the two periods under group buying with strategic inventory (i.e., ), which is consistent with Proposition 4(i) and Proposition 5(i). Thus, the retailers have incentives to hold strategic inventory, which is contrary to the common view that inventory should be reduced or not held. Proposition 6(ii) shows that the supplier’s profit in the two periods is higher (i.e., ) and the supplier also benefits from strategic inventory in the two periods. According to Proposition 5(ii), although the supplier’s profit in period 1 is higher and that in period 2 is lower, her total profit in the two periods is higher, indicating that her profit improvement in period 1 is higher than her profit loss in period 2. Therefore, the supplier hopes the retailers to hold strategic inventory, and strategic inventory achieves a win–win outcome for the supplier and the retailers. Proposition 6(iii) shows that the profit of the supply chain in the two periods is higher (i.e., ) and indicates that strategic inventory reduces double marginalization and improves supply chain performance. Proposition 6(iv) shows that consumer surplus in the two periods is higher (i.e., ) and indicates that strategic inventory also plays a positive role in improving consumer surplus, which is consistent with Proposition 4(ii).

Proposition 6(

v,

vi) show the impacts of the holding cost and the competition intensity on the changes in the profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, in the two periods. Proposition 6(

v) indicates that the higher the holding cost, the less the profits of the retailers and the supply chain, as well as consumer surplus, increase, while the more the supplier’s profit increases, as demonstrated in

Figure 5a.

Figure 5a demonstrates the impact of the holding cost on changes in profits and consumer surplus in the two periods when

,

, and

. Proposition 6(

vi) indicates that the higher the competition intensity, the less the profits of the retailers, the supplier, and the supply chain, as well as consumer surplus, increase, as demonstrated in

Figure 5b.

Figure 5b demonstrates the impact of the competition intensity on changes in profits and consumer surplus in the two periods when

,

, and

.

6. Discussion and Conclusions

Among the research on supply chain management, the topics of cooperation and competition between upstream suppliers and downstream retailers have always been the focus of the academia and the industry. On the one hand, in order to obtain quantity discounts, retailers form an alliance to jointly purchase products from suppliers. On the other hand, as an effective negotiation tool, strategic inventory can help retailers to obtain competitive advantages in procurement. In this paper, we consider a two-tier distribution channel consisting of one supplier and two competing retailers who can hold strategic inventory. The retailers jointly purchase products from the supplier and compete in the final market in the two periods, and the supplier offers a quantity discount contract. We consider a Stackelberg game where the supplier, as the leader, first sets her discount rate, and then the retailers, as the followers, simultaneously decide their purchasing quantities. We build models under group buying with and without strategic inventory, and use backward induction to obtain the equilibrium outcomes. By comparing the equilibrium outcomes under group buying with and without strategic inventory, we explore the effect of strategic inventory on the retailers, the supplier, the supply chain, and consumers.

We obtain the condition for the existence of strategic inventory, that is, the retailers will hold strategic inventory under group buying only when the holding cost is low or the basic wholesale price is high. We show that a higher holding cost is detrimental to the retailers, the supply chain, and consumers, but beneficial to the supplier. We also find that intensified competition is detrimental to the retailers, the supplier, the supply chain, and consumers. Furthermore, we further compare the equilibrium outcomes under group buying with and without the possibility of strategic inventory. We find that the discount level in period 1 is lower, while that in period 2 is higher. The retailers’ retail price and quantity remain unchanged, and the purchasing quantity increases in period 1, while the retail price and purchasing quantity decrease and the retail quantity increases in period 2. The supplier’s wholesale price remains the same in period 1 and decreases in period 2. Interestingly, we find that, contrary to the common view that inventory should be reduced or not held, the retailers have incentives to hold strategic inventory. The supplier also prefers that because strategic inventory benefits her. In addition, strategic inventory can improve supply chain performance and consumer surplus. Therefore, the retailers that sell products such as durable goods and industrial goods can properly hold strategic inventory, which should be encouraged by their suppliers, supply chain consultants, and consumers.

The contributions of our research are as follows. First, unlike most existing studies considering group buying in one period only, our research constructs a two-period model under group buying. Furthermore, our research is the first paper to integrate strategic inventory into group buying, while the existing studies on group buying do not consider the existence of strategic inventory. In addition, we examine the impact of strategic inventory on the operational decisions of a supplier and two retailers in a competing environment, while existing studies on strategic inventory focus only on the non-competitive environment.

Our research may inevitably have some limitations and can be extended in the following ways. First, we assume the two retailers are symmetric, so future research can take into account asymmetric retailers. Second, in addition to quantity competition between the retailers in the final market, price competition is also a direction worth studying. Finally, we assume that the supplier and the retailers fully share their information, but they have some private information in many cases. For example, the supplier may have some private information about supply and sales, and the retailers may know more about market demand and inventory. Thus, information asymmetry and information sharing is another direction for future research.